Finance and Economics Discussion Series

Federal Reserve Board, Washington, D.C.

ISSN 1936-2854 (Print)

ISSN 2767-3898 (Online)

Risk Perception and Loan Underwriting in Securitized

Commercial Mortgages

Simon Firestone, Nathan Godin, Akos Horvath, Jacob Sagi

2024-019

Please cite this paper as:

Firestone, Simon, Nathan Godin, Akos Horvath, and Jacob Sagi (2024). “Risk Perception

and Loan Underwriting in Securitized Commercial Mortgages,” Finance and Economics

Discussion Series 2024-019. Washington: Board of Governors of the Federal Reserve System,

https://doi.org/10.17016/FEDS.2024.019.

NOTE: Staff working papers in the Finance and Economics Discussion Series (FEDS) are preliminary

materials circulated to stimulate discussion and critical comment. The analysis and conclusions set forth

are those of the authors and do not indicate concurrence by other members of the research staff or the

Board of Governors. References in publications to the Finance and Economics Discussion Series (other than

acknowledgement) should be cleared with the author(s) to protect the tentative character of these papers.

Risk Perception and Loan Underwriting in Securitized

Commercial Mortgages

By Simon Firestone, Nathan Godin, Akos Horvath, Jacob Sagi

∗

Draft: April 2024

We use model-implied volatility to proxy for property risk

perceptions in the commercial real estate lending market.

Although loan-to-value ratios (LTVs) unconditionally decreased

following the Global Financial Crisis, LTVs conditioned on

implied volatility and other theoretically motivated fundamental

determinants of optimal leverage show no conclusive trend before or

after the crisis. Taking reported property and loan attributes at face

value, we find no clear pattern of unwarranted credit being extended

to commercial real estate assets. We conclude that systematically

higher LTV decisions pre-crisis would have primarily stemmed from

risk misperceptions rather than imprudent practices. Our findings

suggest that the aggregate LTV level should be interpreted as a

proxy for lending standards only after controlling for aggregate risk

perceptions, among a host of asset and lending market factors.

Our findings also highlight the importance of measuring and tracking

aggregate risk perceptions in informing regulators and policymakers.

JEL: C22, D80, G01, G10, G18, G21, R38

Keywords: Loan underwriting, Lending standards, Global Financial

Crisis, Mortgages, Real estate finance, Implied volatility

∗

Business, University of California, Berkeley (nathan godin@berkeley.edu); Horvath: Federal Reserve

Board of Governors, Washington, DC (akos.horv[email protected]); Sagi: Kenan-Flagler Business School,

University of North Carolina at Chapel Hill (jacob sagi@kenan-flagler.unc.edu). We thank Elizabeth

Duncan and Carlos Wardlow for their helpful assistance. We are grateful for the insightful discussion

of Chester Spatt at the 2023 Western Financial Association Conference and the helpful comments from

participants at the 2023 FDIC Bank Research Conference. We also thank seminar participants at the

Federal Reserve Board of Governors, Federal Reserve Bank of Cleveland, University of Wisconsin School of

Business, CUNY Baruch College, UC Berkeley Haas School of Business, and the Securities and Exchange

Commission for their comments. The views expressed in this paper are those of the authors and do not

necessarily reflect the views of the Federal Reserve Board or the Federal Reserve System.

I. Introduction

Against which of these assets should one extend more credit in 2023: a subur-

ban office or a warehouse facility leased to an e-commerce company? With the

relative uncertainty surrounding work-from-home trends, the answer seems clear—

but it may have been a tossup twenty years ago. This example illustrates the core

motivation of our paper. Loan-to-value ratios (LTVs) are often viewed as a primary

measure of underwriting standards in commercial real estate (CRE) lending.

1

We argue that variation in observed LTVs should be interpreted through the lens

of the lender’s (originator’s) risk perceptions, which not only vary across collateral

(property) types but also over time. What might be interpreted as “aggressively”

high LTV, may, in fact, be optimal or justifiable given the property’s riskiness and

the business cycle. Theoretically, this idea is not new: Jaffee and Russell (1976)

demonstrate that lenders may limit credit (i.e., require more “skin in the game”)

when it is hard to tell which borrowers are riskier, and Leland and Pyle (1977)

provide a framework of firm financing with greater equity accompanying greater

risk. Lenders’ willingness to extend more credit should reflect perceived property

risk and not only “lax” or “tight” credit conditions (which may also reflect lenders’

risk tolerance or cost of capital).

Despite the clear role of risk perceptions, aggregate changes in LTV are often

interpreted as changes in underwriting standards when it comes to measuring

the aggressiveness of real estate lending. For instance, a 2010 Congressional

Oversight Panel report by Elizabeth Warren et al. (2010) after the Global Financial

Crisis (GFC) came to the following conclusion:

“The commercial real estate bubble [. . . ] resulted in the origination of a

significant amount of commercial real estate loans based on dramatically

weakened underwriting standards. These loans were based on overly

aggressive rental or cash flow projections [. . . ], had higher levels of

allowable leverage, and were not soundly underwritten.”

The culprits identified in the above quote are unrealistic cash flow forecasts

and overly high LTVs, consistent with other assessments (e.g., Levitin and Wachter,

1

Although the income-to-debt ratio and the debt service coverage ratios are also common qualifiers

of CRE loan underwriting, we find that the empirical relationship between perceived property risk and

LTV is stronger than the empirical relationship between property risk and these alternative ratios.

2

2013). Although there is evidence to suggest that property income measures are,

at times, inflated by commercial mortgage-backed securities (CMBS) originators

(Griffin and Priest, 2023), the diagnosis of aggressive LTVs is a narrative that is

more difficult to test, though it may often be conjectured. Jacob and Manzi (2005)

describe what they believe to be lenders pushing the limit on LTVs in a trend

toward “weaker lending standards,” and Fabozzi, McBride and Clancy (2015)

claim that this tendency was especially egregious in 2006 and 2007. Meanwhile,

Wilcox (2012) and Wilcox (2018) argue that aggregate LTVs may not provide a

faithful portrayal of underwriting standards.

We provide empirical evidence that, controlling for implied ex ante perceptions

of property risk, as proxied by the implied volatility (IV) of individual properties,

the average LTVs of securitized CRE loans in the period 2000–04 were only about

1.5 percentage points higher than the average LTVs in the post risk retention rule

period of 2016–20. Likewise, average LTVs in 2005–07 were similar to those in

2008–15

. Differences among epochs shrink further when we control for property cap

rate (cash yield) spreads over the 10-year U.S. Treasury yield. Indeed, we find that

credit rationing “frontiers” (i.e., maximum LTV thresholds) were most permissive

in 2000–04, and they were most restrictive in 2005–07, coinciding with the peak

of collateralized debt obligation (CDO) issuances. Importantly, credit rationing

frontiers explain only a negligible fraction of LTV variation across epochs, while

perceived property risk explains the lion’s share.

Our main contribution is demonstrating that LTVs for securitized CRE loans,

throughout different economic epochs from 2000 to 2020, were largely driven by

perceived property risk and market fundamentals. We calculate implied volatility

using a two-factor derivative asset pricing model, which allows for standard CRE

mortgage contract provisions. In the model, IV is the asset’s diffusion risk that

rationalizes the loan’s interest rate given its LTV, maturity, and amortization

schedule, as well as the property’s cap rate, the term structure of U.S. Treasury

yields, and the mortgage market liquidity premium.

2

Our findings are consistent

with tradeoff theories of optimal leverage (e.g., Leland, 1994), which imply that

observed LTVs should decline with IV and cap rates. On its own, IV explains about

2/3 of the cross-sectional and time series variation in LTV. Controlling for the cap

2

We estimate liquidity premium on the CRE mortgage market as the effective yield spread between

short-term AAA-rated tranches of CMBSs and U.S. Treasury securities with equivalent maturities.

3

rate and various (such as, property type and location) fixed effects helps explain an

additional 10 percent of LTV variation. The residual time series variation seems

to be random. Our results are in line with Driessen and Van Hemert (2012) and

Stanton and Wallace (2018), who find no evidence that underwriting practices in

the CRE mortgage market deteriorated in the way that they did in the residential

real estate mortgage market before the GFC. Our results are also consistent with

the position in Wilcox (2012) and Wilcox (2018) that LTVs, on their own, may not

be informative about aggregate loan underwriting standards.

From the collapse of the CRE market in the wake of the GFC, it is tempting to

conclude that CRE loan leverage was overly aggressive before the crisis. However,

after controlling for implied volatility, we find no evidence for abnormally high

LTVs. What we do find is that risk perceptions were lower in 2003–07 than in

any other epoch from 2000 to 2020. Hence, our findings suggest systematic shifts

in perceived property risk as a compelling explanation for the growth in CRE

lending in 2003–07, which fueled the subsequent CRE market decline. Moreover,

to the extent that there was a failure in the CRE mortgage market in the run-up

to the GFC, our findings may also indicate aggregate risk misperceptions.

3

Indeed,

systematic misperceptions of risk would have led to more credit extended but also

to CRE loan underpricing (i.e., low interest rates).

The paper is organized as follows. Section II provides theoretical background

for conceptualizing the aggregate LTV as a dynamic variable that captures changes

in systematic risk perceptions as well as other property and capital market

attributes—even in the presence of frictions due to taxes and costs of default.

Section II reviews the related academic literature and provides institutional details

on the CMBS market. Section III describes our data. Section IV analyzes our

implied volatility estimates and their relationship to other measures of property risk.

Section V presents our main results, examining CRE loan LTVs over time with and

without controls for determinants of optimal leverage, including (and especially)

implied volatility. Section VI concludes.

3

There is an important distinction between aggressive loan underwriting and loan underpricing.

In the former case, lenders knowingly undertake more risk than warranted by prudent practices. In the

latter case, lenders falsely believe that they follow best underwriting practices.

4

II. Conceptual motivation and methodological overview

Mortgage provision in the primary market depends on the price of liquidity in

the secondary mortgage market, competition among lenders, and the availability

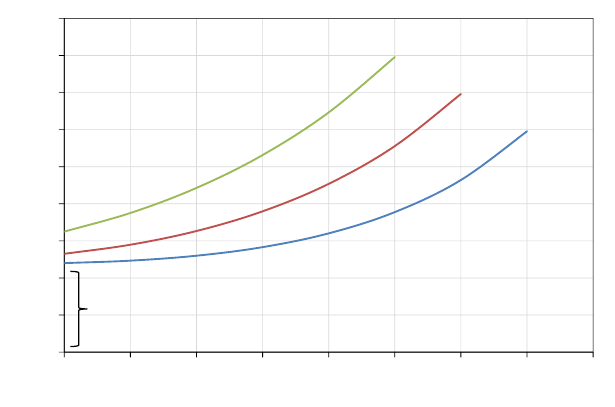

of capital in the credit market, all of which are held fixed. Figure 1 shows stylized

mortgage offer curves for properties with different perceived risk.

4

The mortgage

offer curves are truncated beyond a certain LTV because of credit rationing due

to asymmetric information (Jaffee and Russell, 1976; Leland and Pyle, 1977) and

dead-weight costs of default (Leland, 1994).

Figure 1. Stylized mortgage offer curves for properties with different risk

This figure shows stylized five-year zero-coupon mortgage offer curves for properties with different levels

of perceived risk. Property risk is proxied by annualized asset volatility (“vol”). The vertical axis shows

the mortgage spread over a zero-coupon five-year U.S. Treasury at which lenders would be willing to

issue the mortgage loan given the loan-to-value ratio and the annualized asset volatility. The curves are

computed using the Merton (1974) model and incorporate a liquidity spread, which represents the price

of liquidity in the mortgage-backed securities market.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

50% 55% 60% 65% 70% 75% 80% 85% 90%

Spread (pp)

Loan-to-value ratio

vol = 13%

vol = 17%

vol = 21%

"Liquidity spread"

Given the mortgage offer curve specific to the property, the borrower’s choice

reduces to picking the LTV. In the Leland (1994) model, for example, the optimal

borrower’s choice is decreasing in the property’s cap rate, increasing in the owner’s

4

In this stylized chart, we ignore other mortgage contract terms available to the borrower and

commensurately priced by the lender, including maturity, interim coupon payments, and prepayment

options. We do take such loan features into account in our empirical methodology.

5

tax rate, and decreasing in asset volatility. All else being equal, a model with

rational agents yields equilibrium LTVs that decrease in asset volatility.

There are several key takeaways from the conceptual considerations above.

First, time variation in aggregate LTVs may be entirely attributable to changing

market fundamentals, rather than the tension between regulators and lenders or

agency frictions within lending institutions. Second, in those instances where

LTV limits are below the optimal leverage point for a sufficiently large number

of borrowers, there would be clustering at the credit rationing frontier. Third,

the frontier should decline with perceived property risk. Finally, although lenders

and borrowers do not directly express or observe asset volatility, their risk

assessment is implicit in the loan spread at which the contract is originated.

In Figure 1 above, it is sufficient to know that a loan with a 67% LTV is priced at

2 percentage points above the five-year U.S. Treasury yield to conclude that the

perceived property risk was roughly 17% in implied volatility.

A. Overview of empirical approach and results

Our null hypothesis is that the cross section of LTVs results from borrower

demand in response to rational mortgage offer curves, akin to those depicted in

Figure 1. Under the null hypothesis, it is consistent with prudent lending to provide

an infinitely elastic supply of credit at any point on the curves. Risk misperception

corresponds to lending using offer curves that are systematically lower or higher

than the true asset volatilities, which could be detected ex post. By contrast,

aggressive lending manifests ex ante as loans that would not normally be made

(e.g., an 80% LTV loan with asset volatility of 21% in Figure 1). Hence, one could

test for aggressive lending in a period like 2005–07 by examining whether the

credit rationing frontier was higher during that period than at other times.

5

In order to test the null hypothesis described above, and look for evidence

of aggressive lending practices, we first estimate the implied volatility of each

property underlying a sample of securitized CRE mortgages. The mortgage pricing

model that we use to estimate IV captures various ex ante features of the deal,

including the property’s cap rate, the loan’s term and amortization schedule,

5

Note that changes in the credit rationing frontier could result from the influence of fundamental

factors, such as a systematic change in dead-weight costs of default. Therefore, identifying an epoch with

a higher rationing frontier does not constitute evidence for aggressive lending practices.

6

default and interest rate risk, and mortgage market liquidity.

6

Under the null

hypothesis defined above, IV measures the lender’s perceived property risk. Second,

we identify the credit rationing frontier, as a function of IV, for four time periods

in our sample. We confirm that, consistent with the null hypothesis, the frontier

gradually declines with implied volatility in each of the four periods.

Next, we examine the rationing frontiers and empirically reject the narrative

that lenders were more aggressive in the run-up to the GFC. We use ex ante

fundamentals to explain the variation of LTVs across loans and over time, such

as implied volatility, cap rate, and other property and market features that can

influence mortgage offer curves and borrower demand for loans. We fit a censored

(tobit) regression model for LTV, using the rationing frontier as upper bound,

and conduct a counterfactual analysis. In particular, we fix the frontier over time

and compare actual and estimated counterfactual LTVs to analyze the effect of

changing frontiers. We find little evidence that shifts in the rationing frontier

explain LTVs, which indicates that, even if such shifts are driven by changing

underwriting standards, they have little effect on the distribution of LTVs.

What we do find is that the leading determinant of credit provision is implied

volatility (perceived property risk). Importantly, this relationship is not mechanical.

If borrowers randomly selected LTVs from the mortgage offer curves in Figure 1,

then the only link between LTVs and risk perceptions would be through credit

rationing, because the rationing frontier is more likely to be binding at higher IVs.

This is not consistent with our result that shifts in the rationing frontier explain

little of the distribution of LTVs. By contrast, if borrowers optimally choose LTVs

to trade off costly default against the benefits of debt (e.g., lower taxes), then,

consistent with our empirical findings, LTVs vary with property risk even if the

rationing frontier is not a binding constraint.

B. Literature on commercial real estate risk and mortgage implied volatility

We contribute to an evolving understanding of CRE asset volatility. Previous

analyses use aggregate data to study CRE price dynamics. Ciochetti et al. (2002)

create a property value volatility index at the property type-census district level.

Plazzi, Torous and Valkanov (2010) use quarterly averages at the metropolitan

6

We also examine the possibility that prepayment options affect our results. We confirm that,

because of the presence of large prepayment penalties in this market segment, they do not.

7

statistical area level for broad property types and apply the Campbell and Shiller

(1988) price-dividend decomposition to better understand the characteristics of

CRE rents, cap rates, and asset returns. They find that CRE returns are related

to the local regulatory environment and population density, and that expected

returns are related to factors such as local population, employment, and income

growth as well as construction costs. Using property-level data, we find that many

of these factors are important determinants of asset volatility.

Studies using property-level data have shed light on the magnitude of id-

iosyncratic asset volatility, that is, how much higher asset volatility is than can

be inferred from indexes or other area averages. Plazzi, Torous and Valkanov

(2010) calculate that, aggregated at the metropolitan statistical area-level, the

standard deviation of CRE excess returns ranges from 3.7% to 6.1%, depending

on the property type. By contrast, Downing, Stanton and Wallace (2008) estimate

the asset volatility of CMBS loans using a two-factor Titman and Torous (1989)

model. They find implied volatilities in excess of 20%—higher than our estimates

for their sample period but similar to our post-GFC calculations. Sagi (2021)

uses property-level data from the National Council of Real Estate Investment

Fiduciaries to measure price appreciation volatility. He finds that the standard

deviation of annual price appreciation volatility is about 13%.

7

The mortgage pricing model we use to estimate implied volatility builds on

an extensive body of literature that applies option theoretical methods for pricing

mortgage debt. Some models stipulate a partial differential equation for property

value that is solved using finite difference methods (Titman and Torous, 1989;

Kau et al., 1995). Another popular method, and the one we employ, uses a

binomial model for property valuation (Leung and Sirmans, 1990; Giliberto and

Ling, 1992; Hilliard, Kau and Slawson, 1998; Ciochetti and Vandell, 1999). Similar

to our pricing approach, many of these models incorporate default and prepayment

options. However, while other models assume a single stochastic mean-reverting

interest rate process similar to Cox, Ingersoll and Ross (1985), we model interest

rates using multiple competing models. Furthermore, we include contractual

7

Asset pricing models typically assume that the asset price follows a geometric Brownian motion,

and thus the variance of cumulative price appreciation is linear in the length of the holding period.

Consequently, as the holding period approaches zero, return volatility also approaches zero. By contrast,

Sagi (2021) finds that volatility remains high even for short holding periods. He traces this phenomenon

to transaction risk, finding that the return data fit well to predictions from a search model.

8

characteristics, such as interest-only versus amortizing payment schedules, and

property attributes, such as the cap rate.

Our analysis is closest to that of Downing, Stanton and Wallace (2008).

They also use a two-factor pricing model that prices the mortgage at par, albeit

with the goal to examine the relationship between IVs and CMBS ratings. Similar

to our approach, mortgage value in their model is a function of short rate dynamics

and the property value process. By contrast, our model incorporates a richer set

of loan and property characteristics, including property income and the length

of the interest-only period. Finally, their analysis ends in 2006, while we also

examine developments right before and after the GFC.

C. Evolution of the commercial mortgage-backed securities market

The CRE loans in our data set are CMBS loans: loans originated to be pooled

within Real Estate Mortgage Investment Conduit trusts that issue MBSs. CMBSs

allocate risk among different tranches: the tranches least exposed to credit risk

typically receive investment-grade ratings, while the tranches that absorb credit

losses first are often unrated. In the past two decades, various changes in the

CMBS market affected both the cost of funding and the market for riskier tranches.

In particular, the investor base of riskier tranches changed because of the rise and

fall of CDOs as well as regulatory changes.

Before 2005, unrated tranches were usually held by a set of special

(“B-piece”)

investors, who were involved in security design, performed due diligence, and

selected the servicer responsible for handling delinquencies. In the time period

between 2005 and 2008, it became common practice among CMBS issuers to

repackage such tranches in CRE CDOs. Rating agencies, which made (overly)

optimistic assumptions about the benefits of diversification, assigned favorable

ratings to many CDO tranches. Another factor affecting CMBS markets before

the GFC was a reduction in regulatory capital requirements, as both commercial

bank and investment bank capital requirements for CMBS were reduced in 2004.

Duca and Ling (2020) calculate that commercial bank capital requirements were

reduced from 8% to 2%, while investment bank capital requirements were reduced

from 6% to 3.7%, permitting much higher levels of leverage. As a result, the cost

of funding decreased for both commercial and investment banks, making it easier

for CMBS issuers to sell riskier tranches.

9

After the GFC, CMBS issuance stopped for several years and the CRE

CDO market disappeared. In response to the crisis, regulators increased capital

requirements for commercial banks at the end of 2010, by which time the

major investment banks had been merged with commercial banks. Moreover,

U.S. regulatory agencies proposed Regulation RR, requiring issuers of asset-backed

securities to retain at least five percent of the credit risk, with the intention of

ensuring that issuer incentives are aligned with those of investors.

8

Issuers may

satisfy the risk retention requirement by holding a “vertical” piece of the issued

security, which includes a portion of all tranches, a “horizontal” piece of the

riskiest tranche, or a combination of the two approaches. Although “qualified”

CMBS issuances are exempt from Regulation RR, they are defined in a relatively

conservative manner.

9

Consequently, the risk retention requirement is often

binding for issuers (Flynn Jr, Ghent and Tchistyi, 2020).

Motivated by the substantive variation in the CMBS market and regulatory

environment, we subdivide our sample period into the following four epochs.

1) 2000–04: “B-piece” investors retain the riskiest tranches of CMBSs.

2)

2005–07: CMBS issuers repackage portions of riskier tranches as CRE

CDOs, part of which receive investment-grade ratings. Regulatory capital

requirements associated with CMBS holdings decrease.

3)

2008–15: CMBS issuances plummet then gradually recover to pre-2005 levels.

4) 2016–20: The risk retention rule takes effect in December 2016.

These epoch boundaries are also consistent with the empirical distribution of

CRE loan originations over time. Indeed, as Figure 2 shows, the number of loan

originations exhibits clear cutoffs at the epoch boundaries we use.

8

The risk retention rule was finalized in October 2014 and came into full effect in December 2016.

See https://www.sec.gov/news/pressrelease/2014-236.html for more information.

9

Regulation RR defines a qualifying CRE loan as a fixed-rate loan with a minimum maturity of

10 years and a maximum amortization period of 25 years. Lenders must document property income

for at least the previous two years. The borrower’s debt service ratio must exceed 1.25 for multifamily

properties, 1.5 for leased properties, and 1.7 for all other loans. Furthermore, the combined LTVs of all

loans on the property cannot exceed 70%, and the LTV of the first lien loan cannot exceed 65%.

10

III. Data construction and summary statistics

A. Securitized mortgage loan data collection

Our data consist of 58,127 securitized CRE loans from the year 2000.

10

The data are provided by Morningstar, which gathers information from public

CMBS disclosures, including a rich set of loan and property characteristics.

The Morningstar data include loans originated by a variety of institutions and are

not dominated by a single underwriting approach. Many loans are originated by

large U.S. banks, such as Bank of America and Citibank. The top ten originators

also include large foreign banks, such as Deutsche Bank, Credit Suisse, and UBS.

Non-depository institutions are a substantial part of the market, but no single

such institution has a large market share.

The complete data set consists of 111,465 loans. For the purposes of our

analysis, we drop loans missing key variables needed for our analysis and loans

with problematic observations (see Appendix A for more details). Specifically,

we drop loans that have missing or wrong data for key inputs such as the date of

origination, the loan interest rate, whether the loan is interest-only or amortizing,

and the date of maturity. We also drop non-fixed-rate and pari passu loans, which

our model does not price, as well as agency CMBS loans because the agency

guarantees would distort our implied volatility estimates. Finally, for analytical

and expositional simplicity, we restrict our sample to single-property loans, which

constitute the overwhelming majority of observations.

The data collection process described above results in a sample of 58,127

CRE loans. We present summary statistics for these loans in Table 1 and their

corresponding cross-sectional distributions in Figure F2 of Appendix F. Loans

vary widely in size, from $2 million to over $2.5 billion. LTVs are generally around

70%. The debt yield, the ratio of net operating income (NOI) to loan amount at

origination, varies between 7% and 15%. The debt service coverage ratio (DSCR),

the ratio of NOI to debt servicing amount at origination, falls generally between 1.2

and 2.4. The vast majority (more than 80%) of loans are 10-year loans.

10

Securitized CRE loans are only part of the overall CRE loan market. Black et al. (2017) compare

CMBS loans in the Morningstar data with portfolio CRE loans reported by large U.S. banks on the

FR Y-14 form. They find that these banks are more likely to hold riskier loans, such as construction

loans, in their portfolio. Portfolio loans are also more likely to have floating interest rates, shorter terms,

and lower LTVs than CMBS loans. From their results, it is not clear that securitized and portfolio CRE

loans differ when one sets aside construction loans, which we exclude from our empirical analysis.

11

Table 1—Characteristics of sample commercial real estate loans

This table shows summary statistics for key characteristics of commercial real estate mortgage loans

in our sample, containing fixed-rate, single-property loans securitized in non-agency commercial

mortgage-backed securities (CMBSs). From left to right, the columns show the number of observations

and the sample mean, standard deviation, as well as the 10

th

and 90

th

percentiles of variables in the

cross section of sample loans. At the bottom of the table, the respective spread measures represent

the percentage point yield spreads of sample loans over the 10-year zero-coupon U.S. Treasury yield

and the value-weighted effective yield of the securities constituting the ICE BofA 0-to-3-year AAA

U.S. Fixed-Rate CMBS Index. (Source: ICE Data Indices, LLC, used with permission.)

Count Mean SD P10 P90

Loan amount ($1,000) 58,127 11,465 16,694 2,010 24,260

Loan term (months) 58,127 113 24 83 120

Amortization period (months) 58,127 312 110 0 360

Interest-only period (months) 58,127 21 35 0 60

Loan-to-value ratio 58,127 0.68 0.11 0.55 0.79

Debt yield 58,127 0.11 0.04 0.07 0.15

Debt service coverage ratio 58,127 1.69 0.71 1.18 2.32

Spread over 10-yr U.S. Treasury (pp) 58,127 1.85 0.75 0.92 2.78

Spread over 0-3-yr AAA CMBS (pp) 58,127 1.84 1.17 0.36 3.32

Figure 2 and Table 2 show the distribution of observations over time and

across property types. The volume of loan originations steadily increased until the

GFC, fell to almost zero in 2008, and gradually recovered after 2010. The most

common property types are retail and multifamily, and also a large number of

loans belong to the “other” category.

11

Hotel and industrial properties have the

smallest frequency share in the sample.

We present summary statistics for the properties used as collateral for sample

CRE loans in Table 3. The median property is nine years old and nearly fully leased.

Properties vary widely in size, from 16 thousand to 24 million sqft. Some property-

level variables are unevenly populated, mostly due to heterogeneous measurement

and reporting standards across property types. For instance, information on the

lead tenant is not collected for multifamily properties because they have many

small units, each leased to a different tenant.

11

The “other” category consists of mini-storage and mixed-use properties representing a combination

of property types such as a complex with both multifamily and retail property.

12

Figure 2. Annual number of sample commercial real estate loan originations over time

This figure shows the annual number of commercial real estate mortgage loan originations in our

sample, color coded by time period (epoch). The sample contains fixed-rate, single-property loans

securitized in non-agency commercial mortgage-backed securities. Epoch choice is explained in Section II.C.

0

2,000

4,000

6,000

8,000

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Number of Observations Over Time

Table 2—Distribution of sample commercial real estate loans across property types

This table shows the absolute and relative frequencies of commercial real estate mortgage loans in our

sample across different collateral property types. The sample contains fixed-rate, single-property loans

securitized in non-agency commercial mortgage-backed securities.

Property type Count Share

Hotel 4,808 8.3%

Industrial 3,052 5.3%

Multifamily 18,972 32.6%

Office 9,308 16.0%

Other 5,903 10.2%

Retail 16,084 27.7%

Total 58,127 100.0%

In our data filtering, we drop loans with a debt yield less than 0.07 and DSCR

less than 1.25. These lower bounds correspond to standard underwriting limits

(i.e., lenders are reluctant to lend if the debt yield or DSCR is too low) and fall

around the 10

th

percentile in our full sample of CMBS loans. When the debt

yield and DSCR are very low, it may suggest that the property is not currently

13

Table 3—Characteristics of sample commercial real estate loan properties

This table shows summary statistics for key characteristics of the properties used as collateral for

commercial real estate mortgage loans in our sample at the time of loan origination. The sample contains

fixed-rate, single-property loans securitized in non-agency commercial mortgage-backed securities.

From left to right, the columns show the number of observations and the sample mean, standard

deviation, as well as the 10

th

and 90

th

percentiles of variables in the cross section of sample properties.

The area of the property in square feet, as well as the derived variables occupancy rate and lead tenant

share, are available only for industrial, office, retail, and most “other” property types. By commercial real

estate market convention, the size of hotel and multifamily properties is measured by the number of units.

Count Mean SD P10 P90

Property value ($1,000) 58,127 17,524 28,014 3,070 36,000

Net operating income ($1,000) 58,127 1,158 1,771 214 2,335

Area (1,000 sqft) 33,562 112.45 151.08 15.99 240.02

Age (years) 52,569 14.26 15.77 1.00 35.00

Occupancy rate 31,929 0.94 0.10 0.83 1.00

Lead tenant area share 29,333 0.42 0.29 0.12 1.00

Lead tenant lease length (years) 29,832 15.98 240.45 2.17 16.25

stabilized—even if it may be anticipated to be shortly. Since our model uses the

property’s underwritten cap rate as an input, including non-stabilized properties

would distort our implied risk estimate. We are left with 48,468 observations,

which we use throughout our empirical analysis in the paper.

B. Adjustment for capital market liquidity dynamics

One limitation of our mortgage valuation model is that it incorporates only

two dynamic factors: the short interest rate process and the property value process.

However, in practice, Christopoulos (2017) shows that mortgage pricing is also

affected by a time-varying liquidity premium. Therefore, without appropriate

correction, our model would attribute an increase in primary CRE mortgage rates

due to a higher liquidity premium to increased credit risk, which would cause an

upward bias in our volatility estimates.

We take the liquidity premium into account by adjusting loan rates before

the model-based property valuation step. Specifically, we create a monthly time

series of the CMBS liquidity spread by taking the value-weighted effective yield of

securities in the ICE BofA 0-to-3-Year AAA U.S. Fixed-Rate CMBS Index minus

the yield of zero-coupon U.S. Treasury securities with the corresponding effective

14

(i.e., option-adjusted) duration.

12

We then adjust the mortgage rate for each loan

by the prevailing liquidity spread as follows:

(1) r

adj

= r

observed

− (CMBS spread − 120bp),

where 120 basis points is the median value of the CMBS yield spread defined

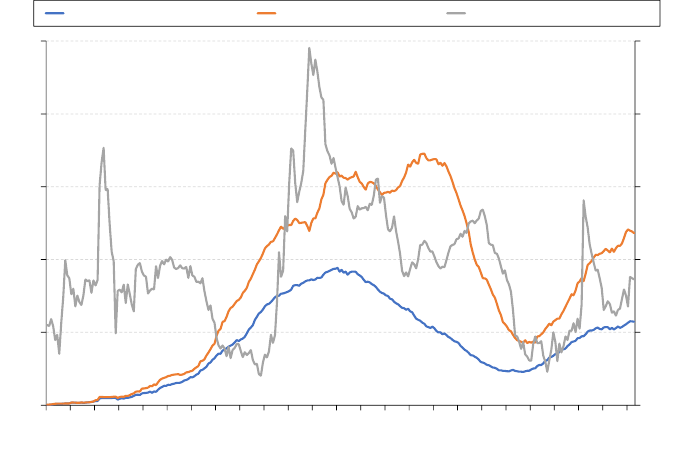

above. Figure 3 shows the yield spread and the number and market value of the

CMBSs with the shortest duration. Although this adjustment leaves a constant

baseline level of liquidity premium embedded in mortgage rates, the remaining

upward bias should permit relative comparisons of perceived property risk over

time based on our model-implied volatilities.

Figure 3. Statistics for 0-to-3-year AAA fixed-rate commercial mortgage-backed securities

This figure shows quarterly aggregates from 1998 to 2022 for the commercial mortgage-backed

securities (CMBSs) constituting the ICE BofA 0-to-3-Year AAA U.S. Fixed-Rate CMBS Index. (Source:

ICE Data Indices, LLC, used with permission.) UST yield spread is defined as the basis point (bp)

difference between the value-weighted mean effective yield of the index constituents over the yield of

the corresponding zero-coupon U.S. Treasury security with maturity equal to the value-weighted mean

effective duration of the index constituents.

32

64

128

256

512

1,024

0

50

100

150

200

250

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Number of securities (x10) Market value ($ billion) UST yield spread (bp, right)

12

Source: ICE Data Indices, LLC, used with permission.

15

IV. Implied volatility estimation and diagnostics

We use a two-factor model (with disaster risk) to estimate implied asset

volatility, which we then use as a proxy measure for perceived property risk.

The model ignores correlations between U.S. Treasury yields and property values

and is described in Appendix B. Although there is no standard way to measure

property risk in the presence of market frictions and incompleteness, our implied

volatility estimate is a reasonable measure of risk perception.

13

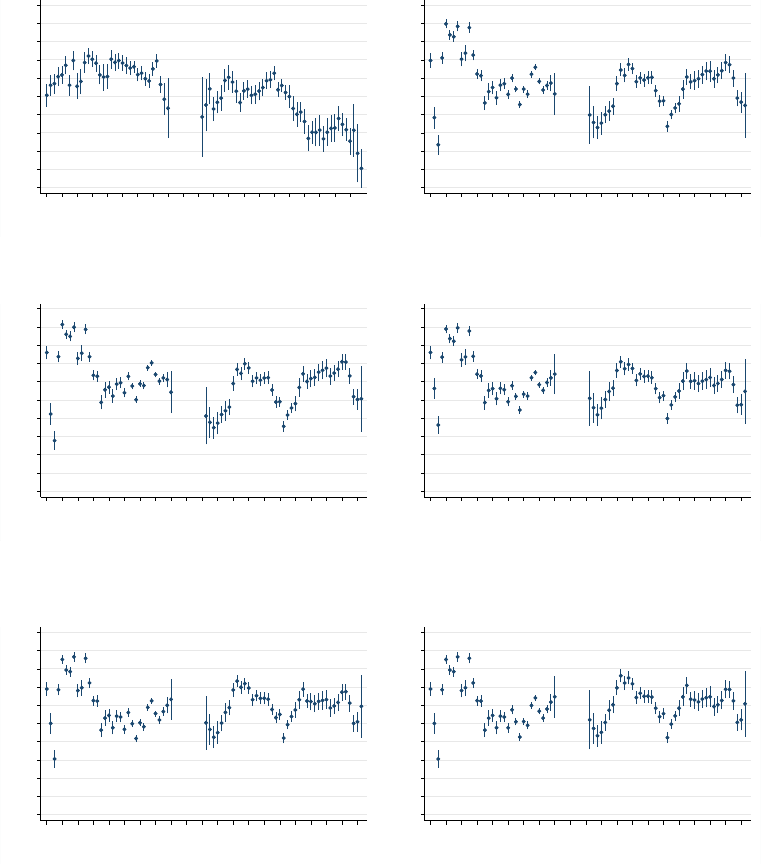

Figure 4 shows different implied volatility estimates based on our model.

The first IV estimate makes no liquidity adjustments to mortgage rates and does

not consider the effect of prepayment options. The second IV estimate allows

for optimal prepayment in the presence of contractual penalties. Save for 2012,

the presence of prepayment penalties makes little difference in implied volatility.

This is because prepayment penalties, which are ubiquitous in the CRE mortgage

market, are usually sufficiently punitive to render the value of a prepayment

option second-order in mortgage valuation. Notably, given missing data problems

(see Appendix A for further details), ignoring prepayment options in our model

has the advantage of permitting a larger data set. The third IV estimate applies

the liquidity adjustment to mortgage rates discussed in Section III.B and ignores

prepayment options. Adjusting rates for mortgage market liquidity has a profound

effect on the implied measure of property risk. Therefore, because of concerns

raised earlier about risk mismeasurement, we use the liquidity-adjusted implied

volatilities throughout our empirical analysis in the paper.

Figure 5 depicts the distribution of implied volatilities calculated using liquidity

adjustments (and no prepayment options). The time series mean (median) is 20%

(19%) and the standard deviation is 7.5%. The time variation in IVs is pronounced

and corresponds to shifts in the entire distribution, which suggests that perceived

property risk changes systematically over time. It is tempting to expect this time

series variation to coincide with property market cycles, but that need not be the

case because risk perceptions and liquidity on the credit market also affect the

13

The risk-neutral valuation methodology is based on the assumption that contingent claims can

be replicated through self-financing portfolio strategies. Clearly, this assumption does not hold in the

illiquid real estate market. Hence, in some sense, relying on the risk-neutral valuation methodology is

similar to assuming the normality of unobserved shocks in a linear filtering problem. We acknowledge the

limitations of this approach and provide validity and robustness tests, but our IV estimate is ultimately a

proxy measure for, rather than an exact identification of, the property risk perceived by lenders.

16

Figure 4. Sample means of implied volatility estimates over time

This figure shows the cross-sectional means of the estimated model-implied volatilities of commercial real

estate mortgage loans in our sample over time. The sample contains fixed-rate, single-property loans,

with debt yields over 7% and debt service coverage ratios over 1.25, securitized in non-agency commercial

mortgage-backed securities. The implied volatilities are estimated using the two-factor model described

in Appendix B. There are three batches of estimates: a baseline batch without prepayment penalties

or market liquidity adjustment, a batch with prepayment penalties, and a batch with market liquidity

adjustment. The market liquidity adjustment process is explained in Section III.B.

0.00

0.05

0.10

0.15

0.20

0.25

0.30

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Baseline Prepayment Liquidity

property market equilibrium. For example, during times of low perceived risk

and high liquidity in credit markets, more properties meet lenders’ and borrowers’

criteria for financing. Hence, the effect of credit market cycles is also reflected in

CRE loan terms and, ultimately, in our volatility estimates.

Indeed, the period with the lowest average IV is 2003–07, which coincides with

the period of the greatest number of CMBS loan originations (Figure 2) and liquid

credit markets. Meanwhile, IVs in 2008–10 are likely biased downward because

lenders extended credit only to the safest properties as credit markets dried up

(Figure 3). By contrast, the highest IVs come from 2001 and 2017–19, which are

periods characterized by relative liquidity in credit markets. Such high IVs are a

function of higher-than-average perceived property risk in the aggregate as well as

an increased willingness by lenders and borrowers to finance riskier assets.

17

Figure 5. Sample quartiles of implied volatilities over time

This figure shows the cross-sectional quartiles of the estimated model-implied volatilities of the commercial

real estate mortgage loans in our sample over time. The sample contains fixed-rate, single-property loans,

with debt yields over 7% and debt service coverage ratios over 1.25, securitized in non-agency commercial

mortgage-backed securities. The implied volatilities are estimated using the two-factor model described in

Appendix B, applying the market liquidity adjustment explained in Section III.B. For lack of observations,

the quartiles cannot be estimated in 2009, when the commercial real estate mortgage market dried up.

0.00

0.05

0.10

0.15

0.20

0.25

0.30

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

1st Quartile Median 3st Quartile

A. Structural determinants of implied volatility

One potential critique of our use of implied volatility as a proxy for perceived

property risk is the claim that lenders were risk insensitive when setting CRE

loan spreads pre-GFC. In particular, our IVs might capture something other

than property risk in the run-up to the GFC. For instance, pressure to originate

for fees during the height of CDO issuances could have spurred competition for

originating CMBS loans, resulting in exceptionally low mortgage rates, which do

not accurately reflect the true risk of the underlying properties.

We address this critique, and validate the conjecture that implied volatility

is related to structural determinants of property risk, by investigating the pre-

and post-GFC drivers of IV and verifying whether relevant macroeconomic and

property-level risk indicators contributed similarly to risk perceptions over time.

Table 4 examines the pre- and post-crisis relationship between IV (the dependent

18

variable) and various structural variables, such as state GDP, real estate sector

GDP, unemployment rate, and income per capita as well as property size and age.

Property and interacted state and time fixed effects are included. Property age,

state GDP, and state employment rates are positively correlated with risk,

consistent with the findings in Fisher et al. (2022) that urban density is associated

with higher property market risk. Controlling for these variables, we find that

property size and state income levels are negatively related to risk. Importantly,

almost every coefficient that is significant post-GFC is also significant pre-GFC

and has the same sign. If anything, the marginal effects of these variables on IV

are stronger before the crisis than after it.

Table 4—Marginal effects of structural variables on implied volatility (%)

This table shows the estimated marginal effects of relevant local macroeconomic and property-specific

variables on the estimated model-implied volatilities of commercial real estate mortgage loans in our

sample. The sample consists of fixed-rate, single-property loans, with debt yields over 7% and debt service

coverage ratios over 1.25, securitized in non-agency commercial mortgage-backed securities. The marginal

effects are estimated on subsamples before and after the Global Financial Crisis (GFC), using a linear

regression model with the logarithm of implied volatility as dependent variable. The model includes

loan originator, property state, and property type-quarter of origination fixed effects. Standard errors

are double clustered by state and quarter. The implied volatilities are estimated using the two-factor

model described in Appendix B, applying the market liquidity adjustment explained in Section III.B.

Local macroeconomic variables are measured at a quarterly frequency and obtained from the Bureau of

Economic Analysis. “GDP in sector” stands for the gross domestic product of the real estate industry.

Pre-GFC Post-GFC

100 × Log of state real GDP (USD mm) 0.008

∗

0.009

∗∗

100 × Log of state real GDP in sector (USD mm) 0.012 −0.002

100 × Log of state income per capita (USD) −0.045

∗∗

−0.027

∗∗∗

State unemployment rate (%) −0.128 −0.126

∗∗∗

Property Age (years) 0.022

∗∗∗

0.008

∗∗∗

100 × Log of property size (sqft) −0.010

∗∗∗

−0.004

∗∗∗

100 × Log of property size (units) −0.110

∗∗∗

−0.043

∗∗∗

Number of observations 25,493 15,869

∗

p < 0.1,

∗∗

p < 0.05,

∗∗∗

p < 0.01

Additional analysis, not reported here, suggests no significant difference

across IVs based on whether CRE loans were issued by large U.S. banks, smaller

U.S. banks, foreign banks, nonbank lenders, or ex-post acquired or failed lenders.

Overall, we find no empirical evidence that IVs were decoupled from property

fundamentals before the GFC, as compared to the post-GFC period.

19

V. Loan-to-value ratios and risk perceptions

Consistent with a tradeoff theory of optimal firm leverage, Figure 6 shows

that LTV exhibits a strong inverse relationship with implied volatility. Indeed,

a linear regression of IV on LTV yields a far superior fit than a regression on the

other two common CRE mortgage metrics (i.e., DSCR and debt yield). At any

level of perceived property risk, it appears that LTVs were generally highest in

Epoch 1 (2000–04). A notable exception is low-risk loans (with IVs below 15%),

for which the most aggressive period was Epoch 2 (2005–07), when the issuance of

CDOs became prevalent. Interestingly, the same epoch has relatively conservative

LTVs for high-risk loans (with IVs above 20%), while the risk-retention Epoch 4

features slightly higher LTVs than Epoch 3 (2008–15).

Figure 6. Mean loan-to-value ratios across implied volatility bins and epochs

This figure shows the sample means of the loan-to-value ratios (LTVs) of commercial real estate

loans that fall into a given integer bin of model-implied volatility and were originated in a given

time period (epoch). The sample contains fixed-rate, single-property loans, with debt yields over 7%

and debt service coverage ratios over 1.25, securitized in non-agency commercial mortgage-backed

securities. Epoch choice is explained in Section II.C. The implied volatilities are estimated using the two-

factor model described in Appendix B, applying the market liquidity adjustment explained in Section III.B.

0.3

0.4

0.5

0.6

0.7

0.8

0.10 0.15 0.20 0.25 0.30 0.35

Implied Volatility

2000-04 2005-07 2008-15 2016-20

It is important to emphasize that the inverse relationship in Figure 6 is not

tautological. In a frictionless setting, a so-called Modigliani-Miller world, LTV

20

would be arbitrary, and plotting LTVs against IVs would yield no (or a random)

pattern. By contrast, the theories of credit rationing (Jaffee and Russell, 1976;

Leland and Pyle, 1977) and tax benefit–bankruptcy tradeoff (Leland, 1994) predict

a downward-sloping relationship, which we observe empirically.

Figure 6 suggests that there is time variation in leverage choice, even after we

control for perceived property risk. This variation may arise simply from shifts in

the credit rationing frontier, but it may also be due to differences in cap rates or

other, potentially unobserved, property characteristics. In principle, any variable

that affects optimal firm leverage can confound the observed relationship between

LTV and IV. Such variables may include the local credit environment, the marginal

tax rate of investors, and capital expenditure expectations not reflected in cap

rates. In our analysis, we control for such factors and examine their effect on LTV

to gain insight into the evolution of the supply and demand of CRE credit.

A. Credit rationing frontier estimation and diagnostics

In this subsection, we estimate the credit rationing frontier and examine

changes in it over time. Since applying a rationing frontier results in a truncated

distribution of observed LTVs, the observed mean of LTVs moves monotonically

with the truncation point, as long as the distribution of borrower demand is

unchanged. Therefore, a natural question is how much variation in LTV is driven

by changes in the frontier. Our conjecture is that more aggressive lending practices

would primarily be manifested as increases in the rationing frontier.

We define and estimate the rationing frontier as a function of IV, which

shows the maximum amount of leverage that lenders are willing to accept at a

certain level of perceived property risk. Given the scarcity of observations at the

extremes of the distribution, we estimate the frontier only for IVs between 5%

and 40%. The existence of a rationing frontier is clearly visible (see Figure F3 in

the Appendix), with clustering at around 80% LTV for IVs between 5% and 20%.

Using a quantile regression, we estimate the frontier as the 95

th

percentile of LTV

within each 1 percent IV interval (“IV bin”) for each of the four epochs.

14

14

In unreported non-parametric analysis, we verify that the rationing frontier estimate is robust to

the choice of the specific LTV percentile. Furthermore, the 95

th

percentile passes density discontinuity

tests and falls within the cluster of observations lying on the frontier in all four epochs.

21

Figure 7 shows the rationing frontier estimates as a function of IV by epoch.

The 2005–07 epoch stands out in being generally lower than the others. Using the

standard error estimates from our quantile regression, a pairwise mean comparison

across rationing frontier estimates across epochs (see Table 5) shows that the

frontier for this period is, on average, about 4 percentage points lower than the

frontier for the 2000–04 epoch, and about 2 to 3 percentage points lower than the

frontiers after the GFC. This result is contrary to the common belief that lending

standards were lax in the period leading up to the crisis.

Figure 7. Credit rationin g frontier estimates by epoch

This figure shows our credit rationing frontier estimates across periods (epochs). The frontiers are

estimated by fitting a quantile regression model for the 95

th

percentile of the loan-to-value ratios (LTVs) of

commercial real estate loans that fall into a given integer bin of model-implied volatility and were originated

in a given epoch. The estimation sample contains fixed-rate, single-property loans, with debt yields over

7% and debt service coverage ratios over 1.25, securitized in non-agency commercial mortgage-backed

securities. Epoch choice is explained in Section II.C. The implied volatilities are estimated using the two-

factor model described in Appendix B, applying the market liquidity adjustment explained in Section III.B.

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

LTV

0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40

Implied Volatility

2000-04 2005-07 2008-15 2016-20

Overall, our analysis of rationing frontiers does not support a narrative that

CRE lending was more aggressive in the 2005–07 epoch. One possible resolution

for the paradox of low rationing frontier in this epoch is that perceived property

risk was systematically biased downward. Such misperceptions may have led

to excessive supply of credit (e.g., an 80% LTV loan for a property deemed

22

Table 5—Testing mean differences between rationing frontier estimates across epochs

This table shows the results of statistically testing mean differences between rationing frontier estimates

across different periods (epochs). The frontiers are estimated by fitting a quantile regression model

for the 95

th

percentile of the loan-to-value ratios of commercial real estate loans that fall into a given

integer model-implied volatility bin and were originated in a given epoch. The estimation sample

contains fixed-rate, single-property loans, with debt yields over 7% and debt service coverage ratios over

1.25, securitized in non-agency commercial mortgage-backed securities. Epoch choice is explained in

Section II.C. The implied volatilities are estimated using the two-factor model described in Appendix B,

applying the market liquidity adjustment explained in Section III.B. From left to right, the columns

show the mean differences (Diff.), their standard errors (Std. err.), t-statistics, and corresponding p-values.

Frontier pair Diff. Std. err. t-stat p-value

2005–2007 vs. 2000–2004 −0.041 0.0022 −18.64 0.0000

2008–2015 vs. 2000–2004 −0.012 0.0016 −7.86 0.0000

2016–2020 vs. 2000–2004 −0.025 0.0016 −15.22 0.0000

2008–2015 vs. 2005–2007 0.029 0.0023 12.36 0.0000

2016–2020 vs. 2005–2007 0.017 0.0023 7.09 0.0000

2016–2020 vs. 2008–2015 −0.012 0.0018 −6.86 0.0000

to have a volatility of 13% when its volatility is in fact 21%). An alternative

explanation is that loan originators were less risk sensitive when setting mortgage

rates because property risk would affect tranches that were subsequently placed

in CDOs. Although plausible at face value, this alternative is not supported by

our empirical analysis of IV determinants in Section IV, leaving open the question

why credit rationing was tighter in 2005–07.

B. Quantification of loan-to-value ratio determinants

Although we find no empirical support for a laxer credit rationing frontier

before the crisis, it is still useful to examine if shifts in the frontier, which may

be partly driven by imprudent lending practices, have a substantive effect on

the distribution of LTVs. Indeed, based on the analysis of the rationing frontier,

one might argue that the 2000–04 epoch was characterized by lending that was

too permissive. In this section, we analyze the influence of such frontier shifts and,

more broadly, investigate how much of the variation in LTV can be explained by

changes in risk perceptions and property fundamentals.

For our LTV analysis, we introduce the following notation. The demand for

credit by the borrower of loan

i

is

LT V

i

. The amount of credit that is observed to

be extended is

cLT V

i

=

min{R

(

c

i

, b

(

IV

i

))

, LT V

i

}

, where

R

(

c, k

) is the rationing

23

frontier in Epoch

c

and implied volatility bin

k

, as identified in the previous section.

We fit a censored linear regression (tobit) model to cLT V of the form:

(2)

cLT V

i

= max

0, min

R(c

i

, b(IV

i

)),

µ

type

+ µ

s,q

+ o

i

+ α(c

i

)IV

i

+ β

1

CRS

i

+ β

2

CRS

i

2

+ m

m

m

q

γ

γ

γ + ε

i

=

= max

0, min

R(c

i

, b(IV

i

)), x

i

β + ε

i

,

where

µ

type

are property type fixed effects,

µ

s,q

are quarterly time fixed effects and

state/county fixed effects,

o

i

are originator fixed effects,

IV

is implied volatility

(with epoch-specific coefficients), CRS is the cap rate spread over the 10-year

U.S. Treasury yield, and

ε ∼ N

(0

, σ

2

ε

) is the model noise term.

15

Additionally,

m

m

m

q

is a vector of quarterly macro-level variables that we include in model

specifications without time fixed effects.

We present the model coefficient estimates in Table 6, which indicate a strong

negative relationship between LTV and IV. Notably, strictly on its own, and with

a fixed slope coefficient, IV explains two-thirds of LTV variation over time. When

we control for time and property type fixed effects,

2005–07

emerges as the epoch

with the highest sensitivity to IV. This result is also robust to the presence of fixed

effects for the 111 originators in our sample, which suggests that the idiosyncratic

characteristics of individual originators—including those that potentially overstate

property fundamentals, as documented in

Griffin and Priest (2023)

—do not drive

the estimated relationship between LTV and IV. The coefficient of the cap rate

spread is significant and takes the negative sign predicted in Leland (1994).

The CMBS yield spread of short-term AAA CMBS bonds over U.S. Treasury

securities, which measures illiquidity in the mortgage market, accounts for a

large portion of the time series variation in the data. Construed as a cost of

financing, market illiquidity should negatively impact the choice of optimal leverage,

consistent with the sign of its estimated coefficient.

Using the model coefficient estimates, we conduct a counterfactual analysis,

investigating the effect of LTV determinants over time. In particular, we examine

15

The cap rate spread over the 10-year yield is a measure of the cap rate net of the risk-free rate.

Leland (1994) shows that optimal LTV should decline with cap rate. The intuition is that, under the

risk-neutral measure, all assets grow at the same rate (the risk-free rate), so an asset that reinvests income

will grow more than an asset that distributes income. Correspondingly, a slower-growing asset is more

likely to default at loan maturity. We use net cap rate because interest rates experienced a secular decline

between 2000 and 2020, accompanied by a commensurately declining property cap rate.

24

Table 6—Estimation results of censored linear regression for the loan-to-value ratio

This table shows the estimation results of the censored linear regression model defined in Equation

(2)

.

The estimation sample contains fixed-rate, single-property loans, with debt yields over 7% and debt service

coverage ratios over 1.25, securitized in non-agency commercial mortgage-backed securities. The dependent

variable is the loan-to-value ratio, and IV stands for the model-implied volatility estimate for sample loans.

The implied volatilities are estimated using the two-factor model described in Appendix B, applying the

market liquidity adjustment explained in Section III.B. The columns show different model specifications

with an expanding set of explanatory variables and fixed effects included. Standard errors are clustered

by the quarter of loan origination and reported under the corresponding coefficient estimates in parentheses.

(1) (2) (3) (4) (5) (6) (7) (8)

IV -1.28

(0.05)

2000–2004 # IV -1.23 -1.21 -1.46 -1.40 -1.39 -1.38 -1.16

(0.05) (0.05) (0.07) (0.06) (0.06) (0.06) (0.04)

2005–2007 # IV -1.37 -1.32 -1.68 -1.64 -1.61 -1.64 -1.42

(0.05) (0.07) (0.03) (0.03) (0.03) (0.03) (0.06)

2008–2015 # IV -1.37 -1.34 -1.16 -1.29 -1.27 -1.26 -1.17

(0.05) (0.06) (0.03) (0.03) (0.03) (0.03) (0.04)

2016–2020 # IV -1.27 -1.25 -1.23 -1.31 -1.29 -1.28 -1.25

(0.04) (0.05) (0.03) (0.03) (0.03) (0.03) (0.04)

Caprate spread 0.15 -0.07 -0.20 -0.40 -0.43 -0.14

(0.19) (0.13) (0.12) (0.12) (0.12) (0.16)

CMBS yield spread -4.62

(0.73)

UST 10yr yield 0.31

(0.37)

Time (quarterly) x x x

Property type x x x x x

Loan originator x x x x

Property state x

Property state × Time x

Property county x

Generalized R

2

0.61 0.62 0.63 0.71 0.73 0.74 0.76 0.71

Number of observations 45,917 45,917 45,917 45,917 45,917 45,878 45,878 45,779

the effect of shifts in the rationing frontier across epochs on LTVs. To this end,

we estimate counterfactual LTVs, denoted as

cLT V

∗

, setting certain independent

variables in the model constant over time. Formally, we estimate

cLT V

∗

i

= E

n

max

0, min

R(c

∗

i

, b(IV

∗

i

)), LT V

∗

| cLT V

i

,

ˆ

β

β

β, ˆσ

2

ε

,x

x

x

∗

i

o

,(3)

where

cLT V

is the observable,

cLT V

∗

is the censored counterfactual, and

LT V

∗

is the latent counterfactual LTV of the loan,

ˆ

β

β

β

and

ˆσ

2

ε

are the vector of coefficient

estimates and the noise variance estimate from the 8

th

model specification in

Table 6, and

x

x

x

∗

i

is the vector of independent variable values we use for a specific

25

counterfactual scenario. Depending on the observed relation of

cLT V

and the

rationing frontier R, the expression in Equation (3) becomes

(4) cLT V

∗

i

=

max

0, min

R

∗

i

, cLT V

i

+ (x

x

x

∗

i

ˆ

β

β

β − x

x

x

i

ˆ

β

β

β)

if cLT V

i

< R

i

,

E

n

max

0, min

R

∗

i

, LT V

∗

i

o

if cLT V

i

>= R

i

,

where

R

i

=

R

(

c

i

, b

(

IV

i

)) is the original rationing frontier,

R

∗

i

=

R

(

c

∗

i

, b

(

IV

∗

i

))

is the rationing frontier in the counterfactual scenario, and

LT V

∗

i

is the latent

counterfactual LTV of the loan, which follows the truncated normal distribution

N

T R

(x

x

x

∗

i

ˆ

β

β

β, ˆσ

2

ε

) with lower bound R

i

+ (x

x

x

∗

i

ˆ

β

β

β − x

x

x

i

ˆ

β

β

β).

Figure 8 shows the mean LTV in each year of the original data set (Panel A)

and for various counterfactual data sets (Panels B through F). The original data

clearly exhibit a secular decline of LTVs over the sample period. However, this

trend disappears in Panel B, using a counterfactual data set where IV for each

loan is fixed at its sample mean (20%). Further setting the cap rate spread to its

sample mean of 3.7% (Panel C) does not make much difference (consistent with

the estimate in Column 8 of Figure 8). Fixing the CMBS yield spread does appear

to reduce the time series variation (Panel D), while fixing the U.S. Treasury yield

has little effect (Panel E). Importantly, fixing the rationing frontier to correspond

to the first epoch (2000–04) also has little effect on the time series means (Panel F).

Recalling that the first epoch features the most permissive rationing frontier and

the second epoch the least, one might expect a large change in LTVs in the 2005–07

epoch when moving from Panel E to Panel F. Our analysis suggests that shifts in

the rationing frontier have little effect on the distribution of LTVs.

26

Figure 8. Means of actual and counterfactual loan-to-value ratios over time

This figure shows the means of the actual (Panel A) and counterfactual (rest of the panels) loan-to-value

ratios of commercial lean estate loans in the sample over time, with 99% confidence intervals. The sample

contains fixed-rate, single-property loans, with debt yields over 7% and debt service coverage ratios over

1.25, securitized in non-agency commercial mortgage-backed securities. The counterfactual loan-to-value

ratios are estimated by applying Equation

(3)

and using the 8

th

censored linear model specification in

Table 6. Panels B to F incrementally fix the values of various explanatory variables. UST stands for

the 10-year zero-coupon U.S. Treasury yield, while IV and CRS stand for model-implied volatility and

capitalization rate spread over the UST, respectively.

(a) Actual sample means

0.56

0.58

0.60

0.62

0.64

0.66

0.68

0.70

0.72

0.74

0.76

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

(Unconditional)

Mean LTVs with 99% CIs

(b) Setting IVs to 20%

0.56

0.58

0.60

0.62

0.64

0.66

0.68

0.70

0.72

0.74

0.76

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

(Conditional on IV = 20%)

Mean LTVs with 99% CIs

(c) Setting IVs to 20% and CRSs to 370bp

0.56

0.58

0.60

0.62

0.64

0.66

0.68

0.70

0.72

0.74

0.76

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

(Conditional on IV = 20% and CRS = 370bp)

Mean LTVs with 99% CIs

(d) Setting IVs to 20%, CRSs to 370bp, and

CMBS spread to 120bp

0.56

0.58

0.60

0.62

0.64

0.66

0.68

0.70

0.72

0.74

0.76

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

(Conditional on IV = 20%, CRS = 370bp, and CMBS = 120bp)

Mean LTVs with 99% CIs

(e) Setting IVs to 20%, CRSs to 370bp,

CMBS spread to 120bp, and UST to 3.2%

0.56

0.58

0.60

0.62

0.64

0.66

0.68

0.70

0.72

0.74

0.76

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

(Conditional on IV = 20%, CRS = 370bp, CMBS = 120bp, UST10 = 3.2%)

Mean LTVs with 99% CIs

(f) Setting IVs to 20%, CRSs to 370bp,

CMBS spread to 120bp, UST to 3.2%, and fixing

rationing frontier at Epoch 1 level

0.56

0.58

0.60

0.62

0.64

0.66

0.68

0.70

0.72

0.74

0.76

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

(Conditional on IV = 20%, CRS = 370bp, CMBS = 120bp, UST10 = 3.2%, and Static Frontier)

Mean LTVs with 99% CIs

27

Table 7 compares the annual counterfactual LTV means across the four epochs

and shows that they are statistically distinct. This result means that there is still

statistically significant residual variation across epochs, even after controlling for

IV, cap rate, CMBS spread, U.S. Treasury yield, and changes in the rationing

frontier. That said, the residual time variation does not seem to coincide with

macro events and may rather correspond to shifts in the demand for CRE loans.

Moreover, the residual differences in mean LTV are economically small: less than

three percentage points across all three epochs in Column 6 of Table 7. Notably,

the residual mean differences between Epochs 1 and 4 as well as the difference

between Epochs 2 and 3 are less than one percentage point.

Table 7—Actual and counterfactual means of loan-to-value ratios across epochs

This table shows the means of the actual (Column 1) and counterfactual (rest of the columns) loan-to-value

ratios of commercial lean estate loans in the sample across periods (epochs). The sample contains

fixed-rate, single-property loans, with debt yields over 7% and debt service coverage ratios over 1.25,

securitized in non-agency commercial mortgage-backed securities. The counterfactual loan-to-value ratios

are estimated by applying Equation

(3)

and using the 8

th

censored linear model specification in Table 6.

Each regression, (2)-(6) incrementally fixes the values of various explanatory variables. US10 stands for

the 10-year zero-coupon U.S. Treasury yield, while IV and CRS stand for model-implied volatility and

capitalization rate spread over the US10, respectively. CMBS stands for the market liquidity spread

defined in Section III.B. Robust standard errors are reported in parentheses. At the bottom,

F-statistics

are reported for the joint mean equality tests across Epochs 1 to 4 and Epochs 2 to 4, respectively.

Epoch (1) (2) (3) (4) (5) (6)

2000–2004 68.8 69.4 69.8 69.7 69.1 69.1

(0.1) (0.1) (0.1) (0.1) (0.1) (0.1)

2005–2007 68.7 67.1 68.1 67.1 66.5 66.8

(0.1) (0.0) (0.0) (0.0) (0.0) (0.0)

2008–2015 66.8 66.2 66.6 67.3 67.6 67.8

(0.1) (0.1) (0.1) (0.1) (0.1) (0.1)

2016–2020 62.8 67.6 68.2 67.8 68.1 68.4

(0.1) (0.1) (0.1) (0.1) (0.1) (0.1)

IV = 20% x x x x x

CRS = 370bp x x x x

CMBS = 120bp x x x

US10 = 3.2% x x

Frontier set to Epoch 1 level x

Wald F Stat. of 1–4 equality 587.7 430.4 438.9 403.2 368.1 300.1

Wald F Stat. of 2–4 equality 711.4 109.1 224.1 20.9 175.9 160.9

Number of observations 47,616 45,779 45,779 45,779 45,779 45,779

It is clear from the generalized

R

2

coefficient in Table 6, as well as the

counterfactual LTVs in Figure 8, that the first-order determinant of LTV in

28

the sample is perceived property risk. We assess the individual contribution of

explanatory variables to the cross-sectional variation of LTV

∗

by sequentially

decomposing its sample variance into components of the following form:

(5) VC

n,t

=

Cov

LT V

∗

t

, LT V

∗

t

|

(x

1

,...,x

n−1

)=(¯x

1

,...,¯x

n−1

)

− LT V

∗

t

|

(x

1

,...,x

n

)=(¯x

1

,...,¯x

n

)

V ar

LT V

∗

t

,

where

LT V

∗

t

|

(x

1

,...,x

n

)=(¯x

1

,...,¯x

n

)

denotes the counterfactual latent LTVs in year

t

,

obtained by fixing variables

x

1

to

x

n

at their sample means.

16

Accordingly, the first

variance component is defined as

(5a) VC

1,t

=

Cov

LT V

∗

t

, LT V

∗

t

− LT V

∗

t

|

x

1

=¯x

1

V ar

LT V

∗

t

,

which simplifies to

V ar

(

β

1

x

1

)

/V ar

(

LT V

∗

), which in turn is akin to the

R

2

coefficient of a simple linear regression of

LT V

∗

on

x

1

. Analogously, the residual

variance component is defined as

(5b) VC

ε,t

=

Cov

LT V

∗

t