TrafficSituation&AirlinesRecovery

14,833flightsonMonday 20July(+14%with+1,853 flightscomparedtoMonday 6July)reachingnearly

42%of2019levels.Significantstepchangeon 1

st

ofJuly formany airlinesandtrafficlevelshaveslowly

increasedsincethen.

Vastmajorityofairlinesoperatedmoreroutesandfrequenciesfrom1

st

ofJulyfollowingtherelaxationof

someofthetravelrestrictions, especially withinEurope.Ryanairremainsthe busiestcarriers with 1,042

flightson20July(+5%on6July)followedbyTurkishAirlines(590flights,+4%),easyJet(582flights,+79%),

WizzAir(539flights,+5%)andAirFrance(475flights,

+22%).

CarriersoperatinginSouthernEurope(andMorocco)recordedhighgrowthratestoo(e.g.Vueling+52%,

AirEuropa+145%,TUI+72%,RoyalAirMaroc+171%)

IATAreporteda substantialnumberofpassengers booking tickets close to departure date,whichmakes

theschedulesplanningandoptimisationmoredifficult.

All

‐cargoflightsstillcomparableto2019levels.BusinessAviationrecoveringfast(13%below2019levels,

accountingfor14%oftotaltraffic).Low‐costandtraditionalflights~70%below2019levels(each).

Expecttoreach60%ofpeakdays2019levelsaftermid‐Augustwithpotentiallyupto21,000flights,

inline

withlatesttrafficscenariospublishedbyEUROCONTROLon 24April.

TrafficFlows&CountryPairs

Themaintrafficflowistheintra‐Europeflowwith12,905flightson20 July.Alltrafficflowshaveslightly

increasedoverthelast2weeks.Intra‐Europeflightsincreasedby14%butarestill53%below2019levels.

Domesticflowsarestilldominating:8ofthetop10 flowsaredomestic.FlowstoandfromSouthernEurope

countriescontinuetoshowimportantincreasesoverthelast2weeks(eg.Germany‐Spain+24%,Spain‐UK

+63%,France‐Spain+52%,Greece‐UKrestarting).

SituationoutsideEurope

US

Domestic traffic is slightly improving since early June, reaching‐50% of 2019 levels on 12 July.

Internationalflowsremainsverylowatsome‐80%exceptflowsto/fromMexico.

DallasFWandAtlantaairportsseemtohaveexperiencedastepchangeasinEuropefrom1

st

ofJuly.

Asia/Pacific

After a one‐month hiatus (virus resurgence in Beijing area), Chinese domestic flights started to

increaseagain,reaching11,139flightson19July,thehighestlevelssinceend‐January.

Even if the volume of international flights in China is less important than the domesti c one, the

internationaltrafficremained

at65%belowpre‐COVIDlevelssinceearlyMarch.

QantaswillnotrestoreitsinternationalnetworkuntilSummer2021.

MiddleEast

Bothinternationalanddomesticflightsaresmoo thlyrecoveringinMiddle‐Eastarea(about33.

SomeairlinesnowoperateagainfromandtoEgyptandKuwaitsinceMid‐July.

EmiratesresumedA380flightstoLondonandParisinJuly,andwillcontinuetodosoinAugust.

AirportInformation

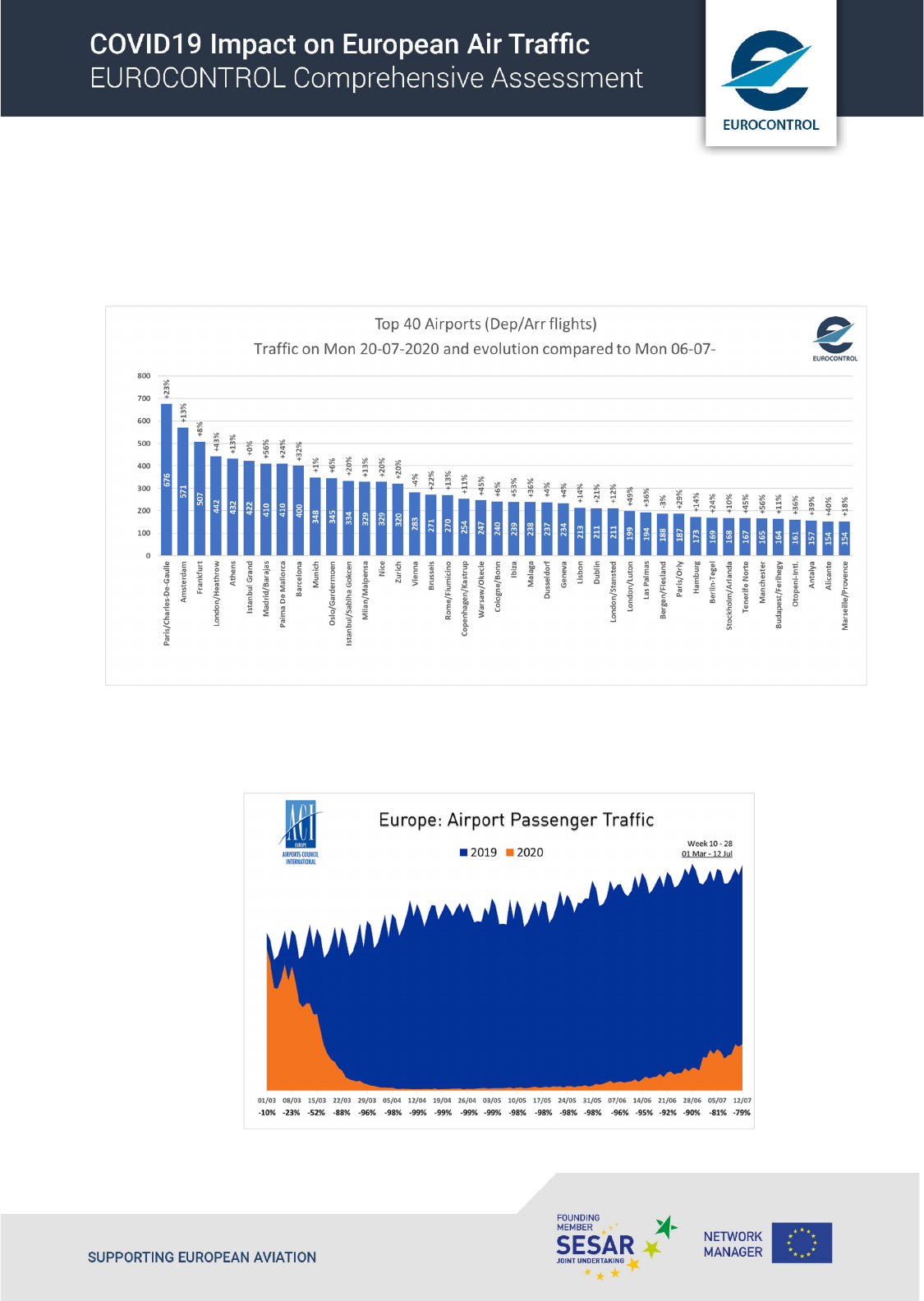

Paris/CDGwasthebusiestairportwith676flights(departures&arrivals)on20July,followedbyAmsterdam

andFrankfurt.

SmoothincreaseformanyairportsbutparticularlyforSouthernEuropeairportslikeAthens(+13%),Palma

deMallorca(+24%)andBarcelona(+32%).

ThenumberofpassengeratACIairportsconti nued

torampup afterthesharpincreaseinearlyJulyand

reached1.76millionon12July(still79%below2019levels).

Tuesday, 21 July 2020

1. TrafficSituationandAirlinesRecovery

14,833flightsonMon day20July,(+14%with+1,853flightscomparedto Monday6July).Thisis

nearly42%of2019trafficlevels.Therewasasteady increaseofflights sincemid‐April(+300%).

Basedona7‐daymovingaverage,a59.7%decreaseisrecordedcomparedto2019.Significant

step

change on 1

st

Julyfor manyairlines.Sincethen, no further step changebut steady and smooth

increasesformostairlines.

NOPRecoveryPlan:BasedontheassumptionthattheStateswillcontinuetoeasetravelrestrictions

asannounced,andduetothe factairlinesstartedoperatingtheirrevisedSummerschedules,the

trafficintheNetworkManagerAreaisexpectedtoreachupto18,000flightsonpeakdaysduringthe

second

halfofJulyandgraduallyreachuptopotentially21,000flightsonpeakdaysaftermid‐August

2020.Thiswouldrepresentupto60%ofthe2019trafficonpeakdaysforthe secondhalfofAugust.

Ryanairwasbyfartheairlinehavingthehighestnumberofflights

with1,042flightsonMonday20

July,a5%increaseonMonday6July.

Most ofthe busiest traditional carriers airlines reported modest growth rates comparedto two

weeksago:TurkishAirlines(590flights,+3%),Lufthansa(440flights,+8%),SAS(320flights,+10%),

KLM(244flights,+7%),Swiss(175

flights,+22%).SincethestepchangewasrecordedinearlyJuly,

flightshavebeenaddedto thenetworkmoreprogressivelyoverthelasttwoweeks.To benoted:

BritishAirwaysmorethandoubleditsnumberofflights(+113%,adding 130flights),addingnew

routesandincreasingfrequenciesallotherEurope.

TheairlinesaddingthehighestnumberofflightswhencomparingMonday20Julywiththesame

day,twoweeksago,were:easyJet(+79%,adding256flights)followedbyBritishAirways(+113%

adding130flights),Vueling(+52%adding101flights),Jet2.com(+559%adding95flights,from17

flightson6July

to112flightson20July)andAirFrance(+22%adding+87flights).

CarriersoperatinginSouthernEurope(andMorocco,aftertherestartofdomestictraffic)recorded

high growth rates too (e.g. Vueling‐see above, Air Europa +145%, TUI +72%, Royal Air Maroc

+171%).

RestartplansforkeyEuropeanairlines:

IATAreportedthatpassengersaremakinglastminutebookings(41%ofglobaltravellersbookedup

to3daysbeforedepartureinJune).Airlinesfindquitedifficulttosmoothlyplanandoptimizetheir

schedules.Moreover,passengersarenowusingtheirvouchers(proposedsincemid

‐Marchto“cover”

flightscancellations),whichmeansthatairlines“nowincurthecostoftransportingthe sepassengers

‐againstnoorlimitednewrevenues”(IATA,17July).

Expansion/Resumptionplans:

o airBalticannouncingplanstoexpanditsnetworkto69routesbytheendofAugust,upfrom

36routesoperated

inJune2020.Anticipatestooperate89routesinSummer2021.

o easyJetintendingtoresu me afurther100servicesfromtheUK inAugust,andafurther6

flights from Croatia, bringing the totalfromthereto12 Europeandestinationsby end‐July

2020.Italsoplanstoresume95%ofitsregulardestinationsfromAmsterdaminAugust.

o Icelandairbringingitsinternationalnetworkprogressivelybackbetweenmid‐Julyandend‐

August2020,resumingflightsto20Europeandestinationsand2NorthAmericanroutes.

o Jet2.comrestoring200servicesbetweenmid‐Julyandend

‐August2020.

o KLMresumingitsAmsterdamtoShanghaiservice.

o LufthansaresumingservicetoGeorgiainAugust.

o NorwegianAirUKresuminglong‐haulflightsbetweenLondonandtheUSinDecember,

restoring7routes.

o

WizzAirannouncingover190additionalrouteslaunchforsummer(seebelow,too).

PlanningtobaseoneadditionalaircraftatBelgradeandoneatStPetersburg(asofDec.

2020).

Delayedrestart:

o BrusselsAirlinespostponingresumptionoflong‐haulservices,originallyplannedtostart

againinAugust2020

.

o ElAlextendingitssuspensionofpassengerflightsuntil31August2020.

o RoyalAirMarocpostponingresumptionofinternationalservicesto11August2020.

o Ryanair cutting 1,000 flights between Ireland and UK in August and September due to

quarantinerestrictionsinIreland.

Updatedstrategies:

o AerLingusplanningtoplacenewlydeliveredaircraftinlongtermstorage.

o BritishAirwayslookingtoeaseitsfinancialdifficultiesandemergefromthepandemicwitha

raftofmeasuresincludingretiringitsentire747fleet;planningamajorrestructuring;while

inparallellookingtoraise€1millionfromthesaleofcorporateartworksasthecarrier.

o WizzAirsuspendingsever alrout es/postponinglaunchesowingtolowdemandand

changesintr avelrestrictionsandbiosecuritymeasures

Basedon traffic levels, the ranking of States is progressively gett ing backto the

ranking before

COVID.Top5busiestStates

1

includesGe rmany(+8%),France(+9%),UK(+33%),Spain(+34%)and

Italy(+16%).Likelastweek,thereisanoticeableincreaseinSouthernStatesoverthelast2weeks

notablyforSpainCont inentalbutalsoforSpainCanarias(+46%),Malta(+36%),Greece(+22%)as

wellasMorocco (+125%, especially owing to

therestartof AirArabiaMaroc).BalticStates have

alsorecordedstronggrowthrates.

1

excludingoverflights.

Overall situation against EUROCONTROL traffic scenarios: June traffic is in line with the

EUROCONTROLtrafficscenarioof24Aprilwith‐63%comparedtoJuly2019forthefirst20daysof

July.

When consid ering market segments, while all‐cargo flights remained stable during the crisis,

businessaviationis

recoveringfasterbeingonly13%below2019levels(representing14%oftotal

flightson 18July).Low‐costandtraditionalflights(~72%ofthetotal)arerespectively68%and70%

below2019trafficlevels.

2. TrafficFlows&CountryPairs

The major traffic flow is the intra‐Europe flow with 12,905 flights on 20 July. All traffic flows

increasedoverthelast2weeks.SlowergrowthratesarerecordedforflowsbetweenEuropeand

Asia/Pacific (virus re surgences)and flows between Europe and South‐Atlantic (this regionis the

newepicentre

oftheglobalcoronaviruspandemic).TrafficlevelsbetweenEuropeandNorth‐Africa

havesignificantlyincreased (+66%) owingnotablytothe restart oftrafficinMorocco(domestic)

andEgypt.Intra‐Europeflightsincreasedby14%butarestill‐53%vs2019.

ECAC=44European States.

REGION 06‐07‐2020 20‐07‐2020 %vs.2019

Intra‐Europe 11,318 12,905 +14% ‐53%

Europe<‐>Asia/Pacific 264 274 +4% ‐66%

Europe<‐>Mid‐Atlantic 44 51 +16% ‐71%

Europe<‐> M iddle‐East 325 344 +6% ‐80%

Europe<‐>NorthAtlantic 324 349 +8% ‐76%

Europe<‐>North‐Africa 142 236 +66% ‐80%

Europe<‐>OtherEurope 152 193 +27% ‐85%

Europe<‐>South‐Atlantic 47 48 +2% ‐75%

Europe<‐>SouthernAfrica 101 117 +16% ‐62%

Domesticflowsarestillthemostactiveflows(i.e.8ofthetop10flowsaredomestic).Theflows

to/fromsouthernEuropeancountriescontinuetoshowimportantincreasesoverthelast2weeks

(eg.Germany‐Spain+24%,Spain‐UK+63%,France‐Spain+52%,Greece‐UKrestarting).Tobenoted:

the

decreases for Norway and Greece domestic flows (resp.‐1% and‐5%) as well as France‐

Germany(‐4%)andGermany‐Turkey(‐5%).

3. SituationoutsideEurope

United‐State s:AfterasignificantdropoftrafficintheUSbytheendofMarch,USdomestictraffic

hasslightlyimprovedsinceearlyJunewithanoticeablestepchangeon1

st

Julyreaching‐50%of

2019inweekendingJuly12.Internationalflowsremainlowat‐80%exceptflowsto/fromMexico.

AfterasignificantdropoftrafficintheUSatallairportsattheendofMarch,atimidrecoverycan

benotedforNewYorkJFK,SanFrancisco,Seat tleandLosAngeles.Interestingly,DallasFWand

AtlantaseemtohaveexperiencedthesamestepchangeasinEuropefrom

1

st

ofJuly.Domestic

trafficatDallasFWseemstorecovermorequicklythaninthe5otherairports.Thesedataare

basedonOpenSkyNetworkADSBdata.

China: The numberofdomesticflights collapsed from end‐January (~14,000 flights) andstarted

recovering since end‐February. This smooth recovery

has been hindered mid‐June as virus

resurgence in Beijing areas (see below)led to a drop andthen,a stagnation of trafficlevels for

roughly one month. Very recently, Chinese domestic flights started to increase again, reaching

11,139flightson19July,thehighestlevelssinceend‐January.Thenumber

ofInternationalflights

remained stable over thesameperiod(with 1,216 flights,i.e.65%belowpre‐COVID levels).The

sameistrueforoverflights(516).

DetailsatairportslevelinChinaillustratethesignificantandquickdropoftrafficmid‐Junedueto

thelocalCOVID‐19outbreakatBeijingCapitalandDaxingairports.ChengduandGuangzhouwere

slightlyimpactedtoo,buttoalimitedextent.SinceearlyJuly,thenumberofflightsataffected

airportsispickingupagain.

MiddleEast:Internationalandintra‐Middle‐Easttrafficdroppedquicklyaroundmid‐Marchfrom

some 3,000 flightsa day to~400.Sincethe beginn ing of April,Intra‐Middle‐Easttrafficis slowly

recoveringreaching979flightson19July,Internationaltrafficfollowsthe

samepath(926).

TrafficatmainMiddle‐Eastairportsisslowlyrecoveringsincemid‐Aprilbutremainsfarbelowthe

situationbeforeCOVID‐19.RiyadhandJeddahshowedastrongincreaseon1

st

ofJunefollowedby

amorelimitedoneon1

st

ofJuly.

Restartplansforkeyworldwideairlines:

US

o American Airlines & JetBlue Airways planning on integrating, subject to regulatory

approval, their networks and codesharing arrangements, increasing connectivity and

addingfor2021newlonghaulmarketsinEurope.

o Deltaisproposingthedecreaseoftheminimumwageforpilotsby15%foroneyear.

MiddleEast&Africa

o EmiratesresumingA380flightsinmid‐JulytoLondonandParis,andresumingA380

flightsto5moreglobaldestinationsinAugustincludingAmsterdam,buckingthetrendat

other

A380operatorswhosefleetshavebeengrounded.

o EmiratessuspendingtheDubai‐Zagrebserviceuntil2021.

o JazeeraAirwaysresumingflightsfromKuwaiton1Augustto20destinations,4ofwhich

intheEUROCONTROLnetwork.

o AirCairoandEgyptAirresuming flightsfromEg yptfrommid‐July2020,10ofwhichin

theEUROCONTROLnetwork.

o Ethiop ian

Airlinesareresumingservicesto IstanbulandanumberofWestAfrican

destinations.

Asia/Pacific

o AirChinaresuminginternationalflightsinAugustto20destinations,9ofwhichinthe

EUROCONTROLnetwork.

o Thai Airways postponing resumption of international services from 1 August to 1

September2020.

o QANTAS

notplanningtorestoreitsinternatio nalnetworkuntilSummer2021.

4. AirportInformation

ParisCDGwasthebusiestairportwith676dep/arrflightson20July,followedbyAmsterdamand

Frankfurt. Here again, smooth increases for many airports but particularly for southern Europe

airports like Athens (+13%), Palma de Mallorca (+24%) and Barcelona (+32%). To be noted:

stagnationatIstanbulGrandanddecreases

atVienna(‐4%)andBergen(‐3%).

Afterhavingreachedanall‐timelowvalueof60,356passengersatEuropeanairportson18April

(i.e.‐99% compared to2019), thenumberof passengerhas started to increase again. Together

withthejumpintrafficthe1

st

ofJuly,thenumberofpassengeratACIairportsis improvingand

amountedto~1.76millionon12July(still79%below2019levels).

5. Economic

FuelPrice:Afterhavingbeenataround200UScentspergallon(cts/gal)atthebeginningof2020,

thejetfuelpricehasdroppedtoalow41cts/galon24April.Sincethen,togetherwiththetraffic

recovery,thejetfuelpricehasbeenmultipliedby2.6toreach

105cts/galon17July.

Tofurthe r assistyouinyouranalysis,EUROCONTROLprovidesthefollowingadditionalinformationon

adailybasis(dailyupdatesatapproximately12:00CET)andeveryFridayforthelastitem:

1. EUROCONTROLDailyTrafficVariationdashboard:

www.eurocontrol.int/Economics/DailyTrafficVar iation (or via theCOVID‐19 button on

thetopofourhomepagewww.eurocontrol.int)

Thisdashboardprovides trafficfor Day+1for allEuropeanStates;forthelargest

airports;foreachAreaControlCentre(ACC);andforthelargestairlineoperators.

2. COVIDRelated‐NOTAMSWithNetworkImpact(i.e.summaryofairspacerestrictions):

https://www.public.nm.eurocontrol.int/PUBPORTAL/gateway/spec/index.html

TheNetworkOperationsPortal(NOP)under“LatestNews”isupdateddailywitha

summarytableofthemostsignificantCOVID‐19NOTAMsapplicableat12.00UTC.

3. NOPRecoveryPlan:

https://www.public.nm.eurocontrol.int/PUBPORTAL/gateway/spec/index.html

Thisreport,updatedeveryFriday,isaspecialversionoftheNetworkoperation

Plan supporting aviation response to the COVID‐19 Crisis. It is developed in

cooperationwiththeoperationalstakeholdersensuringarollingoutlook.