Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

1

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

AUTO SECURE – STANDALONE OWN

DAMAGE PRIVATE CAR POLICY

UIN: IRDAN108RPMT0001V02201920

POLICY WORDINGS

TATA AIG General Insurance Co. Ltd.

Registered Oce:

Peninsula Business Park, Tower A, 15th Floor,

G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780

Email: [email protected]

Website: www.tataaig.com

IRDA of India Registration No: 108

CIN: U85110MH2000PLC128425

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

2

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

Whereas the Insured by a proposal and declaration

dated as stated in the Schedule which shall be the

basis of this contract and is deemed to be incorporated

herein has applied to TATA AIG GENERAL INSURANCE

COMPANY LIMITED (hereinafter called the Company) for

the Insurance hereinafter contained and has paid the

premium mentioned in the schedule as consideration

for such Insurance in respect of accidental loss or

damage occurring during the Period of Insurance.

NOW THIS POLICY WITNESSETH:

That subject to the Terms, Exceptions and Conditions

contained herein or endorsed or expressed hereon;

LOSS OF OR DAMAGE TO THE VEHICLE INSURED –

OWN DAMAGE SECTION

Coverage under this policy is only for own damage and

no other liability in connection with the vehicle.

1. The Company will indemnify the Insured against

loss or damage to the vehicle insured hereunder

and/or its accessories whilst thereon:

(i) by re, explosion self-ignition or lightning;

(ii) by burglary, housebreaking or theft;

(iii) by riot and strike;

(iv) by earthquake (Fire and Shock Damage);

(v) by ood, typhoon, hurricane, storm, tempest,

inundation, cyclone, hailstorm, frost;

(vi) by accidental external means;

(vii) by malicious act;

(viii) by terrorist activity;

(ix) whilst in transit by road rail inland - waterway

lift elevator or air;

(x) by landslide, rockslide.

Subject to a deduction for depreciation at

the rates mentioned below in respect of the

parts replaced

1. For All Rubber/ Nylon/ Plastic

Parts, tyres, tubes and batteries

50%

2. For Fibre glass components 30%

3. For All Parts made of Glass NIL

4. Rate of depreciation for all

other parts including wooden

parts will be as per following

schedule

Age of the vehicle

% of

Depreciation

Not Exceeding 6 months NIL

Exceeding 6 months but not

exceeding 1 year

5%

Exceeding 1 year but not

exceeding 2 years

10%

Exceeding 2 year but not

exceeding 3 years

15%

Exceeding 3 years but not

exceeding 4 years

25%

Exceeding 4 years but not

exceeding 5 years

35%

Exceeding 5 years but not

exceeding 10 years

40%

Exceeding 10 years 50%

5. Rate of depreciation for painting: In the case of

painting, depreciation rate of 50% shall be applied

only on the material cost of total painting charges.

In case of a consolidated bill for painting charges,

the material component shall be considered as

25% of the total painting charges for the purpose

of applying the depreciation.

6. In the case of repair, no depreciation shall

be deducted on Non-OEM (Original Equipment

Manufacturer)/ Non-OES (Original Equipment

Supplier) parts that are used in repairs.

2. The Company shall not be liable to make any

payment in respect of:

(a) Consequential loss, depreciation, wear and

tear, mechanical or electrical breakdown,

failures or breakages;

(b) Damage to tyres and tubes unless the vehicle

is damaged at the same time in which case the

liability of the Company shall be limited to 50%

of the cost of replacement. And

(c) Any accidental loss or damage suered whilst

the Insured or any person driving the vehicle

with the knowledge and consent of the Insured

is under the inuence of intoxicating liquor or

drugs.

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

3

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

3. In the event of the vehicle being disabled by

reason of loss or damage covered under this Policy

the Company will bear the reasonable cost of

protection and removal to the nearest repairer and

redelivery to the insured but not exceeding in all

Rs. 1500/- in respect of any one accident.

4. The insured may authorise the repair of the vehicle

necessitated by damage for which the Company

may be liable under this Policy provided that:

(a) the estimated cost of such repair including

replacements, if any, does not exceed Rs. 500/-;

(b) the company is furnished forthwith with a

detailed estimate of the cost of repairs;

and

(c) the Insured shall give the Company every

assistance to see that such repair is necessary

and the charges are reasonable.

SUM INSURED - INSURED’S DECLARED VALUE (IDV)

The Insured’s Declared Value (IDV) of the vehicle will

be deemed to be the ‘SUM INSURED’ for the purpose

of this Policy which is xed at the commencement of

each Period of insurance / policy year (where period of

insurance exceeds one year), as the case may be, for

the insured vehicle.

The IDV of the vehicle (and accessories if any tted to the

vehicle) is to be xed on the basis of the manufacturer’s

listed selling price of the brand and model as the vehicle

insured at the commencement of insurance/renewal

and adjusted for depreciation (as per scheduled below):

The schedule of age-wise depreciation as shown below

is applicable for the purpose of Total Loss/Constructive

Total Loss (TL/CTL) claims only.

THE SCHEDULE OF DEPRECIATION FOR FIXING IDV

OF THE VEHICLE

Age of The Vehicle

% of Depreciation

For Fixing IDV

Not exceeding 6 months 5%

Exceeding 6 months but not

exceeding 1 year

15%

Exceeding 1 year but not

exceeding 2 years

20%

Exceeding 2 years but not

exceeding 3 years

30%

Exceeding 3 years but not

exceeding 4 years

40%

Exceeding 4 years but not

exceeding 5 years

50%

IDV of vehicles beyond 5 years of age and of obsolete

models of vehicles (i.e. models which the manufacturers

have discontinued to manufacture) is to be determined

on the basis of an understanding between the insurer

and the insured.

IDV shall be treated as the ‘Market Value’ throughout

the Period of insurance / policy year (where period

of insurance exceeds one year), as the case may be,

without any further depreciation for the purpose of

Total Loss (TL) / Constructive Total Loss (CTL) claims.

The insured vehicle shall be treated as a CTL if the

aggregate cost of retrieval and/or repair of the vehicle,

subject to terms and conditions of the policy, exceeds

75% of the IDV of the vehicle.

AVOIDANCE OF CERTAIN TERMS AND RIGHT OF

RECOVERY

Nothing in this Policy or any endorsement hereon shall

aect the right of any person indemnied by this Policy

or any other person to recover an amount under or by

virtue of the provisions of the Motor Vehicles Act.

But the Insured shall repay to the Company all sums

paid by the Company which the Company would not

have been liable to pay but for the said provisions.

APPLICATION OF LIMITS OF INDEMNITY

In the event of any accident involving indemnity to

more than one person any limitation by the terms of

this Policy and/or of any Endorsement thereon of the

amount of any indemnity shall apply to the aggregate

amount of indemnity to all persons indemnied and

such indemnity shall apply in priority to the insured.

GENERAL EXCEPTIONS

The Company shall not be liable under this policy in

respect of

1. Any accidental loss or damage and/or liability

caused sustained or incurred outside the

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

4

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

Geographical Area.

2. Any claim arising out of any contractual liability;

3. Any accidental loss or damage and/or liability

caused sustained or incurred whilst the vehicle

insured herein is

(a) being used otherwise than in accordance with

the ‘Limitations as to Use’ or

(b) being driven by or is for the purpose of being

driven by him/her in the charge of any person

other than a Driver as stated in the Driver’s

Clause.

4. (a) any accidental loss or damage to any property

whatsoever or any loss or expense whatsoever

resulting or arising there from or any consequential

loss.

(b) any liability of whatsoever nature directly

or indirectly caused by or contributed to

by or arising from ionising radiations or

contamination by radioactivity from any

nuclear fuel or from any nuclear waste from the

combustion of nuclear fuel. For the purpose of

this exception combustion shall include any

self sustaining process of nuclear ssion;

5. Any accidental loss or damage or liability directly or

indirectly caused by or contributed to by or arising

from nuclear weapons material;

6. Any accidental loss or damage and/or liability

directly or indirectly or proximately or remotely

occasioned by contributed to by or traceable to or

arising out of or in connection with war, invasion,

the act of foreign enemies, hostilities or warlike

operations (whether before or after declaration of

war) civil war, mutiny rebellion, military or usurped

power or by any direct or indirect consequence of

any of the said occurrences and in the event of any

claim hereunder the insured shall prove that the

accidental loss or damage and/or liability arose

independently of and was in no way connected with

or occasioned by or contributed to by or traceable

to any of the said occurrences or any consequences

thereof and in default of such proof, the Company

shall not be liable to make any payment in respect

of such a claim.

DEDUCTIBLE

The Company shall not be liable for each and every

claim under this Policy in respect of the deductible

stated in the Schedule.

GENERAL CONDITIONS

This Policy and the Schedule shall be read together and

any word or expression to which a specic meaning

has been attached in any part of this Policy or of the

Schedule shall bear the same meaning wherever it may

appear.

A) Conditions precedent to contract

1. Premium to be paid for the Period of Insurance

before Policy commencement date as opted by

insured in the proposal form.

2. The due observance and fulllment of the

terms conditions and endorsements of this

policy in so far as they relate to anything to be

done or complied with by the insured and the

truth of the statements and answers in the said

proposal shall be condition precedent to any

liability of the Company to make any payment

under this policy.

B) Conditions during the contract

1. Duties and Obligations after Occurrence of

an Insured Event

1) Notice shall be given in writing to

the Company immediately upon the

occurrence of any accidental loss or

damage and in the event of any claim

and thereafter the insured shall give all

such information and assistance as the

Company shall require. Every letter claim

writ summons and/or process or copy

thereof shall be forwarded to the Company

immediately on receipt by the insured.

2) Notice shall also be given in writing to

the Company immediately the insured

shall have knowledge of any impending

prosecution Inquest or Fatal Inquiry in

respect of any occurrence which may give

rise to a claim under this policy.

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

5

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

3) In case of theft or criminal act which may

be the subject of a claim under this policy

the insured shall give immediate notice

to the police and co-operate with the

company in securing the conviction of the

oender.

4) No admission oer promise payment

or indemnity shall be made or given by

or on behalf of the insured without the

written consent of the Company which

shall be entitled if it so desires to take

over and conduct in the name of the

insured the defence or settlement of any

claim or to prosecute in the name of the

insured for its own benet any claim for

indemnity or damages or otherwise and

shall have full discretion in the conduct

of any proceedings or in the settlement

of any claim and the insured shall give all

such information and assistance as the

Company may require.

5) The Company may at its own option repair

reinstate or replace the vehicle insured

or part thereof and/or its accessories or

may pay in cash the amount of the loss or

damage and the liability of the Company

shall not exceed:

(a) for total loss / constructive total loss

of the vehicle - the Insured’s Declared

Value (IDV) of the vehicle (including

accessories thereon) as specied in

the Schedule less the value of the

wreck.

(b) for partial losses, i.e. losses other than

Total Loss/Constructive Total Loss of

the vehicle - actual and reasonable

costs of repair and/or replacement

of parts lost/damaged subject to

depreciation as per limits specied.

(c) The Company shall not deduct any

amount in lieu of salvage value.

Salvage, if any, will be surrendered to

the Company and the company shall

collect the salvage from the insured.

2. Reasonable Care

The Insured shall take all reasonable steps

to safeguard the vehicle insured from loss

or damage and to maintain it in ecient

condition.

3. Right to Inspect

The Company shall have at all times free and

full access to examine the vehicle insured or

any part thereof or any driver or employee of

the insured. In the event of any accident or

breakdown, the vehicle insured shall not be

left unattended without proper precautions

being taken to prevent further damage or loss

and if the vehicle insured be driven before the

necessary repairs are eected, any extension

of the damage or any further damage to the

vehicle shall be entirely at the insured’s own risk.

4. Cancellation

I. Cancellation by Insurer

The Company may cancel the policy on the

grounds of established fraud by sending

seven days’ notice by recorded delivery

to the insured at insured’s last known

address and in which case the policy will

be cancelled ‘ab-initio’ with forfeiture of

premium and non-consideration of claim,

if any.

II. Cancellation by Insured

The policy may be cancelled at any time by

the insured without assigning any reason

provided no claim has arisen during the

period of insurance. The insured shall

be entitled to a refund of proportionate

premium for the unexpired period in the

running year and full refund of premium

for remaining full policy years (where

period of insurance exceeds one year) .

Double Insurance:

When the insured vehicle is covered

under another policy with identical cover,

then the policy commencing later may be

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

6

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

cancelled by the insured subject to the

following.

If a vehicle is insured at any time with two

dierent oces of the same insurer, 100%

refund of premium of one policy shall be

allowed by cancelling the later of the two

policies. However, if the two policies are

issued by two dierent insurers, the policy

commencing later shall be cancelled by

the insurer concerned and pro-rata refund

of premium thereon shall be allowed.

If however, due to requirements of Banks/

Financial Institutions, intimated to the

insurer in writing, the earlier dated policy

is required to be cancelled, then refund of

premium will be allowed after retaining

premium on pro-rate basis for the period

the policy was in force prior to cancellation.

In either case, no refund of premium shall

be allowed for such cancellation if any

claim has arisen on either of the policies

during the period when both the policies

were in operation, but prior to cancellation

of one of the policies.

5. Contribution

If at the time of occurrence of an event that

gives rise to any claim under this policy,

there is in existence any other insurance

covering the same loss, damage or liability,

the Company shall not be liable to pay or

contribute more than its ratable proportion of

any compensation cost or expense.

6. Change of Vehicle:

Vehicle insured under the policy can be

substituted by another private car for the

balance period of the policy subject to

adjustment of premium, if any, on pro-rata basis

from the date of substitution on submission

of fresh proposal form. Where the vehicle

so substituted is not a total loss, evidence in

support of continuation of insurance on the

substituted vehicle shall be submitted before

such substitution.

7. Transfer of Insurance:

Transfer of “Own Damage” section of the policy

in favour of the transferee, shall be made on

receipt of a specic request from the transferee

within 14 days from the date of transfer along

with, acceptable evidence of sale, original old

certicate of insurance for eecting transfer

in the record and issuance of fresh Certicate

of Insurance/ endorsement in the name of the

transferee eective from the date of transfer.

If request for transfer is made after 14 days

from the date of transfer then transfer will be

eective from the date request is received by

us and payment of dierential premium, if any.

If the transferee is not entitled to the benet

of the No Claim Bonus (NCB) shown on the

policy, or is entitled to a lesser percentage of

NCB than that existing in the policy, recovery

of the dierence between the transferee’s

entitlement, if any, and that shown on policy

shall be made before eecting the transfer.

8. No Claim Bonus:

a) No Claim Bonus(NCB) can be earned only

in the Own Damage section of Policies. For

policies covering Fire and/or Theft Risks,

the NCB will be applicable only on the Fire

and / or Theft components of the premium.

An insured becomes entitled to NCB only

at the renewal of a policy after the expiry

of the full duration of 12 months.

b) No Claim Bonus, wherever applicable, will

be as per the following table.

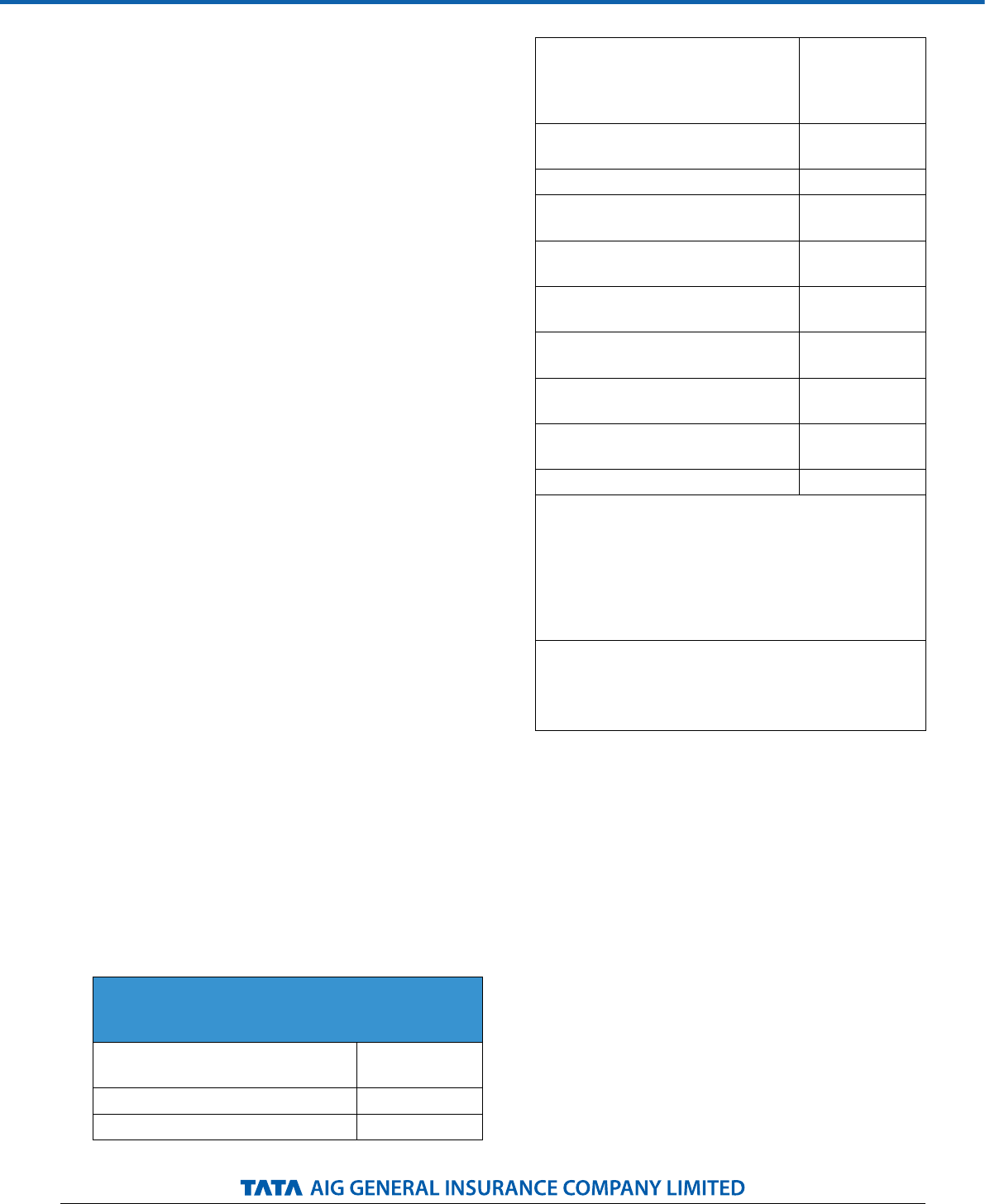

ALL TYPES OF VEHICLES

% OF DISCOUNT

ON OWN

DAMAGE

PREMIUM

No claim made or

pending during the

preceding full year of

insurance

20%

No claim made or

pending during the

preceding 2 consecutive

years of insurance

25%

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

7

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

No claim made or

pending during the

preceding 3 consecutive

years of insurance

35%

No claim made or

pending during the

preceding 4 consecutive

years of insurance

45%

No claim made or

pending during the

preceding 5 consecutive

years of insurance

50%

c) The entitlement of NCB shall follow the

fortune of the original insured and not the

vehicle or the policy. In the event of transfer

of interest in the policy from one insured

to another, the entitlement of NCB for the

new insured will be as per the transferee’s

eligibility following the transfer of interest.

It is however, claried that the entitlement

of No Claim Bonus will be applicable for

the substituted vehicle subject to the

provision that the substituted vehicle on

which the entitled NCB is to be applied

is of the same class (as per this tari) as

the vehicle on which the NCB has been

earned.

Provided that where the insured is an

individual, and on his/ her death the

custody and use of the vehicle pass to his/

her spouse and/or children and/or parents,

the NCB entitlement of the original insured

will pass on to such person/s to whom the

custody and use of the vehicle pass.

d) The percentage of NCB earned on a

vehicle owned by an institution during

the period when it was allotted to and

exclusively operated by an employee

should be passed on to the employee if

the ownership of the vehicle is transferred

in the name of the employee. This will

however require submission of a suitable

letter from the employer conrming that

prior to transfer of ownership of the

vehicle to the employee, it was allotted to

and exclusively operated by the employee

during the period in which the NCB was

earned.

e) In the event of the insured, transferring

his insurance from one insurer to another

insurer, the transferee insurer may allow

the same rate of NCB which the insured

would have received from the previous

insurer. Evidence of the insured’s NCB

entitlement either in the form of a renewal

notice or a letter conrming the NCB

entitlement from the previous insurer will

be required for this purpose.

f) Where the insured is unable to produce

such evidence of NCB entitlement from

the previous insurer, the claimed NCB

may be permitted after obtaining from the

insured a declaration as per the following

wording:

“I / We declare that the rate of NCB claimed

by me/us is correct and that no claim as

arisen in the expiring policy period (copy

of the policy enclosed). I/We further

undertake that if this declaration is found

to be incorrect, all benets under the

policy in respect of Own Damage Section

of the Policy will stand forfeited.”

Notwithstanding the above declaration,

the insurer allowing the NCB will be obliged

to write to the policy issuing oce of the

previous insurer by recorded delivery

calling for conrmation of the entitlement

and rate of NCB for the particular insured

and the previous insurer shall be obliged

to provide the information sought within

30 days of receipt of the letter of enquiry

failing which the matter will be treated as a

breach of Tari on the part of the previous

insurer. Failure of the insurer granting the

NCB to write to the previous insurer within

21 days after granting the cover will also

constitute a breach of the Tari.

g) If an insured vehicle is sold and not

replaced immediately and the policy is not

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

8

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

renewed immediately after expiry, NCB,

if any, may be granted on a subsequent

insurance, provided such fresh insurance

is eected within 3 (three) years from the

expiry of the previous insurance. The rate

of NCB applicable to the fresh policy shall

be that earned at the expiry of the last 12

months period of insurance.

h) On production of evidence of having

earned NCB abroad, an insured may be

granted NCB on a new policy taken out in

India as per entitlement earned abroad,

provided the policy is taken out in India

within three years of expiry of the overseas

insurance policy, subject to relevant

provisions of NCB under these rules.

i) Except as provided in Clauses (g), no

NCB can be allowed when a policy is not

renewed within 90 days of its expiry.

j) Except as provided in Clauses (g), (h) and (i)

above, NCB is to be allowed only when the

vehicle has been insured continuously for

a period of 12 months without any break.

C) Conditions when a claim arises

The insured / claimant will intimate claim to TATA

AIG via –

I. Call Centre:

• Toll Free Number – 18002667780

• Email - [email protected]

• Website – www.tataaig.com

II. Insured or claimant shall furnish immediate

loss details, which shall include details of the

loss event, location of the loss, location of the

damaged vehicle, and names and telephone

numbers of contact personnel

III. If the claim is for theft, insured should report

to the Police as well as insurer within 48 hrs

from theft and obtain an FIR or a written

acknowledgement from the Police authorities.

Notice of claim must be given by you to us

immediately after an actual or potential loss begins

or as soon as reasonably possible after actual or

potential loss begins.

In case of vehicle theft, a police complaint has to

be led immediately after the loss. Please keep the

following information ready when you call the call

centre:

1. Your Contact Numbers

2. Policy Number

3. Name of Insured

4. Date & Time of loss

5. Location of loss

6. Nature of Loss

7. Place & Contact Details of the person at the

loss location

IV. In the event the claim is not settled within

30 days, the Company shall be liable to pay

interest at a rate, which is 2% above the bank

rate from the date of receipt of last relevant

and necessary document from the Insured/

claimant by Company till the date of actual

payment.

V. Failure to furnish evidence within the time

required shall not invalidate nor reduce any

claim if You can satisfy Us that it was not

reasonably possible for You to give the proof

within such time.

Note: The above list is only indicative. You may be

asked for additional documents. For more details,

please refer to the intimation cum preliminary

claim form.

D) Conditions for renewal of the contract

Renewal Notice

The Policy may be renewed with our consent. The

benets under the policy or/and the terms and

conditions of the policy, including premium rate

may be subject to change.

We, however, are not bound to give notice that

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

9

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

it is due for renewal. Unless renewed as herein

provided, this Policy shall terminate at the expiration

of the period for which premium has been paid /

received. No renewal receipt shall be valid unless it

is on the printed form of the Company and signed

by an authorized ocial of the Company.

E) Special Conditions

1. In the event of the death of the sole insured, this

policy will not immediately lapse but will remain

valid for a period of three months from the date

of the death of insured or until the expiry of this

policy (whichever is earlier). During the said period,

legal heir(s) of the insured to whom the custody

and use of the Motor Vehicle passes may apply to

have this policy transferred to the name(s) of the

heir(s) or obtain a new insurance policy for the

Motor Vehicle.

Where such legal heir(s) desire(s) to apply for

a transfer of this policy or obtain a new policy

for the vehicle such heir(s) should make an

application to the Company accordingly within the

aforesaid period. All such applications should be

accompanied by:-

a. Death certicate in respect of the insured

b. Proof of title to the vehicle

c. Original Policy

Auto Secure Endorsements (attached to and forming

part of Policy)

IMT 1. Extension of Geographical Area

In consideration of the payment of an additional

premium of Rs……….it is hereby understood and agreed

that notwithstanding anything contained in this Policy

to the contrary the Geographical Area in this Policy

shall from the . . ./ . ./ . . . . to the . …/. . /. . . .(both days

inclusive) be deemed to include *

It is further specically understood and agreed that

such geographical extension excludes cover for damage

to the vehicle insured / injury to its occupants in respect

of the vehicle insured during sea voyage / air passage

for the purpose of ferrying the vehicle insured to the

extended geographical area.

Subject otherwise to the terms exceptions conditions

and limitations of this Policy.

NOTE:- Insert Nepal/ Sri Lanka/ Maldives/ Bhutan/

Pakistan/ Bangladesh as the case may be.

IMT. 3. TRANSFER OF INTEREST

It is hereby understood and agreed that as from

…/…/……. (refer policy schedule) the interest in the policy

is transferred to and vested in ……….... of ……………….

(refer policy schedule) carrying on or engaged in

the business or profession of ……………. (refer policy

schedule) who shall be deemed to be the insured and

whose proposal and declaration dated .. /…/…. (refer

policy schedule) shall be deemed to be incorporated in

and to be the basis of this contract.

Provided always that for the purpose of the No Claim

Bonus (except in case of employer-employee transfer as

per general condition B.8.3), no period during which the

interest in this policy has been vested in any previous

Insured shall accrue to the benet of .....

Subject otherwise to the terms exceptions conditions

and limitations of this policy.

IMT 4. Change of Vehicle

It is hereby understood and agreed that as from …/…../ …... the vehicle bearing Registration Number ………….. is

deemed to be deleted from the Schedule of the Policy and the vehicle with details specied hereunder is deemed

to be included therein-

Regd. No. Engine/

Chassis No.

Make Type of Body C.C. Year of

Manufacture

Seating

Capacity

including

Driver

IDV

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

10

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

In consequence of this change, an extra / refund

premium of Rs….... is charged/ allowed to the insured.

Subject otherwise to the terms exceptions conditions

and limitations of this Policy.

IMT 5. HIRE PURCHASE AGREEMENT

It is hereby understood and agreed that ..... [hereinafter

referred to as the Owners (refer Policy Schedule)] are

the Owners of the vehicle insured and that the vehicle

insured is subject of an Hire’ Purchase Agreement made

between the Owners on the one part and the insured on

the other part and it is further understood and agreed

that the Owners are interested in any monies which but

for this Endorsement would be, payable to the insured

under this Policy in respect of such loss or damage to

the vehicle insured as cannot be made good by repair

and/or replacement of parts and such monies shall be

paid to the Owners as long as they are the Owners of

the vehicle insured and their receipt shall be a full and

nal discharge to the insurer in respect of such loss or

damage.

Save as by this Endorsement expressly agreed nothing

herein shall modify or aect the rights and liabilities

of the insured or the insurer respectively under or in

connection with this Policy.

Subject otherwise to the terms exceptions conditions

and limitations of this Policy.

IMT6. LEASE AGREEMENT

It is hereby understood and agreed that ........ [hereinafter

referred to as the Lessors (refer Policy Schedule)] are

the Owners of the vehicle insured and that the vehicle

insured is the subject of a Lease Agreement made

between the Lessor on the one part and the insured

on the other part and it is further understood and

agreed that the Lessors are interested in any monies

which but for this Endorsement would be payable to

the insured under this Policy in respect of such loss

or damage to the vehicle insured as cannot be made

good by repair and/or replacement of parts and such

monies shall be paid to the Lessors as long as they are

the owners of the vehicle insured and their receipt shall

be a full and nal discharge to the insurer in respect of

such loss or damage. It is also understood and agreed

that notwithstanding any provision in the Leasing

Agreement to the contrary, this Policy is issued to the

insured namely................. (refer Policy Schedule) as the

principal party and not as agent or trustee and nothing

herein contained shall be construed as constituting

the insured an agent or trustee for the Lessors or as

an assignment (whether legal or equitable) by the

insured to the Lessors, of his rights benets and claims

under this Policy and further nothing herein shall be

construed as creating or vesting any right in the Owner/

Lessor to sue the insurer in any capacity whatsoever for

any alleged breach of its obligations hereunder.

Save as by this Endorsement expressly agreed nothing

herein shall modify or aect the rights and liabilities

of the insured or the insurer respectively under or in

connection with this Policy.

Subject otherwise to the terms exceptions conditions

and limitations of this Policy.

IMT 7. VEHICLE SUBJECT TO HYPOTHECATION

AGREEMENT

It is hereby declared and agreed that the vehicle insured

is pledged to /hypothecated with ...............................

[hereinafter referred to as the “Pledgee” (refer Policy

Schedule)] and it is further understood and agreed

that the Pledgee is interested in any monies which but

for this Endorsement would be payable to the insured

under this Policy in respect of such loss or damage to

the vehicle insured as cannot be made good by repair

and/or replacement of parts and such monies shall be

paid to the Pledgee as long as they are the Pledgee of

the vehicle insured and their receipt shall be a full and

nal discharge to the insurer in respect of such loss or

damage.

Save as by this Endorsement expressly agreed that

nothing herein shall modify or aect the rights or

liabilities of the insured or the insurer respectively

under or in connection with this Policy or any term,

provision or condition thereof.

Subject otherwise to the terms exceptions conditions

and limitations of this Policy.

IMT 8. DISCOUNT FOR MEMBERSHIP OF RECOGNISED

AUTOMOBILE ASSOCIATIONS

It is hereby understood and agreed that in consideration

of insured’s membership of ………………** a discount

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

11

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

in premium of Rs. ……….* is allowed to the insured

hereunder from …./…../…...

It is further understood and agreed that if the insured

ceases to be a member of the above mentioned

association during the currency of this Policy the

insured shall immediately notify the insurer accordingly

and refund to the insurer a proportionate amount of

the discount allowed on this account for the unexpired

period of the cover.

Subject otherwise to the terms, exceptions, conditions

and limitations of the policy

IMT 9. DISCOUNT FOR VINTAGE CARS (Applicable to

Private Cars only)

It is hereby understood and agreed that in consideration

of the insured car having been certied as a Vintage Car

by the Vintage and Classic Car Club of India, a discount

of Rs. ………. is allowed to the insured from …./…../……

Subject otherwise to the terms exceptions conditions

and limitations of the policy

IMT 10. INSTALLATION OF ANTI-THEFT DEVICE

In consideration of certication by …………………* that

an Anti-Theft device approved by Automobile Research

Association of India (ARAI), Pune has been installed

in the vehicle insured herein a premium discount of

Rs…………** is hereby allowed to the insured.

It is hereby understood and agreed that the insured

shall ensure at all times that this Anti-theft device

installed in the vehicle insured is maintained in ecient

condition till the expiry of this policy.

Subject otherwise to the terms, exceptions, conditions

and limitations of the policy

IMT 12. DISCOUNT FOR SPECIALLY DESIGNED/

MODIFIED VEHICLES FOR THE BLIND, HANDICAPPED

AND MENTALLY CHALLENGED PERSONS.

Notwithstanding anything to the contrary contained

in the policy it is hereby understood and agreed that

the vehicle insured being specially designed /modied

for use of blind, handicapped and mentally challenged

persons and suitable endorsement to this eect having

been incorporated in the Registration Book by the

Registering Authority, a discount of 50% on the Own

Damage premium for the vehicle insured is hereby

allowed to the insured.

Subject otherwise to the terms exceptions conditions

and limitations of the policy.

IMT.13 .USE OF VEHICLE WITHIN INSURED’S OWN

PREMISES

It is hereby understood and agreed that the insurer

shall not be liable in respect of the vehicle insured

while the vehicle is being used elsewhere than in

the insured’s premises except where the vehicle is

specically required for a mission to ght a re.

For the purposes of this endorsement ‘Use conned

to own premises’ shall mean use only on insured’s

premises to which public have no general right of

access.

IMT 19. COVER FOR VEHICLES IMPORTED WITHOUT

CUSTOMS DUTY

Notwithstanding anything to the contrary contained

in this Policy it is hereby understood and agreed that

in the event of loss or damage to the vehicle insured

and/or its accessories necessitating the supply of a part

not obtainable from stocks held in the country in which

the vehicle insured is held for repair or in the event of

the insurer exercising the option under Condition B.1.5

to pay in cash the amount of the loss or damage the

liability of the insurer in respect of any such part shall be

limited to:

(a) (i) the price quoted in the latest catalogue or the

price list issued by the Manufacturer or his Agent

for the country in which the vehicle insured is held

for repair less depreciation applicable;

OR

(ii) if no such catalogue or price list exists the price

list obtaining at the Manufacturer’s Works plus

the reasonable cost of transport otherwise

than by air to the country in which the vehicle

insured is held for repair and the amount of

the relative import duty less depreciation

applicable under the Policy;

and

(b) the reasonable cost of tting such parts,

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

12

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

Subject otherwise to the terms conditions limitations

and exceptions of this Policy.

IMT 22.COMPULSORY DEDUCTIBLE

Notwithstanding anything to the contrary contained

in the Policy it is hereby understood and agreed that

the insured shall bear under Own Damage Section of

the Policy in respect of each and every event (including

event giving rise to a total loss/constructive total loss)

the rst Rs.........* (refer Policy Schedule) (or any less

expenditure which may incurred) or any expenditure

for which provision has been made under this Policy

and/or of any expenditure by the insurer in the exercise

of his discretion under Condition no. B.1.5 for Private

Cars/Two wheeler Policy.

If the expenditure incurred by the insurer shall include

any amount for which the insured is responsible

hereunder such amount shall be repaid by the insured

to the insurer forthwith.

For the purpose of this Endorsement the expression

“event” shall mean an event or series of events arising

out of one cause in connection with the vehicle insured

in respect of which indemnify is provided under this Policy.

Subject otherwise to the terms conditions limitations

and exceptions of this Policy.

IMT 22A VOLUNTARY DEDUCTIBLE

It is by declared and agreed that the insured having

opted a voluntary deductible of Rs.____ (refer schedule)

a reduction in premium of Rs. _____under Own Damage

Section of the policy is hereby allowed.

In consideration of the above, it is hereby understood

and agreed that the insured shall bear under Own

Damage Section of the policy in respect of each and

every event (including event giving rise to a total loss/

constructive total loss) the rst Rs......(refer policy

schedule) or (any less expenditure which may be

incurred) of any expenditure for which provision has

been made under this policy and/or of any expenditure

by the insurer in the exercise of his discretion under

Condition no. B.1.5 of this policy.

If the expenditure incurred by the insurer shall include

any amount for which the insured is responsible

hereunder such amount shall be repaid by the insured

to the insurer forthwith.

For the purpose of this Endorsement the expression

“event” shall mean an event or series of events arising

out of one cause in connection with the vehicle insured

in respect of which indemnity is provided under this

policy.

Subject otherwise to the terms conditions limitations

and exceptions of this Policy.

IMT 24.ELECTRICAL/ELECTRONIC FITTINGS

(Items tted in the vehicle but not included in the

manufacturer’s listed selling price of the vehicle -

Package Policy only)

In consideration of the payment of additional premium

of Rs.......(refer Policy Schedule) notwithstanding

anything to the contrary contained in the Policy it is

hereby understood and agreed that the insurer will

indemnify the insured against loss of or damage to such

electrical and/or electronic tting(s) as specied in the

schedule whilst it/these is/are tted in or on the vehicle

insured where such loss or damage is occasioned by

any of the perils mentioned in Own Damage Section of

the Policy. The insurer shall, however, not be liable for

loss of or damage to such tting(s) caused by/as a result

of mechanical or electrical breakdown. Provided always

that the liability of the insurer hereunder shall not

exceed the Insured’s Declared Value (IDV) of the item.

Subject otherwise to the terms conditions limitations

and exceptions of this Policy.

IMT 25. CNG/LPG KIT IN BI-FUEL SYSTEM

(Own Damage cover for the kit )

In consideration of the payment of premium of

Rs…………… notwithstanding anything to the contrary

contained in the policy it is hereby understood and

agreed that the insurer will indemnify the insured in

terms conditions limitations and exceptions of Section

1 of the policy against loss and/or damage to the

CNG/LPG kit tted in the vehicle insured arising from

an accidental loss or damage to the vehicle insured,

subject to the limit of the Insured’s Declared Value of

the CNG/LPG kit specied in the Schedule of the policy.

Subject otherwise to the terms conditions limitations

and exceptions of this Policy.

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

13

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

IMT. 32. ACCIDENTS TO SOLDIERS /SAILORS/ AIRMEN

EMPLOYED AS DRIVERS

In consideration of the payment of an additional

premium of Rs 100/-* it is hereby understood and

agreed that in the event of any Soldier/Sailor/Airman

employed by the insured to drive the vehicle insured

being injured or killed whilst so employed, this policy will

extend to relieve the insured of his liability to indemnify

Ministry of Defence under the respective Regulations.

Subject otherwise to the terms, conditions limitations

and exceptions of this Policy.

* This additional premium is at and irrespective of

period of insurance not exceeding 12 months. Any

extension of the period of insurance beyond 12 months

will call for payment of further additional premium

under this endorsement .

Auto Secure – Standalone Own Damage Private Car

Policy Add On Covers

TA01 Depreciation Reimbursement - SAOD Private

Car Policy

(IRDAN108RP0001V01201920/A0003V01201920)

This cover is applicable if it is shown on your

schedule.

What is Covered:

We will pay you the amount of depreciation

deducted on the value of parts replaced under

own damage claim, lodged under section 1 (own

damage) of the policy. We will pay for the rst

2 claims reported to us during the Period of

insurance.

Special Conditions applicable to this cover in

addition to the General Conditions:

• A claim where replacement of any part is not

involved and no depreciation is deducted under

own damage claim, will not be considered as

claim under this cover.

• Vehicle is repaired at any of our Authorised

Garage/Authorised workshop/Authorised

service station.

TA02 Daily Allowance - SAOD Private Car Policy

(IRDAN108RP0001V01201920/A0004V01201920)

(Applicable to the Policies issued with this add-on

before the date 3rd June 2024)

This cover is applicable if it is shown on your

schedule.

What is Covered:

We will pay You Daily Allowance as mentioned in

the schedule to enable you to meet the cost of hired

transport to reduce Your inconvenience, if Your

Vehicle is damaged by a covered peril mentioned

in Own Damage Section of the policy.

The allowance would be payable for a maximum

period of 10 days during the period of insurance.

In case of theft/total loss claim, we will pay for

maximum 15 days during the period of insurance.

Reasonable time taken for repair in respect of

damages not admissible under Own Damage

Section of the policy (as agreed between you,

surveyor & garage/workshop manager) would be

excluded for the purpose of computation of Daily

Allowance.

Your entitlement of Daily Allowance will start from

the following calendar day of Your Vehicle reaching

the garage for repair or the day of intimation of

claim to Us, whichever is later and shall end on the

day garage intimates you to take delivery of the

Vehicle.

What is not Covered:

The Daily allowance will not be payable if any or all

of the following condition applies:

1. If you are claiming only for windscreen or glass

damage under Own Damage Section of the

policy.

2. If Vehicle is not repaired at the Authorised

Garage

3. If claim under Own Damage Section is not valid

and admissible.

4. If time required for repair of motor vehicle is

up to 3 days.

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

14

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

TA05 Return to Invoice - SAOD Private Car Policy

(IRDAN108RP0001V01201920/A0005V02201920)

What is covered:

In consideration of payment of additional premium,

We will pay the dierence between Insured’s

Declared Value (IDV) of the insured vehicle and

on-road price (including electronic/electrical/non

electrical/electronic accessories/bi-fuel kit provided

by manufacturer/dealer) of a new vehicle of similar

make and model published by manufacturer/

dealer in case of Total Loss/Constructive Total Loss/

Theft of your vehicle. On road price shall include

registration fees, road tax & Insurance charges.

Insurance charges will be limited to the amount

arrived at by multiplying prevailing Own Damage

Rate on the date of accident with Insured’s Declared

Value (IDV) & applicable Basic Third Party Premium.

For obsolete models, on road price shall mean last

on road price listed by manufacturer/dealer.

For imported vehicles, we will pay the shortfall

between the Insured’s Declared Value (IDV) of

the insured vehicle and the landed cost of a new

vehicle of a similar make and model.

Special conditions applicable to this cover:

• The nance company/bank whose interest is

endorsed on the policy must agree in writing.

What is not covered:

We will not pay if:

• the Total Loss/CTL and theft claim is not valid

and admissible under section 1 of the policy.

• nal investigation report of police conrming

the theft of the vehicle in case of theft claim is

not submitted to us.

Subject otherwise to the terms, exceptions,

conditions and limitations of this Policy

TA06 No Claim Bonus Protection Cover - SAOD

Private Car Policy (IRDAN108RP0001V01201920/

A0006V01201920)

This cover is applicable if it is shown on Your

schedule.

What is Covered

We will allow you the same No claim bonus, as

shown on Your schedule at the time of renewal

provided-

• The rate of No claim bonus as shown in the

schedule is an accumulation of 2 or more claim

free years and their being no own damage

claim in preceding 2 years.

• Not more than 1 own damage claim is

registered in the current period of insurance.

• The renewal of policy is done with Us within 90

days of expiry of the policy

• The claim is not a Total LOSS (TL)/Constructive

Total Loss (CTL)

Special conditions applicable to this benet in

addition to the general conditions:

• The claim made for damages only to the

windscreen glass/rear glass/door glasses sun

roof glass, will not be considered as a claim

under this benet.

• The claim only partial theft of accessories/

parts will not be considered as a claim under

this benet.

• A claim for theft of entire motor vehicle will

not be considered as a TL/CTL for this purpose

provided a new motor vehicle is purchased

and insured with Us within 90 days of the theft,

in which case, We will allow same No claim

bonus on New motor vehicle as is shown in the

schedule

TA08 Repair of Glass, Fibre, Plastic &

Rubber Parts - SAOD Private Car Policy

(IRDAN108RP0001V01201920/A0007V01201920)

What is Covered:

A claim for only Glass/plastic/rubber/ber part

where You opt for repairs rather than replacement,

at our authorised workshops/authorised dealers/

authorised service stations will not aect Your No

Claim Bonus eligibility at the time renewal with Us

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

15

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

provided number of such claim does not exceed

one and there is no other claim for damage to the

vehicle during the period of insurance.

What is not Covered:

1. Cost of painting of parts without any other

repair associated with these parts.

TA09 Loss of personal belongings - SAOD Private

Car Policy (IRDAN108RP0001V01201920/

A0008V01201920)

This cover is applicable if it is shown on your

schedule.

We will pay for the loss or damage to you and your

Family member’s personal belongings caused by

perils mentioned under Own Damage Section of

the policy while they are in the vehicle at the time

of loss or damage to the vehicle.

Personal belongings for the purpose of this section

means items such as clothes and other articles of

personal nature likely to be worn, used or carried

and includes audio/video tapes, CDs but excludes

money, securities, cheques, bank drafts, credit or

debit cards, jewellery, lens, glasses, travel tickets,

watches, valuables, manuscripts, paintings and

items of similar nature. Any goods or samples

carried in connections with any trade or business is

not covered.

A police report must be led for claims due to

burglary, house-breaking or theft.

The maximum amount payable under this section is

Rs (Refer Schedule) during the period of insurance.

Any claim under this section will be admissible

only when there is a valid and admissible claim

in respect of the vehicle arising out of the same

accident.

The insured will bear rst Rs. 250 of each and every

claim under this section.

TA10 Emergency Transport & Hotel Expenses - SAOD

Private Car Policy (IRDAN108RP0001V01201920/

A0009V01201920)

This cover is applicable if it is shown on your

schedule.

We will pay towards the cost of overnight stay

and taxi charges for returning back to Your place

of residence or the nearest city You are traveling

to if Your motor vehicle has met with an accident

by any of the peril mentioned under Own Damage

Section of the policy and cannot be driven. We

will pay maximum Rs (refer schedule) for any one

accident and Rs (Refer Schedule) during the period

of insurance. Documentary proof of expenditure

must be submitted by any claim under this section.

Any claim under this section will be admissible only

when there is a valid & admissible claim in respect

of the vehicle arising out of the same accident.

TA15 Key Replacement - SAOD Private Car Policy

(IRDAN108RP0001V01201920/A0010V01201920)

This cover is applicable if it shown on Your schedule.

What is Covered

1. Key Replacement – We will reimburse You for

the cost of replacing your vehicle keys which

are lost or stolen.

2. Break-in Protection – We will reimburse you

for the cost of replacing your locks and keys if

your vehicle is broken into. The covered costs

include the labor cost for replacing the lock.

What is not Covered

We will not pay for:

1. costs other than those listed in the “What is

Covered” section;

2. the cost to replace keys to vehicles that You do

not own for personal use;

Coverage Conditions

For break-in protection claims, you must provide

an ocial police report that conrms the incident

happened within the period of insurance.

TA16 Engine Secure - SAOD Private Car Policy

(IRDAN108RP0001V01201920/A0012V01201920)

This cover is applicable if it is shown on your

schedule.

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

16

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

What is covered:

We will pay you repair and replacement expenses

for the loss or damage to -

1. Internal parts of the engine

2. Gear Box, Transmission or Dierential

Assembly

Provided loss or damage is due to ingress of water

in the engine or leakage of lubricating oil from

engine/respective assembly.

We will also pay for the lubricating oils/consumables

used in the respective assembly i.e. material, which

is used up and needs continuous replenishment

such as engine oil, gear box oil etc. but excluding fuel.

What is not covered:

We shall not indemnify you under this endorsement

in respect of-

1. Loss or damage covered under manufacturer

warranty; recall campaign or forming part of

maintenance/preventive maintenance.

2. Any aggravation of loss or damage including

corrosion due to delay in intimation to us and/

or retrieving the vehicle from water logged area.

3. Ageing, depreciation, wear and tear.

Special Condition:

Claim under this endorsement will be admissible

only if -

1. In case of water damage, there is and evidence

of vehicle being submerged or stopped in

water logged area.

2. In case of leakage of lubricating oil, there is

a visible evidence of accidental damage to

engine or respective assembly.

3. Vehicle is transported/towed to garage within

2 (Two) days of water receding from the water

logged area.

4. You have taken all reasonable steps, safeguards

and precautions to avoid any loss or damage

and also prevent aggravation of loss once the

loss or damage to the vehicle is sustained and

noticed by You.

Deductible:

We shall not be liable for each and every claim

under this coverage in respect of deductible stated

in the schedule.

Subject otherwise to terms, conditions, limitations

and exceptions of the policy.

TA17 Tyre Secure - SAOD Private Car Policy

(IRDAN108RP0001V01201920/A0013V01201920)

This cover is applicable if it shown on your schedule.

What is covered

We will cover expenses for repair and/or

replacement, as may be necessitated arising out of

accidental loss or damage to tyres and tubes.

In any situation company’s liability would not

exceed the following, basis the unused tread depth

of respective tyre (not applicable if Full cover is

opted)-

• Unused tread depth of <3 mm - Considered as

normal wear and tear and is not covered.

• Unused tread depth of >=3 mm to <5 mm –

50% of cost of new tyre and/or tube.

• Unused tread depth of >=5 to < 7 mm - 75% of

cost of new tyre and/or tube

• Unused tread depth of > = 7 mm - 100% of cost

of new tyre and/or tube

Unused Tread depth will be measured at the

centre of the tread. Minimum 4 measurements

at 4 dierent places will be taken for the purpose

of arriving at means tread depth which will be the

basis of indemnity under the coverage.

Whenever replacement of tyre will be allowed it

will be of the same make and specication and

if tyre of similar specication is not available and

replaced tyre is superior to damaged tyre then We

will not be liable for betterment charges. Maximum

of 4 (four) replacements will be allowed during the

Period of Insurance.

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

17

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

If damage to tyre and tube is due to the accidental

damage to the insured vehicle covered under

“Own Damage” section of the policy. Our liability

under this cover will be restricted to the dierence

of depreciation percentage applied under “Own

Damage” section and as mentioned above basis

the unused tread depth.

What is not covered

1. If vehicle is not repaired at Authorized garage.

2. loss or damage arising out of natural wear

and tear including unevenly worn tyres

caused by defective steering geometry outside

manufacturer’s recommended limits or wheel

balance, failure of suspension component,

wheel bearing or shock absorber.

3. any loss or damage within rst 15 days of

inception of the policy.

4. any loss or damage occurred prior to inception

of the policy

5. any loss or damage resulting into total loss of

the vehicle

6. routine maintenance including adjustment,

alignment, balancing or rotation of wheels/

tyres/tubes

7. Loss or damage to wheel accessories, any

other parts or rim.

8. theft of tyre(s)/tube(s) or its parts accessories

without vehicle being stolen or theft of entire

vehicle.

9. if the tyre(s)/tube(s) being claimed is dierent

from tyre(s) insured/supplied as original

equipment along with the vehicle unless

informed to us and mentioned/endorsed on

the policy.

10. fraudulent act committed by insured or the

workshop or any person entrusted possession

of the vehicle by insured.

11. loss or damage arising out of improper storage

or transportation

12. any consequential loss or damage such as but

not limited to noises, vibrations and sensations

that do not aect tyre function or performance.

13. loss or damage arising out of modications not

approved by tyre manufacturer.

14. loss or damage resulting from hard driving due

to race, rally or illegal activities.

15. loss or damage due to neglect of periodic

maintenance as specied by manufacturer.

16. loss or damage resulting from poor

workmanship while repair.

17. loss or damage arising out of any manufacturing

defect or design including manufacturer’s

recall.

18. minor damage or scratch not aecting the

functioning

19. tyre which has been used for its full specied

life as per manufacturer’s guideline or where

unused tread depth is less than 3 mm.

Important Conditions

1. If you make a fraudulent claim which is

declined as per para 10 of “What We will not

cover”, coverage under this section shall cease

with immediate eect.

2. If during the Period of insurance any tyre is

replaced for any reason for which claim is not

preferred under the coverage, cover on new

tyre would not be available unless details of

new tyre are informed to us.

3. In case of replacement of tyre for which a claim

is preferred under the coverage replaced tyre

can be included by way of endorsement by

paying requisite premium.

4. All claims must be made within 3 working days

of damage.

5. You must take all reasonable steps to avoid loss

or damage to tyre(s). You must not continue to

drive the vehicle after any damage or incident

if this could cause further damage to tyre(s).

TA18 Consumable Expenses - SAOD Private Car Policy

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

18

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

(IRDAN108RP0001V01201920/A0014V01201920)

This cover is applicable if it shown on your schedule.

What is covered

We will cover cost of consumables required to be

replaced/replenished arising from an accident to

the insured vehicle. Consumable for the purpose

of this cover shall include engine oil, gear box

oil, lubricants, nut & bolt, screw, distilled water,

grease, oil lter, bearing, washers, clip, break oil,

air conditioner gas and items of similar nature

excluding fuel.

What is not covered

1. Any consumable not associated with admissible

Own Damage claim under Own Damage of the

policy.

2. If there is no valid and admissible claim under

Own Damage section of the policy.

3. If vehicle is not repaired at Authorized garage

TA19 Road Side Assistance - SAOD Private Car Policy

(IRDAN108RP0001V01201920/A0015V01201920)

(This cover is applicable if it is shown on your

schedule)

These services will be oered to you during the

Period of Insurance as mentioned on your Policy

Schedule or Certicate of Insurance.

Repair and Towing Assistance

Service for Flat Tyre

In the event insured Vehicle is immobilized due to

a at tyre, you will get the assistance of a vehicle

technician to replace the at tyre with the spare

stepney tyre of the Vehicle at the location of

breakdown. In case the spare tyre is not available

in the insured Vehicle, the at tyre will be taken to

the nearest at tyre repair shop for repairs & re-

attached to the Vehicle. All incidental charges for

transporting the tyre to the repair shop and its

repair cost shall be borne by you.

Flat Battery – Jump Start Service

In the event insured Vehicle is immobilized, due to

rundown battery, you will get the assistance of a

Vehicle technician to jump start the ssVehicle with

appropriate means. If the run down battery has to

be replaced with a new battery, the cost of such

battery replacement and any costs to obtain the

battery will be borne by you. All costs involved in

charging of the run down battery will also be borne

by you.

Repair on the spot

In the event insured Vehicle breaks down due

to a minor mechanical / electrical fault making it

immobile and immediate repair on the spot is

deemed possible, you will get the assistance of a

vehicle technician for repairing the breakdown

at the location of breakdown. Cost of Material &

Spare Parts, if required, to repair the vehicle on the

spot and any other incidental conveyance to obtain

such material & spare parts will be borne by you.

Spare Key Retrieval / Service for Keys Locked

Inside

If the keys of the insured vehicle are locked inside

the vehicle, lost, or misplaced, and in case you

need and request to arrange for another set from

your place of residence or oce by courier to the

location of the vehicle, the same will be arranged

after receiving the requisite authorizations from

you with regards to the person designated to hand

over the same. You may be requested to submit an

identity proof at the time of delivery of the keys.

Alternatively, at your request, you will be assisted

by a car technician to attempt to open the car with

normally available tools at the location of the event.

Identity proof for matching with car ownership

information on record will be required prior to

attempting this service.

Fuel Support (Emergency Fuel Delivery)

In the event insured Vehicle runs out of fuel and

hence is immobilized, you will get the assistance

of emergency fuel (up to 5 liters on a chargeable

basis) at the location of breakdown.

Emergency Towing Assistance

In case of Break-down:

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

19

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

In the event insured Vehicle suers an immobilizing

break down due to a mechanical or electrical fault

which cannot be repaired on the spot, you will get

the assistance in towing the vehicle to the nearest

garage, using the best available towing mechanism,

within a radius of 25 Kms. from the location of the

breakdown. In case the towing distance exceeds

the mentioned limit, you will be informed of the

expected additional costs, which will need to be

paid by you to the vendor at vendor’s actual rates.

In case of an Accident:

In the event insured Vehicle suers an immobilizing

break down due to an accident, you will get the

assistance in towing the vehicle to the nearest

garage, using the appropriate towing mechanism

within a radius of 25 Kms. from the location of the

breakdown. In case the towing distance exceeds

the mentioned limit, you will be informed of the

expected additional costs, which will need to be

paid by you at the vendor’s actual rates.

Concierge Services:

SMS Relays/Emergency Message Service

In the event of breakdown or accident to your

insured vehicle under our policy your urgent

messages will be relayed to a person of your choice.

Continuation / Return Journey (Taxi Support)

In the event the insured vehicle is immobilized due

to a breakdown, outside the municipal/corporation

limits of your home city, and the vehicle cannot be

repaired the same day, you will get the assistance

for arrangement of alternate mode of transport

(Taxi) to continue the journey or return to your

home town from the location of the breakdown. In

the normal course “C” Class vehicles (as per widely

used categorization of the automobile industry) will

be arranged on a best eort basis. However, in case

the same is not available owing to geographical or

other constraints, you will be provided the next best

class of vehicle available. Taxi fare for the journey

will be borne by you and shall be paid directly to

the vendor.

Hotel Accommodation

In the event insured vehicle is immobilized due to

a breakdown which has taken place and cannot be

repaired the same day, you will get the assistance

in organizing for Hotel accommodation near the

location of the event. You will have to bear the cost

of stay and you will be informed of the amount to

be paid in advance directly to the Hotel.

Pick up of repaired vehicle

In the event insured Vehicle suers an immobilizing

breakdown/accident which is outside the limits

of your home city, and the vehicle is towed to the

nearest garage which determines that the vehicle

cannot be repaired the same day, you will get the

assistance to pick the vehicle from the location

of incident and transport it to the desired location by

providing driver facility service after the vehicle is fully

repaired. The cost of driver shall be borne by you.

Important Note: You will not be required to pay

for labor cost and round-trip conveyance costs

of the service provider except cost of material/

spare parts and conveyance/transportation cost to

obtain them, if required, to repair the Vehicle and

any other cost specically mentioned in the above

services.

Further, If your insured vehicle is immobilized due

to breakdown, and is eligible for services, but as a

rare chance, you do not get the eligible assistance

as mentioned above, you will be reimbursed the

costs incurred for towing the insured Vehicle to

the nearest garage not exceeding Rs.2000/- per

event for towing or Rs.250/- per event for other

services. To qualify for reimbursement, you must

have called the toll free number and obtained an

authorization, prior to availing external service and

must provide necessary documents justifying the

event and the actual costs borne.

Geographical territory:

These services are available on National highways,

state highways and motorable roads of cities within

mainland India, except in the states of Mizoram,

Nagaland, Tripura, Arunachal Pradesh, Sikkim.

LIMITATIONS:

1 The Services will be provided on a best eort

Registered Oce: Peninsula Business Park, Tower A, 15th Floor, G.K. Marg, Lower Parel, Mumbai – 400013

24x7 Toll Free No: 1800 266 7780 | Email: [email protected] | Website: www.tataaig.com

IRDA of India Registration No: 108 | CIN:U85110MH2000PLC128425

20

Auto Secure - Standalone Own Damage Private Car Policy

UIN: IRDAN108RPMT0001V02201920

basis, subject to regulations in force locally.

2 The services would not be provided under

following conditions:

Acts of God (including exceptional adverse

weather conditions), earthquake, re (not

caused by the negligence of either party), war

(declared or undeclared), invasion, rebellion,

revolt, riot (other than among employees of

either party), civil commotion, civil war, acts

of terrorism, nuclear ssion, strike, act(s) of

omission/commission by any concerned,

Government(s), or government agencies,

judicial or quasi-judicial authorities.

3 loss of or damage to luggage or other personal

eects that might occur during the services

performance.

4 Vehicles should not be used for the purpose

of racing, rallying, motor-sports, or in any

instance where the Vehicle is not being used /

driven in accordance with applicable laws and

regulations.