State University of New York College at Buffalo - Buffalo State University State University of New York College at Buffalo - Buffalo State University

Digital Commons at Buffalo State Digital Commons at Buffalo State

Applied Economics Theses Economics and Finance

8-2013

Forecasting Foreign Exchange Rates Forecasting Foreign Exchange Rates

Timothy M. Znaczko

STATE UNIVERSITY OF NEW YORK BUFFALO STATE

Advisor Advisor

Dr. Theodore F. Byrley, Chair and Associate Professor of Economics and Finance

First Reader First Reader

Dr. Theodore F. Byrley, Chair and Associate Professor of Economics and Finance

Second Reader Second Reader

Dr. Ted Schmidt, Associate Professor of Economics and Finance

Third Reader Third Reader

Dr. Fred Floss, Professor of Ecnomics and Finance

Department Chair Department Chair

Dr. Theodore F. Byrley, Chair and Associate Professor of Economics and Finance

To learn more about the Economics and Finance Department and its educational programs,

research, and resources, go to http://economics.buffalostate.edu/.

Recommended Citation Recommended Citation

Znaczko, Timothy M., "Forecasting Foreign Exchange Rates" (2013).

Applied Economics Theses

. 4.

https://digitalcommons.buffalostate.edu/economics_theses/4

Follow this and additional works at: https://digitalcommons.buffalostate.edu/economics_theses

Part of the Business Administration, Management, and Operations Commons, Finance and Financial

Management Commons, and the International Business Commons

STATE UNIVERSITY OF NEW YORK

COLLEGE AT BUFFALO

DEPARTMENT OF ECONOMICS AND FINANCE

FORECASTING FOREIGN EXCHANGE RATES

A THESIS IN

ECONOMICS AND FINANCE

BY

TIMOTHY M ZNACZKO

SUBMITTED IN PARTIAL FULFILLMENT

OF THE REQUIREMENTS

FOR THE DEGREE OF

MASTER OF ARTS

AUGUST 2013

Approved by:

Theodore F. Byrley, Ph.D. CFA

Chair and Associate Professor of Economics and Finance

Chair of Committee

Thesis Advisor

Kevin J. Railey, Ph.D.

Associate Provost and Dean of the Graduate School

© Copyright by

Timothy M Znaczko

2013

ii

THESIS COMMITTEE

Theodore F. Byrley, Ph.D. CFA

Associate Professor, Economics and Finance,

Chair of Committee

Thesis Advisor

Ted P. Schmidt, Ph.D.

Associate Professor, Economics and Finance

Committee Member

iii

Acknowledgements

No successful work can ever be the effect of a single individual effort. I take this

opportunity to express my deep gratitude towards everyone who has been of immense

help throughout, until the completion of the project. I earnestly wish to express my

heartfelt thanks for Dr. Byrley (Associate Professor, Economics and Finance) whose

invaluable guidance and advice let me achieve the goal of this project. My sincere thanks

are extended to Dr. Kasper (Assistant Professor, Economics and Finance) who has been

instrumental in the successful culmination of this work.

iv

TABLE OF CONTENTS

SIGNATORY …………………………………………………………………… ii

ACKNOWLEDGMENTS ……………………………………………………… iii

LIST OF TABLES ……………………………………………………………… vi

LIST OF FIGURES ……………………………………………………………… vi

1.0 INTRODUCTION ……………………………………………………………… 7

1.1 Background …………………………………………………………… 7-9

1.2 Problem Statement and Purpose of the Thesis ……………………… 9-10

1.3 Significance of the Thesis ………………………………………… 11-17

1.4 The Path of Query ………………………………………………… 18-20

1.5 Limitations ………………………………………………………… 20-21

2.0 REVIEW OF LITERATURE

………………………………………………… 21-22

2.1 Exchange Rate Systems …………………………………………… 22-24

2.2 Exchange Rate Variables …………………………………………… 24-31

2.3 Meese & Rogoff …………………………………………………… 31-32

2.4 Random Walk Model ……………………………………………… 33-35

2.5 Akaike and Schwarz Criteria ……………………………………… 35-36

2.6 Wiener-Kolmogorv Filter ………………………………………… 36-37

2.7 Engel & West ……………………………………………………… 37-38

2.8 McCracken & Sapp ………………………………………………… 38-39

2.9 Zhang & Berardi ………………………………………………… 39-40

3.0 METHODOLOGY

…………………………………………………………… 41-42

3.1 Estimation and Forecasting Methods……………………………… 42-43

3.1.1 Least Squared Model …………………………………… 43-44

v

3.1.2 Regression ………………………………………………… 44-47

3.1.3 Box-Jenkins ………………………………………………… 48-50

3.1.4 Simple Moving Average …………………………………… 51

3.1.5 Exponential Smoothing …………………………………… 52

3.1.6 Mean Square Error & Root Square Error ………………… 52-53

3.1.7 Theil’s U Statistic …………………………………………… 53-54

3.2 Model Comparisons …………………………………………………… 54

3.3 Data Elements ……………………………………………………… 55

4.0 ANALYSIS OF TABLES

………………………………………………………… 55

4.1 Forecast Methods …………………………………………………… 56-59

5.0 CONCLUSION AND RECOMMENDATIONS

…………………………………… 60-62

6.0 REFERENCES

……………………………………………………………… 67-69

7.0 APPENDIX

………………………………………………………………… 70-103

vi

LIST OF TABLES

Table 4.1.A: Canadian Dollar Forecast ………………………………………… 57

Table 4.1.B: British Pound Forecast …………………………………………… 58

Table 4.1.C: Japanese Yen Forecast …………………………………………… 59

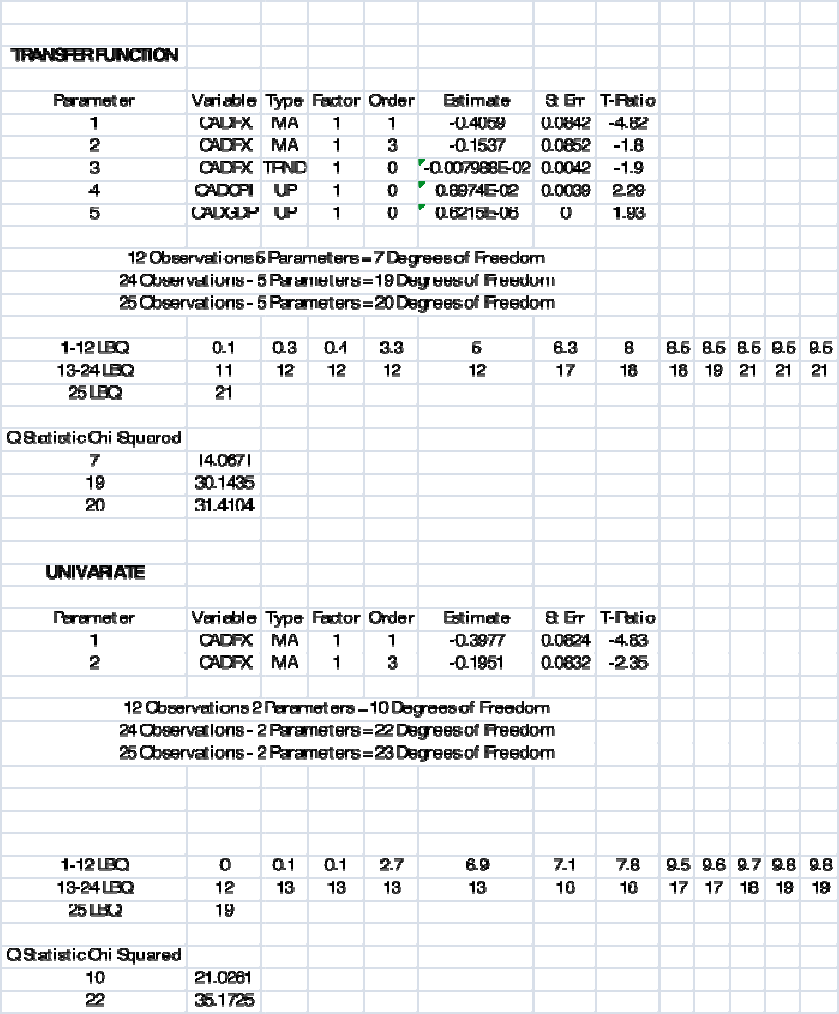

Table 4.2: Canadian Dollar Transfer Function Results ………………………… 63

Table 4.3: Japanese Yen Transfer Function Results …………………………… 64

Table 4.4: British Pound Transfer Function Results …………………………… 65

LIST OF FIGURES

Figure 1.1: Model Selection Process ………………………………………… 17

Figure 3.1: Linear Regression Graph: ACF and PACF for an AR(1) process … 46

Figure 3.2: Linear Regression Graph: ACF and PACF for an AR(2) process … 47

Figure 3.3: Linear Regression Graph: ACF and PACF for a MA(1) process … 47

Figure 3.4: Linear Regression Graph: ACF and PACF for a MA(2) process … 66

7

1.0 Introduction

1.1 Background

Determination of exchange rates was once fairly simple. During the years of the

Bretton Woods System (a system put in place in 1944 when the leaders of allied nations

met at Bretton Woods, NH to set up a stable economic structure out of the chaos of

World War II), there were long periods of exchange rate stability. Despite the inherent

problems, pegged systems lend a degree of confidence to currency price predictions.

There were major readjustments to the system if a currency became too far out of line

with economics, but there were few surprises because adjustments could be anticipated

well in advance. This is no longer the case.

Current practices rely on exchange rate forecasts as a cornerstone of most, if not

all, international business and banking decisions. Speculations based on exchange rate

forecasts provide the opportunity to create sizeable profits for businesses and banks. The

constant movement of rates in the foreign exchange market, combined with the rapid

internationalization of business, has resulted in the demand for forecasting methods.

In general, forecasting requires the presumption of a set of relationships among

variables. In other words, economic forecasting requires models. Forecasting techniques

are based on formal models and may rely on an assumed sequence of casual relationships

(e.g., simulation models), or on the data-based development of statistical relationships

8

between the variable of interest and past values of the same series (intrinsic models),

and/or past values of various exogenous variables (extrinsic models).

1

One feature common to both exploratory and causal and extrinsic and intrinsic

statistical models is that their predictive ability depends on the assumption that

relationships established in the past will continue reasonably unchanged into the future.

It makes little difference whether the nature of this relationship is specified in terms of a

logical or theoretical framework, or a statistical dependence. The stability of the

forecasting model is not the only condition necessary for profitable forecasting. A more

fundamental condition is that the actions of other forecasters do not wipe out any possible

profit from successful prediction. Recent developments in time series theory have led to

the frequent use of methods that forecast by fitting some functional relation to the

historical values of the series and extrapolating them into the future.

The international monetary environment in which the exchange rate forecasts are

made has passed through several transitions. The most common transition is that national

monetary authorities have pledged to maintain exchange rates within small margins

around a target rate or a “par value.” This value could be changed whenever the balance

of payments of a country moves in disequilibrium and when it becomes clear that various

alternative policies are ineffective. Forecasting procedures developed in this

environment consist of a three-step process: the examination of the balance of payments

and other trends one derives from pressure on a currency; the indication from the level of

central bank foreign exchange reserves (including borrowing facilities) of the point in

1

Ian H. Giddy and Gunter Dufey, "The Random Behavior of Flexible Exchange Rates: Implications for

Forecasting." Journal of International Business Studies, 1 (1975): 1-32.

9

time when a situation becomes critical; and the crucial prediction of which one of the

rather limited policy options economic decision-makers resort to in times of crisis.

1.2 Problem Statement and Purpose of the Thesis

World currencies are being traded everyday against one another to the tune of

trillions of dollars per day. Through this trading each currency is pegged and measured

against the other by an exchange rate. An exchange rate is the price of one currency

expressed in terms of another currency. The question that arises is: what causes

exchange rates to change, and how does one predict future value?

Time series analysis involves both model identification and parameter estimation.

Most analyses would agree the identification problem is more difficult. Once the

functional form of a model is specified, estimating the model parameters is usually

straightforward. To identify a model that best represents a time series, it is necessary to

be clear about the purpose of the model. Is the model’s chief objective to explain the

nature of the system generating the series? Or, is the model to be judged on its ability to

predict future values of the time series? Therefore, to arrive at a model that represents

only the main features of the series, a selection criterion, which balances model, fit, and

model complexity, must be used.

2

The purpose of this thesis is to seek answers to different questions regarding the

forecasting of foreign exchange rates. Exchange rate movement is regularly monitored

by central banks for macroeconomic analysis and market surveillance purposes. Results

in the literature show exchange rate models perform poorly in out-of-sample prediction

2

Eily Murphee and Anne Koehler, “A comparison of the Akaike and Schwarz Criteria for Selecting Model

Order.” Applied Statistic, 37 (1988): 187-195.

10

analysis, even though some models have good in-sample analysis. The results were

found using methods including moving average, exponential smoothing, random walk,

and Box-Jenkins transfer function. The questions that I ask are: how accurate are these

models when compared to a random prediction of future exchange rates, and what

variables, if any, allow for the most accurate prediction? I am motivated to research this

issue because I currently work in the insurance business and am interested in actuarial

science.

This thesis is to research a variety of foreign exchange forecasting models and

gather data for several different countries and variables in order to compare the future

predictions to a random walk model. There are several objectives I will pursue to

determine if this thesis is valid. One objective is to define the specific formulas used for

each model, including which variable each model uses. Another objective is to run tests

of all the models, variables, and data, and compare the viability of the results. A number

of questions will arise and will be investigated.

The outcome of this course is my written statement. My anticipation of this thesis

is that foreign exchange rate forecast models do not outperform a random walk model

when predicting future rates. The evaluation of this course will be the assessment of my

thesis and oral defense by my thesis committee.

11

1.3 Significance of the Thesis

International forecasts are usually settled in the near future. Exchange rate

forecasts are necessary to evaluate the foreign denominated cash flows involved in

international transactions. Thus, exchange rate forecasting is very important to evaluate

the benefits and risks attached to the international business environment.

A wide variety of forecasting techniques and models claim that they are able to

help predict future values of exchange rates. There is a need to investigate and evaluate

these forecasting claims and compare the results accordingly.

This thesis provides comparative results that are important for forecast model

selection used in predicting and trading foreign exchange rates. The results of this thesis

will provide a foundation as to whether there is a clear-cut model that should be used in

predicting foreign exchange rates.

The first question that arises is: are there different methods used in order to

forecast different currencies? There are different methods of forecasting exchange rates.

One approach may consider various factors specific to long-term cycle rise. For instance,

data for a certain country would be looked at based on productivity indices, inflation,

unemployment rate, trade balance, and more. A different approach focuses on the current

and past real value of the exchange rate. Forecasting can be based on the investor, so

changes in rate can be determined and patterns charted. There can be any number of

methods used to attempt to predict the trend of the exchange rate and information such as

political instability, natural disasters and speculation.

Currency speculation involves buying, selling and holding currencies in order to

make a profit from favorable fluctuations in exchange rates. It involves a high degree of

12

risk since predicting what events will influence exchange rates during a specific period of

time, as well as the magnitude of the influence, is very difficult. Currency speculation

can have serious consequences on a national currency and accordingly on a country's

economy. While a major benefit of speculation is an increase in liquidity (more units of

currency being used in transactions rather than reserves), speculation can also devalue or

inflate a currency to the point at which a country’s stock market and overall economy

starts to follow suit. Heavy trading in a currency creates “artificial demand” and can

increase the prices of goods beyond an inflation-adjusted level.

The second question that arises is: what are the macro variables that should be

used for forecasting variables? Information plays an important role in regarding the

potential return on foreign exchange trading. The general view about exchange rates is if

the exchange rate of a country is properly valued, it does not substantially affect the

macroeconomic variables and, therefore, the macroeconomic performance of that

country. Volatility in exchange rate of a country can affect the investment in that country

adversely. It creates an uncertain environment for investment in that country and requires

that the country’s resources be reallocated among various sectors of the country’s

economy.

One variable that plays a role in the movement of the exchange rate is foreign

direct investment. The role of foreign direct investment for the growth of developing

countries is very important. Foreign investors are motivated to invest in a host country if

the prospects of earning long-term profits by contributing towards the country’s

production sector are obvious. Foreign direct investment not only contributes towards

13

capital formation in developing countries, but it is also a source of transfer of

technological and innovative skills from developed to developing countries.

Inflation can also affect the fluctuation of an exchange rate. Inflation affects the

value of goods and services because purchasing power parity is a fundamental

determinant of exchange rates. Inflation in one country translates into a rise in the price

of goods and services in that country, whereas the value of products in other countries

remains unchanged where inflation is subdued. The result of this discrepancy is that the

currency of the country experiencing inflation plummets against those other currencies

that do not, resulting in a devaluation of their currency.

An example of variables affecting the foreign exchange rate of a local currency

can be seen in gross domestic product. If a country imports more goods and services than

it exports, then the result is a current account deficit. That country must finance that

current account deficit, either by international borrowing or by selling more capital assets

than it buys internationally. Conversely, when the country exports more than it imports,

its trading partners must finance their current account deficits, either by borrowing or by

selling more capital assets than they purchased, both affecting the rate.

Another question now arises. Is forecasting feasible? In many ways, there is no

conflict between fundamental and technical analysis. The decisions that result from

economic or policy changes are far reaching; these actions may cause a long-term change

in the direction of prices and may not be reflected immediately. Actions based on long-

term forecasts may involve considerable risk. Integrated with a technical method of

known risk, which determines price trends over shorter intervals, investors and

researchers have gained practical solutions to their forecasting problems.

14

A fundamental study may be a composite of supply and demand elements such as

statistical reports, expected use, political ramifications, labor influence, price support

programs, and industrial development. The result of a fundamental analysis is a forecast.

Technical analysis is a study of patterns and movements. Its elements are normally

limited to price, volume, and open interest. It is considered to be the study of the market

itself. The results of technical analysis may be a short- or long-term forecast based on

recurring patterns; however, technical methods often limit their goals to the statement

that prices are moving either up or down. One advantage of technical analysis is it is

completely self-contained. The accuracy of the data is certain.

To successfully forecast, one must act on news that has not yet been printed and

anticipate changes. One must recognize recurring patterns in price movement and

determine the most likely results of such patterns. One must also determine the trend of

the market by isolating the basic direction of data over a selected time interval.

Forecasts are limited by the data used in the analysis. This raises the question:

what data should be used? There is a multitude of statistical data that might be used other

than the data related to a specific inquiry. Some of this data is easily included such as

prices, but other data may add to a more certain forecast; however, the data may not be

that readily available. The time frame of the data impacts both the type of forecast as

well as the nature of the forecast. For example, if using only weekly data, there is so

much emphasis on the trend that your forecast is already pre-determined. A shorter time

may guarantee a faster response to changes, but it does not assure better results.

When sampling is used to obtain data, it is common to divide entire subsets of

data into discrete parts and attempt a representative sampling of each portion. These

15

samples are then weighted to reflect the perceived impact of each part on the whole.

Such a weighting will magnify or reduce the errors in each of the discrete sections. The

result of such weighting may cause an error in bias. Even large numbers within a sample

cannot overcome intentional bias introduced by weighting one or more parts.

Technical analysis is based on a perfect set of data. Each price that is recorded is

exact and reflects the netting out of all information at that moment. Most other statistical

data, although appearing to be very specific, are normally an average value, which can

represent a broad range of numbers, all of them either large or small. When an average is

used, it is necessary to collect enough data to make that average accurate. When using

small, incomplete, or representative sets of data, the approximate error, or accuracy of the

sample, should be known. A critical element of forecasting is the recognition that there

exists a pattern in the time series data. Forecasting a trend or cycle requires a

methodology different from that of forecasting seasonal differences. A time series is

nothing more than observed successive values of a variable or variables over regular

intervals of time.

There are four basic components that make up time series data that can influence

our forecast of future outcomes:

Secular trend (

T

)

Seasonal variation (

S

)

Cyclical variations (

C

)

Random or irregular variation ( )

3

3

J.K. Sharma, Business Statistics (New Delhi, India: Dorling Kindersley, 2007), 543.

I

16

The time series model that is generally used is a multiplicative model that shows

the relationship between each component and the original data of a time series (

Y

) as:

Y

=

T

∗

S

∗

C

∗

I

Secular trend is the long-term growth movement of a time series. The trend may

be upward, downward, or steady. Seasonal variation refers to repetitive fluctuations that

occur within a period of one year. Cyclical variations are wave-like movements that are

observable over extended periods of time. Random variation refers to variation in a time

series that is not accounted for by trend, seasonal, or cyclical variations. Because of its

unsystematic nature, the random or irregular variation is erratic with no discernible

pattern.

The final question that needs to be answered is: do any of the techniques

outperform the random walk model? Some methods of analyzing data are more complex

than others. All good forecasting methods begin with a sound premise. One must first

know what he or she is trying to extract from the data before selecting a technique. The

choice of methods depends on the specifics of the situation as well as the formal

statistical criteria that guide model selection within certain approaches. The choice of

selecting a technique depends on the objectives of that forecast.

Forecasting methodologies fall into three categories: quantitative models,

qualitative models, and technological approaches. Quantitative models, also known as

statistical models, are objective approaches to forecasting. They dominate the field as

they provide a systematic series of steps that can be replicated and applied to a variety of

conditions. The qualitative methods of forecasting are called non-statistical or judgmental

approaches to making forecasts. These approaches depend heavily on expert opinion and

the forecaster’s judgment. The qualitative

are scarce. The techniques used in the technological approach combine the quantitative

and qualitative approaches so that a long

model are to respond to technologic

to make a forecast.

4

Figure 1

Figure 1-1

4

Perry J. Kaufman,

Trading Systems and Methods

17

the forecaster’s judgment. The qualitative

approaches are adopted when historical data

are scarce. The techniques used in the technological approach combine the quantitative

and qualitative approaches so that a long

-

term forecast is made. The objectives of the

model are to respond to technologic

al, societal, political, and economic changes in order

Figure 1

-1 shows the process of model selection.

Trading Systems and Methods

(New York: John Wiley & Sons, 1998), 1

approaches are adopted when historical data

are scarce. The techniques used in the technological approach combine the quantitative

term forecast is made. The objectives of the

al, societal, political, and economic changes in order

(New York: John Wiley & Sons, 1998), 1

-4.

18

1.4 The Path of Query

Regression analysis is a way of measuring the relationship between two or more

sets of data and involves statistical measurements that determine the type of relationship

that exists between the data studied. Regression analysis is often applied separately to

the basic components of a time series, that is, the trend, seasonal or secular, and cyclic

elements. These three factors are present in all price data. The part of the data that

cannot be explained by these three elements is considered random or unaccountable.

Trends are the basis of many trading systems. Long-term trends can be related to

economic factors such as inflation or shifts in the U.S. dollar due to the balance of trade

or changing interest rates. The reasons for the existence of short-term trends are not

always clear since trends that exist over a period of a few days cannot always be related

to economic factors but may be strictly behavioral.

5

The random element of price movement is a composite of everything

unexplained. There is a special relationship in the way price moves over various time

intervals, the way price reacts to periodic reports, and the way prices fluctuate due to the

time of the year. Most trading strategies use one price per day, usually the closing price,

but some methods will average the high, low, and closing prices. Economic analysis

operates on weekly or monthly average data but may use a single price for convenience.

Two reasons for the infrequent data are the availability of most major statistics on supply

and demand and the intrinsic long-term perspective of the analysis. The use of less

frequent data will cause a smoothing effect. The highest and lowest prices will no longer

5

Kaufman, Trading Systems and Methods, 37-38.

19

appear, and the data will seem more stable. Even when using daily data, the intraday

highs and lows have been eliminated, and the closing prices show less erratic movement.

6

A regression analysis, which identifies the trend over a specific time period, will

not be influenced by cyclic patterns or short-term trends that are the same length as the

time interval used in the analysis. The time interval used in the regression analysis is

selected to be long (or multiples of other cycles) if the impact of short-term patterns is to

be reduced. To emphasize the movement caused by other phenomena, the time interval

should be less than one-half of that period. In this way, a trend technique or forecasting

model may be used to identify a seasonal or cyclic element.

7

Having discussed the research problem, purpose and need for evaluating, and

selecting forecasting models, we now describe and summarize related research conducted

in this field by previous experts and economists. This is followed by a discussion of the

methodology that is used along with conclusions and recommendations for future

research and development.

Data gathered for this project was collected from the Federal Reserve Bank of St.

Louis website. There were three variables used for four different countries. The

countries used were Japan, Canada, Great Britain, and the United States. All variables

used are for the time period of January 1980 to October 2010, based on a quarterly

frequency. The aggregation method used for each variable is an average.

The first variable is foreign exchange rates. The data uses an average of the daily

figures based on buying rates in New York City and is based upon one denomination of

local currency compared to one U.S. Dollar.

6

Cheol S. Eun and Bruce G. Resnick, International Financial Management (New Delhi: McGraw Hill,

2008), 59-73.

7

Ibid., 141-151.

20

The next variable used is gross domestic product (GDP). The GDP data for Japan

is seasonally adjusted based on billions of Japanese YEN. Canadian GDP is seasonally

adjusted data based upon millions of Canadian Dollars. GDP in Great Britain is also

seasonally adjusted based upon millions of British Pounds.

The third variable used is CPI, or Consumer Price Index. This data is not

seasonally adjusted and is denoted as a percentage. These variables are selected for this

study after consulting foreign exchange traders at Citibank. Although several other

variables can and are used, these are the three that are consistent among the several

trading desks.

1.5 Limitations

A forecast represents an expectation about a future value or values of a variable.

The expectation is constructed using an information set selected by the forecaster. The

exchange rate depends on fundamentals such as relative national money supplies, real

incomes, short-term interest rates, expected inflation differentials, and cumulated trade

balances. These fundamentals are currently used by the head traders of foreign exchange

currencies at Citibank.

There are several limitations that can be identified in evaluating forecasting

performance. One limitation in time series forecasting is that the data may or may not be

adjusted for seasonality, which is used to balance data fluctuation over a period of time.

This can also be referred to as stationarity, in which data is transformed to include or

exclude seasonal trends.

21

There are also factors that lead to long-run real exchange rates that may not be

found in historical data. The factors can range from economic crisis to natural disasters.

Examples are war, earthquakes, political turmoil, oil prices, and global trade patterns.

The topic of economic forecasting is vast and many models have been presented

over the years. There is no way to determine which forecasting model is the best fit due

to limitations and the inability to predict future occurrences. The purpose of this thesis is

to answer the four main questions that arose during research. Are there different methods

used in order to forecast different currencies? What are the macro variables that should

be used to forecast currencies? Is forecasting feasible? Do any of the techniques

outperform the random walk model?

2.0 Review of Literature

In this study we look to use exchange rate as a dependent variable. The need for

the intermediate monetary target variable arises because monetary instruments (e.g., the

bank rate, cash reserve requirements, open market operations), and the ultimate goal of

monetary policy (e.g., a higher rate of economic growth, price stability, a surplus in the

balance of payments) do not have a direct relationship. In order to determine if exchange

rates influence GDP and interest rates, we most know the link between them.

Exchange rate fluctuations play a key role in determining economic policy. These

fluctuations have repercussions on economic performances. It is essentially the

dependence with respect to imports and specialization in exports that account for

exchange rate fluctuations on the economic performances of countries. In order to

22

stabilize the economy during these fluctuations, government may increase or decrease

money supplies, which, in turn, can weaken or strengthen the price of the exchange rate.

In fundamental models of exchange rate, macroeconomic variables such as

interest rates, money supplies, gross domestic products, trade account balances, and

commodity prices have long been perceived as the determinants of the equilibrium

exchange rate. The foreign exchange rate in fundamental models is classified as a highly

liquid market where all information is public, and traders in the market share the same

expectations with no information advantage over the other.

8

2.1 Exchange Rate Systems

Confidence in a currency is the greatest determinant of an exchange rate.

Decisions based on expected future developments may affect the currency. An exchange

of currency can be based on one of four main types of exchange rate systems:

Fully fixed exchange rates

Semi-fixed exchange rates

Free-floating exchange rates

Managed floating exchange rates

9

The Federal Reserve Bank of New York carries out foreign exchange-related

activities on behalf of the Federal Reserve System and the U.S. Treasury. In this

capacity, the bank monitors and analyzes global financial market developments, manages

8

Andrew W. Mullinex and Victor Murnide, Handbook of International Banking (London: Edward Elgar

Publishing Limited, 2003), 350-358.

9

The Federal Reserve Board. "FRB: Speech, Bernanke--International Monetary Reform and Capital

Freedom--October 14, 2004."

http://www.federalreserve.gov/boarddocs/speeches/2004/20041014/

(accessed 30 March 2009).

23

the U.S. foreign currency reserves, and from time to time intervenes in the foreign

exchange market.

The U.S. Treasury has the overall responsibility for managing the U.S.

government’s foreign currency holdings. It works closely with the Federal Reserve to

regulate the dollar’s position in the forex markets. If the Treasury feels there is a need to

weaken or strengthen the dollar, it instructs the Federal Reserve Bank of New York to

intervene in the forex market as the Treasury’s agent. The Federal Reserve Bank of New

York buys dollars and sells foreign currency to support the value of the dollar. The bank

also sells dollars and buys foreign currency to try to exert downward pressure on the

price of the dollar.

10

The transactions in the intervention are small compared to the total volume of

trading in the forex market, and these actions do not shift the balance of supply and

demand immediately. Instead, intervention is used as a device to signal a desired

exchange rate movement and affect the behavior of investors in the forex market. Central

banks in other countries have similar concerns about their currencies and sometimes

intervene in the forex market as well. Usually, intervention operations are undertaken in

coordination with other central banks. Some countries have special arrangements with

other countries to help them keep their currencies stable. Many less developed countries

have their currencies pegged to other currencies so that their value rises and falls

simultaneously with the stronger currency.

11

In a fully fixed exchange rate system, the government (or the central bank acting

on its behalf) intervenes in the currency market in order to keep the exchange rate close

10

The Federal Reserve Board. "FRB: Speech, Bernanke--International Monetary Reform and Capital

Freedom--October 14, 2004”.

11

Ibid.

24

to a fixed target. It is committed to a single fixed exchange rate and does not allow major

fluctuations from this central rate. In a semi-fixed exchange rate system, currency can

move inside permitted ranges of fluctuation. The exchange rate is the dominant target of

economic policy making. Interest rates are set to meet the target, and the exchange rate is

given a specific target. This is the major difference between fully and semi-fixed

exchanges rates. However, the semi-fixed holds most of the same characteristics as the

fully fixed exchange rate.

12

A floating exchange rate system is a monetary system in which exchange rates are

allowed to move due to market forces without interventions of national governments.

With floating exchange rates, changes in market demand and supply cause a currency to

change a value. Pure free-floating exchange rates are rare. Most governments at one

time or another seek to manage the value of their currency through changes in interest.

In a free-floating exchange rate system, the value of the currency is determined solely by

market supply and demand forces in the foreign exchange market. Trade flows and

capital flows are the main factors affecting the exchange rates and other controls.

13

2.2 Exchange Rate Variables

In looking domestically at the United States, the current account deficit is

conceptually equal to the gap between domestic investment and domestic saving as

12

The Federal Reserve Board. "FRB: Speech, Bernanke--International Monetary Reform and Capital

Freedom--October 14, 2004”.

13

Ibid.

25

matter of international account, which can be seen in the national income identity. The

following graph shows the 2012 U.S. trade deficit when compared to China.

14

2012: U.S. trade in goods with China

NOTE: All figures are in millions of U.S. dollars on a nominal basis, not seasonally

adjusted unless otherwise specified. Details may not equal totals due to rounding.

Month Exports Imports Balance

January 2012

8,372.0

34,394.6

-

26,022.6

February 2012

8,760.7

28,124.7

-

19,363.9

March 2012

9,829.7

31,501.8

-

21,672.0

April 2012

8,456.5

33,011.0

-

24,554.5

May 2012

8,898.6

34,942.0

-

26,043.4

June 2012

8,518.7

35,919.8

-

27,401.2

July 2012

8,554.1

37,929.9

-

29,375.8

August 2012

8,609.2

37,297.3

-

28,688.1

September 2012

8,790.9

37,849.9

-

29,059.0

October 2012

10,823.3

40,289.5

-

29,466.2

November 2012

10,594.4

39,548.2

-

28,953.8

December 2012

10,382.0

34,835.0

-

24,453.0

TOTAL 2012 110,590.1 425,643.6 -315,053.5

When investments in the United States are higher than domestic saving,

foreigners make up the difference, and the United States has a current account deficit. In

contrast, if savings exceed investment in a country, then that country has a current

account surplus and its people invest abroad. The growth of the U.S. current account

deficit for more than a decade has been linked to high levels of domestic U.S. capital

formation compared to domestic U.S. saving. Perceived high rates of return on U.S.

assets (based on sustained strong productivity growth relative to the rest of the world)

14

The United States Census Bureau. "2012: U.S. trade in goods with China.”

http://www.census.gov/foreign-trade/balance/c5700.html (accessed March 24, 2012).

26

show U.S. economic performance and the attractiveness of the U.S. investment climate,

attracting foreign investment. Sustained external demand for the United States assets has

both supported the dollar in the foreign exchange markets over the years and allowed the

United States to achieve levels of capital formation that would have otherwise not been

possible. Robust growth in investment is critical to the non-inflationary growth of

production and employment.

15

For a country to be involved in international trade, finance, and investment, it is

necessary to have access to foreign currencies of other countries. The sale and purchase

of foreign currencies take place in the foreign exchange markets. This market allows for

the movement of large volumes of funds (about three trillion dollars per year) for

investment purposes around the world. Any changes in exchange rates are important

because of the effect they have on the prices we pay for imports, the prices we receive for

our exports, and the amount of money flowing into and out of the economy.

For example, if the volume of the U.S. dollar appreciates (increases in value),

exports become more attractive and overseas customers have to find more U.S. dollars to

buy the same volume of exports. If the U.S. dollar depreciates (decreases in value), then

U.S. exports become cheaper, and imports become more attractive. U.S. exports are now

more competitive in global markets because of the depreciation of the U.S. dollar.

Currently, overseas buyers of U.S. products have to find fewer U.S. dollars to buy the

same value of exports. Decreasing import prices can decrease production costs and

inflation rates in any domestic economy.

15

The Federal Reserve Board. "FRB: Speech, Meyer -- The Future of Money and of Monetary Policy."

http://www.federalreserve.gov/boarddocs/speeches/2001/20011205/ (accessed March 15 2010).

27

There are several factors that affect the demand for U.S. dollars. The first factor

to look at is the demand for U.S. exports. When overseas consumers buy U.S. goods and

services, they need to convert their currency into U.S. dollars to pay for the exports.

Therefore, any increase in the demand for U.S. exports should increase the value of the

dollar.

Changes in world economic conditions and international competitiveness will

affect the demand for the U.S. dollar. High levels of world economic growth can

increase the demand for goods and services and the demand for the U.S. dollar. To be

competitive in the global market, the United States’ goods and services must be as cheap

as its international competitors. If U.S. inflation rates and costs are relatively higher than

its overseas competitors, then the goods and services will be more expensive. High U.S.

inflation rates help cause a loss of export markets, reduce the demand for the dollar, and

force a depreciation of the dollar. However, lower rates of inflation typically increase the

demand for U.S. exports and appreciate the value of the dollar.

16

Capital inflow also affects the demand for U.S. dollars. Foreign investors wishing

to invest in the United States must also exchange their own currency for dollars. A

number of factors may influence the investment decision. If interest rates are relatively

higher than overseas interest rates, this will increase the capital inflow and the demand

for U.S. dollars. The expectation of higher levels of domestic growth will influence the

size of capital inflow and increase the demand for dollars, causing a currency

appreciation. A decline in the level of capital inflow, however, may cause a fall in the

demand for dollars, resulting in currency depreciation.

16

The Federal Reserve Board. “FRB: Speech, Meyer -- The Future of Money and of Monetary Policy."

28

There are also several factors that affect the supply of U.S. dollars. Demand for

imports plays a significant role. Just as foreigners must pay for exports with U.S. dollars,

we must pay overseas producers foreign currency for imported goods. If the dollar

demand for imported goods and services increases, so does the supply of dollars. The

increase in the supply of U.S. dollars puts downward pressure on the value of the dollar.

An increase in capital outflow can occur as a result of higher interest repayments

on overseas loans (net income transfers) or increased demand for foreign assets. This

means that investors need to sell U.S. dollars (increasing the supply) in the foreign

exchange market to obtain other countries’ currencies. The increase in the supply of

dollars could cause a decrease (depreciation) in the value of the U.S. dollar. The level of

domestic interest rates and investor confidences in the U.S. dollar also influence the

supply. If there are high rates of inflation in the United States, imported goods and

services would be cheaper relative to domestically produced products. If speculators lose

confidence in the economy and feel that future values of the U.S. dollar will be lower

than present levels, a depreciation of the exchange rate can occur. This happens because

when speculators sell U.S. dollars to avoid future losses, the supply of dollars increases,

putting downward pressure on the exchange rate.

How does this information tie directly into the U.S. economy? The United States

budget currently has a deficit or current account deficit. There is a process of adjustment

to current account deficit. The possible causes of an emerging or growing current

account deficit are the same issues that cause depreciation as discussed earlier. Three of

the most prominent causes are: domestic incomes increasing at a faster pace than foreign

29

incomes; domestic inflation at a faster pace than foreign inflation rates; and domestic

interest rates that are lower than foreign interest rates.

A growing deficit is likely to increase the supply of domestic money to the

foreign exchange market. Assuming that the demand for domestic money has not

changed, the resulting excess supply will likely induce depreciation of the domestic

currency on the foreign exchange market. The depreciation of the domestic currency

makes the nation’s exportable goods look cheaper to foreigners and imports from abroad

appear more expensive to citizens, thereby alleviating the current deficit. How foreign

exchange market transactions affect the domestic supply of a nation depends upon the

identities of the purchasers and sellers of the exchange. With a current deficit, one source

of the increased supply of domestic currency to the forex market is foreigners who have

acquired the domestic currency as export earnings, incomes from investors in the nation,

or transfers from citizens or government of the nation. If foreigners supply quantities of

the domestic currency to other foreigners through the forex market, the relevant domestic

money supply (that which motivates the behavior of citizens of the nation) does not

change.

Another source of increased supply of domestic currency to the forex market is

the efforts by citizens of the nation to convert quantities of domestic currency into foreign

currencies in order to purchase imports from foreign sources, invest overseas, or make

transfers to foreigners. To the extent that foreign interests acquire money balances

denominated in units of the domestic currency from citizens of the nation, the nation’s

relevant domestic money supply decreases. Assuming that the domestic demand for

money does not change, the domestic money supply decrease may result in falling

30

domestic prices, rising domestic interest rates, and decreasing employment. The falling

domestic prices of goods tend to increase the volume of exports and reduce the volume of

imports. The rising domestic interest rates tend to decrease the volume of investment by

citizens in other countries and increase the volume of investment by foreigners in the

nation. The decreasing domestic employment decreases income in the nation and, thus,

curbs imports.

One view is that the burden of adjustment borne by domestic prices, interest rates,

and employment is lessened by the currency depreciation. Another view is that these

three phenomena supplement the depreciation of the domestic currency in alleviating the

current deficit. However, if the depreciation of the domestic currency is prevented by

government authorities that are resolved to “defend the currency” from further weakening

or depreciation, the burden of adjustment to the deficit will descend upon domestic

prices, interest rates, and employment.

17

Some of the domestic money, which is supplied to the forex market, may be

acquired by citizens of the nation who may wish to convert foreign currency denominated

export earnings, investment income, or gifts from foreigners into domestic currency for

repatriation. Such currency transactions between citizens of the same nation do not affect

the domestic money supply, even though they pass through the forex market. Such

citizen-to-citizen forex market transactions may be large enough relative to the volume of

transactions between citizens and foreigners that the reduction of the domestic money

supply consequent upon a deficit will itself be diminished. Although the usual

presumption is that the domestic money supply decreases, the volume of citizen-to-

citizen or foreigner-to-foreigner transactions in the domestic currency is large enough

17

The Federal Reserve Board. "FRB: Speech, Meyer -- The Future of Money and of Monetary Policy.”

31

that the money supply may be little affected by a deficit. In this case, the domestic

macroeconomic adjustment will be minimal, and the correction of the imbalance will

depend largely upon depreciation of the currency if the government will let it ensue.

The depressive macroeconomic effects of a decrease of the relevant domestic

money supply in response to a deficit may motivate the government of the nation to

attempt to neutralize the monetary contraction with offsetting purchases of bonds in the

open market. If domestic macroeconomic contraction is prevented, the full burden of the

adjustment of the deficit must fall upon exchange rate depreciation. If the government

also resolves to prevent its currency from depreciating by intervening in the forex market

to purchase quantities of the domestic currency, no mechanism of adjustment is allowed

to function, and the current deficit may persist indefinitely. It may be inferred that a

fixed exchange rate system is fundamentally incompatible with the exercise of modern

macroeconomic policy to stabilize the domestic economy.

18

2.3 Meese & Rogoff

The difficulty in predicting future exchange rates has been a longstanding issue in

international economics. The forecasting experiment proposed by Richard Meese and

Kenneth Rogoff is by what exchange rate models are judged. Meese and Rogoff

examined the relationship between real exchange rates and real interest rates over the

modern (post 1970) flexible rate period. They concluded that the exchange rate depends

on fundamentals such as relative national money supplies, real incomes, short-term

interest rates, expected inflation differentials, and cumulated trade balances. The

18

Robert Wade, Governing The Market: Economic Theory and the Role of Government in East Asian

Industrialization (New Jersey: Princeton University Press, 1990), 159-168.

underlying assumption is that goods market prices adjust slowly in response to

anticipated disturbances and to excess demand. Consequently, less than perfectly

anticipated monetary

disturbances can cause temporary deviations in the real exchange

rate from its long-

run equilibrium value. Meese and Rogoff used the following equation

for forecasting exchange rates:

()( =−Ε

+

+

θ

k

kt

ktt

q

qq

where

t

Ε

is the time expec

tations operator,

prevail at time t

if all prices were fully flexible, and

parameter. In addition,

θ

is a function of the structural parameters of the model.

However, additive disturbances (such as money market shocks) do not affect

general,

t

Ε

(q

t+k

)

will not equal

shocks follow random walk processes.

Meese & Rogoff challenged the long

determine currency values. They found that a random walk model was just as good at

predicting

exchange rates as models based on fundamentals. In short, their findings

suggest economic fundamentals, like trade balances, money supply, national income, and

other key variables, are of little use in forecasting exchange rates between countries with

rou

ghly similar inflation rates.

19

Kenneth Rogoff and Richard Meese, "Was it Real? The Exchange Rate

Over the Modern Floating-

Rate Period."

20

Ibid.

21

Ibid.

32

underlying assumption is that goods market prices adjust slowly in response to

anticipated disturbances and to excess demand. Consequently, less than perfectly

disturbances can cause temporary deviations in the real exchange

run equilibrium value. Meese and Rogoff used the following equation

for forecasting exchange rates:

10), <<−

θ

k

t

q

q

tations operator,

t

q

is the real exchange rate that would

if all prices were fully flexible, and

θ

is the speed of adjustment

is a function of the structural parameters of the model.

However, additive disturbances (such as money market shocks) do not affect

will not equal

t

q

unless there are no real shocks or unless all real

shocks follow random walk processes.

20

Meese & Rogoff challenged the long

-

held idea that economic fundamentals

determine currency values. They found that a random walk model was just as good at

exchange rates as models based on fundamentals. In short, their findings

suggest economic fundamentals, like trade balances, money supply, national income, and

other key variables, are of little use in forecasting exchange rates between countries with

ghly similar inflation rates.

21

Kenneth Rogoff and Richard Meese, "Was it Real? The Exchange Rate

-

Interest Differential Relation

Rate Period."

The Journal of Finance

, no. 43 (September 1998): 933

underlying assumption is that goods market prices adjust slowly in response to

anticipated disturbances and to excess demand. Consequently, less than perfectly

disturbances can cause temporary deviations in the real exchange

run equilibrium value. Meese and Rogoff used the following equation

is the real exchange rate that would

is the speed of adjustment

is a function of the structural parameters of the model.

19

However, additive disturbances (such as money market shocks) do not affect

θ

.

In

unless there are no real shocks or unless all real

held idea that economic fundamentals

determine currency values. They found that a random walk model was just as good at

exchange rates as models based on fundamentals. In short, their findings

suggest economic fundamentals, like trade balances, money supply, national income, and

other key variables, are of little use in forecasting exchange rates between countries with

Interest Differential Relation

, no. 43 (September 1998): 933

-948

33

2.4 Random Walk Model

It has been the position of many fundamental and economic analysis advocates

that there is no sequential correlation between the direction of a price movement from

one day to the next. Their position is that prices will seek a level that will balance the

supply and demand factors, but that this level will be reached in an unpredictable manner

as prices move in an irregular response to the latest available information or news release.

If the random walk theory is correct, many well-defined trading methods based on

mathematics and pattern recognition will fail. The strongest argument against the

random movement supporters is price anticipation. One can argue that all participants

(the market) know exactly where prices should move following the release of news.

Excluding anticipation, the apparent random movement of prices depends on both

the time interval and the frequency of data used. When a long time span is used, from

one to twenty years, and the data are averaged to increase the smoothing process, the

trending characteristics will change, along with seasonal and cyclic variations. Technical

methods such as moving averages are often used to isolate these price characteristics.

The averaging of data into quarterly prices will smooth out the irregular daily movements

and results in noticeably positive correlations between successive prices. The use of

daily data over a long-term interval introduces noise and obscures uniform patterns.

In the long run, most future prices find a level of equilibrium and, over some time

period, show characteristics of mean reverting (returning to a local average price);

however, short-term price movement can be very different from a random series of

numbers. It often contains two unique properties: exceptionally long runs of price in a

single direction, and asymmetry, the unequal size of moves in different directions.

34

Although the long-term trends are not of great interest to future traders, short-tern price

movements, which are cause by anticipation rather than actual events, and extreme

volatility, prices that are seen far from value, countertrend systems that rely on mean

reversion, and those that attempt to capture trends of less duration, have been

successful.

22

Meese & Rogoff considered six univariate time series models involving a variety

of pre-filtering techniques and lag length selection criteria, a random walk with drift

parameter, and an unconstrained vector auto regression; none could out-predict the

random walk model: , where is white noise with mean zero and constant

variance.

The six time series models used were the following: (1) an unconstrained auto

regression (AR) in which the longest lag considered (M) is set to equal (n/log, n), where n

is the sample size; (2) AR in which lag lengths are determined by Schwarz’s criterion; (3)

AR in which lag lengths are determined by Akaike’s criterion; (4) long AR estimated by

using observations that are arbitrarily weighed by powers of 0.95; (5) the Wiener-

Kolmogorov prediction formula; (6) AR estimated by minimizing the sum of the absolute

values of errors. The pre-filtering techniques involve differencing, de-seasonalizing, and

removing time trends.

The following three formulas define the random-walk model:

(1a)

it

S

+

ˆ

=

1−

+it

S

i = 1,2,…..15

22

Kaufman, Trading Systems and Methods, 37.

ttt

ass

+

=

−1 t

a

35

(1b)

it

S

+

ˆ

=

t

S

i = 1,2,…..15

(1c)

it

S

+

ˆ

=

u

i

ˆ

+

t

S

i = 1,2,…..15

where is the simple arithmetic mean of the changes in the values of in the estimation

period.

23

2.5 Akaike and Schwarz Criteria

As stated earlier, time series analysis involves both model identification and

parameter estimation, and a selection criterion that balances model, fit, and model

complexity must be used to arrive at a model. The Akaike information criterion (AIC)

(Akaike, 1974) and Schwarz information criterion (SIC) (Schwarz, 1978) are two

objective measures of a model’s suitability, which take these considerations into account.

They differ in terms of the penalty attached to increasing the model order.

Given observations Y(1)…..Y(n), define M

j

(Y(1),…..Y(n)) to be the maximum

value of the likelihood for the jth model under consideration. The Akaike procedure is to

choose the model that minimizes

,

where

is the number of free parameters in the model. The Schwarz criterion is to

choose the model that minimizes

23

Murphree and Koehler, "A comparison of the Akaike and Schwarz Criteria for Selecting Model Order,"

187-195.

u

ˆ

t

S

36

Therefore, if n ≥ 8, the Schwarz criterion will tend to favor models of lower dimension

than those chosen by the AIC.

24

This criterion concluded that the AIC would frequently choose higher order

models for empirical data. Also, in forecasts for series when the AIC and SIC models

differ, there is evidence that neither criterion has a clear edge in identifying models

having small prediction set errors. The findings of this study argue for using SUC rather

than AIC to choose the order of ARIMA model.

2.6 Wiener-Kolmogorv Filter

The Wiener-Kolmogorov (WK) signal extraction filter, extended to handle

nonstationary signal and noise, has minimum Mean Square Error (MSE) among filters

that preserve the signal's initial values; however, the stochastic dynamics of the signal

estimate typically differ substantially from that of the target. The use of such filters,

although widespread, is observed to produce dips in the spectrum of the seasonal

adjustments of seasonal time series. These spectral troughs tend to correspond to negative

autocorrelations at lags 12 and 24 in practice, a phenomenon that will be called "negative

seasonality." So-called "square root" WK filters were introduced by Wecker in the case

of stationary signal and noise to ensure that the signal estimate shared the same stochastic

dynamics as the original signal, and, therefore, remove the problem of spectral dips.

This represents a different statistical philosophy: not only do we want to closely

estimate a target quantity, but also we desire that the internal properties and dynamics of

our estimate closely resemble those of the target. The MSE criterion ignores this aspect

24

Ibid.

37

of the signal extraction problem, whereas the square root WK filters account for this issue

at the cost of accruing additional MSE. This paper provides empirical documentation of

negative seasonality and provides matrix formulas for square root WK filters that are

appropriate for finite samples of non-stationary time series. We apply these filters to

produce seasonal adjustments without inappropriate spectral troughs.

25

2.7 Engel & West

A well-known stylized fact about nominal exchange rates among low-inflation

advanced countries, particularly U.S. exchange rates, is that their logs are approximately

random walks. Meese and Rogoff (1983) found that the structural models of the 1970s

could not “beat” a random walk in explaining exchange-rate movements.

Why? One obvious explanation is that the macroeconomic variables that

determine exchange rates themselves follow random walks. If the log of the nominal

exchange rate is a linear function of forcing variables that are random walks, then it will

inherit the random walk property. The problem with this explanation is that the

economic “fundamentals” proposed in the most popular of exchange rates do not, in fact,

follow simple random walks.

One resolution to this problem is that there may be some other fundamentals, ones

that have been proposed in some models but are not easily measurable or ones that have

not yet been proposed at all, that are important in determining exchange rates. If these

“unobserved” fundamentals follow random walks and dominate the variation in exchange

25

Tucker McElroy, "A Modified Model-based Seasonal Adjustment that Reduces Spectral Troughs and

Negative Seasonal Correlation." http://www.census.gov/srd/www/abstract/rrs2008-12.htm (accessed 2

March 2009).

38

rate changes, then exchange rates will nearly be random walks (even if the standard

“observed” fundamentals are not).

26

Engel & West conclude that asset-market models, in which the exchange rate is

expressed as a discontinued sum of the current and expected future values of the observed

fundamentals, can account for a sizeable fraction of the variance when the discount factor

is large. The Engel & West explanation for a random walk provides a rationale for a

substantial fraction of the movement in exchange rates. But there is still a role for left-

out forcing variables, perhaps money demand errors, a risk premium, mis-measurement

of the fundamentals, or other variables implied by other theories or noise.

2.8 McCracken & Sapp

Since the breakdown of the Bretton Woods agreement, researchers have used a

wide variety of structural models to try to predict exchange rate movements. Finding

consistent evidence that these models outperform a random walk has proven elusive.

McCracken & Sapp use p values based on developed tests of forecast accuracy and

encompassing q values designed to mitigate multiple testing problems. Both p and q

values can be interpreted as measures of a statistics significance. For example, if a test

statistic has a p value of 5%, one would expect that among a random sample of pairs of

statistics and hypothesis from the same population as the statistic, that on average 5% of

those hypothesis are null and have statistics that will reject. Conversely, if a statistic has

26

Kenneth D. West and Charles Engel, "Accounting for Exchange-Rate Variability in Present-Value

Models When the Discount Factor Is near 1." The American Economic Review 94 (2004): 119-125.

39

a q value of 5%, you would expect on average that 5% of the statistics that reject actually

correspond to the null hypothesis.

27

The other statistic used to test for significance is MSE t statistic. These statistics

provide evidence of short, medium, and long horizon predictability.

Out of 400 tests, there were 154 cases where the p values are less than 5%.

Similarly, of the 400 tests, 338 have q values less than 10%, while 210 have q values less

than 5%. The MSE t statistic shows that there are no significant changes in predictive

ability. All cases show values less than 10%.

Their findings suggest that detecting predictability in exchange rates using

regressions can be strongly influenced by the choice of test statistics and the manner in

which it is employed. The results also yielded evidence that structural exchange rate

models do not exhibit an ability to predict exchange rates. Similar to other studies, the

evidence is consistent with there being more short-term predictability in exchange rates,

and the results are relatively insensitive to the choice of the model.

2.9 Zhang & Berardi

Artificial neural networks have been widely used as a promising alternative

approach to time series forecasting. Neural networks are data-driven, self-adaptive

nonlinear methods that do not require specific assumptions about the underlying model.

Instead of fitting the data with a pre-specified model form, neural networks let the data

itself serve as direct evidence to support the model’s estimation of the underlying

generation process. The network ultimately selected may not be the true optimal model

27

Michael, W. McCracken and Stephen G. Sapp, "Evaluating the Predictability of Exchange Rates Using

Long-Horizon Regressions: Mind your p’s and q’s." Journal of Money, Credit and Banking, Vol. 37, No. 3

(June 2005): 473-494.

40

because of a large number of factors that could affect neural network training and model

selection. These factors include network architecture, activation functions, training

algorithm, and data normalization. Alternative data sampling from a stationary process

can have a significant effect on individual model selection and prediction. This impact

may be magnified if the process parameters evolve or shift over time.

For the methodology in this example, Zhang and Berardi use weekly exchange

rate data. They combine neural networks trained with different initial random weights

but with the same data. The neural network trained with different starting weights may

be stuck with different minimums, each of which can have different forecasting

performances.

Results show that different approaches to forming ensembles for time series

forecasting have quite different effects on forecasting results. Neural network ensembles

created by simply varying the starting random weights are not as competent as the

traditional random walk model. Therefore, this method of ensemble forecasting may not

be effective for forecasting exchange rates.

28

28

G.P. Zhang and V.L. Berardi, "Time Series Forecasting with Neural Network Ensembles: An application

for Exchange Rate Prediction." The Journal of the Operational Research Society, Vol. 52, 6 (June 2001):

652-664.

41

3.0 Methodology

Much of the probability theory of time series assumes that time series exhibit a

constant mean and constant variance over time, a condition known as stationarity. Non-

stationary components of time series can usually be removed to make the series

stationary. For example, one can take differences of a time series to remove trends or

seasonal variations.

Forecasts are generated with forecasting equations consistent with the method

used to estimate the model parameters. Thus, the estimation method specified controls

the way the forecast produces results. The forecast procedure provides a way of

forecasting one or more time series automatically. It does not enable you to identify

models or test for model adequacy. This is why it is important to test and select the

correct forecast model.

Statistical measures are helpful in determining the appropriate mathematical form

for the forecast model (i.e. in deciding whether an autoregressive model, a moving

average model, or a mixed model should be used for a particular time series).

29

Once one knows there is a fundamental relationship between data, based on the

measuring of the properties of dependence and correlation, a formula can be found that

expresses one price movement in terms of the other prices and data. The predictive

qualities of these methods are best when applied to data that has been seen before, as in

prices that are within the range of historic data. Forecasting reliability decreases sharply

when values are based on extrapolation outside the previous occurrences. This

phenomenon will also be true of other trending methods. This is based on the movement

29

Kaufman, Trading Systems and Methods, 63.

42

of historical data; when prices move to new levels, the result of the model will often

deteriorate. The techniques most commonly used for evaluating the direction or tendency

of prices, both within prior ranges and at new levels, are called autoregressive functions.

3.1 Estimation and Forecasting Methods

Time series forecasting methods are based on analysis of historical data. These

methods support the assumption that past patterns in data can be used to forecast future

data points. The following statistics are used to measure the forecast error:

1. Moving averages (simple moving average, weighted moving average): forecast is

based on arithmetic average of a given number of past data points

2. Exponential smoothing (single exponential smoothing, double exponential smoothing):

a type of weighted moving average that allows inclusion of trends, etc.

3. Mathematical models (trend lines, log-linear models, Fourier series, etc.): linear or

non-linear models fitted to time-series data, usually by regression methods

4. Box-Jenkins method: autocorrelation methods used to identify underlying time series

and to fit the "best" model

The components of the time series forecast model used contain the following

components:

1. Average: the mean of the observations over time

2. Trend: a gradual increase or decrease in the average over time

3. Seasonal influence: predictable, short-term cycling behavior due to time of day, week,

month, season, year, etc.

43

4. Cyclical movement: unpredictable, long-term cycling behavior due to business cycle or

product/service life cycle

5. Random error: remaining variation that cannot be explained by the other four

components

There are two aspects of forecasting errors to be concerned about: bias and

accuracy. A forecast is biased if it errs more in one direction than in the other. The

method tends to under-forecast or over-forecast. A forecast accuracy refers to the

distance of the forecasts from actual demand, ignoring the direction of that error.

30

3.1.1 Least Squared Model

The least-squares regression model can be used to find the relationship between

two dependent variables or to find how prices move when driven by known related

factors. A simple error analysis can be used to evaluate the predictive qualities of this

method. Assume that there is a lengthy price series for foreign exchange rates, and we

would like to know how many prior quarters are optimum for predicting the next

quarter’s price. The answer is found by looking at the average error in the predictions. If

the number of quarters in the calculation increases and the predictive error decreases,

then the answer is improving; if the error stops decreasing, then the accuracy limit has

been reached. Error analysis can improve most trend calculation.

Determination of the best predictive model using error analysis can be applied to

any forecasting technique. This works particularly well when comparing the error of two

different forecasting methods evaluated over the same number of periods, eliminating the

30

Ibid., 55-65.

44

bias caused by longer and shorter intervals. It is also practical to carry the error analysis

one step further and include the results of the prediction error. This gives a measure of

out-of-sample forecast accuracy and lends confidence to the predictive qualities of the

technique.

Having selected the most accurate forecast model, the size of the prior period

predictive error can be used to resolve the future decision. Consider the following

situations:

1. The prediction and the actual price are very close (high confidence level). For

example, the error may have 1 standard deviation = .25.

2. The current forecast error is within 1 standard deviation of expectations;

therefore, we continue to follow the trend strategy.

3. The current forecast error is between 1 and 3 standard deviations of

expectations; therefore, we are cautious, yet understand that this is normal but

less frequent.

4. The current forecast error is greater than 3 standard deviations of expectations.

This is unusual, indicates high risk, and may identify a price shock.

Alternately, it could indicate a trend turning point.

3.1.2 Regression

When most people talk about regression, they think about a straight line, which is the

most popular application. A linear regression is the straight line relationship of two sets

of data. It is most often found using a technique called a best fit, which selects the

45

straight line that comes closest to most of the data points. Using the prices of two

variables, such as foreign exchange rates and interest rates, their linear relationship is the

straight line (or first order) equation.

The linear correlation, which uses a value called the coefficient of determination or

the correlation coefficient, expresses the relationship of the data on a scale of +1 (perfect

positive correlation), 0 (no relationship between the data), and -1 (perfect negative

correlation). The correlation coefficient is derived from the deviation, or variation, in the

data. It is based on the relationship total deviation = explained deviation + unexplained

deviation.

The linear regression slope returns the slope of the straight line given the data series