________________________________________________________________________________

All policies are subject to amendment. Please refer to the Rutgers University Policy Library website

(policies.rutgers.edu) for the official, most recent version.

Page 1 of 3

UNIVERSITY POLICY

1. Po

licy Statement

It is

the policy of Rutgers University (the “University”) to provide reasonable, necessary, and

appropriate “relocation expenses” (as defined below) for new employees.

It is the responsibility of each department to ensure that any covered expenses qualify as relocation

expenses and to bear such relocation expenses within its budget.

2. Re

ason for Policy

To pr

ovide guidance on the payment of relocation expenses for new employees.

3. Wh

o Should Read This Policy

All members of the University community involved in recruiting and hiring new employees.

4. Resources

Pr

ocedures to implement this policy are posted on the following websites:

Office of the University Controller:

University Tax Department (“Tax”): Procedure for Reimbursement of Relocation Expenses

Uni

versity Payroll Services (“Payroll”):

Taxable Moving Expense Reimbursement Form – Fillable PDF

Version

Uni

versity Procurement Services (“Procurement”):

https://procurementservices.rutgers.edu/process-

employee-relocation-reimbursement

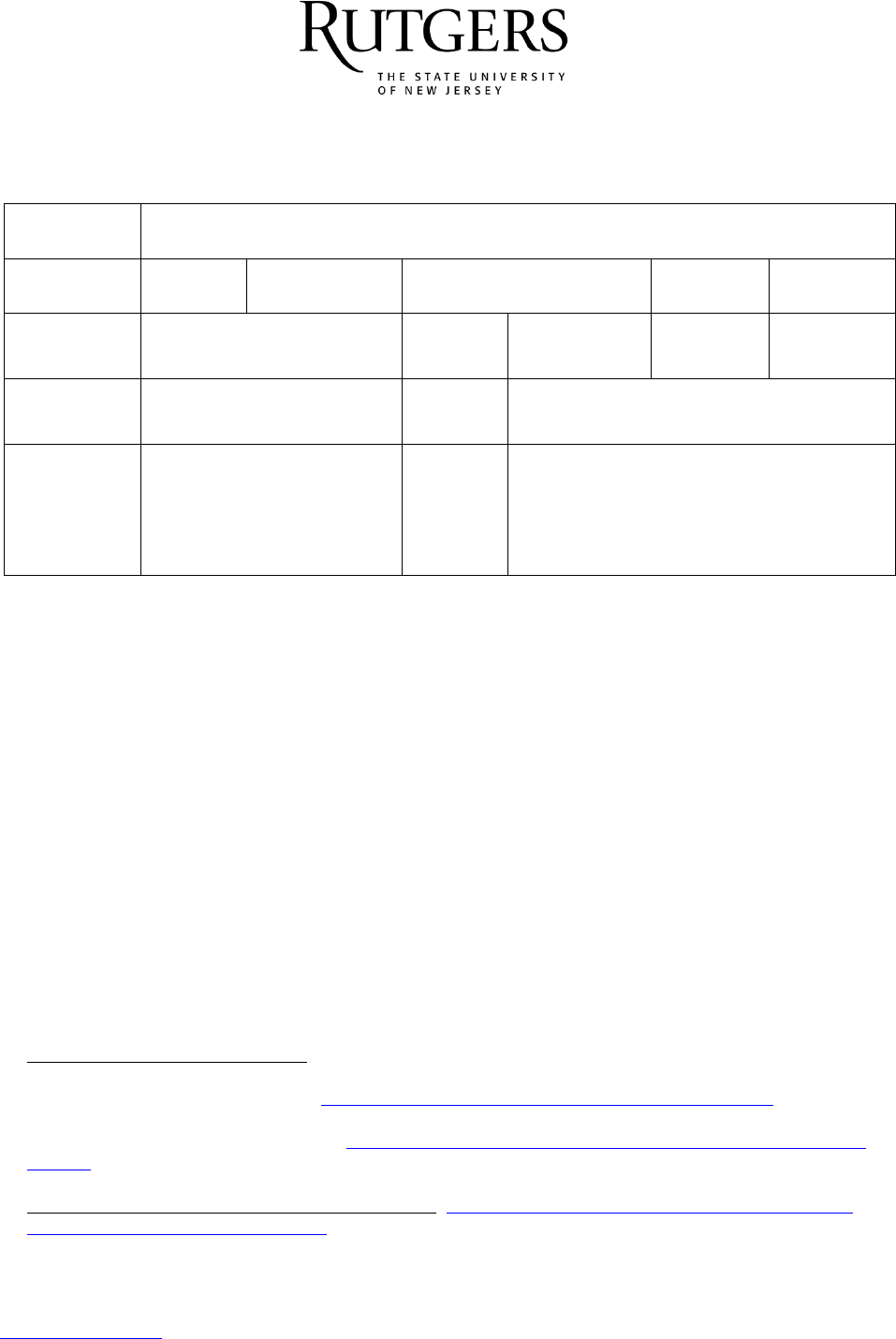

Policy

Name:

Employee Relocation Expense Reimbursement

Section #:

40.2.22

Section Title:

Fiscal Management

Formerly

Book:

6.1.13

Approval

Authority:

Executive Vice President for

Finance and Administration

and University Treasurer

Adopted:

1988

Reviewed:

08/27/2018

Responsible

Executive:

Vice President for Finance

and Budget

Revised:

09/29/2000; 04/04/2004; 05/02/2005;

08/24/2006; 07/24/2007; 04/2008;

10/01/2013; 10/23/2013; 08/27/2018

Responsible

Office:

University Controller’s Office

(Tax Department & Payroll

Services) and University

Procurement Services

Contact:

University Controller’s Office:

Tax Dept.: 848-445-2054

Payroll Services: 848-445-2113

University Procurement: 848-445-4375

________________________________________________________________________________

All policies are subject to amendment. Please refer to the Rutgers University Policy Library website

(policies.rutgers.edu) for the official, most recent version.

Page 2 of 3

5. Definitions

The term relocation expenses means the reasonable and actual costs incurred for (1) moving

personal household effects to a location within proximity to the campuses of the University;

(2) travel expenses to relocate the new employee, the new employee’s spouse, and the new

employee’s dependent children to a new place of residence within proximity of the campuses of the

University; (3) moving laboratory/office equipment to a location that is a University office, laboratory,

or place of business; (4) the cost of short-term storage of household effects; and (5) shipment of

automobile(s) to the employee’s new residence within proximity to the campuses of the University.

Actual costs are monies expended to compensate for hired labor and equipment to load, move, and

unload tangible property.

Examples of such costs include the rental of trucks, trailers, moving equipment, or other expenses

directly related to the relocation. Relocation Expenses do not include compensation for labor of a

new employee or a new employee’s spouse/dependents. Relocation Expenses must be supported

by original receipts.

6. The Policy

The University may provide relocation expenses for new employees. At the time an offer is

extended to a prospective employee, the hiring department may elect to directly pay for or

reimburse that new employee’s relocation expenses. The decision of whether to cover relocation

expenses and the extent to which such relocation expenses will be covered should be guided, at a

minimum, by the following criteria:

• The hiring department’s access to budgetary resources;

• The total estimated relocation expenses;

• The benefits that accrue to the University and the hiring department as a

result of the new employee; and

• The nature of the position being filled by the new employee.

The hiring department must cover all approved relocation expenses within such department’s own

budget. It is the hiring department’s responsibility to ensure that all costs to be borne by its budget

qualify as relocation expenses.

A. Payment or Reimbursement of Relocation Expenses

Relocation expenses may be paid directly by the University through Procurement.

Procurement, upon notification by the hiring department, will coordinate with the new employee

to assist in the selection of a University approved commercial moving company to perform the

move and complete the necessary billing procedures. The hiring department must submit a

purchase requisition to Procurement for approval. Upon approval, Procurement will forward the

purchase order to the selected moving company.

The hiring department may permit a new employee to make personal relocation arrangements

with subsequent reimbursement. All expenses submitted for reimbursement must continue to

fall within the definition of Relocation Expenses set forth in section 5 of this Policy. Estimates

are not required for self-moves.

B. Travel Expenses

Relocation expenses may include travel expenses of the new employee and such employee’s

spouse and dependent children if such expenses are associated with their relocation. Such

travel expenses may include the (1) cost of meals and accommodations required in transit, and

(2) cost of travel in advance of the relocation for the sole purpose of searching for a new

________________________________________________________________________________

All policies are subject to amendment. Please refer to the Rutgers University Policy Library website

(policies.rutgers.edu) for the official, most recent version.

Page 3 of 3

residence within proximity to the campuses of the University. In order to qualify as reasonable,

such travel expenses must not exceed the lowest logical coach class airfare by the most direct

route from the new employee’s place of current residence to the vicinity of the University’s

campuses. Departments are expected to strongly encourage travelers to use one of the

University’s preferred travel agencies to book their arrangements. Users are referred to the

travel website at

https://procurementservices.rutgers.edu/travel.

7. Taxation of Relocation Expenses

All relocation expenses (except the expenses of moving laboratory equipment or office equipment

from a previous office to a University office), incurred during the calendar years 2018 through

2025, constitute taxable income to the employee pursuant to the enactment of the

Tax Cut and

Jobs Act of 2017 (Pub. L. 115-97). Previously, Federal law drew a distinction between “qualified”

moving expenses and other expenses. “Qualified” moving expenses could be paid or reimbursed

on a non-taxable basis. That is no longer the case for calendar years 2018 through 2025. All

relocation expenses must be included in the employee’s taxable income and are subject to all

applicable withholding taxes.

The hiring department, in its discretion and subject to the availability of funds, may provide a

gross-up of the reimbursement to cover Federal income taxes incurred for relocation expenses

paid by the University.

8. Questions and Assistance

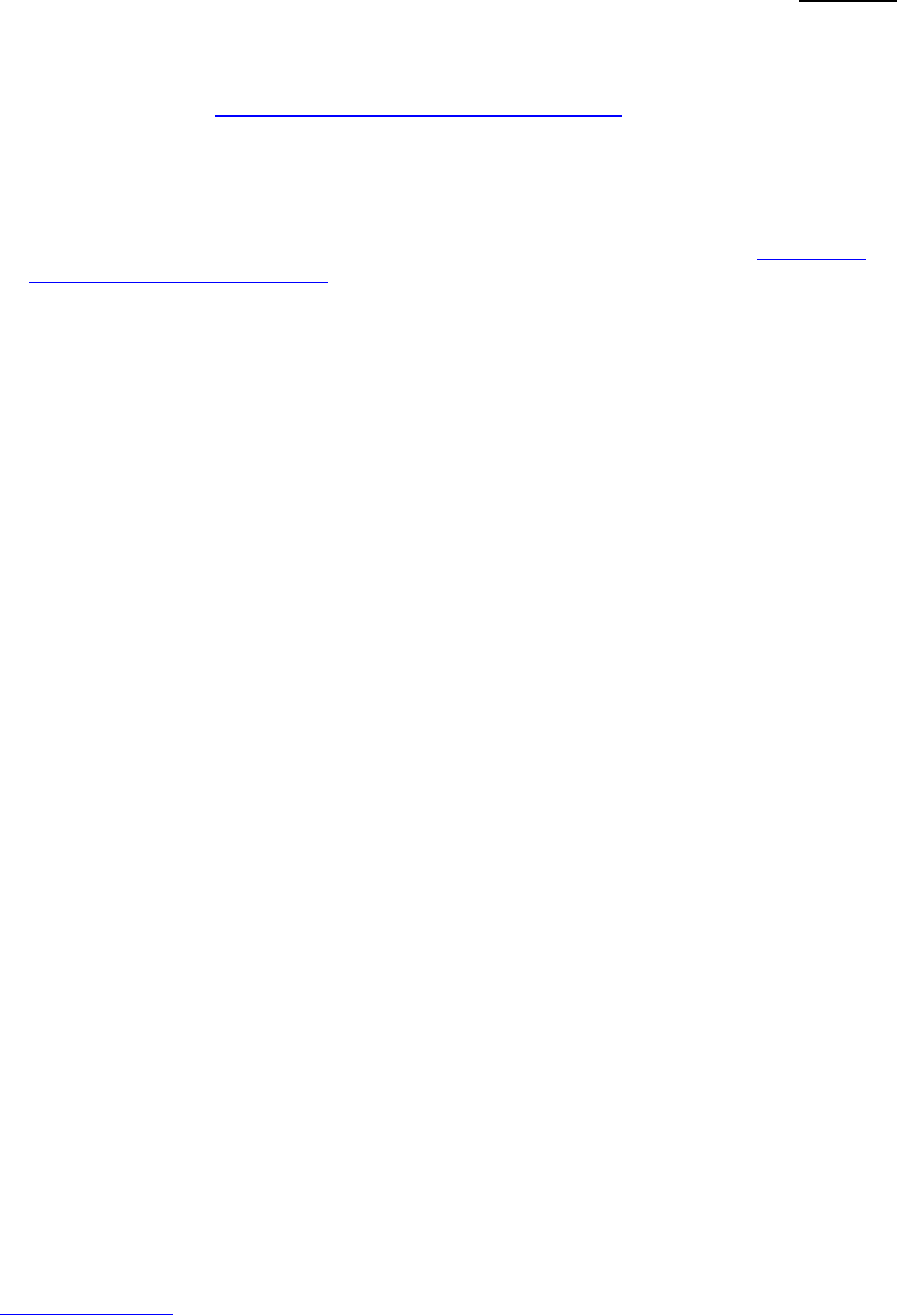

The following offices are available for further information and assistance on this matter:

Telephone

Payroll Services

848-445-2113

Procurement

Services

848-445-4375

Tax Department

848-445-2054