Understanding My Statement

Every financial services provider is required to send you an account statement. But at

Edward Jones, we want to do much more than simply what’s required. We view your

statement as an essential source of information for your decision-making. The easier it is

for you to understand your statement, including the customization we oer, the more

empowered you’ll be to make decisions for your future.

Let’s Get Started!

The following pages answer many of the

questions you may have about your

account statement. After you

read this guide, you will:

• Know the options available

for customizing your

statement

• Know where to locate specific

information on your statement

• Have a better understanding of

terms used throughout your

statement

• Know where to find additional

information

edwardjones.com

Member SIPC

Table of Contents

I want to know the following:

What Are My Accounts’ Values? ...................................................... 1

What Products and Services Am I Using? ..............................................2

How Am I Doing? .................................................................3–8

Personal Rate of Return with Performance Benchmarks Option

Account Summary Line Graph and Table

Summary of Income

Estimated Interest and Dividends

Summary of Assets

What Assets Do I Own, and How Much Are They Worth?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9–12

Am I On Track to Achieve My Goals? .................................................13

When Is My Retirement Fee Due? ....................................................14

Which Beneficiaries Do I Have On File? ...............................................14

How Much Am I Required to Take Out of My Retirement Account? ...................... 15

What Activity Has Occurred in My Account? ........................................15–17

Does My Statement Display Details of My Realized Gains and Losses? ...................18

Frequently Asked Questions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Glossary ........................................................20–21

Appendix: Information Provided in

Additional Sections of the Statement .............................. 22–23

Resources ........................................................ 24

PAGE 1 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

What Are My Accounts’ Values?

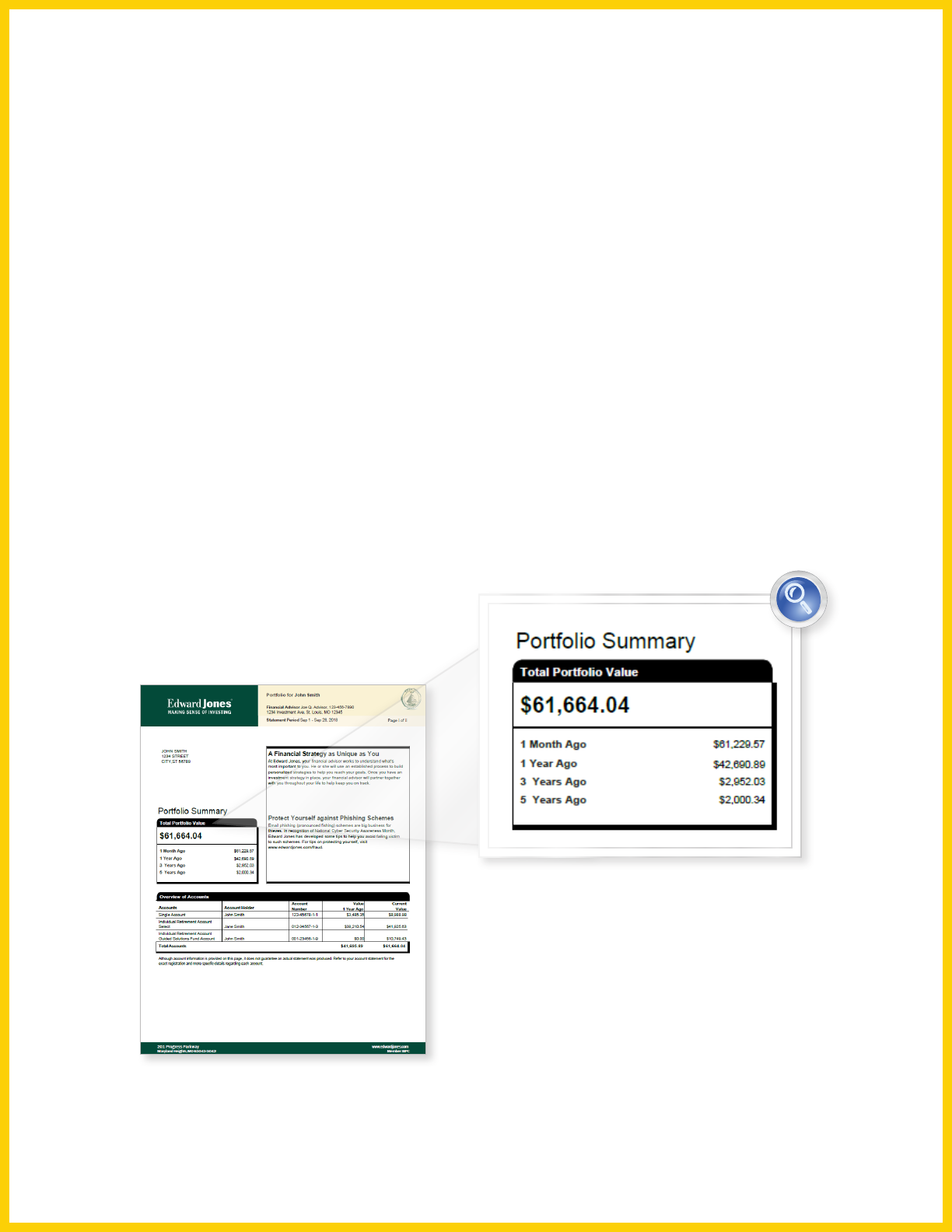

Portfolio Summary

The Portfolio Summary at the beginning of your statement package includes a total value

for all of the accounts in your statement mailing group.

Other features of the summary include:

• A list of your investment accounts and their values compared with their values one month

ago, one year ago, three years ago and five years ago

• A section for other products and services, including loans and credit cards

• The contact information for your financial advisor displayed in the header, which is also

provided on each page of your statement

You will receive the Portfolio Summary if you have more than one account in your statement

mailing group.

PAGE 2 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

What Products and Services Am I Using?

At Edward Jones, we oer many types of investments and services. This section provides

information on those you have chosen, such as:

• Loans

• Credit cards

• Trust services

• Insurance protection

You can find your account numbers, balances, available credit and interest rates

(if applicable) on these investments and services.

Overview of Other Products and Services

Loans and Credit Account Number Balance

Approved

Credit

Available

Credit

Interest

Rate

Amount of money you can borrow

for John A Doe &

Jane B Doe 123-45678-9-0 -$74,534.68 $79,704* $5,170 5.25%

* Your approved credit is not a commitment to loan funds. It is based on the value of your investment account which could change daily.

The amount you may be eligible to borrow may differ from your approved credit. Borrowing against securities has its risks and is not

appropriate for everyone. If the value of your collateral declines, you may be required to deposit cash or additional securities, or the

securities in your account may be sold to meet the margin call. The interest rate will vary depending on the amount you borrowed and

will begin to accrue from the date of the loan and be charged to the account. A minimum account value is required if you have loan

features on your account. Call your nancial advisor today.

If you receive a Portfolio Summary for a given statement period, this information will display

in the Overview of Other Products and Services section within your Portfolio Summary.

If you do not receive a Portfolio Summary, the Summary of Other Products and Services

section will display within the body of your statement and provide this information for

the given account.

Please note: An available line of credit will display even if you have not chosen to use this

service. This amount can fluctuate daily based on the value of your account.

PAGE 3 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

How Am I Doing?

When it comes to tracking your progress, you have options. You may select what’s best for

you via the Settings page of Online Access or by contacting your financial advisor.

You may opt to receive:

• Your personal rate of return with or without benchmarks

• The account summary option of your choice

• An income summary

• An estimate of your interest and dividends

• An asset summary

Personal Rate of Return

Your personal rate of return measures the performance of your account. It helps you track

your progress as you work toward your long-term goals.

The Rate of Return section displays your personal rate of return for the current quarter,

the year to date, the last 12 months, three years annualized and five years annualized.

Once you opt in to receive this section, you can choose to display it monthly or quarterly

(March, June, September and December).

Rate of Return

Your Personal Rate of Return for

Assets Held at Edward Jones

This Quarter Year to Date

Last 12

Months

3 Years

Annualized

5 Years

Annualized

1.22% 1.22% 9.80% 8.74% 11.15%

Your Personal Rate of Return: Your Personal Rate of Return measures the investment performance of your account. It incorporates

the timing of your additions and withdrawals and reects commissions and fees paid. Reviewing Your Personal Rate of Return is

important to help ensure you’re on track to achieving your nancial goals.

The performance of your investments is tracked since they have been held in the current account, but no earlier than Jan. 1, 2009. This also

includes investments you owned during this time period but have since sold. Certain events, including a transfer of an investment between

accounts, share class conversion, or change in an investment’s identication code (CUSIP) caused by a corporate action, will impact the time

frame over which the investment’s rate of return is calculated.

Information used to calculate performance may have been obtained from third parties and Edward Jones cannot guarantee the accuracy of

such information.

For the most current information, contact your nancial advisor or visit edwardjones.com/rateofreturn.

PAGE 4 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Personal Rate of Return with Performance Benchmarks Option

This example of the Rate of Return section includes the optional Performance Benchmarks,

which are a general measure of the market’s performance in these asset classes.

Rate of Return

This Quarter Year to Date

Last 12

Months

3 Years

Annualized

5 Years

Annualized

Your Personal Rate of Return for Assets

Held at Edward Jones

1.32% 1.32% 10.01% 5.91% 12.78%

Your Personal Rate of Return is as of September 21, 2018. Performance Benchmarks are as of Sept. 21, 2018.

Performance Benchmarks

Benchmark A 1.45% 1.45% 21.43% 15.09% 20.62%

Benchmark B -2.00% -2.00% 12.64% 5.65% 15.37%

Benchmark C 1.60% 1.60% -0.33% 3.71% 4.82%

Your Personal Rate of Return: Your Personal Rate of Return measures the investment performance of your account. It incorporates

the timing of your additions and withdrawals and reects commissions and fees paid. Reviewing Your Personal Rate of Return is

important to help ensure you’re on track to achieving your nancial goals.

Performance Benchmarks: Your Personal Rate of Return should be compared to the return necessary to achieve your nancial goals.

However, we understand many investors would like to compare their Personal Rate of Return to market indexes. Keep in mind this may

not be an accurate comparison, as your Personal Rate of Return incorporates the timing of your specic additions and withdrawals and

your specic investment mix, while published returns of market indexes do not.

These market indexes are used as a general measure of market performance for several major asset classes. Market indexes assume

reinvestment of all distributions and do not take into account brokerage fees, taxes or investment management fees.

The performance of your investments is tracked since they have been held in the current account, but no earlier than Jan. 1, 2009. This also

includes investments you owned during this time period but have since sold. Certain events, including a transfer of an investment between

accounts, share class conversion, or change in an investment’s identication code (CUSIP) caused by a corporate action, will impact the time

frame over which the investment’s rate of return is calculated.

Information used to calculate performance may have been obtained from third parties and Edward Jones cannot guarantee the accuracy of

such information.

For the most current information, contact your nancial advisor or visit edwardjones.com/rateofreturn.

Rate of Return Indexes Disclosure

S&P 500 Index: A broad-based measurement of changes in stock market conditions based on the average performance of 500 widely

held common stocks. While many of the stocks are among the largest, this index also includes many relatively small companies. It is a oat

adjusted capitalization-weighted index (stock price times number of publicly available shares outstanding), calculated on a total return basis

with dividends reinvested.

S&P 700 Index: The S&P 700 index measures the non-United States component of global equity markets. The index covers all regions in-

cluded in the S&P Global 1200 (Europe, Japan, Canada, Australia, Asia, and Latin America) except for the United States which is represented

by the S&P 500. The index is market-cap weighted and based in U.S. dollars.

BarCap Aggregate Bond Index: Measures the performance of government, mortgage-backed, asset-backed and corporate securities with at

least one year to maturity.

You may choose to receive the Rate of Return section without the Performance

Benchmarks feature.

PAGE 5 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Account Summary Line Graph and Table

Option 1 – Value Summary

The Value Summary section provides details on your total account value for the current

period and calendar year. It categorizes your activity, including your total account-based

fees and charges, to help you track these values over time. For more information about the

change in value line item, see the Glossary. For more information about fees and charges,

see the Appendix.

This Period This Year

Beginning Value $536,381.15 $536,836.71

Assets Added to Account $0.00 $0.00

Assets Withdrawn from Account $0.00 $0.00

Fees and charges -$548.06 -$3,729.18

Change In Value $27,131.50 $26,134.94

Option 2 – Line Graph

The Value of Your Account line graph illustrates your account’s value over time.

Value of Your Account

$240,000

$200,000

$180,000

$120,000

$80,000

Dec

2015

Mar

2016

Jun Sep Dec Mar

2017

Jun Sep

Option 3 – Line Graph and Value Summary

The automatic setting for your statement is to display the Value Summary table and Value

of Your Account line graph. You do have the option to display either section alternatively.

PAGE 6 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Summary of Income

Summary of Income is an optional section that shows your total distributions for the

current period and year broken down by the type of income.

We also provide “Income reported in a prior year” separately from other current-year

distributions when applicable.

If you’d like to estimate what income may be taxable versus tax-free before you receive your

Consolidated 1099 for the tax year, this section may be helpful when working with your tax

professional for tax reporting purposes. This section can also provide other distributions or

charges, such as loan interest for the current period and year.

Summary of Income

This Period This Year

Income distributions from securities

Taxable Tax-free Total Taxable Tax-free Total

Interest $0.38 $287.50 $287.88 $0.97 $856.25 $857.22

Dividends

Qualied (Q)* 90.40 90.40 745.73 745.73

Total $90.78 $287.50 $378.28 $746.70 $856.25 $1,602.95

*Reduced Tax Eligible

Note: Your year-end tax documents (eg., Form 1099) will provide specic classications of your income distributions. Qualied (Q)

dividends may be taxed at reduced rates. Nonqualied (N) dividends may be taxed at ordinary rates. A portion of your Partially Qualied

(P) dividends may also be taxed at reduced rates. Edward Jones, its employees and nancial advisors cannot provide tax or legal advice.

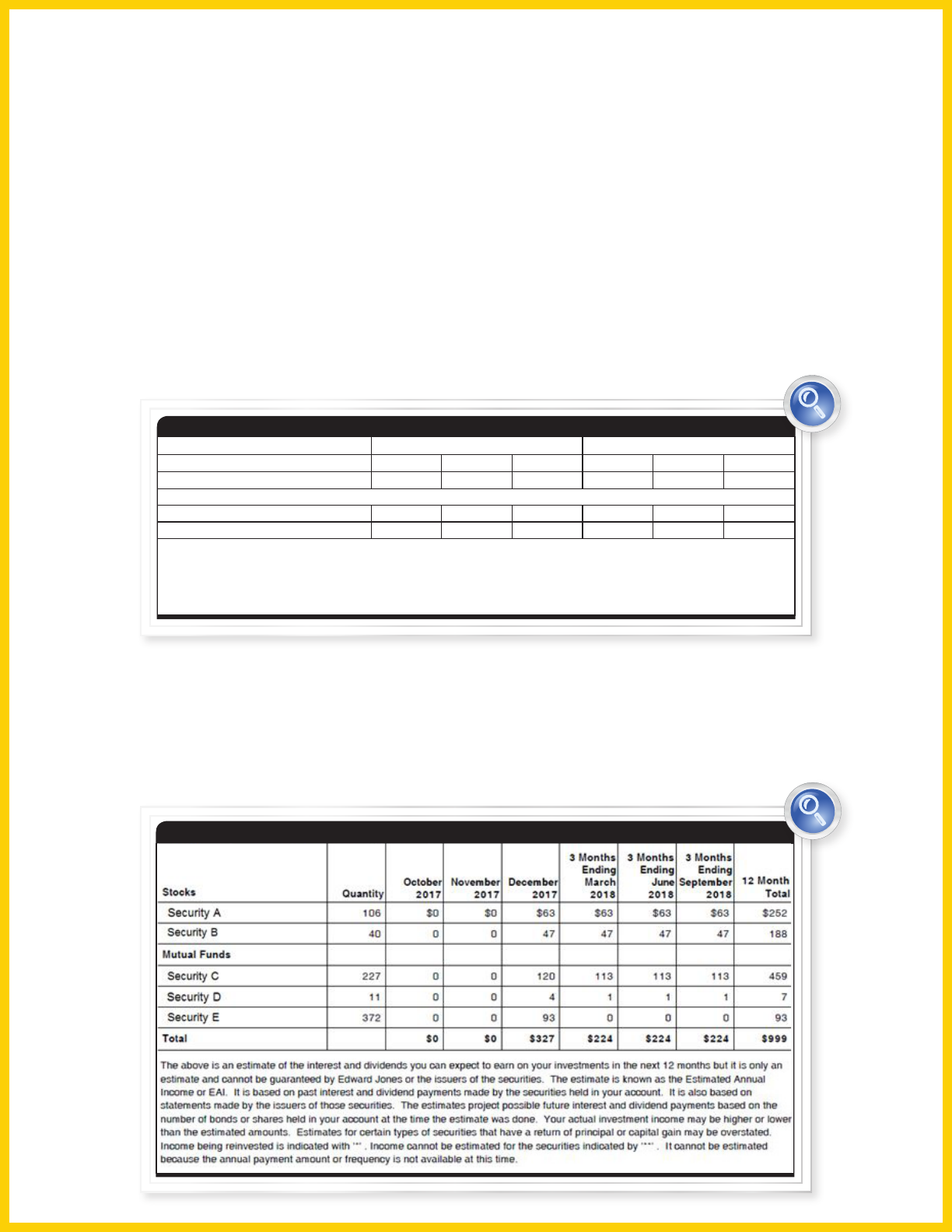

Estimated Interest and Dividends

To track your estimated income, the option to display any combination of three estimated

interest and dividends sections is available:

Table by security: Provides estimated totals by security for the next three months and the

next three quarters

Estimated Interest and Dividends by Security

PAGE 7 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Table by month: Provides estimated totals by month as well as the amounts reinvested and

not reinvested

Estimated Interest and Dividends by Month

Month Not Reinvested Reinvested Total

June 0 480 480

July 125 201 326

August 350 94 444

September 0 334 334

October 90 203 293

November 0 97 97

December 0 530 530

January 125 167 292

February 350 94 444

March 0 319 319

April 90 202 292

May 0 94 94

Bar chart by month: Illustrates estimated totals by month as well as the amounts reinvested

and not reinvested

Estimated Interest and Dividends Bar Chart

Reinvested

Not Reinvested

$20,000

$16,000

$12,000

$8,000

$4,000

$0

Jul Oct

Jan

Apr

You may choose to select the tables that provide estimated interest and dividends by

security and by month if you’d like to see detailed information for each security and your

expected monthly totals.

If you prefer to see an illustration of your estimated interest and dividends, you may find

the bar chart to be more beneficial.

PAGE 8 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Summary of Assets

You have the option to display a categorized asset summary that provides:

• Current and previous months’ totals

• The amount your values have changed between the current and the previous month

• Percentage held in each category

Summary of Assets (as of September 28, 2018)

Held at Edward Jones

Value as of

06/30

Value as of

09/28 Dollar Change % of Total Value

Cash, Insured Bank Deposit &

Money Market funds 2,364.36 2,364.36 0.00 0.74%

Bonds 163,944.75 163,868.60 76.15 51.41

Stocks 7,087.07 7,210.17 -123.10 2.22

Mutual funds 145,539.35 147,571.77 -2,032.42 45.63

Total at Edward Jones $318,935.53 $321,014.90 -$2,079.37 100%

Account Value

$318,935.53 $321,014.90 -$2,079.37

PAGE 9 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

What Assets Do I Own, and

How Much Are They Worth?

The Asset Details section shows the value of every item you hold at Edward Jones.

For your convenience, we include outside assets linked to your Edward Jones account if that

information is available to us.

You may select the options below via the Settings page of Online Access or by contacting

your financial advisor.

Option 1 – Performance/Cost Basis

Cost Basis and Unrealized Gain/Loss Summary

Displaying Cost Basis and Unrealized Gain/Loss columns, as shown in this illustration, is an

optional setting. The Asset Details section displays dashes in the Cost Basis and Unrealized

Gain/Loss columns when the cost basis is unavailable or unknown.

Asset Details (as of Sept. 28, 2018) additional details at edwardjones.com/access

Mutual Funds Price Quantity Cost Basis

Unrealized

Gain/Loss Value

Security A 53.83 36.175 1,272.34 674.96 $1,947.30

Security B 48.61 1,289.196 —— —— 62,667.82

We categorize your assets to make them easier to find on your statement. The asset categories

represented in your account determine the columns shown throughout this section.

PAGE 10 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Cost Basis and Unrealized Gain/Loss Detail

This optional setting provides you with cost basis and unrealized gain/loss for each of your

lots, including a lot for your dividend reinvestments. You will see one lot (versus multiple

lots) for securities that use the average cost method, such as open-end mutual funds.

Assets held at Edward Jones

Balance

Cash $9.55

Total Cash, Money Market

and Insured Bank Deposit $9.55

Stocks Price Quantity Cost Basis

Unrealized

Gain/Loss Value

ABC 114.71 35.76167 3,303.93 798.29 4,102.22

Breakdown by Lot Cost Per Share Current Share Cost Basis

Unrealized

Gain/Loss Value

Purchase Date 5/28/2014 $91.92 35.00 3,217.40 797.45 4,014.85

Dividend Reinvest $113.60* — 86.53 0.84 87.37

CDE 39.62 98.68529 4,111.21 -201.30 3,909.91

Breakdown by Lot Cost Per Share Current Share Cost Basis

Unrealized

Gain/Loss Value

Purchase Date 5/28/2014 $41.67 95.00 3,959.30 -195.40 3,763.90

Dividend Reinvest $41.22* — 151.91 -5.90 146.01

EFG 70.08 66.71969 4,289.58 386.14 4,675.72

Breakdown by Lot Cost Per Share Current Share Cost Basis

Unrealized

Gain/Loss Value

Purchase Date 5/28/2014 $64.16 65.00 4,170.95 384.25 4,555.20

Dividend Reinvest $68.98* — 118.63 1.89 120.52

* - Average cost per share

Cost basis is the amount of your investment for tax purposes and is used to calculate gain or loss upon sale or other disposition of a

security. It is not a measure of performance. The cost basis amounts on your statement should not be relied upon for tax preparation

purposes. Cost basis information may be from outside sources and has not been veried for accuracy. Refer to your ofcial tax documents

for information about reporting cost basis. Consult a qualied tax advisor or an attorney regarding your situation. If you believe the cost

PAGE 11 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Security Rate of Return

This setting provides a rate of return percentage for each of your securities and is the

automatic setting for this option. You automatically receive the Rate of Return section

(provides account-level performance) on a monthly basis when you select this option.

*Your Rate of Return for each individual asset above is as of July 22, 2016. Returns greater than 12 months are annualized.

Your Rate of Return in the Asset Details section above measures the investment performance of each of your individual assets.

It incorporates the timing of your additions and withdrawals and reects commissions and fees paid. Reviewing your Rate of Return

is important to help ensure you’re on track to achieving your nancial goals.

The performance of your investments is tracked since they have been held in the current account, but no earlier than Jan. 1, 2009. Certain

events, including a transfer of an investment between accounts, share class conversion, or change in an investment’s identication code

(CUSIP) caused by a corporate action, will impact the time frame over which the investment’s rate of return is calculated.

Information used to calculate performance may have been obtained from third parties and Edward Jones cannot guarantee the accuracy of

such information.

For the most current information, contact your nancial advisor or visit edwardjones.com/performance

Mutual Funds Price Quantity Value Rate of Return*

ABC Fund 96.00 1,040.84772 99,921.38 2.89%

XYZ Fund 23.18.0 4,339.3491 100,586.11 1.89%

Total Account Value $200,507.49

Basic Holdings without Cost Basis or Performance

This optional setting provides you with key details about each security: the price, quantity

and value for equities and maturity date, maturity value and current value for fixed income.

Assets held at Edward Jones

Mutual Funds Price Quantity Value

ABC Fund CIA

Symbol: ABC

Asset Category: Growth $45.62 20.54 $937.03

XYZ Fund CIA

Symbol: XYZ

Asset Category: Growth & Income $48.94 223.032 $10,915.19

Total Account Value

$11,852.22

w

PAGE 12 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Option 2 – Additional Asset Details

You may choose to display additional asset details beneath the name of your security,

including:

• Symbol

• CUSIP

• Asset Category

• Research Rating

• Estimated Yield

• Subaccount Information

Because each of your securities may have dierent characteristics, the details provided

by selecting this option may vary by asset type.

Ratings- Ratings from Standard & Poor’s (S&P), Moody’s and Fitch may be shown for certain securities. S&P requires we inform you: (1)

Ratings are NOT recommendations to buy, hold, sell or make any investment decisions and DO NOT address suitability or future

performance; (2) S&P DOES NOT guarantee the accuracy, completeness, or availability of any ratings and is NOT responsible for results

obtained from the use of any ratings. Certain disclaimers related to its ratings as are more specically stated at http://www.

standardandpoors.com/disclaimers.

The bond ratings shown are the highest of several possible credit ratings assigned by S&P, Moody’s or Fitch for a prticular bond and may

reect factors in addition to the credit quality of the issuer, such as bond insurance or participation in a credit enhancement program. For

more details contact your nancial advisor.

Edward Jones Fixed Income research reports may exist for certain bonds/issuers held in your account. You may obtain copies of the

research reports through Online Access or from your nancial advisor.

PAGE 13 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Am I On Track to Achieve My Goals?

The Financial Foundation section provides a snapshot of your retirement goal and the

accounts assigned to it. The section features the risk tolerance, planned retirement age(s),

desired annual spending and portfolio objective you discussed with your financial advisor as

well as the objectives and values for accounts assigned to the goal.

You automatically receive this section after completing an annual review for your retirement

account or establishing a retirement goal for a new account.

NOTE: It is important to review your account(s) to keep your investments aligned with your risk tolerance and positioned to achieve your goal.

Please contact your nancial advisor to update any missing or outdated Financial Foundation information.

Reaching your personal nancial goals depends on a strong foundation. At Edward Jones, we believe that foundation consists of regular reviews of

your goals and their time frames, your comfort with risk (such as market volatility) and the way assets are allocated within your portfolio. Following

is a summary of your nancial foundation based on your discussions with your nancial advisor.

Retirement Goal for Doe, John & Jane

Living in

Retirement

Risk Tolerance

John

Medium

Jane

Medium

Projected Spending

Through

John to Spend to Age

90

Jane to Spend to Age

70

Desired Annual

Spending

$40,000

Retirement

Portfolio Objective

Balanced Toward

Growth

The Desired Annual Spending amount does not include variable expenses or debt payments you may have discussed with your nancial advisor.

Accounts Assigned to your Retirement Goal

Accounts Account Holder Account Number Portfolio Objective - Account

Individual Retirement Account

(grandfathered)

John Doe XXX-XX111-1-4 Balanced Toward Growth

Joint Tenants with Right of Survivorship John Doe & Jane Doe XXX-XX222-1-1 —

Individual Retirement Account

(grandfathered)

Jane Doe XXX-XX333-1-6 Balanced Toward Growth

Account Portfolio Objective

Your account portfolio objective displays on the front page of the statement once it has been

recorded in our system. This information is a reminder of this important conversation as you

work to achieve your long-term goals. Contact your branch team for additional details.

Traditional Individual Retirement Account

Portfolio Objective - Account: Growth Focus

Value SummaryAccount Value

This Period This Year

Beginning value $20,376.38 $15,248.88

Assets added to account 1.000.00 4,580.00

Assets withdrawn from account 0.00 0.00

Fees and charges 0.00 0.00

Change in value -89.39 1,458.11

Ending Value $21,286.99

$21,286.99

1 Month Ago $20,376.38

1 Year Ago $13,801.36

3 Years Ago $9,822.83

5 Years Ago $6,389.02

PAGE 14 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

When Is My Retirement Fee Due?

A Retirement Fee Notice displays on the quarter-end statement preceding your fee’s due

date. This due date falls in the month of the anniversary of your account opening.

You will continue to see the notice until you pay the fee or until the month in which it is

due, whichever comes first. For example, your notice will display on December, January

and February statements if your fee is due in March and remains unpaid.

Amount due for account 123-45678-9-0

Due date

$40.00

March 20, 2018

To learn more about the various payment methods available to you, contact your nancial advisor.

Retirement Fee Notice

If you’ve selected an AutoPay option, this information will display at the bottom of this

section. To designate an AutoPay method for your retirement account fee, contact your

financial advisor.

Which Beneficiaries Do I Have On File?

You have the option to display information for up to five primary beneficiaries for your

retirement accounts and accounts with a Transfer on Death Agreement in place. The

Designated Beneficiaries section, which displays quarterly, helps you verify that your

beneficiary information is up-to-date.

Primary

John A Doe 100.00%

Additional beneciary designation information on le

Our records currently reect the beneciary(ies) above as the person(s) you intend to receive the assets in your account in the event of

your death. Take a moment to ensure our records are accurate and complete by comparing this information to your most recent signed

“Beneciary Designation” form. Please contact your Edward Jones nancial advisor if your beneciary information needs updating.

If you have more than five primary beneficiaries or any contingent, non-individual (e.g., an

entity, estate or trust) or specialized beneficiaries, you will see a note at the bottom of this

section indicating that we have additional information on file for your account.

It is important to review and update the beneficiary designations on all your accounts

regularly. It is particularly important when you have a major change in your life or when

there are changes that may impact your estate. Contact your financial advisor to update

your beneficiary designations. You may select this section for your statement via the

Settings page of Online Access or by contacting your financial advisor.

PAGE 15 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

How Much Am I Required to Take

Out of My Retirement Account?

When you reach age 72, you generally are required to begin taking distributions from your

traditional, SEP or SIMPLE IRA or employer-sponsored retirement plan. We know that

managing your required minimum distributions (RMDs) can be challenging. This section

can help you keep track.

Please remember, the amounts you see here are only for the assets in your retirement

account at Edward Jones. If you hold other retirement accounts, you may need to take

distributions from them as well.

201 Progress Parkway

Maryland Heights, MO 63043-3042

www.edwardjones.com

Member SIPC

Account Holder(s) John L Hailey

Account Number 100-94965-1-2

Account Type Traditional Individual Retirement Account

Financial Advisor Jayne D. Wakeman, 352-674-0063

3608 Wedgewood Lane, Buffalo Ridge Plaza II (466W), the Villages, FL

Statement Date Aug 31 - Sep 27, 2013

Page 2 of 3

4

Amoun

t due for account 100-94965-1-2 $40.00

Du

e date December 20, 2013

T

o learn more about the various payment methods available to you, contact your Financial Advisor.

Date

Description

Quantity

Amount

9/1

6 Dividend on Investment Co of America Fd A on 9.209 Shares @ 0.14

$1.29

9/1

6 Reinvestment into Investment Co of America Fd A @ 35.82 0.036 -1.29

Retirement Fee Notice

7

Summary of Assets (as of Sep 27, 2013) additional details at www.edwardjones.com/access

Cash, Money Market funds &

Insured Bank Deposit

Balance

Cash

$600.96

Mutual Funds

Price

Quantity

Amoun

t

Invested

Amoun

t Withdrawn

Since Inception

Value

Investment Co of America Fd A 35.96 9.245 6,216.41 -6,930.00 332.45

Total Account Value $933.41

Retirement Summary

This Period

Cumulative

201

3 Contributions $0.00 $0.00

201

2 Contributions 0.00 0.00

201

3 Net Distributions 0.00 1,040.00

201

3 Federal Tax Withholding 0.00 260.00

201

3 Gross Distributions 0.00 1,300.00

Required Minimum Distribution (RMD) Summary

This information is based solely on this account.

Amount you are required to withdraw this year $80.49

Amount paid to you to date $1,300.00

Amount remaining to be withdrawn this year $0.00

Investment and Other Activity

@@

Required Minimum Distribution (RMD) Summary

This information is based solely on the value of assets held in this account as of 12/31 of the prior year.

Amount you are required to withdraw this year $80.49

Amount paid to you to date $1,300.00

Amount remaining to be withdrawn this year $0.00

Retirement Fee Notice

Amount due for account 123-45678-9-0 $40.00

Due date March 20, 2013

To learn more about the various payment methods available to you, contact your nancial advisor.

What Activity Has Occurred in My Account?

You have three options for displaying your account activity: chronologically, by category

or both ways. You may select the options below via the Settings page of Online Access or

by contacting your financial advisor.

Option 1 - Order Activity Chronologically

The Investment and Other Activity by Date section shows activity chronologically for the

statement period and is the automatic setting. This option may be useful for you if you

prefer to use dates to track the activity that took place in your account. You’ll see the date

the transaction took place, a brief description of the transaction, a quantity and a dollar

amount (if applicable). It’s important to note that the date shown for trade transactions is

the settlement date (up to two business days after the trade date).

PAGE 16 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Option 2 - Order Activity by Category

If you choose to display your account activity by category, you receive two sections:

Summary of Activity and Detail of Activity by Category. The totals provided for the

categories in the summary section directly relate to the activity reported in the detail section.

This option may be ideal for you if you have a lot of activity within multiple categories.

Summary of Activity

Summary of Income

This Period This Year

Income distributions from securities

Taxable Tax-free Total Taxable Tax-free Total

Interest $0.38 $287.50 $287.88 $0.97 $856.25 $857.22

Dividends

Quali ed (Q)* 90.40 90.40 745.73 745.73

Total $90.78 $287.50 $378.28 $746.70 $856.25 $1,602.95

*Reduced Tax Eligible

Note: Your year-end tax documents (eg., Form 1099) will provide speci c classi cations of your income distributions. Quali ed (Q)

dividends may be taxed at reduced rates. Nonquali ed (N) dividends may be taxed at ordinary rates. A portion of your Partially Quali ed

(P) dividends may also be taxed at reduced rates. Edward Jones, its employees and nancial advisors cannot provide tax or legal advice.

You should review your speci c situation with your tax or legal professionals.

Beginning Balance of Cash, Money Market funds and Insured Bank Deposit $23,807.00

Additions Subtractions

Income $138.75

Total Additions $138.75

Withdrawals to Purchase Securities -$69.35

Total Subtractions -$69.35

Ending Balance of Cash, Money Market funds and Insured Bank Deposit $ 23,876.40

Detail of Activity by Category

Additions - Income Date Where Invested Quantity

Amount per

share/rate Amount

Interest

Security A 5/27 Money Mkt 5 4.57 22.85

Security B 5/27 Money Mkt 10 4.63 46.30

Money Market Dividends

Money Market for 29 Days 5/20 Money Mkt 0.01 0.25

Dividends

Security E at Daily Accrual Rate

Tax Info N 5/01 Reinvested 714.559 12.44

Security C at Daily Accrual Rate

Tax Info N 5/01 Reinvested 442.255

Security D

Tax Info P 5/02 Reinvested 3,451.426 0.01 34.51

Subtractions - Withdrawals to Purchase Securities Date

Source of

Funds Quantity

Amount per

share/rate Amount

Reinvestments

Reinvestment into Security E 5/01 Income 1.238 10.05 -12.44

Reinvestment into Security C 5/01 Income 1.95 11.49 -22.40

Reinvestment into Security D 5/02 Income 13.694 2.52 -34.51

PAGE 17 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Option 3 - Order Activity Chronologically and by Category

You may choose to display your activity both ways, by category and chronologically. You

would then receive the Summary of Activity, Detail of Activity by Category, and Investment

and Other Activity by Date sections simultaneously.

Loans Detail

Some activity in the Loans Detail section relates to activity in the Investment and Other

Activity by Date section. Funds from Example 1A are applied to the loan balance in Example

1B. Funds from Example 2A are applied to the loan balance in Example 2B.

The other activity shown takes place only within the Loans Detail section. As you see, this

section enables you to track the increases and reductions to your loan balance easily. Please

contact your financial advisor if you have questions about your situation.

PAGE 18 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Does My Statement Display Details of

My Realized Gains and Losses?

Though a summary of realized gains and losses displays automatically upon a sale, you

can choose to see more detailed information. You may select this option via the Settings

page of Online Access or by contacting your financial advisor.

The Detail of Realized Gain/Loss from Sale of Securities section displays when a sale of a

security occurs during the statement period and if you have realized gains or losses for the

current statement period and/or the current year.

Purchase

Date

Sale

Date Quantity Cost Basis Proceeds

Realized

Gain/Loss

Security A 8/24/2010 09/16 1,012.232 $4,124.19 $6,620.00 $2,495.81 LT

Security B ------------ 09/26 123.203 2,910.46 6,000.00 3,089.54 LT

Security C 8/24/2010 09/26 900.746 3,669.95 6,035.00 2,365.05 LT

Detail of Realized Gain/Loss from Sale of Securities

Summary of Realized Gain/Loss

The Summary of Realized Gain/Loss section displays automatically upon a sale and/or

if there is a realized gain or loss for the current period. The cumulative gains/losses for

securities in the account are displayed within the short-term (held one year or less)

and/or long-term (held for more than one year) holding period category.

This Year

Short Term (assets held 1 year or less)

$0.00

Long Term (held over 1 year)

645.84

Total $645.84

Summary totals may not include proceeds from uncosted securities or certain corporate actions.

PAGE 19 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Frequently Asked Questions

Q: Why do I receive an account statement

in some months and not others?

A: We are required to send you a statement

at least every quarter if you hold any

balances or positions with us. You’ll also

get a statement for any month in which

you have activity other than reinvested

money market dividends, pending trades

or interest on your cash balance. You’ll

see those activities the next time you get

a statement. Contact your financial

advisor if you would like to receive a

statement every month.

Q: Why is my statement period not always

the first and last day of the month?

A: At Edward Jones, our statement period

ends on the last business Friday of the

month, with the month of December

being the only exception. In December,

the statement period always ends on

Dec. 31. The next statement period starts

the following day.

Q: Where do I find on my statement the

commissions paid for the purchase or

sale of a security?

A: This information may appear on your

trade confirmation. The ways in which

this information displays on trade confir-

mations vary by security type. Contact

your financial advisor if you have any

additional questions.

Q: How do I customize my statement so

it displays the information that is most

important to me?

A: After discussing with your financial

advisor the options that might be best

for your account(s), you can work with

him or her to make updates or select

your preferences at your convenience on

the Settings page of Online Access.

After your preferences have been select-

ed, your new statement options will

display on your next statement. If you’re

not signed up for Online Access, visit

edwardjones.com/access to learn more

and enroll, or contact your local oce

for assistance.

Q: How can I get my statements delivered

electronically?

A: Sign up for Online Access, and you’ll

receive an email when your account

statements are available for you online.

Online Access enables you to view your

account information, track progress

toward your goals, communicate with

your branch and much more, all from

your computer, tablet or mobile device.

Visit edwardjones.com/access for more

information.

PAGE 20 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Glossary

Beneficiary – An individual, institution,

trust or estate that receives, or may become

eligible to receive, benefits under a will, an

insurance policy, a retirement plan, an

annuity, a trust or other contract.

Bond Rating – A method of evaluating the

quality and safety of a bond. This rating is

based on an examination of the issuer’s

financial strength and the likelihood that it

will be able to meet scheduled repayments.

Ratings range from AAA (best) to D (worst).

The rating shown on your statement is

provided by Standard & Poor’s (S&P),

Moody’s or Fitch. The bond ratings shown

on your statement are the highest of several

possible credit ratings assigned by S&P,

Moody’s or Fitch for a particular bond and

may reflect factors in addition to the credit

quality of the issuer, such as bond insurance

or participation in a credit enhancement

program. For more details, contact your

financial advisor or visit edwardjones.com/

bondcreditratings

Change in Value – Demonstrates how

market fluctuation and other factors

(including income, commission and accrued

interest) aected your account’s total value.

See below for the full calculation:

Change in Value:

Ending Value

- Beginning Value

- Assets Added

+ Assets Withdrawn

+ Fees and Charges

= Change in Value

For more information on the specific fees

and charges reflected in the change in

value calculation of the Value Summary,

see the Appendix.

Contribution – Payment to an annuity or

retirement plan. This is the amount that was

deposited into a retirement account.

Conversion – The movement of cash or

other assets from a traditional IRA, SEP IRA

or SIMPLE IRA (that has met the two-year

waiting period) to a Roth IRA. A conversion

is a reportable event.

Cost Basis – This figure may help you

understand a security’s taxable gain or loss.

It is generally the original amount paid for a

security, including commissions and fees,

and is adjusted for reinvestments of income

and sales. It may also be adjusted for capital

distributions, original issue discount (OID),

mergers, stock splits, spin-os and other

events that occur after purchase. Depending

upon your circumstances, your cost basis

may not reflect all applicable adjustments.

It should not be used for tax preparation

purposes without first consulting with your

tax professional.

Distribution –

• A payment of cash or assets “in kind”

to an IRA owner

• A reportable event

Excess Accumulations – An amount of

a required minimum distribution (RMD)

that is not withdrawn by the set deadline.

This amount may be subject to a 50%

IRS penalty.

In-kind Distribution – The distribution of an

asset in a form other than cash. Shares of

stock and mutual funds are two examples.

Realized Gain/Loss – The dierence

between the cost basis and the amount

received upon a sale, redemption or ex-

change of a security. This number should

be verified by your tax professional before

you use it for tax preparation purposes.

PAGE 21 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Recharacterization – When a client makes

a contribution to a Roth IRA then later

transfers all or a portion of that contribution

to a traditional IRA.

OR

When a client converts all or a portion of a

traditional, SEP or SIMPLE IRA’s assets to a

Roth IRA then later transfers all or a portion

of the original conversion amount back to a

traditional, SEP or SIMPLE IRA.

Research Rating – The rating (Buy, Sell,

Hold, FYI and Under Review) assigned by

our Equity Research department on a stock.

Our Fixed Income Research department may

provide research on certain bonds. You can

access full research reports including addi-

tional disclosures via Online Access or from

your financial advisor.

Rollover – Generally a tax-free, reportable

event that occurs when cash or other

assets are withdrawn from one eligible

retirement plan and all or part is put into

another eligible retirement plan within

60 calendar days.

Settlement Date – The date when an execut-

ed “buy” or “sell” trade must be completed.

This is the date by which the buyer must pay

for a security and the seller must complete

the transfer of a security.

Tax Free – Refers to the taxation of divi-

dends. Tax-free dividends may be exempt

from federal, state and local income taxes.

Please speak with your tax professional for

more information on reduced tax rates.

Trade Date – The date a trade is placed and

filled in an account.

Transfer on Death Agreement – A contract

between you and Edward Jones allowing the

distribution of assets from your account

upon your death.

Unrealized Gain/Loss – The dierence

between the current cost basis and the

current value of an investment. The unreal-

ized gain or loss shown on statements can

generally be used by you, when working

with your financial advisor and tax profes-

sional, to estimate the taxable gain or loss

that could have resulted if you sold an

investment on the day of the statement.

Note: Edward Jones, its employees and

financial advisors cannot provide tax or

legal advice. You should consult your

attorney or qualified tax advisor regarding

your situation.

PAGE 22 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Appendix

Information Provided in

Additional Sections of the Statement

Section Contents

Disclosure Displays important disclosures about investing with Edward Jones.

See edwardjones.com/statementdisclosures for more information.

Interested

Parties

Confirms that an interested party (for example, your attorney or tax

professional) received a copy of your statement. Speak with your

financial advisor to set up this service or if you have additional questions.

Maturity

Schedule

Displays the laddering for your certificates of deposit and bonds.

It includes the maturing values, current market values and percentage

of total maturing values if you hold these assets at Edward Jones. This

section assists with long-term planning, as laddering can help balance

the risks associated with price and income fluctuation. This section is

optional, so contact your financial advisor if you wish for it to display

on your statement.

Money Market

and Insured

Bank Deposit

Detail by Date

Sections

Illustrates how money moves into and out of (deposits and withdrawals)

your money market fund or Insured Bank Deposit. The running balance

helps you with reconciling these kinds of transactions. The applicable

section displays automatically if you have a money market fund or

Insured Bank Deposit in your account.

Note: The available money market fund types are Money Market

Investment Shares and Money Market Retirement Shares.

Open Orders Provides information about your limit, stop and stop limit orders.

An indicator is provided next to the price displayed to indicate the

type of order.

Open Order Type Open Order Indicator

Stop <$00.00> STP

Limit <$00.00> LMT

Stop Limit <$00.00> STP <$00.00>LMT

Pending Trades Displays the trade activity that has not yet settled within the current

statement period.

PAGE 23 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Appendix (continued)

Information Provided in

Additional Sections of the Statement

Section Contents

Retirement

Summary

Displays reportable activity that took place within the statement period,

which may include contributions, conversions, distributions, excesses,

recharacterizations, rollovers and transfers.

Summary of

Check-writing

Expenses

Displays the amounts for checks written from your Edward Jones

account if a category was assigned to the transaction. To assign a

category, you must enter an expense code in the box marked “EC” on

your check. The section will display for the calendar year the expense

code was used. Because the section shows how your funds have

been allocated by category, it can assist you with budgeting.

See your financial advisor for the list of expense code categories.

Value

Summary:

Fees and

charges

The “Fees and charges” amount shown in your Value Summary includes

activity fees and margin loan interest. It does not include fees for

dividend reinvestments and trade transactions. The dividend reinvest-

ment fee is reflected in the detailed activity section of your statement.

The “Fees and charges” amount does not include commissions or

mark-ups from the purchase of specific investments.

For more information regarding fees and charges, see

edwardjones.com/disclosures/account-fees/index.html.

Your

Relationship

and Mailing

Group(s)

Shows the accounts grouped together at Edward Jones

for planning and mailing purposes.

PAGE 24 OF 24 OPR-5453Q-A EXP 31 MAY 2021 © 2020 EDWARD D. JONES & CO., L.P. ALL RIGHTS RESERVED.

Get Your Statements and Other

Account Documents More

Quickly with Online Access

Don’t like waiting for your statements to arrive in the mail?

With Edward Jones Online Access, you receive an email message

when your documents are available online. Online Access is a great

way to stay connected with your accounts, keep track of your

progress and securely communicate with your financial advisor.

Visit edwardjones.com/access to learn more and sign up.

Resources

Your Financial Advisor

Refer to the top of your statement for your

financial advisor’s contact information.

Edward Jones Client Relations

201 Progress Parkway

Maryland Heights, MO 63043

800-441-2357

Monday–Friday

7 a.m.–7 p.m. CT

Online Access

edwardjones.com/access

Toll-free support line: 800-441-5203

Monday–Friday

7 a.m.–9 p.m. CT

Saturday–Sunday

8 a.m.–4 p.m. CT

edwardjones.com

Member SIPC