U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [1]

Property & Casualty Insurance Industry

PROPERTY & CASUALTY OVERVIEW

The first half of 2023 was challenging for P&C insurers due to continued

inflationary pressures and natural catastrophes which led to the largest mid-year

underwiting loss in over a decade and drove net income down nearly 70%

compared to a year ago. A recovery in equity markets produced unrealized

investment gains versus significant losses last year, resulting in a rebound in

policyholders’s surplus to $1.1 trillion at June 30, 2023.

While the long trend of industry profits continued into the first half of 2023,

operating results in the second half of the year have the potential to be impacted

by a number of factors including, natural catastrophes, economic inflation, and

high reinsurance costs.

U.S. Property/Casualty Insurance Industry Results

For the six months ended

June 30,

Chg. 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014

Direct Premiums Written 10.3%

$478.6 $434.0 $394.8 $362.3 $355.2 $340.6 $321.3 $306.9 $295.5 $282.8

Net Premiums Written 9.2%

$424.3 $388.6 $351.2 $327.6 $315.3 $316.7 $280.4 $268.8 $261.

1 $251.4

Net Premiums Earned 8.6%

$395.5 $364.1 $333.3 $316.6 $308.3 $297.4 $270.4 $261.6 $252.

5 $243.0

Net Loss & LAE Incurred 16.1%

$310.8 $267.8 $231.9 $217.2 $215.8 $204.9 $197.5 $186.9 $175.0 $171.8

Underwriting Expenses 6.2%

$106.4 $100.2 $93.7 $90.2 $85.4 $85.3 $75.8 $74.5 $72.4 $69.3

Underwriting Gain (Loss) (407.8%)

($22.2) ($4.4) $7.3 $8.9 $6.5 $7.0 ($3.2) ($0.2) $4.

7 $1.5

Net Loss Ratio 5.0 pts

78.6% 73.5% 69.6% 68.6% 70.0% 68.9% 73.0% 71.4% 69.3% 70.7%

Expense Ratio (0.5) pts

25.2% 25.8% 26.7% 27.5% 27.1% 26.9% 27.0% 27.7% 27.

7% 27.6%

Dividend Ratio (0.1) pts

0.38% 0.47% 0.71% 1.55% 0.55% 0.53% 0.54% 0.55% 0.

53% 0.57%

Combined Ratio 4.4 pts

104.2% 99.8% 96.9% 97.7% 97.6% 96.3% 100.6% 99.7% 97.6% 98.8%

Investment Inc. Earned (12.1%)

$34.5 $39.3 $28.9 $28.3 $29.3 $28.9 $25.6 $24.2 $24.7 $25.2

Realized Gains (Losses) (33.8%)

$2.4 $3.6 $9.7 ($0.9) $4.6 $5.5 $3.9 $4.8 $8.5 $7.6

Investment Gain (Loss) (13.9%)

$36.9 $42.9 $38.6 $27.4 $33.9 $34.4 $29.5 $29.0 $33.

2 $32.8

Investment Yield (a) (0.56)-pts 3.19% 3.75% 2.90% 3.15% 3.47% 3.50% 3.

28% 3.24% 3.32% 3.48%

Net Income (b) (69.2%)

$10.4 $33.8 $39.8 $26.8 $34.8 $35.8 $17.7 $22.2 $32.7 $28.5

Return on Revenue (5.9)-pts 2.4% 8.3% 10.7% 7.8% 10.2% 10.8% 5.

9% 7.6% 11.4% 10.3%

June 30,

Chg. 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014

Capital & Surplus (b) 7.1%

$1,071.6 $1,000.9 $1,077.6 $955.1 $891.2 $780.0 $786.0 $734.0 $705.9 $706.7

(a) annualized, (b) adjusted to removed stacked entities

NM = Not Meaningful

December 31, 2014-2022

(in billions, except for percent)

Inside the Report

Page No.

Market Conditions ....................... 2

Writings ....................................... 3

Underwriting Operations .......... 4,5

Investment Operations ................ 5

Net Income .................................. 6

Cash Flow & Liquidity .................. 6

Capital & Surplus ......................... 6

Reserves ...................................... 7

Title Industry ............................ 7-8

U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [2]

MARKET CONDITIONS

Premium Pricing

Hard market conditions continued in the U.S. Property & Casualty insurance industry in most lines of business.

Inflationary pressures have driven up property valuations leading to higher rates. According to the Council of Insurance

Agents and Brokers (CIAB) Commercial Property/Casualty Market Report Q2 2023 (April 1 – June 30), Q2 2023 was the

twenty-third consecutive quarter of increased commercial premiums with respondents reporting an average increase

of 8.9% across all account sizes, compared to 8.8% in Q1.

The report noted that the commercial property line was the outlier in terms of premium pricing, increasing 18.3% in

the second quarter. Rising property values and increased frequency and severity of natural disasters were compounded

by decreased reinsurance placement. Workers’ compensation recorded its sixth consecutive quarter of rate decreases

while commercial auto rates increased 10.4%, marking fifty consecutive quarters of premium increases.

Capacity

Despite hard market conditions and worsening

underwriting results, the industry has recorded a long

trend of profits, boosting capital levels and keeping

the net writings leverage ratio under 80% since 2009.

Headwinds created by increased natural disasters and

inflationary pressures impacting personal lines

results, rising interest rates weighing on investment

returns, and higher reinsurance costs will challenge

insurers bottom lines in the second half of the year.

Despite these challenges capital remains strong.

76.3%

65%

70%

75%

80%

85%

90%

95%

100%

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 '22 Jun-

23

Net Writings Leverage

U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [3]

WRITINGS

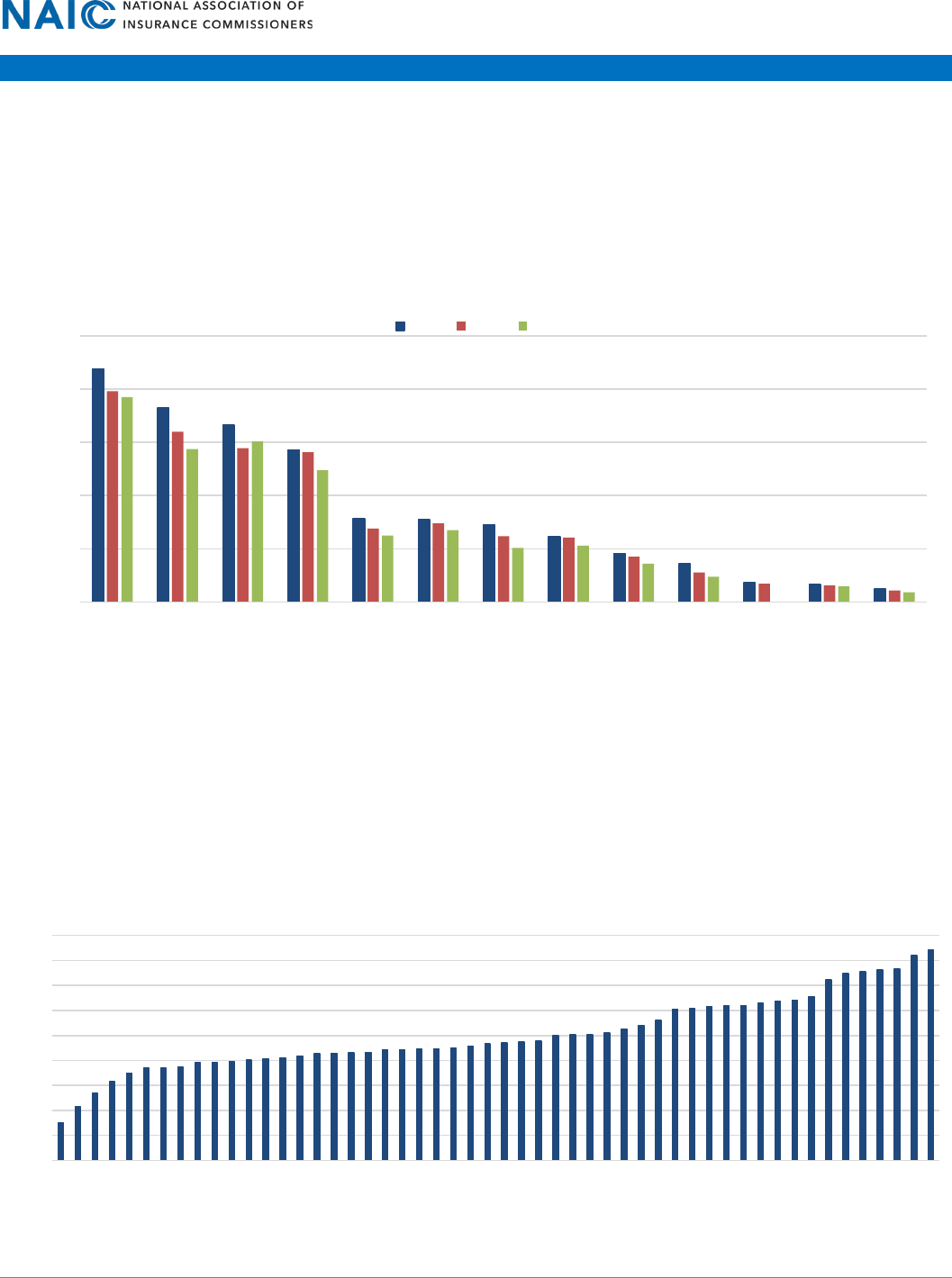

Direct premiums written (DPW) increased 10.3% to $478.6 billion in the first half of 2023 compared to $434.0 billion

for the same period in 2022. Construction material and labor cost increases resulted in higher claim payouts for

property lines. Additionally, auto repair costs have increased due to the higher cost of parts and labor, leading to

higher claims payouts. Insurers have responded by increasing premiums in nearly all major lines. The most notable

change was in the homeowners line, where premiums increased 14.1% YoY and 27.0% compared to mid-year 2021.

The auto liability and physical damage lines experienced YoY increases of 10.5% and 15.1%, respectively. The chart

below shows the DPW for the industry’s top lines of business for the last three mid-year periods.

Geographically, nearly all states and territories experienced DPW growth. California recorded the greatest market

share at 11.4% and DPW increased 7.4% YoY. Both Texas and Florida recorded the next highest market share at 9.7%

and 9.5%, respectively, and each saw premium increases of over 16.0%.

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

Prvt Psgr Auto Liability

Homeowners MP

Auto Physical Damage

Other Liability

Commercial Multiple

Peril

Workers'

Compensation

Allied Lines

Commercial Auto

Liability

Inland Marine

Fire

Commercial Auto

Physical Damage

Medical Prof Liab

Surety

DPW Change by LOB - Current Year to Date ($B)

2Q23 2Q22 2Q21

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

VI

ID

DE

CT

WA

NY

MI

CA

MD

ND

AK

MA

WI

PA

IL

WV

IA

VT

KS

IN

NE

NV

HI

KY

NJ

NH

MN

MT

MS

RI

OH

GA

ME

NC

VA

OK

TN

MO

AL

SD

LA

AR

CO

UT

OR

AZ

PR

WY

SC

NM

TX

FL

Geographic Change in DPW (CYTD to PYTD)

U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [4]

UNDERWRITING OPERATIONS

The P&C industry recorded a $22.2 billion underwriting

loss for the first half of 2023, its second consecutive mid-

year loss and the largest mid-year loss since 2011.

Despite substantial pricing and underwriting actions

taken by insurers, the personal lines segment continued

its downturn primarily due to the high inflation and

natural catastrophes which were significantly higher at

an estimated $32 billion in the U.S. in the first half of 2023

compared to $19 billion for the same period last year. In

contrast, commercial lines results were favorable due to

a trend of rate increases and tighter underwriting

guidelines in most lines since the fourth quarter of 2018.

For the current period, net premiums earned increased

8.6% to $395.5 billion while net losses and LAE incurred

increased 16.1% to $310.8 billion resulting in a 5.0-point

deterioration in the net loss ratio to 78.6%. The expense

ratio experienced a minor improvement to 25.2% due to

net premium written growth. Overall, the combined ratio deteriorated 4.4-points to 104.2%.

The recent challenges with underwriting profitability in the P&C industry is largely attributed to personal lines

performance. Personal auto lines experienced an increase in accident frequency after the pandemic related shutdowns

were lifted and traffic volumes returned to normal. Inflation hit a 40-year high in mid-year 2022 and continues to wreak

havoc on the cost of claims during the second half of 2023. Additionally, the homeowners line has been challenged by

natural catastrophes as well as inflation which is driving up replacement costs. The $32 billion in insured losses related

to natural catastrophes in the first half of the year contributed 8.1-points to the overall industry’s net loss ratio of

78.6%. The chart below shows the pure direct loss ratio (PDLR) by segment for the last ten mid-year periods.

90%

95%

100%

105%

110%

$180

$230

$280

$330

$380

$430

'14 '15 '16 '17 '18 '19 '20 '21 '22 '23

($B)

Earned Prem Loss, LAE, & U/W Exp Combined Ratio

Underwriting Income (Six months ended June 30)

78.4%

58.1%

67.6%

40%

45%

50%

55%

60%

65%

70%

75%

80%

85%

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Pure Direct Loss Ratio

Six Months Ended June 30

Personal Lines Commercial Lines All P&C Lines

U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [5]

Within the personal lines segment, the PDLR for the homeowners line deteriorated sharply to 81.2% in the current

period compared to 66.2% for the same period last year. The private passenger auto liability line worsened 3.6-points

to 75.6% while personal auto physical damage improved 1.0-point but still remained elevated at 79.1%. The

commercial lines segment results were favorable as evidenced by a PDLR of 58.1%, however, the commercial multiple

peril line experienced an 11.1-point deterioration to 64.2% driven by higher property loss costs resulting in a 69.8%

PDLR in the non-liability portion and an overall PDLR of 64.2%. The workers’ compensation line has seen eight plus

years of underwriting profits primarily due to the release of prior year reserves.

INVESTMENT OPERATIONS

Investment gains were 13.9% lower than the first half of last year, totaling $36.9 billion for the six months ended June

30, 2023. Net investment income earned was 12.1% lower while fluctuations in equity markets produced a 33.8%

decrease in realized capital gains to $2.4 billion compared to $3.6 billion a year ago and a 75.3% decrease compared

to June 30, 2021.

Investment yield (annualized) was 3.19% versus 3.75%

for the prior year period due to the 12.1% decrease in

net investment income earned. The main vehicle for

investment income was bonds, which leaves insurers

exposed to interest rate risk. To combat inflation, the

U.S. Federal Reserve (Fed) increased the federal funds

rate four times in 2023. The Fed raised the rate by one

quarter of a point in July, bringing the benchmark

interest rate up to a target range of 5.25-5.50%, the

highest since 2008.

Bonds comprised the majority of the industry’s cash and

invested assets at 49.2%, while unaffiliated common

stocks were 20.8%, affiliated common stocks 13.1%,

Schedule BA assets 7.7%, cash, cash equivalents and

short-term investments totaled 6.6%, mortgage loans

1.3%, and all other cash and invested assets 1.3%.

66.2%

72.0%

80.1%

48.4%

58.8%

53.1%

68.6%

81.2%

75.6%

79.1%

48.6%

57.9%

64.2%

72.9%

Homeowners Prvt. Psgr. Auto

Liability

Prvt. Psgr. Auto

Physical Dmg.

Workers' Comp Other Liability Commercial

Multiple Peril

Commercial Auto

Liability

PDLR Primary Lines of Business

2Q22 2Q23

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

'14 '15 '16 '17 '18 '19 '20 '21 '22 '23

Investment Income (Six months ended June 30)

Investment Income ($B) Investment Yield (Annualized)

U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [6]

NET INCOME

Net income of $10.4 billion was 69.2% lower compared

to the same period last year. The steep underwriting

loss was offset by investment gains to continue the long

trend of industry profits.

Return on revenue (RoR) of 2.4% was 5.9-points lower

compared to last year’s RoR of 8.3% as net income was

significantly lower in relation to net premiums earned

and investment gains.

CASH FLOW & LIQUIDITY

Net cash provided by operating activities decreased

19.8% compared to the same period in 2022 to $38.6

billion. The deterioration stemmed from an 18.4%

increase in benefit and loss related payments as higher

loss costs in personal lines continued. Partially

offsetting the increase in loss payments was an 11.8%

increase in premiums collected net of reinsurance.

The liquidity ratio worsened 0.3-points but remained

solid at 80.0% at June 30, 2023. Liquid assets increased

8.0% while adjusted liabilities increased 8.3%.

CAPITAL & SURPLUS

Industry aggregated policyholders’ surplus (adjusted to

eliminate stacking) totaled $1.1 trillion at June 30,

2023, a 7.1% increase compared to $1.0 trillion at

December 31, 2022. Although net income was lower

compared to last year, insurers reported unrealized

capital gains of $70.8 billion compared to unrealized

capital losses of $122.3 billion for the same period a

year ago.

0%

2%

4%

6%

8%

10%

12%

14%

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

'14 '15 '16 '17 '18 '19 '20 '21 '22 '23

Net Income (Six months ended June 30)

Net Income ($B) ROR

$23.3

$22.9

$26.1

$16.0

$40.8

$37.2

$45.9

$64.2

$48.2

$38.6

$0

$10

$20

$30

$40

$50

$60

$70

'14 '15 '16 '17 '18 '19 '20 '21 '22 '23

(Billions)

Cash from Operations (Six months ended June 30)

1,071,611

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

$1,100

'05 '07 '09 '11 '13 '15 '17 19 21 6/30/2023

Capital & Surplus ($B)

U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [7]

RESERVES

Loss and LAE reserves increased 2.6% since the prior

year-end to $882.0 billion at June 30, 2023, and was

comprised of $741.2 billion unpaid losses and $140.8

billion unpaid LAE. For the current period, reserve

leverage improved 3.6-points to 82.3% compared to

85.9% at the prior year-end attributable to the increase

in surplus.

The trend in net favorable loss reserve development

continued with an overall redundancy of $5.4 billion in

the first half of 2023, which consisted of a $71.2 billion

redundancy in prior year IBNR loss and LAE reserves,

partially offset by a $65.8 billion deficiency in prior year

known case loss and LAE reserves.

Title Industry

Title Industry Results

For the six months

ended June 30,

YoY Chg. 2023 2022 2021 2020 2019

Direct Premiums Written

(39.9)% $7,356 $12,234 $12,315 $8,136 $6,913

Direct Ops.

(41.9)% $751 $1,292 $1,226 $863 $854

Non-Aff. Agency Ops.

(41.2)% $4,715 $8,022 $7,997 $5,211 $4,257

Aff. Agency Ops.

(35.3)% $1,890 $2,919 $3,092 $2,063 $1,803

Premiums Earned

(38.0)% $7,438 $11,988 $11,969 $8,034 $6,871

Loss & LAE Incurred

16.0% $363 $313 $285 $255 $283

Operating Exp Incurred

(36.1)% $7,324 $11,461 $11,454 $7,828 $6,710

Net Operating Gain/(Loss)

(70.8)% $317 $1,085 $1,190 $633 $465

Net Inv. Income Earned

55.1% $274 $177 $168 $203 $202

Net Realized Gain/(Loss)

NM $(21) $77 $25 $(26) $44

Net Inv. Gain (Loss)

(0.3)% $254 $254 $193 $178 $247

Net Income

(56.7)% $473 $1,093 $1,108 $675 $585

Loss Ratio

2.3-pts 4.9% 2.6% 2.4% 3.2% 4.1%

Expense Ratio

2.9-pts 98.5% 95.6% 95.7% 97.5% 97.7%

Combined Ratio

5.1-pts 103.4% 98.2% 98.1% 100.6% 101.8%

Net Unrealized Gain/(Loss)

NM $14 $(667) $270 $(187) $215

Net Cash from Operations

(84.3)% $138 $879 $1,286 $689 $348

NM=Not Meaningful

(in millions, except for percent data)

$882.0

70%

75%

80%

85%

90%

95%

100%

$500

$550

$600

$650

$700

$750

$800

$850

$900

'13 '14 '15 '16 '17 '18 '19 '20 '21 '22 6/23

Loss & LAE Reserves ($B)

Loss & LAE Reserves Reserve Leverage

U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [8]

Title Industry Overview

The U.S. Title sector recorded a 39.9% decline in DPW

compared to this time last year, reflecting a slowdown

in new housing starts driven by higher interest rates.

The decrease occurred in all three segments, direct

operations, affiliated operations, and non-affiliated

agency operations.

A net operating gain of $317.4 million was reported for

the first half of 2023, representing a 70.8% YoY

decrease compared to $1.1 billion for the first half of

2022, driven by a 38.0% decrease in earned premiums

while losses and loss adjustment expenses incurred

remained relatively unchanged. The mid-year

combined ratio of 103.4% was 5.1-points higher than

last year.

A net investment gain of $253.5 million was roughly the

same as the prior year period. Net investment income

earned was $274.1 million, a 55.1% increase compared

to 2022 while realized investment losses totaled $20.6

million versus realized gains of $77.0 million last year.

Overall, lower operating income drove a 56.7% decline

in net income to $473.3 million.

Policyholder Surplus (PHS) decreased 8.2% compared

to mid-year 2022. This decrease was primarily driven by

lower net income and $532.0 million in dividends to

stockholders and partially offset by unrealized

investment gains. The return on surplus decreased 8.1-

points YoY as the decrease in net income was greater

than the decline in surplus.

11.4%

12.1%

16.8%

16.1%

8.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

$

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

2019 2020 2021 2022 2023 YTD

June 30 PHS ($M) and Return on Surplus

PHS ($M) Return on Surplus

$585

$675

$1,108

$1,093

$473

101.8%

100.6%

98.1%

98.2%

103.4%

97.0%

98.0%

99.0%

100.0%

101.0%

102.0%

103.0%

104.0%

$400

$500

$600

$700

$800

$900

$1,000

$1,100

$1,200

2019 2020 2021 2022 2023

Five Years of Net Income ($M) and the

Combined Ratio

Net Income Combined Ratio

U.S. Property & Casualty and Title Insurance Industries – 2023 First Half Results

© 2023 National Association of Insurance Commissioners [9]

NAIC Financial Regulatory Services

Financial Analysis and Examination Department

Contributors:

Brian Briggs, P/C Senior Financial Analyst

| 816.783.8925

Contacts:

Bruce Jenson, Assistant Director - Solvency Monitoring

BJenso[email protected]

| 816.783.8348

Andy Daleo, Senior Manager – P/C Domestic and International Analysis

| 816.783.8141

Rodney Good, P/C & Title Financial Analysis Manager II

| 816.783.8430

DISCLAIMER

The NAIC 2023 Mid-

Year Property/Casualty & Title Insurance Industry Analysis Report is a limited scope analysis based on the aggregated

information filed to the NAIC’s Financial Data Repository as of June 30, 2023 and written by the Financial Regulatory Services Department staff.

This report does not constitute the official opinion or views of the NAIC membership or any particular state insurance department.