Texas Department of Banking

Strategic Plan

Fiscal Years 2025-2029

Texas Department of Banking

2601 N. Lamar Blvd.

Austin, Texas 78705

Toll Free 877-276-5554

www.dob.texas.gov

Agency Strategic Plan

Fiscal Years 2025 to 2029

By

Texas Department of Banking

Finance Commission of Texas

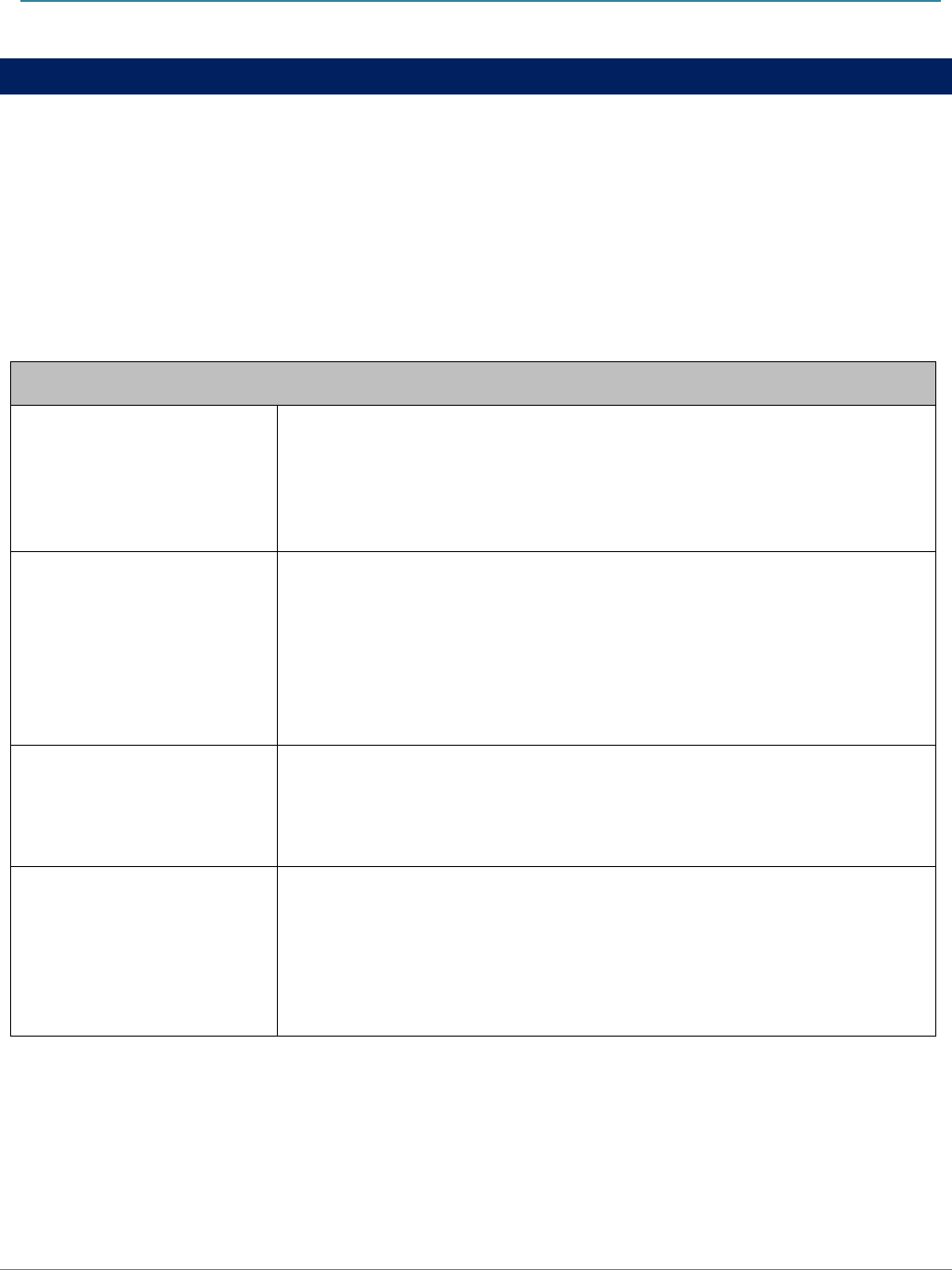

Commission Member Dates of Term Hometown

Phillip A. Holt, Chair

Feb 23, 2016 to Feb 1, 2028

Bonham

Robert (Bob) Borochoff

Feb 22, 2016 to Feb 1, 2028

Houston

Hector J. Cerna

Dec 16, 2015 to Feb 1, 2026

Eagle Pass

Kathleen K. Fields

May 16, 2024 to Feb 1, 2028

San Antonio

Glen Martin (Marty) Green

June 27, 2022 to Feb 1, 2028

Dallas

Troy L. Lambden

May 16, 2024 to Feb 1, 2030

Graham

Sharon McCormick

April 20, 2020 to Feb 1, 2026

Frisco

Roselyn (Rosie) Morris, Ph.D.

March 24, 2022 to Feb 1, 2026

San Marcos

David W. Osborn

May 16, 2024 to Feb 1, 2030

El Paso

Miguel Romano, Jr.

May 16, 2024 to Feb 1, 2030

Austin

Laura Nassri Warren

April 20, 2020 to Feb 1, 2026

Palmhurst

Submitted June 1, 2024

/s/ Charles G. Cooper

_______________

_________________

Charles G. Cooper, Banking Commissioner

Table of Contents

DEPARTMENT OF BANKING MISSION .................................................................................................. 1

AGENCY GOALS AND ACTION PLANS ................................................................................................... 1

Goal: Effective Bank and Trust Regulation ............................................................................................................................. 1

Actions Required to Achieve Goal .............................................................................................................................................. 1

Goals and Action Items Support Statewide Objectives .............................................................................................................. 2

Other Considerations ................................................................................................................................................................. 5

Overview ................................................................................................................................................................................ 5

Effective Examinations ........................................................................................................................................................... 5

Staffing Resources .................................................................................................................................................................. 6

Examination Workforce Challenges ....................................................................................................................................... 7

Challenges for Regulated Entities........................................................................................................................................... 7

Goal: Effective Regulation of Non-Depository Supervision Licensees ..................................................................................... 9

Actions Required to Achieve Goal .............................................................................................................................................. 9

Goals and Action Items Support Statewide Objectives ............................................................................................................ 10

Other Considerations ............................................................................................................................................................... 13

Overview .............................................................................................................................................................................. 13

Effective Examinations ......................................................................................................................................................... 14

Staffing Resources ................................................................................................................................................................ 14

Examination Workforce Challenges ..................................................................................................................................... 15

Challenges for MSBs ............................................................................................................................................................. 16

Challenges for PFCs and PCCs .............................................................................................................................................. 17

Unlicensed and Illegal Activity ............................................................................................................................................. 18

Goal: Effective Regulation Through Corporate Activities ...................................................................................................... 18

Actions Required to Achieve Goal ............................................................................................................................................ 18

Goals and Action Items Support Statewide Objectives ............................................................................................................ 19

Other Considerations ............................................................................................................................................................... 20

Overview .............................................................................................................................................................................. 20

Applications and Filings ........................................................................................................................................................ 20

Technology ........................................................................................................................................................................... 21

Corporate Activities Workforce Challenges ......................................................................................................................... 21

Goal: Effective and Efficient Operations Compliant with State Laws .................................................................................... 22

Actions Required to Achieve Goal ............................................................................................................................................ 22

Goals and Action Items Support Statewide Objectives ............................................................................................................ 22

Other Considerations ............................................................................................................................................................... 24

Overview .............................................................................................................................................................................. 24

Employee Surveys and Job Satisfaction ............................................................................................................................... 25

Legal ..................................................................................................................................................................................... 25

Management Information Systems (MIS) ............................................................................................................................ 26

Financial Education .............................................................................................................................................................. 27

Consumer Assistance ........................................................................................................................................................... 27

Administrative Services ........................................................................................................................................................ 27

COOP .................................................................................................................................................................................... 27

CAPPS ................................................................................................................................................................................... 28

Succession Planning and Employee Retention and Recruiting ............................................................................................ 28

Finance Commission Building ............................................................................................................................................... 30

Sunset Review ...................................................................................................................................................................... 30

REDUNDANCIES AND IMPEDIMENTS ................................................................................................. 31

SUPPLEMENTAL SCHEDULES

SCHEDULE A: BUDGET STRUCTURE…………………….………………………………..………………………..………………A-1

SCHEDULE B: PERFORMANCE MEASURE DEFINITIONS……………………..…….………………………..…….…..…B-1

SCHEDULE C: HISTORICALLY UNDERUTILIZED BUSINESS PLAN………………………...………...………………….C-1

SCHEDULE D: STATEWIDE CAPITAL PLAN…………………………………………………….…..…………………………..N/A

SCHEDULE E: HEALTH & HUMAN SERVICES STRATEGIC PLANNING..……………………………..……...……..N/A

SCHEDULE F: AGENCY WORKFORCE PLAN………………………………………………………………...…..….……..…..F-1

SCHEDULE G: WORKFORCE DEVELOPMENT SYSTEM STRATEGIC PLANNING…………..…………………….N/A

SCHEDULE H: REPORT ON CUSTOMER SERVICE……………………………..………………….…..……………………..H-1

SCHEDULE I: CYBERTRAINING CERTIFICATION………………………………………………………………………………..I-1

This page intentionally left blank

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 1

Department of Banking Mission

The mission of the Department of Banking is to ensure Texas has a safe, sound, and

competitive financial services system.

Agency Goals and Action Plans

The Department’s mission is accomplished primarily by the examination and supervision of our

chartered and licensed entities. To meet our goals and fulfill our mission, the Department will abide

by these core values and operating principles:

• Adhere to the highest ethical and professional standards.

• Be statutorily accountable and responsible.

• Anticipate and respond to a dynamic environment.

• Identify and promote innovative practices.

• Operate efficiently and maintain consistent and prudent regulatory standards.

• Communicate effectively.

• Foster teamwork while encouraging individual excellence and career development.

• Provide a desirable work environment that values cultural and individual differences.

• Seek input from and be responsive to the public, our supervised entities, and State leadership.

• Adhere to the principle of “Tough but Fair” regulatory oversight.

Goal: Effective Bank and Trust Regulation

Ensure timely, fair, and effective supervision and regulation of the financial institutions under our

jurisdiction. The regulatory process promotes a stable banking and financial services environment and

provides the public with convenient, safe, and competitive financial services. Provide quality regulation

and maintain the credibility of the Department with the public, industries we regulate, federal banking

regulators, and other government agencies.

Actions Required to Achieve Goal

• Conduct commercial bank, trust company, and foreign bank agency, foreign bank branch, and

foreign bank representative office (foreign bank organizations) examinations, in cooperation

with the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve Bank (FRB),

while conforming with the Department’s examination priority schedule and in a thorough,

accurate, and timely manner.

• Maintain contact with, and monitor the condition of, regulated entities between examinations

through processes which include an off-site monitoring program. Continue to improve off-site

monitoring processes by augmenting our management information systems (MIS).

• Research and report on changing industry, statutory, and economic conditions, and develop

appropriate supervisory strategies to adapt to these changes.

Agency Goals and Action Plans

2| Texas Department of Banking · 2025-2029 Strategic Plan

• React timely and appropriately when needed to implement disaster preparedness plans and

adjust to changing situations as applicable to continue providing effective oversight of regulated

entities.

• Monitor industry status and engage in regular communication with federal regulators (FDIC and

FRB) and the Conference of State Bank Supervisors (CSBS).

• Obtain feedback from regulated entities regarding proposed rule changes.

• Promote cybersecurity awareness and best practices among our regulated entities and

employees.

• Maintain a cybersecurity tracking system and monitor remediation efforts associated with

cybersecurity incidents reported by our regulated entities.

• Identify and investigate fraudulent activities and insider abuse.

• Ensure correction-oriented enforcement actions are taken, as appropriate, against regulated

entities that demonstrate higher than normal weakness or risk, including consideration of

noncompliance with laws, regulations, and policies.

• Maintain sufficient regulatory resources in the event of industry deterioration or systemic

industry problems, the reallocation of federal regulatory resources away from Texas, or a

significant increase in the regulated asset base.

• Attract and retain qualified employees through a competitive salary program, specialized

training, and career advancement opportunities. Promote a culture of state service as a career.

• Optimize efficiencies in the examination process by utilizing electronic examination tools and

the Department’s secure data exchange portal to share information with regulated entities and

federal counterparts.

• Improve the agency’s technologies through the adoption of cloud offerings, where appropriate,

and by ensuring current technologies are in use to support regulatory obligations and

operations.

• Enhance the Department’s examination procedures and scoping processes to effectively utilize

examination resources for evaluating risks and risk management practices of our regulated

entities.

• Provide regulatory and supervisory information through the agency’s website.

• Maintain accreditation status by CSBS.

Goals and Action Items Support Statewide Objectives

1. Accountable to tax and fee payers of Texas.

Consumers

• Ensure Texans have access to safe and sound financial services providers that comply

with applicable laws and regulations.

• Provide consumers with various avenues for filing complaints on entities regulated by

the Department.

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 3

• Protect consumers by maintaining the Closed Account Notification System which

provides depository institutions with a method to report compromised accounts closed

due to fraud or identity theft to check verification entities.

• Ensure adherence to self-leveling, self-funding and Self-Directed, Semi-Independent

(SDSI) statutory requirements.

Regulated Entities

• Provide useful and timely information on the website.

• Issue regulatory and supervisory guidance as appropriate and make these available

through the Department’s Law and Guidance Manual.

• Communicate with industry stakeholders regarding important issues.

• Seek input on the annual budget through a public hearing.

• Provide employees of regulated entities a secure avenue to report suspicious activity,

fraud, or abuse to the Department.

• Ensure that the cost of regulation is reasonable and equitable for all regulated entities.

• Operate efficiently and maintain consistent and prudent regulatory standards.

2. Efficient such that maximum results are produced with a minimum waste of taxpayer

funds, including the elimination of redundant and

non-core functions.

• Continue to coordinate examinations and other supervisory activities and produce joint

regulatory responses when applicable to reduce duplicative responses to financial

institutions.

• Maintain a data exchange portal which is used by regulated entities and examination

staff to improve the secure transmission of information.

• Adopt and maintain appropriate technologies to support efficient, effective, and secure

operations.

• Leverage technology to conduct efficient, risk-focused examinations that target areas

of concern and facilitate effective examinations on and off-site.

• Review examination procedures on a continual basis and develop and refine procedures

to address industry trends when necessary.

• Allow flexible work schedules where appropriate to reduce on-site examination time and

travel burden, and to minimize associated expenses.

• Perform off-site monitoring to maintain awareness of, and contact with, regulated

entities between on-site examinations.

3. Effective in successfully fulfilling core functions, measuring success in achieving

performance measures, and implementing plans to continuously improve.

• Meet or exceed performance measures related to banks, trust companies, and foreign

bank organizations.

• Explore ways to further automate examination and related administrative processes.

Agency Goals and Action Plans

4| Texas Department of Banking · 2025-2029 Strategic Plan

• Monitor legislative and emerging issues as well as their impact on regulated entities.

• Perform continual reviews of examination procedures and policies.

• Review regulatory and supervisory guidance frequently to ensure they are current and

relevant.

• Provide ongoing formal and informal training opportunities for examination staff.

4. Attentive to providing excellent customer service.

• Provide professional and timely resolutions to consumer complaints.

• Seek feedback from consumers upon closure of their complaint against a regulated

entity.

• Seek feedback from regulated entities at the conclusion of each examination and

through the annual Rate the Department Survey.

• Adhere to policies regarding timely dissemination of reports of examinations.

• Notify regulated entities of new or revised rules, regulations, or policies in a timely

manner.

• Participate in outreach events dedicated to informing and educating bankers and trust

administrators.

• Ensure management of banks, trust companies, and foreign bank organizations are well-

informed about the progress of examinations and findings.

5. Transparent such that agency actions can be understood by any Texan.

• Ensure the Department’s website contains the following information:

o Proposed rule changes written in plain language and instructions on how to

submit comments;

o Enforcement actions and orders;

o Examination procedures;

o Corporate applications, notices, and filing activity;

o Department-issued regulatory and supervisory guidance accessible through the

Law and Guidance Manual; and

o Accurate lists of entities currently (or formerly) supervised, registered, and

licensed by the Department.

• Provide status reports regarding agency activities and industry conditions to the Finance

Commission of Texas (FC).

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 5

Other Considerations

Overview

Overall, state-chartered banks are operating with strong capital but face an increasingly challenging

operating environment with labor shortages, high interest rates, and inflationary pressures. Concerns

related to liquidity and credit risks are at the forefront. The Department must be prepared for a

potential rise in problem institutions, which could place additional strains on agency resources. The

Bank and Trust Supervision Division will continue to actively monitor, evaluate, and respond to the

risks posed to our regulated entities. The Department strives to react quickly to changing economic

conditions as well as catastrophic events.

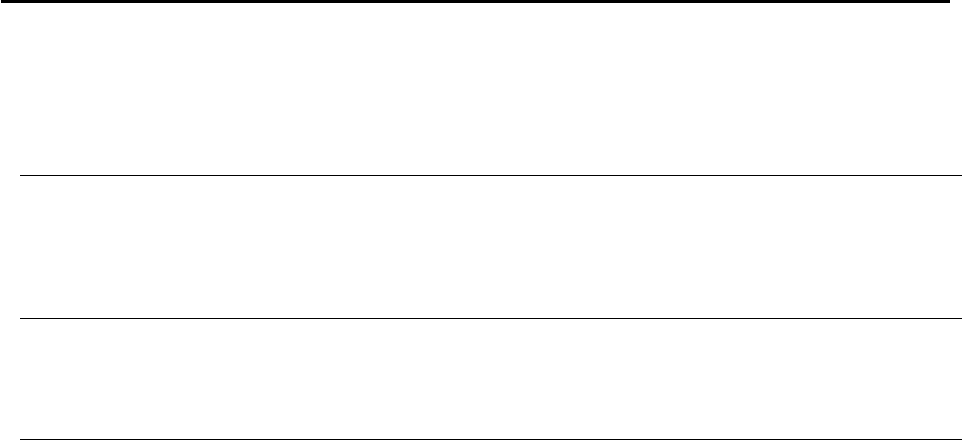

The number and total assets of banking entities supervised by the Department as of December 31,

2023, is shown in the following table:

Regulated Entities

Number of Entities

As of

December 31, 2023

Total Assets

($ millions)

Commercial Banks 213 432,115

Commercial Bank Trust

Departments

35 109,803

(1)

Trust Companies

16 Non-exempt

20 Exempt

170,316

(2)

Offices of Foreign Bank

Organizations (FBOs)

(3)

4 Agencies

17 Representative Offices

3 Branches

114,299

(1) Asset under management is not included in total assets of commercial banks.

(2) Fiduciary assets for public trust companies (non-exempt) only.

(3) Foreign bank agency, representative office, or branch licensed to operate in Texas.

The number of regulated financial institutions has declined over the years primarily due to

consolidations; however, the dollar volume of assets under supervision reflects a significant increase

due to acquisitions, charter conversions, and organic growth. This trend has produced banks that are

more complex, larger in size, operate offices in more diverse geographic locations, and offer a broader

array of products and services.

Effective Examinations

Department employees must be knowledgeable of regulatory changes, emerging trends, and economic

conditions at both the state and national levels to be successful in meeting the agency’s goals.

Monitoring concerns surrounding the stability of state-chartered financial institutions and identifying

the individual banks and trust companies that demonstrate an increased risk profile are critical.

Examiners routinely review institutional exposures to changing economic conditions, and when

appropriate, the agency acts to mitigate these risks.

Agency Goals and Action Plans

6| Texas Department of Banking · 2025-2029 Strategic Plan

The Bank and Trust Supervision Division staff are primarily responsible for conducting examinations

and performing off-site monitoring of state-chartered banks and trust companies. Risk-focused and

forward-looking examinations are conducted utilizing an improved examination scoping process and

risk-focused procedures. Examinations are often performed using a hybrid approach with examination

staff working on-site as well as off-site.

The Department participates with the FDIC and FRB in a longstanding, cooperative examination

program, which provides for both alternating and joint bank examinations. The agency must meet the

highest expectations and supervisory standards to maintain the state’s role in enhancing the dual

banking system. This program improves efficiencies for the Department and federal regulators while

providing a benefit to regulated entities by reducing regulatory burden. As part of the cooperative

examination program, the agency must also be accredited by CSBS.

Division staff utilizes the FDIC’s Examination Tools Suite (ETS) to review and document examinations.

ETS allows for the collaboration of findings among examination staff and review examiners while also

allowing bank examiners with the Department, FDIC, and FRB to share information more effectively

in the examination of financial institutions for safety and soundness.

The agency utilizes a secure

Internet portal for regulated entities and federal counterparts to exchange information with the

Department. A new web-based platform was slated to be released at year-end 2022, however,

programming delays occurred. Progress continues to be made on implementing the selected platform

which will include added security features. The enhanced data exchange platform is projected to be

released in 2025.

Staffing Resources

A large portion of the Department’s resources are dedicated to the activities of the Bank and Trust

Supervision Division. As of March 31, 2024, the division represents 65% of the agency’s 184

employees. Based on the authorized staffing plan, however, the division is understaffed by 20 full-

time employees as of March 2024. In addition, 18% of the division staff are eligible to retire or includes

return-to-work retirees who may leave at any time in 2024. This increases to 26% over the next five

years.

Historically, the agency has experienced high turnover with financial examiners in the first five years

of employment, leaving a void in the number of examiners qualified to become mid-level examiners.

This mid-level workforce gap has been difficult to fill given that there are so few applicants for mid-

level positions that require a certain level of skills and experience. Further, senior management

continues to face the challenges of having a high number of well-tenured financial examiners eligible

to retire over the next five years and a shortage of mid-level examiners available to take their place

if these retirements occur. The Department will continue to focus on recruiting and retention efforts.

As regulated entities continue to become more complex, the need to be fully staffed is more critical.

Much of the examination staff have experienced an increase in workload while operating with

insufficient resources, increasing the risk of worker fatigue. This trend is likely to continue until staffing

levels are in line with the staffing plan. Staffing changes due to retirements and resignations resulting

in less experienced examiner staff could affect the agency’s ability to meet its priorities as well as

impact productivity among the remaining staff over the next five years.

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 7

Examination Workforce Challenges

Texas state-chartered banks continue to grow in asset-size and complexity, a continuing trend that is

not expected to change for the foreseeable future. To meet the challenges resulting from the growth

in size and sophistication, the Department must retain experienced examiners, provide specialized

training for less experienced staff, and hire qualified personnel with examiner experience if available.

This includes specialty examiners skilled in capital markets, Bank Secrecy Act/Anti-Money Laundering,

trust, and Information Technology (IT) areas.

Banks often rely on third parties to provide various products and services. This includes partnering

with financial technology (FinTech) companies, which are non-depository financial service providers

relying heavily on technology to improve their use and delivery to customers almost exclusively

through an online platform. As banks increase their reliance on these types of companies for services,

the Department will need to provide appropriate training for existing personnel and consider hiring

additional personnel with specific knowledge and background in evaluating the potential risks posed

by this technology, including unique electronic product delivery methods, blockchain technology, and

cryptocurrency. Further, additional tenured examiners will be required to complete these examinations

within the mandated timeframes.

Financial examiners must have the proper experience and training to capably assess the risks in the

industry. The general training policy includes on-the-job training, seminars, conferences, and required

core curriculum of internal and external schools. Training courses and seminars which had been

primarily conducted virtually during the pandemic are gradually transitioning back to a more effective

in-person training format. The Department has resumed conducting in-person internal examiner

schools which were postponed due to the pandemic. In addition, an intense training program for newly

hired assistant examiners was successfully implemented in June 2023. The program focuses on the

fundamentals of commercial bank examination and will be utilized going forward as part of the

agency’s internal training program. This formalized training program is expected to shorten the

timeframe for commissioning financial examiners and improve efficiencies within the agency. IT and

cybersecurity training remains a priority and all Department field examiners and related directors must

attend periodic IT training to stay abreast of this changing environment.

Significant resources are dedicated to developing assistant examiners into commissioned examiners.

The estimated cost to adequately train an examiner in the financial examiner levels I-III through the

first four years of employment is approximately $325,000. This educational investment into an

examiner’s career is essential to achieving the agency’s mission and offering effective examinations.

As banks and trust companies under the Department’s supervision become larger and more complex,

additional resources will be required for staff development, further impacting the agency’s budget in

the next five years.

Efforts to hire experienced examiners from external sources have not been productive; however, we

will attempt to improve staffing levels through enhanced recruiting. As indicated above, the new

internal training program has been successful. We will continue to focus on this method and refine the

structure.

Challenges for Regulated Entities

The Department continually monitors state-chartered banks and the factors that could impact an

institution’s financial condition. The factors listed below are expected to create challenges for the

banking industry over the next five years:

Agency Goals and Action Plans

8| Texas Department of Banking · 2025-2029 Strategic Plan

(1) Cybersecurity threat detection and prevention while also providing modern electronic banking

conveniences for customers.

(2) Instabilities in economic conditions, high interest rates, and inflationary pressures that could

impact asset quality and other performance metrics.

(3) The cost of complying with federal rules and regulations, primarily for smaller community

banks.

(4) Competition for deposits and pricing pressures associated with the tightening of credit

underwriting standards.

(5) Succession planning as it relates to the recruitment and retention of qualified staff to replace

retiring management and board members, especially in smaller, rural communities.

(6) Commercial Real Estate and funding concentrations without effective risk mitigation strategies

especially in an elevated interest rate environment.

(7) Identifying and maintaining safeguards against IT vulnerabilities.

(8) Maintaining reliable funding sources and sound asset quality in an environment of higher

interest rates, compared to prior years, and depreciation within portfolios.

(9) Changes in the Texas economy caused by external events, international trade disputes and

geopolitical conflicts, weakness in specific industries, or cybersecurity incidents which could

impact financial service providers and the customers who rely on them.

(10) Finding new revenue sources without disproportionately increasing compliance, credit, and

operational risks.

(11) Increased competition in the personnel area from other financial service providers, especially

from non-banks.

(12) Climate-related events such as hurricanes, wildfires, floods, and droughts can impact credit

and investment risk.

As financial institutions implement advanced automation and innovative technology including

cybersecurity, data privacy, and data management risks will continue to increase. Financial records

and monetary transmission systems are targets for unauthorized access by sophisticated hackers,

terrorists, and other cybercriminals. The trend toward increasingly sophisticated cyber-attacks is

expected to continue. The Department and federal banking agencies require financial institutions to

perform internal cybersecurity risk assessments that are reviewed at each examination. The

Department maintains a cybersecurity tracking system to monitor events and management’s

remediation efforts associated with incidents reported by our regulated entities. The Department’s

website also provides numerous cybersecurity resources for bankers.

The competitive landscape for commercial banks is changing with the growth and diversity in FinTech

companies and other non-traditional business models. Mortgage lending, insurance, and payment

platforms, for example, are products/services FinTech companies increasingly provide. They often

have faster approval times and lower overall operating costs, placing additional competitive pressures

on traditional brick-and-mortar banks. Strong growth in FinTech-related companies and non-

traditional lines of business models are expected to continue, further impacting the traditional banking

environment. As a result, some banks are strategically partnering with FinTech companies to enhance

the services provided to their customers.

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 9

The use of digital assets is disrupting the financial services marketplace, and some Texas state-

chartered banks and trust companies have expressed interest in offering such assets. President Biden

issued an Executive Order (EO) in March 2022, Ensuring the Responsible Development of Digital

Assets. The EO contained six key priorities: consumer and investor protection; promoting financial

stability; countering illicit finance; U.S. leadership in the global financial system and economic

competitiveness; financial inclusion; and responsible innovation. The order tasked the U.S. Treasury

and other federal financial regulators as well as Congress to identify and address risks that digital

assets pose to financial stability and financial market integrity while promoting safe growth. In April

2022, the FDIC issued a Financial Institution Letter that stated, in part, that any FDIC-supervised

institution that intends to engage in crypto or other digital assets should notify the FDIC for review

and feedback. The federal financial regulatory agencies continue to assess current and proposed

crypto-asset-related activities by banking organizations and whether or how they can be legally

permissible, and conducted in a manner that is safe and sound and in compliance with applicable laws

and regulations. The Department has determined that Texas state-chartered banks and trust

companies, under their existing legal powers, can provide custodial services for customers who

possess virtual currency. Digital asset technology is expected to continue evolving over the next five

years and warrants close attention as it has demonstrated to be highly volatile and vulnerable. The

Department will continue to evaluate this technology and the ramifications associated with the EO and

guidance provided by federal agencies and adjust processes as needed to ensure the safety and

soundness of chartered entities.

Goal: Effective Regulation of Non-Depository Supervision Licensees

Ensure timely, fair, and effective supervision and regulation of the non-depository licensees under our

jurisdiction. The regulatory process promotes a stable financial services environment and provides the

public with convenient, safe, and competitive financial services. Provide quality regulation and

maintain the credibility of the Department with the public, industries we regulate, and other

government agencies.

Actions Required to Achieve Goal

• Conduct Money Services Business (MSB), Prepaid Funeral Contract (PFC), and Perpetual Care

Cemetery (PCC) examinations, in conformance with the Department’s examination priority

schedule and in a thorough, accurate, coordinated, and timely manner. MSB examinations are

conducted either independently or jointly with other state regulatory entities, or in cooperation

with federal regulatory entities.

• Maintain contact with and monitor the condition of regulated entities between examinations.

Continue to improve off-site monitoring processes by augmenting our management information

systems (MIS).

• Monitor fluctuations in economic conditions, geopolitical risks, and inflationary pressures that

will impact non-depository financial service providers.

• Promote cybersecurity awareness and best practices among our employees, and regulated

entities.

• Maintain a cybersecurity tracking system for cybersecurity incidents reported by MSBs.

Agency Goals and Action Plans

10| Texas Department of Banking · 2025-2029 Strategic Plan

• Actively participate in the Multi-State MSB Examination Task Force (MMET), Money Transmitter

Regulators Association (MTRA), and CSBS and its various committees, to promote and improve

the nationwide framework for cooperation and coordination among state regulators to ensure

a uniform regulatory oversight of the MSB industry.

• Maintain MSB examination efficiencies through cooperation and coordination among states by

developing uniform examination procedures and practices and actively participating in the

standardization of a networked supervision approach. Participation in the MMET’s multi-state

networked supervision system conserves Department resources and minimizes the regulatory

burden on supervised entities while achieving our objectives.

• Collaborate and coordinate with MSB regulators in other states in the implementation of the

Model Money Transmission Modernization Act (Model Law).

• Collaborate with stakeholders, industry auditors, and legislators in the implementation of the

Digital Assets Service Provider law passed by the 88

th

Texas Legislature in 2023.

• Optimize efficiencies in the examination process utilizing available electronic examination tools

and the secure data exchange portal to share information with regulated entities and other

state regulators.

• Research, monitor, and report on changes to the industry, including statutory and economic

conditions, and digital assets market evolutions. Develop appropriate supervisory strategies to

adapt to these changes.

• Monitor the impact of potential federal legislation on licensed money transmitters and engage

in regular communication with federal and state regulators.

• Provide the industry access to regulatory and supervisory information through the agency’s

website.

• Obtain feedback from license holders regarding proposed rule changes.

• Identify and investigate non-licensed entities and illegal activities.

• Ensure proper enforcement actions are issued against unlicensed entities to bring such

establishments into compliance with rules and regulations.

• Ensure correction-oriented enforcement actions are issued against regulated entities that

demonstrate noncompliance with rules and regulations.

• Attract and retain qualified employees through a competitive salary program, specialized

training, and career advancement opportunities. Promote a culture of state service as a career.

• React appropriately when needed to implement disaster preparedness plans and adjust to

changing situations as needed to continue to provide effective oversight of regulated entities.

• Maintain MSB accreditation status by CSBS.

Goals and Action Items Support Statewide Objectives

1. Accountable to tax and fee payers of Texas.

Consumers

• Ensure Texans have access to safe and sound financial services providers that comply

with applicable laws and regulations.

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 11

• Ensure consumer funds collected for PFCs will be available when needed.

• Ensure the required perpetual care amounts paid by consumers as part of the purchase

of an interment right in a PCC are properly deposited in a trust account and managed

appropriately.

• Ensure consumer funds collected by an MSB are properly accounted for and transmitted

to the consumer’s designated recipient and/or beneficiary or made available to the

consumer at a later time.

• Provide consumers with various avenues for filing complaints on entities regulated by

the Department.

• Oversee the Prepaid Funeral Guaranty Fund.

• Ensure adherence to self-leveling, self-funding and SDSI statutory requirements.

Regulated Entities

• Provide useful and timely information on the website.

• Issue regulatory and supervisory guidance as appropriate and make these available

through the Department’s Law and Guidance Manual.

• Organize stakeholder meetings to gather feedback on proposed rules and regulations.

• Seek input on the annual budget through a public hearing.

• Provide outreach efforts to industry stakeholders for discussing important issues.

• Provide employees of regulated entities a secure avenue to report suspicious activity,

fraud, or abuse to the Department.

• Operate efficiently and maintain consistent and prudent regulatory standards.

• Ensure that the cost of regulation is reasonable and equitable for all regulated entities.

2. Efficient such that maximum results are produced with a minimum waste of taxpayer

funds, including the elimination of redundant and

non-core functions.

• Accept another state's MSB examination report, when certain criteria are met, to avoid

unnecessary regulatory duplication and facilitate the process of supervision and

examination with the least regulatory burden to our licensed entities.

• Maintain a data exchange portal which is used by regulated entities and examination

staff to improve the secure transmission of information.

• Adopt and maintain appropriate technologies to support efficient, effective, and secure

operations.

• Utilize and continue to enhance technology allowing examiners to be more efficient when

on-site and perform portions of an examination off-site, when practical.

• Receive PFC, PCC, and MSB annual report submissions online to reduce processing time.

• Review examination procedures on a continual basis and develop and refine procedures

to address industry trends when necessary.

Agency Goals and Action Plans

12| Texas Department of Banking · 2025-2029 Strategic Plan

• Allow flexible work schedules where appropriate to reduce on-site examination time and

travel burden, and to minimize associated expenses.

• Coordinate and participate in multi-state MSB examinations utilizing the MTRA and

MMET standard examination procedures and networked supervision approach.

3. Effective in successfully fulfilling core functions, measuring success in achieving

performance measures, and implementing plans to continuously improve.

• Meet or exceed performance measures related to MSBs, PFCs, and PCCs.

• Monitor legislative and emerging issues as well as their impact on regulated entities.

• Perform continual reviews of examination procedures and policies.

• Review regulatory and supervisory guidance regularly to ensure they are current and

relevant.

• Explore ways to further automate examination and related administrative processes.

• Provide formal and informal training opportunities for examination staff.

4. Attentive to providing excellent customer service.

• Provide professional and timely resolutions to consumer complaints.

• Seek feedback from consumers upon closure of their complaint against a regulated

entity.

• Maintain PFC website to provide information that will help consumers to make informed

decisions relating to the purchase of preneed funeral merchandise or services.

• Seek feedback from regulated entities through the annual Rate the Department Survey.

• Utilize feedback from MTRA post-examination survey data collected from multi-state

joint examinations.

• Notify regulated entities of new or revised rules, regulations, or policies in a timely

manner.

• Ensure management of entities under examination is well-informed about the progress

of examinations and findings.

5. Transparent such that agency actions can be understood by any Texan.

• Ensure the Department’s website contains the following information:

o Proposed rule changes written in plain language and instructions on how to

submit comments;

o Enforcement actions and orders;

o Examination procedures;

o Corporate applications, notices, and filing activity;

o Department-issued regulatory and supervisory guidance accessible through the

Law and Guidance Manual; and

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 13

o Accurate lists of entities currently (or formerly) supervised, registered, and

licensed by the Department.

• Provide status reports regarding agency activities and industry conditions to the Finance

Commission of Texas (FC).

Other Considerations

Overview

The Department must continue to stay abreast of industry changes and challenges, especially with

more complex MSBs such as those that provide cryptocurrency or other digital asset services. With

the evolving MSB industry and the increase in more complex licensees, the agency will face strains on

staffing and operations if additional resources are not available.

Department staff must remain knowledgeable of regulatory changes, emerging trends, and economic

conditions at both the state and national level to effectively regulate and supervise licensees. The

agency will continue to work closely with organizations, such as CSBS and MTRA, and federal agencies

such as the Financial Crimes Enforcement Network (FinCEN), Consumer Financial Protection Bureau

(CFPB), and Internal Revenue Service to stay informed of the matters affecting our regulated non-

depository industries. Collaborating with other regulators and industry groups helps the Department

provide MSBs with clear and consistent guidance and allows examination personnel to stay abreast of

current and emerging issues. A high level of knowledge and expertise is essential as NDS staff are

increasingly collaborating with the Corporate Activities Division and the Legal Division staff on

applications for new MT licensees. The Department is considered a leader in MSB regulation and

examinations, often leading multi-state examinations, participating in the various non-depository

committees that establish nationwide processes and procedures, and providing guidance on related

emerging issues in the industry.

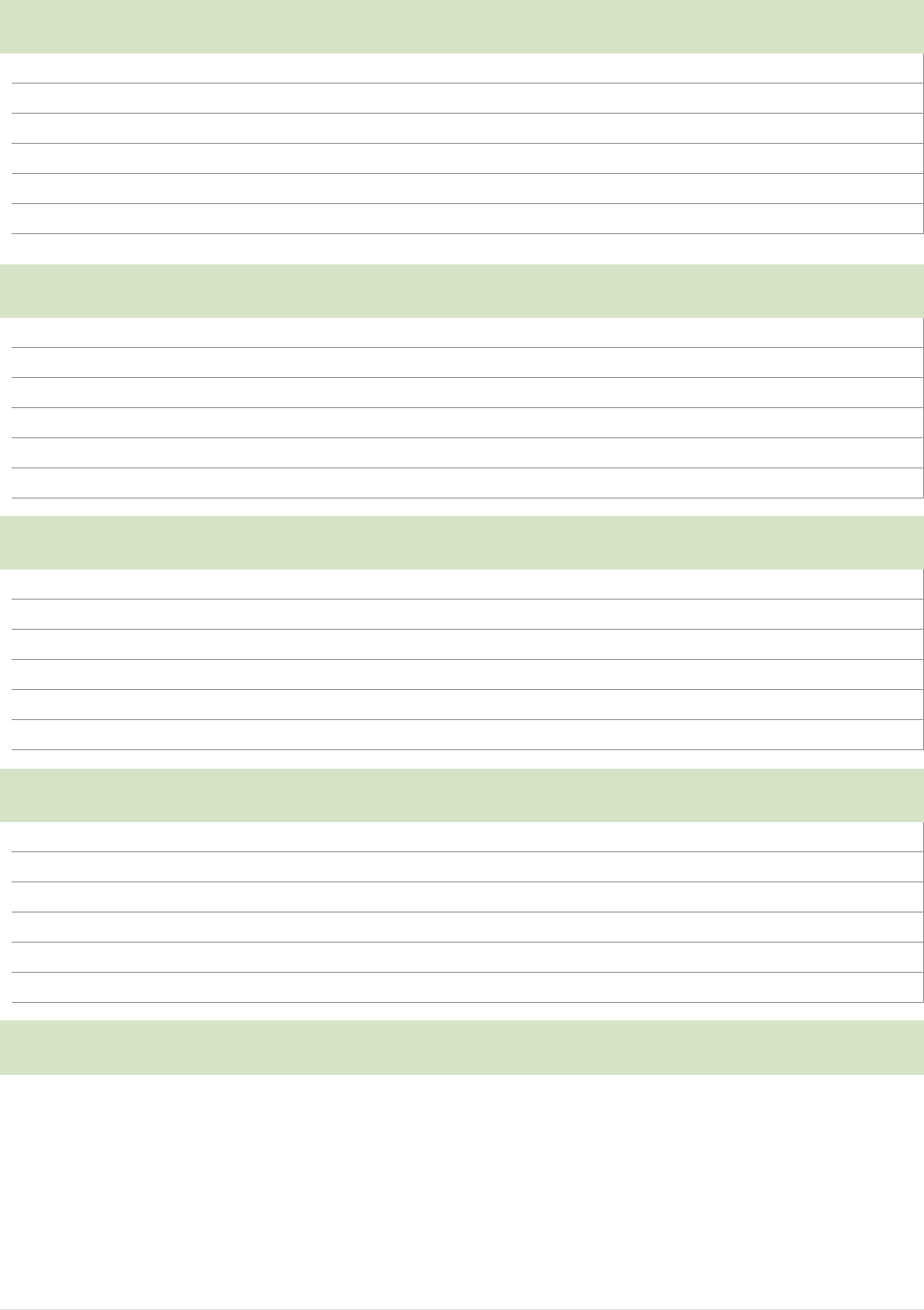

The number and total assets of the Department’s non-depository licensees subject to examinations

are shown in the following table:

Regulated Entities

Number of Entities

As of

December 31, 2023

Total

Assets

($ millions)

Money Services Businesses* 194 342,675

Prepaid Funeral Contract Sellers

335 4,876

Perpetual Care Cemeteries 245 469

*MT and CEX licensees

The primary regulatory programs administered by the Department are funded through assessments,

like those in Texas Administrative Code, Title 7, §§ 33.27(e)(1) and (e)(2), requiring each regulated

industry to pay its proportionate share of the cost of regulation. The purpose of most fees charged by

the Department, whether for an application, an examination, or another purpose, is to enable the

Department to be self-supporting and each regulatory program to be self-sustaining. Further, since

Agency Goals and Action Plans

14| Texas Department of Banking · 2025-2029 Strategic Plan

the Department may not directly or indirectly cause the State’s General Revenue Fund to incur such

costs, the Department must periodically evaluate its operations and financial forecasts to determine

whether the fee structure equitably funds the cost of regulation, as required by statute, and adequately

supports the department and relevant regulatory programs.

Assessments for the money services industry have remained the same since 2014, and operational

expenses have significantly increased over the 10-year period. Although penalties assessed to both

licensed and unlicensed entities for non-compliance have offset assessments collected from the

industry to fund the cost of regulation, they are inherently inconsistent from year to year. An analysis

of the Department’s current and projected revenues revealed that key regulatory functions performed

by the Non-Depository Supervision Division are not adequately funded by the existing fee structure

primarily due to the increasing complexity of MSB examinations, which require additional staff

resources and higher operational expenses, and the overall declining penalties. The Department has

a proposal to amend §33.27 of the Texas Administrative Code that would give the Commissioner the

ability to increase the allowable annual assessments paid by MSBs to offset the forecasted funding

shortfalls.

Effective Examinations

Examinations of MSB, PFC, and PCC entities are conducted using a hybrid approach utilizing a

combination of on-site and off-site activity, considering the risk level of each entity.

The Department participates in the MMET multi-state networked supervision system which utilizes

uniform MSB examination procedures and practices among participating states. This level of

collaboration allows the Department to conserve resources and minimizes the regulatory burden on

supervised entities while achieving agency objectives. The MMET facilitates coordinated examinations

among states as well as in partnership with the CFPB and FinCEN. In addition, the Department’s

examination cycle for MSB license holders aligns closely with several of the other state regulators

participating in the networked supervision of multi-state MSBs. This has improved examination

collaboration and efficiencies and reduced the regulatory burden on MT license holders without

impacting the agency’s ability to effectively ensure compliance with applicable regulations. It also

allows the Department to allocate additional resources to examinations of more complex, higher-risk,

and recently licensed MSBs.

CSBS, in conjunction with a working group that includes Department personnel, developed IT

procedures for all non-depository financial service providers. These procedures will continue to be

utilized by Department examiners as they provide a unified standard when examining MSBs, focusing

on the MT business lines.

CEX license holders are not part of the nationwide networked supervision approach as the Department

is their primary state regulator.

Staffing Resources

Examinations and monitoring of licensees are conducted by Non-Depository Supervision Division

(NDS) staff, which represents 11% of the Department’s employees as of March 31, 2024. Based on

the authorized staffing plan, however, the division is understaffed by five full-time employees as of

March 2024.

Although the number of MSB licensees has remained stable, it is anticipated that additional MSB

licenses will be issued in the next two years. As MSB licensees continue to increase significantly in size

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 15

and complexity, the need to be fully staffed is more critical. Additionally, the passage of Chapter 160

of the Finance Code by the 88

th

Texas Legislature charges the Department with ensuring money

transmitters that qualify as digital asset service providers comply with certain standards. The statute

requires the Department to utilize staffing resources to build out an expanded regulatory scheme to

administer this new regulation, including an expanded examination scope for the eligible digital asset

service providers.

Additional staff will be needed to conduct IT examinations of MSB license holders. The Department will

need to provide specialized training for less experienced staff and hire qualified personnel with

examiner/industry experience in the IT areas, if available. As a result, the Department will require

more MSB examiners going forward.

The number of PFC licensees continues to decline while the number of PCC licensees remains stable.

These trends are expected to continue over the next five years. Most of the PFC/PCC examination staff

are mid-to-senior level examiners. An additional entry-level examiner will be needed to balance the

staffing for PFC/PCC examiners.

Currently NDS staff are well diversified in terms of experience and knowledge. However, 24% of the

NDS Division is eligible to retire in the next five years. Staffing changes due to retirements or

resignations could affect productivity and examination priorities if there is a significant loss of expertise

and knowledge.

Examination Workforce Challenges

Division staff must stay informed of regulatory changes, and current and emerging issues, and adapt

quickly to adequately supervise non-depository entities. Retaining and maintaining a well-trained staff

to properly oversee licensed MSB, PFC, and PCC entities is critical in protecting the interests of Texas

consumers. The Department requires a core training curriculum for examiners which also creates a

progression for promotion. Employee retention is critical as financial examiner turnover is costly for

the Department.

MSB

The Department must continually develop the supervisory skills of MSB examiners to meet the

challenges of evolving technology, the growing complexity of MSBs, and increasingly sophisticated

cybersecurity threats. Understanding the activities of traditional and emerging payment systems,

including digital assets, blockchain technology, and the multi-layer structure of parties involved, is

vital to ensure public safety and confidence in the various payment systems. Training is essential to

develop and enhance examiners’ skills in this digital arena. However, there could be some difficulty

finding relevant training for some digital assets due to their evolving nature and uncertainties in the

regulatory framework. The Department is working on expanding internal core training materials for

MSB examiners. To stay abreast of the ever-changing IT and cybersecurity environment, all MSB

examiners and the Director of NDS must attend periodic IT training.

Every MSB examination contains an IT component. The reviews may be limited or expanded,

depending on staffing resources and the overall risk of a license holder. Expanded IT reviews are

planned and coordinated with the Bank and Trust Supervision Division’s IT examination staff or with

other state regulatory agencies participating in the examination. Department staff examining MSBs

must be knowledgeable of emerging technologies as MSB licensees expand into more innovative

Agency Goals and Action Plans

16| Texas Department of Banking · 2025-2029 Strategic Plan

products and services. The Department will need more experienced IT examiners to assist with these

examinations as the complexity of the services provided by MSBs grows.

In addition, the Department will continue to be challenged to identify illegal activities and unlicensed

entities doing business with Texans, particularly internet-based companies. Given the continuous

growth in and sophistication of MSB licensees, additional experienced staff is required to complete

examinations and meet performance goals. Staffing changes due to retirements or resignations and

the onboarding of less experienced examiners could strain agency resources. Training costs for NDS

examiners could also increase over the next five years as the agency works on expanding core training

for less experienced MSB examiners.

PFC and PCC

The Department has increased efficiencies by cross training PFC and PCC examination staff and

conducting both on-site and off-site reviews and examinations. The division provides on-the-job

training and utilizes the external sources available for professional growth and development. However,

because of the uniqueness of the regulation of PFCs and PCCs, opportunities for industry-related

training from outside sources are limited, aside from fraud detection and financial statement analysis.

The Department will strive to maintain current staffing levels for PFC and PCC examinations. The

experience levels are well balanced among these examiners; however, an additional entry-level

examiner may be needed should any retirements or turnover occur. If significant staffing changes

occur within the PFC and PCC examination group in the next five years, productivity and examination

priorities could be affected.

Challenges for MSBs

The MSB industry is continually evolving as companies explore new methods for providing existing

and new products to consumers. MSB business plans continue to be more complex, shifting towards

more innovative technology products and services, such as digital assets and blockchain technology,

and away from traditional money transmission activities. FinTech is a growing industry with many

companies capitalizing on innovative technology and the consumer’s reliance on smart devices.

Further, FinTech companies and banks are partnering to provide the products and services that

consumers demand. Internet and mobile payment volumes continue to grow as consumers and

merchants increasingly rely on peer-to-peer payment applications and mobile wallets to complete

financial transactions. The complexity of agreements and business plans will require the Department

to stay abreast of technological advances within the industry.

Each state has its own licensing requirements making it challenging for MTs to operate in multiple

states. Also, states have varying examination frequency cycles which results in most of the larger

multistate MSBs being examined annually by either joint or individual states. To help reduce regulatory

burden, CSBS, in conjunction with a working group that included Department personnel, developed

and released the Model Law in August 2021, which was designed to replace existing state money

transmission laws and create a single set of nationwide standards and requirements for MTs. The

Model Law was devised to standardize definitions, exemptions, the licensing/application process, legal

framework, and safety and soundness requirements to modernize the state financial regulatory

system. If adopted by most states’ legislative bodies, it will ensure the standardization of all areas of

regulation, licensing, and supervision, and eliminate unnecessary regulatory burden for MTs and more

effectively utilize regulator resources. Each state will be responsible for adopting and incorporating the

Model Law into their own statutory framework. The 88

th

Texas Legislature passed the Money Services

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 17

Modernization Act (Finance Code Chapter 152) which became effective on September 1, 2023. This

Act sets out new requirements including a higher minimum tangible net worth which may create

challenges for some licensees. The Department will continue to work on implementing the

requirements of this model law.

Cryptocurrencies and other digital assets are primarily held by third-party custodial account holders,

or digital asset service providers, that facilitate trading and maintain custody of the digital assets. With

the passage of House Bill 1666 by the 88

th

Texas Legislature, digital asset service providers that meet

certain conditions are subject to reporting requirements per Chapter 160 of the Finance Code. The

Department, through the Finance Commission, will be issuing rules to clarify these requirements. In

addition, the Department will work with licensees, industry auditors, and legislators to educate and

clarify the requirements of this new law.

As advanced technology is adopted, MSBs must have established policies and procedures that help

prevent criminals from hacking computer information systems, infrastructures, and/or computer

networks containing valuable customer information. As noted previously in the Bank and Trust

Regulation section, MSBs are required to report cybersecurity incidents to the Banking Commissioner

promptly if they experience a material incident. The Department continues to maintain a cybersecurity

tracking system to monitor incidents reported by MSBs. Cybersecurity threat detection and prevention

will remain prevalent for this industry and the agency will continue to promote awareness in this area.

Challenges for PFCs and PCCs

The death care industry, which includes PFCs and PCCs, operates in a well-established regulatory

environment. While the number of permit holders administering trust-funded prepaid funeral benefits

continues to decline due to consolidations and conversions to insurance-funded PFCs, the amount of

funds administered by Department-licensed PFCs is increasing. This trend is expected to continue.

Similar to many other industries, the death care industry has been affected by labor shortages and

employee turnover, including funeral directors, embalmers, and administrative staff. Consequently,

regulated entities frequently require additional regulatory oversight and supervision to assess

compliance deficiencies associated with new employee compliance training.

In the PFC industry, cremations continue to surpass traditional burial rates. This trend is expected to

continue. The rise in cremations can be attributed to several factors. The most prevalent is the lower

cost of cremation when compared to a traditional funeral service. As the shift in consumer demand

continues, the death care industry is responding by offering all-inclusive, direct cremation packages

or by providing specialized products and innovative services to help offset this lost revenue. The

Department must ensure that complete and accurate disclosures of all funeral goods and services

purchased are reflected on prepaid funeral contracts. At the federal level, the Federal Trade

Commission (FTC) is currently evaluating changes to the Funeral Rule, including the proposed

requirement for funeral homes to provide price lists electronically and include the pricelists on any

website maintained by the funeral home. While price lists are reviewed at each PFC examination, this

action would lead to improved public access to funeral goods and services prices.

In the PCC industry, the income generated from perpetual care trust funds is earmarked for the general

maintenance and care of the cemetery. In addition, cemetery profitability continues to be greatly

affected by the trend towards cremation and away from traditional burial. Smaller perpetual care

cemeteries often struggle to generate sufficient revenue to properly maintain the cemetery or employ

sufficient staff to achieve recordkeeping compliance. To assist PCCs with smaller perpetual care trusts,

Agency Goals and Action Plans

18| Texas Department of Banking · 2025-2029 Strategic Plan

funds may be temporarily placed in segregated interest-bearing accounts which provide relief from

cost-prohibitive trustee fees. In addition, many small PCCs have been engaged in soliciting donations

and volunteers from their community to assist in caring for and maintaining the cemetery property.

These challenges for PFC and PCC industries are expected to continue over the next five years.

Department staff will continue to monitor these trends and their impact on PFC and PCC licensees.

Unlicensed and Illegal Activity

The Department continues to monitor for unlicensed money transmission services. With the rise in

popularity of digital assets, business operators exchanging sovereign currency for digital currency may

be considered money transmitters and if so, must be licensed. This can be a challenge to identify as

the business models in this space are diverse and change continually. As such, monitoring for

unlicensed money transmission services has required additional resources from the Legal and NDS

Divisions. When unauthorized activity is identified, the agency issues appropriate administrative

penalties and requires the entity to obtain a permanent license or cease conducting unlicensed

activities in Texas. Over the next five years, additional staffing may be needed as MSBs submit license

applications resulting from unlicensed activity.

The Department also continues to monitor for illegal and fraudulent activity in the death care industry,

including the misallocation or defalcation of prepaid funeral funds or unauthorized sale of prepaid

funeral benefits. The agency will continue to monitor developments in the death care industry issues

that may impact consumer contracts or could pose a threat to the safety and soundness of the licensed

entities.

Goal: Effective Regulation Through Corporate Activities

Provide an effective process to evaluate and act upon corporate filings requesting to initiate, expand,

or modify financial services to Texans. In doing so, ensure that the prospective owners, managers,

and operators of financial service entities are capable of offering citizens of Texas access to convenient,

safe, sound, and competitive financial services.

Actions Required to Achieve Goal

• Process all filings in a timely and thorough manner while adhering to the principle of providing

Texans with access to convenient and competitive financial services operating in a safe and

sound manner.

• Optimize efficiencies in the application process by enhancing automated systems, where

possible, to improve the quality and speed of information exchanged internally and between

the Department, its stakeholders, applicants, and the various federal and state agencies that

we partner with to process applications.

• Reduce dependencies on obsolete technologies through the adoption of cloud offerings where

appropriate and by ensuring current technologies are in use to support regulatory obligations

and operations.

• Perform thorough background checks as appropriate to determine if the individuals proposed

have the experience, personal and financial integrity, and financial acumen to direct and/or

lead a financial institution or MSB’s affairs in a safe, sound, and legal manner.

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 19

• Attract and retain qualified employees through a competitive salary program, specialized

training, and career advancement opportunities. Promote a culture of state service as a career.

Goals and Action Items Support Statewide Objectives

1. Accountable to tax and fee payers of Texas.

• Charter and license entities with sound business operations and plans that demonstrate

the ability and propensity to abide by applicable laws, including consumer protection

laws.

• Promote a thriving and competitive financial services industry.

• Prevent the introduction of bad actors into a regulated entity by performing appropriate

background checks.

• Ensure adherence to self-leveling, self-funding and SDSI statutory requirements.

• Ensure that the cost of regulation is reasonable and equitable for all regulated entities.

2. Efficient such that maximum results are produced with a minimum waste of taxpayer

funds, including the elimination of redundant and

non-core functions.

• Ensure staffing resources are periodically evaluated and adjusted in consideration of

application type, volume, complexity, and risk.

• Utilize the Corporate Application Filing Entry (CAFE) platform to securely receive

electronic filings and accompanying documentation.

• Adopt and maintain appropriate technologies to support efficient, effective, and secure

operations.

• Allow the use of federal or other states’ forms, when available, to minimize duplicate

efforts by the applicant.

• Utilize the Nationwide Multistate Licensing System & Registry (NMLS) for receiving and

processing MSB applications.

3. Effective in successfully fulfilling core functions, measuring success in achieving

performance measures, and implementing plans to continuously improve.

• Meet or exceed performance measures for processing bank, trust, MSB, and check

verification company applications.

• Strive to reduce manual processes by leveraging technology.

• Promote collaboration between divisions to extract requisite information.

4. Attentive to providing excellent customer service.

• Expedite application processing, review, and approval processes.

• Monitor compliance with rules to ensure timely responses to applications.

• Review forms and applications regularly to improve the quality of initial submission and

ease of completion, flexibility, and ultimately timely processing.

Agency Goals and Action Plans

20| Texas Department of Banking · 2025-2029 Strategic Plan

• Seek feedback from entities using Corporate Activities Division services through the

annual Rate the Department Survey.

5. Transparent such that agency actions can be understood by any Texan.

• Ensure Corporate Activities application forms are logically organized, readily available

to the public on our website, and meet accessibility standards.

• Provide corporate application activity information on our website.

• Ensure that our website continues to accurately list the entities currently (or formerly)

supervised, registered, and licensed by the Department.

Other Considerations

Overview

The Department is entrusted with ensuring the safety of the public’s money held by businesses that

provide financial services. Entities chartered or licensed by the Department include banks, trust

companies, foreign bank organizations, MSBs, PFC sellers, and PCCs. These chartered or licensed

entities are subject to examinations to ensure each is operating in a safe and sound manner and in

compliance with state and federal laws. Check verification entities are required to register with the

Department but are not subject to examination. The Corporate Activities Division processes, evaluates,

and acts upon all applications and filings requested by businesses wanting to initiate, expand, or

modify financial services for Texans.

Applications and Filings

The strong economy and business-friendly climate in Texas continue to attract companies to the state.

Over the next five years, the volume of corporate applications and filings related to entities chartered

and licensed by the Department is expected to remain at elevated levels while increasing in complexity.

Mergers and consolidations are expected to continue at a steady pace for the banking sector,

particularly among smaller community banks that find it harder to operate profitably in an environment

with increasing costs, competition, regulatory requirements, and succession planning challenges.

Charter conversion activity has been steady. Since the beginning of 2019, there have been 14

conversions of national banks or state savings banks to the Texas commercial bank charter totaling

approximately $22 billion in assets. This trend is expected to continue. Since the 2010s, the number

of de novo bank charters issued has been minimal. There were two de novo bank charters issued

between 2019 and 2023 with one application in process for 2024. In recent years, a commonly used

alternative to obtain a bank charter is for organizers to acquire a smaller bank and then relocate the

home office to a different location. The Department has, however, seen an increase in activity related

to de novo trust company charters. Since 2019, there have been five de novo trust company charters

issued. This application activity is expected to continue. The number of MSB license applications has

significantly increased each year and is expected to grow as advances in digital assets for financial

services evolve.

Applications focused on business models that integrate traditional banking with services typically

provided by MSBs continue to increase. This includes banking models utilizing digital platforms

centered around advanced or blockchain technology. The agency anticipates more bank applications

Agency Goals and Action Plans

2025-2029 Strategic Plan · Texas Department of Banking | 21

and filings with technologically driven business models, including digital assets, over the next five

years. As noted previously in the Bank and Trust Regulation section, in March of 2022, President Biden

issued an Executive Order (EO) on Ensuring the Responsible Development of Digital Assets which

outlined the first approach to addressing the risks and potential benefits of digital assets and their

underlying technology. Since then, federal agencies have developed frameworks and policy

recommendations on how to achieve these priorities. The Department will continue to monitor the

effects of this EO and any new guidance or rules to address current and emerging risks.

As mentioned previously in the Non-Depository Supervision Regulation section, digital asset service

providers that meet certain requirements must obtain and maintain a MT license. The implementation

of this new regulation directly impacts the application process for financial service providers offering

or interested in digital assets. In addition, the passage of the Money Services Modernization Act (Texas

Finance Code Chapter 152) which became effective on September 1, 2023, sets out new requirements

for MSBs that must be considered in the application processes as well. The Department will continue

to update processes associated with this law to ensure the safety and soundness of licensed and

chartered entities.

Applications to register as a check verification entity are nominal. As of December 31, 2023, two check

verification entities were registered with the agency.

Technology

The Department utilizes technology to optimize the efficiency of the application process. Two web-

based programs are available allowing entities to submit applications and notice filings securely

through electronic portals: MSBs use the NMLS to transmit electronic applications, while all other

chartered and registered entities utilize the CAFE platform. All entities, except MSBs, can utilize the

payment feature in CAFE for submitting application filing fees.

As part of the modernization efforts in the MSB licensing process, the Department now participates in

the Multistate Money Services Businesses Licensing Agreement Program (MMLA). This program,

developed in collaboration with CSBS, is designed to streamline and create efficiencies in the licensing

processes for state regulators as well as NMLS users.

Corporate Activities Workforce Challenges

The Department’s Corporate Activities analytical staff evaluates corporate applications and must

continue to stay abreast of current and emerging technologies as well as innovative financial products

and services. To ensure a safe, sound, and competitive financial system, the division must continue

to maintain a knowledgeable staff to ensure financial service providers operating in Texas are properly