8-1

Chapter 8

Compensation Scheme for Foreign Service Personnel

In pursuance of an independent foreign policy, Republic Act (RA) No. 7157,

“Philippine Foreign Service Act of 1991,” was enacted on September 19, 1991,

to reorganize and strengthen the Philippine Foreign Service. One of its

objectives is to provide suitable salaries, allowances and benefits that will

attract personnel from all walks of Philippine life and to appoint persons to

positions in the Foreign Service solely on the basis of merit and demonstrated

capability in the promotion of national interests.

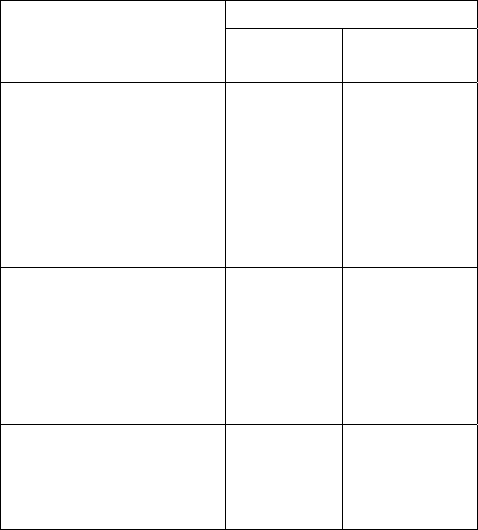

8.1 Coverage

The compensation scheme established under RA No. 7157 covers the

following classes of positions under the Foreign Service Group:

Classes Salary Grade

Foreign Service Staff Employee III 5

Foreign Service Staff Employee II 7

Foreign Service Staff Employee I 9

Foreign Service Staff Officer IV 11

Foreign Service Staff Officer III 15

Foreign Service Staff Officer II 18

Foreign Service Staff Officer I 22

Foreign Service Officer, Class IV 22

Foreign Service Officer, Class III 23

Foreign Service Officer, Class II 24

Foreign Service Officer, Class I 25

Counsellor 26

Chief of Mission, Class II 27

Chief of Mission, Class I 29

8.2 Designations When Assigned Abroad

When assigned abroad, Foreign Service Officers shall be commissioned

as diplomatic or consular officers, or both. All official acts of these

officers shall be performed under such commissions. Their diplomatic

and consular titles, however, shall be coterminous with their assignments

at the foreign posts. When in the foreign service, their designations are

as follows:

8.2.1 A Chief of Mission shall be assigned as ambassador extraordinary

and plenipotentiary to head a diplomatic mission or as deputy

Manual on Position Classification and Compensation

8-2

head of mission or as consul general to head a consular

establishment.

8.2.2 A Counsellor (Career Minister) shall be assigned as career minister

in a diplomatic mission, or as consul general to head a consular

establishment.

8.2.3 A Foreign Service Officer, Class I, shall be assigned as first

secretary in a diplomatic mission or consul in a consular

establishment.

8.2.4 A Foreign Service Officer, Class II, shall be assigned as second

secretary in a diplomatic mission or consul in a consular

establishment.

8.2.5 A Foreign Service Officer, Class III, shall be assigned as third

secretary in a diplomatic mission or vice-consul in a consular

establishment.

8.2.6 A Foreign Service Officer, Class IV, shall be assigned as third

secretary in a diplomatic mission or vice-consul in a consular

establishment.

In a diplomatic post where there is a consular section, Foreign Service

Officers may be designated as both diplomatic and consular officers.

8.3 Designations When in the Home Office

When in the Home Office, Foreign Service Officers are designated as

follows:

8.3.1 A Chief of Mission shall be designated as assistant secretary when

assigned to head any of the principal offices of the Department of

Foreign Affairs (DFA).

8.3.2 A Counsellor (Career Minister) may be designated as executive

director of an office.

8.3.3 A Foreign Service Officer, Class I, may be designated as division

director.

8.3.4 A Foreign Service Officer, Class II, Class III, or Class IV, may be

designated as assistant division director.

Compensation Scheme for Foreign Service Personnel

8-3

8.3.5 A Foreign Service Officer in any class, including chiefs of mission

and career ministers, may be designated as special assistant to

the Secretary or to the Undersecretary of Foreign Affairs.

8.3.6 A Foreign Service Officer below the rank of chief of mission may

be designated as principal assistant in any office.

Any assignment in the home office requiring a rank higher than the

actual rank of the officer assigned shall be in an acting capacity.

8.4 System of Allowances

8.4.1 Allowances When Assigned Abroad

Foreign Service personnel who are assigned in foreign posts are

entitled to the following allowances as provided under RA No.

7157:

8.4.1.1 Overseas Allowance (OA)

8.4.1.1.1 Purpose of OA - It is granted to Foreign

Service personnel who are citizens of the

Philippines to adjust their take home pay

taking into account the:

• changes in the cost of living abroad

which arise from changes in foreign

currency conversion rates;

• differentials in the cost of living

between the Philippines and foreign

posts; and

• extraordinary and necessary expenses,

not otherwise compensated for, which

are incurred by officers or employees

in the foreign posts.

8.4.1.1.2 Basic Annual Rates of OA - The basic annual

rates of OA are indicated in Annex A of this

Chapter.

8.4.1.1.3 Indices for OA - The DFA indices for OA

indicated in Annex B of this Chapter shall be

Manual on Position Classification and Compensation

8-4

used to compute the OA at the post of

assignment.

8.4.1.1.4 OA for Husband and Wife - The husband

and wife who are assigned in the same post

shall be entitled to separate OA

corresponding to each of their respective

ranks.

8.4.1.1.5 Conditions for Grant of OA - The grant of

OA shall be in accordance with the

provisions of Section 66 of RA No. 7157 and

subject to the condition that nobody shall

suffer a reduction as a result of the revision

of the rates/indices. In case of reduction,

the rates shall apply prospectively and the

personnel concerned shall continue to

receive their present OA for the duration of

their tour of duty at the post.

8.4.1.1.6 OA for Personnel Assigned at Hardship

Posts - Personnel assigned in hardship

posts, as may be determined by the DFA

Secretary, shall receive an additional 5%

increase in their OA to meet other expenses

brought about by dangerous, unhealthy or

excessively adverse living conditions

prevailing at post, subject to the availability

of funds.

8.4.1.1.7 OA for Personnel on Temporary Assignment

- Foreign service personnel assigned

abroad, including chiefs of mission, who are

detailed to another post shall, for the

duration of the detail, be entitled to the OA

based on the index of the post where they

are temporarily assigned.

8.4.1.1.8 Review and Adjustment of OA Rates - The

basic annual rates of OA may be adjusted

not oftener than once a year, as determined

by the President, upon the recommendation

of the Permanent Committee created under

Section 67, RA No. 7157, consisting of the

DFA Secretary, the Department of Budget

Compensation Scheme for Foreign Service Personnel

8-5

and Management Secretary and the Bangko

Sentral ng Pilipinas Governor.

8.4.1.1.9 Index of Newly Opened Post - In the case

of a newly opened foreign service post

which index has not yet been fixed, the

index of the nearest post in terms of

economic conditions shall apply, pending

Executive approval of an appropriate index

for the new post.

8.4.1.2 Living Quarters Allowance (LQA)

8.4.1.2.1 Purpose of LQA - It is granted to foreign

service personnel to enable them to rent

and maintain quarters befitting their

representative capacities.

8.4.1.2.2 Basic Annual Rates of LQA - The basic

annual rates of LQA which are commutable

are as indicated in Annex A of this Chapter.

8.4.1.2.3 Indices for LQA - The DFA indices for LQA

indicated in Annex B of this Chapter shall be

used to compute the LQA at the post of

assignment.

8.4.1.2.4 Conditions for Grant of LQA - The grant of

LQA shall be in accordance with the

provisions of Section 65 of RA No. 7157 and

subject to the condition that nobody shall

suffer a reduction as a result of the revision

of the rates/indices. In case of reduction,

the rates shall apply prospectively and the

personnel concerned shall continue to

receive their present LQA for the duration of

their tour of duty at the post.

8.4.1.2.5 Classification of Family Status - Payment

of the LQA shall be based on the following

classification of foreign service personnel:

• With family – if living at the post of

assignment with the spouse or at least

one (1) qualified dependent child who

has not reached 21 years of age

Manual on Position Classification and Compensation

8-6

• Without family – if single, widow, or

widower, or legally separated, and

living without dependent

Unmarried children who are mentally

or physically handicapped as attested

to by a medical certificate, incapable of

supporting themselves and living with

the officer or employee abroad, shall

be considered, for this purpose,

regardless of age, as dependents.

8.4.1.2.6 Basis of Payment of LQA - Payment of the

LQA shall be made strictly on the basis of

actual status at post. However, those whose

dependents have temporarily left their

residences at the posts shall retain their

“with family” status, provided that for the

duration of their absences, the personnel

concerned shall not move to cheaper or

smaller lodgings; provided, further, that

their absence at any one time shall not

exceed beyond three (3) months; provided,

finally, that the dependents have not

established residences elsewhere. Gainful

employment outside of post is an indication

of having changed domicile.

8.4.1.2.7 LQA of Husband and Wife - In the case of

husband and wife who are both assigned in

one (1) post, only the spouse with the

higher rank shall be entitled to the LQA, and

for purposes of family status under Item

8.4.1.2.5 hereof, the other spouse shall be

considered as dependent.

8.4.1.2.8 Joint Rental of Apartment or Housing Unit -

In case where, because of acute housing

shortage, prohibitive rental cost or other

circumstances, two (2) or more foreign

service personnel are constrained to rent

one (1) apartment or housing unit jointly,

the claimants shall be entitled to their

respective allowances, provided that the

Head of Post shall certify in the claim

Compensation Scheme for Foreign Service Personnel

8-7

voucher that their individual allowances are

insufficient to cover the rental of one (1)

apartment or housing unit at the post.

8.4.1.2.9 Advance Payment of LQA - In posts where

there is a standard practice among

landlords to require advance rental or

deposit equivalent to at least six (6) months

to one (1) year rental of the unit, payment

in advance of LQA sufficient to cover the

required amount may be authorized,

provided that the advance rental shall be

paid directly to the landlord by the post;

provided, further, that the claimant shall

submit to the Home Office a copy of the

pertinent contract of lease duly certified by

the Head of Post which should invariably

contain a diplomatic clause; provided that in

case of recall, reassignment or for any

other reason, the unexpired portion of the

amount paid shall be duly refunded to the

post, subject to the condition that in case of

force majeure whereby the unexpired

portion is not refunded, the claimant shall

not be held accountable.

8.4.1.2.10 Payment of Key Money for Goodwill and

Rental Through a Real Estate Agent – In

places where the new lessees are invariably

required at the outset to pay key money for

goodwill and in places where lessees are

required by the host government, or by

customary business practice, to rent a

house or apartment unit through an agent

and pay the corresponding real estate

agent’s fee or commission upon signing of

the lease contract, payment of the above

may be authorized chargeable against the

account of the Department concerned,

provided that the Head of Post shall certify

in the pertinent cash voucher that such

payments are required by the host

government or customary at the post and

not refunded by the owner to the lessee;

provided further, that any key money

and/or real estate agent’s fee or

Manual on Position Classification and Compensation

8-8

commission that may be required upon

renewal of the lease contract shall likewise

be chargeable against the account of the

Department concerned.

8.4.1.2.11 Actual Rental – In lieu of commutable living

quarters allowance, payment of actual

rental of quarters occupied by the Head of

Post may be authorized, subject to the

availability of funds and as may be

warranted by the housing situation in the

post of assignment. Payment of the utilities

shall be in accordance with regulations as

may be prescribed by the DFA Secretary.

8.4.1.2.12 Index of Newly-Opened Post - In the case

of a newly-opened foreign service post

which index has not yet been fixed, the

index of the nearest post in terms of

economic conditions shall apply, pending

approval of an appropriate index for the

new post.

8.4.1.3 Post Allowance (PA)

8.4.1.3.1 Purpose of PA - It is granted to defray

unusual expenses incident to the operation

and maintenance of the official residence

suitable for the chief of diplomatic mission

or consular representative of the Philippines

at the post.

8.4.1.3.2 Allotment Fund for PA - An allotment fund

may be made by the DFA Secretary to

defray the unusual expenses incident to the

operation and maintenance of an official

residence suitable for the chief diplomatic or

consular representative of the Philippines at

the post.

8.4.1.3.3 Payment of PA – The PA shall be granted at

a per annum rate beginning on the first

day of the month following arrival thereat.

It shall be payable only when on duty status

at his/her station.

Compensation Scheme for Foreign Service Personnel

8-9

8.4.1.3.4 Duty Status - A Head of Mission or Principal

Officer shall be considered on duty status

even when on:

• temporary duty outside the city or

place where the officer maintains

regular office but within the territorial

limits of the officer’s diplomatic or

consular jurisdiction

• temporary duty outside the diplomatic

or consular jurisdiction for a

consecutive period not exceeding 60

days; beyond 60 days, no allowance

shall be paid except as specifically

approved by the President; payment

of PA to be resumed only on the date

of the actual return to the territory

within the officer’s diplomatic or

consular jurisdiction

• leave of absence with pay, provided

the leave is spent within the territorial

jurisdiction of the post; no PA to be

paid if the officer goes on leave with

pay outside the territorial jurisdiction

of the post

8.4.1.3.5 Territorial Limits - The territorial limits, in

case of concurrent jurisdiction, shall extend

to all countries or areas covered by the

concurrent offices.

8.4.1.3.6 No PA shall be paid if the officer lives in a

hotel as residence.

8.4.1.3.7 Entitlement to PA may be suspended due to

insufficiency of funds.

8.4.1.4 Family Allowance (FA)

8.4.1.4.1 Purpose of FA - It is granted to assist

foreign service personnel living with their

families at the post of assignment in

meeting the incremental expenses arising

from foreign assignment, computed for the

Manual on Position Classification and Compensation

8-10

dependent spouse and for unmarried legal

minor dependent children not exceeding

three (3) in number.

8.4.1.4.2 Rates of FA – An officer or employee, other

than an alien or casual/contractual

employee, who is assigned abroad and

whose family resides with the officer or

employee at the post of assignment, shall

be entitled to a commutable FA equivalent

to:

• US$ 150 per month for the dependent

spouse; and

• US$ 75 per month for each dependent

child not exceeding three (3) in

number.

8.4.1.4.3 Definition of Dependent Child - A dependent

child shall mean legitimate, illegitimate,

legitimated or legally adopted child who is

not over 21 years, unmarried, not gainfully

employed, and living with the officer or

employee at the post of assignment.

8.4.1.4.4 When Unmarried Children are Considered

Dependents - Unmarried children who are

mentally or physically handicapped as

attested to by medical certificate, incapable

of supporting themselves and living with the

officer or employee abroad, shall be

considered, for this purpose, regardless of

age, as dependents.

8.4.1.4.5 Dependents Not Living with Foreign Service

Personnel - Subject to the prior approval of

the Department head, full FA may be paid

to any claimant whose dependent does not

live with the officer or employee at the post

of assignment under any of the following

circumstances:

• The officer or employee is compelled

to live alone due to dangerous, notably

unhealthy or excessively adverse living

Compensation Scheme for Foreign Service Personnel

8-11

conditions, or by other unavoidable

circumstances like lack of appropriate,

reasonable educational facilities for the

officer’s or employee’s children; or

• For the convenience of the

Government, the officer or employee

must live alone without any or all the

members of the officer’s or employee’s

family at the post of assignment.

All other meritorious cases may be

considered by the Department head as the

circumstances and the exigencies of the

service may warrant.

8.4.1.5 Clothing Allowance (CA)

8.4.1.5.1 Purpose of CA - It covers the increased cost

of clothing incurred in posts where the

climate is different from that of the

Philippines or where unusual circumstances

exist.

8.4.1.5.2 Rates of CA - The following are the rates for

CA which shall be granted once every 12

months:

Rates in US $

Rank Tropical

Zone

Temperate

Zone

Chiefs of Mission,

Counsellors (Career

Ministers) and those

assigned as Principal

Officers or Consuls

General

$400

$500

Foreign Service

Officers including

those assigned as

Consuls or Acting

Principal Officers

$300

$400

Foreign Service Staff

Officers and

Employees

$200

$250

Manual on Position Classification and Compensation

8-12

8.4.1.5.3 Classification of Posts - The rates of

payment of CA shall be in accordance with

the following classification of posts:

• The following posts are considered as

falling under the temperate zone,

having 4 distinct seasons, namely,

summer, autumn, winter and spring:

Abu Dhabi Hanoi Riyadh

Ankara Hongkong Rome

Athens Islamabad San Francisco

Baghdad Jeddah Santiago

Beijing Kobe Seoul

Berne Kuwait Stockholm

Bonn London Sydney

Brasilia Los Angeles Tehran

Brussels Madrid Tel Aviv

Bucharest Manama The Hague

Budapest Mexico City Tokyo

Buenos Aires Milan Toronto

Cairo Moscow Tripoli

Canberra Muscat Vancouver

Chicago New Delhi Vatican City

Dhaka New York Vienna

Doha Ottawa Washington, D.C.

Geneva Paris Wellington

Hamburg Pretoria Xiamen

• The following posts are considered as

falling under the tropical zone:

Agana Jakarta Phnom Penh

Bangkok Kuala Lumpur Port Moresby

Brunei Lagos Saipan

Havana Manado Singapore

Honolulu Nairobi Yangon

8.4.1.6 Medical Allowance (MA)

8.4.1.6.1 Purpose of MA - It is intended to cover the

cost of medical insurance in countries where

medical care is unusually expensive,

including cost of hospitalization and medical

treatment of foreign service personnel and

legal dependents living with the officer or

employee at the post.

Compensation Scheme for Foreign Service Personnel

8-13

8.4.1.6.2 Medical Insurance - Foreign service

personnel may be required by the DFA

to subscribe to a medical insurance

scheme available in the host country.

Twenty-five percent (25%) of the

corresponding premiums shall be payable

by the personnel concerned and 75%

thereof shall be borne by the Government

as its contribution.

8.4.1.6.3 Hospitalization - In the event of illness or

injury requiring hospitalization of a foreign

service personnel, not as a result of vicious

habits, intemperance or misconduct on

his/her part, the Government shall

reimburse the cost of medical expenses

provided that no medical insurance scheme

is available in the post of assignment.

8.4.1.6.4 Medical Expenses - The medical expenses

shall cover the cost of hospitalization and/or

payment of the services of the attending

physician, including travel expenses to and

from the hospital or clinic, and such

other incidental expenses as may be

incurred in connection with such

hospitalization treatment but not to exceed

US$1,000.

8.4.1.6.5 Legal Dependents - Only legal dependents

living with the officer or employee at the

post shall be entitled to the MA.

8.4.1.7 Representation Allowance (RA)

8.4.1.7.1 Purpose of RA - It is granted to chiefs of

mission, special envoys, permanent

delegates or representatives to international

bodies, principal officers, and other ranking

diplomatic officers, and ranking foreign

service officers stationed abroad to enable

such officers to uphold the prestige of the

Republic of the Philippines, to represent the

country with dignity and distinction, and to

carry out their functions more effectively.

Manual on Position Classification and Compensation

8-14

8.4.1.7.2 Uses of RA - RA shall be expended only for

purposes which are of a public character,

beneficial to the interests of the public

service, and connected with the exercise of

the functions of the Government in relation

to the conduct of foreign affairs. They may

be expended for necessary entertainment,

charitable contributions, memorials, flowers,

gifts, club initiation fees, membership dues,

and the like. The office to whom the

allowance is granted may disburse any

portion of it to cover necessary

entertainment by the officer’s subordinates

to accomplish certain tasks assigned to

them.

8.4.1.7.3 Supporting Document - Expenses charged

to RA must be supported by proper receipts

or vouchers if the individual amount of

expenditures exceeds US$50.00 or its

equivalent. Where expenses are incurred

for entertainment, the voucher must be

accompanied by a statement of the officer

concerned or by such proofs showing that

the expenses have been made in the public

interest.

8.4.1.7.4 Special Entertainment - Should special

entertaining be necessary because of formal

visits of Philippine dignitaries travelling on

diplomatic or special passports, the DFA

Secretary shall be informed in advance

thereof and specific requests for funds

therefor shall be made. No such expenses

shall be incurred without the prior

authorization of the DFA Secretary.

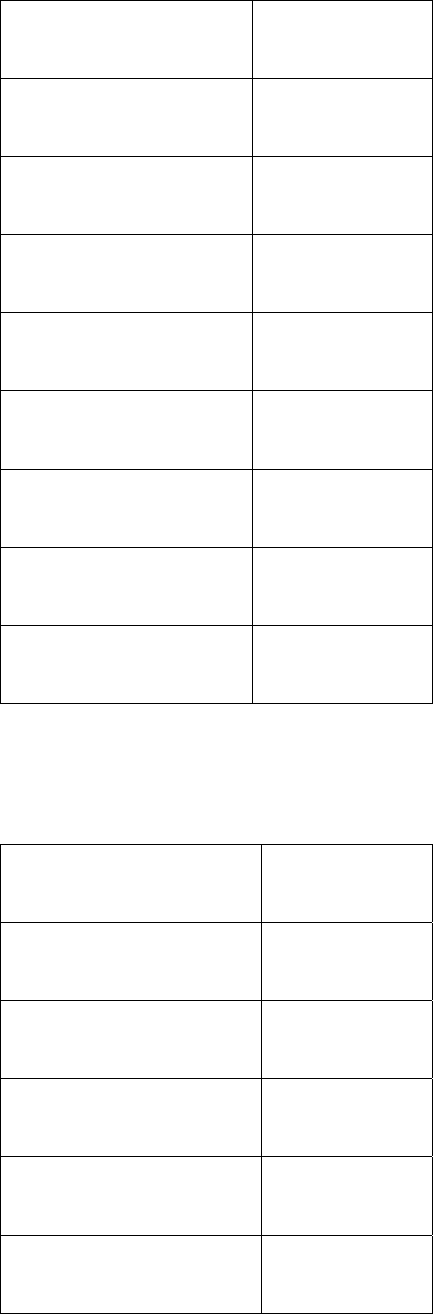

8.4.1.7.5 The annual RA rates are as follows:

• High Cost Posts are posts which have

overseas allowance index in the range

of 90 and above

Compensation Scheme for Foreign Service Personnel

8-15

Rank/Position

Representation

Allowance

Chief of Mission

(not Head of Post)

US $ 6,000

Counsellor

(Career Minister)

4,500

Foreign Service Officer,

Class I

3,600

Foreign Service Officer,

Class II

2,700

Foreign Service Officer,

Class III

1,800

Foreign Service Officer,

Class IV

1,800

Foreign Service Staff

Officer I

1,440

Others duly authorized

by the Secretary

1,440

• Medium Cost Posts are posts which

have overseas allowance indices in the

range of 80 to 89

Rank/Position

Representation

Allowance

Chief of Mission

(not Head of Post)

US $ 3,600

Counsellor

(Career Minister)

3,600

Foreign Service Officer,

Class I

2,880

Foreign Service Officer,

Class II

2,160

Foreign Service Officer,

Class III

1,440

Manual on Position Classification and Compensation

8-16

Rank/Position

Representation

Allowance

Foreign Service Officer,

Class IV

1,440

Foreign Service Staff

Officer I

1,080

Others duly authorized

by the Secretary

1,080

• Low Cost Posts are posts which have

overseas allowance indices in the

range of 70 to 79

Rank/Position

Representation

Allowance

Chief of Mission

(not Head of Post)

US $ 2,700

Career Minister

2,700

Foreign Service Officer,

Class I

2,100

Foreign Service Officer,

Class II

1,620

Foreign Service Officer,

Class III

1,080

Foreign Service Officer,

Class IV

1,080

Foreign Service Staff

Officer I

900

Others duly authorized

by the Secretary

900

8.4.1.8 Education Allowance (EA)

8.4.1.8.1 Purpose of EA - It is granted to compensate

for additional cost incurred to educate legal

dependents not exceeding 3 who are

Compensation Scheme for Foreign Service Personnel

8-17

enrolled in the primary, elementary and

high school levels where free public

education at the post is not provided for.

8.4.1.8.2 Actual Costs – The EA may be granted as

reimbursement of actual costs, within such

maximum amount as set by the DFA and

DBM Secretaries, with the approval of the

President, per school year for each child,

subject to presentation of receipts and

other evidences of payment of

matriculation, tuition fees, books and other

school fees.

8.5 Service Attachés

8.5.1 Assignment and Accreditation - The assignment and accreditation

of personnel in any agency of the Government as service attachés

to embassies or representatives to consulates shall have the prior

clearance of the DFA Secretary who shall take into account the

specific places where the services of these officers or employees

from the other government agencies are needed, except Trade

Attachés who shall be assigned and accredited only after

consultation with the Department of Trade and Industry

Secretary.

8.5.2 Appointments - The authority to appoint service attachés and

representatives shall be vested in the Department Secretary

sending them. An agency shall have only one (1) service attaché

or representative accredited to one (1) post, except military and

trade attachés.

8.5.3 Assimilated Ranks - The President shall determine, upon

recommendation of the DFA Secretary, the assimilated ranks of

service attachés for purposes of compensation.

8.5.3.1 As a general rule and except as the President may

appoint, no officer of the Philippine Government outside

of the DFA shall be assigned an assimilated rank higher

than Foreign Service Officer, Class I.

8.5.3.2 The assimilated ranks shall not confer diplomatic

rankings for purposes of protocol.

Manual on Position Classification and Compensation

8-18

The assimilated ranks of military and civilian attachés from the

Department of National Defense, Department of Trade and

Industry, Department of Tourism, Department of Finance and

Department of Agriculture are indicated in Annex C of this

Chapter.

Compensation Scheme for Foreign Service Personnel

8-19

Annex A

Table of Annual Rates for Overseas and Living Quarters Allowances

for Foreign Service Personnel

(in US $)

Living Quarters (LQA)

Rank/Position

Overseas

Allowance

(OA)

With

Family

Without

Family

Chief of Mission

Head of Diplomatic Mission

Others, including Consul General

69,599

60,521

42,871

35,723

35,041

29,199

Counsellor (Career Minister) 52,626 31,064 25,394

Foreign Service Officer, Class I 45,762 28,244 23,080

Foreign Service Officer, Class II 41,601 25,674 20,986

Foreign Service Officer, Class III 37,819 23,341 19,079

Foreign Service Officer, Class IV 34,382 21,218 17,342

Foreign Service Staff Officer I 34,382 21,218 17,342

Foreign Service Staff Officer II 32,744 19,288 16,518

Foreign Service Staff Officer III 31,185 18,371 15,731

Foreign Service Staff Officer IV 29,700 17,496 14,980

Foreign Service Staff Employee I 27,000 15,868 13,588

Foreign Service Staff Employee II 25,714 15,868 13,588

Forei

g

n Service Staff Employee III 24,490 15,868 13,588

Manual on Position Classification and Compensation

8-20

Annex B

Table of Indices for Overseas and Living Quarters Allowances

for Foreign Service Personnel

Post

OA

in %

L

Q

A

in %

Post

OA

in %

L

Q

A

in %

Abu Dhabi

Abuja

Agana

Amman

Ankara

Athens

Baghdad

Bandar Seri Begawan

Bangkok

Barcelona

Beijing

Beirut

Berlin

Berne

Bonn

Brasilia

Brussels

Bucharest

Budapest

Buenos Aires

Cairo

Canberra

Caracas

Chicago

Colombo

Dakar

Dhaka

Dili

Doha

Dubai

Dublin

Geneva

Guangzhou

Hamburg

Hanoi

Havana

Holy See

86

93

100

77

86

89

84

75

77

94

89

90

98

107

93

82

94

81

92

82

76

90

82

100

77

91

77

89

79

86

95

107

89

92

79

85

96

100

90

100

100

110

130

100

95

95

130

95

125

130

130

130

110

130

130

130

90

95

97

115

100

70

100

65

100

100

100

130

130

100

130

70

100

130

Madrid

Manado

Manama

Melbourne

Mexico City

Milan

Montreal

Moscow

Muscat

Nairobi

New Delhi

New Orleans

New York

Osaka

Oslo

Ottawa

Paris

Phnom Penh

Pohnpei

Port Moresby

Prague

Pretoria

Rabat

Riyadh

Rome

Saipan

San Diego

San Francisco

Santiago

Seattle

Seoul

Shanghai

Singapore

Stockholm

Sydney

Tehran

Tel-Aviv

94

70

91

90

85

96

93

95

81

78

79

100

100

128

105

91

98

75

86

88

90

92

83

86

96

86

100

100

82

100

107

89

80

99

90

83

90

130

70

100

100

115

130

100

130

100

90

70

100

100

150

130

102

130

90

100

115

130

100

100

100

130

100

100

100

90

100

125

100

100

130

100

95

125

Compensation Scheme for Foreign Service Personnel

8-21

Note: The reference post for the annual rates for OA and LQA (at 100%) is New

York City.

Sample Computation of OA and LQA

Given:

Employee A, married with one dependent child, holding the position of Foreign

Service Staff Officer I and posted in Geneva

OA = US $ 34,382

LQA = US $ 21,218

Required: Annual proportionate OA and LQA while in Geneva

OA = US $ 34,382 for the reference post x 107% for Geneva

----------------------------------

100% for the reference post

OA = (US $ 34,382) (1.07)

OA = US $ 36,788.74

LQA = US $ 21,218 for the reference post x 130% for Geneva

----------------------------------

100% for the reference post

LQA = (US $ 21,218) (1.30)

LQA = US $ 27,583.40

Post

OA

in %

L

Q

A

in %

Post

OA

in %

L

Q

A

in %

Hongkong SAR

Honolulu

Houston

Islamabad

Jakarta

Jeddah

Koror

Kuala Lumpur

Kuwait City

Libreville

Lima

Lisbon

London

Los Angeles

100

100

100

80

81

86

86

75

81

93

78

87

100

100

115

110

100

70

95

100

100

90

100

100

90

130

130

100

The Hague

Tokyo

Toronto

Tripoli

Vancouver

Holy See

Vienna

Vientiane

Warsaw

Washington, D.C.

Wellington

Winnipeg

Xiamen

Yangon

93

128

93

82

91

96

96

80

85

100

90

91

89

83

130

150

102

100

102

130

130

70

130

100

115

100

95

70

Manual on Position Classification and Compensation

8-22

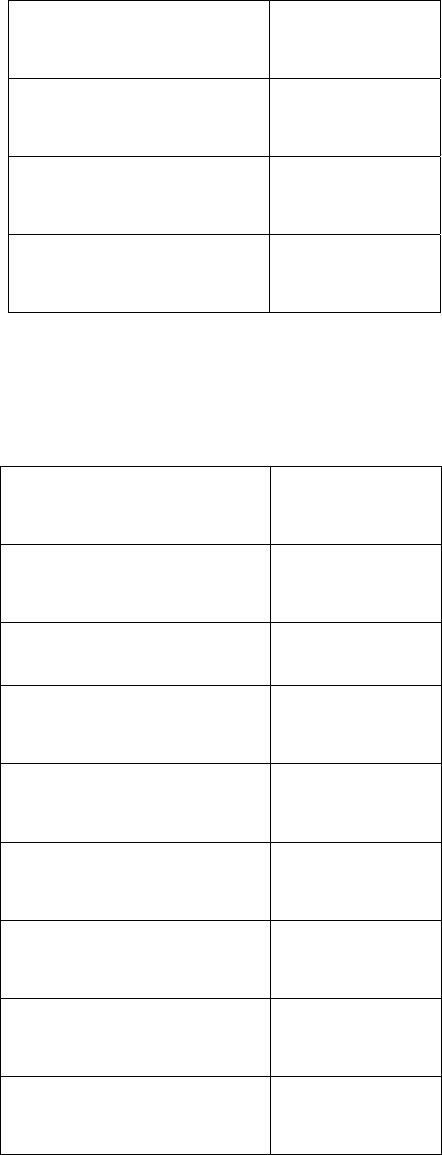

Annex C

Assimilated Ranks of Military and Civilian Attachés, Representatives and

Other Personnel of the Philippine Government Stationed Abroad

Department Position/Designation Assimilated Rank

(a) Department of National

Defense

(b) Department of

Trade and Industry

Brigadier General

Colonel/Navy Capatain

Lieutenant Colonel/

Major/Lieutenant

Commander/Commander

Captain/Lieutenant Senior

Grade

First Lieutenant/Lieutenant

Junior Grade

Second Lieutenant/Ensign

Special Trade

Representative

Foreign Trade Service

Officer I

Foreign Trade Service

Officer II

Foreign Trade Service

Officer III

Foreign Trade Service

Officer IV

Foreign Trade Service Staff

Officer

Counsellor

Foreign Service Officer,

Class I

Foreign Service Officer,

Class II

Foreign Service Officer,

Class III

Foreign Service Officer,

Class IV

Foreign Service Officer,

Class IV

Counsellor

Foreign Service Officer,

Class I

Foreign Service Officer,

Class II

Foreign Staff Officer,

Class III

Foreign Service Officer,

Class IV

Foreign Service Staff

Officer II

Compensation Scheme for Foreign Service Personnel

8-23

Department Position/Designation Assimilated Rank

(c) Department of Tourism

(d) Department of

Finance

(e) Department of Labor

and Employment

Tourism Attaché

Public Relations Officer IV

Administrative Assistant

Tourism Promotion Assistant

Regional Convention

Coordinator

Convention Service Officer

Senior Market Assistant

Administrative Assistant II

Finance Attaché

Revenue Attaché

Assistant Revenue Attaché

Labor Attaché II

Labor Attaché I

Overseas Worker Welfare

Officer IV

Overseas Worker Welfare

Foreign Service Officer,

Class I

Foreign Service Officer,

Class II

Foreign Service Staff

Officer IV

Foreign Service Staff

Officer III

Foreign Service Officer,

Class I

Foreign Service Officer,

Class II

Foreign Service Staff

Officer IV

Foreign Service Staff

Officer III

Foreign Service Officer,

Class I

Foreign Service Officer,

Class I

Foreign Service Officer,

Class II

Foreign Service Officer,

Class I

Foreign Service Officer,

Class II

Foreign Service Officer,

Class III

Foreign Service Staff

Manual on Position Classification and Compensation

8-24

Department Position/Designation Assimilated Rank

(f) Department of

Agriculture

Officer III

(Center Coordinator)

Agricultural Attaché

Agricultural Analyst

Officer I

Foreign Service Officer,

Class I

Foreign Service Officer,

Class III

Note:

The allowances/benefits of incumbents of the positions from the above-listed Departments while

stationed abroad are computed in the same manner as those of foreign service personnel of the

DFA, based on the assimilated ranks.