IFRS 16 Impact forecast: guidance

Guidance to accompany form for submission on 12 January

2022

Issued: 9 December 2021

Introduction

IFRS 16 is effective for NHS bodies from 1 April 2022. The transition from IAS 17 to IFRS 16 will

have an impact on both capital and revenue outturns for 2022/23 and beyond. HM Treasury

requires information from the Department of Health and Social Care to support adjustments to

‘Main Estimates’ – the process by which Departmental Limits will be set for 2022/23. This

information is required ahead of the usual timing of the NHS planning round. Information

supplied by NHS bodies in this return will be used in submissions to HM Treasury which

will inform the Departmental capital and revenue limits, so it is important that these sheets

are completed as accurately as possible.

We do not yet have clarity from HM Treasury on how this information will be used to set CDEL, or

whether there will be separate controls nationally. The forthcoming 2022/23 Planning Guidance

will offer advice on how this should be reflected in planning returns..

If you have queries in relation to the completion of this IFRS 16 Impact Forecast template please

contact provider.accounts@improvement.nhs.uk if you are a provider, or

england.yearendaccoun[email protected] if you are a commissioning organisation.

Contents of this document

Submission ................................................................................................................................. 2

Completion guidance .................................................................................................................. 2

Input sheet – A-Existing leases property .................................................................................. 3

Input sheet: B-Existing leases non-property ............................................................................ 4

Input sheet: C-New leases Input ............................................................................................. 4

Input sheet: D – Future years ................................................................................................. 6

Summary sheet ....................................................................................................................... 6

Key technical points to remember ............................................................................................... 7

Summary of IFRS 16 budgeting treatments................................................................................. 8

Annex: Worked examples ........................................................................................................... 9

Submission

Completed templates should be submitted no later than Wednesday 12 January 2022 (noon).

Please ensure all validation errors have been passed or discussed in advance with the relevant

team using the contact details on the previous page. All submissions will be reviewed by the

national team and any queries will be raised with the contact listed on the front of the form.

Please ensure the contact details listed are the most appropriate contact to be resolving these

queries.

For commissioning organisations, completed forms should be submitted in the following link:

https://nhsengland.sharepoint.com/sites/ccgfin/DropOffLibrary. Once submitted an email will be

sent to confirm receipt of the submission.

For provider organisations, completed forms should be submitted on your NHS Improvement

portal.

Completion guidance

This form has been updated based on feedback from the 2020/21 exercise. It now contains 4

input sheets – these tabs are coloured orange for reference. All other sheets are formula driven

from these orange tabs. Existing leases (leases which have already commenced or are due to

commence before 1 April 2022) are now entered separately to new leases expected to

commence during 2022/23. HM Treasury also requires property and non-property (equipment)

leases to be assessed separately.

We expect HM Treasury to require information from us over the subsequent three years. To

inform this, tab D asks summary questions on the expected impact of IFRS 16 in 2023/24 and

2024/25 which is distinct from 2022/23.

The return focuses on leasing arrangements where the transition to IFRS 16 may impact the

capital or revenue outturn measured under central government budgeting rules. It therefore only

considers leases where the organisation is a lessee and subleases where the organisation is an

intermediate lessor. PFI / LIFT arrangements and leases where the organisation is a lessor (other

than subleases) should not be included in this form.

Guidance for completing each of the tables in these sheets is summarised in the sections below.

Within the template itself you will also find the following guidance and checks:

• Table specific completion instructions are included in boxes directly above each table in

the template.

• Grey information boxes are included on many of the rows and columns which give

additional information when clicked on relating to the input required.

• Validation and other checks are included to the right hand side of each input table

checking the accuracy, consistency and reasonableness of information entered.

Illustrative examples for different leasing circumstances are given in Annex 1 of this guidance

document for reference.

Input sheet – A-Existing leases property

This entire sheet relates to existing property leases. If the organisation has no existing property

leases (or ones that will be entered into by 31 March 2022), this sheet should be ignored.

Table A1 – Existing property leases – 1 April 2022 transition adjustment

This table collects the forecast 1 April 2022 opening balance adjustment to bring right of use

assets on SoFP for existing leases (those which commenced or will commence before 1 April

2022). It should be completed as follows:

1. Enter the forecast 31 March 2022 NBV of existing finance leased assets under IAS 17 into

the first row (subcode LBS0010), split by counterparty.

2. Transition adjustments to bring existing operating leased assets on SoFP should then be

entered below (subcode LBS0020). Peppercorn leased assets should be recorded

separately on LBS0030.

3. If the organisation is an intermediate lessor with existing operating subleases reassessed

as finance leases on 1 April, these assets should be derecognised in subcode LBS0050.

4. Enter the total quantity of existing leases (as a lessee only) on the final row (subcode

LBS0070).

These transition entries as at 1 April 2022 will not affect the Departmental capital budget.

Table A2 – Existing property leases – revenue impact of IFRS 16 in 2022/23

This table collects the forecast change in revenue costs in 2022/23 for existing leases. It should

be completed as follows:

1. For lessees, enter revenue costs of existing leases on an IFRS 16 basis in columns F to

H, split by counterparty. This should include depreciation and interest for both existing

finance leases and existing operating leases brought on SoFP on 1 April. For low value/

short term leases and any variable lease payments or irrecoverable VAT not included in

the lease liability, please include these expensed costs in the ‘lease expenditure in opex

row’.

a. When this exercise was run previously, some entities omitted their interest costs as

they had not discounted the liability citing that they could not identify the effective

interest rate in the lease. Please note that all existing operating leases coming on

SoFP on 1 April should be discounted using the HMT determined incremental

borrowing rate. See guidance below.

b. Ensure depreciation on peppercorn leases is correctly split out (subcode LBS0120)

– this is treated differently in revenue budgets.

2. In columns I to J, enter the costs of the same leases as though they were continuing on an

IAS 17 basis in 2022/23.

a. For existing operating leases that come on SoFP under IFRS 16, do not forget to

include the lease payments here that would have been expensed under IAS 17.

b. Please ensure these costs are recorded under the same counterparty as the

equivalent IFRS 16 costs already recorded.

c. Ensure that lease payments that would have been charged to expenditure on an

IAS 17 basis are not omitted as this will overstate the impact of applying IFRS 16.

This figure should include such costs even if they were not disclosed in the

operating leases line in accounts previously.

3. For intermediate lessors of existing subleases, these may be classified as operating or

finance leases. In columns F to H please enter the sublease income and depreciation

charge associated with operating subleases and the interest income expected to be

earned on finance subleases. In columns I to K enter the same information for these

leases as though they were continuing on an IAS 17 basis. For many leases, these figures

will be the same as the IFRS 16 figures. However some existing operating subleases may

be reassessed as finance leases on transition.

a. Only information on subleases should be included here. Other leases where the

organisation is a lessor should not be impacted and should therefore be excluded

from this return.

4. The incremental impact of applying IFRS 16 in 2022/23 is then calculated in columns L to

O. Please check these figures look as expected and resolve any checks that are failing on

the right hand side of the table.

Table A3 – existing property leases – Capital impact of IFRS 16 in 2022/23

This table collects the forecast capital costs in 2022/23 relating to existing leases.

1. Lease liability remeasurements - as liabilities for existing operating leases will be

measured initially on 1 April 2022 it is unlikely that any reassessments of judgements in

respect of lease term will be forecast. However, this row may include an estimate of

inflationary uplift for any lease liabilities that include index linked lease payments that are

expected to change during the year. See guidance below.

2. Dilapidation provisions arising – this provision is often built up in line with utilisation of the

asset. New amounts arising in year are capitalised under IFRS 16 and should be recorded

here.

3. Utilisation of dilapidation provisions at the end of the least term incurs a capital charge.

Note this only relates to dilapidation provisions capitalised since the adoption of IFRS 16

only so cannot exceed the amounts recorded in the row above.

Under IAS 17 there would be no subsequent expenditure scoring to capital budgets so no IAS 17

equivalent input is required.

Input sheet: B-Existing leases non-property

Tables B1, B2 and B3 on this sheet are identical to tables A1, A2 and A3 on the previous sheet

but collect data on existing non-property (equipment) leases only. Please ensure existing leases

are recorded on the correct sheet. Please follow the guidance given for tables A1 to A3 above. If

the organisation has no existing equipment leases (or ones that will be entered into by 31 March

2022), this sheet should be ignored.

Input sheet: C-New leases Input

This tab collects information on all new leases (for a lessee) and subleases (for intermediate

lessors) forecast to commence in 2022/23 (on or after 1 April 2022). No entries relating to existing

leases should be included on the sheet. It collects both property and non-property leases.

We appreciate that some organisations may not have formally agreed all new leases commencing

in 2022/23 yet so please make a best estimate of the lease details here where that is the case.

Where existing leases are due to expire during 2022/23 and a decision has not yet been made on

whether it will be renewed / replaced with a new lease, if it is likely that it will be replaced with a

similar lease then please capture that impact. Similar leases can be grouped in one row where

easier. Where entities are not expecting to enter into any new leases in 2022/23 this sheet can be

ignored.

Table C1 – New on-SoFP leases (lessee)

This table collects details of new on-SoFP leases (lessee) on a lease by lease basis. When

completing the table:

• Please complete the table from left to right. Some columns will become editable and

require entry based on entries entered earlier (to the left) in the table. This will ask for

details about the lease first, then IFRS 16 initial recognition entries (capital), followed by

IFRS 16 22/23 revenue entries, and lastly IAS 17 equivalent accounting entries as though

IFRS 16 did not apply.

• Do not include any new leases where the short term / low value practical expedient

applies (these are included in table C2 instead).

• There is initially space for 10 new leases. New rows can be added to the table by clicking

the button beneath it (make sure macros are enabled) to a maximum of 50. Once

unhidden, these additional rows cannot be re-hidden.

• Where multiple similar leases will commence, these can be grouped together and entered

on a single row.

• Once complete, please review and resolve checks to the right which will flag where entries

appear incomplete or inconsistent.

Table C2 – New low value / short term leases (lessee)

This table collects summarised information on low value / short term leases commencing in

2022/23 which will not be recognised on balance sheet. Please enter the aggregate in-year lease

charge to operating expenditure and the number of such leases expected to commence, split by

counterparty. No separate IAS 17 information is required as this is expected to be the same.

Table C3 – New sub-leases (intermediate lessor)

This table should be completed with any new subleases (where the organisation is the

intermediate lessor) expected to commence during 2022/23. Please leave blank if your

organisation is not an intermediate lessor. No other leases where the entity is a lessor should be

included in this form.

• Please complete the table from left to right. This will ask for details about the sublease

lease first. Identifying whether the sublease is a finance or operating lease on an IFRS 16

basis will determine which subsequent columns need to be completed. Where the

sublease is an operating lease under IFRS 16 or a finance lease under both bases, no IAS

17 details will be required.

• There is initially space for 5 new subleases. New rows can be added to the table by

clicking the button beneath it (make sure macros are enabled) to a maximum of 20. Once

unhidden, these additional rows cannot be re-hidden.

• Once complete, please review and resolve checks to the right which will flag where entries

appear incomplete or inconsistent.

• Once all relevant tables have been completed, the figures entered will feed through onto

the next two tabs of the workbook: ‘New leases – property’ and ‘New leases – non-

property’. Please review these tabs and check that the incremental capital and revenue

impacts calculated for new leases at the bottom of each table is in line with your

expectation.

Input sheet: D – Future years

HM Treasury has also requested IFRS 16 impact information for 2023/24 and 2024/25. We

appreciate that detailed plans for years 2 and 3 post implementation is not realistic. In order to

facilitate a national estimate we are therefore asking some focused questions.

Table D1 – lease liabilities subject to inflation increases

Guidance for how to fill in this table is included within the form. Please leave this table blank if

you are unsure.

Table D2 – significant changes in 2023/24 and 2024/25

This table identifies significant changes in leasing activity in 2023/24 and/or 2024/25. The initial

question for each year must be completed by all entities.

Summary sheet

This sheet summarises the impacts of IFRS 16 entered into all sheets. Entities should review this

sheet once all tabs are complete to assess the overall reasonableness of the forecast impact.

Table 1 summarises the capital and revenue impact by sheet to help organisations identify which

tab any unexpected impacts are coming from. Table 2 summarises the capital and revenue

impact by nature of expenditure to show where the impacts of IFRS 16 are arising.

In forecasts submitted in the 2020/21 exercise, some organisations submitted returns forecasting

a revenue benefit (excluding peppercorn leases) as a result of implementing IFRS 16. This may

suggest that some entities had not correctly applied the mandated transitional approach to

existing operating leases at that time. For existing operating leases, the asset value on 1 April

2022 should be equal to the calculated liability. This models the subsequent revenue costs as

though it were year 1 of the lease, when interest is at its highest. In this circumstance we would

usually expect depreciation plus interest to be higher than the lease costs charged to I&E on a

straight line basis under IAS 17. If you are forecasting a revenue benefit (excluding peppercorn

lease income and peppercorn depreciation) then please consider whether the correct transitional

approach has been applied.

Key technical points to remember

The DHSC GAM IFRS 16 supplement is essential reading for all bodies. It sets out the key

principles of IFRS 16 and also the public sector adaptations applicable to the NHS. However,

entities will also need to refer directly to the standard for more detailed guidance. When preparing

your IFRS 16 models and forecasts please remember the following technical points:

• Irrecoverable VAT should not be included in the lease liability and therefore not in the value

of the right of use asset. Any irrecoverable VAT arising from a leasing arrangement should

be expensed in the period that it is due.

• Leasehold improvements paid for by the tenant do not form part of the right of use asset

value. These are recognised under IAS 16. Existing leasehold improvements should not be

reclassified as ‘right of use assets’ on 1 April and new leasehold improvements should be

capitalised as ‘owned’ assets. Leasehold improvements are not impacted by IFRS 16 so

should not be included in this return.

• Variable lease payments that depend on an index or a rate are included in the initial lease

liability. These payments are initially measured using the index or rate as at the

commencement date. Where payments are linked to inflation this means measuring future

lease payments in the initial liability assuming that RPI or CPI will not move (ie no inflation).

An estimate of future inflation is not included in the initial lease liability. This will arise as a

subsequent remeasurement.

• Public sector bodies are implementing IFRS 16 using the cumulative catch-up approach on

1 April 2022 and not restating the prior year. As a result, IFRS 16 requires the incremental

borrowing rate (set by HMT) to be used as the discount rate on all existing operating leases

coming on SoFP on 1 April. This applies even where an interest rate is implicit in the lease.

HM Treasury has not yet issued a discount rate for the 2021 calendar year (expected

around Christmas). For now, please use the 2020 rate (0.91%) and we will advise when the

updated rate has been issued.

• The DHSC GAM removes the option for NHS bodies to apply IFRS 16 to intangible assets.

No lease components for the use of intangible assets should be included in this return.

• Where the lessee is liable for restoration costs (dilapidations), IFRS 16 requires the

expenditure to be capitalised in the right of use asset value. Note that for existing leases, no

new dilapidation provisions arise on transition to IFRS 16 and no adjustments are made to

the right of use asset value in respect of amounts already provided and charged to

expenditure in a previous year.

Summary of IFRS 16 budgeting treatments

The application central government budgeting rules following application of IFRS 16 is

determined by HM Treasury and set out in the IFRS 16 supplementary budgeting guidance. A

summary of the key provisions is as follows:

• For new leases from 1 April 2022, the initial value of the right of use asset scores to capital

budgets upon commencement of the lease term.

• Subsequent remeasurements of the lease liability are recognised in the right of use asset

value and also score to capital budgets.

• Capitalised dilapidation provisions score to capital budgets when the provision is settled at

the end of the lease term.

• Depreciation and interest will score against revenue performance measures.

• Peppercorn lease additions are treated in the same way as granted or donated assets,

including related depreciation and impairments.

• Early terminations and new finance leases (for a lessor) will follow existing treatments for

asset disposals upon derecognition.

Annex: Worked examples

Note for commissioners: not all of these examples will be relevant for commissioners. In the

screenshots below the column for ‘Leases with NHS providers’ is shown as ‘Leases with NHSE group

bodies’ in the template for commissioning organisations. Programme and admin splits are not shown.

City Hospital has three existing leases and expects to enter into two new leases during 2022/23.

Lease details

Existing leases:

Lease 1 – City Hospital leases equipment from an external company. The lease commenced on 1

August 2019 and has a lease term of 10 years. The provider recognised this as a finance lease

under IAS 17. The lease liability was discounted using the rate implicit in the lease which was

2.5%. The equipment is reclassified from PPE to right of use assets on transition with no

adjustments to the value of the asset or lease liability.

Lease 2 – City Hospital leases some office space from a neighbouring NHS Trust. Under IAS 17

this was an operating lease and is due to expire (without renewal) in 6 months.

Lease 3 – City Hospital rents a building from NHS Property Services for £5 million per annum.

City Hospital is deemed to control the use of this asset. The lease is currently undocumented;

previously under IAS 17 the Trust recognised annual lease expenditure but did not disclose a

future commitment. In applying IFRS 16 where the Trust is reasonably certain to exercise its right

to extend the lease this is part of the lease term: City Hospital documents its local assessment of

lease term at 10 years and applies the HMT determined incremental borrowing rate on transition.

New leases:

Lease 4 – A local NHS Trust grants City Hospital use of a parcel of land for 50 years on which

City Hospital will build a car park. City Hospital will pay a peppercorn rent of £100 per annum. The

fair value of the land is £1.3m. There is no interest rate implicit in the agreement so the HMT

determined incremental borrowing rate of 0.91% is used. This would not have been a finance

lease under IAS 17.

Lease 5 – A new lease for additional IT equipment will commence on 1 August 2022 with a lease

term of 10 years. The rate implicit in the lease is 2.4% with annual lease payments of £500k. This

would have been a finance lease under IAS 17.

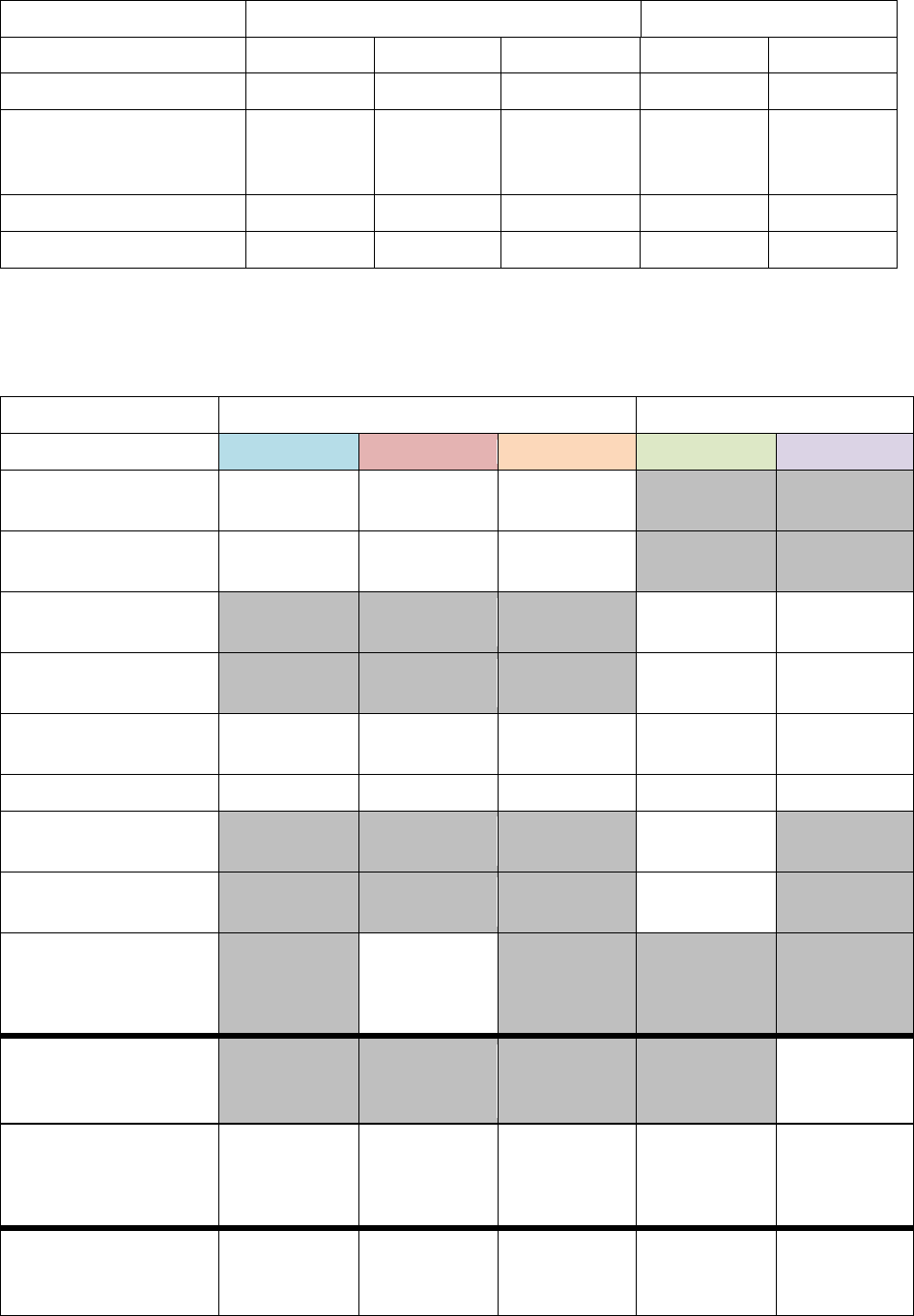

Summary of lease details

Existing leases

New leases

Lease 1

Lease 2

Lease 3

Lease 4

Lease 5

Counterparty

External

NHS

provider

Other DHSC

group body

NHS

provider

External

Commencement date

01/08/2019

01/10/2019

01/04/2015

01/01/2023

01/08/2022

Remaining lease terms

(years) on 1 April 2022

7.3

0.5

10

50

10

Existing leases

New leases

Lease 1

Lease 2

Lease 3

Lease 4

Lease 5

IAS 17 classification

Finance

Operating

Operating

Operating

Finance

IFRS 16 transition /

application

No change

Short term

1 April 22

Asset =

liability

On-SoFP

peppercorn

On-SoFP

Annual lease charge

£350k

£50k

£5,000k

£0.1k

£500k

Applicable discount rate

2.5%

n/a

0.91%*

0.91%*

2.4%

* 2021 rate of 0.91% used as 2022 rate not yet published by HM Treasury.

Lease model outputs

Existing leases

New leases

Lease 1

Lease 2

Lease 3

Lease 4

Lease 5

Liability @ 1 April

2022

£2,551k

NIL

£47,586k

Asset @ 1 April

2022

£2,247k

NIL

£47,586k

Liability @

commencement

£4k

£4,399k

Asset @

commencement

£1,300k

£4,399k

Depreciation (exc.

peppercorn) – 2022/23

£306k

NIL

£4,759k

negligible

£293k

Interest in 2022/23

£58k

NIL

£433k

negligible

£70k

Peppercorn I&E

credit - 2022/23

£1,296k

Peppercorn

depreciation 2022/23

£6k

IFRS 16: operating

expenditure charge

(for short term / low

value)

£25k

(Six months)

IAS 17: capital

addition for new

finance lease

£4,399k

IAS 17: operating

expenditure charge

(straight line basis for

operating leases)

NIL

£25k

£5,000k

negligible

NIL

Revenue impact

before peppercorn

leases

NIL

NIL

£192k

adverse

negligible

NIL

Worked examples: tab ‘A-Existing leases – property’ and tab ‘B-Existing leases -non property’

Tab B - Existing non-property leases:

Lease 1 – The NBV of the existing

finance leased equipment exists in the

accounts at 31 March 2022 before

transition (entered into table B1 on tab

B-Existing leases -non property). Here it

allocated to the ‘external to DHSC group’

counterparty’ column. There is no

transition adjustment relating to this

lease.

Tab A - Existing property leases:

Lease 3 – Existing NHS Property

Services lease is adjusted on-SoFP on 1

April with asset equal to liability (entered

into table A1 on tab A-Existing leases -

property). Here it is allocated to the

‘DHSC group counterparty’ column.

Lease 2 – This lease does not appear on Table A1,

as it has a remaining term of only 6 months and

therefore does not transition on SoFP on 1 April 22.

Step 1 – Enter values for existing leases before transition and any transition adjustments on assets on 1 April 2022. Note: property and

non-property leases must be entered on different tabs. This adjustment is entered in table A1 (tab A) and B1 (tab B)

Existing property leases (Tab A):

Lease 3 –

depreciation

and interest on

existing NHS

Property

services lease

Lease 2 – six

months of lease

rentals to

neighbouring

NHS trust

Step 2 – Allocate IFRS 16 revenue costs for existing leases into the first three columns of the table between the different leasing

counterparties.

Step 3 – Provide the revenue costs of the same leases if they were to be continued to be accounted for on an IAS 17 basis.

Step 2

Lease 3 – the NHS Property Services lease

would have been charged to expenditure

under IAS 17 as operating lease expenditure.

Lease 2 – the £25k

rentals would have

also been lease

expenditure in opex

under IAS 17

Step 3

Existing non-Property (equipment) leases (Tab B):

Lease 1 – depreciation and

interest on existing external

finance lease

Step 2

Lease 1 – was a finance lease under

IAS 17 and would have incurred the

same depreciation and interest

Step 3

Worked examples: tab ‘C-New leases – input sheet

Section 1: Lease details

Enter values in table C1 for all new on-SoFP leases commencing in 2022/23. This table has four sections working across from left to right:

Section 1: Lease details

Section 2: IFRS 16 – 2022/23 capital entries

Section 3: IFRS 16 – 2022/23 revenue entries

Section 4: IAS 17 basis – 2022/23 entries

NOTE – for illustrative purposes, each section in this table is shown in separate screen prints.

Lease 4 – Identifying the peppercorn lease

in this section will open up cells further to

the right in table C1.

Average annual lease payment is calculated

once lease term and total gross cash

commitment columns are completed.

Section 2: IFRS 16 – 2022/23 capital entries

IFRS 16 capital entries entered in this section.

Main codes NEW11 to NEW15 are expected to make up

the initial asset value in NEW16, with the exception of

peppercorn leases.

Lease 4 – As peppercorn lease the right of

use asset is measured initially at fair value

(as this is not currently an operational

asset).

Section 3: IFRS 16 – 2022/23 revenue entries

Lease 4 – As peppercorn lease was

identified in section 1, peppercorn lease gain

entered here.

Lease 4 – peppercorn lease depreciation

Interest and non-peppercorn element of

depreciation is negligible (<£0.1k) so

rounded to 0 in the template.

Lease 5 – depreciation and

interest on new external

lease

Section 4: IAS 17 basis – 2022/23 entries

Lease 4 – the £100 peppercorn

payment would have been

expensed under IAS 17. Rounds

to £0k in this template.

Lease 5 – would have been a finance

lease under IAS 17 so would have

incurred the same capital and revenue

expenditure in this example.

Identifying whether the new lease would

have been an operating or finance lease

under IAS 17 will determine which cells to

the right are required to be populated.

Worked examples: tabs ‘New leases – property’ and ‘New leases – non-property’

New leases – property (revenue impact):

Values in both these tabs are calculated based on information included on tab ‘C-New lease – input sheet’.

Lease 4 – gain on peppercorn

lease asset, depreciation and

negligible interest under IFRS 16.

Lease 4 – the £100

peppercorn payment would

have been expensed under

IAS 17.

Lease 4 – net incremental revenue impact of

applying IFRS 16 is calculated. Note as a

peppercorn leases are akin to donated assets,

there is no impact on adjusted financial

performance.

New leases – property (capital impact):

Lease 4 – The right of use asset

addition counts as gross capex,

however an adjustment is applied in

CDEL to remove the difference

between the value of the right of use

asset and peppercorn liability.

New leases – non-property (revenue impact):

Lease 5 – depreciation and

interest on new external

lease

Lease 5 – would have been a

finance lease under IAS 17 so in this

example, would have incurred the

same depreciation and interest.

New leases – non-property (capital impact):

Lease 5 – would have

been a finance lease

under IAS 17 so in

this example, there is

no incremental impact

on capital expenditure