MACStats:

Medicaid and

CHIP Data Book

DECEMBER 2023

Medicaid and CHIP Payment

and Access Commission

About MACPAC

The Medicaid and CHIP Payment and Access Commission (MACPAC) is a non-partisan legislative branch

agency that provides policy and data analysis and makes recommendations to Congress, the Secretary

of the U.S. Department of Health and Human Services, and the states on a wide array of issues aecting

Medicaid and the State Children’s Health Insurance Program (CHIP). The U.S. Comptroller General appoints

MACPAC’s 17 commissioners, who come from diverse regions across the United States and bring broad

expertise and a wide range of perspectives on Medicaid and CHIP.

MACPAC serves as an independent source of information on Medicaid and CHIP, publishing issue

briefs and data reports throughout the year to support policy analysis and program accountability.

The Commission’s authorizing statute, Section 1900 of the Social Security Act, outlines a number of areas

for analysis, including:

• payment;

• eligibility;

• enrollment and retention;

• coverage;

• access to care;

• quality of care; and

• the programs’ interaction with Medicare and the health care system generally.

MACPAC’s authorizing statute also requires the Commission to submit reports to Congress by March 15

and June 15 of each year. In carrying out its work, the Commission holds public meetings and regularly

consults with state ocials, congressional and executive branch sta, beneciaries, health care providers,

researchers, and policy experts.

MACStats:

Medicaid and

CHIP Data Book

DECEMBER 2023

Medicaid and CHIP Payment

and Access Commission

MACStats: Medicaid and CHIP Data Book

v

Commission Members and Terms

Commission Members and Terms

Melanie Bella, MBA, Chair

Philadelphia, PA

Robert Duncan, MBA, Vice Chair

Prospect, CT

Term Expires April 2024

Verlon Johnson, MPA

Acentra Health

Olympia Fields, IL

John B. McCarthy, MPA

Speire Healthcare Strategies

Nashville, TN

Katherine Weno, DDS, JD

Independent Public Health Consultant

Iowa City, IA

Heidi L. Allen, PhD, MSW

Columbia University School of Social Work

New York, NY

Melanie Bella, MBA

Cressey & Company

Philadelphia, PA

Robert Duncan, MBA

Connecticut Children’s–Hartford

Prospect, CT

Term Expires April 2025

Sonja L. Bjork, JD

Partnership HealthPlan of California

Faireld, CA

Tricia Brooks, MBA

Georgetown University Center for Children

and Families

Bow, NH

Jennifer L. Gerstor, FSA, MAAA

Milliman

Seattle, WA

Angelo P. Giardino, MD, PhD, MPH

The University of Utah

Salt Lake City, UT

Dennis Heaphy, MPH, MEd, MDiv

Massachusetts Disability Policy Consortium

Boston, MA

Rhonda M. Medows, MD

Renton, WA

Term Expires April 2026

Timothy Hill, MPA

American Institutes for Research

Columbia, MD

Carolyn Ingram, MBA

Molina Healthcare, Inc.

Santa Fe, NM

Patti Killingsworth

CareBridge

Nashville, TN

Adrienne McFadden, MD, JD

Buoy Health, Inc.

Tampa, FL

Jami Snyder, MA

JSN Strategies, LLC

Phoenix, AZ

December 2023

vi

Commission Sta

Commission Sta

Kate Massey, MPA, Executive Director Kiswana Williams, Executive Assistant

Communications

Caroline Broder, Director of Communications

Carolyn Kaneko, Graphic Designer

Melanie Raible-Tocci, Communications Specialist

Policy Directors

Kirstin Blom, MIPA

Policy Director

Joanne Jee, MPH

Policy Director and Congressional Liaison

Chris Park, MS

Policy Director and Data Analytics Advisor

Principal Analysts

Martha Heberlein, MA

Principal Analyst and Research Advisor

Robert Nelb, MPH

Aaron Pervin, MPH

Principal Analyst and Contracting Ocer

Melinda Becker Roach, MS

Melissa Schober, MPM

Amy Zettle, MPP

Senior Analysts

Asmaa Albaroudi, MSG

Lesley Baseman, MPH

Tamara Huson, MSPH

Linn Jennings, MS

Audrey Nuamah, MPH

Analysts

Drew Gerber, MPH Jerry Mi

Research Assistants

Gabby Ballweg Ava Williams

Operations and Finance

Annie Andrianasolo, MBA,

Chief Administrative Ocer

Nick Ngo, Chief Information Ocer

Kevin Ochieng, Senior IT Specialist

Steve Pereyra, Financial Management Analyst

Ken Pezzella, CGFM, Chief Financial Ocer

Erica Williams, Human Resources Specialist

MACStats: Medicaid and CHIP Data Book

vii

Table of Contents

Table of Contents

Commission Members and Terms .............................................................................................................v

Commission Staff .....................................................................................................................................vi

Introduction ............................................................................................................................................... xi

SECTION 1: Overview—Key Statistics ................................................................................................. 1

Key Points .............................................................................................................................................2

EXHIBIT 1. Medicaid and CHIP Enrollment as a Percentage of the U.S. Population,

2022 (millions) ......................................................................................................................3

EXHIBIT 2. Characteristics of Non-Institutionalized Individuals by Age and Source

of Health Coverage, 2022 ....................................................................................................4

EXHIBIT 3. National Health Expenditures by Type and Payer, 2021 ...................................................... 9

EXHIBIT 4. Major Health Programs and Other Components of Federal Budget as

a Share of Federal Outlays, FYs 1965–2022 ..................................................................... 12

EXHIBIT 5. Medicaid as a Share of States’ Total Budgets and State-Funded Budgets,

SFY 2021 ........................................................................................................................... 14

EXHIBIT 6. Federal Medical Assistance Percentages and Enhanced FMAPs by State,

FYs 2021–2024 .................................................................................................................. 17

SECTION 2: Trends ................................................................................................................................21

Key Points ...........................................................................................................................................22

EXHIBIT 7. Medicaid Beneciaries (Persons Served) by Eligibility Group,

FYs 1975–2021 (thousands) ..............................................................................................23

EXHIBIT 8. Medicaid Enrollment and Spending, FYs 1972–2022 ........................................................ 25

EXHIBIT 9. Annual Growth in Medicaid Enrollment and Spending, FYs 1982–2022 ........................... 26

EXHIBIT 10. Medicaid Enrollment and Total Spending Levels and Annual Growth,

FYs 1972–2022 ..................................................................................................................27

EXHIBIT 11. Full-Benet Medicaid and CHIP Enrollment, Selected Months in 2013–2023 ...................29

EXHIBIT 12. Historical and Projected National Health Expenditures by Payer for Selected

Years, CYs 1970–2031 .......................................................................................................32

December 2023

viii

Table of Contents

EXHIBIT 13. Medicaid as a Share of State Budgets Including and Excluding Federal Funds,

SFYs 1995 –2021 ...............................................................................................................34

SECTION 3: Program Enrollment and Spending ............................................................................... 37

Key Points ...........................................................................................................................................38

EXHIBIT 14. Medicaid Enrollment by State, Eligibility Group, and Dually Eligible Status,

FY 2021 (thousands) .......................................................................................................... 39

EXHIBIT 15. Medicaid Full-Year Equivalent Enrollment by State and Eligibility Group,

FY 2021 (thousands) ..........................................................................................................42

EXHIBIT 16. Medicaid Spending by State, Category, and Source of Funds,

FY 2022 (millions) ..............................................................................................................45

EXHIBIT 17. Total Medicaid Benet Spending by State and Category,

FY 2022 (millions) ..............................................................................................................48

EXHIBIT 18. Distribution of Medicaid Benet Spending by Eligibility Group and

Service Category, FY 2021 ................................................................................................ 51

EXHIBIT 19. Medicaid Benet Spending Per Full-Year Equivalent Enrollee (FYE)

by Eligibility Group and Service Category, FY 2021 .......................................................... 52

EXHIBIT 20. Distribution of Medicaid Enrollment and Benet Spending by Users

and Non-Users of Long-Term Services and Supports, FY 2021 .......................................53

EXHIBIT 21. Medicaid Spending by State, Eligibility Group, and Dually Eligible Status,

FY 2021 (millions)...............................................................................................................54

EXHIBIT 22. Medicaid Benet Spending Per Full-Year Equivalent Enrollee (FYE)

by State and Eligibility Group, FY 2021 .............................................................................57

EXHIBIT 23. Medicaid Benet Spending per Full-Year Equivalent Enrollee for

Newly Eligible Adult and All Enrollees by State, FY 2022 ..................................................60

EXHIBIT 24. Medicaid Supplemental Payments to Hospital Providers by State,

FY 2022 (millions) ..............................................................................................................63

EXHIBIT 25. Medicaid Supplemental Payments to Non-Hospital Providers by State,

FY 2022 (millions) ..............................................................................................................65

EXHIBIT 26. Medicaid Gross Spending for Drugs by Delivery System and Brand

or Generic Status, FY 2022 (millions) ................................................................................68

EXHIBIT 27. Medicaid Drug Prescriptions by Delivery System and Brand or

Generic Status, FY 2022 (thousands) ................................................................................ 71

MACStats: Medicaid and CHIP Data Book

ix

Table of Contents

EXHIBIT 28. Medicaid Gross Spending and Rebates for Drugs by Delivery System,

FY 2022 (millions) .............................................................................................................. 74

EXHIBIT 29. Percentage of Medicaid Enrollees in Managed Care by State, July 1, 2021 .....................77

EXHIBIT 30. Percentage of Medicaid Enrollees in Managed Care by State and

Eligibility Group, FY 2021 ...................................................................................................80

EXHIBIT 31. Total Medicaid Administrative Spending by State and Category,

FY 2022 (millions) ..............................................................................................................85

EXHIBIT 32. Child Enrollment in CHIP and Medicaid by State, FY 2022 (thousands) ...........................88

EXHIBIT 33. CHIP Spending by State, FY 2022 (millions) .....................................................................90

EXHIBIT 34. Federal CHIP Allotments, FYs 2021–2023 (millions) .........................................................93

SECTION 4: Medicaid and CHIP Eligibility ......................................................................................... 95

Key Points ...........................................................................................................................................96

EXHIBIT 35. Medicaid and CHIP Income Eligibility Levels as a Percentage of the FPL

for Children and Pregnant Women by State, July 2023 ..................................................... 97

EXHIBIT 36. Medicaid Income Eligibility Levels as a Percentage of the Federal Poverty

Level for Non-Aged, Non-Disabled, Non-Pregnant Adults by State, July 2023 ...............100

EXHIBIT 37. Medicaid Income Eligibility Levels as a Percentage of the Federal Poverty

Level for Individuals Age 65 and Older and Persons with Disabilities

by State, 2023 ..................................................................................................................103

EXHIBIT 38. Income as a Percentage of the Federal Poverty Level (FPL) for Various

Family Sizes, 2023 ........................................................................................................... 106

SECTION 5: Beneciary Health, Service Use, and Access to Care ...............................................109

Key Points ......................................................................................................................................... 110

EXHIBIT 39. Coverage, Demographic, and Health Characteristics of Non-Institutionalized

Individuals Age 0–18 by Primary Source of Health Coverage, 2022 ................................111

EXHIBIT 40. Use of Care among Non-Institutionalized Individuals Age 0–18 by Primary

Source of Health Coverage, 2022, NHIS Data ................................................................ 115

EXHIBIT 41. Use of Care among Non-Institutionalized Individuals Age 0–18 by Primary

Source of Health Coverage, 2021, MEPS Data ............................................................... 117

EXHIBIT 42. Measures of Access to Care among Non-Institutionalized Individuals

Age 0–18 by Primary Source of Health Coverage, 2022, NHIS Data .............................. 119

December 2023

x

Table of Contents

EXHIBIT 43. Access to and Experience of Care among Non-Institutionalized Individuals

Age 0–18 by Primary Source of Health Coverage, 2021, MEPS Data ............................ 121

EXHIBIT 44. Coverage, Demographic, and Health Characteristics of Non-Institutionalized

Individuals Age 19–64 by Primary Source of Health Coverage, 2022 ............................ 123

EXHIBIT 45. Use of Care among Non-Institutionalized Individuals Age 19–64 by Primary

Source of Health Coverage, 2022, NHIS Data ................................................................ 129

EXHIBIT 46. Use of Care among Non-Institutionalized Individuals Age 19–64 by Primary

Source of Health Coverage, 2021, MEPS Data ............................................................... 132

EXHIBIT 47. Measures of Access to Care among Non-Institutionalized Individuals

Age 19–64 by Primary Source of Health Coverage, 2022, NHIS Data ........................... 135

EXHIBIT 48. Access to and Experience of Care among Non-Institutionalized Individuals

Age 19–64 by Primary Source of Health Coverage, 2021, MEPS Data .......................... 137

SECTION 6: Technical Guide to MACStats .......................................................................................141

Interpreting Medicaid and CHIP Enrollment and Spending Numbers ...................................................... 143

Understanding Data on Health and Other Characteristics of Medicaid and CHIP Populations ............... 145

Methodology for T-MSIS Analysis ............................................................................................................ 146

EXHIBIT 49. MACPAC Assignment of T-MSIS Eligibility Groups ......................................................... 147

Methodology for Adjusting Benet Spending Data ................................................................................... 148

EXHIBIT 50. Medicaid Benet Spending in T-MSIS and CMS-64 Data by State,

FY 2021 (millions).............................................................................................................150

EXHIBIT 51. Service Categories Used to Adjust FY 2021 Medicaid Benet Spending in

T-MSIS to Match CMS-64 Totals ..................................................................................... 152

Understanding Managed Care Enrollment and Spending Data ............................................................... 155

Endnotes .........................................................................................................................................156

MACStats: Medicaid and CHIP Data Book

xi

Introduction

Introduction

This 2023 edition of the MACStats: Medicaid and

CHIP Data Book presents the most current data

available on Medicaid and the State Children’s Health

Insurance Program (CHIP), two programs that provide

a safety net for low-income populations who otherwise

would not have access to health care coverage and

that cover services other payers often do not cover.

The MACStats data book compiles the broad range of

Medicaid and CHIP statistics that MACPAC regularly

updates on macpac.gov into a single, end-of-year

publication. Our purpose is to bring together in one

place federal and state data on Medicaid and CHIP

that come from multiple data sources and are often

dicult to nd.

The data book provides context for understanding

these programs and how they t in the larger health

care system. Medicaid and CHIP covered more than

30 percent of the U.S. population in 2022 (Exhibit

1). Spending and enrollment in Medicaid typically

grow around recessions and slow when the economy

improves. As of July 2023, 91.5 million people were

enrolled in Medicaid and CHIP. While enrollment is

higher than July 2022, it has been decreasing from

its peak as states begin to disenroll beneciaries

following the end of the continuous coverage

requirement that was attached to the federal medical

assistance percentage (FMAP) increase under the

Families First Coronavirus Response Act (FFCRA, P.L.

116-127) (Exhibit 11).

Although the share of the federal budget devoted to

Medicaid and Medicare has grown steadily since the

programs were enacted in 1965, Medicaid and CHIP

spending combined continue to account for a small

share of the federal budget. In scal year (FY) 2022,

the share of federal spending on Medicaid and CHIP

increased from the prior scal year. This increase

reects both an increase in federal Medicaid spending

as enrollment and the federal share of Medicaid

increased under the provisions of the FFCRA, as well

as a large decrease in other federal spending related

to pandemic-related relief (Exhibit 4).

Total Medicaid spending was $830.6 billion in FY

2022 (Exhibit 16). Spending for CHIP was $22.3

billion (Exhibit 33). Medicaid spending increased 10.2

percent in FY 2022. This increase was largely driven by

increased enrollment under the continuous coverage

requirement during the public health emergency as

spending per full-year equivalent enrollee only increased

1.0 percent (Exhibit 10). In FY 2021, individuals eligible

on the basis of disability and enrollees age 65 and older

accounted for about 21 percent of Medicaid enrollees but

about 52 percent of program spending (Exhibits 14 and

21). Many of these individuals were users of long-term

services and supports.

MACStats continues to include tables on access to

and experience of care among non-institutionalized

individuals. These data show that Medicaid enrollees

were as likely to report not having diculty reaching

their usual medical provider by phone during business

hours as those covered by private insurance but

were more likely to report having a dicult time

reaching their usual medical provider after hours

for urgent medical needs compared to those with

private insurance (Exhibits 43 and 48). As in prior

years, Medicaid and CHIP enrollees of all ages were

more likely to be persons of color and to report fair

or poor health than individuals who were covered by

private insurance (Exhibit 2). Children whose primary

coverage source is Medicaid or CHIP are as likely to

report seeing a doctor or having a wellness visit within

the past year as those with private coverage and more

likely than those who are uninsured (Exhibit 40).

The pages that follow are divided into six sections:

•

an overview with key statistics on Medicaid and

CHIP;

•

trends in Medicaid spending, enrollment, and

share of state budgets;

•

Medicaid and CHIP enrollment and spending,

with information presented by state, service

category, and eligibility group;

•

Medicaid and CHIP eligibility;

•

measures of beneciary health, use of services,

and access to care; and

•

a technical guide regarding data sources,

methods, and guidance for interpreting exhibits.

We would like to thank sta at the Centers for Medicare

& Medicaid Services and our contractors—the State

Health Access Data Assistance Center at the University

of Minnesota and Acumen, LLC—who provided insights

and assistance. We would also like to thank Lori

Michelle Ryan for providing copyediting services.

SECTION 1:

Overview—

Key Statistics

Section 1: Overview—Key Statistics

December 2023

2

Section 1: Overview—Key Statistics

Key Points

•

In 2022, more than 30 percent of the U.S. population was enrolled in Medicaid or the State

Children’s Health Insurance Program (CHIP) at some point during the year: 93.8 million in Medicaid

and 8.3 million in CHIP (Exhibit 1). About 39 percent of children had Medicaid or CHIP coverage in

2022 (Exhibit 2).

•

About 34 percent of individuals enrolled in Medicaid or CHIP in 2022 had family incomes below

100 percent of the federal poverty level (FPL). Over half of all individuals (53.5 percent) enrolled

in Medicaid or CHIP had incomes of less than 138 percent FPL, the threshold used to determine

eligibility for Medicaid in states that have expanded Medicaid to low-income adults (Exhibit 2).

•

Medicaid and CHIP enrollees of all ages were more likely to be in fair or poor health than

individuals who were covered by private insurance or who were uninsured (Exhibit 2).

•

Medicaid and CHIP together accounted for 17.8 percent of national health expenditures in calendar

year 2021, less than either Medicare (21.2 percent) or private insurance (28.5 percent) (Exhibit 3).

•

In general, the share of the federal budget devoted to Medicaid and Medicare has grown steadily

since the programs were enacted in 1965. In scal year (FY) 2022, the share of federal spending

on Medicaid and CHIP (9.7 percent) increased from the prior scal year (7.8 percent) due to the

increase in the federal medical assistance percentage (FMAP) and enrollment growth under the

continuous coverage requirement under the Families First Coronavirus Response Act (FFCRA, P.L.

116-127) as well as a large decrease in other federal spending related to pandemic-related relief

(Exhibit 4).

•

In FY 2022, Medicaid continued to account for a smaller share of the federal budget (9.4 percent)

than Medicare (11.9 percent) (Exhibit 4).

•

Medicaid spending as a share of state budgets varies depending on whether federal funds are

included. Considering only the state-funded portion of state budgets (i.e., the portion states must

nance on their own through taxes and other means), Medicaid’s share was 14.4 percent in state

scal year (SFY) 2021. When federal funds are included, Medicaid’s share was 26.8 percent in SFY

2021 (Exhibit 5).

MACStats: Medicaid and CHIP Data Book

3

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

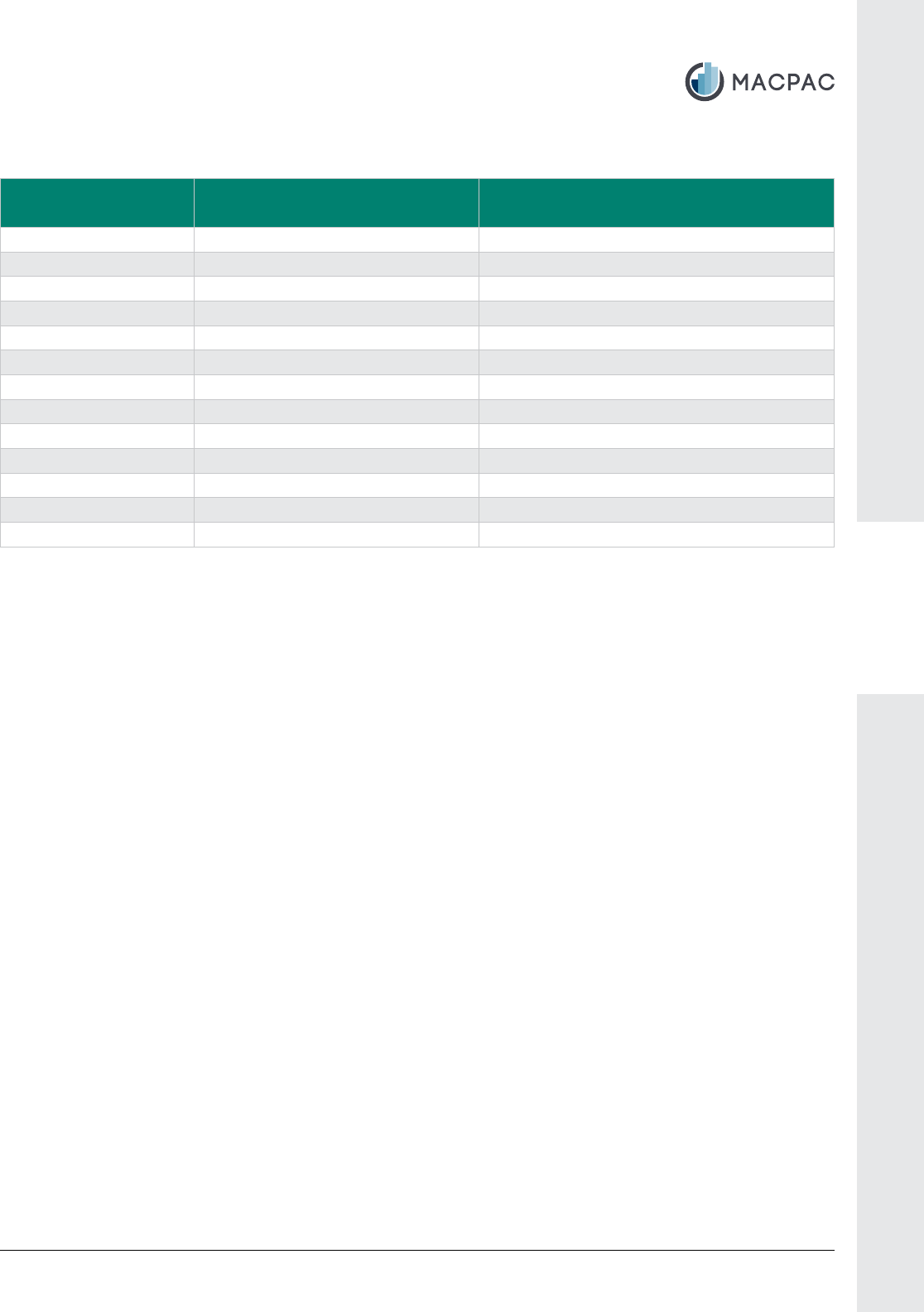

EXHIBIT 1. Medicaid and CHIP Enrollment as a Percentage of the U.S. Population, 2022 (millions)

Population Ever during FY 2022 Point in time during FY 2022 Point in time during CY 2022

Estimates based on administrative data (CMS)

1

Survey data (NHIS)

2

Medicaid enrollees 93.8

3

87.1

3

Not available

CHIP enrollees 8.3

4

7.2

5

Not available

Totals for Medicaid and CHIP 102.0 94.3 63.8

U.S. Census Bureau data Survey data (NHIS)

2

U.S. population 333.6

6

332.9

6

326.8

Administrative and Census Bureau data Survey data (NHIS)

2

Medicaid and CHIP enrollment as a

percentage of U.S. population

30.6%

1

28.3% 19.5%

Notes: FY is scal year. CY is calendar year. NHIS is National Health Interview Survey. Excludes the territories. Medicaid and CHIP enrollment numbers can

vary for reasons including dierences in the sources of data (e.g., administrative records versus survey interviews), categories of individuals included in the data

(e.g., those receiving full versus limited benets, those who are living in the community versus an institution such as a nursing facility), and the enrollment period

examined (e.g., ever during the year versus at a point in time). For a more detailed discussion of enrollment numbers, see https://www.macpac.gov/macstats/data-

sources-and-methods/.

¹ Estimates based on administrative data are from Transformed Medicaid Statistical Information System (T-MSIS), CHIP Statistical Enrollment Data System

(SEDS), and the president’s budget. Medicaid and CHIP enrollment numbers obtained from administrative data include individuals who received limited benets

(e.g., emergency services only). Combining administrative totals from Medicaid and CHIP may cause some individuals to be double counted if they were enrolled

in both programs during the year. Overcounting of enrollees in the administrative data may occur for other reasons—for example, individuals may move and be

enrolled in two states’ Medicaid programs during the year. Excludes about 1.6 million individuals in the territories.

² NHIS data exclude individuals in active-duty military and in institutions such as nursing facilities; in addition, surveys such as the NHIS generally do not classify

limited benets as Medicaid or CHIP coverage, and respondents are known to underreport Medicaid and CHIP coverage.

³ Medicaid enrollment estimates based on administrative data are from MACPAC analysis of FY 2022 T-MSIS data as of February 2023.

⁴ CHIP enrollment estimates from administrative data in the ever-enrolled column are from MACPAC analysis of CHIP SEDS data (see Exhibit 32).

⁵ CHIP enrollment estimates from administrative data in the point-in-time column are from the FY 2024 president's budget.

⁶ The Census Bureau number in the ever-enrolled column was the estimated U.S. resident population as of September 2022 (the month with the largest count

in FY 2022); the number of residents ever living in the United States during the year is not available. The Census Bureau point-in-time number is the average

estimated monthly number of U.S. residents for FY 2022.

Sources: MACPAC, 2023, analysis of the following: T-MSIS data as of February 2023; CHIP SEDS data as of August 14, 2023; HHS, 2023, FY 2024 president's

budget for HHS, Baltimore, MD, https://www.hhs.gov/sites/default/les/fy-2024-budget-in-brief.pdf; NHIS data; and U.S. Census Bureau, 2023, Monthly population

estimates for the United States: April 1, 2020 to December 1, 2023 (NA-EST2022-POP) https://www2.census.gov/programs-surveys/popest/tables/2020-2022/

national/totals/NA-EST2022-POP.xlsx.

December 2023

4

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 1

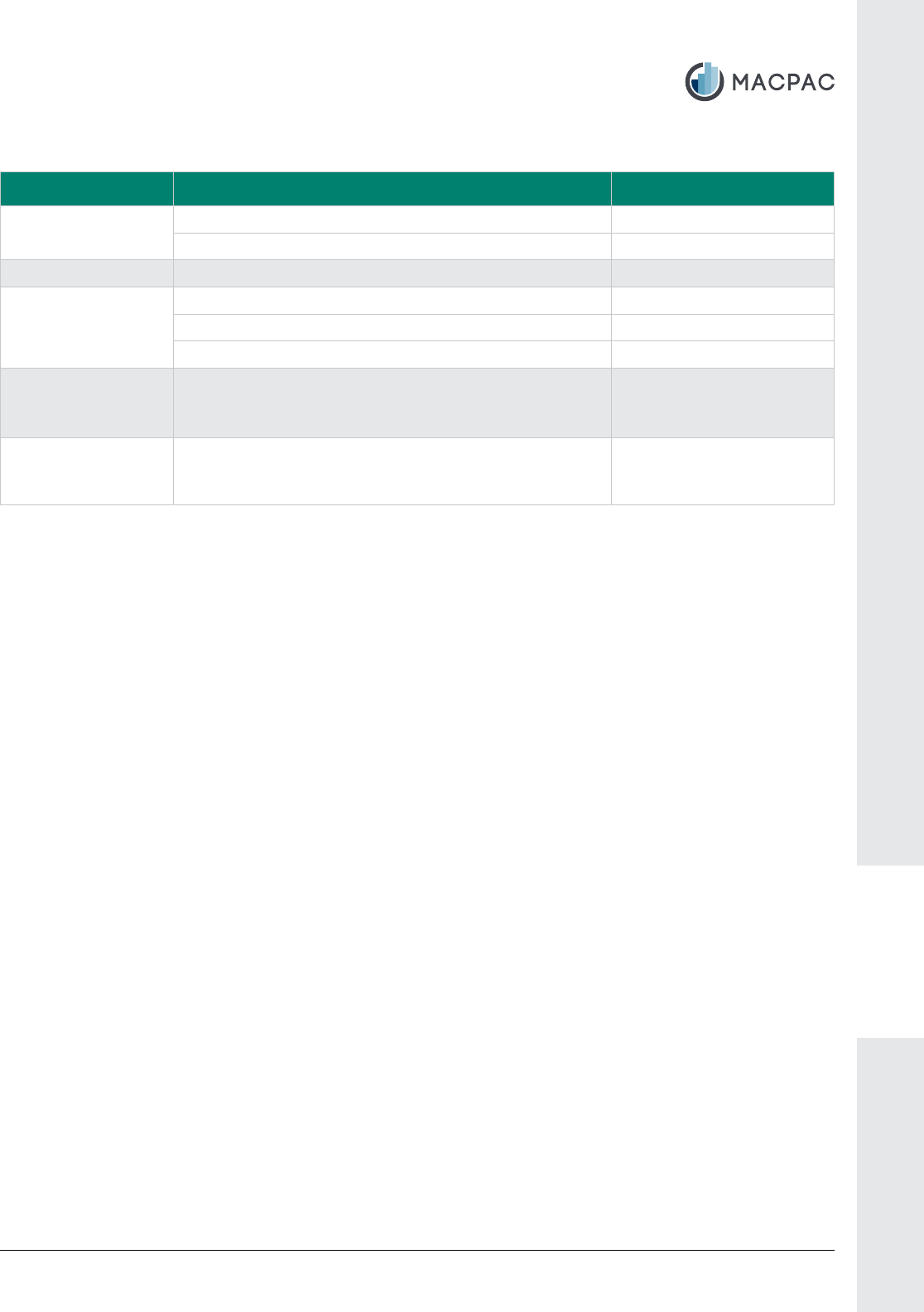

EXHIBIT 2. Characteristics of Non-Institutionalized Individuals by Age and Source of Health Coverage, 2022

Characteristic

Selected coverage source at

time of interview, all ages

1

Selected coverage source at time of

interview, age 0–18

1

Total Medicare Private

2

Medicaid

or CHIP

3

Uninsured

4

Total Private

2

Medicaid

or CHIP

3

Uninsured

4

Total (percent distribution across

coverage sources)

5

100.0% 24.0% 60.8% 19.5% 8.6% 100.0% 54.7% 38.7% 4.2%

Coverage

Length of time with any coverage during year

Full year 89.2* 99.1* 96.7 96.3 – 94.6* 98.2 98.0 –

Part year 5.0* 0.9* 3.3 3.7 26.6* 3.1* 1.8 2.0 35.3*

No coverage during year 5.8* – – – 73.4* 2.3* – – 64.7*

Multiple coverage sources at time of interview

Yes, any Medicare and Medicaid/

CHIP combination

6

1.9* 10.2 – 9.7 – – – – –

Yes, any private and Medicaid/CHIP

combination

0.8* – 1.3* 4.2 – 1.9* 3.4* 4.8 –

Yes, any other combination 7.6* 40.6* 12.5* 1.2 – – – – –

No 89.7* 49.2* 86.2* 84.9 100.0* 98.1* 96.6* 95.2 100.0*

Demographics

Age

0–18 23.6* † 21.2* 46.7 11.7* 100.0 100.0 100.0 100.0

19–64 59.1* 13.2* 65.7* 45.9 86.9* – –

– –

65 or older

17.4* 86.7* 13.1* 7.4 1.4* – – – –

Gender

Male 49.2* 45.6 50.0* 44.1 56.3* 51.1 51.8 50.8 52.0

Female 50.8* 54.4 50.0* 55.9 43.7* 48.9 48.2 49.2 48.0

Race

Hispanic 19.1* 8.7* 13.8* 29.3 44.4* 25.6* 16.8* 36.3 43.0

White, non-Hispanic 59.6* 74.8* 67.3* 39.6 35.7* 51.0* 64.2* 34.0 41.2

Black, non-Hispanic 12.0* 10.4* 9.4* 20.0 12.7* 12.4* 7.5* 20.0 7.0*

Native Indian, non-Hispanic 0.8 † 0.5 † 1.4 † † † †

Asian, non-Hispanic 5.7 4.4 6.3 5.3 3.7* 4.6* 5.5* 3.3 5.0

Other single and multiple races,

non-Hispanic

2.8* 1.0* 2.7* 3.8 2.0* 5.4 5.6 4.9 †

MACStats: Medicaid and CHIP Data Book

5

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

EXHIBIT 2. (continued)

Characteristic

Selected coverage source at

time of interview, age 19–64

1

Selected coverage source at time of

interview, age 65 or older

1

Total Medicare Private

2

Medicaid

or CHIP

3

Uninsured

4

Total Medicare Private

2

Medicaid

or CHIP

3

Total (percent distribution

across coverage sources)

5

100.0% 4.2% 67.6% 15.2% 12.6% 100.0% 93.2% 45.7% 8.3%

Coverage

Length of time with any coverage during year

Full year 84.2* 97.9* 95.6* 94.2 – 98.6 99.2 99.5 98.5

Part year 7.1* 2.1* 4.4* 5.8 25.8* 0.8 0.8 † †

No coverage during year 8.7* – – – 74.2* 0.6* – – –

Multiple coverage sources at time of interview

Yes, any Medicare and Medicaid/

CHIP combination

6

1.3* 31.2* – 8.6 – 6.5* 7.0* – 78.4

Yes, any private and Medicaid/

CHIP combination

0.6* – 0.9* 4.1 – † – † †

Yes, any other combination 0.8 19.7* 1.2* 0.7 – 40.9* 43.8* 89.6* 11.6

No 97.2* 49.1* 97.9 86.6 100.0* 52.6* 49.2* 10.3 9.4

Demographics

Age

0–18 – – – – – – – – –

19–64 100.0 100.0 100.0 100.0 100.0 – – –

–

65 or older

– – – – – 100.0 100.0 100.0 100.0

Gender

Male 49.5* 50.0* 50.1* 38.1 57.3* 45.6* 44.9* 46.2* 38.8

Female 50.5* 50.0* 49.9* 61.9 42.7* 54.4* 55.1* 53.8* 61.2

Race

Hispanic 19.4* 12.1* 14.3* 22.9 44.0* 9.4* 8.2* 6.4* 25.9

White, non-Hispanic 58.6* 64.2* 65.5* 45.1 35.4* 74.6* 76.5* 81.7* 41.0

Black, non-Hispanic 12.6* 16.7 10.5* 20.2 13.6* 9.6* 9.5* 6.9* 18.5

American Indian or Alaska Native,

non-Hispanic

0.8 † 0.4 † 1.4 † † 0.4 †

Asian, non-Hispanic 6.4 3.9* 7.1 6.2 3.5* 5.0* 4.5* 3.6* 12.4

Other single and multiple races,

non-Hispanic

2.3* 2.3 2.2* 3.3 2.0* 0.8 0.8 1.0 †

December 2023

6

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 1

EXHIBIT 2. (continued)

Characteristic

Selected coverage source at

time of interview, all ages

1

Selected coverage source at time of

interview, age 0–18

1

Total Medicare Private

2

Medicaid

or CHIP

3

Uninsured

4

Total Private

2

Medicaid

or CHIP

3

Uninsured

4

Education

7

Less than high school 10.3%* 13.4%* 4.9%* 22.6% 25.7% – – – –

High school diploma/GED 27.0* 30.7* 22.5* 37.8 37.9 – – – –

Some college 29.6 28.6 29.9 30.0 24.5* – – – –

College or graduate degree 33.2* 27.3* 42.8* 9.5 11.9* – – – –

Marital status

7

Married 52.7* 55.1* 59.5* 28.6 37.4* – – – –

Widowed 5.9 19.0* 3.9* 5.8 2.0* – – – –

Divorced or separated 10.1* 14.6 8.2* 14.8 9.2* – – – –

Living with partner 9.0* 3.3* 8.1* 12.5 18.2* – – – –

Never married 22.3* 8.0* 20.3* 38.3 33.1* – – – –

Family income

Has income less than 138 percent FPL 18.8* 19.2* 6.1* 53.5 33.2* 25.3%* 5.4%* 53.8% 32.5%*

Has income in ranges shown below

Less than 100 percent FPL 11.0*

10.3* 3.1* 33.9

19.8* 15.4* 2.9* 33.2 21.6*

100–199 percent FPL 18.7* 22.1* 9.9* 38.2 30.6* 22.1* 9.2* 40.2 25.1*

200–399 percent FPL 29.1* 31.3* 29.7* 21.7 34.1* 29.0* 32.9* 21.7 37.6*

400 percent FPL or higher 41.2* 36.2* 57.2* 6.2 15.5* 33.5* 55.0* 4.9 15.7*

Other demographic characteristics

Citizen of United States 93.1 97.5* 95.6* 93.5 68.7* 97.1 98.5* 97.2 80.2*

Parent of a dependent child

7

26.4* 2.1* 27.7* 34.8 35.5 – – – –

Currently working

7

63.7* 16.6* 75.5* 44.3 71.5* – – – –

Veteran

7

7.7* 15.2* 5.8* 2.3 2.9 – – – –

Family receives SSI or SSDI 8.3* 17.6* 4.2* 20.1 5.0* 6.1* 2.5* 11.8 †

Health

Current health status

Excellent or very good 62.8* 39.8* 68.5* 56.8 58.7 86.0* 90.6* 79.1 81.1

Good 25.3 32.8* 23.7 25.1 28.7* 11.2* 7.9* 15.7 16.0

Fair or poor 11.9* 27.4* 7.9* 18.1 12.6* 2.8* 1.4* 5.1 †

MACStats: Medicaid and CHIP Data Book

7

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

EXHIBIT 2. (continued)

Characteristic

Selected coverage source at

time of interview, age 19–64

1

Selected coverage source at time of

interview, age 65 or older

1

Total Medicare Private

2

Medicaid

or CHIP

3

Uninsured

4

Total Medicare Private

2

Medicaid

or CHIP

3

Education

7

Less than high school 9.5%* 19.4% 4.2%* 20.0% 25.1%* 13.1%* 12.5%* 8.2%* 39.5%

High school diploma/GED 26.4* 39.6 21.4* 38.7 38.3 28.9 29.3 27.6* 32.2

Some college 29.9 28.1 30.2 31.3 24.7* 28.4* 28.7* 28.5* 21.5

College or graduate degree 34.2* 12.9* 44.2* 10.0 11.9 29.6* 29.5* 35.7* 6.7

Marital status

7

Married 51.2* 41.4* 58.5* 28.3 37.7* 57.5* 57.1* 64.8* 30.8

Widowed 1.7* 6.1* 1.2* 2.7 1.7* 20.3* 21.0 17.6* 24.9

Divorced or separated 9.0* 19.0* 7.6* 13.1 9.1* 13.9* 14.0* 11.0* 25.5

Living with partner 10.9* 7.0* 9.2* 13.8 18.3* 2.9 2.8 2.4* 4.7

Never married 27.3* 26.6* 23.5* 42.2 33.2* 5.4* 5.1* 4.2* 14.1

Family income

Has income less than 138 percent FPL 17.0* 40.5* 6.1* 51.8 33.3* 16.0* 16.0* 7.6* 62.4

Has income in ranges shown below

Less than 100 percent FPL 10.1* 24.4*

3.2* 33.3

19.5* 8.3* 8.2* 3.3* 42.3

100–199 percent FPL 16.9* 33.5 9.3* 36.6 31.2* 20.3* 20.4* 14.3* 34.6

200–399 percent FPL 28.3* 25.3 28.4* 22.3 33.6* 31.9* 32.2* 31.2* 17.7

400 percent FPL or higher 44.7* 16.8* 59.1* 7.8 15.7* 39.5* 39.2* 51.1* 5.4

Other demographic characteristics

Citizen of United States 90.4 95.9* 94.1* 90.6 67.7* 96.6* 97.7* 98.3* 86.4

Parent of a dependent child

7

34.0* 12.4* 33.1* 40.2 36.1* 0.7 0.5 0.9 †

Currently working

7

76.9* 16.4* 85.6* 50.2 72.3* 19.4* 16.6* 24.9* 7.9

Veteran

7

5.2* 6.9* 4.1* 2.0 2.9 16.3* 16.4* 14.6* 4.4

Family receives SSI or SSDI 8.8* 70.9* 4.3* 26.5 5.2* 9.4* 9.6* 6.3* 36.0

Health

Current health status

Excellent or very good 59.3* 17.8* 65.4* 40.0 56.2* 43.3* 43.1* 48.3* 20.1

Good

28.6*

29.6 27.0* 33.5 30.5 33.4 33.3 32.5 32.4

Fair or poor

12.1*

52.7* 7.7* 26.5 13.3* 23.3* 23.6* 19.2* 47.4

December 2023

8

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 1

EXHIBIT 2. (continued)

Notes: GED is general educational development test. FPL is federal poverty level. SSI is Supplemental Security Income. SSDI is Social Security Disability

Insurance. Percentage calculations for each item in the exhibit exclude individuals with missing and unknown values. Standard errors are available in the Excel

version of this exhibit at https://www.macpac.gov/publication/characteristics-of-non-institutionalized-individuals-by-source-of-health-insurance/. The individual

components listed under the subcategories are not always mutually exclusive and may not add to 100 percent. Due to dierences in methodology (such as the

wording of questions, length of recall periods, and prompts or probes used to elicit responses), estimates obtained from dierent survey data sources will vary.

For example, the National Health Interview Survey (NHIS) is known to produce higher estimates of service use than the Medical Expenditures Panel Survey

(MEPS). For purposes of comparing groups of individuals (as in this exhibit), the NHIS provides the most recent information available. For other purposes, such as

measuring levels of use relative to a particular benchmark or goal, it may be appropriate to consult estimates from MEPS or another source.

The NHIS underwent a substantial redesign in 2019, and users should be cautious about making any comparisons to prior years. More information about the

redesign is available at https://www.cdc.gov/nchs/nhis/2019_quest_redesign.htm/.

*Dierence from Medicaid or CHIP is statistically signicant at the 0.05 level.

† Estimate is unreliable because it has a relative standard error greater than or equal to 30 percent.

– Dash indicates zero.

1

Total includes all non-institutionalized individuals, regardless of coverage source. In this exhibit, the values across health insurance coverage types may not

sum to 100 percent for each age group because individuals may have multiple sources of coverage and because not all types of coverage are displayed. Other

MACStats exhibits apply a hierarchy to assign individuals with multiple coverage sources to a primary source and may therefore have dierent results than those

shown here. Coverage source is dened as of the time of the survey interview. Since an individual may have multiple coverage sources or changes over time,

responses to survey questions may reect characteristics or experiences associated with a coverage source other than the one assigned in this exhibit.

2

Private health insurance coverage excludes plans that paid for only one type of service, such as accidents or dental care.

3

Medicaid or CHIP also includes persons covered by other state-sponsored health plans.

4

Individuals were dened as uninsured if they did not have any private health insurance, Medicaid, CHIP, Medicare, state-sponsored or other government-

sponsored health plan, or military plan. Individuals were also dened as uninsured if they had only Indian Health Service coverage or only a private plan that paid

for one type of service, such as accidents or dental care.

5

Components may not sum to 100 percent because individuals may have multiple sources of coverage and because not all types of coverage are displayed.

6

NHIS and other survey data underestimate the number of individuals dually enrolled in Medicare and Medicaid, in part because most surveys do not count those

whose only Medicaid benet is payment of Medicare premiums and cost sharing as having Medicaid coverage.

7

Information is limited to those age 19 or older.

Source: MACPAC, 2023, analysis of NHIS data.

MACStats: Medicaid and CHIP Data Book

9

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

EXHIBIT 3. National Health Expenditures by Type and Payer, 2021

Type of expenditure

Payer amount (millions) and share of total

Total Medicaid CHIP Medicare

Private

insurance

Other

health

insurance

1

Other

third-

party

payers

2

Out of

pocket

Total payer expenditures $4,255,127 $734,011 $22,254 $900,787 $1,211,431 $149,883 $803,608 $433,153

Hospital care 1,323,912 245,307 5,591 350,726 448,778 86,091 153,335 34,083

Physician and clinical services 864,563 99,332 4,874 222,082 328,077 38,768 105,860 65,570

Dental services 161,777 15,263 2,586 4,729 64,934 2,109 8,720 63,436

Other professional services

3

130,647 9,494 480 36,240 37,490 – 17,453 29,490

Home health care 125,195 42,788 64 46,583 15,926 698 6,242 12,895

Other non-durable medical products

4

97,387 – – 2,332 – – – 95,055

Prescription drugs 377,987 39,624 2,281 119,923 151,680 10,146 4,495 49,839

Durable medical equipment

5

67,126 9,102 222 12,357 13,087 – 984 31,374

Nursing care facilities and continuing

care retirement communities

6

181,314 54,267 18 40,589 16,281 6,796 18,972 44,391

Other health, residential, and

personal care services

7

223,479 129,641 1,966 4,302 14,773 924 64,852 7,020

Administration

8

307,106 89,191 4,172 60,925 120,405 4,350 28,062 –

Public health activity 187,604 – – – – – 187,604 –

Investment 207,031 – – – – – 207,029 –

December 2023

10

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 1

EXHIBIT 3. (continued)

Type of expenditure

Payer amount (millions) and share of total

Total Medicaid CHIP Medicare

Private

insurance

Other

health

insurance

1

Other

third-

party

payers

2

Out of

pocket

Total payer share of expenditures 100.0% 17.3% 0.5% 21.2% 28.5% 3.5% 18.9% 10.2%

Hospital care 100.0 18.5 0.4 26.5 33.9 6.5 11.6 2.6

Physician and clinical services 100.0 11.5 0.6 25.7 37.9 4.5 12.2 7.6

Dental services 100.0 9.4 1.6 2.9 40.1 1.3 5.4 39.2

Other professional services

3

100.0 7.3 0.4 27.7 28.7 – 13.4 22.6

Home health care 100.0 34.2 0.1 37.2 12.7 0.6 5.0 10.3

Other non-durable medical products

4

100.0 – – 2.4 – – – 97.6

Prescription drugs 100.0 10.5 0.6 31.7 40.1 2.7 1.2 13.2

Durable medical equipment

5

100.0 13.6 0.3 18.4 19.5 – 1.5 46.7

Nursing care facilities and continuing

care retirement communities

6

100.0 29.9 0.0 22.4 9.0 3.7 10.5 24.5

Other health, residential, and

personal care services

7

100.0 58.0 0.9 1.9 6.6 0.4 29.0 3.1

Administration

8

100.0 29.0 1.4 19.8 39.2 1.4 9.1 –

Public health activity 100.0 – – – – – 100.0 –

Investment 100.0 – – – – – 100.0 –

Notes: Every ve years National Health Expenditure Accounts undergo a comprehensive revision that includes the incorporation of newly available source data,

methodological and denitional changes, and benchmark estimates from the U.S. Census Bureau’s quinquennial Economic Census. The values shown here reect

the comprehensive revision made in 2019, and thus, the gures shown here may reect methodological and denitional shifts within payer and service categories

from prior publications of MACStats. For example, the 2019 methodology improved the allocation of Medicaid managed care premiums to the goods and services

categories for some states by the additional use of Medicaid Drug Rebate System data. This change caused a downward revision to retail prescription drug

spending and an upward revision for most of the other service categories.

MACStats: Medicaid and CHIP Data Book

11

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

EXHIBIT 3. (continued)

– Dash indicates zero; 0.0% indicates an amount less than 0.05% that rounds to zero.

1

U.S. Department of Defense and U.S. Department of Veterans Aairs.

2

Includes all other public and private programs and expenditures except for out-of-pocket amounts.

3

The other professional services category includes services provided in establishments operated by health practitioners other than physicians and dentists,

including those provided by private-duty nurses; chiropractors; podiatrists; optometrists; and physical, occupational, and speech therapists.

4

The other non-durable medical products category includes the retail sales of non-prescription drugs and medical sundries.

5

The durable medical equipment category includes retail sales of items such as contact lenses, eyeglasses, and other ophthalmic products; surgical and

orthopedic products; hearing aids; wheelchairs; and medical equipment rentals.

6

The nursing care facilities and continuing care retirement communities category includes nursing and rehabilitative services provided in freestanding nursing

home facilities that are generally provided for an extended period of time by registered or licensed practical nurses and other sta.

7

The other health, residential, and personal care category includes spending for Medicaid home- and community-based waivers, care provided in residential

facilities for people with intellectual disabilities or mental health and substance abuse disorders, ambulance services, school health, and worksite health care.

8

The administrative category includes the administrative cost of health care programs (e.g., Medicare and Medicaid) and the net cost of private health insurance

(administrative costs as well as additions to reserves, rate credits and dividends, premium taxes, and plan prots or losses).

Sources: Oce of the Actuary (OACT), CMS, 2022, National health expenditures by type of service and source of funds: Calendar years 1960–2021, Baltimore,

MD: OACT, https://www.cms.gov/les/zip/national-health-expenditures-type-service-and-source-funds-cy-1960-2021.zip. OACT, 2022, National health expenditure

accounts: Methodology paper, 2021, Baltimore, MD: OACT, https://www.cms.gov/les/document/denitions-sources-and-methods.pdf. OACT, 2020, Summary

of 2019 comprehensive revision to the national health expenditure accounts, Baltimore, MD: OACT, https://www.cms.gov/les/document/summary-benchmark-

changes-2019.pdf.

December 2023

12

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 1

EXHIBIT 4. Major Health Programs and Other Components of Federal Budget as a Share of Federal Outlays,

FYs 1965–2022

Medicaid

Medicare

Social Security

Net interest

Discretionary,

non-defense

Discretionary,

defense

Other mandatory

programs

Exchang

e

subsidies

CHIP

MACStats: Medicaid and CHIP Data Book

13

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

EXHIBIT 4. (continued)

Fiscal year

Mandatory programs Discretionary programs

Net interest

Medicaid CHIP Medicare

Exchange

subsidies

Social

Security Other Defense

Non-

defense

1965

0.2% – – – 14.4% 12.3% 43.2% 22.6% 7.3%

1970

1.4 – 3.0% – 15.2 11.6 41.9 19.6 7.3

1975

2.1 – 3.7 – 19.1 20.6 26.4 21.2 7.0

1980

2.4 – 5.2 – 19.8 16.9 22.8 24.0 8.9

1985

2.4 – 6.8 – 19.7 13.5 26.7 17.2 13.7

1990

3.3 – 7.6 – 19.7 14.7 24.0 16.0 14.7

1995

5.9 – 10.4 – 22.0 10.5 18.0 17.9 15.3

2000

6.6 0.1% 10.9 – 22.7 13.0 16.5 17.9 12.5

2005

7.4 0.2 11.9 – 21.0 12.9 20.0 19.2 7.4

2006

6.8 0.2 12.2 – 20.5 13.4 19.6 18.7 8.5

2007

7.0 0.2 13.6 – 21.3 11.0 20.1 18.1 8.7

2008

6.8 0.2 12.9 – 20.5 13.0 20.5 17.5 8.5

2009

7.1 0.2 12.1 – 19.3 20.8 18.7 16.5 5.3

2010

7.9 0.2 12.9 – 20.3 14.1 19.9 19.0 5.7

2011

7.6 0.2 13.3 – 20.1 14.9 19.4 18.0 6.4

2012

7.1 0.3 13.2 – 21.8 15.2 19.0 17.2 6.2

2013

7.7 0.3 14.2 – 23.4 13.2 18.1 16.7 6.4

2014

8.6 0.3 14.4 0.4% 24.1 12.1 17.0 16.6 6.5

2015

9.5 0.3 14.6 0.7 23.9 13.2 15.8 15.9 6.0

2016

9.6 0.4 15.3 0.8 23.6 13.4 15.2 15.6 6.2

2017

9.4 0.4 14.9 1.0 23.6 14.0 14.8 15.3 6.6

2018

9.5 0.4 14.2 1.1 23.9 12.3 15.2 15.5 7.9

2019

9.2 0.4 14.5 1.1 23.4 13.0 15.2 14.9 8.4

2020

7.0 0.3 11.7 0.8 16.6 33.5 10.9 13.9 5.3

2021

7.6 0.2 10.1 0.9 16.5 35.4 10.9 13.1 5.2

2022

9.4 0.3 11.9 1.3 19.3 23.7 12.0 14.5 7.6

Notes: FY is scal year.

– Dash indicates zero.

Source: MACPAC, 2023, analysis of Oce of Management and Budget (OMB), Tables 6.1, 8.5, and 8.7, in Historical tables, budget of the United States

Government, scal year 2024, Washington, DC: OMB, https://www.govinfo.gov/app/details/BUDGET-2024-TAB/context.

December 2023

14

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 1

EXHIBIT 5. Medicaid as a Share of States’ Total Budgets and State-Funded Budgets, SFY 2021

State

Total budget (including state and federal funds) State-funded budget

Dollars

(millions)

Total spending as a share

of total budget

1

Dollars

(millions)

State-funded spending as a share

of state-funded budget

1

Medicaid

Elementary

and secondary

education

Higher

education Medicaid

Elementary

and secondary

education

Higher

education

Total $2,678,389 26.8% 18.7% 8.5% $1,585,532 14.4% 24.3% 12.2%

Alabama 31,918 24.0 19.9 19.8 19,303 8.9 27.8 26.1

Alaska 11,700 17.8 11.2 4.9 6,817 7.8 19.0 6.1

Arizona 66,826 24.0 10.9 11.1 50,556 6.1 11.4 12.5

Arkansas 31,052 26.1 12.8 12.2 18,727 8.4 16.6 20.2

California 498,883 22.7 18.0 4.9 226,589 16.8 28.2 7.9

Colorado 31,776 37.9 18.5 9.7 21,247 21.0 24.0 12.4

Connecticut 37,305 23.7 12.6 10.4 27,988 16.3 13.4 13.1

Delaware 13,257 19.5 22.1 3.6 9,301 8.1 27.9 4.4

District of Columbia 16,180 21.9 18.9 3.3 10,637 7.2 25.8 2.7

Florida 93,718 31.3 18.3 8.8 58,112 18.2 23.7 14.1

Georgia 64,286 21.0 28.5 16.7 39,581 9.1 28.0 25.7

Hawaii 24,401 11.5 9.6 5.4 19,150 4.6 9.9

6.8

Idaho 10,206 24.1 23.7 8.7 5,504 13.5 36.8 13.5

Illinois 115,535 22.5 11.3 1.9 88,855 10.3 11.0 2.3

Indiana 44,682 34.9 23.9 4.5 24,363 15.5 38.4 8.3

Iowa 28,522 23.2 15.6 23.1 18,102 12.8 19.8 33.0

Kansas 21,808 18.6 26.1 14.2 14,883 9.6 33.8 17.1

Kentucky 42,377 33.3 14.4 18.0 20,899 12.6 23.0 31.1

Louisiana 34,717 44.4 16.8 8.6 18,123 17.3 23.3 16.3

Maine 12,103 28.9 16.5 2.9 6,485 16.1 23.1 5.3

Maryland 55,058 21.5 18.0 13.0 33,313 12.0 23.5 17.5

Massachusetts 67,221 28.8 14.1 2.2 47,739 19.7 16.1 3.2

Michigan 68,420 31.1 23.4 3.7 38,325 14.5 35.5 6.3

Minnesota 48,019 28.8 24.0 3.9 30,011 17.9 33.4 6.3

Mississippi 22,231 24.4 15.8 18.1 11,948 8.7 21.5 31.1

MACStats: Medicaid and CHIP Data Book

15

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

EXHIBIT 5. (continued)

State

Total budget (including state and federal funds) State-funded budget

Dollars

(millions)

Total spending as a share

of total budget

1

Dollars

(millions)

State-funded spending as a share

of state-funded budget

1

Medicaid

Elementary

and secondary

education

Higher

education Medicaid

Elementary

and secondary

education

Higher

education

Missouri $29,779 37.5% 21.3% 4.3% $18,305 29.1% 27.4% 5.4%

Montana 11,133 20.5 10.1 6.2 5,187 8.9 17.8 13.0

Nebraska 15,067 19.1 12.3 20.5 9,986 10.5 13.6 25.0

Nevada 15,671 29.3 15.6 6.0 10,193 9.9 20.4 9.2

New Hampshire 7,535 32.1 18.1 2.0 3,953 22.8 29.3 3.8

New Jersey 78,706 22.9 25.1 8.5 54,250 10.4 28.8 11.9

New Mexico 24,727 29.0 16.0 12.5 12,185 10.2 27.5 20.4

New York 186,588 35.2 17.2 6.1 114,903 18.7 25.1 9.5

North Carolina 59,445 28.9 22.6 18.0 36,999 14.8 29.5 18.8

North Dakota 8,590 15.2 16.3 17.0 5,590 7.9 19.8 23.6

Ohio 81,216 39.3 15.9 4.0 46,865 18.2 22.0 6.2

Oklahoma 27,768 20.7 15.9 20.1 16,984 10.7 19.4 27.3

Oregon 66,771 16.7 10.0 3.5 44,586 5.9 13.1

5.1

Pennsylvania 103,258 36.6 18.3 2.0 60,200 23.7 22.5 3.4

Rhode Island 13,352 22.0 12.2 8.9 6,787 14.9 19.9 17.2

South Carolina 29,958 24.3 19.2 17.9 17,910 10.0 24.5 28.9

South Dakota 6,779 13.7 15.9 13.5 3,231 10.0 18.4 24.9

Tennessee 39,984 32.3 17.7 12.5 21,554 19.9 25.4 22.6

Texas 135,187 30.8 37.4 14.8 64,314 16.8 43.9 19.8

Utah 19,777 19.8 24.2 12.3 13,461 8.5 31.2 18.1

Vermont 7,290 22.6 29.8 2.4 4,028 14.6 48.1 3.2

Virginia 74,658 21.5 12.5 11.2 47,179 12.0 16.6 14.8

Washington 60,536 25.8 26.3 12.6 41,922 12.3 35.1 17.9

West Virginia 17,438 26.0 15.0 10.6 11,965 6.5 17.8 14.8

Wisconsin 59,355 21.3 15.2 11.7 41,782 12.9 19.2 12.3

Wyoming 5,620 11.2 16.2 6.5 4,654 6.2 19.6 7.9

December 2023

16

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 1

EXHIBIT 5. (continued)

Notes: SFY is state scal year. Total budget includes federal and all other funds. State-funded budget includes state general funds, other state funds, and bonds.

Other state funds are amounts from revenue sources that are restricted by law for particular government functions or activities, which for Medicaid includes

provider taxes and local funds. Medicaid, elementary and secondary education, and higher education represent the largest total budget shares among functions

broken out separately by the National Association of State Budget Ocers (NASBO). Functions not shown here are transportation, corrections, public assistance,

and all other (includes hospitals, economic development, housing environmental programs, CHIP, parks and recreation, natural resources, and air and water

transportation). Medicaid spending amounts exclude administrative costs but include Medicare Part D phased-down state contribution (also referred to as

clawback) payments.

1

Total and state-funded budget shares should be viewed with caution because they reect varying state practices. For example, in Ohio, federal reimbursements

for Medicaid expenditures funded from the General Revenue Fund (GRF) are deposited into the GRF. In prior reports, this practice made Ohio's general revenue

expenditures look higher and conversely made its federal expenditures look lower relative to most other states that do not follow this practice. In the 2019–2022

reports, NASBO removed the federal funds from the GRF number to be consistent with budget presentations in other NASBO surveys, and thus, Ohio's state-

funded Medicaid spending is less than what was reported in prior years. In addition, in many states, some functions—particularly elementary and secondary

education—may be partially funded outside of the state budget by local governments.

Source: NASBO, 2022, 2022 State expenditure report: scal years 2020–2022, Washington, DC: NASBO, https://www.nasbo.org/reports-data/state-expenditure-

report/state-expenditure-archives.

MACStats: Medicaid and CHIP Data Book

17

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

EXHIBIT 6. Federal Medical Assistance Percentages and Enhanced FMAPs by State, FYs 2021–2024

State

FMAPs for Medicaid

1

E-FMAPs for CHIP

FY 2021

(Emergency)

2, 3

FY 2022

(Emergency)

2, 3

FY 2023 Q1-2

(Emergency)

2, 4

FY 2023 Q3

(Emergency)

2, 4

FY 2023 Q4

(Emergency)

2, 4

FY 2024

5

FY 2021

(Emergency)

3, 6

FY 2022

(Emergency)

3, 6

FY 2023 Q1-2

(Emergency)

4, 6

FY 2023 Q3

(Emergency)

4, 6

FY 2023 Q4

(Emergency)

4, 6

FY 2024

5, 6

Alabama 78.78% 78.57% 78.63% 77.43% 74.93% 73.12% 85.15% 85.00% 85.04% 84.20% 82.45% 81.18%

Alaska 56.20 56.20 56.20 55.00 52.50 50.01 69.34 69.34 69.34 68.50 66.75 65.01

Arizona 76.21 76.21 75.76 74.56 72.06 66.29 83.35 83.35 83.03 82.19 80.44 76.40

Arkansas 77.43 77.82 77.51 76.31 73.81 72.00 84.20 84.47 84.26 83.42 81.67 80.40

California 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

Colorado 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34

69.34 68.50 66.75 65.00

Connecticut 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

Delaware 63.94 63.92 64.69 63.49 60.99 59.71 74.76 74.74 75.28 74.44 72.69 71.80

District of

Columbia

76.20 76.20 76.20 75.00 72.50 70.00 83.34 83.34 83.34 82.50 80.75 79.00

Florida 68.16 67.23 66.25 65.05 62.55 57.96 77.71 77.06 76.38 75.54 73.79 70.57

Georgia 73.23 73.05 72.22 71.02 68.52 65.89 81.26 81.14 80.55 79.71 77.96 76.12

Hawaii 59.22 59.84 62.26 61.06 58.56 58.56 71.45 71.89 73.58 72.74 70.99 70.99

Idaho 76.61 76.41 76.31 75.11 72.61 69.72 83.63 83.49 83.42 82.58 80.83 78.80

Illinois 57.16 57.29 56.20 55.00 52.50 51.09 70.01 70.10 69.34 68.50 66.75 65.76

Indiana 72.03 72.50 71.86 70.66 68.16 65.62 80.42 80.75 80.30 79.46 77.71 75.93

Iowa 67.95 68.34 69.33 68.13 65.63 64.13 77.57 77.84 78.53 77.69 75.94

74.89

Kansas 65.88 66.36 65.96 64.76 62.26 60.97 76.12 76.45 76.17 75.33 73.58 72.68

Kentucky 78.25 78.95 78.37 77.17 74.67 71.78 84.78 85.27 84.86 84.02 82.27 80.25

Louisiana 73.62 74.22 73.48 72.28 69.78 67.67 81.53 81.95 81.44 80.60 78.85 77.37

Maine 69.89 70.20 69.49 68.29 65.79 62.65 78.92 79.14 78.64 77.80 76.05 73.86

Maryland 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

Massachusetts 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

Michigan 70.28 71.68 70.91 69.71 67.21 64.94 79.20 80.18 79.64 78.80 77.05 75.46

Minnesota 56.20 56.71 56.99 55.79 53.29 51.49 69.34 69.70 69.89 69.05 67.30 66.04

Mississippi 83.96 84.51 84.06 82.86 80.36 77.27 88.77 89.16 88.84 88.00 86.25 84.09

Missouri 71.16 72.56 72.01 70.81 68.31 66.07 79.81 80.79 80.41 79.57 77.82 76.25

Montana 71.80 71.10

70.32 69.12 66.62 63.91 80.26 79.77 79.22 78.38 76.63 74.74

Nebraska 62.67 64.00 64.07 62.87 60.37 58.60 73.87 74.80 74.85 74.01 72.26 71.02

December 2023

18

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 1

EXHIBIT 6. (continued)

State

FMAPs for Medicaid

1

E-FMAPs for CHIP

FY 2021

(Emergency)

2, 3

FY 2022

(Emergency)

2, 3

FY 2023 Q1-2

(Emergency)

2, 4

FY 2023 Q3

(Emergency)

2, 4

FY 2023 Q4

(Emergency)

2, 4

FY 2024

5

FY 2021

(Emergency)

3, 6

FY 2022

(Emergency)

3, 6

FY 2023 Q1-2

(Emergency)

4, 6

FY 2023 Q3

(Emergency)

4, 6

FY 2023 Q4

(Emergency)

4, 6

FY 2024

5, 6

Nevada 69.50% 68.79% 68.85% 67.65% 65.15% 60.77% 78.65% 78.15% 78.20% 77.36% 75.61% 72.54%

New Hampshire 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

New Jersey 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

New Mexico 79.66 79.91 79.46 78.26 75.76 72.59 85.76 85.94 85.62 84.78 83.03 80.81

New York 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

North Carolina 73.60 73.85 73.91 72.71 70.21 65.91 81.52 81.70

81.74 80.90 79.15 76.14

North Dakota 58.60 59.79 57.75 56.55 54.05 53.82 71.02 71.85 70.43 69.59 67.84 67.67

Ohio 69.83 70.30 69.78 68.58 66.08 64.30 78.88 79.21 78.85 78.01 76.26 75.01

Oklahoma 74.19 74.51 73.56 72.36 69.86 67.53 81.93 82.16 81.49 80.65 78.90 77.27

Oregon 67.04 66.42 66.52 65.32 62.82 59.31 76.93 76.49 76.56 75.72 73.97 71.52

Pennsylvania 58.40 58.88 58.20 57.00 54.50 54.12 70.88 71.22 70.74 69.90 68.15 67.88

Rhode Island 60.29 61.08 60.16 58.96 56.46 55.01 72.20 72.76 72.11 71.27 69.52 68.51

South Carolina 76.83 76.95 76.78 75.58 73.08 69.53 83.78 83.87 83.75 82.91 81.16 78.67

South Dakota 64.48 64.89 62.94 61.74 59.24 54.98 75.14 75.42 74.06 73.22 71.47 68.49

Tennessee 72.30 72.56 72.30 71.10 68.60 65.28 80.61 80.79 80.61 79.77 78.02 75.70

Texas 68.01 67.00 66.07 64.87 62.37 60.15 77.61 76.90 76.25 75.41 73.66 72.11

Utah 73.72 73.03 72.10 70.90 68.40 65.90 81.60 81.12 80.47 79.63 77.88 76.13

Vermont 60.77 62.67 62.02 60.82 58.32 56.75 72.54 73.87 73.41 72.57 70.82 69.73

Virginia 56.20 56.20 56.85 55.65 53.15 51.22 69.34 69.34 69.80 68.96 67.21 65.85

Washington 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

West Virginia 81.19 80.88 80.22 79.02 76.52 74.10 86.83 86.62 86.15 85.31 83.56 81.87

Wisconsin 65.57 66.08 66.30 65.10 62.60 60.66 75.90 76.26 76.41 75.57 73.82 72.46

Wyoming 56.20 56.20 56.20 55.00 52.50 50.00 69.34 69.34 69.34 68.50 66.75 65.00

American

Samoa

7

89.20 89.20 89.20 88.00 85.50 83.00 92.44 92.44 92.44 91.60 89.85 88.10

Guam

7

89.20 89.20 89.20 88.00 85.50 83.00 92.44 92.44 92.44 91.60 89.85 88.10

N. Mariana

Islands

7

89.20 89.20 89.20 88.00 85.50 83.00 92.44 92.44 92.44 91.60 89.85 88.10

Puerto Rico

7

82.20 82.20 82.20 81.00 78.50 76.00 87.54 87.54 87.54 86.70 84.95 83.20

Virgin Islands

7

89.20 89.20 89.20 88.00 85.50 83.00 92.44 92.44 92.44 91.60 89.85 88.10

MACStats: Medicaid and CHIP Data Book

19

Section 1: Overview—Key Statistics

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 1

EXHIBIT 6. (continued)

Notes: FY is scal year. FMAP is federal medical assistance percentage. E-FMAP is enhanced FMAP. Q is quarter. The federal government’s share of most Medicaid service

costs is determined by the FMAP, with some exceptions. For Medicaid administrative costs, the federal share does not vary by state and is generally 50 percent. The E-FMAP

determines the federal share of both service and administrative costs for CHIP, subject to the availability of funds from a state’s federal allotments for CHIP.

FMAPs for Medicaid are generally calculated based on a formula that compares each state’s per capita income to U.S. per capita income and provides a higher federal match

for states with lower per capita incomes, subject to a statutory minimum (50 percent) and maximum (83 percent). The general formula for a given state is: FMAP = 1 – [(state

per capita income squared ÷ U.S. per capita income squared) × 0.45].

Medicaid exceptions to this formula include the District of Columbia (set in statute at 70 percent) and the territories (set in statute at 55 percent). Other Medicaid exceptions

apply to certain services, providers, or situations (e.g., services provided through an Indian Health Service facility receive an FMAP of 100 percent). E-FMAPs for CHIP are

calculated by reducing the state share under regular FMAPs for Medicaid by 30 percent.

1

For certain newly eligible individuals under the Medicaid expansion beginning in 2014, there is an increased FMAP (100 percent in 2014 through 2016, phasing down to 90

percent in 2020 and subsequent years). An increased FMAP is also available for certain states that expanded eligibility to low-income parents and non-pregnant adults without

children before enactment of the Patient Protection and Aordable Care Act (ACA, P.L. 111-148, as amended).

2

The Families First Coronavirus Response Act of 2020 (FFCRA, P.L. 116-127) provides a temporary 6.2 percentage point FMAP increase during a public health emergency for

each calendar quarter occurring during the period beginning on the rst day of the public health emergency period, as dened in Section 1135(g)(1)(B) of the Social Security Act

(the Act), and ending on the last day of the calendar quarter in which the last day of such emergency period occurs. The Secretary of the U.S. Department of Health and Human

Services declared a public health emergency on January 31, 2020, with an eective date of January 27, 2020, meaning the FMAP increase is eective January 1, 2020. States,

including the District of Columbia and the territories, must meet certain maintenance-of-eort requirements to qualify for the FMAP increase. The FMAP increase does not apply

to the Medicaid expansion population or other services such as those received at an Indian Health Service facility that already receive a higher matching rate.

3

Because the public health emergency period was in eect for all of FYs 2021 and 2022, this exhibit displays only the FY 2021 and 2022 FMAPs and E-FMAPs with the 6.2

percentage point increase under the FFCRA.

4

Section 5131(a) of the Consolidated Appropriations Act, 2023 (P.L. 117-328) subsequently amended the FFCRA to phase down the FMAP increase during calendar year

2023. For the quarter beginning April 1, 2023, and ending June 30, 2023 (Q3 of FY 2023), the FMAP increase is 5 percentage points. For the quarter beginning July 1, 2023,

and ending September 30, 2023, the FMAP increase is 2.5 percentage points (Q4 of FY 2023). For the quarter beginning October 1, 2023, and ending December 31, 2023 (Q1

for FY 2024), the FMAP increase is 1.5 percentage points. Section 5131(b) of the Consolidated Appropriations Act, 2023 added a new §1902(tt) of the Act that requires states

submit to CMS certain monthly data about activities related to eligibility redeterminations conducted during the period from April 1, 2023, to June 30, 2024. If a state does not

satisfy the reporting requirements in §1902(tt) during the period from July 1, 2023, to June 30, 2024, CMS shall reduce the FMAP for the state by the number of percentage

points (not to exceed 1 percentage point) equal to the product of 0.25 percentage points and the number of scal quarters during such period for which the state has failed to

satisfy the reporting requirements.

5

The FMAPs displayed for FY 2024 are the percentages that are in eect for January 1, 2024, to September 30, 2024. The FMAPs for the rst quarter of FY 2024 would

receive a 1.5 percentage point increase under the Consolidated Appropriations Act, 2023 (see footnote 4).

6

Because the E-FMAP in Section 2105(b) of the Act is calculated based on the FMAP, the E-FMAP is also higher for states, though not in the same amount, for the duration of

the public health emergency period.

7

Under numerous legislation that was subsequently consolidated under the Consolidated Appropriations Act, 2023 (P.L. 117-328), American Samoa, Guam, Northern Mariana

Islands, and the Virgin Islands receive an FMAP of 83 percent beginning December 21, 2019, and Puerto Rico receives an FMAP of 76 percent from December 21, 2019,

through December 3, 2021, and January 1, 2022, through September 30, 2027, but would receive its normal FMAP of 55 percent between December 4, 2021, and December

31, 2021. The E-FMAPs for FYs 2021–2024 were calculated o these increased FMAPs.

Sources: U.S. Department of Health and Human Services, Federal Register notices for FYs 2021–2024; Consolidated Appropriations Act, 2023 (P.L. 117-328);

Centers for Medicare & Medicaid Services, Families First Coronavirus Response Act – Increased FMAP FAQs, March 24, 2020, https://www.medicaid.gov/state-

resource-center/downloads/covid-19-section-6008-faqs.pdf; Center for Medicaid and CHIP Services, CMS, 2020, E-mail to MACPAC, March 27 and March 30.

SECTION 2:

Trends

December 2023

22

Section 2: Trends

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 2

Section 2: Trends

Key Points

•

Medicaid spending and enrollment are aected by federal and state policy choices as well as

economic factors (Exhibits 8–10). For example:

– Spending and enrollment both grew around the recessions of 2001 and 2007 through 2009 and

then slowed as economic conditions improved.

– Large increases in Medicaid enrollment and spending in scal years (FYs) 2014 and 2015 were

primarily due to expanded eligibility under the Patient Protection and Aordable Care Act (ACA,

P.L. 111-148, as amended).

– Enrollment continues to increase since 2020 due to the continuous coverage requirement

attached to the federal medical assistance percentage (FMAP) increase under the Families

First Coronavirus Response Act (FFCRA, P.L. 116-127). From July 2022 to July 2023,

enrollment in Medicaid and the State Children’s Health Insurance Program (CHIP) increased

by 1.6 percent. While enrollment is higher than in 2022, it has been decreasing from its

peak as states begin to disenroll beneciaries following the end of the continuous coverage

requirement. Enrollment decreased in 20 states in 2022 (Exhibit 11).

•

Medicaid enrollment trends vary by eligibility group (Exhibit 7).

– Adults (excluding those eligible on the basis of disability) generally experience larger enrollment

increases during periods of economic recession than other eligibility groups. For example,

from FY 2008 through FY 2013, enrollment for adults grew on average 5.8 percent annually,

compared with 3.0 percent annually for children (excluding those eligible on the basis of

disability) and individuals qualifying for Medicaid on the basis of disability.

– Enrollment for adults has grown substantially due to the expansion of Medicaid under the ACA,

increasing at an average annual rate of 9.2 percent from FY 2013 through FY 2021.

– Individuals age 65 and older generally have the slowest growth rate regardless of time period.

•

Medicaid’s share of state-funded budgets (excluding federal funds) and total state budgets (including

federal funds) has varied over time. In state scal year 2015, Medicaid’s share of total state budgets

increased, but its share of state-funded budgets decreased slightly—the decrease can be attributed

to 100 percent federal funding made available for low-income adults not otherwise eligible on the

basis of disability, who became newly eligible for Medicaid under the ACA. Most recently, Medicaid’s

share of state-funded budgets has decreased from 2018 to 2021 due to additional states expanding

Medicaid and the FMAP increase under the FFCRA (Exhibit 13).

•

Medicaid and CHIP expenditures as a share of national health expenditures are projected to

decrease from 17.8 percent in 2021 to about 17.3 percent in 2031. Medicare’s share is projected to

increase from 21.2 percent to 25.8 percent during the same time period (Exhibit 12).

MACStats: Medicaid and CHIP Data Book

23

Section 2: Trends

MACStats

Section 6 Section 3Section 5 Section 2Section 4

Section 1

MACStats

Section 2

EXHIBIT 7. Medicaid Beneciaries (Persons Served) by Eligibility Group, FYs 1975–2021 (thousands)

Fiscal year Total Child Adult

1

Disabled Aged Unknown

1975 22,007 9,598 4,529 2,464 3,615 1,801

1976 22,815 9,924 4,773 2,669 3,612 1,837

1977 22,832 9,651 4,785 2,802 3,636 1,958

1978 21,965 9,376 4,643 2,718 3,376 1,852

1979 21,520 9,106 4,570 2,753 3,364 1,727

1980 21,605 9,333 4,877 2,911 3,440 1,044

1981 21,980 9,581 5,187 3,079 3,367 766

1982 21,603 9,563 5,356 2,891 3,240 553

1983 21,554 9,535 5,592 2,921 3,372 134

1984 21,607 9,684 5,600 2,913 3,238 172

1985 21,814 9,757 5,518 3,012 3,061 466

1986 22,515 10,029 5,647 3,182 3,140 517

1987 23,109 10,168 5,599 3,381 3,224 737

1988 22,907 10,037 5,503 3,487 3,159 721

1989 23,511 10,318 5,717 3,590 3,132 754

1990 25,255 11,220 6,010 3,718 3,202 1,105

1991 27,967 12,855 6,703 4,033 3,341 1,035

1992 31,150 15,200 7,040 4,487 3,749 674

1993 33,432 16,285 7,505 5,016 3,863 763

1994 35,053 17,194 7,586 5,458 4,035 780

1995 36,282 17,164 7,604 5,858 4,119 1,537

1996 36,118 16,739 7,127 6,221 4,285 1,746

1997 34,872 15,791 6,803 6,129 3,955 2,195

1998 40,096 18,969 7,895 6,637 3,964 2,631

1999 39,748 18,233 7,446 6,690 3,698 3,682

2000 41,212 18,528 8,538 6,688 3,640 3,817

2001 45,164 20,181 9,707 7,114 3,812 4,349

2002 46,839 21,487 10,847 7,182 3,789 3,534

2003 50,716 23,742 11,530 7,664 4,041 3,739

December 2023

24

Section 2: Trends

MACStats

Section 6 Section 3Section 5 Section 2Section 4 Section 1

MACStats

Section 2

EXHIBIT 7. (continued)

Fiscal year Total Child Adult

1

Disabled Aged Unknown

2004 54,250 25,415 12,325 8,123 4,349 4,037

2005 56,276 25,979 12,431 8,205 4,395 5,266

2006 56,264 26,358 12,495 8,334 4,374 4,703

2007 55,210 26,061 12,264 8,423 4,044 4,418

2008 56,962 26,479 12,739 8,685 4,147 4,912

2009 60,880 28,344 14,245 9,031 4,195 5,066

2010 63,730 30,024 15,368 9,341 4,289 4,709

2011 65,831 30,175 16,069 9,609 4,331 5,646

2012 65,584 30,467 16,483 9,836 4,376 4,423

2013 67,516 30,703 16,889 10,123 4,500 5,301

2018

2

82,940 30,769 28,870 9,062 6,086 8,153

2019 81,655 29,998 29,792 8,811 6,265 6,789

2020 81,316 30,126 30,830 8,703 6,574 5,083

2021 85,007 31,458 34,225 8,728 6,846 3,749

Notes: FY is scal year. Excludes Medicaid-expansion CHIP and the territories. Beneciaries (enrollees for whom payments are made) are shown here because

they provide the only historical time series data directly available before FY 1990. Most current analyses of individuals in Medicaid reect enrollees. For additional

discussion, see https://www.macpac.gov/macstats/data-sources-and-methods/. The increase in FY 1998 reects a change in how Medicaid beneciaries are

counted: beginning in FY 1998, a Medicaid-eligible person who received only coverage for managed care benets was included in this series as a beneciary.

Children and adults who qualify for Medicaid on the basis of a disability are included in the disabled category. In addition, although disability is not a basis of