When is it legal and when is it not?

Deducting Money

from Workers’ Wages

Training for all Agricultural Employers in New York State

Revised as of 2015

Deductions From Wages

Which New York State Laws Address Deductions

from Worker’s Wages?

• New York State Labor Law Section 193

• New York Codes, Rules and Regulations Part 195

2

Deductions From Wages

Employers cannot make any deductions from wages, or require an employee to make

payments, except those that fall within the following four categories:

1. Mandatory Deductions that are required by any law, rule or regulation;

2. Deductions listed, or similar to those listed, in section 193 of the labor law,

which are expressly pre-authorized in writing by the employee and are for the

benefit of the employee;

3. Deductions for the repayment of wage advances; and

4. Deductions for the recovery of overpayments of wages, where the overpayment

is due to a mathematical or clerical error by the employer.

3

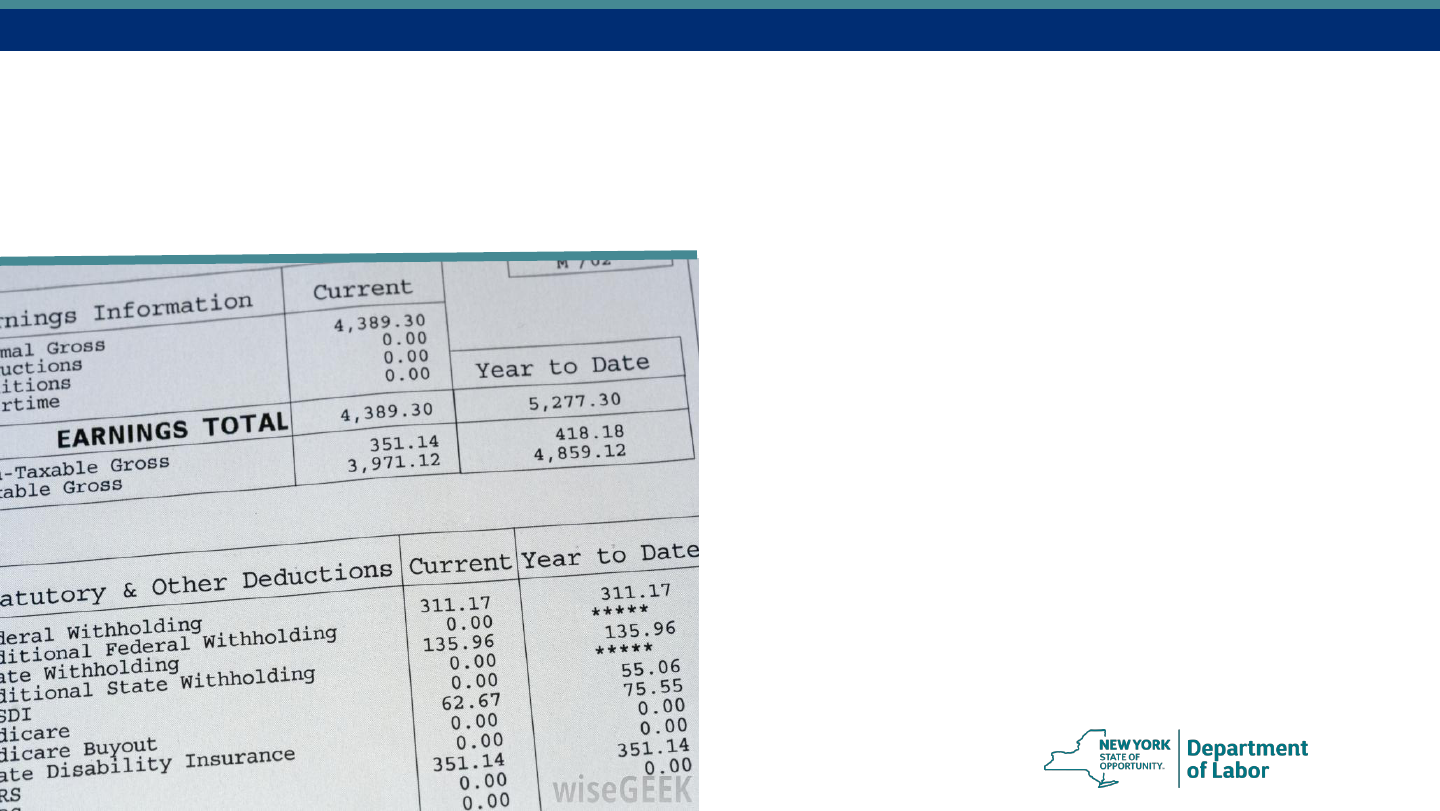

Mandatory Deductions Required by Law

Payroll deductions required by law are always okay

For example:

• Federal Tax

• State Tax

• Medicare

• Social Security

• Court-ordered garnishments

4

Deductions Permitted Only with

Employee Consent

Examples where employee consent is required include deductions for:

• Insurance Premiums

• Retirement Plans or Pensions

• Charitable Contributions

• Fitness Club Memberships

• Child Care

Certain deductions that are pre-authorized by, and for the benefit

of, the employee are also allowed. These deductions are limited

to those specifically listed in Section 193 1(b), and to “similar

payments for the benefit of the employee.”

5

What Are Similar Payments for the Benefit of

the Employee Under Section 193?

A payment benefits the employee if it provides financial or other support for the employee, or his or

her family.

To be considered “similar” a payment must fall into one of the following categories:

• health and welfare benefits;

• pension and retirement benefits;

• child care and educational benefits;

• charitable benefits;

• dues and assessments;

• transportation; and

• food and lodging

Some of these categories of benefits are not typically offered to workers in agriculture.

If you believe you provide one of these benefits, please contact the Department of Labor at:

Phone: (877) 466 – 9757 or Email: [email protected].gov

6

What Does Pre-authorized Mean?

For all wage deductions where employee consent is required, the deduction can only be made

if it is pre-authorized in writing. Pre-authorized means that there must be a written agreement

between the employer and employee before the deduction is made.

Written authorization notices must:

• Be in a written document,

• Provided to and voluntarily signed by the employee, and

• Contain all the terms and conditions of the deduction, including its benefit to the

employee, and

• Detail the manner in which the deductions will be made, including the amount of

each deduction and the total cost, and

• Be written in easily understood language

Remember: Employers must obtain written employee consent before making the deduction;

as well as, prior to any change in the terms of the deduction.

7

Wage Advances

Wage Advances occur when an employer pays an employee his or her

wages before they are earned, in anticipation of future earnings.

Example: An agricultural employer advances a week’s worth of wages

to newly-arrived, migrant workers who will live on the farm. They may

need money to buy groceries and other supplies that they will need

before pay day.

• An advance cannot have interest or fees

• Advances may be recovered through payroll

deductions, with written authorization by the employee

Note: The advance amount should be practical so that it can be repaid

within a reasonable amount of time, such as within the temporary

employment or growing period. The best practice would be to advance

no more than one week’s worth of wages.

8

Deductions for Wage Advances

Written Authorization…

Before an advance is given, both the employer and employee must agree to the

terms, in writing. It must be easy to understand and printed in a legible font,

no smaller than 12 pt. This written authorization must describe the timing and

duration of the repayment deduction and must include:

• Total amount of the advance

• Amount of each deduction to repay the total advance

• The dates for each deduction

• Notice that the worker may dispute any deduction that is not in the agreement

• A description of the dispute process

9

Written Authorization Cont’d

Timing and Duration

Timing – The written agreement must describe when the

deductions will begin and end, as well as

Duration – How long will the deductions last

• No additional advances are allowed until the advance is

fully repaid.

• All written authorizations and any disputes that arise from

the authorization must be kept on file for at least six years

after the worker is no longer employed.

10

Method of Recovery for Advances

• Only the agreed-upon amounts may be deducted

• Deductions may be taken directly from the worker’s

wages but must be clearly listed on the worker’s wage

statement

• Deductions may also be by separate transaction,

meaning that the worker can pay the employer by cash,

check or money order, but the employer must provide a

receipt for monies received.

• If the employment ends before the advance is fully

repaid, an employer may deduct the full remaining

balance owed, regardless of the paycheck amount.

11

12

13

14

15

Overpayments to an Employee

Overpayments due to an employer’s math or other clerical error may be

deducted from an employee’s wages, but only if specific steps are taken.

Example: Payroll accidentally pays out the incorrect # of hours, units or

incorrectly factors in overtime at time and a half for agricultural workers.

Notice of Intent : The employer must provide a ‘Notice of Intent’ to the employee

at least three days before the date of a deduction if the entire deduction will be

taken in a single wage payment, OR three weeks prior to the start of deductions

that will be taken periodically.

Limits to Timing, Duration, Frequency, and Method: An employer can recover

overpayments made within eight weeks before the issuance of a notice of intent

to recoup an overpayment Additionally, an employer may not make wage

deductions more frequently than once per pay period.

16

Overpayments to an Employee cont’d

Amount: The amount an employer may recover for overpayments through wage

deductions is limited to the following:

1. Where the entire overpayment is less than or equal to the net wages in the next wage

payment, the entire amount of the overpayment may be recouped in the next wage

payment; otherwise,

2. Deductions for overpayments are limited to 12.5 percent of the gross wages

(provided the deduction does not reduce wages below the minimum wage rate).

Dispute Resolution: Employers are required to adopt and notify employees of the

procedure to dispute the overpayment and terms of recovery, or seek a delay in the

recovery of the overpayment.

Repayments by the Employer: The employer is required to repay the employee for any

deduction found to be improper under the dispute resolution procedure.

17

Dispute Procedure

Overview

STEP 1

EMPLOYER

ISSUES NOTICE

OF INTENT

STEP 2

EMPLOYEE

SUBMITS

WRITTEN

OBJECTION

NOTICE

STEP 3

EMPLOYER STOPS

DEDUCTIONS

STEP 4

EMPLOYER

PROVIDES

WRITTEN

RESPONSE TO

EMPLOYEE

STEP 5

EMPLOYER &

EMPLOYEE

DISPUTE

RESOLUTION

MEETING

STEP 6

EMPLOYER’S

WRITTEN FINAL

DETERMINATION

18

Dispute Procedure

STEP 1 – Employer’s NOTICE

OF INTENT Informs the worker

that an overpayment will be

repaid through wage

deductions.

• If the entire repayment will

be taken from the wages,

then notice must be given

three days prior to the start

of the deductions.

• If a partial repayment will

be taken, then the notice

must be given three weeks

prior to the deductions.

STEP 2 – Employee’s WRITTEN

OBJECTION The employee may

dispute the overpayment and

deductions if he or she

disagrees.

• The employee has only one

week to submit his or her

written objection to the

employer.

STEP 3 - DEDUCTIONS STOP

The employer may not make

any deductions during the

dispute process.

• Depending on the result,

the employer may not start

making the deductions until

three weeks after issuing

the Final Determination to

the employee.

19

Dispute Procedure Continued

STEP 4 – Employer’s WRITTEN

RESPONSE The employer must

address the employee's

concerns, in writing, within

one week.

• The employer's response

must explain whether or

not he or she agrees with

the employee and explain

why.

• The employer must invite

the employee, in writing, to

a resolution meeting

within one week of

providing the written

response to the worker.

STEP 5 - RESOLUTION MEETING

The employer and employee may

discuss any remaining issues at an

in-person meeting.

• The employer must address

the matter in a written, Final

Determination within one

week of the meeting date.

STEP 6 - FINAL DETERMINATION

The employer must consider all of

the employee's concerns in the

final, written decision.

• The employer must wait

three weeks to begin

making deductions, or

• Must repay all deductions

to the employee ASAP or in

the next paycheck.

20

What deductions are not allowed?

Prohibited deductions

• Repayment of employer losses, including spoilage and product damage

• Fines or penalties incurred by the employer through the conduct of the employee

• Employee theft

• The cost of uniforms

• Tools, equipment and clothing required for work

• Broken tools or equipment

• Fines, tardiness, excessive leave, misconduct, quitting without notice

• Fees, interest or the employer’s administrative costs

21

What about Housing and Utilities?

Deductions for housing are not allowed; however, you

can take an allowance towards the minimum wage.

For workers who are not migrant or seasonal farm workers, you may consider a

housing allowance (that includes utilities) towards meeting the minimum wage, as

follows:

• $18.95/week for single occupancy (private room in shared residence)

• $12.65/week for multiple occupancy (shared room/dorm arrangement)

or

• $5.00/day for an individual apartment

• $8.00/day for individual apartment with family

Note: Housing and utilities provided to migrant and seasonal farm

workers must be free.

18

How about Cable Television or Premium Channels?

Deductions from an employees wages for Cable

Television are not allowed.

The employee should open a cable account in his or her own

name. If this is not possible, then the employer can open a cable

account for the employer-provided housing, and seek payment

of the bill by presenting the bill to the workers, highlighting the

coverage period and the total. The employees may then pay the

cable company directly.

The bill may not be deducted from the worker’s checks, nor by

separate transaction.

23

Can I Deduct for food?

If an employer provides prepared meals to workers, (s)he may credit

$1.70 per meal toward the minimum wage if the employee earns more

than $254.00 in a two-week period.

• If the employee earns less, no meal allowance can be counted.

• The meal credit must be clearly listed on the wage statement and

cannot be taken for meals not received.

No, Deductions for food are not allowed.

Meal Allowances

24

Thank You!

The Division of Immigrant Policies & Affairs

Tel: (877) 466 – 9757

Email: dipa@labor.ny.gov

25