AN ANALYSIS OF MORTGAGE

REFINANCING, 2001-2003

November 2004

Office of Policy

Development

and Research

U.S. Department of Housing and Urban Development

An Analysis of Mortgage Refinancing, 2001-2003

I. Introduction

Homeowners in the United States have had several opportunities to refinance in

the past decade as interest rates have fluctuated but have been relatively low compared to

earlier decades. A further decline in interest rates since the middle of 2001 has given

homeowners additional refinancing opportunities. This paper examines this recent

refinancing wave and its impact on refinancing households’ consumption and debt

burden. The paper also provides statistics on the demographics of households that have

refinanced their mortgages in recent years.

Main Findings. Some of the key findings of this paper include:

• Between January 2001 and June 2003, mortgage interest rates dropped by

more than 20 percent. Mortgage interest rates dropped from 7.01 percent in

the first quarter of 2001 to 5.52 percent in the second quarter of 2003.

Mortgage interest rates increased to around 5.92 percent during the fourth

quarter of 2003 but dropped to 5.60 percent during the first quarter of 2004.

These drops in the mortgage interest rate provided households with a

sustained opportunity to refinance to lower monthly payments or take equity

out of their homes for consumption and investment.

• The total number of refinance loans increased from approximately 2.5 million

in 2000 to more than 15 million in 2003.

• The total pre-tax payment savings available to households that refinanced

their loans between January 2001 and December 2003 grew to an estimated

$3.6 billion to $4.0 billion per month by year-end 2003, for a potential

cumulative mortgage payment savings of $54 billion to $61 billion through

March 2004.

• Household wealth, in the form of home equity, has increased substantially

because of house price appreciation. Many households have used their

mortgage payment savings to borrow against this increased home equity. For

example, households converted an estimated $139 billion of home equity into

cash in 2003 alone.

• Households have used the cashed-out equity to make improvements to their

homes. Approximately 35 percent of cashed-out equity has been used for

home improvement. Refinancing in 2003 alone helped fund approximately

$100 billion in home improvements. These improvements should contribute

further to the growth in home values.

• Households have also used the cashed-out equity to improve their financial

position. Households have used 47 percent of their cashed-out equity to pay

off high-cost consumer debt and make investments. The result is that

households are in a better position to spend and save in the future.

• Households at all income levels have taken advantage of opportunities to

refinance their mortgages. The most recent Home Mortgage Disclosure Act

(HMDA) data indicate that refinancing by low-income households increased

by more than 200 percent in 2002 from its 2000 level. Similarly, refinance

loans for moderate- and upper-income households increased by approximately

300 and 400 percent, respectively, from their 2000 levels.

• Minorities have also taken advantage of recent drops in the interest rate.

However, African-Americans and Hispanics continue to rely

disproportionately on higher-cost subprime loans to refinance.

The rest of the paper is as follows. Section II provides statistics on the recent

refinancing wave and compares it to previous periods of heavy refinancing in the 1990s.

Section III characterizes households’ motivations for refinancing and estimates the

impact of refinancing on household savings and consumption. Section IV provides

descriptive statistics on the demographics of households that have refinanced during the

latest refinance wave.

II. Refinance Activity and Mortgage Rates, 1990-2003

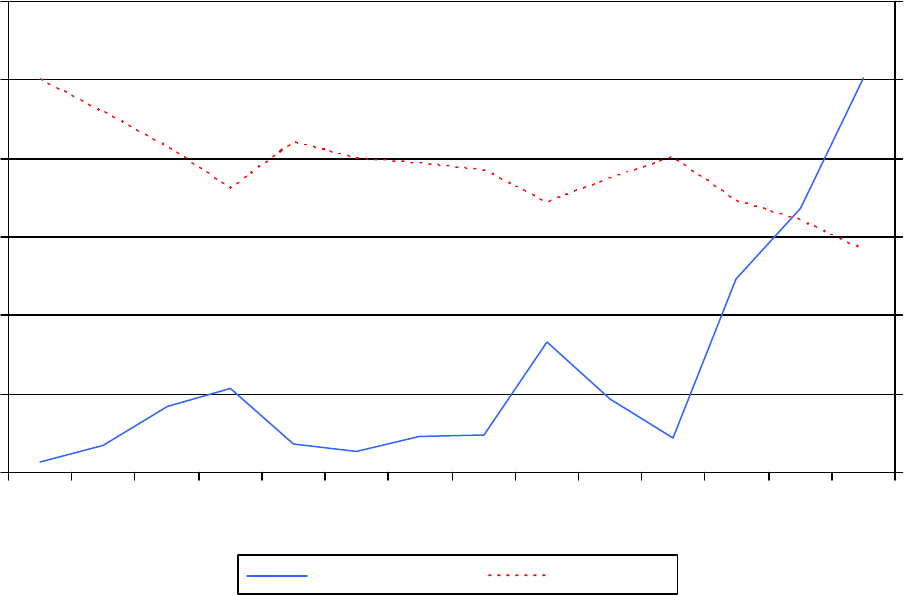

The total refinance volume increased dramatically beginning in 2001 and

continued through 2002 and into 2003. Households refinanced $1.2 trillion of mortgage

debt in 2001 and $1.7 trillion in 2002. The Mortgage Bankers Association (MBA)

estimates that 2003 was another record high year for refinancing, with loan refinances

totaling approximately $2.5 trillion.

1

The main reason for the increase in refinance

activity was a 21 percent drop in interest rates from 7.01 percent in the first quarter of

2001 to 5.52 percent in the second quarter of 2003.

2

(See Figure 1.)

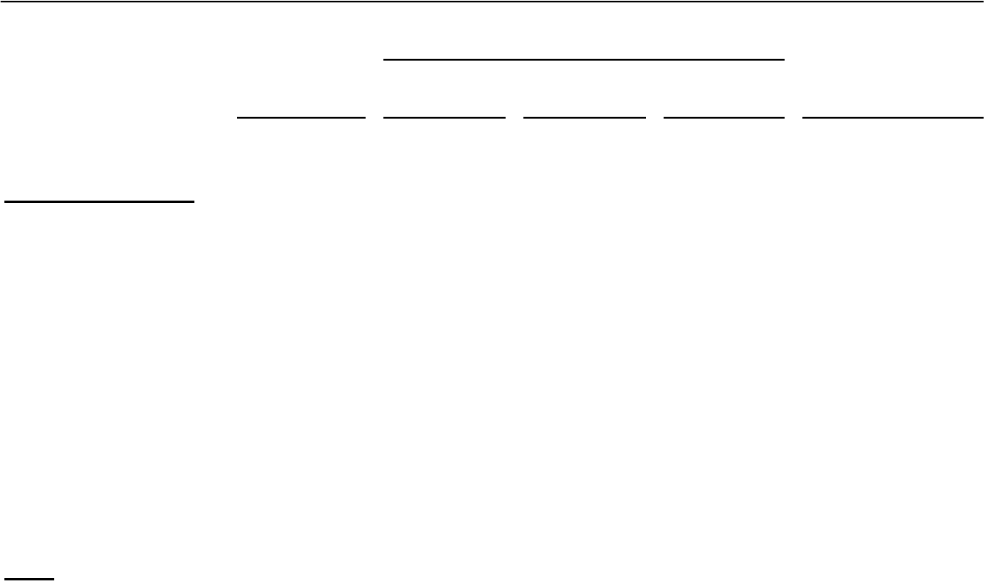

The main factor driving households’ decision to refinance is the difference

between the interest rate on their current mortgages and the interest rate they could obtain

by refinancing. As illustrated in Figure 2, the refinance share of total mortgage

originations increased most significantly from 1990 through 2003 whenever there was a

large drop in interest rates. The refinance share of overall mortgage originations rose

above 50 percent in 1993, 1998, and 2001 through the second quarter of 2003, when

interest rates had decreased by more than 100 basis points.

3

(See Figure 2.)

III. The Impact of Refinancing

The drop in interest rates beginning in 2001 and an increase in housing prices

have provided households with the opportunity to reduce monthly mortgage payments,

increase consumption, and restructure their debt and asset portfolios. This section

2

quantifies the payment savings available to households during the recent refinancing

wave and discusses how households have used those interest savings.

Many households have taken advantage of lower interest rates to reduce monthly

mortgage payments. The reduction in monthly mortgage payments has made a

corresponding amount of income available to fund additional consumption, savings, or

debt. Many households have chosen to borrow more than the amount needed to pay off

their old mortgage. These households “cashed out equity” and often used these funds to

pay off higher cost debt (e.g., credit card debt, second mortgages, and home equity lines

of credit), purchase goods and services, or increase their liquid assets.

A. Savings From Refinancing

Researchers at the Board of Governors of the Federal Reserve System report that

during 2001 and the first part of 2002 households used refinancing to take advantage of

lower interest rates or alter other terms of their mortgage. The Federal Reserve estimated

that, holding the other terms of the loans unchanged, the lower interest rates obtained by

refinancing households over this period would have saved $13.1 billion per year in

annual mortgage payments.

4

Further drops in the interest rate since the middle of 2002

(the end of the Federal Reserve sample period) have contributed to additional refinancing

and payment savings.

Freddie Mac reports data on the refinancing activity of conventional conforming

loans in its portfolio. These data include statistics on overall refinancing, the proportion

of loans taking cash out, the ratio of the old interest rate to the new interest rate, and the

average age of the loans.

5

Based on these data, HUD has estimated the potential

aggregate monthly payment savings from refinancing households’ existing unpaid

balance at the lower interest rate, all else equal. The estimate covers households that

have refinanced since the beginning of 2001 through the end of 2003. Table 1 reports

that the total aggregate pre-tax savings for all households that refinanced over this period

grew to an estimated $3.6 billion per month.

6

This estimate of potential mortgage

payment savings translates into a $54 billion cumulative mortgage payment savings

through March 2004 for all households that refinanced between January 2001 and

December 2003.

7

The cumulative mortgage payment savings in 2003 alone accounted

for $30 billion of the $54 billion savings. As discussed in Section III.B below, the pre-

tax savings estimates reported here are conservative estimates. That section considers

some alternative assumptions that yield higher estimates of payment savings.

Table 2 reports estimates of refinancing volume and monthly payments by Census

sub-region and by state. Households in California accounted for the highest share of

refinancing each year beginning with 2001. In 2003, for example, California accounted

for $624 billion of the $2.5 trillion in national refinancing. Table 2 also reports that the

total aggregate payment savings for all California households that refinanced in 2001

through 2003 was an estimated $0.89 billion per month.

8

3

B. Alternative Assumptions and Savings Estimates

The estimates of monthly payment savings reported above in Section III.A were

based on certain assumptions that suggest the reported savings may be somewhat

conservative. First, the assumption regarding cash payments of closing costs (2 percent)

may be too high, given that many consumers financed their closing costs by taking out a

higher rate mortgage.

9

Unfortunately, information is not available on the extent to which

refinancing homeowners pay closing costs by cash or by taking out a higher interest rate

loan. If cash-paid closing costs amounted to just one percent (half of the original

assumption), then the total aggregate savings per month for all households that refinanced

from 2001 through 2003 would increase from $3.6 billion to $3.9 billion per month;

cumulative mortgage payment savings through March 2004 would increase from $54

billion to $59 billion.

Also, the financial benefits reported in Section III.A are restricted to the savings

associated with the old unpaid balance that existed prior to refinancing. Thus, the

payment estimates in Section III.A do not include any financial benefit to the refinancing

homeowner from taking cash out or from increasing their new refinanced loan to pay off

existing second mortgages, home equity lines of credit, or consumer debt (such as credit

cards).

10

This benefit is not included in the payment savings reported in Section III.A. If

only one-fourth of cash-outs and payoffs of existing debt resulted in an average interest

rate reduction comparable to the change in payments savings, then the total aggregate

savings per month for all households that refinanced since the start of 2001 would

increase from $3.6 billion to $3.7 billion per month; cumulative mortgage payment

savings through March 2004 would increase from $54 billion to $56 billion.

While there is some uncertainty around these alternative assumptions (closing

costs and cash outs/mortgage consolidations), it is still useful to show their cumulative

effects on the payment savings. If the cash-paid closing cost assumption is reduced to

one percent and consumers receive interest-reduction benefits on one-fourth of the

volume of cash outs and second mortgage consolidations, then total aggregate savings per

month would increase from $3.6 billion to $4.0 billion per month; cumulative mortgage

payment savings through March 2004 would increase from $54 billion to $61 billion.

11

C. Cash-Out Refinances

Many households refinance their mortgages to reduce their monthly mortgage

payments and make additional monthly income available for increased consumption or

savings. Other households have chosen to borrow more than they need to pay off their

old mortgage and cash out home equity. The Federal Reserve researchers report that

approximately 45 percent of households that refinanced also took equity out of their

home. By comparison, they report that only 35 percent of households that refinanced

took equity out of their homes during the refinancing wave in 1998 and early 1999. They

cite more rapid house price appreciation and sharply rising consumer debt as reasons for

the higher cash-out rate during the current refinancing wave.

12

4

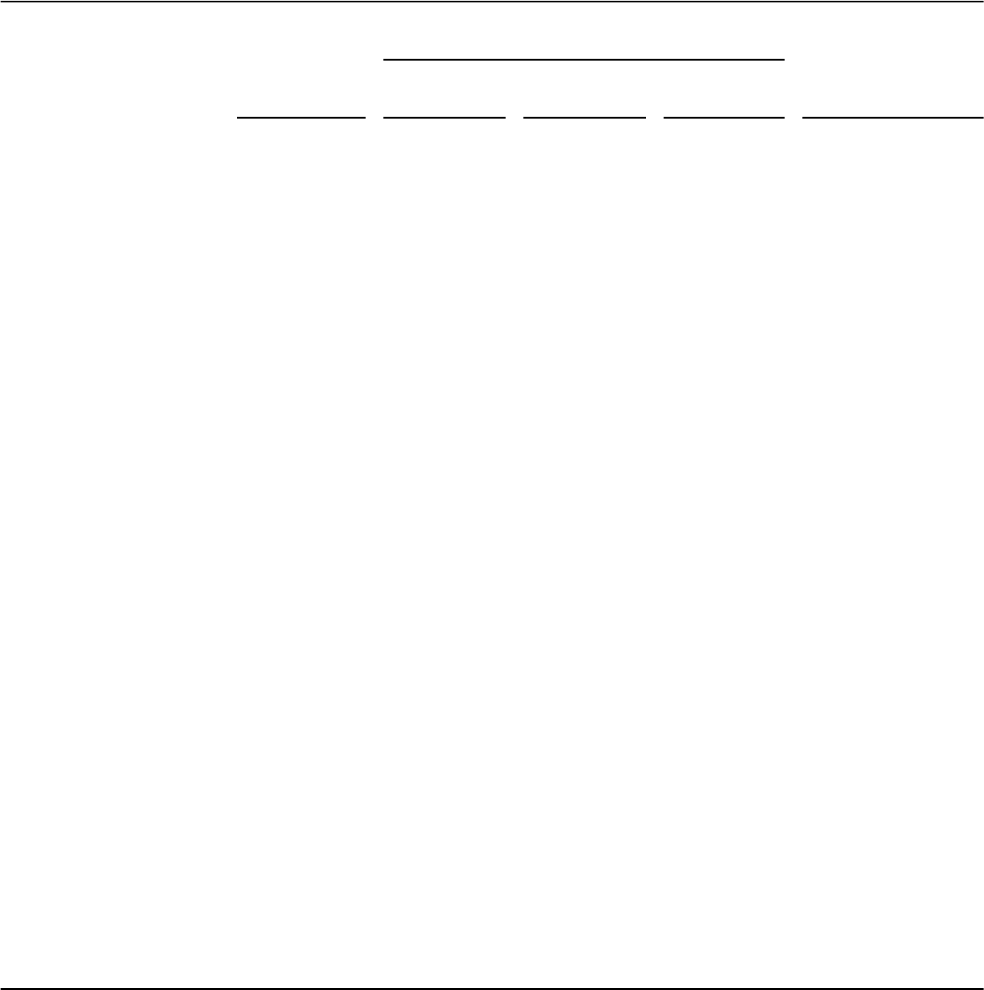

Freddie Mac economists estimate that households converted approximately $188

billion in home equity in 2001 and 2002. (See Figure 3.) They estimate that in 2003

alone, households converted approximately $139 billion in home equity to cash.

13

However, they conclude that rising housing prices replaced most of the reduction in home

equity that households cashed out in 2003.

14

Households have used recent home equity withdrawals for a variety of purposes.

The Federal Reserve researchers found that cash-out refinances were used for home

improvement (35 percent), consumer and other debt repayment (26 percent), consumer

expenditures (16 percent), and investment (21 percent).

15

Freddie Mac estimates that in

2003, cashed-out home equity helped fund more than $100 billion worth of home

improvements.

16

Researchers at the New York Federal Reserve Bank concluded that

households had used the cashed-out equity from the latest refinancing wave to reduce

higher-cost consumer debt and make more investments while still maintaining their same

rate of consumption. They concluded that the recent refinancing had improved

households’ balance sheets, leaving them in a better position to spend and save in the

future.

17

IV. Refinancing Statistics By Demographic Characteristics

As described in Section II, the drop in interest rates beginning in 2001 caused a

surge in overall refinance activity that continued into 2003. HUD’s analysis of HMDA

data show that the total number of refinance loans increased from approximately 2.5

million in 2000 to nearly 8 million in 2001, 10 million in 2002, and 15 million in 2003.

18

(See Figure 4.) This section breaks out the increase in refinancing by type of mortgage

product, household income, and racial or ethnic group.

Mortgage Product.

19

The absolute number of refinances increased dramatically

from 2000 levels for each mortgage type.(See Table 3.) In summary:

• Conventional prime refinance lending increased from 1,747,676 loans in 2000

to 6,555,410 in 2001 and 8,790,210 in 2002. Conventional prime refinance

loans were over 12.6 million in 2003.

• Conventional subprime refinance lending increased from 586,522 loans in

2000 to 732,424 loans in 2001 and 909,302 loans in 2002. Conventional

subprime refinance loans were over 1.2 million in 2003.

• Government-insured refinance loans increased from 65,410 in 2000 to

556,982 in 2001 and decreased slightly in 2002 to 539,918. Government-

insured refinance loans were approximately 922,000 in 2003.

The conventional prime and government-insured shares of overall refinances

increased in response to the decline in the interest rate. The subprime share of overall

refinance loans decreased from approximately 24 percent in 2000 to approximately 9

percent in 2001 through 2003. (See Table 3 and Figure 5.) The subprime share of

5

refinance lending declined because subprime refinancing is less responsive to interest

rates than prime and government-insured lending.

20

Therefore, a decrease in interest

rates will not lead to an increase in subprime refinancing that is proportional to the

increase in prime or government-insured lending.

Household Income. Low-income households have historically refinanced at a

slower rate than higher income households. However, since the recent drop in interest

rates, households at all income levels have taken advantage of the lower interest rates to

refinance their mortgages. Refinance loans for low-income households were 205% above

their 2000 level, an increase from 717,690 loans in 2000 to 2,191,489 loans in 2002.

Similarly, refinances for moderate-income and upper-income households in 2002 were

295% and 388% percent, respectively, above their 2000 levels.

21

(See Table 4.)

Household Racial or Ethnic Group. Refinance loans for African-Americans

increased from 173,696 loans in 2000 to 322,714 loans in 2001 and 389,562 loans in

2002. Refinance loans for Hispanics increased from 132,238 loans in 2000 to 399,026

loans in 2001 and 502,489 loans in 2002. (See Table 5a.)

Table 5b and Figure 6 show that African-Americans and Hispanics rely

disproportionately on FHA or subprime loans to refinance their mortgages. African-

Americans accounted for 3.8 percent of all refinance loans in 2002 but 9.2 percent of all

subprime refinance loans and 12.3 percent of all FHA-insured refinance loans. Hispanics

accounted for 4.9 percent of all refinances in 2002 but 8.0 percent of all subprime

refinances and 13.3 percent of all FHA-insured refinance loans.

Table 5b and Figure 7 show that African-Americans are more likely to refinance

their mortgages during periods of higher interest rates than other racial or ethnic groups.

African-Americans accounted for 7.1 percent of all refinance loans in 2000 when the

average interest rate was 8.04 percent compared to 3.8 percent of all refinance loans in

2002 when the average interest rate was 6.43 percent.

6

1

The Mortgage Bankers Association (MBA) is the source for the data on refinancing volume. See

http://www.mbaa.org/marketdata/forecasts/ffMAR2004.pdf

.

2

Interest rates increased from a low of 5.26 percent during the month of June 2003 to 5.92 percent during

the fourth quarter of 2003. In February 2004, interest rates dropped to 5.64 percent. See Freddie Mac

Survey of Commitment Rate and Points, Monthly Average 30-Year Fixed Rate Mortgages Since 1971

posted at www.mbaa.org/marketdata/data/02/fm30yr_rates.htm. See also www.freddiemac.com/pmms.

MBA also publishes interest rate survey data, which is available at

http://www.mbaa.org/marketdata/data/01/mba30yr_rates.htm

.

3

MBA is the source of the refinance share of total loan volume. See

www.mortgagebankers.org/marketdata/data/03/1-4_originations.html

.

4

Glenn Canner, Karen Dynan, and Wayne Passmore, “Mortgage Refinancing in 2001 and Early 2002,”

Federal Reserve Bulletin

, December 2002.

5

The Freddie Mac data are for conventional conforming loans. Thus, they exclude jumbo conventional

loans (i.e., conventional loans over the conforming loan limit, which was $322,700 in 2003) and

government loans (mainly loans insured by the Federal Housing Administration or guaranteed by the

Veterans Administration). See http://www.freddiemac.com/news/finance/data.html

.

6

The estimate of mortgage payment savings is a pre-tax measure since mortgage interest is tax deductible.

HUD estimates are based on MBA refinance volume data and data from Freddie Mac’s Primary Mortgage

Market Survey data and Cash-Out Refinancing Report. See www.freddiemac.com/pmms and

www.freddiemac.com/news/finance/cashout_faq.html

. HUD’s estimate of potential mortgage payment

savings is based on refinancing the household’s existing unpaid principal balance (UPB) at the lower

interest rate, everything else constant. HUD uses the Freddie Mac data for the share of cash-outs and

consolidations to convert the MBA total refinance volume (which includes cash-out refinances, closing

costs, and consolidation of home equity seconds and lines of credit) into an estimate of the unpaid principal

balance that existed prior to the refinancing. HUD assumes that the new refinance loan amount is equal to

the old (or pre-refinance) UPB plus closing costs equal to 2 percent of the UPB; this follows Canner,

Dynan, and Passmore, op. cit. As discussed in the text, this closing cost adjustment may be high given that

many households choose a higher interest rate and pay no costs at closing. Furthermore, as also discussed

in the text, there may be additional payment savings from the use of cash-outs and from the refinancing of

home equity seconds and lines of credit. Finally, HUD’s estimate is based on the remaining maturity of the

mortgage for the average household and does not adjust for the fact that many households obtain a further

reduction in their monthly mortgage payments by extending the length of their mortgages. The estimate

does not adjust for households that do not have a reduction in monthly mortgage payments because they

convert their mortgages into shorter-term mortgages. For example, a significant number of households take

advantage of lower interest rates to convert to 15-year mortgages. While these households may continue to

pay the same monthly mortgage payment, they still realize a significant total interest cost savings over the

lives of their new loans.

7

The calculation of the $54 billion in cumulative monthly pre-tax savings assumes that homeowners who

refinanced in any particular quarter between January 2001 and December 2003 receive payment savings

through March 2004, with the payment savings starting in the quarter after they refinanced. HUD estimates

are based on data from Freddie Mac’s Primary Mortgage Market Survey

data and Cash-Out Refinancing

Report. See www.freddiemac.com/pmms and www.freddiemac.com/news/finance/cashout_faq.html.

8

Source: HUD tabulation of Home Mortgage Disclosure Act (HMDA) data and MBA data for refinance

volume. State breakouts are estimated using mortgage shares from HMDA data. Loans reported under

HMDA are primarily for properties in metropolitan areas. See

www.mortgagebankers.org/marketdata/data/03/1-4_originations.html

for MBA data.

7

9

In this case, the closing costs would be completely (in the case of the so-called “zero-closing-cost” loan)

or partially financed through a “yield spread premium”, which is the extra amount (i.e., price over par

value) that lenders receive when selling loans with above-market interest rates. Essentially, the borrower

accepts a higher interest rate and monthly payment in order to avoid paying the closing costs with higher

upfront charges. In that case, HUD’s payment calculations would reflect the closing costs through a higher

monthly payment on the refinanced loan (due to the higher interest rate on the refinanced loan). If overall

closing costs are three percent of the loan amount, HUD’s two percent assumption implicitly assumes that

one percent is paid through yield spread premiums. If refinance loans have lower closing costs than three

percent, or if more than one percent is paid through yield spread premiums, then the two percent closing

cost assumption for upfront and cash-paid closing costs in HUD’s base model would be too high.

10

In the case of a traditional home equity line of credit, the homeowner is paying only current market rates

to begin with, so there is no monthly payment savings from replacing an old, higher rate loan with a new,

lower current-market rate loan. This is the basic rationale for using the Freddie Mac data to exclude these

payoffs of home equity loans from the monthly payment calculations. However, some home equity second

mortgages that are paid off with the proceeds may have high interest rates, thus resulting in monthly

payment savings to the refinancing homeowner.

11

The savings reported in the text are pre-tax payment savings. Post-tax savings will be lower because

those refinancing households that itemize will have less mortgage interest to deduct, which will increase

their taxable income and their federal and state income taxes. The Federal Reserve researchers (Canner,

Dynan, Passmore, op. cit.) provided one approach for estimating th

e net savings after accounting for federal

and state taxes. They calculated a post-tax estimate of savings by multiplying (a) 83 percent (the ratio of

home mortgage interest deducted to total mortgage interest paid by homeowners in 1999) times

(b) 26

percent (the average marginal federal tax rate of taxpayers deducting their mortgage interest in 1999 was

estimated to be 21 percent and the average marginal state tax rate was assumed to be 5 percent.) Given the

recent decrease in tax rates, the estimated marginal federal tax rate may be slightly lower than the 1999

level of 21 percent. Still, the Federal Reserve researchers’ approach can be used to provide a rough

estimate of the impact of incorporating taxes into the analysis. Assuming that the $3.6-$4.0 billion in

monthly payment savings consisted of interest savings (nearly true in the first few years of mortgage

amortization), then the increase in homeowners’ income taxes would be obtained by multiplying (a) 0.83

times

(b) 0.26 times (c) $3.6-$4.0 billion, which yields $0.77-$0.86 billion. Deducting this from the $3.6-

$4.0 billion in pre-tax savings yields $2.8-$3.1 billion in post-tax savings. Under these assumptions, the

cumulative pre-tax savings of $54-$61 billion would be $42-$48 billion on an after-tax basis.

12

See Canner, Dynan, and Passmore, op. cit.

13

By comparison, households converted approximately $40 billion in home equity to cash during the 1998

refinance wave. See Freddie Mac’s Cash-Out Refinancing Report, which is available at

www.freddiemac.com/news/finance/data.html

.

14

“Share of Home Refinancings Taking Cash Out Grows As Overall Refi Levels Begin To Wane In Fourth

Quarter 2003,” Freddie Mac. February 4, 2004. See also www.mbaa.org/briefs/04/0204fm.html.

15

See Canner, Dynan, and Passmore, op. cit.

16

“Share of Home Refinancings Taking Cash Out Grows As Overall Refi Levels Begin To Wane In Fourth

Quarter 2003,” Freddie Mac. February 4, 2004. See also www.mbaa.org/briefs/04/0204fm.html

.

17

Margaret M. McConnell, Richard W. Peach, and Alex Al-Haschimi, “After the Refinancing Boom: Will

Consumers Scale Back Their Spending?” Current Issues in Economics and Finance, December 2003.

18

Source: HUD tabulations of Home Mortgage Disclosure Act (HMDA) data. HMDA data comprise the

most comprehensive public database on mortgages in the United States. Policymakers and researchers

8

have used these data extensively to examine mortgage market trends and patterns of affordable lending at

the national and local levels. HMDA data are not without their limitations. Although most lenders are

required to report under HMDA (and these lenders account for the majority of mortgages originated in the

United States), HMDA data are not a complete census of mortgage lenders and mortgage activity. For

more information on HMDA data, see www.ffiec.gov

. HMDA data do not have a field that identifies

subprime and manufactured home loans. HUD annually compiles a list of subprime and manufactured

home lender specialists that report HMDA data.

19

The mortgage origination data reported in this section are derived from HUD tabulations of HMDA data.

20

Government-insured lending includes FHA loans, Veterans Administration (VA) loans, and Rural

Housing Service (RHS) loans.

21

Low-income is defined as no more than 80 percent of area median income, moderate-income is 80 to 120

percent, and upper-income is more than 120 percent.

9

Figure 1

Refinancing Volume By Interest Rate

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

0

2

4

6

8

10

12

Refinance Volume (Billions)

Interest Rate

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003

Refinance Volume Interest Rate

Source: MBA

Figure 2

30 Year Fixed Interest Rate

By Refinance Share of Total Loan Volume (1990-2002)

0

10

20

30

40

50

60

70

0

2

4

6

8

10

12

Refinance Share

Interest Rate

1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

iRef nance Share Interest Rate

Source: MBA data

Figure 3

Cashed-Out Home Equity

2

22

42

62

82

0

1

2

3

4

5

6

7

8

9

Cashed-Out Home Equity (in Billions)

102

122

142

162

Interest Rate

1996 1997 1998 1999 2000 2001 2002 2003

Cashed-Out Home Equity Interest Rate

Source: Freddie Mac

Figure 4

Overall Refinance Activity (Loans)

0

2

4

6

8

10

12

0

1

2

3

4

5

6

7

8

9

Interest Rate

Refinance Loans (Millions)

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Total Interest Rate

Source: HUD tabulation of HMDA data

Figure 5

Subprime Share of Refinance Loans

4

9

14

19

24

29

0

1

2

3

4

5

6

7

8

9

Refinance Share

Interest Rate

1995 1996 1997 1998 1999 2000 2001 2002

Subprime Share Interest Rate

Source: HUD tabulation of HMDA data

Figure 6

Share of 2002 Refinance Loans

By Mortgage Product and Racial or Ethnic Group

Refinance Share

72

62

52

42

32

22

12

2

African American Hispanic White

All Subprime FHA

Source: HUD tabulation of HMDA data

Figure 7

Share of Refinance Loans

By Mortgage Product and Racial or Ethnic Group

2

3

4

5

6

7

8

0

1

2

3

4

5

6

7

8

9

Refinance Share

Interest Rate

1996 1997 1998 1999 2000 2001

African American Share Hispanic Share Interest Rate

Source: HUD tabulation of HMDA data

2002

Table 1

Mortgage Payment Savings For January 2001 Through December 2003

Year Quarter Interest Rate

Originations

($billions)

MBA

Refinance

Percentage

MBA

Total

Refinance

Volume

($billions)

Cash-Out

Refinance

%

(Freddie

Mac

)

Cash-Out

Refinance and

Home Equity

Consolidation %

(

Freddie Mac

)

Median of

Old/New

Rate

Implied

Rate

Median Age of

Refinanced

Loan

Monthly Payment

Savings (Billions)

Annual Payment

Savings (Billions)

2001 1 7.01% $418 54% $226 8.7% 14.2% 1.16 8.13% 1.6 $0.12 $1.45

2 7.13% $579 53% $307 8.7% 14.2% 1.15 8.20% 2.5 $0.15 $1.83

3 6.97% $507 46% $233 8.7% 14.2% 1.14 7.94% 2.7 $0.10 $1.23

4 6.78% $739 70% $517 8.7% 14.2% 1.19 8.07% 2.8 $0.32 $3.84

$2,243 $1,283 $0.70 $8.35

2002 1 6.97% $518 58% $300 8.0% 12.3% 1.16 8.08% 3.4 $0.16 $1.90

2 6.82% $552 43% $237 8.0% 12.3% 1.14 7.77% 3.4 $0.10 $1.23

3 6.29% $774 61% $472 8.0% 12.3% 1.19 7.49% 2.9 $0.27 $3.22

4 6.08% $1,010 74% $747 8.0% 12.3% 1.22 7.41% 2.4 $0.49 $5.84

$2,854 $1,757 $1.02 $12.19

2003 1 5.84% $794 71% $564 7.1% 10.9% 1.23 7.18% 1.9 $0.37 $4.50

2 5.52% $1,187 71% $843 7.1% 10.9% 1.26 6.95% 1.7 $0.60 $7.21

3 6.01% $1,199 68% $815 7.1% 10.9% 1.28 7.70% 1.7 $0.71 $8.57

4 5.92% $633 49% $310 7.1% 10.9% 1.22 7.22% 2.2 $0.20 $2.38

$3,813 $2,532 $1.89 $22.66

3-Year Tota

l

$3.60 $43.20

Table 2

Refinance Volume and Monthly Payment Savings

By State

Share

Refinance Originations (Billions)

Monthly

of National Payment Savings

Refinances 2001 2002 2003 (Billions)

National 100.00% $1,233.65 $1,682.68 $2,514.60 $3.6000

Census Sub-Region

New England 6.8% $83.82 $114.33 $170.85 $0.2446

Middle Atlantic 10.1% $125.20 $170.78 $255.21 $0.3654

East North Central 16.6% $204.60 $279.08 $417.05 $0.5971

West North Central 5.5% $67.36 $91.88 $137.31 $0.1966

South Atlantic 15.7% $194.27 $264.98 $395.98 $0.5669

East South Central 2.9% $36.07 $49.20 $73.53 $0.1053

West South Central 4.2% $51.56 $70.33 $105.10 $0.1505

Mountain 8.1% $100.32 $136.84 $204.49 $0.2928

Pacific 28.9% $356.30 $485.99 $726.26 $1.0397

Alaska and Hawaii 0.5% $6.70 $9.14 $13.65 $0.0195

Puerto Rico 0.6% $7.44 $10.15 $15.17 $0.0217

State

Alaska 0.13% $1.60 $2.18 $3.26 $0.0047

Alabama 0.73% $8.97 $12.24 $18.29 $0.0262

Arkansas 0.32% $3.94 $5.37 $8.03 $0.0115

Arizona 2.07% $25.57 $34.87 $52.12 $0.0746

California 24.80% $305.97 $417.34 $623.67 $0.8929

Colorado 3.37% $41.51 $56.62 $84.62 $0.1211

Connecticut 1.57% $19.38 $26.43 $39.50 $0.0565

District of Columbia 0.26% $3.21 $4.38 $6.55 $0.0094

Delaware 0.29% $3.52 $4.80 $7.18 $0.0103

Florida 4.05% $50.01 $68.21 $101.94 $0.1459

Georgia 2.55% $31.47 $42.93 $64.15 $0.0918

Hawaii 0.42% $5.14 $7.01 $10.47 $0.0150

Iowa 0.51% $6.29 $8.58 $12.83 $0.0184

Idaho 0.34% $4.21 $5.74 $8.57 $0.0123

Illinois 5.26% $64.93 $88.56 $132.35 $0.1895

Indiana 1.63% $20.08 $27.39 $40.94 $0.0586

Kansas 0.60% $7.44 $10.15 $15.16 $0.0217

Kentucky 0.79% $9.72 $13.26 $19.82 $0.0284

Louisiana 0.63% $7.74 $10.56 $15.78 $0.0226

Massachusetts 3.91% $48.19 $65.73 $98.22 $0.1406

Maryland 2.59% $32.01 $43.66 $65.24 $0.0934

Table 2 (Continued)

Refinance Volume and Monthly Payment Savings

By State

Share Refinance Originations (Billions) Monthly

of National Payment Savings

Refinances 2001 2002 2003 (Billions)

Maine 0.28% $3.51 $4.79 $7.16 $0.0102

Michigan 4.55% $56.10 $76.52 $114.35 $0.1637

Minnesota 2.22% $27.44 $37.43 $55.94 $0.0801

Missouri 1.65% $20.34 $27.74 $41.45 $0.0593

Mississippi 0.33% $4.11 $5.60 $8.37 $0.0120

Montanna 0.17% $2.06 $2.81 $4.20 $0.0060

North Carolina 2.13% $26.26 $35.81 $53.52 $0.0766

North Dakota 0.06% $0.78 $1.06 $1.58 $0.0023

Nebraska 0.33% $4.08 $5.56 $8.32 $0.0119

New Hampshire 0.50% $6.13 $8.36 $12.49 $0.0179

New Jersey 3.80% $46.93 $64.01 $95.66 $0.1369

New Mexico 0.37% $4.61 $6.28 $9.39 $0.0134

Nevada 0.79% $9.73 $13.27 $19.84 $0.0284

New York 3.35% $41.34 $56.39 $84.27 $0.1206

Ohio 3.21% $39.54 $53.94 $80.60 $0.1154

Oklahoma 0.41% $5.08 $6.93 $10.36 $0.0148

Oregon 1.26% $15.53 $21.18 $31.65 $0.0453

Pennsylvania 3.05% $37.68 $51.39 $76.80 $0.1099

Rhode Island 0.41% $5.11 $6.97 $10.42 $0.0149

South Carolina 0.92% $11.39 $15.53 $23.21 $0.0332

South Dakota 0.11% $1.41 $1.92 $2.87 $0.0041

Tennessee 1.09% $13.49 $18.41 $27.50 $0.0394

Texas 2.85% $35.11 $47.89 $71.57 $0.1025

Utah 0.99% $12.19 $16.63 $24.85 $0.0356

Virgina 2.86% $35.24 $48.07 $71.83 $0.1028

Vermont 0.16% $2.01 $2.75 $4.10 $0.0059

Washington 3.00% $36.96 $50.42 $75.34 $0.1079

Wisconsin 2.04% $25.20 $34.37 $51.36 $0.0735

West Virginia 0.19% $2.34 $3.20 $4.77 $0.0068

Wyoming 0.09% $1.06 $1.45 $2.16 $0.0031

Source: HMDA Data for Refinance Share, MBA Data for Refinance Originations

Table 3

Refinance Activity By Mortgage Product (Number of Refinance Loans)

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Conventional Prime 5,193,426 2,041,197 1,345,499 2,057,989 2,029,925 5,301,244 3,314,756 1,747,676 6,555,410 8,790,210

Conventional Subprime 69,318 118,594 151,164 302,529 536,742 763,937 757,077 586,522 732,424 909,302

Manufactured Home 9,368 40,379 38,841 45,234 58,317 89,014 53,193 33,993 32,558 13,430

FHA 581,315 203,240 64,286 111,598 106,503 334,823 183,190 58,012 405,703 379,696

VA 244,337 115,874 38,799 59,155 56,765 215,632 77,464 7,027 150,560 158,407

RHS 665 508 270 1,282 1,111 564 555 371 719 1,815

Total 6,098,429 2,519,792 1,638,859 2,577,787 2,789,363 6,705,214 4,386,235 2,433,601 7,877,374 10,252,860

Conventional Prime 85.2% 81.0% 82.1% 79.8% 72.8% 79.1% 75.6% 71.8% 83.2% 85.7%

Conventional Subprime 1.1% 4.7% 9.2% 11.7% 19.2% 11.4% 17.3% 24.1% 9.3% 8.9%

Manufactured Home 0.2% 1.6% 2.4% 1.8% 2.1% 1.3% 1.2% 1.4% 0.4% 0.1%

FHA 9.5% 8.1% 3.9% 4.3% 3.8% 5.0% 4.2% 2.4% 5.2% 3.7%

VA 4.0% 4.6% 2.4% 2.3% 2.0% 3.2% 1.8% 0.3% 1.9% 1.5%

RHS 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Source: HMDA data.

Note: HMDA does not have a field that identifies subprime and manufactured home loans. HUD annually compiles a list

of subprime and manufactured home specialists that report under HMDA.

Table 4

Mortgage Refinancing by Borrower Income (Number of Refinance Loans)

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

Percent of the Area

Median Income

Not More Than 50% 159,832 117,203 80,874 141,086 184,618 333,118 342,636 235,641 444,843 574,777

50-60% 132,024 79,386 57,252 97,745 124,247 233,095 226,576 145,802 341,940 448,660

60-80% 430,906 216,114 148,267 254,952 314,122 615,858 543,049 336,247 887,215 1,168,052

Low-Income 722,762 412,703 286,393 493,783 622,987 1,182,071 1,112,261 717,690 1,673,998 2,191,489

80-90% 281,350 121,986 81,739 139,292 169,828 352,455 282,720 167,687 484,950 627,080

90-100% 310,832 128,174 86,178 146,192 171,969 357,013 275,678 164,117 494,179 636,881

100-120% 619,625 237,882 158,957 266,242 318,221 669,707 505,850 286,617 914,832 1,177,021

Moderate-Income 1,211,807 488,042 326,874 551,726 660,018 1,379,175 1,064,248 618,421 1,893,961 2,440,982

120-150% 807,054 282,433 190,369 311,907 373,943 820,769 580,040 320,066 1,104,673 1,418,783

More Than 150% 1,879,690 632,719 414,437 614,815 767,640 1,719,016 1,175,317 615,727 2,346,998 3,147,635

Upper-Income 2,686,744 915,152 604,806 926,722 1,141,583 2,539,785 1,755,357 935,793 3,451,671 4,566,418

Not Available 1,477,116 703,895 420,786 605,556 364,775 1,604,183 454,369 161,697 857,744 1,053,971

Total 6,098,429 2,519,792 1,638,859 2,577,787 2,789,363 6,705,214 4,386,235 2,433,601 7,877,374 10,252,860

Source: HMDA data.

Note: Low-income is defined as no more than 80 percent of area median, moderate-income

is 80 to 120 percent, and upper-income is more than 120 percent.

Table 5a

Refinance Activity By Mortgage Product and Racial or Ethnic Group (Number of Refinance Loans)

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

All

American Indian 19,797 10,587 6,125 7,880 8,427 18,997 14,194 8,285 20,076 30,313

Asian 233,889 81,959 40,218 54,475 59,403 172,128 102,960 46,226 234,169 368,124

African American 160,344 130,238 99,203 146,776 173,942 303,504 259,583 173,696 322,714 389,562

Hispanic 197,942 118,340 70,590 97,137 102,351 246,124 206,811 132,238 399,026 502,489

White 5,006,151 1,954,321 1,250,286 1,949,022 2,003,522 4,930,153 2,933,707 1,494,670 5,230,102 6,718,821

Other 30,010 16,737 13,150 18,710 30,393 61,452 37,781 17,228 69,349 133,671

Not Provided 300,883 143,659 119,546 243,428 346,079 818,403 733,365 513,861 1,426,106 1,878,922

Not Applicable 28,676 12,958 10,514 16,446 18,042 30,529 22,226 12,477 33,557 34,699

Joint 120,737 50,993 29,227 43,913 47,204 123,924 75,608 34,920 142,275 196,259

Total 6,098,429 2,519,792 1,638,859 2,577,787 2,789,363 6,705,214 4,386,235 2,433,601 7,877,374 10,252,860

Subprime

American Indian 222 412 460 1,012 1,705 2,517 3,643 2,345 2,224 3,622

Asian 3,506 2,869 2,224 3,832 6,678 10,195 9,553 7,619 13,354 20,135

African American 9,466 18,958 24,710 44,534 74,058 102,339 104,796 80,613 72,072 84,043

Hispanic 4,183 7,284 7,544 13,150 21,571 32,220 36,586 32,505 46,042 72,645

White 40,207 66,195 77,485 152,738 269,025 358,262 330,040 252,187 297,973 381,736

Other 784 1,541 3,382 3,915 8,095 7,564 7,059 3,696 7,083 11,544

Not Provided 9,243 18,806 32,887 75,783 144,748 235,348 251,074 200,104 282,326 319,962

Not Applicable 474 565 685 3,956 4,137 7,690 6,675 1,341 2,751 2,535

Joint 1,233 1,964 1,787 3,609 6,725 7,802 7,651 6,112 8,599 13,080

Grand Total 69,318 118,594 151,164 302,529 536,742 763,937 757,077 586,522 732,424 909,302

FHA

American Indian 2,943 1,112 262 530 517 2,305 903 391 1,452 1,958

Asian 10,088 3,569 1,114 1,766 1,924 5,796 2,801 958 6,243 6,029

African American 30,408 17,911 6,862 11,624 11,423 35,083 22,444 8,536 50,525 46,705

Hispanic 38,659 21,216 7,659 12,058 15,956 38,589 22,007 7,749 54,257 50,624

White 423,554 131,451 40,805 70,453 64,980 206,470 102,018 33,320 223,100 201,565

Other 2,449 1,488 837 899 1,077 3,339 2,041 530 4,425 4,445

Not Provided 51,890 20,808 4,824 11,162 7,431 33,256 26,558 5,251 55,447 59,146

Not Applicable 7,612 1,394 530 703 837 1,914 653 221 1,671 1,384

Joint 13,712 4,291 1,393 2,403 2,358 8,071 3,765 1,056 8,583 7,840

Grand Total 581,315 203,240 64,286 111,598 106,503 334,823 183,190 58,012 405,703 379,696

Source: HMDA data.

Table 5b

Refinance Share By Mortgage Product and Racial or Ethnic Group

1993 1994 1995 1996 1997 1998 1999 2000 2001 2002

All

American Indian 0.3% 0.4% 0.4% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.3%

Asian 3.8% 3.3% 2.5% 2.1% 2.1% 2.6% 2.3% 1.9% 3.0% 3.6%

African American 2.6% 5.2% 6.1% 5.7% 6.2% 4.5% 5.9% 7.1% 4.1% 3.8%

Hispanic 3.2% 4.7% 4.3% 3.8% 3.7% 3.7% 4.7% 5.4% 5.1% 4.9%

White 82.1% 77.6% 76.3% 75.6% 71.8% 73.5% 66.9% 61.4% 66.4% 65.5%

Other 0.5% 0.7% 0.8% 0.7% 1.1% 0.9% 0.9% 0.7% 0.9% 1.3%

Not Provided 4.9% 5.7% 7.3% 9.4% 12.4% 12.2% 16.7% 21.1% 18.1% 18.3%

Not Applicable 0.5% 0.5% 0.6% 0.6% 0.6% 0.5% 0.5% 0.5% 0.4% 0.3%

Joint 2.0% 2.0% 1.8% 1.7% 1.7% 1.8% 1.7% 1.4% 1.8% 1.9%

Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Sub

p

rime

American Indian 0.3% 0.3% 0.3% 0.3% 0.3% 0.3% 0.5% 0.4% 0.3% 0.4%

Asian 5.1% 2.4% 1.5% 1.3% 1.2% 1.3% 1.3% 1.3% 1.8% 2.2%

African American 13.7% 16.0% 16.3% 14.7% 13.8% 13.4% 13.8% 13.7% 9.8% 9.2%

Hispanic 6.0% 6.1% 5.0% 4.3% 4.0% 4.2% 4.8% 5.5% 6.3% 8.0%

White 58.0% 55.8% 51.3% 50.5% 50.1% 46.9% 43.6% 43.0% 40.7% 42.0%

Other 1.1% 1.3% 2.2% 1.3% 1.5% 1.0% 0.9% 0.6% 1.0% 1.3%

Not Provided 13.3% 15.9% 21.8% 25.0% 27.0% 30.8% 33.2% 34.1% 38.5% 35.2%

Not Applicable 0.7% 0.5% 0.5% 1.3% 0.8% 1.0% 0.9% 0.2% 0.4% 0.3%

Joint 1.8% 1.7% 1.2% 1.2% 1.3% 1.0% 1.0% 1.0% 1.2% 1.4%

Grand Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

FHA

American Indian 0.5% 0.5% 0.4% 0.5% 0.5% 0.7% 0.5% 0.7% 0.4% 0.5%

Asian 1.7% 1.8% 1.7% 1.6% 1.8% 1.7% 1.5% 1.7% 1.5% 1.6%

African American 5.2% 8.8% 10.7% 10.4% 10.7% 10.5% 12.3% 14.7% 12.5% 12.3%

Hispanic 6.7% 10.4% 11.9% 10.8% 15.0% 11.5% 12.0% 13.4% 13.4% 13.3%

White 72.9% 64.7% 63.5% 63.1% 61.0% 61.7% 55.7% 57.4% 55.0% 53.1%

Other 0.4% 0.7% 1.3% 0.8% 1.0% 1.0% 1.1% 0.9% 1.1% 1.2%

Not Provided 8.9% 10.2% 7.5% 10.0% 7.0% 9.9% 14.5% 9.1% 13.7% 15.6%

Not Applicable 1.3% 0.7% 0.8% 0.6% 0.8% 0.6% 0.4% 0.4% 0.4% 0.4%

Joint 2.4% 2.1% 2.2% 2.2% 2.2% 2.4% 2.1% 1.8% 2.1% 2.1%

Grand Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Source: HMDA data.