WP/06/80

A Practical Model-Based Approach to

Monetary Policy Analysis—Overview

Andrew Berg, Philippe Karam, and Douglas Laxton

© 2006 International Monetary Fund WP/06/80

IMF Working Paper

Policy Development and Review Department, Research Department, and IMF Institute

A Practical Model-Based Approach to Monetary Policy Analysis—Overview

Prepared by Andrew Berg, Philippe Karam, and Douglas Laxton

1

Authorized for distribution by Andrew Berg, Gian Maria Milesi-Ferretti, and Ralph Chami

March 2006

Abstract

This Working Paper should not be reported as representing the views of the IMF.

The views expressed in this Working Paper are those of the author(s) and do not necessarily represent

those of the IMF or IMF policy. Working Papers describe research in progress by the author(s) and are

published to elicit comments and to further debate.

This paper motivates and describes an approach to forecasting and monetary policy analysis

based on the use of a simple structural macroeconomic model, along the lines of those in use

in a number of central banks. It contrasts this approach with financial programming and its

emphasis on monetary aggregates, as well as with more econometrically driven analyses. It

presents illustrative results from an application to Canada. A companion paper provides a

more detailed how-to guide and introduces a set of tools designed to facilitate this approach.

JEL Classification Numbers: E52, E47, C51

Keywords: Monetary policy, forecasting and simulation, model construction, and estimation

Author(s) E-Mail Address: aberg@imf.org, [email protected], dlaxton@imf.org

1

The framework outlined here is being used by several IMF desk economists who meet regularly to share

experiences, solve problems, and present results—Ricardo Adrogue, Zsofia Arvai, Roberto Benelli, Natan Epstein,

Thomas Harjes, Ben Hunt, Jorge Canales Kriljenko, Irineu Evangelista de Carvalho Filho, Roberto Garcia-Saltos,

Eva Jenkner, Meral Karasulu, Daniel Leigh, Rodolfo Luzio, Vincent Moissinac, Susanna Mursula, Papa N’Diaye,

Anton Nakov, Hang Thi Thu Nguyen, Luca Ricci, Pau Rabanal, and Ivan Tchakarov. We would like to thank

Alin Mirestean and Kexue Liu for providing support to new members of the team. We thank Jamie Armour,

André Binette, and Patrick Perrier (Bank of Canada), and David Reifschneider (Federal Reserve Board) who

generously shared data and simulation results. We also thank Shekhar Aiyar, Andrew Feltenstein,

Charles Freedman, Peter Isard, Gian Maria Milesi-Ferretti, G. Russell Kincaid, Tohkir Mirzoev, and

Carlo Sdralevich for their helpful comments on an earlier draft, Pille Snydstrup for editorial assistance, and

Asmahan Bedri and Lei Lei Myaing for their work on the graphs and tables.

- 2 -

Contents Page

I. Introduction ........................................................................................................................... 3

II. Monetary Policy Analysis at the Fund................................................................................. 5

A. Financial Programming as a Tool for Monetary Policy Analysis.................................... 5

B. Econometric Models ........................................................................................................ 8

III. Macroeconomic Modeling.................................................................................................. 9

A. The Role of Macroeconomic Models............................................................................... 9

B. The Model ...................................................................................................................... 11

IV. Building the Model........................................................................................................... 17

V. Forecasting and Policy Analysis........................................................................................ 20

VI. An Example. ..................................................................................................................... 22

A. Overview........................................................................................................................ 22

B. Building the model......................................................................................................... 23

C. Using the Model for Forecasting and Policy Analysis at the IMF................................. 25

VII. Caveats and Future Work................................................................................................ 27

VIII. Conclusions.................................................................................................................... 29

References............................................................................................................................... 39

Tables

1. Baseline Forecast with Desk Judgment – WEO Scenario...................................................36

2. Canada: Canadian Interest Rate Shock – One Quarter Increase of 100 b.p. .....................37

3. United States: U.S. Interest Rate Shock – One Quarter Increase of 100 b.p. ....................38

Figures

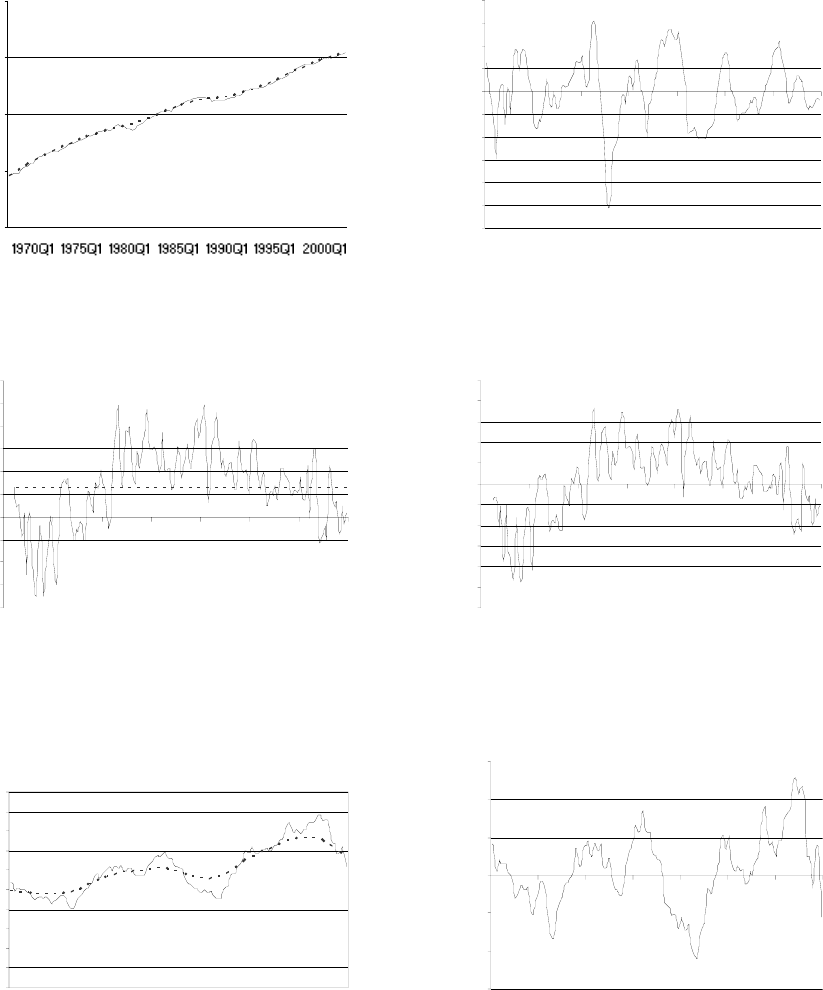

1. Output Growth, Inflation, Interest Rates, and Exchange Rates: Canada and the United

States………………………………………………………………………………………31

2. Model Variables for Canada................................................................................................32

3. Model Variables for the United States.................................................................................33

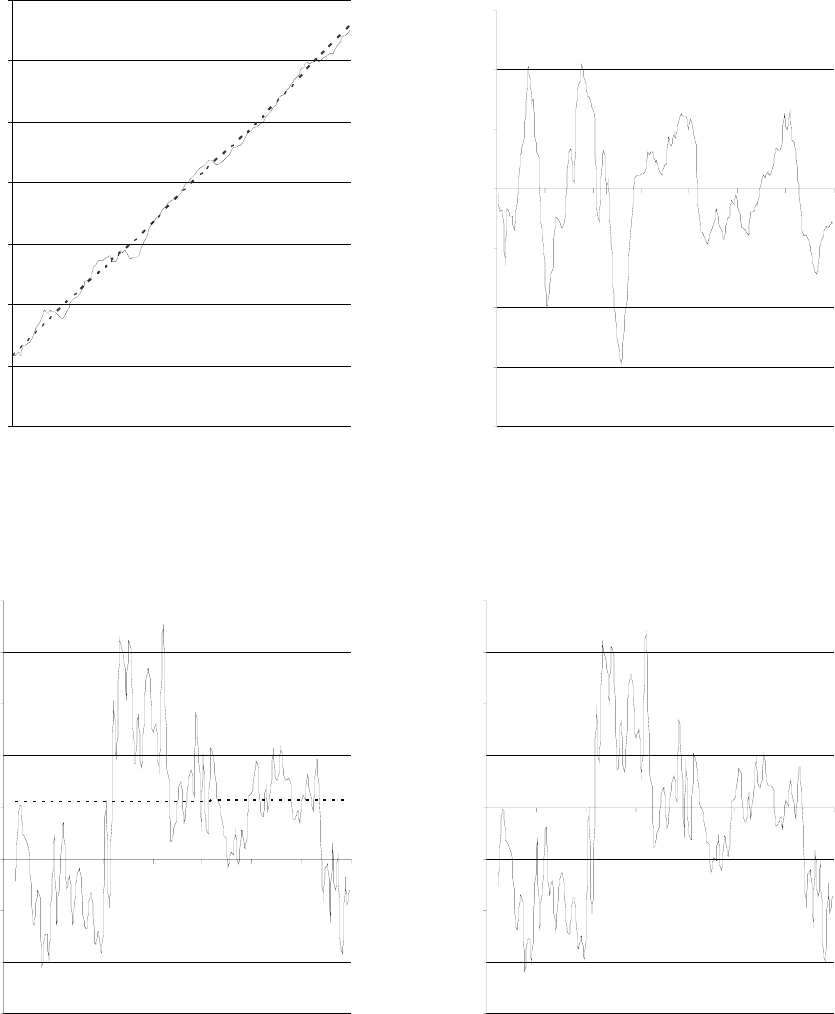

4. Dynamic Responses of Output, Inflation, and Short-Term Interest Rates: Comparing

SMPMOD and QPM............................................................................................................34

5. Dynamic Responses of Output, Inflation, and Short-Term Interest Rates: Comparing

SMPMOD and FRBUS........................................................................................................35

- 3 -

"All models are wrong! Some are useful" –George Box

2

I. I

NTRODUCTION

Twenty years ago, standard academic treatments of monetary policy analysis did not satisfy

policymakers' needs. The focus was on building microeconomic foundations for various

features of the monetary transmission mechanism, for example capturing the implications of

a cash-in-advance constraint for money demand. Modeling efforts centered on real business

cycle dynamic general equilibrium frameworks in which markets continuously cleared and

there was little scope for monetary policy. Policymakers had to rely on ad hoc models such

as IS/LM and Mundell-Fleming that lacked adequate treatment of expectations and stock-

flow relationships.

3

In recent years, economists have learned how to build simple, coherent, and plausible models

of the monetary transmission mechanism. In the New Keynesian synthesis, there has been a

convergence between the useful empirically motivated IS/LM models developed in several

policymaking institutions and dynamic stochastic general equilibrium approaches that take

expectations seriously and are built on solid microeconomic foundations. The simple

workhorse model now consists of an aggregate demand (or IS) curve, a price-setting (or

Phillips) curve, and a policy reaction function relating the policy interest rate to variables like

output and inflation. These sorts of models embody the basic principle that the fundamental

role for monetary policy is to provide an anchor for inflation and inflation expectations. They

are consistent with a view of the world familiar to policymakers, a world in which: because

of nominal and real rigidities, aggregate demand determines output in the short run;

expectations matter for inflation and output; and monetary policy is expressed in terms of a

rule for setting the nominal interest rate.

4

Small (or for that matter large) structural models themselves do not produce accurate

forecasts. Any good baseline forecast is based mostly on judgment.

5

Rather, these models are

useful because they assemble various understandings about how the economy works into a

coherent whole, so that joint implications can be assessed. Forecasts can be explicit about

policy reactions, the source of shocks, and risks resulting from different assumptions about

the functioning of the economy. For example, is the inflation target expected to be met in the

2

George E.P. Box and Norman R. Draper, “Empirical Model-Building and Response Surfaces” (Wiley 1987)

pp. 424.

3

In a popular graduate textbook by Blanchard and Fischer (1989), the presentation of these types of models was

relegated to the last chapter entitled "Some Useful Models."

4

We have obviously not done justice to this story here. Recent surveys include Clarida, Gertler and Gali (1999),

Lane (2001), and Woodford (2003a).

5

For a description about the role of judgment in the macro forecasts that are used in central banks see Sims

(2002) and Svennson and Tetlow (2005). Romer and Romer (2000) and Sims (2002) show that the judgemental

forecasts made at the Fed are better than pure model-based forecasts.

- 4 -

future given the current stance of monetary policy and the output gap? What if exchange rate

pass-through is lower than in the past? They can also shed light on the implications of

following different sorts of policy rules. If the authorities "lean against the wind" with

respect to exchange rate movements, what happens to output and inflation volatility?

Moreover, above all these things, the use of macro models can provide a systematic

methodology for assessing the policy implications of uncertainty by providing a framework

for analyzing and characterizing the risks around any conditional baseline macroeconomic

projection path.

Macroeconomic models such as those we discuss here have become important tools for many

central banks.

6

This reflects the models’ ability to help policymakers structure their thinking,

discussions, and forecasting exercises. For inflation targeting central banks, there is an extra

bonus. A key feature of inflation targeting is the communication with the public of the

rationale for the monetary policy stance, so as to coordinate expectations around the desired

outcome. A small, coherent, and sensible economic model is a useful vehicle for this sort of

communication.

7

This paper is motivated by the impression that the approach presented here would be a useful

addition to the standard toolkit of. IMF economists, who produce a large number of modern

analyses of various aspects of monetary policy, including those using methods more

sophisticated than those we discuss in this paper.

8

This has not, however, systematically

influenced the standard analytic tools used by most country teams in their nuts-and-bolts

operational work. In several instances in recent years, staff teams have in their country work

applied analyses broadly of the sort we are advocating here. However, in the absence of

easily available tools and a community of like-minded analysts, these initiatives have

remained isolated. Our goal is to try to generalize and strengthen these efforts.

The typical country application of this approach would be to a country with a floating

exchange rate regime and a formal or implicit inflation targeting monetary framework. The

framework can be applied to countries in which the float is managed, either in the sense that

monetary policy reacts to the exchange rate or that there is substantial foreign exchange

intervention.

6

The degree of complexity and sophistication of macroeconomic models varies considerably across central

banks. Models broadly along the lines of that presented here have often formed the basis of successful modeling

efforts. Several institutions are building a new generation of core workhorse models with stronger choice-

theoretic foundations. However, it is wise to start with simpler models to begin with and then develop more

sophisticated systems over time—see Laxton and Scott (2000).

7

Laxton and Scott (2000) and Canales-Kriljenko and others (2005) discuss the role of models as well as the full

range of related issues in operationalizing an inflation targeting framework.

8

See for example Leigh (2005), Parrado (2004), and Eggertson and Woodford (2003).

- 5 -

A key feature of this approach is that the economic structure of the model is more important

than purely fitting the data. Indeed, we suggest following the practice of most central banks

and taking an eclectic approach to determining the parameters of the model. A purely

econometric approach, in which a general set of equations is fit to the data, does not

generally result in a useful model. The economy is characterized by a high degree of

simultaneity and forward-looking behavior, while data series are generally short and subject

to structural change, for example in the monetary policy regime. In this context, it is not

possible to reliably estimate parameters and infer cause and effect. More fundamentally,

purely empirically based models do not permit the analysis of changes in policy rules or

changes in the assumptions about how the economy works. For purposes of policy analysis,

the model must first of all be identified, in that each of the equations has a clear economic

interpretation. Thus, rather than estimate a reduced-form empirically based model whose

structural interpretation is doubtful, we suggest using a broader collection of information to

help parameterize a structural macroeconomic model.

The goal of this paper is to motivate and describe a macro-model based approach to

forecasting and monetary policy analysis. The next section reviews the current practice of

monetary policy analysis at the Fund and discusses various alternative approaches.

Section III introduces and discusses a simple benchmark New Keynesian model. Section IV

discusses how to match the model with reality. Section V describes how to conduct a

forecasting and monetary policy analysis with the model. Section VI puts the model through

its paces, parameterizing it for Canada and carrying out a forecasting and risk assessment

exercise. Section VII provides caveats and suggestions for future work. Section VIII

concludes.

A companion paper (Berg, Karam, and Laxton, 2006) enters into more detail and introduces

a set of tools designed to facilitate the implementation of this approach.

9

We hope that many

economists engaged in applied policy analysis at the IMF will adopt and eventually develop

and enrich these tools, moving on to richer models as necessary. We also expect that insights

these economists gain will in turn be useful to the broader academic community.

II. M

ONETARY POLICY ANALYSIS AT THE IMF

A. Financial Programming as a Tool for Monetary Policy Analysis

The central analytic framework for IMF program design and policy analysis remains

financial programming, whose central task is the design of a consistent set of policies

intended to move an economy toward internal and external balance. Macroeconomic

aggregates are traditionally derived from an interconnected set of macroeconomic accounts:

the national income and product accounts, the balance of payments, government finance

9

The two papers overlap substantially. This paper targets mainly newcomers to modern structural

macroeconomic modeling and potential consumers. The “how-to-guide” contains more nuts-and bolts details

for modelers. It thus abbreviates the material contained in sections II and IIIA of this paper and expands on the

rest.

- 6 -

statistics and the monetary accounts. Financial programming combines these accounts and

formulates internally consistent macroeconomic forecasts of the economy under

consideration. This framework has value as a consistency check and when it is applied in

combination with an appealing set of behavioral relations and assumptions.

10

As a guide to the analysis and conduct of monetary policy, however, the framework has

limited applicability. The standard analytic framework for the analysis of monetary policy

has concentrated on monetary aggregates.

11

At the core is a key relation for monetary policy

analysis known as the quantity equation:

p

ym

v

=

where m is an appropriate monetary

aggregate (such as base money), p is the relevant price level, y is real output, and v is (by

definition) the velocity of money. The economics comes from the thought that velocity is a

function of interest rates and other factors. In practice, the analyst provides a set of forecasts

for p and y. An assumption made about the path of v then implies an appropriate path for m.

The balance sheet identity of the central bank equates m to the level of international reserves,

R, plus net domestic assets, NDA. Typically, a Fund program would embody a floor for the

path of R and a ceiling for the path of NDA consistent with the appropriate path for m.

In the broader academic and policy making community, the move away from a focus on

monetary aggregates has been dramatic and is now nearly complete. Monetary policy without

money is the benchmark in standard undergraduate and graduate texts, reflecting analytic

developments and, most importantly, central bank practice around the world. In the words of

Benjamin Friedman (2003), "One of the most significant changes in monetary economics in

recent years has been the virtual disappearance of what was once a dominant focus on money

. . . as part of the analytical framework that economists use to think about issues of monetary

policy."

12

The financial programming approach to monetary policy analysis may remain relevant when

direct central-bank financing of the fiscal deficit is a central policy concern, particularly for a

fixed exchange rate regime. In this context, financial programming usefully emphasizes that

more credit to government, and thus NDA, implies fewer reserves, given a path for money

balances.

In middle-income and developed countries, however, monetary policy is more frequently

being formulated in a context of a managed floating exchange rate and a formal or informal

10

IMF (2004a) provides a recent official description and assessment of financial programming, emphasizing its

usefulness as an organizing framework and the need to supplement it with other tools in particular

circumstances.

11

See IMF (2004b).

12

Leeper and Roush (2003) also make this point and cite as examples Romer (2000), Stiglitz and Walsh (2002),

and Woodford (2003a). Clarida, Gali and Gertler (1999) estimate monetary policy reaction functions for several

countries and argue that even avowed money targeters such as the Bundesbank did not in fact practice targeting

monetary aggregates. Stone and Bhundia (2004) survey large and more developed countries (75-85 countries)

and point out that money targets were used by only five countries in 1990, and by 2000 this regime became

extinct.

- 7 -

inflation-targeting regime, and largely independently of the fiscal authorities. In this

situation, financial programming provides little guidance for the conduct of monetary policy.

First, money demand rarely serves as an anchor for the conduct of monetary policy. As has

been widely recognized, money demand is often too unstable to be relied upon as a

framework for setting the stance of monetary policy. More importantly, even a stable money

demand curve typically implies large idiosyncratic movements in money demand. It is rarely

possible to isolate the shocks to money demand from the policy shocks that are of interest.

13

Most fundamentally, this framework does not provide a useful framework for talking about

monetary policy. Central questions involve issues such as whether the policy interest rate is

set correctly, how the authorities should react to exchange rate movements, how the forecast

depends on various economic assumptions, and so on. The financial-programming

framework buries this entire discussion in the determination of velocity and its relationship to

interest rates. Discussions frequently revolve around explanations, largely ex post

rationalizations, for observed movements of money aggregates. Where central banks have

ceased to employ a financial programming framework, the value of the Fund relying on this

procedure to frame discussions is particularly low. Staff cannot easily engage with the

counterparts on a technical level, nor do interactions with Fund staff serve to sharpen the

technical discussions within the central bank—a lost opportunity.

14

The staff is aware of these problems. Moreover, as Mussa and Savastano (2000) emphasize,

financial programming is an accounting framework only and does not in itself force Fund

economists into particular policy conclusions. The implications remain serious, nonetheless.

The excessive reliance on financial programming implies that staff may not have sufficient

analytic support in thinking about monetary policy issues. And financial programming, as the

only readily available tool, often receives too much weight. This may be a reflection of the

well-documented phenomenon known in the behavioral finance literature as the "anchoring

heuristic," in which decision processes are often dominated by available pieces of

information even if they are obviously of no relevance.

15

13

IMF (2004a) provides an in-depth discussion of analytic frameworks and program design in Fund-supported

programs. It notes the usefulness of financial programming as an organizing framework as well as the need to

supplement it with other tools in particular circumstances. IMF (2004b) analyzes the experience with monetary

aggregates in Fund-supported programs. It concludes that the high correlation between monetary aggregates and

inflation reaffirms the importance of nominal anchors for controlling inflation. Berg and others (2003) discuss

monetary policy in post-crisis situations and argue that, even in those cases, there is little practical role for

monetary aggregates in the assessment of monetary policy in practice.

14

The question of the role of financial programming in Fund conditionality is a related but distinct question that

is outside the scope of this paper. In IMF programs, the value of traditional monetary aggregate conditionality

resides partly in its “safety” features. In this case, the monetary aggregate targets are not meant to structure

thinking or policy with respect to “everyday” monetary policy choices but rather to identify gross breaches of

the policy. Blejer and others (2001) discuss the difficulties involved in applying standard Fund quantitative

performance criteria for monetary policy to countries that follow an inflation-targeting regime.

15

Bofinger and Schmidt (2004) rely on the anchoring heuristic to explain the otherwise puzzling tendency of

professional foreign exchange forecasters to perform substantially worse than a naïve random walk and, in

particular, to pay too much attention to actual changes in the exchange rate.

- 8 -

B. Econometric Models

Fund staff has in recent years sought more useful analytic frameworks for thinking about

monetary policy. One approach has been to estimate empirically-motivated inflation

equations, often in the context of a VAR with equilibrium correction.

16

While sometimes

useful, this approach has several major drawbacks. First, there are rarely enough data for

reliable inference. In most countries, the current monetary policy regime has been in place

for only a few years. In an economy in which expectations play a key role and everything

tends to depend on everything else, inference in such samples is unreliable.

A more fundamental problem with econometric approaches for our purposes is that the

nonstructural data-based approach does not lend itself to answering the questions of interest

to policymakers. For example, where countries are seeking to better anchor inflation

expectations in order to reduce inflation persistence and real volatility, it makes little sense to

employ a statistical methodology that hard wires policy parameters in reduced-form

equations and provides no direct role for policy to change them. An emphasis on data fitting

can lead, in practice, to models that lack critical features such as forward-looking inflation

expectations, on the grounds that such features are much harder to implement empirically.

The absence of such features makes estimated models misspecified and, of course, also more

vulnerable to the Lucas critique, in that changes in the monetary policy reaction function, for

example, lose a channel through which they influence other equations.

Similarly, classical hypothesis testing asks the wrong sorts of questions. For example, an

econometric estimation of the equation for output determination might start by testing the

null hypotheses that the interest rate does not affect the output gap or the exchange rate. In

small samples, we might well not be able to reject the nulls. In thinking about the monetary

policy transmission mechanism, though, these are uninteresting hypotheses. In practice, this

methodology has sometimes produced models with very weak monetary transmission

mechanisms, where extremely large changes in interest rates would be necessary to anchor

inflation to the target in response to shocks that continuously disturb the economy.

The structural vector autoregression (SVAR) approach attempts to make explicit identifying

assumptions in order to be able to give the estimates structural interpretations. These

identifying assumptions usually take the form of restrictions in contemporaneous reaction of

one variable to shocks emanating from another variable. Unfortunately, in a simultaneous

economy in which expectations are important, it is extremely difficult to credibly identify the

key equations, in other words to assert with any confidence that one equation is really an

"inflation" equation and the shocks are shocks to the price level, while another equation is a

monetary policy equation. The identification problem is particularly difficult when the model

includes two asset prices, for example the interest rate and the exchange rate. In this

situation, each is likely to depend on the other at any frequencies, rendering dubious any

identification depending on the typical contemporaneous exclusion restrictions.

16

Garratt and others (2003) estimate a small quarterly model for the United Kingdom.

- 9 -

A related approach estimates a vector equilibrium correction model and avoids making

explicit assumptions to identify the equations. An equation normalized so that inflation is on

the left-hand side is considered to represent the underlying economic process for inflation,

based on the plausibility of the estimated signs and parameter stability in the face of shocks

to other equations (“super-exogeneity”). This approach may serve in forecasting but, even

more than the SVAR strategy, cannot be relied on to produce reliable structural models of the

economy.

17

The most fundamental problem with econometrically-driven approaches is that policy-

makers need first of all a model that is economically meaningful and transparent, and that

allows them to study the implications of various economic assumptions and policy

interventions. In other words, they need a structural macro model. In the next section, we

discuss alternatives. We do not suggest eschewing econometrics entirely, and in Section IV

we return to the uses of econometrics in the context of the question of how to parameterize

simple structural models.

III. M

ACROECONOMIC MODELING

A. The Role of Macroeconomic Models

Macroeconomic models for monetary policy analysis are designed to describe the

interactions of key macroeconomic variables over the medium term. The main purpose is not

to produce a forecast understood as best guess of the values of the main variables. In practice,

models do not produce the forecast, economists do. What models can do is provide a

coherency check on the judgment that produces the main forecast. They allow the systematic

analysis of risks to the forecast, including sensitivity to various assumptions, shocks, and

policy responses. Most importantly, they provide a framework that can help to ask the right

questions.

We propose here that analysis center around a small core model with only four key

behavioral equations. This model attempts to allow for consistent projections for real GDP,

inflation, the real interest rate, and the real exchange rate, all in terms of deviations from

equilibrium levels. Its advantage is that it can be relatively transparent and simple and still

allow consideration of the key features of the economy for monetary policy analysis.

17

See Faust and Whiteman (1997).

- 10 -

Such a model is silent on a number of critical issues. It abstracts from issues related to

aggregate supply and fiscal solvency and does not explore the determinants of the current

account, the equilibrium levels of real GDP, the real exchange rate or the real interest rate.

These considerations are of course essential to policy analysis and forecasting. The

framework described below allows judgment about them to be incorporated into the model’s

forecasts and the implications of different assumptions explored. But the model itself

provides little direct help in articulating their determinants.

Because the model abstracts from so many issues, there may be a tendency to add various

features to the model. Models such as those we propose below are, in somewhat more

complicated form, at the heart of both central bank practice and enormous current research

efforts worldwide. Thus, there is great scope to develop the model further. It is important,

though, that additions not detract from the clarity of the model. Where the skills and

resources are available, the model may be extended to include full microeconomic

foundations, stock-flow dynamics, non-traded sectors, and other features that allow explicit

treatment of a number of additional issues.

18

The model should not be allowed to become a

“black box” however. One intermediate approach may be to build an auxiliary model for,

say, fiscal policy, which considers the expenditure component of government spending, the

implications for households’ intertemporal savings decisions, and ways of thinking about

Ricardian Equivalence, the debt stock, and so on. The overall implications of fiscal policy for

aggregate demand could then be integrated into the core model.

19

The model presented here blends the New Keynesian emphasis on nominal and real rigidities

and a role of aggregate demand in output determination, with the real business cycle tradition

methods of dynamic stochastic general equilibrium (DSGE) modeling with rational

expectations. The model is structural because each of its equations has an economic

interpretation. Causality and identification are not in question. Policy interventions have

counterparts in changes in parameters or shocks, and their influence can be analyzed by

studying the resulting changes in the model’s outcomes. It is general equilibrium because the

main variables of interest are endogenous and depend on each other. It is stochastic in that

random shocks affect each endogenous variable and it is possible to use the model to derive

measures of uncertainty in the underlying baseline forecasts. It incorporates rational

expectations because expectations depend on the model's own forecasts, so there is no way to

consistently fool economic agents.

20

18

The IMF’s Global Economy Model (GEM), described in Laxton and Pesenti (2003), for example, represents

such a model. The set of tools that we rely upon for our simple model, described in an Appendix in the

companion paper, are similar to those required to work with GEM.

19

Coats, Laxton and Rose (2003) describe how such an approach is practiced in the Czech Republic, based on a

core model along the lines described in this paper. The IMF has developed a multi-country, new-open-economy

macro model to study the medium-term and long-term implications of fiscal policies. See Botman and others

(2006).

20

We say “consistently” because it may be appropriate to extend the model to incorporate an element of

adaptive expectations.

- 11 -

Such models are often derived explicitly from microeconomic foundations in the literature.

21

The core elements include consumers who maximize expected utility and firms that are

subject to monopolistic competition who adjust prices only periodically. Such micro-

foundations are ultimately critical and should play a central role in determining the model's

specification insofar as the model itself must be coherent and embody the economic ideas the

modeler wishes to emphasize. However, we do not derive our baseline model below from

microeconomic foundations. We allow for adaptive as well as rational expectations and

substantial inertia in the equations. We could appeal to theory to justify these features, but we

do not believe that, in practice, appealing to specific micro foundations serves to tie down

magnitudes. We believe that this pragmatic approach to modeling represents the current state

of the art in many policymaking institutions, where modelers “engage but don’t marry

theory.”

22

B. The Model

The model has four equations: (1) an aggregate demand or IS curve that relates the level of

real activity to expected and past real activity, the real interest rate, and the real exchange

rate; (2) a price-setting or Phillips curve that relates inflation to past and expected inflation,

the output gap, and the exchange rate; (3) an uncovered interest parity condition for the

exchange rate, with some allowance for backward-looking expectations; and (4) a rule for

setting the policy interest rate as a function of the output gap and expected inflation.

23

The

model expresses each variable in terms of its deviation from equilibrium, in other words in

”gap” terms. The model itself does not attempt to explain movements in equilibrium real

output, the real exchange rate, or the real interest rate, or in the inflation target. Rather, these

are taken as given from various sources employing filtering methodologies or using the

analyst judgment and views about these equilibrium values.

24

Output gap equation

Output depends on aggregate demand and hence the real interest rate and the real exchange

rate, as well as past and future output itself.

y

tttzgapttRRgaptlagtldt

zzRRRRygapygapygap

εββββ

+−+−−+≡

−−−−−+

)()(

*

11

*

1111

( 1 )

21

See Gali and Monacelli (2002) and Monacelli (2004) for micro-founded models along the lines of that

discussed here (pg. 112).

22

Leeper (2003), page 112, uses this terminology to describe the state of the art in model building in central

banks.

23

For an accessible introduction to this exploding literature, see for example Clarida, Gali, and Gertler (1999).

For a recent overview, see Woodford (2003a).

24

The companion paper describes the model and in particular the supply side in somewhat more detail.

- 12 -

where ygap is the output gap, RR is the real interest rate in percentage points, z is the real

exchange rate (measured so an increase is a depreciation, in percentage points), and the *

denotes equilibrium measures of a variable. The output gap ygap

t

is measured as the

deviation, in percentage points, of actual output from a measure of the trend or equilibrium

level of GDP (a positive number indicates that output is above trend).

Significant lags in the transmission of monetary policy imply that, for most economies, we

would expect that the sum of β

RRgap

and β

zgap

to be small relative to the parameter on the

lagged gap in the equation. In particular, experience suggests that that for most economies

the sum of β

RRgap

and β

zgap

would lie between 0.10 and 0.25 for a quarterly model.

25

A β

RRgap

coefficient of 0.10 implies for example that a one percentage point increase in interest rates

would lead to a 0.10 percent fall in the output gap the following period. The parameter on the

lagged gap term, β

lag

, would typically lie between 0.50 and 0.90. We would expect a small

coefficient on the lead of the of the output gap that might range from 0.05 to roughly 0.15.

For industrial economies, we would expect that β

zgap

would typically be smaller than β

RRgap

and would depend on the degree of openness.

Phillips curve

Inflation depends on expected and lagged inflation, the output gap, and the exchange rate

gap.

26

[

]

π

ππ

εααπαπαπ

ttztygaptldtldt t

zzygap +−++−+=

−−−+ 1114

4)1(4

( 2 )

This equation embodies several key ideas about the role of monetary policy:

• The fundamental role of monetary policy is to provide a nominal anchor for inflation.

In equation (2), the coefficients on expected and lagged inflation sum to one,

implying that any constant level of inflation can be a solution to this equation, as long

as the output gap and the real exchange rate gap are zero. There is no “natural”

tendency for inflation to move to some particular level; rather, it is the monetary

policy reaction function that pulls inflation towards the target.

• Monetary policy influences inflation through its effects on output and the exchange

rate. Thus, the coefficients on the output and exchange rate gaps must be greater than

zero. Otherwise, monetary policy would have no effect on inflation.

25

The proposed parameter values in this section are based on experience with this type of model in a number of

countries. Many have been implemented at central banks and are unpublished; see however Coats, Laxton and

Rose (2003) for an application to the Czech Republic.

26

Inflation is measured as the annualized quarterly change, in percent, so

()

(

)

[

]

1

loglog400

−

−

=

ttt

cpicpi

π

.

t

4

π

is the four-quarter change in the CPI, in other words )]log()[log(1004

4−

−

=

ttt

cpicpi

π

.

- 13 -

• The central bank cannot consistently fool people. To ensure this, the coefficient on

expected inflation must be positive. If instead α

πld

is zero, then the central bank could

keep output permanently above equilibrium by constantly “surprising” agents with

higher-than-expected inflation.

A standard derivation from microeconomic foundations assuming optimizing firms with

rational expectations implies that expectations depend only on future inflation, so α

πld

= 1.

A value less than 1 can be rationalized as resulting from the idea that there is a component

of backward-looking expectations based for example on learning, imperfect credibility of

the central bank, or indexation.

The behavior of the economy depends critically on the value of α

πld.

If inflation expectations

are entirely forward looking (α

πld

is equal to 1), then inflation is equal to the sum of all future

output and exchange rate gaps. A small but persistent increase in interest rates will have a

large and immediate effect on current inflation. In this “speedboat” economy, small

recalibrations of the monetary-policy wheel, if perceived to be persistent, will cause large

jumps in inflation through forward-looking inflation expectations. If expectations are largely

backward-looking, on the other hand (α

πld

is close to 0), then current inflation is a function of

lagged values of the gaps, and only an accumulation of many periods of interest rate

adjustments can move current inflation toward some desired path. In this “aircraft carrier”

economy, the wheel must be turned well in advance of the date at which inflation will begin

to change substantially. Where price-setting is flexible and the monetary authorities are fully

credible, high values of α

πld

might be reasonable, but for most countries values of α

πld

significantly below 0.50 seem to produce results that are usually considered to be more

consistent with data.

The value of α

z

determines the effects of exchange rate changes on inflation. α

z

would

typically be larger in economies that are very open. Higher exchange rate pass-through is

generally also observed in countries where monetary policy credibility is low and where the

value-added of the distribution sector is low. There is significant evidence of pricing-to-

market behavior in many economies, suggesting that α

z

would be considerably smaller than

the import weight in the CPI basket.

27

Exchange rate

We assume an interest parity (IP) condition holds, so:

*

1

/4

eUSz

tt t t t t

z z RR RR

ρ

ε

+

⎡⎤

=− − − +

⎣⎦

( 3 )

where RR

t

US

is the real U.S. interest rate and ρ

t

*

is the equilibrium risk premium.

As before,

27

Many factors impact on the exchange rate pass-through and its determinants, including central bank

credibility, the composition of trade, the importance of distribution costs, the nature of shocks, and the degree of

monopoly power.

- 14 -

RR

t

is the policy real interest rate and z

t

is the real exchange rate. The interest rate term is

divided by 4 because the interest rates and the risk premium are measured at annual rates,

where z

t

is quarterly.

28

We assume a coefficient of one on the interest rate differential, as implied by the IP

condition. This result has been frequently challenged empirically. In defense of this

assumption, the simultaneity involving interest rates and exchange rates makes any effort to

estimate this coefficient particularly difficult. The estimated coefficient on the interest rate

differential will be biased

downward to the extent that the monetary authorities “lean against

the wind” of exchange rate movements.

29

We allow but do not impose (model-consistent) rational expectations for the exchange rate:

(

)

111

1

−++

−+=

tztz

e

t

zzz

δδ

( 4 )

When δ

z

= 1, we recover Dornbusch (1976) overshooting dynamics. In practice, overshooting

often seems to take place in slower motion, and a value of δ

z

somewhat less than 1 may

provide more realistic dynamics. Unfortunately, there is little consensus across countries or

observers on a reasonable value for δ

z

.

30

Monetary policy rule

We assume that the monetary policy instrument is based on some short-term nominal interest

rate, and that the central bank sets this instrument in order to achieve a target level for

inflation, π

*

. It may also react to deviations of output from equilibrium. So:

**

14

4

(1 ) * ( 4 4 )

RS

t RSlag t RSlag t t t ygap t t

t

RS RS RR ygap

π

γ

γπγππγε

−+

+

⎡⎤

=+− ++−+ +

⎣⎦

( 5 )

28

Thus, any deviation of interest rates from equilibrium either at home or abroad should result in the exchange

rate deviating from equilibrium, unless such rate deviations were identical. Any other movement in exchange

rates is captured by the residual in the exchange rate equation, which can be thought of as a temporary shock to

the risk premium.

29

If the model as outlined in this section is used to generate artificial data, and the IP equation is estimated with

OLS on this artificial data, the estimated coefficient on the interest rate differential is likely to be zero or even

negative. See Chin and Meredith (1998) for an example.

30

The value of δ

z

matters for forecasting and policy analysis. When δ

z

= 1, the real exchange rate will be a

function of the future sum of real interest differentials (and risk premia) and will provide a direct and rapid

channel through which monetary policy will operate. Some policymakers have argued that more robust policies

should assume a much smaller value of δ

z

because it may be imprudent to rely so heavily on these forward-

looking linkages in the face of uncertainty. Isard and Laxton (2000) show that under uncertainty about the value

of δ

z

, it will be prudent to assume that δ

z

is slightly below 0.5 because of larger and asymmetric costs that would

result from assuming extreme values such as zero or one.

- 15 -

The structure and parameters of this equation have a variety of implications.

31

An important

conclusion from assessments of monetary policy in the 1970s, and one embedded in the

structure of this model, is that a stable inflation rate requires a positive

π

γ

.

32

Beyond this, our

framework does not allow explicit discussion of optimality, in the absence of microeconomic

foundations.

33

But it may be useful to note that how strongly the authorities should react

depends on the other features of the economy. If the economy is very forward-looking, for

example, as implied by the “speedboat” version of the Phillips curve, then moderate but

persistent reactions to expected inflation should be enough to keep inflation close to target.

If, on the other hand, the Phillips curve is of the “aircraft carrier” type, then a forward-

looking approach to monetary policy may require a more aggressive reaction.

Following Woodford (2003b), we allow for the possibility that the central bank smoothes

interest rates, adjusting them fairly slowly to the desired value based on deviations of

inflation and output from equilibrium. In typical empirically-based reaction functions the

value for

RSlag

γ

falls between 0.50 and 1.0.

Arguments other than inflation and output may belong in the reaction function.

34

A variety of

papers have explored in particular the question of whether the exchange rate belongs in the

reaction function.

In general, adding the exchange rate typically makes little difference when

uncovered interest parity holds, because in this case the exchange rate is purely a function of

expected future interest rates and so contains little information not already contained in other

variables. When exchange rate volatility itself matters to policy makers, or when the

exchange rate expectations contain an element of adaptive expectations, there may be an

additional role for monetary policy to respond directly to the exchange rate.

35

In a broader departure from the canonical model, the monetary policy instrument may be

something other than the interest rate. In countries where the exchange rate is the nominal

31

For a brief introduction to the vast literature evaluating alternative monetary policy rules see Hunt and Orr

(1999) and Taylor (1999).

32

This restriction, which is necessary to provide an anchor for the system, has come to be known as the Taylor

principle, after John Taylor who popularized the idea of using interest rate reaction functions as guidelines for

evaluating the stance of monetary policy. The original 1993 Taylor rule imposed a zero weight on interest rate

smoothing (

RSlag

γ

= 0) and implied a

π

γ

(a backward-looking, year-on-year measure of inflation in that case)

of 0.5 and a value for

ygap

γ

of 0.5. After specifying a loss function it is straightforward technically either to

optimize the parameters in a simple rule or to compute the path of interest rates with optimal control

techniques—see Laxton and Pesenti (2003) and Svensson and Tetlow (2005) for examples of both approaches.

33

The analyst could create a loss function, for example one that depends on the variance of output and inflation

and possibly interest rates and then simulate the model to determine how, in the face of a given pattern of

shocks, a particular rule performs.

34

For a recent review of interest rate rules for developing economies, see IMF Research Bulletin, June 2005,

Volume 6, Number 2.

35

See Hunt, Isard and Laxton (2003) as well as Elekdag and Tchakarov (2004).

- 16 -

anchor, for example, the instrument could be nominal exchange rate instead of the nominal

interest rate.

36

The supply side

This model has only a rudimentary supply side. Output and the real interest rate appear in all

the behavioral equations in gap terms, implying that only deviations from equilibrium levels

for output and the real interest rate are modeled. The supply-side variables are assumed to

follow simple stochastic processes; in practice this means that the analyst must make

assumptions about their values. Then, to take one variable as an example, output itself will

depend on the output gap from equation (1) and equilibrium output:

*

ttt

yygapy +≡

( 6 )

This reflects a choice for simplicity, and in particular recognition that only a much more

complicated model would provide a useful supply side. The implications of a positive

permanent supply shock for the output gap and inflation, for example, are complex. The

increase in capacity may reduce the output gap and prices. On the other hand, an investment

boom will tend to result until the capital stock has adjusted to the higher level of

productivity.

37

Each key supply-side variable is assumed to depend only on its own lagged values and

shocks. This specification serves to provide a set of residuals that can be manipulated so the

resulting response of the economy can be examined.

•

Potential output is assumed to grow at some steady state growth rate, with potentially

serially correlated shocks to both the level and growth rate (thus permanent shocks to

the level) of potential output.

•

The equilibrium real interest rate and the equilibrium real exchange rate are assumed

to follow a stationary process, with temporary but possibly persistent shocks around

some steady-state level.

•

The equilibrium risk premium is calculated as the value of the risk premium that

keeps the real exchange rate on its equilibrium trajectory, given that interest rates are

36

Parrado (2004) estimates a reaction function for Singapore in which the instrument is the change in the

exchange rate. It would in principle also be possible to extend the model to a

situation in which a monetary

aggregate serves as the instrument, though as discussed above substantial consideration should be given to the

question of whether this is a sensible or realistic reaction function. Alternatively, if monetary aggregates carry

information about future inflation not otherwise captured in the model, they could be included in the inflation

equation; the authorities would then react to monetary aggregates through their effect on expected inflation.

37

Many models have interesting treatments of the supply side and address these issues. The IMF’s GEM

represents one approach.

- 17 -

at their equilibrium values. Temporary shocks to the exchange rate are equivalent to

and can be interpreted as temporary shocks to the risk premium.

•

The inflation target is assumed to be equal to its lagged value, with only permanent

shocks.

In a forecasting and policy analysis exercise, the equilibrium values for the domestic real

interest rate, the foreign (U.S.) real interest rate, potential output, and the inflation target may

come, as usual, from a variety of sources, including judgmental estimates of the authorities or

econometric analyses. The programs described in the companion paper provide a flexible

filter that extracts long-run values from actual data.

Care must be taken in interpreting the effects of these supply-shock residuals. For example,

permanent and temporary shocks to potential output have no effects on the output gap and

inflation (of course they move output itself). The analyst could model richer implications “by

hand,” by adding a set of shocks that move potential output, the output gap, and the inflation

rate, according to her sense of how the underlying supply shock will manifest itself.

Similarly, permanent shocks to the equilibrium real interest rate are reflected one-for-one in

movements of the actual real interest rate to achieve equilibrium in the IS curve.

38

The risk

premium will also shift by the same amount in order to achieve equilibrium in the exchange

rate equation. There is also no long-run effect on potential output, simply because this is not

modeled. The supply side could be enriched with a model in which capital accumulation

depends on productivity and the cost of capital, so that potential output would fall in response

to an equilibrium real interest rate increase.

In shocking or forecasting the exchange rate, the analyst must decide whether to adjust the

actual exchange rate and/or the equilibrium real exchange rate. A depreciation of the actual

exchange rate will be expansionary because it opens up a positive exchange rate gap, though

the effect is mitigated by the resulting inflation and monetary policy response. A depreciation

of the equilibrium exchange rate will result in a corresponding move of the actual exchange

rate. There will be an inflationary impact but no direct expansionary effect on aggregate

demand.

IV. BUILDING THE MODEL

The answers a model gives depend crucially on the parameter values. How does the analyst

choose them? We suggest taking an eclectic approach to capturing the key economic features

of policy interest, following the practice in most model-using policymaking institutions. The

basic idea is to choose coefficients that seem reasonable based on economic principles,

available econometric evidence, and an understanding of the functioning of the economy, and

38

If the central bank smoothes interest rates, then there are some transitional dynamics until the nominal rate

adjusts to the new equilibrium.

- 18 -

then to look at how sensible the properties of the resulting model are. An iterative calibration

process results in which reasonable coefficient values are chosen, the properties of the model

examined, and changes made to the coefficient values, or the structure of the model, until the

model behaves appropriately.

Why not just estimate the model econometrically? After all, econometric estimates of the

entire model can be viewed as a systematic version of this suggested procedure, in that they

involve choosing parameters to minimize residuals. The answer lies in the need for a more

eclectic approach. We have emphasized the need to choose the structure of the model based

on economic and not econometric considerations. For similar reasons, useful parameter

values will typically not come from a purely econometric approach. As discussed above, the

data are inadequate, time series too short, and structural changes abound. More

fundamentally, to be useful to policymakers, a model-based approach needs to readily

accommodate their views about the economy that derive from a variety of sources, including

simply experience, other models or countries, and discussions with other observers.

39

The use of calibration does not mean that conventional estimation exercises are to be

abandoned. Indeed, a structural model can provide a useful organizing device for posing

questions that might be answered in part by looking at the data, and for integrating the

answers into a coherent framework. A potential advantage of a model-oriented approach is

that it forces attention on a few basic economic questions and places less emphasis on

technical econometric issues.

Two questions immediately emerge: how do we choose reasonable coefficients, and how do

we judge the resulting performance of the model?

The accumulated experience with similar models as well as theory can provide some

guidance in choosing parameters, as discussed in Section III above. A variety of more

systematic tools are also available.

In traditional calibration exercises of models with explicit micro-foundations, estimates of

structural parameters such as the elasticity of substitution between different types of goods

(say for example domestically produced tradables and imported goods) can be drawn from

microeconomic studies. The model we use is reasonably well-grounded in theory, so that an

understanding of the underlying structural determinants of the main parameters may help

with parameterization. However, the above model is not explicitly micro-founded. In part

this is because theory can rationalize many of the observed features of the economy but does

not (yet) serve to tie down precise magnitudes.

40

39

Experience with use within the IMF to date suggests that, where the authorities are willing and able to discuss

their own views on the properties of the economy and of their own models, the process of using the model to

solicit the judgment of policymakers has worked particularly well.

40

Of course, an enormous amount of research is now directed at improving the microeconomic foundations of

these sorts of models to make them more consistent with the inertia in the data. It is likely that, over time,

reference to larger micro-founded structural models will become a more important part of designing and

calibrating smaller policy models.

- 19 -

A variety of econometric techniques can be useful in parameterizing the model. Single

equation estimates can sometimes shed substantial light. For example, Orphanides (2003)

estimates the monetary policy reaction function of the U.S. Federal Reserve. He uses survey

measures and the Federal Reserve’s own real-time forecasts of expected inflation and the

output gap to avoid the endogeneity and measurement problems usually associated with

estimating forward-looking monetary policy reaction functions.

41

The model is not to be judged primarily by how well the parameters themselves are chosen or

how well the model fits the data, however. Rather, the adequacy of a model for policy

analysis will depend on how well it captures key aspects of the monetary policy transmission

mechanism. For example, the model should provide reasonable estimates of: how long it

takes a shock to the exchange rate to feed into the price level; the size of the sacrifice ratio—

in other words, the amount of output that must be foregone to achieve a given permanent

reduction in the rate of inflation, and how the inflation rate responds to the output gap.

Some of this feel may come from an examination of natural experiments, in which the

analyst effectively identifies a shock based on specialized knowledge of the policy process

and can trace out its effects. For example, a look at past disinflation episodes may shed some

light on measures of the historical sacrifice ratio. Another approach is to examine the

properties of models that have been developed over time in central banks and other policy

institutions. In cases where such models are used for day-to-day policy analysis the results

may correspond with the collective judgment of the policymakers and thus may represent a

convenient insight into that judgment.

42

A comparison with well-established models from

similar countries may also be helpful. Finally, econometric analyses can shed light on some

of these questions; for example, the model’s properties could be compared to the impulse

responses of a VAR.

Of course, the choice of parameters and examination of model properties are two sides of the

same coin. A practical approach is to develop an initial working version of the model,

choosing

coefficients that seem reasonable based on economic principles, available

econometric evidence, and an understanding of the functioning of the economy, and then

assess the system properties of the resulting model. An iterative process evolves in which

reasonable coefficient values are chosen, the properties of the model are examined, and

changes are made to the structure of the model where this is required for the model to behave

appropriately.

The main disadvantage of calibration is that it does not lend itself easily to formal statistical

inference, which has always been an important priority in both academic and policymaking

circles. The use of various system estimation techniques to parameterize DSGE models and

41

The Orphanides (2003) monetary policy reaction function is implemented as an option in the example

program discussed below.

42

Schmidt-Hebbel and Tapia (2002) have compiled views about the monetary policy transmission mechanism

and other features of the economy from twenty central banks.

- 20 -

assess their performance is an active area of research.

43

Recent developments in the

application of Bayesian estimation techniques represent a particularly promising way to bring

data and statistical tests to bear in a way that is consistent with the practical approach we

suggest.

44

These techniques provide answers to the question: to what extent are the data

consistent with prior views about parameter values to permit the data to speak in a way that is

consistent with the practical approach we suggest.

45

We do not see the Bayesian estimation, or any econometric techniques, as alternatives to the

parameterization techniques described above but rather as complements. Rather, one piece of

the puzzle will be to ask what the data say about the parameters. The analyst incorporates this

information into the model and moves on to the next step.

V. FORECASTING AND POLICY ANALYSIS

46

A model of the sort we have described, simplified as it may be, can be very helpful in the

process of forecasting and analyzing monetary policy, based on the successful experience of

a large number of central banks that started with similar models. The model itself does not

make the central forecast. The forecast itself may come from some combination of several

sources: forecasting models of various sorts; market expectations; judgments of senior

policymakers; and, most importantly for the IMF, interactions with the country authorities

themselves. The model can serve, however, to frame the discussion about the forecast, risks

to the forecast, appropriate responses to a variety of shocks, and dependencies of the forecast

and policy recommendations on various sorts of assumptions about the functioning of the

economy.

In this section we outline a three-step procedure for creating and using model-based forecasts

for monetary policy analysis, given that a model has already been developed.

43

For a discussion of estimation issues of models designed for monetary policy analysis, see Coletti and others

(1996), Hunt, Rose, and Scott (2000), Benes and others (2003), Faust and Whiteman (1997), and Kapetanios,

Pagan and Scott (2005). For a critical assessment of approaches that are based excessively on letting the data

speak for designing policy models see Coletti and others (1996), Faust and Whiteman (1997), Hunt, Rose, and

Scott (2000) and Coats, Laxton and Rose (2003).

44

These Bayesian techniques can be thought of as a more formal version of the calibration/parameterization

method described here. An Appendix in the companion paper refers to details of a particular software called

DYNARE (Juillard, 2004) which presents tools these techniques.

45

We have developed examples of programs for these types of models and shared them with desk economists.

For example, Hunt, Tchaidze, and Westin (2005) estimate the model discussed in this paper in the case of

Iceland using Bayesian techniques. See Smets and Wouters (2004) and Juillard and others (2005) for other

recent applications to DSGE macroeconomic models.

46

The companion paper (Berg, Karam, and Laxton 2006b) contains a similar but somewhat more detailed

version of this section.

- 21 -

1. The analyst starts with historical data on output, inflation and other selected key

variables. It is also useful to include in the database purely judgmental forecasts out several

quarters for these same variables. There are two distinct reasons for including pure judgment

forecasts in this database.

• It is usually appropriate to treat judgmental near-term forecasts as actual data,

allowing the model forecasts to “kick in” only subsequently. For example, in many

central banks, it is recognized that the model cannot do remotely as well as experts at

forecasting the first one or two quarters. These are often based on preliminary related

data (e.g. GDP may lag several months, but retail sales, industrial production etc.

come out much more quickly).

• The database may contain a much longer judgmental forecast, for example several

years out, which may be interesting to analyze in light of the model. This could be a

forecast provided by the authorities to IMF staff, for example.

2. The analyst creates forecasts of key equilibrium variables that are taken as given in

the model, notably the inflation target, potential output, and equilibrium real interest and

exchange rates. These estimates should be based on a variety of sources. The monetary

authorities may announce an inflation target. Estimates for the other series may come from

including smoothing the original series and/or judgment-based assessments, for example

imposing on the smoothed series a view about potential output in a particular quarter or about

structural changes in equilibrium values not captured by smoothing.

3. We now turn to generating the forecasts. Three types of forecasts may be interesting:

• A pure judgment forecast results from imposing the judgmental forecasts from step

1 on the model. The residuals are a measure of how much “twisting” of the model this

requires. The model is a gross simplification of reality, and the existence of residuals

should not be a surprise. But sizable, serially correlated errors might suggest that the

forecast may be ignoring the tensions inherent in the normal dynamic processes of the

economy. It may be interesting to see under what assumptions the forecasts make

more sense.

• A pure model-based forecast results from solving the model under the assumption

that all future residuals are zero.

• A hybrid forecast is a mix of these two pure forms. The analyst manipulates the

future residuals (these judgmental residuals are often called add-factors or temps) or

directly sets certain future values of endogenous variables (“tunes”) to create a

forecast that combines judgment with the model. For example, the residuals for the

current period are a measure of how far the current situation is away from the

predictions of the model. It may be prudent to allow these residuals to shrink over a

few quarters to zero rather than jump to the model forecasts in one step, on the

grounds that the model is missing something about the current situation and whatever

this is should not be expected to disappear overnight. More generally, the analyst may

- 22 -

be interested in fixing a path for, say, the policy interest rate temporarily for two or

three quarters and observing the outcome of the model. Or, the analyst may believe

that the model is underestimating growth and adjust the forecasts accordingly.

The hybrid forecast is at the heart of the forecasting and policy analysis exercise. First, it is in

this context that the central forecast emerges, given that this forecast will rarely be purely

model based but will involve substantial judgment about the evolution of the economy.

Second, alternative scenarios, policies, and shocks can be examined. These would typically

include:

•

Sensitivities to alternative assumptions. For example, the analyst might consider

alternative paths for the exchange rate and examine the effects of these alternative

assumptions on the forecast, under the view that the link between interest rates and

exchange rates is both difficult to predict and not well captured by the model. The

analyst might also explore sensitivities to changes in the parameters or structure of

the model or assumptions about equilibrium values such as potential output.

•

Implications of various shocks. Where the model explicitly incorporates the shock in

question, such as with aggregate demand, prices, or the exchange rate, this is

straightforward. Otherwise, substantial judgment is required to decide how, say, a

supply shock might manifest itself in terms of the model.

•

Alternative policy responses, including add-factors or tunes to the interest rate or

changes in the monetary policy reaction function.

VI. AN EXAMPLE

A. Overview

We now demonstrate the entire process. First, we design, parameterize and test a model of

the Canadian and U.S. economy. Second, we carry out a forecasting exercise. We base our

forecasting exercise on a set of judgmental forecasts for Canadian and U.S. variables that

extend through 2009. We will use the model to assess and carry out sensitivity analysis with

respect to this purely judgmental forecast. In this vein, we choose the Canadian and U.S.

economies in part to emphasize that calibration and use of this sort of model is not a

mechanical exercise. Two of us have significant experience working on these economies, as

is required to develop and use any model wisely.

47

The key equations of the model are the same as the canonical model presented in Section III,

except that they have been modified to reflect two key features of the Canadian economy: its

dependence on the U.S. economy and the importance of oil prices. The simple canonical

47

The companion paper goes into substantially more detail. A more extensive example of the implementation of

a similar model can be found in Coats, Laxton and Rose (2003).

- 23 -

model has been extended so that the Canadian output gap also depends on the U.S. output

gap. In addition, the real oil price is added to the inflation equation and the equation that

determines potential output in both countries.

48

In order to capture some of the key issues

surrounding the effects of oil price changes, we also include a variable measuring “core

inflation,” which excludes volatile items such as energy prices.

49

The equation for core

inflation excludes the direct effects of oil prices but allows some pass-through from the

overall CPI to core inflation.

B. Building the model

Some history and data

The top three panels of Figure 1 report year-on-year output growth, CPI inflation and short-

term interest rates for Canada, and, for reference, the United States. The bottom panel of

Figure 1 reports the bilateral exchange rate between Canada and the United States. The close

connection with U.S. GDP, interest rates, and inflation is evident. This sample covers a

period of a flexible exchange rate regime, transitions between low (high) and high (low)

inflation regimes in both countries, as well as a period for Canada that includes a formal

inflation-targeting regime that started in 1991.

Figure 2 plots the trend and detrended measures of output, real interest rates and the real

exchange rate that will be used in the model for Canada. Similarly, Figure 3 plots the

measures of output and the real interest rates for the United States. The trend measures of

output in both countries were constructed using a filter that smoothes the original series. In

addition, we imposed the staff view that the trend value of output was 1.7 percent above

actual output in 2004Q2 in the United States and 0.4 percent in the case of Canada.

50

The

trend real exchange rate is based on smoothed historical data as well as the assumption that it

was equal to the actual real exchange rate in 2004Q1. The equilibrium short-term real interest

rate is assumed to be constant at 2.5 percent in Canada and 2.25 percent in the United States

implying a steady-state small-country risk premium of 25 basis points.

48

This very simple specification roughly mimics the properties of the GEM and other models like FRB-US that

model oil as a factor of production. See Hunt (2005).

49

We had to add a measure of core inflation to the model because the Bank of Canada’s Quarterly Projection

Model (QPM) uses this as its key inflation variable, and we wanted to do some comparisons across the two

models.

50

Obviously, there is considerable uncertainty about these estimates. The implications of different estimates for

the output gap can be easily and quickly analyzed, however.

- 24 -

Parameterization

The parameters of the models for Canada and the United States were calibrated on the basis

of the model’s system properties and by comparing the dynamics of our Small Monetary

Policy Model (dubbed SMPMOD) with other models of the U.S. and Canadian economies.

51

To give a flavor for the exercise, consider the equation for headline inflation (equation 2

above). We set the weight on the lead terms in the inflation equation (α

πld

) to 0.20 in both

economies. This implies weights on the lagged inflation terms (1-α

πld

) of 0.80, implying

significant intrinsic inertia in the inflation process. These parameters, combined with the

weight on the output gap (α

ygap

), will be the principal determinants of the output costs of

disinflation. We set the weights on the output gaps in both countries at 0.30, yielding a

sacrifice ratio of around 1.3 in both countries.

52

This sacrifice ratio is significantly lower than

reduced-form econometric estimates of the sacrifice ratio that were estimated over sample

periods that included transitions from low to high inflation in the late 1960s and early 1970s,

or from high to low inflation in the early 1980s. Using quarterly data from 1964 to 1988

Cozier and Wilkinson (1990) estimate the sacrifice ratio to be around 2. A very similar

sacrifice ratio is embodied in the Department of Finance’s NAOMI model and an even larger

estimate of 3 is in the Bank of Canada’s QPM model. The smaller sacrifice ratios in

SMPMOD are by design, given our belief that the econometric estimates above are biased

estimates of the current sacrifice ratio as they reflect the experiences of slow learning

associated with moving between high and low levels of inflation regimes in the 1980s.