NBER WORKING PAPER SERIES

DSGE MODELS FOR MONETARY POLICY ANALYSIS

Lawrence J. Christiano

Mathias Trabandt

Karl Walentin

Working Paper 16074

http://www.nber.org/papers/w16074

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

June 2010

We are grateful for advice from Michael Woodford and for comments from Volker Wieland. We are

grateful for assistance from Daisuke Ikeda and Matthias Kehrig. The views expressed in this paper

are solely the responsibility of the authors and should not be interpreted as reflecting the views of the

European Central Bank, or of Sveriges Riksbank, or of the National Bureau of Economic Research.

NBER working papers are circulated for discussion and comment purposes. They have not been peer-

reviewed or been subject to the review by the NBER Board of Directors that accompanies official

NBER publications.

© 2010 by Lawrence J. Christiano, Mathias Trabandt, and Karl Walentin. All rights reserved. Short

sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided

that full credit, including © notice, is given to the source.

DSGE Models for Monetary Policy Analysis

Lawrence J. Christiano, Mathias Trabandt, and Karl Walentin

NBER Working Paper No. 16074

June 2010

JEL No. E2,E3,E5,J6

ABSTRACT

Monetary DSGE models are widely used because they fit the data well and they can be used to address

important monetary policy questions. We provide a selective review of these developments. Policy

analysis with DSGE models requires using data to assign numerical values to model parameters. The

chapter describes and implements Bayesian moment matching and impulse response matching procedures

for this purpose.

Lawrence J. Christiano

Department of Economics

Northwestern University

2003 Sheridan Road

Evanston, IL 60208

and NBER

Mathias Trabandt

European Central Bank

Kaiserstrasse 29

60311 Frankfurt am Main

GERMANY

and Sveriges Riksbank

Karl Walentin

Sveriges Riksbank

103 37 Stockholm

Sweden

An online appendix is available at:

http://www.nber.org/data-appendix/w16074

Conten ts

1 Introduction....................................... 3

2 SimpleModel ...................................... 5

2.1 Private Economy ................................. 7

2.1.1 Households ................................ 7

2.1.2 Firms ................................... 7

2.1.3 Aggregate Resources and the Priv ate Sector Equilibrium Conditions . 11

2.2 Log -lin ea rized Equ ilibrium with Taylor Rule . . . ............... 12

2.3 FrischLaborSupplyElasticity.......................... 16

3 SimpleModel:SomeImplicationsforMonetaryPolicy ............... 18

3.1 Taylor Principle .................................. 20

3.2 Monetary Policy and InefficientBooms ..................... 25

3.3 UsingUnemploymenttoEstimatetheOutputGap .............. 27

3.3.1 AMeasureoftheInformationContentofUnemployment....... 27

3.3.2 TheCTWModelofUnemployment................... 28

3.3.3 LimitedInformationBayesianInference................. 31

3.3.4 EstimatingtheOutputGapUsingtheCTWModel.......... 34

3.4 UsingHPFilteredOutputtoEstimatetheOutputGap............ 37

4 Medium-Sized DSGE Model .............................. 39

4.1 Goods Production ................................. 40

4.2 Households .................................... 43

4.2.1 HouseholdsandtheLaborMarket.................... 44

4.2.2 Wages,EmploymentandMonopolyUnions............... 47

4.2.3 CapitalAccumulation .......................... 49

4.2.4 HouseholdOptimizationProblem .................... 52

4.3 FiscalandMonetaryAuthorities,andEquilibrium............... 52

4.4 AdjustmentCostFunctions ........................... 53

5 Estimation Strategy................................... 53

5.1 VARStep ..................................... 53

5.2 ImpulseResponseMatchingStep ........................ 55

5.3 Com putation of V (θ

0

,ζ

0

,T) ........................... 56

5.4 Laplace Approximation of the Posterior Distrib ution . . . .......... 58

6 Medium-SizedDSGEModel:Results ......................... 59

6.1 VARResults.................................... 59

6.1.1 MonetaryPolicyShocks ......................... 60

6.1.2 TechnologyShocks ............................ 62

6.2 Model Results ................................... 62

6.2.1 Parameters . ............................... 62

6.2.2 ImpulseResponses ............................ 63

6.3 Assessin g VAR Robustn ess and Accuracy of the Laplace Approxima tion . . . 65

7 Conclusion........................................ 65

2

1. Introduction

There has been enormous progress in recent years in the development of dynam ic, stocha stic

general equilibrium (DSGE) models for the purpose of monetary policy analysis. These

models have been sho w n to fit aggreg ate data well b y conven tional econom etric m easu res.

For example, they ha ve been sho w n to do as well or better than simple atheoretical statistical

models at forecasting outside the sample of data on whic h they were estimated. In part

because of these successes, a consensus has formed around a par ticular m odel structure, the

New Keyn esian model.

Our objectiv e is to present a selective review of these developments. We presen t sev e ral

exam p les to illustrate the kind of policy questions the models can be used to addr ess. We

also con vey a sense of how w ell the models fit the data. In all cases, our discussion tak es

place in the simplest version of the model required to make our point. As a result, w e do

not dev elop one single model. Instead, w e w ork with sever al models.

We begin by presenting a detailed derivation of a version of the standard New Keyn esian

model with price setting frictions and no capital or other com plica tions. We then use v e rsions

of this simple model to address several importan t policy issues. For examp le, the past few

decades have witnessed the emergence of a consensus that monetary policy ought to respond

aggressively to changes in actual or expected inflation. This prescription for mon eta ry policy

is known as the ‘Tay lor principle’. The standar d version of the simple model is used to

articulate wh y this prescription is a good one. Ho wever, alternative v ersion s of the model

can be used to identify potential pitfalls for the Tay lor principle. In particular, a policy-

induced rise in the nominal interest rate m ay destabilize the economy by perversely giving a

direct boost to inflation. This can happen if the standard model is modified to incorporate

a so-called working capital c hannel, which corresponds to the assumption that firms m ust

borro w to finance their variable inputs.

We then turn to the m uch-discussed issue of the in teraction between m oneta ry policy

and volatility in asset prices and other aggregate economic variables. Here, we explain ho w

vigorous application of the Taylor principle could inadvertently trigger an inefficient boom

in output and asset prices.

Finally, w e discuss the use of DSGE models for addressing a k ey policy question, “how

big is the gap between the level of economic activity and the best level that is achievable

b y policy?” An estimate of the output gap not only pro vides an indication about how effi-

cien tly resources are being used. In the New Keynesian framework, the output gap is also

asignalofinflatio n pressure. Informally, the unemployme nt rate is thought to provide a

direct observation on the efficiency of resource allocation. For example, a large increase in

the nu mber of people reporting to be ‘ready and willing to w or k ’ but not em ployed sug-

3

gests, at least at a casual lev el, that resources are being w asted and that the output gap is

negative. DS G E models can be used to formalize and assess these informal hun ches. We

do this b y introducing unemplo yment in to the standard New Keynesian model along the

lines recen tly proposed in Christiano, Trabandt and Walen tin (2010a) (CTW). We use the

model to describe circumstance in whic h w e can expect the unemplo yment rate to pro vid e

useful information about the output gap. We also report evidence whic h suggests that these

condition s may be satisfied in the US data.

Although the creators of the Hodrick and Prescott (1997) (HP) filter never intend ed it

to be used to estimate the New Keynesian output gap concept, it is in fact often used for

this purpose. We show that whether the HP filter is a good estimator of the gap depends

sensitively on the details of the under lying model economy. This discussion involves a careful

review of the in tuition of ho w the New Keynesian model responds to shoc ks. Interestingly,

a New Keynesian model fit to US data suggests the conditions are satisfied for the HP filter

to be a good estim ator of the output gap. In our discussion, we explain that there are

several ca veats that must be taken in to accoun t before concluding that the HP filte r is a

good estimator of the output gap.

Policy analysis with DSGE models, even the simple analyses summa rized above, require

assigning values to model para m eters. In recent yea rs, the Ba yesian approach to eco nom e trics

has taken o ver as the dominan t one for this purpose. In conven tional applications, the

Bay esian approac h is a so-called full information procedure because the analyst specifies

the join t likelihood of the available observations in complete detail. As a result, many

of the limited information tools in macroeconomists’ econo m etric toolbo x ha ve been de-

emph asized in recent times. Th ese tools includ e meth ods that matc h model and data second

mom e nts and that m atch model and emp irical imp ulse response functions. Follo w ing the

w ork of Chernozhukov and Hong (2003), Kim (2002), Kwan (1999) and others, we sho w ho w

the Bay esia n approach can be applied in limited information con texts after all. We apply

a Ba yesian moment matching approach in section 3.3.3 and a Bay esia n impulse response

function matching approac h in section 5.2.

The new monetary DS G E models are of interest not just because they represent laborato-

ries for the analysis of important m onetary policy questions. They are also of interest because

they appear to resolve a classic empirical puzzle about the effects of monetary policy. It has

long been thought that it is virtually impossible to explain the very slo w response of inflation

to a moneta ry disturbance without appealing to completely implausible assumptions about

price frictions (see, e.g., Mankiw (2000)). How ev er, it turns out that modern DSGE models

do pro vide an accoun t of the inertia in inflation and the strong response of real variables to

mon etary policy disturbances, without appealing to seemingly implausible parameter values.

Moreover, the m odels sim u ltaneo usly explain the dynamic response of the economy to other

4

shocks. We review these important findin gs. We explain in detail the contribution of each

feature of the consensus medium -sized New Keynesian model in ac h ieving this result. This

discussion follo w s closely the analysis in Christiano, Eic h enbaum and Evans (2005) (CEE)

and Altig, Christiano, Eic henbaum and Linde (2005) (A C EL ).

The econom etric technique that is particularly suited to the shock-based analysis de-

scribed in the previous paragraph, is the one that matc hes impu lse response functions esti-

mated by vector autoregressions (VARs) with the corresponding objects in a model. Using

US macroeconom ic data, we sho w ho w the parameters of the consensus DSGE model are

estimated b y this impu lse-response matc hing procedure. Th e advan tage of this econometric

approach is transparen cy and focus. The transparency reflects that the estimation strategy

has a sim ple graphical representation, inv olving objects - impulse response functions - about

which econom ists have stron g intuition. The advantage of focus comes from the possibil-

ity of studying the empirical properties of a model without ha ving to specify a full set of

shocks. As noted above, w e show how to im plem ent the imp ulse response m atching strategy

using Ba yesian m ethods. In particular, w e are able to im plemen t all the machinery of priors

and posteriors, as well as the marginal lik elihood as a measure of model fit in our impulse

response function matching exercise.

The paper is organized as follows. Section 2 describes the simple New Keynesian model

withou t capital. The follo w in g section reviews some policy im plication s of that model.

The medium -sized v ersion of the model, designed to econom etrically address a ric h set of

macroeconomic data, is described in section 4. Section 5 reviews our Bayesian impulse

response matching strategy. Section 6 reviews the results and conclusions are offered in

Section 7. Many algebraic derivations are relegated to a separate tec h nical appendix.

1

2. Simple Model

This section analyzes v ersion s of the standard Calvo-stic ky price New K eyn esian m odel with-

out capital. In practice, the analysis of the standard New Keynesian model often begins with

the familiar three equations: the linearized ‘Phillips curve’, ‘IS curve’ and monetar y policy

rule. We cannot simply begin with these three equations here because w e also study depar-

tures from the standard model. For this reason, we must derive the equilibrium conditions

from their foundations.

The ver sion of the New Keynesian model studied in this section is the one considered

in Clarida, Gali and Gertler (1999) and Woodford (2003), modified in two ways. First, we

in troduce the wo rking capital channel emphasized b y CEE and Barth and Ramey (2002).

2

1

The technical appendix can be found at

h t tp://www.faculty.econ.northwestern.edu/faculty/christiano/research/Handbook/technical_appendix.pdf.

2

The fi rst monetary DSGE model we are aware of that incorporates a working capital channel is Fuerst

5

The working capital chann el results from the assum p tion that firms’ variable inputs m u st be

financed by short term loans. With this assumption, c hanges in the interest rate affect the

economy by c han ging firm s’ variable production costs, in addition to operating through the

usual spending mec hanism. There are sev eral reasons to take the working capital c hannel

seriously. Using US Flow of Funds data, Barth and Ramey (2002) argue that a substan tial

fraction of firm s’ variable input costs are borrowed in advance. Ch ristiano , Eic h enbaum , and

Evans (1997) provide v ecto r autoregression evidence suggesting the presence of a w orkin g

capital channel. Cho wdhury, Hoffmann and Schabert (2006) and Ra venna and Walsh (2006)

provide additional evidence supporting the working capital c han nel, based on instrumental

variables estimates of a suitably modified Phillips cur ve. Finally, section 4 below shows that

incorporating the working capital chan nel helps to explain the ‘price puzzle’ in the v ecto r

autoregr ession literatur e and provides a response to Ball (1994)’s ‘dis-inflationary boom’

critique of stic k y price models.

We explore a second modification to the classic New Keynesian model by incorporating

the assumption about materials inputs proposed in Basu (1995). Basu argues that a large

part - as much as half - of a firm ’s output is used as inputs by other firms. The working

capital channel introduces the interest rate in to costs while the mater ials assum p tion makes

those costs big. In the next section of this paper we sho w that these t wo factors hav e

potentially far-reaching consequences for monetary policy.

This section is organize d as follows. We begin by describing the pr ivate sector o f the ec on-

omy, and deriving equilibrium conditions associated with optimization and market clearing.

In the next subsection, w e specify the monetary policy rule and definetheTaylorruleequi-

librium. The last subsection discusses the interp retatio n of a k ey parameter in our utility

function. T he parameter controls the elasticity with which the labor input in our model

econom y adjusts in response to a c hange in the real w age. Traditionally, this parameter

has been view ed as being restricted by microeconomic evidence on the Frisch labor supply

elasticit y. We summ arize recent thinking stim ulated by the semin al w o rk of Rogerson (1988)

and Hansen (1985), according to whic h this parameter is in fact not restricted by evidence

on the Frisch elasticity.

(1992). Other early examples include Christiano (1991) and Christiano and Eichenbaum (1992a).

6

2.1. Private Economy

2.1.1. Households

We suppose there is a large n umber of identical households. The representa tive household

solves the following problem:

max

{C

t

,H

t

,B

t+1

}

E

0

∞

X

t=0

β

t

Ã

log C

t

−

H

1+φ

t

1+φ

!

, 0 <β<1,φ≥ 0, (2.1)

subject to

P

t

C

t

+ B

t+1

≤ B

t

R

t−1

+ W

t

H

t

+ Transfers and profits

t

. (2.2)

Here, C

t

and H

t

denote household consumption and market wo rk, respectiv ely. In (2.2),

B

t+1

denotes the quantity of a nominal bond purchased by the household in period t and

R

t

denotes the one-period gross nominal rate of in terest on a bond purchased in period t.

Finally, W

t

denotes the competitively determined nominal w age rate. The parameter, φ, is

discussed in section 2.3 belo w .

The representativ e ho usehold equates the m arg inal cost of working, in consumption units,

with the marginal benefit, the real w a ge:

C

t

H

φ

t

=

W

t

P

t

. (2.3)

The representative household also equates the utility cost of the consumption foregone in

acquiring a bond with the corresponding benefit:

1

C

t

= βE

t

1

C

t+1

R

t

π

t+1

. (2.4)

Here, π

t+1

denotes the gross rate of inflation from t to t +1.

2.1.2. Firms

A k ey feature of the N ew Keyn esian model is its assumption that there are price-setting

frictions. These frictions are in troduced in order to accom m odate the evidence of inertia in

aggregate inflation. Obviously, the presence of price-setting frictions requires that firms hav e

the po wer to set prices, and this in turn requires the presence of monopoly power. A challenge

is to create an en v ironm ent in which there is monopoly power, without con tr ad icting the

obvious fact that actual econo mies hav e a v ery large n umber of firms. The Dixit-Stiglitz

framework of production handles this challenge very nicely, because it has a v ery large

n u mber of price-setting monopolist firms. In particular, gross output is produced using a

representative, competitive firm using the follow ing tec hnology:

Y

t

=

µ

Z

1

0

Y

1

λ

f

i,t

di

¶

λ

f

,λ

f

> 1, (2.5)

7

where λ

f

gov erns the degree of substitution between the different inputs. The represen tative

firm takes the price of gross output, P

t

, and the price of in termediate inputs, P

it

, as giv en.

Profit ma x imization leads to the following first order condition:

Y

i,t

= Y

t

µ

P

i,t

P

t

¶

−

λ

f

λ

f

−1

. (2.6)

Substituting (2.6) in to (2.5) yields the follo wing relation between the aggregate price lev el

and the prices of intermediate goods:

P

t

=

µ

Z

1

0

P

−

1

λ

f

−1

i,t

di

¶

−

(

λ

f

−1

)

. (2.7)

The i

th

intermediate good is produced by a single mon opolist, who takes (2.6) as its

demand curve. The value of λ

f

determines ho w muc h monopoly pow er the i

th

producer has.

If λ

f

is large, then in term edia te goods are poor substitutes for each other, and the monopoly

supplier of good i has a lot of market po wer. Consistent with this, note that if λ

f

is large,

then the demand for Y

i,t

is relatively price inelastic (see (2.6)). If λ

f

is close to unity, so that

each Y

i,t

is alm o st a perfect sub stitute for Y

j,t

,j6= i,theni

th

firm faces a demand curve that

is almo st perfectly elastic. In this case, the firm has virtually no market po wer.

The production function of the i

th

mono polist is:

Y

i,t

= z

t

H

γ

i,t

I

1−γ

it

, 0 <γ≤ 1, (2.8)

where z

t

is a tec hnology shock whose stoch astic properties are specified below. Here, H

it

denotes the lev el of employment by the i

th

monopolist. We follow Basu (1995) in supposing

that the i

th

mono polist uses the quan tity of materials, I

it

, as inputs to production. Th e

materials, I

it

, are converted one-for-one from Y

t

in (2.5). For γ<1, each inter m ed iate good

producer in effect uses the output of all the other in termediate produces as input. W h en

γ =1, then materials inputs are not used in production.

The nom in al mar gin al cost of the intermediate good producer is the follow ing Co bb-

Douglasfunctionofthepriceofitstwoinputs:

marginal cost

t

=

µ

¯

P

t

1 − γ

¶

1−γ

µ

¯

W

t

γ

¶

γ

1

z

t

.

Here,

¯

W

t

and

¯

P

t

are the effectiv e prices of H

it

and I

it

, respectively:

¯

W

t

=(1− ν

t

)(1− ψ + ψR

t

) W

t

(2.9)

¯

P

t

=(1− ν

t

)(1− ψ + ψR

t

) P

t

.

In this expression, ν

t

denotes a subsidy to intermediate good firms and the term involving

the interest rate reflects the presence of a ‘working capital chan nel’. For examp le, ψ =1

8

corresponds to the case where the full amoun t of the cost of labor and materials m u st be

financed at the beginning of the period. W hen ψ =0, no advanced financing is required. A

k ey variable in the model is the ratio of nominal marginal cost to the price of gross output,

P

t

:

s

t

=(1− ν

t

)

µ

1

1 − γ

¶

1−γ

µ

¯w

t

γ

¶

γ

(1 − ψ + ψR

t

) , (2.10)

where ¯w

t

denotes the scaled real wage rate:

¯w

t

≡

W

t

z

1

γ

t

P

t

. (2.11)

If in te rm ed iate good firms faced no price-setting frictions, they wou ld all set their price

as a fixed markup over nominal marginal cost:

λ

f

P

t

s

t

. (2.12)

In fact, w e assume there are price-setting frictions along the lines proposed by Ca lvo (198 3).

An intermediate firm can set its price optimally with probability 1−ξ

p

, and with probability

ξ

p

it m ust k eep its price unchanged relativ e to what it wa s in the previous period:

P

i,t

= P

i,t−1

.

Consider the 1 − ξ

p

intermediate good firms that are able to set their prices optimally in

period t. There are no state variables in the in ter m ediate good firm problem and all the

firms face the same demand curve. A s a result, all firms able to optim iz e their pr ices in

period t choose the same price, whic h we denote b y

˜

P

t

. It is clear that optim izing firms do

not set

˜

P

t

equal to (2.12). Setting

˜

P

t

to (2.12) would be optimal from the perspective of the

current period, but it does not tak e in to account the possibilit y that the firm may be stuck

with

˜

P

t

for several periods into the future. Instead, the intermediate good firms that have

an opportunity reoptimize their price in the current period, do so to solve:

max

˜

P

t

E

t

∞

X

j=0

¡

ξ

p

β

¢

j

υ

t+j

³

˜

P

t

Y

i,t+j

− P

t+j

s

t+j

Y

i,t+j

´

, (2.13)

subject to the demand curv e, (2.6), and the definition of margin al cost, (2.10). In (2.13),

β

j

υ

t+j

is the multiplier on the household’s nominal period t + j budget constrain t. Becau se

they are the own ers of the intermediate good firms, households are the recipien ts of firm

profits. In this w ay, it is natural that the firm should weigh profits in different dates and

states of nature using β

j

υ

t+j

. Intermediate good firms take υ

t+j

as giv en. The nature of the

family’s preferences, (2.1), implies:

υ

t+j

=

1

P

t+j

C

t+j

.

9

In (2.13) the presence of ξ

p

reflects that in termediate good firms are only concerned with

future scenarios in which they are not able to reoptim ize the price c h osen in period t.

The first order condition associated with (2.13) is:

˜p

t

=

E

t

P

∞

j=0

¡

βξ

p

¢

j

(X

t,j

)

−

λ

f

λ

f

−1

λ

f

s

t+j

E

t

P

∞

j=0

¡

βξ

p

¢

j

(X

t,j

)

−

1

λ

f

−1

=

K

f

t

F

f

t

, (2.14)

where K

f

t

and F

f

t

denote the num erator and denominator of the ratio after the first equalit y,

respectively. Also,

˜p

t

≡

˜

P

t

P

t

,X

t,j

≡

½

1

π

t+j

···π

t+1

j>0

1 j =0

.

Not surprisingly, (2.14) implies

˜

P

t

is set to (2.12) when ξ

p

=0.Whenξ

p

> 0, optimizing

firm s set their prices so that (2.12) is satisfied on average. It is useful to write the numerator

and denomin ator in (2.14) in recursive form . Thus,

K

f

t

= λ

f

s

t

+ βξ

p

E

t

π

λ

f

λ

f

−1

t+1

K

f

t+1

, (2.15)

F

f

t

=1+βξ

p

E

t

π

1

λ

f

−1

t+1

F

f

t+1

. (2.16)

Expression (2.7) simplifies when we take in to account that (i) the 1 − ξ

p

intermediate

good firms that set their price optimally all set it to

˜

P

t

and (ii) the ξ

p

firm s that cannot

reset their price are selected at random from the set of all firm s. Doing so,

˜p

t

=

⎡

⎣

1 − ξ

p

π

1

λ

f

−1

t

1 − ξ

p

⎤

⎦

−

(

λ

f

−1

)

. (2.17)

It is convenient to use (2.17) to eliminate ˜p

t

in (2.14):

K

f

t

= F

f

t

⎛

⎝

1 − ξ

p

π

1

λ

f

−1

t

1 − ξ

p

⎞

⎠

−

(

λ

f

−1

)

. (2.18)

When γ<1, cost minim ization by the i

th

intermediate good producer leads it to equate

the relative price of its labor and materials inputs to the corresponding relative marginal

productivities:

¯

W

t

¯

P

t

=

W

t

P

t

=

γ

1 − γ

I

it

H

it

=

γ

1 − γ

I

t

H

t

. (2.19)

Evidently, eac h firm uses the same ratio of inputs, regardless of its output price, P

it

.

10

2.1.3. Aggregate Resources and the Private Sector Equilibrium Conditions

A notable feature of the New Keynesian model is the absence of an aggregate production

function. That is, given information about aggregate inputs and technology, it is not possible

to sa y wha t aggregate output, Y

t

, is. ThisisbecauseY

t

also depends on how inputs are

distributed among the various in termediate good producers. For a giv en amoun t of aggregate

inputs, Y

t

is maximized by distributing the inpu ts equally across producers. A n unequ al

distribution of inputs results in a low er level of Y

t

. In the New K eynesian model with Calvo

price frictions, resources are unequally allocated across in term ediate good firms if, and only

if, P

it

differs across i. Price dispersion in the model is caused b y the interaction of inflation

with price-setting frictions. With price dispersion, the price mechanism ceases to allocate

resources efficien tly, as too m uch production is done in firm s with low prices and too little

in the firm s with high prices. Yun (1996) derived a very simple formula that chara cterizes

the loss of output due to price dispersion. We rederiv e the analog of Yun (1996)’s formula

that is relevant for our setting.

Let Y

∗

t

denote the unw eighted in tegral of gross output across interm ed iate good produc-

ers:

Y

∗

t

≡

Z

1

0

Y

i,t

di =

Z

1

0

z

t

µ

H

it

I

it

¶

γ

I

it

di = z

t

µ

H

t

I

t

¶

γ

I

t

= z

t

H

γ

t

I

1−γ

t

.

Here, w e have used linear homogeneity of the production function function, as w ell as the

result in (2.19), that all intermediate good producers use the same labor to materials ratio.

An alternativ e representa tion of Y

∗

t

makesuseofthedemandcurve,(2.6):

Y

∗

t

= Y

t

Z

1

0

µ

P

i,t

P

t

¶

−

λ

f

λ

f

−1

di = Y

t

P

λ

f

λ

f

−1

t

Z

1

0

(P

i,t

)

−

λ

f

λ

f

−1

di = Y

t

P

λ

f

λ

f

−1

t

(P

∗

t

)

−

λ

f

λ

f

−1

. (2.20)

Th us,

Y

t

= p

∗

t

z

t

H

γ

t

I

1−γ

t

,

where

p

∗

t

≡

µ

P

∗

t

P

t

¶

λ

f

λ

f

−1

. (2.21)

Here, p

∗

t

≤ 1 denotes Yun (1996)’s measure of the output lost due to price dispersion. From

(2.20),

P

∗

t

=

∙

Z

1

0

(P

i,t

)

−

λ

f

λ

f

−1

di

¸

−

λ

f

−1

λ

f

. (2.22)

Accordingto(2.21),p

∗

t

is a monotone function of the ratio of two different weigh ted averages

of interm ediate good prices. Th e ratio of these t wo weigh ted aver ages can only be at its

11

maximum of unity if all prices are the same.

3

Taking in to accoun t observations (i) and (ii) after (2.16), (2.22) reduces (after dividing

by P

t

and taking into accoun t (2.21)) to:

p

∗

t

=

⎡

⎢

⎣

¡

1 − ξ

p

¢

⎛

⎝

1 − ξ

p

π

1

λ

f

−1

t

1 − ξ

p

⎞

⎠

λ

f

+ ξ

p

π

λ

f

λ

f

−1

t

p

∗

t−1

⎤

⎥

⎦

−1

. (2.23)

Accord ing to (2.23), there is price dispersion in the curren t period if there was dispersion

in the previous period and/or if there is a curren t shock to dispersion. Such a shock must

operate through the aggregate rate of inflation .

We conclude that the relation bet ween aggregate inputs and gross output is given b y:

C

t

+ I

t

= p

∗

t

z

t

H

γ

t

I

1−γ

t

. (2.24)

Here, C

t

+ I

t

represents total gross output, while C

t

represents value added.

The private sector equilibrium conditions of the model are (2.3), (2.4), (2.10), (2.15),

(2.16), (2.18), (2.19), (2.23) and (2.24). This represents 9 equations in the follo wing 11

unkno wns:

C

t

,H

t

,I

t

,R

t

,π

t

,p

∗

t

,K

f

t

,F

f

t

,

W

t

P

t

,s

t

,ν

t

. (2.25)

As it stands, the system is underdetermined. T h is is not surprising, since we have said

nothing about monetary policy or how ν

t

is determ ine d. We turn to this in the follo w ing

section.

2.2. Log-line ar ize d Equ ilib r ium with Taylor Rule

We log-linear ize the equilibrium conditio ns of the m odel about its nonstoch astic steady

state. We assume that monetary policy is governed by a Tay lor rule which responds to the

deviation between actual inflation and a zero inflation target. As a result, inflation is zero in

the nonstoc ha stic steady state. In addition, we suppose that the intermediate good subsidy,

ν

t

, is set to the constan t value that causes the price of goods to equal the social marginal

cost of production in steady state. To see wh at this implies for ν

t

, recall that in steady state

firm s set their price as a markup, λ

f

, o ver marginal cost. Th at is, they equate the object in

(2.12) to P

t

, so that

λ

f

s =1.

3

The distortion, p

∗

t

, is of interest in its own righ t. It is a sort of ‘endogenous Solow residual’ of the kind

called for by Prescott (1998). Whether the magnitude of fluctuations in p

∗

t

are quan titatively important

given the actual price dispersion in data is something that deserves exploration. A difficultythatmustbe

overcome, in such an exploration, is determining what the benchmark efficient dispersion of prices is in the

data. In the model it is efficient for all prices to be exactly the same, but that is obviously only a convenient

normalization.

12

Using (2.10) to substitute out for the steady state value of s, the latter expression reduces,

in steady state, to:

λ

f

(1 − ν)(1− ψ + ψR)

"

µ

1

1 − γ

¶

1−γ

µ

¯w

γ

¶

γ

#

=1.

Because we assume competitiv e labor markets, the object in square brac kets is the ratio of

social marg inal cost to price. As a result, it is socially efficient for this expression to equal

unity. Th is is accomplished in the steady state by setting ν as follows:

1 − ν =

1

λ

f

(1 − ψ + ψR)

. (2.26)

Our treatment of policy implies that the steady state allocations of our model economy

are efficient in the sense that they coincide with the solution to a particular planning problem.

To defin e this problem, it is conv en ient to adopt the follow in g scaling of variables:

c

t

≡

C

t

z

1/γ

t

,i

t

≡

I

t

z

1/γ

t

. (2.27)

The plannin g problem is:

max

{c

t

,H

t

,i

t

}

E

0

∞

X

t=0

β

t

"

log c

t

−

H

1+φ

t

1+φ

#

, subject to c

t

+ i

t

= H

γ

t

i

1−γ

t

. (2.28)

The problem , (2.28), is that of a planner who allocates resources efficien tly across interme-

diate goods and who does not permit monopoly po wer distortions. Because there is no state

variable in the proble m , it is obvious that the choice variables that solve (2.28) are constan t

o ver time. This implies that the C

t

and I

t

that solve the planning problem are a fixed pro-

portion of z

1/γ

t

o ver time. It turns out that the allocations that solv e (2.28) also solve the

Ramsey optimal policy problem of maximizing (2.1) with respect to the 11 variables listed

in (2.25) subject to the 9 equations listed before equation (2.25).

4

Because inflation, π

t

, fluctuates in equilibrium , (2.23) suggests that p

∗

t

fluctu ates too. It

turns out, howev er, tha t p

∗

t

is consta nt to a first order appro x im ation. To see this, note that

the absence of inflation in the steady state also guarantees there is no price dispersion in

steady state in the sense that p

∗

t

is at its maxim al value of unit y (see (2.23)). With p

∗

t

at its

maximum in steady state, small perturbations ha ve a zero first-order impact on p

∗

t

. This can

be seen b y noting that π

t

is absent from the log-linear expansion of (2.23) about p

∗

t

=1:

ˆp

∗

t

= ξ

p

ˆp

∗

t−1

. (2.29)

4

The statement in the text is strictly true only in the case where the initial distortion in prices is zero,

that is p

∗

t−1

=1. If this condition does not hold, then it does hold asymptotically and may even hold as an

approximation after a small number of periods.

13

Here, a hat o ver a variable indicates:

ˆ

t

=

d

t

,

where denotes the steady state of the variable,

t

, and d

t

=

t

− denotes a small

perturbation in

t

from steady state. We suppose that in the initial period, ˆp

∗

t−1

=0, so

that, to a first order approximation, ˆp

∗

t

=0for all t.

Log-linear izing (2.15), (2.16) and (2.18) we obtain the usual representation of the Phillips

curve:

ˆπ

t

=

¡

1 − βξ

p

¢¡

1 − ξ

p

¢

ξ

p

ˆs

t

+ βE

t

ˆπ

t+1

. (2.30)

Combining (2.3) with (2.10), taking in to accoun t (2.27) and our the setting of ν in (2.26),

real marginal cost is:

s

t

=

1

λ

f

1 − ψ + ψR

t

1 − ψ + ψR

µ

1

1 − γ

¶

1−γ

Ã

c

t

H

φ

t

γ

!

γ

.

Then,

ˆs

t

= γ

³

φ

ˆ

H

t

+ˆc

t

´

+

ψ

(1 − ψ) β + ψ

ˆ

R

t

. (2.31)

Substituting out for the real wage in (2.19) using (2.3) and applying (2.27),

H

φ+1

t

c

t

=

γ

1 − γ

i

t

. (2.32)

Similarly, scaling (2.24):

c

t

+ i

t

= H

γ

t

i

1−γ

t

.

Using (2.32) to substitute out for i

t

in the abo ve expression, w e obtain:

c

t

+

1 − γ

γ

H

φ+1

t

c

t

= H

γ

t

∙

1 − γ

γ

H

φ+1

t

c

t

¸

1−γ

.

Log-linearizing this expression around the steady state implies, after some algebra,

ˆc

t

=

ˆ

H

t

. (2.33)

Substituting the latter into (2.31), we obtain:

ˆs

t

= γ (1 + φ)ˆc

t

+

ψ

(1 − ψ) β + ψ

ˆ

R

t

. (2.34)

In (2.34), ˆc

t

is the percent deviatio n of c

t

from its steady state value. Since this steady state

value coincides with the constant c

t

that solv es (2.28) for each t, ˆc

t

also corresponds to the

14

output gap. The notation w e use to denote the output gap is x

t

. Using this notation for th e

output gap and substituting out for ˆs

t

into the Phillips curve, we obtain:

ˆπ

t

= κ

p

∙

γ (1 + φ) x

t

+

ψ

(1 − ψ) β + ψ

ˆ

R

t

¸

+ βE

t

ˆπ

t+1

, (2.35)

where

κ

p

≡

¡

1 − βξ

p

¢¡

1 − ξ

p

¢

ξ

p

.

When γ =1and ψ =0, (2.35) reduces to the ‘Phillips curve’ in the classic New Keynesian

model. W hen materials are an important factor of production, so that γ is small, then a

givenjumpintheoutputgap,x

t

, has a smaller impact on inflation. Th e reason is that in this

case the aggregate price index is part of the input cost for in term ediate good producers. So, a

small price response to a given output gap is an equilibrium because individua l interm e diate

good firm s ha ve less of an incentiv e to raise their prices in this case. With ψ>0, (2.35)

indicates that a jump in the in terest rate drives up prices. This is because with an activ e

working capital chann el a rise in the interest rate driv es up marginal cost.

5

Now consider the in tertem poral Euler equation. Expressing (2.4) in term s of scaled

variables,

1=E

t

βc

t

c

t+1

μ

1

γ

z,t+1

R

t

π

t+1

,μ

z,t+1

≡

z

t+1

z

t

.

Log-linearly expand ing about steady state and recalling that ˆc

t

corresponds to the output

gap:

0=E

t

∙

x

t

− x

t+1

−

1

γ

ˆμ

z,t+1

+

ˆ

R

t

− ˆπ

t+1

¸

,

or,

x

t

= E

t

h

x

t+1

−

³

ˆ

R

t

− bπ

t+1

−

ˆ

R

∗

t

´i

, (2.36)

where

ˆ

R

∗

t

≡

1

γ

E

t

ˆμ

z,t+1

. (2.37)

We suppose that monetary policy, when linearized about steady state, is char acterized

by the following Ta ylor rule:

ˆ

R

t

= r

π

E

t

ˆπ

t+1

+ r

x

x

t

. (2.38)

The equilibrium of the log-linearly expa nd ed economy is giv e n by (2.37), (2.35), (2.36) and

(2.38).

5

Equation (2.35) resembles equation (13) in Ravenna and Walsh (2006), except that we also allow for

materials inputs, i.e., γ<1.

15

2.3. Frisch Labor Supply Elasticity

The magnitude of the parameter, φ, in the household utilit y function plays an important role

in the analysis in later sections. This paramete r has been the focus of m uch debate in macro-

econom ics. Note from (2.3) that the elasticity of H

t

with respect to the real wage, holding C

t

constant, is 1/φ. The condition, “holding C

t

constant”, could mean that the elasticity refers

to the response of H

t

to a change in the real w age that is of very short duration, so short

that the household’s wealth - and, hence, consumption - is left unaffected. Alternatively, the

elasticity could refer to the response of H

t

to a chang e in the real w a ge that is associated with

an offsetting lump sum transfer payment that k eep s wealth unch ang ed. The debate about

φ centers on the in ter pretation of H

t

. Under one interp retation , H

t

represents the amoun t

of hours w o rked b y a t y pical person in the labor force. W ith this in terpreta tion, 1/φ is the

Frisch labor supply elasticit y.

6

This is perhaps the most straigh t for ward int erpreta tion of

1/φ given our assump tion that the economy is populated by identical households, in whic h

H

t

is the labor effort of the t yp ical household. An alternative in terpretation of H

t

is that it

represents the number of people working, and that 1/φ mea sures the elasticity with whic h

marginal people substitute in and out of employ m ent in response to a change in the wage.

Under this interpretation, 1/φ need not correspond to the labor supply elasticit y of any

particular person. The t wo differen t in terpretations of H

t

give rise to very different views

about ho w data ought to be used to restrict the value of φ.

Thereisaninfluen tial labor m arket literature that estim ates the Frisch labor supply

elasticity using household level data. The general fin din g is that, although the Frisch elas-

ticit y varies somewha t across different t ypes of people, on the whole the elasticities are v ery

small. Some hav e in terpreted this to mean that only large values of φ (say, larger than

unity) are consistent with the data. Initially, this int rep retat ion w as widely accepted by

macroeconom ists. How ever, the in terp retatio n ga ve rise to a puzzle for equilibrium models

of the business cycle. Ov er the business cycle, employment flu ctuates a great deal more

than real w a ges. W h en view ed through the prism of equilibrium models the aggregate data

appeared to suggest that people respond elastically to changes in the w age. But, this seemed

inconsisten t with the microeconomic evidence that individual labor supply elasticities are in

fact small. At the present time, a consensus is emerging that what initially appeared to be

aconflict between micro and macro data is in fact no conflictatall. Theideaisthatthe

Frisc h elasticity in the micro data and the labor supply elasticit y in the macro data represent

6

The Frisch labor supply elasticit y refers to the substitution effect associated with a change in the wage

rate. It is the percent change in a person’s labor supply in response to a ch ange in the real wage, holding

the marginal utility of consumption fixed. Throughout this paper, we assume that utility is additively

separable in consumption and leisure, so that constancy of the marginal utility of consumption translates

into constancy of consumption.

16

at best distan tly related objects.

It is well know n that much of the business cycle variation in em ployment reflects changes

in the quantity of people w o rkin g, not in the num ber of hours w orked by a typical household.

Beginning at least with the w ork of Rogerson (1988) and Hansen (1985), it has been argued

that eve n if the individual’s labor supply elasticity is zero o ver most values of the wage,

aggrega te employment could nev erth eless respond highly elastically to small chan ge s in the

real w age. This can occur if there are many people who are near the margin bet ween w orking

in the ma rket and dev o ting their time to other activities. An example is a spouse who is

doing productive w ork in the home, and y et who might be tempted by a small rise in the

market wage to substitute in to the mar ket. Anoth er exam p le is teenagers who m ay be close

to the margin between pursuing additional education and work ing, w ho could be indu ced to

switch to working by a small rise in the wage. F inally, there is the elderly person wh o might

be induced b y a small rise in the market w age to dela y retirement. These examples suggest

that aggregate emplo y m ent m ight fluctuate substantially in response to sm all c h an ges in the

real w age, ev e n if the individual household’s Frisch elasticity of labor supply is zero o ver all

values of the w a ge, except the one value that induces a shift in or out of the labor market.

7

The ideas in the previous paragrap hs can be illustrated in our model. Such an illustration

obviously requires that households have several members (e.g., teenagers, elderly, middle-

aged work ing spouses). The realistic assumption is to suppose that ‘sev eral’ means 3 or 4,

but this w ou ld embroil us in technica l comp lication s which would tak e us a way from the

main idea. Instead, we adopt the techn ically conv en ient assumption that the househo ld has

a large nu mber of members, one for each of the poin ts on the line bounded b y 0 and 1.

8

In

addition, w e assume that a household mem ber only has the option to w ork full time or not

at all. Their Frisc h labor supply elasticit y is zero for most values of the wage. Let l ∈ [0, 1]

index a particular member in the family. Suppose this member enjoy s the follo w ing utility

if emp loyed:

log (C

t

) − l

φ

,φ>0,

and the following utility if not emp loyed:

log (C

t

) .

Househ old members are ordered according to their degree of aversion to wo rk. Those with

high values of l ha ve a high a version (for example, sma ll c h ild ren, and elder ly or chronically

ill people) to wo rk , and those with l near zero hav e v ery little a version. We suppose that

househ old decisions are made on a utilita rian basis, in a w ay that ma xim izes the equally

7

See Rogerson and Wallenius (2009) for additional discussion and analysis.

8

Our approach is most similar to the approach of Gali (2010), though it also resembles the recent work

of Mulligan (2001) and Krusell, Mukoyama, Rogerson and Sahin (2008).

17

weigh ted in tegra l of utility across all household members. Under these circumstances, effi-

ciency dictates that all members receiv e the same lev el of consumptio n, whether employed or

not. In addition, if H

t

members are to be em ployed, then those with 0 ≤ l ≤ H

t

should work

and those with l>H

t

should not. For a household with consumption, C

t

, and em ployment,

H

t

, utility is, after in tegratin g o ver all l ∈ [0, 1] :

log (C

t

) −

H

1+φ

t

1+φ

, (2.39)

which coincides with the period utility functio n in (2.1). Under this interpreta tion of the

utility function, (2.3) remains the relevant first order condition for labor. In this case, given

the wa ge, W

t

/P

t

, the household sends out a nu mber of members, H

t

, to work until the utility

cost of work for the marg inal w orker, H

φ

t

, is equated to the corresponding utility benefitto

the household, (W

t

/P

t

) /C

t

.

Note that under this in terpretation of the utilit y function, H

t

denotes a quantity of

workers and φ dictates the elasticit y with which different members of the households enter

orleaveemploymentinresponsetoshocks. Thecaseinwhichφ is large corresponds to the

case where household members differ relatively sharply in terms of their a version to w ork.

In this case there are not many members w ith disutility of w ork close to tha t of the margin al

w orker. As a result, a given change in the wage induces only a small c hange in emplo yment.

If φ is v ery small, then there is a large n umber of househ old members close to indifferen t

bet ween working and not wo rk ing, and so a sma ll ch ange in the real wage elicits a large labor

supply response.

Given that most of the business cycle variation in the labor input is in the form of

n u mbers of people em ployed, we think the m ost sensib le in terpr etation of H

t

is that it

measur es n umbers of people working. Accord ingly, 1/φ is not to be interpreted as a Frisch

elasticit y, whic h we instead assume to be zero.

3. Sim ple Model: Some Im p lic a tio n s for Mon e t a r y Policy

Monetary DSGE models ha ve been used to gain insigh t into a variet y of issues that are

importan t for monetary policy. We discuss some of these issues using variants of the simple

model developed in the previous section. A key feature of that model is that it is flexible, and

can be adjusted to suit differ ent questions and poin ts of view. The classic New Keynesian

model, the one with no working capital c hannel and no materials inputs (i.e., γ =1, ψ =0)

can be used to articu late the rationale for the Taylor prin ciple. But, varian ts of the New

Key nesian framework can also be used to articulate c ha llen ges to that principle. The first two

subsections belo w describe t wo suc h c ha llenges. The fact that the New Keynesian framework

can accommodate a variety of perspectives on important policy questions is an importan t

18

strength. This is because the framework helps to clarify debates and to mo tivate econometric

analyses so that data can be used to resolve those debates.

9

The last two subsections address the problem of estimating the output gap. The output

gap is an important variable for policy analysis because it is a measure of the efficiency

with whic h economic resources are allocated. In addition , New Keynesian models imply that

theoutputgapisanimportantdeterminantofinflation, a variable of particular concern

to monetary policy makers. We define the output gap as the percen t deviation between

actual output and potentia l output, where potentia l output is output in the Ram sey-efficient

equilib r iu m .

10

We use the classic New Keynesian model to study three w ays of estimating the output

gap. The first uses the structure of the simple New K eyn esian model to estimate the output

gap as a laten t variable. The second approac h modifies the New Keynesian model to include

unemploymen t along the lines indicated by CTW. This modification of the model allow s us to

in vestigate the information con tent of the unemployment rate for the output gap. In addition,

b y sho w in g one wa y that unem ployment can be in teg ra ted into the model, the discussion

represents anot her illustration of the v ersa tility of the New Keynesian framework.

11

The last

section below explores the Hodric k-P rescott (HP) filter as a device for estimating the output

gap. In the course of the analysis, we illustrate the Baye sian limited information moment

matching procedure discussed in the introduction.

9

For example, the Chowdhury, Hoffmann and Schabert (2006) and Ravenna and Walsh (2006) papers

cited in the previous section, sho w how the assumptions of the New Keynesian model can be used to develop

an empirical characterization of the importance of the working capital channel.

10

In our model, the Ramsey-equilibrium turns out to be what is often called the ‘first-best equilibrium’,

the one that is not distorted by monopoly power (and, hence, shocks to the Phillips curve, to the extent that

they represent markup disturbances, i.e., shocks to λ

f

in (2.5)) or flexible prices.

11

For an alternative recent approach to the introduction of unemployment into a DSGE model, see Gali

(2010). Gali demonstrates that with a modest reinterpretation of variables, the standard DSGE model with

sticky wages summarized in the next section contains a theory of unemployme nt. In the model of the labor

market used there (it was proposed by Erceg, Henderson and Levin (2000)) wages are set by a monopoly

union. As a result, the wage rate is higher than the marginal cost of working. Under these circumstances, one

can define the unemployed as the difference between the number of people actually working and the number

of people that would be working if the cost of work for the marginal person were equated to the wage rate.

Gali (2010a) shows how unemployment data can be used to help estimate the output gap, as we do here. The

CTW and Gali models of unemployment are quite different. For example, in the text we analyze a version of

the CTW model in whic h labor markets are perfectly competitive, so Gali’s ‘monopoly power’ concept of un-

employment is zero in this model. In addition, the efficient level of unemployment in the sense that we use the

term here, is zero in Gali’s definition, but positive in our definition. This is because in our model, unemploy-

men t is an inevitable by-product of an activity that must be undertaken to find a job. For an extensive discus-

sion of the differences between our model and Gali’s see section F in the technical appendix to CTW, which

can be found at http://faculty.wcas.northwestern.edu/~lchrist/research/Riksbank/technicalappendix.pdf.

19

3.1. Taylor Principle

A key objective of m one tary policy is the maintenance of low and stable inflation . The

classic New Keynesian model defined by γ =1and ψ =0can be used to articulate the

risk that inflation expectations might become self-fulfilling unless the monetary authorities

adopt the appropriate monetary policy. The classic model can also be used to explain the

widesprea d consensus that ‘appropriate monetary’ policy means a monetary policy that

embeds the Tay lor principle: a 1% rise in inflation should be met by a greater than 1%

rise in the nominal interest rate. This subsection explains ho w the classic New Keynesian

model rationalizes the wisdo m of imp lem enting the Ta ylor principle. Howev er, wh en we

incorporate the assump tion of a working capital c han nel - par ticularly when the share of

mater ials in gross output is as high as it is in the data - the Ta y lor princip le becom es a

source of instability. This is perhaps not surprising. W hen the wo rking capital cha nn el

is strong, if the monetary authorit y raises the inter est rate in response to rising inflation

expectations, the resulting rise in costs produces the higher inflation that people expect.

12

It is convenient to summarize the linearized equations of our model here:

ˆ

R

∗

t

= E

t

1

γ

ˆμ

z,t+1

(3.1)

ˆπ

t

= κ

p

h

γ (1 + φ) x

t

+ α

ψ

ˆ

R

t

i

+ βE

t

ˆπ

t+1

(3.2)

x

t

= E

t

h

x

t+1

−

³

ˆ

R

t

− ˆπ

t+1

−

ˆ

R

∗

t

´i

(3.3)

ˆ

R

t

= r

π

E

t

ˆπ

t+1

+ r

x

x

t

, (3.4)

where

α

ψ

=

ψ

(1 − ψ) β + ψ

.

The specification of the model is complete when we take a stand on the la w of motion for

the exogenous shoc k. We do this in the follow in g subsections as needed.

We begin by reviewing the case for the Ta ylo r principle using the classic New Keyn esian

model, with γ =1,ψ=0. We get to the heart of the argumen t using the deterministic

v e rsion of the model, in which

ˆ

R

∗

t

≡ 0. In addition, it is conv enient to suppose that monetary

policy is characterized by r

x

=0. Throughout, w e adopt the presumption that the only valid

equilib ria are paths for ˆπ

t

,

ˆ

R

t

and x

t

that converge to steady state, i.e., 0.

13

Under these

12

Bruc kner and Schabert (2003) make an argument similar to ours, though they do not consider the impact

of materials inputs, which we find to be important.

13

Although our presumption is standard, justifying it is harder than one might have thought. For example,

Benhabib, Schmitt-Grohe and Uribe (2002) have presented examples in which some explosive paths for the

linearized equilibrium conditions are symptomatic of perfectly sensible equilibria for the actual econom y

underlying the linear approximations. In these cases, focusing on the non-explosive paths of the linearized

economy may be valid after all if we imagine that monetary policy is a Taylor rule with a particular escape

20

circumstan ces, (3.2) and (3.3) can be solved forward as follo w s:

ˆπ

t

= κ

p

γ (1 + φ) x

t

+ βκ

p

γ (1 + φ) x

t+1

+ β

2

κ

p

γ (1 + φ) x

t+2

+ ... (3.5)

and

x

t

= −

³

ˆ

R

t

− ˆπ

t+1

´

−

³

ˆ

R

t+1

− ˆπ

t+2

´

−

³

ˆ

R

t+2

− ˆπ

t+3

´

− ... (3.6)

In (3.6) we have used the fact that in our setting a path con verges to zero if, and only if, it

convergesfastenoughsothatasumliketheonein(3.6)iswelldefined.

14

Equa tion (3.5)

shows that inflation is a function of the presen t and future output gap. Equatio n (3.6) sho w s

that the curren t output gap is a function of the long term real interest rate (i.e., the sum on

the righ t of (3.6)) in the model.

Unde r the Taylor principle, the classic New Keynesian model implies that a rise in infla-

tion expectations launch es a sequence of ev ents whic h ultimately leads to a moderation in

actual inflation. Seeing this moderation in actual inflatio n, people’s higher inflation expec-

tations w ould quic kly dissipate before they can be a source of economic instability. The way

this works is that the rise in the real rate of interest slow s spending, causing the output gap

to shrink (see (3.6)). The fall in actual inflation occurs as the reduction in output reduces

pressure on resources and driv es do wn the mar ginal cost of production (see (3.2)). Strictly

speaking, we have just described a rationale for the Ta ylor principle that is based on learning

(for a formal discussion, see McC allum (2009)). Under rational expectations, the posited

rise in inflationexpectationswouldnotoccurinthefirst place if policy obeys the Taylor

principle.

A similar argument shows that if the monetary authority does not obey the Ta ylor

principle, i.e., r

π

< 1, then a rise in inflation expectations can be self-fulfilling. T h is is not

surprising, since in this case the rise in expected inflation is associated with a fall in the

real interest rate. According to (3.6) this produces a rise in the output gap. By raising

marg in al cost, the Phillips cur ve, (3.5), implies that actu al inflation rises. Seeing higher

actual inflatio n , people’s higher inflation expectations are confirmed. In this wa y, with

r

π

< 1 ariseininflation expectations becomes self-fulfilling b y triggering a boom in output

and actual inflation. It is easy to see that with r

π

< 1 many equilibria are possible. A drop

in inflation expectations can cause a fall in outpu t and inflation. Inflation expectations could

clause. The escape clause specifies that in the event the economy threatens to follow an explosive path, the

monetary authority commits to switch to a monetary policy of targeting the money growth rate. There are

examples of monetary models in which the escape clause monetary policy justifies the type of equilibrium

selection we adopt in the text (see Benhabib, Schmitt-Grohe and Uribe (2002), and Christiano and Rostagno

(2001) for further discussion). For a more recent debate about the validity of the equilibrium selection

adopted in the text, see McCallum (2009) and Cochrane (2009) and the references they cite.

14

The reason for this can be seen below, where we show that the solution to this equation is a linear

combination of terms like aλ

t

. Such an expression converges to zero if, and only if, it is also summable.

21

be random, causing random flu ctu ations bet ween booms and recessions.

15

In this way, the classic New Keynesian model has been used to articulate the idea that the

Ta y lor principle prom o tes stability, while absence of the Ta y lo r principle makes the economy

vulnerab le to flu ctu ations in self-fulfilling expectations.

The preceding results are particularly easy to establish formally under the assumption

of rational expectations. We con tinue to main tain the simplifying assumption, r

x

=0. We

reduce the model to a single second order differen ce equation in inflation. Substitute ou t for

ˆ

R

t

in (3.2) and (3.3) using (3.4). Then, solv e (3.2) for x

t

and use this to substitute out for

x

t

in (3.3). These operations result in the follo w ing second order difference equation in ˆπ

t

:

ˆπ

t

+[κ

p

γ (1 + φ)(r

π

− 1) − (κ

p

α

ψ

r

π

+ β) − 1] ˆπ

t+1

+(κ

p

α

ψ

r

π

+ β)ˆπ

t+2

=0.

The general set of solutions to this difference equation can be written as follow s:

ˆπ

t

= a

0

λ

t

1

+ a

1

λ

t

2

,

for arbitrary a

0

,a

1

. Here, λ

i

, i =1, 2, are the roots of the following second order polynomial:

1+[κ

p

γ (1 + φ)(r

π

− 1) − (κ

p

α

ψ

r

π

+ β +1)]λ +(κ

p

α

ψ

r

π

+ β) λ

2

=0.

Thus, there is a two dimensiona l space of solutions to the equilibrium conditions (i.e., one

for each possible value of a

0

and a

1

). We continue to apply our presumption that among

these solutions, only the ones in whic h the variables converge to zero (i.e., to steady state)

correspond to equilibria. Th us, uniqueness of equilibrium requires that both λ

1

and λ

2

be

larger than unit y in absolute value. In this case, the un iqu e equilibrium is the solution

associated with a

0

= a

1

=0. If one or both of λ

i

,i=1, 2 are less than unit y in absolute

value, then there are many solutions to the equilibrium conditions that are equilibria. We

can think of these equilibria as corresponding to different, self-fulfilling, expectations.

The follo w in g result can be established for the classic New Keyn esian m odel, with γ =1

and ψ =0. The model economy has a unique equilibrium if, and only if r

π

> 1 (see, e.g.,

15

Clarida, Gali and Gertler (1999) argue that the high inflation of the 1970s in many countries can be

explained as reflecting the failure to respect the Taylor principle in the early 1970s. Christiano and Gust

(2000) criticize this argument on the ground that one did not observe a boom in employment in the 1970s.

Christiano and Gust argue that even if one thought of the 1970s as also a time of bad technology shoc ks (fuel

costs and commodity prices soared then), the CGG analysis predicts that employmen t should have boomed.

Christiano and Gust present an alternative model, a ‘limited participation’ model, which has the same

implications for the Taylor principle that the CGG model has. However, the Christiano and Gust model has

averydifferent implication for what happens to real allocations in a self-fulfilling inflation episode. Because

ofthepresenceofanimportantworking capital channel, the self-fulfilling inflation episode is associated with

a recession in output and employment. Thus, Christiano and Gust conclude that the 1970s might well reflect

the failure to implement the Taylor principle, but only if the analysis is done in a model different from the

CGG model.

22

Bulla r d and Mitra (2002)). This is consistent with the int uitio n about the Taylo r principle

discussed above.

We now re-examin e the case for the Ta ylor principle when there is a w orking capital

c ha nn el. The reason the Taylor principle works in the classic New Keynesian model is that

a rise in the interest rate leads to a fall in inflat ion b y curtailing aggregate spending. But,

with a working capital channel, ψ>0, an increase in the interest rate has a second effect.

By raising marginal cost (see (3.2)), a rise in the interest rate places upward pressure on

inflation. If the working capital channel is strong enough, then monetary policy with r

π

> 1

may ‘add fuel to the fire’ when infla tion expectations rise. The sharp rise in the nomin al

rate of interest in response to a rise in inflation expectations may actually cause the inflation

that people expected. In this way the Tay lor principle could actually be destabilizing. Of

course, for this to be true requires that the working capital channel be strong enough. For a

small enough working capital c hannel (i.e., small ψ) imp lemen tin g the Taylo r principle wo u ld

still have the effect of inoculating the economy from destabilizing fluctuations in inflation

expectations.

Whether the presence of the w orking capital channel in fact overturns the wisdom of

implem enting the Ta y lor principle is a nu m er ical question. We m ust assign values to the

model parameters and in vestigate whether one or both of λ

1

and λ

2

are less than unity in

absolu te value. If this is the case, then implem enting the Taylor principle does not stabilize

inflation expectations. Throughout, we set

β =0.99,ξ

p

=0.75,r

π

=1.5.

The discoun t rate is 4 percent, at an annual rate and the value of ξ

p

implies an average tim e

betw een price reoptim izatio n of one ye ar. In addition, monetary policy is cha ract erized b y

a strong commitmen t to the Ta ylor principle. We consider two values for the interest rate

response to the output gap, r

x

=0and r

x

=0.1. For robustness, w e also consider a version

of (3.4) in which the monetary authorit y reacts to current inflation.

We do not ha ve a strong prior about the parameter, φ, that con tro ls the disutilit y of

labor (see section 2.3 above), so we consider two values, φ =1and φ =0.1. To have a sense

of the appropriate value of γ, we follo w Basu (1995). He argues, using man u facturing data,

that the share of materials in gross output is roughly 1/2. Recall that the steady state of

our model coincides with the solution to (2.28), so that

i

c + i

=1− γ.

Th us, Basu’s empirical fin din g suggests a value for γ in a neighborhood of 1/2.

16

The

16

Actually, this is a conservativ e estimate of γ.Hadwenotselectedν to extinguish monopoly power in

the steady state, our estimate of γ would have been lower. See Basu (1995) for more discussion of this point.

23

instrumental variables results in Ravenn a and Walsh (2006) sugg ests that a value of the

working capital share, ψ, in a neigh borhood of unity is consistent with the data.

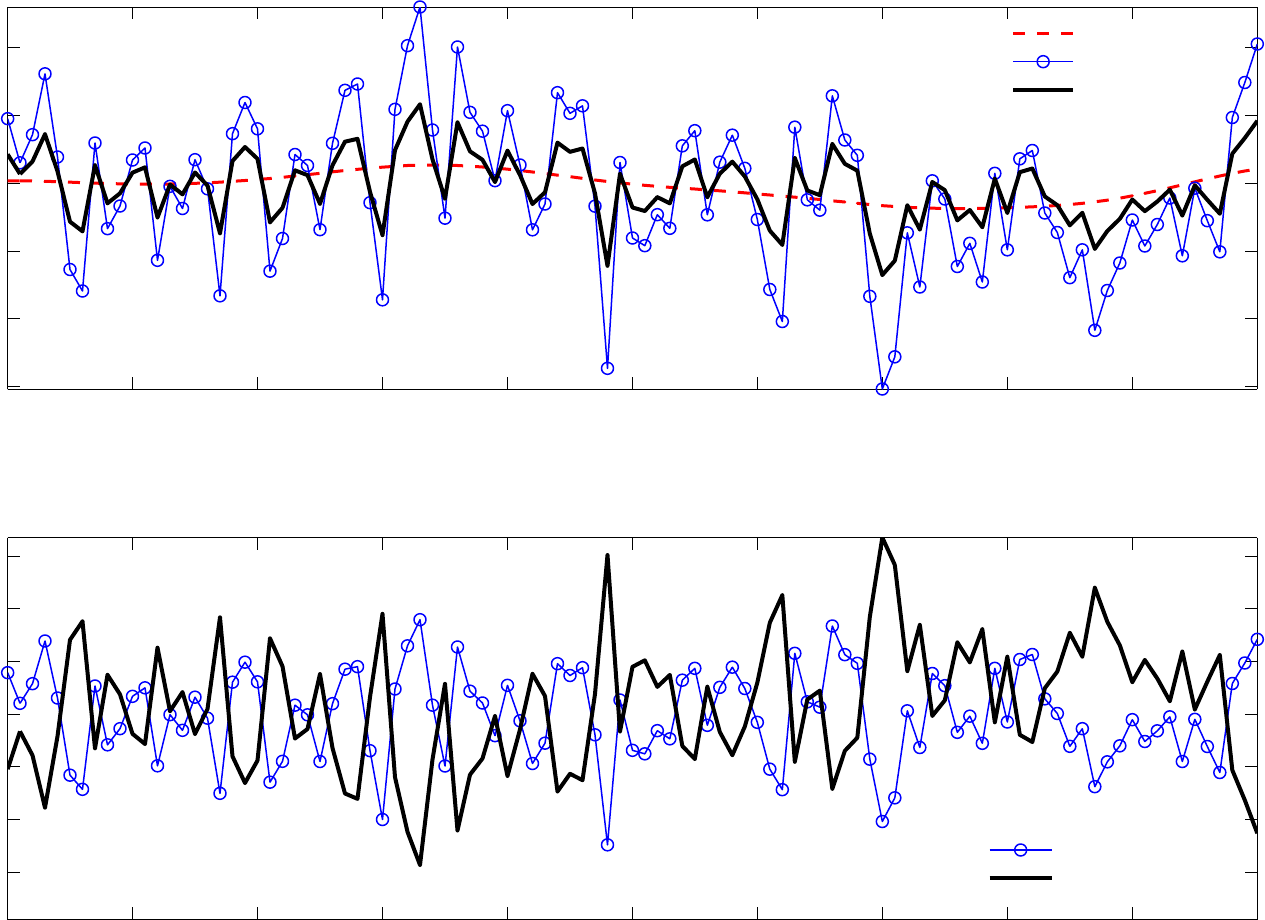

Figure 1 display s our results. The upper ro w of figures pro vides results for the case in

(3.4), in which the policy author ity reacts to the one-quarter-a head expectation of inflation,

E

t

ˆπ

t+1

.Thelowerrowoffigures corresponds to the case where the policy mak er responds

instead to curren t inflation, ˆπ

t

. The horizon tal and vertical axes indicate a range of values

for γ and ψ, respectively. The grey areas correspond to the parameter v alues where one

or both of λ

i

,i=1, 2 are less than unity in absolute value. Tec hnica lly, the steady state

equilibr ium of the economy is said to be ‘indeterminate’ for parame teriza tion s in the grey

area. In t uitively, the grey area corresponds to parameterizations of our econom y in whic h

the Ta y lor principle does not stabilize inflation expectations. The white areas in the fig-

ures correspond to parameter izations where implementing the Ta ylor principle successfully

stabilizes the economy.

Consider the upper two left sets of graphs in Figure 1 first. N ote that in eac h case, ψ =0

and γ =1are poin ts in the white area, consisten t with the discussion above. Ho wever, a

v ery small increase in the value of ψ puts the model in to the grey area. Moreover, this is

true regardless of the value of γ. For these parameterization s the aggressive response of the

in terest rate to higher inflation expectations only produces the higher inflation that people

anticipate. We can see in the right two figures of the first row, that r

x

> 0 greatly reduces

the extent of the grey area. Still, for γ =0.5 and ψ near unity the model is in the grey area

and implem enting the Ta ylor principle would be counterproductive.

Now consider the bottom row of graphs. Note that in all cases, if γ =1then the model is

alw a ys in the determinacy region. That is, for the economy to be vulnerable to self-fulfilling

expectations, it m ust not only be that there is a substan tial w orkin g capital chan nel, but

it m ust also be that materials are a substan tial fraction of gross output. The second graph

fromtheleftshowsthatwithγ =0.5,φ=0.1 and ψ above rough ly 0.6,themodelisin

the grey area. When φ is substantially higher, the firstgraphfromtheleftindicatesthat

the grey area is smaller. Note that with r

x

> 0, the grey area has almost shrunk to zero,

accordingtothetwolastgraphs.

We conclud e from this analysis that in the presence of a working capital c han nel, sharply

raising the interest rate in response to higher inflation could actually be counterp roductive.

This is more likely to be the case when the share of materials inputs in gross output is

high. Wh en this is so, one cannot rely exclusively on the Ta ylor principle to ensure stable

inflation and output performance. In the example, responding strongly to the output gap

could restore stabilit y. How ever, in practice the output gap is hard to measure.

17

At best, the

policy authority can respond to variables that are correlated with the output gap. Studying

17

For further discussion of this point, see sections 3.3 and 3.4 below .

24

the imp lication s for determina cy of responding to such variables w ou ld be an in ter estin g

project, but w ould tak e us beyond the scope of this paper. Still, the discussion illustrates