clearygottlieb.com

© Cleary Gottlieb Steen & Hamilton LLP, 2023. All rights reserved.

This memorandum was prepared as a service to clients and other friends of Cleary Gottlieb to report on recent developments that may be of interest to them. The information in it is therefore

general, and should not be considered or relied on as legal advic

ALERT MEMORANDUM

Belgium Implements the EU Mobility

Directive

June 13, 2023

On June 6, the Belgian law transposing the EU Mobility Directive

1

Belgian Mobility

Lawwas published.

2

This new law introduces a number of notable changes to the rules

on cross-border mergers, de-mergers and conversions involving a Belgian company.

Significantly delayed beyond the European transposition deadline of January 31, 2023,

most provisions of the Belgian Mobility Law will enter into effect on June 16, 2023 with

the other provisions entering into effect on June 30, 2023, or December 15, 2023.

In the absence of harmonized rules on cross-border reorganizations, the Court of

Justice of the European Union (CJEU) had developed case-law based on the

freedom of establishment protected under the Treaty on the Functioning of the

European Union (TFEU) which intended to enable cross-border mobility for EU

companies. However, cross-border mobility for EU companies has remained

difficult in practice as rules differed between Member States, making the process

burdensome and complex to navigate. With the Mobility Directive, the European

legislator adopted harmonized rules to facilitate cross-border movement in the

EU, while being attentive to the interests of (minority) shareholders, creditors

and employees.

1

Directive (EU) 2019/2121 of the European Parliament and of the Council of 27 November 2019 amending Directive (EU)

2017/1132 as regards cross-border conversions, mergers and de-mergers.

2

Available at http://www.ejustice.just.fgov.be/eli/wet/2023/05/25/2023042154/staatsblad. The most extensive changes are to

Books 12 and 14 of the Belgian Code of Companies and AssociBCCA, with more limited changes to Books 5 and 7

of the BCCA, the Code of Private International Law (on conflicts of laws rules) and the Judicial Code.

If you have any questions

concerning this

memorandum, please reach

out to your regular firm

contact or the following

authors

Brus sels

Marijke Spooren

+32 2 2872075

Jan-Frederik Keustermans

+32 2 287 2187

Kasper Theunissen

+32 2 287 2108

Lene Verhaegen

+32 2 287 2051

ALERT MEMORA ND UM

2

Overview of selected key changes

⎯ Shareholders opposing the cross-border reorganization are granted a cash out right. In essence, this

gives dissenting shareholders the right to exit the company in return for a cash compensation.

⎯ Shareholders are given additional tools to challenge the exchange ratio of the reorganization.

⎯ Sufficient creditor protection becomes a condition to completion of the reorganization and a minimum

three month waiting period applies between announcement and completion of the reorganization to

ensure creditors have sufficient time to exercise their rights.

⎯ The reorganization proposal may be published on the company website.

⎯ Cross-border and domestic conversions are approved with a 75% majority (lowered from 80%).

⎯ The notary is entrusted with a strengthened gatekeeper function, involving additional checks to be

performed and broader investigation rights.

⎯ A sister-sister merger and de-merger by separation are introduced, two new types of reorganization

transactions.

⎯ Employees will benefit from increased protection, including a standstill obligation in respect of

existing employee participation rights.

I. RECAP OF THE MOBILITY DIRECTIVE

AND MAIN REORGANIZATION

TRANSACTIONS

A. Mobility Directive

3

3

First by Directive (EU) 2005/56/EC of the European Parliament and of the Council of October 26, 2005 on cross-border

mergers and then by Directive (EU) 2017/1132 of the of the European Parliament and of the Council of June 14, 2017 relating

to certain aspects of company law.

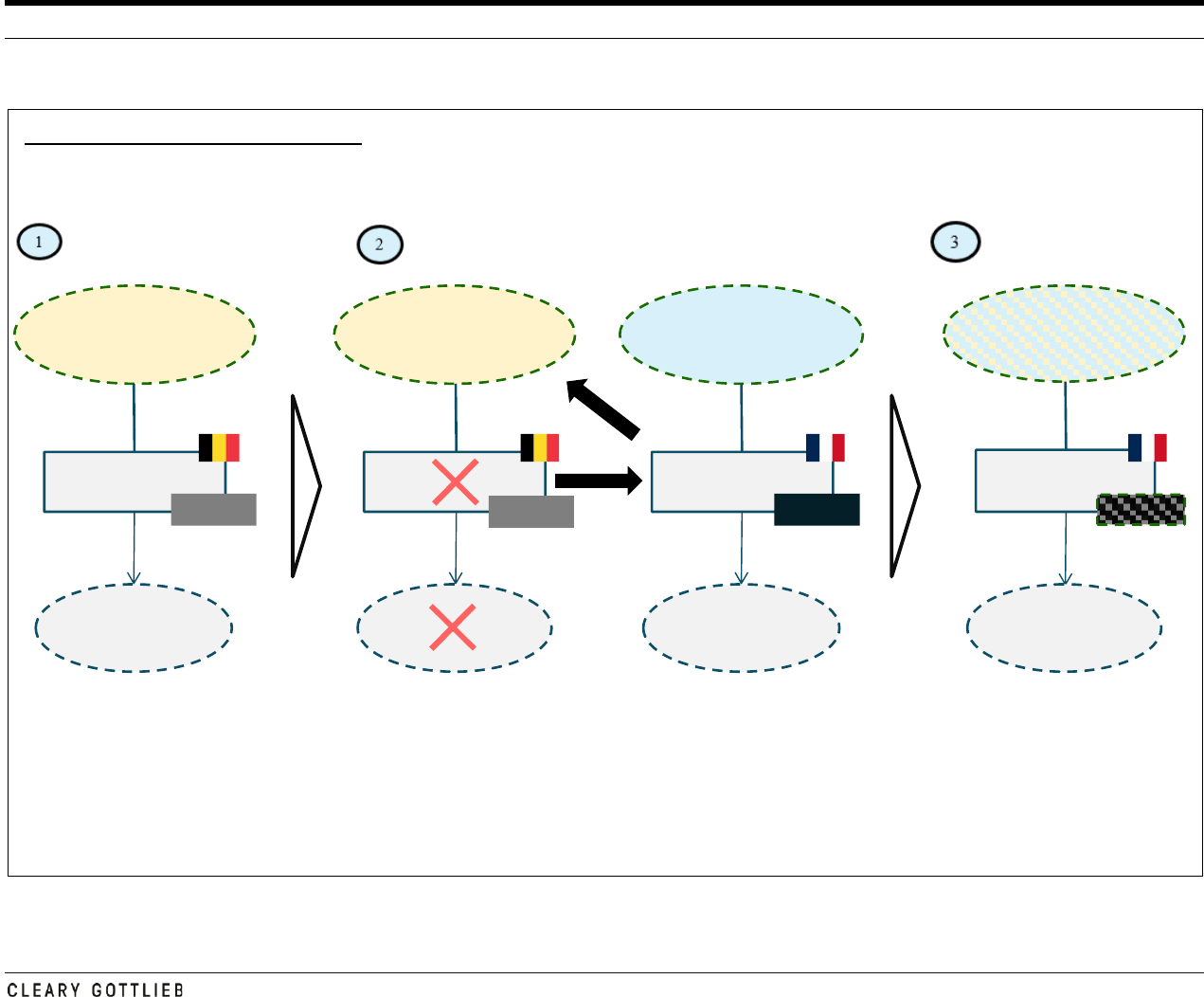

B. Typology of reorganization transactions

i.e.

See

ALERT MEMORA ND UM

3

A possible variation to this, is a cross-border partial de-

merger, pursuant to which only part of the assets and

liabilities of the de-merged company transfer to one or

more acquiring companies (in exchange for which the

of the de-merged company receive shares

in the acquiring company or companies and possibly a

limited cash payment) and the de-merged company

continues to exist.

In a reorganization through cross-border conversion, a

company will essentially move its seat to another

jurisdiction. This will result in a conversion of the legal

form under which the company is registered. The

relevant company will continuously retain its legal

personality in the process.

II. SCOPE OF APPLICATION OF BELGIAN

MOBILITY LAW

4

See new Artt. 12:116/1 BCCA (cross-border merger), 12:137 BCCA (cross-border de-merger) and 14:25/1 BCCA (cross-

border conversion).

III. KEY CHANGES

A. Cash-out right dissenting shareholders

4

i. Scope of application

The cash-out right only applies in the context of

cross-border reorganizations where the acquiring

company is incorporated outside of Belgium and

where it concerns not a purely Belgian domestic

reorganization.

The cash-out right only applies to dissenting

shareholders or holders of profit sharing

ALERT MEMORA ND UM

4

certificates.

5

Holders of other types of securities

(e.g., holders of subscription rights or bondholders)

are not granted a cash-out right.

6

ii. How to exercise the cash-out right

First, the dissenting shareholder needs to pre-notify

the company of its intention to exercise the cash out

right. This should enable the merged, de-merged or

converting company to calculate the maximum

cash-out costs of the cross-border reorganization, as

they will have been made aware of the possible

maximum number of shareholders to be cashed out

in case the reorganization proceeds. This also

means that shareholders who have not pre-notified

their intention to cash-out cannot change their mind

later on.

Second, the dissenting shareholder must vote

against (in person or by proxy) the proposal for the

cross-border reorganization at the relevant

A shareholder who has not

voted or who has abstained from voting on the

cross-border reorganization cannot cash out.

Third, the dissenting shareholder must, during the

relevant formally re-

confirm the exercise of its cash-out right.

5

In this Alert Memorandum, , for these purposes, includes holders of profit sharing certificates

unless expressly indicated otherwise.

6

Dissenting bondholders are treated as third-party creditors who fall within the scope of the revised creditor protection

mechanism (see section III.C below). Subscription rights holders should rely on the protection offered by article 5:59 or 7:71

BCCA, respectively, unless otherwise provided in the terms and conditions governing the subscription rights.

iii. Valuation and implementation

a. Process

ALERT MEMORA ND UM

5

Focus – Possibility to challenge valuation

Shareholders who wish to make use of their cash-

out right, but do not agree with the cash

compensation offered by the company, can

challenge the proposed cash compensation in

front of the President of the Enterprise Court in

summary proceedings. The claim must be

launched against the company within one month

after the vote on the reorganization. If the

litigating shareholders are successful, they may

obtain an additional cash compensation. The

additional compensation will not be available to

shareholders who did not join the litigation.

b. Cash-out funded by the company

Nevertheless, the typical net asset and liquidity

tests

7

and share buyback rules

8

do not apply to the

possible cash outflow in connection with the cash-

7

For instance, Artt. 5:142, 5:143 and 7:212 BCCA.

8

For instance, Artt. 5:145 and 7:215 BCCA.

9

Art. 5:154 BCCA.

10

More fundamentally, the cash-out right provided for by the Belgian Mobility Law indeed stems from EU law (the Mobility

Directive) and the Belgian procedure of exit and exclusion

rules. Interesting questions may arise in practice however, for instance if a cross-border reorganization is announced while a

procedure for exit or exclusion of certain shareholders of a BV/SRL is already separately on-going.

out right. In the BV/SRL, the default rules on exit

and exclusion

9

are

also excluded in the context of a cross-border

reorganization. Although neither the Belgian

Mobility Law, nor the explanatory memorandum

clarify the reasoning for such exclusion, this has

presumably been done to avoid conflicting

outcomes depending on the procedural avenue

chosen by individual dissenting shareholders or the

company (i.e., in the context of a cross-border

reorganization, neither the shareholders, nor the

company can claim to rely on default procedures for

association of a BV/SRL may provide for).

10

To mitigate possible adverse consequences for the

he Belgian Mobility Law

specifies that there can be no payment towards the

exiting shareholders as long as the creditors who

have requested additional security or another form

of guarantee have not received such assurances

(unless their claim has been paid or rejected in

court, see section III.C below). The creditors are,

however, not automatically notified of shareholders

intending to exercise their cash-out right. Creditors

may therefore not be fully aware of the potential

adverse impact of the cash-out right on their

position, although diligent creditors should request

the relevant information from the company.

To address liquidity concerns, the company benefits

from a payment term of up to two months as of the

completion of the cross-border reorganization to

pay the cash compensation to exiting shareholders.

If need be, the company could procure additional

sources of financing during such time. Pending the

two-month period, exiting shareholders are

considered ordinary creditors which may, again,

discourage shareholders from making use of the

ALERT MEMORA ND UM

6

cash-out right.

c. Cancellation of shares of the exiting

shareholder

11

Focus – Minimum cash condition

To avoid excessive cash outflow for the company

in connection with the exercise of the cash-out

right, companies should consider including

(additional) conditions precedent that must be

fulfilled for the reorganization to proceed. One

could for example imagine a condition

stipulating a maximum number of shares that can

be cashed out (so that, in excess of such

threshold, the reorganization will be deemed to

not have been approved) or inversely that the

transaction only proceeds in case the

compan(y)(ies) involved have a minimum level

of liquidity available to them immediately after

paying out all the exiting security holders.

12

A

similar condition has become commonplace in

(U.S.) de-SPAC transactions, referred to as the

11

The relevant provisions (Artt. 12:116/1, §1 in fine, 12:137, §1 in fine, and 14:25/1 in fine) oddly enough do not refer to a

cancellation of profit sharing certificates.

12

In other words, the transaction only proceeds in case (i) shareholders holding in the aggregate less than X% of the shares

exercise their cash-out right or (ii) the company will have at least X amount of available cash after making all the cash-out

payments.

13

Notably, profit sharing certificate holders do not have the option to challenge the exchange ratio proposed by the board of

directors.

14

Only for cross-border mergers and de-mergers because there is, of course, no exchange ratio in the context of a cross-border

conversion.

B. Right to challenge the exchange ratio

13

14

ALERT MEMORA ND UM

7

A few takeaways and key questions around “fair” valuation

⎯ cash compensation should be equivalent to the

value of [the] sharesgenerally accepted

valuation methods

15

The appropriate valuation will thus need to be determined on a case-by-case

basis, taking into account the sector, activities and lifecycle stage of the company concerned.

⎯ A company could consider introducing in its articles of association which valuation method should be

used by the board of directors to calculate the cash-out right. For instance, in the context of the general

uitsluiting” / “exclusion uittreding” / “retrait

principle, bound by formulas or other price determination mechanisms set forth in the articles of

association

16

While the Belgian legislator has not replicated these principles in Book 12 and 14 of the BCCA with

respect to the cash-out right, judges might take such formulas or other price determination mechanisms

into account, at least to the extent they are considered

⎯ As mentioned, the reference date for the valuation is the date immediately prior to the announcement of

the transaction. In other words, the valuation of the acquired company should not take the impact of the

reorganization itself into account. Therefore, the company could conceivably

reorganization giving rise to the cash-out right,

may not have had an opportunity to monetize their shares.

17

⎯ If the company is listed, the (unaffected, pre-announcement) stock price will be the most obvious point

of reference to calibrate the cash-out right. That being said, this is also the scenario in which the cash-

out right will be least relevant as shareholders of listed companies usually have ample liquidity

opportunities.

⎯ In most other instances, there will be no independent valuation readily available so that the acquired

company will need to be valued for the specific purpose of the cross-border reorganization, which

implies a significant additional step (and costs) in cross-border reorganizations. Even if the

reorganization is part of a broader sale transaction, the valuation for the cash-out right will probably be

different from the valuation of the overall sale transaction as the latter will most likely be specific to the

transaction (e.g., taking into account expected synergies).

C. Creditor protection mechanism in cross-

border reorganizations

15

The explanatory memorandum mentions that the board could opt for valuation of the shares at book value, but it also

immediately adds the shareholders can object against such valuation.

16

Artt. 2:67 and 2:69 BCCA.

si

18

ALERT MEMORA ND UM

8

i.e.

e.g.

19

17

This -

emptive rights).

18

Under the prior regime for cross-border reorganizations, the creditor protection mechanism came into play post-transaction.

In particular, creditors had the right to request additional security within two months after completion of the transaction, which

is less favorable for creditors for obvious reasons. This has remained the applicable regime for domestic reorganizations as in

such scenario, the rights of creditors are typically less affected.

19

The relevant notary should simultaneously be informed of any such request for additional security.

20

This is tied to the EU Foreign Subsidies Regulation (2022/2560) and the need for disclosure in that regard. On the EU

Foreign Subsidies Regulation, see Cleary Gottlieb Alert Memorandum of July 13, 2022.

Focus – Increased content requirements for

reorganization proposals

The information to be included in proposals

related to cross-border reorganizations has been

expanded. For instance, the proposal must now

refer to the cash compensation offered to

shareholders wishing to cash out, the security

offered to creditors, the expected consequences

of the reorganization for employment and

whether the company has received subsidies or

grants in the five years preceding the

reorganization if the acquiring company is not

governed by Belgian law.

20

Relatedly,

corresponding board and auditor reports will also

have to be more elaborate under the new regime.

D. Corporate formalities

i. Publication of the reorganization proposal

Under the old regime, the company had to file the

reorganization proposal with the registry of the

Enterprise Court for publication in the Belgian Official

Gazette, with a six-week waiting period between the

filing date and the date of the vote on the transaction.

The Belgian Mobility Law allows for an alternative

form of publication of the proposal,

website, together with a publication in the Belgian

Official Gazette of, among others, a hyperlink to the

company website. This change applies to cross-border

and domestic reorganizations alike.

ALERT MEMORA ND UM

9

Focus – Online publication

and

seem intuitively appealing, we question whether this option will be popular in practice, in particular in the

context of domestic transactions. Indeed, in domestic reorganizations, the moment as of when the six-week

waiting period will commence will depend on the method chosen by the company for publication of the

reorganization proposal:

⎯ Full proposal in Belgian Official Gazette: As is currently the case, if the full reorganization proposal

is published in the Belgian Official Gazette, the six-week waiting period starts as of the date of filing

of the proposal with the registry of th

receipt).

⎯ Proposal on company website: By contrast, and oddly enough, if the company decides to make the

proposal available on its website, the company will still need to publish a hyperlink to its website in

the Belgian Official Gazette and the six-week waiting period will only starts as of the date of

publication of the hyperlink in the Belgian Official Gazette. Since one can expect one to two weeks

between filing the registry of the Enterprise Court and actual publication in the Belgian Official

Gazette, this second option represents an additional delay in the timeline towards completion of the

reorganization, in addition to creating uncertainty about the exact start date of the waiting period.

ii. Required majorities at EGMs

21

22

21

Because the Mobility Directive provides that the required majority for approval of a cross-border conversion may not be

higher than the required majority for approval of a cross-border merger (which, under Belgian law, is 75%). The Belgian

legislator then decided to also lower the required majority for domestic conversions to 75%.

22

Artt. 5:47 and 7:57 BCCA.

iii. Strengthened gatekeeper function for

notary in cross-border reorganizations

ALERT MEMORA ND UM

10

see Focus –

Entry into force

23

set up for unlawful or

fraudulent purposes leading to or aimed at the

circumvention of EU or national law, or for criminal

purposes.

all relevant facts and circumstances,

including indicative factors

24

23

See The assessment

should also take into account relevant facts and circumstances related to employee participation rights, in particular as regards

negotiations on such rights where those negotiations were triggered by reaching four fifths of the applicable national threshold.

The competent authority may consider that if the cross-border operation were to result in the company having its place of

effective management or place of economic activity in the Member State in which the company or companies are to be

registered after the cross‐border operation, that would be an indication of an absence of circumstances leading to abuse or

fraud.

24

Artt. 12:117, 12:138 and 14:26 BCCA.

25

Art. 160b(4)(c) Mobility Directive; Art. 12:8, 3° BCCA.

aimed at the circumvention of EU or

national law

E. New types of reorganization

i. Cross-border de-merger by separation

25

ALERT MEMORA ND UM

11

i.e.

See

ii. Sister-sister merger

26

26

Art. 119(2)(d) Mobility Directive; Art. 12:7, 2° BCCA.

27

For example, the disclosure in the merger proposal is more limited and the board and statutory auditor of the acquired

company will not have to draw up any reports. In addition,

to vote on the sister-sister merger.

27

See

F. Employee participation rights, information

and consultation

e.g.

ALERT MEMORA ND UM

12

G. T

28

liability claims against directors related to decisions

or conduct prior to the effective date of the cross-

border reorganization (i.e., when the relevant

company had its registered seat in Belgium in

such instances, Belgian law (including the cap on

conduct).

litigation brought by creditors whose debt claim

existed prior to the date of publication of the

proposal on the cross-border reorganization,

provided the litigation is initiated by the creditors

within two years after completion of the cross-

border reorganization.

claims from (former) shareholders and holder of

profit sharing certificates who have exited the

company, using their cash-out right, with respect to

the amount of the cash compensation to be received

28

The Belgian Code of International Private law already contained one exception allowing Belgian judges to resolve on

company is lo

connection with such country.

or with respect to the payment of such cash

compensation.

Focus – Entry into force

The new rules introduced by the Belgian

Mobility Law will apply to all transactions

(whether domestic or cross-border) for which the

reorganization proposals are filed with the

registry of the Enterprise Court after June 16,

2023, i.e., 10 days after publication of the

Belgian Mobility Law in the Belgian Official

Gazette. For long-planned reorganizations,

which may have been in the works for several

months, this relatively sudden entry into force

may be unsettling (especially for cross-border

reorganizations, where the legal framework is

significantly amended).

As an exception to the above, the requirement

that the company needs to submit a tax and social

security certificate to the notary for purposes of

obtaining the required pre-reorganization

certificate in the context of cross-border

reorganizations will only enter into force on a

later date still to be determined via royal decree

(and at the latest on December 15, 2023).

Finally, certain specific technical rules that

require changes and cross-border integration of

governmental administrative functions (e.g.,

rules relating to communication between the

Belgian Crossroads Bank for Enterprises and

other EU company registers) will enter into force

as of June 30, 2023.

ALERT MEMORA ND UM

13

IV. CONCLUSION AND PRACTICAL

TAKEAWAYS

As mentioned, Belgium already had modern and

detailed rules on cross-border reorganizations on the

books. Implementing cross-border reorganizations in

or out of Belgium will following the Belgian Mobility

Law require more time and will become more

formalistic. The law mostly reinforces the rights of the

various stakeholders (shareholders, employees,

creditors, including the Belgian tax authorities) in the

context of cross-border reorganizations, without

making it easier as such to implement

reorganizations from a purely Belgian perspective.

However, it also remains to be seen whether it will

actually be more difficult for Belgian companies to

engage in cross-border reorganizations in practice. The

Mobility Directive brings uniform rules throughout the

EU for cross-border reorganizations, including

notably in EU member states that did previously not

yet have rules on cross-border reorganizations.

Engaging in cross-border reorganizations may therefore

become easier with respect to certain EU member states

as a result of the Mobility Directive, whereas it may

become more difficult with respect to other EU member

states.

In any event:

The newly introduced cash-out right and right to

challenge the exchange ratio will likely introduce

interesting dynamics in cross-border

reorganizations, especially where the shareholder

base of the disappearing company is vocal.

Dissenting minority shareholders may seek to put

pressure on the board of directors by rallying

support for their position and enticing other

(minority) shareholders to either exercise their

cash-out right or to challenge the exchange ratio

offered. Shareholders now certainly have

strong(er) tools to challenge cross-border

reorganizations they disagree with.

considerably improved. Previously, creditor

protection was an ex-post consideration with

creditors being able to request additional security

only after the transaction had taken place. Now

creditor protection will become a pre-closing

condition in cross-border reorganizations and

creditors will have a period of at least three months

before completion of the transaction to exercise

their rights.

The strengthened gatekeeper function of the notary

in cross-border reorganizations represents a new

and additional hurdle for which a new practice will

need to develop. The criteria to be assessed by the

notary are broadly formulated and if not

interpreted sufficiently narrowly may lead to

increased legal uncertainty.

The Belgian legislator has decided to not fully align

the rules applicable to cross-border reorganizations

with the rules applicable to domestic transactions.

While it is understandable that there should be

different standards applicable to domestic and

cross-border reorganizations (with the former

generally assumed to have a less profound impact

on the position of shareholders, creditors,

employees and other stakeholders), this does mean

that going forward there will be an important

divergence between the respective rules applicable

to domestic and cross-border reorganizations.

As is often the case with a new legal framework, it

remains to be seen how all of these new

requirements and procedures will be used (by

shareholders and their advisors) and interpreted (by

the courts) in practice. Upon a first reading of the

Belgian Mobility Law, there are, however, a few

uncertainties arising from unclear drafting or

apparent missing cross-references that may lead to

uncertainty in practice. When Belgian companies

will effectively engage in cross-border

reorganizations under the new legal framework,

additional questions will undoubtedly arise.

ALERT MEMORA ND UM

14

ANNEX A: SCHEMATICS

SCHEMATIC: CROSS-BORDER MERGER

ALERT MEMORA ND UM

15

SCHEMATIC: CROSS-BORDER DE-MERGER

ALERT MEMORA ND UM

16

SCHEMATIC: CROSS-BORDER CONVERSION

ALERT MEMORA ND UM

17

SCHEMATIC: CROSS-BORDER DE-MERGER BY SEPARATION

ALERT MEMORA ND UM

18

SCHEMATIC: SISTER-SITER MERGER