Annual Report

July 1, 2020 - June 30, 2021

Pete Ricketts, Governor

Kelly Lammers, Director

Annual Report

July 1, 2020 - June 30, 2021

1526 K Street | Suite 300 | PO Box 95006 |

Lincoln, NE 68508

Main Office: (402) 471-2171

Consumer Hotline: (877) 471-3445

ndbf.nebraska.gov

ndbf.nebraska.gov 2020 Nebraska Department of Banking & Finance 2

Overview 3

Vision 3

Mission Statement 3

Department Staff 4

Director’s Message 5

Year in Review 7

Department Budget & Funding 14

Financial Institutions Division

General Information

State-Chartered Institutions & Licensees/

Registrants

15

Activity by the Institution 15

Activity by the Numbers 15

Financial Institutions Total Resources

State Chartered Commercial Banks’

Aggregate Balance Sheet

17

18

Banks

State-Chartered Banks with Branches

21

Historical Data

State-Chartered Banks

32

Registered Bank Holding Companies 33

Commercial Bank Members of the

Federal Reserve System

38

Trusts

State-Chartered Banks Authorized to

Operate with Trust Powers

State-Chartered Trust Companies

39

39

Credit Unions

State-Chartered Credit Unions

Consumer Lending

Delayed Deposit Services Businesses

Installment Loan Companies

Sales Finance Companies

Money Transmitter Licensees

Mortgage Bankers

41

42

43

46

50

Single Bank Pooled Collateral Program 20

Bureau of Securities

General Information

Licensees/Registrants by the Numbers

New Registrations

Loan Brokers

Enforcement Actions

Securities Registrations and Exemptions

60

60

60

61

62

Historical Data

Securities Act Cash Fund Status

Issuer Applications

Registration of Broker-Dealers and Agents

63

63

63

Appendices

A. Department Leadership Through the

Years

B. Historical Data—State Chartered Banks

1897 to present

C. Credit Union Comparative Statement

D. State Chartered Trust Company

Comparative Statement

E. DDS Financial Statement

F. Historical Data—Securities Act Cash

Fund Status 1939 to present

G. Historical Data—Issuer Applications

1939 to present

H. Historical Data—Registration of Broker-

Dealers and Agents 1939 to present

64

65

68

70

71

72

74

75

Table of Contents

ndbf.nebraska.gov 2020 Nebraska Department of Banking & Finance 3

Department Overview

The Department of Banking was created by Nebraska legislators to regulate state-chartered banks and other financial

industries within the state. In 1939, regulation of state securities laws was also placed under the jurisdiction of the

Department of Banking. Today, the Nebraska Department of Banking and Finance regulates and supervises various

financial industries on behalf of the State of Nebraska and its residents.

Our Vision

The Department’s Vision is to make Nebraska the most trusted financial home for people and businesses.

Our Mission

Our mission is to protect and maintain the public confidence through the fair, efficient, and experienced supervision of

the state-regulated financial services industries; to assist the public in their dealings with those entities; to assist those

whom we regulate in a manner which allows them to remain competitive, yet maintain their soundness in compliance

with the law; to fulfill our statutory responsibilities with regard to all licensees and registrants; and to investigate violations

of the laws and cooperate with other agencies in seeking a timely resolution of problems and questions.

What We Do

Our agency serves the citizens of Nebraska through our various duties. Our field staff examines state-chartered

financial institutions and other state-licensed industries to ensure sound operations and compliance with state laws. We

register securities offered in Nebraska, business opportunities, investment advisors, and broker-dealers. Our staff also

investigates securities violations and consumer complaints against state-chartered or state-licensed entities.

The Nebraska Department of Banking and Finance is an agency in the executive branch of the state under the direct

supervision of the Governor. The Director of Banking and Finance is appointed by the Governor. We draw no funds

from the General Fund of Nebraska; our agency is funded entirely by the industries we regulate. Our agency is

comprised of two divisions—Financial Institutions and Bureau of Securities. Together these two divisions regulate

several different financial industries. Listed are the various industries regulated by each section.

Financial Institutions

State-chartered banks, credit unions, savings & loans, and trust companies

Mortgage lenders

Consumer lenders (installment loan companies, sales finance companies)

Money Transmitters

Delayed Deposit Services (also known as payday lenders)

Bureau of Securities

Securities registrations and exemptions

Broker-dealers and agents

Investment advisors and representatives

Business opportunities (includes franchise filings)

Seller-assisted marketing plans and consumer rental purchase agreements

Nebraska Commodity Code

Loan Brokers

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 4

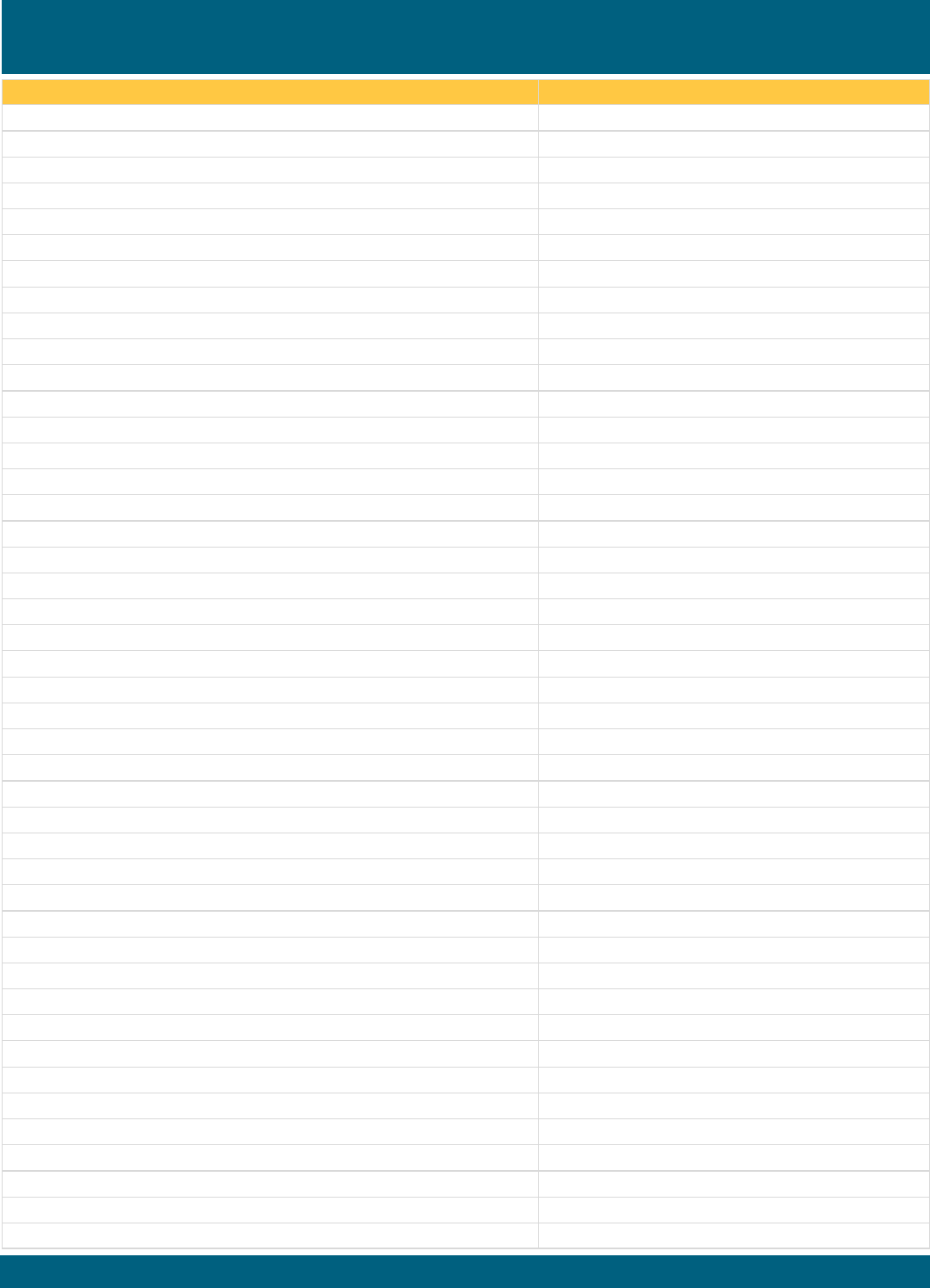

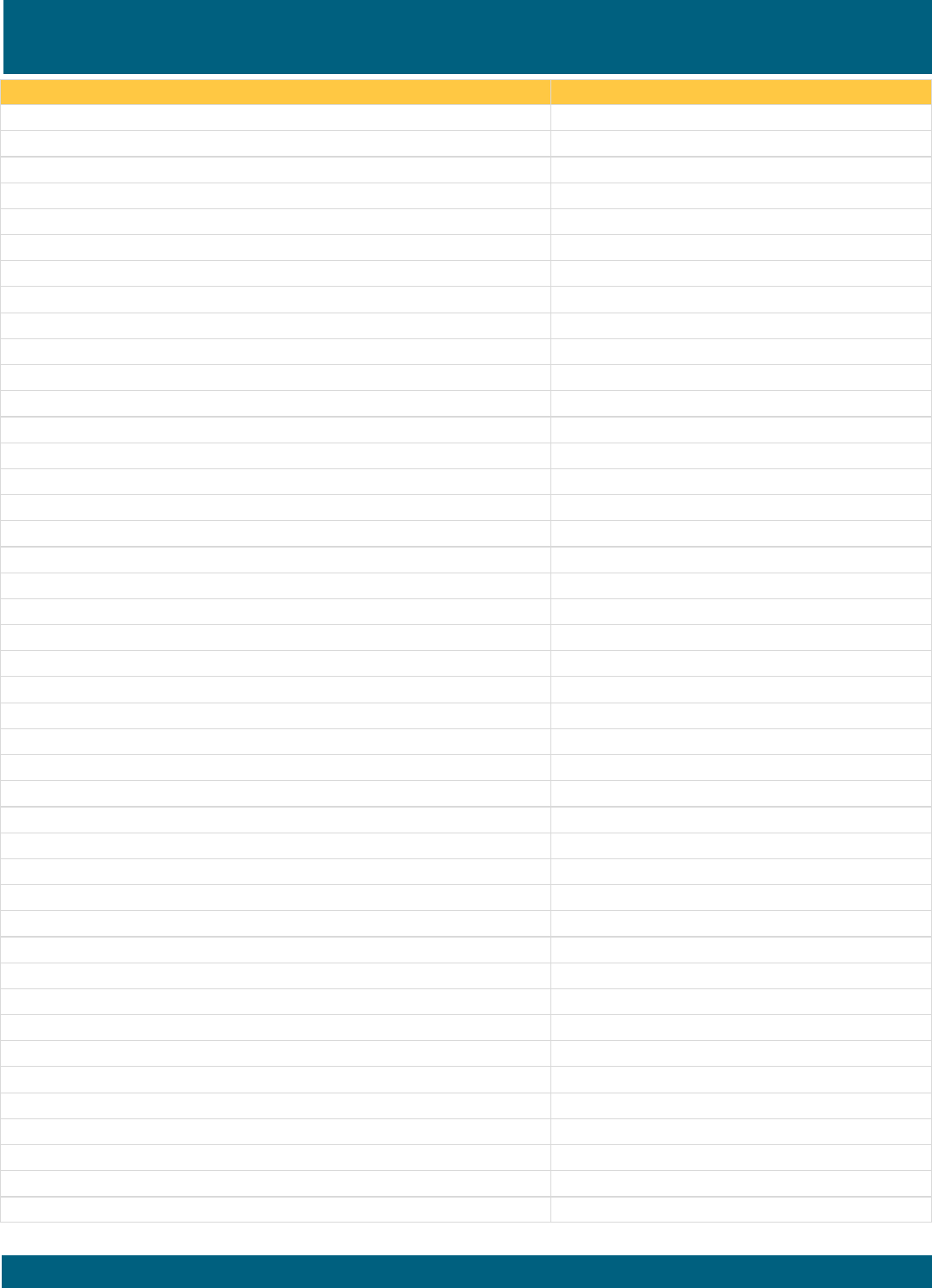

2021 Department Staff

Director .................................................................... Kelly Lammers

Mark Quandahl*

Financial Institutions Division

Deputy Director ............................................................ Darcy Bailar

Review Examiners ...................................................... Darren Davis

Brody Focken

Gregory G. Freese

Scott Peter

Shannon Van Houten

Accounting Examiner Specialist ......................... Michelle Lindner

Capital Markets Examiner Specialist ....................... Jose Salinas

BSA Examiner Specialist ...................................... Jaunita Koerner

IT Examiner Specialist ............................................. Rachel Newell

Trust Examiner Specialist ................................................. Ted Hall

Omaha District Bank Examiners

James P. McTygue, Supervising Examiner

Maxwell Cameron

Brittany Jackson

Cassidy Stork

Jordan Taylor

Nolan Nordhues*

Lincoln District Bank Examiners

Brian Nielsen, Supervising Examiner

Whitney Baggs

Henry Gonzalez

Benjamin Kiolbasa

Austin Malone

Alexander Thorson

Conna Wiese

Matthew Van Pelt*

Kearney Bank Examiners

Michael Miller, Supervising Examiner

Rhonda Johnson

Corey Lienemann

Tyler Mestl

Taylor Simmerman

Adam Starr

Perry T. Neill*

Non-Depository Examiners

Grant Dittman

Jeff Peterson

Brian Simpson

David Pace*

Administrative Assistants ................................... Bobbi Alexander

Kathy Sparks

Staff Assistant .......................................................... Susie Hansen

Bureau of Securities

Deputy Director ...................................................... Claire McHenry

Securities Bureau Counsel ..................................... Mike Cameron

Investigation & Compliance (Investigations)

Unit Supervisor ............................................... Thomas A. Sindelar

Investigation & Compliance (Registration & Compliance)

Unit Supervisor .................................................... Rodney R. Griess

Examiners ............................................................. Alfred Berchtold

Stevan Vasic

Jackie L. Walter

Security Analysts ............................................... Samantha Billings

Christine Cooney

Administrative Assistants .................................. Angela Burchess

Cynthia Velazquez

Legal Division

General Counsel ............................. Patricia A. Humlicek Herstein

Financial Institutions Counsel ..................................... Tag Herbek

Michael McDannel*

Consumer Finance Counsel ............................. William Lawrence

Money Transmitters Counsel .................... John E. “Jack” Jensen

Senior Staff Attorney ..................................... Christopher German

Paralegals ......................................................................... Ann Divis

Cindy Faris

Administrative Assistants ......................... Sandra Blumanhourst

Debbie Yost

Business/Accounting Division

Business Manager ................................................... Margo Sawyer

Accountant........................................................... Grace Rittenburg

Accounting Clerk/Receptionist ..................................... Julie Foral

Human Resources Division

Personnel Officer ....................................................... Susie Voecks

Information Systems Division

Chief Information Technology Officer ........................ Mike Fabry

IT Database Analyst ................................................... Steve Covert

Infrastructure Business System Analyst ........... Shailaja Chivkula

*Left employment during fiscal year

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 5

Director’s Message

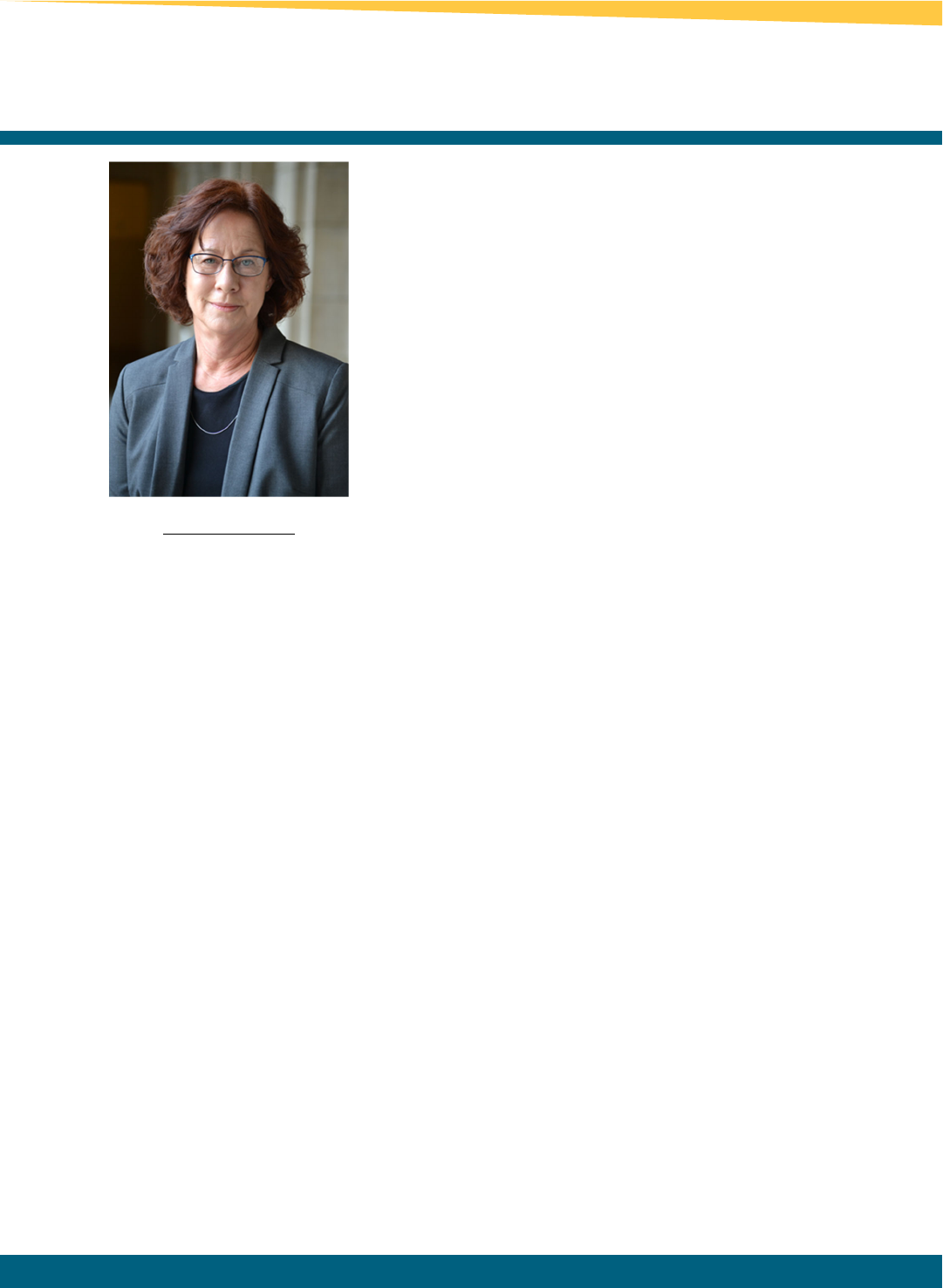

Kelly Lammers, Director

HISTORY IN THE MAKING

I was honored to be appointed by Governor Pete Ricketts

as the Nebraska Director of Banking and Finance in

September of 2020. As a lifelong student of banking and

finance, I marvel at Nebraskans’ ability to create

opportunity through the delivery of available credit,

investments, and groundbreaking thinking. The art of

financial services is constantly changing, connecting the

promise of contract performance with the certainty of

money. As a regulator, I witnessed the industry change

with the enactment of new laws which allowed bank

branching, ATMs, direct deposit, and mutual funds to

create a way for individuals to obtain financial services

not previously available. I watched the commitment of

those in the financial service industry to make all that hap-

pen. As we research, observe, and regulate the next step

in financial services and understand that the impact of

Covid-19 is not yet over, we hold true to our mission, to

protect and maintain the confidence of Nebraska

financial institutions.

Delivering on the State’s Mission to create opportunity

through more effective, more efficient, and customer

focused state government requires the NDBF dedicated

team of specialists performing administration, licensing,

and professional services. Only with skilled staff and

trained professionals is it possible to pivot to meet the

needs of the customer with record demand for licenses,

to look to the future and offer contributions to what

became the Nebraska Financial Innovation Act, and

review decades of on-site processes to develop new

hybrid approaches to investigations and examinations. At

all-times the Department upheld our focus on maintaining

high availability and quality while reducing travel and lags

in available information. Additionally, the Department

also closed out a multi-month peer review of our

mortgage regulation division and received Mortgage

Accredited Status on November 23, 2020, by the

Conference of State Bank Supervisors. With

consideration of our customer, our industries, and our

team, the Department delivers on the promise to offer

regulatory perspective in the present and plan for the

future, while retaining the lessons learned in the past.

This report offers many charts, graphs, and tables

reflecting the detailed work performed by the NDBF team

in FY 2021. A common economic movement during

times of uncertainty is growth in bank deposits, often

called a rush to quality. Nebraska-chartered banks’ total

assets grew by more than 14% to over $55 Billion FY 2021

which was due to a blend of economic considerations as

well as the migration of two additional charters into the

State system. Examination rates for the upcoming year

decreased 9%. Addressing issues of quality and safety

along with growth, the NDBF remote examinations

evolved into hybrid examinations and questions of capital

and reserves were routinely addressed.

Significant growth in the mortgage industry largely

associated with a blend of Covid challenges influencing

personal income and historic low mortgage interest rates,

required professionals to fill the demand. The

Department leveraged automation with a highly skilled

team and processed a 40.5% increase in mortgage loan

originators to a total of over 5,470 individuals, which in

turn fueled 26% growth in the $19 Billion dollar-serviced

loan area. The securities industry also saw significantly

increased demand for their products, with the Department

stepping up to the task and processing a 17% increase in

new registrations of Broker Dealer Agents, exemptions

increased 10% and total revenue was up nearly 30% or

more than $7 million. The entire financial services

industry as well as the NDBF requires being innovatively

available for their customers, delivering timely and

cost-effective solutions, and at the same time maintaining

quality loans, investments, examinations, and licensing.

Making decisions on personal investments, placing

money on deposit, obtaining a home loan and a host of

other activity in Nebraska, effectively grows the industries

that Grow Nebraska.

The Department, through the bid process, selected the

Nebraska Bankers Insurance and Services Company

(NBISCO) to administer the Nebraska Pooled Collateral

program, which became effective July 1, 2020. Utilization

of the program has grown since its inception to currently

include 16 banks, totaling over $1.2 Billion in public

deposits and $1.5 Billion in pledging. The program not

only made pledging more efficient for the banks and the

tracking of pledge securities more efficient for over 200

Director’s Message

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 6

municipalities, but it also made money available to

Nebraskans. One banker reported success of this

program in being able to redirect money previously

pledged to public funds now toward the funding of more

than 50 additional local mortgage loans.

The Department’s legal agenda, covered in more detail

later in this report, included the passage of the omnibus

bill, maintaining the ability for State banks and credit

unions to exercise the same powers as national or federal

charters as well as a bill that enabled the securities

industry to temporarily hold transactions that are

associated with suspected financial exploitation of

vulnerable adults. Yet the most pioneering banking effort

in decades was made law with the passage of the

Nebraska Financial Innovation Act. The Department is

ready and excited to lead Nebraska as the second state

to create a “digital asset depository” based platform to

manage and create controllable electronic records. As

the financial literacy and legal conformity of digital assets

evolves, the Department is preparing a team of forward-

thinking lawyers and examiners to jointly deliver the rules

and guidance that will identify the opportunities of the

Nebraska Chartered Digital Asset Depository. With the

law effective October 1, 2021, over 20 NDBF lawyers and

examiners are both continuing their assigned tasks and

also attending training and achieving certifications to

provide a standard regulatory expectation of promise and

certainly into the Digital Asset Depository charter.

A year influenced by Covid-19 must include celebrations

of meeting challenges. I encourage you to read the

articles and tables in the balance of this Annual Report

reflecting on NDBF licensed services in our quest to

deliver licensed financial choices to Nebraskans. Yet,

history in the making isn’t simply meeting challenges, it is

delivering on the Nebraska spirit to produce, to increase

yields, and to know our neighbors; it is to Grow Nebraska

by making Nebraska Financial Services the first choice

for individuals as well as businesses.

Sincerely,

Kelly Lammers, Director

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 7

A Year In Review

FINANCIAL INSTITUTIONS

Darcy Bailar, Deputy Director

I am excited to be making my Annual Report debut as

Deputy Director of Financial Institutions! I assumed this

role in November 2020 during a time when “business-as-

usual” was evolving rapidly for the financial industry, as

well as many others. The NDBF team has continued

great work in a year that posed many challenges and

changes to traditional processes. I am incredibly proud

of the effective and fluid responses from our team. We

take great pride in successfully fulfilling the NDBF vision

and mission to ensure the continued safety and

soundness of Nebraska financial institutions.

Nebraska state-chartered financial institutions continue

to grow, be profitable and well-capitalized, and serve as

critical community resources for citizens across Nebras-

ka. State banks account for 94% of bank charters in

Nebraska and have combined total assets of

$55,094,981,000. During this year, four banks merged

into existing state-chartered financial institutions, two

banks converted from national to Nebraska-state

charters, and ten new bank branches were approved. On

a nationwide comparison, Nebraska ranks #8 in the

nation in number of state-chartered institutions, and #32

by total assets. Trust powers are authorized for 29 state

banks, in addition to four state-chartered trust companies

with total assets under management of $12,397,394.

NDBF charters 11 credit unions with total assets of

$897,100,340. There was one merger between two state-

chartered credit unions during this year as well.

Non-Depository industries have also continued to show a

high level of growth in presence and transaction volume in

Nebraska. NDBF licenses 5,471 Mortgage Loan

Originators and 426 Mortgage Banker Companies with

total assets of $1,945,092,001,706. Money Transmitter

Company licenses total 162 and a combined

$402,426,638,640 in total assets. Additional non-

depository licenses include 98 Sales Finance Companies,

4 Installment Loan Companies, and 19 Delayed Deposit

Service (DDS) Companies.

NDBF conducted and/or assisted with 87 depository and

40 non-depository examinations throughout this year. The

examinations at the start of this period began in offsite

only (remote) format. Throughout the second half of the

year, the examination format was shifted to a hybrid

examination with much of the examination work

continuing to be completed offsite, but also often

including onsite management discussions, credit review,

and/or Board exit meetings. This hybrid format, although

still evolving, will become the new standard for NDBF

examinations as it considers the needs of all stakeholders

and is applied and adjusted as needed to each financial

institution. Hybrid examinations will maintain prudent

regulatory standards and align with the NDBF vision and

mission. Post-examination industry survey results

indicate that NDBF examinations continue to be

conducted in a fair and objective manner.

The NDBF team resolved 95 consumer complaints

throughout the year across multiple financial industries.

In these cases, we often serve as the conduit between a

regulated entity and the customer base it serves, while

monitoring the business practices of Nebraska-regulated

financial institutions.

Examiner training and industry outreach opportunities

continued chiefly in a virtual format. These types of

activities included examiner schools, conferences with

industry professionals, and various events with our

regulatory counterparts. These activities remain critical in

continuous examiner development and maintaining an

effective regulatory relationship with all financial entities.

The Single Bank Pooled Collateral Program was

successfully implemented on July 1, 2020. Banks

participating in this program indicate that it has allowed

funds previously used for pledging purposes to be

redirected for other uses within the bank. In addition to

scheduled examinations, NDBF monitors monthly activity

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 8

A Year In Review

and reporting metrics from the program’s current

administrator, NBISCO.

As was true for almost all facets of business and

government sectors across our nation, this year brought

forth the heightened opportunity and responsibility to

review various "lessons learned" and resulting industry

impacts. Process improvement techniques were

utilized to evaluate NDBF procedures related to

examination activities; industry data collection and

sharing; and documentation review, storage, and

retention. We will continue leveraging all these

resources in our efforts for more effective, efficient, and

customer focused state government.

We look forward to the continued success in all of

Nebraska's financial industries, both new and existing, in

the coming year!

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 9

A Year In Review

Bureau of Securities

Claire McHenry, Deputy Director

The Bureau of Securities continued its efforts to protect

investors and Grow Nebraska in FY 2021. The Bureau

administers and enforces the Securities Act of Nebraska

(“Act”), as well as several other consumer and business

protection statutes to protect investors and promote fair

and efficient markets in Nebraska. Strong state

securities regulation is essential to maintaining a stable

securities industry, protecting the public from illegal

operations, and encouraging the formation of capital

and the creation of new jobs in Nebraska.

The Act provides for the registration or exemption of

securities, registration of firms and individuals,

examination of registered firms, and enforcement of the

Act through administrative, civil, and criminal actions.

This is possible due to the hard work and dedication of

the Bureau’s specialists, analysts, examiners,

supervisors, and legal staff.

During FY 2021, the Bureau:

Processed 30,497 securities registration and notice filings

offering over $27 billion in securities;

Provided oversight to 1,418 broker-dealer firms and state-

registered investment adviser firms;

Provided oversight to 122,682 Nebraska-registered broker-

dealer agents and investment adviser representatives;

Opened 14 examinations and closed 17 examinations of

registered firms; and

Initiated 24 new investigations and closed 14 investigations.

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 10

A Year In Review

The Bureau remains a net contributor to the General Fund

of the State of Nebraska. In FY 2021, the Bureau’s

expenditures were $1,624,552, and the revenue collected

was $34,024,193, primarily from registration and licensing

fees. The Bureau transferred $25,900,000 from the

Securities Act Cash Fund to the General Fund. Since

2015, the Bureau has transferred $197,900,000 to the

General Fund. Since 2000, the Bureau has transferred

over $490,900,000 to the General Fund.

In FY 2021, the Bureau remained committed to meeting

the needs of Nebraskans and business during the

pandemic. The Bureau extended temporary relief to

broker-dealers and investments from registration

requirements for persons temporarily displaced during the

pandemic, provided extensions for filing deadlines, and

relief from physical signature requirements. The

emergency orders providing such relief were rescinded on

June 30, 2021 with the end of Nebraska’s coronavirus

state of emergency. The Bureau saw significant increases

in the amount of securities offered in Nebraska as well as

increases the number of firms and persons registering to

do business in Nebraska. The Bureau transitioned to

virtual and video outreach programs to continue meeting

with industry and investors, including launching the My

MoNEy Nebraska video series with the Nebraska

Department of Insurance to teach basic financial literacy.

Senator Brett Lindstrom of the Banking, Commerce and

Insurance Committee introduced the Department’s bill, LB

297, to adopt the Nebraska Protection of Vulnerable

Adults from Financial Exploitation. LB 297 was based on

model legislation from the North American Securities

Administrators Association to provide broker-dealers and

investment advisers with new tools to deal with suspected

cases of financial exploitation of vulnerable adults and

senior adults. LB 297 provides for voluntary reporting of

financial exploitation to the Department and Adult

Protective Services, notification to appropriate third

parties, maintenance and sharing of records of suspected

financial exploitation, and the ability to hold transactions

and disbursements. LB 297 also provides broker-dealers,

investment advisers, and other qualified persons that act

in good faith and with reasonable care from civil or

administrative liability for actions taken under LB 297. LB

297 was passed by the Legislature on March 25, 2021 and

signed into law by Governor Pete Ricketts on March 31,

2021.

The Bureau carried out an active examination cycle in FY

2021 that prioritized state-registered investment advisers

and broker-dealer branch offices. In response to the

pandemic, the Bureau transitioned to remote

examinations and worked with firms to arrange

extensions and to submit documents electronically.

Examiners were able to identify and correct deficiencies in

firms, thereby strengthening compliance structures and

protecting investors.

The Bureau engaged in active enforcement of the Act in

FY 2021. The Department issued Cease and Desist

Orders against two internet cryptocurrency “investment”

companies for selling unregistered securities and acting

as unregistered broker-dealers. The Department entered

into a consent order to address unregistered investment

advisory activity. The Bureau saw in increase in

complaints involving investments in precious metals in

self-directed individual retirement accounts and released

a consumer advisory to alert investors about the risks of

investing in precious metals. Additionally, the Department

and the Office of the Nebraska Attorney General joined the

Commodity Futures Trading Commission and 29 other

states in filing a complaint against Metals.com and

Barrick Capital, Inc. to halt a precious metals scheme that

solicited $185 million from at least 1,600 senior and other

investors, including $600,000 from Nebraska investors.

The United States District Court for the Northern District

of Texas entered an injunction, froze defendants’ assets,

and appointed a receiver. The Bureau is working with the

receiver to return assets to Nebraskans.

The Bureau engaged in vigorous enforcement of the Act in

FY 2020. The Department issued a Cease and Desist

Order against an Omaha man, prohibiting him from

making untrue statements of material fact in connection

with offer and sale of securities. The Department also

entered into two consent orders to address unregistered

broker-dealer activity in Nebraska. At the outset of the

pandemic, the Bureau was concerned that unscrupulous

actors would use market volatility and fears of COVID to

take advantage of investors. To address these concerns,

the Bureau issued consumer advisories warning

Nebraskans to be on the look out for persons looking to

profit from fear and uncertainty and COVID-related scams

and providing advice on how to protect yourself from

COVID-related scams.

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 11

A Year In Review

Legal Division

Patricia A. Humlicek Herstein

General Counsel

The Department’s Legal Division continued its strong

focus on protecting Nebraska consumers and assisting

the industries we regulate. We handled a myriad of

issues during this last fiscal year.

ADMINISTRATIVE

Twenty-two orders approving depository financial

institution applications were issued this fiscal year.

These included 11 branches, 6 mergers, 2 charter

conversions, 2 moves, and 1 mobile branch. In

addition, the Department approved six requests for

amendments to previously issued approval orders.

One petition was denied.

The mortgage banking industry showed record

licensing growth, and this was reflected in the number

of mortgage loan originator orders. 107 conditional

orders approving licenses were issued, along with 50

orders denying initial and renewal applications, and 40

Notices of Abandonment.

The Department also entered into Consent Agreements

and Consent Orders to resolve regulatory matters

related to banks, money transmitters, mortgage

bankers, and securities.

The 106th Legislature, Second Session, convened on

January 6, 2021. The Legislature adopted a number of

special conditions to ensure safety as the pandemic

continued, including all-day committee hearings at the

start of the session, and was able to complete the

session as originally planned.

LEGISLATIVE

Two bills were introduced this session on behalf of the

Department.

LB 363 was the Department’s omnibus bill introduced

by Banking, Commerce and Insurance (BCI)

Committee Chair Matt Williams, and updated ten

separate Acts under the Department’s jurisdiction. LB

363 carried the emergency clause and became effec-

tive March 18, 2021.

On a Department-wide basis, LB 363 included annual

revisions updating cross-referenced federal statutes

and regulations to refer to those statutes and regula-

tions as they existed on January 1, 2021. These

included statutes in the Nebraska Banking Act, the

Securities Act of Nebraska, the Nebraska Commodity

Code, the Consumer Rental Purchase Agreement Act,

and the Seller-Assisted Marketing Plan Act, as well as

laws relating to savings and loan associations,

financial exploitation, and the Uniform Commercial

Code.

LB 363 provided these substantive updates to the

laws governing the institutions and entities under the

Department’s Financial Institutions Division.

Within the Nebraska Banking Act, Section 8-163,

governing the calculation of dividends, was

amended to replace the references to ‘undivided

profits on hand’ and ‘net profits on hand’ with

‘retained net earnings’ and to clearly define that

term by basing it on an existing report that already

includes the calculation of net income.

Department examiners had reported violations of

this statute that occurred because the existing

definition of ‘net profits on hand’ was

misinterpreted.

The Trust Company Act was revised to update

provisions related to an institution’s board of

directors. Information is now required to be

submitted on proposed board members as part of

a charter application; the President of the trust

company must be a member of the board; and

clarification that any person appointed to fill a

vacancy on the board requires approval of the

Department was included. These revisions mirror

provisions in the Nebraska Banking Act.

Significant amendments were made to the

Nebraska Money Transmitters Act to reflect the

growth and progression of the money transmitter

industry since 2014 (when the Act replaced the

Nebraska Sale of Checks and Funds

Transmission Act) and to provide the Department

with additional administrative tools. These

changes provided.

An exemption for collection agencies, credit

services organizations, and debt

management businesses licensed by the

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 12

A Year In Review

Nebraska Secretary of State acting within the

scope of those licenses, from licensing under

the Act, in order to eliminate a dual regulatory

burden.

Clarification that a license is required for

persons providing money transmission services

to a Nebraska resident even if the resident is

not physically present in Nebraska at the time

of the transaction. This amendment was

primarily intended to protect persons serving in

the military, wherever stationed, and will assist

Nebraskans who use a money transmitter

service while out of the state.

A requirement that licensees place customer

funds in banks that carry federal deposit

account insurance, which eliminated the risk

that licensees could hold client funds in

uninsured institutions.

Requirements that a licensee must be

organized, and have a physical location, in the

United States and its territories, and submit

financial statements for key shareholders. At

the same time, a requirement that licensees

submit a locations report as part of the annual

renewal process was repealed.

Additional investigative authority to the

Department; established a 21-Day response

deadline for notices of investigation and

inquiries from NDBF and authorized a $2,000/

day fine for failure to respond; and provided for

a lien and civil action if the fine is not paid.

The Installment Sales Act was amended to revise

the definition of “sales finance company” to include

parties that acquire any rights of ownership,

servicing, managing, participating or otherwise

engaging with a consumer on behalf of the

purchaser of the installment sales contracts from

one or more sellers, and to require that a licensee

increase its surety bond by $50,000 for each branch

office licensed in Nebraska.

The Installment Loan Act was similarly amended to

require a license for parties who acquire any rights

of ownership, or who service, manage, participate in,

or otherwise hold an installment loan or engage in

business with an installment loan borrower. This

amendment and the similar amendment in the

Installment Sales Act reflect the evolution of these

industries from one entity handling a transaction

from beginning to end.

The re-enactment of the depository financial

institutions “wild card” statutes to provide equal

rights, powers, privileges, benefits, and immunities

for state-chartered banks, savings and loans, and

credit unions, with their respective federal

counterparts, as of January 1, 2021. Due to state

constitutional restrictions, these statutes are

amended annually.

LB 363 provided a substantive update to the Securities

Act of Nebraska, which is administered by the

Department’s Securities Bureau, with an amendment to

Section 8-1109.02 of the Act. The amendment provides

authority to the Department to cure late filing of notices

for the sale of federal covered securities under section

18(b)(4) of the federal Securities Act of 1933, known as

federal Rule 506 filings. The amendment authorizes the

Director of the Department to issue an order curing the

late filing and requires the payment of a late fee in

addition to the initial filing fee. A cure process permits

issuers to continue to use an exemption originally relied

on and provides a more effective and efficient means to

do business in Nebraska while allowing Nebraskans

additional opportunities to purchase securities.

LB 297 was introduced on behalf of the Department by

Senator Brett Lindstrom, Vice-Chair of BCI, to address

financial exploitation in the securities area. LB 297

provides for a voluntary reporting structure for broker-

dealers, investment advisers, and other qualified

persons to notify the Department or Adult Protective

Services when they reasonably believe that a senior

adult or vulnerable adult is the victim of financial

exploitation. LB 297 further authorizes broker-dealers

and investment advisers to hold transactions and

disbursements when the firm reasonably believes that

the senior adult or vulnerable adult is the victim of

financial exploitation. Deputy Director Claire McHenry

discusses LB 297 in more detail in her review. LB 297

carried an operative date of August 28, 2021.

We appreciate the efforts of Senator Williams, Senator

Lindstrom, and Committee Counsel Bill Marienau in

enacting the Department’s proposals.

Director Kelly Lammers testified in a neutral position on

LB 649, which adopted the Nebraska Financial

Innovation Act creating digital asset depository

institutions and providing for the chartering, operation,

and regulation of such institutions. The Department is

the designated supervisor of these new financial

institutions. LB 649 also allows all state-chartered

banks, with prior Department approval, to provide

custodial services for controllable electronic records

within a digital asset department within the bank.

Corresponding amendments to the Nebraska Banking

Act and the Nebraska Money Transmitters Act were

included in the bill. LB 649 becomes effective October

1, 2021. The Department will be adopting rules, forms,

and procedures as it implements the new Act.

The Department anticipates requesting legislative

updates in the 2022 session.

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 13

A Year In Review

Retirements

A huge Thank You! to Department staff who retired this fiscal year:

Financial Institutions Counsel Michael W. McDannel retired on September 3, 2020,

after more than thirty-one years of service to the Department. Mike’s strong work

ethic and dedication to the financial protection of Nebraska citizens will long be

remembered.

Director Mark Quandahl retired September 7, 2020, having been appointed Director

in 2015. Mark led the implementation of the Department’s mission and vision and

initiated the streamlining of Department processes and the reduction of the

regulatory burden on Nebraska’s financial industries.

Senior Examiner Perry Neill retired on December 23, 2020, completing more than

thirty-six years with the Department. Perry examined banks in central and western

Nebraska for the entirety of his career and mentored many new examiners.

In Memoriam

Charles W. Mitchell, former Deputy Director of the Department, passed away November 17, 2020, at

94 years of age. Known to Department staff and many in the financial industries as “Mitch,” he was

a WWII U.S. Navy veteran and a graduate of Nebraska Wesleyan University. Mitch served as Deputy

Director for many of his thirty years with the Department and was Acting Director in 1979. Mitch

retired from the Department in 1985. The Department extends condolences to his wife, Betty, two

sons, three daughters, seven grandchildren and seven great-grandchildren.

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 14

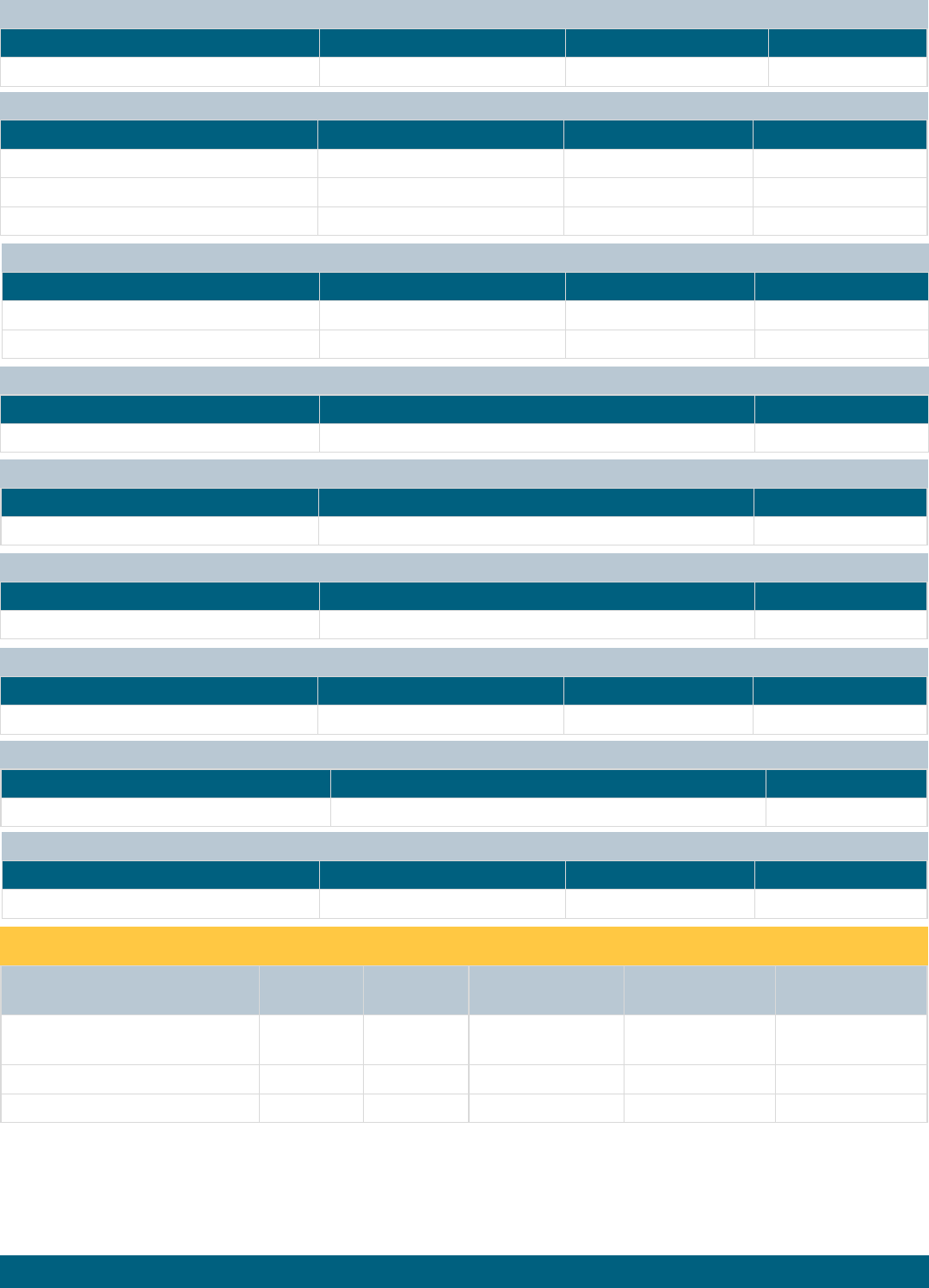

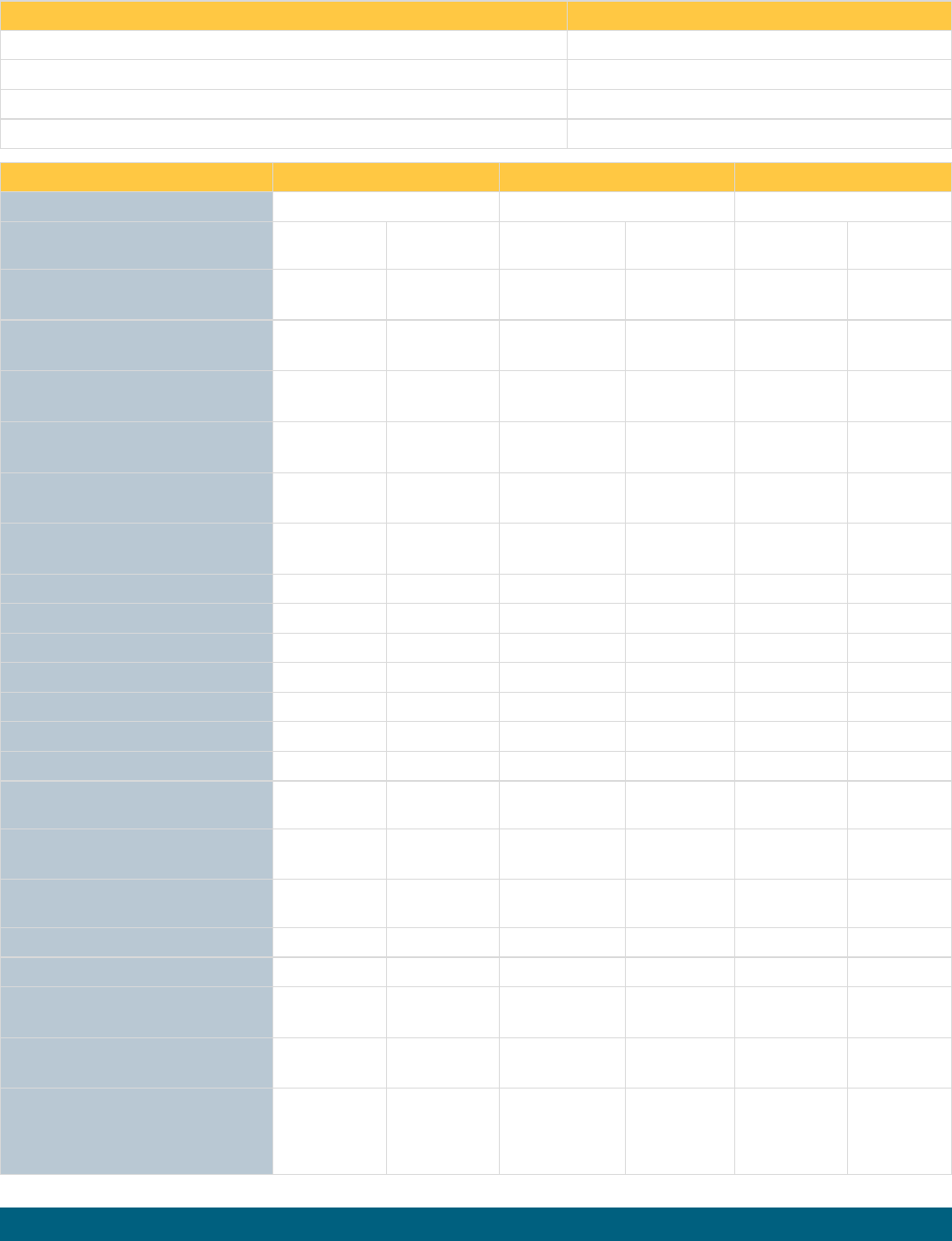

Department Budget & Funding

Fiscal Year July 1, 2020—June 30, 2021

The Department is fully funded by fees received from the

industries it regulates. Fees are deposited in two funds

with one used for supervision by the Financial Institutions

Division and the other by the Bureau of Securities.

The Financial Institutions fund receives most of its reve-

nue from an annual assessment based on assets and ex-

amination fees. The Bureau of Securities is funded

through fees from the registration of securities and the

licensing of securities industry personnel.

Financial Institutions

Revenues

Beginning Balance 1,957,497

Banking & Trust Companies 4,748,549

Credit Unions &

Savings and Loan

117,991

Mortgage Lending 1,352,290

Money Transmitters 62,225

Delayed Deposit Services 13

Consumer Lending 36,841

Total Revenues for Fiscal Year 6,317,908

Expenditures

Employee Salaries & Benefits 4,621,613

Operating Expenses 725,258

Capital Expenditures 51,980

Total Expenditures for Fiscal Year 5,398,851

Ending Balance 2,876,554

Costs collected from enforcement cases 6,388

Monies secured for the School Fund 35,700

Bureau of Securities

Revenues

Beginning Balance 2,205,264

Securities and Registration Fees 27,255,574

Private Offering Fees 140,800

Broker-Dealer/Broker-Dealer Agents/

Investment Adviser Fees

6,526,470

Interest Income 98,489

Cost of Investigations 2,000

Miscellaneous 860

Total Revenues for Fiscal Year 34,024,193

Expenditures

Employee Salaries & Benefits 1,259,533

Operating Expenses 313,039

Capital Expenditures 51,980

Total Expenditures for Fiscal 1,624,552

Monies transferred to the State of

Nebraska General Fund

25,900,000

Ending Balance 8,704,905

Monies secured for the School Fund 3,000

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 15

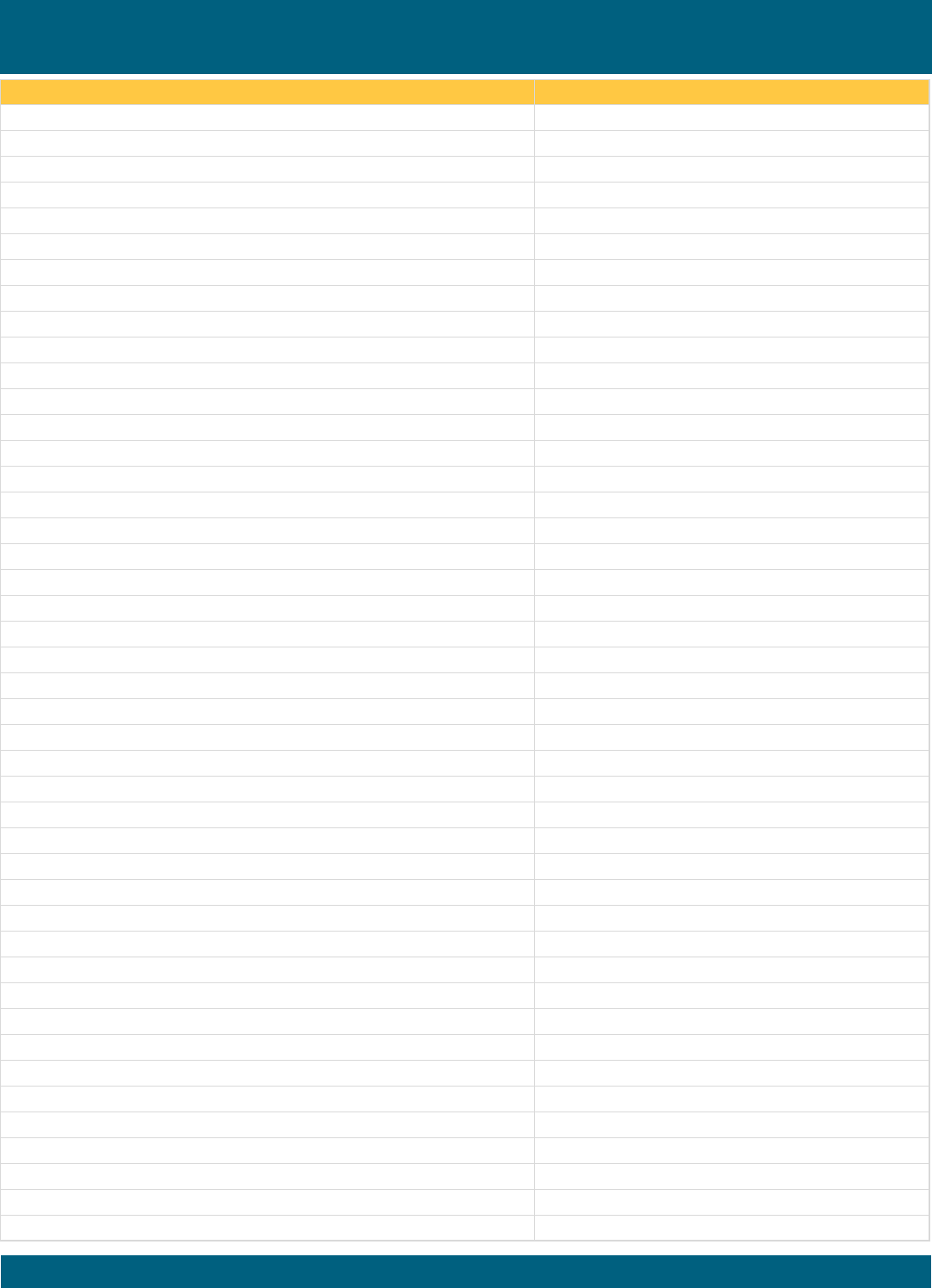

Financial Institutions Division

By the Numbers

Financial Institutions 6/30/2016 6/30/2017 6/30/2018 6/30/2019 6/30/2020 6/30/2021

State-Chartered Banks 163 158 156 153 147 146

Savings & Loan Associations 0 0 0 0 0 0

Credit Unions 14 13 13 12 12 11

Trust Companies 4 4 4 4 4 4

Delayed Deposit Services 87 80 75 74 65 19

Installment Loan Companies 10 13 13 2 3 4

Sales Finance Companies 94 139 139 92 97 98

Mortgage Bankers 353 374 385 369 391 426

Mortgage Loan Originators 2,693 3,396 3,900 3,319 3,893 5,471

Money Transmitters 83 93 104 125 133 162

Numbers include main offices only.

Conversion to State-Chartered Bank 2 Loan Production Office Notices Received 9

Bank Mergers Approved 4 Bank Branch Relocations Approved 0

Credit Union Mergers Approved 1 Name Changes 2

Bank Branch Acquisitions Approved 0 Bank Closings 0

New Bank Branch Offices Approved 10 Trust Charter Cancellations 0

Activity by the Institutions—Fiscal Year 2021

Activity by the Numbers—Fiscal Year 2021

Former Institution Current Institution City Date of Conversion

Midwest Bank, N.A. Midwest Bank Pierce 6/30/2021

Conversion to State-Chartered Bank

NebraskaLand National Bank NebraskaLand Bank North Platte 6/30/2021

Bank Mergers

Institution Bank Acquired Approved

Cornerstone Bank, York, NE The Bank of Tilden, Tilden 9/23/2020

First State Bank Nebraska, Lincoln, NE Plattsmouth State Bank, Plattsmouth 11/9/2020

Tri Valley Bank, Talmage, NE Eagle State Bank, Eagle 9/28/2020

Homestead Bank, Cozad, NE First National Bank of Chadron, Chadron 4/6/2021

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 16

Loan Production Office Notices Received

Institution City Location Date Received

First Nebraska Bank Valley Norfolk 8/17/2020

Five Points Bank Grand Island Norfolk 8/24/2020

Security First Bank Lincoln Lincoln 8/31/2020

CharterWest Bank West Point LaVista 9/28/2020

Platte Valley Bank Scottsbluff Alliance 2/16/2021

Platte Valley Bank Scottsbluff Chadron 2/16/2021

CharterWest Bank West Point Council Bluffs, IA 2/26/2021

Elkhorn Valley Bank & Trust Norfolk Yankton, SD 2/26/2021

Dundee Bank Omaha Council Bluffs, IA 5/4/2021

Move of Charter and Main Office

Institution City Location Approved

Frontier Bank Omaha Omaha 9/22/2020

New Bank Branch Office

Institution City Location Approved

Core Bank Omaha Papillion 9/4/2020

Bank of the Valley Bellwood Schuyler 11/19/2020

West Gate Bank Lincoln Omaha 12/11/2020

Citizens State Bank Wisner Mobile (Cass County) 1/12/2021

Platte Valley Bank Scottsbluff Alliance 4/22/2021

Platte Valley Bank Scottsbluff Chadron 4/22/2021

Elkhorn Valley Bank & Trust Norfolk Yankton, SD 5/4/2021

Five Points Bank

Grand Is-

land

Elkhorn 6/9/2021

FirsTier Bank Kimball Cheyenne, WY 6/21/2021

Riverstone Bank Talmage Syracuse 6/30/2021

Branch Acquisitions

Institution City Location Approved

None

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 17

Institutions

Number

6/30/2020

Number

6/30/2021

Assets

6/30/2020

Assets

6/30/2021

Gain (Loss)

State-Chartered Commercial

Banks

147 146 $48,094,176,000 $55,094,981,000 $7,000,805,000

Credit Unions 12 11 $782,519,196 $897,100,340 $114,681,144

Trust Companies 4 4 *$10,651,213 $12,397,394 $1,746,181

Financial Institutions Total Resources

Bank Branch Office Relocations

Institution City Branch Relocation Approved

None

Loan Production Office Relocations

Institution City LPO Relocation Date Received

Tri Valley Bank Talmage Syracuse 1/6/2021

CharterWest Bank West Point Council Bluffs, IA 6/14/2021

CharterWest Bank West Point McCook 6/23/2021

Name Changes

Prior Name of Institution Current Name City Approved

Tri Valley Bank Riverstone Bank Talmage 12/23/2020

Bank of Bennington i3 Bank Bennington 5/17/2021

Bank Closings

Name of Institution Location Date Closed

None

New Trust Company

Institution City Approved

None

Trust Charter Office Relocations—Same City

Institution City Approved

Bridges Trust Company Omaha 9/30/2020

New Trust Branch Offices

Institution City Branch Relocation Approved

None

Credit Union Mergers

Institution Credit Union Acquired Approved

First Nebraska Credit Union, Omaha, NE Construction Industries Credit Union, Lincoln, NE 5/26/2021

New Credit Union Branch Offices

Institution City Branch Location Approved

None

*Amended from previous fiscal year.

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 18

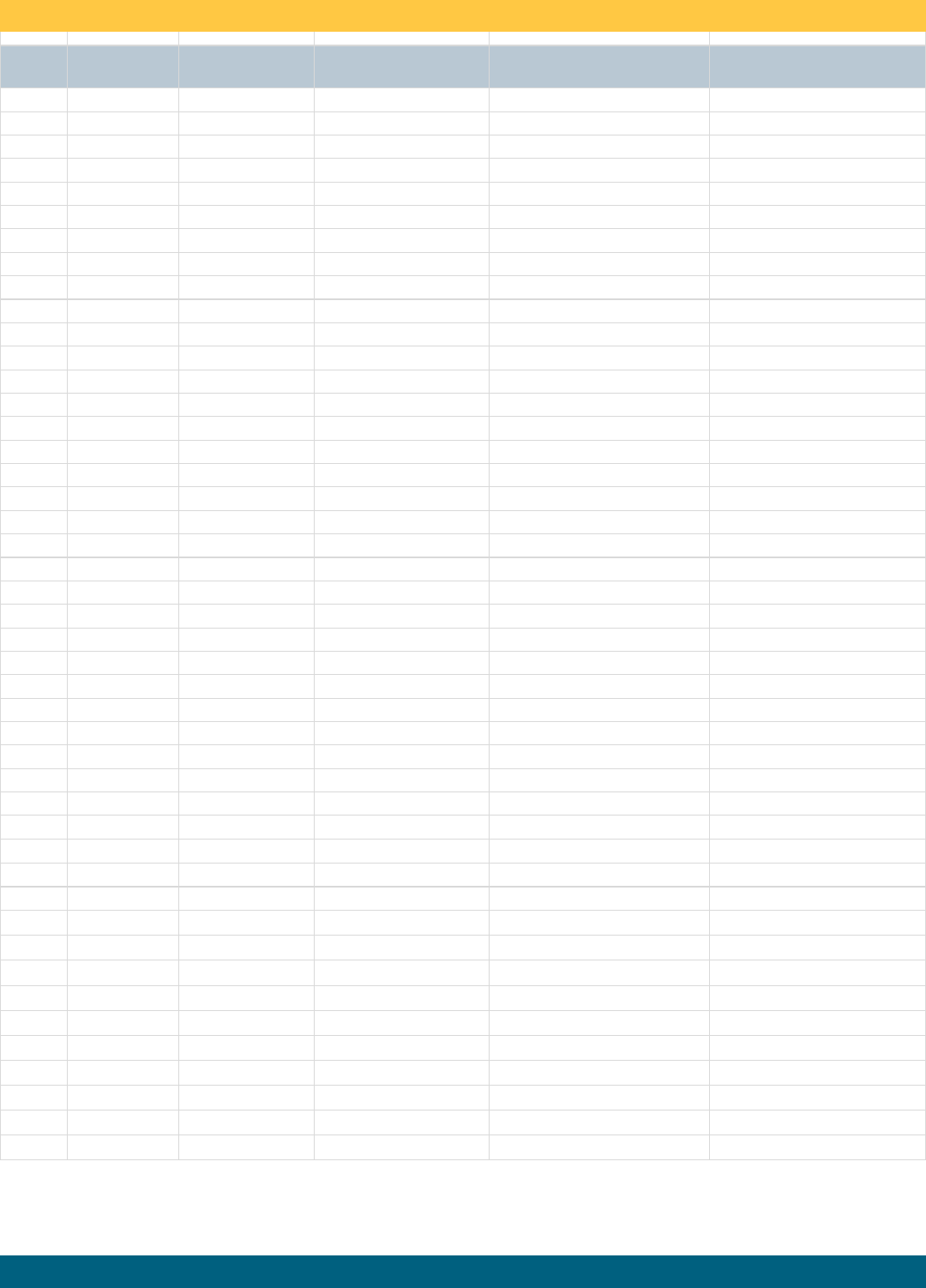

6/30/2019 6/30/2020 6/30/2021

Number of Institutions 153 147 146

Number of Employees 7,941 7,962 8,405

ASSETS: (Dollar amounts in thousands)

Non-Interest Bearing Balances 685,764 846,873 915,085

Interest Bearing Balances 1,555,901 3,052,323 4,521,248

Securities 6,573,356 7,274,265 11,200,169

Federal Funds Sold & Securities Purchased to Resell 243,830 508,926 444,866

Loans and Leases 31,126,335 34,794,261 36,247,335

Allowance for Loan Losses 444,957 502,141 556,791

Loan and Leases, Net 30,681,378 34,292,120 35,690,544

Assets held in Trading Accounts 24 86 91

Premises and Fixed Assets 635,206 696,127 823,839

Other Real Estate Owned 31,246 28,346 25,312

Intangible Assets 256,033 268,278 278,430

Other Assets, Net 965,779 1,126,832 1,195,397

Total Assets & Losses Deferred $41,628,517 $48,094,176 $55,094,981

LIABILITIES: (Dollar amounts in thousands)

Deposits

Domestic Non-Interest Bearing Deposits 5,275,045 6,668,792 8,871,426

Domestic Interest Bearing Deposits 28,821,996 32,737,499 37,704,169

Total Domestic Deposits 34,097,041 39,406,291 46,575,595

Federal Funds Purchased & Securities Sold 361,769 608,408 447,772

Other Borrowed Money 2,176,130 2,587,506 1,928,720

Mortgage Indebtedness 0 0 0

Notes and Debentures 0 0 0

Other Liabilities 242,492 398,676 341,915

Total Liabilities $36,877,432 $43,000,881 $49,294,002

EQUITY CAPITAL

Perpetual Preferred Stock 20,300 20,300 20,300

Common Stock 125,736 124,061 123,628

Surplus 2,106,534 2,244,748 2,573,598

Undivided Profits 2,498,515 2,704,186 3,083,453

Other Equity Capital Components 0 0 0

Total Equity Capital 4,751,085 5,093,295 5,800,979

Total Liabilities & Equity Capital $41,628,517 $48,094,176 $55,094,981

STATE-CHARTERED COMMERCIAL BANKS’ AGGREGATE BALANCE SHEET

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 19

Nebraska has adopted a deposit cap as set forth in the Nebraska Bank Holding Company Act. Section 8-910 provides

that a holding company may not acquire a bank or banks in Nebraska if the deposits held in Nebraska would be in an

amount greater than 22 percent of the total deposits of all banks in Nebraska plus the total deposits, savings accounts,

passbook accounts, and shares in savings and loan associations and building and loan associations in Nebraska as de-

termined by the Director of the Department on the basis of the most recent mid-year reports.

Total deposits for all banks and savings and loan associations in Nebraska as of June 30, 2021, were $79,855,820,000.

The number was taken from a Federal Deposit Insurance Corporation compilation.

The 22% limitation contained in Section 8-910(2)(c), as of June 30, 2021, would be:

$79,855,820,000

x .22

$17,568,280,400

Deposit Limitations

STATE OF NEBRASKA

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 20

The Single Bank Pooled Collateral Program (SBPC) was authorized by legislative bill (LB) 622 in 2020. The bill was

signed into law and became effective as of July 1, 2020. The bill revised portions of the Public Funds Deposit Security

Act (Neb. Rev. Stat. §§77-2386 – 77-23, 108) to provide financial institutions an alternate means by which to secure

public funds held on deposit. In contrast to the dedicated method of pledging securities directly to individual public

entities, the SBPC allows financial institutions to pledge a pool of securities to all public deposits held in excess of the

FDIC insurance limits.

LB622 authorized the Department to appoint an administrator for the SBPC. In May of 2020, the Department appointed

Nebraska Bankers Insurance and Services Company (NBISCO) as the program administrator. NBISCO’s appointment

runs through June 30, 2022. The appointment may be renewed for an additional three, two-year terms.

The SBPC began accepting participating financial institutions as of July 1, 2020. Since that date, the program has grown

from two participants to 16. Total public deposits in the program have grown from $138,725,000 to $1,144,138,000 over

the period.

The Single Bank Pooled Collateral

Program

STATE OF NEBRASKA

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 21

State Bank

Access Bank Omaha

State Bank 8712 West Dodge Road

Omaha, NE 68114-3459

School

Branch

LaVista West Elementary

LaVista, NE 68128

School

Branch

Bell Elementary School

Papillion, NE 68048

School

Branch

Prairie Queen Elementary School

Papillion, NE 68048

Mobile

Branch

Douglas & Sarpy Counties

Omaha, NE

Branch 1941 South 42nd Street

Omaha, NE 68105

Branch 7223 South 84th Street

LaVista, NE 68128

Branch 2710 South 140th Street

Omaha, NE 68144

Branch 774 Olson Drive

Papillion, NE 68046

Branch 203 North 180th Street

Omaha, NE 68022

Adams Bank & Trust Ogallala

State Bank 315 N. Spruce Street

Ogallala, NE 69153-0720

School

Branch

Chase County Schools

Imperial, NE 69033

School

Branch

Creek Valley Schools

Chappell, NE 69129

Mobile

Branch

El Paso County

Colorado Springs, CO

Branch 265 Cheyenne Mountain

Boulevard East

Colorado Springs, CO

Branch 1310 Garden of the Gods Road

Colorado Springs, CO 80907

Branch 7800 South College Avenue

Fort Collins, CO 80525

Branch 8308 Weld County Road 13

Firestone, CO

Branch 641 2nd Street

Chappell, NE 69129

Branch 205 N. 4th Street

Indianola, NE 69034

Branch 202 State Street

Brule, NE 69127-0156

Branch 121 South Jeffers Street

North Platte, NE 69103-0189

Branch Main Street

Lodgepole, NE 69149

Branch 131 Walnut

Sutherland, NE 69165-0157

Branch Perkins Avenue

Madrid, NE 69150-0098

Branch 545 Broadway

Imperial, NE 69033-0279

Branch 150 Central Avenue

Grant, NE 69140-0160

Branch 310 Mountain Avenue

Berthoud, CO 80513

Branch 10 Ken Pratt Boulevard

Longmont, CO 80501

Branch 3221 South Jeffers Street North

Platte, NE 69101

Branch 1005 So. Range Ave., Suite 300

Colby, KS 67701

Branch 519 West Main Street #B

Sterling, CO 80751

Branch 148 Remington Street, Suite 101

Fort Collins, CO 80524

Adams County Bank Kenesaw

State Bank 401 N. Smith Avenue

Kenesaw, NE 68956

Branch 1307 North Brass Avenue

Juniata, NE 68955

Adams State Bank Adams

State Bank 649 Main Street

Adams, NE 68301

School

Branch

Freeman Public School

Adams, NE 68301

American Exchange Bank Elmwood

State Bank 151 North 4th Street

Elmwood, NE 68349

Branch 440 D Street

Eagle, NE 68347-0407

American Interstate Bank Elkhorn

State Bank 3331 North 204th Street

Elkhorn, NE 68022

Branch 15909 West Maple Road

Omaha, NE 68116

Arbor Bank Nebraska City

State Bank 911 Central Avenue

Nebraska City, NE 68410-0429

Branch 301 Oakland Avenue

Oakland, IA 51560

Branch 716 Illinois

Sidney, IA 51652

Branch 16949 Lakeside Hills Plaza

Omaha, NE 68130

Branch 18924 Evans St.

Omaha, NE 68022

Loan

Production

Office

17117 Burt Street

Omaha, NE 68118

Ashton State Bank Ashton

State Bank 295 Center Avenue

Ashton, NE 68817

Auburn State Bank Auburn

State Bank 1212 J Street

Auburn, NE 68305

Bank of Clarks Clarks

State Bank 301 N. Green Street

Clarks, NE 68628-0125

Branch 201 Vine Street

Silver Creek, NE 68663

Bank of Dixon County Ponca

State Bank 117 E. 3rd Street

Ponca, NE 68770-0570

Branch 218 East Elk Street

Jackson, NE 68743

Branch 412 Main Street

Newcastle, NE 68757

State Bank 118-120 Plum Street

Doniphan, NE 68832-0270

Branch 800 North Burlington

Hastings, NE 68901

Branch 1010 Diers Avenue

Grand Island, NE 68803

Bank of Doniphan Doniphan

Bank of Elgin Elgin

State Bank 101 N. 2nd Street

Elgin, NE 68636-0379

Bank of Hartington Hartington

State Bank 229 N. Broadway

Hartington, NE 68739-0077

Loan

Production

Office

25411 Park Avenue

Niobrara, NE 68760

Branch 304 North Broadway

Hartington, NE 68739

Loan

Production

Office

120 N. Broadway

Bloomfield, NE 68718

Bank of Lewellen Lewellen

State Bank 302 Main Street

Lewellen, NE 69147

Bank of Lindsay Lindsay

State Bank 102 Pine Street

Lindsay, NE 68644

Bank of Mead Mead

State Bank 322 South Vine

Mead, NE 68041-0155

Branch 245 N. Elm

Mead, NE 68041

Bank of Newman Grove Newman Grove

State Bank 416 Hale Avenue

Newman Grove, NE 68758

Bank of Orchard Orchard

State Bank 145 E. 2nd Street

Orchard, NE 68764

Bank of Prague Prague

State Bank 316 W. Center Avenue

Prague, NE 68050-0128

Bank of the Valley Bellwood

State Bank 404 State Street

Bellwood, NE 68624

School

Branch

Bellwood Public School

Bellwood, NE 68624

School

Branch

David City Elementary School

David City, NE 68632

School

Branch

St. Mary's School

David City, NE 68632

School

Branch

Platte Center Elementary

Platte Center, NE 68653

School

Branch

Shell Creek Elementary

Columbus, NE 68601

School

Branch

Humphrey St. Francis

Humphrey, NE 68642

School

Branch

Humphrey Public

Humphrey, NE 68642

School

Branch

St. Isidore School

Columbus, NE 68601

Branch 103 4th Street

Platte Center, NE 68653

Branch 1855 North Fourth Street

David City, NE 68632

Branch 3235 47th Street

Columbus, NE 68601

Branch 502 5th Street

David City, NE 68632

Branch 100 S. 3rd Street

Humphrey, NE 68642

STATE-CHARTERED BANKS (for the period ending June 30, 2021)

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 22

STATE-CHARTERED BANKS (continued)

BankFirst Norfolk

State Bank 100 N. 13th Street

Norfolk, NE 68701

Branch 121 North 27th Street

Ord, NE 68862

Branch 313 East Highway 20

O'Neill, NE 68763

Loan

Production

Office

6800 South 32nd Street

Lincoln, NE 68516

Branch 1211 Riverside Boulevard

Norfolk, NE 68701

Branch 920 South 13th Street

Norfolk, NE 68701

Branch 220 West 7th Street

Wayne, NE 68787

Branch 2530 23rd Street

Columbus, NE 68601

Branch 1371 26th Avenue

Columbus, NE 68601

Branch 127 East Walnut

West Point, NE 68788

Branch 2021 Dakota Avenue

South Sioux City, NE 68776

Branch 402 Main Street

Wakefield, NE 68784

Branch 902 10th Street

Onawa, IA 51040

Branch 2401 Hamilton

Sioux City, IA 51104

Branch 3119 Floyd Boulevard

Sioux City, IA 51104

Branch 3410 Singing Hills Boulevard

Sioux City, IA 51106

Banner Capital Bank Harrisburg

State Bank 205 State Street

Harrisburg, NE 69345

Branch 401 9th Street

Beaver City, NE 68926

Branch 512 Main Street

Alma, NE 68920

Branch 4007 Greenway Street

Cheyenne, WY 82001

Branch 17 N. Wyoming

Guernsey, WY 82204

Loan

Production

Office

1555 Gilchrist

Wheatland, WY 82201

Battle Creek State Bank Battle Creek

State Bank 202 W. Main Street

Battle Creek, NE 68715-0308

Boelus State Bank Boelus

State Bank 523 Delaware Street

Boelus, NE 68820-0233

Bruning Bank Bruning

State Bank 104 E. Main Street

Bruning, NE 68322-0100

Branch 252 South 13th Street

Hebron, NE 68370

Branch 1215 Burlington

Holdrege, NE 68949

Branch 803 South D Street

Broken Bow, NE 68822

Branch 1110 17th Avenue

Kearney, NE 68847

Branch 314 Nippell Street

Winnetoon, NE 68789

Butte State Bank Butte

State Bank 510 Thayer Street

Butte, NE 68722-0028

Branch 425 Hillcrest Boulevard

Spencer, NE 68777

Cattle Bank & Trust Seward

State Bank 104 South 5th Street

Seward, NE 68434

School

Branch

Cattle Bank & Trust—Roper

Elementary Branch

Lincoln, NE 68522

School

Branch

Cattle Bank & Trust—The Arnold

Branch

Lincoln, NE 68524

Branch 405 North Fifth Street

Seward, NE 68434

Branch 6550 Merchant Drive

Lincoln, NE 68521

Cedar Rapids State Bank Cedar Rapids

State Bank 213 W. Main Street

Cedar Rapids, NE 68627-0158

Branch 124 W. St. Joseph Street

Spalding, NE 68665

Loan

Production

Office

7101 Stone Drive

Daphne, AL 36526

Loan

Production

Office

1508 JFK Drive, Ste 201

Bellevue, NE 68005

Cedar Security Bank Fordyce

State Bank 117 Main Street

Fordyce, NE 68736

Branch 309 South Robinson Street

Hartington, NE 68739

Branch 411 St. James Ave

Wynot, NE 68792

CerescoBank Ceresco

State Bank 130 West Elm Street

Ceresco, NE 68017-0036

Chambers State Bank Chambers

State Bank 104 E. Main Street

Chambers, NE 68725

Branch 220 E. Nebraska Street

Ewing, NE 68735

CharterWest Bank West Point

State Bank 201 South Main Street

West Point, NE 68788

Branch 610 4th Street

Pender, NE 68047

Loan

Production

Office

3100 23rd Street, Suite 25

Columbus, NE 68601

Branch 1404 Pine Lake Road

Lincoln, NE 68512

Loan

Production

Office

714 N. Diers Avenue

Grand Island, NE 68803

Branch 141 East Grove

West Point, NE 68788

Branch 308 Main Street

Walthill, NE 68067

Loan

Production

Office

2121 N. Webb Rd., Suite 202

Grand Island, NE 68803

Loan

Production

Office

704 East Side Blvd.

Hastings, NE 68901

Branch 20041 Manderson Street

Elkhorn, NE 68022

Branch 7404 Olson Drive

Papillion, NE 68046

Loan

Production

Office

4511 2nd Avenue, Suite 207

Kearney, NE 68847

Loan

Production

Office

4750 Normal Blvd.

Lincoln, NE 68506

Loan

Production

Office

2901 S. 84th Street, Suite 10

Lincoln, NE 68506

Loan

Production

Office

116 West E Street

McCook, NE 69001

Loan

Production

Office

4604 S. 25th Street

Omaha, NE 68107

Loan

Production

Office

12121 McDermott Plaza

LaVista, NE 68128

Loan

Production

Office

14451-14543 W. Center Road,

Suite 9

Omaha, NE 68144

Loan

Production

Office

500 Willow Avenue Suite 204

Council Bluffs, IA 51503

Citizens Bank & Trust Company in St. Paul

St. Paul

State Bank 721 7th Street

St. Paul, NE 68873-2032

Branch 650 P Street

Loup City, NE 68853

Branch 1634 16th Street

Central City, NE 68826

Citizens State Bank Carleton

State Bank 209 Third Street

Carleton, NE 68326

Citizens State Bank Wisner

State Bank 921 Ave E

Wisner, NE 68791

School

Branch

Wisner-Pilger Elementary

Wisner, NE 68791

Mobile

Branch

Sarpy and Douglas Counties

Papillion, NE

Mobile

Branch

Madison County

Creston, NE

Mobile

Branch

Cedar, Dixon, Wayne and Pierce

Counties

Laurel, NE

Mobile

Branch

Fillmore, Saline and Seward

Counties

Friend, NE

Mobile

Branch

Boone, Greeley and Wheeler

Counties

Spalding, NE

Mobile

Branch

Colfax and Platte Counties

Leigh, NE

Mobile

Branch

Cuming and Stanton Counties

Wisner, NE

Mobile

Branch

Cass County

Plattsmouth, NE 68048

Branch 109 East Sherman

West Point, NE 68788

Branch 201 South Hwy 20

Laurel, NE 68745

Branch 203 Main Street

Leigh, NE 68643

Branch 121 N. Chestnut Street

Spaulding, NE 68665

Brunswick State Bank Brunswick

State Bank 226 2nd Street

Brunswick, NE 68720-0029

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 23

STATE-CHARTERED BANKS (continued)

City Bank & Trust Co. Lincoln

State Bank 2929 Pine Lake Road

Lincoln, NE 68516

Branch 940 P Street

Lincoln, NE 68508

Branch 3900 Pine Lake Road

Lincoln, NE 68516

Branch 4225 Lucille Drive

Lincoln, NE 68502

Branch 1135 Main Street

Crete, NE 68333

Loan

Production

Office

7101 S. 82nd Street

Lincoln, NE 68516

Clarkson Bank Clarkson

State Bank 243 Pine Street

Clarkson, NE 68629-0080

Columbus Bank & Trust Company Columbus

State Bank 2501 13th Street

Columbus, NE 68601-4913

Branch 118 23rd Street, Suite 100

Columbus, NE 68601

Commercial Bank Nelson

State Bank 401 S. Main Street

Nelson, NE 68961-0388

Loan

Production

Office

145 South 10th Street

Geneva, NE 68361

Commercial State Bank Republican City

State Bank 20 Circle Drive

Republican City, NE 68971-0067

Commercial State Bank Wausa

State Bank 519 E. Broadway

Wausa, NE 68786-0179

Branch 617 Central Avenue

Nebraska City, NE 68410

Branch 1918 N. 203rd Street

Elkhorn, NE 68022

Loan

Production

Office

123 North Broadway Street

Bloomfield, NE 68718

Community First Bank Maywood

State Bank 122 S. Commercial Street

Maywood, NE 69038-0045

School

Branch

Tiger Branch of

Community First Bank

Maywood, NE 69038

Branch 306 Pine Street

Big Springs, NE 69122

Branch 338 Main Street

Trenton, NE 69044

Branch 324 Main Street

Stapleton, NE 69163

Branch 410 East Francis

North Platte, NE 69101

Branch 127 W. Main Street

Cedar Bluffs, NE 68015

Core Bank Omaha

State Bank 12100 West Center Road

Omaha, NE 68144

Mobile

Branch

Douglas County

Omaha, NE

Mobile

Branch

Saunders County

Omaha, NE

Mobile

Branch

Otoe County

Douglas, NE

Branch 16805 Q Street

Omaha, NE 68135

Branch 2545 South 180th Street

Omaha, NE 68130

Branch 13220 Birch Drive

Omaha, NE 68164

Branch 12100 West Center Road

Omaha, NE 68144

Branch 7400 College Boulevard

Overland Park, KS 66210

Corn Growers State Bank Murdock

State Bank 333 Nebraska Street

Murdock, NE 68407

Cornerstone Bank York

State Bank 529 North Lincoln Avenue

York, NE 68467

Branch 302 N. Clay Street

Harvard, NE 68944

Branch 119 "C" Street

Shelton, NE 68876

Branch 100 West 6th Street

Davenport, NE 68335

Branch 211 Winters Avenue

Glenvil, NE 68941

Branch 101 West Elm Street

Sutton, NE 68979

Branch 317 Beaver Street

St. Edward, NE 68660

Branch 1206 13th Street

Aurora, NE 68818

Branch 520 Lincoln

Bradshaw, NE 68319

Branch 1631 16th Street

Central City, NE 68826

Branch 1727 23rd Street

Columbus, NE 68601

Branch 3304 16th Street

Columbus, NE 68601

Branch 818 East 23rd Street

Columbus, NE 68601

Branch 1141 G Street

Geneva, NE 68361

Branch 2250 North Diers Avenue

Grand Island, NE 68801

Branch 3501 South Locust Street

Grand Island, NE 68801

Branch 409 A Street

Hampton, NE 68843

Branch 916 North Main Street

Henderson, NE 68371

Branch 100 E. 2nd St.

Tilden, NE 68781

Branch 709 Peabody

Creighton, NE 68729

Branch 604 Main Street

Clearwater, NE 68726

Branch 3511 South Lincoln Avenue

York, NE 68467

Branch 528 Grant Avenue

York, NE 68467

Branch 840 North Diers Avenue

Grand Island, NE 68803

Branch 240 South 3rd Street

Albion, NE 68620

Branch 103 South Brown Ave

Clay Center, NE 68933

Branch Main Street

Polk, NE 68654

Branch Third & Main Streets

Bartlett, NE 68622

Branch 402 Marquis Avenue

Marquette, NE 68854

Branch 401 University Avenue

Guide Rock, NE 68942

Branch 307 North "C" Street

Edgar, NE 68935

Branch 211 Rock Bluff Road

Beaver Lake, NE 68048

Branch 1502 M Street

Franklin, NE 68939

Branch 133 Commercial Avenue

Hildreth, NE 68947

Branch 102 W. Main Street

Murray, NE 68409

Branch 404 W. 1st Street

North Loup, NE 68859

Branch 102 West Sapp

Wilcox, NE 68982

Branch 147 Center Avenue

Malmo, NE 68040

Cornhusker Bank Lincoln

State Bank 8310 "O" Street

Lincoln, NE 68510

Branch 5600 Pioneers Boulevard

Lincoln, NE 68506

Branch 5701 South 34th Street Ste 100

Lincoln, NE 68516

Loan

Production

Office

7575 South 57th Street

Lincoln, NE 68516

Branch 5700 Fremont Street

Lincoln, NE 68504

Branch 5555 South Street

Lincoln, NE 68506

Branch 7200 Van Dorn

Lincoln, NE 68506

Branch 6100 Apple’s Way

Lincoln, NE 68516

Branch 234 Pine Street

Creston, NE 68631

Branch 150 Maple Street

Friend, NE 68359

Branch 754 Gold Coast Drive

Papillion, NE 680146

Branch 2020 W. Eighth Avenue

Plattsmouth, NE 68046

Branch 120 N. 6th

Plattsmouth, NE 68048

Branch 260 Garhan Avenue

Rising City, NE 68658

Branch 400 Main Street

Stromsburg, NE 68666

Branch 902 South Saunders Avenue

Sutton, NE 68979

Branch Midland Street

Waco, NE 68460

Branch 101 David Drive

York, NE 68467

Branch 1730 Lincoln Avenue

York, NE 68467

Branch Main Street

Monroe, NE 68647

Branch 401 East M Street

McCool Junction, NE 68401

Community State Bank Colon

State Bank 102 Spruce Street

Colon, NE 68018-0004

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 24

STATE-CHARTERED BANKS (continued)

Custer Federal State Bank Broken Bow

State Bank 341 South 10th Avenue

Broken Bow, NE 68822

Branch 1305 East 56th Street

Kearney, NE 68847

Dundee Bank Omaha

State Bank 5015 Underwood Avenue

Omaha, NE 68132

School

Branch

All Saints Catholic School

Omaha, NE 68108

School

Branch

Holy Name School

Omaha, NE 68132

Branch 2739 N. 61st Street

Omaha, NE 68104

Branch 302 S. 38th Street

Omaha, NE 68132

Loan

Production

Office

8026 W. Dodge Road

Omaha, NE 68114

Loan

Production

Office

760 W. Gold Coast Rd.,

Suite 109

Papillion, NE 68046

Loan

Production

Office

3717 Harney Street

Omaha, NE 68131

Loan

Production

Office

16909 Lakeside Hills Plaza

Omaha, NE 68130

Loan

Production

Office

15606 Elm St., #102

Omaha, NE 68130

Loan

Production

Office

4949 Underwood Avenue

Omaha, NE 68132

Loan

Production

Office

424 South 8th Avenue

Broken Bow, NE 68822

Loan

Production

Office

229 S. Main Street

Council Bluffs, IA 51503

Elkhorn Valley Bank & Trust Norfolk

State Bank 800 West Benjamin Avenue

Norfolk, NE 68702

Branch 120 East Norfolk Avenue

Norfolk, NE 68702-1007

Branch 1010 Omaha Avenue

Norfolk, NE 68702-0187

Branch 105 S. 2nd Street

Pierce, NE 68767

Branch 2107 Taylor Avenue

Norfolk, NE 68701

Branch 411 East 7th Street

Wayne, NE 68787

Branch 404 S. 25th Street

Norfolk, NE 68701

Mobile

Branch

Wayne County

Wayne, NE

Equitable Bank Grand Island

State Bank 113 N. Locust St.

Grand Island, NE 68802-0160

Branch 619 N. Diers Avenue

Grand Island, NE 68803

Branch 920 S. Jeffers Street

North Platte, NE 69101

Branch 10855 W. Dodge Rd.

Omaha, NE 68154

Exchange Bank Kearney

State Bank 3110 2nd Avenue

Kearney, NE 68847

Branch 1204 Allen Drive

Grand Island, NE 68803

Branch 939 South Locust Street

Grand Island, NE 68801

Loan

Production

Office

322 Houston Street, Suite 111

Manhattan, KS 66503

Branch 14 LaBarre Street

Gibbon, NE 68840

Branch 7655 Pioneers Blvd.

Lincoln, NE 68506

Branch 1720 South Ohio

Salina, KS 67501

Branch 702 North Washington Street

Junction City, KS 66441

Branch 8008 West Dodge Rd.

Omaha, NE 68847

F & M Bank West Point

State Bank 204 North Main Street

West Point, NE 68788

Branch 321 Main Street

Wayne, NE 68787

Branch 2024 Dakota Avenue

South Sioux City, NE 68776

Branch 11504 Willow Park Drive

Gretna, NE 68028

Branch 3300 Plaza Drive

South Sioux City, NE 68776

Branch 930 3rd Street

Sioux City, IA 51101

F&M Bank Falls City

State Bank 1701 Stone Street

Falls City, NE 68355

Branch 1502 Harlan Street

Falls City, NE 68355

Farmers & Merchants Bank Axtell

State Bank 402 Main Avenue

Axtell, NE 68924

Loan

Production

Office

22060 Laurel Oak Drive

Parker, CO 80138

Farmers and Merchants Bank Milford

State Bank 617 First Street

Milford, NE 68405-9611

Branch 301 Nemaha Street

Firth, NE 68358

Branch 202 Locust Street

Panama, NE 68419

Branch 900 Demery Street

Beaver Crossing, NE 68313

Branch 347 C Street

Palmyra, NE 68418

Branch 101 S. Calvert

Lawrence, NE 68957

Branch 355 North Central

Superior, NE 68978

Farmers and Merchants Bank Milligan

State Bank 501 Main Street

Milligan, NE 68406-0010

Branch 719 Wisconsin Street

Cawker City, KS 67430

Farmers and Merchants Bank of Ashland

Ashland

State Bank 1501 Silver Street

Ashland, NE 68003-0217

Branch 504 Highway 6

Ashland, NE 68003

Farmers and Merchants State Bank

Bloomfield

State Bank 103 N. Broadway

Bloomfield, NE 68718-0069

Branch Second and Kansas Streets

Crofton, NE 68730

Branch 301 Main Street

Center, NE 68724

Branch 203 South Robinson

Hartington, NE 68739

Branch 254 10 Park Avenue

Niobrara, NE 68760

Branch 89283 Highway 81

South Yankton, NE 57078

Farmers State Bank Dodge

State Bank 355 2nd Street

Dodge, NE 68633-0067

Branch 823 Main Street

Bridgeport, NE 68633

Branch 1320 West 3rd Street

Alliance, NE 69301

Branch 501 Main Street

Carroll, NE 68723

Branch 205 West 3rd Street

Chadron, NE 69337

Branch 427 Central Avenue

Ericson, NE 68637

Branch 605 North Main Street

Atkinson, NE 68713

Branch 101 N. Thayer Street

Spencer, NE 68777

Branch 1200 Park Drive

Hickman, NE 68372

First Bank & Trust of Fullerton Fullerton

State Bank 230 Broadway

Fullerton, NE 68638

Branch 1101 Cornhusker Highway

Lincoln, NE 68521

Branch 11102 Blondo Street, Suite 102

Omaha, NE 68164

Countryside Bank Unadilla

State Bank 379 Main Street

Unadilla, NE 68454-4039

Branch 334 Main Street

Burr, NE 68324

Branch 976 11th Street

Syracuse, NE 68446

Loan

Production

Office

315 W. Church Street

Albion, NE 68620

Loan

Production

Office

114 Douglas Avenue, Suite 5

Yankton, SD 57078

Enterprise Bank Omaha

State Bank 12800 West Center Road

Omaha, NE 68144-3818

Branch 210 Regency Parkway

Omaha, NE 68114

Mobile

Branch

Douglas County

Omaha, NE

Branch 3015 2nd Avenue

Kearney, NE

Mobile

Branch

Buffalo County

Kearney, NE

Branch 321 South Main

Wilber, NE 68465

Branch 201 W. Eldora Avenue

Weeping Water, NE 68463

Branch 309 Broad Street

Jansen, NE 68377

ndbf.nebraska.gov 2021 Nebraska Department of Banking & Finance 25

STATE-CHARTERED BANKS (continued)

First Bank of Utica Utica

State Bank 785 D Street

Utica, NE 68456

Branch 390 Hector Street

Cordova, NE 68330

Branch 104 Cherry Street

Friend, NE 68359

Branch 407 7th Street

Milligan, NE 68406