Missouri Lottery Winner Claim Form

[ STAPLE TICKET HERE ]

PLEASE PRINT your name, address and phone number on the back of your ticket - YOU MUST SIGN YOUR TICKET. Any

winning Missouri Lottery ticket worth $600 or less can be cashed at a licensed Lottery retailer selling that game, regardless of where the

ticket was purchased and provided the cash is available.

COMPLETE ITEMS 1-17 BELOW. Please use this form to claim INSTANT (Scratchers) or DRAW GAME prizes. You are hereby

advised that items 1, 2, 3, 4, 5, 6, 7, 8, 11, and 12 are subject to being disclosed pursuant to a request under Chapter 610, Missouri

Revised Statutes.

RETAIN A PHOTOCOPY of the front and back of your winning ticket and of this completed form for your personal records.

Staple the ticket to the top right corner of this form. Mail this form and the winning ticket to: MISSOURI LOTTERY, PO BOX 7777,

JEFFERSON CITY, MO 65102-7777, OR hand deliver your ticket and completed claim form to any Missouri Lottery oce.

A

B

C

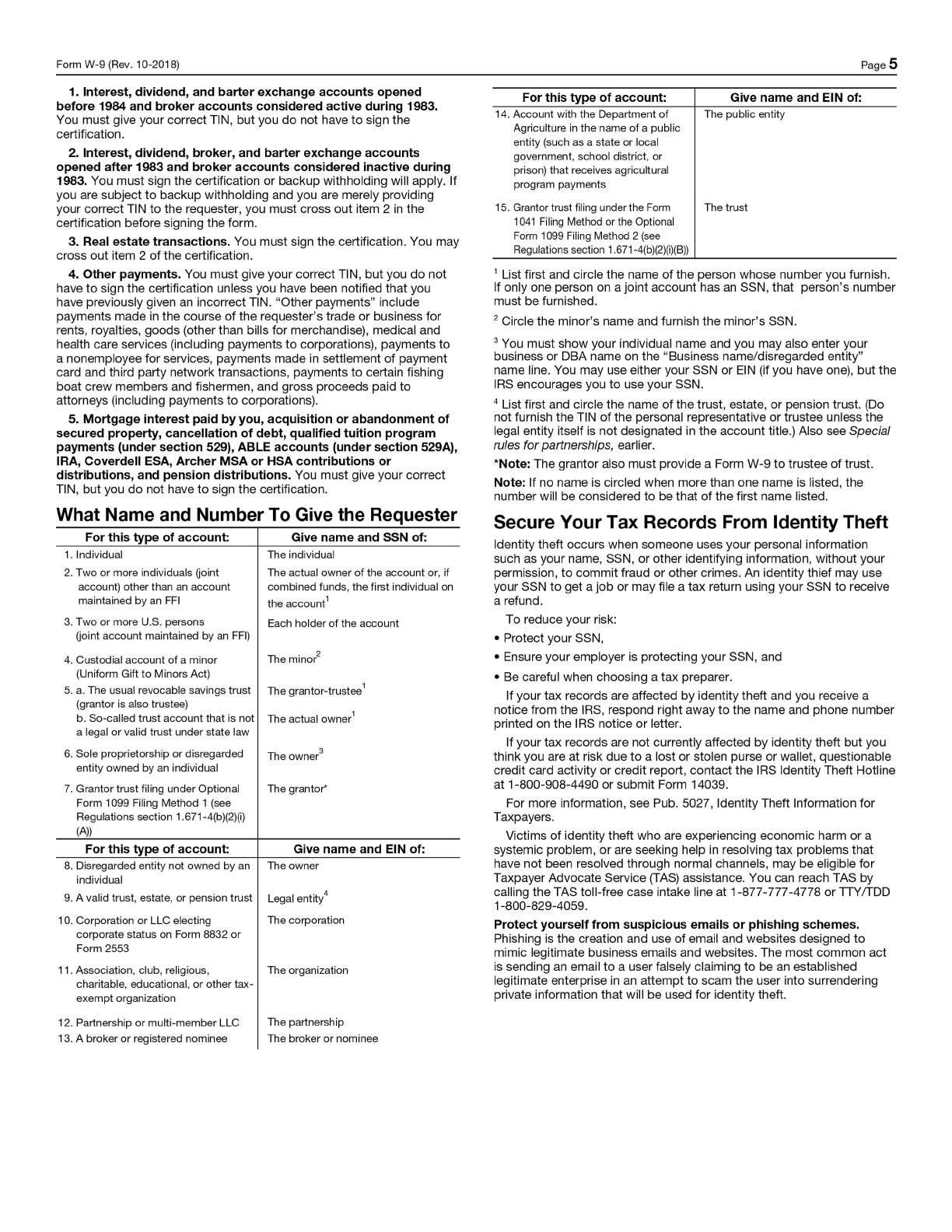

In addition to the claim form, it is your responsibility to complete IRS Form W-9 - Request for Taxpayer Identication Number and

Certification for any taxable winnings over $600.

The Missouri Lottery loves to celebrate winners. However, as of Aug. 28, 2021, that celebration will not include winners’ names

without prior written consent, in accordance with § 313.303 RSMo. As a result, the names of Lottery winners, including

promotional winners, will no longer be made available at MOLottery.com, our mobile app, etc.

Claimant’s Signature:

Date:

17. Under penalty of perjury, I declare that the name, address and Social Security number, which I have furnished, correctly

identies me as the recipient of the prize claimed, that the ticket attached to this form has not been falsely made, altered,

forged or counterfeited and all information set out above is correct.

1. Last Name

2.

First Name

3.

M.I. 4. Date of Birth

MM

5. Mailing Address [Street, Route or PO Box#] 6. City 7. State

8.

Zip Code

9.

SSN# / FIN#

10.

Phone

11.

U.S. Resident

Y or N

[area code]

12. Amount of Prize [before taxes]

16. Are you an employee of, related by blood or marriage to, or an owner/partial owner of a business that sells Missouri Lottery tickets?

Street

DD YY

$

Ocial Missouri Lottery Claim Form

.00

Yes No

13.

Number of people claiming prize

14. If more than one claimant: Is this prize to be paid equally?

Y or N

If not equally, enter

dollar amount you

are claiming

$

15.

If “Yes,” you must state the business name

and address

City

274

South Florida Fair 2021

Form W-9

(Rev. October 2018)

Department of the Treasury

Internal Revenue Service

Request for Taxpayer

Identification Number and Certification

▶

Go to www.irs.gov/FormW9 for instructions and the latest information.

Give Form to the

requester. Do not

send to the IRS.

Print or type.

See Specific Instructions on page 3.

1 Name (as shown on your income tax return). Name is required on this line; do not leave this line blank.

2 Business name/disregarded entity name, if different from above

3 Check appropriate box for federal tax classification of the person whose name is entered on line 1. Check only one of the

following seven boxes.

Individual/sole proprietor or

single-member LLC

C Corporation S Corporation Partnership Trust/estate

Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership)

▶

Note: Check the appropriate box in the line above for the tax classification of the single-member owner. Do not check

LLC if the LLC is classified as a single-member LLC that is disregarded from the owner unless the owner of the LLC is

another LLC that is not disregarded from the owner for U.S. federal tax purposes. Otherwise, a single-member LLC that

is disregarded from the owner should check the appropriate box for the tax classification of its owner.

Other (see instructions)

▶

4 Exemptions (codes apply only to

certain entities, not individuals; see

instructions on page 3):

Exempt payee code (if any)

Exemption from FATCA reporting

code (if any)

(Applies to accounts maintained outside the U.S.)

5 Address (number, street, and apt. or suite no.) See instructions.

6 City, state, and ZIP code

Requester’s name and address (optional)

7 List account number(s) here (optional)

Part I Taxpayer Identification Number (TIN)

Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid

backup withholding. For individuals, this is generally your social security number (SSN). However, for a

resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other

entities, it is your employer identification number (EIN). If you do not have a number, see How to get a

TIN, later.

Note: If the account is in more than one name, see the instructions for line 1. Also see What Name and

Number To Give the Requester for guidelines on whose number to enter.

Social security number

– –

or

Employer identification number

–

Part II Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue

Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am

no longer subject to backup withholding; and

3. I am a U.S. citizen or other U.S. person (defined below); and

4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct.

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because

you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid,

acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments

other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later.

Sign

Here

Signature of

U.S. person

▶

Date

▶

General Instructions

Section references are to the Internal Revenue Code unless otherwise

noted.

Future developments. For the latest information about developments

related to Form W-9 and its instructions, such as legislation enacted

after they were published, go to www.irs.gov/FormW9.

Purpose of Form

An individual or entity (Form W-9 requester) who is required to file an

information return with the IRS must obtain your correct taxpayer

identification number (TIN) which may be your social security number

(SSN), individual taxpayer identification number (ITIN), adoption

taxpayer identification number (ATIN), or employer identification number

(EIN), to report on an information return the amount paid to you, or other

amount reportable on an information return. Examples of information

returns include, but are not limited to, the following.

• Form 1099-INT (interest earned or paid)

• Form 1099-DIV (dividends, including those from stocks or mutual

funds)

• Form 1099-MISC (various types of income, prizes, awards, or gross

proceeds)

• Form 1099-B (stock or mutual fund sales and certain other

transactions by brokers)

• Form 1099-S (proceeds from real estate transactions)

• Form 1099-K (merchant card and third party network transactions)

• Form 1098 (home mortgage interest), 1098-E (student loan interest),

1098-T (tuition)

• Form 1099-C (canceled debt)

• Form 1099-A (acquisition or abandonment of secured property)

Use Form W-9 only if you are a U.S. person (including a resident

alien), to provide your correct TIN.

If you do not return Form W-9 to the requester with a TIN, you might

be subject to backup withholding. See What is backup withholding,

later.

Cat. No. 10231X

Form W-9 (Rev. 10-2018)