Residential Mortgage Refinancing During the COVID-19 Pandemic

by Lauren Lambie-Hanson, September 2020

Abstract

Historically low interest rates have spurred a refinance wave among American homeowners,

particularly those with higher credit scores and greater home equity. However, millions of

borrowers may still benefit from refinancing, and industry forecasts suggest interest rates will

remain low over the next 12 months. This special report provides a survey of recent activity in

the market for mortgage refinances and estimates the number of refinance candidates remaining

to be over 17 million, based on the most recent data available. The report describes indicators of

borrower interest in refinancing and cautions that increased mortgage forbearance and

nonpayment rates during the pandemic may preclude many borrowers from partaking in today’s

low interest rates, which have the potential to lower monthly mortgage payments at a time when

such savings would be particularly beneficial to households.

________________________

The author thanks Julia Cheney, Ronel Elul, Andreas Fuster, Andrew Hertzberg, Aurel Hizmo, Bob Hunt, James

Vickery, and Paul Willen for helpful suggestions.

Disclaimer: This Philadelphia Fed report represents research that is being circulated for discussion purposes. The

views expressed in this paper are solely those of the author and do not necessarily reflect the views of the Federal

Reserve Bank of Philadelphia or the Federal Reserve System. Nothing in the text should be construed as an

endorsement of any organization or its products or services. Any errors or omissions are the responsibility of the

author. No statements here should be treated as legal advice. Philadelphia Fed publications relating to COVID-19

are free to download at https://www.philadelphiafed.org/covid-19.

2

In 2019, the Federal Reserve cut the federal funds rate three times, followed by two emergency

rate cuts in 2020 in response to the COVID-19‒related economic crisis, leaving the federal funds

rate near zero. These movements have resulted in a significant reduction in the 30-year, fixed-

rate mortgage interest rate.

1

According to Freddie Mac’s Primary Mortgage Market Survey, in

mid-July, average weekly mortgage rates fell below 3 percent for the first time in recorded

history (Freddie Mac, 2020). Over the last several months, many active mortgage borrowers have

become candidates for refinancing to lower their interest rates.

This CFI Special Report surveys recent evidence from the mortgage market on refinance

interest rate locks and originations, describing the uptick in volume and the characteristics of

loans locked during the pandemic. Despite the significant increase in refinancing, many prime

mortgage borrowers in the U.S. could gain financially from refinancing and appear to be eligible

to refinance, based on observable underwriting characteristics. Specifically, as of July 2020,

when the interest rate averaged 3.02 percent, about 17.3 million loans appeared to be good

candidates for refinancing, or about 34 percent of active mortgages. This is the greatest number

of refinance candidates in the last 18 years.

In most of August and the beginning of September, rates continued to fall, further

expanding the pool of refinance candidates. For the week of September 10, Freddie Mac reported

an average interest rate of 2.86 percent, the lowest observed rate since the beginning of the data

series in 1971. It is conceivable that mortgage rates could fall even further in response to

pandemic-related pressures and accommodative monetary policy. If mortgage rates were to fall

to 2.8 percent, for example, 22 million borrowers in the July snapshot would stand to gain from

refinancing, or 43 percent of all mortgage borrowers. However, interest rates fluctuated in late

August, following the Federal Housing Finance Agency (FHFA)’s announced 50 basis point

increase in loan-level pricing adjustments for refinance mortgages. This change was initially set

to take effect for loans delivered to Fannie Mae and Freddie Mac on September 1 or later, and

early evidence shows a spike in refinance interest rates, particularly relative to purchase rates, as

1

The Federal Reserve System also directly influenced mortgage interest rates in two ways. In March, the Fed

announced it “will purchase Treasury securities and agency mortgage-backed securities in the amounts needed to

support smooth market functioning and effective transmission of monetary policy to broader financial conditions

and the economy,” (Federal Reserve Board of Governors, 2020a). Indeed, between March and August, the Fed

purchased about $1 trillion in agency mortgage-backed securities, and in May, the Fed began buying agency MBS

with coupons of 2.0 percent (Federal Reserve Bank of New York, 2020), providing incentives for lenders to make

loans with lower interest rates.

3

a portion of the fee is passed along to borrowers. Under usual conditions, interest rates for

conventional purchase mortgages are very similar to rates for rate- or term-conventional

refinances; however, since the “adverse market fee” was announced, a wedge between the two

rates quickly emerged. On August 25, the FHFA announced it would delay the implementation

of the fee until December 1, and shortly thereafter, the wedge between refi and purchase loans

shrank.

In the end, not all borrowers who are in the money to refinance will, even if they appear

to be qualified, based on observable underwriting characteristics. Borrower interest in

refinancing — measured through credit report inquiries — has ticked up during the pandemic but

still remains lower than in previous periods of falling interest rates. And lenders appear to be

reducing mortgage supply — the July 2020 Federal Reserve Board of Governors’ Senior Loan

Officer Opinion Survey (SLOOS) on Bank Lending Practices found that 55 percent of banks had

tightened mortgage credit standards in the previous three months.

2

Furthermore, given

widespread job losses, furloughs, and reductions in workers’ hours, many borrowers who want to

refinance will not be able to because of standard income and employment underwriting

requirements. In other words, refinancing may be out of reach for many households that need the

monthly savings the most.

Falling Rates Generate Surging Refinance Applications, Especially Among Borrowers with

Excellent Credit

Mortgage interest rates most recently began falling in November 2018, causing refinance

applications to surge, according to the Mortgage Bankers Association (MBA) refinance

application index (Figure 1). However, the continued reduction in rates that accompanied the

onset of the pandemic resulted in a particularly large refi application surge in March 2020, when

the MBA refinance application index reached its highest point since 2009. The spike was short

lived, but the index remains more than twice as high as its typical level over the past five years.

2

See Federal Reserve Board of Governors (2020b). These statistics refer specifically to conventional, conforming

loans that are eligible for purchase by Fannie Mae and Freddie Mac.

4

Figure 1. Refinance Application Volume and 30-Year Mortgage Interest Rates

Data sources: Mortgage Bankers Association Weekly Application Survey (Refinance Index, not seasonally adjusted)

and Freddie Mac Primary Mortgage Market Survey interest rate data on 30-year fixed-rate mortgages

It is a known feature of the mortgage market that when interest rates drop, a greater

percentage of the borrowers who refinance have higher credit quality as compared with periods

when rates are not falling (Amromin, Bhutta, and Keys, 2020). This perhaps signals that

borrowers with higher credit scores (many of whom have more experience refinancing) may be

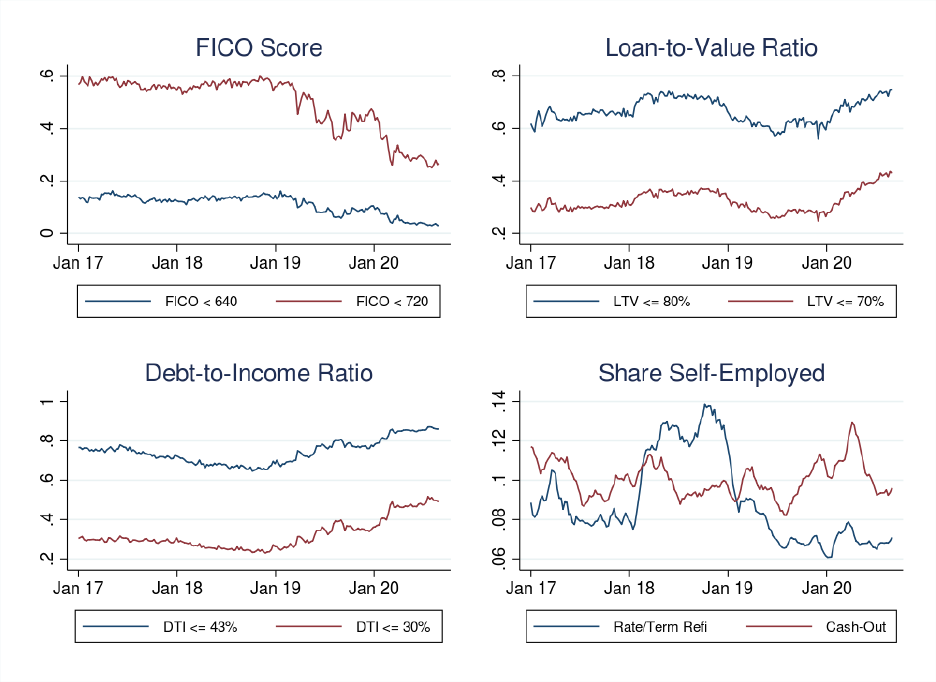

paying greater attention to interest rates (Agarwal, Rosen, and Yao, 2016). Indeed, as shown in

Figure 2, not long after rates began dropping in late 2018, the percentage of borrowers with

higher credit scores locking rates began to decline.

3

The percentage of borrowers with less-than-prime credit (here measured as having a

FICO score below 720) has fallen dramatically during the pandemic. In late July and early

August 2020, only 25 percent of borrowers who locked rates to refinance had FICO scores below

3

This analysis uses data from Optimal Blue on mortgage interest rate locks. Optimal Blue data (as referenced

throughout) is aggregated, anonymized mortgage market/rates data that does not contain lender or customer

identities or complete rate sheets. Optimal Blue estimates that about one-third of U.S. mortgage locks are included

in the data.

5

720 (down from nearly 60 percent in January 2017‒November 2018), and only 3 percent of

borrowers had subprime scores (below 640). Similarly, a much larger share of borrowers in

recent months had debt-to-income ratios of 30 percent or less.

Interestingly, however, the percentage of borrowers with low LTVs (below 80 percent or

70 percent) initially fell as rates dropped in late 2019, indicating greater credit risk among

refinancers, all else equal. But in 2020, the share of low-LTV borrowers began to increase. As of

mid-August, 42 percent of borrowers locking rates to refinance had very low LTVs (less than 70

percent), the highest percentage in over three years. Although this is probably in part driven by

increased demand for refinancing coming from borrowers with lower credit risk, as is typical in

most refinance waves, the patterns from SLOOS indicate a tightening of credit conditions,

suggesting that in this time period, both demand- and supply-side explanations were at work.

Figure 2. Who Is Refinancing? Characteristics of Mortgage Rate Locks,

January 2017–August 2020

Data source: Optimal Blue data. Note: Charts include conventional conforming, FHA, VA, and jumbo

refinance mortgages. Data are displayed weekly.

6

Borrowers who are self-employed have consistently made up just 6 percent to 8 percent

of those locking refinance loans in 2020 to lower their interest rate or change their loan term

(Rate/Term Refi in Figure 2’s lower right panel). In March, as pandemic-related business

shutdowns loomed, an increased share of rate locks for cash-out refinances were by self-

employed borrowers (as high as 13 percent). This groups’ share of cash-out locks fell

dramatically in April onward and now sits at about 9.5 percent.

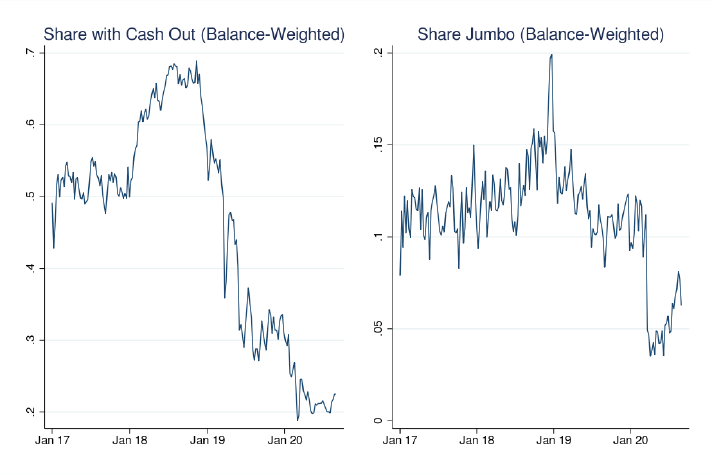

Intuitively, in times when interest rates are falling, a greater share of refinances are

interest rate or term refinances (such as refinancing from a 30-year to a 15-year mortgage), as

opposed to refinances in which cash is taken out by the borrower. In recent months, just one in

five borrowers who refinanced took cash out. In late April, the FHFA announced that Fannie

Mae and Freddie Mac would be allowed to purchase new loans that are in forbearance, but they

would not if the loan was a cash-out refinance. Lenders argue that this policy change forced

mortgage interest rates for cash-out refinances higher, diminishing demand (Berry, 2020).

Figure 3. Types of Refinance Loans Locked, January 2017–August 2020

Data source: Optimal Blue data. Note: Charts include conventional conforming, FHA, VA, and jumbo refinance

mortgages. Data are displayed weekly.

Finally, refinances by jumbo mortgage borrowers declined substantially (and abruptly)

since the onset of the pandemic. Wells Fargo, the nation’s largest jumbo mortgage lender,

announced in April that it would restrict its jumbo refinance lending only to its wealth

7

management clientele and would not purchase jumbo refinance loans originated by other

institutions (Eisen, 2020; McLaughlin, 2020), although in July, Wells Fargo began offering

jumbo refinances to its broader base of existing customers (Finkelstein, 2020). Jumbo loans are

often originated by or sold to banks, which hold them in portfolio. As a large number of

institutions eschewed jumbo loans to make room on their balance sheets for other types of

pandemic lending, it became more difficult for borrowers to refinance a jumbo loan, and interest

rates in the jumbo market rose and became more volatile (McLaughlin, 2020).

Many Refinance Candidates Remain — But How Many Will Attempt to Refinance?

Despite the strong demand for refinancing during the pandemic, many candidates remain —

either because they did not refinance yet or because rates have continued to fall and the pool of

borrowers eligible to refinance has continued to grow. Borrowers who lock an interest rate do not

always go through with the loan. Between June 2019 and February 2020, about 80 percent of

refinance locks resulted in an origination. In March, this briefly dropped to about 72 percent but

then rebounded to normal levels in April and May (Optimal Blue and Andrew Davidson &

Company, 2020).

Estimating the Number of Refinance Candidates

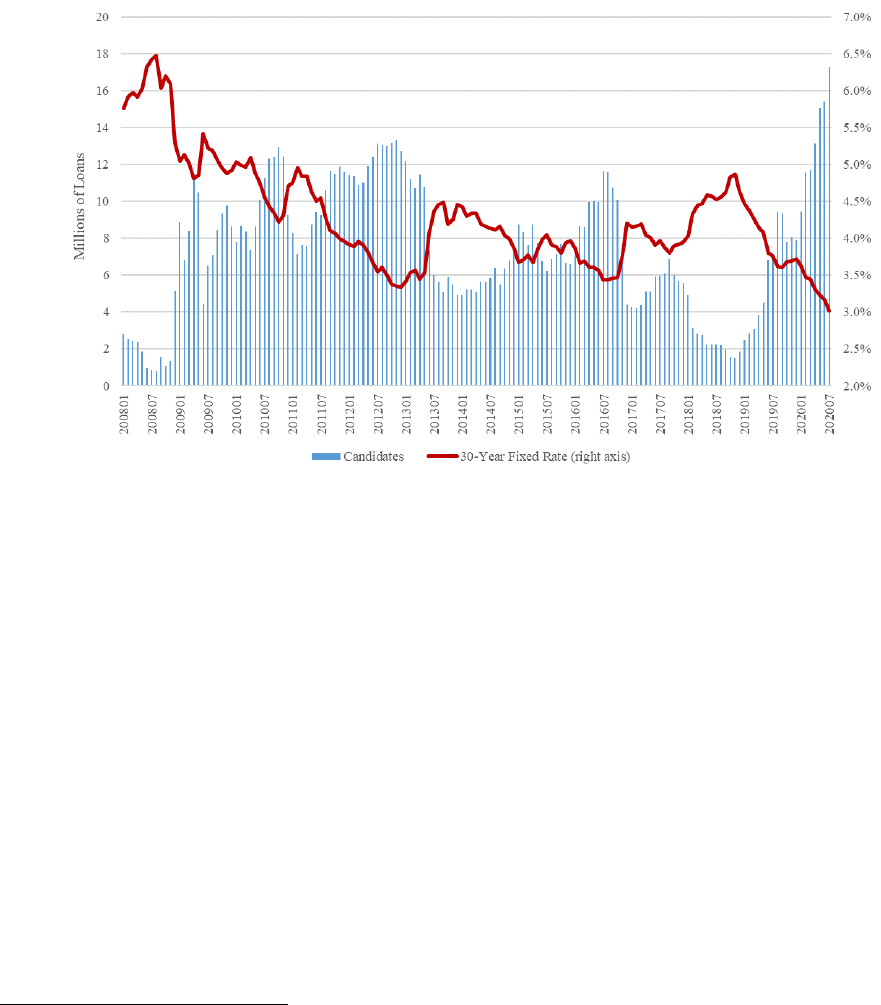

Figure 4 captures the number of active borrowers who appear to be strong candidates for

refinancing to the prevailing market rate (as reported by Freddie Mac) over time. We assume the

borrower’s interest rate must be at least 75 basis points above the market rate for the borrower to

have a financial incentive to refinance. We also require that she stand to save at least $100/month

in payments and that she must have at least five years left on her loan term. To be considered

eligible, she must have a current credit score of at least 720, have at least 20 percent equity in her

home (accounting for all liens), and be current on her mortgage payments.

As of July 2020, when the average fixed rate was 3.02 percent, there were 17.3 million

active loans that were refi candidates (borrowers who appeared both qualified and in the money),

about 34 percent of all active mortgages and the largest number of candidates observed over the

past 12 years.

8

Figure 4. Estimated Refinance Candidates (Millions) by Month, January 2008‒July 2020

Data sources: Black Knight McDash data and Freddie Mac Primary Mortgage Market Survey interest rate data.

Note: Candidates are borrowers who have FICO scores of at least 720, have at least 20 percent equity, are current on

mortgage payments, and could lower their interest rate by 75bps (and payment by at least $100/month) by

refinancing to current market rates. See the Technical Appendix for additional details.

If these 17.3 million borrowers all refinanced to the prevailing rate, they would save an

aggregate $6.25 billion in mortgage payments each month (not accounting for closing costs).

Dividing the potential aggregate payment reductions by the number of candidates yields the

average monthly payment reduction per loan, which was $361 in July.

4

It is important to point

out that these calculations are based on the assumption that borrowers refinance into either a new

30-year or 15-year mortgage, depending on the term remaining on their existing loan.

5

The number of refinance candidates is very sensitive to interest rates, as shown in Figure

5. During the week of September 10, average rates fell to 2.86 percent, the lowest observed rate

4

Savings from refinancing can help boost the economy. Wong (2019) estimates a 4 percent increase in consumption

(about $2,000 per borrower) in the first year after refinancing. Importantly, this increase in consumption appears to

be a general equilibrium effect. Although refinances represent a wealth transfer from mortgage investors to

borrowers when borrowers refinance to lower rates, there’s no observable reduction in spending by these other

parties in the economy (specifically, renters and owners who do not refinance). However, it’s unclear how the

$2,000 estimate extrapolates to the current crisis. Worse labor market conditions may mean that they spend a greater

share of any mortgage payment savings, while quarantines, retail closures, and economic uncertainty may mean they

spend less.

5

In practice, 89 percent of refinances originated in 2020 did have a term of 15 or 30 years, according to the Black

Knight McDash data used in this analysis.

9

since the beginning of Freddie Mac’s data series in 1971. At that interest rate, over 21 million

borrowers in the July snapshot (about 42 percent of active mortgages) would have been

candidates for refinancing. Figure 5 also shows how the share of active mortgage borrowers in

July who are refinance candidates increases if we include borrowers with less than 20 percent

equity, with a credit score below 720, and who are not current on their mortgage payments.

Figure 5. Refinance Candidates’ Sensitivity to Interest Rate Changes,

Loans Active in July 2020

Data sources: Black Knight McDash data and Freddie Mac Primary Mortgage Market Survey interest rate data. See

the Technical Appendix for calculation details. Category A is restricted to borrowers with adequate equity, credit

score, and payment status. Categories B, C, and D sequentially relax these criteria.

Of course, not all candidates refinance. Borrowers may fail to refinance because of a lack

of awareness, an intention to move in the near future, or an expectation that rates may fall

further.

6

On the one hand, borrowers concerned about their household liquidity or potential

depreciation of their homes may be energized to refinance. On the other hand, many borrowers

have faced job loss or reductions in their work hours, threatening their eligibility to get a new

loan.

6

Based on the ratio of all mortgage applications and originations captured in Home Mortgage Disclosure Act data to

the number of candidates, each month about 5 percent to 10 percent as many borrowers refinance as there are

candidates during typical economic times.

10

Borrower Interest in Refinancing

One measure of attention and interest in refinancing is whether borrowers are applying for new

mortgages, as indicated by mortgage credit inquiries appearing on their credit reports. Inquiries

reflect “hard pulls” of a borrower’s credit report, which typically happen after a borrower has

requested a mortgage preapproval or completed a mortgage application. Figure 5 displays the

percentage of active mortgage borrowers in each month who had inquired about a new mortgage

at some point during the previous six months. The dark-blue solid line represents all active

borrowers, and the orange line shows eligible, in-the-money borrowers (corresponding to the

estimated candidates displayed in Figure 4). The teal dashed line shows eligible borrowers who

are not in the money that month, and the dark-blue dotted line displays borrowers who are

ineligible because of poor mortgage performance, a low credit score, or insufficient equity.

One might expect that those who are eligible and in the money to refinance would be

more likely to apply for new mortgage credit than those who do not appear to have a financial

incentive to refinance. In fact, the data tell us that those who are ineligible to refinance because

of credit or equity constraints are actually the most likely to apply for new credit, except when

rates have fallen rapidly, such as this year and in the mid-2012–2013 period. In each of these

periods, rates fell to historic lows, and eligible, in-the-money borrowers quickly responded by

applying for new mortgages.

7

Over the 2009–2020 period displayed in Figure 5, inquiries tended to increase each time

the 30-year mortgage rate dipped. However, there has been a general downward trend in

inquiries over time, potentially indicating less interest in or attention to refinancing. This is

consistent with borrowers in recent years having less potential payment savings from

refinancing, relative to refinance candidates in earlier periods when rates were declining, whose

interest rates had a larger spread relative to the market rate. Although the six-month inquiry rates

have increased in recent months, they still remain lower than in previous refi waves. Borrowers

7

Prior research has found that credit-constrained mortgage borrowers actively apply for new mortgage credit, but

they are less likely to ultimately refinance (Lambie-Hanson and Reid, 2018), partly because their applications are

less likely to be approved by lenders (Goodman, Bai, and Li, 2019). Several factors may be at play. Credit-

constrained borrowers may have higher application rates because they need to apply for longer periods of time

before being accepted, but it could also be because they have a stronger incentive to refinance, if reducing their

monthly mortgage payments would have a greater relative impact on their budget.

11

may be responding weakly to historically low interest rates because of unemployment and

greater economic uncertainty.

Figure 6. Mortgage Borrowers with at Least One Inquiry for Mortgage Credit

in Previous Six Months, January 2009–July 2020

Data sources: Black Knight McDash data, Equifax Credit Risk Insight Servicing data, and Freddie Mac interest rate

data

Rising Forbearance and Nonpayment Rates May Hinder Refinances

Although some borrowers are enjoying low interest rates and refinancing to lower monthly

payments, a large set of borrowers is struggling to make mortgage payments, including a large

number of mortgage borrowers who are receiving loan accommodations, such as forbearance. In

July, including loans in payment deferral programs, 6.4 percent of U.S. mortgages were 60 or

more days past due, relative to just 2.5 percent in January. In fact, this measure of the 60+ days-

past-due rate increased in every state during this time (Figure 7), and national past due rates this

June and July hit their highest levels since 2013.

Not all borrowers who are past due on their mortgage payments are in immediate risk of

foreclosure, however, since these figures include borrowers who have stopped making their

payments but are on forbearance plans. As of May, an estimated 8.8 percent of mortgage

borrowers nationally were in forbearance, including 12.5 percent of Ginnie Mae borrowers

(Black Knight Financial Services, 2020).

12

Figure 7. Active Mortgages 60+ Days Past Due, January versus July 2020*

Data source: Black Knight McDash data

Note: This source includes as past due those mortgages in payment deferral programs in which a payment has not

been made as well as delinquent mortgages that are not in accommodation.

13

Analysis from the Dallas Fed estimated that, by offering assistance to individuals and

employers, the Coronavirus Aid, Relief, and Economic Security (CARES) Act prevented $2.6

billion to $3.5 billion in mortgage payment delinquencies each month during the second quarter

of 2020 (Zhou, 2020). However, with the CARES Act expiring on July 31 and no extension or

replacement currently agreed upon, borrowers may soon be at greater risk.

Conclusion

Industry experts forecast 30-year mortgage interest rates staying well below 2019 levels, with

rates hovering around 3.1 percent (Mortgage Bankers Association, 2020) or even sustaining

levels as low as 2.5 percent (Optimal Blue and Andrew Davidson & Company, 2020). This

would perpetuate the wave of refinances we have experienced so far in 2020. Some borrowers

who refinanced in 2020 may even find it advantageous to refinance again, if low rates persist.

The Mortgage Bankers Association’s Mortgage Finance Forecast issued in mid-August 2020

projected strong refinance volume in the second half of 2020, with $760 billion in new

originations (Mortgage Bankers Association, 2020).

8

These forecasts were released shortly after Fannie Mae and Freddie Mac announced on

August 12 the 50 basis point “adverse market fee” the FHFA approved for them to add to

refinance mortgages, a fee that applies to loans delivered to the government-sponsored

enterprises (GSEs). This was initially announced to take effect on September 1 but was

subsequently delayed until December 1. The fees that GSEs charge lenders when buying and

securitizing their loans get passed on, in part, to borrowers. As shown in Figure 8, following the

GSEs’ announcement, a wedge emerged between the interest rates of purchase and rate-term

refinances after the initial announcement, although it closed somewhat in the days after August

25, when the effective date of the fee was pushed back to December.

8

For comparison, the Mortgage Bankers Association estimated refinance volume in the entire year of 2019 to be

$901 billion, followed by $886 billion in the first half of this year (Mortgage Bankers Association, 2020).

14

Figure 8. Conventional Mortgage Refinance Rates, June–August 2020

Data sources: Optimal Blue. Rates reflect average interest rates on 30-year conventional loans locked by borrowers

who have a FICO score of 740+, whose loan-to-value ratio is no greater than 80 percent, whose debt-to-income-ratio

is no greater than 43 percent, and who pay zero points at closing. Refinances include rate and term refinances only

(that is, they exclude cash-out loans). Data end on September 3, 2020.

Even if rates return to historically low levels, not all borrowers are likely to partake in the

benefits of lower interest rates. Mortgage delinquencies are rising, spurred by historically rapid

increases in unemployment. With extensions of unemployment benefits being far from certain,

some experts are predicting additional defaults and more forbearance requests without additional

government intervention (Haggerty and Lang, 2020).

One proposal by Federal Reserve economists is for Fannie Mae, Freddie Mac, and Ginnie

Mae to create a streamlined refinance program, allowing borrowers to refinance their mortgages

without income and employment verification (Gerardi, Loewenstein, and Willen, 2020).

According to their forecasts, if such a program were adopted, it would reduce the default hazard

for the median Fannie Mae and Freddie Mac (Ginnie Mae) borrower by 17 percent (14 percent)

when the existing loan’s maturity is kept constant, and 37 percent (33 percent) if the loan’s

maturity is recast into a longer term, which would lower monthly payments even more. In one

option proposed in their plan, dubbed “HARP 3.0,” Gerardi, Loewenstein, and Willen explain

that current default risk could be held constant while even allowing borrowers to take out limited

cash out, up to a median of $30,000 for Fannie Mae/Freddie Mac borrowers and $18,000 for

Ginnie Mae borrowers.

15

References

Agarwal, Summit, Richard J. Rosen, and Vincent Yao. “Why Do Borrowers Make Mortgage

Refinancing Mistakes?” Management Science 62(12): 3494‒509.

Amromin, Gene, Neil Bhutta, and Benjamin Keys. 2020. “Refinancing, Monetary Policy, and

the Credit Cycle.” Annual Review of Financial Economics 12: 4.1‒4.27.

Berry, Kate. 2020. “Cash-Out Refis Dry Up as Price Hikes Prove Too Costly.” American

Banker, May 4, 2020. https://www.americanbanker.com/news/cash-out-refis-dry-up-as-

price-hikes-prove-too-costly.

Black Knight Financial Services. 2020. “Mortgage Monitor: May 2020 Report.”

https://cdn.blackknightinc.com/wp-

content/uploads/2020/07/BKI_MM_May2020_Report.pdf.

Eisen, Ben. 2020. “Wells Fargo Curtails Jumbo Loans Amid Market Turmoil.” The Wall

Street Journal, April 4, 2020. https://www.wsj.com/articles/wells-fargo-curtails-jumbo-

loans-amid-market-turmoil-11586037701.

Federal Reserve Bank of New York. 2020. “Agency MBS Historical Operational Results and

Planned Purchase Amounts.” Accessed September 13, 2020.

https://www.newyorkfed.org/markets/ambs/ambs_schedule.

Federal Reserve Board of Governors. 2020a. “Federal Reserve Announces Extensive New

Measures to Support the Economy.” Press release issued on March 23, 2020 at 8:00 a.m.

ET. https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323b.htm.

Federal Reserve Board of Governors. 2020b. “The July 2020 Senior Loan Officer Opinion

Survey on Bank Lending Practices,” August 3, 2020.

https://www.federalreserve.gov/data/documents/sloos-202007-fullreport.pdf.

Finkelstein, Brad. 2020. “Wells Fargo Expands Nonconforming Jumbo Refi Loan Criteria.”

American Banker, July 10, 2020.

https://www.americanbanker.com/news/wells-fargo-expands-nonconforming-jumbo-refi-

loan-criteria.

Freddie Mac. 2020. “Primary Mortgage Market Survey.” Accessed September 13, 2020.

http://www.freddiemac.com/pmms/docs/historicalweeklydata.xls.

Gerardi, Kristopher, Lara Loewenstein, and Paul Willen. 2020. “Evaluating the Benefits of

a Streamlined Refinance Program,” Federal Reserve Bank of Philadelphia Working Paper

20-21.

https://www.clevelandfed.org/~/media/content/newsroom%20and%20events/publications

/working%20papers/2020/wp%202021.pdf.

Goodman, Laurie S., Bing Bai, and Wei Li. 2019. “Real Denial Rates: A New Tool to Look at

16

Who Is Receiving Mortgage Credit.” Housing Policy Debate 29(5): 795–819.

https://doi.org/10.1080/10511482.2018.1524441.

Haggerty, Neil, and Hannah Lang. 2020. “Will GOP Plan to Slash Unemployment Aid Trigger

Wave of Loan Defaults?” American Banker, July 28, 2020.

https://www.americanbanker.com/news/will-gop-plan-to-slash-unemployment-aid-

trigger-wave-of-loan-defaults.

Lambie-Hanson, Lauren, and Carolina Reid. 2018. “Stuck in Subprime? Examining the Barriers

to Refinancing Mortgage Debt.” Housing Policy Debate 28(5): 770–796.

https://doi.org/10.1080/10511482.2018.1460384.

McLaughlin, Katy. 2020. “Why Jumbo Mortgage Rates Make No Sense Right Now.” The Wall

Street Journal, August 20, 2020.

https://www.wsj.com/articles/jumbo-mortgage-rates-11597945255.

Mortgage Bankers Association. 2020. “MBA Mortgage Finance Forecast: August 20, 2020.”

https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-

and-commentary/mortgage-finance-forecast-archives.

Optimal Blue and Andrew Davidson & Company. 2020. “Mortgage Pricing Insights, August

2020.” https://engage.optimalblue.com/hubfs/Mortgage-Pricing-Insights/0820-Mortgage-

Pricing-Insights.pdf.

Wong, Arlene. 2019. “Refinancing and the Transmission of Monetary Policy to Consumption.”

Unpublished working paper. May 2019.

Zhou, Xiaoqing. 2020. “CARES Act Likely to Blunt Mortgage Delinquency Rate Increase.”

Dallas Fed Economics blog, May 26, 2020.

https://www.dallasfed.org/research/economics/2020/0526.

17

Technical Appendix

Weighting: Information on first-lien mortgages is taken from Black Knight McDash data and

aggregated up to the market using Flow of Funds (Z.1, L.218) data (subtracting home equity loan

and line of credit balances). To adjust the data to be more representative of the market, we

weight by category of loan (k): held in portfolio, held in agency (Fannie Mae/Freddie

Mac/Ginnie Mae) securities, or held in private-label mortgage-backed securities.

Incentives for refinancing: Borrowers are considered “in the money” to refinance if 1) the

prevailing fixed rate is at least 75bps below their current rate, 2) they have 60+ months

remaining on their mortgage term, and 3) they would save at least $100/month by refinancing.

Borrowers with terms of 17 years (204 months) or fewer remaining are assumed to refinance to a

15-year mortgage, so their rate is compared with the prevailing rate for 15-year, fixed-rate

mortgages, and their expected mortgage payment change is calculated, assuming they take on a

15-year term. All other borrowers are compared with the 30-year fixed rate, and payments are

calculated based on a 30-year term.

Loan eligibility requirement for candidacy: Active borrowers are considered “eligible” to

refinance in period t if they meet three conditions: 1) have a contemporaneous credit score of ≥

720, 2) are current on mortgage payments, and 3) have equity of ≥ 20 percent. Black Knight

McDash data lack information on second liens held by the borrower, so the calculations above

are initially based on mark-to-market loan-to-value (LTV) ratio of first lien ≤ 80 percent. (This

LTV is based on the origination LTV. The numerator is updated to the outstanding principal

balance of the loan, and the denominator is updated from the time of origination to time t using

the amount of county house price appreciation that took place during that period.) To account for

second liens, we adjust down the aggregate number of refinance candidates by the percentage of

candidates in period t in group k that had first-lien LTV ≤ 80 percent but combined LTV > 80

percent using credit bureau data from Equifax’s Credit Risk Insight Servicing data, which is

merged to Black Knight McDash data.

Meaningfulness of refinance candidate estimates: The measure of refinance candidates in

month t is strongly correlated with the number of mortgage applications that month, according to

Home Mortgage Disclosure Act data. For the period January 2009–October 2018, the R

2

was

0.64.