Consultation Paper No.10/2021

Telecom Regulatory Authority of India

Consultation Paper

on

Regulatory Framework for Promoting Data Economy

Through Establishment of Data Centres, Content

Delivery Networks, and Interconnect Exchanges in India

New Delhi, India

16

th

December 2021

Mahanagar Door Sanchar Bhawan,

Jawahar Lal Nehru Marg,

New Delhi – 110002

Stakeholders are requested to furnish their comments to Advisor

(BB&PA), TRAI, by 13

th

January 2022 and counter-comments, if any

by 27

th

January 2022.

Comments and counter-comments would be posted on TRAI’s

website: www.trai.gov.in. The comments/counter-comments may be

sent, preferably in electronic form, to Shri Sanjeev Kumar Sharma,

Advisor (Broadband and Policy Analysis), Telecom Regulatory

Authority of India, on the email id: [email protected] with a copy

to [email protected] and jtadvbb[email protected] respectively.

For any clarification/information, Shri Sanjeev Kumar Sharma,

Advisor, (Broadband and Policy Analysis), may be contacted at

Telephone No - +91-11-23236119

CONTENTS

Chapter

Topic

Page No.

Chapter 1

Introduction

1

Chapter 2

Data Centres

12

Chapter 3

Content Delivery Networks

78

Chapter 4

Interconnect Exchanges

105

Chapter 5

Data Ethics — Privacy, Ownership, and

Security

136

Chapter 6

Issues for Consultation

158

TABLES

ANNEXURES

Annexure I

Data Centre Standards and Certifications

165

Annexure II

Illustrative List of approval/clearances

required before commencement of a Data

Centre operation

169

Annexure III

IXPs: Global Experience

173

List of Acronyms

179

Table 2.1

Number of Data Centres operating in India

36

Table 2.2

Data Centre policies of various states

37

Table 3.1

Global practices: regulatory Framework for

CDN service providers

91

Table 4.1

Non-profit IXP business models

120

Table 4.2

Number of ISPs connected at NIXI nodes over

the years

123

Table 4.3

IXPs operating in India (as of September

2021)

129

Table 4.4

APNIC cost structure for a new member for

obtaining ASN

132

1

CHAPTER 1

INTRODUCTION

1.1 During the last two decades, in an increasingly knowledge-driven

globalized world, telecommunication and the internet have emerged as

key drivers of economic and social development. They have enabled

better connectivity among users, increased the use of Information and

Communications Technology (ICT) services, and facilitated the

emergence of a variety of new business models. ICT not only

contributes directly to the GDP through the production of goods and

services but also spurs innovation in the ways of production and

delivery, leading to increased employment and labor productivity.

India has one of the fastest-growing ICT sectors in the world, with ICTs

being used to deliver critical goods and services to millions of Indians.

1.2 Communications services such as voice, video, data, internet, and

wideband multimedia have become indispensable in modern society.

With the proliferation of technology, for different purposes, the

Government, private enterprises, and people in general are relying

more and more on ICT services such as digital platforms, online

content, and broadband connectivity. The digital transformation is

emerging as a key driver of sweeping changes in the world around us.

The telecommunication industry is at the forefront of this

transformation, adding value to the Digital Economy.

A. Boosting Data Economy

1.3 Data economy is an integral part of modern economy. Data has also

become a key asset for innovation. The advantage of controlling data

by online platform-based companies is increasingly recognized and

such existing companies act as an entry barrier for new entrants,

leading to near monopoly in global digital markets. The data gap

applies not only at the country level between developed and developing

economies. It is also increasingly leading to debates on the need for

policy intervention to create level playing field. The gap is growing

2

wider for small and developing countries that are far behind in their

digital investments and capabilities. Moreover, countries are forming

different data protection and trade regimes. As per the Organization

for Economic Co-operation and Development, “The Digital Economy

incorporates all economic activity reliant on, or significantly enhanced

by the use of digital inputs, including digital technologies, digital

infrastructure, digital services, and data. It refers to all producers and

consumers, including Government, that are utilizing these digital inputs

in their economic activities”. Also, the Digital Economy Value Chain is

the innovation of the value chain, driven by the following key digital

elements:

a. Servers, Storage, and Networking Equipment

b. Data Centres

c. Cloud Computing and Services

d. Content and Applications

e. Connectivity – Leased Circuits, Internet, Content Delivery Networks

f. Interconnection – Internet Exchange Points

1.4 Almost everything has switched to the online mode during the

pandemic resulting in an enormous increase in data consumption.

With the rollout of 5G, IoT, and AI, more data would be created via

widespread, geographically distributed networks and new-age devices.

Further, 5G would bring new use cases of Enhanced Mobile

Broadband (eMBB), Ultra-Reliable Low Latency Communications

(URLLC), and Massive Machine Type Communications (MMTC). 5G,

along with edge computing, would fulfill the needs for ultra-reliable,

low-latency, and high-throughput communications. This convergence

of computing and communication services will pave the way for a boon

in the data economy for any nation. For undertaking successful data

economy initiatives by any nation, having distributed edge computing

infrastructure, massive data storage facilities, and a robust, and

efficient internet exchange point infrastructure are pre-requisites.

3

1.5 Figure 1 depicts the notable key drivers for boosting data economy of

India.

Figure 1.1: Boosting data economy

1.6 To keep pace with the global data economy initiatives, it would be

necessary to formulate reliable frameworks and policies that would

encourage development of 5G, IoT, Data Centers, and associated

services, data analytics, edge computing, digital platforms, and

applications. As these services can be delivered remotely, India can

become a global hub for such systems and services.

1.7 As India aims to strengthen its position in the digital economy, it

becomes imperative for the country to use futuristic technologies as a

lever for growth. This becomes even more important while considering

the various policy initiatives that the competing economies have come

up with, along with the amount of investment and resources they are

committing towards digital transformation. The Digital India program

of the Government, launched in 2015, brought the topic of digitization

to the forefront of public discourse. Since then, considerable progress

has been achieved in several areas such as the construction of

Boosting

Data

economy

Application SPs,

aggregators,

platform SP and

intermediaries

Communica

tion

networks

Content

creators

Content

delivery

networks

Interconnect

Exchanges

Cloud

computing

and

services

Data

privacy,

ownership

and

security

Data

centers

and data

parks

4

broadband highways, development of local Data Centres, public

internet access, e-governance, development of basic information

technology skills etc.

1.8 National Digital Communications Policy (NDCP)-2018 also emphasizes

that “Digital infrastructure and services are increasingly emerging as

key enablers and critical determinants of a country’s growth and well-

being. With significant capabilities in both telecommunications

and software, India, compared to most countries, stands poised

to benefit from harnessing new digital technologies and

platforms to unlock productivity, as well as to reach unserved

and underserved markets; thus, catalyzing economic growth and

development, generating new- age jobs, livelihoods and ensuring

access to next-generation services for its citizens.”

1.9 Digital infrastructure is boosting the data economy, and the services

are fast moving beyond the traditional telecom services domain. With

large- and small-business companies embracing innovative

technologies and more users connecting to the internet, data is the key

input for firms to develop and deliver digital services and products.

The key contemporary infrastructure that is required to boost the

digital ecosystem and facilities include:

I. Data Centres – used for edge computing, hosting of content, and

delivering cloud-based services,

II. Content Delivery Networks – used for delivering the content from

the cloud to the edge of the network, and

III. Internet Exchange Points – enables networks to exchange traffic

with each other in the internet infrastructure.

Together these three form the part of what can be termed as “Digital

communication infrastructure and services”.

I. Data Centre (DC)

1.10 The world is going digital at a pace faster than expected. Partly, this is

driven by the pandemic-induced ‘Global Lockdown’, which has

5

resulted in a data surge arising out of increased digital social

interactions and online transactions. From enterprises to individuals,

usage of cloud services has increased to enable online mobility and

easy sharing of data. Cloud services facilitate the flow of user data from

front-end clients, through the internet, to the provider’s systems, and

back. Users can access cloud services with nothing more than a

computer, operating system, and internet connectivity, or virtual

private network (VPN).

1.11 Data Centre is a physical facility that is used to house applications

and data. The value chain comprises a mix of segments, including real

estate and construction, hardware equipment, utilities (power, water,

cooling), networking and software services. Online platforms and

websites’ digital data, content, and information are stored in the cloud

servers located in Data Centres, and the same is accessed by users

through broadband connectivity. On user requests, servers in the Data

Centres compute and process the required data to make available

desired information to the user. Due to the vital role of Data Centres

in the digital world, the development of local Data Centres is a priority

for both private players and Governments across the countries.

1.12 The Indian Data Centre market size is projected to reach USD 1.5

billion by 2022

1

, growing at a CAGR of 11.4%, and is expected to reach

~$5 billion by 2025

2

. The market is primarily driven by growing

internet penetration, increased cloud adoption, Government’s

digitization initiatives, and the push towards data localization.

II. Content Delivery Network (CDN)

1.13 CDN is a system of distributed group of servers and networks that

deliver pages and other web content to a user, based on the geographic

location of the user, the origin of the webpage, and the content delivery

server. The group of servers works together to provide fast delivery of

1

2

NASSCOM Report India The Next Data Center Hub, February 2021

6

internet content. CDNs have emerged as overlay networks on the

internet to provide better support for delivering commercial content

than was available using basic, best-effort internet packet transport

services. A CDN allows for the quick transfer of assets needed for

loading internet content, including HTML pages, JavaScript files,

stylesheets, images, and videos. The content delivery with and without

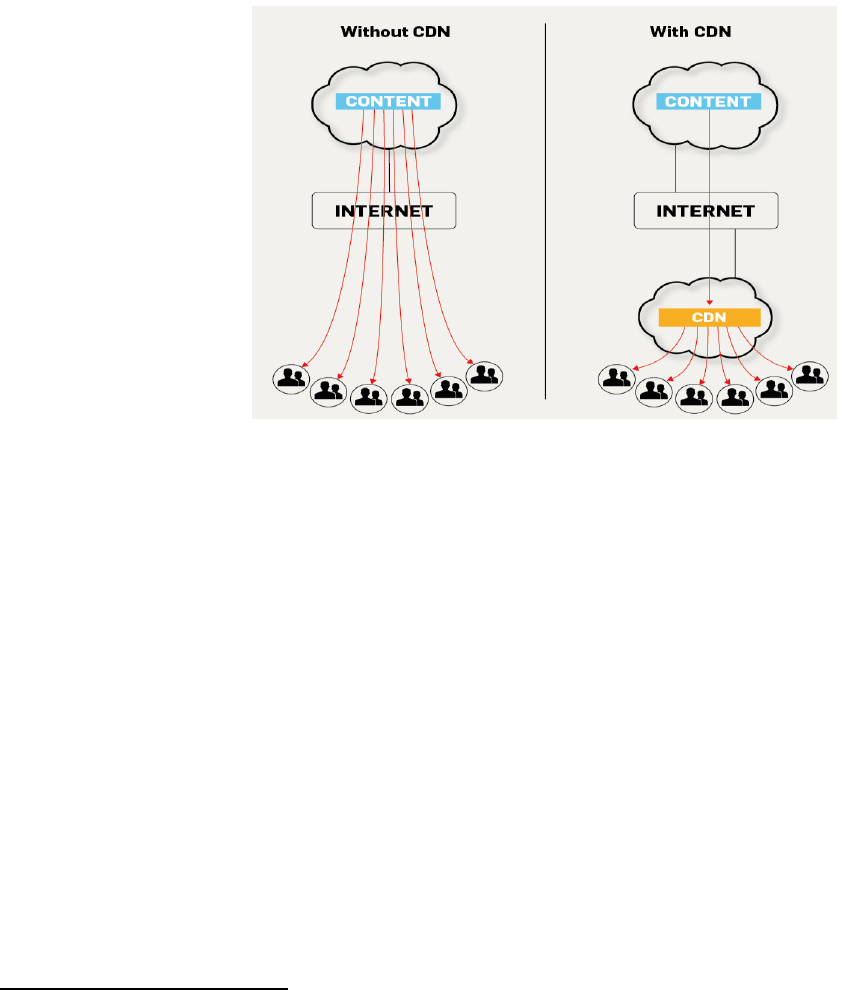

CDN is shown in Figure 1.2.

Figure 1.2: Content distribution with and without CDN

(Source: globaldots.com)

1.14 To minimize the distance between the users’ computer and the

websites’ server, a CDN stores a cached version of its content in

multiple geographical locations (points of presence or PoPs). Each PoP

contains several caching servers responsible for content delivery to

visitors within its proximity.

1.15 The global CDN market is forecasted to grow by $48.48 bn during

2021-2025, progressing at a CAGR of almost 30% during the forecast

period

3

. According to the Cisco Annual report (2018-2023),

4

video

comprises more than 50% of the overall data consumed over the

internet, which is expected to increase up to 80% by 2025. The

demand for various online video formats, such as on-demand video

3

https://www.marketsandmarkets.com/Market-Reports/content-delivery-networks-cdn-market-657.html

4

https://www.cisco.com/executive-perspectives/annual-internet-report/white-paper-c11-741490.html

7

streaming, live video streaming, cloud TV, and over-the-top (OTT), has

been continuously increasing over the past few years. Therefore, the

rising consumption of web-based, high-definition videos is the major

factor contributing to the increase in the adoption of CDN. In addition,

the explosion in the use of social networking sites is also one of the

major reasons for the increase in videos, photos, animations, and text

over the internet. Activities such as transferring, sharing, and posting

rich media files, by the content providers as well as individuals have

increased the burden on the existing networks requiring the addition

of CDN’s for smooth operations.

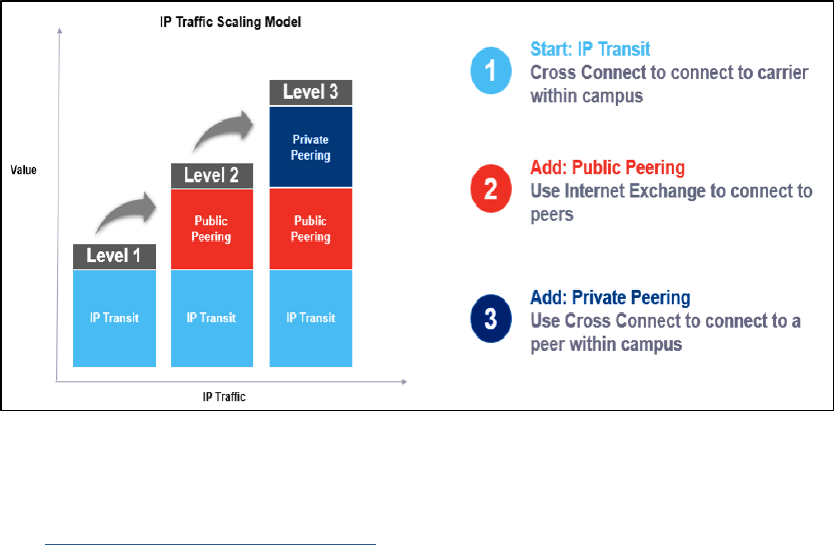

III. Internet Exchange Point (IXP)

1.16 IXP is a technical facility designed to route the traffic quickly and cost-

effectively between different network members by enabling

interconnection. They are essentially large local area networks that are

built with interconnected Ethernet switches. IXPs allow ISPs and

CDNs to interconnect their networks locally. This leads to a flatter

internet, improves international bandwidth utilization, and reduces

the cost and latency of interconnections. IXPs can be grouped into not-

for-profit (e.g., industry associations, academic institutions,

Government agencies) and for-profit organizations. IXP operators,

while still providing public, neutral peering services, may also provide

commercial value-added services (VAS), such as security, access to

cloud services, transport services, synchronization, caching, etc.

1.17 The traffic exchange between two networks connecting at an IXP is

facilitated by an exterior gateway protocol called Border Gateway

Protocol (BGP), which makes routing decisions based on network

rules, hop counts, and other characteristics configured by network

administrators. This saves money on international bandwidth for the

ISPs and improves connectivity for their customers by reducing

latency. International bandwidth utilization and latency are two

crucial factors that affect the end-user experience, when digital

platforms and services are used.

8

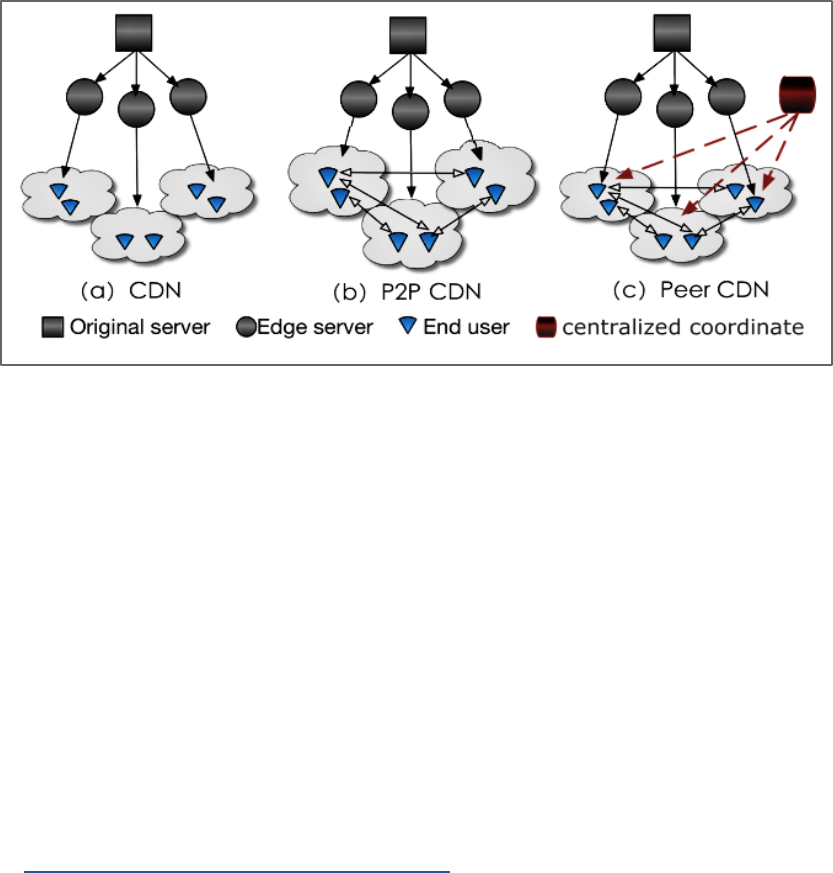

Figure 1.3: DC, CDN and IXP elements of an internet ecosystem

1.18 Commercially, the internet consists of a hierarchy of global, regional,

national, and local providers. Data Centres hosting CDNs are

connected to each other and the internet cloud via IXPs. To enable the

access to the content of a parent CDN or website hosted on an

international DC, global IXPs interconnect with the local IXPs to pass

the traffic to the Indian DCs and thereby to the child CDNs, as shown

in Figure 1.3. ISPs provide the last mile connectivity to users for

accessing the services. A CDN pays ISPs, carriers, and network

operators for hosting its servers in their Data Centres.

1.19 Alongside the operational, interconnection, and bandwidth costs, the

number of hops required by a network to reach the destination server

on which the content is hosted to process the user request is also

critically important. This indicates that there is a necessity for the

expansion of the three key digital elements: International DCs, CDNs,

and IXPs in India for the advancement of the digital economy.

USA

Software

Services

Parent CDN 1

Software

Services

Parent CDN 2

International

Data Center 1

International

Data Center 2

INDIA

Software

Services

Child CDN 1

Software

Services

Child CDN 2

Indian

Data Center 1

Indian

Data Center 2

User 1

User 2

User 3

User 4

ISP

9

B. Need for the present consultation

1.20 Out of the notable key drivers for boosting the data economy of India,

as shown in Figure 1.1, the Authority (TRAI) has already addressed

some of the issues through its following recommendations:

1) Recommendations on Privacy, Security, and Ownership of the

Data in the Telecom Sector dated 16

th

July 2018

2) Recommendations on Cloud Services dated 16

th

August 2017

and 14

th

September 2020

1.21 However, not much work has been done in respect of regulatory

framework for Data Centres, Content Delivery Networks, and

Interconnect exchanges in India. National Digital Communications

Policy (NDCP-2018) seeks to unlock the transformative power of digital

communications networks to achieve the goal of digital empowerment

and improved well-being of the people of India. The missions envisaged

in the policy are as follows:

1) Connect India: Creating robust digital communications

infrastructure to promote ‘Broadband for All’ as a tool for socio-

economic development.

2) Propel India: To harness the power of emerging digital

technologies, including 5G, AI, IoT, Cloud, and Big Data to enable

the provision of future-ready products and services; and to catalyze

the fourth industrial revolution (Industry 4.0) by promoting

Investments, Innovation and IPR generation.

3) Secure India: To secure the interests of citizens and safeguard the

digital sovereignty of India with a focus on ensuring individual

autonomy and choice, data ownership, privacy, and security, while

recognizing data as a crucial economic resource.

10

1.22 Under the Propel India mission, various strategies have been laid out

in the Policy. Strategy no 2.2 mentioned under the Propel India

mission relates to ‘Ensuring a holistic and harmonized approach for

harnessing Emerging Technologies’. Under this strategy, provision

number 2.2(f) envisages that:

2.2 (f) Establishing India as a global hub for cloud computing, content

hosting and delivery, and data communication systems and services.

1.1 Evolving enabling regulatory frameworks and incentives for

promoting the establishment of International Data Centres, Content

Delivery Networks, and Independent Interconnect exchanges in India.

1.2 Enabling a light-touch regulation for the proliferation of cloud-

based systems.

1.3 Facilitating Cloud Service Providers to establish captive fiber

networks.

1.23 The government has proposed to formulate a scheme to incentivize

investments to set up hyper-scale Data Centres in India and boost the

capacity of the existing Data Centre ecosystem. MeitY, in November

2020, had released the draft Data Centre policy, which proposed to

designate Data Centres as infrastructure and group Data Centres

under the essential services category, among other measures. The

draft document proposes a policy, including various

structural/regulatory interventions, investment promotion in this

sector, and seeks to strengthen the "Atmanirbhar Bharat” initiative by

identifying possible opportunities for manufacturing Data Centre

equipment in the country. The draft policy document discusses issues

at a macro level and it may be followed by a detailed implementation

scheme. Keeping in mind the above-mentioned NDCP provisions and

need for pronouncing concrete action points in making India a global

Data Centre hub, the Authority has taken up this initiative on suo

moto basis to issue a consultation paper on ‘Regulatory frameworks

for promoting data economy through establishment of Data Centres,

Content Delivery Networks and interconnect exchanges in India’.

11

1.24 Through the present Consultation Paper (CP), the Authority intends to

seek the inputs of stakeholders on promoting the establishment of (i)

Data Centres, (ii) Content Delivery Networks, and the (iii) Internet

Exchange Points in the country. The CP has been structured into five

chapters. Chapter 1 introduces the background of the subject and sets

the context for present consultation. Chapters 2, 3, and 4 discuss the

issues in the establishment of Data Centres, Content Delivery

Networks, and Internet Exchange Points, respectively. Chapter 5

deliberates on issues related to ‘Data Privacy, Security and Ownership’

with reference to the past recommendations of TRAI of July 2018, as

well as the Personal Data Protection Bill (PDP) of 2019. Chapter 6

summarizes the various issues for consultation.

12

CHAPTER 2

DATA CENTRES

2.1 Data Centres play a crucial role in the digital economy. Everything that

happens online is housed in a Data Centre. These Data Centres have

become a top priority for businesses across the globe to meet their IT

infrastructure requirements. With this shift, Data Centres have moved

beyond being just an additional storage facility. It offers scalability,

security, efficiency, and state-of-the-art technology that are

increasingly demanded by companies and organizations. Also, Data

Centres offer a lot, from safety and reliability to energy efficiency and

cost reduction.

2.2 The Data Centre infrastructure and services business is a very large

emerging business that will boost the digital economy worldwide.

These Data Centres are a unique combination of property, energy, and

technology. Data Centres have been one of the sectors that are least

affected globally and in India due to COVID-19 pandemic, indicating

their crucial role in supporting continued business activity. This Data

Centre sector is witnessing significant growth in the country and will

soon become one of the economic growth engines of India and will

generate large-scale investments and jobs. Data Centres (DC) along

with Internet Exchange Points (IXPs) and Content Delivery Networks

(CDN) together form an important part of digital communication

infrastructure and services. National Digital Communications Policy

(NDCP)-2018 emphasizes digital infrastructure and services as key

enablers and critical determinants of a country’s growth and well-

being. It seeks to unlock the transformative power of digital

communications networks to achieve the goal of digital empowerment

and improved well-being of the people of India. The government of

India is also becoming increasingly reliant on Data Centres for the

Government-to-Citizen (G2C) delivery platforms, such as the National

e-Governance Plan (NeGP), e-visa, and National CSR Data portal, to

name a few. However, factors like high upfront costs, higher power

13

tariffs, maintenance-related issues, security, and high real estate costs

are increasingly impacting the growth of Data Centres. Also, there are

known impediments to its growth such as lack of status as

infrastructure, complex clearance processes, time-consuming

approvals, lack of published standards, absence of specialized building

norms for building the Data Centres, submarine cable network

connectivity limited to few states, and high cost of capital and

operational expenditure, etc. These elements are shown in Figure 2.1

and are discussed in the following paras:

Figure 2.1: Various elements for promoting Data Centres and

parks

Promoting

Data Centers & data

parks

Regulatory/ Policy/

structural intervention

Investment:

Fiscal and non-

fiscal incentives

Ease of doing

business

Standardization

in development

of data centers

Data center

building norms

Making data

center related

equipment and

products in

India

Security

Connectivity/

Backhaul

international

Access to power

and Water

Disaster

recovery

Centre-State

coordination

Capacity

building

Preparing for

future –

edge/AI-

enabled data

centers

14

2.3 Data Centres have evolved significantly in recent years. In the past,

they were highly controlled physical infrastructures, but the adoption

of the cloud has changed that model. When enterprises migrate their

data and workloads to cloud Data Centres, they reside in physical

infrastructures that are best-in-class on-premises Data Centres. As

the data markets continue to move toward on-demand services, the

infrastructure has shifted from on-premises servers to virtualized

infrastructure that supports workloads across both the physical

infrastructure and cloud environments. Initially, only large companies

had their own server farms for storing data, but with the increase in

web-based applications, a hybrid cloud-based storage industry with

third-party storage solutions have come up. India is currently home to

80+ third-party DCs and is witnessing investments in around 15

projects annually, with a growing presence of both local and

international players

5

.

2.4 In general, Data Centres provide facilities necessary to enable reliable,

uninterrupted storage, processing, and transmission of data. The

facilities include all kinds of IT equipment, including servers, storage

systems to run applications, network equipment like switches, routers,

and firewalls, as well as the cabling for connectivity purposes. A Data

Centre also contains adequate infrastructure in the building area,

such as power distribution and supplementary power systems, racks,

electrical switching, ventilation, and cooling systems. The basic

building blocks of a Data Centre are represented in Figure 2.2.

5

NASSCOM Report: India The Next Data Centre Hub Feb 2021

15

Figure 2.2: Basic building blocks of a Data Centre

(Source: NASSCOM Cloud)

2.5 The core components of a Data Centre design include routers,

switches, firewalls, storage systems, servers, and application delivery

controllers. These components store and manage business-critical

data and applications. Together, they provide:

a. Network infrastructure – This connects servers (physical and

virtualized), Data Centre services, storage, and external

connectivity to end-user locations.

b. Storage infrastructure – Data is the fuel of the modern Data

Centre. Storage systems are used to hold this valuable commodity.

c. Computing resourcesؘ – Applications are the engines of a Data

Centre. Servers provide processing, memory, local storage, and

network connectivity that drive applications.

Data Centre — Models

2.6 Various types of DC models are in existence depending upon the

ownership and management of the facilities. A specific model depends

on whether facilities are owned by one or many organizations, how

16

they fit into the topology of other Data Centres, what technologies they

use for computing, storage, and their energy efficiency. The extent of

DC usage generally differs based on size and business operation.

Broadly DC investments in India can be categorized into ‘Captive’ and

‘Outsourced’ Data Centres. Captive models are Data Centres

specifically designed to meet the needs of a business or enterprise,

which are not shared with other organizations. On the other hand, the

outsourced models are developed and operated by third-party service

providers, providing shared services of data management to various

organizations. These can be classified as – Colocation Services, Hosting

Services, and Hybrid Services. Thus, the DCs can be owned and

operated through different models deliberated as under:

A. Captive Data Centre - Large enterprises own and operate their own

data storage facilities, which are known as captive Data Centres

where the data of a single organization is stored and processed. The

facility is owned, operated, and maintained by the company whose

data is hosted. This DC is also implemented as the Landlord

investment model, in which the investor provides basic facilities

such as space and/or power. Tenants set up their own servers,

facilities, and staff as per their requirements.

Captive DCs have advantages like control over the infrastructure,

security, but are disadvantageous in terms of higher CapEx and

OpEx and limited scalability. Investments in captive DCs by private

sector enterprises in India have been declining primarily on

account of shift of the business to the cloud platforms, even though

it’s use is growing for Governments and public enterprises. On

average, there are new investments in at least 60 captive DC

projects annually in India

6

; where demand is primarily driven by

the public sector and educational institutions. While it is largely

restricted to expansion and up-gradation of the existing facilities

for the private sector.

6

NASSCOM Report India The Next Data Centre Hub, February 2021

17

B. Outsourced Data Centre - These DCs have advantages in form

and of scalability, reduced CapEx, improved physical security but

have disadvantages in form of hidden costs and less control over

the infrastructure.

i. Colocation Data Centre: The organizations buy large spaces

and construct the basic Data Centre structure and then lease

out space to customers for setting up their own IT equipment.

These equipment needs to be maintained by the customers, with

the host maintaining the facility. The host also provides

additional facilities like engineering services, infrastructure

facilities, network services, power, and backup. Tenants pay

rent and set up their own servers. Major end-users of colocation

services in India include cloud service providers, Banking,

financial services and insurance (BFSI), entertainment sector,

content delivery network providers and e-commerce

organizations.

ii. Hosting Data Centre: These Data Centres have servers and

related IT equipment that can be leased by customers from the

host of a large storage facility. Customers are responsible for the

maintenance and operation of these servers, including their

organization and security. The majority of the outsourced DC

developers/operators, such as NTT Global Data Centres

(Netmagic) and CtrlS offer hosting services in India. Also, global

cloud service providers such as AWS, Microsoft, Google, IBM,

and Oracle offer cloud hosting services for Indian customers

through their physical cloud regions in India. On average,

hosting services contribute to 50% of the total revenues of the

local outsourced DC service providers, while colocation and

hybrid services together account for the remaining 50% of the

revenue.

iii. Hybrid Data Centre: It is a combination of colocation as well as

hosting Data Centre. Many larger enterprises continue to rely

on on-site Data Centre facilities, particularly for legacy

equipment and applications, and some enterprises will combine

18

cloud with hosting and colocation services, particularly those

with a relatively small IT staff. In a Hybrid model enterprise,

customers procure infrastructure and host in a colocation

facility, while the Data Centre service provider manages the day-

to-day operations. In India, the market is still in the nascent

stage, with only a few DC operators (such as NTT (Netmagic

Solutions) and CtrlS) are able to provide advanced hybrid

services. Currently, around 20% of the customers opt for hybrid

services. Going forward, this percentage is expected to grow with

the increase in the establishment of colocation centres.

These investment models are devised by investors with varying risk

exposure. Companies who are conservative about Data Centres may

opt for the captive model, while the companies with considerable risk

appetite may opt for co-location and hosting models. As per the

current market dynamics, demand for co-location models is on the rise

in the country.

Benefits of Data Centres on the Economy

2.7 Data Centre (DC) industry has made significant inroads in India. Both

Foreign and Indian players have either already launched Data Centres

in India or have announced significant DC investments in major cities.

India is one of the most capacity-hungry Data Centre markets in the

world and holds immense potential to become a Data Centre hub in

the Asia-Pacific (APAC) region due to its inherent strengths. Being

amongst the fastest-growing major economies of the world, the country

also has a rapidly expanding data consumer base. This is further

emphasized by the presence of he trained and skilled workforce.

Increasing domestic and international demand from sectors such as

banking, financial services, telecommunications, technology, and

infrastructure is providing further boost to this sector. With the

growing reliance on internet services and advanced technologies for

data management, there is already a good demand for high-quality

DCs.

19

2.8 By financing capital-intensive projects and Data Centre investments,

global and multinational companies such as Amazon Web Services,

Microsoft, Google, Equinix, etc. have provided significant economic

and employment benefits worldwide. Initial capital investment and the

ongoing operational expenditure creates and sustains jobs across the

wider economy.

2.9 The thriving Data Centre industry has spilled over benefits to several

sectors and industries in form of digitization, which has been a great

focus of the Government of India. Data Centres help in creating

localized low-cost data storage and processing services which in turn

helps the digital start-up ecosystem to get cost benefits. A notable

advantage that localized Data Centres provide is the reduction of

latency in data access. According to companies that have recently

shifted Data Centres to India, there is a 10% latency reduction in

shifting from a centre in Singapore

7

and a 30% reduction in shifting

from a centre in the U.S. Further, if we compare the cost of manpower,

real estate, and bandwidth, India is at least 60% cheaper than the U.S.

or Singapore

8

. Thus, storing data locally will reduce network latency.

Combined with the impending deployment of 5G, it will further enable

low latency and high-speed services in the Indian market.

2.10 DCs being critical hubs for both technological and economic reasons

are core for digital infrastructure at a regional, national, and global

level. They provide a substantial economic impact to the regions in

which they are located through direct, indirect, and induced effects.

2.10.1 The direct effect is the economic impact directly from a

Data Centre construction and operation. Directly supported jobs

include positions in management, IT and system technicians, electrical

and mechanical maintenance, water management, repair, and

hardware operations, etc.

7

https://www.yotta.com/how-will-data-localization-impact-the-data-center-market-in-india/

8

ibid

20

2.10.2 The indirect effect includes the economic impact through

suppliers of goods and services. The Data Centre creation leads to

demand for local raw materials. The indirectly supported jobs include

positions in security, catering, cleaning and in the construction, and

supply industries across the economy.

2.10.3 Induced effect refers to the economic impact that occurs

when employees at the Data Centre and their supplier industries spend

their wages throughout the economy. The induced jobs are primarily

service-related jobs in industries such as retail trade, transport,

accommodation, restaurants, housing, and finance.

2.11 As mentioned earlier in the direct economic effect, Data Centres

generate an enormous amount of employment, because they are part

of a unique logistics chain consisting of all kinds of companies, from

internet exchanges, hosting, and cloud providers, to consulting firms

and fiber optic providers. The Uptime Institute has forecasted that

Data Centre-related jobs will grow globally from about 2.0 million in

2019 to nearly 2.3 million in 2025. This estimate covers more than

230 specialist job roles for different types and sizes of Data Centres,

with varying criticality requirements, right from design to operation

9

.

Thus, Data Centres not only provide jobs and create an additional

source of income but also strengthen and empower local communities

to meet the demands of the modern economy.

2.12 Creation of large campuses/parks for DC purposes leads to allied

industries being located closely forming geographic clusters for

resource and utility sharing. Forming of DC clusters will likely lead to

investments and growth of industries providing solutions for Data

Centres such as cooling, uninterrupted power, and high-speed

internet connectivity. The establishment of large Data Centres in Tier-

2, Tier-3 cities are likely to have the add-on benefits of encouraging

ISPs to roll out robust Optical Fiber Cable networks for increased

broadband connectivity.

9

https://uptimeinstitute.com/global-data-centre-staffing-forecast-2021-2025

21

2.13 The growth of the DC industry leads to knowledge creation and

innovation, with major cloud storage providers such as Google

extensively training their employees. The suppliers working on the

construction and operation of Data Centres also acquire knowledge of

the domain, which can contribute to the growth of the industry within

India. It also allows these suppliers and employees to export their

services to neighbouring countries/locations for DC establishments,

that are still in the nascent stages in much of South Asia. This effect

has been seen in many countries of Europe where Data Centres were

established in Ireland and Belgium.

Effect of Key Data Centre on the Economy – Case of Google in

Europe

2.14 To keep all of Google's products and services up and running around

the clock, the global tech giant owns and operates Data Centres all

over the world. The majority of Google’s expenditure (nearly 70%) has

gone towards constructing four new Data Centres in Europe. In total,

since 2007, Google has spent EUR 2.3 billion in Europe, i.e., on

average EUR 200 million per year

10

. On top of the construction

expenditure, Google has also spent EUR 0.9 billion on operations of

these facilities, i.e., on average almost EUR 90 million per year. Results

show that, when considering the direct and indirect economic effects,

Google’s investments in the four Data Centres and fiber networks have

supported an overall economic impact of EUR 5.4 billion in GDP

cumulatively over the period 2007-2017, varying between a yearly

impact of EUR 0.2 and 1 billion. Broken down as direct, indirect, and

induced effects of EUR 1.4, 2.2, and 1.7 billion, respectively.

2.15 Similarly, a larger Data Centre network would imply a bigger economic

contribution to the Indian economy. Future growth in user demand for

services like cloud, AI, machine learning, and platform services implies

that investments in Data Centres will continue to increase over time

as in the past. Besides Google, top cloud vendors like AWS, Microsoft,

10

https://www.copenhageneconomics.com/copenhagen-economics-2018-european-data-centres.pdf

22

IBM, and Oracle continue to expand their base with the opening of

cloud regions in the APAC region and a strong physical presence in

China, Singapore, Australia, and India

11

. Five years after opening a

Data Centre in Mumbai, Google Cloud announced opening a Data

Centre in Delhi soon

12

. In April 2020, Google also announced its

planning for a $400m submarine cable that will link India and Italy in

2022. Thus, it is reasonable to expect that Google will continue to

expand its investments in Europe and APAC countries like India, and

consequently, Google’s economic impact would eventually increase

across the globe.

International – policy, initiatives for Data Centre industry

2.16 Globally Data Centre investments have grown significantly in the past

years, led by key players like Google, Facebook, AWS, Alibaba, and

Microsoft. Growth of the digital economy and initiatives for smart cities

continue to boost Data Centre investments in many countries. The

governments around the globe have been successful in attracting these

players to establish Data Centres in their countries. Some of the

nations, which have huge Data Centre markets running successfully

and wherein the major steps were taken by their respective

governments and the incentives provided to the Data Centre players

are discussed below:

2.17 United States – States of the U.S. are competing to attract Data

Centres by offering financial incentives, often by waiving sales or

property taxes on the expensive equipment they use. Many states

provided sales tax exemption and property tax breaks in some form to

enhance the international Data Centre market as follows

13

:

a. Alabama exempts Data Centres from states and local sales and

property taxes by a law that offers up to 30 years of tax breaks for

11

https://www.prnewswire.com/asia-pacific-data-centre-market-outlook-2021-2026.html

12

https://cloud.google.com/about/locations#asia-pacific

13

Source: Associated Press research of laws and interviews with economic-development officials in all 50

states

23

Data Centres investing $400 million and creating at least 20 jobs

with an average annual compensation of $40,000.

b. Arizona provided a sales tax exemption for Data Centres that can

last up to 10-20 years.

c. In Florida, Data Centres fall under the Florida Enterprise Zone

incentives program, which has a qualified target industry tax refund

incentive. Under the scheme, companies that create high-wage jobs

in the state are eligible for tax reimbursements on their corporate

incomes, sales, intangible personal property, and insurance

premiums.

d. Georgia offers a sales tax exemption for equipment in Data Centres

investing at least $15 million annually, and Atlanta ranks among

the leading markets for Data Centres.

e. Colorado provides general job-based tax breaks for Data Centres. H

f. Hawaii offers job creation incentives to Data Centres; however, the

dollar value of incentives is confidential.

g. In Wyoming, a law offers Data Centres that invest at least $5 million

a sales tax exemption on computer equipment. Data Centres that

invest at least $50 million also can get a sales tax break on power

supplies and cooling equipment.

2.18 United Kingdom – The main reasons behind the UK, especially

London being the hotspot for Data Centres are connectivity, a huge

demanding customer base, regulatory and legislative stability. Another

reason is also the availability of skills where the UK has expertise in

sector investments, finance, funding, innovative design, engineering,

and construction.

a. Connectivity: The UK has unparalleled global fiber connections

both in terms of size and reach. The intercontinental fiber reach of

London covers global to local needs, and its major internet

exchanges provide unparalleled access between multiple continents

and Europe.

b. Investment Security: The UK’s safe structured environment,

ownership rights, EoDB, and ROI (return on investment) potentials

24

attract FDI (foreign direct investment). London, described as the

“ultimate place to de-risk”, is important considering that Data

Centres are among the most expensive real-estate investments in

the world.

2.19 Singapore: Singapore is the most sought-after APAC Data Centre

market and has become a primary hub for cloud services within the

region due to its favourable conditions like robust infrastructure,

access to fiber, talented local workforce, and great set of community

partners. Its telecom sector is the most advanced globally, boasting of

first-class connectivity and admirable network infrastructure.

According to the Singapore Economic Development Board, Singapore

is currently home to approximately 50% of Southeast Asia’s Data

Centre capacity. It has continued to improve in indices and has made

substantial improvements in ease of acquiring and registering

property. It now takes less than six days in Singapore to register a

property for building a Data Centre. Similarly, the country’s legal

framework is strong and substantially well placed to protect its

investors against any capital risks. The Government initiated a Next

Generation Broadband Network (NGBN) plan in 2015 for a state-wide

fiber-based network. NGBN is to increase broadband connectivity,

thereby boosting domestic data consumption as well, which in turn

increased the demand for Data Centres. Its strong network

infrastructure, large content distribution network, diverse connectivity

to major APAC markets, pro-business environment, and political

stability are some other factors that favour Singapore’s preference by

Data Centre players. Its low-tax environment has also made it an

attractive location for large corporations. Zero GST tax rate for

international services and exports has attracted many foreign

investors. Growth among the small- and mid-size businesses, in turn,

increased the demand for public cloud services such as Software as a

25

Service (SaaS) and Infrastructure as a Service (IaaS). The Government

incentive to boost the DC market is

14

:

2.19.1 An approved company under the Pioneer Certificate

Incentive (PCI) or Development and Expansion Incentive (DEI) is eligible

for a corporate tax exemption or a concessionary tax rate of 5% or 10%,

respectively, on income derived from qualifying activities.

2.19.2 Singapore’s Data Centre parks also provide power-related

infrastructural facilities like on-site power plants, dual power feeds,

and redundant sources of network path diversity.

2.20 Singapore established multi-activity zones in the 1960s and

specialized SEZs (e.g., petroleum refinery activities) in the 1970s. In

the 2000s, its SEZ policy shifted to creating knowledge-intensive

clusters through the establishment of innovation-driven SEZs focused

on R&D and other high value-added activities. In 2018, the Singapore

Cooperation Enterprise, a Singaporean Government agency, signed a

tripartite agreement to develop a single electronic window solution to

facilitate trade and increase trade efficiencies for the special economic

zone in Nkok, Gabon. The other two parties to the agreement were the

Gabon Special Economic Zone—an international public-private

partnership comprising the Government of Gabon, Olam International

(Singapore), and the African Finance Corporation—and the Singapore-

based global trade facilitation platform provider vCargo Cloud.

15

2.21 Nongsa Digital Park (NDP), located in the northeast of Batam, has been

upgraded from a technological park to an SEZ. 25 Hectare of the park

has been allocated to develop the Data Centres in the first phase, with

plans for expansion in the future. This decision has signified NDP as

the ‘Digital Bridge’ between Singapore and Indonesia to grow the digital

economy that was identified as a joint growth sector between the two

countries during RISING 50 leaders’ retreat in Singapore. The Park

hopes to become a hub for Data Centres, the Data Centre market

14

www.edb.gov.sg

15

https://unctad.org/system/files/official-document/WIR2019_CH4.pdf

26

growth is expected to intensify in the region, driving demand for "edge

Data Centres" located closer to the end-users so they can benefit from

lower latency, higher security, and greater control of their data.

2.22 Malaysia: Malaysia is one of the preferred destinations for shared

services and Data Centres in the APAC region due to various initiatives

it has undertaken. The Malaysian DC market is broadly marked by

expansion, efficiency, and consolidation. Ample land, good

infrastructure, educated workforce, and political stability are the

advantages. Due to the presence of many global network providers, it

has good international network connectivity. Multimedia Super

Corridor or MSC Malaysia is a Special Economic Zone initiative for the

global IT industry and is designed to be the R&D centre for IT

industries. MSC Malaysia status is given to both local and foreign

companies that develop or use multimedia technologies to produce and

enhance their products and services as well as for product

development. The current ecosystem, under which the Government

functions, seems to be driving Malaysia’s ability to attract Data Centre

investments. The incentives are as follows

16

:

I. Freedom to source funds globally for investments.

II. Globally competitive telecommunication tariffs.

III. Income tax exemption (for 5 years and extendable by additional 5

years) on statutory income (or value-added income) derived from

services provided about core income-generating activities for MSC.

IV. Unrestrained employment of local and foreign knowledge workers.

Malaysia has consistently been ranked as one of the most business-

friendly countries in the Ease of Doing Business index. For

example, starting a business in Malaysia takes only three days. The

country favours DC business investment because of an assured

availability of land. Malaysia has the second-fastest process for

registering property in Asia. Besides, the country also generates

surplus electricity that ensures that an energy-intensive industry

16

taxsummaries.pwc.com

27

like Data Centres is assured of a constant supply of electricity.

Electricity and energy costs are minimum in Malaysia among the

South-East Asian countries. Moreover, it has access to renewable

power from hydroelectric dams which is appealing for companies

with environmental mandates.

2.23 China: China leads the world in internet consumption, and the DC

market has benefited from the factors of rapid economic growth

coupled with the quick adoption of IT and digital services by the

Government. Traditional industries are encouraged by policies to

embrace digital transformation and ultimately has driven the data

market growth, with which China has become the second-largest Data

Centre market worldwide—behind the USA. Chinese Government has

designated Data Centres as a nationally strategic investment sector

since 2017, as part of a policy to encourage further investments in

advanced technologies like cloud computing, AI, and Big Data, which

is now allowing more Government-supported Data Centre

deployments. The regional Chinese Governments are also promoting a

Data Centre sector as a means of advancing regional economic

development. For example, Hubei Province is aiming to create a Data

Centre cluster in China as North Virginia is doing in the USA. Several

cooperation projects are signed between the Hubei Government and

ZTE Corp. The Hubei Government has set up efforts in a phase-wise

manner to provide infrastructure and encourage investment to help

ZTE finish the Data Centre project in 2020 and achieve long-term

goals. China’s regulator Ministry of Industry and Information

Technology (MIIT) has formulated a separate license called Internet

Data Centre (IDC) license in 2015. Operators require an IDC license to

build or lease Data Centre services. Investors establishing a Data

Centre in China must review a variety of considerations, ranging from

the local climate to infrastructure quality and tax incentives. Local

authorities in lower-tier cities are generally more open to establishing

new centres and often provide tax and land incentives. Data Centres

28

within China’s tech parks also enjoy more favourable Government

policies and better amenities.

2.24 Hong Kong: Hong Kong has emerged as the key regional Data Centre

location because of its low tax rate, well-established legal system,

extensive business network, reliable energy supply, reliable network

connectivity, blooming start-ups, and IP protection. The Government

support for a Data Centre includes land supply by industrial estates,

availability of greenfield sites for sale, land earmarked specifically for

Data Centres, facilitation units and thematic portal, waiver/fee

exemption for using parts of existing industrial buildings, and tailor-

made lease modifications of industrial lots for Data Centre use.

Demand drivers for Data Centres in India

2.25 Presently, with the Digital India initiative, the Government is pushing

for the growth of the digital economy through supporting Data Centre

development. The Government of India recognizes the importance of

digital infrastructure and utilizes public and private clouds to deliver

solutions to Indian citizens. Increased penetration of the internet

(including in rural areas) and the rapid emergence of e-commerce are

the main factors for the continued growth of the Data Centre market

in the country. Also, many IT and software companies are now

migrating to cloud-based business operations that are contributing to

the Data Centre co-location and hosting services in India.

2.26 Major workforce was compelled to go remote due to the pandemic,

which has led to an increasing number of companies investing in IT

and cloud services. This rising digitization has given a stimulus to the

demand for Data Centres in the past few years. The need for scaling

up the data processing and storage requirements has been

underscored by the increased data consumption during the lockdown.

A CBRE report

17

forecasts technology, fintech,

pharmaceuticals/healthcare, education, and media and content to be

17

http://cbre.vo.llnwd.net/India_Major%20Report_Data%20Centres_The%20Next%20Charged%20Up%20Wave

29

the key drivers of the Data Centre segment. On account of more users

coming into the fold of technology, technical convergence, the

proliferation of Industry 4.0, the upward trajectory will sustain the

Data Centre segment in the country. Digital inclusion will play a

pivotal role in attracting investment in Data Centres and dispersing

Data Centres to Tier-2 or Toer 3 cities and creating skilled jobs.

I. Data Explosion

2.27 India has witnessed a digital thrust since the enhanced focus by the

Government on the Digital India flagship program to improve online

infrastructure and increase digital literacy and penetration, with

several initiatives leading to an unprecedented digital explosion.

Digital adoption has become critical for personal and business needs;

moreover, this digitization push accelerated during COVID-19, with

data-usage-per-subscriber rising at an all-time high of 12GB per

month in the quarter ending September 2020

18

, amidst increased

work-from-home, online education, OTT consumption, online gaming,

and casual internet use during the lockdown. With the cheapest data

tariffs in the world, affordable smartphones, the data usage would

effortlessly increase from 12GB/user/month currently to

25GB/user/month by 2025

19

. To support these overlaying volumes of

data explosion, Data Centre storage space growth is inevitable.

2.28 Indian Data Centre market investments are expected to grow at a

CAGR of 5% (~2X of the global market) to reach $4.6 billion per annum

by 2025

20

. The Data Centre market is witnessing a continuous uptrend

owing to growing internet penetration, increased adoption of cloud,

rising use of big data analytics and IoT, increased thrust on data

localization, and other data economy factors. Below is a peek into the

factors that will continue to drive Data Centre investments in India:

18

TRAI Performance Indicator Report

19

ANAROCK Navigating the India Data Centre Lifecycle Report

20

NASSCOM Report: India The Next Data Centre Hub Feb 2021

30

2.28.1 Internet penetration: Being the second largest internet

market, India has an internet user base of over 750 million subscribers

by the end of December 2020

21

, which is expected to reach one billion

by 2025. Digital adoption has increased data traffic and pushed the

occupancy rate of colocation Data Centres, with several investors

planning to expand their capacities across major locations.

2.28.2 Cloud adoption: The pandemic has accelerated the rate

of cloud adoption, and India’s public cloud services are expected to

reach $5 billion by 2023. This shift has pushed increased investments

in hyper-scale Data Centres with the global DC market investments

expected to reach ~$200 billion per annum by 2025, and India is

expected to account for 2.3% of these total investments.

2.28.3 Big Data and IoT: Big data analytics is expected to grow

at a CAGR around 29% to reach $68 billion by 2025. Number of IoT

devices is expected to reach around 75 billion in 2025, generating 79.4

zettabytes of data, accounting for a need for more data storage space.

India is expected to be a frontrunner in the Internet of Things (IoT)

adoption in Asia-Pacific requiring huge Data Centre space.

2.28.4 Data Economy factors - India is set to become a thriving

data economy in the APAC region with growing digital services. Indians

are the largest audience of social media and OTT platforms. OTT

subscribers are 30 million as of July 2020

22

, and this number is likely

to grow with an increased smartphone and internet penetration.

Mobile points of sale transactions are expected to rise from US$ 16 Bn

in 2020 to US$ 44 Bn in 2024 (28% CAGR)

23

. Also, digital commerce

usage is expected to rise from US$ 57 Bn in 2020 to US$ 94 Bn in

2024 (13% CAGR)

23

.

2.29 The NDCP–2018 has emphasized accelerating Industry 4.0 to develop

a market for IoT/ M2M connectivity services in sectors including

Agriculture, Smart Cities, Intelligent Transport Networks, etc. The

21

TRAI Performance Indicator Report

22

https://www.ibef.org/blogs/india-s-ott-market

23

statista.com

31

Government of India has also announced many M2M or IoT mega

projects, which have the potential to impact socio-economic life. Some

of them are:

I. Development of 100 Smart Cities project and rejuvenating 500

others by the Ministry of Urban Development.

II. The Ministry of Power has taken up 14 Smart grid pilots with an

average customer base of around 20,000 each.

III. The Ministry of Road Transport has mandated that all commercial

vehicles of more than 22 seating capacity be enabled with GPS,

emergency calls, etc.

Thus, M2M will continue to see strong growth with technological,

political, and economic factors coming together. Also, with the

enhancement in M2M communications, the amount of data will

increase tremendously, thereby stimulating the growth of the Data

Centre industry.

2.30 During the pandemic, the DC sector have played a critical role in

keeping the country online, which made service providers to fast track

their planned expansions. The investments in capacity expansion by

operators worldwide picked up since Q3 2020 owing to the surge in

demand in the DC market. Data Centres will also become one of the

most preferred forms of alternative real estate asset, with the focus

shifting to large hyperscale developments. The widening e-commerce

network in India will boost the DC segment, as it increasingly needs

help in managing its growing database. Passing policies such as the

National E-commerce Policy, NDCP-2018, Personal Data Protection

Bill, and the Policy framework on Data Centre by the Government will

accelerate demand.

II. 5G rollout

2.31 The Data Centre continued to remain an essential aspect of the

Telecom and IT industry. With the increasing data storage demands of

the telecom sector, Data Centres are becoming a more strategic asset

32

for telecom operators. Data Centres that were used primarily to

support internal functions, are today used to deliver end-user

applications, including content and video. The investments made by

the telecom providers in their Data Centre offerings are thus allowing

them to leverage their assets to build another segment of business to

earn revenue. As networks ramp up their support for 5G and IoT, the

DC providers are focusing on the edge and the increasing need to

locate more capacity close to the end-users, while TSPs are re-

evaluating the role of their Data Centres.

2.32 Introduction of 5G in India will bring forward more content in the

marketplace, and thereby generate demand for more storage. 5G

technology will transform the industry by revamping its existing

processes and infrastructure. Small cell technology will be used

heavily to roll out 5G coverage. Moreover, 5G connectivity will

introduce the idea of ‘many to one’ methodology where the user's

endpoint device will need to communicate with many towers or

antennas of the small cells, at the same time, thereby requiring more

Data Centres. Data Centres will need to be close enough to these cells

to maintain 5G’s low latency performance and meet service-level

agreements. Data Centres that have been set up for 4G will have the

capacity for handling 5G data; however, they will have to change their

infrastructure to cater to 5G’s frequencies. Micro Data Centres might

even be deployed at the base of cell towers, allowing limited data

processing with even faster response times for critical applications.

2.33 The infrastructure of 5G wireless networks will be based on Software-

defined networking (SDN), which provides communication

arrangements between cloud applications and services and a user’s

mobile terminal. Network Functions Virtualization (NFV) is another

major driver of change in the telco Data Centre. NFV often planned in

conjunction with SDN transformation will give TSPs the ability to use

network resources more efficiently. The future of Data Centres in the

upcoming 5G SDN era will have a major impact on the telco Data

Centre networking domain, including the various implementation

33

scenarios and approaches of new challenges. As TSPs transform their

Data Centres to support SDN and NFV, demand escalates for a set of

Data Centres especially operating for telecom needs.

2.34 Telecom Data Centres: A telecom Data Centre is a facility owned and

operated by a Telecommunications or a Service Provider company.

These Data Centres generally require very high connectivity and are

mainly responsible for driving content delivery, mobile services, and

cloud services. Telecom providers may run the Data Centre within a

Data Centre similar to a Colocation Data Centre. As India is turning to

be a favorite market for the cloud ecosystem (Software-as-a-Service,

Platform-as-a-Service, and Infrastructure-as-a-Service), telecom

companies are keen to get a place in the lucrative Data Centre market,

partner with global players looking to offer value-added services, and

rollout 5G services. For example, Nextra by Airtel has a nationwide

portfolio of around 10 large Data Centres and more than 120 edge Data

Centres, providing customers with co-location services, cloud

infrastructure, managed hosting, data backup, disaster recovery, and

remote infrastructure management. Airtel Nextra will invest Rs 5,000

cr to expand Data Centre business plans to build seven hyper-scale

Data Centres, which will triple its capacities and help India become a

regional hub for Data Centres. As per news reports even Reliance Jio

Infocomm Ltd plans to build a data centre in Uttar Pradesh at an

investment of around $950 million

24

. This is driving a change to

telecom Data Centre demands for network operators.

III. Data Localization

2.35 Data localization laws are gaining prominence, such as GDPR in

Europe and Cybersecurity Law in China, owing to their rapid digital

development. With many organizations going through a technological

shift via Data Centre decommissioning and migration to the cloud, the

need to secure data privacy has become more urgent in the context of

24

https://www.livemint.com/industry/telecom/jio-plans-near-1-billion-data-centre-in-uttar-pradesh-

11614039904599.html

34

organizations, considering the emerging threat scenarios and

implications of a data breach. A Gartner release informs that 80% of

enterprises are expected to migrate away from on-premises Data

Centres to the cloud by 2025. However, the proposed Data Protection

Bill may empower the Government to exempt such companies, which

only process the personal data of foreign nationals who are not present

in India. This move may incentivize these companies to ramp up their

Data Centre capacity in the country. Storing data locally will reduce

network latency and improve speed. With this, some of the latest

providers with resource ownership will be able to build massive

capacities of Data Centres at much higher scalability and quality but

at much-reduced costs.

Data explosion + Data localization = India −> the new Data Hub

in Asia

IV. India- The new Data Centre hub

2.36 With the data localization rules coming in, existing Data Centre

capacity will end up being highly constrained. Data localization has

laid the stone for the development of hyperscale Data Centres in India

to cater to this increasing data consumption demand. India currently

needs to ramp up its Data Centre capacity by at least 15 times in the

next 7 to 8 years to be able to handle the massive amount of data influx

that will enter its borders because of data localization. Service

providers like NTT (Netmagic), ST Telemedia, CtrlS, Yotta

Infrastructure Solutions, RackBank are investing in DC development

to support the unprecedented demand that will arise through data

localization policy. India is a more viable and economic place to build

and operate large-scale Data Centres. Data explosion along with the

Government's decision of data localization will surely make India a

Global Data Centre Hub.

2.37 India holds an enormous potential to become the ‘next destination’ for

Data Centres propelled by the policy initiatives, increasing customer

35

base, and corporate requirements for data storage. Its relative position

in the Asia-Pacific region also means that neighboring countries may

look to India as a key provider of infrastructure to the region like

Singapore. The increasing demand for cloud services induces global

internet companies such as Amazon, Apple, Facebook, and Google to

amplify global Data Centre capacity growth. This may very well provide

an opportunity for the cloud and IT companies to invest in the APAC

region, especially India to develop the capacity.

India − policy, initiatives for Data Centre industry

2.38 Despite the wide demand and progress of the Data Centres, in reality,

the establishment of a Data Centre has many hurdles from a selection

of location, acquiring permissions, building and operational costs,

infrastructure, and availability of resources, security, data

management, etc., to handle the storage facilities.

2.39 The Data Centre establishment requires tremendous investment at the

preliminary stage due to costly real estate, power infrastructure, water

requirement and improving wide area network connectivity. Acquiring

land, obtaining permits, and ensuring an uninterrupted power supply

are major requirements for establishment of Data Centres. Land

requirements depend upon the tier, i.e., space capacity (refer to

Annexure I for Data Centre tiers) of the Data Centre. According to the

CBRE report

25

, the land required for captive Data Centres is at least

20,000–40,000 sq. ft., and that for third-party Data Centres is at least

100,000–200,000 sq. ft. Similarly, the investment in the construction

of a Data Centre would depend on its tier. The investments needed to

construct a Tier 4 Data Centre would, on average, be INR 24,000–

25,000 per sq. ft. and for a Tier 3 centre, the cost would be INR 16,000–

18,000 per sq. ft. Based on the geographies of the location there are

differentiations in the construction costs, thereby affecting the site

selection process.

25

https://www.realtynmore.com/India-Is-India-the-next-frontier-for-the-data-centre-industry-June-2018.pdf

36

2.40 Many Data Centres have been set up in India, but the focus of Data

Centre players have been on Tier-1 cities like Mumbai, Pune, Chennai,

Delhi for various reasons like the presence of robust connectivity,

uninterrupted power supply, excellent local market, availability of

skilled manpower, etc. The Tier-2, Tier-3 cities, and the rural areas

lack infrastructure, power, and fiber connectivity. The taxes levied on

the real estate make it difficult to buy large parcels of land for a Data

Centre. This leads to increased costs deterring players from entering

this segment. The real estate players can shift their focus to Tier-2

cities, which could prove to be more reliable, offering affordable real

estate options and lower labour costs. Tier-2 cities can also be a

hotspot for hosting disaster recovery sites for the main Data Centres.

Considering the potential of such cities, the only areas of improvement

are transport connectivity, internet connectivity, and the power supply

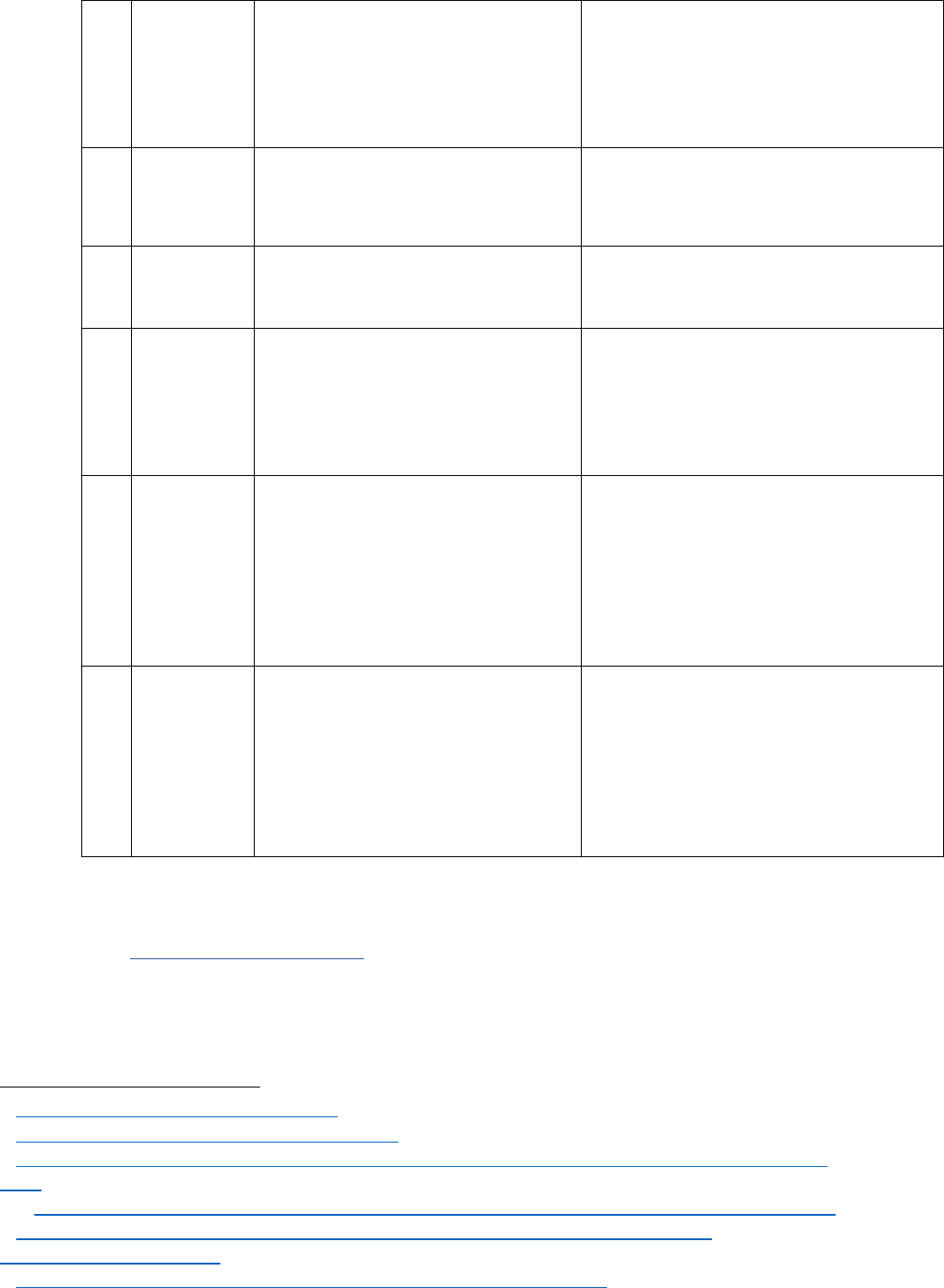

in these regions. Table 2.1 gives an outlook of several Data Centres in

major cities in India. The area map shows that there is a clear lack of

opportunities for Data Centres expansion in the north, northeast, and

central regions, though there is a substantial internet penetration and

digital services explosion in those regions. As of September 2021, there

are 172 colocation Data Centres from 26 areas in India

26

.

26

https://www.datacentremap.com/india/

Location

No. of DCs

Delhi-NCR

26

Bengaluru

31

Chennai

14

Pune

10

Mumbai

25

Ahmedabad

8

Kolkata

9

Hyderabad

11

Other cities

38

Figure 2.3: Data Centres area map

(Source: datacentermap.com/India/)

Table 2.1: Number of Data

Centres operating in India as

of September 2021

37

2.41 Annually, the Indian market is witnessing investments in a few Data

Centre projects from DC service providers. Maharashtra continues to

dominate with an investment share of over 50% in the market. While

Mumbai and Chennai remain the foremost choices, the other metro

cities of Hyderabad, NCR and Bangalore are also of interest given the

huge catchment of urban population and large enterprises. Even Tier

2 and Tier 3 locations offer significant cost advantages and have the

potential to overtake Tier-1 cities, especially because of the low labour

costs, manpower requirement of the industry, and economically valued

real estate available in those regions. The favorable policy offered by

some of these states have also played a part. Table 2.2 summarizes

fiscal and non-fiscal incentives offered by some of the states. Whilst

the data requirements of Tier-2 cities are on the rise because of a

decentralized workforce, there will be an increased demand for rapidly

deployable smaller colocation Data Centres built closer to smaller

cities. Building Data Centres in new Tier-2 cities where internet use is

booming is also a strategic business move, as it would help in easing

congestion and speed up internet services, creating increased

opportunities for edge DCs in the country.

Table: 2.2 Data Centre policies of various states

S.

no.

State and DC

Policy

Key Provisions

1

Maharashtra

27

(IT/ITES

Policy – 2015)

a. DCs will be covered under Essential Services and Maintenance (ESMA)

Act

b. DCs are eligible for the below fiscal incentives that are provided for

IT/ITES units:

c. 100% stamp duty exemption to new IT/ITeS units

d. Electricity duty exemptions for 10 years

e. Electricity tariff – power supply at industrial rates

f. Property tax is levied at par with residential rates

g. Registered IT/ITES units shall be exempt from octroi/Local Body Tax

(LBT)/entry tax/escort tax or any other cess

h. Allowing setting-up of IT/ITES units in any zone

27

http://di.maharashtra.gov.in/IT_ITES_Policy_2015_final_English.pdf

38

2

Telangana

28

(Telangana

Data Centre

Policy – 2016)

Fiscal Incentives:

1) Incentives for expansion of IT/ITeS shall be applicable for Data Centre firms

a. Allotment of Govt. land based on eligibility criteria

b. IT is classified as industrial units for levying industrial power tariff

category

c. Green initiative: promote energy efficient equipment usage

d. 100% reimbursement of stamp duty, transfer duty and registration fee

e. Reimburse the cost of filing patents/copy rights to companies having

R&D units in Telangana

2) Establish dual power grid networks, renewable energy under open access

system, provide power at the cost of generation

3) Up to 50% rebate on building fees

4) Land shall be provided at a subsidized cost

Promoting Startups/SMEs:

5) Additional preference to Startups/SMEs for procurement of DC services by

the Government

6) 25% subsidy on lease rentals for 3 years

7) Specific R&D grants