GOSYSTEMTAX™

RSADMINISTRATOR GUIDE

FOR TAX YEAR 2020

Last Updated: January 26, 2021

COPYRIGHTNOTICE

© 2020-2021 Thomson Reuters/Tax &Accounting. All rights reserved. Republication or redistribution of

Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent

of Thomson Reuters. Thomson Reuters and the Kinesis logo are trademarks of Thomson Reuters and its

affiliated companies. More information can be found here.

TABLE OF CONTENTS

Chapter 1: Setting Firm Configuration 1

Firm Administrator Login 1

GeneralOptions 3

Password Restrictions 4

SecurityThreshold 4

Support and Other Options 4

Single Sign-on 4

Document Management Systems 4

E-file Notifications Tab 4

Setting the Notification Level 5

Firm Notification Level 5

Account Notification Level 6

Group Notification Level 6

Locator Notification Level 7

Status toTrigger Email Notifications 8

Email Notifications 8

Sample: Email for Accepted Status 8

Sample: Email for Rejected Status 9

Sample: Email for Submitted Status 9

Sample: Email for Error Not Submitted Status 10

Sample: Email for Conditionally Accepted Status 11

Sample: Email For Awaiting Acknowledgment Status 11

Chapter 2: Security Options 12

Password Reset Feature 12

Firm Configuration 12

Password Reset Process 12

Multiple Use Token 17

History Records 17

Special Situations 18

Password Restrictions 18

Security Threshold 20

Support and Other Options 22

Single Sign-On 23

Restricting Access to Accounts by IP Address 25

ii

Implementing the IP Range Validation 26

Levels of Restriction 27

Redacting Certain Personally Identifiable Information 27

Redacting Information at the Firm Level 28

Redacting Information at the Group Level 29

Redacting/Viewing Information at the Return Level 30

Redaction: Known Limitations 31

Multi-Factor Authentication 32

What is Multi-Factor Authentication? 33

How Does MFA Work? 33

Setting Up and Implementing MFA in Your Firm 33

Generating a Temporary Login Code 34

Chapter 3: Using Access Control to Manage Groups and Users 37

Using Access Control 37

Types of Users and Their Rights 38

Administrators 38

Creating Groups 39

Creating a Group 39

Creating anAdministrator Group 41

Group Rights 44

Creating Users 44

Group Managers 51

Regional Administrators 52

Assigning Users to Existing Groups 55

Logon Hours 57

Using Limited and Preparer Access 59

Assigning Owners of Tax Defaults 62

Assigning Returns to a Group or Groups 63

Assigning Returns to Multiple Group Locations/User Groups 66

Assigning Returns to Group Locations 66

Assigning Multiple Returns to a Single Group 67

Assigning Returns to More than One Group/Location 69

Assigning Returns to Users 70

Reviewing Group Locations and User Groups 74

iii

Chapter 4: Access Control Imports 76

Import New Users 77

Downloading the XML Template Example/Creating a New XML Template 77

Editing the Template Example 78

Editing the Template Attributes 79

Saving the TXT Template to the XML Format 83

Importing into Users into Admin > Access Control Imports 84

Import New Groups 89

Import New Groups Format 90

Import New Groups Data Examples 90

Import Group Accounts 91

Import Group Accounts Data Format 92

Import Group Account Data Examples 92

Import Group - User Assignment 93

Import Group - User Assignment Data Format 94

Import Group - User Assignment Data Examples 94

Import Locator - Group Assignments 95

Import Locator - Group Assignment Data Format 95

Import Locator - Group Assignment Data Examples 96

Disable/Enable Logins 97

Import Users - Disable/Enable Logins Data Format 97

Import Users - Disable/Enable Logins Data Examples 98

Email Addresses 99

Import Users - EmailAddresses Data Examples 100

CHAPTER 1: SETTING FIRM

CONFIGURATION

FIRM ADMINISTRATOR LOGIN

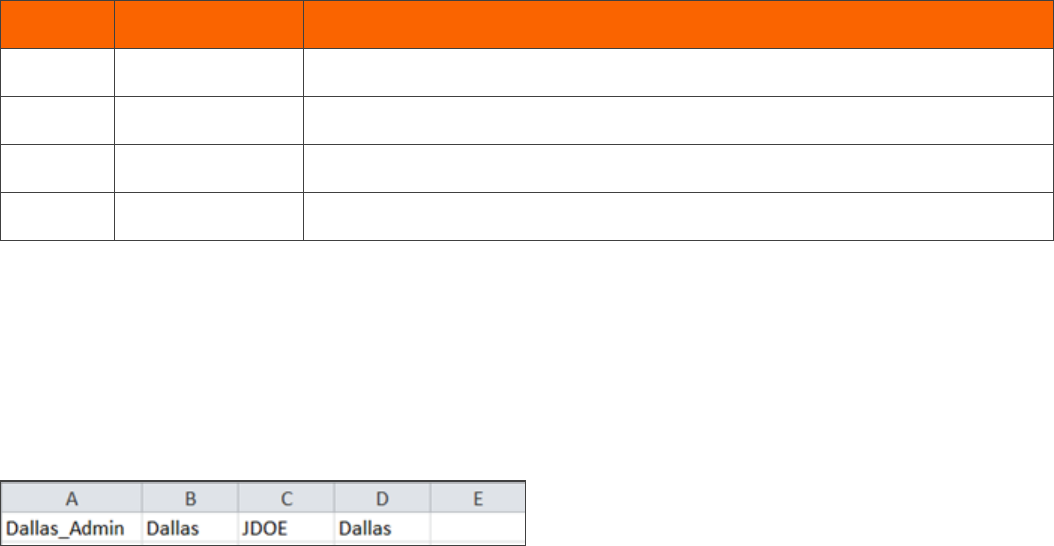

Only administrators can set the Firm Configuration in RS Browser. To log in as the firm administrator, enter:

l the login ID of the firm administrator

l the firm

l “***” in the location field

l the password for the firm administrator.

Figure 1:1

The figure above shows the screen where this information is entered. The firm administrator’s initial login ID is

ADMINISTRATOR. The firm and initial password are indicated in an email sent to the firm administrator. The

firm administrator will be prompted to select a new password upon initial login.

Before setting up other user logins, the *** Firm Administrator should make selections in the Firm

Configuration screens.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

2 Chapter 1: Setting Firm Configuration

Firm Administrator Login

1. Select Admin > Firm Configuration. The following screen appears:

Figure 1:2

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 1: Setting Firm Configuration 3

GeneralOptions

2.

Select the applicable tab to make selections:

l

GeneralOptions (page 3)

l

Password Restrictions (page 4)

l

SecurityThreshold (page 4)

l

Support and Other Options (page 4)

l

Single Sign-on (page 4)

l

Documentum DMS

l

GoFileRoom DMS

l

FileCabinet CS DMS

l

Setting Firm Configuration (page 1)

3. After making your selections, select Update to change your options, or select Restore Defaults to return

to the system options.

4. Select History to review the changes a given user made and the dates of those changes.

GENERALOPTIONS

Use this tab to:

l enable the charge warning dialog

l

set PDF Document as the default printer

l

enable masking of personally identifiable information (see Redacting Certain Personally Identifiable

Information (page 27))

l enable multi-user access to tax returns when using pass-through

l enable password check for tax returns when using pass-through

l enable NetClient CS integration

l

enable password reset capability for users (see Password Reset Feature (page 12)).

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

4 Chapter 1: Setting Firm Configuration

Password Restrictions

PASSWORD RESTRICTIONS

See Password Restrictions (page 18) for more information on password restrictions.

SECURITYTHRESHOLD

See Security Threshold (page 20) for more information on setting security threshold options.

SUPPORT AND OTHER OPTIONS

See Support and Other Options (page 22) for more information on setting support and other options.

SINGLE SIGN-ON

Use this tab to:

l enable single sign on using SAML Authentication

l

require SAML Authentication to login

l allow firm administrators [in *** Location] to login without SAML Authentication.

DOCUMENT MANAGEMENT SYSTEMS

Go to https://www.riahelp.com/html/2020/grs/content/grs_procedures_dms/dms_intro.htm for

information on using Documentum and GoFileRoom.

Firms have multiple options available for e-file status notifications. These options provide firms a way to select

statuses for notification and gives them the ability to set up the notifications at the firm, account, group, or

locator level.

E-FILE NOTIFICATIONS TAB

The E-file Notifications tab appears on the Firm Configuration page. Any user who currently sees the Firm

Configuration page will see this tab; it is not restricted by any additional user right.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 1: Setting Firm Configuration 5

Setting the Notification Level

Figure 1:3

SETTING THE NOTIFICATION LEVEL

Four options are available for the notification level:

l Firm

l Account

l Group

l Locator

These options are mutually exclusive, so only one may be chosen per firm.

Firm Notification Level

This notification level allows the Administrator to select one email address to which all notifications will be sent.

If more than one email address needs to receive the notifications, we suggest setting up a group email address.

All e-file status notifications for returns within the firm will be sent to the email address entered.

Figure 1:4

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

6 Chapter 1: Setting Firm Configuration

Setting the Notification Level

Account Notification Level

This notification level allows the Administrator to assign an email address to each account within the firm for

which notifications will be sent. The accounts may be selected individually, or if the same email address is

desired for more than one account, the accounts may also be multi-selected.

If more than one email address needs to receive notifications for an account, we suggest a group email address

be set up and that email address can be entered here.

All e-file status notifications for returns within the account will be sent to the email address entered.

Figure 1:5

Group Notification Level

This notification level allows notifications to be sent at the group level. When this option is selected, e-file

notifications for returns assigned to a group will be sent to the email address associated with that group.

Figure 1:6

To enter the email address for each group:

1. Select Admin > Access Control.

2. Select the Groups tab.

3.

Select the group.

4. Click the Edit button.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 1: Setting Firm Configuration 7

Setting the Notification Level

5.

Enter an email address in the appropriate field.

Figure 1:7

Locator Notification Level

This notification level allows email notifications to be sent at the locator level using the assignments selected.

Each e-file status may have a different set of people notified. An option for another email address to be included

in the notifications is available via the Other selection.

The locator level notification option requires that you make locator assignments and enter email

addresses in Access Control for all of the assigned users.

Figure 1:8

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

8 Chapter 1: Setting Firm Configuration

Status toTrigger Email Notifications

STATUS TOTRIGGER EMAIL NOTIFICATIONS

For each of the notification levels, with the exception of the Locator Notification Level, these statuses are

available for email notifications:

Figure 1:9

EMAIL NOTIFICATIONS

The email notifications are different for each e-file status. Each notification includes the jurisdiction, year,

taxpayer name, tax type, and locator number for which the status is being sent.

To see a sample email for each of the available statuses, click the View Sample button at the top of the E-file

Notifications page.

Sample: Email for Accepted Status

Figure 1:10

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 1: Setting Firm Configuration 9

Email Notifications

Sample: Email for Rejected Status

Figure 1:11

Sample: Email for Submitted Status

Figure 1:12

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

10 Chapter 1: Setting Firm Configuration

Email Notifications

Sample: Email for Error Not Submitted Status

Figure 1:13

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 1: Setting Firm Configuration 11

Email Notifications

Sample: Email for Conditionally Accepted Status

Figure 1:14

Sample: Email For Awaiting Acknowledgment Status

Figure 1:15

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

CHAPTER 2: SECURITY OPTIONS

PASSWORD RESET FEATURE

Users can reset their passwords without having to rely on their administrators to do it for them. The password

reset process sends an email to the user with a link and an encrypted token embedded in the text of the email

for the user to follow. The process uses the email address stored in the User Info for each user.

Firm Configuration

The password reset capability is Firm selectable, so the Firm administrator must turn it on in Firm

Configuration for the users to be able to take advantage of it. Users that try to use it without the option being

turned on for their firm will get a notification that it is not available for them. The Firm Configuration option

exists under the General Options tab as follows:

Figure 2:1

Password Reset Process

The password reset feature is accessible via the Forgot Password? link on the login page.

Figure 2:2

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

13 Chapter 2: Security Options

Password Reset Feature

After the user clicks on the Forgot Password link, a prompt appears for the user’s Login ID, Firm, and

Location.

Figure 2:3

The user must enter all requested information and then press the Get Password button. The user will then see

a dialog containing the current email address stored in the system for the user and asking the user to confirm

the email address.

Figure 2:4

Users who do not have an email address stored in the system will receive a dialog stating this and suggesting

they contact their administrator.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 14

Password Reset Feature

Once the user has confirmed the email address and has clicked Continue, that user will receive a dialog that

an email has been sent:

Figure 2:5

For security reasons, the password reset process must be completed within the two hours as seen above.

There is a temporary token associated with the request and it will expire after two hours. After the two hours

have passed and the temporary token has not been used, the password reset process must be restarted.

The user will receive an email with instructions similar to the following:

Figure 2:6

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

15 Chapter 2: Security Options

Password Reset Feature

Clicking the link within the email brings the user to a page to enter the Login ID, Firm, and Location:

Figure 2:7

If the link does not work, as the email states, the user can copy and paste the URL into the browser. This will

take the user to a slightly different page with an additional field to enter the temporary token:

Figure 2:8

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 16

Password Reset Feature

After selecting Continue, the user can then enter a new password:

Figure 2:9

A final dialog will display as confirmation that the password reset was completed:

Figure 2:10

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

17 Chapter 2: Security Options

Password Reset Feature

A confirmation email is also sent to the user after the process is complete:

Figure 2:11

Multiple Use Token

The password reset link/temporary token can only be used one time. A user who tries to use it a second time will

get the following error message:

Figure 2:12

History Records

History records are written for the user when the password reset has been requested and also when the

password reset process is complete.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 18

Password Restrictions

Special Situations

Locked Out If a user is locked out after having entered the wrong password too many times, the user is

allowed to use the password reset feature. Once the password reset process is complete, the user will no

longer be locked out.

Disabled If a user is disabled, meaning an administrator has disabled the Login ID within Access Control,

that user will not be able to use the password reset feature as long as the Login ID is disabled.

PASSWORD RESTRICTIONS

Use this screen to select password restrictions and configurations for your users.

Figure 2:13

1. Select Admin > Firm Configuration, and select the Password Restrictions tab.

2. Minimum Password Length: Specify the minimum number of characters required in all new passwords.

Passwords must contain at least eight (8) characters and no more than twenty (20) characters.

3. Password Strength: Specify the strength of the passwords. The IRS requires that each password

contain all four (4) of the following sets of characters:

l English uppercase characters (A - Z)

l English lowercase characters (a - z)

l Base 10 digits (0-9)

l Nonalphanumeric characters, such as @, #, $, and so forth).

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

19 Chapter 2: Security Options

Password Restrictions

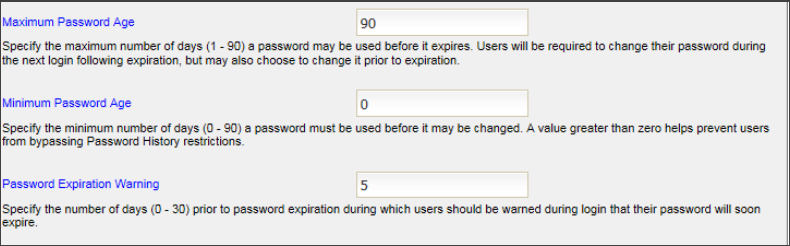

4. Maximum Password Age: Select the maximum password age. This is the number of days that a user

may use a password before it expires. The range is from one (1) day to 90 days. A user will be required to

change the password during the next login after password expiration, but a user can also elect to change a

password at any time before it expires.

Figure 2:14

5. Minimum Password Age: Select the minimum password age. This is the number of days that a user

must use a selected password before it expires. This can range from zero (0) days to 90 days. Selecting a

value greater than 0 prevents users from bypassing the Password History restrictions.

6. Password Expiration Warning: Select the number of days prior to password expiration that a user will

see a message warning that the login for that password will soon expire. This can range from zero (0) days

to thirty (30) days.

7. Password History: Select the number of former passwords (1-24) that the application will store. A user

cannot reuse any password stored in the Password History.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 20

Security Threshold

8. New Password Expiration: Select the option, if desired, for New Password Expiration, and specify the

number of hours (1-168) that a New Password remains valid. New Passwords are single-use passwords

set by the administrator as part of a password reset request or new account creation. Enabling this feature

ensures that new and reset accounts have a user-selected password assigned within the specified

interval.

Figure 2:15

9. When you have selected your options, select Update to change the system defaults, or select Restore

Defaults to revert to the system defaults.

SECURITY THRESHOLD

Use this screen to select lockout and inactivity durations for your users.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

21 Chapter 2: Security Options

Security Threshold

1. Select Admin > Firm Configuration, and select the Security Threshold tab.

Figure 2:16

2. Lockout Threshold: For the lockout threshold, select the maximum number of incorrect passwords (2-

20) that a user may enter before the account is locked out. Once locked out, the user must wait for the

lockout duration interval (set below) or contact an administrator to have the account unlocked.

3. Lockout Duration: If desired, select the option to enable a lockout duration, and set the number of

minutes (1-1440) after a lockout occurs before the account is automatically unlocked. This gives locked-

out users the option to wait the specified period instead of contacting an administrator.

4. Inactivity Threshold: If desired, select the option to enable an inactivity threshold, and specify the

number of days (30-400) that an account or login may go unused before it is automatically disabled.

Accounts disabled due to inactivity will require a firm administrator to re-enable the accounts before they

can be used.

5. Timeout Limit: If desired, select the option to specify the number of minutes (1-30) of session activity

before the system automatically logs the user out.

6. After making your selections, select Update to change your options, or select Restore Defaults to return

to the system options.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 22

Support and Other Options

SUPPORT AND OTHER OPTIONS

Use this screen to select support and other options for your users.

Figure 2:17

1. Select Admin > Firm Configuration, and select the Security Options tab. If desired, select the

Support option to enable Thomson Reuters Support for all returns.

2.

Select the option, if desired, to enable Group Managers.

3. Select the option, if desired, to enable users to view a non-interactive listing of all returns on the Returns

menu. They can view the list even if they do not have access to the open returns listed.

4. For the three Remember Me options, if desired, enable the following values entered on the login page to

be stored on the user’s workstation, so that the fields are prepopulated on subsequent visits to the login

page:

l Login ID

l Firm

l Location.

Figure 2:18

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

23 Chapter 2: Security Options

Single Sign-On

5.

If desired, select the option to suppress time tracking and milestones. Selecting this option suppresses the

time tracking screen when returns are closed for those users who are not required to log in their time.

6. For the IP Range Subnet Validation, please see Restricting Access to Accounts by IP Address.

7. After making your selections, select Update to change your options, or select Restore Defaults to return

to the system options.

SINGLE SIGN-ON

Use this screen to enable single sign-on parameters using SAML authentication for your firm.

This is a separate optional product and will not be available unless your firm is licensed for Single

Sign-On. Please note that the following is for informational purposes only. To implement

SSO, contact your account manager.

Warning!Do not change any of these settings unless you are certain of the correct

values, or you may break your firm’s ability to login into the product!

The SSO configuration information is located on the Admin > Firm Configuration > Single Sign‐On tab.

Figure 2:19

On the Single Sign‐On tab, note the following:

1. The box Enable Single Sign On using SAML Authentication is used to enable single sign-on access

for the firm.

2. REQUIRE SAML Authentication to login forces all users to use SSO for product access. The login

screen will redirect users to the URL entered in the (Optional) Client Redirect URL field, if supplied.

3. Allow Firm Administrators [in *** Location] to login without SAML Authentication allows ***

location firm administrators to log into RS using the login page when the REQUIRE SAML

Authentication to login is checked.

4. Login “Location” is derived from should always be set to Map To SAML NameIdentifier. This uses the

Access > User >Single Sign-On tab > Unique SAML Subject NameIdentifier mapped to this

user entry to the domain user account passed in by the assertion server during SSO login.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 24

Single Sign-On

5. The bottom section after the SAML Assertion Portal Configuration label contains information specific

to the client assertion server configuration.

6. The SAML Source ID (40 hex characters): contains a hash code assigned to a firm as a unique 40-

character firm identifier (Source ID).

7. The URL in the SAML Assertion Retrieval URL/Issuer: field shows the client assertion server callback

URL that the system calls when a user in the firm enters the product using SSO.

8. The SAML Assertion Retrieval User Name: field, usually populated by ssoassertionuser, shows the

user name used with the assertion server callback.

9. The password in the SAML Assertion Retrieval Password: and Confirm: fields is the user password

used with the assertion server callback. The implementation team that sets up your SSO will enter this for

you.

10. The primary and secondary SSO contacts at the firm appears in the SAMLAssertion Portal

Emergency Contact 1 and SAMLAssertion Portal EmergencyContact 2 fields.

Figure 2:20

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

25 Chapter 2: Security Options

Restricting Access to Accounts by IP Address

PING FEDERATE SSO CONFIGURATION

Four steps are required for a client to use our Ping Federate SSO solution.

You must contact your account manager and purchase the SAML Single Sign-On product. This will appear in

the Account Information page in the Products tab.

Complete the Federated Single Sign-On client handout form and return it to Thomson Reuters. The TRTA SSO

Admin team will create an entry in the Ping Federate system using the information in the form.

Enable Single Sign-On in the Admin > Firm Configuration >Single Sign-On tab. Set the other options to

support SSO functionality as the client needs.

The first time a user attempts to log in using the SSO system, the Ping Federate system will send the user to

the RS authentication dialog page with an SSO token. RS will authenticate the user, call the Ping Federate

system web service to notify Ping Federate that the user is authenticated, and pass the SSO token and

product credentials. The Ping Federate service will save the user information in the database that creates the

remote client user account to the RS user account. On all subsequent login attempts, Ping Federate will map

the incoming user account to the RS user account, and the user will be passed straight into the product, if the

user account is still active.

RESTRICTING ACCESS TO ACCOUNTS BY IP ADDRESS

Every computer connected to the Internet has an Internet Protocol (IP) address. Such addresses are written as

four numbers separated by periods. Be sure to get a list of the IP addresses and/or ranges you wish to enter

before you begin.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 26

Restricting Access to Accounts by IP Address

Implementing the IP Range Validation

1.

Sign in as an administrator (location ***).

2. Navigate to Admin > Firm Configuration > Security Options.

Figure 2:21

3. Scroll to the section labeled IP Range Validation.

4.

Select the option to restrict access to the site by IP address.

5.

Enter the IP addresses that you wish to access your firm accounts. Separate multiple IP addresses by

semi-colons.

6. Click Update.

Be sure to include your own IP address! If you do not, you will lock yourself out of your

account the next time you log in.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

27 Chapter 2: Security Options

Redacting Certain Personally Identifiable Information

Levels of Restriction

There are three levels of restriction:

l by firm

l by group of machines

l by machine.

Firm Level To restrict by firm level, enter the first two sets of numbers in the firm’s IP address(es). For

example, for 100.100.10.1, you would enter 100.100.

By Group To restrict access to a group of machines (for example, everyone assigned to a specific location),

enter the first three sets of numbers in the group’s IP address(es). For example, for 100.100.10.1, you would

enter 100.100.10.

By Machine Level To restrict access to only certain machines, enter the full IP address of each machine

allowed to have access.

Restricting access to machines is not the same as restricting access to people! Be

sure, if you intend to restrict access by user, that you use the restrictions in Access

Control to guard your accounts.

REDACTING CERTAIN PERSONALLY IDENTIFIABLE

INFORMATION

The IRS has issued Regulation 301.7216-3, providing guidance affecting tax return preparers regarding the

disclosure of a taxpayer’s Social Security number to a tax return preparer located outside the United States in

order to provide an exception allowing such disclosure with the taxpayer’s consent in limited circumstances.

In most circumstances, such disclosure will not be necessary. In order to protect the privacy of the taxpayer,

Thomson Reuters has created a feature that redacts certain personally identifiable information, such as SSNs

on tax returns across all tax return types. This feature can be implemented as follows:

l Administrators can enable redaction of certain personally identifiable information at the firm level.

l Administrators can then elect to redact certain personally identifiable information at the group level, so that

all accounts assigned to a group will be redacted.

l Administrators can then elect to show certain personally identifiable information for a given return at the

return level.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 28

Redacting Certain Personally Identifiable Information

Redacting Information at the Firm Level

Administrators can choose firm-wide options to apply to all accounts and returns within the firm. To enable

redaction of certain personally identifiable information at the firm level:

1. Select Admin > Firm Configuration > General Options.

2.

Select the option to enable masking of personally identifiable information. Masking is the conversion of

actual SSN to XXX-XX-NNNN when “NNNN” is the actual last four digits of SSN.

Figure 2:22

3.

If you select the option to mask the data in the step above, select one of the following options:

l

All groups will be marked to redact applicable data This affects all groups under Admin >

Access Control.

l

All groups will not be marked to redact applicable data The Administrator must select

individual groups under Admin > Access Control in order to keep those groups from viewing

certain personally identifiable information.

4. Click Update.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

29 Chapter 2: Security Options

Redacting Certain Personally Identifiable Information

Redacting Information at the Group Level

If the second option under Step 3 above is selected, Administrators must select individual groups for redaction.

To do so:

1. Select Admin > Access Control > Groups.

2. Select the Edit button.

3.

Select the option to redact personally identifiable information.

Figure 2:23

4. Click the Update button.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 30

Redacting Certain Personally Identifiable Information

A user assigned to a group that has default masking and another group with redacting enabled will

inherit the default masking level. The user will be able to view the personal information within the

return unless the option is overridden at the return level.

Redacting/Viewing Information at the Return Level

If the firm has enabled redaction of certain personally identifiable information at the firm level, you can unmask

the personally identifiable information for a return as follows:

1.

Select the return to open.

2. Select Returns > More > View Personal Information.

3.

Select the option to view personal information.

Figure 2:24

4.

If this box is checked, and you wish to redact certain personally identifiable information, clear the check

box.

5. Click the Update button.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

31 Chapter 2: Security Options

Redacting Certain Personally Identifiable Information

Redaction: Known Limitations

PRINT

l The printed return will print with masked data for a user without SSN rights, and will print with unmasked

data for a user with SSN rights. The government copy can only be printed by a user with SSN rights. A user

without SSN rights could possibly file a paper return (not government copy) with data that has been

masked.

l Users with SSN rights have access to Existing Print Files. If a user without SSN rights generated the

existing print file, the file will contain masked SSN data. The user can create a new print file to properly

print unmasked SSN data. Users need to exercise caution to ensure that the printed return contains

unmasked data before filing a return.

l Users without SSN rights do not have access to Existing Print Files. The software cannot mask a print file

after it has been generated. We have removed the option to view these artifacts for those users without

SSN rights.

l

Users without SSN rights do not have access to Batch Estimates and Extensions View/Print option.

The print file is generated with unmasked data.

l Users without SSN rights may have access to unmasked data if a compute is not performed before

creating the print file. Some states in Individual returns require a full compute in order to mask all print

data.

PRINT PREVIEW

l Users without SSN rights do not have access to Existing Print Preview Files. The software cannot mask a

print preview file after it has been generated. We have removed the option to view these artifacts for those

users without SSN rights.

l Users with SSN rights have access to Existing Print Preview Files. If a user without SSN rights generated

the existing print preview file, the file will contain masked SSN data. The user can create a new print file to

properly print unmasked SSN data.

l Users without SSN rights may have access to unmasked data if a compute is not performed before

creating the print preview. Some states in Individual returns require a full compute in order to mask all print

data.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 32

Multi-Factor Authentication

E-FILE

All users have the ability to create e-files. The e-files will contain unmasked SSN data. To maintain the security

of SSN data, users without SSN rights will be unable to view XML electronic files through the XML E-file Viewer

or XML download.

OVERRIDDEN SSN DATA

Overrides of SSN data on Tax Forms and Workpapers will not be masked for users without SSN rights.

MULTI-USER ACCESS

l The multi-user access is available. The rights assigned to the first user to open the return decides the

rights requirements of subsequent users’ access. If the second user has the same rights or higher rights

as the first user, the second user will be allowed access and will see the return in its current format (either

masked or unmasked). If a user without SSN rights attempts to open a return currently in use by a user

with SSN rights, a message will appear informing the user of a rights mismatch.

l When multi-user access is in use and a user enters SSN data, all other users currently in the return will be

able to view that data no matter what rights they have.

EXPORT

l

Planner CS and To DIF file export options from within a return are not available to users without SSN

rights.

l All exported data is unmasked. Because the exported data is used for import and/or the creation of new

returns, the data must be unmasked in order to create a viable return and maintain data integrity.

BUSINESS RETURNS

Redaction is not available for business returns.

MULTI-FACTOR AUTHENTICATION

Thomson Reuters strongly recommends that you use multi-factor authentication to provide the highest level

of security for your firm and client data.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

33 Chapter 2: Security Options

Multi-Factor Authentication

What is Multi-Factor Authentication?

Multi-factor authentication adds an additional layer of security that helps protect your firm's confidential data.

Many of your online accounts or software applications are currently protected by a login and password. That

password is the single factor in the authentication process — the way that those applications or services

confirm your identity.

Multi-factor authentication adds at least one more layer of identity verification to that process so your protection

against hacking and fraud attempts is stronger and more secure than a simple password. That additional layer

can take many forms, such as a physical ID card, a digital confirmation code, or even your fingerprint. You use

multi-factor authentication every time you pay a transaction using a debit card or withdraw cash from an ATM:

your debit card is one factor and your PIN is another.

How Does MFA Work?

Thomson Reuters provides multi-factor authentication through the Thomson Reuters Authenticator application.

After installing the mobile application on your smartphone and pairing that device with your application login

credentials, you'll use the Authenticator to confirm your identity every time you log in to the Thomson Reuters

RS system. You do so via a notification that is sent to the Authenticator mobile application, which you can

quickly approve on your mobile device.

Software that works with Thomson Reuters Authenticator allows you to authenticate on three levels:

1. Something you KNOW (your login and password)

2. Something you HAVE (your mobile device with the Thomson Reuters Authenticator application)

3. Something you ARE (your fingerprint, if your device has Touch ID enabled)

Using multi-factor authentication makes it difficult for anyone else to use your login, as any would-be hacker

must either have your mobile device at hand. If you decide to enable fingerprint authentication, hacking

becomes impossible.

Setting Up and Implementing MFA in Your Firm

By default, MFA is an optional feature that individual users can opt into by enabling it for their own accounts. If

desired, RS administrators can enable a setting that requires that all staff members log in with MFA.

We strongly recommend that you use MFA to provide the highest level of security for your firm and client

data. MFA requires a mobile device with the Thomson Reuters Authenticator application installed.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 34

Multi-Factor Authentication

By default, MFA is optional. Firms can set it up if they choose. You can make MFA a required security feature

for staff. This setting requires the administrator rights to change the setting.

1. Select Admin > Firm Config.

2. Select the Security Options tab.

3. Under the heading Multi-factor Authentication, select the options you wish to use.

Figure 2:25

l

Required: When MFA is required, users will be prompted to set up MFA at their next login, after

which they must use a mobile device with the Thomson Reuters Authenticator application to log in to

the RS system.

l

Optional: When MFA is optional, users will not be prompted to set up MFA, but they can opt in to

using the Thomson Reuters Authenticator application to provide an additional layer of security for

their RS logins.

Generating a Temporary Login Code

When a user cannot log in using MFA — such as when users leave their phones at home or a phone is

damaged — users with administrative permissions can generate a temporary, 24-hour numerical code to

enable the user to log in.

1. Go to Admin > Access Control.

2.

Select the user who needs the temporary code.

3. Select User.

4. At the bottom of the screen, locate the button labeled Generate 24-Hour OTP for this User.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

35 Chapter 2: Security Options

Multi-Factor Authentication

5.

Click the button. Generating the code disables any codes previously located for that user’s account.

Figure 2:26

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 2: Security Options 36

Multi-Factor Authentication

6.

A dialog appears to the right with the temporary code.

Figure 2:27

7.

Send the code to the user.

8. Click Close.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

CHAPTER 3: USING ACCESS CONTROL TO

MANAGE GROUPS AND USERS

The Access Control module gives you the flexibility you need to delegate the creation of users and groups

within your firm to administrators in various locations. Groups and users created by each location administrator

are grouped by location. Groups and users created by the location administrator in Dallas are not visible to the

location administrator in Los Angeles, unless the Los Angeles administrator has rights to the same set of

accounts.

To restrict administrators so that they can only modify groups and users in specific locations, make them

Regional Administrators, and assign them the locations that they should be allowed to administer.

History History buttons are available on several of the Access Control dialog boxes. These history logs show

users who have created or modified groups or users and the type of edit made.

Administrators who need to set up tax defaults for a given account must have the tax defaults assigned to their

location before they can modify their tax defaults. See Assigning Owners of Tax Defaults (page 62) for a

description of how this assignment is made.

USING ACCESS CONTROL

Use the Access Control system to set up groups of users who will have access or login rights to the system.

Setting up Access Control is a two-step process:

1.

Associate specific rights with groups as the groups are created.

2.

Associate users with those groups.

The Access Control menu option is visible only to users with administrator rights and is found on the Admin

menu.

Figure 3:1

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

38 Chapter 3: Using Access Control to Manage Groups and Users

Types of Users and Their Rights

TYPES OF USERS AND THEIR RIGHTS

Four types of users are distinguished by the level of rights they have:

FIRM ADMINISTRATORS

l Initiates first login for the firm

l Has access to all accounts for the firm

l Has access to all users in all groups within the firm

l Sets up groups and group access

l Sets up the location names used on the login screen

l Assigns account numbers to groups

l Assigns location administrators to groups

l Assigns Tax Defaults to locations

LOCATION

ADMINISTRATORS

l Sets up users for their location

l Sets user access

l Sets user login IDs and passwords

l Sets up Administrators within their location

l Assigns account numbers for users

l Assigns returns to groups or users

l Updates Tax Defaults assigned to their locations

REGIONAL

ADMINISTRATORS

l Same rights as Location Administrator, but can also setup Administrators

in authorized locations.

USERS

l Accesses accounts assigned by Location Administrators

l May belong to more than one group if authorized by a Location

Administrator

l May allow Support to access returns assigned to them

Administrators

Using groups provides administrators a method of granting rights to users at the group level without having to

modify each user’s rights individually.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 39

Creating Groups

There are three types of administrators:

l firm administrator

l location administrators

l regional administrators.

The firm administrator login must be used initially to set up other firm administrators, regional administrators,

and location administrators who can then create their own groups and users. Any administrator can grant the

administrator right to another user, although only the firm administrator can grant regional administrator rights

to another user.

Firm administrators can designate locations for the users and groups that they create, whereas location

administrators cannot designate locations. This keeps each group and user unique from groups and users

created in other locations.

User Locations have no relationship to Group Locations. Users in any User Location can be

members of any Group, without regard to Group Location.

CREATING GROUPS

Creating a Group

1.

Log in as an administrator.

2. Select Admin > Access Control > Groups tab.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

40 Chapter 3: Using Access Control to Manage Groups and Users

Creating Groups

3. A default Group Location of *** and a list of existing groups appear as shown below.

Figure 3:2

4.

Initially, only the firm group exists (group location ***). This group name varies depending on the name

Thomson Reuters created for the firm during the initial setup. Any member of this firm group has rights to

all accounts.

Assume that offices exist in Dallas, New York, and Los Angeles. Each office has an administrator who creates

groups and users. The firm administrator can create a group for each location and associate one or more

location administrators with any group.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 41

Creating Groups

Creating anAdministrator Group

1. Click the Groups tab, and then click New.

2.

The screen shown below appears.

Figure 3:3

3.

Enter the name of the group and a descriptive unique location. In this example, NEWYORK_ADMIN is

used as the group name, and *** is used as the location.

4.

Select the rights to be granted to administrators associated with this group. Administrators that belong to

this group can pass whatever rights they were granted on this screen on to their own groups and users.

5.

Select each account that the administrator needs to access. Only the assigned accounts are accessible by

members of the group. In this example, the account 396D belongs to the New York office.

Full Access should normally be used when granting access to an entire account. Limited and Preparer

Access restrict access within an account to specific returns assigned to groups or users. See Using

Limited and Preparer Access (page 59) for more information on limiting access to returns.

If Full Access is used, a user has unrestricted access to see and open all returns in the account.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

42 Chapter 3: Using Access Control to Manage Groups and Users

Creating Groups

6. Once you have assigned appropriate rights and accounts to the group, click Update to store the new

group.

7. Click OK to return to this screen for Full Access.

Figure 3:4

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 43

Creating Groups

8. Click OK to return to this screen for Preparer Access.

Figure 3:5

9. Click Close to return to the Groups screen shown below. The new group names should then appear in

the group screen as shown. In this example, the group NEWYORK_ADMIN has Full Access to Account

396D, and the group NEW YORK_PREPARER has Preparer Access to Account 396F.

Choosing a different Group Location in the drop-down arrow box will display different Groups that are

set up for other Locations.

Figure 3:6

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

44 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

Group Rights

Any administrator that is created should be given the maximum rights available so that any new groups or users

created by that administrator may be granted appropriate rights. Restricting rights of an administrator will

prevent them from granting the rights to any group or user that they create or edit. Each right that can be

granted through a group is described below.

Add Returns Having rights to add returns allows users to create new returns by selecting Returns > Create

Return, or by using the Save As option located on the Returns menu after displaying a list of returns. The

Import option found on the Returns Processing menu also requires users to have the Add Returns right if

the import file does not specify an existing locator number for a tax return. The Add Returns right does not

restrict the user from creating returns when using the Separate Returns Joint Data (SRJD) or Tax

Equalization (TEQ) features in the tax application.

Assign Returns The Assign Returns right allows users to make various assignments to returns. Once

returns are displayed after selecting Returns > Find Return, a user can select the Assign Users/Dates

menu option. Firms that have purchased GoTracker® will have the Assign Users/Dates menu option.

Delete Returns Users having the right to deactivate returns may do so by selecting Returns > View Return

Information and clicking the Deactivate Return button. Users that do not have the deactivate right will not be

able to re-roll a tax return since the rollover process will not overwrite existing data unless the user has the

Rollover without Delete Rights right described below. Users who have the right to deactivate returns will be

prompted to Bypass or Overwrite tax return data during the rollover process.

Set Passwords Users having the right to set passwords may set passwords for tax returns or change those

passwords on returns where they already know the existing passwords. Administrators having the Set

Password right do not have to know the existing return password to change it.

Rollover Without Delete Rights Users who should not be allowed to delete returns but who should be able to

re-roll returns will need the Rollover Without Delete Rights right. Users who have either the Deactivate

Return right or the Rollover Without Delete Rights right will be prompted to Bypass or Overwrite tax

return data during the rollover process.

Bypass Return Passwords For Batch Print Users who are members of a Group with this right can

download returns created through the batch print process without having to enter the locator password.

Mask Certain Personal Identifiable Information In order to protect taxpayer privacy, certain personal

information such as SSNs will be masked on tax returns assigned to Groups with this option checked.

CREATING USERS

The first users that should be created are other Firm Administrators in the *** Location. This ensures that there

is a backup *** Administrator login.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 45

Creating Users

Firm Configuration, a right available under Administrator Rights, allows access and edit of Firm

Configuration options. The Firm Configuration right may be selected for Administrators in the *** Location

only.

The figure below shows the rights that are automatically granted when you select the Administrator check

box. When you set up new *** Administrators, the Firm Configuration and Letters and Filing Instructions

rights along with the De-Federate User right will NOT be automatically enabled when you select the

Administrator check box. If these rights should be granted, you must select them separately.

Figure 3:7

The Firm Configuration right will be enabled for any existing Administrators in the *** location.

The primary *** Firm Administrator should remove the right as necessary to ensure that Firm

Configuration changes are only made by appropriately authorized *** Administrators.

The next users that should be created are location administrators. This allows them to log in and create their

own groups and users.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

46 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

1. To create a new user, click the Users tab. This displays the screen shown below.

Figure 3:8

2.

Users are grouped by location. Select the location in the drop-down arrow box to display the users in a

group.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 47

Creating Users

3. Click New. The screen where you create new users appears.

Figure 3:9

4.

Enter the user’s login ID.

Only the firm administrator can specify a new location when creating new users.

Login IDs with a location of *** and who also have the administrator right are considered to be firm or

regional administrators.

Regional administrators may be assigned to multiple locations and will be able to create new users in any

of their assigned locations.

Login IDs with locations other than “***” and the administrator right are considered to be location

administrators.

5. Enter the user’s full name, password, email address, and Employee ID. Enter the password twice to verify

its accuracy.

6. If the user should log time, check the Enable Time Tracking check box and fill in the appropriate hourly

rate.

7.

Check the box if the user is allowed to modify the time log.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

48 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

8.

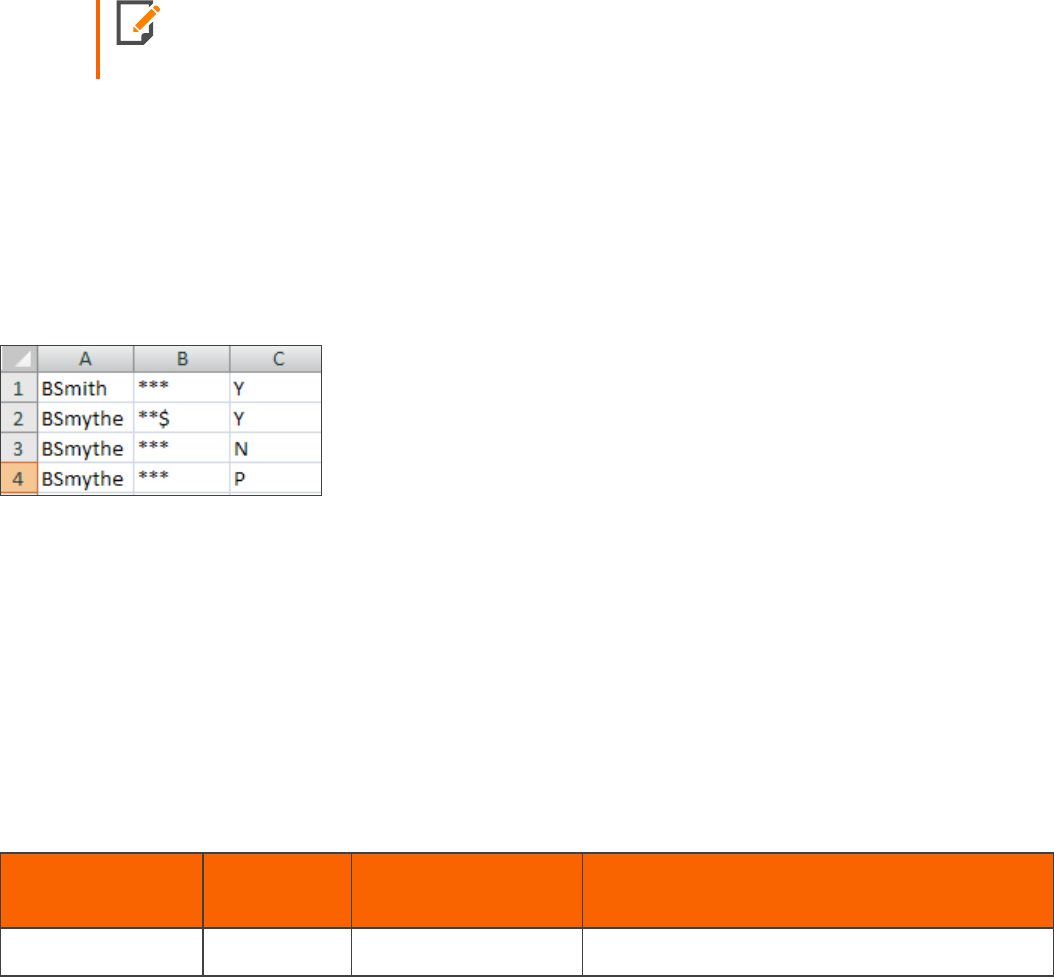

In this example, the firm administrator is creating a login ID for JDOE, a location administrator in DALLAS.

In the Rights section in the lower half of the User tab, check the Administrator check box, if the user is to

be an administrator.

Making a user an administrator enables the Access Control menu option for that user.

9. By default, all administrator rights are enabled when the Administrator check box is selected. You may

remove any rights if you wish to restrict what this administrator can do within Access Control. For

example, if you want the administrator to be able to add or edit groups, but you do not want the

administrator to be able to delete groups, remove the Delete Groups right.

10.

If you wish to make this user a regional administrator, one who can modify groups and users in multiple

locations (but not all locations), check the Regional Administrator check box, and then click the

Regional Administrator tab. Select the locations that the regional administrator can modify, and then

click Assign.

Figure 3:10

11. Additional products may appear in the Rights section of the User tab. These rights must be granted to

each user instead of through groups, since the number of users authorized to access these products or

functions may differ from the number of users that can be created in Access Control. User rights control

whether the user can execute one of these products or functions.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 49

Creating Users

12. Before clicking the Update button, you must click the Groups tab, as shown below, to make the JDoe

login ID a member of at least one group.

A user may belong to multiple groups. If one group grants full access to an account and

another group grants Limited or Preparer access to the same account, the user has full

access to the account.

Figure 3:11

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

50 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

13. On the Groups tab shown above, first select DALLAS, one of the Available Group Locations. Making that

selection displays a list of Available Groups. Click the group named DALLAS_ADMIN in the Available

Groups column. Click Assign to make the JDoe login ID a member of this group.

Figure 3:12

If a user is assigned to only one Group, then the user cannot be deleted unless assigned to

another Group. Conversely, if a Group has only one user, then the Group cannot be

deleted until another user is assigned to that Group.

14. Click Update once you have assigned the user to a group on the Groups tab and checked the

appropriate product and function rights on the User tab.

15. You may use the Rights button to verify that the rights of an existing user are set correctly. Selecting the

Rights button displays a screen showing the Login ID, Location, current login status of the user, the date

and time the user last logged in, as well as user rights and effective account rights. The Rights screen

shows the various accounts the user may access and the access levels of Full, Limited, or Preparer for

each of those accounts. The seven group rights that are granted as part of the group setup process and

Group Membership are also displayed.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 51

Creating Users

16.

Two useful options available to administrators are found on other menus:

l

The Admin > Account Information option shows groups that grant access to specific accounts.

l

The Reports > List Users report also shows users’ rights.

Group Managers

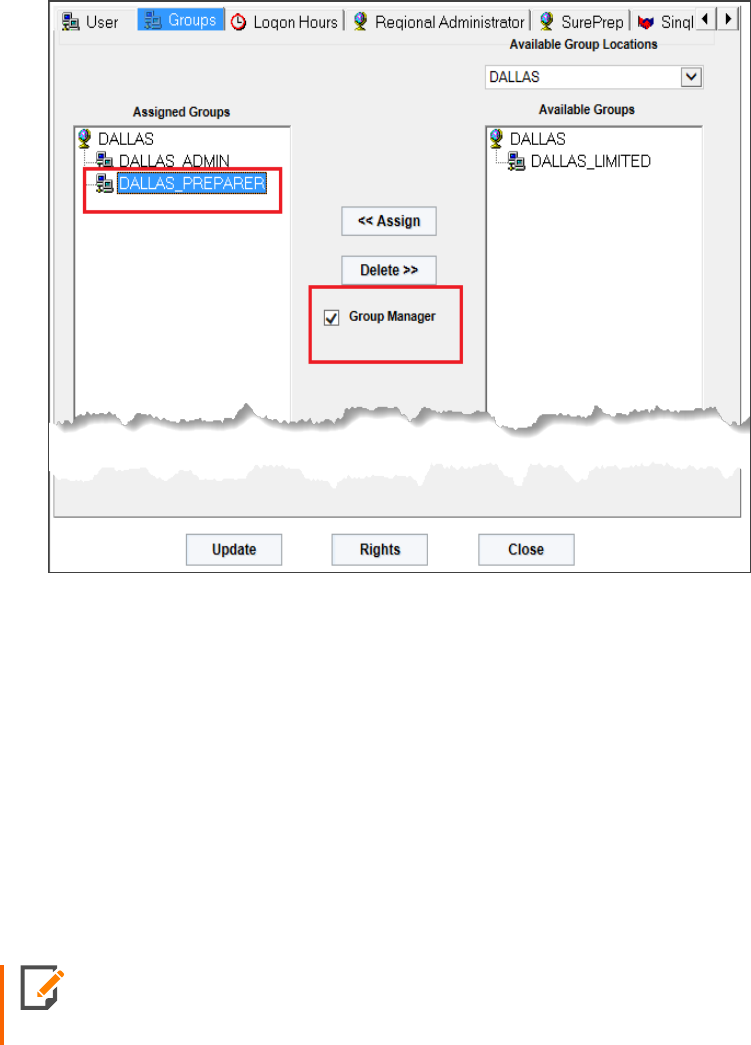

If a user is to be a manager of a user group, the option must be first activated in the Admin > Firm

Configuration > Security Options tab.

Figure 3:13

In Access Control, go to the user who should be a Group Manager. Choose Edit on the User’s Login ID and

proceed to the user’s Groups tab.

1. Make sure the correct Location is displayed and that the correct Available Groups are in the list on the

right.

2.

Highlight the group that JDOE should manage.

3. Check the Group Manager option.

4. When the Available Group (in this case, the DALLAS_PREPARER group) is assigned, the group will

move from the right column to the Assigned Groups column on the left.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

52 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

5.

To show that JDOE is the manager of DALLAS_PREPARER, a plus (+) sign will show in front of DALLAS_

PREPARER group.

Figure 3:14

The Group Manager can:

l Assign or Remove Accounts

l Add or Remove Members.

Regional Administrators

The Regional Administrator role in Access Control is intended to assist the firm administrator in cases

where there are a large number of accounts and/or users that need to be maintained.

Only an administrator logging in with the login ID ADMINISTRATOR can designate a user as a

regional administrator. Once the ADMINISTRATION designates a user as regional administrator,

then that new regional administrator can grant regional administrator status to other users.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 53

Creating Users

To create the regional administrator’s login ID, you must be logged in using login ID Administrator and

Location ***. The Regional Administrator must be created with a location of ***. The login ID should be made a

member of one or more groups, as necessary, to grant access to all accounts within their region. The Regional

Administrator will not be able to grant rights or assign returns in accounts to users if those users do not have

rights to those accounts.

Regional administrators can assign returns from accounts within their region to any Location and Group

throughout the entire firm.

1. Select the Regional Administrator check box shown below.

Figure 3:15

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

54 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

2. Then click the Regional Administrator tab. Assign the necessary locations to the regional administrator.

In this case, JDOE has been made a Regional Administrator for the DALLAS Location.

Figure 3:16

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 55

Creating Users

Assigning Users to Existing Groups

From the Group screen shown below, you can select an existing group to which new users may be added.

1. Select the group, and click Edit.

Figure 3:17

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

56 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

2. Click the Users tab. The following screen appears.

Figure 3:18

The User Location list allows selection of a specific location. The Available Users list box allows selection of

users that currently are not members of the group, including users from other locations. In the example below,

the user BSMITH from Los Angeles can be made a member of the DALLAS_PREPARER group. User-

administrators appear with their login IDs in bold.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 57

Creating Users

Figure 3:19

Assigning users from other locations to a group allows sharing of group rights without requiring the creation of

new groups for these special cases. In this example, user BSMITH in Los Angeles can gain rights to returns in

the Dallas location using this method.

Logon Hours

The tab for Logon Hours enables you to block out times when users would be denied access to the system.

See the screen below for the default settings for 24x7 access.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

58 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

Figure 3:20

This feature could be used if you hire temporaries and you only want them to be able to access the system

when they are physically at your office between 8:00 AM and 6:00 PM. All times are tracked in Greenwich Mean

Time, so you will need to do some time zone calculation translation when using this feature. Both the top and

left borders of the grid act as a toggles for the respective columns and rows. Each of the boxes in the grid can

be toggled between Permit and Deny for that specific hour. Click the word Sunday to deny access on

Sundays.

Click each of the first 13 columns to deny access from 7:00 PM until 7:59 AM Eastern Standard Time. The

screen below shows the appropriate settings to enable access Monday through Friday, from 8:00 AM to 6:00

PM Eastern Standard Time.

Figure 3:21

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 59

Creating Users

Using Limited and Preparer Access

You can restrict what returns a user can see within an account by granting limited or preparer access. If you

have several users requiring access to the same set of returns, use Limited Access. If you want to grant access

to specific returns that a certain user is working with, use Preparer Access.

Both of these access methods require:

l an Account to be assigned as either Limited Access or Preparer Access (not Full), and

l a return to be assigned to either a Group or a Preparer.

LIMITED ACCESS

Suppose you create a group called DALLAS_LIMITED in the Dallas location having full access to account 396D

and Limited Access to account 396F. Users belonging to group DALLAS_LIMITED can see all returns in

account 396F. But members of DALLAS_LIMITED can only see returns if the return(s) in 396D are assigned to

DALLAS_LIMITED [DALLAS].

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

60 Chapter 3: Using Access Control to Manage Groups and Users

Creating Users

Figure 3:22

PREPARER ACCESS

Preparer Access is similar to Limited Access, except that users can only see a return once it is assigned to

them.

Although any of the Group Rights (page 44) may be granted along with Limited or Preparer

access, greater control over returns would be achieved if only the Rollover Without Delete

Rights group right is associated with Limited Access or Preparer Access groups. If the Add

Returns group right is granted without the Assign Returns group right to a Limited Access or

Preparer Access group, users are able to initially assign any new returns they add, but they would

not be able to assign any existing returns that have been assigned to them. If a user forgets to self-

assign a return on the New Return dialog, someone with Assign rights must assign the return to

that user.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 61

Creating Users

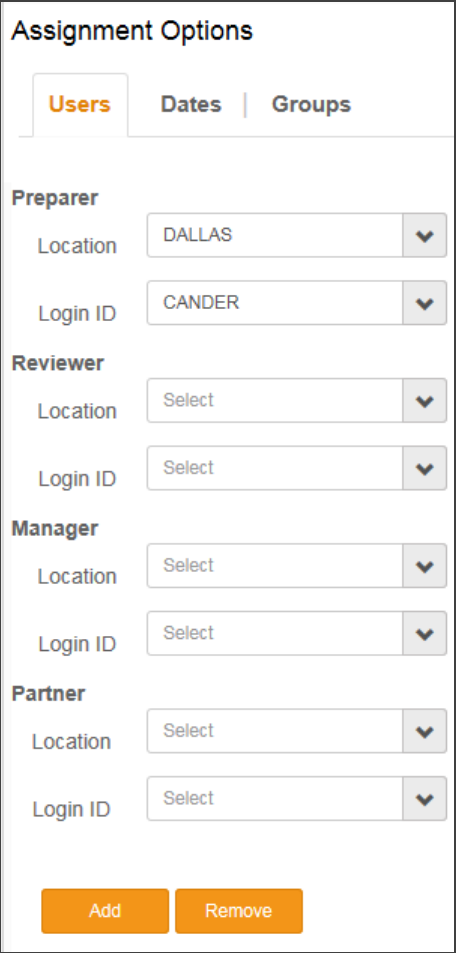

For example, suppose the group called DALLAS_PREPARER in the Dallas location has Preparer Access to

account 396D. A user who is a member of this group cannot see any returns in 396D until the returns are

assigned to that user by populating the Assignment Options > Users tab > Prepare field with that user’s

Location and Login ID as shown below. Click Add at the bottom of the Assignment Options dialog to move

the user’s Login ID to the return’s Preparer column on the left.

Figure 3:23

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

62 Chapter 3: Using Access Control to Manage Groups and Users

Assigning Owners of Tax Defaults

As with Limited access rights, Preparer access is a restricted right. When a user is a member of a

Full (unrestricted) rights group and a Limited (account restricted) group and/or a Preparer (locator

restricted) group within the same account, the least restricted rights control. In this instance the

user will have Full access to all locators within the account.

ASSIGNING OWNERS OF TAX DEFAULTS

Within firms having multiple accounts, the firm administrator may need to assign an owner of the tax defaults for

each account number of the firm. By creating location administrators, you can designate an owner of the tax

defaults for an account to administrators in a given location.

To assign Tax Defaults:

1.

Log in as the firm administrator.

2. Select Admin > Tax Defaults.

3.

The screen shown below appears.

Figure 3:24

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 63

Assigning Returns to a Group or Groups

4. Firm administrators have an Assign button visible on the Tax Defaults screen. After selecting the

account and year, the firm administrator can assign administrators in the designated location as owners of

the tax defaults for account 396D. The following figure shows the assignment screen where you can select

the location.

Figure 3:25

This means that any administrator in the selected location can edit tax defaults for account 396D. All returns

opened in account 396D will use the 396D tax defaults. No nonadministrator user on account 396D may edit the

tax defaults for the account.

This owner designation of the tax defaults for an account gives you control over which administrators can set up

and modify your tax defaults.

ASSIGNING RETURNS TO A GROUP OR GROUPS

Administrators or other users with full access to 396D must select a return or returns to begin assigning the

DALLAS_LIMITED [DALLAS] group and location. To do so:

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

64 Chapter 3: Using Access Control to Manage Groups and Users

Assigning Returns to a Group or Groups

1. In Returns, find a return or returns to be assigned by placing a check mark next to the return. Select More

> Assign Users/Dates.

Figure 3:26

2. On the right accordion Assignment Options section, select the Groups tab. Then select the DALLAS

location in the Locations drop-down options.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 65

Assigning Returns to a Group or Groups

3. Highlight the DALLAS_LIMITED group, and choose Add.

Figure 3:27

4. The Assigned Group will show DALLAS_LIMITED. Click Save Changes.

Figure 3:28

5. Click Returns in the upper left corner to go back to the Returns menu.

6.

As each additional return is assigned to DALLAS_LIMITED using this method, all DALLAS_LIMITED group

users can see and access these additional returns.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

66 Chapter 3: Using Access Control to Manage Groups and Users

Assigning Returns to a Group or Groups

Firms may use Limited Access to prevent users from seeing confidential returns, such as partner

returns. To do so, all preparers should belong to a group having Limited Access. Any new returns

created would have to be assigned to the User Group when created in order to access those

returns.

Assigning Returns to Multiple Group Locations/User Groups

The Administrator now has the ability to assign returns to different group locations and user groups and to

display that information from one hyperlink.

l

Assigning Returns to Group Locations (page 66)

l

Assigning Multiple Returns to a Single Group (page 67)

l

Assigning Returns to More than One Group/Location (page 69)

l

Assigning Returns to Users (page 70)

l

Reviewing Group Locations and User Groups (page 74)

Assigning Returns to Group Locations

Under Returns, select the criteria you wish to use to assign the groups to the correct returns: account, year, tax

type, and so forth. Place a check mark beside each return to assign.

Figure 3:29

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 67

Assigning Returns to a Group or Groups

Assigning Multiple Returns to a Single Group

After placing check marks beside each return to assign, select More > Assign Users/Dates.

Figure 3:30

The following page appears. Select the Groups tab to the right of the screen.

Figure 3:31

Select the Location and Group to assign to these multiple returns. For this example, we will choose group

NEWYORK_PREPARER_NY in Location New York. Choose NEWYORK in the Location drop-down list, and

highlight NEWYORK_PREPARER_NY group. Then click the Add button.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

68 Chapter 3: Using Access Control to Manage Groups and Users

Assigning Returns to a Group or Groups

Figure 3:32

The results will appear on the assigned list to the left. Click Save Changes in the upper right corner of the

Assign Users and Dates returns list. When you have completed your options, go back to the Returns list

page. You can filter your assigned returns by choosing drop-down options in the Assigned Group column.

Figure 3:33

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 69

Assigning Returns to a Group or Groups

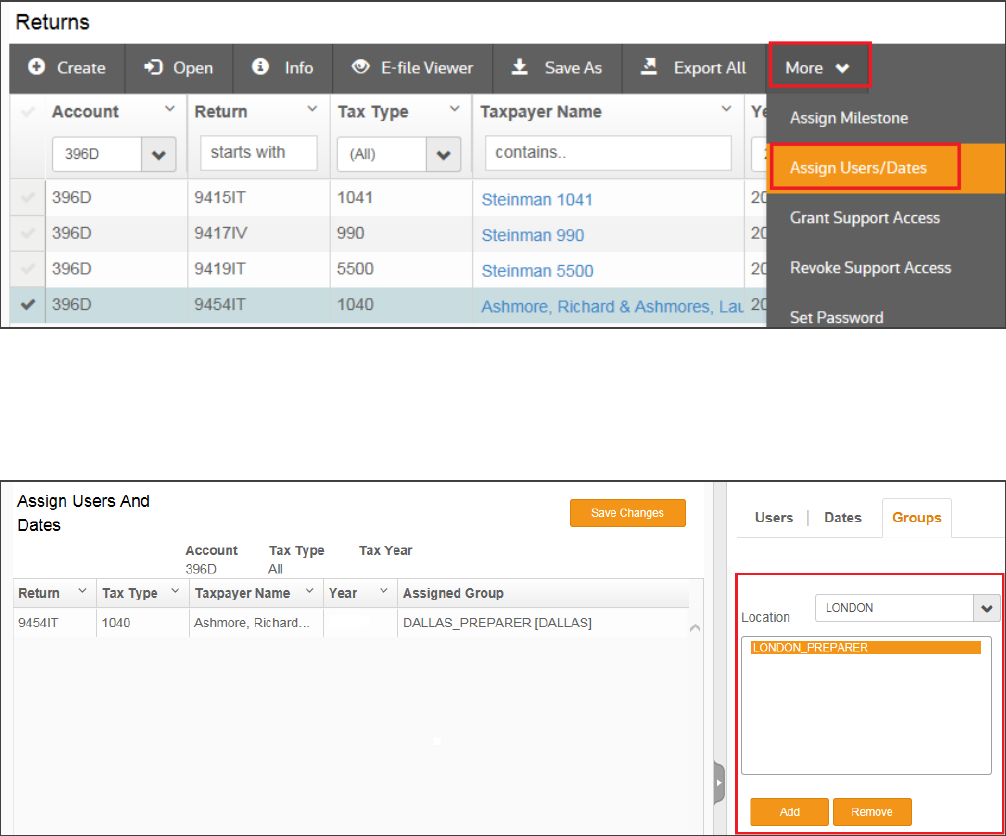

Assigning Returns to More than One Group/Location

The process for assigning more than one Location to returns is the same as assigning one Location to a

return.

1. Place a check mark beside the return(s), and go to More > Assign Users/Dates.

Figure 3:34

2. Go to the Groups tab shown in the column on the right side of the screen. Changing your options and

clicking Add after each selection allows you to assign other Locations and Groups to the listed returns.

Figure 3:35

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

70 Chapter 3: Using Access Control to Manage Groups and Users

Assigning Returns to a Group or Groups

Example: Here are the results of the selected 1040 return after adding Group LONDON_PREPARER in

Location LONDON and Group DALLAS_PREPARER in Location Dallas:

Figure 3:36

Assigning Returns to Users

1. On the Returns list page, place a check mark in the left column of the return(s) you wish to be assigned to

the same user. Open More > Assign Users/Dates.

Figure 3:37

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 71

Assigning Returns to a Group or Groups

2. On the right column of the Assign Users and Dates page are the Assignment Options. Choose the

Users tab.

Figure 3:38

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

72 Chapter 3: Using Access Control to Manage Groups and Users

Assigning Returns to a Group or Groups

3. Open the Location and Login ID for each assignment you want to make and choose the assigned user

from the drop-down list. When you have finished assigning the users to the return(s), click Add.

Figure 3:39

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 73

Assigning Returns to a Group or Groups

4. When the user assignments appear on the left side of the screen, click Save Changes and return to the

Returns list screen.

In order to see the Preparer, Reviewer, Manager, etc. on the Returns List page, you may

need to open the Show/Hide Columns action item and place check marks in the detail

options you want to see on the Returns List page. When you have completed your

choices, click Apply.

Figure 3:40

Here are the results for the assignment made for preparer, reviewer, manager, and partner.

Figure 3:41

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

74 Chapter 3: Using Access Control to Manage Groups and Users

Assigning Returns to a Group or Groups

Reviewing Group Locations and User Groups

1. Select the return you want to review by checking the box next to the return on the Returns screen.

2. Click the Info option above the Returns list.

Figure 3:42

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

Chapter 3: Using Access Control to Manage Groups and Users 75

Assigning Returns to a Group or Groups

3.

The information for the selected return will appear along with the user and group assignments on the

General tab.

Figure 3:43

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

CHAPTER 4: ACCESS CONTROL IMPORTS

Seven (7) different access control imports are available to Administrators who have been granted the Group

Import right:

l

Import New Users (page 77)

l

Import New Groups (page 89)

l

Import Group Accounts (page 91)

l

Import Group - User Assignment (page 93)

l

Import Locator - Group Assignments (page 95)

l

Disable/Enable Logins (page 97)

l

Email Addresses (page 99)

Figure 4:1

GOSYSTEMTAX

RSADMINISTRATOR GUIDE

77 Chapter 4: Access Control Imports

Import New Users

For each of these imports, you must create the import file using an Excel worksheet on an XML file (in the case

of Import New Users).

For all import types except New Users, enter the data for each field in a different column (Field Number 1 in

Column A, Field Number 2 in Column B, Field Number 3 in Column C, etc.). Save the resulting file as a .csv

(column delimited) file prior to import. For numeric account numbers that begin with a leading zero, use a

leading apostrophe to format the account number as text.

For all imports except the Locator – Group Assignment, placeholders are allowed after the first row for

Group Name and Group Location. Fill in Group Name in Column A and Group Location in Column B on

the first row, then leave Columns A and B blank on subsequent rows until a different Group Name or Group

Location is desired. For the Locator – Group Assignment imports, each row or record in the import file

must contain all five of the fields specified in the data format.

IMPORT NEW USERS

Downloading the XML Template Example/Creating a New XML

Template

The format for importing new users into Admin > Access Control Imports > Import New Users is through

an XML template.

You can download the Import New Users XML templates using the Download Template link at the bottom of

the Import New Users screen in the Access Control Imports menu (see the link circled in red below).

CSV template downloads are here also for the other Access Control Import Types.

To download and create the XML templates, do the following steps:

1. Click the Download Template hyperlink.

2.

When prompted, enter a name for your XML file.

3. Make sure the file type is still XML

4. Click Save. Make sure the drive and path is where you want your import XML template to go.

After you save the downloaded template, you can edit your template.

GOSYSTEMTAX

RSADMINISTRATOR GUIDE