User Guide

1

v.05252022

This page is intentionally blank.

2

v.05252022

Contents

What is TouchNet? ..................................................................................................................................... 3

Getting Started ........................................................................................................................................... 3

Request Access to TouchNet ................................................................................................................... 3

Setting up your profile ............................................................................................................................ 4

Logging in and out of TouchNet .............................................................................................................. 7

TouchNet Roles .......................................................................................................................................... 7

Exploring TouchNet by Role ....................................................................................................................... 8

Marketplace Payment Clerk .................................................................................................................... 8

Navigation ........................................................................................................................................... 8

Searching payment transactions ......................................................................................................... 9

Processing a refund ........................................................................................................................... 10

Resending Purchase and Refund notifications .................................................................................. 12

Looking up Customer Information .................................................................................................... 13

Marketplace Accountant ...................................................................................................................... 14

Navigation ......................................................................................................................................... 14

Viewing financial reports .................................................................................................................. 14

Searching payment transactions ....................................................................................................... 16

Payment Gateway Accountant ............................................................................................................ 16

Navigation ......................................................................................................................................... 16

Generating Batch Settlements .......................................................................................................... 17

Viewing Payment Activity ................................................................................................................. 18

Troubleshooting Payment Issues, Investigate Validation Errors ....................................................... 19

Common Payment Processing Errors ................................................................................................ 20

Getting Help ............................................................................................................................................. 20

About this User Guide .............................................................................................................................. 20

3

v.05252022

What is TouchNet?

TouchNet is a global payments company, providing secure and convenient ways to process web-based,

card-not-present payments. It is the University's payment gateway and it's a hosted solution. All

electronic storage, processing, and transmission of cardholder data is NOT on the campus network but is

off premises, taking place at TouchNet, in their data center. Because TouchNet is the University’s online

payment gateway, the Finance CERTIFI Committee

c

an centrally manage procedures, streamline

merchant requests, and provide additional security. All these things help to ensure the University

remains PCI compliant.

Getting Started

Request Access to TouchNet

1. To request TouchNet access, use this link to submit a help request: ServiceNow request for

TouchNet.

Result: You will be taken to the TouchNet/Online Credit Card Payment Support page.

2. Select TouchNet/Online Credit Card Payment Support to request access for new users and

general help. Single Sign-on will prompt you to log in with your Onyen if you are not already

signed in.

4

v.05252022

Note: You can also navigate directly to help.unc.edu and use the search bar to filter TouchNet

resource links, as shown on the next page.

Note: When you submit a request for access, TouchNet support will verify prerequisites (PCI

Training, supervisor approval, SAQ/merchant approval), set up the requested access, then

communicate next steps in an email message to the new user.

Setting up your profile

Once you have received access to TouchNet you’ll complete the following steps to finish setting up your

user profile.

1. You will receive an email with the following information, including a temporary password:

2. Click the link provided in the email.

Result: The TouchNet login screen will display, where you will be prompted to set up an

authentication email address.

You have been set up as a user on the TouchNet system.

url: https://secure.touchnet.com/ucommercecentral

User ID: c21551.ONYEN

Temporary password: Mc62gR$zKz

5

v.05252022

3. Click the Continue button.

4. Enter an authentication email address.

5. Click the Send verification code button.

6. You will be prompted to enter a verification code sent to the email address that you provided.

Check your email for the code. If you do not see the email in your inbox, check your spam or

junk folder.

6

v.05252022

7. Once you have verified an authentication email address you will be prompted to verify an

authentication phone number. Click the Continue button.

8. Enter the phone number you wish to use for authentication purposes. A code will be sent to that

number via text or call depending on the option that you choose.

9. Select the Send Code button to receive the code by text or the Call Me button to receive the

code by phone.

10. You will be prompted to enter the verification code sent phone number that you provided.

11. TouchNet will ask you to reset your password as a first-time user. Enter a new password and

then reenter that same password.

12. Then click the Continue button.

Result: You have now successfully completed new user login for TouchNet.

7

v.05252022

Important: Remember to keep your login credentials in a safe and secure place and do not

share them with others.

Logging in and out of TouchNet

Each time you log in to TouchNet, if it has been more than 24 hours since you last visited the site, you

will be required to re-authenticate using the phone number or email you provided during setup.

Important: Be sure to use the TouchNet URL and only that URL. If you bookmark the URL, edit it to

remove any extra parameters that have been added.

For security, TouchNet is designed to log out idle users quickly.

Best practices for using TouchNet include:

• Have a specific task in mind, log in, complete the task, and log out.

• Don’t forget about your session and let it time out. Use the logout button to logout.

• Only have one session of TouchNet going at a time.

• Clear your cache often and restart the browser. It is best to start with a clean browser session

every time you log in.

Note: Marketplace and Payment Gateway menus can time out at different times.

TouchNet Roles

Users may be granted one or more roles depending on their campus merchant needs. These roles

determine the functionality you’ll have access to within the TouchNet application.

• Marketplace – this role reports at the uPay site level.

• Payment Gateway – this role reports at the merchant level.

Common user roles are described below. Other less common roles are available to central campus

administrators and student services support staff and are intentionally omitted from the guide.

8

v.05252022

• Marketplace Payment Clerk: This role allows the user to search for payment transactions and

process refunds. Payment search results can be helpful for order fulfillment and looking up

customer information (name, address).

• Marketplace Accountant: Users with this role can view and download financial reports. They

can also search transactions but cannot process refunds.

• Payment Gateway Accountant: Users with this role can review all reports for their assigned

campus merchant(s). Common reporting activities are generating batch settlements to support

daily deposit processing, reviewing payment activity for a specific day or date range, and

troubleshooting customer payment issues. Payment Gateway Accountants will typically have

access to ConnectCarolina Finance to submit Daily Deposits. Reasons for having this role are to

generate revenue and settlement reports and to investigate credit card validation errors.

Exploring TouchNet by Role

The following is a brief description about navigation based on user roles. Please note that not all menu

options/features are accessible. This section will highlight the features based on user role.

Marketplace Payment Clerk

Common tasks performed by payment clerk users include:

• Searching for payment transactions.

• Processing refunds.

• Looking up customer information.

Navigation

Follow these steps to access the Marketplace resources:

1. Click the drop-down menu on Applications tab.

2. Select Marketplace from the list.

9

v.05252022

Note: For business offices with multiple sites per TouchNet merchant, you may want to use

Marketplace, which reports on one site at a time.

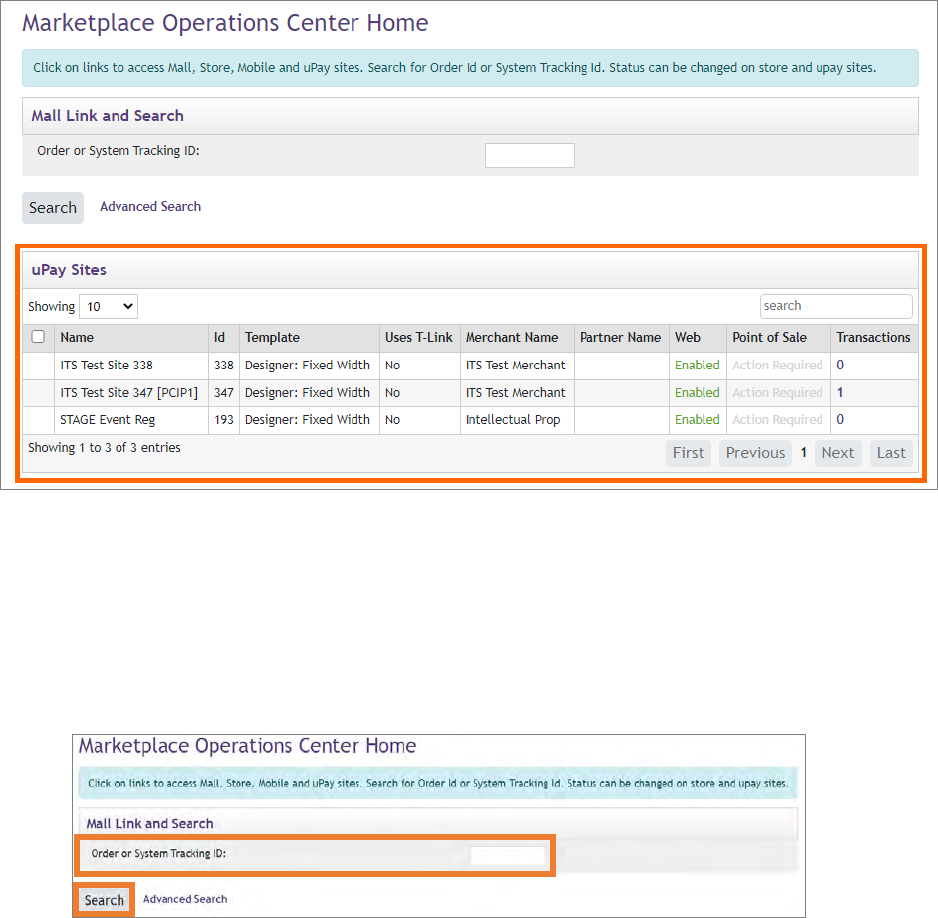

The middle section of the Marketplace home page will show you what sites you have access to. See

example below.

Searching payment transactions

Follow these steps to search for payment transactions:

1. Enter the Order or System Tracking ID.

2. Click the Search button.

Note: If you do not know the Order or System Tracking ID, you can perform an Advanced Search.

Click the Advanced Search link, enter one or more filter values, then click the Run Search

button.

10

v.05252022

Result: The payment search returns records of any payments that fit the search criteria you

entered. To see more detailed information about the payment click the System Tracking ID.

Processing a refund

You can process a refund from the Payment Details page or by using the uPay Refunds option. Follow

these steps to process a refund from the Payment Details page:

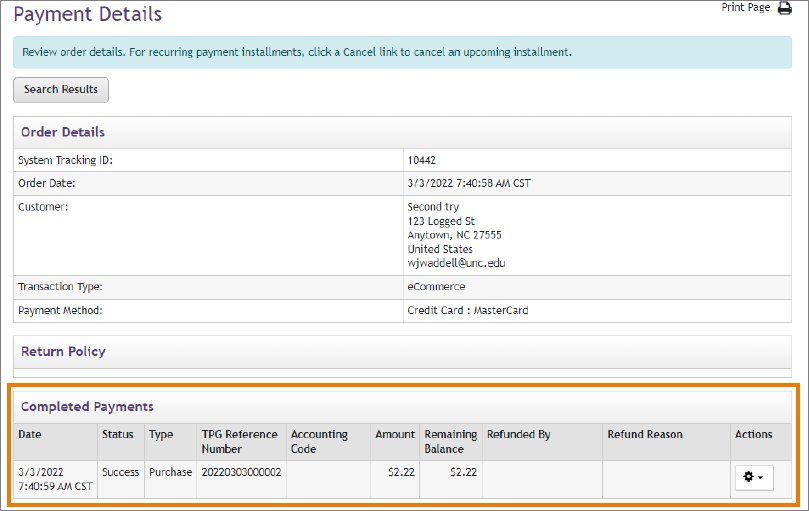

1. After performing a Payment Search and locating the transaction that you need to refund, click

on the System Tracking ID for that transaction to access the Payment Details page.

2. In the Completed Payments section, click on the Action dropdown menu to initiate the refund

process.

Result: You will be redirected to the Refunds page.

3. Enter all or part of the amount in the Refund field.

4. Enter a Refund Reason.

5. Click the Refund link that is in the Action column.

11

v.05252022

Result: If the refund was processed successfully, a "Refund issued" message displays at the top

of the page and the Complete Payments section will display both the Purchase and Return

transactions. Refer to the picture on the following page.

Follow these steps to process a refund using the uPay Refunds option:

1. From the Marketplace Home page, navigate to the Merchant, select Sites, select the uPay Site, then

click on the Refunds option.

2. On the Single Payment Refund tab, search for the payment you wish to refund.

12

v.05252022

3. In the Payment Search Results, locate the payment to refund then click the Refund link that is in the

Action cell for that payment.

4. Enter the refund amount and provide a reason.

5. Click the Refund link to process.

Note: The steps, process, and result are like the first method that was described on the previous

page.

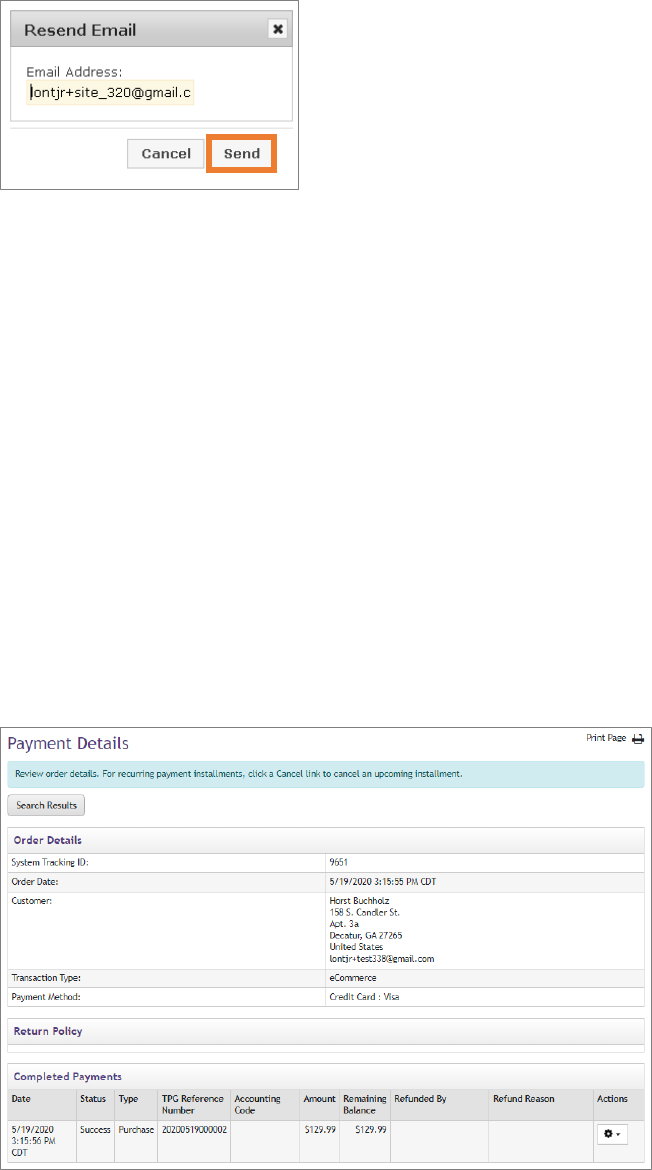

Resending Purchase and Refund notifications

For payments and refunds, your customer receives an email notification. This email is configured to

appear that it is coming from the email address of your uPay Site. Sometimes these notifications are

flagged as spam and may get deleted from the customer’s inbox. You can resend these notifications.

You can also modify the customer’s email address in case it was mistyped when the payment was

processed. Follow these steps to resend a payment or refund email notification:

1. Search for the transaction using the uPay Payment Search option.

2. Click on the System Tracking Id to open the Payment Details page.

3. In the Completed Payments section, click the Actions dropdown menu and select Resend

Purchase Receipt.

Result: The Resend Email prompt appears.

13

v.05252022

4. The Email Address field is prepopulated with the purchaser's email address, or you can enter a

different address.

5. Click the Send button.

Result: The notification is sent, and a success message will display at the top of the page.

Looking up Customer Information

Marketplace Payment Clerks can view details about payment transactions, including customer name and

address information. Follow these steps to view customer information, use the Payment Search option:

1. From the Marketplace Home page, navigate to the Merchant page.

2. Select Sites.

3. Select the uPay Site, then click on the Payment Search option.

4. Enter values in one or more of the search fields and then select the Run Search button.

In the search results list, click on the System Tracking ID link to access customer information for

the transaction.

Result: The Payment Details page appears. Customer information appears in the Order Details

section as shown below.

14

v.05252022

Marketplace Accountant

Common tasks performed by accountant users include:

• Viewing financial reports.

• Accountants can also search payment transactions but cannot process refunds.

Note: For Accountants who also have Payment Gateway access, if your merchant has multiple uPay Sites

you may want to use Marketplace which reports on one site at a time. Payment Gateway reports are at

the merchant level and include all sites for the merchant.

Navigation

Follow these steps to access the Marketplace resource:

1. Click the drop-down menu on Applications tab.

2. Select Marketplace from the list.

Viewing financial reports

The middle section of the Marketplace home page will show you what sites you have access to. Choose

the left side navigation menu to access reports.

The Revenue report provides evidence of the uPay Site deposit:

1. From the navigation menu on the left, choose Marketplace Reports.

2. Select uPay Sites.

3. Choose your site.

4. Select Revenue.

15

v.05252022

Result: The uPay Revenue Report page appears. Report filters are prefilled and will need to be

adjusted.

5. Adjust the settings to the desired date and time values then click View.

Result: The report will display based on your criteria. Click the Export to CSV to download the

report into an Excel file.

16

v.05252022

Searching payment transactions

The Transaction Detail report contains all available transaction information for a date and time range.

1. From the left navigation menu, select Marketplace Reports, then uPay Sites. Choose your site.

2. Select Transaction Details. The Transaction Detail Report page appears.

3. Adjust the settings to the correct date and time values then click View.

Result: The report will display based on your criteria. You can choose to export summary or

details into an Excel file.

Payment Gateway Accountant

Common tasks performed by payment gateway users include:

• Generating batch settlement and payment activity reports.

• Troubleshooting customer payment issues.

Navigation

Follow these steps to access the Payment Gateway resources:

1. Click the Applications tab.

2. From the drop-down menu select Payment Gateway.

Result: The Payment Gateway Home page will appear.

17

v.05252022

Generating Batch Settlements

A Batch Settlement is a type of report that can be useful in preparing daily deposits. Follow these steps

to complete a Batch Settlement in Payment Gateway:

1. Select Reports from the navigation menu on the left.

Result: The Report Selection screen will display.

2. Select Credit Card from the Payment Type options.

3. Select Batch Settlement from the Report options.

4. Click the View button.

Result: The report displays.

Note: You can be liberal with the day and time ranges, as you will only get one line per day.

18

v.05252022

Follow these steps to combine the batch summary and export as an Excel or CSV file:

1. Select Payment Gateway from the navigation menu on the left.

2. Select Reports.

Result: The Report Selection screen will display.

3. Select Credit Card from the Payment Type options.

4. Select Batch Details from the Report options.

5. Choose your date range.

6. In the Export field choose from the dropdown Excel or CSV.

Result: A pop-up window will display offering you the option to Open or Save the file.

Note: Opening in Excel will allow you to configure the report to choose certain batch numbers

and file them as evidence for the deposit.

Viewing Payment Activity

Follow these steps to view the Activity Report:

1. Select Payment Gateway from the navigation menu on the left.

2. Click Reports.

Result: The Report Selection screen will display.

3. Select Credit Card from the Payment Type options.

4. Select Activity from the Report options.

19

v.05252022

5. Choose your date range then click View.

Troubleshooting Payment Issues, Investigate Validation Errors

Credit Card Validation Errors

• The Activity report lists all transactions for your date range. The report includes a return code

value for each transaction, the “TPG Rc” value. A negative return code indicates an error was

returned to TouchNet by the customer’s card issuing bank.

• You can look up return codes and descriptions on this publicly available

website: https://secure.touchnet.net/help/ech/default.htm

.

20

v.05252022

Common Payment Processing Errors

Getting Help

About this User Guide

This guide provides step-by-step instructions on how to perform various functions in the TouchNet

system. If you have questions about the content of this guide, or notice missing or out-of-date

information, please email [email protected].edu

.

Error Code

Description

-1657

Generic failed: card will not be accepted, must go to card issuer

-1698

Generic failed: card will not be accepted, must go to card issuer

-1724

Address verification failed: zip code only is checked

-1741

CVV2 invalid

-1757

Card rejected because of too many failures

-1764

Insufficient funds

-1772

“need verbal auth from merchant”

-1777

Generic failed: card will not be accepted, must go to card issuer