TV Licence Fee Enforcement Review

Presented to the Houses of Parliament pursuant to section 77 of the

Deregulation Act 2015

July 2015

©Crown copyright 2015

We can also provide documents to meet the specific requirements for people with disabilities.

Please email en[email protected].gov.uk

Department for Culture, Media & Sport

Printed in the UK on recycled paper

You may re-use this information (excluding logos) free of charge in any

format or medium, under the terms of the Open Government Licence.

To view this licence, visit http://www.nationalarchives.gov.uk/doc/

open-government-licence/ or e-mail: psi@nationalarchives.gsi.gov.uk.

Where we have identified any third party copyright information you will

need to obtain permission from the copyright holders concerned.

Any enquiries regarding this document should be sent to us at

enquiries@culture.gsi.gov.uk

This document is also available from our website at www.gov.uk/dcms

Print ISBN 9781474122078

Web ISBN 9781474122085

ID 16061503 07/15

TV Licence Fee Enforcement Review

2

Contents

Foreword 3

Executive Summary 5

Chapter 1: Introduction and Background to the Review 9

Chapter 2: Current Law and Enforcement Regime 14

Chapter 3: Consultation Options 22

3a. Option 1 - Retain the Current Criminal Enforcement System 23

3b. Option 2 - Reform of current system 34

3c. Option 3 - Out-of-court settlement 48

3d. Option 4 - Fixed Monetary Penalty 56

3e. Option 5 - Civil Monetary Penalty 64

3f. Option 6 - Civil Debt 71

Chapter 4: Other options for change 76

Chapter 5: Conclusions and Next Steps 79

Annexes

A: Terms of Reference 81

B: Cost-Benefit Analysis 82

C: Jurisdictional Differences 101

D: Summary of Legal Framework 102

E: Analysis of Key Evidence 107

F: Summary of Consultation Process and Responses Received 112

TV Licence Fee Enforcement Review

3

Foreword

In October 2014, I was appointed by the Secretary of State to undertake an independent review of the

enforcement regime for television licence evasion. Under the law as it currently stands, the installation

or use of a television receiver without a licence is an offence under section 363 of the Communications

Act 2003. The offence is punishable by way of a fine up to a maximum of £1000. Concerns about the

operation of the criminal offence have been expressed in Parliament and elsewhere. The importance

attached to these concerns is evidenced by the enactment of section 77 of the Deregulation Act 2015,

which imposed a duty on the Secretary of State to review the criminal enforcement of licence fee

evasion and to consider proposals for reform, including possible decriminalisation.

This is not the first time that this complex issue has received detailed consideration. In his Review of

the Criminal Courts of England and Wales (2001), Sir Robin Auld recommended that the use of a

television without a licence should remain a criminal offence, but that it should be dealt with in the first

instance by a fixed penalty notice, discounted for prompt purchase of a licence and payment of penalty,

and subject to the defendant’s right to dispute guilt in court. This recommendation was considered by

the Home Office and a number of drawbacks to such a fixed penalty scheme were identified (chiefly

that it might lead to an increase in evasion and be costly to implement).

More recently, in February 2015, the House of Commons Select Committee Report ‘Future of the BBC’

criticised the criminal offence as anachronistic and out of proportion with responses to non-payment for

services such as gas, electricity and water, but concluded that decriminalisation was not feasible under

the current system of licence fee collection.

Following a lengthy process of review, during which I have been assisted by a wide range of individuals

and organisations, I have concluded that, in the overall public interest, the current system of criminal

enforcement should be maintained, at least while the method of licence fee collection remains in its

present form. Any significant change to the current system of enforcement, including a move towards

decriminalisation, carries the risk of an increase in evasion and would involve significant cost to the

taxpayer and those who pay the licence fee. While my principal conclusion is that the current system

of criminal deterrence and prosecution should be maintained, I have, where possible, made

suggestions for improvements to be made.

TV Licence Fee Enforcement Review

4

It is significant that this Review has taken place shortly in advance of an in-depth review of the BBC’s

Royal Charter. The Charter Review will look in detail at the BBC’s operations, as well as the mechanism

for collecting the licence fee. I recognise in this report that any change to the method of licence fee

collection is likely to have an impact on the viability of introducing a non-criminal scheme of

enforcement. It is to be hoped that the recommendations and observations made in this report will be

of assistance to those involved in the Charter Review.

During the course of the Review I received unfailingly courteous and encouraging support from officials

in the Department for Culture, Media and Sport. The Review Team comprised Sophie Marment,

Genevieve Mitchell, Dan Lihou, Tessa Gilder-Smith, Vivek Kumar and Lawrence Bird. To each of them

I owe an enormous debt of gratitude.

The views expressed in this Report are my own.

David Perry QC

TV Licence Fee Enforcement Review

5

Executive Summary

A television licence is required to watch live or nearly live broadcast television content on any electronic

device in the United Kingdom. Responsibility for collecting the licence fee lies with the BBC, which

operates under the trading name TV Licensing.

1

Section 363 of the Communications Act 2003 provides that a person who installs or uses a television

receiver without being authorised by a licence is guilty of an offence. The offence is punishable by way

of a fine up to a maximum of £1000.

This report considers whether the sanctions currently in place for TV licence evasion are appropriate

and fair, and whether the regime represents good value for licence fee payers and taxpayers.

The obligation to conduct a review of the sanctions regime is contained in section 77 of the Deregulation

Act 2015. Section 77 was enacted as a result of concerns expressed by Parliamentarians and others

that the criminal nature of the current regime represents a disproportionate response to the problem of

licence fee evasion. Section 77, among other things, requires this Review to “examine proposals for

decriminalisation of offences under section 363”.

The Review’s objectives were identified in the Terms of Reference:

● To examine whether the sanctions for contravening this offence are appropriate, fair,

and whether the regime represents value for money for licence fee payers and

taxpayers.

● To identify and assess options for amending the current enforcement regime, including

those for decriminalisation of TV licensing offences, and whether these options would

represent an improvement, based on a number of key considerations (set out below).

● To make recommendations to the Government by the end of June 2015.

The key considerations were identified as follows:

a. Value for money for licence fee payers and taxpayers in enforcement of the failure to

have a TV licence, including operational, revenue and investment costs of the

enforcement regime to the BBC and to the court system.

b. Fairness for all licence fee payers, and effectiveness in deterring evasion.

c. Proportionality and ease of enforcement.

1

TV Licensing has contracted most of its day-to-day activities to Capita Business Services Ltd (‘Capita’), which

carries out enquiries in relation to licence fee evasion. Collection of the licence fee, by the sale of licences,

takes place by way of over-the-counter services provided by PayPoint plc (‘PayPoint’) in the UK, and by the

Post Office in the Isle of Man and Channel Islands. Marketing and printing services are contracted to Proximity

London Ltd.

TV Licence Fee Enforcement Review

6

d. The degree to which the regime is easy to understand by all.

e. Where appropriate, practical considerations for effective transition from the current

regime to a different one.

The Review was announced on 9 September 2014 and the public consultation document was published

on 12 February 2015. The consultation period ran from 12 February to 1 May 2015. For the purposes

of the public consultation, the Review Team developed six policy options, which ranged from preserving

the current system, to outright decriminalisation with enforcement taking place through a civil (not

criminal) process. This broad range of options ensured that all possibilities for reform were the subject

of consideration during the course of the Review process.

In addition to the consultation process, the Review gathered evidence

2

through interviews with

representatives of the BBC, consumer groups, Government organisations, individuals involved in the

administration of criminal justice, representatives of the devolved nations and the Crown Dependencies

of Jersey, Guernsey and the Isle of Man, as well as other experts.

Following a detailed assessment of the various policy options, and having regard to the key

considerations set out in the Terms of Reference, the Review has concluded that there should be no

fundamental change in the sanctions regime as it applies to the current licence fee collection

system.

The current regime represents a broadly fair and proportionate response to the problem of licence fee

evasion and provides good value for money (both for licence fee payers and taxpayers). The principal

reason for reaching this conclusion is that within the constraints of the current licence fee collection

system, any change would risk undermining the deterrent effect provided by the criminal offences and

would almost certainly add complexity to the enforcement regime, with a corresponding increase in the

burden of cost.

The Culture, Media and Sport Select Committee has also recently concluded that decriminalisation of

licence fee evasion is not feasible, at least not under the present scheme of licence fee collection.

3

The

mechanism by which the licence fee is collected is a matter that will be the subject of further

consideration in the forthcoming review of the BBC’s Royal Charter.

4

On the basis of the evidence available to the Review, it is concluded that many of the concerns

expressed in relation to the criminal offence provide no compelling basis for change. In broad terms,

2

This Review uses the term ‘evidence’ to describe all the information submitted to the consultation and

gathered by the Review Team, rather than in any technical or forensic sense.

3

‘Future of the BBC’, Culture, Media and Sport Select Committee 2015:

http://www.publications.parliament.uk/pa/cm201415/cmselect/cmcumeds/315/315.pdf.

4

The BBC is governed by a Royal Charter, rather than an Act of Parliament, to underline the BBC's

independence. The Charter and accompanying Framework Agreement are drawn up by the Government and,

together, they set out how the corporation should be run, structured and funded and what its purpose should

be. The current Royal Charter came into full effect on 1 January 2007 and expires on 31 December 2016.

Charter Review is the process by which the Government considers all aspects of the operation of the BBC and

may renew the Charter should it choose to do. At the time of writing this report it is expected that the

Government will soon announce details of the Charter Review.

TV Licence Fee Enforcement Review

7

the current enforcement regime is operated fairly and efficiently by TV Licensing and the BBC and it

has proved to be successful in reducing levels of evasion.

That said, there is scope to improve the current system in advance of any changes that might follow

the Charter Review, particularly in relation to the transparency of the prosecution process and the tone

of TV Licensing’s written communications. The recommendations contained in the Review are

designed, among other things, to address some of the criticism levelled at the current system of

enforcement and to improve the fairness and effectiveness of the process of investigation and

prosecution.

5

It is also recommended that TV Licensing explore ways to target unlicensed household visits more

effectively.

6

One matter that emerged from the Review process is that in 2012, 70% of those prosecuted for TV

licence evasion were women.

7

On the evidence available it has not been possible to reach any

definitive conclusion to explain the reason for this gender imbalance. There is no evidence of any

discriminatory enforcement practices on the part of TV Licensing. It is recommended that the gender

disparity in TV licence prosecutions should be the subject of investigation and consideration in the

forthcoming Charter Review.

The Review also considers that the investigation and enforcement process would be more efficient if

cable and satellite companies were required to share their subscription information with TV Licensing

and a recommendation is made to this effect.

8

The Review also received a body of evidence to the effect that payment of the licence fee should be

made easier, in order to assist those on low incomes. This could be achieved by amending the

regulations

9

which govern the BBC’s ability to offer flexible payment plans. The Review agrees with

this view and has made a recommendation to this effect.

10

When, as part of Charter Review, consideration is given to the future method of licence fee collection,

it would be helpful to improve public understanding of the activities covered by the licence and how

the licence fee is spent. As a result of developments in technology, the expression “TV Licence” is a

misnomer. Steps should be taken to address the confusion that currently surrounds the licence fee,

both in terms of the activities it covers and the use to which it is put.

11

In addition, consideration should be given to the question of whether non-linear viewing (such as ‘on-

demand’ or ‘catch-up’ broadcasting services) should be included in the licence fee framework, which

it currently is not.

12

5

See recommendation 7.

6

See recommendation 2.

7

The proportion of fines imposed for failure to hold a TV licence in 2012 by gender was 32% male 68% female -

https://www.gov.uk/government/statistics/criminal-court-statistics-quarterly-july-to-september-2014 (table B4a).

8

See recommendation 5.

9

Communication (Television Licensing) Regulations 2004.

10

See recommendation 4.

11

See recommendation 8.

12

See recommendation 9.

TV Licence Fee Enforcement Review

8

The forthcoming Charter Review is likely to look again at the mechanisms by which the licence fee is

collected. Should there be any change in the method of collection (for example, by way of a household

tax or broadcasting levy, as is the case in Germany), a move to another method of enforcement will

become more practicable and the question of decriminalisation will again fall for consideration.

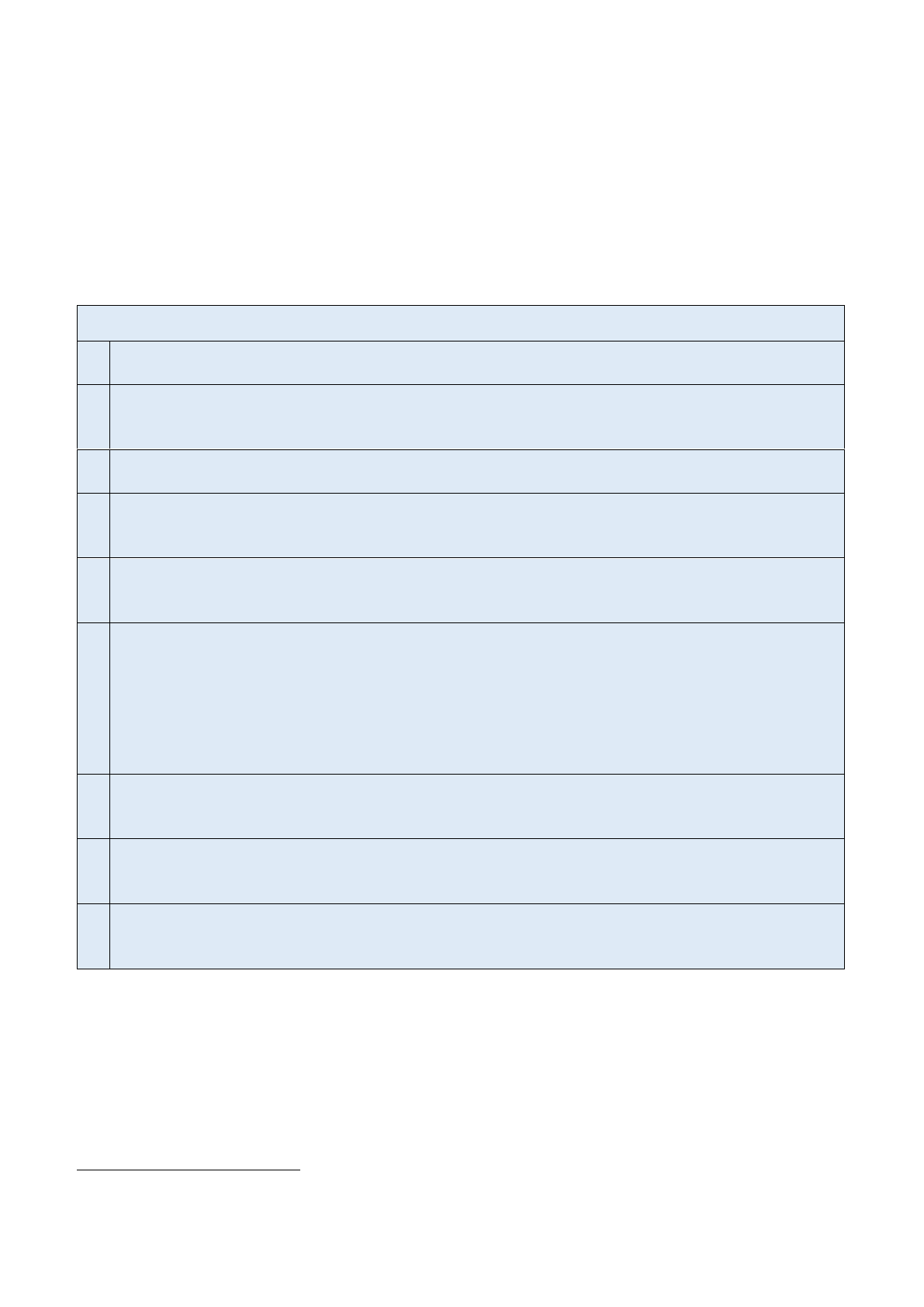

SUMMARY OF RECOMMENDATIONS

1

While the current licence fee collection system is in operation, the current system of

criminal deterrence and prosecution should be maintained.

2

TV Licensing should explore ways to target unlicensed household visits more

effectively, to increase the likelihood of an enquiry officer making contact with

occupiers.

3

The BBC and the Department for Culture, Media and Sport should explore ways to

investigate and consider the gender disparity in TV licence prosecutions.

4

The Department for Culture, Media and Sport, in conjunction with the BBC, should

explore ways of amending the current regulations to allow simple and flexible payment

plans for those facing difficulty in paying the licence fee.

5

Consideration should be given to the introduction of a requirement for cable and

satellite TV companies to share their subscription information with TV Licensing in

order to improve the investigation and enforcement process.

6

TV Licensing should consider increasing the transparency of its prosecution and

enforcement policy, and provide clearer guidance to those at risk of prosecution. This

guidance could take the form of a code detailing the steps that will be taken before

prosecution, including the public interest considerations that will be applied when

deciding whether to prosecute. Any such code should be published and made

available to suspected evaders at the earliest possible opportunity in the enforcement

process.

7

TV Licensing should consider changing the tone and content of its written

communications with households so as to ensure that they are expressed in

reasonable terms and can be easily understood.

8

When considering the structure of licence fee collection as part of the forthcoming

Charter Review, a move towards a simpler system would assist in improving public

understanding of what the licence fee covers.

9

The Charter Review should look at non-linear viewing as a matter of urgency.

Consideration should be given to the inclusion of non-linear viewing within the licence

fee framework.

Next Steps

This report will be presented to Ministers of the Department for Culture, Media and Sport for their

consideration. The Secretary of State will lay the report before both Houses of Parliament and it will be

presented to the BBC Trust. In accordance with section 77 of the Deregulation Act 2015,

13

the Secretary

of State will set out the response and steps to be taken within three months of the Review being

completed.

13

Deregulation Act 2015.

TV Licence Fee Enforcement Review

9

Chapter 1: Introduction and background

to the Review

Introduction

1. This Review was established to consider whether the sanctions currently in place for failure to

hold a TV licence are appropriate and fair, and whether the regime represents good value for

licence fee payers

14

and taxpayers. Under the current law, by reason of section 363 of the

Communications Act 2003, TV licence fee evasion is a criminal offence triable summarily (in

the Magistrates’ Court) and punishable by a fine of up to £1,000.

15

Background

2. The television licence fee was introduced in June 1946 to cover the costs of operation of the

405-line (monochrome analogue television) service. Prior to this, the licence fee covered only

radio services. In 1968, following the introduction of colour transmissions, a colour television

supplement was added to the licence fee. The function of collecting and enforcing the television

licence fee was carried out by the Home Office until 1991, when these responsibilities were

assumed by the BBC. The investigation into and enforcement of the criminal offence is now

carried out by “TV Licensing”. “TV Licensing” is a trading name of the BBC, and includes some

companies contracted by the BBC to administer the collection of television licence fees and

enforcement of the television licensing system.

16

3. The current licence fee is £145.50, for colour, or £49.00 for black and white. Over 25 million

licences are issued each year,

17

generating revenue in 2013/14 of £3.7 billion.

18

4. A licence is required by anyone in the UK who installs or uses a TV receiver. In this context

“use” means viewing live (or nearly live

19

) television broadcasts on any device and derived from

any source, not solely programmes broadcast by the BBC. The licence fee is paid to the BBC

and the revenue derived from the sale of licences is used largely to fund the BBC’s television,

radio and online services, although it also provides funding for other services such as the Welsh

14

In this report, as in the BBC’s Royal Charter, a reference to a “licence fee payer” is not to be taken literally but

includes, not only a person to whom a TV licence is issued under section 364 of the Communications Act 2003,

but also (so far as is sensible in the context) any other person in the UK who watches, listens to or uses any

BBC service, or may do so or wish to do so in the future.

15

Section 363 is set out in full at Annex D.

16

The BBC is a public authority in respect of its television licensing functions and retains overall responsibility

for these activities.

17

2013/14: 25,419,296 (http://www.tvlicensing.co.uk/about/foi-licences-facts-and-figures-AB18).

18

BBC Annual Report and Accounts 2013/14: http://www.bbc.co.uk/annualreport/2014/home.

19

This includes watching live TV broadcasts on a delay, but does not include ‘on demand’ services:

http://www.tvlicensing.co.uk/check-if-you-need-one/topics/technology--devices-and-online-top8.

TV Licence Fee Enforcement Review

10

broadcaster S4C, the nationwide digital switchover and infrastructure projects such as the

delivery of superfast broadband.

20

The TV licence fee can be paid by way of an annual one-off

payment or by quarterly, monthly, or weekly instalments, and there are various payment

methods available to customers.

21

TV Licensing takes active steps to contact unlicensed

households to ensure that individuals are aware of the obligation to hold a licence and also the

options available for payment.

5. In 2013, there were 178,332 prosecutions for failure to hold a TV licence.

22

This represented

approximately 11.5% of all defendants proceeded against before the Magistrates' Court.

23

While

this is a significant number, it appears that the cases account for only a minute fraction of court

time (0.3% on the figures available).

24

6. These cases resulted in 153,369 convictions, which equates to a conviction rate of 86%.

25

The

most common sentence for the offence is a fine, although some cases are dealt with by way of

a conditional or absolute discharge. Very few people actually appear at court as the vast majority

of defendants make a written plea of guilty, which is permitted by the Magistrates’ Court Act

1980.

26

In some instances cases are withdrawn if the evader purchases a licence.

Motivation for Review

7. A duty was placed on the Secretary of State for Culture, Media and Sport to carry out a review

of the sanctions appropriate for the contravention of section 363 of the Communications Act

2003, by section 77 of the Deregulation Act 2015. One of the issues raised during Parliamentary

debates on the Deregulation Bill was a concern that the criminal nature of the current regime is

not a proportionate response to the problem of licence fee evasion. In particular, it was

suggested that the availability of a criminal prosecution, with a financial penalty on conviction,

and the possibility of imprisonment in default of payment, was not comparable to the sanctions

for non-payment of utility service bills, such as water, gas and electricity.

27

Concerns were also

expressed regarding the fairness of the current enforcement regime as applied to some social

20

BBC Annual Report and Accounts 2013/14: http://www.bbc.co.uk/annualreport/2014/home.

21

Payment options include direct debit, credit and debit cards, cheques and postal orders, cash (via Paypoint)

and TV Licence payment cards. The payment options are prescribed in regulations (Communications

Regulations (TV Licensing) 2004).

22

https://www.gov.uk/government/statistics/criminal-justice-statistics-quarterly-december-2013 “Outcomes by

offence”.

23

https://www.gov.uk/government/statistics/criminal-court-statistics-quarterly-july-to-september-2014 shows

1,546,140 Magistrates’ Court cases in 2013. 178,332 of 1,546,140 = 11.5%.

24

Figures provided to the BBC by the Department of Constitutional Affairs in 2005. No more recent figures are

available as this information is not gathered by the Ministry of Justice.

25

“Offences by outcome”, as above. 153,369 of 178,332 = 86%.

26

Magistrates’ Court Act 1980, Section 12(4).

27

However it is to be noted that, unlike these services, TV Licensing is not able to disconnect a non-payer’s

supply or monitor TV usage by way of a pre-payment meter, and so does not have the means with which to

encourage payment before resorting to the court process.

TV Licence Fee Enforcement Review

11

groups, in particular women (who form the majority of defendants in prosecutions for licence

evasion) and those on low incomes.

28

8. The Review’s Terms of Reference also required consideration to be given to the question of

whether improvements could be made to the efficiency of the current system of investigation

and prosecution. It has been suggested in some quarters that savings in time and money could

be achieved by effecting a less radical change than decriminalisation. For example, some have

advocated the adoption of a system similar to the one operated in Scotland, where a fiscal fines

system is operated by the Procurator Fiscal for a range of summary offences including cases

of TV licence evasion.

29

9. Set against these concerns, the BBC has argued that the current enforcement regime is

designed to provide, and does in fact provide, an effective deterrent to evasion and the

existence of the criminal offence has ensured a low rate of evasion at around 5% for the past

five years.

10. The Review has sought to analyse the merits of these competing arguments. This analysis has

been conducted on the basis of the evidence provided to the Review by a number of interest

groups and individuals and in accordance with the key considerations set out in the Review’s

Terms of Reference.

30

11. The House of Commons Culture, Media and Sport Committee has also recently published a

detailed report on the future of the BBC. The Committee’s report includes a valuable discussion

of the future of the licence fee and the issue of decriminalisation. The Committee accepted that

decriminalisation was not a feasible option under the current system of licence fee collection.

Certain observations made by the Committee, relevant to this Review, are addressed in Chapter

4.

Charter Review

12. One highly influential factor behind this Review’s principal recommendation that the sanctions

regime should not be the subject of any significant change is the forthcoming review of the

BBC’s Royal Charter. The close proximity of the Charter Review has obvious implications for

the long-term viability of any changes to the sanctions regime: the Charter Review will involve

an in-depth exploration of the BBC’s operations, and this will involve a review of the BBC’s

funding, including both the mechanism for collecting the licence fee and the process of

enforcement. Any reform of the current regime (such as a move to decriminalisation) carries the

risk of becoming outdated as a result of further reform. If changes are to be made to the BBC’s

funding model, the scheme of enforcement will fall for reconsideration and the case for reform

may become stronger.

28

BBC evidence to the Review. In 2014, 70% of those prosecuted for TV licence fee evasion were women.

29

This fiscal fines system operates as an alternative to prosecution in the sense that, whilst the fiscal fines

system does not alter the criminal nature of the offence, it provides for an out-of-court disposal by way of

financial penalty; this reduces the number of cases coming before the criminal courts. However, the typical

settlement is £75, around half the cost of buying an annual licence. The viability of adopting this option, among

others, has been explored in the course of the Review.

30

The key considerations are set out above at page 4.

TV Licence Fee Enforcement Review

12

Review Methodology

13. The Review Team developed six policy options for the purposes of public consultation. These

options were intended to provide the widest possible scope for potential reform. They ranged

from retaining the criminal offence to outright decriminalisation with the civil courts as opposed

to the criminal courts being used to collect unpaid licence fees.

14. The consultation document was published on 12 February 2015, and by the end of the

consultation period, 1 May 2015, responses had been received from members of the public and

a number of organisations.

31

15. In addition to the consultation process, the Review held a number of meetings with the BBC,

consumer groups, Government organisations, individuals involved in the administration of

criminal justice, representatives from the devolved nations, the Crown Dependencies of Jersey,

Guernsey and the Isle of Man, as well as others including experts in the field of broadcasting.

32

,

33

16. The views expressed by those who participated in the Review represented a broad range of

opinion and the key points to emerge from the evidence are considered in the discussion of the

six options in Chapter 3.

17. It was envisaged at the time of consultation process that the Review would have the benefit of

a behavioural research paper, addressing the impact that decriminalisation would have on the

level of evasion. As things transpired, this proved to be impracticable and, in the absence of its

own behavioural research, a behavioural analysis survey conducted by Harris Interactive

(commissioned by the BBC) was provided to the Review Team. This survey found that the

existence of the criminal offence is in itself a strong factor in deterring evasion. It also found that

the criminal penalties, such as the risk of prosecution or imprisonment, provide the most

effective deterrent to evasion, after a large fine or monetary penalty (in the region of £1000;

significantly higher than the current average fines). The survey further predicted that evasion

rates would rise significantly under a civil model of enforcement. The Review Team conducted

a quality assurance review of the survey and concluded that it was reliable.

34

18. As this Review has been conducted by an independent reviewer, it was not necessary to carry

out an Impact Assessment in advance of the consultation. Notwithstanding the independent

nature of the Review, a limited assessment of the impact of the various options is set out at

31

Details can be found at Annex F.

32

Details can be found at Annex F.

33

It is important to note that this Review took place over the course of the 2015 general election. The roles of a

number of individuals involved in the Review have changed as a result of the election. Most pertinently John

Whittingdale MP was interviewed in his capacity as Chair of the House of Commons Culture, Media and Sport

Select Committee, but is now the Secretary of State for Culture, Media and Sport and will be receiving this

report. There have also been changes to the Ministerial teams of other Departments which provided evidence to

this Review, such as the Ministry of Justice.

34

This quality assurance review is set out in Annex E of this report together with a review of existing literature

on the behavioural impacts of changes in enforcement.

TV Licence Fee Enforcement Review

13

Annex B. It will be the responsibility of the Department for Culture, Media and Sport to consider

the impact of the recommendations contained in this Report, should the Secretary of State

choose to accept any or all of them.

TV Licence Fee Enforcement Review

14

Chapter 2: Current Law and

Enforcement Regime

35

www.tvlicensing.co.uk.

36

http://www.tvlicensing.co.uk/check-if-you-need-one/topics/technology--devices-and-online-top8.

37

Regulation 9(3) of the Communications (Television Licensing) Regulations 2004 provides that “receiving a

television programme service includes a reference to receiving by any means any programme included in that

service, where that programme is received at the same time (or virtually the same time) as it is received by

members of the public by virtue of its being broadcast or distributed as part of that service”.

38

Section 363 of the Communications Act 2003.

39

The Legal Aid, Sentencing and Punishment of Offenders Act 2012 contains a power to increase the

maximum fine level for offences in this band from £1000 to £4000. In the previous Parliament, the Coalition

Government (2010-2015) did not increase the fine level, but this could of course be a matter which a

Government may seek to change.

What is a TV Licence?

A TV licence is a legal permission to install or use television receiving equipment (such as

televisions, computers, laptops, tablets, mobile phones, games consoles, digital boxes and

DVD/VHS recorders) to watch or record television programmes as they are being broadcast. This

applies regardless of which television channels a person receives or how those channels are

received. The licence fee is not a payment for BBC services (or any other television service),

although licence fee revenue is used to fund the BBC along with other services, such as the

delivery of superfast broadband.

35

Who Needs a TV Licence?

Everyone in the UK who installs a television receiver or watches or records a TV programme as it

is broadcast needs to be covered by a TV licence, regardless of the device used to receive the

broadcast.

A single TV licence covers all devices used at a single site, whether home or business (and, for the

most part, portable devices used away from that site).

36

There are different rules for businesses

with multiple premises, or properties such as hotels.

The watching of non-linear broadcasting does not require a TV licence. Non-linear broadcasting is

television programming shown at a different time than when it is broadcast, and includes ‘on

demand’ programming, catch-up television, streaming or downloading programmes after they have

been broadcast on live television, and programmes available online before being broadcast on

television.

37

A person who installs or uses television-receiving equipment without a TV licence is guilty of a

criminal offence under the Communications Act 2003 and is liable to a level 3 fine

38

(currently a

maximum of £1000

39

).

TV Licence Fee Enforcement Review

15

Current Framework

19. The cost of a colour TV licence is £145.50 and the cost of a black and white licence is £49.00.

Concessions are available for blind people, those aged 75 and over, and those living in

qualifying residential care accommodation. The level of the television licence fee, the available

concessions and various payment methods are set out in regulations, principally the

Communication (Television Licensing) Regulations 2004 (as amended).

40

20. The process by which the Government sets the level of the licence fee is known as the licence

fee settlement. The Government consults the BBC over its costs and expenditure, and then

determines the licence amount. The last licence fee settlement was in 2010, at which time the

licence fee was frozen at its current level until 31 March 2017.

21. The licence fee is paid by an individual to TV Licensing, which transfers the sums received into

the Consolidated Fund.

41

The BBC receives its funding in the form of a grant from the

Department for Culture, Media and Sport in an amount equal to the revenue derived from the

TV licence fee, less any administrative costs.

42

22. The BBC uses its grant to fund nine television channels and 57 radio stations; it also provides

a number of other services such as BBC Online and iPlayer. Under the 2010 licence fee

settlement, the BBC assumed a number of additional responsibilities, including an obligation to

provide funding to the BBC World Service and the Welsh public service broadcaster S4C.

43

In

addition, the 2010 settlement provided for an annual payment from licence fee revenue

specifically for the development of superfast broadband. This annual payment of £150m is paid

to Broadband Delivery UK.

44

23. Licence fee collection is managed by the BBC Executive Board,

45

while responsibility for

overseeing the licence fee collection arrangements, and ensuring these are efficient,

appropriate and proportionate, is vested in the BBC Trust.

46

The Trust’s responsibility was first

40

A full list of the amending regulations can be found at Annex D.

41

Section 365 of the Communications Act 2003. The Consolidated Fund is a fund into which all public revenue

is paid and which provides the supply for all public services. The basis of the financial mechanism by which the

Consolidated Fund is operated is governed by the Exchequer and Audit Departments Act 1866 and it is

administered by the Treasury.

42

The BBC receives grant-in-aid from DCMS equal to the revenue from the TV licence fee (less the

Department’s expenses in administering the licensing system - see clause 75 of the BBC Framework

Agreement of 30 June 2006).

43

The detail of how the BBC must carry out these obligations is set out in the BBC Framework Agreement:

http://downloads.bbc.co.uk/bbctrust/assets/files/pdf/about/how_we_govern/agreement_amend_sep11_sum.pdf.

44

Broadband roll-out and use agreement (16 July 2012) between BBC Trust and DCMS -

http://downloads.bbc.co.uk/bbctrust/assets/files/pdf/our_work/local_television/broadband_agreement.pdf.

45

The ‘BBC Executive’ refers to the Executive Board of the BBC, made up of the organisation’s Directors and

responsible for the operational management of the BBC.

46

The ‘BBC Trust’ is the governing body of the BBC. It sets the strategic objectives for the BBC Executive and

monitors its performance.

TV Licence Fee Enforcement Review

16

set out in the 2006 Royal Charter and, under the terms of the Charter, the Trust is required to

ensure that the arrangements for the collection of the licence fee by the BBC Executive are

efficient, appropriate and proportionate.

47

In order to fulfil this function, the Trust committed to

regularly review the BBC Executive’s licence fee collection strategy, as part of the BBC’s annual

report and accounts.

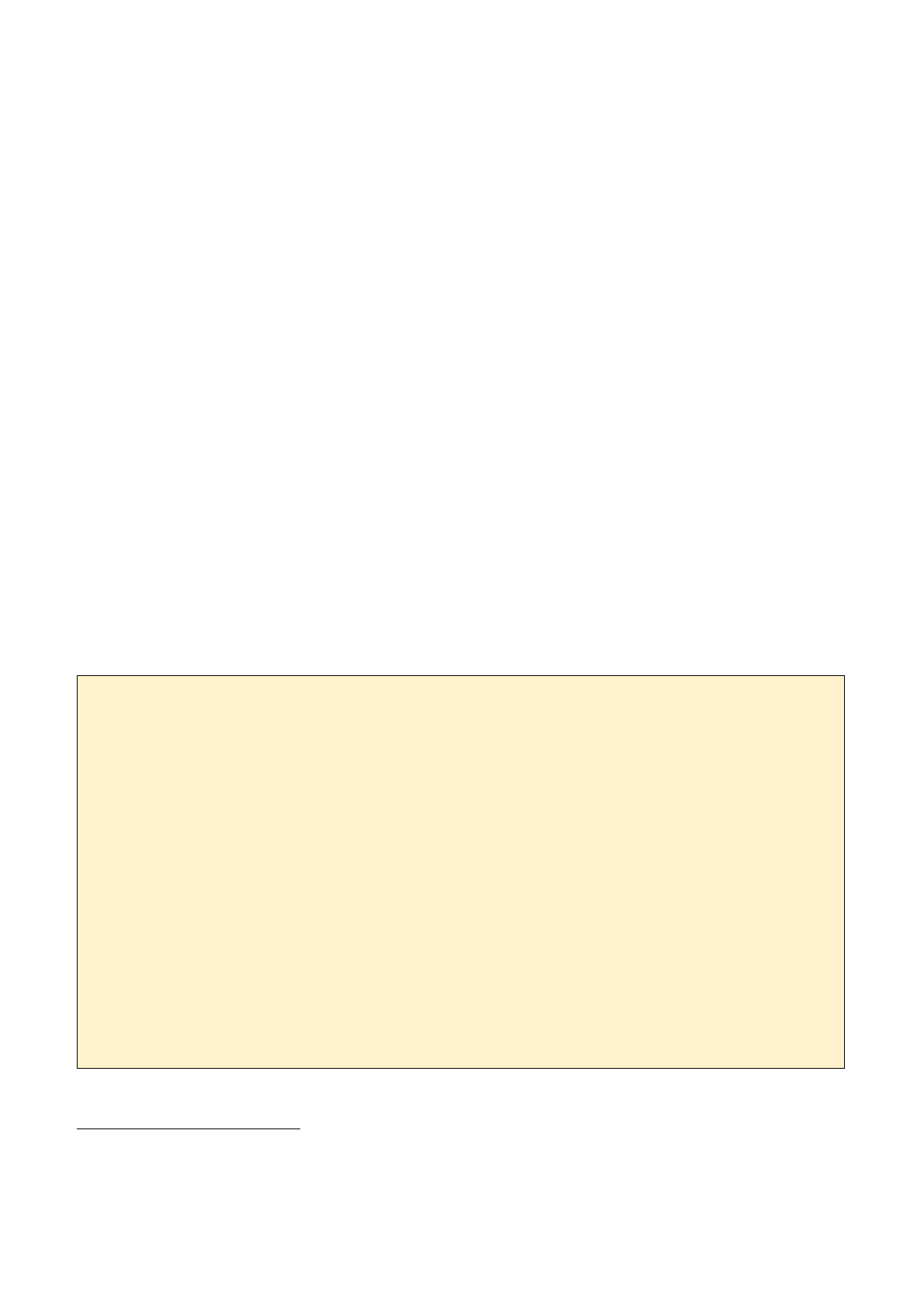

What does the licence fee pay for?

BBC services:

57 radio stations

9 television channels

BBC Online, iPlayer & Red Button

BBC World Service

BBC Monitoring

Non-BBC services:

Funding for S4C

Funding for Broadband and local TV

The BBC Executive must maintain value for

money and secure the finances intended to fund

BBC services for the public at large. The BBC’s

collection strategy needs to be designed to

help people pay for their licence by ensuring

the system is as customer focused as possible.

At the same time it must ensure that it fulfils its

responsibility to the vast majority of

households who pay their licence fee, by

vigorously pursuing those that deliberately

evade payment.

- BBC Trust Review of TV Licence Fee Collection 2009

24. Until June 2013,

48

retailers who sold or rented television receiving devices or equipment were

required to record the name and address of the purchaser or hirer and pass on these details to

TV Licensing. A failure to comply with this requirement was a criminal offence.

49

This information

was used by TV Licensing to target potentially unlicensed usage and was sometimes used as

evidence in criminal prosecutions.

50

Current Enforcement Regime

Investigation

25. The investigation into and enforcement of the TV licence offence is carried out by TV Licensing,

which in turn has a contract with Capita Business Services Ltd (‘Capita’). Capita carries out the

day-to-day operational enforcement activities through its enquiry officers.

47

The BBC Trust has a specific duty under the BBC’s Royal Charter 2006 (Article 24(2)(m)) to ensure that the

arrangements for the collection of the licence fee by the BBC Executive are efficient, appropriate and

proportionate.

48

This requirement was removed by the Enterprise and Regulatory Reform Act 2013, as the Coalition

Government concluded that it “placed an undue administrative burden on retailers.”

49

Section 5 of the Wireless Telegraphy Act 1967 (now repealed).

50

BBC Trust Review of TV Licence Fee Collection 2009: Dealer notifications in 2007/08 resulted in 299,000

licences being sold and 61,000 change of address notifications.

TV Licence Fee Enforcement Review

17

26. Proof of the offence requires evidence that a person has contravened the prohibition in section

363 of the Communications Act 2003, and this is usually obtained during the course of an

investigation conducted by an enquiry officer: either by the officer witnessing the commission of

an offence or by way of an admission made to the officer by an individual.

27. In order to assist its investigations, TV Licensing has compiled a database of unlicensed

addresses. These addresses are the primary target of investigations. Where a TV licence is not

required at a particular address (because no individual within a household has installed or uses

a device to watch live television), the householder may inform TV Licensing of that fact by

submitting a ‘no licence needed’ declaration. This declaration will remove the household from

the list of addresses to be contacted for a period of two years.

51

28. The process of investigation usually involves a number of contacts with an unlicensed

household, initially by letter, followed by a telephone call or visit from an enquiry officer, to

confirm whether or not a licence is required at the particular premises.

29. The primary purpose of household visits is to ensure compliance with the law, and “enable TV

Licensing to remove premises which do not require a TV licence from their enquiries, thus

allowing resources to be concentrated on those [which do]”.

52

30. All household enquiries are undertaken in accordance with TV Licensing’s standards of conduct,

and (in England and Wales) having regard (where relevant) to the Police and Criminal Evidence

Act 1984 and its Codes of Practice.

53

The procedure to be followed by enquiry officers is set out

in Capita’s TV Licensing Visiting Procedures Manual.

54

31. The Visiting Procedures Manual sets out in some detail the procedures for household visits, the

appropriate means of gathering evidence and the appropriate means of communicating with

those in residence. During an enquiry visit, the officers must first establish whether or not they

are speaking to an appropriate person (an adult who normally resides at the address). Officers

are required to introduce themselves and explain the purpose of their visit using an established

identification and verification policy. The Visiting Procedures Manual prescribes a strict process

for the conduct of enquiries, including the information that must be given to or that may be

requested from the ‘customer’. There is also a clear requirement to “treat each visit confidentially

and to make the enquiry without causing offence.”

55

32. The enquiry officer can request permission to enter the premises in order to establish whether

TV receiving equipment is present or in use; they cannot enter unless permission is given and

must leave immediately if this permission is withdrawn.

56

The officer is provided with a standard

51

Although visits may be made to confirm the veracity of the declaration.

52

http://www.tvlicensing.co.uk/about/foi-administering-the-licence-fee-AB20.

53

In other jurisdictions, investigations are carried out in accordance with the requirements of local law.

54

Capita TV Licensing England & Wales Visiting Procedures, 2014.

55

Capita TV Licensing England & Wales Visiting Procedures, 2014.

56

Capita TV Licensing England & Wales Visiting Procedures, 2014.

TV Licence Fee Enforcement Review

18

form which is used to record the details of the visit. This form is retained by the officer (and a

copy provided to the customer) for subsequent enforcement purposes and for possible later use

in court, should it become necessary. At the conclusion of the visit the appropriate person is

invited to sign the form to indicate agreement with any recorded statement of facts. As soon as

there are reasonable grounds for suspecting that the person in question has committed an

offence the officer must administer a caution.

57

33. In certain limited circumstances, a search warrant may be issued by a Magistrates’ Court to

authorise access to a property.

58

Such a warrant is only available where there are reasonable

grounds for believing that an offence has been committed and where TV Licensing is able to

satisfy the court that it has no alternative means to obtain relevant evidence. TV Licensing must

also demonstrate that it has exhausted all reasonable means to gain the cooperation of the

occupant and that access will not otherwise be granted to the relevant premises.

59

A search

warrant authorises a single entry and search of the premises within one month of the warrant

being issued.

34. The search will usually be carried out by two enquiry officers, supported by a police officer.

60

The officers are empowered to examine electronic devices to establish whether or not they are

capable of receiving television broadcasts. Capita’s policy is that a search must cease once

sufficient evidence has been gathered.

61

Prosecution

35. Where evidence is obtained of the commission of an offence, TV Licensing will usually

encourage compliance with the law before embarking on a prosecution. According to the BBC,

its primary concern, at least in the case of first-time offenders, is to ensure compliance with the

obligation to obtain a licence, and prosecution is a matter of last resort. Thus, subject to any

other relevant considerations, where a householder agrees to purchase a licence, it is likely that

no further enforcement action will be undertaken.

62

36. Criminal prosecutions are brought only if the evidence is of sufficient quality to meet the

evidential test set out in the Code for Crown Prosecutors (that is, where the evidence is sufficient

to provide a realistic prospect of conviction). Once the evidential test is satisfied, TV Licensing

applies the public interest test, namely whether it is in the public interest to prosecute. The public

interest test involves weighing factors both for and against prosecution, and taking into account

all relevant circumstances.

57

The caution refers to the officer informing the individual that they do not have to say anything, but it may harm

their defence if they do not mention when questioned something which they later rely on in court and that

anything they do say may be given in evidence.

58

Section 366 of the Communications Act 2003.

59

Section 366 of the Communications Act 2003.

60

The BBC advises that this is not a statutory requirement but is TV Licensing’s preferred policy. On very rare

occasions a search may go ahead without a police officer, if none is available.

61

Capita TV Licensing England & Wales Visiting Procedures, 2014.

62

BBC consultation response.

TV Licence Fee Enforcement Review

19

37. As a ‘summary only’ offence, prosecutions for TV licence payment evasion are brought in the

Magistrates’ Court. TV Licensing acts as the prosecuting authority and is responsible for

presenting the case in court.

38. In 2013, in England and Wales there were 178,322 prosecutions for the evasion offence and

153,369 people were convicted.

63

Of these, 152,664 were fined.

64

It is important to note that the

offence is not punishable by way of imprisonment: the maximum penalty is currently a fine

not exceeding £1,000.

65

Despite the large number of cases, prosecutions take up only 0.3% of

court time. Many defendants plead guilty by post and prosecutions are usually listed at a single

sitting devoted exclusively to hearing such cases. The Magistrates’ Court Sentencing

Guidelines

66

set out common aggravating and mitigating factors and a basis for assessing the

level of any fine. The average level of the fine imposed for licence evasion in England and Wales

is £170.

67

According to figures provided by the Ministry of Justice, 70% of those prosecuted are

female.

39. The TV licence offence is not a “recordable offence” so those found guilty do not receive a

centrally-recorded criminal record.

40. Non-payment of a fine may ultimately result in the court ordering a period of imprisonment in

default of payment, however a period of imprisonment may only be imposed as a measure

of last resort, where there is a wilful refusal or culpable neglect on the part of the

offender

68

, and where all other enforcement methods have been tried or at least

considered.

69

The use of imprisonment in the case of unpaid fines is designed to enforce the

Magistrates’ Courts’ order and is not a punitive measure imposed in respect of the evasion

offence.

41. In 2013, 32 people were imprisoned for non-payment of a fine imposed following conviction for

TV licence evasion.

70

63

https://www.gov.uk/government/statistics/criminal-justice-statistics-quarterly-december-2013 “Outcomes by

offence”.

64

“Outcomes by offence”, as above. 86% of the cases brought to court result in a conviction. 99.5% of those

convicted are fined and the vast majority of the remainder are dealt with by way of a conditional or absolute

discharge.

65

Section 363 of the Communications Act 2003.

66

When sentencing offences committed after 6 April 2010, every court is under a statutory obligation to follow

any relevant Sentencing Council guidelines unless it would be contrary to the interests of justice to do so. In this

case, the Sentencing Guidelines Council’s ‘Magistrates' Court Sentencing Guidelines’ (updated October 2014).

67

Ministry of Justice consultation response (2013 figures).

68

Magistrates' Court Act 1980 sections 75 to 91.

69

This is explained in more detail in Annex D.

70

The statistics in relation to those imprisoned for wilful refusal or culpable neglect to pay the fine do not give

any indication whether the defendants in the cases in which imprisonment was ordered were also imprisoned

for other matters or had other outstanding fines. This is addressed in our consideration of Option 1.

TV Licence Fee Enforcement Review

20

Recent Procedural Reforms

42. The Criminal Justice and Courts Act 2015 provides a new single justice procedure

71

which aims

to ensure that the Magistrates’ Court is able to deal more effectively with straightforward,

uncontested cases. This procedure offers an alternative form of proceedings by which cases

will be brought before the court at the earliest opportunity and dealt with on the papers by a

single justice.

72

In other words, the cases are not heard in open court with the result that court

time is saved.

43. The same legislation also introduced a ‘criminal courts charge’, that is a charge levied against

all adult offenders convicted of a criminal offence.

73

The charge levied against persons

convicted of the TV licence fee evasion offence following a plea of guilty is £150.

74

The revenue

is retained by the Ministry of Justice. Those convicted following a trial will be required to pay

£520.

75

The rationale behind the criminal courts charge is that adult offenders should pay

towards the cost of running the criminal justice system. This cost, unlike the fine element of the

penalty, is not subject to means-testing.

76

The criminal courts charge has been included in our

Cost-Benefit Analysis (Annex B), but its potential impact on TV licence fee evasion cases is not

yet clear. It is inevitably the case that the charge will add to the financial burden imposed on

defendants and this is a matter of concern, at least in the case of those on low incomes.

Devolved Administrations and Crown Dependencies

44. There are several differences in the enforcement procedures as they apply across the various

part of the UK and the Crown Dependencies of Jersey, Guernsey and the Isle of Man.

77

45. In Scotland, evasion cases are investigated by TV Licensing, but prosecutions are brought by

the Procurator Fiscal. Under powers provided by statute,

78

the Procurator Fiscal may decide to

use an out-of-court disposal option which means that a defendant may avoid prosecution by

agreeing to pay a fixed sum of money. In Scotland significantly fewer cases are dealt with by

the courts as a majority of defendants utilise this out-of-court disposal option. The advantages

and disadvantages of adopting this approach in England, Wales, Northern Ireland and the

Crown Dependencies (Jersey, Guernsey and the Isle of Man) are discussed further in Chapter

3.

71

Criminal Justice and Courts Act 2015, section 48 (inserting section 16A into the Magistrates’ Court Act 1980)

in force April 2015 http://www.legislation.gov.uk/ukpga/2015/2/contents/enacted.

72

Ministry of Justice consultation response.

73

Criminal Courts and Justice Act 2015, section 54 (inserting sections 21A to 21F into the Prosecution of

Offences Act 1985).

74

The Prosecution of Offences Act 1985 (Criminal Courts Charge) Regulations 2015.

75

The Prosecution of Offences Act 1985 (Criminal Courts Charge) Regulations 2015.

76

The legislation (CJC Act 2015) requires the courts not to take the charge into account when determining other

financial imposition amounts.

77

Section 363 of the Communications Act 2003 applies throughout the United Kingdom and has been extended

to Jersey, Guernsey and the Isle of Man by Orders of Council.

78

Section 302 of the Criminal Procedure (Scotland) Act 1995.

TV Licence Fee Enforcement Review

21

46. In Northern Ireland and the Crown Dependencies there are some slight variations in the

enforcement regime. In Jersey, for example, TV Licensing provides information obtained from

its investigations to the local police authority which then conducts its own investigation; any

prosecutions are taken forward by the Centenier.

79

47. The level of fines imposed in these jurisdictions is broadly comparable to the level in England

and Wales, although the out-of-court disposal in Scotland involves a typical payment of £75.

80

79

The differences in enforcement across the relevant jurisdictions can be found at Annex C.

80

Evidence provided by the Crown Office and Procurator Fiscal Service (COPFS): in 2013/14, 94% of cases of

TV licence fee evasion in Scotland resulted in a payment of £75 (12603 of the 13431).

TV Licence Fee Enforcement Review

22

Chapter 3: Consultation Options

48. Part of the Review process involved identifying and assessing possible options for amending

the current regime of criminal enforcement, including decriminalisation of the TV licence evasion

offence. Six possible options were identified. The assessment process involved considering

whether the adoption of any of the options would represent an improvement on the current

regime.

49. The assessment was carried out by reference to the key considerations as set out in the Terms

of Reference:

a. value for money for licence fee payers and taxpayers in enforcement of the failure to have

a TV licence, including operational, revenue and investment costs of the enforcement

regime to the BBC and to the court system;

b. fairness to all licence fee payers, and effectiveness in deterring evasion;

c. proportionality and ease of enforcement;

d. the degree to which the regime is easy to understand by all; and

e. where appropriate, practical considerations for effective transition from the current regime

to a different one.

50. The Review Team intentionally developed a broad range of policy options to ensure that the

possibility of reform was fully and properly explored in the course of the Review. The six options

are set out below in summary form:

1

Retain the current criminal enforcement system

2

Reform of current system: leave the current offence as it stands, but reform the current

criminal enforcement system.

3

Out-of-court settlement: retain the criminal offence, with an option for disposal by way

of an out-of-court settlement.

4

Fixed monetary penalty: retain the criminal offence, with an option for disposal by way

of a fixed monetary penalty.

5

Civil monetary penalty: decriminalise and enforce via a civil infraction.

6

Civil debt: decriminalise and enforce as a civil debt.

51. Each of these options is analysed in more detail in the sections which follow.

TV Licence Fee Enforcement Review

23

3a. OPTION 1

Retain the current criminal enforcement system

52. Under Option 1 the current criminal offence and existing sentencing powers would be retained

as they are at present. The operation of the current system of criminal enforcement is explained

in Chapter 2 above. In summary, the current system of dealing with TV licence evasion is based

on the existence of a criminal offence, punishable by way of a fine. This is intended to serve the

public interest by providing a powerful deterrent to evasion. The offence is triable only in the

Magistrates’ Court. The conviction rate is 86%. In the vast majority of cases offenders are fined

and the average fine is £170.

81

Overview

53. Taking into account all the evidence available to the Review, and having regard to the key

considerations set out in the Terms of Reference, we have concluded that the current sanctions

regime provides a broadly fair and proportionate response to the problem of licence fee evasion.

The factors that have been most influential in reaching this conclusion are as follows:

i) The need for an effective deterrent in the interest of licence fee payers in particular and

taxpayers in general.

ii) The current high level of compliance with the legal obligation to hold a TV licence.

iii) The relatively low cost of enforcement and prosecution.

iv) The difficulties associated with identifying evasion, and the efficiencies of using the

Magistrates’ Court for the purposes of prosecution and enforcement of the financial penalty.

v) The difficulties that would arise if any of the other options were otherwise to be adopted.

54. We should make clear that this conclusion is based on problems associated with providing an

effective deterrent and efficient system of enforcement under the existing model of licence fee

collection. The case for reform, including possible decriminalisation, will become more powerful

if changes are made to the mechanism by which the licence fee is collected. This will be one of

the matters considered in the forthcoming Charter Review.

55. While we have concluded that the current system of enforcement should be maintained, the

case has been made for improvements in certain aspects of the current enforcement process

and these improvements are addressed in our discussion of Option 2 below.

56. We discuss the factors that have informed our conclusion in relation to Option 1 in the following

paragraphs.

81

Ministry of Justice consultation response (2013 figures).

TV Licence Fee Enforcement Review

24

Deterrence

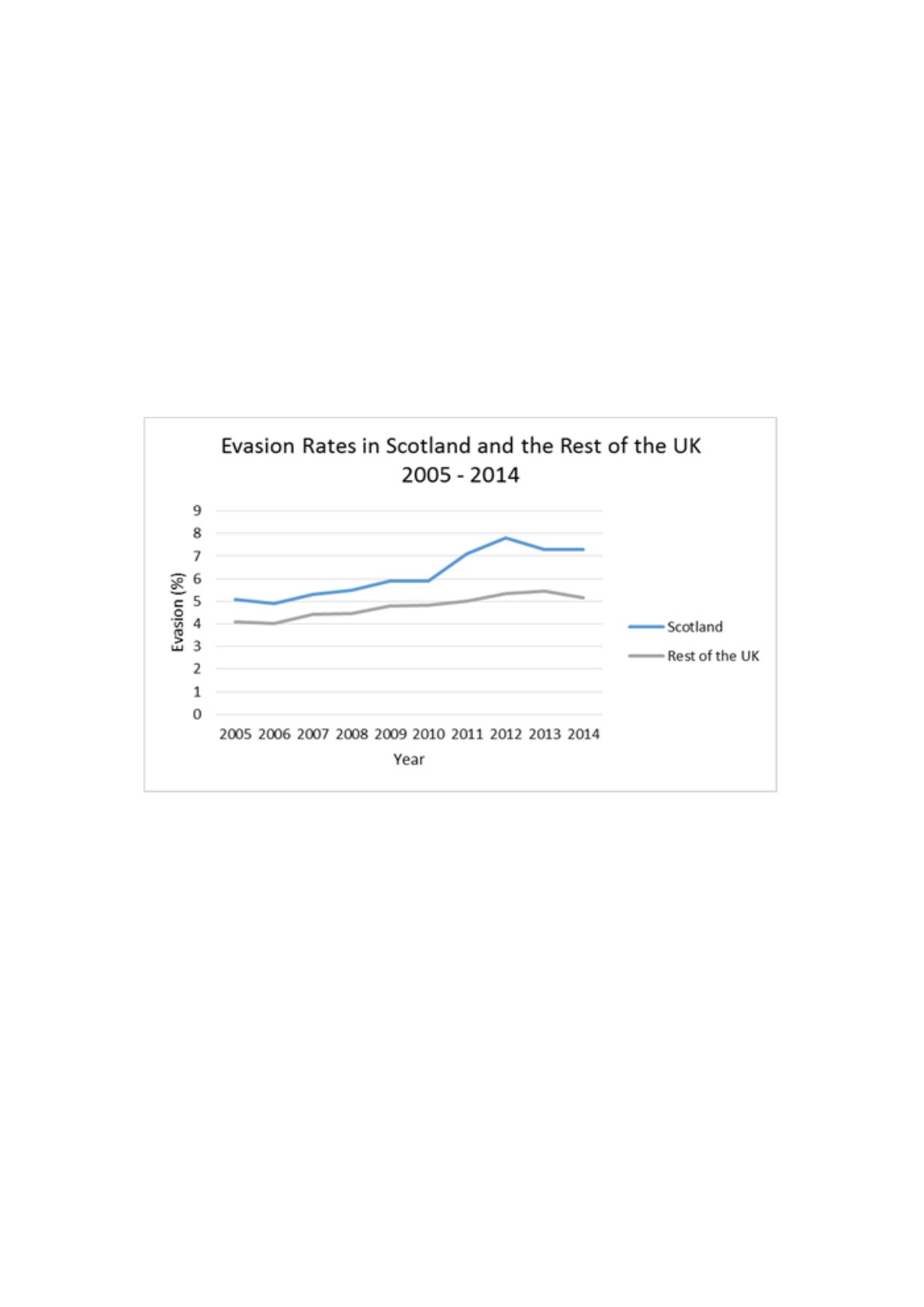

57. Since 1991 the BBC has had significant success in reducing the evasion rate.

82

In England and

Wales it has been maintained at around 5% since 2005 (levels of evasion are higher in Scotland

and Northern Ireland).

83

The BBC maintains that this is one of the lowest evasion rates in

Europe, and lower than a range of countries comparable to the UK in terms of their public

service broadcasting infrastructure and legal systems. It is certainly lower than Italy (26%),

Ireland (12%) and Poland (65%).

84

58. The existence of the criminal offence is intended to provide a strong deterrent to evasion. The

BBC has argued that a strong deterrent is necessary because it is easy to commit the evasion

offence and investigation can be difficult. In support of its argument, the BBC emphasised that

unlike providers of utility services, such as water, gas and electricity, it cannot meter its supply

of broadcast, switch off its services or control access to its programmes.

59. The arguments advanced by the BBC are supported by a research study undertaken by Harris

Interactive.

85

This research study suggests that the public identifies a large fine (around £1,000),

together with other factors (including the risk of prosecution), as the most effective deterrent

against evasion.

86

The study suggests that evasion rates would increase if the current model is

replaced by either a purely civil or hybrid model (such as out-of-court settlements) involving a

fine or payment of, say, £150. Increases in evasion rates are predicted even if the current model

is replaced with either a purely civil or hybrid model involving larger fines or payments of over

£300.

60. The same study suggests that the existence of a criminal offence is in itself a strong factor in

deterring evasion (with 54% purchasing a licence ‘because it’s the law’ or ‘it’s illegal not to’)

87

and evasion rates would increase significantly under a civil model as they are less effective at

making people pay.

88

61. There is no doubt that the mere existence of the criminal offence plays a significant part in

deterring licence fee evasion, and a move from the current system of criminal enforcement

carries the risk of an increase in the scale of evasion, with a corresponding loss of revenue to

the BBC.

82

BBC Trust Review of Licence Fee Enforcement, 2009.

83

BBC Trust Review of Licence Fee Enforcement, 2009.

84

http://www.tvlicensing.co.uk/cs/media-centre/news/view.app?id=1362435051910.

85

It is to be borne in mind that the research study was commissioned by the BBC, but was quality assured by

analysts from the Department for Culture, Media and Sport, who agreed that it is a robust study.

86

The study is analysed in more detail at Annex E.

87

Harris Interactive Behavioural Research, BBC consultation response.

88

Harris Interactive Behavioural Research.

TV Licence Fee Enforcement Review

25

Compliance with the legal obligation

62. Since the BBC assumed responsibility for licence fee collection from the Home Office, the

evasion rate has reduced from 12.7% (in 1991) to around 5%

89

(in England and Wales). This is

a notable reduction as even a small increase in evasion has significant cost implications: the

current 5% evasion rate equates to approximately £200m of lost income for the BBC.

90

63. TV Licensing and Capita argue that without the deterrent effect of the criminal sanction and the

powers currently available to investigators, the process of enforcement would become even

more difficult and expensive for licence fee payers.

Cost

64. Under the current system the principal cost to the taxpayer is the cost of court time. The total

number of TV licence evasion prosecutions brought to court in 2013 was 178,332, which

represented 11.5% of all Magistrates’ Court cases in that year.

91

Despite the large number of

cases, they appear to be dealt with efficiently, and take up only 0.3% of court time;

92

with many

defendants pleading guilty by post. TV licence evasion prosecutions are usually listed to be

heard at a single sitting devoted exclusively to hearing such cases.

93

The courts have similar

procedures for hearing traffic offences which are considered to deliver fair and efficient

outcomes.

94

65. The Ministry of Justice has expressed the view that the proportion of Magistrates’ workload

taken up with TV licence prosecutions is “relatively minor” and the extent to which judicial and

administrative resources could be reduced is “limited with minimal scope for cash savings.”

95

It

estimates that the annual cost to the taxpayer of TV Licensing prosecutions is no greater than

£5m a year and, further to this, the government and courts receive the revenue of the fines

(where recovered), which reduces the cost to the taxpayer even further.

66. An estimated £26m of TV Licensing evasion fines are imposed each year,

96

and although the

actual figure collected is lower,

97

court time and enforcement costs are largely met by the

amounts recovered. The Ministry of Justice expects that there will be further savings in court

time as a result of amendments to the system of summary justice effected by the Criminal

89

BBC Trust Review of Licence Fee Enforcement, 2009 (the figure has remained at around 5% since 2009).

90

Cost-Benefit Analysis (Annex B).

91

https://www.gov.uk/government/statistics/criminal-court-statistics-quarterly-july-to-september-2014.

92

Figures provided to the BBC by the Department of Constitutional Affairs in 2005.

93

The Review visited a Magistrates’ Court on two occasions and observed a number of TV licence fee evasion

cases.

94

Ministry of Justice consultation response.

95

Ministry of Justice consultation response.

96

Ministry of Justice consultation response.

97

The Ministry of Justice advises that fines are sometimes revised once means to pay information is provided

and, for a variety of reasons, a number may cancelled or administratively written off for a variety of reasons. In

2012 around a third of fines imposed for TV Licence Fee evasion were collected within 12 months.

TV Licence Fee Enforcement Review

26

Justice and Courts Act 2015, and the introduction of the criminal courts charge is likely to reduce

the burden on the taxpayer even further.

67. So far as costs to the licence fee payer are concerned, the BBC spends around 2.7% of TV

licence fee revenues on investigating and prosecuting licence fee evasion.

98

This figure, which

amounts to £102m,

99

is a significant fall from the 6% spent when the scheme of prosecution

and enforcement was administered by the Home Office.

100

68. During interviews, BBC representatives told us they consider the current system to be both

efficient and fair. We were informed that collection costs were reduced by £9m between 2013

and 2014 and that the contract with Capita is designed to deliver £220m of savings between

2012 and 2020.

101

The Ministry of Justice also expressed the view that the current scheme is

fair and provides good value for money.

Difficulties in investigation

69. The investigation process is undertaken by TV Licensing and Capita on behalf of the BBC. TV

Licensing and Capita informed us that the offence can be difficult to detect and enquiry officers,

with only limited powers of investigation, have to rely to a very great extent on evidence obtained

as a result of their household visits. These visits can sometimes be difficult and are often

contentious. The BBC drew our attention to the fact that proving the offence had become even

more difficult in recent years, because of the expanding range of devices that are capable of

being used as television receivers.

102

Efficiencies arising from the use of the criminal courts

70. Although investigations into evasion can be difficult, the court process is relatively

straightforward and the financial penalties are relatively easy to enforce. As noted, despite the

number of cases, the process of hearing licence fee evasion takes up very little in terms of court

time.

103

In order to facilitate enforcement of the financial penalty, the Magistrates’ Court will

frequently be provided with information by the defendant which enables it to determine whether

an attachment of earnings or benefits order would be an effective method of recovering any

fine.

98

BBC Annual Report and Accounts 2013/14.

http://www.bbc.co.uk/annualreport/2014/executive/finances/licence_fee.html.

99

BBC Annual Report and Accounts 2013/14.

http://www.bbc.co.uk/annualreport/2014/executive/finances/licence_fee.html.

100

House of Commons Culture, Media and Sport Committee, ‘Future of the BBC’, Fourth Report of Session

2014/15, p82.

101

BBC Annual Report and Accounts 2013/14 -

http://www.bbc.co.uk/annualreport/2014/executive/finances/licence_fee.html.

102

BBC consultation response.

103

BBC consultation response.

TV Licence Fee Enforcement Review

27

71. Under the current system the BBC has no responsibility for the enforcement of fines, with the

result that the enforcement cost is not passed on to the licence fee payer. The BBC will

frequently recover some of its investigation and prosecution costs by way of an order for costs

against the convicted defendant. In 2012/13 the BBC was awarded £13.1m in costs and

recovered £9.5m, a recovery rate of 73%.

104

Difficulties of reform

72. The two most significant difficulties that pose an obstacle to reform are the increased risk of

evasion and the costs (investment and operational) involved in implementing an alternative

scheme of enforcement. These issues are addressed under Options 3 to 6 below.

Arguments Against Criminal Enforcement

73. Having set out the principal reasons for recommending the continuation of the current sanctions

regime, in this section we consider the arguments advanced against criminal enforcement.

74. The principal argument advanced against the continuing existence of a criminal offence is that

the criminal law is an inappropriate mechanism through which to address the problem of TV

licence evasion. This argument has three principal strands. First, the use of the criminal law is

in itself disproportionate and unfairly stigmatises those who cannot pay the licence fee. Second,

TV licence fee evaders are sent to prison and this is a disproportionate response to the problem

posed by evasion. Third, a disproportionate number of prosecutions are brought against women

and those on low incomes.

The use of the criminal law

75. The argument against the use of the criminal law deserves careful consideration. The criminal

law involves the use by the state of coercive powers and penalties. The mere existence of a

criminal offence requires strong justification, either in terms of the harmful nature of the

prohibited conduct, or in terms of deterring conduct in which the public as a whole has an

interest. Increasingly, at least in England and Wales, the criminal law has been used in the

public interest as a regulatory device, extending to conduct lacking any form of moral turpitude.

76. The TV licence evasion offence is a form of regulatory crime and its existence may be justified

on two broad bases. First, evasion imposes an additional financial burden on the licence fee

payer. For this reason alone it is necessary to mark the importance of compliance with the legal

obligation and deter evasion. Second, the general public has an interest in maintaining the

quality of programmes and other broadcasting services, and the existence of the criminal

offence reflects the significance attached to this important public interest.

104

BBC consultation response.

TV Licence Fee Enforcement Review

28

The operation of the offence

77. In its support for the existing sanctions regime, the BBC emphasised that the current

enforcement system was being operated, so far as possible, to reduce the burden on the courts

and to encourage the purchase of TV licences. There are, moreover, restrictions on the

institution of criminal prosecutions and a prosecution will not be brought unless there is a

realistic prospect of conviction and it is in the public interest to prosecute. The offence must

then be proved ‘beyond reasonable doubt’. The BBC maintains that this leads to fewer members

of the public being proceeded against than would be likely under a civil enforcement system

operating where proof on the ‘balance of probability’ is sufficient.

105

This is explored in more

detail under Options 5 and 6.

78. We were informed by TV Licensing and Capita that, as a general rule, TV Licensing will not

initiate criminal proceedings, or will discontinue proceedings already begun, if the individual

subject to investigation or prosecution is a first-time offender and agrees to buy a TV licence.

106

This is true for the vast majority of cases, though this policy is not extended to those first-time

offenders wilfully trying to avoid prosecution (for example, by making a false ‘no licence needed’

declaration, or causing a search warrant to be issued). It is not clear whether this policy is always

understood by defendants and the Review has concluded that the exercise of the discretion not

to prosecute is capable of being made more transparent. This is explored in more detail when

considering Option 2.

Imprisonment not an available penalty

79. During the course of the Review it appeared that some of the criticisms of the current regime

were based on a number of misconceptions. First, there appears to be a widespread, though

erroneous, belief that the offence is punishable by a period of imprisonment. As we have noted,

the maximum penalty is a fine of £1000 and the average fine imposed on convicted defendants

is £170.

80. Given what appears to be a widespread belief that TV licence fee evaders receive sentences

of imprisonment, it is important to emphasise that this is not the case. Imprisonment is available

in certain limited circumstances where a fine is unpaid and where the offender either wilfully

refuses to pay or is guilty of culpable neglect.

81. The sentencing process is explained in the following paragraphs.

105

BBC consultation response.

106

BBC evidence to the Review.

TV Licence Fee Enforcement Review

29

Means

82. The sentencing guidelines applicable to Magistrates’ Courts