1 | Page TeamWorks Travel & Expense System Version Date: 11/13/15

Atlanta, Georgia 30334

How to Itemize a Hotel Expense with

Multiple Room Rates on the Same Stay

The following procedure is used is used to itemize hotel expenses. You are required to

itemize all expenses for hotel stays whether direct billed or paid by the traveler. Please

refer to the Statewide Travel Policy, Section 3: Lodging for more details regarding

Lodging expenses.

Once you have imported the hotel expense from Available Expenses open the hotel

expense. However, if the expense was not imported as an Available Expense and you

entered the expense manually, uncheck the Travel Allowance box and enter an

explanation in the Comment box why the hotel was not booked through TTE Travel.

This could be as simple as Direct Billed Hotel or Conference Hotel could not book in

TTE.

• Verify or enter the total reimbursable amount from the Hotel Receipt in the Amount

field.

• Verify that the transaction date is the date you checked out of the hotel

• Update or enter any other required fields if necessary

• If this hotel was not booked through TTE Travel, you must uncheck Travel

Allowance.

• Click on Itemize

• Verify or enter the Check Out date

• Enter either the Number of Nights you stayed or the Check-in Date

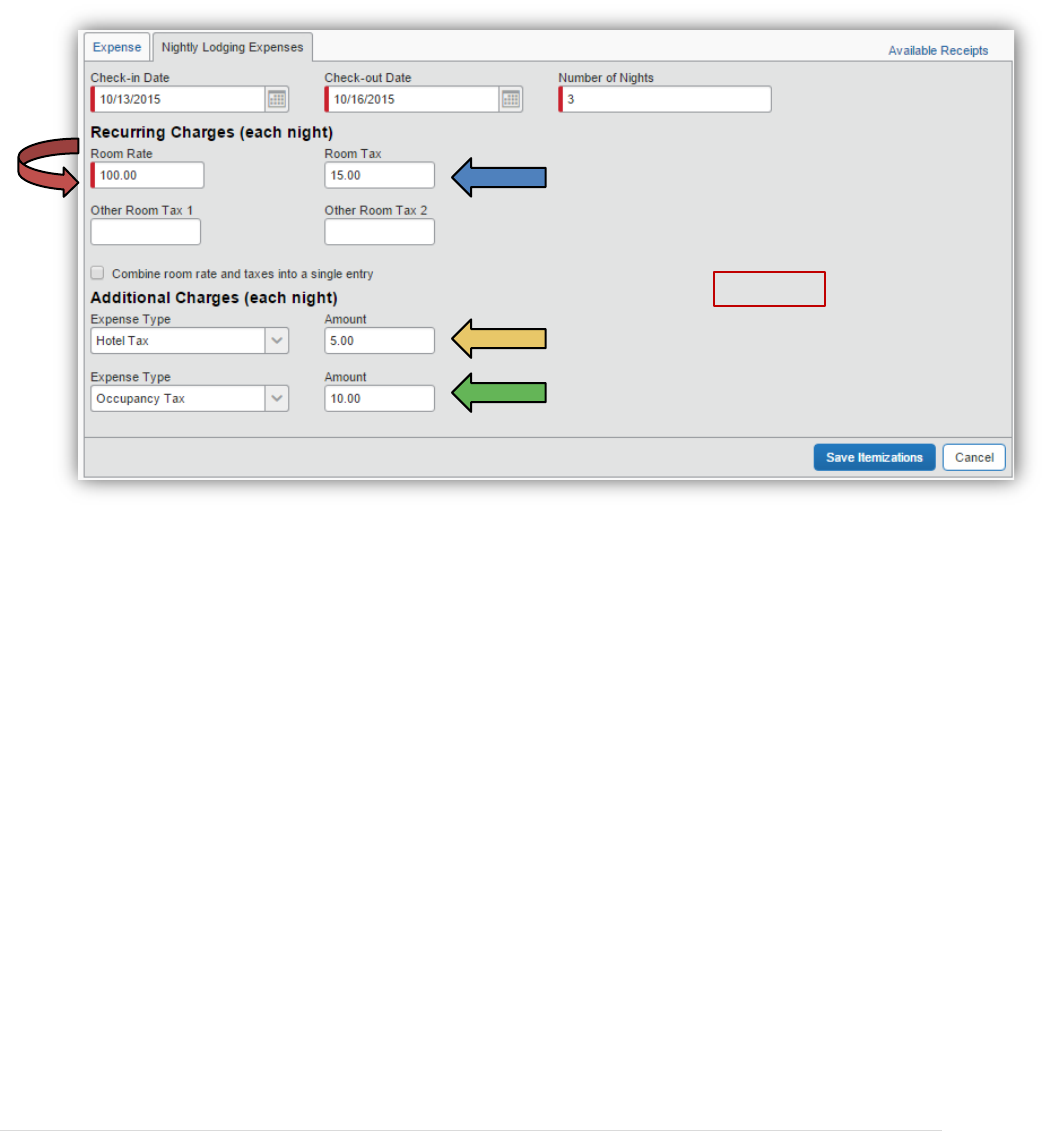

• Enter Recurring Charges:

NOTE: In our example the total Hotel Expense was $395 with two nights at a $100

Room Rate, Sales Tax at $15, Transportation Tax of $5 and Occupancy Tax of $10

and the last night was at a Room Rate of $95, Sales Tax of $12, Transportation Bill

Tax of $5 and an Occupancy Tax of $8.

o Enter the nightly Room Rate, if you had a different nightly rate on one or

more nights enter the room rate for the majority of the nights of your stay.

o Enter the Room Tax (Sales Tax), if you had a different nightly sales tax on

one or more nights enter the sales tax for the majority of the nights of your

stay.

Do not enter data into either of the Other Tax fields

2 | Page TeamWorks Travel & Expense System Version Date: 11/13/15

Atlanta, Georgia 30334

o If the hotel was in Georgia, to enter the flat nightly Transportation Bill Tax of

$5, go to the Additional Charges section, click on the drop down in Expense

Type, scroll to Lodging Expense, select Hotel Tax

Enter $5.

o If the hotel was in Georgia and the Occupancy (Hotel motel) Tax was not

exempted, go to the Additional Charges section, click on the drop down in

the second Expense Type, scroll to Lodging Expense and select Occupancy

Tax

o Click Save Itemizations.

• The Recurring Charges are displayed on the Expense Report and a Red Flag Error

is registered in Exceptions and on the Expense Item itself since there is an Un-

itemized Remaining Balance.

o Adjust each Hotel, Hotel Tax (Sales Tax) or Occupancy Tax item that was a

different rate on your hotel receipt.

o Click on the hotel expense for a night that had a different Room Rate

In our example we are choosing Hotel for 10/15/2015

3 | Page TeamWorks Travel & Expense System Version Date: 11/13/15

Atlanta, Georgia 30334

o The itemization for that one day opens:

o Enter the correct Room Rate for that night.

In our example it is $95

o Click Save

• Repeat the same process of for the entry for that same date for Hotel Tax (Sales

Tax) and Occupancy Tax (for Georgia hotels). The Transportation Bill Tax for

Georgia hotels will not vary. It is a flat $5 per night.

• If the Remaining Balance is not zero you will need to choose enter any un-itemized

expenses included in the total for the hotel stay.

4 | Page TeamWorks Travel & Expense System Version Date: 11/13/15

Atlanta, Georgia 30334

o Click on the arrow in the Expense Type field and select the expense type

you need to add charges for. For this example, we scrolled to

Communications and selected Internet Charges and entered the $15

remaining amount to that Expense.

You must fully account for any remaining balance and use as

many Expense Types as required.

o Click Save

• When the total amount of the Hotel Expense originally entered is completely

itemized, any Exceptions will clear and the expense entry is finished.

• At some point prior to submitting your expense report you must attach a copy of the

hotel bill to the expense report as indicated by the icon.

o If your entry was for a direct billed stay and the hotel could not give you an

itemized receipt, your agency is required to provide this to you.

All state agencies are required to attach copies of receipts for any hotel expense.

5 | Page TeamWorks Travel & Expense System Version Date: 11/13/15

Atlanta, Georgia 30334

NOTE: To collapse the hotel expense entry to one line, click on the down arrow to the left

of the date.

NOTE: You can reopen the expense at any time by clicking on the right facing arrow to the

left of the expense date.