Rochester Institute of Technology Rochester Institute of Technology

RIT Digital Institutional Repository RIT Digital Institutional Repository

Theses

5-2015

Zero Based Budgeting in KCS Implementing Zero Based Zero Based Budgeting in KCS Implementing Zero Based

Budgeting Method in Kosovo Correctional Service Budgeting Method in Kosovo Correctional Service

Burim N. Haxholli

Follow this and additional works at: https://repository.rit.edu/theses

Recommended Citation Recommended Citation

Haxholli, Burim N., "Zero Based Budgeting in KCS Implementing Zero Based Budgeting Method in Kosovo

Correctional Service" (2015). Thesis. Rochester Institute of Technology. Accessed from

This Senior Project is brought to you for free and open access by the RIT Libraries. For more information, please

contact [email protected].

Capstone Project: Zero Based Budgeting in KCS

Implementing Zero Based Budgeting Method in Kosovo Correctional Service

Burim N. Haxholli

May 2015

“Submitted as a draft Capstone Project Proposal in partial fulfillment

of a Master of Science Degree in Professional Studies

at the American University in Kosovo”

Zero Based Budgeting for KCS 2

Acknowledgements

I would like to express my special thanks to my Mom and Dad

and family for always supporting me and always being there for

me.

Secondly I would like to thank USAID for scholarship award

to attend the master program in this prestigious university and

giving us young Kosovars the possibility to enhance our education,

to contribute in our newly established country and improve the

Public Administration Sector.

Another special thanks of gratitude to my professor Dr.

Vernon Hayes, who helped me in doing a lot of Research from which

I learned many new things and I am really thankful.

In the end, I would like to thank all of my friends and

colleagues for their willingness and readiness to help me achieve my

goals.

Zero Based Budgeting for KCS 3

Abstract ...................................................................................................................................7

1. CHAPTER ONE ..............................................................................................................8

1.1. Kosovo Budgeting Practices .............................................................................................8

Description: Officials of Public Financial Management ...............................................................9

1.1.0. Article 10. Chief administrative officer. .............................................................................9

1.1.1. Article 11. Internal Auditor................................................................................................9

1.1.2. Article 12. Chief Financial Officer.....................................................................................9

1.1.3. Article 13. Procurement Officer ....................................................................................... 10

1.1.4. Article 14. Certifying Officer........................................................................................... 10

1.2. Role and the Mission of the Ministry of Justice .................................................................. 10

1.2.1 Kosovo Correctional Service ............................................................................................ 11

1.3. Methodology ...................................................................................................................... 12

2. CHAPTER TWO .................................................................................................................. 15

2.0. What is Zero Based Budgeting? .......................................................................................... 15

SWOT - Zero Base Budgeting Strength and Weaknesses .......................................................... 16

2.2. The Planning and Budgeting Process in Perspective ........................................................... 16

2.3. Where Zero Based Budgeting Can Be Used? ...................................................................... 20

2.3.0. Industry and Government ................................................................................................ 20

2.3.1. Zero Based Budgeting and Planning Program Budgeting ................................................. 20

2.3.2. Defining the Objectives of ZBB....................................................................................... 23

2.3.4. Responsibility .................................................................................................................. 24

2.4. What is its history? Who used it? 2. Why did it fail? ......................................................... 24

3. CHAPTER THREE ............................................................................................................... 25

3.0. Rebirth of ZBB ................................................................................................................... 25

3.1. FY 2016 Zero-Based Budget Analysis Georgia Department of Corrections ZBB Program:. 26

3.1.2 Results of Analysis ........................................................................................................... 27

Zero Based Budgeting for KCS 4

3.1.3 Program Operations: ......................................................................................................... 27

3.1.5 Georgia Department of Corrections .................................................................................. 29

3.1.7 Implementing Program Budgeting and Zero Base Budgeting in EU Countries .................. 31

3.2. Lessons for Serbia .............................................................................................................. 31

3.3. State of Idaho Budget Process ............................................................................................ 32

3.4. Idaho Zero-Base Budget (ZBB) Initiative ........................................................................... 33

3.4.1 Idaho Department of Correction ....................................................................................... 36

4. CHAPTER FOUR ................................................................................................................. 38

4.1. Audit Report on the Financial Statements of the Ministry Of Justice for the Year Ended 31

December 2013. ........................................................................................................................ 38

4.2. Audit Report on the Financial Statements of the Ministry Of Justice for the Year Ended 31

December 2012 ......................................................................................................................... 40

4.3. Audit Report on the Financial Statements of the Ministry Of Justice for the Year Ended 31

December 2011 ......................................................................................................................... 41

5. FIVE YEAR SCENARIO (INCREMENTAL VS. ZBB) ....................................................... 43

6. Potential Use in Kosovo ........................................................................................................ 47

5.1. Would it truly benefit Kosovo Departments? ...................................................................... 48

Works Cited .............................................................................................................................. 49

Annex 51

Questionnaire: Zero Based Budgeting New Budgeting Approach to Kosovo Public Services .... 51

Zero Based Budgeting for KCS 5

LIST OF TABLES

TABLE 1.MOJ BUDGET FOR YEAR 2015 - SPENDING OF FUNDS BROKEN DOWN BY ECONOMIC CATEGORIES .............. 11

TABLE 2. STRENGTHS AND WEAKNESSES OF ZBB .................................................................................................. 16

TABLE 3. DECISION PACKAGES .............................................................................................................................. 20

TABLE 4. ZERO BASED BUDGETING SAMPLE FORM ................................................................................................ 22

TABLE 5. ZBB PROGRAM: PRIVATE PRISONS (KEY ACTIVITIES AND ALTERNATIVE APPROACH ................................ 28

TABLE 6. ZBB PROGRAM: PRIVATE PRISONS: FINANCIAL SUMMARY ...................................................................... 29

TABLE 7. PERFORMANCE MEASURES GEORGIA DEPARTMENT OF CORRECTIONS ...................................................... 30

TABLE 8.IDAHO POPULATION ................................................................................................................................ 32

TABLE 9.MOJ FINANCIAL STATEMENTS AS OF 31-DEC-2013 .................................................................................. 38

TABLE 10. MOJ BUDGET 2012: SPENDING OF FUNDS BY ECONOMIC CATEGORIES- OUTTURN AGAINST THE BUDGET (IN

€) ................................................................................................................................................................ 40

TABLE 11. MOJ BUDGET 2011: SPENDING OF FUNDS BROKEN DOWN BY ECONOMIC CATEGORIES- OUTTURN AGAINST

THE BUDGET

(IN €) ....................................................................................................................................... 41

TABLE 12. CORRECTIONAL SERVICES FY2014 BUDGET COMPARISON BETWEEN KOSOVA AND STATE OF IDAHO (USA)

................................................................................................................................................................... 47

LIST OF FIGURES

F

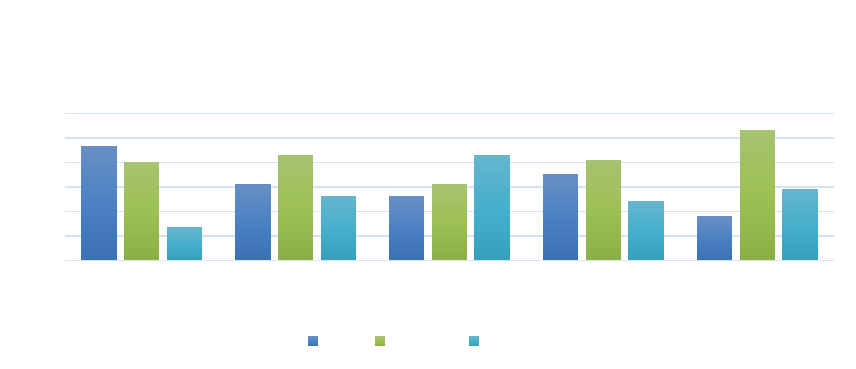

IGURE 1. PRESENTING BUDGET FORECAST EVALUATION ...................................................................................... 12

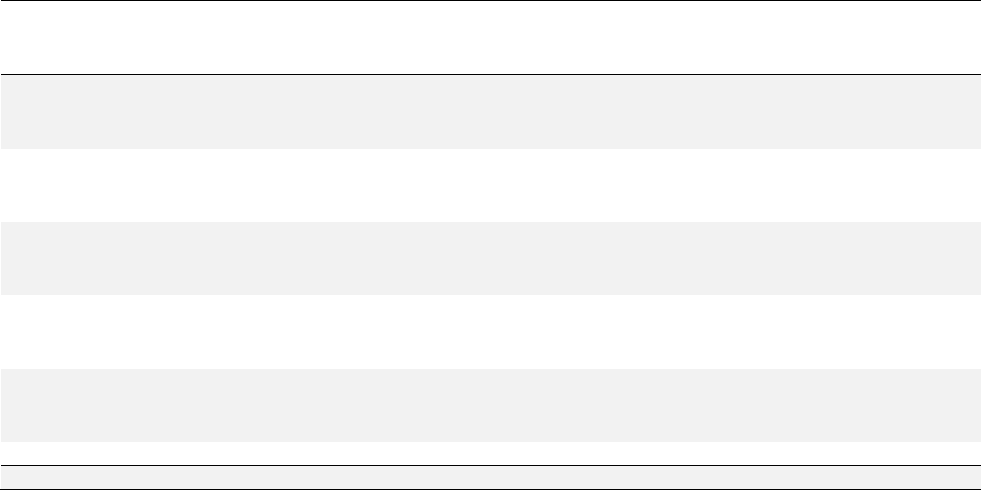

FIGURE 2. SURVEY RESPONDS ON BUDGET CATEGORIES .......................................................................................... 13

FIGURE 3. SURVEY ON TRADITIONAL VS. ZBB BUDGETING .................................................................................... 14

FIGURE 4. ZERO BASED BUDGETING PROCESS ........................................................................................................ 17

FIGURE 5.DECISION PACKAGES SAMPLE ................................................................................................................ 18

FIGURE 6. INCREMENTAL BUDGETING 5YRS SCENARIO ‘000................................................................................... 43

FIGURE 7. INCREMENTAL BUDGETING DEVIATION .................................................................................................. 44

FIGURE 8. ZERO BASED BUDGETING 5YRS SCENARIO ‘000 ..................................................................................... 45

FIGURE 9. ACTUAL INCREMENTAL BUDGET LINE SAMPLE (REPEATED AMOUNT 5YRS IN ROW) ................................ 46

Zero Based Budgeting for KCS 6

ACRONYMS

MOJ Ministry of Justice Kosova

DOJ Department of Justice Kosova

KCS Kosova Correctional Service

ZBB Zero Based Budgeting

PPBS Planning Program Budgeting System

EU European Union

USA Unites State of America

MF Ministry of Finance

CFO Chief Financial Officer

FMC Financial Management

Zero Based Budgeting for KCS 7

Abstract

This project addresses the need on improving performance in budget planning through Zero

Based Budgeting and its implementation in Public Sector. Project will focus on Kosovo

Correctional Service and will expand through its comparison with other local and central

budgeting organizations within Kosovo and therein other countries of EU, USA.

The project starts with the fact that there is an ongoing problem with budget planning in

KCS / MOJ and furthermore the research will be expanded through auditing reports, budget

planning, implementation problems and its tights with strategic planning. In addition, this

project will address through ZBB a role model to improve budget performance and

accountability of well-functioning departmental budgeting, which is crucial for final budget

presentation.

Moreover, it will present similar international practicing of Zero Based Budgeting,

identify similarities and differences between research departments, and present a set of

recommendations to improve the current experience in departmental budgeting, accountability in

performance, governance, capacity, reporting and its effectiveness.

Zero Based Budgeting for KCS 8

1. CHAPTER ONE

1.1. Kosovo Budgeting Practices

Budget process and the institutions involved in this process The Ministry of Finance in

coordination with budgetary organizations prepares the Kosovo Budget, which is approved by

the end of the year, by the Assembly of Kosovo. The budget for the next year is prepared during

the current year through a number of actions known as the budget process. Until it reaches a final

form as the Draft-law on budget, and before it is submitted for approval in Assembly, the budget

process is usually conducted between the Ministry of Finance and budgetary organizations. The

latter, according to MF guidelines, submit their budgetary proposals according to plans and

objectives defined by the work plans. (GAP, 2013)

According to the Law on Public Financial Management and Accountability, "budget

organization means any authority or public undertaking that directly receives an appropriation."

(Assembly of the Republic of Kosovo, 2008).

In the process of drafting the budget, the Ministry of Finance and budget organizations

interact with each other in two directions: from bottom-up – when budget organizations have the

freedom of planning the expenses and requests for budget depending on their plans; and, from

top-down – when budget organizations are allocated the budget taking into account the budget

and expenditure of that organization from the previous year, but not by taking into account the

budget needs of these organizations. As in many countries, Kosovo applies a mixed system of

the two directions, which means that budget organizations prepare or propose their budget for

expenditure within one year (bottom-up direction) but are limited in this preparation because of

the budget ceilings, as it is known in this field (top-down direction). (GAP, 2013)

Zero Based Budgeting for KCS 9

Description: Officials of Public Financial Management

1.1.0. Article 10. Chief administrative officer.

10.1 A chief Administrative Office shall have principal legal responsibility for ensuring

that his/her budget organization, autonomous executive agency or public undertaking, and its

personnel, thoroughly and adequately comply with, observe and implement all applicable

provisions of the present law and the FMC Rules. (Assembly of the Republic of Kosovo, 2008,

p. 14)

1.1.1. Article 11. Internal Auditor

11.1 Every budget organization, autonomous executive agency and public undertaking

shall comply with all applicable requirement of the Law on Internal Audit, including these

provision imposing a requirement to establish and maintain an Internal Audit Unit or to

otherwise procure the services of and Internal Auditor. (Assembly of the Republic of Kosovo,

2008, p. 14)

1.1.2. Article 12. Chief Financial Officer

In the case of CFO of budget organization or a autonomous executive agency, such CFO

shall have the authority and responsibility for : (i) developing the proposed budget and

appropriations request of the budget organization or autonomous executive agency; (ii) ensuring

that all transactions are accurately recorded in the Treasury Accounting Record; (iii) ensuring

that all legitimate invoice received are promptly submitted for payment through the Treasury

system; (iv) overseeing and supervising all aspects of budget reporting ; and (v) any function

delegated to the CFO in accordance with the FMC Rules. All Work of the CFO must strictly

comply with the FMC Rules. (Assembly of the Republic of Kosovo, 2008, p. 14)

Zero Based Budgeting for KCS 10

1.1.3. Article 13. Procurement Officer

13.1 Each budget organization, autonomous executive agency and public undertaking

shall have a Procurement Officer, who shall be responsible for conducting the budget

organizations procurement activities in accordance with the Law on Public Procurement.

(Assembly of the Republic of Kosovo, 2008, p. 14)

1.1.4. Article 14. Certifying Officer

14.4 The certifying Officer shall be responsible for a) ensuring that the applicable terms

of public contract have been fulfilled before any payment under such contract is made or

authorized; and b) ensuring that the expenditure of public money under any public contract is

one in accordance with the FMC Rules. The Certifying Officer shall also perform any other task

required of a Certifying Officer under the FMC Rules.

14.5 The Certifying Officer shall identify and promptly report in writing all of non-

compliances to the Chief Administrative Officer, the CFO and any other senior official of the

budget organization, autonomous executive agency or public undertaking. (Assembly of the

Republic of Kosovo, 2008, p. 14)

1.2. Role and the Mission of the Ministry of Justice

To ensure efficient, independent and impartial judicial and prosecutorial system, safe and

equal for all the citizens. Ministry of Justice according to the international standards ensures

professional treatment of the detainees, sentenced prisoners, victims of violence, and victims of

trafficking and protected witnesses. Ministry of Justice drafts the legislation in accordance with

the constitution of the Republic of Kosova and harmonizes the laws with the EU standards,

Zero Based Budgeting for KCS 11

develop international legal cooperation, and ensure easier access in the justice institutions for the

minorities. (Justice M. o., 2015)

Departments within MOJ: Kosovo Correctional Service, Kosovo Probation Service,

Forensic Department, Department of Legal Affairs, Department for International Legal

Cooperation, Department of Finance and General Services, Department for European Integration

and Policy Coordination, Department of Procurement, Office for Statistics. (Justice M. o., 2015)

1.2.1 Kosovo Correctional Service

KCS is responsible for the administration of prisoners, detainees, minors under the laws

of the Republic of Kosovo and European conventions and other regulations issued in the

respective institutions. KCS is responsible for the supervision and management of correctional

institutions (6 detention centers, 3 Correctional Centers and High Security Prison) in different

levels of security and supervision of persons under the care of KCS and staff in working (Justice

M. o., Kosovo Correctional Service, 2015)

Table 1.MOJ Budget for Year 2015 - Spending of funds broken down by economic categories

Spending of funds broken down by economic

categories

Amount €

%

Wages and Salaries

9,762,594

62.59%

Goods and Services

3,807,527

24.41%

Utilities

605,313

3.88%

Subsidies and Transfers

0

0%

Capital Investments

1,422,500

9.12%

Total 15,597,934

100%

*Employees

1,626

*Prisoners *1500

(Finance, 2015 Budgeting, 2015) * Prisoners number is of FY2013.

Zero Based Budgeting for KCS 12

1.3. Methodology

This study uses method research designed to determine whether current budgeting

method has positive or negative impact in KCS/MOJ through current financial method in

government of Kosova activity indictors.

The quantitative piece of this research involves budget and financial authorities to clarify

their opinion about gaps of current budgeting and to answer a question; can it be improved

through a ZBB process? An online survey was sent to public administration finance directors and

budget managers consisting of 11 questions examining the budget preparation level, the other

questions directly addressed whether zero-based budgeting is better than incremental budgeting,

and which budget categories are weaker due to a lack of budget preparation. Survey measure was

prepared with simple questions, and responds were calculated immediately through Google form

application. (See Figure 1.1, 1.2 and 1.3 below for statistical data).

Statistical data of the respondents from online questionnaire on evaluating the degree of

budget forecast for main budget categories in Republic of Kosova.

Figure 1. Presenting Budget Forecast Evaluation

47%

31%

26%

35%

18%

40%

43%

31%

41%

53%

13%

26%

43%

24%

29%

0%

10%

20%

30%

40%

50%

60%

Captial Budgeting Wages & Salaries Goods and

Services

Utilities Subsidies and

Transfers

Evaluate a degree in bugdet forecasting and

expenditures for following categories

Poor Medium Excellent

Zero Based Budgeting for KCS 13

Figure 1. The survey shows measurement of what are the main categories effected by weak

budgeting preparation and those are: Capital budgeting; b) Wages and Salaries; c) Utilities; d)

Goods and Services; e) Subsidies and Transfers.

Figure 2. Survey responds on budget categories

Figure 2. Statistical data of the respondent from online questionnaire on evaluating the level of

budget preparation in Republic of Kosova

On Figure 2. The questionnaire shows that only 12% are happy with current level of budget

preparation in Kosovo and others 47% says its good and 41% believe that budget preparation

needs improvement.

0%

10%

20%

30%

40%

50%

Excellent Good Poor

12%

47%

41%

Evaluate Level of budget Preparation in Republic of Kosovo

Excellent Good Poor

Zero Based Budgeting for KCS 14

Figure 3. Survey on Traditional vs. ZBB Budgeting

On Figure 3. The questionnaire shows that only 53% of budget professionals in Kosova support

traditional budgeting and the rest of 47% think that through ZBB can be adopted to our

government services. A lack of this questionnaire remains at responds of those that never heard

of ZBB before.

53%

47%

Traditional Budgeting vs ZBB

Traditional Budgeting ( Incremental Budgeting)

Zero Based Budgeting ( Starting from Scratch)

Zero Based Budgeting for KCS 15

2. CHAPTER TWO

2.0. What is Zero Based Budgeting?

ZBB begins with a zero balance and formulates objectives to be achieved. All activities

are analyzed for the current year. The manager may decide to fund an existing project at the

same level as last year after the review. However, it is most likely that funding will be increased

or decreased, based on new information. It is also possible that an alternative way may be used

for that project, based on current cost or time considerations. The ZBB approach sets minimum

funding amounts for each major activity (e.g., product, service). Amounts above the minimum

level must be fully justified in order to be approved by upper management. Each program,

product, or service is looked at each year to determine its benefit. If an activity cannot be

supported as having value, it is not funded. The manager is not concerned with the past but rather

looks at the current and future viability. The manager, in effect, discards the deadwood.

Programs with inefficiencies, waste, and anything that no longer makes financial sense are

dropped. (Shim, 2011, p. 322)

The ZBB process involves:

1. Developing assumptions

2. Ranking proposals

3. Appraising and controlling

4. Preparing the budget

5. Identifying and evaluating decision units (Shim, 2011, p. 322)

Zero Based Budgeting for KCS 16

SWOT - Zero Base Budgeting Strength and Weaknesses

Table 2. Strengths and Weaknesses of ZBB

Strength and weaknesses breakdown

Strength

Weakness

Efficient Allocation Of Resources

Detects Inflated Budget

Drives Managers To Find Cost Effective

Way To Improve Operations

It Is Adaptable

It Is Based On Need Rather Than On

Historical Data

Encourages Cost Reduction

Motivational

Decentralized

Communicative

Easy To Check

Only really applicable to a service

environment

Time consuming

Difficulty in creating the budget

Requires additional training for staff and

managers

Causes dissatisfaction

May cause budget triggering deficit (if

it’s not able to cover the planned budget)

May cause budget increase for certain

categories

May lead to lost continuity of action and

short term planning

2.2. The Planning and Budgeting Process in Perspective

Many managers have suggested that zero base budgeting be renamed “zero-base

planning” or “zero-base planning and budgeting” because the process required effective planning

and immediately shows up any lack of planning. The planning and budgeting process can be

contrasted as follows: (Pyhrr, 1973, p. 2)

• Planning identifies the output desired.

• Budgeting identified the input required. (Pyhrr, 1973, p. 2)

Zero Based Budgeting for KCS 17

Figure 4. Zero Based Budgeting Process

(Pyhrr, 1973, p. 3)

Raking is Simple 5 Step Process:

1. Given agreement on the standard to be used (ROL, DCF etc.).

2. Rank all programs from top to bottom based on that standard.

3. Determine the cutoff point, considered available resources or affordability.

4. Approve and fund all programs above the cutoff level and defer or eliminate all others.

5. Communicate the decision to the upper management. (Shim, 2011, pp. 61,62)

Some other methods or processes are by voting, using multiple standards, matching

ranking with strategic planning of the organization. (Shim, 2011, p. 62)

Planning

Establishing plans

and programms

Setting goals and

objectives

Making basic policy

decesions

Zero Base Budgeting

Detail indentification

and evaluation of

activities, alternatives,

and costs to achieve

planns.

Evaluation

Test budget against

plan Determine

tradeoff between

goals and cost

Budget and

Operating

Plan

Zero Based Budgeting for KCS 18

Figure 5.Decision Packages Sample

(Pyhrr, 1973, p. 16)

There are two basic steps of zero-base budgeting:

1. Developing “decision packages.” This step involves analyzing and describing each

discrete activity – current as well as new in one or more decision packages.

2. Ranking “decision packaged.” This step involves evaluating and ranking these

packages in order of importance through cost/benefit analysis object.

(Pyhrr, 1973, p. 5)

A

(165 packages)

B1

(38 packages)

B2

(65 packages)

C1

(10 Pakacges)

C2

(28 packages)

D1

(5 packages)

D2

(8 packages)

D3

(15 pakages)

C3

(17 pakages)

B3

(75 packages)

Final consolidated

ranking reviewed

at top.

Upper Level

Consolidation

Level.

Lower Level

Consolidation

Level.

Organizational

level where

decision packages

developed (cost

center).

One ranking

for entire

organization

Zero Based Budgeting for KCS 19

Step 1. Developing Decision Packages

A decision package identifies a discrete activity, function or operation in a definitive

manner for management evaluation and comparison with other activities. This identification

includes:

• Purpose ( or goal and objectives)

• Consequences of not performing activity.

• Measures of performance.

• Alternative courses of action.

• Costs and benefits. (Pyhrr, 1973, p. 6)

Step 2. Ranking. Developing Decision Packages

The ranking process provides management with a technique for allocating its limited

resources by making it concentrate on these questions: “How much should we spend?”, “Where

should we spend it? (Pyhrr, 1973, p. 15)

In ranking proposals, upper management will rely heavily on the recommendations made

by managers who have a keen knowledge of their decision units. Quantitative and qualitative

factors must be considered. A cost/benefit analysis should be performed for each decision unit.

The ranking of decision packages goes in the order of decreasing benefit. The manager

must identify those products or services that are the most crucial. The highest priority should be

assigned to the minimum increment of service below which the unit cannot operate effectively.

Zero Based Budgeting for KCS 20

Top management performs the final ranking after obtaining initial recommendations of

managers within the company’s divisions, departments, and cost centers. If a manager’s

recommendations are rejected, he or she should be notified why. (Shim, 2011, p. 324)

Table 3. Decision Packages

Sample Of Decision Packages

Product A–Decision Package

Alternative A $200,000 1 Year

Recommended Way $250,000 6 Months

Alternative B $350,000 2 Months

(Shim, 2011, p. 325)

2.3. Where Zero Based Budgeting Can Be Used?

2.3.0. Industry and Government

The Zero-based budgeting process consists of identifying decision packages and then

ranking them in order of importance through a cost/benefit analysis. Therefore, zero-base

budgeting can be used on any activities, function, or operations where a cost/benefit relationship

can be identified- even if this evaluation is highly subjective. (Pyhrr, 1973, p. 19)

2.3.1. Zero Based Budgeting and Planning Program Budgeting

Zero base budgeting reinforces PPB efforts because it provides a solid foundation of

information about functions and operations. This foundation can reinforce and improve PPB

efforts in several ways, through Program structure, Issue identification, Special analysis,

Program and financial plans (projections, financial data, and program measures). (Pyhrr, 1973, p.

154)

Zero Based Budgeting for KCS 21

Based on Peter Phyrr chapter regarding ZBB and PPB:

• Zero-base budgeting and PPB are compatible.

• Zero-base budgeting fills the critical gaps in PPB.

• Zero-base budgeting reinforces PPB.

• PPB can provide the planning and policy framework required to effectively

implement zero-base budgeting. (Pyhrr, 1973, p. 152)

Zero-based budgeting has been identified as:

An operating planning and budgeting process which requires each managers to justify his

entire budget requests in detail from scratch (Hence zero base) and shifts the burden of proof to

each manager to justify why he should spend money at all. This approach requires that all

activities be identified in “the decision packages” which will be evaluated by systematic analysis

and ranked in the order of importance. (Cheek, 1977, p. 12)

With ZBB, every line item in the budget must be approved with no preferences to

previous expenses but based on the priorities of this budget year. The ZBB requires a thorough

evaluation and starts from zero and then we move towards the ultimate goals based on what we

have in terms of revenues and expenses. Comparing to traditional budgeting, which is based on

the last year’s figures almost similar to the previous fiscal year history, whereas ZBB is budget,

is increase either decreased based on the priority packages. (Cheek, 1977)

Zero Based Budgeting for KCS 22

Table 4. Zero Based Budgeting Sample Form

Agency:

Code:

Cost center description

Priority ranking

For this decision package, please thoroughly answer the following questions with as much detail as

is necessary:

1. Why this cost center necessary and what does the taxpayer get in return?

2. How does this cost center and its base level of funding support your agency's strategic plan

and fulfill legal mandates (cite the legal mandates it fulfills)?

3. What adjustments would be made if this cost center (or some portion of it) was eliminated?

4. What are the performance measures and outcomes for this cost center?

Alternatives

Cost description

Benefit description

Further develop this decision package by reconstructing the cost center's operation up from zero

base according to what is absolutely needed to fulfill your agency's legal requirements in the most

efficient and effective way. Critical to this step is the identification and analysis of alternative

approaches to how business is currently undertaken within this cost center (please identify

opportunities to do the job differently and better). This reconstruction should reflect the preferred

alternative (from the alternative box below) to the current structure. Alternatives may include the

need to, for example, propose legislation to eliminate low value or out-of-date mandates,

reorganize or re-engineer work processes, further exploit information technology applications,

including system consolidation, outsource services to contractors, share or transfer work

responsibilities to other cost centers, programs, or agencies.

Merely developing and compiling decision packages detailing what organization is up to

accomplishes no useful purpose other than providing information. What is required is to focus

and direct the organization resources towards pre-agreed needs or objectives. (Shim, 2011, p. 54)

Zero base budgeting (ZBB) can be used by non-financial managers to identify, plan and

control project and programs. It enhances effectiveness and efficiency and matches services level

to available resources. Each manager must justify a budget detail, beginning zero balance. It can

lower production, service and operating costs. (Shim, 2011, p. 321)

ZBB is a priority form of budgeting, ranking activities such as products and services. It

may be used by managers to review and analyze programs, proposals, activities, and functions to

Zero Based Budgeting for KCS 23

increase profitability, enhance efficiency, or lower costs. ZBB results in the optimum allocation

of company resources. There is an input-output relationship. (Shim, 2011, p. 321)

ZBB considers the objectives of the activity and how it is to be accomplished. The failure

to fund an activity may results in adverse consequences that have to be taken into account. For

example, the failure to produce a particular product may adversely affect the sale of related

products in the company overall product line. (Shim, 2011, p. 321)

Managers who benefit from using ZBB include production manages, purchase managers,

marketing managers to appraise competing alternative product lines formulate and advertising

strategy, evaluate salesperson performance, establish and monitor marketing priorities. A cost

benefit analysis should be undertaken for each sales program in terms of staff, product, and

territory. The objectives of each subunit (e.g. department, responsibility center) should be

consistent with the overall goals of the company. (Shim, 2011, p. 321)

2.3.2. Defining the Objectives of ZBB

The first step in structuring a zero-base budgeting system is to establish objectives for the

effort. This normally involves a brief informal meeting among administrators, controller and his

budget staff. Some of the uses to which zero-base budgeting might be put:

1. Developing an operating plan and budget for the coming year.

2. Conducting a one-time cost reduction effort on staff overhead.

3. Diagnosing what is really going on in the organization to refine policy or set long-

range policy or set long-range objectives.

4. Allocating staff overhead to product lined and profit centers on more equitable

basis.

5. Validating the feasibility of the long-range plan.

Zero Based Budgeting for KCS 24

6. Auditing the effectiveness of staff programs.

7. Providing a database to restructure the entire organization (Cheek, 1977, p. 21)

2.3.4. Responsibility

The responsibility could be divided based on the organization experience. The more the

organization is innovative and has been frequently active with employment, new technology

follow up, this organization can lean its planning to individual managers within the department.

However, if the organization is less experienced could use multifunctional force. Those

organizations, which have generally weak management at the grass roots (or promising but

immature one) but do have a number of “stars” who could innovate generally, opt for task force

approach. (Cheek, 1977, p. 26)

2.4. What is its history? Who used it? 2. Why did it fail?

The first record of zero-based budgeting (ZBB) application in the public sector occurred

in the Department of the Agriculture in 1964, mainly because of Secretary Orville Freeman’s

interest in budgeting (Cheek, 1977, pp. 12-3). This attempt was short-lived in spite of top-level

support. Each responsibility center charged with budgeting functions fought to further its

priorities while ignoring the goals, objectives, priorities, and instructions of the department.

Among the problems, contributing to ZBB’s failure to take hold in the Department of

Agriculture included short lead-time for budget preparation and massive paperwork. (Bartley,

1997, p. 127). Despite the failed implementation of ZBB, it motivated the department’s top

management to initiate the involvement of all levels of operating managers in the budgetary

process. (Bartley, 1997, p. 127)

Zero Based Budgeting for KCS 25

3. CHAPTER THREE

3.0. Rebirth of ZBB

Momentum for ZBB in public sector began when the state of Georgia (under then-

governor Carter), the city of Garland, Texas, and a few other entities implements it during the

early 1970’s. When Jimmy Carter was elected president in 1976, his support for ZBB in the

federal government infused new enthusiasm about ZBB in government. A number of especially

attractive features were then being emphasized, such as effective planning and control and

efficient allocation of scarce budgetary resources, clearly setting forth benefits to be gained

versus costs to be incurred for each program or activity undertaken. In ZBB, every dollar

allocation is required to stand or fall on its merit. Each increment or unit of cost for an activity or

program requested must generate and equal or greater increment of benefit. Zero-based-

budgetary requires constant matching of costs versus benefits, no program or activity can be

continues simply because a budget request is made. (Bartley, 1997, pp. 127-128)

Governor Nathan Deal directed the Office of Planning and Budget (OPB) to implement

Zero-Based Budgeting as part of the budget development process, fulfilling his commitment to

Georgia's citizens to implement ZBB. The purpose of the zero-based budget analysis is to

assess individual programs against their statutory responsibilities, purpose, cost to provide

services, and outcomes achieved in order to determine the efficiency and effectiveness of the

program and its activities. (Dunn, 2015)

The ZBB review process formalizes the work inherent in OPB budget analysis and

provides a systematic review and reporting of the activities, performance and expenditures of the

programs in the state budget. The ZBB document is a summary of the information gathered and

Zero Based Budgeting for KCS 26

analyzed by OPB as part of our ZBB reviews. The document includes four sections for each

program reviewed:

1. Results of Analysis: This section summarizes OPB’s analysis and provides

recommendations for future review or changes to the program budget and

operations.

2. Program Purpose and Key Activities: This section lists the agency and program

purpose. A list of the program’s key activities is provided with its authority,

number of positions, state funds and total funds budgeted is also provided in this

section.

3. Performance Measures: This section lists the goals of the program and a set of

measures for the program.

4. Financials: This section provides a summary of the program expenditures and

budget. The section lists two years of expenditures, the current fiscal year budget,

Governor has recommended changes and recommended budget. (Dunn, 2015)

3.1. FY 2016 Zero-Based Budget Analysis Georgia Department of Corrections ZBB Program:

Georgia Department of Corrections, ZBB Program: Private Prisons

FY 2016 Zero-Based Budget Report- Purpose of Review

The Georgia Department of Corrections (GDC) administers the prison and probation

sentences of offenders adjudicated by Georgia's courts.

The Private Prisons program consists of four facilities, under two contracts, with

Corrections Corporations of America (CCA) and GEO Corporation. Combined, these facilities

are contracted to house up to 7,974 inmates, typically of low to medium risk. The purpose of this

Zero Based Budgeting for KCS 27

review is to evaluate the cost-effectiveness of program activities and assess the need of private

prisons as part of Georgia's future correctional infrastructure. (Dunn, 2015, p. 60)

3.1.2 Results of Analysis

1. Statutory Alignment: Program activities are aligned with statutory responsibilities.

2. Staffing Levels: There are no positions funded in this program.

3. Fleet Management: There are no motor vehicles assigned to the program.

4. Performance Measures: OPB worked with the agency to identify metrics for key program

activities. The updated measures accurately reflect the performance of the program.

5. Budget Impact: Maintain the current funding level. (Dunn, 2015, p. 60)

3.1.3 Program Operations:

The Criminal Justice Reform Act of 2012 is expected to divert low risk inmates and drug

offenders away from the correctional system through the utilization of alternative sentencing

programs such as county drug courts. These diversions are expected to negate the previously

projected 8% increase in the prison population and $264 million in associated costs. The future

prison population will consist of a more hardened and higher risk inmate, of which private

prisons are not currently equipped to detain. Private prisons utilize an “open bay” housing design

structure in the majority of their facilities. This design is meant to accommodate a low to

medium security risk inmate and is not conducive to accommodate a large number of inmates

who require single-cell confinement. (Dunn, 2015, p. 54)

Recommendation: Evaluate contracts with private prison vendors on an annual basis to

ensure that offenders' profiles fit private prison capacity and capabilities.

Zero Based Budgeting for KCS 28

Research has shown that offenders who re-enter communities after receiving evidence

based programming (substance abuse, educational, and vocational) are up to 7.5% less likely to

reoffend within three years. Private prisons are required to provide components of evidence

based programming to offenders, but programs are not standardized among the private prison

facilities.

Research has shown that offenders who re-enter communities after receiving evidence

based programming (substance abuse, educational, and vocational) are up to 7.5% less likely to

reoffend within three years. Private prisons are required to provide components of evidence-

based programming to offenders, but programs are not standardized among the private prison

facilities. (Dunn, 2015, p. 54)

3.1.4. Georgia Department of Corrections

Table 5. ZBB Program: Private Prisons (Key Activities and Alternative Approach

(Dunn, 2015, p. 54)

FY 2015 FY 2015

State Funds Total Budget

Riverbend

Correction

al Facility

Opened in December 2011 as an adult male medium security

prison in Milledgeville with a max capacity by contract of 1,500

inmates. Offers various academic, vocational, and counseling

classes to rehabilitate offenders. Owned and operated by the

GEO Gro up

$28,196,250 $28,196,250 0 $28,196,250

Wheeler

Correction

al Facility

Opened in 1998 as an adult male medium security prison in

Alamo with a max capacity by contract of 2,638 inmates. Offers

various academic, vocational, and counseling classes as well

as faith-based programs to rehabilitate offenders. Owned and

operated by Corrections Corporation of America.

42,733,573 42,733,573 0 42,733,573

Jenkins

Correction

al Facility

Opened in 2012 as an adult male medium security prison in

Millen with a max capacity by contract of 1,150 inmates. Offers

various academic, vocational, and counseling classes as well

as faith-based programs. Owned and operated by Corrections

Corporation of America

22,057,863 22,057,863 0 22,057,863

Coffee

Correction

al Facility

Opened in 1998 as an adult male medium and close security

prisonin Nicholls with a max capacity by contract of 2,628.

Offers various academic, vocational, and counseling classes

as well as faith-based programs. Owned and operated by

Corrections Corporation of America.

41,920,338 41,920,338 0 41,920,338

$134,908,024 $134,908,024 $0 $134,908,024

Total:

Zero Based Budget Review

(State Funds)

Activity

Description

Changes

Recommendations

Key

activities

Zero Based Budgeting for KCS 29

3.1.5 Georgia Department of Corrections

Table 6. ZBB Program: Private Prisons: Financial Summary

Expenditures FY2015 Zero Based Budget Review

Objects Of

Expenditures

FY2013 FY2014

Personal Services

Regular

Operating

Expenses

Motor Vehicle

Purchases

Equipment

Computer

Charges

Real Estate

Rentals

Telecommunications

Contractual

Services

$134,694,789

$133,811,261

$134,908,024

$0 $134,908,024

Total

Expenditures

$134,694,789

$133,811,261

$134,908,024 $0 $134,908,024

Fund type

State General

Funds

$134,694,789

$133,811,261

$134,908,024

$0

$134,908,024

Total Funds

$134,694,789

$133,811,261

$134,908,024

$0

$134,908,024

(Dunn, 2015, p. 57)

Zero Based Budgeting for KCS 30

3.1.6. Georgia Department of Corrections

ZBB Program: Private Prisons - Performance Measures

Agency Purpose:

The Georgia Department of Corrections administers the prison and probation sentences

of offenders adjudicated by Georgia courts. The Department of Corrections creates a safer

Georgia by effectively managing offenders and providing opportunities for positive change.

Program Purpose:

The purpose of this program is to contract with private companies to provide cost-

effective prison facilities that ensure public safety.

Table 7. Performance Measures Georgia Department of Corrections

Performance Measures Actuals

FY 2011

FY 2012

FY 2013

FY 2014

Annual Occupancy Rate

97%

83%

99%

99%

Three-Year Felony Reconviction Rate

31%

28%

30%

30%

Number of Ged Diplomas Received In Private

Prisons

178

82

200

234

Number Of Contracted Private Prison Beds as A

Percentage Of All Inmate Beds

11%

14%

16%

17%

Average Daily Cost Per Inmate

*$46

$53

$51

N/A

(Dunn, 2015, p. 58)

Zero Based Budgeting for KCS 31

3.1.7 Implementing Program Budgeting and Zero Base Budgeting in EU Countries

Experiments with program budgeting were first initiated in the US at the federal

government level, during the 1960s (Planning, Programming and Budgeting System, PPBS).

Since then the methodology was improved, but program budgeting is still not widely used in

Europe. Later, starting from the 1970s zero base budgeting (ZBB) was developed as a

continuation of PPBS. According to the latest budget system law, program budgeting will be

compulsory in Serbia starting from 2015. (Gábor Péteri, 2009, p. 12)

Program budgeting is based on the hierarchical structure of public functions. So the

actual spending programs have to be defined within the overall system of goals and objectives

set by a government. The specific services are derived through 3-4 levels of these hierarchical

goals. For example the overall objective of “clean city” is further broken down to sub-programs

and marking an activity, like “snow removal” at the end. (Gábor Péteri, 2009, p. 12)

3.2. Lessons for Serbia

The fiscal planning rules and budgeting methods cannot be standardized across all

government levels. At the national level where the main task is to allocate categorical transfers

among local budgets, the planning techniques are built more on incremental budgeting. At the

local government level planning the service organizations’ budget appropriations might be more

program oriented, using elements of performance budgeting. (Gábor Péteri, 2009, p. 14)

However, at both levels of government there is a need for changing the main function of

the budget. Presently the budget is primarily an instrument for authorizing spending and

exercising control over the usage of public funds. The main purpose of budgeting should be

forecasting combined with greater discretion in setting the appropriations. At the national level it

Zero Based Budgeting for KCS 32

would require the higher share of non-categorical transfers and general grants against categorical

grants. (Gábor Péteri, 2009, p. 14)

At the local government level, when the task is to allocate funds among several indirect

budget users, the planning methods might be changed. A gradual shift has to be made from the

line item incremental budgeting towards performance based and program budgeting. At the most

innovative local governments in selected service areas, elements of the modern planning

techniques have to develop. (Gábor Péteri, 2009, p. 14)

3.3. State of Idaho Budget Process

Idaho, the state's largest city and capital is Boise. Area, 83,557 sq mi (216,413 sq km).

Population (2000) 1,293,953, a 28.5% increase since the 1990 census. Capital and largest city,

Boise. Statehood, July 3, 1890 (43d state). (Infoplease, 2015)

Table 8.Idaho Population

Idaho, United States Census Bureau, People Quick Facts. Idaho, USA

Population, 2013 Estimate

1,612,843

316,497,531

Population, 2010 (April 1) Estimates Base

1,567,652

308,758,105

Population, Percent Change - April 1, 2010 To July 1, 2014 4.3% 3.3%

Population, Percent Change - April 1, 2010 To July 1, 2013 2.9% 2.5%

Population, 2010

1,567,582

308,745,538

Persons Under 5 Years, Percent, 2013

7.0%

6.3%

Persons Under 18 Years, Percent, 2013

26.5%

23.3%

Persons 65 Years And Over, Percent, 2013

13.8%

14.1%

Female Persons, Percent, 2013

49.9%

50.8%

(Census Bureau, 2015)

Zero Based Budgeting for KCS 33

3.4. Idaho Zero-Base Budget (ZBB) Initiative

Department of Administration

The Department of Administration was one of the first state agencies to undergo the

Zero-Based Budgeting process as a result of Governor Otter's initiative to re-evaluate each line

of state spending starting from the base of zero. (idaho.gov, 2015)

In a reverse working process of traditional budgeting, the Department reviewed its

mission and its mandates first. Not only did it determine whether its budget and resources are

supporting those charges, but it examined whether aspects of its edict should be modernized

based on the current economy and/or advances in technology and strategic business practices.

It was a valuable exercise for managers as well as our front-line staff members, who also

contributed to the project. (idaho.gov, 2015)

The Process Used for Gap Analysis:

The Department of Administration created a 16-member ZBB team composed of

Program Managers, its Deputy Attorney General, Chief of Staff, and Program Specialist to

provide support services. Work teams were created within each of the programs. Three templates

were designed for use by the work teams to stimulate discussions. The Task Template is a matrix

used for listing all tasks of the program down the side, with answers to questions about each of

the tasks across the page. Questions posed for each of the tasks included:

• Does the program/service support and contribute to the mission of the agency?

• Do they meet constituency needs? Do they overall entities functions?

• Any measureable evidence of the value of the service/program under review?

• Are goals/objectives of the program important enough to warrant expenditures

made?

Zero Based Budgeting for KCS 34

• What would happen if the program/services were not provided at all? (gov., 2015,

p. 1)

• Are there other less costly, more efficient ways of achieving these objectives?

• Would benefits be greater if all or part of the funds spent was used for other

programs?

The Mandate Template is a matrix used for listing down the side all sections of Idaho

Code, Administrative Rules, and Executive Orders affecting each of the programs, with answers

to questions related to each of the mandates across the page. Prior to filling this spreadsheet out,

our Deputy Attorney General spelled-out all applicable code, rules, and executive orders

affecting the Department and explained what they all meant in non-technical language.

Questions posed for each of the mandates included:

• Is the Department fulfilling the mandate’s intent?

• Does the mandate support and contribute to the mission of the agency?

• Do they meet constituency needs? Do they duplicate other entities functions?

• Are the mandates important enough to warrant continuation?

• What would happen if the mandate was not provided at all?

• Are there other less costly, more efficient ways of satisfying these mandates?

• Would benefits be greater if all or part of the funds spent was sued for other

programs?

• Based on analysis of the data collected in each of the templates, the work groups

identified any gaps that became apparent between tasks and mandates. The Gap

• Template is a matrix that poses the following questions:

Zero Based Budgeting for KCS 35

• What tasks are NOT mandated, but we ARE doing them? Do they support our

mission? Why are we doing them?

• What tasks ARE mandated but are NOT done? Should they be mandated?

• (gov., 2015, p. 1)

• What tasks ARE mandated and we ARE doing them, but should we be doing

them anymore? Why?

• What tasks are NOT mandated, we are NOT doing them, but should we be doing

them? Should they be mandated?

• What continuing tasks, whether mandated or not, could be done more efficiently

and/or cost effectively? What would be required?

Once the Gap Templates were complete, work groups were asked to delineate what

would be required for any proposed changes—legislative changes, more/less staff, more/less

appropriation, for example. Simultaneous to this process, Divisions determined how to organize

their cost centers in anticipation of incorporating approved changes identified in the gap analysis

processes and for writing decision units for the Fiscal Year 2011 budget. This packet contains a

listing of those cost centers for FY2011; a section of proposed code deletions, modifications, and

addition; other gaps identified; and, a long list of suggested efficiencies, in many cases not

requiring code changes or additional resources. The next step is to discuss proposed changes to

the Department with the Director, and receive any approvals and direction for proceeding with

the zero-based budget for FY2011. (gov., 2015, p. 2)

Zero Based Budgeting for KCS 36

3.4.1 Idaho Department of Correction

The Idaho Department of Correction's Bureau of Management Services and Bureau of

Contract Services support IDOC's public safety mission by providing a wide range of support

activities. Management Services provides budget and payroll management; information

technology; and fiscal services (Cost of Supervision and Offender Account Management.)

Contract Services provides grant/contract administration; offender records; dietary

services; capital construction projects, and contract facility monitoring. (idoc.idaho.gov, 2015)

IN FISCAL YEAR 2010, the Idaho Department of

Correction (IDOC) had $143.2 million in prison

expenditures. However, the state also had more than $1.5

million in prison-related costs outside the department’s

budget.

The total cost of Idaho’s prisons—to incarcerate an average

daily population of 7,402—was therefore $144.7 million, of

which 1.0 percent were costs outside the corrections budget.

Zero Based Budgeting for KCS 37

Determining the total cost of state prisons requires accounting for expenditures in all areas of

government that support the prison system—not just those within the corrections budget.

The additional costs to taxpayers can include expenses that are centralized for

administrative purposes (such as employee benefits and capital costs) and services for inmates

funded through other agencies. Prison costs also include the cost of underfunded contributions to

corrections employees’ pensions and retiree health care plans; states must pay the remainder of

those contributions in the future. (Justice V. I., 2012)

Prison costs outside the IDOC’s budget included the

following: RETIREE HEALTH CARE CONTRIBUTION.

The state of Idaho made a payment of $247,000 for

corrections employees in 2010. (Justice V. I., 2012)

UNDERFUNDED RETIREE HEALTH CARE

CONTRIBUTIONS. In 2010, the state contributed 51 percent

of the annual amount required to fully fund retiree health care

benefits in the end. The state will need to pay the remaining

$237,000, plus interest, to provide for the retiree health care

benefits for corrections employees that are scheduled under

current law. (Justice V. I., 2012)

STATEWIDE ADMINISTRATIVE COSTS. In 2009, the

most recent year for which Vera could obtain data, the IDOC incurred $973,000 in indirect costs

(such as auditing or information technology) paid by state administrative agencies. Indirect costs

related to prison operations that are provided by these agencies were determined using the

Statewide Cost Allocation Plan (SWCAP). (Justice V. I., 2012)

OTHER STATE COSTS. A portion of the costs of capital improvements, judgments, and

legal claims were funded outside the corrections department. Vera could not obtain this

information and these costs are not included in this fact sheet. Therefore, the state’s total prison

cost calculated for this report is a conservative estimate. (Justice V. I., 2012)

Zero Based Budgeting for KCS 38

4. CHAPTER FOUR

Correctional Service of Kosova Findings & Analysis

4.1. Audit Report on the Financial Statements of the Ministry Of Justice for the Year Ended 31

December 2013.

Budget Planning and Execution: We have considered the source of budget funds for MoJ and

spending of funds by economic categories. This is highlighted in the following tables:

Table 9.MOJ Financial Statements as of 31-Dec-2013

Economic Categories Amount € Final Budget 2013 Outturn

2011

Outturn

Wages And Salaries 10,124,215 9,688,604 9,510,257 9,123,140

Goods And Services 5,826,116 6,053,553 5,173,127 5,714,551

Utilities 827,258 907,258 858,186 809,957

Subsidies And Transfers 200,000 400,000 31,698 60,965

Capital Investments 1,622,500 1,537,400 1,144,252 793,321

Total

18,600,089

18,226,815

16,227,936

16,501,934

(Finance, 2015 Budgeting, 2015, p. 12)

Issue 2 – Low Budget Execution in Capital Investments – High Priority

Finding: Expenditures for Capital Investments compared to the final budget for this

category were 60%. Failure to execute four projects, which in absence of eligible bids were in

retendering process, had an impact on this. This resulted in changing the time of their execution.

Zero Based Budgeting for KCS 39

Risk: Low budget execution in particular with capital projects may lead to the risk that

resources are inefficiently used and may reduce the effectiveness of the expenditure plans.

(Finance, 2015 Budgeting, 2015, p. 14)

Issue 4 Finding: According to Financial Rule no. 01/2013 on Spending of Public Funds, the

authorizing officer (budget holder) authorizes the request for the commitment of funds for all

purchases, whilst the procurement office prepares and creates the purchase order.

Then the request for supply by the Economic Operator (EO) is made. In the case “Supply

with fuel” in two payment orders in the amount of €94,467 and €97,749, we found the supply in

KCS started prior to the initiation of the request for supply by the internal users. In the first

payment, the supply occurred in December, whilst the request was made on 17.01.2013, i.e.

commitment of funds and purchase order were made on 24.01.2013.

In the second payment, supply started in February whilst the request was made on

07.03.2013 and commitment of funds and purchase order were made on 11.04.2013.

Risk: Supply with Goods and Services without the initiation of request from the requesting

units and without the commitment of funds may lead to the purchase of goods or to unnecessary

services delivered to the Ministry. This may result in the inefficient use of resources and reduces

the effectiveness of expenditure plans. This situation is challenging to the adequate functioning

of internal control. (Finance, 2015 Budgeting, 2015, p. 15)

Zero Based Budgeting for KCS 40

4.2. Audit Report on the Financial Statements of the Ministry Of Justice for the Year Ended 31

December 2012

Despite all the progress, the MoJ needs to make many improvements. The most

challenging area remains budget planning and execution. The MoJ had budget surpluses of 13%,

and executed only 57% of the capital investments budget. Evidently, the annual procurement

plan is done without preliminary analysis of market prices, without properly identifying projects

objectively that are to be carried out, and without proper monitoring. (General Audit, 2012, p. 5)

Table 10. MOJ Budget 2012: Spending of funds by economic categories- Outturn against the budget (in €)

Economic Categories

Initial Budget

%

Final

%

Wages And Salaries

10,070,780

52.5%

9,793,717

52.4%

Goods And Services

5,475,857

28.6%

5,894,756

31.6%

Utilities

2,558,532

13.3%

2,012,037

10.8%

Subsidies And Transfers

844,258

4.4%

944,258

5.1%

Capital Investments

220,000

1.1%

35,000

0.2%

Total

19,169,427

18,679,768

(General Audit, 2012, p. 12)

The table above shows that the Initial Budget was in the amount of €19,169,427, and the

Final Budget was in the amount of €18,679,768. Therefore, we see a reduction for €489,659

compared to the Initial Budget. (General Audit, 2012, p. 12)

3. Issue - Shortcomings in executing capital projects – Priority Significant

Finding: Capital expenditures compared to the final budget were 57%. This indicates that a large

part of capital projects was not implemented. In a nine-month period was spent only 17% of the

budget and the other 40% of the budget was spent in the last quarter.

Zero Based Budgeting for KCS 41

Risk: There is a significant disagreement between the plan and expenditures. Due to poor

planning of expenditures, capital projects were not implemented. The risk of this is generating

high budget surpluses. (General Audit, 2012, p. 12)

4.3. Audit Report on the Financial Statements of the Ministry Of Justice for the Year Ended 31

December 2011

Table 11. MOJ Budget 2011: Spending of funds broken down by economic categories- Outturn against the budget (in

€)

Table 11. shows that MoJ had an increase of final budget for €598,095 compared to the

initial budget. In the following, we will disclose budget movements by category of expenditures.

Table 11. shows an increase in the category of Wages and Salaries for €101,145. Such increase

was due to Government’s decision on the Brain Fund in the amount of €64,320, whilst the other

amount of €36,825 was from own source revenues, for payment of committees on exam

attendance. In the category of Goods and Services, there was a budget increase of €1,400,054.

Such increase is as a result of presentation of the prisoners’ private funds as well as presentation

of foreign donations in the final budget. (General Auditor, 2011, p. 9)

Economic Categories

Initial Budget

%

Reviewed

Budget

%

Outturn

2011

%

Wages And Salaries

10,005,742

49.68%

10,106,887

48.73%

9,123,140

55.29%

Goods And Services

5,668,145

28.14%

7,068,199

34.08%

5,714,551

34.63%

Utilities

2,020,000

10.03%

1,360,966

6.56%

60,965

0.37%

Subsidies And Transfers

1,603,572

7.96%

1,359,502

6.56%

793,321

4.81%

Capital Investments

844,258

4.19%

844,258

4.07%

809,957

4.91%

Total

20,141,717

20,739,812

16,501,934

Zero Based Budgeting for KCS 42

Fund for Subsidies and Transfers was decreased for €659,034 compared to the initial

budget. The budget cuts were made upon decisions of the Prime Minister of Kosova. The amount

€525,000 was cut based on the decision of 19th of October 2011 on internal harmonization; the

amount of €105,000 was transferred to the Judicial Institute of Kosova based on the decision of

23rd of November 2011. The amount of 28,934€ was cut based on the decision of 23rd of

November 2011. (General Auditor, 2011, p. 10)

A budget cut in the amount of €244,070 was also made in the Capital Investments on

27th of July 2011, aiming budget savings. (General Auditor, 2011, p. 10)

Planned (final) budget for 2011 was €20,739,812. The MoJ managed to spend the amount

of €16,501,934 or around 80% of the budget. If we see the budget execution based on economic

categories, we see that a low execution rate was in the categories of Subsidies by 4% and Capital

Investments by 58%. Low execution in the category of Subsidies and Transfers resulted due to

improper budgeting. The MoJ had budgeted means in this category for drafting of laws.

Considering the budget execution based on periods, there is also a poor budget execution. Over

30% of budget was spent only in the last three months. (General Auditor, 2011, p. 10)

Conclusion: The MoJ for 2011 did not have a good budget performance. Low level of execution

is mainly noticed in the categories of Subsidies and Transfers and Capital Investments. (General

Auditor, 2011, p. 10)

5. FIVE YEAR SCENARIO (INCREMENTAL VS. ZBB)

Figure 6. Incremental Budgeting 5Yrs Scenario ‘000

Description:

Incremental Budgeting

2011 2012 2013 2014 2015

EUR.

Expenses

Estimation

Expenses

Diff.

Estimation

Expenses

Diff.

Estimation

Expenses

Diff.

Estimation

Expenses

Diff.

Ratio

1%

-6%

-2%

-1%

-0.2%

-2%

4%

1%

1. Total MOJ Revenues

20,142

20,338

19,121

-

1,217

18,733

18,600

-133

18,572

18,115

-457

18,914

19,011

96

Wages and salaries

10,006

10,103

10,023

-81

9,306

10,076

770

10,061

9,823

-238

10,256

11,817

1,561

Goods and services

5,668

5,723

5,476

-247

5,272

5,826

554

5,817

5,745

-73

5,998

4,870

-

1,128

Of which: Utilities

844

852

844

-8

785

827

42

826

827

1

864

733

-131

Subsidies and Transfers

2,020

2,040

220

-

1,820

1,879

200

-

1,679

200

50

-150

52

20

-32

Subsidies for PE

Capital expenditures

1,604

1,619

2,559

939

1,491

1,623

131

1,620

1,623

2

1,694

1,523

-172

Own revenues

48

48

48

48

50

48

-2

KCS Budget Participation

/ Total MOJ Revenues

70%

78%

82%

80%

82%

2. Total KCS Expenses

14,189

14,861

15,232

14,581

15,598

Wages and salaries

8,152

8,152

8,552

8,064

9,763

Goods and services

4,200

4,068

4,465

4,346

3,808

Of which: Utilities

649

649

649

649

605

Subsidies and Transfers

Subsidies for PE

Capital expenditures

1,189

1,993

1,568

1,523

1,423

Own revenues

3. Remaining Departments

5,953

4,260

3,368

3,534

3,413

(Finance, Buxheti i Republikës së Kosovës, 2015;2014;2013;2012;2011)

Zero Based Budgeting for KCS 44

Based on actual incremental budgeting we can see the following budget expenses deviation:

Figure 7. Incremental Budgeting Deviation

Fiscal Year

Surplus Budget

Deficit Budget

Total

2012

1,217,000€

0.00

1,217,000€

2013

133,000€

0.00

133,000€

2014

457,000€

0.00

457,000€

2015

0.00

-96,000€

-96,000€

Grand Total

1,807,000 €

-96,000 €

1,711,000 €

Based on the actual budget comparison we can notice that there is a total deviation from 1.7 Million EUR. Surplus of estimated

budget and spent budget for four years. Moreover, there are discrepancies between the budget categories in estimations and

expenditures. In this case, budgetary organization to achieve its final reconciliation to the total budget need to move funds from one

category to another, which violates the rules established in respect of budgetary limits.

Surplus of the sums which appeared can be allocated in any other position required. By this a regular practice is reported that

the biggest percentage of annual budget is spend in last quarter of budgetary organizations, to avoid budget surplus, which if not

spend, the government will reduce of subsequent year's budget for of the same volume.

Zero Based Budgeting for KCS 45

Figure 8. Zero Based Budgeting 5Yrs Scenario ‘000

Description:

Zero Based Budgeting

2011 2012 2013 2014 2015

EUR.

Expenses

Estimation

Expenses

Diff.

Estimation

Expenses

Diff.

Estimation

Expenses

Diff.

Estimation

Expenses

Diff.

Ratio

Risk Surplus/Deficit

1. Total MOJ Revenues

20,142

19,121

19,121

0

18,600

18,600

0

18,115

18,115

0

19,011

19,011

0

Wages and salaries

10,006

10,023

10,023

10,076

10,076

9,823

9,823

11,817

11,817

Goods and services

5,668

5,476

5,476

5,826

5,826

5,745

5,745

4,870

4,870

Of which: Utilities

844

844

844

827

827

827

827

733

733

Subsidies and Transfers

2,020

220

220

200

200

50

50

20

20

Subsidies for PE

Capital expenditures

1,604

2,559

2,559

1,623

1,623

1,623

1,623

1,523

1,523

Own revenues

48

48

48

48

48

48

KCS Budget

Participation

/ Total MOJ Revenues

70%

78%

82%

80%

82%

2. Total KCS Expenses

14,189

14,861

15,232

14,581

15,598

Wages and salaries

8,152

8,152

8,552

8,064

9,763

Goods and services

4,200

4,068

4,465

4,346

3,808

Of which: Utilities

649

649

649

649

605

Subsidies and Transfers

Subsidies for PE

Capital expenditures

1,189

1,993

1,568

1,523

1,423

Own revenues

3. Remaining

Departments

5,953

4,260

3,368

3,534

3,413

(Finance, Buxheti i Republikës së Kosovës, 2015;2014;2013;2012;2011)

Zero Based Budgeting for KCS 46

Zero based budgeting when comparing to incremental budgeting has no difference with budget surplus or deficit, therefore the total

deviation is zero. This scenario shows the best result if ZBB is implemented correctly.

Figure 9. Actual Incremental Budget Line Sample (Repeated Amount 5yrs in row)

Project Name (KCS) 31-Dec-11 31-Dec-12 31-Dec-13 31-Dec-14 31-Dec-15

Establishment of a special

unit for monitoring and

transporting prisoners

150,000

150,000

150,000

150,000

150,000

Renovation of the roof (roof

maintenance of facilities and

prisons )

50,000

50,000

50,000

50,000

50,000

(Finance, Buxheti i Republikës së Kosovës, 2015;2014;2013;2012;2011)

As seen Figure 9. presents two budget categories among other budget projects in KCS, which are re-estimated each year and

exact amount of money was spent. This is additional argument that incremental budget preparation mindset is narrow and it costs extra

euros to the government of Kosova, especially poor estimations cause by public services organization such as KCS. What

incremental budgeting leaves out of the account is analyzing the need for financing new project from scratch but leaving budget

organization spend more money in repetitive capital projects, goods and services and rise stocks of goods, while ignoring needs in

enhancing organization strategy as ZBB suggests.

6. Potential Use in Kosovo

A. Can we apply ZBB to Kosovo?

Table 12. Correctional Services FY2014 Budget Comparison between Kosova and State of Idaho (USA)

Description State Of Kosova State Of Idaho

Population

Size Of Budget In MOJ

Number Of Employees In KCS

Inmates

Average Annual Cost Per Inmate

1,859,203

USD 20.7 MIL

1,608

1,500

USD 13,826

1,634,464

USD 143.2 MIL

1,960

8,120

USD 19,545

The Republic of Kosovo has approximate figures to that of state of Idaho. From statistical

data, Kosovo has population of 1.8 million while state of Idaho has 1.6 million, the correctional

staff numbers is approximately 1,608 in Kosova and 1,960 in Idaho, and the average cost per

prisoner brought in a buck for Kosovo is 13.826USD and 19.545USD for the state of Idaho.

Given the state of Idaho has a larger budget, a large number of prisoners and implements