New Jersey Department of Agriculture

New Jersey’s Comprehensive Risk

Management Educational Newsletter

Spring 2020

WHAT IS CROP

INSURANCE??

“Crop Insurance

Protects Rural

America, Solidifies Popularity as Risk-

Management Tool”

“Crop insurance proved to be a critical risk-management tool for America’s farmers in 2019, keeping rural

America afloat during what was one of the most difficult years in recent memory. Crop insurance policies

protected a record 380 million acres of land, or more than 90 percent of planted acres.” (Article from “Crop

Insurance Keeps America Growing”)

Many farmers and producers don’t realize the importance of crop insurance until it’s too late. The United States

Department of Agriculture (USDA) with its Risk Management Agency (RMA) has targeted a few states, New

Jersey being one of the lucky few, to educate the public on the various polices revolving around crop insurance.

Crop insurance is a shared responsibility by both the federal government and private sectors. This is because if

there were unforeseen circumstances such as a government shutdown, farmers are not left unprotected

because the private sectors can help maintain their insurance plans.

Crop insurance is very flexible and covers a majority of crops. More than 130 crops are covered and is not only

for grain farmers. Crop insurance does not solely cover weather related incidents it also assists in other natural

disaster situations. In addition, crop insurance is not restricted to crops. For example, the Whole Farm Revenue

Insurance aid diverse farms by covering both their crops and livestock.

The USDA/RMA assure agricultural business to be at ease and strive to make both producers and consumers

experience a better sustainable livelihood.

For more information about crop insurance please visit, https://www.rma.usda.gov/

Whole Farm Revenue Protection (WFRP)

The more diverse your farm, the better!

Why WFRP??

• Covers a large range of commodities on the farm under one insurance policy this includes organic

commodities, livestock, and those marketing to locals.

• It is available in all 50 states

• Covers up to $8.5 million (with up to $1 mil each for animal/animal products and

greenhouse/nursery) but must have at least 3 commodities to receive a whole farm subsidy

• You help establish prices to value commodities (but these must meet expected value guidelines)

and marketing contracts can be used within policy limitations.

Coverage

WFRP protects your farm against the loss of farm revenue that you earn/ expect to earn from

• Commodities, including Industrial Hemp, you produce during the insurance period

• Commodities you buy for resale during the insurance period

• All commodities on the farm except timber, forest, and forest products

• This policy also covers replants of crops (with approval)

Buying Whole-Farm Revenue Protection

You can buy Whole-Farm Revenue Protection from a crop insurance agent by the sales closing date

shown for each county in the actuarial documents at

webapp.rma.usda.gov/apps/actuarialinformationbrowser/. A list of crop insurance agents is available at

all USDA service centers and on the RMA website at www.rma.usda.gov/en/Information-Tools/Agent-

Locator-Page.

• Documents for your crop insurance Agent

o Five years of previous tax forms (For the 2020 policy year, tax forms from 2014-2018

are required)

o Information on what will be produced during insurance year (Farm Operation Report)

Important Dates

• Sales Closing, Cancellation, and Termination Dates

o NEW JERSEY: Calendar Year and Early Fiscal Year

Filers...…… March 15, 2020

NEW JERSEY: Late Fiscal Year Filers ……. …...….

November 20, 2020

• Revised Farm Operation Report Dates

o All Filers .........................................………. July 15, 2020

• Contract Change Date .....................….……. ……August 31, 2020

o Talk to your crop insurance agent about the dates that apply for your county.

*You can locate other counties that may not be listed, just visit the Web Actuarial Information. Below illustrates

the actuarial information locator. Complete the entries and click view report to see the eligibilities.

Actuarial Information Browser 2017

Browse by Application

AIB Landing Page

AIB 2011

AIB 2012

AIB 2013

AIB 2014

AIB 2015

AIB 2016

AIB 2017

Crop

Livestock Gross Margin

Livestock Risk Protection

Rainfall Index

Vegetation Index

AIB 2018

AIB 2019

AIB 2020

AIB 2021

Agent Locator

Cost Estimator

Price Discovery

Livestock Reports

RIRS System

Information Tools > AIB 2017 > Crop

Crop

Commodity:

Select a Commodity

Commodity Year:

Select a Commodity Year

Insurance Plan:

Select an Insurance Plan

State:

Select a State

County:

Select a County

View Report

Commodity Year, as used throughout this application, represents Crop Year / Insurance Year

as applicable for the commodity.

Beekeepers in New Jersey now have a reliable way to insure their colonies. It is called API – short for

Apiculture Pilot Insurance Program and is brought to us by the USDA’s Risk Management Agency (RMA).

Through this new program, beekeepers can choose to insure any number of their colonies against losses

due to lower than normal rainfall in the geographic area where their colonies are placed. This new

insurance tool can be valuable to the state’s beekeepers, allowing them to remain financially sound and

ensuring that the many crops, trees and plants in New Jersey will be thoroughly pollinated.

Using the API Decision tool, below is an example of how API can help a typical beekeeper in Central New

Jersey.

Protection Factors for Monmouth County, Grid No. 24222:

• Coverage Level: 80%

• Productivity Factor: 130%

• Insurable Interest: 100%

• Insured Colonies: 25

• Sample Year: 2018

• Intervals of Protection: May-June (40% insured)

July-August (60% insured)

Level of Protection:

• Dollar Amount of Protection: $63.78

• Total Policy Protection: $1,595

• Subsidy Level: 55%

❖ If interested, the following article offers more details on API: Bee Culture – API Article.

❖ To see how API can be of benefit to your New Jersey colonies, use the API Decision tool.

❖ For more information, reach out to a qualified Crop Insurance Agent.

Apiculture Pilot Insurance Program

Hemp APH Insurance Program

In December 2019, the Federal Crop Insurance Corporation Board of

Directors approved the Hemp APH Insurance Program. APH is privately

administered under section 508(h) of the Federal Crop Insurance Act.

For New Jersey Producers: Although producers cannot purchase crop insurance for hemp this year, they

will be able to in 2021. Hemp coverage is also available through Whole Farm; you can find it listed on each

county’s commodity list and it includes: Hemp Industrial, Hemp Fiber, Hemp Flower, and Hemp Seeds. In

order to be eligible next year, producers must keep 12 months of records showing hemp production,

register with the Farm Service Agency (FSA) and the NJ Department of Agriculture.

Eligibility

Hemp producers must comply with…

• Applicable with state laws

• Tribal or federal regulations for hemp production

• Have at least one year of history producing the crop

• Have a processor contract with a processor for the sale of the insured hemp

• Comply with the 2014 Farm Bill or be licensed under a state or federal program. Being a part of a

state or university research pilot would satisfy this requirement.

Tetrahydrocannabinol (THC)

The 2018 Farm Bill defines hemp as containing 0.3 percent or less tetrahydrocannabinol (THC) at its dry

properties. According to the Hemp Crop Provisions, hemp having THC above the federal statutory

compliance level will not be eligible for an insurable cause of loss. Also, hemp does not qualify for replant

payments under this policy.

The following Hemp APH Insurance Program materials will be available and may be accessed on the RMA

Web site: https://www.rma.usda.gov.

• Hemp Crop Provisions (20-1218)

• Hemp Crop Insurance Standards Handbook (FCIC-20600U)

Important dates for the 2021 crop year:

• Closing dates for the Hemp APH Insurance Program is March 15, 2021

• Producers have until March 16, 2021, to obtain coverage

For more information on federal regulations for hemp visit…

https://www.fsa.usda.gov/news-room/news-releases/2020/usda-announces-details-of-risk-management-

programs-for-hemp-producers

For more information on NJ regulations on hemp visit…

• https://www.nj.gov/agriculture/divisions/pi/prog/nj_hemp.html

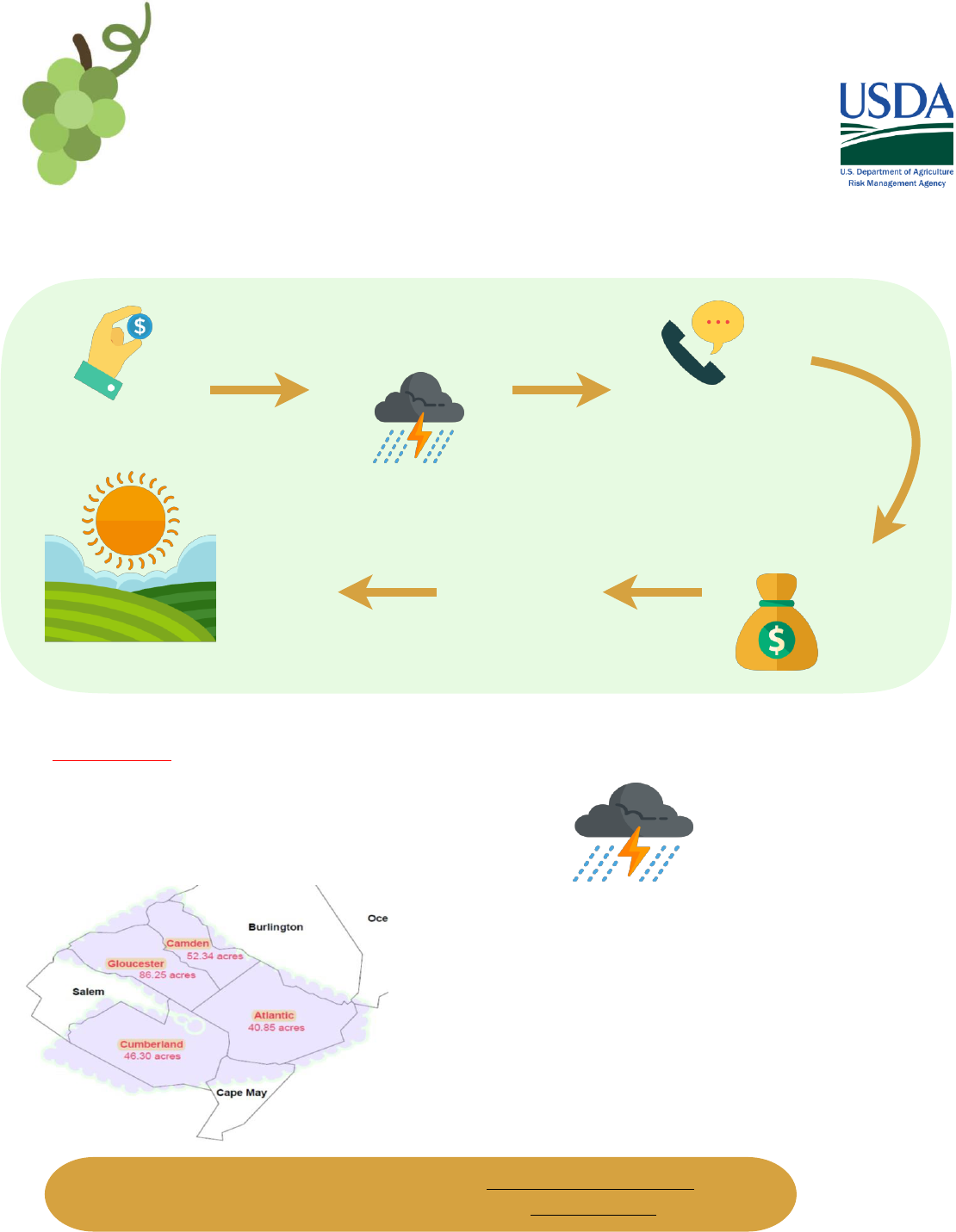

INSURING GRAPES NJ 2020

How it works: Crop insurance is a safety net for farmers that helps you manage

risk. If you have a crop failure, crop insurance can help you plant again next year.

Causes for Loss

•

Four Counties are insurable for

Grapes in New Jersey.

•

Excess Moisture

•

Drought

•

Cold temperatures

•

Hail

•

Disease

•

Freeze

•

HOWEVER, freeze on vinifera is

not insurable if recognized

cultural practices are not carried

out.

Find an Agent Use the Agent Locator tool at

rma.usda.gov/tools/agent.html

Learn More Find crop insurance information at

www.rm.usda.gov

You buy

a policy

You can farm

again next

year

Notify your agent

&

fi

le a claim

If you have

a crop

failure

You receive an

indemnity

payment

Your farm

continues for

another year

• Over 40 grape varieties are insurable in

these counties.

Requirements -

You must grow grapes:

➢ For wine, juice, raisins, or canning (not as table grapes).

➢ That meet the minimum production requirement of 2 T/A in at least 1 of the 3

previous crop years

➢ That are grown in a vineyard that is inspected and considered acceptable to us.

➢ Native and Hybrid grapes insurable the fourth growing season

➢ Vinifera grapes insurable the 5th growing season after set out

Important Insurance Deadlines and Reporting Requirements

Nov. 20, 2019: Sales Closing, Policy Change, Cancellation, Termination Date

Jan. 15, 2020: Acreage / Production Report Date

Aug. 15, 2020: Premium

Billing Date

Nov. 20, 2020: End of

Insurance Period

A Grower from NY states:

"I have used crop insurance for my vineyard since the

1980s. A spring frost—a frost after the grapes have

budded—is devastating for grape growers. When this

happened in 2015, I received an indemnity payment. I

will always buy crop insurance. There’s too much at

stake.” (Provided by RMA's Education Partner-Cornell

University)

Nursery Value Select (NVS) Pilot Program Training

for Nursery Stakeholders

Coverage in Alabama, Colorado, Florida, Michigan, Oregon, Tennessee, Texas, Washington, and

NEW JERSEY (Available for 2020 in Atlantic, Cape May, Cumberland, and Gloucester Counties

only)

❖ NVS is a pilot program that allows coverage for nursery crops (NO CROP IS TOO SMALL TO RECIEVE

COVERAGE)

❖ Crop coverage is between 50 to 75 percent and

premiums are subsidized (shown by the table)

❖ NVS is an asset-based insurance

❖ Producers may choose which crops to insure,

however, they must meet certain requirements such that

o It receives 40% of its gross income from the wholesale marketing of nursery plants

o Is grown to standards set by the program

o Grown and sold with roots

Nursery plants may not be insurable if:

❖ Grown in containers containing two or more different genera or species

❖ Any plant that is classified by a state or county as illegal to grow or sell

❖ They are grown solely for harvest of buds, flowers, or greenery

The Following situations are not covered:

❖ Collapse or failure of buildings/structures

❖ Disease or insect infestation

❖ Failure of plants to grow to a standard size set by federal regulations

❖ Inadequate power supply, unless such inadequacy is a result of an insurable cause of loss; and

❖ Inability to market nursery products due to a stop sales order, quarantine, etc…

Protected Against (Losses incurred must be reported to

agent within 72 hours)

❖ Adverse Weather (droughts)

❖ Failure of irrigation water supply if due to an insurable

cause of loss

❖ Fire

❖ Wildlife

❖ Natural disasters

Important Dates

For Alabama, Florida, New Jersey and Texas:

❖ Sales Closing/Cancellation ……… May 1, 2020

❖ Contract Change Date ……… January 31, 2021

❖ Insurance Period Begins ………… June 1, 2020

For more information see: https://www.rma.usda.gov/en/Topics/Nursery/Nursery-Value-Select

Item

Percent

Coverage Level

Premium Subsidy

Your Premium Share

50

55

60

65

70

75

67

64

64

59

59

55

33

36

36

41

41

45

Sweet Corn Processing

Processing Corn can only be insured if…

➢ The acreage is reported (acreage report)

➢ Is established under a contract

➢ The contract is compiled throughout the year

*Available is Maryland, Delaware, Pennsylvania, New York, and now in NEW

JERSEY (CUMBERLAND and SALEM COUNTIES)

➢ The NJ maximum insurable contract price for 2020 is…

o $179.00 for conventional

o $268.00 for organic

Insurance Period

Coverage begins when the processing sweet corn is planted and

Ends with:

➢ Destruction of the crop

➢ Abandonment of the crop

➢ Completion of harvest

➢ The date the processing sweet corn should have been harvested

o but was not harvested;

➢ Adjustments of a claim

o September 20

Causes of Loss

Protected from:

➢ Wildlife.

➢ Adverse Weather conditions such as frost, wind, drought

➢ Fire

➢ Insect damage and plant disease except for improper application of control measures

➢ Failure of irrigation water supply, if caused by an insured peril during the insurance period.

Important Dates

Sales Closing Date.......................March 15, 2020

Acreage Reporting Date..................July 15, 2020

*For more information on how to purchase a policy, contact your local crop insurance

agent or check out the RMA website at https://www.rma.usda.gov/Information-Tools/Agent-Locator-

Page . NO CROPS LEFT BEHIND!!!

This Photo by Unknown Author is

NJriskmgmt@ag.nj.gov | 609-633-0722

This material is funded in partnership by USDA, Risk Management Agency and under award number

RM18RMETS524C015. This info is brought to you by the New Jersey Comprehensive Risk Management Education for

Agricultural Producers. In accordance with Federal civil rights law and U.S. Department of Agriculture (USDA) civil

rights regulations and policies, the USDA, its Agencies, offices, and employees, and institutions participating in or

administering USDA programs are prohibited from discriminating based on race, color, national origin, religion, sex,

gender identity (including gender expression), sexual orientation, disability, age, marital status, family/parental

status, income derived from a public assistance program, political beliefs, or reprisal or retaliation for prior civil

rights activity, in any program or activity conducted or funded by USDA (not all bases apply to all programs). USDA is

an equal opportunity provider, employer, and lender.