2

2020 Trends in Investing Survey

About the 2020 Trends

in Investing Survey

The 2020 Trends in Investing Survey was conducted by the Journal of

Financial Planning and the Financial Planning Association® (FPA®), and

sponsored by Janus Henderson Investors, an FPA Strategic Partner.

The survey was elded in March 2020 and received 242 online responses

from nancial advisers who offer clients investment advice and/or

implement investment recommendations.

3

2020 Trends in Investing Survey

Environmental, social, and governance (ESG) funds are gaining popularity,

and nancial advisers may be shifting to more equities during the market

downturn caused by the COVID-19 pandemic, according to the 2020 Trends

in Investing Survey, conducted by the Journal of Financial Planning and the

Financial Planning Association

®

(FPA

®

), and sponsored by Janus Henderson

Investors.

ESG funds were rst added to the survey in 2018, when 26% of advisers

indicated they were currently using or recommending ESG funds with clients.

That percentage remained steady at 26% in 2019 and increased meaningfully

to 38% of advisers currently using or recommending ESG funds in 2020.

Nearly one-third (29%) of advisers indicated in the 2020 survey that they

plan to increase their use/recommendation of ESG funds over the next 12

months. And almost 40% of advisers indicated that, in the last six months,

clients have asked them about investing in ESG funds.

The 2020 survey results also reveal how the COVID-19 pandemic is starting

to impact asset allocation, economic outlooks, and investing decisions.

Survey results suggest they plan to pull back somewhat on recommending

cash and equivalents, while increasing their recommendations of some

equities.

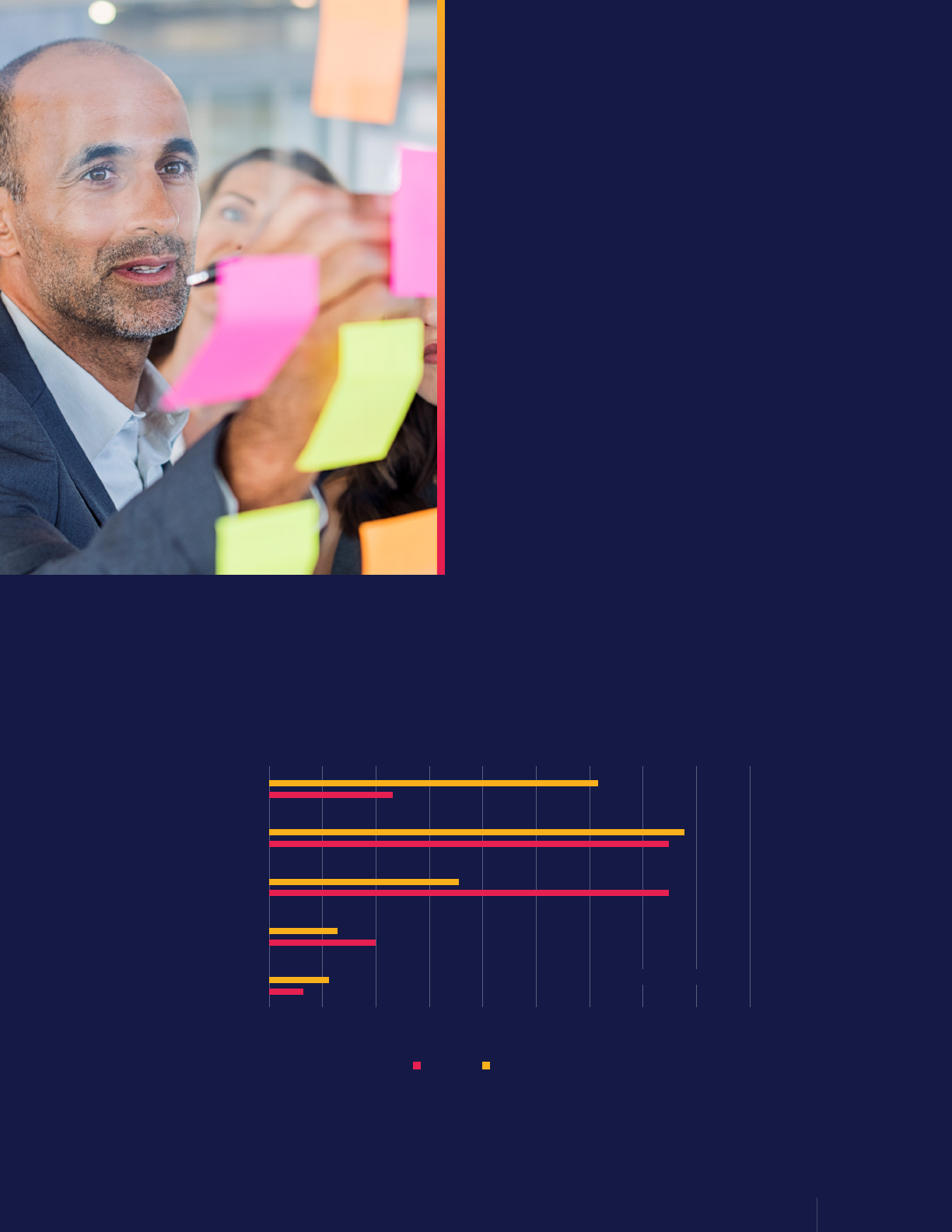

Advisers were asked which investments they intend to increase and decrease

their use of over the next 12 months. ETFs were chosen by 52% of survey

respondents when asked which investments they plan to increase their use

of over the next 12 months. In addition, almost one-third (29%) plan to

increase their use of ESG funds in 2020 (compared to 19% in 2019), and

one-quarter plan to increase their use of individual stocks (compared to

15% in 2019). Meanwhile, 14% of advisers said they plan to decrease their

use/recommendation of cash and equivalents in 2020, compared to 5% who

indicated so in 2019.

FPA’s annual Trends in Investing survey was rst conducted in 2006. Year-

over-year results have illustrated the eects of the 2007–2008 nancial

crisis, with a clear shift out of individual stocks and into index products

including ETFs and mutual funds (see the graph on page 5). The 2020 survey,

elded during March, is unique because of the COVID-19 pandemic. Future

surveys will likely continue to illustrate the eects of the pandemic on

investment decisions, asset allocation changes, and economic outlooks.

Executive Summary

4

2020 Trends in Investing Survey

Which investment vehicles do you currently

use/recommend with your clients

*Separately managed accounts, structured products, and precious metals were not included prior to the 2019 survey.

2018 2019 2020

Exchange-traded funds (ETFs)

87% 88% 85%

Cash and equivalents

83% 80% 75%

Mutual funds (non-wrap)

73% 70% 75%

Individual stocks

56% 54% 51%

ESG funds

26% 26% 38%

Individual bonds

46% 42% 37%

Mutual fund wrap program(s)

32% 31% 30%

Variable annuities (immediate and/or deferred)

28% 26% 26%

Separately managed accounts

N/A 26% 25%*

Fixed permanent life insurance products

23% 24% 24%

Fixed annuities (immediate and/or deferred)

26% 23% 24%

Indexed annuities

16% 15% 18%

Individually traded REITs (not held in mutual fund)

22% 20% 15%

Variable permanent life insurance

18% 14% 13%

Non-traded REITs

13% 13% 10%

Private equity funds

12% 12% 9%

Other alternative investments (if bought directly,

not included in other investment vehicles)

17% 13% 8%

Structured products

N/A 11% 7%*

Options

13% 9% 7%

Precious metals

N/A 5% 5%*

Hedge funds (directly, not through mutual funds)

9% 8% 4%

Other

9% 4% 2%

Cryptocurrencies

1% <1% <1%

Investments Used

5

2020 Trends in Investing Survey

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

ETFs Cash and

Equivalents

Mutual Funds

(non-wrap)

Individual

Stocks

ESG Funds Individual

Bonds

Mutual

Fund Wrap

Program(s)

Variable

Annuities

Fixed

Annuities

Changes to Investment Usage, 2006–2020

Q: Which investment vehicles do you currently use/recommend with your

clients? (select all that apply)

Source: FPA Trends in Investing Surveys (not all options are displayed here). ESG funds were not included prior to the 2018 survey.

Results are ordered by 2020 data.

Key Finding: ESG Funds on the Rise

Environmental, social, and governance funds were rst

added as an optional investment vehicle to the survey in 2018,

when 26% of advisers indicated they were currently using

or recommending ESG funds with clients. That percentage

remained steady at 26% in the 2019 survey, and increased

meaningfully to 38% in 2020. This supports other industry data

that indicates an almost four-fold increase in new assets in ESG

funds from 2018 ($5.5 billion) to 2019 ($20.6 billion), according

to Morningstar*. And, in the 2020 Trends in Investing Survey,

nearly one-third (29%) of advisers indicated they plan to

increase their use/recommendation of ESG funds over the next

12 months.

* cnbc.com/2020/01/14/esg-funds-see-record-inows-in-2019.html

2006

2010

2014

2018

2020

6

2020 Trends in Investing Survey

ESG Themes and Sustainable Investment

for Client Portfolios

A commentary from Janus Henderson Investors

Environmental, Social and Governance (ESG) investing across

the globe has seen dierent levels of uptake. While investors

in Europe and Asia have increased focus on ESG factors within

allocations for several years, U.S. investors are earlier in their

shift toward these considerations within their investment

portfolios. A key objective for ESG investment is the goal of

generating sustainable, long-term returns. To this objective, the

Janus Henderson Global Sustainable Equity Strategy has been

managed for almost 30 years for investors.

Sustainable investing is broader than factoring into account

ESG considerations, though that is an important element. At the

heart of our investment process is the belief that the sustainable

investment returns may be generated by companies that provide

solutions to today’s challenges by creating wealth and meeting

societal needs without damaging our natural capital. Our

approach seeks to invest in leading companies whose products

or services are of benet to the development of a sustainable

global economy. In doing so, we actively avoid investing in

companies with products or services that do environmental or

social harm. In tandem, sustainable investing should focus on

companies with attractive nancial characteristics and that

demonstrate strong management of operational ESG factors/

issues.

Environmental and social considerations form the foundation

of our investment framework. We aim to invest in businesses

that are strategically aligned with the powerful environmental

and social trends changing the shape of the global economy:

climate change, resource constraints, aging population, and

population growth. We believe these businesses should exhibit

capital growth by virtue of having products or services that

enable positive environmental or social change and thereby have

an impact on the development of a sustainable global economy.

Companies are assessed to see if they fall under at least one of

our 10 environmental and social themes that encompass positive

criteria. This assessment is based on the impact of the products/

services the company oers. It is quantitative and qualitative

in nature and involves a rigorous look at the life cycle of the

product or service.

7

2020 Trends in Investing Survey

There are two sides to sustainable investing. We believe it

is equally important to avoid investing in companies whose

products or services negatively impact the environment or

society and that are contrary to the United Nations Sustainable

Development Goals as it is to invest in companies that have

a positive impact. For this reason, we actively avoid direct

investments in fossil fuels, tobacco, weapons, alcohol, meat and

dairy production, fast food and sugary drinks, toxic chemicals,

and fur. While many consumer brands may not operate for the

purpose of a sustainable economy, there are plenty of companies

that have come to recognize that a sustainable approach to

delivering goods and services and providing solutions to social

and environmental problems can be a protable enterprise.

Sustainable Investments in Client

Portfolios

In general, we’ve seen sustainability strategies be more resilient

during market downturns. While it is likely too early to say with

any certainty that we can see the eects of the coronavirus

pandemic on the appetite for sustainable investment, we are

hopeful this crisis will serve to underline the attractiveness of

sustainable investing and how it may lead to better outcomes,

not only for investors but also for the environment and for

society. As such, sustainable investment may have a role

in client portfolios beyond the traditional equity and xed

income mix. Sustainable investment strategies can serve as a

core or a satellite exposure in a portfolio, and as ESG factors

are integrated into the broader investment process, dedicated

sustainable investment strategies may serve to actively tilt

portfolios toward these factors. As early adopters of sustainable

investment, we believe that persistent investment returns are

generated by companies with resilient, compounding growth

characteristics, and these attributes are more often found in

companies that are on the right side of sustainability trends.

— Janus Henderson Sustainable Equity Investment Team

(for more perspectives, visit janushenderson.com/esg)

Environmental, Social and Governance (ESG) or sustainable investing takes into

consideration factors beyond traditional nancial analysis to select securities. This

may limit the available investments and result in performance and exposures that

dier from other strategies or broad benchmarks focused on similar areas of the

market. Janus Henderson is a trademark of Janus Henderson Group plc or one of its

subsidiaries. © Janus Henderson Group plc.

8

2020 Trends in Investing Survey

Which investment vehicles do you expect to increase

your use/recommendation of in the next 12 months?

2019 2020

Exchange-traded funds (ETFs)

45% 52%

ESG funds

19% 29%

Individual stocks

15% 25%

Mutual funds (non-wrap)

19% 24%

Cash and equivalents

25% 22%

Mutual fund wrap program(s)

14% 19%

None. I do not plan to increase the use/

recommendation of any investment vehicles

18% 19%

Indexed annuities

8% 12%

Fixed annuities (immediate or deferred)

11% 11%

Individual bonds

16% 11%

Variable annuities (immediate or deferred)

8% 11%

Separately managed accounts

9% 9%

Fixed permanent life insurance products

6% 8%

Structured products

6% 7%

Options

2% 5%

Private equity funds

6% 5%

Non-traded REITs

3% 4%

Other alternative investments (if bought directly,

not included in other investment vehicles)

7% 4%

Precious metals

3% 4%

Variable permanent life insurance

4% 3%

Individually traded REITs (not held in mutual

fund)

4% 2%

Hedge funds (directly, not through mutual funds)

4% 1%

Cryptocurrencies

<1% 0%

9

2020 Trends in Investing Survey

Which investment vehicles do you expect to decrease

your use/recommendation of in the next 12 months?

Key Finding: A Move to Equities?

When asked which investments they intend to increase and decrease their use of over the next 12 months,

advisers’ responses appear to indicate a move away from cash and into more equities—particularly

compared to 2019 survey results. For example, when asked which investments they plan to increase their

use of, 52% of advisers said ETFs in 2020, compared to 45% in 2019. Almost one-third (29%) said they

plan to increase their use of ESG funds in 2020, compared to 19% in 2019, and 25% plan to increase their

use of induvial stocks, compared to 15% in 2019. Meanwhile, 14% of advisers said they plan to decrease

their use/recommendation of cash and equivalents in 2020, compared to 5% who indicated so in 2019.

2019 2020

None. I do not plan to increase the use/recommendation

of any investment vehicles

36% 44%

Mutual funds (non-wrap)

19% 17%

Individual stocks

23% 15%

Individual bonds

13% 15%

Cash and equivalents

5% 14%

Variable annuities (immediate or deferred)

9% 7%

Fixed annuities (immediate or deferred)

5% 6%

Mutual funds wrap program(s)

5% 6%

Indexed annuities

3% 5%

Exchange-traded funds (ETFs)

6% 4%

Non-traded REITs

4% 4%

Cryptocurrencies

0% 3%

Hedge funds (directly, not through mutual funds)

1% 3%

Separately managed accounts

1% 3%

Individually traded REITs (not held in mutual fund)

3% 2%

Variable permanent life insurance

2% 2%

Fixed permanent life insurance products

2% 2%

Private equity funds

<1% 2%

ESG funds

<1% 2%

Precious metals

<1% 2%

Options

2% 1%

Structured products

1% 1%

Other alternative investments (if bought directly,

not included in other investment vehicles)

<1% 1%

10

2020 Trends in Investing Survey

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

Bullish Somewhat Bullish Neutral Somewhat

Bearish

Bearish

What Is Your Investment Outlook?

In March 2020, advisers generally had a more

optimistic economic outlook for the longer term

(the next ve years) compared to the shorter term

(next six months). Overall, advisers’ economic

outlook has shifted over the last two years. In

2019, advisers were more bullish for the short-

term than they are now. And, in 2019, an uptick

in a bearish outlook for the 2019–2021 period

indicated possible uncertainty following the 2020

election. In 2018, advisers were generally bullish

for the next six months, but their longer-term

expectations for the economy were waning. In

2020, the opposite appears true.

Economic Outlook

Next 6 months

Next 12 months

Next 2 years

Next 5 years

11

2020 Trends in Investing Survey

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%

Bearish

Somewhat Bearish

Neutral

Somewhat Bullish

Bullish

What Is Your Economic Outlook for the Next 6 Months?

Key Finding: Market Outlook

Shifts Amidst a Pandemic

Advisers were asked about their economic outlook

for the next six months, 12 months, two years, and

ve years. When results of the entire survey period

(March 7–31) are split into two periods, before

and after March 13*, a shift emerges in advisers’

short-term outlook. In early March, advisers were

generally neutral or somewhat bearish, with just

12% bearish. After March 13, almost one-third of

advisers were bearish (31%). Clearly, the COVID-19

pandemic is aecting advisers’ short-term

economic outlook.

*On March 13, President Trump declared a national state of

emergency concerning COVID-19.

3/7-3/12 3/13-3/31

12

2020 Trends in Investing Survey

CLIENTS ASKING ABOUT CORONAVIRUS

AND VOLATILITY

The 2020 survey was elded between March 7 and March 31.

It is no surprise then that advisers reported that clients were

asking about the eects of general volatility (76%) and the

coronavirus (70%) in their portfolio. Most advisers also reported

that clients were asking about how the SECURE Act might

impact their portfolio and/or their overall retirement plan. And

compared to 2019 survey results, advisers reported less interest

among clients in investing in marijuana or cannabis stocks and

companies, as well as cryptocurrencies in 2020.

Which topics have clients inquired about in the past 6 months?

*Coronavirus and the SECURE Act were added to the survey in 2020.

Additional Resource: If you’re elding questions from clients wondering if they should tap into their

IRA or employer-provided retirement plan during this time of volatility, access the June 2020 Journal

of Financial Planning article, “Exploring the Financial Planning Decisions Related to Greater Access to

Retirement Funds Via the CARES Act,” by Kenn Tacchino, J.D., LL.M. This special report, available at

FPAJournal.org, oers guidance on common client questions.

2019 2020

Effects of general volatility on their portfolio

70% 76%

Effects of the coronavirus on their portfolio

N/A 70%*

Effects of the SECURE Act on their portfolio and/or their

overall retirement plan

N/A 52%*

Fees and other costs of investments

50% 43%

Investing in ESG/socially responsible investing

35% 39%

Investing in maruana or cannabis stocks/companies

55% 34%

Effects of tax reform (Tax Cuts and Jobs Act) on their

portfolio

51% 27%

Investing in cryptocurrencies

25% 17%

Other

4% 2%

13

2020 Trends in Investing Survey

Taking Another Look at Asset Allocation

Similar to previous years, the 2020 survey results show that the majority of advisers (57%) have re-

evaluated their asset allocation recommendation within the last three months. And among those

advisers, 66% said the reason for doing so was simply because they continually reevaluate their asset

allocations. However, advisers’ reasons for doing so did change later in March, most likely in response to

the COVID-19 pandemic (see the table below).

Additional Resource: If you are reevaluating your asset allocation strategy, you may be wondering if

your traditional approach will suce during this time of volatility and uncertainty. Adam Hetts, vice

president, head of portfolio construction and strategy at Janus Henderson Investors, quells these

concerns in his June 2020 Journal of Financial Planning article, “Portfolio Analysis in a Time of Chaos”

(available at FPAJournal.org).

Reasons for Reevaluating Asset Allocation

Q: I reevaluate the asset allocation strategy I typically recommend/

implement because of anticipated/existing changes in (select all that apply)

The survey was open March 7–31. On March 13, President Trump declared a national state of emergency concerning COVID-19.

Period 1

(3/7 to 3/12)

Period 2

(3/13 to 3/31)

Total Period

(3/7 to 3/31)

Legislation (TCJA, etc.)

23% 26% 25%

The economy in general

26% 64% 57%

Market volatility

45% 58% 52%

Specic investments

25% 22% 23%

Ination

11% 19% 15%

Administrative aspects of investments (cost, lead manager, etc.)

21% 13% 17%

Client and industry interest in ESG factors

7% 15% 11%

I continually reevaluate the asset allocation strategy I typically

recommend/implement

71% 61% 66%

Asset Allocation

and Active vs. Passive

14

2020 Trends in Investing Survey

Active Vs. Passive

The majority of advisers (66%) continue to favor

a blend of active and passive management—a

consistent trend for the last several years. However,

2020 results show a slight decrease in a pure passive

approach. Twenty-four percent of 2020 survey

respondents said passive management provides the

best overall investment performance (taking costs

into account), down from 29% in 2019.

Q: In general, which type of management do you think provides

the best overall investment performance taking into account

costs associated with each management style?

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

2014 2015 2016 2017 2018 2019 2020

Active Management Passive Management A Blend of the Two

15

2020 Trends in Investing Survey

Independent IAR/RIA 54%

Registered rep, independent adviser

aliated with a B-D

19%

Dually registered adviser 9%

Unregistered planner/adviser 8%

Registered rep, employee for a B-D 5%

Registered rep working for a bank, credit

union, or savings & loan

3%

Other 2%

What is your primary practice model/registration status?

What designations do you hold?

How many years have you been in the nancial services profession?

About the Respondents

How are you compensated by your clients for your investment services?

35% 22% 18% 13% 12%

21 or more 5 or less 6 to 10 11 to 15 16 to 20

61% 38% 1%

Fee only Fee and commission Commission only

79% 21% 10% 8% 5% 3%

CFP® FINRA registered rep None AIF® ChFC® CFA

16

2020 Trends in Investing Survey

About the Journal of Financial Planning

First published in 1979, the mission of the Journal of Financial Planning is to expand the body of

knowledge in the nancial planning profession. With monthly feature articles, interviews, columns, and

peer-reviewed technical contributions, the Journal’s content is dynamic, innovative, thought-provoking,

and directly benecial to nancial advisers in their work. Learn more.

About the Financial Planning Association

The Financial Planning Association

®

(FPA

®

) is the principal membership organization for CERTIFIED

FINANCIAL PLANNER™ professionals, educators, nancial services professionals and students who are

committed to elevating the profession that transforms lives through the power of nancial planning.

With a focus on the practice, business and profession of nancial planning, FPA advances nancial

planning practitioners through every phase of their careers, from novice to master to leader of the

profession. Learn more about FPA at FinancialPlanningAssociation.org and follow on Twitter at

twitter.com/fpassociation.

About Janus Henderson Investors

Janus Henderson Group (JHG) is a leading global active asset manager dedicated to helping investors

achieve long-term nancial goals through a broad range of investment solutions, including equities,

xed income, quantitative equities, multi asset and alternative asset class strategies.

Janus Henderson has approximately $294.4 billion in assets under management (at 31 March 2020),

more than 2,000 employees and oces in 27 cities worldwide. Headquartered in London, the company is

listed on the New York Stock Exchange (NYSE) and the Australian Securities Exchange (ASX).

Learn more about Janus Henderson Investors at janushenderson.com.

Janus Henderson is a trademark of Janus Henderson Group plc or one of its subsidiaries.

© Janus Henderson Group plc

Partners