REVERSE

MORTGAGES

FHA Needs to

Improve Monitoring

and Oversight of

Loan Outcomes

and Servicing

Report to Congressional Requesters

September 2019

GAO-19-702

United States Government Accountability Office

______________________________________ United States Government Accountability Office

September 2019

REVERSE MORTGAGES

FHA

Needs to Improve Monitoring and Oversight of

Loan

Outcomes and Servicing

What GAO Found

The vast majority of reverse mortgages are made under the Federal Housing

Administration’s (FHA) Home Equity Conversion Mortgage (HECM) program. In

recent years, a growing percentage of HECMs insured by FHA have ended

because borrowers defaulted on their loans. While death of the borrower is the

most commonly reported reason why HECMs terminate, the percentage of

terminations due to borrower defaults increased from 2 percent in fiscal year

2014 to 18 percent in fiscal year 2018 (see figure). Most HECM defaults are due

to borrowers not meeting occupancy requirements or failing to pay property

charges, such as property taxes or homeowners insurance. Since 2015, FHA has

allowed HECM servicers to put borrowers who are behind on property charges

onto repayment plans to help prevent foreclosures, but as of fiscal year-end

2018, only about 22 percent of these borrowers had received this option.

Reported Home Equity Conversion Mortgage Termination Reasons, Fiscal Years 2014–2018

FHA’s monitoring, performance assessment, and reporting for the HECM

program have weaknesses. FHA loan data do not currently capture the reason

for about 30 percent of HECM terminations (see figure). FHA also has not

established comprehensive performance indicators for the HECM portfolio and

has not regularly tracked key performance metrics, such as reasons for HECM

terminations and the number of distressed borrowers who have received

foreclosure prevention options. Additionally, FHA has not developed internal

reports to comprehensively monitor patterns and trends in loan outcomes. As a

result, FHA does not know how well the HECM program is serving its purpose of

helping meet the financial needs of elderly homeowners.

FHA has not conducted on-site reviews of HECM servicers since fiscal year 2013

and has not benefited from oversight efforts by the Consumer Financial

Protection Bureau (CFPB). FHA officials said they planned to resume the reviews

in fiscal year 2020, starting with three servicers that account for most of the

market. However, as of August 2019, FHA had not developed updated review

procedures and did not have a risk-based method for prioritizing reviews. CFPB

conducts examinations of reverse mortgage servicers but does not provide the

results to FHA because the agencies do not have an agreement for sharing

confidential supervisory information. Without better oversight and information

sharing, FHA lacks assurance that servicers are following requirements,

including those designed to help protect borrowers.

Why GAO Did This Study

Reverse mortgages allow seniors to

convert part of their home equity into

payments from a lender while still living

in their homes. Most reverse mortgages

are made under FHA’s HECM program,

which insures lenders against losses on

these loans. HECMs terminate when a

borrower repays or refinances the loan

or the loan becomes due because the

borrower died, moved, or defaulted.

Defaults occur when borrowers fail to

meet mortgage conditions such as

paying property taxes. These borrowers

risk foreclosure and loss of their homes.

FHA allows HECM servicers to offer

borrowers foreclosure prevention

options. Most HECM servicers are

supervised by CFPB.

GAO was asked to review HECM loan

outcomes and servicing and related

federal oversight efforts. Among other

objectives, this report examines (1) what

FHA data show about HECM

terminations and the use of foreclosure

prevention options, (2) the extent to

which FHA assesses and monitors the

HECM portfolio, and (3) the extent to

which FHA and CFPB oversee HECM

servicers. GAO analyzed FHA loan data

and FHA and CFPB documents on

HECM servicer oversight. GAO also

interviewed agency officials, the five

largest HECM servicers (representing

99 percent of the market), and legal aid

groups representing HECM borrowers.

What GAO Recommends

GAO makes eight recommendations to

FHA to, among other things, improve its

monitoring and assessment of the

HECM portfolio and oversight of HECM

servicers, and one recommendation to

CFPB to share HECM servicer

examination information with FHA. FHA

and CFPB generally agreed with the

recommendations.

View GAO-19-702. For more information,

contact

Alicia Puente Cackley at (202) 512-8678

or

Highlights of GAO-19-702, a report to

congressional requesters

Page i GAO-19-702 Reverse Mortgages

Letter 1

Background 5

HECM Defaults Have Increased, and Use of Foreclosure

Prevention Options Is Limited or Unknown 18

Weaknesses Exist in HECM Termination Data, Performance

Assessment, and Portfolio Monitoring 28

FHA’s Oversight of Servicers and Collaboration on Oversight

between FHA and CFPB Are Limited 37

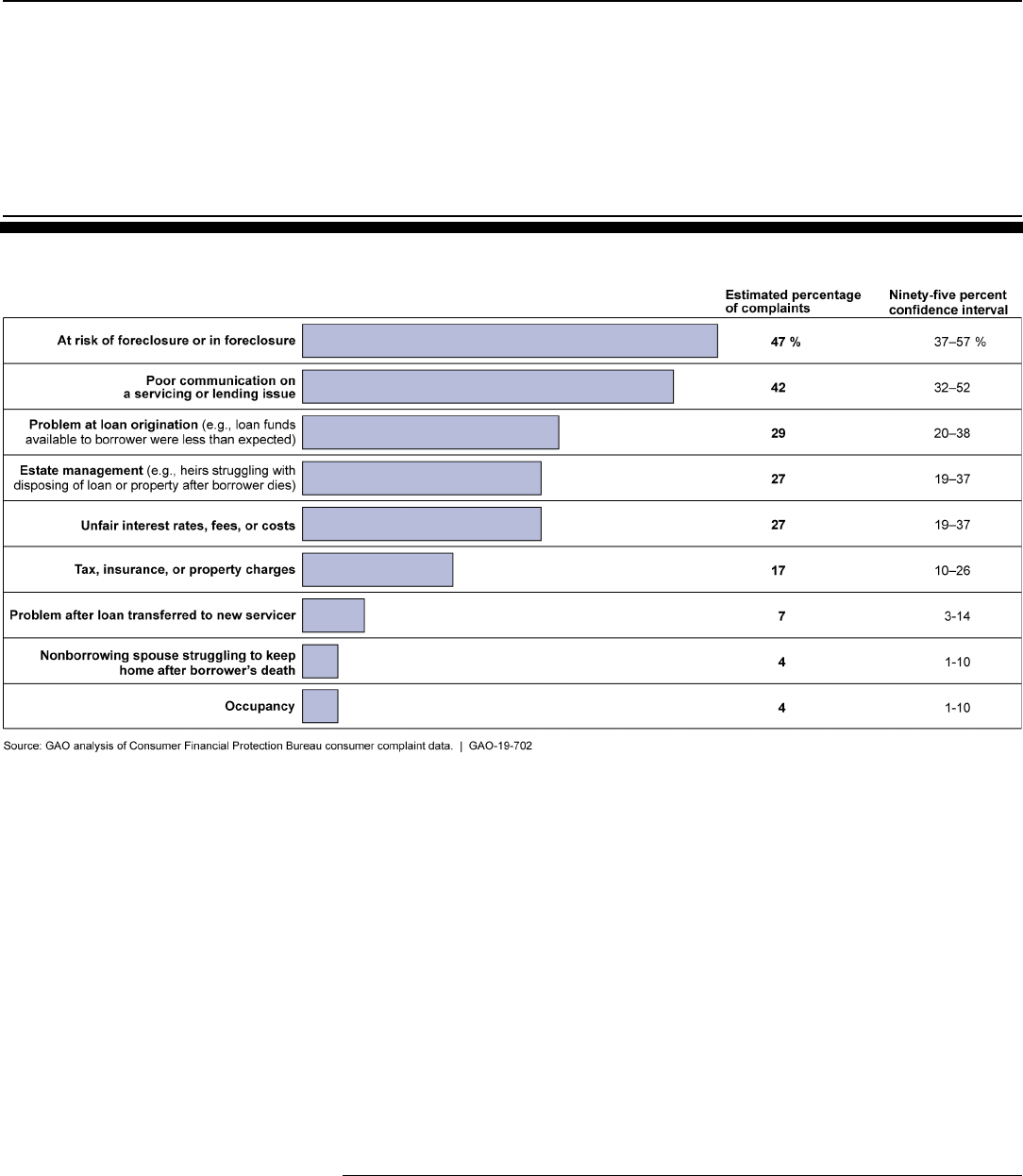

CFPB Collects and Analyzes Consumer Complaints on Reverse

Mortgages, but FHA Does Not Use All Available Data 45

Housing Market Conditions, Exit of Large Bank Lenders, and

Policy Changes Help Explain the Decline in Reverse Mortgages

since 2010 54

Conclusions 60

Recommendations for Executive Action 61

Agency Comments and Our Evaluation 63

Appendix I Objectives, Scope, and Methodology 66

Appendix II Description of and Results for GAO’s Econometric

Model of Home Equity Conversion Mortgage Take-Up Rates 77

Appendix III Reported Home Equity Conversion Mortgage

Termination Reasons 92

Appendix IV Reported Home Equity Conversion Mortgage

Terminations and Defaults 93

Appendix V Comments from the Department of Housing

and Urban Development 95

Contents

Page ii GAO-19-702 Reverse Mortgages

Appendix VI Comments from the Consumer Financial Protection Bureau 99

Appendix VII GAO Contact and Staff Acknowledgments 100

Tables

Table 1: Summary of Selected Federal Housing Administration

(FHA) Foreclosure Prevention Options for Home Equity

Conversion Mortgage (HECM) Borrowers 23

Table 2: Summary of Mortgagee Optional Election Assignments,

Fiscal Years 2015–2018 24

Table 3: Number of FHA On-Site Reviews of Home Equity

Conversion Mortgage Servicers, Fiscal Years 2010–2018 38

Table 4: Number of Reverse Mortgage Complaints Received by

the Consumer Financial Protection Bureau (CFPB),

Calendar Years 2015–2018 47

Table 5: Reported Home Equity Conversion Mortgage

Terminations, Fiscal Years 2014–2018 68

Table 6: Descriptive Statistics, List of Variables Used in

Regression Analysis, 2004–2016 86

Table 7: Fixed-Effects Regression Estimates of HECM Take-Up

Rates, 2004–2016 87

Table 8: Reported Home Equity Conversion Mortgage (HECM)

Termination Reasons, Number and Percentage of Loans,

Fiscal Years 2014–2018 92

Table 9: Reported Home Equity Conversion Mortgage

Terminations and Defaults, by State, Number and

Percentage of Loans, Fiscal Years 2014–2018 93

Figures

Figure 1: Difference between Forward and Reverse Mortgages 6

Figure 2: Home Equity Conversion Mortgage Termination

Reasons and Repayment Alternatives 9

Figure 3: Status of Home Equity Conversion Mortgages, Fiscal

Years 1989–2018 10

Figure 4: Reported Home Equity Conversion Mortgage

Termination Reasons, Fiscal Years 2014–2018 19

Page iii GAO-19-702 Reverse Mortgages

Figure 5: Total Reported Servicer Advances for Terminated Home

Equity Conversion Mortgages, Fiscal Years 2014–2018 22

Figure 6: Types of Reverse Mortgage Complaints Received by the

Consumer Financial Protection Bureau, Calendar Years

2015–2018 49

Figure 7: Home Equity Conversion Mortgage (HECM) Originations

and Take-up Rates, Calendar Years 1989–2018 55

Abbreviations

CFPB Consumer Financial Protection Bureau

Fannie Mae Federal National Mortgage Association

FHA Federal Housing Administration

HECM Home Equity Conversion Mortgage

HERMIT Home Equity Reverse Mortgage Information

Technology

HUD Department of Housing and Urban Development

IPUMS NHGIS Integrated Public Use Microdata Series National

Historical Geographic Information System

OMB Office of Management and Budget

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page 1 GAO-19-702 Reverse Mortgages

441 G St. N.W.

Washington, DC 20548

September 25, 2019

The Honorable Maxine Waters

Chairwoman

Committee on Financial Services

House of Representatives

The Honorable Denny Heck

House of Representatives

The aging of the U.S. population, the large share of seniors’ wealth held

in home equity, and the preference of many older adults to age in place

underscore the importance of knowing more about reverse mortgages

and the role they play for some senior homeowners. A reverse mortgage

is a type of loan that allows eligible seniors to convert part of their home

equity into payments from a lender while still living in their homes.

Congress authorized the Department of Housing and Urban Development

(HUD) to insure reverse mortgages to help meet the financial needs of

elderly homeowners.

1

The vast majority of reverse mortgages are made

under the Home Equity Conversion Mortgage (HECM) program

administered by HUD’s Federal Housing Administration (FHA).

2

HECMs

are originated and serviced by private FHA-approved lenders and

servicers. FHA insures these entities against losses on the loans and

charges borrowers premiums to help cover the potential cost of insurance

claims. While not involved in administering the HECM program, the

Consumer Financial Protection Bureau (CFPB) collects consumer

complaints about reverse mortgages and supervises nonbank

(nondepository institution) reverse mortgage lenders and servicers for

compliance with, and enforces violations of, federal consumer financial

protection laws.

3

1

Congress authorized the Home Equity Conversion Mortgage (HECM) program in 1988 by

adding Section 255 to Title II of the National Housing Act. See Housing and Community

Development Act of 1987, Pub. L. No. 100-242, § 417 (1988) (codified as amended at 12

U.S.C. § 1715z-20).

2

The reverse mortgage market includes some proprietary (non-FHA) products but is

currently dominated by HECMs. Proprietary reverse mortgages were outside the scope of

our review.

3

As discussed later in this report, the HECM market is currently dominated by nonbank

lenders and servicers.

Letter

Page 2 GAO-19-702 Reverse Mortgages

Reverse mortgage servicing involves a range of activities, such as

making payments to borrowers, providing monthly account statements,

monitoring loan balances, and responding to borrower inquiries. If a

borrower falls behind on property charges (for example, taxes and

homeowners insurance), servicers must generally temporarily pay them

on the borrower’s behalf (referred to in this report as servicer advances)

but may ultimately initiate foreclosure proceedings if the borrower does

not catch up.

4

In recent years, FHA has made program changes allowing

servicers to offer foreclosure prevention options—options for distressed

HECM borrowers to help delay or avoid foreclosure.

HECMs terminate—that is, the loan balance is paid off and the loan

ends—for a variety of reasons. For example, borrowers may choose to

repay the loan or refinance into a new HECM. Additionally, events such

as the borrower dying, moving, or defaulting—that is, not meeting

mortgage conditions—result in the loan becoming “due and payable.” In

some cases, generally when a borrower defaults, the lender may

foreclose on the borrower to obtain title to the property and sell the home

to satisfy the debt.

5

In these circumstances, the borrower may end up

being displaced from his or her home. Consumer advocacy organizations

have expressed concerns about an observed increase in HECM

foreclosures and servicing problems.

6

You asked us to review HECM loan outcomes and servicing and related

federal oversight efforts. This report examines (1) what FHA data show

about HECM terminations, servicer advances, and the use of foreclosure

prevention options; (2) FHA’s assessment and monitoring of HECM

portfolio performance, servicer advances, and foreclosure prevention

4

In addition to property taxes and homeowners insurance premiums, borrowers must pay

other property charges such as homeowners’ association or condominium fees and any

other special assessments that may be levied by municipalities or state law on the

property. See 24 C.F.R. § 206.205. As discussed later in this report, servicers offer some

borrowers repayment plans to help pay unpaid property charges. According to FHA policy,

no borrower may be given more than 60 months to repay the servicer advances. See

Department of Housing and Urban Development, Mortgagee Letter 2015-11 (Apr. 23,

2015).

5

In some cases, the borrower may be able to deed the property to the servicer to satisfy

the debt and avoid foreclosure, known as a deed-in-lieu of foreclosure.

6

Center for NYC Neighborhoods, Protecting Senior Homeowners from Reverse Mortgage

Foreclosure: Policy Brief (August 2017) and National Consumer Law Center, Examples of

Senior Homeowners Struggling with Ineffective and Inconsistent Servicing of HECM

Loans (October 2017).

Page 3 GAO-19-702 Reverse Mortgages

options; (3) FHA’s and CFPB’s oversight of HECM servicers; (4) how

FHA and CFPB collect, analyze, and respond to consumer complaints

about HECMs; and (5) how and why the market for HECMs has changed

in recent years.

To address the first and second objectives, we analyzed FHA data to

determine the number of and reasons for HECM terminations in fiscal

years 2014 through 2018.

7

We also analyzed FHA data on servicer

advances for unpaid property charges and other costs for HECMs in a

due and payable status. Additionally, we analyzed information from FHA

on HECM borrowers approved for selected foreclosure prevention

options. To assess the reliability of FHA’s data, we reviewed FHA

documentation, performed electronic testing on the data to check for

missing values and obvious errors, corroborated the data with other

available sources (such as published FHA reports), and interviewed

agency officials and FHA’s data system contractor about interpreting data

fields. We determined the data were sufficiently reliable for characterizing

loan terminations, servicer advances, and use of foreclosure prevention

options in the HECM program. We also reviewed FHA data and reports

and interviewed FHA officials to determine how the agency monitors and

analyzes the HECM portfolio, including the use of any performance

indicators or program evaluations. We compared FHA’s practices against

leading practices for assessing program performance, federal internal

control standards, and Office of Management and Budget (OMB) policies

and procedures on managing federal credit programs (OMB Circular A-

129).

8

To address the third objective, we reviewed FHA and CFPB policies and

procedures for overseeing HECM servicers and interviewed agency

officials with oversight responsibilities. We reviewed completed

examinations of HECM servicers to determine the extent to which the

7

The federal fiscal year begins on October 1 and ends on September 30 of each year.

8

We have previously identified performance goals and measures as important

management tools that can serve as leading practices for planning at lower levels within

federal agencies, such as individual programs or initiatives. For example, see GAO,

Veterans Justice Outreach Program: VA Could Improve Management by Establishing

Performance Measures and More Fully Assessing Risks, GAO-16-393 (Washington, D.C.:

Apr. 28, 2016); Performance Measurement and Evaluation: Definitions and Relationships,

GAO-11-646SP (Washington, D.C.: May 2, 2011). See also Standards for Internal Control

in the Federal Government, GAO-14-704G (Washington, D.C.: September 2014). See

also Office of Management and Budget, Policies for Federal Credit Programs and Non-

Tax Receivables, OMB Circular No. A-129 (revised January 2013).

Page 4 GAO-19-702 Reverse Mortgages

agencies have assessed and taken steps to enforce compliance with

servicing and consumer protection requirements. We compared FHA’s

oversight of HECM servicers to relevant parts of OMB Circular A-129.

Additionally, we interviewed FHA and CFPB officials to determine the

extent to which the agencies collaborate and share information on

oversight of HECM servicers. We compared their efforts to approaches

federal agencies use to enhance collaboration toward joint goals that we

identified in prior work.

9

To address the fourth objective, we analyzed all reverse mortgage

consumer complaints received by CFPB through its Consumer Complaint

Database from calendar years 2015 through 2018 to determine the

number of complaints by year, state, submission method (for example,

internet, phone, or email), and company. We also analyzed a random

generalizable sample of 100 reverse mortgage consumer complaints to

identify patterns in consumer-described issues about reverse mortgages.

We determined the CFPB data were sufficiently reliable for the analysis

we conducted by reviewing CFPB documentation, performing electronic

testing of the data, and interviewing CFPB officials about our

interpretation of data fields. To determine the extent to which FHA

collects and analyzes complaints, we reviewed the nearly 105,000

HECM-related calls received by the National Servicing Center from

calendar years 2015 through 2018. We also reviewed the 147 HECM-

related calls received by the FHA Resource Center during the same time.

However, we did not perform an analysis on these data similar to that

conducted on the CFPB data because of limitations in how the data were

collected. For example, data did not include information on whether the

call was a complaint or inquiry, and a large majority of the data did not

include information on who the caller was (e.g., a borrower, servicer, or

lender). Additionally, we reviewed CFPB and FHA policies and

procedures for collecting and addressing consumer complaints and for

incorporating consumer complaints into their oversight of HECM

servicers. Further, we interviewed officials from both agencies to better

understand their complaint processes. We compared CFPB’s and FHA’s

efforts against federal internal control standards and against criteria we

developed previously on leveraging related agency resources.

10

9

GAO, Managing for Results: Key Considerations for Implementing Interagency

Collaborative Mechanisms, GAO-12-1022, (Washington, D.C.: Sept. 27, 2012).

10

GAO-14-704G and GAO-12-1022.

Page 5 GAO-19-702 Reverse Mortgages

To address the fifth objective, we analyzed FHA data from calendar years

1989 (the start of the HECM program) through 2018 to identify trends in

the volume of HECM originations. Additionally, using FHA and Census

Bureau data, we calculated HECM take-up rates—the ratio of new HECM

originations to senior homeowners—from calendar years 2000 through

2017 to measure the extent to which senior homeowners participate in

the program. We also developed an econometric model using FHA,

Census Bureau, and other data to examine the relationship between

HECM take-up rates and a number of explanatory variables. We also

reviewed relevant research and interviewed academic and HUD

economists about other factors (for example, consumers’ perception of

reverse mortgages) that are difficult to directly include in the model but

that may influence HECM take-up rates. Appendix I contains a more

detailed description of our objectives, scope, and methodology. Appendix

II contains a description and results of our econometric model of factors

associated with HECM take-up rates.

We conducted this performance audit from July 2018 to September 2019

in accordance with generally accepted government auditing standards.

Those standards require that we plan and perform the audit to obtain

sufficient, appropriate evidence to provide a reasonable basis for our

findings and conclusions based on our audit objectives. We believe that

the evidence obtained provides a reasonable basis for our findings and

conclusions based on our audit objectives.

A reverse mortgage is a nonrecourse loan against home equity that does

not require mortgage payments as long as the borrower meets certain

conditions. In contrast to traditional forward mortgages, reverse

mortgages typically are “rising debt, falling equity” loans (see fig. 1). As

the borrower receives payments from the lender, the lender adds the

principal and interest to the loan balance, reducing the borrower’s home

equity. Also unlike traditional forward mortgages, reverse mortgages have

no fixed term.

Background

HECM Program

Page 6 GAO-19-702 Reverse Mortgages

Figure 1: Difference between Forward and Reverse Mortgages

Page 7 GAO-19-702 Reverse Mortgages

Prospective borrowers must meet a number of requirements to be eligible

for a HECM (see sidebar). The amount of money a borrower can receive

from a HECM—called the principal limit—depends on three things: (1) the

age of the youngest borrower or eligible nonborrowing spouse, (2) the

lesser of the appraised value of the home or the FHA mortgage limit as of

the date of loan closing (for calendar year 2019, $726,525), and (3) the

expected average interest rate.

11

The borrower can receive funds in a variety of ways—for example, as

monthly payments, a line of credit, a combination of the two, or a single

lump sum.

12

A large majority of borrowers choose the line of credit option.

The interest rate lenders charge is typically an adjustable rate, although

the lump sum option can be chosen at a fixed interest rate.

HECMs can terminate for a variety of reasons. For example, a borrower

may choose to repay the loan, refinance into a new HECM, or be required

to satisfy the debt because the loan has become due and payable. A

HECM becomes due and payable when a borrower dies, fails to retain

ownership of the home, or does not meet his or her mortgage obligations

such as paying property charges, meeting occupancy requirements, or

maintaining the home.

13

In these cases, the borrowers or heirs must

satisfy the debt or correct the condition that resulted in the due and

payable loan status.

14

In this report, we use the term default to refer to

11

According to Mortgagee Letter 2014-07, a nonborrowing spouse is defined as the

spouse, as determined by the law of the state in which the borrower and spouse reside or

the state of celebration, at the time of closing and who is not listed on the mortgage as a

borrower. In the case of a HECM for Purchase, the principal limit is based on the lesser of

the appraised value of the home or the sale price of the property being purchased. HECM

for Purchase is a program in which seniors may use a HECM to buy a new home. Unlike a

traditional HECM, a HECM for purchase is made against the value of the home to be

purchased, rather than against the value of a home the borrower already owns.

12

The monthly payments can be for as long as the borrower has the loan (tenure

payments) or for a fixed period (term payments). Borrowers cannot receive more than the

greater of 60 percent of the principal limit amount or the sum of mandatory obligations

plus 10 percent of the principal limit in the first year of the loan.

13

See 24 C.F.R. § 206.27(c). An example of failing to retain ownership of the home is

when one individual conveys title to the home to another individual, such as an aging

parent transferring ownership to an adult child.

14

According to FHA, servicers are required to obtain HUD approval prior to calling loans

due and payable for certain reasons, such as failure to meet occupancy requirements and

property charge defaults.

Home Equity Conversion Mortgage (HECM)

Eligibility Requirements

Key borrower requirements

• Be 62 years of age or older

• Own your home outright or have sufficient

equity in your home to secure the HECM

• Occupy the property as your principal

residence

• Participate in a consumer information

session given by a HECM counselor

approved by the Department of Housing

and Urban Development (HUD)

Key financial requirements

• Have financial resources to continue to

make timely payment of ongoing property

charges (e.g., taxes and insurance)

• Verification of income, assets, financial

obligations, and credit history

Source: GAO analysis of HUD information. | GAO-19-702

Page 8 GAO-19-702 Reverse Mortgages

HECMs that are due and payable because the borrower has not paid

property charges, met occupancy requirements, or maintained the home.

HECM borrowers (or their heirs) satisfy the debt by (1) paying the loan

balance using their own funds, (2) selling the home and using the

proceeds to pay off the loan balance, (3) providing a deed-in-lieu of

foreclosure (which transfers title for the property to the lender to satisfy

the debt), or (4) selling the home for at least the lesser of the loan

balance or 95 percent of the property’s appraised value (also known as a

short sale). According to FHA regulations, the borrowers or their heirs

generally have 30 days after being notified that the loan is due and

payable to satisfy the debt or bring the loan out of due and payable

status.

15

Servicers generally have 6 months to take first legal action to

initiate foreclosure from the date that they, as applicable, notified, should

have notified, or received approval from FHA that the HECM is due and

payable. According to FHA regulations, the borrower is generally allowed

to correct the condition that resulted in the due and payable loan status

and reinstate the loan, even after foreclosure proceedings have begun.

16

Figure 2 illustrates the reasons why HECMs terminate and how borrowers

typically satisfy the debt under various termination scenarios.

15

See 24 C.F.R. § 206.125(a)(2). If a loan becomes due and payable due to a reason

other than the death of the borrower, such as if a mortgage condition has not been met,

the lender has 30 days to notify FHA. In the case of borrower death, the lender has 60

days to notify FHA. After notifying and receiving approval (as applicable) from FHA that

the HECM can be called due and payable, the lender has 30 days to notify the borrower

(or their heirs). The borrower (or the heirs) has 30 days from the date of notice to engage

in one of the options noted or the lender may proceed with foreclosure.

16

24 C.F.R. § 206.125(a)(3).

Page 9 GAO-19-702 Reverse Mortgages

Figure 2: Home Equity Conversion Mortgage Termination Reasons and Repayment Alternatives

If the servicer experiences a loss because the loan balance exceeds the

recovery from selling the property, the lender can file a claim with FHA for

the difference. Additionally, when the loan balance reaches 98 percent of

the maximum claim amount (the lesser of the appraised value of the

home at origination or FHA’s loan limit), the lender can “assign” the loan

to FHA and file a claim for the full amount of the loan balance, up to the

maximum claim amount. Lenders can only assign HECMs in good

standing to FHA (that is, assignments can only be for HECMs not in a due

and payable status). FHA continues to service the assigned loans using a

contractor until the loans become due, either due to the death of the

borrower or for other reasons. Additionally, the FHA insurance

guarantees borrowers will be able to access their loan funds, even if the

loan balance exceeds the current value of the home or if the lender

experiences financial difficulty. Further, if the borrower or heir sells the

Page 10 GAO-19-702 Reverse Mortgages

home to repay the loan, he or she will not be responsible for any loan

amount above the value of the home.

As of the end of fiscal year 2018, FHA had insured over 1 million HECMs.

According to FHA data, these include an active HECM portfolio of

approximately 551,000 loans serviced by various FHA-approved

servicers, 79,000 FHA-assigned loans serviced by an FHA contractor,

and about 468,000 terminated loans (see fig. 3). HECM terminations have

exceeded new originations every year since fiscal year 2016, and the

number of HECMs assigned to FHA has grown substantially since fiscal

year 2014.

17

Figure 3: Status of Home Equity Conversion Mortgages, Fiscal Years 1989–2018

17

Throughout this report, we use the term “originations” to refer to HECMs originated by

lenders and subsequently approved for mortgage insurance (endorsed) by FHA.

Page 11 GAO-19-702 Reverse Mortgages

Note: The active Home Equity Conversion Mortgage portfolio consists of both privately owned and

FHA-assigned loans.

As of the end of fiscal year 2018, FHA’s total insurance-in-force for

HECMs (total insured mortgage balances outstanding) was roughly $100

billion. HECMs are held in two FHA insurance funds. HECMs originated

prior to fiscal year 2009 are in the General Insurance and Special Risk

Insurance Fund (roughly 27 percent of all HECMs), and those originated

in fiscal year 2009 and later are in the Mutual Mortgage Insurance Fund

(roughly 73 percent of all HECMs).

18

When the post-2008 HECM portfolio

became part of FHA’s Mutual Mortgage Insurance Fund, it also was

included in the fund’s capital ratio assessment and became subject to

annual actuarial reviews.

19

As we found in a November 2017 report,

subjecting HECMs to the annual actuarial review requirements has

improved the transparency of the program’s financial condition and has

highlighted the financial risks of the HECM portfolio to FHA.

20

According to FHA, the financial performance of the HECM portfolio has

been historically volatile, largely due to uncertainty in future home prices,

interest rates, and other factors. In recent years, FHA has responded with

several policy changes to help strengthen the portfolio’s financial

performance and mitigate risks. Because FHA’s projected losses on

HECMs depend on factors such as maximum claim amount, the length of

time the borrower stays in the home, changes in home prices, and

interest rates, most of FHA’s policy changes have been aimed at better

aligning expected revenues (charging borrowers premiums) with

expected costs (cash outflows due to paying insurance claims). For

example, FHA has made changes to insurance premiums and principal

18

Beginning with the fiscal year 2009 loan cohort, the Housing and Economic Recovery

Act of 2008 placed new HECMs in FHA’s Mutual Mortgage Insurance Fund.

19

The capital ratio is the fund’s economic value divided by the amortized insurance-in-

force. The National Housing Act requires an annual independent actuarial review of the

fund’s financial position. See 12 U.S.C. § 1708(a)(4). Each year, an independent actuarial

contractor conducts two separate actuarial reviews—one for forward mortgages and one

for HECMs—to estimate the economic value of the two portfolios. In a separate annual

report to Congress, FHA combines the findings of the forward mortgage and HECM

actuarial reviews to determine the capital ratio for the fund as a whole.

20

For additional information, see GAO, Federal Housing Administration: Capital

Requirements and Stress Testing Practices Need Strengthening, GAO-18-92

(Washington, D.C.: Nov. 9, 2017).

Page 12 GAO-19-702 Reverse Mortgages

limits, the most recent of which took effect in fiscal year 2018.

21

Effective

in fiscal year 2019, FHA also revised property appraisal practices for new

HECMs to guard against inflated property valuations.

22

According to

agency officials, FHA made this change to address appraisal bias

concerns identified in research by an economist in HUD’s Office of Policy

Development and Research.

23

The HECM market includes various participants. After a lender originates

a HECM, the loan must be serviced until it terminates. HECM lenders and

servicers must be FHA-approved and can be the same entity but often

are not. HECM lenders often sell the mortgage to another entity, which

FHA refers to as an investor, and this entity has the right to enforce the

mortgage agreement.

24

HECM servicers are typically third parties that

contract with lenders or investors but do not have ownership in the loans

they service. As previously discussed, HECM servicers perform a number

of functions, such as making payments to the borrowers and providing

monthly account statements. Servicers also must monitor borrower

compliance with various mortgage conditions and, if necessary,

21

For new HECMs, FHA currently charges an initial mortgage insurance premium of 2

percent at loan closing and, over the life of the loan, an annual mortgage insurance

premium of 0.5 percent of the outstanding mortgage balance. See Mortgagee Letter 2017-

12. Prior to that mortgagee letter, the initial mortgage insurance premium was 0.5 percent

and the annual insurance premium was 1.25 percent for amounts 60 percent or less of the

principal limit, and the initial mortgage insurance premium was 2.5 percent for amounts

greater than 60 percent of the principal limit.

22

Inflated property appraisals can negatively affect the financial performance of the HECM

program because the appraised value is used in determining the amount of home equity

available to the borrower and the amount of any insurance claim paid to a lender. Since

October 1, 2018, FHA has performed a property appraisal risk assessment on all HECMs

submitted for approval of insurance. Lenders are required to provide a second

independent property appraisal in cases where FHA determines there may be inflated

property valuations. See Department of Housing and Urban Development, Mortgagee

Letter 2018-06 (Sept. 28, 2018).

23

Kevin Park, “Reverse Mortgage Collateral: Undermaintenance or Overappraisal?”

Cityscape: A Journal of Policy Development and Research, vol. 19, no. 1 (2017): pp.7-28.

24

Servicing accompanies all mortgages, but the right to service a mortgage becomes a

distinct asset when contractually separated from the loan when the loan is sold or

securitized. Originators can service mortgages that they originate or purchase, or they can

sell the mortgages but retain the mortgage servicing rights. Servicers other than the

originator may also purchase mortgage servicing rights on securitized loans or may be

hired to service loans for others. For more information on nonbank mortgage servicers,

see GAO, Nonbank Mortgage Servicers: Existing Regulatory Oversight Could Be

Strengthened, GAO-16-278 (Washington, D.C.: Mar. 10, 2016).

HECM Market Participants

Page 13 GAO-19-702 Reverse Mortgages

communicate with borrowers about any violation of these conditions

(defaults) and, as appropriate, ways they can avoid being foreclosed on.

HECM servicers also transfer up-front and annual insurance premiums to

FHA each month and file claims with FHA for losses on insured HECMs.

In carrying out these duties, servicers are responsible for complying with

various requirements, including FHA regulations, policies, and

procedures, as well as federal consumer financial laws.

Historically, commercial banks, thrifts, and credit unions were the primary

lenders and servicers of mortgage loans. Following the 2007–2009

financial crisis and subsequent revisions to regulatory bank capital

requirements, banks reevaluated the benefits and costs of being in the

mortgage lending market, as well as retaining mortgages and the right to

service them. Since the financial crisis, some banks have exited or

reduced their mortgage lending and servicing businesses. This

development, among others, created an opportunity for nonbank

servicers to increase their presence in the mortgage market. Nonbank

issuers such as mortgage originators and servicers are not subject to the

same comprehensive federal safety and soundness standards as banks.

While banks offer a variety of financial products to consumers, nonbank

servicers are generally involved only in mortgage-related activities and do

not take deposits from consumers.

Almost all HECMs are originated, owned, and serviced by nonbank

entities:

• Lenders. According to FHA, in fiscal year 2018, 54 lenders originated

HECMs, including 49 nonbank entities and five banks.

• Investors. As of the end of fiscal year 2018, six investors (all nonbank

entities) and the Federal National Mortgage Association (Fannie Mae)

owned roughly 92 percent of the privately owned (non-FHA-assigned)

HECM portfolio, while the remaining 8 percent was owned by a

mixture of bank and nonbank entities.

25

• Servicers. Five nonbank entities serviced over 99 percent of the

privately owned HECM portfolio as of the end of fiscal year 2018. As

25

Fannie Mae is a government-sponsored enterprise that purchases mortgages from

lenders and either pools the loans into securities or holds them in its portfolio.

Page 14 GAO-19-702 Reverse Mortgages

previously noted, FHA has a contractor (also a nonbank entity) that

services FHA-assigned HECMs.

A number of federal agencies have roles in overseeing the reverse

mortgage market, including the following:

• FHA. Insures HECMs and administers the HECM program, including

issuing program regulations and enforcing program requirements.

FHA supplements regulations through additional policies, procedures,

and other written communications for the HECM program. For

example, FHA officials said the agency utilizes its Single Family

Housing Handbook, HECM handbook, and mortgagee letters to

communicate changes about the HECM program.

26

In 2013,

Congress enacted a law that allowed FHA to make changes to HECM

program requirements by notice or mortgagee letter in addition to

regulation.

27

Since then, FHA has made several policy changes to the

HECM program through mortgagee letters.

• CFPB. Supervises nonbank reverse mortgage lenders and servicers

for compliance with, and enforces violations of, federal consumer

financial protection laws.

28

CFPB can also issue regulations under the

federal consumer protection laws addressed specifically to protecting

consumers considering reverse mortgages.

29

Additionally, CFPB

examines entities for compliance with federal consumer financial laws

to obtain information about an institution’s compliance management

systems and procedures and to detect and assess risks to consumers

26

A mortgagee letter is a written communication to lenders and servicers about changes in

FHA operations, policies, and procedures. Mortgagee letters for the HECM program are

accessible at https://www.hud.gov/program_offices/housing/sfh/hecm/hecmml.

27

The Reverse Mortgage Stabilization Act of 2013, Pub. L. No. 113-29, § 2, 127 Stat. 509

(2013) (codified at 12 U.S.C. § 1715z-20(h)). According to the act, the HUD Secretary has

the discretion to make any additional or alternative requirements that are necessary to

improve the fiscal safety and soundness of the HECM program.

28

CFPB also has supervisory authority over insured depository institutions and credit

unions with more than $10 billion in assets for compliance with requirements of federal

consumer financial law. See 12 U.S.C. § 5515(a).

29

CFPB was created by the Dodd-Frank Wall Street Reform and Consumer Protection Act

and has rulemaking authority to implement provisions of federal consumer financial law

and enforcement authority to assess servicers’ compliance with various mortgage

servicing rules. See Consumer Financial Protection Act of 2010, Pub. L. No. 111-203, §§

1021, 1024, 124 Stat. 1376, 1979, 1987 (2010) (codified as amended at 12 U.S.C. §§

5511, 5514).

Federal Entities Involved

in Reverse Mortgage

Oversight

Page 15 GAO-19-702 Reverse Mortgages

and markets. Further, CFPB collects consumer complaints regarding

consumer financial products or services (including reverse mortgages)

and educates consumers about their rights under federal consumer

financial protection laws.

• Federal depository institution regulators. These regulators monitor

compliance with relevant laws and regulations, such as provisions of

the Federal Trade Commission Act and the Truth in Lending Act,

primarily through periodic examinations, for federally regulated

lenders that originate HECMs.

30

Several features and requirements of the HECM program provide

consumer protections to borrowers. For example, borrowers must

undergo preloan counseling, the program limits costs and fees lenders

can charge, and lenders must provide certain disclosures. In addition,

FHA has made several changes to the HECM program in recent years to

help borrowers who have defaulted due to unpaid property charges. As

previously discussed, if a HECM borrower does not pay his or her

property charges, FHA regulations generally require the servicer to pay

the property charges on the borrower’s behalf to help avoid a tax

foreclosure by the local authority and protect the investor’s and FHA’s

interest in the home. FHA regulations also allow servicers to charge

certain fees once a loan is called due and payable. These are typically

amounts related to attorney or trustee fees, property preservation, and

appraisal fees during the foreclosure process. The payments and fees

that servicers make on behalf of borrowers—referred to as servicer

advances in this report—are added to the loan balance and accrue

interest.

In 2010, HUD’s Office of Inspector General reported that HUD was not

tracking borrower defaults or servicer advances for the HECM program

30

Depository institutions include institutions chartered as commercial banks, savings

associations (or thrifts), or credit unions. The federal depository institution regulators are

the Board of Governors of the Federal Reserve System, Federal Deposit Insurance

Corporation, Office of the Comptroller of the Currency, and National Credit Union

Administration.

Consumer Protections and

Foreclosure Prevention

Options

Page 16 GAO-19-702 Reverse Mortgages

and made several recommendations to FHA.

31

To address these

recommendations, FHA took several steps. For example, in 2011, FHA

stopped the practice of allowing servicers to defer foreclosing on loans

that were in default due to unpaid property changes and issued a

mortgagee letter addressing how to handle these loans.

32

Additionally, in

September 2012, FHA announced the launch of a new data system for

the HECM program, the Home Equity Reverse Mortgage Information

Technology (HERMIT) system which would be used starting in October

2012.

33

With this new system, FHA combined former legacy systems that

had been used to collect insurance premiums, service FHA-assigned

loans, and process claims. According to FHA, adopting the HERMIT

system allowed FHA to better monitor and track the HECM portfolio in

real time and to automate insurance claim processing.

Finally, FHA modified program features to help minimize potential

borrower defaults and help strengthen borrower eligibility requirements.

For example, in 2013, FHA reduced the amount of equity borrowers could

generally withdraw during the first year from 100 to 60 percent of the

principal limit.

34

According to FHA, this change was designed to

encourage borrowers to access their equity slowly over time rather than

all at once to reduce risks to borrowers and FHA’s insurance fund. In

2015, the financial requirements for HECMs changed to include a

financial assessment of the prospective borrower prior to loan approval.

35

31

Department of Housing and Urban Development, Office of the Inspector General, HUD

Was Not Tracking Almost 13,000 Defaulted HECM Loans With Maximum Claim Amounts

of Potentially More Than $2.5 Billion, 2010-FW-0003 (Aug. 25, 2010). The report

recommended that FHA (1) discontinue the practice of allowing servicers to defer

foreclosure on loans in default due to nonpayment of taxes and insurance; (2) issue formal

guidance to servicers regarding loans in default due to nonpayment of taxes and

insurance; (3) develop and implement a plan to minimize the risk of future defaults due to

nonpayment of taxes and insurance; and (4) develop a data system to better track

defaults and amounts.

32

See Department of Housing and Urban Development, Mortgagee Letter 2011-01 (Jan.

3, 2011). Mortgagee Letter 2011-01 was rescinded and replaced by Mortgagee Letter

2015-11 (Apr. 23, 2015).

33

See Department of Housing and Urban Development, Mortgagee Letter 2012-17 (Sept.

11, 2012).

34

See Department of Housing and Urban Development Mortgagee Letter 2013-27 (Sept.

3, 2013).

35

See Department of Housing and Urban Development, Mortgagee Letter 2014-21 (Nov.

10, 2014) and Mortgagee Letter 2014-22 (Nov. 14, 2014). The financial assessment

requirements in these letters were effective as of April 27, 2015.

Page 17 GAO-19-702 Reverse Mortgages

FHA began requiring HECM lenders to look at the prospective borrower’s

credit history, income, assets, and financial obligations. Based on the

results of the financial assessment, the lender may require a set-aside for

the payment of property charges.

36

Additionally, FHA made several program changes to help distressed

HECM borrowers by allowing servicers to offer options to help borrowers

delay or in some cases avoid foreclosure if they are behind on paying

property charges. These foreclosure prevention options include

repayment plans, at-risk extensions, and extensions for low-balance

arrearage, as described later in this report.

37

FHA also has taken steps to

help nonborrowing spouses stay in their homes after a borrowing spouse

dies by deferring repayment of the HECM as long as the nonborrowing

spouse fulfills certain conditions.

38

In these cases, the servicer can assign

36

According to FHA regulations, HECM lenders may require what is referred to as a “life

expectancy set-aside” for the payment of certain property charges. See 24 C.F.R. §

206.205.

37

See Department of Housing and Urban Development Mortgagee, Letter 2015-11 (Apr.

23, 2015) and Mortgagee Letter 2016-07 (Mar. 30, 2016). According to Mortgagee Letter

2015-11, servicers may offer borrowers in default due to unpaid property charges

repayment plans to satisfy outstanding servicer advances made for unpaid property

charges or an extension of foreclosure time frames due to a borrower being “at-risk.”

According to the mortgagee letter, the servicer must determine if the borrower is eligible

for a repayment plan under FHA’s requirements. If a repayment plan is insufficient or

unsuccessful, borrowers may request an “at-risk” extension if the youngest living borrower

is at least 80 years old and has critical circumstances such as a terminal illness,

substantiated long-term physical disability, or a “unique” occupancy need (e.g., terminal

illness of family member receiving care in the residence). According to Mortgagee Letter

2016-07, servicers may delay submitting a due and payable request (and proceeding with

foreclosure) if the borrower owes less than $2,000 in unpaid taxes and insurance.

According to the letter, servicers must document either that (1) they contacted the

borrower, the borrower has expressed a willingness to repay, and the borrower is currently

attempting to make payments or (2) they were unable to contact the borrower but the

borrower is current on occupancy requirements and there is no indication the borrower

has vacated the property.

38

In 2013, a federal district court found that HUD had interpreted the HECM authorizing

statute incorrectly when it required loans to be due and payable upon a borrower’s death

even when a nonborrowing spouse was present in the home. See Bennett v. Donovan, 4

F.Supp. 3d 5 (D.D.C. 2013). Following the court decision, HUD has issued various

mortgagee letters establishing a process known as the mortgagee optional election

assignment, which allows nonborrowing spouses to avoid foreclosure and defer paying off

the loan balance.

Page 18 GAO-19-702 Reverse Mortgages

the HECM to FHA under what FHA refers to as the mortgagee optional

election assignment process.

39

Our analysis of FHA data found that about 272,155 HECMs terminated

from fiscal years 2014 through 2018.

40

Over that period, the number of

terminations rose from about 24,000 in fiscal year 2014 to a peak of

roughly 82,000 in fiscal year 2016, before declining to about 60,000 in

fiscal year 2018, as previously shown in figure 3.

41

As shown in figure 4, death of the borrower was the most common

reported reason for HECM terminations, followed by borrower defaults.

42

39

See Department of Housing and Urban Development, Mortgagee Letter 2015-15 (June

12, 2015). The mortgagee letter established the process, as well as time frames, for when

servicers need to submit information to FHA in order for the loan to be assigned to FHA.

The time frames were extended for certain assignments in an additional mortgagee letter.

See Department of Housing and Urban Development, Mortgagee Letter 2016-05 (Feb. 12,

2016).

40

See fig.3 for a comparison of active and terminated HECMs during this period.

41

We report on data starting in fiscal year 2014 because, as previously discussed, FHA

adopted a new system of record (HERMIT) for the HECM program in fiscal year 2013.

Unless otherwise noted, we analyzed data for the HECM program for the 5-year period

spanning fiscal years 2014–2018.

42

The HERMIT system records borrower death and conveyed title as a type of default for

administrative reasons related to the claims filing process. We did not categorize borrower

deaths or conveyed titles as defaults in order to differentiate those cases from loan

terminations resulting from living borrowers not meeting their mortgage obligations. We

treated them as separate loan termination reasons. We removed HECMs that had

previously been assigned to FHA and that terminated in fiscal years 2014 through 2018

from our termination analysis. We did not include them because, as discussed later in this

report, FHA’s practice is to not foreclose on FHA-assigned HECMs that default.

Accordingly, the denominator for our terminations analysis was 256,147 loans. For more

information on our termination analysis methodology, see app. I. For detailed information

on the number of loans and percentages by termination reason for fiscal years 2014–

2018, see app. III.

HECM Defaults Have

Increased, and Use of

Foreclosure

Prevention Options Is

Limited or Unknown

Death of the Borrower Is

the Most Common Reason

for HECM Terminations,

but Defaults Have

Increased in Recent Years

Page 19 GAO-19-702 Reverse Mortgages

The relative size of each termination category varied from fiscal years

2014 through 2018, with borrower defaults accounting for an increasing

proportion of terminations in recent years. In fiscal year 2018, borrower

defaults made up 18 percent of terminations.

Figure 4: Reported Home Equity Conversion Mortgage Termination Reasons, Fiscal Years 2014–2018

Note: Due to rounding, figures may not sum to 100 percent.

Specific results for all major termination categories over the 5-year period

were as follows:

Death. About 34 percent of terminations (approximately 87,000 loans)

were due to the death of the borrower. Borrower deaths ranged from

roughly 29 percent to 40 percent of annual terminations over the 5-

year period.

Default. About 15 percent of terminations (approximately 40,000

loans) were due to borrower defaults. As discussed in appendix IV,

this percentage varied widely by location and was highest in Michigan

(36 percent) and lowest in the District of Columbia (1 percent). About

29,000 defaults were for noncompliance with occupancy or residency

requirements, about 11,000 were for nonpayment of property charges,

Page 20 GAO-19-702 Reverse Mortgages

and about 200 were for not keeping the property in good repair. The

borrowers of these loans likely lost their homes through foreclosure or

a deed-in-lieu of foreclosure.

43

However, it is possible that some of

these borrowers would have ultimately lost their homes even if they

had not taken out a HECM. For example, as noted in CFPB’s 2012

report to Congress on reverse mortgages, some borrowers may have

taken out a HECM to help pay off their traditional mortgage rather

than as a way to pay for everyday expenses. In these cases, the

money borrowers received from their HECMs may have helped them

temporarily but may ultimately have been prolonging an unsustainable

financial situation.

44

In addition, some borrowers who did not meet

occupancy or residency requirements may have permanently moved

out of their homes—for example, to assisted living or nursing home

facilities.

45

Borrower defaults as a percentage of annual HECM terminations grew

from 2 percent of terminations in fiscal year 2014 to 18 percent in

fiscal year 2018. Noncompliance with occupancy requirements was

the primary cause of defaults each year, but unpaid property charges

represented a growing share. From fiscal years 2014 through 2018,

property charge defaults as a percentage of all defaults grew from 26

percent to 45 percent, and property charge defaults as a percentage

of all terminations grew from less than 1 percent to 8 percent.

• Loan balance repaid. About 9 percent of terminations (approximately

23,000 loans) were due to the borrower repaying the loan balance.

This category accounted for a declining share of terminations over the

5-year period, falling from 24 percent in fiscal year 2014 to 4 percent

in 2018.

43

Due to limitations in how short sales are coded in the HERMIT system, we could not

readily distinguish between short sales used after a borrower default and those used after

a borrower’s death. According to FHA, short sales are used in both circumstances.

44

See Consumer Financial Protection Bureau, Reverse Mortgages: Report to Congress

(Washington, D.C.: June 28, 2012).

45

Representatives from some legal aid organizations have cited instances where HECM

borrowers were reportedly residing in their homes but were foreclosed on for not

completing and returning annual occupancy certificates—a task that might become more

difficult for some borrowers as they age. The five HECM servicers we spoke with

described methods they use in addition to occupancy certificates to remind borrowers

about or verify compliance with occupancy requirements. These include phone calls,

reminder letters, and property inspections. We did not attempt to independently verify

servicers’ use of these methods or claims that borrowers residing in their homes were

foreclosed on for not returning occupancy certificates.

Page 21 GAO-19-702 Reverse Mortgages

• Refinanced. About 8 percent of terminations (about 20,000 loans)

were due to the borrower refinancing into a new HECM. This category

remained relatively stable over the 5-year period, accounting for about

5 percent to 10 percent of terminations each year.

• Borrower moved or conveyed title. About 3 percent of terminations

(approximately 8,000 loans) were due to the borrower either moving

or conveying title to the property to someone else. The percentage of

terminations in this category declined from 6 percent in fiscal year

2014 to 2 percent in fiscal year 2018.

• Unknown. For about 30 percent of terminations (roughly 78,000

loans), we were unable to readily determine a termination reason from

FHA’s data. Over the 5-year period, this category accounted for over

25 percent of terminations each year and reached a high of 39

percent in fiscal year 2018. We discuss challenges related to

determining termination reasons later in this report.

For HECMs that terminated in fiscal years 2014 through 2018, servicers

advanced almost $3 billion on behalf of borrowers for unpaid property

charges or various other costs that are charged once a loan becomes due

and payable.

46

The advances increased from $508 million in fiscal year

2014 to a peak of $731 million in fiscal year 2016, before declining to

$453 million in fiscal year 2018 (see fig. 5). This pattern aligns with the

overall trend in terminations, which also peaked in fiscal year 2016. Over

the 5-year period, advances for property charges made up 58 percent of

the total. The remaining 42 percent consisted of advances for other costs,

many of them foreclosure-related, such as attorney fees and appraisal

costs.

46

According to the HERMIT User Guide, corporate advances are any expense incurred by

the lender or servicer for any disbursement made on a borrower’s behalf after the HECM

becomes due and payable. These include advances for taxes, insurance, or condominium

or homeowners’ association dues (property charges); attorney and trustee fees; title,

recording, or sheriff fees; state and other taxes on deeds; special assessment liens; bank

attorney fees for bankruptcy proceedings; and appraisal fees.

HECM Servicers

Advanced Almost $3

Billion on Behalf of

Borrowers for Unpaid

Property Charges or Other

Costs

Page 22 GAO-19-702 Reverse Mortgages

Figure 5: Total Reported Servicer Advances for Terminated Home Equity

Conversion Mortgages, Fiscal Years 2014–2018

From fiscal years 2014 through 2018, HECM servicers advanced a total

of $567 million on behalf of living borrowers who defaulted on their

HECMs due to unpaid property charges.

47

For these loans, the median

advance was $7,007.

48

47

FHA officials told us HECM servicers continue to pay property charges after a borrower

dies to avoid a tax foreclosure on the property.

48

Additionally, the mean advance was $12,653. We also found that the amount advanced

for these loans varied widely. For example, advances at the 25th and 75th percentiles

were approximately $2,923 and $15,445, respectively.

Page 23 GAO-19-702 Reverse Mortgages

From April 2015 (the effective date of FHA’s current repayment plan

policy) through the end of fiscal year 2018, 22 percent of HECM

borrowers with overdue property charges had received repayment plans,

and FHA’s information on the use of other foreclosure prevention options

was limited.

49

As previously noted, property charge defaults and issues

surrounding nonborrowing spouses not being included on the mortgage

have been long-standing problems in the HECM program.

50

Since 2015,

FHA has made program changes to allow servicers to offer different types

of foreclosure prevention options to distressed HECM borrowers and

nonborrowing spouses of deceased borrowers (see table 1). These

options can help delay and, in some cases, avoid foreclosure.

Table 1: Summary of Selected Federal Housing Administration (FHA) Foreclosure Prevention Options for Home Equity

Conversion Mortgage (HECM) Borrowers

Foreclosure prevention

option

Description

Effective date

Mortgagee optional

election assignment

Allows a HECM servicer to assign the loan to FHA so that an eligible nonborrowing

spouse can stay in the home after the borrower’s death.

June 2015

Repayment plan

Allows a borrower in default due to unpaid property charges to repay them over a

maximum of 60 months, as long as the borrower meets certain financial criteria.

During this time, the HECM servicer delays foreclosure by requesting an extension of

foreclosure time frames from FHA.

April 2015

At-risk extension

Allows a HECM servicer to delay foreclosure for borrowers at least 80 years old who

are in default due to unpaid property charges and are experiencing a critical

circumstance such as a terminal illness or long-term disability. HECM servicers must

request from FHA an extension of foreclosure time frames, and supporting

documentation for extensions must be updated annually.

April 2015

Low-balance extension

Allows a HECM servicer to delay calling a loan due and payable when the borrower

owes less than $2,000 for unpaid property taxes or hazard insurance.

March 2016

Source: GAO analysis of FHA mortgagee letters. | GAO-19-702

According to officials from HUD’s Office of General Counsel, HUD does

not have the statutory authority to require servicers to provide HECM

49

As described later in this report, we conducted this analysis using data from April 23,

2015—the effective date of FHA’s current policy on repayment plans—to September 30,

2018.

50

See Department of Housing and Urban Development, Office of Inspector General, 2010-

FW-0003. See also Bennett v. Donovan, 4 F.Supp.3d 5 (D.D.C. 2013).

About One-Quarter of

HECM Borrowers with

Overdue Property

Charges Received

Repayment Plans, and

Use of Other Foreclosure

Prevention Options Is

Limited or Unknown

Page 24 GAO-19-702 Reverse Mortgages

borrowers foreclosure prevention options.

51

Our analysis of FHA data

found that servicers’ use of selected foreclosure prevention options for

HECM borrowers was limited or that FHA did not have readily available

information to assess the extent of use, as follows:

Mortgagee optional election assignments. According to information

generated by FHA, HECM servicers submitted 1,445 requests for

mortgagee optional election assignments from June 2015 (when FHA

made this option available) through September 30, 2018 (see table 2). In

total, FHA approved roughly 70 percent (1,013) of the requests and

denied the remaining 30 percent (432).

Table 2: Summary of Mortgagee Optional Election Assignments, Fiscal Years 2015–2018

Mortgagee optional election

assignment status June–September 2015

2016

2017 2018

Total

Percentage

Requested

429

434

293

289

1,445

100

Approved

411

176

211

215

1,013

70

Denied

18

258

82

74

432

30

Source: Federal Housing Administration. | GAO-19-702

Note: The mortgagee optional election assignment process went into effect in June 2015.

According to FHA officials, the top two reasons for denying mortgagee

optional election assignments were HECM servicers not meeting the

deadline for electing to pursue the assignment and not meeting the

51

Officials from HUD’s Office of General Counsel said that, in contrast, HUD does have

statutory authority to mandate foreclosure prevention options for forward mortgage

borrowers because the options mitigate financial losses to FHA. According to the officials,

section 230 of the National Housing Act provides FHA the statutory authority to require

loss mitigation activities for forward mortgages, such as forbearance or loan modification,

as an alternative to foreclosure. See 12 U.S.C. § 1710(a)(2); 12 U.S.C. § 1715u(a). The

officials said the difference in statutory authority stems partly from differences in how

forward and reverse mortgages work. Officials from HUD’s Office of General Counsel

noted that traditional loss mitigation options focus on helping borrowers make payments to

lenders and continue paying down their loan balances, which helps mitigate losses to FHA

by reducing foreclosures, insured loan amounts, and claim payments. The officials said

that because reverse mortgage borrowers generally do not make payments to their lender

and have increasing loan balances, options that help HECM borrowers delay or avoid

foreclosure generally do not mitigate losses to FHA.

Page 25 GAO-19-702 Reverse Mortgages

deadline to initiate the assignment.

52

FHA officials told us the third most

common reason for denial was a nonborrowing spouse not submitting

evidence of marketable title to the property or the legal right to remain in

the property for life within required time frames.

53

With respect to the 432

denials, FHA provided information indicating that as of May 31, 2019, 79

percent (342) of the associated loans had not terminated; 14 percent (62

loans) terminated because the loan balance had been paid off; and the

remaining 7 percent ended in foreclosure (22 loans), deed-in-lieu of

foreclosure (four loans), or short sale (two loans).

Estimating the universe of HECMs potentially eligible for mortgagee

optional election assignments is difficult because nonborrowing spouses

were not listed on loan documentation for HECMs originated prior to

August 4, 2014.

54

As a result, FHA does not know how many eligible

nonborrowing spouses could have, but did not, apply for the mortgagee

optional election assignment, or how many are potentially eligible to apply

for it in the future. FHA officials told us they have relied on an industry

association and HECM servicers to estimate how many nonborrowing

spouses may be associated with pre-August 2014 HECMs.

55

52

Mortgagee Letter 2015-15 (effective June 12, 2015) details HECM servicer requirements

for the mortgagee optional election assignment process and specifies two main time

frames servicers must meet. First, HECM servicers must elect to pursue the assignment

within 120 days of the borrower’s death. Second, if the servicer elects to pursue

assignment and determines that the nonborrowing spouse and the HECM meet eligibility

requirements, it must initiate the assignment to FHA within 120 days of the election

decision. Mortgagee Letter 2016-05 (effective Feb. 12, 2016) allows servicers to request a

60-day extension for the nonborrowing spouse to demonstrate that legal title or the legal

right to remain in the house has been secured and for the servicer to complete its

assessment.

53

Mortgagee Letter 2015-15 states that in order to be an eligible surviving nonborrowing

spouse, an individual, among other things, must have or obtain this information within 90

days following the death of the borrowing spouse.

54

According to officials, FHA has required lenders to collect nonborrowing spouse

information for HECMs originated on or after August 4, 2014. See Department of Housing

and Urban Development, Mortgagee Letter 2014-07 (Apr. 25, 2014).

55

In September 2018, representatives of the National Reverse Mortgage Lenders

Association told us the association estimated that there were about 8,600 outstanding

HECMs that potentially had an associated nonborrowing spouse not originally named on

the loan. The association estimated this number by asking its members to identify loans

originated before August 2014 that had only one borrower but reported being married at

the time of loan origination. The 8,600 figure is a rough estimate because, among other

things, it is not known whether the borrowers are still married and not all reverse mortgage

servicers are members of the association.

Page 26 GAO-19-702 Reverse Mortgages

FHA officials told us they sent letters to borrowers with FHA-assigned

HECMs that were originated prior to August 4, 2014, to inform them of the

mortgagee optional election process and ask them to self-identify whether

there was a nonborrowing spouse associated with their loan. FHA officials

also noted they were drafting a similar letter for servicers to send to

borrowers with HECMs not assigned to FHA. As of August 2019, the

servicer letter was still in draft form, pending completion of an ongoing

internal review of FHA’s mortgagee optional election assignment

processes and the related time frames. FHA officials said once the

ongoing review is complete, they anticipated that FHA would issue a new

mortgagee letter with revised time frames that would afford both HECM

servicers and borrowers more time to meet FHA requirements for

mortgagee optional election assignments.

Repayment plans. Our analysis of FHA data showed that 22 percent of

borrowers with property charge defaults were granted a repayment plan

from April 2015 (the effective date of FHA’s current repayment plan

policy) through the end of fiscal year 2018. All five legal aid organizations

we interviewed said the availability of repayment plans was a top

concern. For example, for some of their clients, repayment plans were

unavailable because the borrowers did not meet certain financial

requirements. In contrast, representatives of the top five HECM servicers

told us they generally do offer repayment plans when feasible to help

borrowers delay or avoid foreclosure. Servicers we interviewed noted that

while repayment plans can delay or avoid foreclosure, they are rarely

successful in the long-run and borrowers in such plans often miss

payments. Servicers said the same reasons that typically contribute to

initial defaults also explain why repayment plans are rarely successful.

For example, borrowers on limited incomes may struggle to pay

increasing property tax and insurance costs or may fall behind on

property charges when the death of a spouse reduces their income.

At-risk extensions. Our analysis of FHA data found that from April 2015

(the effective date of FHA’s at-risk extension policy) through the end of

fiscal year 2018, about 2 percent of borrowers with property charge

defaults received an at-risk extension. To grant an at-risk extension, FHA

requires HECM servicers to provide valid documentation that the

youngest living borrower is at least 80 years of age and has critical

circumstances such as a terminal illness, long-term physical disability, or

a unique occupancy need (for example, terminal illness of family member

Page 27 GAO-19-702 Reverse Mortgages

living in the home).

56

Representatives from one legal aid organization told

us that some HECM servicers have straightforward requirements for the

documentation borrowers must submit to obtain an at-risk extension,

while others do not. Representatives from another legal aid organization

said that meeting FHA’s annual renewal requirement for at-risk

extensions was challenging for some borrowers because they have to

submit documentation to HECM servicers every year as they age and

continue to struggle with serious health issues or disabilities.

Low-balance extensions. FHA officials told us they do not track how

often HECM servicers use the option to delay calling a loan due and

payable if the borrower has unpaid property charges of less than $2,000.

Our analysis of FHA data on servicer advances found that approximately

8,800 HECMs that terminated in fiscal years 2014 through 2018 had

unpaid property charges of less than $2,000 at the time of termination.

57

Some of these HECMs may have been eligible for a low-balance

extension when they terminated. Representatives from one legal aid

organization said they represented a HECM borrower who was at risk of

foreclosure for having 27 cents in unpaid property charges. HECM

servicers told us they use the low-balance extension option to varying

degrees. For example, representatives from one servicer said the servicer

follows instructions from the entity that owns the HECM and, in some

cases, the owners of the loan do not want to offer the low-balance

extension to the borrower. In these cases the servicer calls the loan due

and payable for any amount in unpaid property charges and initiates the

foreclosure process in accordance with FHA regulations. Another HECM

servicer told us it tries to use the low-balance extension every time a

borrower owes less than $2,000 in unpaid property charges.

56

See Department of Housing and Urban Development, Mortgagee Letter 2015-11 (Apr.

23, 2015).

57

To conduct this analysis we requested data on total advances, including data on unpaid

property charges, from FHA’s contractor that administers the HERMIT system.

Additionally, we requested borrower death dates to determine unpaid property charges

before and after HECM borrowers’ deaths. We calculated the total number of loans with

unpaid property charges of less than $2,000 for living borrowers by removing any loans for

which the borrower had died.

Page 28 GAO-19-702 Reverse Mortgages

Since fiscal year 2013, FHA has used the HERMIT system to collect data

on the servicing of HECMs, but the system does not contain

comprehensive and accurate data about the reasons why HECMs

terminate, a key servicing event. According to the HERMIT User Guide,

servicers should provide a reason in HERMIT when they terminate a

HECM.

58

However, as noted previously in figure 4, for about 30 percent of

HECM terminations from fiscal years 2014 through 2018 (roughly 78,000

loans), we were unable to determine the reason for termination.

59

Specifically, for these loans we could not identify in HERMIT any