Official Form 201

Voluntary Petition for Non-Individuals Filing for Bankruptcy

page 1

Fill in this information to identify the case:

United States Bankruptcy Court for the:

District of Delaware

(State)

Case number (if known):

Chapter

11

☐ Check if this is an

amended filing

Official Form 201

Voluntary Petition for Non-Individuals Filing for

Bankruptcy

04/19

If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor’s name and the

case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is

available.

1. Debtor’s Name

PES Energy Inc.

N/A

2. All other names debtor used

in the last 8 years

Include any assumed names,

trade names, and doing

business as names

3. Debtor’s federal Employer

Identification Number (EIN)

83-1160661

4. Debtor’s address

Principal place of business

1735 Market Street, 11th Floor

Mailing address, if different from principal place

of business

Number Street

Number Street

Philadelphia, Pennsylvania 19103

P.O. Box

City State Zip Code

Philadelphia

City State Zip Code

Location of principal assets, if different from

principal place of business

Number Street

County

City State Zip Code

5. Debtor’s website (URL)

http://pes-companies.com/

☒ Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP))

☐ Partnership (excluding LLP)

6. Type of debtor

☐ Other. Specify:

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 1 of 26

Debtor

PES Energy Inc.

Case number (if known)

Name

Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy page 2

7. Describe debtor’s business

A. Check One:

☐ Health Care Business (as defined in 11 U.S.C. § 101(27A))

☐ Single Asset Real Estate (as defined in 11 U.S.C. § 101(51B))

☐ Railroad (as defined in 11 U.S.C. § 101(44))

☐ Stockbroker (as defined in 11 U.S.C. § 101(53A))

☐ Commodity Broker (as defined in 11 U.S.C. § 101(6))

☐ Clearing Bank (as defined in 11 U.S.C. § 781(3))

☒ None of the above

B. Check all that apply:

☐ Tax-exempt entity (as described in 26 U.S.C. § 501)

☐ Investment company, including hedge fund or pooled investment vehicle (as defined in 15 U.S.C.

§ 80a-3)

☐ Investment advisor (as defined in 15 U.S.C. § 80b-2(a)(11))

C. NAICS (North American Industry Classification System) 4-digit code that best describes debtor. See

http://www.uscourts.gov/four-digit-national-association-naics-codes .

3241 (Petroleum and Coal Products Manufacturing)

8. Under which chapter of the

Bankruptcy Code is the

debtor filing?

Check One:

☐ Chapter 7

☐ Chapter 9

☒ Chapter 11. Check all that apply:

☐ Debtor’s aggregate noncontingent liquidated debts (excluding debts owed to

insiders or affiliates) are less than $2,725,625 (amount subject to adjustment on

4/01/22 and every 3 years after that).

☐ The debtor is a small business debtor as defined in 11 U.S.C. § 101(51D). If the

debtor is a small business debtor, attach the most recent balance sheet, statement

of operations, cash-flow statement, and federal income tax return, or if all of these

documents do not exist, follow the procedure in 11 U.S.C. § 1116(1)(B).

☐ A plan is being filed with this petition.

☐ Acceptances of the plan were solicited prepetition from one or more classes of

creditors, in accordance with 11 U.S.C. § 1126(b).

☐ The debtor is required to file periodic reports (for example, 10K and 10Q) with the

Securities and Exchange Commission according to § 13 or 15(d) of the Securities

Exchange Act of 1934. File the Attachment to Voluntary Petition for Non-Individuals

Filing for Bankruptcy under Chapter 11 (Official Form 201A) with this form.

☐ The debtor is a shell company as defined in the Securities Exchange Act of 1934 Rule

12b-2.

☐ Chapter 12

☒ No

☐ Yes.

District

When

MM/DD/YYYY

Case number

9. Were prior bankruptcy cases

filed by or against the debtor

within the last 8 years?

If more than 2 cases, attach a

separate list.

District

When

MM/DD/YYYY

Case number

Relationship

Affiliate

☐ No

☒ Yes.

Debtor

See Rider 1

District

District of Delaware

07/21/2019

10. Are any bankruptcy cases

pending or being filed by a

business partner or an

affiliate of the debtor?

List all cases. If more than 1,

attach a separate list.

Case number, if known _______________________

When

MM / DD / YYYY

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 2 of 26

Debtor PES Energy Inc. Case number (if known)

Name

Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy page 3

11. Why is the case filed in this

district?

Check all that apply:

☒ Debtor has had its domicile, principal place of business, or principal assets in this district for 180 days

immediately preceding the date of this petition or for a longer part of such 180 days than in any other

district.

☒ A bankruptcy case concerning debtor's affiliate, general partner, or partnership is pending in this district.

12. Does the debtor own or have

possession of any real

property or personal property

that needs immediate

attention?

☒ No

☐ Yes. Answer below for each property that needs immediate attention. Attach additional sheets if needed.

Why does the property need immediate attention? (Check all that apply.)

☐ It poses or is alleged to pose a threat of imminent and identifiable hazard to public health or

safety.

What is the hazard?

☐ It needs to be physically secured or protected from the weather.

☐ It includes perishable goods or assets that could quickly deteriorate or lose value without

attention (for example, livestock, seasonal goods, meat, dairy, produce, or securities-related

assets or other options).

☐ Other

Where is the property?

Number Street

City State Zip Code

Is the property insured?

☐ No

☐ Yes. Insurance agency

Contact name

Phone

Statistical and administrative information

13. Debtor's estimation of

available funds

Check one:

☒ Funds will be available for distribution to unsecured creditors.

☐ After any administrative expenses are paid, no funds will be available for distribution to unsecured creditors.

14. Estimated number of

creditors (on a

consolidated basis)

☐ 1-49 ☒ 1,000-5,000 ☐ 25,001-50,000

☐ 50-99 ☐ 5,001-10,000 ☐ 50,001-100,000

☐ 100-199 ☐ 10,001-25,000 ☐ More than 100,000

☐ 200-999

15. Estimated assets (on a

consolidated basis)

☐ $0-$50,000 ☐ $1,000,001-$10 million ☐ $500,000,001-$1 billion

☐ $50,001-$100,000 ☐ $10,000,001-$50 million ☒ $1,000,000,001-$10 billion

☐ $100,001-$500,000 ☐ $50,000,001-$100 million ☐ $10,000,000,001-$50 billion

☐ $500,001-$1 million ☐ $100,000,001-$500 million ☐ More than $50 billion

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 3 of 26

Debtor

PES Energy Inc.

Case number (if known)

Name

Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy page 4

16. Estimated liabilities (on

a consolidated basis)

☐ $0-$50,000 ☐ $1,000,001-$10 million ☐ $500,000,001-$1 billion

☐ $50,001-$100,000 ☐ $10,000,001-$50 million ☒ $1,000,000,001-$10 billion

☐ $100,001-$500,000 ☐ $50,000,001-$100 million ☐ $10,000,000,001-$50 billion

☐ $500,001-$1 million ☐ $100,000,001-$500 million ☐ More than $50 billion

Request for Relief, Declaration, and Signatures

WARNING -- Bankruptcy fraud is a serious crime. Making a false statement in connection with a bankruptcy case can result in fines up to

$500,000 or imprisonment for up to 20 years, or both. 18 U.S.C. §§ 152, 1341, 1519, and 3571.

17. Declaration and signature of

authorized representative of

debtor

The debtor requests relief in accordance with the chapter of title 11, United States Code, specified in this

petition.

I have been authorized to file this petition on behalf of the debtor.

I have examined the information in this petition and have a reasonable belief that the information is true and

correct.

I declare under penalty of perjury that the foregoing is true and correct.

Executed on

07/21/2019

MM/ DD / YYYY

/s/ Jeffrey S. Stein

Jeffrey S. Stein

Signature of authorized representative of debtor Printed name

Title

Authorized Signatory

18. Signature of attorney

/s/ Laura Davis Jones

Date

07/21/2019

Signature of attorney for debtor MM/ DD/YYYY

Laura Davis Jones

Printed name

Pachulski Stang Ziehl & Jones LLP

Firm name

919 North Market Street, 17th Floor

Number Street

Wilmington

Delaware

19899-8705

(Courier 19801)

City

(302) 652-4100

State ZIP Code

Contact phone

2436

Delaware

Email address

Bar number State

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 4 of 26

Fill in this information to identify the case:

United States Bankruptcy Court for the:

District of Delaware

(State)

Case number (if known):

Chapter

11

☐ Check if this is an

amended filing

Rider 1

Pending Bankruptcy Cases Filed by the Debtor and Affiliates of the Debtor

On the date hereof, each of the entities listed below (collectively, the “Debtors”) filed a petition in the United

States Bankruptcy Court for the District of Delaware for relief under chapter 11 of title 11 of the United States Code.

The Debtors have moved for joint administration of these cases under the case number assigned to the chapter 11

case of PES Holdings, LLC.

PES Holdings, LLC

North Yard GP, LLC

North Yard Logistics, L.P.

PES Administrative Services, LLC

PES Energy Inc.

PES Intermediate, LLC

PES Ultimate Holdings, LLC

Philadelphia Energy Solutions Refining and Marketing LLC

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 5 of 26

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

)

In re:

)

Chapter 11

)

PES ENERGY INC.,

)

Case No. 19-[_____] (___)

)

Debtor.

)

)

LIST OF EQUITY SECURITY HOLDERS

1

Debtor

Equity Holders

Address of Equity Holder

Percentage of

Equity Held

Class A

Credit Suisse Asset Management

One Madison Ave, 10th Floor

Attn: Philip Blake

New York, NY 10010

29.43%

Bardin Hill

477 Madison Ave

New York, NY 10022

26.71%

PES Equity, LLC

c/o Energy Transfer Partners, LP

Attn: General Counsel/Legal Dept

8111 Westchester Drive

Dallas, TX 75225

7.43%

Third Point Loan LLC

390 Park Ave

New York, NY 10012

7.27%

MJX Asset Management, LLC

12 East 49th Street, 29th Floor

Attn: Fred Taylor

New York, NY 10017

2.89%

Individuals (PES Management)

1735 Market Street

Philadelphia, PA 19103

2.72%

LCM Asset Management, LLC

399 Park Ave, 22nd Floor

Attn: Francois Laberenne

New York, NY 10022

2.69%

Wellington Management Company

LLP

280 Congress Street

Attn: Gilbert Daniel

Boston, MA 02210

2.21%

PES Energy Inc.

American Money Management Corp.

301 E 4th Street, 27th Floor

Attn: Patrick Byrne

0.89%

1

This list serves as the disclosure required to be made by the debtor pursuant to rule 1007 of the Federal Rules of

Bankruptcy Procedure. All equity positions listed are as of the date of commencement of the chapter 11 case.

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 6 of 26

Rider 1

Cincinnati, OH 45202

New York Life Insurance Company

51 Madison Ave

New York, NY 10010

0.70%

JH Lane Partners Master Fund, LP

126 E 56th Street, Suite 1620

New York, NY 10022

0.65%

Serengeti Asset Management

632 Broadway

New York, NY 10012

0.39%

American Financial

301 E 4th Street

Cincinnati, OH 45202

0.33%

NYL Investors LLC

51 Madison Ave

New York, NY 10010

0.27%

Zapalit Management LLC

767 5th Ave, 19th Floor

New York, NY 10153

0.23%

Seaport

175 Highland Ave, Suite 406

Needham, MA 02494

0.15%

Bank of America

222 Broadway

New York, NY 10001

0.10%

Marathon Asset Management LP

One Bryant Park, 38th Floor

Attn: Andy Wong

New York, NY 10036

0.06%

John Sosnowski

Address Redacted

0.02%

Cowen and Company LLC

31111 Agoura Road, Suite 200

Westlake Village, CA 91361

0.01%

Class B

PES Energy Inc.

Carlyle PES, L.L.C.

c/o The Carlyle Group

Attn: General Counsel/Legal Dept

520 Madison Ave

New York, NY 10022

1001 Pennsylvania Ave NW

Washington, DC 20004-2505

15.00%

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 7 of 26

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

)

In re:

)

Chapter 11

)

PES ENERGY INC.,

)

Case No. 19-[_____] (___)

)

Debtor.

)

)

CORPORATE OWNERSHIP STATEMENT

Pursuant to rules 1007(a)(1) and 7007.1 of the Federal Rules of Bankruptcy Procedure, the following are

corporations, other than a government unit, that directly or indirectly own 10% or more of any class of the debtor’s

equity interest:

Shareholder

Approximate Percentage of Shares Held

Class B

Carlyle PES, L.L.C.

15.00%

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 8 of 26

KE 62463605

Fill in this information to identify the case:

Debtor name

PES Holdings, LLC, et al.

United States Bankruptcy Court for the:

District of Delaware

Check if this is an

Case number (If known):

(State)

amended filing

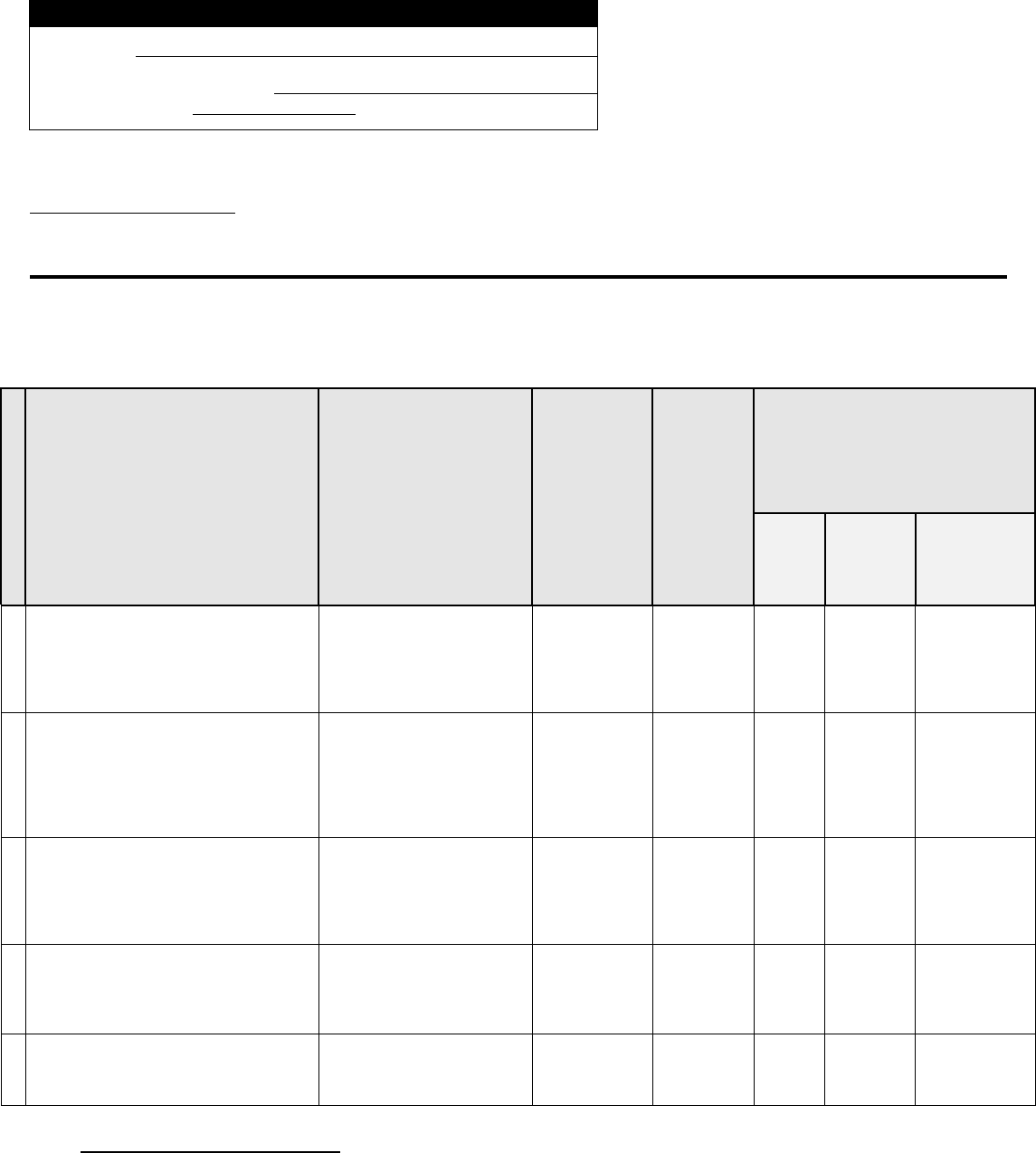

Official Form 204

Chapter 11 or Chapter 9 Cases: List of Creditors Who Have the 50 Largest

Unsecured Claims and Are Not Insiders 12/15

A list of creditors holding the 50 largest unsecured claims must be filed in a Chapter 11 or Chapter 9 case. Include claims which

the debtor disputes. Do not include claims by any person or entity who is an insider, as defined in 11 U.S.C. § 101(31). Also, do not

include claims by secured creditors, unless the unsecured claim resulting from inadequate collateral value places the creditor

among the holders of the 50 largest unsecured claims.

Amount of claim

If the claim is fully unsecured, fill in only

unsecured claim amount. If claim is partially

secured, fill in total claim amount and

deduction for value of collateral or setoff to

calculate unsecured claim.

Name of creditor and complete mailing

address, including zip code

Name, telephone number and

email address of creditor

contact

Nature of claim

(for example,

trade debts,

bank loans,

professional

services, and

government

contracts)

Indicate if

claim is

contingent,

unliquidated,

or disputed

Total

claim, if

partially

secured

1Deduction

for value of

collateral

or setoff

[1]

Unsecured

Claim

1

TRINITY INDUSTRIES LEASING COMPANY

2525 STEMMONS FREEWAY

DALLAS, TX 75207

MELENDY E. LOVETT

SENIOR VICE PRESIDENT AND

CHIEF FINANCIAL OFFICER

PHONE: 586-285-1692

EMAIL:

Trade Payable

$4,078,864

2

CSX TRANSPORTATION INC

500 WATER STREET

15TH FLOOR

JACKSONVILLE, FL 32202

NATHAN D. GOLDMAN

EXECUTIVE VP AND CHIEF LEGAL

OFFICER

PHONE: 904-359-3200

FAX: 904-359-2459

EMAIL:

Trade Payable

$3,876,177

3

BNSF RAILWAY COMPANY

920 SE QUINCY

9TH FLOOR

TOPEKA, KS 66612-1116

JULIE PIGGOTT

EXECUTIVE VICE PRESIDENT &

CHIEF FINANCIAL OFFICER

PHONE: 817-698-8119

EMAIL:

Trade Payable

$3,482,198

4

CONSTELLATION NEW ENERGY INC

100 CONSTELLATION WAY

SUITE 500

BALTIMORE, MD 21202-6302

JIM MCHUGH

CEO

EMAIL:

JIMMCHUGH@CONSTELLATION.

COM

Trade Payable

$2,676,084

5

ENVTECH INC

300 EDISON WAY

RENO, NV 89502

Trade Payable

$2,500,000

1

The Debtors reserve the right to assert setoff and other rights with respect to any of the claims listed herein.

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 9 of 26

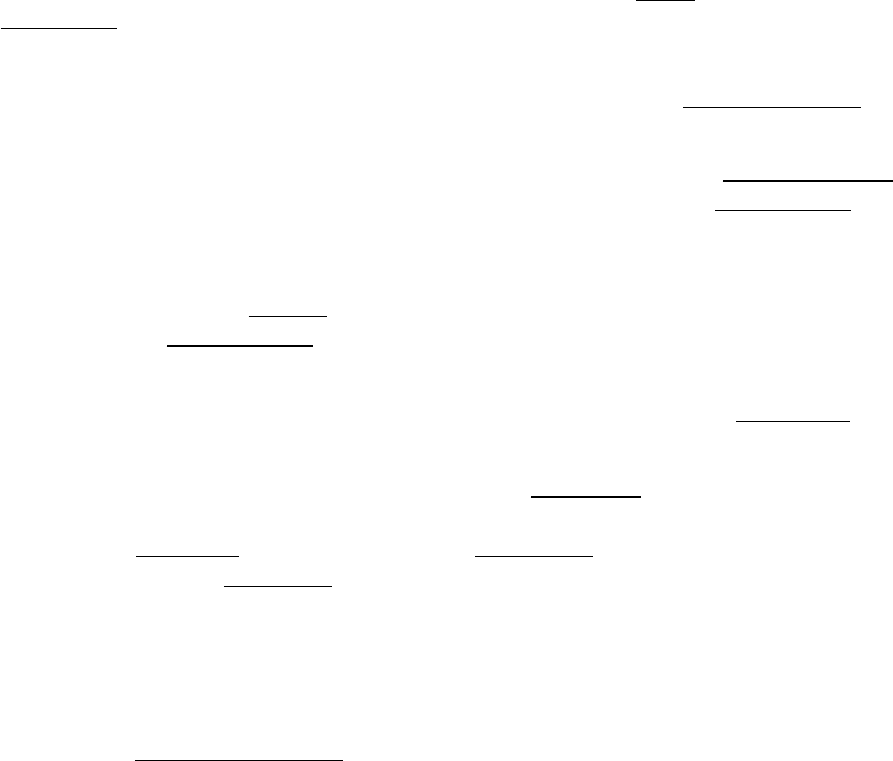

2

Amount of claim

If the claim is fully unsecured, fill in only

unsecured claim amount. If claim is partially

secured, fill in total claim amount and

deduction for value of collateral or setoff to

calculate unsecured claim.

Name of creditor and complete mailing

address, including zip code

Name, telephone number and

email address of creditor

contact

Nature of claim

(for example,

trade debts,

bank loans,

professional

services, and

government

contracts)

Indicate if

claim is

contingent,

unliquidated,

or disputed

Total

claim, if

partially

secured

1Deduction

for value of

collateral

or setoff

[1]

Unsecured

Claim

6

OSG BULK SHIPS INC.

TWO HARBOUR PLACE

302 KNIGHTS RUN AVENUE, SUITE 1200

TAMPA, FL 33602

SUSAN ALLAN

VICE PRESIDENT, GENERAL

COUNSEL

PHONE: 813-209-0600

FAX: 813-221-2769

EMAIL: [email protected]

Trade Payable

$2,245,115

7

TSAKOS ENERGY NAVIGATION LTD

367 SYNGROU AVENUE

ATHENS, 175 64

GREECE

Trade Payable

$1,999,157

8

BRAND INSULATION SERVICES

32 IRON SIDE COURT

WILLINGBORO, NJ 08046

Trade Payable

$1,665,012

9

BAKER HUGHESPO BOX 301057DALLAS, TX

75303-1057

LORENZO SIMONELLI

CEO

EMAIL:

LORENZO.SIMONELLI@BAKERH

UGHES.COM

Trade Payable

$1,499,625

10

WR GRACE & CO-CONN

7500 GRACE DRIVE

COLUMBIA, MD 21044

HUDSON LA FORCE

PRESIDENT AND CEO

PHONE: 410-531-4000

FAX: 410-531-4367

Trade Payable

$1,497,394

11

J J WHITE INC

5500 BINGHAM STREET

PHILADELPHIA, PA 19120

Trade Payable

$1,021,287

12

SUNOCO PARTNERS MARKETING & TERMINAL

LP

3801 WEST CHESTER PIKE

NEWTON SQUARE, PA 19073

Trade Payable

$748,363

13

COLONIAL PIPELINE COMPANY

1185 SANCTUARY PARKWAY

SUITE 100

ALPHARETTA, GA 30009-4738

Trade Payable

$705,727

14

PECO ENERGY

PO BOX 37629

PHILADELPHIA, PA 19101

MICHAEL A. INNOCENZO

PRESIDENT & CEO

Trade Payable

$683,314

15

UNITED RENTALS (NORTH AMERICA)

100 FIRST STAMFORD PLACE, SUITE 700

STAMFORD, CT 06902

Trade Payable

$673,286

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 10 of 26

3

Amount of claim

If the claim is fully unsecured, fill in only

unsecured claim amount. If claim is partially

secured, fill in total claim amount and

deduction for value of collateral or setoff to

calculate unsecured claim.

Name of creditor and complete mailing

address, including zip code

Name, telephone number and

email address of creditor

contact

Nature of claim

(for example,

trade debts,

bank loans,

professional

services, and

government

contracts)

Indicate if

claim is

contingent,

unliquidated,

or disputed

Total

claim, if

partially

secured

1Deduction

for value of

collateral

or setoff

[1]

Unsecured

Claim

16

RIGGS DISTLER & COMPANY

4 ESTERBROOK LANE

CHERRY HILL, NJ 08003

STEPHEN M. ZEMAITATIS, JR.

PRESIDENT

PHONE: 856-433-6000

FAX: 856-433-6035

EMAIL:

SZEMAITATISJR@RIGGSDISTLER.

COM

Trade Payable

$616,908

17

CHARTER BROKERAGE LLC

383 MAIN AVENUE, SUITE 400

NORWALK, CT 06851

C. BOBBY WAID

CEO

PHONE: 281-599-1252 EXT. 203

EMAIL:

BWAID@CHARTERBROKERAGE.

NET

Trade Payable

$600,000

18

FISHER TANK COMPANY

3131 W 4TH ST

CHESTER, PA 19013-1822

Trade Payable

$546,505

19

MAN DIESEL & TURBO NORTH AMERICA

1600A BRITTMOORE ROAD

HOUSTON, TX 77043

Trade Payable

$521,825

20

MUREX LLC

5057 KELLER SPRINGS ROAD

ADDISON, TX 75001

Trade Payable

$521,000

21

CHALMERS & KUBECK INC

150 COMMERCE DRIVE

ASTON, PA 19014

Trade Payable

$496,195

22

ANDERSON CONSTRUCTION SERVICES

6958 TORRESDALE AVENUE STE 300

PHILADELPHIA, PA 19135

RICKE C. FOSTER

VICE PRESIDENT

PHONE: 215-331-7150

FAX: 215-332-8350

EMAIL:

RICKF@ANDERSONCONSTRUCTI

ONSERV.COM

Trade Payable

$486,794

23

BRENNTAG NORTHEAST INC

81 W. HULLER LANE

READING, PA 19605

Trade Payable

$413,651

24

NOOTER CONSTRUCTION CO

6 NESHAMINY INTERPLEX SUITE 300

TREVOSE, PA 19053

Trade Payable

$405,366

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 11 of 26

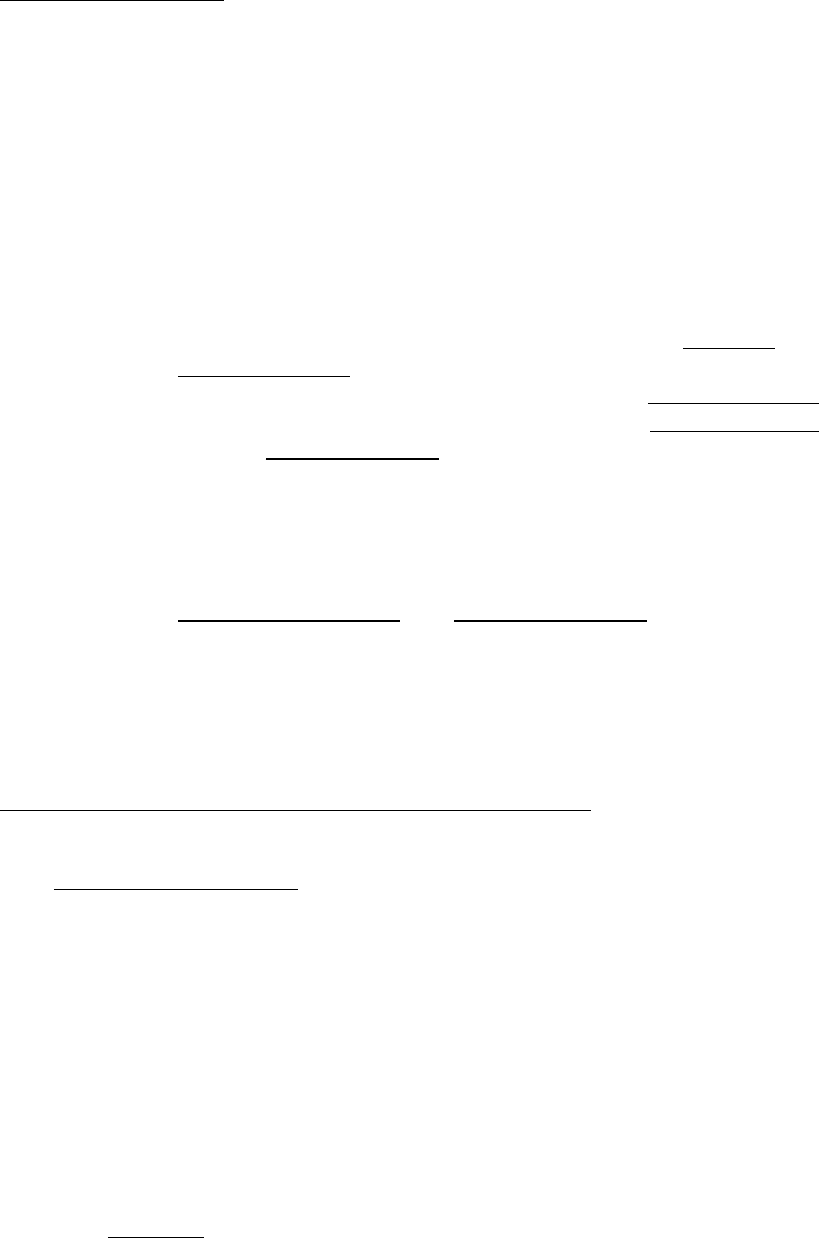

4

Amount of claim

If the claim is fully unsecured, fill in only

unsecured claim amount. If claim is partially

secured, fill in total claim amount and

deduction for value of collateral or setoff to

calculate unsecured claim.

Name of creditor and complete mailing

address, including zip code

Name, telephone number and

email address of creditor

contact

Nature of claim

(for example,

trade debts,

bank loans,

professional

services, and

government

contracts)

Indicate if

claim is

contingent,

unliquidated,

or disputed

Total

claim, if

partially

secured

1Deduction

for value of

collateral

or setoff

[1]

Unsecured

Claim

25

COLONIAL ENERGY, INC.

3975 FAIR RIDGE DRIVE

SUITE T-10

FAIRFAX, VA 22033

Trade Payable

$402,528

26

KINDER MORGAN LIQUID TERMINALS, LLC

PO BOX 201607

DEPT 3019

DALLAS, TX 75320

DAVID MICHELS

VICE PRESIDENT AND CHIEF

FINANCIAL OFFICER

PHONE: 713-420-4200

EMAIL:

DAVID_MICHELS@KINDERMOR

GAN.COM

Trade Payable

$357,632

27

MATRIX SERVICE IND CONT INC

5100 E. SKELLY DR., STE. 100

TULSA, OK 74135-6577

KEVIN S. CAVANAH

CFO

PHONE: 918-838-8822

EMAIL:

KCAVANAH@MATRIXSERVICECO

MPANY.COM

Trade Payable

$354,830

28

G C ZARNAS & COMPANY INC - PA

850 JENNINGS STREET

BETHLEHEM, PA 18017

STEVE ZARNAS

OWNER & PRESIDENT

PHONE: 610-866-0923

FAX: 610-866-4065

Trade Payable

$332,153

29

ALLSTATE POWER VAC INC

928 EAST HAZELWOOD AVENUE

RAHWAY, NJ 07065

Trade Payable

$300,520

30

BELCHER ROOFING CORPORATION

111 COMMERCE DR.

MONTGOMERYVILLE, PA 18936

KEVIN BELCHER

PRESIDENT

PHONE: 215-362-5400

EMAIL:

KBELCHER@BELCHERROOFING.

COM

Trade Payable

$288,681

31

UNIVAR USA INC

3075 HIGHLAND PARKWAY SUITE 200

DOWNERS GROVE, IL 60515

Trade Payable

$286,246

32

BUCKEYE PIPE LINE COMPANY, L.P.

ONE GREENWAY PLAZA

SUITE 600

HOUSTON, TX 77046

Trade Payable

$282,595

33

SCHECK MECHANICAL CORPORATION

ONE EAST OAK HILL DRIVE, SUITE 100

WESTMONT, IL 60559

Trade Payable

$252,030

34

ARCHER DANIELS MIDLAND COMPANY

4666 FARIES PARKWAY

DECATUR, IL 62526

JUAN R. LUCIANO

PRESIDENT

PHONE: 217-424-5200

FAX: 217-424-5200

Trade Payable

$243,853

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 12 of 26

5

Amount of claim

If the claim is fully unsecured, fill in only

unsecured claim amount. If claim is partially

secured, fill in total claim amount and

deduction for value of collateral or setoff to

calculate unsecured claim.

Name of creditor and complete mailing

address, including zip code

Name, telephone number and

email address of creditor

contact

Nature of claim

(for example,

trade debts,

bank loans,

professional

services, and

government

contracts)

Indicate if

claim is

contingent,

unliquidated,

or disputed

Total

claim, if

partially

secured

1Deduction

for value of

collateral

or setoff

[1]

Unsecured

Claim

35

JOHNSON MATTHEY PROCESS

115 ELI WHITNEY BLVD

SAVANNAH, GA 31408

ROBERT MACLEOD

CEO

PHONE: 912-748-0630

EMAIL:

ROBERT.MACLEOD@MATTHEY.

COM

Trade Payable

$243,092

36

L M SERVICE CO INC

6809 WESTFIELD AVENUE

PENNSAUKEN, NJ 08110-1527

Trade Payable

$230,500

37

TEAM INDUSTRIAL SERVICES INC

13131 DAIRY ASHFORD RD. STE. 600

SUGAR LAND, TX 77478

AMERINO GATTI

CEO

PHONE: 800-662-8326

Trade Payable

$221,047

38

WATCO TRANSLOADING

315 W 3RD ST.

PITTSBURG, KS 66762

Trade Payable

$219,450

39

ALLIED UNIVERSAL

P. O. BOX 828854

PHILADELPHIA, PA 19182-8854

Trade Payable

$219,026

40

VANE LINE BUNKERING INC

2100 FRANKFURST AVENUE

BALTIMORE, MD 21226-1026

Trade Payable

$215,044

41

NEREUS SHIPPING S.A.

AKTI MIAOULI 35/39

41

PIRAEUS, 185 36

GREECE

Trade Payable

$210,292

42

DEVON PROPERTY SERVICES LLC

7 N WATERLOO ROAD

DEVON, PA 19333

GENERAL MANAGER

PHONE: 610-999-8785

Trade Payable

$197,909

43

CLEAN HARBORS INDUSTRIAL SERVICES

42 LONGWATER DRIVE

NORWELL, MA 02061-9149

ALAN MCKIN

FOUNDER & CEO

PHONE: 781-792-5000

EMAIL:

MCKIM.WILLIAM@CLEANHARB

ORS.COM

Trade Payable

$193,899

44

VEOLIA NORTH AMERICA REGENERATION

4760 WORLD HOUSTON PKWY

STE 100

HOUSTON, TX 77032

Trade Payable

$193,149

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 13 of 26

6

Amount of claim

If the claim is fully unsecured, fill in only

unsecured claim amount. If claim is partially

secured, fill in total claim amount and

deduction for value of collateral or setoff to

calculate unsecured claim.

Name of creditor and complete mailing

address, including zip code

Name, telephone number and

email address of creditor

contact

Nature of claim

(for example,

trade debts,

bank loans,

professional

services, and

government

contracts)

Indicate if

claim is

contingent,

unliquidated,

or disputed

Total

claim, if

partially

secured

1Deduction

for value of

collateral

or setoff

[1]

Unsecured

Claim

45

ATLAS COPCO RENTAL LLC

2306 S. BATTLEGROUND ROAD

LA PORTE, TX 77571

Trade Payable

$193,047

46

HONEYWELL

101 COLUMBIA RD

MORRISTOWN, NJ 07962

Trade Payable

$189,401

47

TRC

PO BOX 536282

PITTSBURGH, PA 15253-5904

Trade Payable

$166,950

48

ECO-ENERGY FUELING SOLUTIONS

6100 TOWER CIRCLE #500

FRANKLIN, TN 37067

JOSH BAILEY

CEO

PHONE: 615-778-2898

EMAIL: JOSHB@ECO-

ENERGYINC.COM

Trade Payable

$161,203

49

PROCONEX

103 ENTERPRISE DR

ROYERSFORD, PA 19468

DAWN SEIFRIED

VICE PRESIDENT & CHIEF

FINANCIAL OFFICER

EMAIL:

DAWN.SEIFRIED@PROCONEXDI

RECT.COM

Trade Payable

$158,323

50

MISTRAS SERVICES

195 CLARKSVILLE ROAD

PRINCETON JUNCTION, NJ 08550

DENNIS BERTOLOTTI

PRESIDENT & CEO

PHONE: 609-716-4000

FAX: 609-716-4179

EMAIL:

DENNIS.BERTOLOTTI@MISTRAS

GROUP.COM

Trade Payable

$158,235

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 14 of 26

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

)

In re:

)

Chapter 11

)

PES HOLDINGS, LLC,

)

Case No. 19-___________(___)

)

Debtor.

)

)

CERTIFICATION OF CREDITOR MATRIX

Pursuant to Rule 1007-2 of the Local Rules of Bankruptcy Practice and Procedure for the United States

Bankruptcy Court for the District of Delaware, the above-captioned debtor and its affiliated debtors in possession

(collectively, the “Debtors”)

2

hereby certify that the Creditor Matrix submitted herewith contains the names and

addresses of the Debtors’ creditors. To the best of the Debtors’ knowledge, the Creditor Matrix is complete, correct,

and consistent with Debtors’ books and records.

The information contained herein is based upon a review of the Debtors’ books and records as of the petition

date. However, no comprehensive legal and/or factual investigations with regard to possible defenses to any claims

set forth in the Creditor Matrix have been completed. Therefore, the listing does not, and should not, be deemed to

constitute: (1) a waiver of any defense to any listed claims; (2) an acknowledgement of the allowability of any listed

claims; and/or (3) a waiver of any other right or legal position of the Debtors.

2

The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification

number, are: PES Holdings, LLC (8157); North Yard GP, LLC (5458); North Yard Logistics, L.P. (5952); PES

Administrative Services, LLC (3022); PES Energy Inc. (0661); PES Intermediate, LLC (0074); PES Ultimate

Holdings, LLC (6061); and Philadelphia Energy Solutions Refining and Marketing LLC (9574). The Debtors’

service address is: 1735 Market Street, Philadelphia, Pennsylvania 19103.

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 15 of 26

Fill in this information to identify the case and this filing:

Debtor Name PES Energy Inc.

United States Bankruptcy Court for the:

District of Delaware

(State)

Case number (If known):

Official Form 202

Declaration Under Penalty of Perjury for Non-Individual Debtors 12/15

An individual who is authorized to act on behalf of a non-individual debtor, such as a corporation or partnership, must sign

and submit this form for the schedules of assets and liabilities, any other document that requires a declaration that is not

included in the document, and any amendments of those documents. This form must state the individual’s position or

relationship to the debtor, the identity of the document, and the date. Bankruptcy Rules 1008 and 9011.

WARNING -- Bankruptcy fraud is a serious crime. Making a false statement, concealing property, or obtaining money or

property by fraud in connection with a bankruptcy case can result in fines up to $500,000 or imprisonment for up to 20

years, or both. 18 U.S.C. §§ 152, 1341, 1519, and 3571.

Declaration and signature

I am the president, another officer, or an authorized agent of the corporation; a member or an authorized agent of

the partnership; or another individual serving as a representative of the debtor in this case.

I have examined the information in the documents checked below and I have a reasonable belief that the information

is true and correct:

☐

Schedule A/B: Assets-Real and Personal Property (Official Form 206A/B)

☐

Schedule D: Creditors Who Have Claims Secured by Property (Official Form 206D)

☐

Schedule E/F: Creditors Who Have Unsecured Claims (Official Form 206E/F)

☐

Schedule G: Executory Contracts and Unexpired Leases (Official Form 206G)

☐

Schedule H: Codebtors (Official Form 206H)

☐

Summary of Assets and Liabilities for Non-Individuals (Official Form 206Sum)

☐

Amended Schedule

☒

Chapter 11 or Chapter 9 Cases: Consolidated List of Creditors Who Have the 50 Largest Unsecured Claims

and Are Not Insiders (Official Form 204)

☒

Other document that requires a declaration List of Equity Security Holders, Corporate Ownership

Statement, and Creditor Matrix

I declare under penalty of perjury that the foregoing is true and correct.

Executed on

07/21/2019

/s/ Jeffrey S. Stein

MM/ DD/YYYY

Signature of individual signing on behalf of debtor

Jeffrey S. Stein

Printed name

Authorized Signatory

Position or relationship to debtor

Official Form 202 Declaration Under Penalty of Perjury for Non-Individual Debtors

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 16 of 26

PES ENERGY INC.

SECRETARY’S CERTIFICATE

July 21, 2019

The undersigned, John B. McShane, as Secretary of PES Energy Inc. (the “Company”),

hereby certifies as follows:

1. I am the duly qualified and elected Secretary of the Company and, as such, I am familiar

with the facts herein certified and I am duly authorized to certify the same on behalf of

the Company.

2. Attached hereto is a true, complete, and correct copy of the resolutions of the board of

directors of the Company (collectively, the “Board”), duly adopted at a properly

convened and joint meeting of the Board of July 21, 2019, in accordance with the bylaws

of the Company.

3. Since their adoption and execution, the Resolutions have not been modified, rescinded, or

amended and are in full force and effect as of the date hereof, and the Resolutions are the

only resolutions adopted by the Board relating to the authorization and ratification of all

corporate actions taken in connection with the matters referred to therein.

[Signature page follows]

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 17 of 26

[Signature Page to Certification of Secretary]

IN WITNESS WHEREOF, I have hereunto set my hand on behalf of the Company as of

the date hereof.

PES Energy Inc.

By: ______________________________

Name: John B. McShane

Title: Secretary

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 18 of 26

RESOLUTIONS

OF THE BOARD OF DIRECTORS

OF

PES ENERGY INC.

CHAPTER 11 FILING AUTHORIZATION, APPOINTMENT OF A

CHIEF RESTRUCTURING OFFICER, AUTHORIZATION OF RETENTION OF

PROFESSIONALS, AND APPROVAL OF DEBTOR-IN POSSESSION FINANCING

July 21, 2019

WHEREAS, the members of the board of directors (the “Board”) of PES Energy Inc.

(“PES Energy”) a Delaware corporation, acting on behalf of:

1) the Corporation, in its own capacity and in its capacity as managing member of PES

Ultimate Holdings, LLC, a Delaware limited liability company (“Ultimate Holdings”);

2) Ultimate Holdings, in its own capacity and in its capacity as the managing member of

(a) PES Intermediate, LLC, a Delaware limited liability company (“PES Intermediate”),

and (b) PES Holdings, LLC, a Delaware limited liability company (“PES Holdings”);

3) PES Holdings, in its own capacity and in its capacity as the managing member of

(a) Philadelphia Energy Solutions Refining and Marketing LLC, a Delaware limited

liability company (“PESRM”), and (b) North Yard GP, LLC, a Delaware limited liability

company (“North Yard GP”);

4) PESRM, in its own capacity and in its capacity as the managing member of PES

Administrative Services, LLC, a Delaware limited liability company (“PES Admin”);

5) North Yard GP, in its own capacity and in its capacity as the general partner of North Yard

Logistics, L.P., a Delaware limited partnership (“North Yard” and together with Ultimate

Holdings, PES Intermediate, PES Holdings, PESRM, PES Admin and North Yard GP,

each a “Subsidiary” and collectively, the “Subsidiaries” and together with PES Energy,

collectively, the “Companies”); and

6) PES Intermediate, North Yard and PES Admin, each in its own capacity,

do hereby consent in writing, pursuant to Section 141(f) of the Delaware General Corporation Law

and (as applicable) the bylaws, limited liability company agreement, limited partnership

agreement, or similar document (in each case as amended or amended and restated to date) of each

Company (the “Governing Document”), to the taking of the following actions and the adoption of

the following recitals and resolutions, and to the waiver of all notices and the holding of a meeting

for the purpose of considering the same:

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 19 of 26

CHAPTER 11 FILING

WHEREAS, the Board has considered presentations by the management and the financial

and legal advisors of the Companies regarding the liabilities and liquidity situation of the

Companies, the strategic alternatives available to it and the effect of the foregoing on the

Companies’ business.

WHEREAS, the Board has had the opportunity to consult with the management and the

financial and legal advisors of the Companies and fully consider each of the strategic alternatives

available to the Companies.

RESOLVED, that in the judgment of the Board, it is desirable and in the best interests of

the Companies (including a consideration of their creditors and other parties in interest) that PES

Holdings and certain of its subsidiaries and affiliates identified on Annex A attached hereto

(collectively, the “Filing Companies”), shall be, and hereby are, authorized to file or cause to be

filed, voluntary petitions for relief for the Filing Companies (the “Chapter 11 Cases”) under the

provisions of chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in a court

of proper jurisdiction (the “Bankruptcy Court”) and any other petition for relief or recognition or

other order that may be desirable under applicable law in the United States; and

RESOLVED, that the Chief Executive Officer, the President, the General Counsel, the

Chief Operating Officer, the Chief Financial Officer, any Senior Vice President, any Vice

President, any Assistant Vice President, or any other duly appointed officer of the Company

(collectively, the “Authorized Signatories” or “Authorized Officers”), acting alone or with one or

more other Authorized Signatories be, and they hereby are, authorized, empowered and directed

to execute and file on behalf of the Company all petitions, schedules, lists and other motions,

papers, or documents, and to take any and all action that they deem necessary or proper to obtain

such relief including without limitation, any action necessary to maintain the ordinary course

operation of the Company’s business.

APPOINTMENT OF CHIEF RESTRUCTURING OFFICER

WHEREAS, on July 3, 2019, the Board established the Restructuring Committee

(the “Restructuring Committee”) to review strategic restructuring alternatives of the Companies,

propose such alternatives to the Board for consideration and approval, and, as approved and

directed by the Board, and implement those strategic restructuring initiatives;

WHEREAS, the Companies has evaluated potential restructuring transactions;

WHEREAS, the Restructuring Committee discussed the foregoing with the Companies’

Authorized Officers and representatives and the Companies’ legal, financial, and restructuring

advisors and has recommended to the Board that it is in the best interest of the Companies that the

Companies retain a Chief Restructuring Officer to address the potential restructuring of the Filing

Companies;

NOW, THEREFORE, BE IT RESOLVED, that the Board hereby appoints Jeffrey S.

Stein (the “Executive”) as the Chief Restructuring Officer of the Filing Companies for the purpose

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 20 of 26

of performing the duties and responsibilities of the Chief Restructuring Officer and such other

duties and responsibilities as may be determined by the Board to be reasonably related thereto;

FURTHER RESOLVED, that the Chief Restructuring Officer shall have such authority

with respect to the Companies as is described in the Consulting Agreement, substantially in the

form annexed hereto as Annex 1, by and among PES Holdings and the Executive (the “Consulting

Agreement”), including to:

a. identify and explore the Companies’ refinancing/restructuring options that are intended to

be deleveraging and value accretive to the Companies;

b. assess options to optimize the Companies’ capital structure;

c. manage and implement the restructuring plan(s) of the Companies;

d. explore and recommend asset acquisition(s), disposition(s), merger(s) or other strategic

transaction(s);

e. communicate and/or negotiate with outside constituents, including, but not limited to,

lenders to the Companies;

f. develop and implement cash management strategies and processes designed to enhance

liquidity;

g. review and analyze the revised business plan(s), including financial and operating budgets,

provided by the Companies’ management;

h. review and recommend changes that would enhance the efficiency and cost effectiveness

of the Companies’ corporate organization;

i. review the Companies’ business reporting systems and recommend changes to improve

effectiveness; and

j. provide such other similar services as may be requested by the Board,

FURTHER RESOLVED, that entry into the Consulting Agreement is hereby approved,

and that the Authorized Signatories (and their designees and delegates), acting alone or with one

or more other Authorized Signatories, shall, and hereby are, authorized to enter into and execute,

on behalf of PES Holdings, the Consulting Agreement.

RETENTION OF PROFESSIONALS

WHEREAS, the Board has considered presentations by the management and the financial

and legal advisors of each Company regarding the liabilities and liquidity situation of each

Company, the strategic alternatives available to it and the effect of the foregoing on each

Company’s business.

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 21 of 26

RESOLVED, that each of the Authorized Signatories be, and they hereby are, authorized

and directed to employ the law firm of Kirkland & Ellis LLP and Kirkland & Ellis International

LLP (together, “Kirkland”) as general bankruptcy counsel to represent and assist the Companies

in carrying out their duties under the Bankruptcy Code, and to take any and all actions to advance

the Companies’ rights and obligations, including filing any motions, objections, replies,

applications, or pleadings; and in connection therewith, each of the Authorized Signatories, with

power of delegation, is hereby authorized and directed to execute appropriate retention

agreements, pay appropriate retainers, and to cause to be filed an appropriate application for

authority to retain the services of Kirkland.

RESOLVED, that each of the Authorized Signatories be, and they hereby are, authorized

and directed to employ the law firm of Pachulski, Stang, Ziehl & Jones LLP (“PSZJ”) as local

bankruptcy counsel to represent and assist the Companies in carrying out their duties under the

Bankruptcy Code, and to take any and all actions to advance the Companies’ rights and obligations,

including filing any motions, objections, replies, applications, or pleadings; and in connection

therewith, each of the Authorized Signatories, with power of delegation, is hereby authorized and

directed to execute appropriate retention agreements, pay appropriate retainers, and to cause to be

filed an appropriate application for authority to retain the services of PSZJ.

RESOLVED, that each of the Authorized Signatories be, and they hereby are, authorized

and directed to employ the firm of PJT Partners LP (“PJT”) as financial advisor to, among other

things, assist the Companies in evaluating their business and prospects, developing long-term

business plans, developing financial data for evaluation by the Board, creditors, or other third

parties, as requested by the Companies, evaluating the Companies’ capital structure, responding

to issues related to the Companies’ financial liquidity, and in any sale, reorganization, business

combination, or similar disposition of the Company’s assets; and in connection therewith, each of

the Authorized Signatories, with power of delegation, is hereby authorized and directed to execute

appropriate retention agreements, pay appropriate retainers, and to cause to be filed an appropriate

application for authority to retain the services of PJT.

RESOLVED, that each of the Authorized Signatories be, and they hereby are, authorized

and directed to employ the firm of Alvarez & Marsal North America, LLC, together with

employees of its affiliates (all of which are wholly owned by its parent company and employees),

its wholly owned subsidiaries, and independent contractors (collectively, “A&M”), as

restructuring advisor to the Companies to represent and assist the Companies in carrying out their

duties under the Bankruptcy Code, and to take any and all actions to advance the Companies’

rights and obligations; and in connection therewith, each of the Authorized Signatories, with power

of delegation, is hereby authorized and directed to execute appropriate retention agreements, pay

appropriate retainers, and to cause to be filed an appropriate application for authority to employ or

retain the services of A&M.

RESOLVED, that each of the Authorized Signatories be, and they hereby are, authorized

and directed to employ the firm of Omni Management Group, Inc. (“Omni”) as notice and claims

agent to represent and assist the Companies in carrying out their duties under the Bankruptcy Code,

and to take any and all actions to advance the Companies’ rights and obligations; and in connection

therewith, each of the Authorized Signatories, with power of delegation, is hereby authorized and

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 22 of 26

directed to execute appropriate retention agreements, pay appropriate retainers, and to cause to be

filed appropriate applications for authority to retain the services of Omni.

RESOLVED, that each of the Authorized Signatories be, and they hereby are, authorized

and directed to employ any other professionals to assist the Companies in carrying out their duties

under the Bankruptcy Code; and in connection therewith, each of the Authorized Signatories, with

power of delegation, is hereby authorized and directed to execute appropriate retention

agreements, pay appropriate retainers and fees, and to cause to be filed an appropriate application

for authority to retain the services of any other professionals as necessary.

RESOLVED, that each of the Authorized Signatories be, and they hereby are, with power

of delegation, authorized, empowered and directed to execute and file all petitions, schedules,

motions, lists, applications, pleadings, and other papers and, in connection therewith, to employ

and retain all assistance by legal counsel, accountants, financial advisors, and other professionals

and to take and perform any and all further acts and deeds that each of the Authorized Signatories

deem necessary, proper, or desirable in connection with each Filing Company’s Chapter 11 Cases,

with a view to the successful prosecution of such case.

DEBTOR-IN-POSSESSION FINANCING, CASH COLLATERAL, AND ADEQUATE

PROTECTION

WHEREAS, reference is made to that one or more certain debtor-in-possession credit

agreement (each, together with all exhibits, schedules, and annexes thereto, as amended, amended

and restated, supplement or otherwise modified from time to time, a “DIP Credit Agreement”)

dated as of, or about, the date hereof, that sets forth the terms and conditions of the debtor-in-

possession financing to be provided to the Filing Companies by the lenders listed therein (the “DIP

Lenders”)

WHEREAS, based on such review, each Board believes the Filing Companies will obtain

benefits from the transactions contemplated by the DIP Credit Agreements; and

WHEREAS, it is in the best interest of each Filing Company to enter into each agreement,

document, instrument, certificate, recording and filing relating thereto.

NOW, THEREFORE, BE IT,

RESOLVED, that the terms and provisions of the DIP Credit Agreements and such other

instruments, certificates, agreements and documents as may be reasonably requested by any

administrative agent thereunder or contemplated by the DIP Credit Agreements (collectively,

the “DIP Loan Documents”), substantially in the form presented to the Board, delivered pursuant

to the DIP Credit Agreements and each Filing Company’s performance of its obligations,

including any guarantees contemplated thereunder, and the grant of security under the DIP Loan

Documents, and to enter into each agreement, document, instrument, certificate, recording and

filing relating thereto, be, and hereby are, in all respects, ratified, approved, confirmed and

authorized.

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 23 of 26

RESOLVED, that each of the Authorized Signatories, acting alone or with one or more

other Authorized Signatories be, and hereby is, authorized and empowered to negotiate (including

to negotiate any terms of the DIP Credit Agreements which deviate from the terms set forth in the

form presented to the Board), make, execute, acknowledge, verify, issue, deliver, and to cause

each Filing Company to perform its obligations under, each of the DIP Loan Documents, and each

of the instruments, agreements and documents contemplated thereby, in the name and on behalf

of each Filing Company, under its corporate seal or otherwise, substantially as specified in the DIP

Credit Agreements, with such execution by said Authorized Signatory to constitute conclusive

evidence of his/her approval of the terms thereof, including any departures therein from the terms

as specified in the DIP Credit Agreements.

RESOLVED, that each Board hereby authorizes the collateral agent under any DIP Credit

Agreement (each, a “Collateral Agent”) to file or record any financing statements, assignments for

security or other instruments, documents and agreements with respect to the Collateral

(contemplated by the DIP Credit Agreements) in the name of each Filing Company as may be

necessary or desirable to perfect the security interests granted to the Collateral Agents under the

DIP Loan Documents. The Collateral Agents are authorized to use the collateral description “all

assets of the Filing Company whether now owned or hereafter acquired” or any similar description

in any such financing statements.

RESOLVED, that each of the Authorized Signatories be, and hereby is, authorized and

empowered to take all such further actions including, without limitation, to make all payments and

remittances and to incur all fees and expenses on behalf of each Filing Company in connection

with any transaction contemplated by these resolutions, such payment to conclusively evidence

the necessity or appropriateness thereof, to arrange for and enter into supplemental agreements,

amendments, instruments, certificates, agreements or documents relating to the transactions

contemplated by the DIP Credit Agreements or any of the other DIP Loan Documents and to

execute and deliver all such supplemental agreements, amendments, instruments, certificates or

documents in the name and on behalf of each Filing Company, under its corporate seal or

otherwise, which shall in their sole judgment be necessary, proper or advisable in order to perform

the Filing Company’s obligations under or in connection with the DIP Credit Agreements or any

of the other DIP Loan Documents and the transactions contemplated therein, and to carry out fully

the intent of the foregoing resolutions.

RESOLVED, that the Authorized Signatories be and hereby are authorized and

empowered to take all actions or to not take any action in the name of each Filing Company with

respect to the transactions contemplated by these resolutions as the sole shareholder, partner,

member, or managing member of each direct subsidiary of any such Filing Company, in each case,

as such Authorized Signatory shall deem necessary or desirable in such Authorized Signatory’s

reasonable business judgment, including without limitation the authorization of resolutions and

agreements necessary to authorize the execution, delivery and performance pursuant to any DIP

Loan Document (including affidavits, financing statements, notices, reaffirmations and

amendments and restatements of existing documents) as may be necessary or convenient to

effectuate the purposes of the transactions contemplated herein.

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 24 of 26

RESOLVED, that, without in any way limiting the authority heretofore granted to the

officers of each Filing Company or that may have been otherwise conferred upon them, the officers

of each Filing Company be, and each hereby is, authorized and empowered, in the name and on

behalf of each Filing Company, to execute and deliver any and all documents, agreements and

instruments, to take any and all actions, and to do any and all things, they, and each of them

severally, may deem necessary or desirable in order to carry out the intent and purposes of the

foregoing resolutions.

RESOLVED, that any and all actions taken by any officer or officers of each Filing

Company prior to the date of adoption of the foregoing resolutions, which would have been

authorized by the foregoing resolutions but for the fact that such actions were taken prior to such

date, be, and each hereby is, ratified, approved, confirmed and adopted as the duly ratified and

official act of each Filing Company.

GENERAL

RESOLVED, that in addition to the specific authorizations heretofore conferred upon the

Authorized Signatories, each of the Authorized Signatories (and their designees and delegates) be,

and they hereby are, authorized and empowered, in the name of and on behalf of the Company to

take or cause to be taken any and all such other and further action, and to execute, acknowledge,

deliver and file any and all such agreements, certificates, instruments and other documents and to

pay all expenses, including but not limited to filing fees, in each case as in such Authorized

Signatory’s judgment, shall be necessary, advisable or desirable in order to fully carry out the

intent and accomplish the purposes of the resolutions adopted herein.

RESOLVED, that the Board has received sufficient notice of the actions and transactions

relating to the matters contemplated by the foregoing resolutions, as may be required by the

organizational documents of the Company, or hereby waive any right to have received such notice.

RESOLVED, that all acts, actions and transactions relating to the matters contemplated

by the foregoing resolutions done in the name of and on behalf of the Company, which acts would

have been approved by the foregoing resolutions except that such acts were taken before the

adoption of these resolutions, are hereby in all respects approved and ratified as the true acts and

deeds of the Company with the same force and effect as if each such act, transaction, agreement

or certificate has been specifically authorized in advance by resolution of the Board.

RESOLVED, that each of the Authorized Signatories (and their designees and delegates)

be, and hereby is, authorized and empowered to take all actions or to not take any action in the

name of the Company with respect to the transactions contemplated by these resolutions

hereunder, as such Authorized Signatory shall deem necessary or desirable in such Authorized

Signatory’s reasonable business judgment to effectuate the purposes of the transactions

contemplated herein.

* * * *

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 25 of 26

Annex A

Filing Companies

PES Holdings, LLC

PES Energy Inc.

PES Ultimate Holdings, LLC

PES Intermediate, LLC

Philadelphia Energy Solutions Refining and Marketing LLC

North Yard Logistics, L.P.

North Yard GP, LLC

PES Administrative Services, LLC

Case 19-11630-KG Doc 1 Filed 07/21/19 Page 26 of 26