2022 Exempt Org. Return

prepared for:

Pitney Meadows Community Farm, Inc.

112 Spring Street, Suite 206

Saratoga Springs, NY 12866

WHITTEMORE, DOWEN & RICCIARDELLI, LLP

333 AVIATION RD BLDG B

QUEENSBURY, NY 12804

WHITTEMORE, DOWEN & RICCIARDELLI, LLP

333 AVIATION RD BLDG B

QUEENSBURY, NY 12804

(518) 792-0918

November 9, 2023

Pitney Meadows Community Farm, Inc.

112 Spring Street, Suite 206

Saratoga Springs, NY 12866

Dear John:

Your 2022 Federal Return of Organization Exempt from Income Tax will be electronically filed

with the Internal Revenue Service upon receipt of a signed Form 8879-TE - IRS e-file Signature

Authorization. No tax is payable with the filing of this return.

You are now required to file your New York Annual Financial Report for Charitable

Organizations with the Charities Bureau through their online portal at the website noted below.

You must create an online account with the Charities Bureau, and have a valid email address and

a primary contact person to register. Two distinct officials of the organization are required to

provide an electronic signature. You will need to have their names and email addresses available

when completing the online filing. You will also be required to attach a PDF of IRS Form

990/990EZ, which we have provided to you. There is a balance due of $275, payable by

November 15, 2023, which must be paid by credit card or electronic check.

https://ag.ny.gov/annual_filing_checklist

Included in your tax return package are forms relating to your e-file returns. There is one form

for each government authority (i.e., IRS and/or state) for which a return will be electronically

filed. These forms authorize our office to submit the returns electronically. An authorized

person must sign and date these forms and return them to our office BEFORE we can submit the

returns electronically. Also, we are enclosing copies of these forms in the copy of your returns.

Please be aware that only schedules specifically denoted in the top right-hand corner as "Open

for Public Inspection" are as such. In the absence of this specific language, note that the

schedule is not open for public inspection. Also, please note that your organization's exemption

application, related documents, and signed information returns for the last 3 years must be

available for public inspection and furnished to anyone who requests a copy in writing.

Sign and date the copies provided for your files, including e-file authorization forms, and retain

indefinitely.

Please call if you have any questions.

Sincerely,

Colin D. Combs, CPA

OMB No. 1545-0047

IRS e-file Signature Authorization

Form 8879-TE

for a Tax Exempt Entity

For calendar year 2022, or fiscal year beginning , 2022, and ending , 20

2022

Do not send to the IRS. Keep for your records.

Department of the Treasury

Internal Revenue Service

Go to www.irs.gov/Form8879TE for the latest information.

Name of filer

EIN or SSN

Name and title of officer or person subject to tax

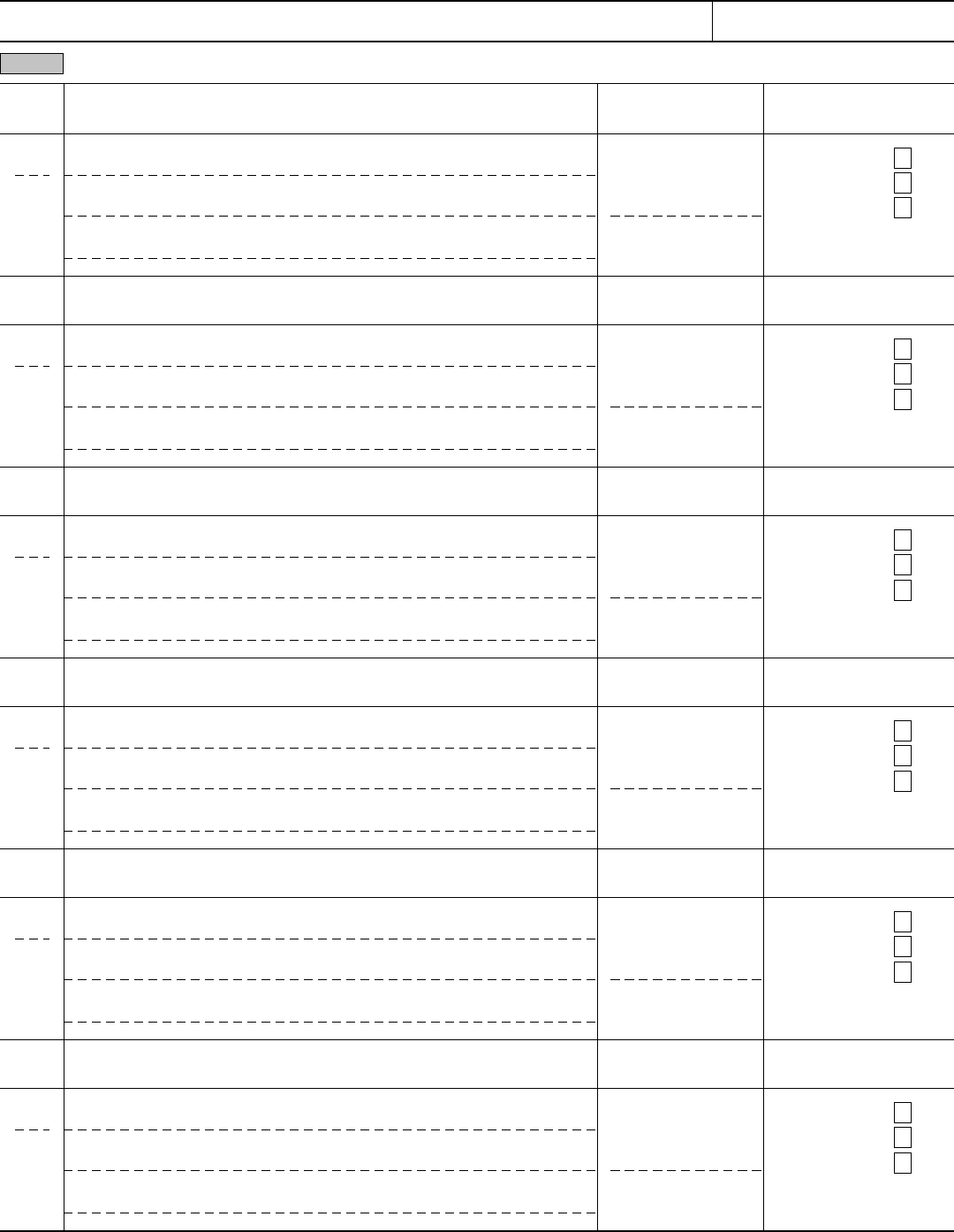

Part I Type of Return and Return Information

Check the box for the return for which you are using this Form 8879-TE and enter the applicable amount, if any, from the return. Form 8038-CP

and Form 5330 filers may enter dollars and cents. For all other forms, enter whole dollars only. If you check the box on line 1a, 2a, 3a, 4a, 5a,

6a, 7a, 8a, 9a, or 10a below, and the amount on that line for the return being filed with this form was blank, then leave line 1b, 2b, 3b, 4b, 5b,

6b, 7b, 8b, 9b, or 10b, whichever is applicable, blank (do not enter -0-). But, if you entered -0- on the return, then enter -0- on the applicable

line below. Do not complete more than one line in Part I.

1a b Total revenue, if any (Form 990, Part VIII, column (A), line 12). . . . . . . . . . . . 1b

Form 990 check here. . . . . .

2a b Total revenue, if any (Form 990-EZ, line 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

Form 990-EZ check here . .

3a b Total tax (Form 1120-POL, line 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3b

Form 1120-POL check here

4a b Tax based on investment income (Form 990-PF, Part V, line 5) . . . . . . . . . . . 4b

Form 990-PF check here . .

5a b Balance due (Form 8868, line 3c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

Form 8868 check here. . . . .

6a b Total tax (Form 990-T, Part III, line 4). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

Form 990-T check here. . . .

7a b Total tax (Form 4720, Part III, line 1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

Form 4720 check here. . . . .

8a b FMV of assets at end of tax year (Form 5227, Item D). . . . . . . . . . . . . . . . . . . . . 8b

Form 5227 check here. . . . .

9a b Tax due (Form 5330, Part II, line 19). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9b

Form 5330 check here. . . . .

10a b Amount of credit payment requested (Form 8038-CP, Part III, line 22). . . . 10b

Form 8038-CP check here.

Part II Declaration and Signature Authorization of Officer or Person Subject to Tax

I am a person subject to tax with respect to

Under penalties of perjury, I declare that

I am an officer of the above entity or

(name of entity)

, (EIN)

and that I have examined a copy of the 2022 electronic return and accompanying schedules and statements, and, to the best of my knowledge

and belief, they are true, correct, and complete. I further declare that the amount in Part I above is the amount shown on the copy of the

electronic return. I consent to allow my intermediate service provider, transmitter, or electronic return originator (ERO) to send the return to the

IRS and to receive from the IRS (a) an acknowledgement of receipt or reason for rejection of the transmission, (b) the reason for any delay in

processing the return or refund, and

(c)

the date of any refund. If applicable, I authorize the U.S. Treasury and its designated Financial Agent to

initiate an electronic funds withdrawal (direct debit) entry to the financial institution account indicated in the tax preparation software for payment

of the federal taxes owed on this return, and the financial institution to debit the entry to this account. To revoke a payment, I must contact the

U.S. Treasury Financial Agent at 1-888-353-4537 no later than 2 business days prior to the payment (settlement) date. I also authorize the

financial institutions involved in the processing of the electronic payment of taxes to receive confidential information necessary to answer

inquiries and resolve issues related to the payment. I have selected a personal identification number (PIN) as my signature for the electronic

return and, if applicable, the consent to electronic funds withdrawal.

PIN: check one box only

as my signature

I authorize

to enter my PIN

ERO firm name

Enter five numbers, but

do not enter all zeros

on the tax year 2022 electronically filed return. If I have indicated within this return that a copy of the return is being filed with a state

agency(ies) regulating charities as part of the IRS Fed/State program, I also authorize the aforementioned ERO to enter my PIN on the

return's disclosure consent screen.

As an officer or person subject to tax with respect to the entity, I will enter my PIN as my signature on the tax year 2022 electronically filed

return. If I have indicated within this return that a copy of the return is being filed with a state agency(ies) regulating charities as part of

the IRS Fed/State program, I will enter my PIN on the return's disclosure consent screen.

DateSignature of officer or person subject to tax

Part III Certification and Authentication

ERO's EFIN/PIN. Enter your six-digit electronic filing identification

number (EFIN) followed by your five-digit self-selected PIN.

Do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature on the 2022 electronically filed return indicated above. I confirm that I

am submitting this return in accordance with the requirements of Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS e-file

Providers for Business Returns.

ERO's signature Date

ERO Must Retain This Form ' See Instructions

Do Not Submit This Form to the IRS Unless Requested To Do So

TEEA8800L 09/29/22

BAA For Privacy and Paperwork Reduction Act Notice, see instructions. Form 8879-TE (2022)

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

JOHN FRANCK TREASURER

1,345,144.

X

X

69049

X

WHITTEMORE, DOWEN & RICCIARDELLI, LLP

14185691356

COLIN D. COMBS, CPA

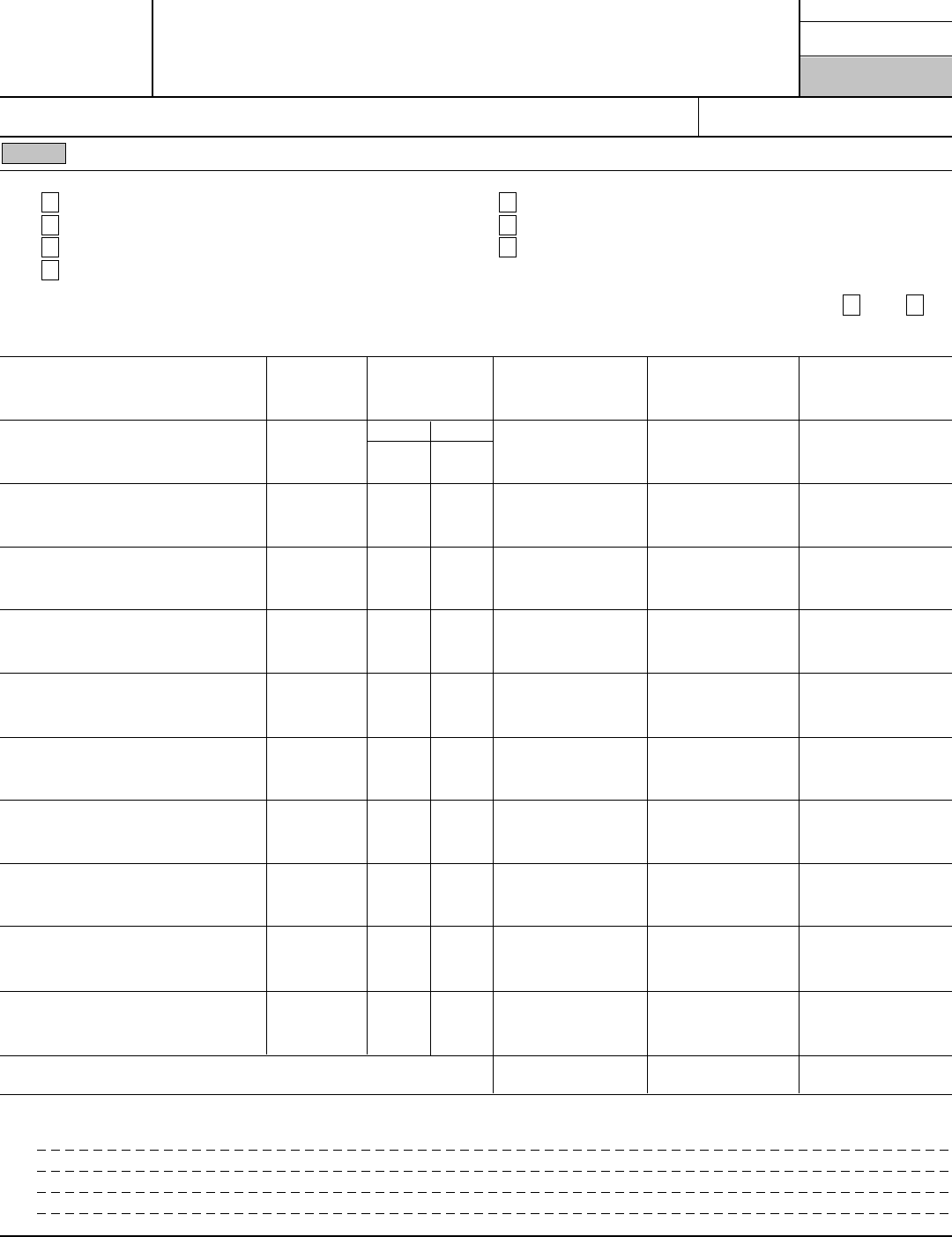

OMB No. 1545-0047

Form

990

Return of Organization Exempt From Income Tax

2022

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

Open to Public

Do not enter social security numbers on this form as it may be made public.

Department of the Treasury

Inspection

Internal Revenue Service

Go to www.irs.gov/Form990 for instructions and the latest information.

A For the 2022 calendar year, or tax year beginning , 2022, and ending , 20

Employer identification number

C D

Check if applicable:

B

Address change

Telephone number

E

Name change

Initial return

Final return/terminated

$

Amended return Gross receiptsG

Is this a group return for subordinates?

H(a)

Name and address of principal officer:F

Application pending

Yes No

H(b)

Are all subordinates included?

Yes No

If "No," attach a list. See instructions.

( )

Tax-exempt status: 501(c)(3) 501(c) (insert no.) 4947(a)(1) or 527

I

Group exemption number

J Website:

H(c)

Form of organization: Corporation Trust Association Other Year of formation: State of legal domicile:K L M

Part I Summary

Briefly describe the organization's mission or most significant activities:

1

Check this box if the organization discontinued its operations or disposed of more than 25% of its net assets.

2

Number of voting members of the governing body (Part VI, line 1a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 3

Number of independent voting members of the governing body (Part VI, line 1b). . . . . . . . . . . . . . . . . . . . . . .

4

4

Total number of individuals employed in calendar year 2022 (Part V, line 2a) . . . . . . . . . . . . . . . . . . . . . . . . . .

5 5

Total number of volunteers (estimate if necessary). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

Total unrelated business revenue from Part VIII, column (C), line 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a 7a

Net unrelated business taxable income from Form 990-T, Part I, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b 7b

Prior Year Current Year

Contributions and grants (Part VIII, line 1h). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Program service revenue (Part VIII, line 2g). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Investment income (Part VIII, column (A), lines 3, 4, and 7d) . . . . . . . . . . . . . . . . . . . . . . . . .

10

Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e). . . . . . . . . . . . . . . .

11

Total revenue ' add lines 8 through 11 (must equal Part VIII, column (A), line 12) . . . . .

12

Grants and similar amounts paid (Part IX, column (A), lines 1-3). . . . . . . . . . . . . . . . . . . . . .

13

Benefits paid to or for members (Part IX, column (A), line 4). . . . . . . . . . . . . . . . . . . . . . . . . .

14

Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10). . . . . .

15

Professional fundraising fees (Part IX, column (A), line 11e). . . . . . . . . . . . . . . . . . . . . . . . . .

16a

Total fundraising expenses (Part IX, column (D), line 25)

b

Other expenses (Part IX, column (A), lines 11a-11d, 11f-24e). . . . . . . . . . . . . . . . . . . . . . . . .

17

Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25). . . . . . . . . . . . .

18

Revenue less expenses. Subtract line 18 from line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

End of Year

Beginning of Current Year

Total assets (Part X, line 16). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

Total liabilities (Part X, line 26) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

Net assets or fund balances. Subtract line 21 from line 20. . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

Part II Signature Block

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and

complete. Declaration of preparer (other than officer) is based on all information of which preparer has any knowledge.

Signature of officer Date

Sign

Here

Type or print name and title

Print/Type preparer's name Preparer's signature Date PTIN

Check if

self-employed

Paid

Firm's name

Preparer

Use Only

Firm's EIN

Firm's address

Phone no.

May the IRS discuss this return with the preparer shown above? See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

TEEA0101L 09/01/22

BAA For Paperwork Reduction Act Notice, see the separate instructions. Form 990 (2022)

PITNEY MEADOWS COMMUNITY FARM, INC.

112 SPRING STREET, SUITE 206

SARATOGA SPRINGS, NY 12866

81-2724904

518-290-0008

X

WWW.PITNEYMEADOWSCOMMUNITYFARM.ORG

3,805,687.3,334,876.

84,935.98,415.

3,890,622.3,433,291.

522,349.240,768.

822,795.786,543.

384,973.405,207.

58,849.

437,822.381,336.

1,345,144.1,027,311.

134,008.213,867.

18,171.29,357.

43,889.22,654.

1,149,076.761,433.

0.

0.

230

19

10

10

NY2016

X

1,935,449.

TREASURERJOHN FRANCK

X

X

TO PROVIDE EDUCATION OF FARMING

PRACTICES, SUSTAINABILITY PRINCIPLES, AND ACCESS TO FRESH, HEALTHY FOOD.

COLIN D. COMBS, CPA P00968109

WHITTEMORE, DOWEN & RICCIARDELLI, LLP

82-0548504333 AVIATION RD BLDG B

(518) 792-0918QUEENSBURY, NY 12804

SAME AS C ABOVE

JOHN FRANCK

COLIN D. COMBS, CPA

Form 990 (2022) Page 2

Part III Statement of Program Service Accomplishments

Check if Schedule O contains a response or note to any line in this Part III. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Briefly describe the organization's mission:

1

Did the organization undertake any significant program services during the year which were not listed on the prior

2

Form 990 or 990-EZ?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

If "Yes," describe these new services on Schedule O.

Did the organization cease conducting, or make significant changes in how it conducts, any program services?. . . .

3 Yes No

If "Yes," describe these changes on Schedule O.

4

Describe the organization's program service accomplishments for each of its three largest program services, as measured by expenses.

Section 501(c)(3) and 501(c)(4) organizations are required to report the amount of grants and allocations to others, the total expenses,

and revenue, if any, for each program service reported.

$ $ $

(Code: ) (Expenses including grants of ) (Revenue )

4a

$ $ $

(Code: ) (Expenses including grants of ) (Revenue )

4b

$ $ $

(Code: ) (Expenses including grants of ) (Revenue )

4c

Other program services (Describe on Schedule O.)

4d

$ $ $(Expenses including grants of ) (Revenue )

4e Total program service expenses

Form 990 (2022)

TEEA0102L 09/01/22BAA

601,823.

601,823. 43,889.

X

X

81-2724904PITNEY MEADOWS COMMUNITY FARM, INC.

X

PITNEY MEADOWS COMMUNITY FARM ENGAGES THE COMMUNITY IN WAYS THAT ALLOW COMMUNITY

MEMBERS TO SEE WHERE THEIR FOOD COMES FROM, AND BE A PART OF THAT PROCESS, WHILE

AIMING TO SUPPORT HEALTHY FOOD CHOICES.

SEE SCHEDULE O

Form 990 (2022) Page 3

Part IV Checklist of Required Schedules

Yes No

Is the organization described in section 501(c)(3) or 4947(a)(1) (other than a private foundation)? If "Yes," complete

1

Schedule A. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Is the organization required to complete Schedule B, Schedule of Contributors? See instructions. . . . . . . . . . . . . . . . . . . . . . .

2 2

Did the organization engage in direct or indirect political campaign activities on behalf of or in opposition to candidates

3

for public office? If "Yes," complete Schedule C, Part I. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Section 501(c)(3) organizations. Did the organization engage in lobbying activities, or have a section 501(h) election

in effect during the tax year? If "Yes," complete Schedule C, Part II. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Is the organization a section 501(c)(4), 501(c)(5), or 501(c)(6) organization that receives membership dues,

5

assessments, or similar amounts as defined in Revenue Procedure 98-19? If "Yes," complete Schedule C, Part III. . . . . .

5

Did the organization maintain any donor advised funds or any similar funds or accounts for which donors have the right

6

to provide advice on the distribution or investment of amounts in such funds or accounts? If "Yes," complete Schedule D,

Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Did the organization receive or hold a conservation easement, including easements to preserve open space, the

7

environment, historic land areas, or historic structures? If "Yes," complete Schedule D, Part II. . . . . . . . . . . . . . . . . . . . . . . . .

7

Did the organization maintain collections of works of art, historical treasures, or other similar assets? If "Yes,"

8

complete Schedule D, Part III. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Did the organization report an amount in Part X, line 21, for escrow or custodial account liability, serve as a custodian

9

for amounts not listed in Part X; or provide credit counseling, debt management, credit repair, or debt negotiation

services? If "Yes," complete Schedule D, Part IV. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Did the organization, directly or through a related organization, hold assets in donor-restricted endowments

10

or in quasi endowments? If "Yes," complete Schedule D, Part V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

If the organization's answer to any of the following questions is "Yes," then complete Schedule D, Parts VI, VII, VIII, IX,

11

or X, as applicable.

Did the organization report an amount for land, buildings, and equipment in Part X, line 10? If "Yes," complete Schedule

a

D, Part VI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11a

Did the organization report an amount for investments

'

other securities in Part X, line 12, that is 5% or more of its total

b

assets reported in Part X, line 16? If "Yes," complete Schedule D, Part VII . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11b

Did the organization report an amount for investments

'

program related in Part X, line 13, that is 5% or more of its total

c

assets reported in Part X, line 16? If "Yes," complete Schedule D, Part VIII. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11c

Did the organization report an amount for other assets in Part X, line 15, that is 5% or more of its total assets reported

d

in Part X, line 16? If "Yes," complete Schedule D, Part IX. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11d

Did the organization report an amount for other liabilities in Part X, line 25? If "Yes," complete Schedule D, Part X. . . . . .

e 11e

Did the organization's separate or consolidated financial statements for the tax year include a footnote that addresses

f

the organization's liability for uncertain tax positions under FIN 48 (ASC 740)? If "Yes," complete Schedule D, Part X . . .

11f

Did the organization obtain separate, independent audited financial statements for the tax year? If "Yes," complete

12a

Schedule D, Parts XI and XII . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12a

Was the organization included in consolidated, independent audited financial statements for the tax year? If "Yes," and

b

if the organization answered "No" to line 12a, then completing Schedule D, Parts XI and XII is optional. . . . . . . . . . . . . . . . .

12b

Is the organization a school described in section 170(b)(1)(A)(ii)? If "Yes," complete Schedule E. . . . . . . . . . . . . . . . . . . . . . .

13 13

Did the organization maintain an office, employees, or agents outside of the United States?. . . . . . . . . . . . . . . . . . . . . . . . . . .

14a 14a

Did the organization have aggregate revenues or expenses of more than $10,000 from grantmaking, fundraising,

b

business, investment, and program service activities outside the United States, or aggregate foreign investments valued

at $100,000 or more? If "Yes," complete Schedule F, Parts I and IV. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14b

Did the organization report on Part IX, column (A), line 3, more than $5,000 of grants or other assistance to or for any

15

foreign organization? If "Yes," complete Schedule F, Parts II and IV. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Did the organization report on Part IX, column (A), line 3, more than $5,000 of aggregate grants or other assistance to

16

or for foreign individuals? If "Yes," complete Schedule F, Parts III and IV. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

Did the organization report a total of more than $15,000 of expenses for professional fundraising services on Part IX,

17

column (A), lines 6 and 11e? If "Yes," complete Schedule G, Part I. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

Did the organization report more than $15,000 total of fundraising event gross income and contributions on Part VIII,

18

lines 1c and 8a? If "Yes," complete Schedule G, Part II. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

Did the organization report more than $15,000 of gross income from gaming activities on Part VIII, line 9a? If "Yes,"

19

complete Schedule G, Part III. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20a

20a

Did the organization operate one or more hospital facilities? If "Yes," complete Schedule H. . . . . . . . . . . . . . . . . . . . . . . . . . . .

If "Yes" to line 20a, did the organization attach a copy of its audited financial statements to this return?. . . . . . . . . . . . . . . .

b 20b

Did the organization report more than $5,000 of grants or other assistance to any domestic organization or

21

domestic government on Part IX, column (A), line 1? If "Yes," complete Schedule I, Parts I and II . . . . . . . . . . . . . . . . . . . . .

21

TEEA0103L 09/01/22BAA Form 990 (2022)

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

Form 990 (2022)

Page

4

Part IV Checklist of Required Schedules (continued)

Yes No

Did the organization report more than $5,000 of grants or other assistance to or for domestic individuals on Part IX,

22

column (A), line 2? If "Yes," complete Schedule I, Parts I and III. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5, about compensation of the organization's current

23

and former officers, directors, trustees, key employees, and highest compensated employees? If "Yes," complete

Schedule J. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than $100,000 as of

24a

the last day of the year, that was issued after December 31, 2002? If a "Yes," answer lines 24b through 24d and

complete Schedule K. If "No," go to line 25a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24a

Did the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception?. . . . . . . . . . . . . . . . . .

b 24b

Did the organization maintain an escrow account other than a refunding escrow at any time during the year to defease

c

any tax-exempt bonds? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24c

Did the organization act as an "on behalf of" issuer for bonds outstanding at any time during the year?. . . . . . . . . . . . . . . . .

d 24d

25a Section 501(c)(3), 501(c)(4), and 501(c)(29) organizations. Did the organization engage in an excess benefit

25a

transaction with a disqualified person during the year? If "Yes," complete Schedule L, Part I. . . . . . . . . . . . . . . . . . . . . . . . . . .

Is the organization aware that it engaged in an excess benefit transaction with a disqualified person in a prior year, and

b

that the transaction has not been reported on any of the organization's prior Forms 990 or 990-EZ? If "Yes," complete

Schedule L, Part I. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25b

Did the organization report any amount on Part X, line 5 or 22, for receivables from or payables to any current or

26

former officer, director, trustee, key employee, creator or founder, substantial contributor, or 35% controlled entity

or family member of any of these persons? If "Yes," complete Schedule L, Part II. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

Did the organization provide a grant or other assistance to any current or former officer, director, trustee, key

27

employee, creator or founder, substantial contributor or employee thereof, a grant selection committee

member, or to a 35% controlled entity (including an employee thereof) or family member of any of these

27

persons? If "Yes," complete Schedule L, Part III . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Was the organization a party to a business transaction with one of the following parties (see the Schedule L, Part IV,

28

instructions for applicable filing thresholds, conditions, and exceptions):

A current or former officer, director, trustee, key employee, creator or founder, or substantial contributor? If

a

28a

"Yes," complete Schedule L, Part IV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A family member of any individual described in line 28a? If "Yes," complete Schedule L, Part IV. . . . . . . . . . . . . . . . . . . . . . .

b

28b

A 35% controlled entity of one or more individuals and/or organizations described in line 28a or 28b? If "Yes,"

c

complete Schedule L, Part IV. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28c

Did the organization receive more than $25,000 in non-cash contributions? If "Yes," complete Schedule M. . . . . . . . . . . . . .

29 29

Did the organization receive contributions of art, historical treasures, or other similar assets, or qualified conservation

30

contributions? If "Yes," complete Schedule M. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

Did the organization liquidate, terminate, or dissolve and cease operations? If "Yes," complete Schedule N, Part I . . . . . .

31 31

Did the organization sell, exchange, dispose of, or transfer more than 25% of its net assets? If "Yes," complete

32

Schedule N, Part II. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

Did the organization own 100% of an entity disregarded as separate from the organization under Regulations sections

33

301.7701-2 and 301.7701-3? If "Yes," complete Schedule R, Part I. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

Was the organization related to any tax-exempt or taxable entity? If "Yes," complete Schedule R, Part II, III, or IV,

34

and Part V, line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

Did the organization have a controlled entity within the meaning of section 512(b)(13)?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35a 35a

If "Yes" to line 35a, did the organization receive any payment from or engage in any transaction with a controlled

b

entity within the meaning of section 512(b)(13)? If "Yes," complete Schedule R, Part V, line 2. . . . . . . . . . . . . . . . . . . . . . . . .

35b

36 Section 501(c)(3) organizations. Did the organization make any transfers to an exempt non-charitable related

36

organization? If "Yes," complete Schedule R, Part V, line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Did the organization conduct more than 5% of its activities through an entity that is not a related organization and that is

37

treated as a partnership for federal income tax purposes? If "Yes," complete Schedule R, Part VI. . . . . . . . . . . . . . . . . . . . . .

37

Did the organization complete Schedule O and provide explanations on Schedule O for Part VI, lines 11b and 19?

38

Note: All Form 990 filers are required to complete Schedule O. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Part V Statements Regarding Other IRS Filings and Tax Compliance

Check if Schedule O contains a response or note to any line in this Part V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Enter the number reported in box 3 of Form 1096. Enter -0- if not applicable . . . . . . . . . . . . . .

1a 1a

Enter the number of Forms W-2G included on line 1a. Enter -0- if not applicable. . . . . . . . . . .

b 1b

Did the organization comply with backup withholding rules for reportable payments to vendors and reportable gaming

c

(gambling) winnings to prize winners?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1c

TEEA0104L 09/01/22

BAA Form 990 (2022)

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

10

0

Form 990 (2022) Page 5

Part V Statements Regarding Other IRS Filings and Tax Compliance (continued)

Yes No

Enter the number of employees reported on Form W-3, Transmittal of Wage and Tax State-

2a

ments, filed for the calendar year ending with or within the year covered by this return . . . . .

2a

If at least one is reported on line 2a, did the organization file all required federal employment tax returns? . . . . . . . . . . . . .

b 2b

Did the organization have unrelated business gross income of $1,000 or more during the year?. . . . . . . . . . . . . . . . . . . . . . . .

3a 3a

If "Yes," has it filed a Form 990-T for this year? If "No" to line 3b, provide an explanation on Schedule O. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b 3b

At any time during the calendar year, did the organization have an interest in, or a signature or other authority over, a

4a

financial account in a foreign country (such as a bank account, securities account, or other financial account)?. . . . . . . . .

4a

If "Yes," enter the name of the foreign country

b

See instructions for filing requirements for FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR).

Was the organization a party to a prohibited tax shelter transaction at any time during the tax year? . . . . . . . . . . . . . . . . . . .

5a 5a

Did any taxable party notify the organization that it was or is a party to a prohibited tax shelter transaction?. . . . . . . . . . . .

b 5b

If "Yes," to line 5a or 5b, did the organization file Form 8886-T? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c 5c

Does the organization have annual gross receipts that are normally greater than $100,000, and did the organization

6a

solicit any contributions that were not tax deductible as charitable contributions?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6a

If "Yes," did the organization include with every solicitation an express statement that such contributions or gifts were

b

not tax deductible?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b

7 Organizations that may receive deductible contributions under section 170(c).

Did the organization receive a payment in excess of $75 made partly as a contribution and partly for goods and

a

services provided to the payor?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

If "Yes," did the organization notify the donor of the value of the goods or services provided?. . . . . . . . . . . . . . . . . . . . . . . . . .

b 7b

Did the organization sell, exchange, or otherwise dispose of tangible personal property for which it was required to file

c

7c

Form 8282? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If "Yes," indicate the number of Forms 8282 filed during the year. . . . . . . . . . . . . . . . . . . . . . . . . .

d 7d

Did the organization receive any funds, directly or indirectly, to pay premiums on a personal benefit contract?. . . . . . . . . .

e 7e

Did the organization, during the year, pay premiums, directly or indirectly, on a personal benefit contract?. . . . . . . . . . . . . .

f 7f

If the organization received a contribution of qualified intellectual property, did the organization file Form 8899

g

as required?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7g

If the organization received a contribution of cars, boats, airplanes, or other vehicles, did the organization file a

h

7h

Form 1098-C?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

Sponsoring organizations maintaining donor advised funds.

Did a donor advised fund maintained by the sponsoring

organization have excess business holdings at any time during the year?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Sponsoring organizations maintaining donor advised funds.

Did the sponsoring organization make any taxable distributions under section 4966? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a 9a

Did the sponsoring organization make a distribution to a donor, donor advisor, or related person?. . . . . . . . . . . . . . . . . . . . . .

b 9b

10 Section 501(c)(7) organizations. Enter:

Initiation fees and capital contributions included on Part VIII, line 12 . . . . . . . . . . . . . . . . . . . . . .

a 10a

Gross receipts, included on Form 990, Part VIII, line 12, for public use of club facilities. . . . .

b 10b

11 Section 501(c)(12) organizations. Enter:

Gross income from members or shareholders. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a 11a

Gross income from other sources. (Do not net amounts due or paid to other sources

b

against amounts due or received from them.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11b

12a Section 4947(a)(1) non-exempt charitable trusts. Is the organization filing Form 990 in lieu of Form 1041?. . . . . . . . . . . . . . 12a

If "Yes," enter the amount of tax-exempt interest received or accrued during the year. . . . . .

b 12b

13 Section 501(c)(29) qualified nonprofit health insurance issuers.

Is the organization licensed to issue qualified health plans in more than one state? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a 13a

Note: See the instructions for additional information the organization must report on Schedule O.

Enter the amount of reserves the organization is required to maintain by the states in

b

which the organization is licensed to issue qualified health plans. . . . . . . . . . . . . . . . . . . . . . . . . .

13b

Enter the amount of reserves on hand. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c 13c

Did the organization receive any payments for indoor tanning services during the tax year?. . . . . . . . . . . . . . . . . . . . . . . . . . . .

14a 14a

If "Yes," has it filed a Form 720 to report these payments? If "No," provide an explanation on Schedule O. . . . . . . . . . . . . .

b 14b

15 Is the organization subject to the section 4960 tax on payment(s) of more than $1,000,000 in remuneration or

15

excess parachute payment(s) during the year?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If "Yes," see the instructions and file Form 4720, Schedule N.

16

Is the organization an educational institution subject to the section 4968 excise tax on net investment income?. . . . . . . . .

16

If "Yes," complete Form 4720, Schedule O.

17 Section 501(c)(21) organizations. Did the trust, or any disqualified or other person engage in any activities that would

17

result in the imposition of an excise tax under section 4951, 4952, or 4953? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If "Yes," complete Form 6069.

TEEA0105L 09/01/22

BAA Form 990 (2022)

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

X

X

X

X

X

X

X

X

X

X

X

19

X

X

X

Form 990 (2022) Page 6

Part VI

Governance, Management, and Disclosure. For each "Yes" response to lines 2 through 7b below, and for

a "No" response to line 8a, 8b, or 10b below, describe the circumstances, processes, or changes on

Schedule O. See instructions.

Check if Schedule O contains a response or note to any line in this Part VI. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section A. Governing Body and Management

Yes No

Enter the number of voting members of the governing body at the end of the tax year. . . . . .

1a 1a

If there are material differences in voting rights among members

of the governing body, or if the governing body delegated broad

authority to an executive committee or similar committee, explain on Schedule O.

Enter the number of voting members included on line 1a, above, who are independent. . . . .

b 1b

Did any officer, director, trustee, or key employee have a family relationship or a business relationship with any other

2

officer, director, trustee, or key employee? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Did the organization delegate control over management duties customarily performed by or under the direct supervision

3

of officers, directors, trustees, or key employees to a management company or other person?. . . . . . . . . . . . . . . . . . . . . . . . .

3

Did the organization make any significant changes to its governing documents

4

since the prior Form 990 was filed?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

Did the organization become aware during the year of a significant diversion of the organization's assets?. . . . . . . . . . . . . .

5 5

Did the organization have members or stockholders?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 6

Did the organization have members, stockholders, or other persons who had the power to elect or appoint one or more

7a

members of the governing body? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

Are any governance decisions of the organization reserved to (or subject to approval by) members,

b

stockholders, or persons other than the governing body?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

Did the organization contemporaneously document the meetings held or written actions undertaken during the year by

8

the following:

The governing body?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a 8a

Each committee with authority to act on behalf of the governing body?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b 8b

Is there any officer, director, trustee, or key employee listed in Part VII, Section A, who cannot be reached at the

9

organization's mailing address? If "Yes," provide the names and addresses on Schedule O. . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Section B. Policies (This Section B requests information about policies not required by the Internal Revenue Code.)

Yes No

Did the organization have local chapters, branches, or affiliates?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10a 10a

If "Yes," did the organization have written policies and procedures governing the activities of such chapters, affiliates, and branches to ensure their

b

operations are consistent with the organization's exempt purposes? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10b

Has the organization provided a complete copy of this Form 990 to all members of its governing body before filing the form?. . . . . . . . . . . . . . . . . . . . . .

11a 11a

Describe on Schedule O the process, if any, used by the organization to review this Form 990.

b

Did the organization have a written conflict of interest policy? If "No," go to line 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12a 12a

Were officers, directors, or trustees, and key employees required to disclose annually interests that could give rise

b

to conflicts?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12b

Did the organization regularly and consistently monitor and enforce compliance with the policy? If "Yes," describe on

c

Schedule O how this was done. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12c

Did the organization have a written whistleblower policy?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 13

Did the organization have a written document retention and destruction policy?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 14

Did the process for determining compensation of the following persons include a review and approval by independent

15

persons, comparability data, and contemporaneous substantiation of the deliberation and decision?

The organization's CEO, Executive Director, or top management official. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a 15a

Other officers or key employees of the organization. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b 15b

If "Yes" to line 15a or 15b, describe the process on Schedule O. See instructions.

Did the organization invest in, contribute assets to, or participate in a joint venture or similar arrangement with a

16a

taxable entity during the year?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16a

If "Yes," did the organization follow a written policy or procedure requiring the organization to evaluate its

b

participation in joint venture arrangements under applicable federal tax law, and take steps to safeguard the

organization's exempt status with respect to such arrangements?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16b

Section C. Disclosure

List the states with which a copy of this Form 990 is required to be filed

17

Section 6104 requires an organization to make its Forms 1023 (1024 or 1024-A, if applicable), 990, and 990-T (section 501(c)(3)s only)

18

available for public inspection. Indicate how you made these available. Check all that apply.

Other (explain on Schedule O)

Own website Another's website Upon request

Describe on Schedule O whether (and if so, how) the organization made its governing documents, conflict of interest policy, and financial statements available to

19

the public during the tax year.

State the name, address, and telephone number of the person who possesses the organization's books and records.

20

TEEA0106L 09/01/22BAA Form 990 (2022)

81-2724904PITNEY MEADOWS COMMUNITY FARM, INC.

JOHN FRANCK 112 SPRING STREET, SUITE 206 SARATOGA SPRINGS NY 12866 518-290-0008

XX

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

X

10

10

X

NY

SEE SCHEDULE O

SEE SCHEDULE O

SEE SCHEDULE O

SEE SCHEDULE O

Form 990 (2022) Page 7

Part VII Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and

Independent Contractors

Check if Schedule O contains a response or note to any line in this Part VII . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

1a

Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the

organization's tax year.

? List all of the organization's current officers, directors, trustees (whether individuals or organizations), regardless of amount of

compensation. Enter -0- in columns (D), (E), and (F) if no compensation was paid.

? List all of the organization's current key employees, if any. See the instructions for definition of "key employee."

? List the organization's five current highest compensated employees (other than an officer, director, trustee, or key employee)

who received reportable compensation (box 5 of Form W-2, box 6 of Form 1099-MISC, and/or box 1 of Form 1099-NEC) of more than $100,000

from the organization and any related organizations.

? List all of the organization's former officers, key employees, and highest compensated employees who received more than $100,000

of reportable compensation from the organization and any related organizations.

?

List all of the organization's

former directors or trustees

that received, in the capacity as a former director or trustee of the

organization, more than $10,000 of reportable compensation from the organization and any related organizations.

See the instructions for the order in which to list the persons above.

Check this box if neither the organization nor any related organization compensated any current officer, director, or trustee.

(C)

Position (do not check more

(A) (D) (E) (F)

(B)

than one box, unless person

Reportable Reportable

Name and title

Average

is both an officer and a

Estimated amount

compensation from compensation from

hours

director/trustee)

of other

the organization related organizations

per

compensation from

(W-2/1099- (W-2/1099-

week

the organization

MISC/1099-NEC) MISC/1099-NEC)

(list any

and related

hours for

organizations

related

organiza-

tions

below

dotted

line)

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

(14)

TEEA0107L 09/01/22

BAA

Form

990

(2022)

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

LYNN TRIZNA 40

EXECUTIVE DIR. 0 X 75,000. 0. 0.

ALISA DALTON 5

CHAIRMAN 0 X X 0. 0. 0.

RICHARD TORKELSON 5

PRESIDENT 0 X X 0. 0. 0.

JIM GOLD 5

SECRETARY 0 X X 0. 0. 0.

BILLIE TAFT 5

TREASURER 0 X X 0. 0. 0.

LORI BELLINGHAM 5

VICE CHAIR 0 X X 0. 0. 0.

BARBARA LINELL GLASER 5

DIRECTOR 0 X 0. 0. 0.

JENNA SCHWARTZHOFF 5

SECRETARY 0 X X 0. 0. 0.

JOHN FRANCK 5

TREASURER 0 X X 0. 0. 0.

MATT KOPANS 5

DIRECTOR 0 X 0. 0. 0.

KIM LONDON 5

DIRECTOR 0 X 0. 0. 0.

LARRY WOOLBRIGHT 5

DIRECTOR 0 X 0. 0. 0.

BROOKE MCCONNELL 5

DIRECTOR 0 X 0. 0. 0.

GINA PECCA 5

DIRECTOR 0 X 0. 0. 0.

Form 990 (2022) Page 8

Part VII Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)

(B) (C)

Position

(D) (E) (F)

Average (do not check more than one

(A)

hours box, unless person is both an

Reportable Reportable

Name and title

Estimated amount

per officer and a director/trustee)

compensation from compensation from

of other

week

the organization related organizations

compensation from

(list any

(W-2/1099- (W-2/1099-

the organization

hours

MISC/1099-NEC) MISC/1099-NEC)

and related

for

organizations

related

organiza

- tions

below

dotted

line)

(15)

(16)

(17)

(18)

(19)

(20)

(21)

(22)

(23)

(24)

(25)

1b Subtotal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c Total from continuation sheets to Part VII, Section A . . . . . . . . . . . . . . . . . . . . . . . . . .

d Total (add lines 1b and 1c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total number of individuals (including but not limited to those listed above) who received more than $100,000 of reportable compensation

2

from the organization

Yes No

3

Did the organization list any former officer, director, trustee, key employee, or highest compensated employee

3

on line 1a? If "Yes,"complete Schedule J for such individual. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

For any individual listed on line 1a, is the sum of reportable compensation and other compensation from

the organization and related organizations greater than $150,000? If "Yes," complete Schedule J for

4

such individual. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual

5

for services rendered to the organization? If "Yes," complete Schedule J for such person. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section B. Independent Contractors

1

Complete this table for your five highest compensated independent contractors that received more than $100,000 of

compensation from the organization. Report compensation for the calendar year ending with or within the organization's tax year.

(A) (B) (C)

Name and business address Description of services Compensation

Total number of independent contractors (including but not limited to those listed above) who received more than

2

$100,000 of compensation from the organization

TEEA0108L 09/01/22

BAA Form 990 (2022)

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

0

X

X

X

0

0.0.75,000.

0.0.75,000.

0.0.0.

JEN DUNN 5

DIRECTOR 0 X 0. 0. 0.

CATHY ALLEN 5

DIRECTOR 0 X 0. 0. 0.

SHANE ZANETTI 5

DIRECTOR 0 X 0. 0. 0.

Form 990 (2022)

Page

9

Part VIII

Statement of Revenue

Check if Schedule O contains a response or note to any line in this Part VIII. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(A) (B) (C) (D)

Total revenue

Related or Unrelated Revenue

exempt business excluded from tax

function revenue under sections

revenue 512-514

Federated campaigns. . . . . . . . . .

1a 1a

Membership dues. . . . . . . . . . . . .

b 1b

Fundraising events. . . . . . . . . . . .

c 1c

Related organizations . . . . . . . . .

d 1d

Government grants (contributions). . . . .

e 1e

All other contributions, gifts, grants, and

f

similar amounts not included above. . . .

1f

Noncash contributions included in

g

1g

lines 1a-1f. . . . . . . . . . . . . . . . . . . . . .

h Total. Add lines 1a-1f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Business Code

2a

b

c

d

e

All other program service revenue. . . .

f

g Total. Add lines 2a-2f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Investment income (including dividends, interest, and

3

other similar amounts). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Income from investment of tax-exempt bond proceeds

4

Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

(i) Real (ii) Personal

Gross rents . . . . . . . .

6a 6a

Less: rental expenses

b

6b

Rental income or (loss)

c

6c

Net rental income or (loss). . . . . . . . . . . . . . . . . . . . . . . . . . .

d

(i) Securities (ii) Other

Gross amount from

7a

sales of assets

7

a

other than inventory

Less: cost or other basis

b

7b

and sales expenses

Gain or (loss). . . . . . .

c

7c

Net gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d

Gross income from fundraising events

8a

(not including

$

of contributions reported on line 1c).

See Part IV, line 18. . . . . . . . . . . . .

8a

Less: direct expenses . . . . . .

b 8b

Net income or (loss) from fundraising events. . . . . . . . . .

c

Gross income from gaming activities.

9a

See Part IV, line 19. . . . . . . . . . . . .

9a

Less: direct expenses . . . . . .

b 9b

Net income or (loss) from gaming activities. . . . . . . . . . .

c

Gross sales of inventory, less . . . . .

10a

returns and allowances. . . . . . . . . .

10a

Less: cost of goods sold. . . .

b 10b

Net income or (loss) from sales of inventory. . . . . . . . . .

c

Business Code

11a

b

c

All other revenue. . . . . . . . . . . . . . . . . . .

d

e Total. Add lines 11a-11d. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Total revenue. See instructions . . . . . . . . . . . . . . . . . . . . . .

TEEA0109L 09/01/22

BAA Form 990 (2022)

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

23,475.

195,530.

930,071.

519,347.

1,149,076.

111000 43,889. 43,889.

43,889.

15,748. 15,748.

2,423. 2,423.

23,475.

25,148. 25,148.

79,606. 79,606.

900099 29,254. 29,254.

29,254.

1,345,144. 152,749. 0. 43,319.

PROGRAM INCOME

518,678.

516,255.

2,423.

60,299.

35,151.

118,505.

38,899.

SITE RENTAL AND MISC

Form 990 (2022) Page 10

Part IX Statement of Functional Expenses

Section 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A).

Check if Schedule O contains a response or note to any line in this Part IX. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(A) (B)

(C) (D)

Do not include amounts reported on lines

Total expenses

Management and

Program service Fundraising

6b, 7b, 8b, 9b, and 10b of Part VIII.

general expenses

expenses expenses

Grants and other assistance to domestic

1

organizations and domestic governments.

See Part IV, line 21. . . . . . . . . . . . . . . . . . . . . . . .

Grants and other assistance to domestic

2

individuals. See Part IV, line 22. . . . . . . . . . . . .

Grants and other assistance to foreign

3

organizations, foreign governments, and for-

eign individuals. See Part IV, lines 15 and 16

Benefits paid to or for members. . . . . . . . . . . . .

4

Compensation of current officers, directors,

5

trustees, and key employees. . . . . . . . . . . . . . . .

Compensation not included above to

6

disqualified persons (as defined under

section 4958(f)(1)) and persons described

in section 4958(c)(3)(B) . . . . . . . . . . . . . . . . . . . .

Other salaries and wages. . . . . . . . . . . . . . . . . . .

7

Pension plan accruals and contributions

8

(include section 401(k) and 403(b)

employer contributions) . . . . . . . . . . . . . . . . . . . .

Other employee benefits . . . . . . . . . . . . . . . . . . .

9

Payroll taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Fees for services (nonemployees):

11

Management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a

Legal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

Accounting. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

c

Lobbying. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

d

Professional fundraising services. See Part IV, line 17. . .

e

Investment management fees. . . . . . . . . . . . . . .

f

g

Other. (If line 11g amount exceeds 10% of line 25, column

(A), amount, list line 11g expenses on Schedule O.). . . . .

Advertising and promotion. . . . . . . . . . . . . . . . . .

12

Office expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

Information technology. . . . . . . . . . . . . . . . . . . . .

14

Royalties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Occupancy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

Travel. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

Payments of travel or entertainment

18

expenses for any federal, state, or local

public officials. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Conferences, conventions, and meetings. . . .

19

Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

Payments to affiliates. . . . . . . . . . . . . . . . . . . . . .

21

Depreciation, depletion, and amortization. . . .

22

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

Other expenses. Itemize expenses not

24

covered above. (List miscellaneous expenses

on line 24e. If line 24e amount exceeds 10%

of line 25, column (A), amount, list line 24e

expenses on Schedule O.). . . . . . . . . . . . . . . . . .

a

b

c

d

All other expenses. . . . . . . . . . . . . . . . . . . . . . . . .

e

25

Total functional expenses. Add lines 1 through 24e. . . .

26 Joint costs. Complete this line only if

the organization reported in column (B)

joint costs from a combined educational

campaign and fundraising solicitation.

Check here if following

SOP 98-2 (ASC 958-720). . . . . . . . . . . . . . . . . . .

BAA

Form

990

(2022)

TEEA0110L 09/01/22

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

75,000. 22,500. 30,000. 22,500.

0. 0. 0. 0.

323,494. 243,171. 56,816. 23,507.

8,843. 5,895. 1,926. 1,022.

30,485. 20,324. 6,641. 3,520.

54. 54.

13,287. 13,287.

1,281. 1,281.

52,109. 48,975. 3,134.

4,667. 4,667.

4,420. 4,420.

10,960. 10,960.

9,975. 9,975.

423. 423.

207. 207.

238. 238.

103,305. 103,305.

14,638. 2,480. 12,158.

65,579. 65,579.

29,985. 29,985.

21,968. 21,968.

12,855. 12,855.

39,022. 19,251. 11,471. 8,300.

822,795. 601,823. 162,123. 58,849.

GARDEN RELATED

REPAIRS & MAINTENANCE

UTILITIES

RECRUITING & PROF. DEVELOPMENT

Form 990 (2022) Page 11

Part X Balance Sheet

Check if Schedule O contains a response or note to any line in this Part X . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(A) (B)

Beginning of year End of year

Cash ' non-interest-bearing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 1

Savings and temporary cash investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 2

Pledges and grants receivable, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 3

Accounts receivable, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 4

Loans and other receivables from any current or former officer, director,

5

trustee, key employee, creator or founder, substantial contributor, or 35%

controlled entity or family member of any of these persons . . . . . . . . . . . . . . . . . . . . .

5

Loans and other receivables from other disqualified persons (as defined under

6

6

section 4958(f)(1)), and persons described in section 4958(c)(3)(B). . . . . . . . . . . . . .

Notes and loans receivable, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 7

Inventories for sale or use. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 8

Prepaid expenses and deferred charges. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 9

Land, buildings, and equipment: cost or other basis.

10a

Complete Part VI of Schedule D. . . . . . . . . . . . . . . . . . . .

10a

Less: accumulated depreciation. . . . . . . . . . . . . . . . . . . .

b 10b 10c

11

Investments ' publicly traded securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12

Investments ' other securities. See Part IV, line 11. . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

Investments ' program-related. See Part IV, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14

Intangible assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15

Other assets. See Part IV, line 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16

16 Total assets. Add lines 1 through 15 (must equal line 33). . . . . . . . . . . . . . . . . . . . . . .

Accounts payable and accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 17

Grants payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 18

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19 19

Tax-exempt bond liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 20

Escrow or custodial account liability. Complete Part IV of Schedule D. . . . . . . . . . .

21 21

Loans and other payables to any current or former officer, director, trustee,

22

key employee, creator or founder, substantial contributor, or 35%

controlled entity or family member of any of these persons . . . . . . . . . . . . . . . . . . . . .

22

Secured mortgages and notes payable to unrelated third parties . . . . . . . . . . . . . . . .

23 23

Unsecured notes and loans payable to unrelated third parties. . . . . . . . . . . . . . . . . . .

24 24

Other liabilities (including federal income tax, payables to related third parties,

25

and other liabilities not included on lines 17-24). Complete Part X of Schedule D.

25

26 Total liabilities. Add lines 17 through 25. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

Organizations that follow FASB ASC 958, check here

and complete lines 27, 28, 32, and 33.

Net assets without donor restrictions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27 27

Net assets with donor restrictions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28 28

Organizations that do not follow FASB ASC 958, check here

and complete lines 29 through 33.

Capital stock or trust principal, or current funds. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29 29

Paid-in or capital surplus, or land, building, or equipment fund. . . . . . . . . . . . . . . . . .

30 30

Retained earnings, endowment, accumulated income, or other funds. . . . . . . . . . . .

31 31

Total net assets or fund balances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32 32

Total liabilities and net assets/fund balances. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33 33

TEEA0111L 09/01/22

BAA Form 990 (2022)

PITNEY MEADOWS COMMUNITY FARM, INC. 81-2724904

120,864. 56,057.

499,886. 787,269.

171,611. 182,288.

210. 605.

91,821. 16,322.

1,430,032.

308,167. 915,686. 1,121,865.

281,431. 227,157.

1,351,782. 1,499,059.

3,433,291. 3,890,622.

33,735. 12,278.

10,732. 5,948.

53,948. 42,846.

23,863.

98,415. 84,935.

X

2,562,670. 3,222,694.

772,206. 582,993.

3,334,876. 3,805,687.

3,433,291. 3,890,622.

Form 990 (2022) Page 12

Part XI Reconciliation of Net Assets

Check if Schedule O contains a response or note to any line in this Part XI. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total revenue (must equal Part VIII, column (A), line 12). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 1

Total expenses (must equal Part IX, column (A), line 25). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 2

Revenue less expenses. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 3

Net assets or fund balances at beginning of year (must equal Part X, line 32, column (A)). . . . . . . . . . . . . . . . . .

4 4

Net unrealized gains (losses) on investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 5

Donated services and use of facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 6

Investment expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 7

Prior period adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 8

Other changes in net assets or fund balances (explain on Schedule O). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 9

Net assets or fund balances at end of year. Combine lines 3 through 9 (must equal Part X, line 32,

10

column (B)) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Part XII Financial Statements and Reporting

Check if Schedule O contains a response or note to any line in this Part XII . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Accounting method used to prepare the Form 990: Cash Accrual Other

1

If the organization changed its method of accounting from a prior year or checked "Other," explain

on Schedule O.

Were the organization's financial statements compiled or reviewed by an independent accountant? . . . . . . . . . . . . . . . . . . . .

2a 2a

If "Yes," check a box below to indicate whether the financial statements for the year were compiled or reviewed on a

separate basis, consolidated basis, or both:

Separate basis Consolidated basis Both consolidated and separate basis

Were the organization's financial statements audited by an independent accountant?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b 2b

If "Yes," check a box below to indicate whether the financial statements for the year were audited on a separate

basis, consolidated basis, or both:

Separate basis Consolidated basis Both consolidated and separate basis

c

If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of the audit,

review, or compilation of its financial statements and selection of an independent accountant?. . . . . . . . . . . . . . . . . . . . . . . . .

2c

If the organization changed either its oversight process or selection process during the tax year, explain

on Schedule O.