Turo

General guidance on the taxation of business income

Turo | General guidance on the taxation of business income

January 2023

2

D

i

s

c

l

a

i

mer

This documentation was prepared by Ernst & Young LLP (“EY”) at the request of Turo. This

documentation is intended solely for information purposes and no Turo Host or other third party may

rely upon it as tax or legal advice or use it for any other purpose. As such, EY and Turo assume no

responsibility whatsoever to Turo Hosts or other third parties as a result of the use of information

contained herein. This documentation was prepared by EY, and does not necessarily reflect the views

of Turo.

This documentation contains information in a summary format. It does not provide tax advice to any

taxpayer because it does not take into account any specific taxpayer’s facts and circumstances. It

assumes that the only business use of a vehicle is Turo-related, that no other business uses for such

vehicles exist, and that all business use occurs within the United States of America. Hosts who

choose to use the Standard Mileage Rate method for computing vehicle expenses recognize that the

protection component of Turo fees represents an estimate and that such amounts may be adjusted

upward or downward upon subsequent IRS examination.

Readers are encouraged to consult with professional advisors for advice concerning specific matters

before making any decision or taking a position on any tax return, and EY and Turo disclaim any

responsibility for positions taken by taxpayers in their individual cases or for any misunderstanding on

the part of readers. While EY has used its best efforts in preparing this documentation, it makes no

representations or warranties with respect to the accuracy or completeness of the contents of this

documentation and specifically disclaims any implied warranties. Neither Turo nor EY shall be liable

for any loss of profit or any other damages, including, but not limited to, direct, indirect, special,

incidental, consequential, or other damages in connection with the information contained in this

documentation.

Please refer to the Car Sharing Regulations guide at https://help.turo.com/en_us/car-sharing-

regulations-SJTQH4lV5 for additional general information about hosting in the United States.

Turo | General guidance on the taxation of business income

January 2023

3

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

Key takeaways: Operating your business on Turo

As a Host operating your business on Turo in the U.S., you are responsible for reporting your business

earnings each year on your income tax return and paying any applicable income and/or self-employment

taxes. The sections that follow in this tax guide will provide more detail on how to report your business

income, potential tax deductions you can take, what your tax reporting obligations are, and resources that

are available to you as a Turo Host. This guide is an overview of the federal income tax rules; it does not

address state income tax rules that may differ from the federal rules. To make it easier to navigate this

guide and how to file your taxes, we’ve included an overview of the key takeaways:

A. How to report your gross income when you receive a Form 1099-K (or even if you don’t)

B. How to report tax deductions for items attributable to gross income from your Turo Form 1099-K

C. Other tax deductions you may be able to take for your business and how to report them —

specifically, the choice between using the Standard Mileage Rate or Actual Expenses method for

deducting automobile expenses

A. How to report your gross income when you receive a Form 1099-K (or even if you don’t)

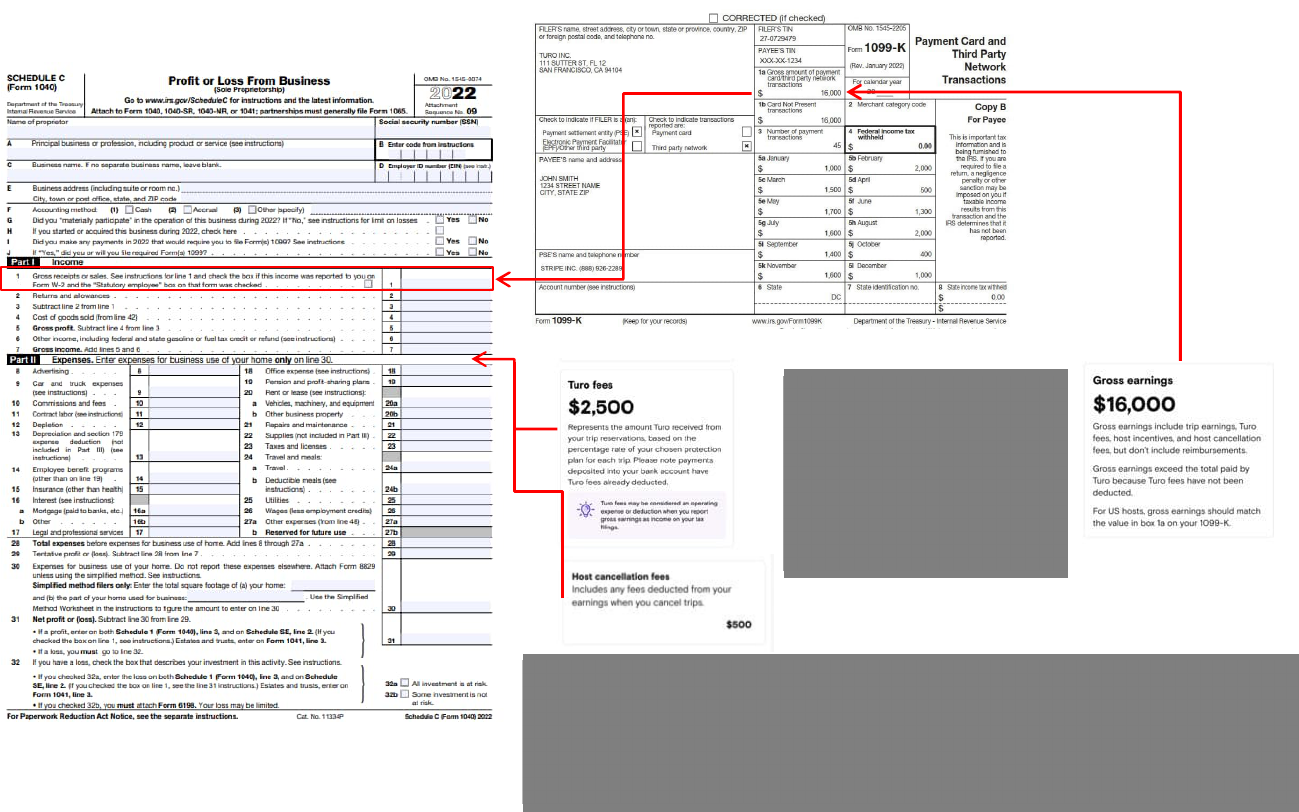

If you qualify, you will receive a Form 1099-K from Turo by January 31. You will report the gross income

on Schedule 1, Page 1, line 8(l) or Schedule C, line 1 in your income tax return.

See Exhibit A for an example of Schedule 1, Page 1 and Exhibit C for an example of Schedule C.

You may not receive a Form 1099-K from Turo. Even if Turo does not send you a Form 1099-K, you will

still need to report your income for income and/or self-employment tax purposes. You should continue to

follow the rules of this guide, utilizing your earnings and tax summary as your pro forma Form 1099-K.

B. How to report tax deductions for items included in your Turo Form 1099-K gross income

The most important items in your earnings and tax summary to look out for when receiving your Form

1099-K from Turo include cancellations and Turo fees. Once you determine these amounts, you will be

able to deduct them as business expenses in the same year.

See section 2 (“Rental income”) and section 4 (“Vehicle expenses that can be deducted”) for more

information.

C. Other tax deductions you may be able to take for your business and how to report them

Besides cancellations and Turo fees, you can deduct other expenses, as long as they qualify as business

expenses. This includes unreimbursed out-of-pocket expenses and reasonable costs of managing your

business. In addition, you must decide whether to use the Standard Mileage Rate method or Actual

Expenses method when deducting vehicle-related expenses. In general, you should choose the method

that generates the largest deduction for you, but you should be aware of certain limitations that exist

depending on which method you choose.

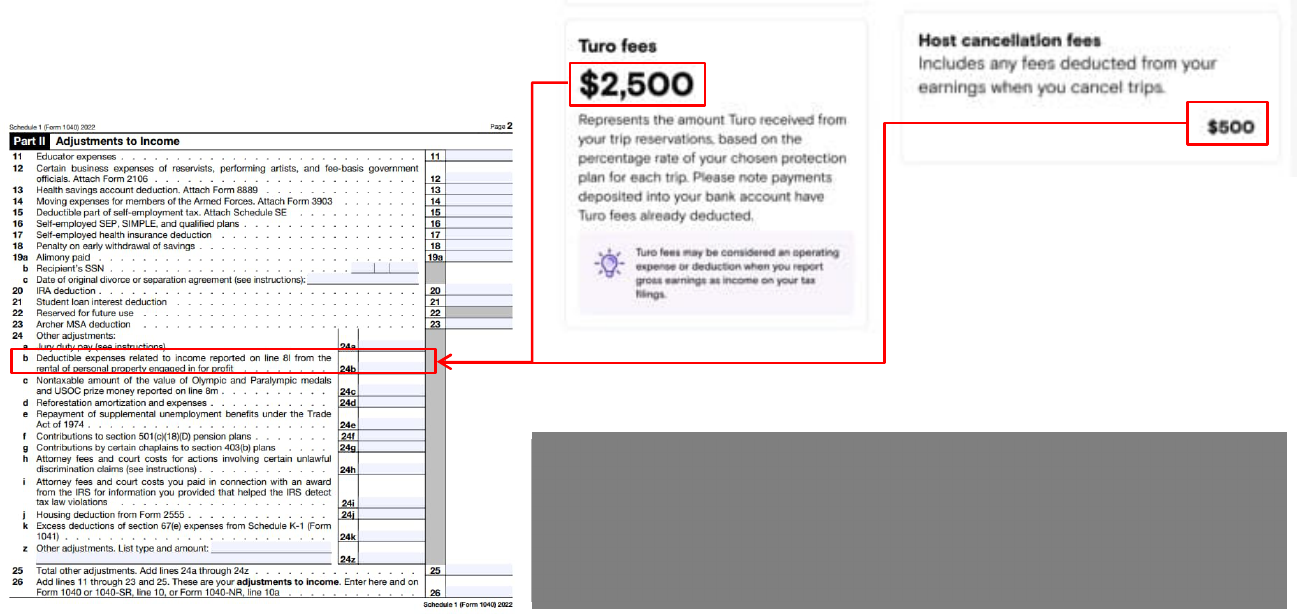

Report qualifying deductible expenses on Schedule 1, Page 2, line 24(b) or Schedule C, lines 8–27a, as

appropriate.

Turo | General guidance on the taxation of business income

January 2023

4

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

See section 4 (“Vehicle expenses that can be deducted”) and section 8 (“How to report rental income and

expenses”) for more information. See section 5 (“Flowchart for reporting vehicle-related expenses”) for a

high-level overview of the Standard Mileage Rate method vs. Actual Expenses method to deducting

automobile expenses.

See Exhibit B for an example of Schedule 1, Page 2 and Exhibit C for an example of Schedule C.

Turo | General guidance on the taxation of business income

January 2023

5

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

Table of contents

1. Who is subject to U.S. income tax? .................................................................................................. 6

2. Rental income .................................................................................................................................. 6

3. What tax information will Turo provide? ............................................................................................ 7

4. Vehicle expenses that can be deducted ........................................................................................... 8

5. Flowchart for reporting vehicle-related expenses .............................................................................. 9

6. Limit on rental losses ..................................................................................................................... 16

7. Self-employment income and qualified business income (“QBI”) ..................................................... 17

8. How to report rental income and expenses ..................................................................................... 17

9. Reporting payments to independent contractors ............................................................................. 18

10. How is (net) rental income taxed? (federal) .................................................................................... 18

11. Quarterly estimated tax payments .................................................................................................. 18

12. Sale of vehicle used as rental property ........................................................................................... 18

13. Documents to be retained .............................................................................................................. 18

14. Other resources ............................................................................................................................. 19

15. Exhibit A – Schedule 1, Page 1 (Form 1040) .................................................................................. 21

16. Exhibit B – Schedule 1, Page 2 (Form 1040) .................................................................................. 22

17. Exhibit C – Schedule C (Form 1040) .............................................................................................. 23

18. Exhibit D – 2022 Tax Rates for Individual Taxpayers ...................................................................... 24

Turo | General guidance on the taxation of business income

January 2023

6

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

1. Who is subject to U.S. income tax?

I am a Turo Host. Am I subject to income tax in the U.S.?

You are subject to U.S. income tax if you have U.S. sourced income. Generally, income derived from U.S.

assets, such as vehicles located in the U.S., is U.S. sourced income and subject to U.S. income tax.

Domestic rental income (i.e., rental income from a

vehicle located inside the U.S.) is taxable in the U.S.

regardless of where the person in receipt of that

income resides. For example, an individual living

outside the U.S. who is in receipt of rental income

from a U.S. vehicle is still subject to tax in the United

States.

Types of taxpayers: cash basis vs. accrual basis

If you are subject to U.S. income tax, you must report

your rental income as a cash-basis or an accrual-

basis taxpayer. Most individuals are cash-basis

taxpayers.

If you are a cash-basis taxpayer, you report rental income on your return for the year you actually or

constructively receive it and you deduct all expenses in the year you actually pay them. You are a cash-

basis taxpayer if you report income in the year you receive it, regardless of when it is earned. Most

individuals are cash-basis taxpayers. You constructively receive income when it is made available to you,

for example, by being credited to your bank account.

If you are an accrual-basis taxpayer, you generally report income when you earn it instead of when you

receive it and you deduct expenses when you incur them instead of when you pay them. Accrual-basis

taxpayers should engage a tax advisor to ensure that rental income and expenses are correctly reported.

2. Rental income

[1]

If you are subject to U.S. income tax, you must include in your gross income all amounts you receive as

rent. Rent is the gross amount of payment received (before any expenses are deducted) for the use of

your vehicle. It can also include payments received for any goods or services that are provided, e.g.,

optional trip add-ons like prepaid fuel and extras.

Taxable rental income is the gross amount of rent received less any allowable expenses. This can also

be referred to as net rental income. If the allowable expenses are greater than the gross amount of rent

received, a rental loss will arise. Taxable rental income/(loss) must be reported and calculated on Form

Schedule 1 (Form 1040) or Form Schedule C (Form 1040). See section 8 (“How to report rental income

and expenses”).

[1] - Peer-to-peer car sharing income is not specifically identified as a category of income in the current Internal

Revenue Code. The IRS considers payments received for the use or occupation of property as rental income.

Turo | General guidance on the taxation of business income

January 2023

7

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

In addition to amounts you receive from Turo as normal vehicle rental payments, you may also receive

other amounts that should be carefully considered in determining the amount of gross rental income to

report. Examples of such amounts that may be includible in gross income:

Cancellations – Any amounts returned to a driver due to a cancellation are not included as

net rental income. Cancellations will be listed in your earnings and tax summary and should

be included as income and also taken as a deduction.

Turo fees are included in rental income. These fees represent Turo’s share of the fees from

renting your vehicle. At the end of the year, Turo will provide an earnings and tax summary

detailing how much of the gross rental income consisted of Turo fees. Depending on the

method you choose to deduct automobile expenses, either 100% or 70% of such Turo fees

are deductible. See section 5.III (“Turo fees”).

Host Incentives that are paid by Turo to you are included in your gross income.

Reimbursements – If Turo reimbursed you for any expenses that were incurred because of

your driver, those payments would neither be gross income nor deductible expenses. The

most common example of this would be parking and/or tolls that were charged to you when

your driver used your vehicle.

3. What tax information will Turo provide?

Turo will provide to you a Form 1099-K (if eligible) and an earnings and tax summary. Both of these

documents should be made available to you no later than January 31. Additional details can be found on

your Host dashboard.

Form 1099-K requires reporting of unadjusted

gross sales, which as described earlier is

defined as transactions without adjustments

for credits, service fees, reimbursements, or

any other amounts. In other words, your gross

sales (defined by Turo as “gross earnings”)

are the total amounts received for each Turo

booking, before being reduced by

cancellations or Turo fees, plus any other

payments received from Turo (e.g., Host

Incentives).

On the other hand, your trip earnings, reflected in the earnings section of your Turo host hub, show your

trip earnings but do not include Turo fees, Host Incentives, or host cancellation fees. To reconcile your

trip earnings to your gross earnings, simply subtract the Turo fees, host incentives, and host cancelation

fees from your gross earnings reported on your Tax summary of Form 1099-K.

Please refer to Exhibits A–C, which include a snapshot of your earnings and tax summary, which will help

you populate either your Schedule 1, Page 1 and 2 or Schedule C.

Turo | General guidance on the taxation of business income

January 2023

8

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

4. Vehicle expenses that can be deducted

As outlined above, taxable rental income is the gross amount of rent received less any allowable

expenses. In general, a deductible or allowable expense is one that is ordinary and necessary, has

actually been paid (for a cash basis taxpayer), and is not regarded as capital in nature. Examples of

deductible expenses include:

Cleaning and maintenance services, including car washes and cleaning supplies purchased

Gasoline and oil changes

Interest on a loan taken out to buy the vehicle

Turo’s Protection Plan, subject to certain restrictions

Lease payments

Fees paid to collect rental income, e.g., service fees charged by Turo

Repairs that are not covered by insurance

Tires

Depreciation on amounts paid to acquire the vehicle, subject to certain limitations (see

section 5.V “Depreciation,”)

The cost of managing the property, e.g., vehicle registration fees, legal fees, and

accountancy fees incurred by a Host in connection with renting the vehicle

Miscellaneous items such as chairs, child car seats, beach umbrellas, water bottles, and

breath mints that are provided to drivers for a fee or as a convenience

This list is not exhaustive.

Turo | General guidance on the taxation of business income

January 2023

9

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

5. Flowchart for reporting vehicle-related expenses

There are two options you may use to deduct your vehicle-related expenses. The following flowchart will

help you determine the better method to use. In general, you should pick the method that results in lower

net rental income. A more detailed discussion related to expenses will follow.

[1]

Allocable expenses include costs that would apply to both business and personal use (e.g., depreciation, lease payments,

maintenance and repairs, gasoline, oil, interest (but not insurance), and/or registration payments).

[2]

Non-allocable expenses include costs directly attributable to only business use (e.g. out-of-pocket expenses, equipment, etc.). Do

NOT include any items for which Turo reimbursed you and reported as “Reimbursements” in your earnings and tax summary.

[3]

See section 8 for more detailed information on material vs. non-material participation.

Divide your total mileage driven during the year between

business use and personal use. Determine your BUP by

dividing the business use miles by the total miles driven.

Note: You may be eligible to claim

Section 179 depreciation or bonus

depreciation.

Multiply your allocable

[1]

vehicle expenses

by your BUP to determine your deductible

allocable vehicle expenses.

(A) Choose one of the following two options

(C) Applying business use % to business expenses

(D) Forms to file

Note: You are not eligible to claim Section

179 depreciation or bonus depreciation.

Multiply your allocable

[1]

vehicle expenses

by your BUP to determine your deductible

allocable vehicle expenses.

IRS Form: Schedule 1 – Additional Income and Adjustments to

Income

Instructions: Use Schedule 1, line 24(b) to report your

deductible expenses computed above. Use Schedule 1, line

8(l) to report your gross receipts from box 1(a) per the Turo-

provided Form 1099-K.

BUP is more than 50%

BUP is 50% or less

Multiply your business use miles by the standard mileage

rate in each separate 6-month period to determine the

deductible amount of vehicle-related expenses.

Add your non-allocable

[2]

business

expenses

Add 70% Turo fees per your

earnings and tax summary

Add 100% Turo fees per your earnings and tax summary

Add your non-allocable

[2]

business expenses

IRS Form: Schedule C – Profit or Loss from Business

Instructions: Use Sch C, lines 8 – 27(a) to report your

deductible expenses computed above. Report your gross

receipts from box 1(a) per the Turo-provided Form 1099-K on

Schedule C, line 1.

Non

-

material participant

[3]

Material participant

[3]

Standard Mileage Rate method

Deduction based on business use miles

The rate is 58.5 cents/mile for miles driven between 1/1/22 –

6/30/2022 and 62.5 cents/mile for miles driven between

7/1/22 – 12/31/22.

Note: Standard mileage includes depreciation, lease

payments, maintenance and repairs, gasoline, oil, insurance

and/or registration payments.

Note: This method is not permitted if you have claimed or

want to claim a Section 179 deduction or bonus depreciation

deduction.

Add allocable

[1]

interest expenses, if

applicable

(B) Deduction instructions

Actual Expense method

Deduction based on your actual vehicle expenses multiplied

by your vehicle’s business use percentage (“BUP”)

Note: This method may allow you to claim a Section 179

deduction or bonus depreciation deduction, depending on

your BUP.

Turo | General guidance on the taxation of business income

January 2023

10

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

I. Deduction methods: Standard Mileage Rate vs. Actual Expenses

In the first year your vehicle was available for use in your business, you have the option of choosing

which deduction methodology favors you more. Therefore, you may find it beneficial to perform

calculations under both methodologies, choosing whichever one is more suitable for you. If you

choose to use the Standard Mileage Rate method, it must be in the first year the car was available

for use in your business. In later years, you are then permitted to switch between methods. If you use

the Standard Mileage Rate method for a car you lease, that method must be used for the entire lease

period (including renewals). If you used the Actual Expenses method in the first year the car was

available for use in your business, then you must continue to use the Actual Expense method. NOTE:

Turo does not track your business or personal miles driven. It is your responsibility to

maintain adequate records to substantiate miles driven.

Standard Mileage Rate method

This method is the simplest way to deduct your expenses, due to the straightforward nature of

reading your vehicle’s odometer to determine the business use miles. To calculate your expense

deduction using the Standard Mileage Rate method, multiply the number of business miles driven

during 1/1/22 – 6/30/22 by 58.5 cents/mile. Then multiply the number of business miles driven during

7/1/22 – 12/31/22 by 62.5 cents/mile. Add these two amounts to determine your deductible vehicle

expenses for 2022.

Other deductions not allowed: Since the Standard mileage rate represents a “standard” rate for all

vehicle expenses, you are not permitted to deduct any additional allocable vehicle expenses related

to depreciation, lease payments, maintenance and repairs, gasoline, oil, insurance, and/or

registration payments.

Note: Interest expense can be deducted under the Standard Mileage Rate method. Follow the

instructions under the Actual Expense method, later, to determine the deductible portion of interest

expense if you are otherwise using the Standard Mileage Rate method for tax reporting purposes.

Certain Hosts are prohibited from using the Standard Mileage Rate method and must use the Actual

Expenses method instead. The following prohibited Hosts include those who:

Lease 5 or more vehicles at the same time

Have already claimed a depreciation deduction for a vehicle under any method other than

straight-line depreciation (see section 5.V “Depreciation”)

Have already claimed a Section 179 deduction or special depreciation (AKA “bonus”)

deduction on the vehicle (see section 5.V “Depreciation”)

Claimed actual car expenses after 1997 for a car that was leased

Turo | General guidance on the taxation of business income

January 2023

11

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

Actual Expense method

Under this method, in addition to tracking your vehicle’s business miles, you must also track your

vehicle’s personal miles as well. You must also record of all the allocable expenses incurred in

relation to your vehicle’s total use. This method requires more time and effort to compute, but may

yield a larger deduction than the Standard Mileage Rate method.

Under this method, your allocable expenses are all expenses that could be assigned to both business

and personal use (e.g., depreciation, lease payments, maintenance and repairs, gas, oil (but not

your personal insurance), and/or registration payments.) See section. 5.III “Turo fees” for details.

For Hosts using the Actual Expense method, include interest expense in “allocable expenses” as

listed in the previous paragraph. For Hosts using the Standard Mileage Rate method, calculate your

allocable share of interest expense only (as outlined in the next paragraph) and include it as part of

deductible expenses along with the Standard Mileage Rate deduction.

To calculate the expense deduction using your actual expenses, you must first calculate your

vehicle’s business use percentage (“BUP”) by allocating the total miles driven in the calendar

between personal use and business use. Do so by reviewing and documenting your vehicle’s

odometer throughout the year.

Next, multiply the BUP by all the allocable expenses related to the vehicle. The result is your actual

expense deduction.

Limitations:

Depending on your BUP, you may or may not be able to claim a Section 179 deduction or

bonus depreciation deduction. If your BUP is 50% or less, you cannot claim Section 179

depreciation or bonus depreciation deduction; further, depreciation deductions may be

computed under longer recovery periods and slower recovery methods. If your BUP is more

than 50%, you are eligible to claim Section 179 depreciation or bonus depreciation (see

section 5.V “Depreciation”).

If your BUP shifts from more than 50% to 50% or less in any tax year, consult your tax

advisor for additional details.

Example:

Standard Mileage Rate

Your vehicle was placed in service for business use for the first time in 2022 and was driven for

5,500 miles for rental purposes. 2,000 of those miles were driven in the first six months of 2022 and

the remainder of the miles were driven in the last six months of 2022. You can deduct $3,357.50

([2,000 x 58.5 cents] + [3,500 x 62.5 cents]) for the year. You may still have additional allocable

interest expense or other non-allocable costs to consider.

Actual Expense

You had total allocable expenses of $8,250 (including interest) for the same vehicle. The vehicle

was used for business purposes for 5,500 miles and used for personal purposes for 1,800 miles.

You divide the business use miles by the total miles to determine a BUP of 75.3% (5,500 / 7,300

miles). Your deductible expenses are $6,212.25 ($8,250 x 75.3%). You do not have additional

allocable interest expense to consider (but may have other non-allocable costs).

Turo | General guidance on the taxation of business income

January 2023

12

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

a. Special rules for lease payments

If you lease a vehicle for 30 days or more, a portion of your allocable and deductible business

lease payments may be subject to the lease inclusion rules. You may need to reduce your

business portion of the lease payment deduction by the lease inclusion amount. Your lease

inclusion amount is determined in part by what type of vehicle you are renting, the vehicle’s

BUP, the fair market value of the vehicle at the time the lease commenced, what date the

lease commenced and will end, and what year of the lease you are currently in.

See the Example under Chapter 4 “Leasing a Car” as listed in IRS Publication 463, Travel,

Gift, and Car Expenses for an example of calculating a lease inclusion amount. For additional

assistance, consult your tax advisor.

You may include allocable vehicle expenses during the period in which the vehicle is not being rented

as long as it is actively being held out for rent. This applies to the periods between rentals, as well as

to the period during which a vehicle is being marketed as a rental for the first time. The IRS can

disallow these deductions if you are unable to show you were actively seeking a profit and had a

reasonable expectation of achieving one. The deduction cannot be disallowed just because your

vehicle is difficult to rent.

Should the IRS determine that your rental activity was not engaged in an active attempt to seek a

profit, it may recharacterize your rental activity as a hobby. The hobby income/loss reporting rules are

complex. Please consult your tax advisor if this becomes the case.

II. Additional non-allocable expenses

Regardless of the method used to determine your share of vehicle expenses, you are permitted to

deduct in full non-allocable expenses that are entirely related to the business use of the vehicle.

Examples of these include:

Miscellaneous items such as beach chairs, child car seats, beach umbrellas, water bottles,

and breath mints that are provided to drivers for a fee or as a convenience

Unreimbursed parking or tolls incurred during rental use

Note: In the earnings and tax summary provided by Turo, do not include as income or deduct any

items listed or related to the “reimbursements” section of the summary.

Example:

As part of your listing, you offer beach chairs, towels, and a tent for an additional fee of $10/day.

During the rental period, your driver incurs a $50 of parking expenses and $40 of tolls, which are

billed directly to you. Turo reimburses you for $40 of tolls as outlined in your earnings and tax

summary.

You would be able to deduct the cost of the beach chairs, towels, and tent in full as business

expenses. In addition, you would be able to deduct the $50 of parking expenses. The $10/day rental

fee is already included in your gross rental income. The $40 of reimbursed tolls is neither included in

your gross income nor deductible by you.

Turo | General guidance on the taxation of business income

January 2023

13

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

III. Turo fees

A component of fees that Turo charges to you includes protecting your vehicle (the “Protection Plan”)

during its business use (i.e., rental) periods.

For Hosts who use the Standard Mileage Rate method of computing net rental income, deduct only a

percentage of the Turo fees as listed on your earnings and tax summary. 70% can be a reasonable

deductible estimate.

Note: Recall that under the Standard Mileage Rate method, insurance expense has already been

factored and included in the Standard Mileage rate, so the fees that Turo charges you for protection

cannot be double-deducted on your tax return (hence, you only deduct 70% of the Turo fees).

For drivers who use the Actual Expenses method, deduct 100% of the Turo fees as listed on your

earnings tax summary.

Note: Under the Actual Expenses method, Turo’s protection is attributable solely to your vehicle’s

business use, and would therefore be 100% deductible as a non-allocable expense.

Example:

Your Turo earnings and tax summary shows Turo fees of $1,100. If you are using the Standard

Mileage Rate method, you can deduct $770 ($1,100 x 70%) of such fees in computing taxable

income. If you are using the Actual Expenses method, you can deduct $1,100 of such fees in

computing taxable income.

IV. Repairs and maintenance vs. improvements – deduct or capitalize

In general, expenses incurred to repair and maintain your vehicle are deductible as repairs and

maintenance expenses (oil changes, replacement of windshield wipers, etc.). With that said, in certain

instances amounts paid may rise to an improvement to your vehicle (replacement of major

components such as the engine, etc.) that must be capitalized. If you incur costs for work performed

on your vehicle, it is best to consult your tax advisor for the tax treatment of any costs incurred.

V. Depreciation

Vehicle owners can recover the purchase cost of their vehicles attributable to business use through

yearly tax deductions. These deductions are called depreciation. Depreciation is a non-cash

deduction since it does not represent an actual outflow of money.

Five factors determine how much depreciation you can deduct each year: (1) your business use

percentage (“BUP”), (2) your basis in your vehicle, (3) the recovery period of the vehicle, (4) the

depreciation method used, and finally, (5) the depreciation convention used.

(1) Your business use of your vehicle is the mileage your vehicle is driven for business, as opposed

to personal, purposes. This use is generally determined as a percentage of your overall use.

(2) Your basis in your vehicle is generally the purchase price of the vehicle, plus any registration

fees and other costs you incurred. Legal fees, documentation fees, recording fees, and transfer

taxes are examples of other costs you need to add to your basis of the property.

Note: Your basis in your vehicle may need to be adjusted if any credits were taken when the vehicle

was purchased (e.g., electric vehicle tax credits). Please consult your tax advisor if this situation

applies to you.

Turo | General guidance on the taxation of business income

January 2023

14

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

Note: If you purchased a vehicle in a previous tax year, and placed it in service for business use the

first time in a different tax year, your basis in the vehicle is the lower of the fair market value on the

date you placed it in service for business or the original basis (i.e., the original purchase price). You

may still be able to take bonus depreciation on the vehicle, but you cannot take a Section 179

deduction.

(3) The recovery period for vehicles represents the number of years over which you will depreciate

your vehicle and claim a depreciation expense. For vehicles, your recovery period is 5 years (or

60 months). The recovery period starts when the property is placed in service. Note that a 5-year

recovery period is actually deducted on 6 years of consecutive tax returns since the year 1 and

year 6 expenses include a fraction of a year’s worth of depreciation.

Example:

You acquire a vehicle that you own in year 1 and place into service in year 1. The vehicle has a

recovery period of 5 years. Depreciation of the vehicle starts in year 1 and will continue until year 6,

when the vehicle is fully depreciated.

(4) The current depreciation method used for tax purposes is called the Modified Accelerated Cost

Recovery System (“MACRS”). Under MACRS, vehicles are able to be depreciated under the

straight-line (“SL”) or declining balance (“DB”) method. The SL method means you depreciate

your vehicle pro rata over the years of the recovery period. The DB method allows you to

accelerate the depreciation deductions during the earlier years of your vehicle’s life.

Note: If the BUP of your vehicle is 50% or less, you must use the SL method under the 5-year

MACRS recovery period.

(5) In addition to choosing a depreciation method, you must determine a depreciation convention.

There are two conventions available: half-year (“HY”) or mid-quarter (“MQ”). Unlike depreciation

methods, your depreciation convention is not a choice, but a factual test. If 40% of the total

depreciable basis of your MACRS property was placed in service during the last 3 months of the

tax year, then all your MACRS property (including your vehicle) is subject to the mid-quarter

convention. If not, you are subject to the half-year convention.

Note: The rules for determining convention become more complicated if Turo income is not your only

business (as the convention test looks at the depreciable basis of all your businesses), or if you have

other types of depreciable property, such as residential or non-residential real property, or property

placed in service and disposed in the same year. If you are unsure as to which convention applies to

you, consult your tax advisor.

IRS Publication 946, Appendix A Chart 1 provides a MACRS Percentage Table Guide that provides

each year’s depreciation deduction (reflected as a percentage of the depreciable basis placed in

service in year 1 under each method and convention).

Example 1:

You purchased your vehicle in cash on June 1, 2022 for $32,000. The vehicle was your only asset

purchased for the year that was used in a trade or business. As part of the purchase, you paid legal

and registration fees of $2,000. You started renting out the vehicle immediately after your purchase.

The BUP for the year is 35%.

The depreciable basis of your vehicle is $34,000 (purchase price of $32,000 plus other costs of

Turo | General guidance on the taxation of business income

January 2023

15

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

$2,000). Since the vehicle is the only asset purchased during the year used in a trade or business,

you are subject to the HY convention. Since the BUP is 50% or less, you are required to use the SL

method to compute your depreciation deduction.

Based off IRS Publication 946, Appendix A, Chart 1, the depreciation percentage to apply in the first

year of the vehicle’s recovery period using the HY convention and SL method is 10% (Table A-8).

Your maximum depreciation deduction is $3,400 (10% times $34,000). Note that this amount has

not yet factored in the BUP of your vehicle for the tax year or the passenger automobile

depreciation limits, as discussed later.

In general, DB methods tend to generate larger depreciation deductions in earlier years followed by

smaller ones in later years, whereas SL/ADS methods provide equal yearly deductions. Over the

course of the vehicle’s recovery period, the depreciation deductions should be the same (without

factoring in BUP and passenger automobile depreciation limits).

Finally, your vehicle is subject to a maximum amount of depreciation that may be claimed in a given

tax year, given the date the vehicle was placed in service. These maximum amounts can be found in

IRS Publication 946, How to Depreciate Property. Electric vehicles have separate (higher) limitations.

To determine the final deductible amount of depreciation expense in the current year, multiply your

vehicle’s BUP by the maximum depreciation allowable for your vehicle based on its year placed in

service under the passenger automobile limitations in “Maximum Depreciation Deduction” as listed in

IRS Publication 946 [a]. Then, compare that amount [a] to your vehicle’s depreciation deduction as

computed under the IRS Publication 946, Appendix A amounts (i.e., without the passenger

automobile limitations), multiplied by your vehicle’s BUP [b]. You are permitted to deduct up to [b], as

long as it is equal to or smaller than [a]; otherwise, your deduction is limited to [a]. Any amount under

[b] that is not recovered in the tax year due to the amount being larger than [a] is subject to potential

deduction in a later tax year.

Example 2:

Your BUP for the vehicle in Example 1 above is 35%. Therefore, your maximum depreciation

deduction in year 1 before the application of the passenger automobile limitations is $1,190 (35% x

$3,400 depreciation before passenger automobile limitation rules).

You look up the maximum depreciation deduction allowable under the passenger automobile

limitations in IRS Publication 946. For automobiles placed in service in 2022, the maximum first year

depreciation deduction is $11,200 (assume no bonus depreciation is taken). You multiply the

maximum deduction within the automobile limits by the BUP to get a maximum depreciation

deduction of $3,920 ($11,200 x 35%).

Since your depreciation deduction without regard to the automobile limits ($1,190) is smaller than

your depreciation deduction with regard to the automobile limits ($3,920), your depreciation

deduction is NOT limited.

The determination of which depreciation method is more beneficial to you over the life of your

vehicle’s planned rental period is complex. In these circumstances, please consult your tax advisor.

(6) Section 179 depreciation deduction

If your vehicle is used more than 50% for business in the first year it is placed in service, you may be

Turo | General guidance on the taxation of business income

January 2023

16

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

eligible to deduct the full purchase price of the vehicle in the first year of service.

(7) Special (“bonus”) depreciation deduction

If your vehicle is used more than 50% for business in the first year it is placed in service, you may be

eligible to deduct the full purchase price of the vehicle in the first year of service (after claiming any

applicable Section 179 deductions).

Note: Taxpayers are still required to allocate their Section 179 and bonus depreciation expenses

based on the BUP of their vehicles.

The rules for determining when it is acceptable to use the Section 179 and special bonus depreciation

amounts are extremely complex. Please consult your tax advisor for additional details.

6. Limit on rental losses

If you incur more rental expenses than your rental income, you have a loss from your rental activity.

Three sets of rules may limit the amount of losses you can deduct. You must consider these rules in

the order shown below. For purposes of this guide, we will treat each vehicle you rent as a separate

activity. The rules for grouping multiple vehicles under the at-risk and passive activity aggregation

rules are complex. For additional details, please consult your tax advisor.

I. At-risk activity limits

This rule is applied first if there is investment in your vehicle for which you are not at risk.

In most cases, any loss from an activity subject to the at-risk rules is allowed only to the extent of the

total amount you have at risk in the activity at the end of the tax year. You are considered “at risk” in

an activity to the extent of cash provided and the adjusted basis of the vehicle you contributed to the

activity. You are also considered at risk for any portion of debt for which you are personally liable or

pledged other property as security which has a fair market value equal to or greater than the

borrowed amount.

Example 1: You pay $40,000 cash to acquire a vehicle. Your at-risk basis in the vehicle is $40,000.

Example 2: You pay $5,000 cash and borrow $35,000 to acquire the same $40,000 vehicle. In case

of default, you would not be personally liable for any uncollectible portion of the loan (i.e., the only

recourse the lender has is to repossess the car), nor have you pledged other property as security for

the loan. Your at-risk basis in the activity is $5,000.

Example 3: You pay $5,000 cash and borrow $35,000 to acquire the same $40,000 vehicle. In case

of default, you would be personally liable for any uncollectible portion of the loan. Your at-risk basis

in the activity is $40,000.

Paying off a loan, becoming personally liable for the loan, or pledging other property with a fair market

value equal to or greater than the balance of the loan also increases your at-risk amount. Likewise,

refinancing the loan such that you become no longer personally liable for the loan, or removing a

pledge of other property as security for the loan reduces your at-risk amount.

If you have a situation where you are subject to the at-risk rules, see Form 6198 and IRS Publication

925. The rules for reporting at-risk limitations are complex. For further assistance, consult your tax

advisor.

Turo | General guidance on the taxation of business income

January 2023

17

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

II. Passive activity limits

Once you have determined what amount of your rental activity you are considered at risk for, you

must apply the passive activity limits. Generally, your rental activity will be considered a passive

activity, unless you can demonstrate that you materially participated in the rental activity (see section

8). Losses generated from passive activities can only offset other sources of passive income.

Example 1: You determine that your vehicle generated a passive activity loss of $2,400 for the

current tax year. You have no other source of passive income to report. Your $2,400 loss is non-

deductible and carries forward as a passive activity loss.

Example 2: In the subsequent year, your vehicle generates another $2,400 passive activity loss.

However, you have $5,000 of other passive income from a separate activity. You report $200 of net

income in the current tax year (since current year passive income exceeds current year and prior

year suspended passive losses).

Note: Losses disallowed due to the at-risk rules and passive activity limits are carried forward

indefinitely until they can be used to offset net rental income in future years.

In the year you dispose of your vehicle, you may be eligible to deduct any prior year suspended

losses.

If you have a situation where you are subject to the passive activity loss rules, see Form 8582 and

IRS Publication 925. Please consult your tax advisor on the application of these loss limitations to

your activities.

III. Excess business loss

Although exceedingly rare, it is possible that your rental activity loss may still be partially disallowed

under the “excess business loss” provisions. Please consult your tax advisor for further information.

7. Self-employment income and qualified business income (“QBI”)

Self-employed persons are persons who are in business for themselves. In addition to owing regular

income tax on your earnings, you may also be subject to self-employment tax as well. Self-employment

income is reportable on Form Schedule SE – Self-Employment Tax (Form 1040). For more information on

whether you would be subject to the self-employment tax reporting rules, consult your tax advisor.

Qualified business income (“QBI”) is income generated in the United States through certain “qualified

trade or business” activities. Income from certain activities may be eligible to take a 20% deduction on

QBI, subject to certain limitations. The application and determination of the QBI rules are extremely

complex. For more information, refer to Form 8995-A and the instructions therein and consult your tax

advisor.

8. How to report rental income and expenses

Most individual taxpayers report rental income and expenses as a “non-material” participant on Form

Schedule 1 (Form 1040).

Use Schedule 1, line 8(l) to report your gross receipts from box 1(a) per your Turo-provided Form 1099-K.

Use Schedule 1, use line 24(b) to report your deductible expenses. See Exhibits A and B for an example

of Schedule 1 (Form 1040), Pages 1 and 2.

Turo | General guidance on the taxation of business income

January 2023

18

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

Some individuals may meet the threshold of “material participant” and report rental income and expenses

on Form Schedule C (Form 1040).

Use Schedule C, line 1 to report gross receipts from box 1(a) from your Turo-provided Form 1099-K. Use

Schedule C, lines 8–27(a) to report your deductible expenses. See Exhibit C for an example of Schedule

C (Form 1040).

The determination of whether you are a material or non-material participant is extremely complex

and highly fact specific. Please consult your tax advisor if you have any questions.

If you have a loss from your rental income activity, you also may need to complete one or both of the

following forms. These forms will need to be completed year over year to keep track of disallowed loss

due to at-risk rule or passive activity limit.

Form 6198, At-Risk Limitations. See At-risk activity limits, earlier.

Form 8582, Passive Activity Loss Limitations. See Passive activity limits, earlier.

9. Reporting payments to independent contractors

If you make $600 or more in payments to independent contractors for services performed on your vehicle

(e.g., cleaning services from a third party), you are required to issue Form 1099-NEC to the independent

contractors and submit a copy to the IRS. See IRS instructions on how to complete Form 1099-NEC.

10. How is (net) rental income taxed? (federal)

For federal income tax purposes, net rental income is taxed at ordinary income tax rates, subject to the

limitations discussed above. Ordinary income tax rates vary, depending on your filing status and overall

income levels. See Exhibit D for 2022 ordinary income tax rates for individual taxpayers.

11. Quarterly estimated tax payments

Estimated taxes is the method used to pay tax on rental income not subject to withholding. If you do not

pay enough tax through withholding or estimated tax, you may be subject to a penalty. Please consult

your tax advisor for more details on your specific circumstances.

12. Sale of vehicle used as rental property

Upon the sale of your vehicle, you must determine whether you have a taxable gain or a loss. The rules

for computing your taxable gain and loss, as well as reporting it, are complex. Please consult your tax

advisor.

13. Documents to be retained

All supporting documentation with respect to rental income and expenses must be kept for tax purposes

regardless of the length of the rental period. You do not need to submit the supporting documentation

with your return. However, the IRS may request copies of the documentation. You should keep a record

of the following:

Receipts for all deductible expenses, including repairs, supplies, cleaning services, etc.

Your Turo-provided Form 1099-K and earnings and tax summaries

Vehicle purchase/lease contracts (including details regarding any financing)

Turo | General guidance on the taxation of business income

January 2023

19

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

Your vehicle odometer logs

Carryforward of passive activity losses not utilized in prior years

Form 1099-NEC issued to independent contractors

Generally, you must keep records that support items shown on your return until the period of limitations

for that return runs out. The period of limitations is the period of time during which you can amend your

return to claim a credit or refund or the IRS can assess additional tax.

If you: Then the period of limitation is:

(a) Owe additional tax and (b), (c), and (d) do not apply to you 3 years

(b) Do not report income that you should and it is more than

25% of the gross income shown on your return

6 years

(c) File a fraudulent return No limit

(d) Do not file a return No limit

(e) File a claim for credit or refund after you filed your return

The later of 3 years or 2 years after tax

was paid

(f) File a claim for a loss from worthless securities 7 years

Additionally, you should keep records relating to your basis in your vehicle until the period of limitations

expires for the year in which you dispose of the vehicle. You must keep these records to figure any

depreciation deduction and to figure the gain or loss when you sell or otherwise dispose of the property.

If you do not keep the requisite records, it may be impossible for you to prove that you incurred deductible

expenses or to establish your basis for gain or loss. Without such proof, the IRS can deny you a

deduction.

When your records are no longer needed for tax purposes, do not discard them until you check to see

whether you have to keep them longer for other purposes. For example, your insurance company or

creditors may require you to keep them longer than the IRS does.

14. Other resources

Below is a list of resources that you can reference for a more thorough explanation on the topics

discussed above.

IRS Guidance and Publications:

Business Use of a Car: https://www.irs.gov/taxtopics/tc510

IRS issues standard mileage rates for 2022: https://www.irs.gov/newsroom/irs-issues-standard-mileage-

rates-for-2022

IRS increases standard mileage rate for remainder of 2022: https://www.irs.gov/newsroom/irs-increases-

mileage-rate-for-remainder-of-2022

IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses:

https://www.irs.gov/publications/p463

Turo | General guidance on the taxation of business income

January 2023

20

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

Recordkeeping: https://www.irs.gov/taxtopics/tc305

IRS Publication 925 (2022), Passive Activity and At-Risk Rules: https://www.irs.gov/pub/irs-pdf/p925.pdf

IRS Publication 946 (2022), How to Depreciate Property: https://www.irs.gov/pub/irs-pdf/p946.pdf

Form 8995-A Qualified Business Income Deduction: https://www.irs.gov/pub/irs-pdf/f8995a.pdf

Self-Employment Tax (Social Security and Medicare Taxes): https://www.irs.gov/businesses/small-

businesses-self-employed/self-employment-tax-social-security-and-medicare-taxes

Instructions for Forms 1099-MISC and 1099-NEC: https://www.irs.gov/instructions/i1099mec

Turo | General guidance on the taxation of business income

January 2023

21

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

15. Exhibit A – Schedule 1, Page 1 (Form 1040)

Use Schedule 1, line 8(l) to

report your gross receipts from

box 1(a) per the Turo-provided

Form 1099-K. This should match

the gross earnings as listed in

your earnings and tax summary.

Turo | General guidance on the taxation of business income

January 2023

22

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

16. Exhibit B – Schedule 1, Page 2 (Form 1040)

For drivers using the Actual Expenses method for tracking vehicle expenses, add

your cancellations and Turo fees (in addition to any other business expenses)

and report in Schedule 1, Page 2, line 24(b). For drivers using the Standard

Mileage Rate method, add cancellations and 70% of your Turo fees (in addition to

any other business expenses) in Schedule 1, Page 2, line 24(b).

Turo | General guidance on the taxation of business income

January 2023

23

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

17. Exhibit C – Schedule C (Form 1040)

For drivers using the Actual Expenses method for tracking vehicle expenses, add

your cancellations and Turo fees (in addition to any other business expenses). For

drivers using the Standard Mileage Rate method, add cancellations, and 70% of

your Turo fees (in addition to any other business expenses). In either case, report

expenses on Schedule C, lines 8–27(a), where appropriate.

Use Schedule C, line 1 to

report your gross receipts

from box 1(a) per the Turo-

provided Form 1099-K. This

should match the gross

earnings as listed in your

earnings and tax summary.

Turo | General guidance on the taxation of business income

January 2023

24

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

18. Exhibit D – 2022 Tax Rates for Individual Taxpayers

Single

Taxable Income Tax Rate

$0 to $10,275 10%

$10,276 to $41,775 $1,027.50 plus 12% of the amount over $10,275

$41,776 to $89,075 $4,807.50 plus 22% of the amount over $41,775

$89,076 to $170,050 $15,213.50 plus 24% of the amount over $89,075

$170,051 to $215,950 $34,647.50 plus 32% of the amount over $170,050

$215,951 to $539,900 $49,335.50 plus 35% of the amount over $215,950

$539,901 or more $162,718 plus 37% of the amount over $539,900

Married Filing Joint Returns and Surviving Spouses

Taxable Income Tax Rate

$0 to $20,550 10%

$20,551 to $83,550 $2,055 plus 12% of the amount over $20,550

$83,551 to $178,150 $9,615 plus 22% of the amount over $83,550

$178,151 to $340,100 $30,427 plus 24% of the amount over $178,150

$340,101 to $431,900 $69,295 plus 32% of the amount over $340,100

$431,901 to $647,850 $98,671 plus 35% of the amount over $431,900

$647,851 or more $174,253.50 plus 37% of the amount over $647,850

Turo | General guidance on the taxation of business income

January 2023

25

Disclaimer

This documentation is intended solely for information purposes and no Turo Host or other third party may rely upon it as tax or legal advice or use it

for any other purpose. As such, EY and Turo assume no responsibility whatsoever to Turo Hosts or other third parties as a result of the use of

information contained herein. This documentation was prepared by EY, and does not necessarily reflect the views of Turo. Please refer to the

disclaimer on page 1 for more information.

Married Filing Separate Returns

Taxable Income Tax Rate

$0 to $10,275 10%

$10,276 to $41,775 $1,027.50 plus 12% of the amount over $10,275

$41,776 to $89,075 $4,807.50 plus 22% of the amount over $41,775

$89,076 to $170,050 $15,213.50 plus 24% of the amount over $89,075

$170,051 to $215,950 $34,647.50 plus 32% of the amount over $170,050

$215,951 to $323,925 $49,335.50 plus 35% of the amount over $215,950

$323,926 or more $87,126.75 plus 37% of the amount over $332,925

Head of Household

Taxable Income Tax Rate

$0 to $14,650 10%

$14,651 to $55,900 $1,465 plus 12% of the amount over $14,650

$55,901 to $89,050 $6,415 plus 22% of the amount over $55,900

$89,051 to $170,050 $13,708 plus 24% of the amount over $89,050

$170,051 to $215,950 $33,148 plus 32% of the amount over $170,050

$215,951 to $539,900 $47,836 plus 35% of the amount over $215,950

$539,901 or more $161,218.50 plus 37% of the amount over $539,900