Consultation Paper

CP17/24**

July 2017

Information about current account services

2

CP17/24

Financial Conduct Authority

Information about current account services

We are asking for comments on

this Consultation Paper (CP) by

25 September 2017.

You can send them to us using

the form on our website at:

www.fca.org.uk/your-fca/

documents/consultation-papers/

cp17-24-response-form.

Or in writing to:

Rebecca Langford

Banking and Payments Policy Team

Financial Conduct Authority

25 The North Colonnade

Canary Wharf

London E14 5HS

Telephone:

0207 066 0532

Email:

cp17-24@fca.org.uk

How to respond Contents

1 Summary 3

2 The wider context 7

3 Considering the case for additional

service information 10

4 Changes to the Banking Conduct

of Business sourcebook 15

5 Discussion of metrics we are not pursuing 33

6 Next steps 37

Annex 1

Questions in this paper 38

Annex 2

Cost benet analysis 40

Annex 3

Compatibility statement 47

Annex 4

Stakeholder expert group 52

Annex 5

Metrics considered 53

Annex 6

Abbreviations used in this paper 60

Appendix 1

Draft rules and guidance

returns you to

the contents list

takes you to helpful

abbreviations

How to navigate this

document onscreen

3

CP17/24

Chapter 1

Financial Conduct Authority

Information about current account services

1 Summary

Why we are consulting

1.1 These proposals seek to promote effective competition by enabling customers to

make effective comparisons between providers of personal current accounts (PCAs)

and business current accounts (BCAs) based on service, and by incentivising providers

to improve service and performance.

Who this applies to

1.2 This consultation paper (CP) affects the majority of current and potential participants

in the PCA and BCA markets as well as those interested in this market.

1.3 The CP applies to firms that accept deposits (banks and building societies) and provide

payment accounts as defined by the Payment Accounts Regulations

1

(typically PCAs)

or BCAs that have the features of a payment account. These firms should read the

whole consultation.

1.4 Organisations which offer comparison services are encouraged to read the whole

consultation and to respond to questions 7 - 10.

1.5 This CP will be of interest to PCA and BCA customers. While we do not expect

customers to read this paper in full, organisations representing consumers may

want to read the summary of the consultation.

The wider context of this consultation

1.6 In its retail banking investigation final report

2

the Competition and Markets Authority

(CMA) recommended that we require firms to publish objective measures of service

performance for both PCAs and BCAs, in addition to the core service quality indicators

it will require the largest current account providers to publish. We committed to

consider doing so, where the evidence supported this and the measures advanced our

objectives.

3

1 http://www.legislation.gov.uk/uksi/2015/2038/pdfs/uksi_20152038_en.pdf

2 https://assets.publishing.service.gov.uk/media/57ac9667e5274a0f6c00007a/retail-banking-market-investigation-full-final-report.pdf

3 November 2016, FCA response to the CMA’s recommendations following its investigation into retail banking.

www.fca.org.uk/publications/corporate-documents/our-response-cma-investigation-competition-retail-banking-market

4

CP17/24

Chapter 1

Financial Conduct Authority

Information about current account services

What we want to change

1.7 Information available to customers about the service provided by individual firms is

rarely provided in a consistent manner that allows comparison between firms. We want

to make it easier for customers to access and assess information about providers’

service, enabling them to make informed comparisons and choose the provider that

best suits their needs. We also want to incentivise BCA and PCA providers to improve

their service and performance.

1.8 To achieve this we propose to require BCA and PCA providers to publish service

information in the following categories:

• Account opening – clear information about the account opening process and

information about how long it takes to open an account and gain access to specied

services including overdraft funds (see paragraphs 4.40-4.55)

• Time taken to replace a lost, stolen or stopped debit card and to organise third party

access to a PCA under a power of attorney (see paragraphs 4.56-4.75)

• Service availability – identifying how and when various services can be accessed and

whether 24-hour help is available for certain matters (see paragraphs 4.76-4.83)

• Major incidents – information about the number of major operational and

security incidents that rms have reported to the FCA, by channel (see paragraphs

4.84-4.88)

1.9 The service information we propose to require firms to publish includes both:

• standing data – information rms will be required to publish and keep up to date, for

example about the times of day when certain services are available

• service metrics – things that we will require rms to measure or count and publish

every quarter

Other proposals

1.10 We propose to require firms with more than 70,000 relevant PCAs or 15,000 BCAs

(held by “banking customers” as defined for the purposes of BCOBS) to publish

this service information. These thresholds apply per brand. We do not consider it

proportionate to require firms to publish service information for smaller brands.

However, if they choose to publish service metrics they will need to comply with those

rules to ensure meaningful and consistent comparisons (see paragraphs 4.13-4.18).

1.11 So that customers and digital comparison services can access service information

we propose that firms should publish it on their website. We also want firms to make

the information available via Application Programming Interface (API) and propose to

require firms that are part of Open Banking and all firms in scope of the rules which use

an API for the purposes of PSD2 to also to make the information published under our

rules available through an API (see paragraph 4.23-4.28).

5

CP17/24

Chapter 2

Financial Conduct Authority

Information about current account services

1.12 We propose that the service metrics should be measured quarterly (beginning in

April 2018) and published within six weeks of the end of each quarter. Depending on

the outcome of this consultation, we will aim for the first publication of the metrics

to coincide with firms’ first publication of the core indicators required by the CMA in

August 2018 (see paragraphs 4.29-4.32).

1.13 We propose not to require service information in a number of areas, including

subjective service quality measures, measures related to fraud, and information

specific to BCAs - for example regarding relationship managers. We are not pursuing

these because our research and analysis suggested that they may duplicate the core

CMA service indicators, not be motivating to customers, not be practical to measure,

or result in unintended consequences. While we are not proposing service information

requirements in these areas now, we will reconsider this in the future if evidence

suggests we should. For further information about service information we are not

pursuing see Chapter 5.

Unintended consequences of our intervention

1.14 In designing our proposals we have considered possible unintended consequences and

these are outlined in this CP. We have sought to be proportionate in designing these

remedies and we are neither proposing that they apply to all firms nor all aspects of

service. The rules we are proposing relate to areas of service that our research tells

us matter to customers. We are mindful that introducing service metrics for some

services and not others may impact the attention that firms pay to ensuring the quality

of other services that are not subject to metrics. We consider that the CMA core

service quality indicators (for those firms which are subject to the CMA’s requirements)

will mitigate this since they focus on overall brand perceptions.

1.15 We are aware that not requiring the smallest firms to provide service information and

not applying rules to certain providers, including credit unions could potentially distort

competition. We propose that if these firms wish to compete by publishing the same or

similar service metrics, they must comply with the relevant rules.

1.16 We will monitor whether publication of service information causes unintended

consequences.

Outcome we are seeking

1.17 We want to improve competition in the current account market by:

• making it easier for customers to make informed comparisons and choose the

provider that best suits their needs based on service, and

• incentivising BCA and PCA providers to improve their service and performance.

1.18 We consider that we will achieve this if the following conditions are met:

6

CP17/24

Chapter 2

Financial Conduct Authority

Information about current account services

• rms comply with requirements to publish meaningful and comparable service

metrics

• customers access and assess the information about providers’ service when

choosing an account

• digital comparison services and the media use the published metrics to draw

attention to the service oered by providers

• there is competitive pressure from market commentary, and

• rms respond to the pressure of reputational damage caused by indications of

providing worse service than their competitors by taking steps to improve service.

Measuring success

1.19 We will gather baseline information about customers’ attitudes and behaviour related

to service information and switching in 2018. We will also interview digital comparison

services to understand their role in distributing service information to customers, and

track media coverage.

1.20 We will repeat this exercise as part of a post-implementation review, expected to take

place in 2019/20, to assess the impact of the changes we make.

Next steps

1.21 The consultation period for this CP is two months. We consider this shorter

consultation period is appropriate as we have engaged with stakeholders, including

firms, extensively as we developed our proposals, and it will allow firms more time for

implementation. Subject to the outcome of the consultation, we would aim to have

rules in place to require the first publication of additional service metrics in August

2018 to coincide with the first publication of the core CMA service quality indicators.

1.22 Please send your response to this CP by 25 September 2017. To submit a response,

please use the online response form on our website or write to us at the address on

page 2.

1.23 If, having considered the feedback to this CP, we propose to make rules we would plan

to publish a Policy Statement later this year.

1.24 We may consider introducing additional service information requirements in the future

should there be evidence that this would benefit customers and improve competition.

7

CP17/24

Chapter 2

Financial Conduct Authority

Information about current account services

2 The wider context

The harm we are trying to address

2.1 The CMA’s retail banking market investigation found that there are barriers to

accessing and assessing information about service quality, which contributes to low

customer engagement in the current account market. This may result in harm as

customers may receive poor value by staying with products that are not best suited to

their needs or do not provide good quality service.

The CMA’s package of remedies

2.2 The CMA identified several remedies which are intended to work together to tackle the

underlying problems identified in the PCA and BCA markets by:

• enabling customers to make reliable comparisons between providers

• ensuring customers can compare the service quality of existing and prospective

providers by requiring rms to make available:

–

information about customers’ willingness to recommend their service to others

–

operational performance metrics with respect to PCA and small and medium-

sized enterprise (SME) banking services, and

–

promoting engagement by prompting customers to consider their banking

arrangements and take appropriate action.

2.3 The CMA is implementing a number of these remedies itself, but has also made five

broad recommendations to the Financial Conduct Authority (FCA). These include

a recommendation that we consider requiring operational performance metrics

(the subject of this consultation), work on Open Banking, designing prompts and

alerts to encourage consumers to consider their banking arrangements, reviewing

the Maximum Monthly Charge for unarranged overdrafts and delivering a more

competitive market for SMEs. Our response to the CMA’s final report outlines the

recommendations the CMA made to the FCA and our response.

4

2.4 The CMA has made an Order which requires the largest PCA and BCA providers to

publish core service quality indicators.

5

Firms will publish results in their branches, on

their websites and in leaflets. These core measures of quality are based on customers’

willingness to recommend their bank’s services to friends, family or colleagues or other

SMEs. They will be measured every six months by an independent survey required by

the CMA with the first set of results due to be published by firms in August 2018. As

4 November 2016 www.fca.org.uk/publications/corporate-documents/our-response-cma-investigation-competition-retail-banking-

market

5 https://www.gov.uk/government/publications/retail-banking-market-investigation-order-2017

8

CP17/24

Chapter 2

Financial Conduct Authority

Information about current account services

discussed at paragraph 1.6, the CMA asked the FCA to consider whether we should

require firms to publish additional objective measures of service performance. This CP

outlines our proposals on this and how we consider them to further our objectives.

How it links to our objectives

2.5 The action we are taking to consider each of the CMA’s recommendations is intended

to advance our statutory objectives, which are broader than the CMA’s remit.

Competition

Requiring the provision of additional service information will improve customer

engagement in the current account market.

2.6 Improving the availability of meaningful and comparable information about service will

make it easier for customers to make informed comparisons and choose the provider

that best suits their needs based on the quality of their service.

2.7 More engaged customers and reputational pressure from publishing service

information should drive providers to improve service and performance to retain

existing and attract new customers.

Consumer Protection

Requiring the provision of additional service information will lead to provision of

services that are better suited to meeting consumers’ needs

2.8 While not directly focussed on our consumer protection objective, as a result of

our intervention we expect to see provision of services that are better suited to

consumers’ needs, for example as providers adjust the service availability and contact

routes they offer.

2.9 Where we require provision of service information to advance our competition

objective, the FCA and other regulators may also be taking action in other ways to

protect consumers, for example in relation to reducing harm arising from major

incidents, fraud and aspects of access to financial services.

9

CP17/24

Chapter 2

Financial Conduct Authority

Information about current account services

What we are doing

2.10 We are proposing rules that would oblige firms to publish information about service for

PCAs and BCAs. The following chapters provide more information on our reasons for

doing this and the detail of our proposals:

• Chapter 3: Considering the case for additional service information

• Chapter 4: Changes to the Banking Conduct of Business sourcebook

• Chapter 5: Discussion of metrics we are not pursuing

• Chapter 6: Next steps

Equality and diversity considerations

2.11 We have considered the equality and diversity issues that may arise from our

proposals.

2.12 Overall, we do not consider that the proposals adversely impact any of the groups with

protected characteristics under the Equality Act 2010 but we will continue to consider

the equality and diversity implications of the proposals during the consultation period.

We will also revisit them when publishing the final rules.

10

CP17/24

Chapter 3

Financial Conduct Authority

Information about current account services

3 Considering the case for additional

service information

3.1 As discussed in paragraph 2.4 the CMA will require firms to publish core service quality

indicators. These will be based on a survey that asks customers how willing they are to

recommend their bank’s services to friends, family or colleagues or other SMEs.

3.2 The CMA recommended that we require firms to publish additional objective measures

of service performance. Having undertaken research and analysis we have decided to

pursue the publication of additional objective service information, as we consider that

doing so will advance our operational objective to promote effective competition.

3.3 In this section we outline the consultation, research and analysis we have undertaken

to come to this conclusion. We also explain why we consider requiring publication of

additional objective service indicators will advance our objectives.

Process

3.4 In summary, our process to consider additional service information included five

stages:

• Review of existing evidence – to analyse the likely eect on customers of consistent

service information, and to develop a long-list of options.

• Establishing a stakeholder expert group – to prioritise and reduce the options to a

shortlist and understand how metrics would be used by rms/intermediaries and

communicated to customers.

• Qualitative consumer research – to get customer views on shortlisted options, and

identify any alternatives.

• Discussions with rms – to understand the potential eects on rm behaviour of

such publication, and their capability to deliver the metrics.

• Analysis of evidence and deciding to pursue publication of additional metrics.

3.5 We provide more detail on each stage of this process below.

11

CP17/24

Chapter 3

Financial Conduct Authority

Information about current account services

Review of existing evidence

3.6 We began by reviewing a considerable amount of existing research and evidence.

This included the CMA’s final report into competition in the retail banking market

6

and

additional information gathered by the CMA on the service information that firms

already collect for internal monitoring purposes. Whilst not directly related, we also

looked at experience of service-disclosure interventions by other regulators, and

experience from FCA interventions requiring data publication, such as on complaints,

the cash savings sunlight remedy, and general insurance claims. We also considered

published research on consumer attitudes to service in relation to bank accounts.

3.7 This review of existing evidence helped us to understand the pros and cons of different

approaches and to develop a list of potential metrics to discuss with stakeholders as

we developed our proposals. It also helped to shape our qualitative research.

Stakeholder expert group

3.8 Acknowledging the complexity of developing industry-wide metrics for services,

we established an external stakeholder expert group (SEG) of consumer and SME

representatives, digital comparison services, service experts, other regulators and a

trade body to inform our consideration of what service quality information could be

made available and how it might be used.

3.9 The SEG considered a long-list of over 90 service information items suggested from

our research and by stakeholders, including items already collected by firms for

internal monitoring purposes, and additional items suggested by SEG members. The

full list of metrics considered is available in Annex 5. Detailed feedback from members

on likely customer and intermediary use, credibility, and interaction with the core

CMA indicators was consistent with findings from our review of existing evidence.

It highlighted what information would most likely be used by customers, digital

comparison services and commentators. It showed that some metrics duplicated

the CMA core indicators, while others could complement them and contribute to

competition in the interests of customers.

3.10 A list of SEG member organisations is available in Annex 4 of this CP. The SEG’s views

are included in our discussion of our proposals in this CP.

Qualitative consumer research

3.11 After considering the views and evidence provided by the SEG, we commissioned

qualitative research into a short-list of over 30 service metrics. The results of the

research are published alongside this report.

7

The research aimed to:

• test customers’ understanding of a short-list of service indicators and their power

to motivate them to consider switching or trying a new current account with another

provider, and

6 https://assets.publishing.service.gov.uk/media/57ac9667e5274a0f6c00007a/retail-banking-market-investigation-full-final-report.pdf

7 www.fca.org.uk/publications/search-results?live_c=1

12

CP17/24

Chapter 3

Financial Conduct Authority

Information about current account services

• test, by dierent areas of service, customers’ preferences for dierent types of

information (eg number of events or duration of events; national average gures or

data about local service).

3.12 The research included ten focus groups with PCA holders, and three workshops and 37

in-depth telephone interviews with SME BCA holders. The research also included eight

face-to-face in-depth interviews with individuals deemed to have additional needs with

regards to their current account. A total of 155 respondents were engaged.

3.13 Participants were asked what was important to them about their current account. They

were also asked to reflect on the CMA core service quality indicators. The research

then tested 34 possible metrics

8

categorised into six groups:

• Communicating with the bank

• Technical service reliability

• Ease of opening an account

• Resolution of issues

• Complaints

• Local branch oering

3.14 The short-list of areas of service and indicators tested in the research was created by

us based on views of the SEG and findings from our review of existing evidence.

3.15 Our qualitative research backs up the views of experts in our SEG that customers value

good service and would be willing to switch account to get it. While some assume ‘all

banks are the same,’ this perception is challenged when they learn about the service

available from other providers. However, often this information is not provided and

when it is available it is rarely provided in a consistent manner that allows comparison

between firms.

3.16 BCA and PCA customers had similar views on what service information they wanted

to see. They considered the CMA core metrics a “useful starting point to understand

which banks were performing.” However, they also wanted to see objective measures

of the service they could expect to receive. They were more interested in measures of

service that were important to them than in aspects of service that they did not expect

to experience. Areas of particular interest were:

• Eciency of response

• Service stability

• Accessibility (particularly out-of-hours)

• Speed and exibility of opening an account.

8 Eight of which were specific to SME audiences and only tested during telephone interviews with this group.

13

CP17/24

Chapter 3

Financial Conduct Authority

Information about current account services

3.17 Customers expect to access service information through digital comparison services

and the media. They expect to use information about service to choose an account.

They also think this information could prompt them to consider switching or trying

another account. Once engaged, they might seek out further information on a firm’s

website.

Discussions with banks and building societies

3.18 We have engaged with banks and building societies individually and by participating

in a series of roundtable meetings with them to discuss potential effects on firms’

behaviour of data publication, and their capability to deliver the additional measures of

service we are proposing. We have also discussed our proposals with trade bodies of

impacted firms.

3.19 These conversations showed that challengers are competing on service in the areas

of interest to customers and there is sufficient differentiation in service to warrant

publication of metrics. Service metrics in these areas would enable customers to

choose their account provider based on its performance, and this along with broader

reputational considerations would encourage account providers to improve their

service.

Decision to propose publication of additional metrics

3.20 The CMA’s retail banking investigation found that there are barriers to accessing

information about service quality which contribute to low consumer engagement in

the current account market. This adversely affects competition in the retail banking

market. Throughout our evidence gathering and consultation process we have seen

a broad and on-going consensus that requiring firms to publish additional service

information alongside the CMA core indicators of service quality will help address this.

3.21 Publication of additional service information will advance our operational objective to

promote effective competition by making it easier for customers to access and assess

information about providers’ service, enabling them to make informed comparisons

and choose the provider that best suits their needs. More engaged customers and

reputational pressure from publishing service information should incentivise BCA

and PCA providers to improve their service and performance to retain and attract

customers. Commonly defined service metrics may be particularly relevant and useful

for smaller banks or building societies that cannot take part in the CMA core service

quality indicator survey and could help them to compete.

3.22 Throughout the process outlined above we considered over 90 service indicators

proposed by stakeholders against a range of criteria including:

• Relevance to customers: to consider whether customers will be suciently

interested in the service information

• Relevance for challengers and smaller banks and building societies: to ensure that

metrics would be adequately relevant and useful for challengers, particularly given

their exclusion from the CMA core indicators

14

CP17/24

Chapter 3

Financial Conduct Authority

Information about current account services

• Relevance to intermediaries: to assess whether intermediaries are likely to use the

proposed service metric in their comparison tools or publications in a way that is

useful for customers

• Dierentiability: to assess whether variation between providers would be of

signicance to customers

• Duplication: to ensure that the proposed metrics do not duplicate information that

is already available or will be available elsewhere

• Unintended consequences: to consider if there are risks that the proposed metric

could lead to unintended consequences leading to detriment to competition, rms

or the market

• Proportionality: to ensure that the metrics are feasible for rms to measure and the

costs are reasonable relative to the benet to customers.

3.23 As a result we propose that firms should publish service information related to the

following aspects of service in this consultation. Unless otherwise stated we propose

to require this information to be published for both PCAs and BCAs:

• Account opening – clear information about the account opening process and

information about how long it takes to open an account and gain access to specied

services including overdraft funds (see paragraphs 4.40-4.55)

• Time taken to replace a lost, stolen or stopped debit card and to organise third party

access to a PCA, under a power of attorney (see paragraphs 4.56-4.75)

• Service availability – identifying how and when various services can be accessed and

whether 24-hour help is available for certain matters (see paragraphs 4.76-4.83)

• Major incidents – information about the number of major operational and security

incidents that rms have reported to the FCA, by channel (see paragraphs 4.84-

4.88).

Q1: Do you agree with our analysis that we should require

publication of service information?

Q2: Doyouagreethatrmsshouldpublishservice

information related to the areas of service outlined? Are

there any other areas we should consider (bearing in mind

our discussion of metrics we are not pursuing in Chapter

5)?

15

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

4 Changes to the Banking Conduct

of Business sourcebook

Introduction

4.1 In this section we consult on new rules in BCOBS to require the publication of additional

service information about:

• Account opening

• Time taken to replace a debit card, and to give a third party access to a PCA under a

power of attorney

• Service availability

• Major incidents

4.2 We discuss the application of the proposed rule changes, including the products and

firms within scope of our rules.

4.3 We also discuss distribution (how we will require firms to make information about

service available to customers) and the timing and frequency (when we expect new

rules to commence and the frequency with which we expect firms to publish service

information).

4.4 We seek feedback from interested stakeholders, particularly customer

representatives, impacted firms and digital comparison services.

Application of proposed rule changes

Products within scope of our rules

4.5 Our main banking rules are in BCOBS. They apply to a range of accounts such as

current accounts and savings accounts. They apply to a range of defined banking

customers, including individual consumers, micro enterprises

9

and charities which have

an annual income of less than £1 million.

4.6 We are confident that BCOBS covers broadly the right banking customers for the

purposes of these rules but, at this time, want to restrict their application to PCAs and

BCAs.

9 An enterprise which: (a) employs fewer than 10 persons; and has a turnover or annual balance sheet that does not exceed

2 million Euros.

16

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

4.7 Despite PCA and BCA being common terms used by both firms and customers,

they are currently not defined in BCOBS or in legislation. We are therefore adopting

a definition of a PCA based on the definition of a ‘payment account’ in the Payment

Accounts Regulations 2015 (PARs). This includes PCAs and basic bank accounts as

well as instant access savings accounts and current account mortgages, where they

are used in a way that is similar to a current account (that is, for day to day payment

transactions).

10

However, we propose to exclude current account mortgages as we

consider that including these might distort the service information that firms report,

making it less relevant to current account customers.

4.8 Our work will allow customers to compare similar current accounts held by the majority

of each provider’s customers. We are aware that a small minority of PCA customers

get preferential service on their account, for example because they have a high

balance or monthly income. We do not want to include these customers in our service

information and metrics because they could skew them to show better performance

than most PCA customers can get.

4.9 In order to ensure fair comparison we therefore propose to define and exclude

‘premium service accounts’. We propose to define such accounts as PCAs which have

eligibility criteria relating to minimum balances or minimum monthly deposits (or both)

whose holders receive better service than non-premium service accounts, based

on any of the service information we propose to require firms to publish. An account

cannot be a premium service account if it is held by 10% or more PCA customers. For

example, an account which has staff available to respond to relevant queries through

telephone banking for more hours of the day than other accounts, or whose account

holders can replace a lost debit card more quickly than other accounts, would be a

premium service account if it is not held by 10% or more of the firm’s PCA customers.

4.10 An account may only be a “payment account” for the purpose of the PARs if it is held

by a “consumer”. As a business user is not a consumer, we propose to define a BCA as

an account which would be a PCA if the account holder were a consumer. Further, we

propose to align our rules with BCOBs, so that only BCAs held by “banking customers”

will be subject to our rules.

Q3: DoyouagreewithPCAsandBCAsbeingdenedby

referencetothedenitionof“paymentaccount”inthe

Payment Accounts Regulations 2015?

Q4: Do you agree that ‘premium service current accounts’

should be excluded from PCA service information?

4.11 There are other accounts that sit outside BCOBS, for example accounts provided by

e-money and payment institutions which are similar to current accounts. There may

be benefits to competition of making information about service quality available to

customers with those accounts. However, our rule making powers do not currently

extend to the providers of such accounts.

4.12 We will monitor the impact of introducing service information for current accounts. If

we consider there could be consumer and competition benefits to requiring service

information to be published for other products such as mortgages, savings accounts

10 We have issued guidance to help firms decide if an account they offer is a Payment Account. www.fca.org.uk/publications/finalised-

guidance/fg16-6-payment-accounts-regulations-2015-definition-payment-account

17

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

that are not payment accounts (as defined by PARs) or insurance, we may consider

doing so.

Providers within scope of our rules

4.13 We propose that firms measure and publish information about each of their brands

separately, as this is the basis on which customers will identify providers. By ‘brand’ we

mean the trading name notified to the FCA.

4.14 We have analysed data related to firms’ market share to consider which firms should

be in scope of our rules. We are unable to publish details of this analysis as this is

commercially sensitive information. The data available to us suggest that it is not

appropriate to require firms with fewer than 70,000 PCAs in a brand to publish

information about their PCA service under that brand, or fewer than 15,000 BCAs in

a brand to publish information about BCA service under that brand. These thresholds

differ from those set by the CMA. For PCAs our proposed PCA definition (as discussed

in paragraph 4.7-4.9) is wider. For BCAs, we propose a narrower application of our

rules, in line with the existing application of BCOBS – limited to micro enterprises and

to charities whose annual turnover is less than £1 million. The CMA’s thresholds are

measured separately for Northern Ireland and Great Britain and cover only active

accounts, while ours relate to all accounts in scope and cover the whole of the UK.

4.15 We consider that the thresholds proposed above will encompass a wide range of

account providers, including challengers, and that this will increase the availability

of information for customers and lead to increased competition in the interest of

customers. We understand that these thresholds will capture firms that are actively

competing for PCA and BCA customers, including all of the firms in scope of the

CMA core indicators plus others which have fewer active accounts than the CMA’s

threshold. We consider that it would not be proportionate to require firms with fewer

accounts than our proposed thresholds to publish service information and metrics.

4.16 Firms with fewer accounts than our proposed threshold may wish to compete on

service in the current account market by publishing information which is the same or

similar to one or more of the service metrics we are requiring larger firms to publish.

However, if they choose to publish information which is within scope of any of the

service metrics (not standing data), we propose that they are required to comply

with the rules as if they did have the requisite number of accounts and are required

to publish all aspects of the metric concerned. For example, if choosing to publish

information about time taken to replace a debit card (see paragraph 4.67-4.69) they

would be required to publish same day, average and 99% response times for the same

quarterly reporting period. This is to ensure a fair and consistent comparison between

firms. We will monitor the impact of these proposals on competition.

4.17 Where firms have fewer than 70,000 PCAs or 15,000 BCAs but later meet this

threshold, we propose that they will not be required to measure service information

for two quarterly reporting periods. This will allow time (at least six months) for them

to introduce the required measuring and reporting capability. For example, if in quarter

one a firm reaches the threshold, it will be required to start measuring metrics and

publishing service information in quarter four. Where a firm, having previously met the

threshold, no longer meets the threshold, they will no longer be required to publish

service information and metrics for any quarter after the one during which they fell

below the threshold.

18

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

4.18 We propose that customers of overseas branches and customers whose

correspondence address is overseas will be excluded from these rules. The service

these customers receive may not be comparable with customers in the UK - for

example it may take longer for firms to send a debit card to them - and we do not

want to reduce the comparability of the service information that firms with a large

overseas presence provide. We also propose to exclude credit unions from the rules,

as providing service information is unlikely to be proportionate since membership

requirements restrict customers’ ability to choose their credit union.

11

Q5: Do you agree with the proposed application of the rules?

In particular do you agree with the providers, customers

and products in scope of the rules?

Q6: Do you agree with the proposed threshold? Do you agree

that providers below the threshold which choose to

publish the same or similar service metrics must comply

with the relevant rules?

Distribution

4.19 We have considered how service information should be made available to customers.

The options we considered have included: requiring firms to report performance

against service indicators to the FCA for publication on the FCA’s website; requiring

firms to make information available directly to customers and digital comparison

services on their own websites; and requiring firms to make information available for

distribution by APIs.

Our research

4.20 Our consumer research found that customers are interested in service and would

consider service information if it were presented to them by digital comparison

services, financial commentators or the media. Currently, the larger, better known

digital comparison services that provide comparisons for financial services (for

example, insurance, credit and banking products) do not compare providers on the

quality of their bank account service. We understand this is due to the lack of regular,

comparable information and that digital comparison services would use new regulated

service information to rank or recommend current accounts and draw attention to

varying levels of service between brands in one place.

4.21 Research in behavioural economics tells us that consumers can find multiple indicators

difficult to assess and compare.

12

We have been mindful of this and are proposing

to require service information only in a handful of areas that are of most interest to

customers. However this still necessitates multiple indicators. There is an important

role for digital comparison services to bring the service information we propose

to require together in a useful, engaging and meaningful way so that it is easy for

customers to access and compare. Doing so would allow customers to compare

accounts based on their own preferences and account usage, going beyond current

comparisons based on price.

11 www.fca.org.uk/publication/forms/mutuals-cu-common-bond-specimen-wording.doc

12 See, for example, ‘Price Lab: An investigation of consumers’ capabilities with complex products’, which can be accessed here:

www.esri.ie/pubs/BKMNEXT306.pdf

19

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

4.22 We are aware that people who are digitally excluded are unlikely to access service

information online. However, we consider that these customers will still benefit

from our proposals. We expect service indicators to be of interest to financial

commentators and the media and that commentary about service quality will appear

in off-line publications. Firms may also choose to use published service metrics in their

marketing. Further, as discussed in paragraph 2.7, we consider that publishing service

information will result in improvements in firms’ service that will benefit all customers.

We will monitor the distribution of the impacts of requiring publication of service

information, including for digitally excluded customers.

Our proposal

4.23 Publishing service information will make it easier for customers to compare accounts.

We expect intermediaries including digital comparison services and the media to

incorporate service information into their offer and that this will be a key channel

through which customers access the information. This method of distribution

reflects customer preferences for accessing service information and it works for

the detailed nature of the metrics and information proposed. We understand that

digital comparison services see opportunities to make the information available to

consumers. For BCAs this data will be available for digital comparison services that may

emerge in 2018 from work of the National Endowment for Science Technology and the

Arts (NESTA) on behalf of the CMA to develop new comparison websites.

13

4.24 We propose to require firms to publish the service information and metrics we will

require on their websites so that they are easily accessible to customers, digital

comparison services and other intermediaries. It is our policy intention that over

time firms will make the information available via API as this format is preferred by

many digital comparison services. However, we are mindful that the costs to firms

not already using API may be very significant, at least initially. We propose to require

firms that are part of the Open Banking initiative to make the service information

and metrics we require available via the same API as they are required to make the

CMA core indicators available from August 2018. We expect firms to work with Open

Banking to do this.

4.25 We think there are incentives for other firms to make this information available via

API, for example because it will be easier for digital comparison services to use it. We

expect many firms will use an API to meet obligations in PSD2 to enable customers

to use the services of account information service providers and payment initiation

service providers. If they do use an API for this purpose we propose to require them

to also make service information available via API. In other cases, we expect digital

comparison services to be able and willing to access data published on firms’ websites.

4.26 Participants in our customer research wanted reassurance about the methodology

and comparability of information. To provide certainty that an independent body has

set the parameters of the service information, we propose to require firms to state

that they are required by the FCA to publish it. Firms which also publish the CMA core

indicators should make clear that the statement that it is required by the FCA does

not refer to the CMA indicators. In addition, we propose to specify the language firms

must use to describe the service information. This is to ensure consistency between

firms and improve ease of comparability. It is important that service information

we prescribe is clear to firms, customers, and intermediaries including comparison

services, so we welcome views on the language chosen.

13 See http://www.nesta.org.uk/project/open-challenge

20

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

4.27 Beyond this, we are not currently proposing to prescribe a presentational style

provided that the language we propose is used and the information is easily accessible.

We consider that information will be more engaging to customers in the firm’s own

presentational style. It is our understanding that intermediaries, including digital

comparison services, can access and compare information that may be presented in a

different format if the content is common. The tables in the proposed BCOBS 7 Annex

1R contain the language we propose to require firms to use.

4.28 We propose that firms notify us of the webpages where they publish the service

information and we may aggregate the data for our own use.

Q7: Do you agree that our proposals will make service

information easily accessible to customers?

Q8: Do you agree that comparison services are an important

route through which customers will access and assess the

service information we propose to prescribe?

Q9: Do you agree with the proposals to require publication via

anAPI,initiallyforthosermsrequiredtobepartofOpen

Bankingandsubsequentlyforthosermsthatwillusean

API for the purposes of PSD2?

Q10: Doyouagreethatweshouldspecifythelanguagerms

use to describe the service information, but not its

presentational format?

Timing and frequency

Discussion

4.29 The first set of CMA core service indicators will be published in August 2018 and we

see significant benefits to launching the additional service information we propose

at the same time. The CMA metrics will be relevant to the banking arrangements of

the vast majority of consumers and we expect them to attract attention from the

media. Aligning with the launch of the CMA metrics will also ensure additional service

information is available for digital comparison services to use in any new services they

plan to launch using the CMA core indicators.

4.30 We have considered the frequency with which we will require publication. The CMA

survey data will be collected over 12 months and published on a rolling six monthly

basis. Quarterly reporting of additional "objective" service indicators would provide

firms a regular opportunity and therefore incentive to improve any areas of poor

performance highlighted. It would also provide more up-to-date insights into the

service available to customers.

Our proposal

4.31 We propose to require firms to measure and publish the service metrics on a quarterly

basis, starting with the first reporting period in the second quarter of 2018 (April-June),

with publication due within six weeks of each end quarter. This allows firms six weeks

to review and quality assure the data, and it also means that the publication dates will

align with the twice yearly reporting of the CMA core service quality survey results.

21

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

Table 1 shows the cycle for the first year of reporting. The date of first collection of

data is determined by the objective of aligning first publication of our proposed metrics

and information with that of the first CMA core service indicators. We propose that the

following years follow the same cycle in order to remain aligned with future CMA survey

results. Standing data should be published and kept up-to-date.

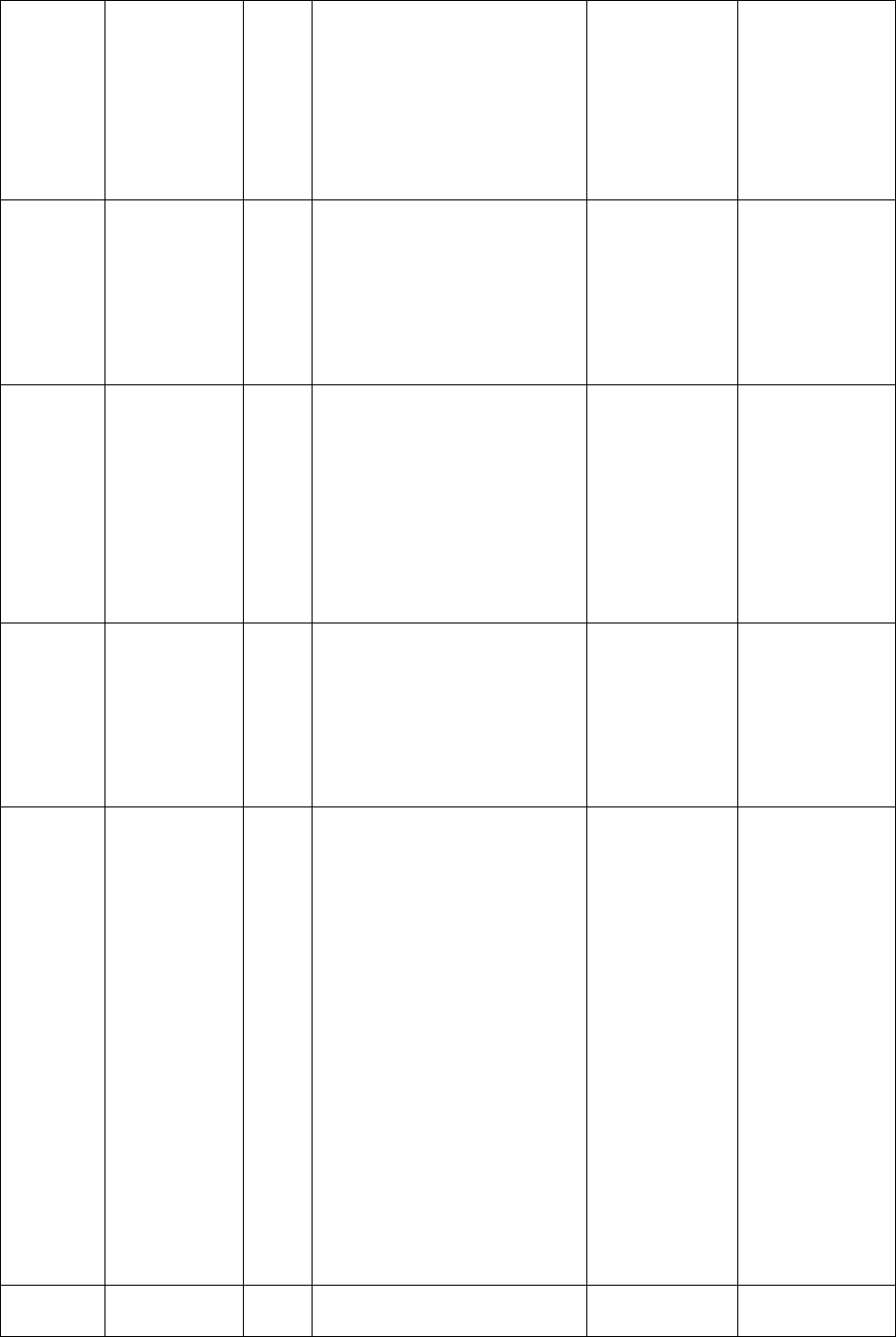

Table 1: Proposed reporting timetable for the rst year

Reporting period

Start of reporting

period

End of reporting

period

Publication of

service information

Q1 2018/19 1 April 2018 30 June 2018 By 15 August 2018

Q2 2018/19 1 July 2018 30 September 2018 By 15 November 2018

Q3 2018/19 1 October 2018 31 December 2018 By 15 February 2019

Q4 2018/19 1 January 2019 31 March 2019 By 15 May 2019

4.32 We have discussed timescales for implementation with firms. We recognise that our

timetable gives firms a limited time period to implement systems changes required

to report performance in a consistent manner. We will seek to make rules as quickly

as practical following this consultation to give firms as much time as possible to

implement.

Q11: Do you agree with our plans for the timing and frequency

ofpublication?Inparticular,doyouagreethattherst

publication of service information under the rules that we

are proposing should be in August 2018, to coincide with

therstoftheCMA'sservicequalityindicators?

The service information

4.33 As discussed in Chapter 3 we undertook significant pre-consultation to decide

whether we should require additional information about service to be published. We

found the following areas of service were of most interest to customers, challengers

and intermediaries including digital comparison services:

• Account opening

• Time taken to resolve issues

• Service availability

• Major incidents

4.34 The remainder of this chapter discusses the case for requiring firms to publish service

information for each of the service areas discussed above. It seeks feedback on the

service information we propose to require firms to publish.

4.35 We found that most of the service information we propose to require was equally

relevant for both BCA and PCA customers, except for third party access under power

of attorney which is only relevant to PCA customers. However, firms often deliver

22

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

services differently to PCA and BCA customers, so we consider it is proportionate and

necessary to separate reporting of BCA and PCA metrics in the majority of cases.

4.36 Where we specify service information by channel we refer to the following definitions:

• Mobile banking – accessing an account via a banking app via any device (including

smart phone or computer)

• Online banking – accessing an account via the internet but not through mobile

banking

• Telephone banking – use of a phone to access an account but not via mobile banking.

Service metrics

4.37 Our research suggests that the dimension of service which is most motivating for

customers and easiest for them to compare across firms is, in many cases, the elapsed

time from when they applied for or requested the service until they receive the service.

To introduce such metrics we have defined a set of events which are sufficiently broad

that they will be of relevance to customers but have start and end times that can be

defined and measured comparably by firms.

4.38 We have considered how best to measure and communicate elapsed time to

customers. Participants in our research were interested in the service they should

expect to receive rather than average service. Following discussions at our SEG and

having considered the management information that firms already collect, we consider

that several metrics are required to provide a realistic indication of service:

• The percentage of customers provided the service on the same day - this shows

how often rms are able to provide the service immediately (within the same day)

• The average number of days within which the service was provided - this provides a

reasonable basis upon which customers can compare rms but may not provide an

accurate indication of how long customers can expect to wait

• The number of days within which the service was provided for 99% of customers –

this shows the longest a customer might normally expect to wait before the issue is

resolved. We recognise that a small number of customer requests may be dicult

to resolve for reasons outside of rms’ control. We note that some rms already

measure the time taken to provide the service to 99% of customers so consider it

proportionate for rms to continue using this measure as we have no evidence that

it is unsuitable.

Standing data

4.39 In other areas of service, the motivating aspect of the service provided by a firm is in

what way customers can access services and when they can speak to somebody who

is suitably trained to answer their query or resolve an issue. In addition, customers

need to know what documents or other information they need to supply to their

current account provider in order to obtain various services. Both these types of

information will change infrequently and are not suited to traditional measurement.

23

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

Account opening

Discussion

Speed of opening an account

4.40 Our research found that PCA and BCA customers were very interested in the time

taken for a new account to become fully functional, with particular emphasis on access

to money and avoiding interruptions to direct debits. While the seven working day

Current Account Switching Service has standardised the switching process between

participant banks, this process only starts once an account has been opened. There

is differentiation, particularly from challengers, on the speed and ease of opening an

account prior to the start of the seven day switch process but this information is not

currently provided to customers comparing accounts. Digital comparison services

have indicated that as this information is relevant to customers they would use this

information in their services if it was available on a consistent basis. We consider that

making objective information about account opening available at the point of account

comparison would remove some of the remaining uncertainty around switching and

enable consumers to make more informed decisions.

4.41 Conversations with firms about service metrics have highlighted concerns that

logging every customer enquiry regarding account opening would be challenging

and potentially invasive. Firms have also stressed that the time customers take to

complete their application following initial enquiry is influenced by factors outside

of the bank or building society’s control. Firms have indicated it would be more

comparable between firms to define a reporting standard that commenced from the

point a customer submitted a completed application including required identification.

We recognise the difficulties and delays customers can experience in the early stages

of the account opening process. However, we consider firms have raised legitimate

issues that hinder measurement prior to submission of a complete application. To

incentivise firms to compete on the ease of applying for a current account we propose

to require firms to publish standing data covering aspects of this process.

4.42 We recognise that there is a tension between introducing metrics related to speed

of account opening and the importance of firms conducting robust and thorough

anti-money laundering and fraud checks, including customer due diligence (CDD)

when opening an account. To avoid this conflict we considered requiring metrics that

did not start until after CDD was complete, as is the case for the seven working day

current account switching process. However, we do not consider this information

would be as useful or as readily understood by customers as a measure covering the

whole account opening process following application, and do not consider concerns

regarding possible impacts on CDD to be insurmountable. Existing FCA rules require

firms’ on-boarding processes, including CDD, to be effective and risk-based; our

service metrics will not alter this. We consider that technological advances mean it is

possible to improve the efficiency of on-boarding processing times without sacrificing

thoroughness.

4.43 Conversations with firms have also highlighted that there are variations in processes

following account opening. From a customer perspective an account is not fully

functional until they can access the services they require. Some providers are able to

provide customers with a debit card and/or access to online and telephone banking

on 'day one' in branches while others have to provide these by post. We consider

that breaking down the account opening process into component parts will provide

customers with sufficient insight into when they can expect the amount to be

functional.

24

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

4.44 The CMA found that PCA customers who are heavy overdraft users could benefit the

most financially from switching their current account.

14

We are separately considering

overdrafts as part of our review of High Cost Credit.

15

We consider that if firms publish

information about the time it takes to make overdraft funds available following account

opening this would help improve certainty for overdraft users who are considering

switching but will require access to overdraft funds very soon after their account is

open. We are mindful of a possible unintended consequence if firms were to offer

fewer overdrafts to personal customers in order to speed up the approval process, but

we consider this a low risk.

Our proposed service information for account opening

Standing data about the account opening process

4.45 We propose to require providers to either publish standing data for each of their PCA

and BCA products (per brand) about the minimum information and documents needed

to open an account, and about how accounts may be opened, or publish a statement

that they do not publish this information. Firms will be free to publish a single set of

standing data, and indicate any variation between accounts. We recognise that a

customer’s circumstances, for example lack of a credit record or a digital footprint,

may impact the account opening process. Information published about the account

opening process should advise customers of circumstances where they may need to

follow a different procedure.

4.46 We also propose to require publication of a statement on the following questions:

• Whether the rm publishes all the information required to open an account in one

place. If it does then the rm must list it or provide a weblink to its location.

• Whether an account can be opened without visiting a branch

• Whether an account can be opened without an appointment in a branch

• Whether an account can be opened with identication provided electronically

• Whether an account can be opened by post

4.47 We also propose to require providers to publish standing data relating to the availability

of a channel through which they can discuss the account opening process, including

how and when customers can apply to open an account, the account opening process,

and overdraft eligibility. See paragraphs 4.76-4.83 on service availability for further

information.

Account opening

4.48 We propose to split measurement of the account opening process into stages to

reflect firms’ differing approaches to the account opening process. When considered

as a set, the metrics will provide an overview of the account opening process from

submission of a complete application to provision of a debit card online banking and

arranged overdraft funds. We propose that for each of these stages firms measure and

publish a same day, average and 99% response time metric (see paragraph 4.38).

14 https://assets.publishing.service.gov.uk/media/57ac9667e5274a0f6c00007a/retail-banking-market-investigation-full-final-report.

pdf

15 www.fca.org.uk/news/press-releases/fca-launches-call-input-high-cost-credit-and-overdrafts

25

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

4.49 The first proposed metrics will require providers to show the time taken from

submission of a complete application to the account being open, ie, the point at

which the customer has been given an account number and can make deposits. This

is intended to reflect the speed of service customers can expect if they submit a

complete application, including required proof of identification.

4.50 Firms that publish a list of the information and documents needed to open an account

will only need to measure the time taken to open the account (as above, have a working

account number) from the point at which they receive all the listed information and

documents. They will not need to include in their metrics those cases where additional

information or documents are required on a case-by-case basis.

4.51 Firms who do not publish a list will have to measure and include in their metrics

all account openings, from the point at which the application is first submitted,

irrespective of whether it is a complete application and irrespective of whether the

firm needs to request further information or documents. The intention here is to

incentivise firms to publish a list, and to ensure that there is no perverse incentive to

avoid requesting further information or documents in appropriate cases (for example,

for client due diligence or anti-fraud purposes).

4.52 We also propose to require providers to publish separate metrics related to the

time taken, following account opening, for a debit card, online banking and arranged

overdraft funds to be available to the customer.

4.53 These metrics are intended to show customers how long they can expect to wait

for services related to their new account to be provided. We recognise that many

customers rely on other services such as access to telephone banking and mobile

banking but consider that limiting metrics to cover the time taken to receive a

debit card, and online banking and arranged overdraft funds to be available to be

proportionate and indicative of the overall speed of service customers can expect at

account opening.

4.54 We propose that each of these metrics should be measured and published separately

rather than as a single metric covering the whole account opening process. Each

metric should be measured and published separately for PCAs and BCAs but not for

each account type. We propose that metrics cover PCAs and BCAs opened via all

channels; we are not proposing that firms publish separate metrics for each channel

as we do not expect that channel will significantly affect the time taken to open the

account.

4.55 The relevant service or action should be included in published service information

for the quarter in which it takes place, irrespective of the quarter in which the other

services or actions take place or the quarter in which the application was made. We

propose that the time taken to, for example, issue a debit card should be measured

up to the point when the customer receives the replacement card (and PIN), but not

activation; we therefore propose that, unless the customer receives the relevant items

on the same day, they be treated as received on the day on which the customer would

be expected to receive them based on the delivery method by which the firm sent

them. Similarly, internet banking should only be treated as enabled once the customer

is expected to have received everything necessary from the firm to access it.

26

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

Q12: Do you agree with the proposed standing data and

metrics for the account opening process?

Q13: Doyouagreethatrmsshouldpublishseparatemetrics

related to the opening of an account, provision of a debit

card, online banking, and an overdraft?

Q14: Doyouagreewithourproposalnottorequirermsto

publish separate metrics for each channel through which

a customer can open an account?

Time taken to replace a debit card, and to give an attorney access to a PCA

Discussion

4.56 Our research found that both PCA and BCA customers would value information about

responsiveness.

4.57 Firms already report information about complaints resolution to us and this is

published on our website. If firms submit a report to the FCA reporting 500 or more

complaints they are required to publish a summary of the complaints data on their

own website.

16

Our experience of complaints reporting has shown that publishing this

information has encouraged firms to improve their performance. Since firms already

publish information about complaints we do not consider it proportionate to require

firms to publish additional information about complaints as part of our current account

service information work.

4.58 Firms do not report or publish information about resolution of requests and issues that

are not complaints. As explained in Chapter 3, participants in our research considered

how quickly they could expect to get a response to a typical question or request to

be a good indicator of overall bank service. They said they would consider switching

provider to receive quicker service. They recognised that they would not expect

firms to publish metrics on everything, but considered some metrics would give an

indication of the levels of service they could expect to receive overall, particularly when

considered alongside the CMA core indicators.

4.59 Digital comparison services in our SEG considered information about the length of

time taken to resolve typical customer queries/issues by channel a good indicator of

service quality that would be easy for them to display and for customers to understand.

However, feedback from the majority of firms has indicated that reporting response

times would require significant changes to their systems and in some circumstances,

particularly for queries made in-branch, response time would be difficult to measure.

4.60 We have considered firms’ concerns and propose to introduce only a limited number of

response time metrics, at least initially. Metrics we propose to introduce relate to:

• Replacing a lost or stolen or stopped debit card, and

• Organising third party access to a PCA under power of attorney.

16 DISP 1.10A1

27

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

4.61 Replacing a stopped card is an inconvenience. We consider that a metric that reflects

the speed with which customers can expect to receive a replacement card is a service

event that is easy to measure and one that will resonate with customers.

4.62 Participants in our research highlighted difficulties arranging third party access to

accounts under power of attorney. We have been working with stakeholders as part

of our Ageing Population project

17

to understand how the financial sector can better

support people who require third party access to accounts. There is significant

scope to improve access to third party access arrangements, and this will require

improvements to services. The BBA recently agreed and published principles (a

voluntary code of practice) to improve access.

18

Given the known issues with third

party access and the growing number of people who require this service, we consider

that requiring publication of service information in this area will provide customers with

a good indication of the quality of service they can expect to receive from firms if they

encounter difficulties with their banking.

4.63 There are many types of third party access ranging from third party mandates agreed

between the customer, third party and the firm, to various legal instruments granting

access including, for example, Lasting Power of Attorney, Appointeeship and Court of

Protection Deputyship. Legislation varies between England and Wales, Scotland and

Northern Ireland. Firms’ processes may not be comparable between types of third

party access arrangements. We propose that our metrics in this area cover powers of

attorney, since we understand these are the most common forms of arrangement.

4.64 We recognise that the early stages of the third party access process, including getting

clear information about how to apply and what documentation is required, can cause

delays and be frustrating for customers. However, it is difficult to measure quality of

these services objectively. We consider that requiring firms to state whether they

have published complete information about how to apply for third party access under

a power of attorney and requiring them to state the hours and channels through which

customers can access staff trained to deal with third party access requests will assist

customers. We discuss our proposals for this in paragraphs 4.76 – 4.83.

4.65 As with our proposed account opening metrics, we considered whether metrics

related to third party access should measure time taken to perform customer due

diligence - for example checking identification and the authenticity of the original

or certified power of attorney certificates provided. As discussed in paragraph 4.42,

we recognise the potential concern that firms might reduce the thoroughness or

compromise anti-money laundering or fraud checks, but consider that there are

adequate incentives for firms to ensure their processes are robust, and also that there

is room for firms to improve the efficiency of their processes.

4.66 Third party access agreements via power of attorney vary. Some attorneys will be

able to access all account features, including use of internet banking and a debit card,

while others may be restricted to viewing account information or making payments by

cheque or in person. For this reason, we do not consider it is possible to define a single

point at which third party access has been granted. Instead we propose is to require

multiple metrics that, as for account opening, capture separate stages of the process

to give an attorney access to a PCA.

17 www.fca.org.uk/publications/discussion-papers/ageing-population-financial-services

18 https://www.bba.org.uk/news/bba-voice/a-little-help-from-friends-and-family

28

CP17/24

Chapter 4

Financial Conduct Authority

Information about current account services

Our proposed metrics for time taken to replace a debit card, and to give an

attorney access to a PCA

Time taken to replace a lost, stolen or stopped debit card

4.67 We propose to require firms to publish the same day, average and 99% response time

metrics (see 4.38) for the time taken to replace lost or stolen cards or cards otherwise

stopped, eg following a security incident. We propose to require these metrics to be

published separately for PCAs and BCAs.

4.68 Measurement of metrics should include cards reported lost or stolen or otherwise

stopped by the firm, and requests made by telephone, in a branch or via online banking

or mobile banking or by any other channel. Time taken to provide the replacement card

should be measured in the same way as for provision of a debit card with a new account

(see paragraphs 4.48-4.55).

4.69 The draft guidance in the instrument which appears at Appendix 1 to this CP refers

to the Payment Services Regulations 2017, which will require a payment service

provider to allow the use of the payment instrument or replace it with a new payment

instrument as soon as practicable after the reasons for stopping its use cease to

exist.

19

Time taken to provide third party access to a PCA under power of attorney

4.70 We propose to require providers to either publish standing data for each of their PCA

products (per brand) about the information and documents necessary to apply for

third party access to a PCA under a power of attorney or a statement that they do not

publish this information. Firms will be free to publish a single set of data, and indicate

any variation between accounts. Information published about access via power of

attorney should advise customers of circumstances where they may need to follow a

different procedure. We propose to require firms that do publish this information to

publish a link to it alongside the statement.

4.71 We propose to split measurement of the process to grant third party access to an

attorney into four stages for the reasons described in paragraph 4.66. For each metric

we will expect firms to publish the same day, average and 99% response time (see

paragraph 4.38).

4.72 The first proposed metric requires providers to show the time taken to provide an

attorney access to the account. By this we mean access that enables the attorney

to ascertain the account balance and obtain information about transactions on the

account. We propose that this metric be measured from the point that the attorney

has requested access and has provided all required ID and documentation to the firm.