AMC Entertainment Holdings, Inc.

2022 Annual Report to Stockholders

On the following pages you will find our Form 10-K for the fiscal year ended December 31, 2022, but excluding

Item 15(b) Exhibits, which have been filed with the Securities and Exchange Commission on February 28,

2023. This Annual Report to Stockholders does not include the contents of the Form 10-K/A (Amendment No. 1)

filed with the Securities and Exchange Commission on April 28, 2023, because the information contained in

such Form 10-K/A is included in the proxy statement for the Company’s 2023 Annual Meeting of Stockholders

which was made available to stockholders concurrently with this document.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT

OF 1934

For the fiscal

y

ear ended December 31, 2022

O

R

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the transition period from to

Commission file number 001-33892

AMC ENTERTAINMENT HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

26-0303916

(I.R.S. Employer Identification No.)

One AMC Way

11500 Ash Street, Leawood, KS

(

Address of

p

rinci

p

al executive offices

)

66211

(

Zi

p

Code

)

(913) 213-2000

Registrant’s telephone number, including area code:

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol Name of each exchange on which registered

Class A common stoc

k

AMC New York Stock Exchange

AMC Preferred Equity Units, each constituting a depositary share representing a 1/100th

interest in a share of Series A Convertible Participating Preferred Stoc

k

APE New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of

Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒

No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and emerging growth company in Rule 12b-2

of the Exchange Act.

Large accelerated filer

☒

Accelerated filer ☐ Non-accelerated filer ☐

Smaller reporting company ☐ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262 (b)) by the registered public accounting firm that prepared or issued its audit

report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the

filing the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received

by any of the registrant’s executive officers during the relevant recovery period pursuant to§240.10D-1(b).

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2022, computed by reference to

the price at which the registrant’s Class A common stock was last sold on the New York Stock Exchange on such date was $7,002,919,062 (516,820,595 shares at a

closing price per share of $13.55).

Shares of Class A common stock outstanding—517,580,416 shares at February 22, 2023

Shares of AMC Preferred Equity Units outstanding, each representing participating voting and economic rights in the equivalent of one (1) share of Class A

common stock —929,849,612 shares at February 22, 2023

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s definitive proxy statement, in connection with its 2022 annual meeting of stockholders, to be filed within 120 days of

December 31, 2022, are incorporated by reference into Part III of this Annual Report on Form 10-K.

1

AMC ENTERTAINMENT HOLDINGS, INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2022

INDEX

Page

PART I

Item 1.

Business ........................................................................... 5

Item 1A.

Risk Factors ........................................................................ 19

Item 1B.

Unresolved Staff Comments ........................................................... 38

Item 2.

Properties .......................................................................... 39

Item 3.

Legal Proceedings ................................................................... 39

Item 4.

Mine Safety Disclosures .............................................................. 39

PART II

Item 5.

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities .................................................................... 40

Item 6.

[Reserved] .......................................................................... 44

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations ......... 44

Item 7A.

Quantitative and Qualitative Disclosures about Market Risk . . . ............................... 79

Item 8.

Financial Statements and Supplementary Data ............................................. 81

Item 9.

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure ........ 155

Item 9A.

Controls and Procedures ............................................................... 155

Item 9B.

Other Information .................................................................... 155

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections ........................... 156

PART III

Item 10.

Directors, Executive Officers and Corporate Governance . . . . . . . ............................. 157

Item 11.

Executive Compensation ............................................................... 157

Item 12.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder

Matters ............................................................................ 157

Item 13.

Certain Relationships and Related Transactions, and Director Independence .................... 157

Item 14.

Principal Accountant Fees and Services .................................................. 157

PART IV

Item 15.

Exhibits, Financial Statement Schedules .................................................. 158

Item 16

Form 10-K Summary .................................................................. 167

2

Forward-Looking Statements

In addition to historical information, this Annual Report on Form 10-K contains “forward-looking statements”

within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words such as “may,” “will,” “forecast,” “estimate,”

“project,” “intend,” “plan,” “expect,” “should,” “believe” and other similar expressions that predict or indicate future

events or trends or that are not statements of historical matters. These forward-looking statements are based only on our

current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies,

projections, anticipated events and trends, the economy and other future conditions and speak only as of the date on

which it is made. Examples of forward-looking statements include statements we make regarding the impact of COVID-

19, future attendance levels, operating revenues and our liquidity. These forward-looking statements involve known and

unknown risks, uncertainties, assumptions and other factors, including those discussed in “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which may cause our actual

results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to,

the following:

• the risks and uncertainties relating to the sufficiency of our existing cash and cash equivalents and available

borrowing capacity to comply with minimum liquidity and financial requirements under our debt covenants

related to borrowings pursuant to the Senior Secured Revolving Credit Facility (as defined in Note 8—

Corporate Borrowings and Finance Lease Liabilities in the Notes to the Consolidated Financial Statements

under Part II, Item 8 thereof), fund operations, and satisfy obligations including cash outflows for deferred

rent and planned capital expenditures currently and through the next twelve months. In order to achieve net

positive operating cash flows and long-term profitability, operating revenues will need to increase

significantly from 2022 levels to levels in line with pre-COVID-19 operating revenues. Domestic industry

box office grosses increased significantly to approximately $7.5 billion during the twelve months ended

December 31, 2022 compared to approximately $4.5 billion during the twelve months ended December 31,

2021. For the twelve months ended December 31, 2019 the domestic industry box office was $11.4 billion.

The Company believes the anticipated volume of titles available for theatrical release and the anticipated

broad appeal of many of those titles will support increased operating revenues and attendance levels.

However, there remain significant risks that may negatively impact operating revenues and attendance

levels, including changes to movie studios release schedules and direct to streaming or other changing

movie studio practices. If we are unable to achieve significantly increased levels of attendance and

operating revenues, we may be required to obtain additional liquidity. If such additional liquidity is not

obtained or insufficient, we likely would seek an in-court or out-of-court restructuring of our liabilities, and

in the event of such future liquidation or bankruptcy proceeding, holders of our Common Stock, AMC

Preferred Equity Units, and other securities would likely suffer a total loss of their investment;

• the ongoing impact of COVID-19 to operations at our theatres, personnel reductions and other cost-cutting

measures and measures to maintain necessary liquidity and increases in expenses relating to precautionary

measures at our facilities to protect the health and well-being of our customers and employees;

• increased use of alternative film delivery methods including premium video on demand or other forms of

entertainment;

• the risk that the North American and international box office in the near term will not recover sufficiently,

resulting in higher cash burn and the need to seek additional financing;

• risks and uncertainties relating to our significant indebtedness, including our borrowings and our ability to

meet our financial maintenance and other covenants;

• shrinking exclusive theatrical release windows or release of movies to theatrical exhibition and streaming

platforms on the same date, and the theatrical release of fewer movies;

• the seasonality of our revenue and working capital, which are dependent upon the timing of motion picture

releases by distributors, such releases being seasonal and resulting in higher attendance and revenues

generally during the summer months and holiday seasons;

3

• intense competition in the geographic areas in which we operate among exhibitors or from other forms of

entertainment;

• certain covenants in the agreements that govern our indebtedness may limit our ability to take advantage of

certain business opportunities and limit or restrict our ability to pay dividends, pre-pay debt, and also to

refinance debt and to do so at favorable terms;

• risks relating to impairment losses, including with respect to goodwill and other intangibles, and theatre

and other closure charges;

• risks relating to motion picture production and performance;

• general and international economic, political, regulatory, social and financial market conditions, including

potential economic recession, inflation, and other risks that may negatively impact discretionary income

and our operating revenues and attendance levels;

• our lack of control over distributors of films;

• limitations on the availability of capital or poor financial results may prevent us from deploying strategic

initiatives;

• an issuance of preferred stock, including the Series A Convertible Participating Preferred Stock

(represented by AMC Preferred Equity Units), could dilute the voting power of the common stockholders

and adversely affect the market value of our Common Stock and AMC Preferred Equity Units;

• limitations on the authorized number of Common Stock shares prevents us from raising additional capital

through common stock issuances;

• our ability to achieve expected synergies, benefits and performance from our strategic initiatives;

• our ability to refinance our indebtedness on terms favorable to us or at all;

• our ability to optimize our theatre circuit through new construction, the transformation of our existing

theatres, and strategically closing underperforming theatres may be subject to delay and unanticipated

costs;

• failures, unavailability or security breaches of our information systems;

• our ability to utilize interest expense deductions will be limited annually due to Section 163(j) of the Tax

Cuts and Jobs Act of 2017;

• our ability to recognize interest deduction carryforwards, net operating loss carryforwards, and other tax

attributes to reduce our future tax liability;

• our ability to recognize certain international deferred tax assets which currently do not have a valuation

allowance recorded;

• impact of the elimination of the calculation of USD LIBOR rates on our contracts indexed to USD LIBOR;

• review by antitrust authorities in connection with acquisition opportunities;

• risks relating to the incurrence of legal liability, including costs associated with the ongoing securities class

action lawsuits;

4

• dependence on key personnel for current and future performance and our ability to attract and retain senior

executives and other key personnel, including in connection with any future acquisitions;

• increased costs in order to comply or resulting from a failure to comply with governmental regulation,

including the General Data Protection Regulation (“GDPR”) and all other current and pending privacy and

data regulations in the jurisdictions where we have operations;

• supply chain disruptions may negatively impact our operating results;

• the availability and/or cost of energy particularly in Europe;

• the dilution caused by recent and potential future sales of our Common Stock and AMC Preferred Equity

Units, including the implications of the proposed conversion of the Series A Convertible Participating

Preferred Stock (which are represented by AMC Preferred Equity Units) to Common Stock, if approved,

could adversely affect the market price of the Common Stock and AMC Preferred Equity Units;

• the market price and trading volume of our shares of Common Stock has been and may continue to be

volatile and such volatility may also apply to our AMC Preferred Equity Units, and purchasers of our

securities could incur substantial losses;

• future offerings of debt, which would be senior to our Common Stock and AMC Preferred Equity Units for

purposes of distributions or upon liquidation, could adversely affect the market price of our Common Stock

and AMC Preferred Equity Units;

• failure to receive the requisite approval necessary from our stockholders at our Special Meeting (as defined

herein) to approve the Charter Amendment Proposals (as defined in Note 16—Subsequent Events in the

Notes to the Consolidated Financial Statements under Part II, Item 8 thereof);

• the potential for political, social, or economic unrest, terrorism, hostilities, cyber-attacks or war, including

the conflict between Russia and Ukraine and that Sweden and Finland (countries where we operate

approximately 100 theatres) signed the accessions protocols on July 5, 2022. If completed, the accession

could cause a deterioration in the relationship each country has with Russia;

• the potential impact of financial and economic sanctions on the regional and global economy, or

widespread health emergencies, such as COVID-19 or other pandemics or epidemics, causing people to

avoid our theatres or other public places where large crowds are in attendance;

• anti-takeover protections in our amended and restated certificate of incorporation and our amended and

restated bylaws may discourage or prevent a takeover of our Company, even if an acquisition would be

beneficial to our stockholders; and

• other risks referenced from time to time in filings with the SEC.

This list of factors that may affect future performance and the accuracy of forward-looking statements is

illustrative but not exhaustive. In addition, new risks and uncertainties may arise from time to time. Accordingly, all

forward-looking statements should be evaluated with an understanding of their inherent uncertainty and we caution

accordingly against relying on forward-looking statements.

Except as required by law, we assume no obligation to publicly update or revise these forward-looking

statements for any reason. Actual results could differ materially from those anticipated in these forward-looking

statements, even if new information becomes available in the future.

Readers are urged to consider these factors carefully in evaluating the forward-looking statements. For further

information about these and other risks and uncertainties as well as strategic initiatives, see Item 1A. “Risk Factors” and

Item 1. “Business” in this Annual Report on Form 10-K.

5

PART I

Item 1. Business.

General Development of Business

AMC Entertainment Holdings, Inc. (“Holdings”), through its direct and indirect subsidiaries, including

American Multi-Cinema, Inc. and its subsidiaries, (collectively with Holdings, unless the context otherwise requires, the

“Company” or “AMC”), is principally involved in the theatrical exhibition business and owns, operates or has interests

in theatres primarily located in the United States and Europe.

Our business was founded in Kansas City, Missouri in 1920. Holdings was incorporated under the laws of the

state of Delaware on June 6, 2007. We maintain our principal executive offices at One AMC Way, 11500 Ash Street,

Leawood, Kansas 66211.

COVID-19 Impact, Company Response and Change in Business Strategy

The North American and International industry box offices have been significantly impacted by the COVID-19

pandemic. The COVID-19 pandemic resulted in the suspension of new movie production, studios postponed new film

releases or moved them to the home video market, streaming, or premium video on demand (“PVOD”) platforms.

The number of previously delayed major movie title releases increased significantly in the second half of 2021,

however the production backlog, due to the COVID-19 pandemic, resulted in significantly fewer wide releases during

2022. A more robust slate of major movie releases is expected during 2023, which has generated optimism that box

office revenues and attendance levels will continue to improve from what we experienced in 2022. The box office

performance in 2022 was also impacted by the direct or simultaneous release of movie titles to the home video or

streaming markets in lieu of theatre exhibition, however this practice has diminished and we believe will have a smaller

impact on the box office performance and attendance levels of our business in 2023.

As of December 31, 2022, we had cash and cash equivalents of approximately $631.5 million. In response to

the COVID-19 pandemic, we adjusted certain elements of our business strategy and took significant steps to preserve

cash. We are continuing to take significant measures to further strengthen our financial position and enhance our

operations, by eliminating non-essential costs, including reductions to our variable costs and elements of our fixed cost

structure, introducing new initiatives, and optimizing our theatrical footprint.

Additionally, we enhanced liquidity through debt issuances, debt refinancing that extended maturities,

purchases of debt below par value, and equity sales. See Note 8—Corporate Borrowings and Finance Lease Liabilities,

Note 9—Stockholders’ Equity, and Note 16—Subsequent Events in the Notes to the Consolidated Financial Statements

under Part II, Item 8 thereof, for further information.

We believe our existing cash and cash equivalents, together with cash generated from operations, will be

sufficient to fund our operations, satisfy our obligations, including cash outflows to repay rent amounts that were

deferred during the COVID-19 pandemic and planned capital expenditures, and comply with minimum liquidity and

financial covenant requirements under our debt covenants related to borrowings pursuant to the Senior Secured

Revolving Credit Facility for at least the next twelve months. In order to achieve net positive operating cash flows and

long-term profitability, we believe that operating revenues will need to increase significantly from 2021 and 2022 levels

to levels in line with pre-COVID-19 operating revenues. We believe the anticipated volume of titles available for

theatrical release, and the anticipated broad appeal of many of those titles will support increased operating revenues and

attendance levels. We believe that recent operating revenues and attendance levels are positive signs of continued

demand for the moviegoing experience. Total revenues for the years ended December 31, 2022, 2021, and 2020 were

$3.9 billion, $2.5 billion, and $1.2 billion, respectively, compared to $5.5 billion for the year ended December 31, 2019.

For the years ended December 31, 2022, 2021, 2020, attendance was 201.0 million patrons, 128.5 million patrons, and

75.2 million patrons, respectively, compared to 356.4 million patrons for the year ended December 31, 2019. Moreover,

it is difficult to predict future operating revenues and attendance levels and there remain significant risks that may

negatively impact operating revenues and attendance, including movie studios release schedules, the production and

theatrical release of fewer films compared to levels before the onset of the COVID-19 pandemic, and direct-to-streaming

or other changing movie studio practices.

6

We currently estimate that our existing cash and cash equivalents will be sufficient to comply with minimum

liquidity and financial covenant requirements under our debt covenants related to borrowings pursuant to the Senior

Secured Revolving Credit Facility, currently and through the next twelve months. Pursuant to the Twelfth Amendment

(as defined in Note 8—Corporate Borrowings and Finance Lease Liabilities in the Notes to the Consolidated Financial

Statements under Part II, Item 8 thereof), the requisite revolving lenders party thereto agreed to extend the suspension

period for the financial covenant applicable to the Senior Secured Revolving Credit Facility under the Credit Agreement

(as defined in Note 8—Corporate Borrowings and Finance Lease Liabilities in the Notes to the Consolidated Financial

Statements under Part II, Item 8 thereof) through March 31, 2024. The current maturity date of the Senior Secured

Revolving Credit Facility is April 22, 2024; since the financial covenant applicable to the Senior Secured Revolving

Credit Facility is tested as of the last day of any fiscal quarter for which financial statements have been (or were required

to have been) delivered, the financial covenant has been effectively suspended through maturity of the Senior Secured

Revolving Credit Facility. As of December 31, 2022 we were subject to a minimum liquidity requirement of $100

million as a condition to the financial covenant suspension period under the Credit Agreement.

The 11.25% Odeon Term Loan due 2023 (“Odeon Term Loan Facility”) was to mature on August 19, 2023

during the third fiscal quarter of the Company’s next calendar year. On October 20, 2022 we completely repaid the

Odeon Term Loan Facility using existing cash and $363.0 million net proceeds from the issuance of new 12.75% Odeon

Senior Secured Notes due 2027 (“Odeon Notes due 2027”).

We actively seek and expect, at any time and from time to time, to continue to seek to retire or purchase our

outstanding debt through cash purchases and/or exchanges for equity (including AMC Preferred Equity Units) or debt, in

open-market purchases, privately negotiated transactions or otherwise. Such repurchases or exchanges, if any will be

upon such terms and at such prices as we may determine, and will depend on prevailing market conditions, our liquidity

requirements, contractual restrictions and other factors. The amounts involved may be material and to the extent equity is

used, dilutive. During the year ended December 31, 2022, we repurchased $118.3 million aggregate principal of the

Second Lien Notes due 2026 for $68.3 million and recorded a gain on extinguishment of $75.0 million in other expense

(income). These 2022 repurchases included a purchase of $15.0 million aggregate principal of the Second Lien Notes

due 2026 from Antara Capital LP (“Antara”), which subsequently became a related party on February 7, 2023, for $5.9

million and a gain on extinguishment of $12.0 million.

Additionally, during the year ended December 31, 2022 we repurchased $5.3 million aggregate principal of the

Senior Subordinated Notes due 2027 for $1.6 million and recorded a gain on extinguishment of $3.7 million in other

expense (income). Accrued interest of $4.5 million was paid in connection with the repurchases. See Note 8—Corporate

Borrowings and Finance Lease Liabilities in the Notes to the Consolidated Financial Statements under Part II, Item 8

thereof, for more information.

We received rent concessions provided by the lessors that aided in mitigating the economic effects of COVID-

19 during the pandemic. These concessions primarily consisted of rent abatements and the deferral of rent payments. As

a result, deferred lease amounts were approximately $157.2 million as of December 31, 2022. Including repayments of

deferred lease amounts, our cash expenditures for rent increased significantly during the year ended December 31, 2022

compared to December 31, 2021. See Note 3—Leases in the Notes to the Consolidated Financial Statements under Part

II, Item 8 in this Form 10-K for a summary of the estimated future repayment terms for the deferred lease amounts due

to COVID-19, and also a summary of the estimated future repayment terms for the minimum operating lease and finance

lease amounts.

It is very difficult to estimate our liquidity requirements, future cash burn rates, future operating revenues, and

attendance levels. Depending on our assumptions regarding the timing and ability to achieve significantly increased

levels of operating revenue, the estimates of amounts of required liquidity vary significantly. In order to achieve net

positive operating cash flows and long-term profitability, we believe that operating revenues will need to increase

significantly to levels in line with pre-COVID-19 operating revenues. Our current cash burn rates are not sustainable.

Further, we cannot accurately predict what future changes may occur to the supply or release date of movie titles

available for theatrical exhibition. Nor can we know with certainty the impact on consumer movie-going behavior of

studios who release movies to theatrical exhibition and their streaming platforms on the same date, or the potential

operating revenue and impact on attendance related to other studio decisions to accelerate in-home availability of their

theatrical movies. Studio negotiations regarding evolving theatrical release models and film licensing terms are ongoing.

There can be no assurance that the operating revenues, attendance levels, and other assumptions used to estimate our

liquidity requirements and future cash burn rates will be correct, and our ability to be predictive is uncertain due to

limited ability to predict studio film release dates and success of individual titles. Further, there can be no assurances that

7

we will be successful in generating the additional liquidity necessary to meet our obligations beyond twelve months from

the issuance of these financial statements on terms acceptable to us or at all. If we are unable to maintain or renegotiate

our minimum liquidity covenant requirements, it could have a significant adverse effect on our business, financial

condition and operating results.

Please see “Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations

of Part II thereof for additional information.

We realized $1.2 billion of cancellation of debt income (“CODI”) in connection with our 2020 debt

restructuring. As a result, $1.2 billion of our federal net operating losses were eliminated due to tax attribute reduction to

offset the CODI. The loss of these attributes may adversely affect our cash flows and therefore our ability to service our

indebtedness.

Narrative Description of Business

We are the world’s largest theatrical exhibition company and an industry leader in innovation and operational

excellence. Over the course of our 100+ year history, we have pioneered many of the theatrical exhibition industry’s

most important innovations. We introduced Multiplex theatres in the 1960s and the North American stadium-seated

Megaplex theatre format in the 1990s. Most recently, we continued to innovate and evolve the movie-going experience

with the deployment of our theatre renovations featuring plush, powered recliner seating and the launch of our U.S.

subscription loyalty tier, AMC Stubs

®

A-List. Our growth has been driven by a combination of organic growth through

reinvestment in our existing assets and through the acquisition of some of the most significant companies in the

theatrical exhibition industry.

Our business is operated in two theatrical exhibition reportable segments, U.S. markets and International

markets. Prior to 2016, we primarily operated in the United States. Our international operations are largely a result of our

acquisition of Odeon and UCI Cinemas Holdings Limited (“Odeon”) in November of 2016 and Nordic Cinema Group

Holding AB (“Nordic”) in March of 2017.

Today, AMC is the largest theatre operator in the world. As of December 31, 2022, we owned, leased or

operated 940 theatres and 10,474 screens in 12 countries, including 586 theatres with a total of 7,648 screens in the

United States and 354 theatres and 2,826 screens in European markets and Saudi Arabia. On January 24, 2023, we sold

our investment in 13 theatres and 85 screens in Saudi Arabia, see Note 16—Subsequent Events in the Notes to the

Consolidated Financial Statements under Part II, Item 8 thereof, for further information. During the year ended

December 31, 2021, we sold the remaining 51% equity interest in Estonia and Lithuania. As of December 31, 2022, we

were the market leader in the United States and Europe including in Italy, Sweden, Norway, and Finland; and a leading

theatre operator in the United Kingdom, Ireland, Spain, Portugal and Germany. We have operations in four of the

world’s 10 largest economies, including four of the six largest European economies (the United Kingdom, Spain, Italy

and Germany) as of December 31, 2022.

As of December 31, 2022, in the U.S. markets, we owned, leased or operated theatres in 43 states and the

District of Columbia, with approximately 50% of the U.S. population living within 10 miles of one of our theatres. We

have a diversified footprint with complementary global geographic and guest demographic profiles, which we believe

gives our circuit a unique profile and offers us strategic and operational advantages while providing our studio partners

with a large and diverse distribution channel. As of December 31, 2022, we operated some of the most productive

theatres in the top markets in the United States and were the market leader in the top two markets: New York and Los

Angeles. As of December 31, 2022, our top five markets, in each of which we held the #1 share position, are Los

Angeles, New York, Chicago, Atlanta and Washington, D.C., according to data provided by Comscore.

As of December 31, 2022, in the International markets, we owned, leased or operated theatres in 10 European

countries and in Saudi Arabia through Saudi Cinema Company, LLC, our joint venture with Saudi Entertainment

Ventures. On January 24, 2023, we sold our investment in Saudi Cinema Company, LLC, see Note 16—Subsequent

Events in the Notes to the Consolidated Financial Statements under Part II, Item 8 thereof, for further information. In all

of these 11 countries, we operate productive assets in each of the country’s capitals. Due to the population density in

Europe, prior to the effects of COVID-19 pandemic, each screen served on average twice the population of a U.S. screen

in a less populated market.

8

The following table provides detail with respect to the geographic location of our theatrical exhibition circuit as

of December 31, 2022:

U.S. Markets

Theatres(1) Screens(1)

Alabama ................................................................................. 18 229

Arizona .................................................................................. 12 197

Arkansas ................................................................................. 4 45

California ................................................................................ 60 800

Colorado ................................................................................. 14 193

Connecticu

t

............................................................................... 9 104

Delaware ................................................................................ 1 14

Florida .................................................................................. 40 612

Georgia .................................................................................. 30 378

Idaho ................................................................................... 1 11

Illinois .................................................................................. 47 578

Indiana .................................................................................. 23 301

Iowa .................................................................................... 5 71

Kansas .................................................................................. 9 132

Kentucky ................................................................................ 2 40

Louisiana ................................................................................ 7 99

Maryland ................................................................................ 15 171

Massachusetts ............................................................................. 10 142

Michigan ................................................................................ 11 172

Minnesota ................................................................................ 7 101

Missouri ................................................................................. 11 132

Montana ................................................................................. 5 55

N

ebraska ................................................................................. 2 21

N

evada .................................................................................. 2 28

N

ew Hampshire ........................................................................... 1 10

N

ew Jersey ............................................................................... 25 322

N

ew Mexico .............................................................................. 1 12

N

ew York ................................................................................ 30 322

N

orth Carolina ............................................................................ 22 293

N

orth Dakota ............................................................................. 2 19

Ohio .................................................................................... 14 176

Oklahoma ................................................................................ 13 153

Oregon .................................................................................. 2 25

Pennsylvania .............................................................................. 27 308

South Carolina ............................................................................ 2 26

South Dakota ............................................................................. 1 10

Tennessee ................................................................................ 19 235

Texas ................................................................................... 43 621

Utah .................................................................................... 3 29

Virginia ................................................................................. 13 173

Washington ............................................................................... 15 181

West Virginia ............................................................................. 2 20

Wisconsin ................................................................................ 5 73

District of Columbia ........................................................................ 1 14

Total U.S. Markets ...................................................................... 586 7,648

International Markets

Denmark ................................................................................. 2 12

Finlan

d

.................................................................................. 29 170

Germany ................................................................................. 22 197

Ireland .................................................................................. 11 77

Italy .................................................................................... 41 419

N

orway .................................................................................. 12 91

Portugal ................................................................................. 3 44

Saudi Arabia (2) ........................................................................... 13 85

Spain ................................................................................... 37 438

Sweden .................................................................................. 74 407

United Kingdom ........................................................................... 110 886

Total International Markets ................................................................ 354 2,826

Total ................................................................................ 940 10,474

(1) Included in the above table are 75 theatres and 400 screens that we manage or in which we have a partial

ownership interest. In the U.S. markets segment, we manage or have a partial interest in five theatres and

61 screens. In the International markets segment, we manage or have a partial interest in 70 theatres and

339 screens.

9

(2) On January 24, 2023, we sold our investment in 13 theatres and 85 screens in Saudi Arabia. See Note 16—

Subsequent Events in the Notes to the Consolidated Financial Statements under Part II, Item 8 thereof, for

further information.

Our theatrical exhibition revenues are generated primarily from box office admissions and theatre food and

beverage sales. We offer consumers a broad range of entertainment alternatives including traditional film programming,

private theatre rentals, independent and foreign films, performing arts, music and sports. We also offer food and

beverage alternatives beyond traditional concession items, including made-to-order meals, customized coffee, healthy

snacks, beer, wine, premium cocktails, and dine-in theatre options. The balance of our revenues are generated from

ancillary sources, including on-screen advertising, fees earned from our customer loyalty program, rental of theatre

auditoriums, income from gift card and exchange ticket sales, and online ticketing fees.

Our Strategy

We are committed to maintaining a leadership position in the exhibition industry by focusing on forward-

thinking initiatives for the benefit of our guests. We do this through a combination of unique marketing outreach,

seamless digital technology and innovative theatre amenities designed to 1) transform AMC into a world-class leader in

customer engagement, 2) deliver the best in-person experience while at AMC theatres, 3) selectively enhance our

footprint through expansion in certain markets and strategic closure of underperforming theatres, 4) pursue adjacent

opportunities that extend the AMC brand, and 5) explore attractive acquisitions leveraging our existing capabilities and

core competencies. Consistent with our history and culture of innovation, we believe our vision and relentless focus on

these key elements, which apply strategic and marketing components to traditional theatrical exhibition, will drive our

future success.

As discussed above, the COVID-19 pandemic has had a significant impact on our business. We have taken and

continue to take steps to adapt our business strategy in response to the COVID-19 pandemic, including adjusting our

theatre operating hours in those markets where we are open to align screen availability and associated theatre operating

costs with attendance levels for each theatre. We have also taken and continue to take significant steps to preserve cash

by eliminating non-essential costs. Our capital allocation strategy will be driven by the cash generation of our business

and will be contingent on maintaining adequate liquidity as well as a required return threshold.

1)

Transform AMC into a World-Class Leader in Customer Engagement

AMC engages movie-goers through advances in technology and marketing activities to strengthen the bonds

with our current guests and create new connections with potential customers that drive both growth and loyalty. AMC

serves our guests, end-to-end, from before they enter our theatres, through their enjoyment of a comprehensive spectrum

of film content while at our theatres and then again after the movie when they’ve left the theatre and are deciding what

film to see the next time they visit.

In our U.S. markets, we begin the process of engagement with AMC Stubs

®

, our customer loyalty program,

which allows members to earn rewards, receive discounts and participate in exclusive members-only offerings and

services. It features a paid tier called AMC Stubs Premiere™ for a flat annual membership fee and a non-paid tier called

AMC Stubs Insider™. Both programs reward loyal guests for their patronage of AMC theatres. Rewards earned are

redeemable on future purchases at AMC locations.

AMC Stubs

®

A-List is our monthly subscription-based tier of our AMC Stubs

®

loyalty program. This program

offers guests admission to movies at AMC up to three times per week, including multiple movies per day and repeat

visits to already seen movies from $19.95 to $24.95 per month depending upon the geographic market. AMC Stubs

®

A-

List also includes premium offerings including IMAX

®

, Dolby Cinema™ at AMC, RealD, Prime and other proprietary

PLF brands. AMC Stubs

®

A-List members can book tickets online in advance and select specific seats at AMC Theatres

with reserved seating.

As of December 31, 2022, we had approximately 28,200,000 member households enrolled in AMC Stubs

®

A-

List, AMC Stubs Premiere™ and AMC Stubs Insider™ programs on a combined basis. Our AMC Stubs

®

members

represented approximately 43% of AMC’s U.S. market attendance during the year ended December 31, 2022. Our large

database of identified movie-goers also provides us with additional insight into our customers’ movie preferences. This

enables us to have an increasingly comprehensive, more personalized and targeted marketing effort.

10

In our International markets, we currently have loyalty programs in the major territories in which we operate.

Movie-goers can earn points for spending money at the theatre, and those points can be redeemed for tickets and

concession items at a later date. We currently have more than 14,400,000 members in our various International loyalty

programs.

Our marketing efforts expand beyond our loyalty program. We continue to improve our customer connections

through our website and mobile apps and expand our online and movie offerings. We upgraded our mobile applications

across the U.S. circuit with the ability to order food and beverage offerings via our mobile applications while ordering

tickets ahead of scheduled showtimes.

In June 2021, the Company launched AMC Investor Connect (“AIC”), an innovative new communication

initiative to engage directly with its sizable retail shareholder base and convert shareholders into AMC consumers. AIC

allows AMC shareholders to self-identify through the AMC website and receive AMC special offers and important

Company updates. As part of AIC, domestic members must sign up for an AMC Stubs account, which includes

providing additional personalized data that allows AMC to more precisely engage with our investor consumers. As of

February 23, 2023, there were 923,950 global self-identified AMC shareholder members of AIC, which is comprised of

both registered and beneficial shareholders.

2)

Deliver the best in-person experience while at AMC theatres

In conjunction with our advances in technology and marketing initiatives, and consistent with our long-term

growth strategy, we plan to continue investing in our theatres and enhancing the consumer experience to deliver the best

in-person experience and take greater advantage of incremental revenue-generating opportunities, primarily through

comfort and convenience innovations, imaginative food and beverage initiatives, and exciting premium large format

(“PLF”) offerings.

Comfort and Convenience Innovations. Recliner seating is the key feature of our theatre renovations. We

believe that maximizing comfort and convenience for our customers will be increasingly necessary to maintain and

improve our relevance. These renovations, in conjunction with capital contributions from our landlords, involve

stripping theatres to their basic structure in order to replace finishes throughout, upgrading the sight and sound

experience, installing modernized points of sale and, most importantly, replacing traditional theatre seats with plush,

electric recliners that allow customers to deploy a leg rest and fully recline at the push of a button. Upon reopening a

remodeled theatre, we typically increase the ticket price to reflect the enhanced consumer experience.

As of December 31, 2022, in our U.S. markets, we featured recliner seating in approximately 361 U.S. theatres,

including Dine-in-Theatres, totaling approximately 3,503 screens and representing 45.8% of total U.S. screens. In our

International markets, as of December 31, 2022, we had recliner seating in approximately 96 International theatres,

totaling approximately 621 screens and representing 22.0% of total International screens.

Open-source internet ticketing makes AMC’s entire universe of seats in the U.S. (approximately 1.0 million as

of December 31, 2022), for all our show times, as available as possible, on as many websites and mobile applications as

possible. Our tickets are currently on sale either directly or through mobile apps, at our own website and our mobile apps

and other third-party ticketing vendors. For the year ended December 31, 2022, approximately 66% of our tickets were

purchased online in the U.S., with approximately 81% of total online tickets being purchased through AMC.

Traditional payment sources are evolving rapidly around the globe as the use of cryptocurrencies become more

popular and convenient. In response, during the fourth quarter of 2021, we introduced the ability for consumers to pay

for tickets, food and beverage items and associated gifts cards with cryptocurrencies in the U.S. markets, including

Bitcoin, Ethereum, Litecoin, Dogecoin, Ripple, ShibaInu and Bitcoin Cash. The acceptance of cryptocurrency is

designed to offer guests greater flexibility and convenience. These transactions all settle in U.S. Dollars. We did not hold

any cryptocurrency during the years ended December 31, 2022 and December 31, 2021.

Imaginative Food and Beverage Initiatives. Our deployment initiatives also apply to food and beverage

enhancements. We have expanded our menu of enhanced food and beverage products to include meals, healthy snacks,

premium beers, wine and mixed drinks, and other gourmet products. Our long-term growth strategy calls for investment

across a spectrum of enhanced food and beverage formats, ranging from simple, less capital-intensive food and beverage

design improvements to the development of new dine-in theatre options. We have expanded the capabilities of our

online and mobile apps to include the ability to pre-order food and beverages when advanced tickets are purchased.

11

Guests are able to order food and beverage items when buying tickets in advance and have the items ready upon arrival

and available at dedicated pick-up areas or delivered to seat at select theatres.

Our MacGuffins Bar and Lounges (“MacGuffins”) give us an opportunity to engage our legal age customers.

As of December 31, 2022, we offer alcohol in approximately 357 AMC theatres in the U.S. markets and 236 theatres in

our International markets and continue to explore expansion globally.

Exciting Premium Large Format Offerings. PLF auditoriums generate our highest customer satisfaction

scores, and we believe the investment in premium formats increases the value of the movie-going experience for our

guests, ultimately leading to additional ticket revenue. To that end, we are committed to investing in and expanding our

offerings of the best sight and sound experiences through a combination of our partnerships with IMAX

®

and Dolby

Cinema™ and the further development of our own proprietary PLF offering, AMC Prime.

• IMAX

®

. IMAX

®

is one of the world’s leading entertainment technology companies, specializing in

motion picture technologies and presentations.

As of December 31, 2022, AMC was the largest IMAX

®

exhibitor in the U.S., with 186 (3D enabled)

IMAX

®

screens and a 55% market share. Each one of our IMAX

®

local installations is protected by

geographic exclusivity, and as of December 31, 2022, our IMAX

®

screen count was 96% greater than our

closest competitor. Additionally, as of December 31, 2022, our per-screen grosses were 22% higher than

our closest competition. We also operate 35 IMAX® screens in International markets. As part of our long-

term growth strategy, we expect to continue to expand our IMAX

®

relationship across the U.S. and Europe,

further strengthening our position as the largest IMAX

®

exhibitor in the U.S. and a leading IMAX

®

exhibitor in the United Kingdom and Europe.

• Dolby Cinema™. Dolby Cinema™ offers a premium cinema offering for movie-goers that combines

state-of-the-art image and sound technologies with inspired theatre design and comfort. Dolby Cinema™ at

AMC includes Dolby Vision™ laser projection and object-oriented Dolby Atmos

®

audio technology, as

well as AMC’s plush power reclining seats with seat transducers that vibrate with the action on screen.

As of December 31, 2022, we operated 156 Dolby Cinema™ at AMC auditoriums in the U.S and nine

Dolby Cinema™ Auditoriums in the International markets. We expect to expand the deployment of our

innovative Dolby Cinema™ auditoriums in both our U.S. and International markets as part of our long-

term growth strategy.

• In-house PLF Brands. We also offer our private label PLF experience at many of our locations, with

superior sight and sound technology and enhanced seating as contrasted with our traditional auditoriums.

These proprietary PLF auditoriums offer an enhanced theatrical experience for movie-goers beyond our

current core theatres, at a lower price premium than IMAX

®

or Dolby Cinema™. Therefore, it may be

especially relevant in smaller or more price-sensitive markets. As of December 31, 2022, we operated 57

screens under proprietary PLF brand names in the U.S. markets and 83 screens in the International markets.

The following table provides detail with respect to large screen formats, such as IMAX

®

and our proprietary

Dolby Cinema™, other PLF screens, enhanced food and beverage offerings and our premium seating as deployed

throughout our circuit on December 31, 2022:

U.S. Markets International Markets

Format Theatres Screens Theatres Screens

IMAX® ......................................... 185 186 35 35

Dolby Cinema™ .................................. 156 156 9 9

Other PLF ....................................... 57 57 82 83

Dine-in theatres ................................... 49 684 3 13

Premium seatin

g

.................................. 361 3,503 96 621

Laser at AMC. We launched Laser at AMC, a broadscale initiative to upgrade the projectors at 3,500

auditoriums throughout the United States, with cutting-edge laser projectors. The Laser at AMC experience delivered by

laser projection from Cinionic provides guaranteed light levels that are at the top end of the 2D DCI specification. The

technology improves image contrast, produces more vivid colors, and maximizes brightness, compared to digital

projectors with a xenon light source. We are partnering with Cinionic, a global leader in laser-powered cinema solutions,

12

through their Cinema-as-a-Service program which requires minimal upfront capital investment required by AMC. The

initial agreement to install 3,500 projectors is expected to be completed by 2026.

3) Expand and Strategically Close Underperforming Theatres

Our long-term growth strategy includes the deployment of our strategic growth initiatives, opening new-build

theatres and continued exploration of small acquisitions. By expanding our platform through disciplined new-build

theatres and acquisitions, we are able to further deploy our proven strategic initiatives while further diversifying our

consumer base, leading to greater appeal for more films. The additional scale achieved through new-build theatres and

acquisitions also serves to benefit AMC through global procurement savings and increased overhead efficiencies. We

believe that expansion offers us additional opportunities to introduce our proven guest-focused strategies to movie-goers

and will generate meaningful benefits to guests, employees, studio partners and our shareholders.

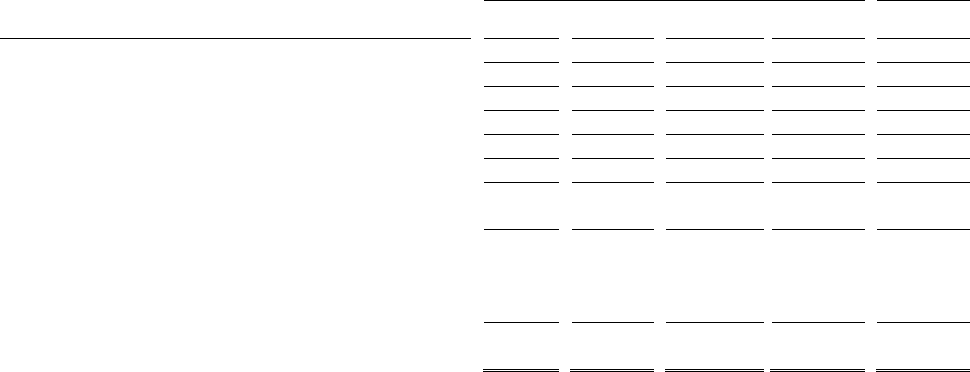

The following table sets forth our historical information concerning new builds (including expansions),

acquisitions and dispositions (including permanent closures of underperforming theatres and net construction closures)

and end-of-period operated theatres and screens through December 31, 2022:

Permanent/Temporary

Closures/(Openings),

New Builds Acquisitions net Total Theatres

Number o

f

Number o

f

Number o

f

Number o

f

Number o

f

Number o

f

Number o

f

Number o

f

Fiscal Year Theatres Screens Theatres Screens Theatres Screens Theatres Screens

Beginning balance ..................... 1,014 11,169

Calendar 2018 ........................ 11 89 4 39 23 206 1,006 11,091

Calendar 2019 ........................ 10 85 7 70 19 205 1,004 11,041

Calendar 2020 ........................ 8 63 1 14 63 575 950 10,543

Calendar 2021 ........................ 10 82 11 140 25 203 946 10,562

Calendar 2022 ........................ 7 51 15 157 28 296 940 10,474

46 370 38 420 158 1,485

4) Pursue Adjacent Opportunities that Extend the AMC Brand

We believe there is considerable opportunity to extend and monetize the AMC brand outside of our movie

theatre auditoriums. We plan to pursue opportunities that capitalize on our attractive customer base, our leading brand,

our 100+ years of food and beverage expertise, and technology capabilities.

As part of that strategy, in the fourth quarter of 2021, we announced we would be expanding our food and

beverage business beyond theatrical exhibition and enter the multi-billion dollar popcorn industry with the launch of

AMC Theatres Perfectly Popcorn in the U.S. markets.

• Beginning in 2023, we will offer prepackaged and ready-to-pop microwaveable AMC Theatres Perfectly

Popcorn, which will become available for purchase in supermarkets and convenience stores around the

country.

• Freshly popped AMC Theatres Perfectly Popcorn is available through food delivery-to-home services. In

this way, consumers will be able to enjoy a slice of the AMC experience when being entertained at home.

• “To Go” packages at our theatres of freshly popped popcorn for takeout and/or pickup.

AMC Theatres Perfectly Popcorn is an opportunity to diversify our business and to create a new food and

beverage revenue stream for the Company.

In early 2023, the Company will offer the AMC Entertainment Visa Credit Card. Credit card holders will have

the opportunity to earn additional AMC Stubs reward points when they use their AMC Entertainment Visa Credit Card

at the movies and on everyday purchases.

13

5) Explore Attractive Acquisitions Leveraging Our Existing Capabilities and Core Competencies

As part of our plans to pursue value-enhancing initiatives that lead to diversification of our business, we will

consider attractive and opportunistic acquisitions inside and outside the Exhibition industry that leverage AMC’s

footprint and capabilities as well as the core competencies and experiences of AMC’s management team.

Our Competitive Strengths

We believe we have the following competitive strengths:

Leading guest engagement through digital marketing and technology platforms. Through our AMC

Stubs

®

loyalty program, we have developed a consumer database of some 28.2 million households, representing

approximately 58 million individuals. Our digital marketing and technology platforms allow us to engage with these

customers frequently, efficiently and on a very personalized level. We believe personalized data drives increased

engagement, resulting in higher attendance.

Leading Market Share in Important, Affluent and Diverse Markets. As of December 31, 2022, across our

three biggest metropolitan markets in the United States—New York, Los Angeles and Chicago, representing 19% of the

country’s total box office—we held a 44% combined market share. We had theatres located in the top 25 U.S. markets,

holding the #1 or #2 position in 18 of those 25 markets based on box office revenue. We are also the #1 theatre operator

in Italy, Sweden, Norway, and Finland; the #2 operator in the United Kingdom, Ireland, Spain, and Portugal; and the #4

operator in Germany as of December 31, 2022. We believe our strong presence in these top markets makes our theatres

highly visible and therefore strategically more important to content providers, who rely on the large audiences and

marketing momentum provided by major markets to drive opinion-making and deliver a movie’s overall box office

results.

We also have a diversified footprint with complementary global geographic and guest demographic profiles.

We have theatres in more densely populated major metropolitan markets, where there is also a scarcity of attractive retail

real estate opportunities, as well as complementary suburban and rural markets. Guests from different demographic and

geographic profiles have different tastes in movies, and we believe by broadening our geographic base, we can help

mitigate the impact of film genre volatility on our box office revenues.

Well Located, Highly Productive Theatres. Our theatres are generally located in the top retail centers across

the United States. We believe this provides for long-term visibility and higher productivity and is a key element in the

success of our enhanced food and beverage and more comfort and convenience initiatives. Our location strategy,

combined with our strong major market presence, enable us to deliver industry-leading theatre-level productivity. During

the year ended December 31, 2022, 8 of the 10 highest grossing theatres in the United States were AMC theatres,

according to data provided by Comscore. During the same period, AMC’s U.S. markets average total revenues per

theatre was approximately $5.1 million. This per unit productivity is important not only to content providers, but also to

developers and landlords, for whom per location and per square foot sales numbers are critical measures.

AMC Classic theatres are located primarily in smaller, suburban and rural markets, which affects total revenues

per theatre. However, in general, theatres located in smaller suburban and rural markets tend to have less competition

and a lower cost structure.

In our International markets, many theatres are located in top retail centers in major metropolitan markets with

high visibility. We believe that deploying our proven strategic initiatives in these markets will help drive attendance and

greatly improve productivity. Other theatres are in larger and mid-sized cities and towns in affluent regions.

Deployment of unique pricing structures to enhance revenue. AMC has developed a dedicated pricing

department and, as a result, we have deployed several different strategic pricing structures that have increased revenue

and profitability.

In June 2018, we launched AMC Stubs

®

A-List, a subscription pricing structure that offers members three

movies a week, including premium formats, for a monthly fee ranging from $19.95 to $24.95 depending on geographical

location. Around the same time, we launched “Discount Tuesday” which offers AMC Stubs

®

members a reduced price

for movie attendance on Tuesdays. Prior to the COVID-19 pandemic, the results showed an incremental increase in

attendance and corresponding increase in admissions and food and beverage revenue.

14

Sources of Revenue

Box Office Admissions and Film Content. Box office admissions are our largest source of revenue. We

predominantly license theatrical films from distributors owned by major film production companies and from

independent distributors on a film-by-film and theatre-by-theatre basis. Film exhibition costs are based on a share of

admissions revenues and are accrued based on estimates of the final settlement pursuant to our film licenses. These

licenses typically state that rental fees are based on the box office performance of each film, though in certain

circumstances and less frequently, our rental fees are based on a mutually agreed settlement rate that is fixed. In some

European territories, film rental fees are established on a weekly basis and some licenses use a per capita agreement

instead of a revenue share, paying a flat amount per ticket.

The North American and International industry box office have been significantly impacted by the COVID-19

pandemic. As a result, film distributors have postponed new film theatrical releases and/or shortened or disregarded the

period of theatrical exclusivity (the “window”) and reduced the number of theatrically released motion pictures.

Theatrical releases may continue to be postponed and windows shortened or disregarded while the box office suffers

from COVID-19 impacts. As a result of the reduction in theatrical film releases, we have licensed and exhibited a larger

number of previously released films that have lower film rental terms. We have made adjustments to theatre operating

hours to align screen availability and associated theatre operating costs with attendance levels for each theatre.

As we continue our recovery from the impacts of the COVID-19 pandemic on our business, AMC’s admissions

revenues and attendance levels remain significantly behind pre-pandemic levels. Admissions revenues for the years

ended December 31, 2022 and 2021 were $2.2 billion and $1.4 billion, respectively, compared to $3.3 billion for the

year ended December 31, 2019. For the years ended December 31, 2022 and 2021, attendance was 201.0 million patrons

and 128.5 million patrons, respectively, compared to 356.4 million patrons for the year ended December 31, 2019.

During the year ended December 31, 2022, films licensed from our seven largest movie studio distributors

based on revenues accounted for approximately 88% of our U.S. admissions revenues, which consisted of Universal,

Disney, Paramount, Warner Bros., Sony, 20th Century Studios, and Lionsgate. In Europe, approximately 73% of our box

office revenue came from films attributed to our four largest movie distributor groups; which consisted of Disney,

Universal, Warner Bros, and Paramount. Our revenues attributable to individual distributors may vary significantly from

year to year depending upon the commercial success of each distributor’s films in any given year.

Food and Beverage. Food and beverage sales are our second largest source of revenue after box office

admissions. We offer enhanced food and beverage products that include meals, healthy snacks, premium liquor, beer and

wine options, and other gourmet products. Our long-term growth strategy calls for investment across a spectrum of

enhanced food and beverage formats, ranging from simple, less capital-intensive food and beverage menu improvements

to the expansion of our Dine-In Theatre brand.

We currently operate 49 Dine-In Theatres in the U.S. and three Dine-In Theatres in Europe that deliver chef-

inspired menus with seat-side or delivery service to luxury recliners with tables. Our recent Dine-In Theatre concepts are

designed to capitalize on the latest food service trend, the fast and casual eating experience.

Our MacGuffins Bar and Lounges (“MacGuffins”) give us an opportunity to engage our legal age customers.

As of December 31, 2022, we offer alcohol in approximately 357 AMC theatres in the U.S. markets and 236 theatres in

our International markets and continue to explore expansion globally.

Theatrical Exhibition Industry and Competition

U.S. markets. In the United States, the movie exhibition business is large and mature. While in any given

calendar quarter the quantity and quality of movies can drive volatile results, box office revenues have generally

advanced from 2011 to 2019. The industry’s best year ever, in terms of revenues, was 2018, with box office revenues of

approximately $11.9 billion, an increase of approximately 7.1% from 2017, with 1.3 billion admissions in the U.S. and

Canada.

We believe it is the quality of the movie-going experience that will define future success. Whether through

enhanced food and beverage options (Food and Beverage Kiosks, Marketplaces, Coca-Cola Freestyle, MacGuffins or

Dine-in Theatres), more comfort and convenience (recliner seating, open-source internet ticketing, reserved seating),

engagement and loyalty (AMC Stubs

®

, mobile apps, social media) or sight and sound (digital and laser projection, 3D,

15

Dolby Cinema™ at AMC, IMAX

®

or other PLF screens), it is the ease of use and the amenities that these innovations

bring to customers that we believe will drive sustained profitability in the years ahead.

The following table represents information about the U.S./Canada exhibition industry obtained from the

National Association of Theatre Owners, with the exception of box office revenues for calendar years 2022 and 2021

obtained from Comscore. See Management’s Discussion and Analysis of Financial Condition and Results of Operations

under Part II, Item 7 thereof for information regarding our operating data:

Box Office Average

Revenues Attendance Ticket

Calendar Year (in millions) (in millions) Price

2022 .............................................................. $7,454 708 $ 10.53

2021 .............................................................. 4,544 447 10.17

2020 .............................................................. 2,205 240 9.18

2019 .............................................................. 11,400 1,244 9.16

2018 .............................................................. 11,880 1,304 9.11

2017 .............................................................. 11,091 1,236 8.97

2016 .............................................................. 11,372 1,314 8.65

2015 .............................................................. 11,120 1,320 8.42

2014 .............................................................. 10,400 1,270 8.19

2013 .............................................................. 10,920 1,340 8.15

Based on information obtained from Comscore, we believe that the three largest exhibitors, in terms of

U.S./Canada box office revenue (AMC, Regal Entertainment Group, and Cinemark Holdings, Inc.) generated

approximately 54% of the box office revenues in 2022.

International markets. Movie-going is a popular leisure activity with high penetration across key geographies

in our International markets. Theatre appeal has proven resilient to competition for consumers’ leisure spending and to

recessionary periods and we believe we will continue to benefit from increased spending across International markets.

The European market lags the U.S. market across a number of factors, including annual spend per customer, number of

IMAX

®

screens and screens per capita, which causes us to believe that the deployment of our customer initiatives will be

successful in these markets. On the other hand, our European markets are more densely populated and operate with

fewer screens per one million of population, making the screens we acquired more valuable.

Additionally, U.S. films generate the majority of the box office in Europe, but movie-goers in specific

geographies also welcome locally produced films with local actors and familiar story lines which can mitigate film genre

attendance fluctuations. Going forward, we believe we will see positive growth in theatre attendance as we continue to

deploy our proven guest-centered innovations like recliner seating, enhanced food and beverage offerings, and premium

large format experiences. Like the United States, the international industry box office suffered from months of theatre

closures, significantly fewer new films and reopening restrictions and generated far fewer sales than 2019.

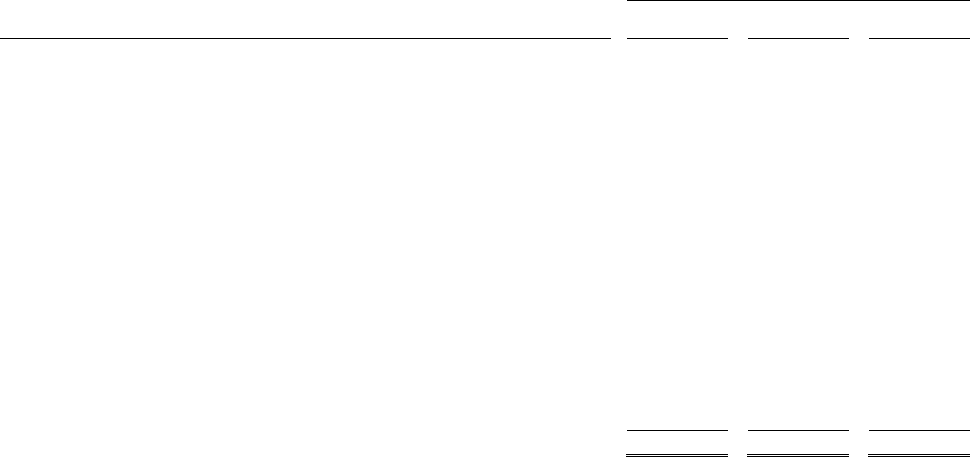

The following table provides information about the exhibition industry attendance for the International markets

where we operate obtained from territory industry trade sources, see Management’s Discussion and Analysis of

Financial Condition and Results of Operations under Part II, Item 7 thereof for information regarding our operating data:

Calendar Year

(In millions) 2022 2021 2020 2019 2018

United Kin

g

dom .................................. 117.5 74.6 44.0 176.0 177.3

German

y

......................................... 78.6 42.5 37.3 119.9 104.2

Spain ............................................ 59.8 41.5 28.7 105.8 97.8

Ital

y

............................................ 47.9 26.6 30.2 104.7 91.8

Sweden .......................................... 10.4 6.1 5.4 15.8 16.3

Irelan

d

.......................................... 10.7 6.1 3.9 15.1 15.8

Portu

g

al ......................................... 9.2 5.3 3.6 15.2 14.6

N

orwa

y

.......................................... 8.8 5.6 4.8 11.3 12.1

Finlan

d

.......................................... 5.8 3.4 3.9 8.4 8.1

Total ............................................ 348.7 211.7 161.8 572.2 538.0

16

Competition. Our theatres are subject to varying degrees of competition in the geographic areas in which they

operate. Competition is often intense with respect to attracting patrons, licensing motion pictures and finding new theatre

sites. Where real estate is readily available, it is easier to open a theatre near one of our theatres, which may adversely

affect operations at our theatre. However, in certain of our densely populated major metropolitan markets, we believe a

scarcity of attractive retail real estate opportunities enhances the strategic value of our existing theatres. We also believe

the complexity inherent in operating in these major metropolitan markets is a deterrent to other less sophisticated

competitors, protecting our market share position.

The theatrical exhibition industry faces competition from other forms of out-of-home entertainment, such as

concerts, amusement parks and sporting events, and from other distribution channels for filmed entertainment, such as

cable television, pay-per-view, video streaming services, PVOD, and home video systems, as well as from all other

forms of entertainment.

We believe movie-going is a compelling consumer out-of-home entertainment experience. Movie theatres

currently garner a relatively small share of overall consumer entertainment time and spend, and our industry benefits