ANNUAL COMPREHENSIVE

FINANCIAL REPORT

Years Ended September 30, 2021 and 2020

Tucson Airport Authority

Tucson, Arizona

2 0 21

2021

TUCSON AIRPORT AUTHORITY

ANNUAL COMPREHENSIVE FINANCIAL REPORT

Prepared by the Finance Department

Years Ended September 30, 2021 and 2020

Tucson, Arizona

This page intentionally left blank.

i

Mission Statement

Provide a sustainable airport system and constantly pursue initiatives that promote and grow business opportunities.

Vision

Landing Prosperity in Southern Arizona

ii TUCSON AIRPORT AUTHORITY 2021 ACFR

2021 Board of Directors and Members

ACTIVE MEMBERS

Bruce I. Ash

President

Paul Ash Management

Co., L.L.C.

Henry K. Boice

(Ret.) President

Northern Trust Company

Larry Cesare

Partner/General Manager

B.H.C. Hotel Management

Francis X. Chambers

Director

AvPORTS

*Steven R. Cole

President

Southwest Appraisal

Associates

D. June Crawford

(Ret.) President

Copygraphix, Inc.

Michael J. Duran

(Ret.) Vice President &

Chief Development Officer

Tucson Medical Center

& TMC Foundation

Vance L. Falbaum

Sr. Vice President &

Financial Advisor

RBC Wealth Management

John L. Fendenheim

Owner

Fendenheim Enterprises

Guillermo P. Figueroa

Senior Network

Implementation Program

Manager

Lumen Technologies

Tony Finley

Chief Financial Officer

Long Companies/

Long Realty Co.

Michael W. Franks

President

Seaver Franks Architects

David E. Hameroff

Attorney

The Hameroff Law

Firm, P.C.

Michael F. Hannley

Founder

Bank of Tucson

Brandt Hazen

President

Hazen Enterprises, Inc.

Steven Holmes

Superintendent

Sunnyside Unified School

District

* Lisa Lovallo

Vice President and

Market Manager

Cox Southern Arizona

* Lisa H. Israel

President Emeritus

La Posada at

Park Center, Inc.

Herb Kai

Manager

Kai Family Entities

Francine Katz

Chief Development Officer,

Tucson Jewish Community

Center

Gary Kippur

President

Tucson Iron & Metal

Lee D. Lambert

Chancellor

Pima Community College

Larry M. Lang

President

Diversified Design &

Construction, Inc.

David Lyons

Executive Vice President

Regional President

National Bank of Arizona

Michael McGrath

Partner

Mesch, Clark &

Rothschild P.C.

Omar Mireles

President

HSL Asset Management

Ned L. Norris, Jr.

Chairman

Tohono O’odham Nation

Tim J. Overton

Broker

Allen & Young

Business Brokerage

Steve Pagnucco

Vice President, Operations

Universal Avionics

R. Tony Penn

President/CEO

United Way of Tucson

and Southern Arizona

Lea Márquez Peterson

Principal

Márquez Peterson Group

Commissioner

Arizona Corporation

Commission

Ricardo Platt

Vice President, Development

Ed2 Corp.

Stephen E. Quinlan

Chairman Emeritus

Long Realty Company

Principal

Whisper Canyon Holdings,

C.L.C.

Joaquin Ruiz

Vice President Global

Environmental Futures

University of Arizona

Ronald K. Sable

President

Concord Solutions Ltd.

Calline Sanchez

Vice President Worldwide

Systems Lab Services and

Technical Universities IBM

David C. Smallhouse

Managing Partner

Miramar Ventures, L.L.C.

Lucinda J. Smedley

Publisher/Principal

TREND Report/Real

Estate Consulting Group

Michael Stilb

President/

Managing Director

CBRE-MAS

Izaro Urreiztieta

Senior Vice President

PNC Financial Services

Mercy A. Valencia Ed.D.

(Ret.) Assistant Vice President

Real Estate Administration

University of Arizona

Katherine R. Ward

Principal

GV Strategic Advisors

Ellen K. Wheeler, J.D.

Retired

BOARD OF DIRECTORS

CHAIR

Bruce L. Dusenberry

President

Horizon Moving Group

VICE CHAIR

Michael S. Hammond

President/CEO

Cushman & Wakefield

PICOR Commercial

Real Estate Services

SECRETARY

Keri L. Silvyn

Partner

Lazarus & Silvyn, P.C.

TREASURER

William R. Assenmacher

CEO

CAID Industries,

Incorporated

IMMEDIATE PAST CHAIR,

DIRECTOR

Taunya Villic ana

Co-Founder/CEO

Affinity Wealth Management

DIRECTOR

Robert L. Draper

President

O’Rielly Chevrolet, Inc.

DIRECTOR

Judy Rich

President and CEO

TMC HealthCare and Tucson

Medical Center

DIRECTOR

Phillip Swaim

President

Swaim Associates, Ltd.

DIRECTOR

Todd Jackson

Attorney

Jackson & Oden, P.C.

DIRECTOR

Sally G. Fernandez

President

Safety Dynamics, Inc.

iii

EMERITUS MEMBERS

Judith K. Abrams

* Larry R. Adamson, Esq.

* Laura T. Almquist

* Hal W. Ashton

Edith Sayre Auslander

Raymond Bernal

* Edwin L. Biggers

* Elizabeth T. Bilby

* Fred T. Boice

* Susan G. Boswell

John H. Bremond

Archibald M. Brown, Jr.

Chanda S. Budhabhatti

James J. Burns

Jack C. Camper

* John L. Carter

Paul W. Cella

Joseph R. Cesare

Stephen W. Christy

Ginny L. Clements

Jim H. Click, Jr.

Jack D. Davis

Richard Davis

Patty Doar

* Darryl B. Dobras

* Katie Dusenberry

Stephen Eggen, Jr.

* Arnold R. Elias

* Robert A. Elliott

George Favela

Steven D. Fell

Louise L. Francesconi

Edward S. Frohling

Peter V. Gallo

Jaime Esteban Gibbons

David Goldstein

Arthur L. Gonzales

Elizabeth Gonzalez

Dr. Thomas Grogan

Barbara L. Harper

Duff Hearon

Lawrence M. Hecker

* Richard F. Imwalle

* Charles Jackson

Daisy M. Jenkins

Robert Johnston

Darryl O. Jones

Rosemary J. Koberlein

Meg Olson Lee

Jan Lesher

Dr. Peter Likins

Humberto S. Lopez

David M. Lovitt, Jr.

Richard Lukso

Sharon B. Megdal, Ph.D.

Octavio A. Molera

Chris Monson

Rebecca R. Montaño

* Gary M. Munsinger, Ph.D.

Rick T. Myers, Jr.

James E. Neihart

* R. B. O’Rielly

Richard D. Parlett

Judy Patrick

* Mary Levy Peachin

Charles M. Pettis

Gregory A. Pivirotto

* Ernesto V. Portillo

* Timothy J. Prouty

James F. Ronstadt

* Karl G. Ronstadt

Roberto C. Ruiz

Warren S. Rustand

* James M. Sakrison

* Rubin Salter, Jr.

John P. Schaefer, Ph.D.

* Past President / Chairman

S. L. Schorr

* Ted Sitterley, Jr.

* Jacob F. Struble

Steven Thu

Steven D. Touché

Richard S. Walden

Jonathan D. Walker

Michael R. Wattis

Paul Weitman

David T.C. Wright

* Thomas A. Zlaket

iv TUCSON AIRPORT AUTHORITY 2021 ACFR

Table of Contents

INTRODUCTION SECTION

Transmittal Letter

Organization 1

Economic Conditions and Outlook 2

State and Local Economic Outlook 2

Air Service at Tucson International Airport 3

Financial Impact of Reduced Travel Related to COVID-19 4

Major Initiatives 4

Capital Improvement Program 4

Major Maintenance Program 6

Federal and State Funding 8

Passenger Facility Charge Program 8

Financial Policies and Practices 9

Budgetary Controls 9

Long-Term Financial Planning 10

Capital Financing and Debt Management 11

Internal Controls......................................................................................................................................................... 11

Other Information 11

Requests For Information 11

Awards and Acknowledgements 12

Certifi cate of Achievement 13

Organizational Structure 14

Airlines and Tenants 15

FINANCIAL SECTION

Independent Auditors’ Report 16

Management’s Discussion and Analysis 18

Basic Financial Statements

Statements of Net Position 33

Statements of Revenues, Expenses and Changes in Net Position 35

Statements of Cash Flows 36

Notes to Financial Statements

Note 1 Organization and Reporting Entity 38

Note 2 Summary of Signifi cant Accounting Policies 38

Note 3 Cash, Cash Equivalents and Investments 44

Note 4 Capital Assets 48

Note 5 Unearned Revenues 50

Note 6 Bonds Payable 50

Note 7 Pension and Other Post Employment Benefi t (OPEB) Plans 52

Note 8 Passenger Facility Charges 66

Note 9 Risk Management 66

Note 10 Commitments 66

Note 11 Environmental Matters, Litigation, and Contingencies 67

Note 12 Concentrations 69

Note 13 Restricted Net Position 70

v

FINANCIAL SECTION (continued)

Required Supplementary Information

Schedule of the TAA’s Proportionate Share of the Net Pension Liability - Cost Sharing Plan (ASRS) 76

Schedule of the TAA’s Proportionate Share of the Net OPEB Liability - Cost Sharing Plan (ASRS) 78

Multiyear Schedule of Changes in Net Pension Liability (Asset) and

Related Ratios Agent Retirement (PSPRS) - Fire Department 80

Multiyear Schedule of Changes in Net OPEB Liability (Asset) and

Related Ratios Agent Retirement (PSPRS) - Fire Department 82

Multiyear Schedule of Changes in Net Pension Liability (Asset) and

Related Ratios Agent Retirement (PSPRS) - Police Department 84

Multiyear Schedule of Changes in Net OPEB Liability (Asset) and

Related Ratios Agent Retirement (PSPRS) - Police Department 86

Schedule of the TAA’s Proportionate Share of the

Net Pension Liability – Cost Sharing Plan (PSPRS Fire - Tier 3) 88

Schedule of the TAA’s Proportionate Share of the

Net OPEB Liability – Cost Sharing Plan (PSPRS Fire - Tier 3) 90

Schedule of the TAA’s Proportionate Share of the

Net Pension Liability – Cost Sharing Plan (PSPRS Police - Tier 3) 92

Schedule of the TAA’s Proportionate Share of the

Net OPEB Liability – Cost Sharing Plan (PSPRS Police - Tier 3) 94

STATISTICAL SECTION

Financial Trends

Net Position and Changes in Net Position 98

Revenue Capacity

Principal Revenue Sources 100

Principal Revenue Source Ratios 102

Rates and Charges 102

Debt Capacity

Ratios of Outstanding Debt, Debt Service and Debt Limits 104

Airport Revenue Bond Coverage Per Bond Resolutions 106

Demographic and Economic Information

Population in the Air Service Area 108

Unemployment Rates in the Air Service Area 108

Major Employers in the Air Service Area 110

Operating Information

TAA Employees 112

Airport Information – Tucson International Airport 114

Airport Information – Ryan Airfi eld 116

Passenger, Cargo and Mail Summary 118

Aircraft Operations Summary 120

Enplaned Passengers By Scheduled Carrier 120

Scheduled Carrier Landed Weights 122

Scheduled Air Service Information 124

This page intentionally left blank.

INTRODUCTION

INTRODUCTION

INTRODUCTION 1

September 30, 2022

Board of Directors

Tucson Airport Authority

7250 S. Tucson Blvd, Suite 300

Tucson, Arizona 85756

Ladies and Gentlemen:

It is our pleasure to present the Annual Comprehensive Financial Report (Annual Report) of the Tucson

Airport Authority, Inc. (TAA) for the fi scal year (FY) ended September 30, 2021. Responsibility for both the

accuracy of the data and completeness and fairness of the presenta on, including all disclosures, rests with

management of the TAA. To the best of our knowledge and belief, the enclosed informa on is accurate and

complete in all material respects and reported in a manner designed to present fairly the fi nancial posi on,

results of opera ons, and cash fl ows in accordance with Generally Accepted Accoun ng Principles (GAAP).

GAAP requires that management provide a narra ve overview and analysis to accompany the fi nancial

statements in the form of a Management’s Discussion and Analysis (MD&A). This introductory le er

should be read in conjunc on with the MD&A, which can be found immediately following the report of the

independent auditors in the fi nancial sec on of the Annual Report.

BeachFleischman PLLC, the TAA’s independent auditor, has rendered an unmodifi ed opinion that the

fi nancial statements for the year ended September 30, 2021, present fairly, in all material respects, the

fi nancial posi on, changes in net posi on and cash fl ows.

BeachFleischman also performed the federal single audit of all federally funded grant programs.

Par cipa on in the single audit program is mandatory as a condi on for con nued funding eligibility.

Similarly, BeachFleischman performed the audit of the TAA’s Passenger Facility Charge program.

BeachFleischman has rendered an unmodifi ed opinion regarding both the federal single audit and the

Passenger Facility Charge program in separate reports.

Organization

The TAA was established on April 12, 1948, as a civic, non-profi t corpora on, as provided for under Arizona

law, to develop, promote, operate, and maintain airports and air transporta on facili es adjacent to the

City of Tucson (City) and in Pima County (County). Under Arizona law, the TAA is authorized to acquire,

own, control, equip, improve, maintain, operate, and regulate airports and enter into agreements with

corpora ons engaged in the air transporta on industry for the opera on of airports. The TAA operates

Tucson Interna onal Airport (TUS) and Ryan Airfi eld (RYN) as an essen al government func on under

Arizona law.

The TAA’s bylaws call for ac ve membership of up to 60 individuals who are residents of TUS’s service

area. Membership vacancies are fi lled through a nomina on process and elec on by ac ve members at

each annual mee ng. Members are eligible to be an Ac ve Member for a term of fi een (15) years with a

possible one- me extension of fi ve (5) years, for a total of twenty (20) years. Following a member’s ac ve

term of service to TAA, which can be requested as early as a er ten (10) years of ac ve service, Members

are then eligible to become a non-vo ng Emeritus Member.

2 TUCSON AIRPORT AUTHORITY 2021 ACFR

The TAA’s Board of Directors (Board) consists of no more than eleven and no less than seven TAA members.

The composi on of the Board includes the Immediate Past Chair as a vo ng member for one year. The

remaining directors are elected by ac ve TAA members, typically to staggered terms of three years, and

may serve a maximum of 10 years. Directors receive no salary or compensa on for their services, but by

resolu on of the Board may be reimbursed for actual expenses paid or obligated to be paid in connec on

with services rendered solely for the benefi t of the TAA.

The Board appoints the Chief Execu ve Offi cer (CEO), who serves at its pleasure. The Offi ce of the CEO

includes the departments of Air Service Development and Marke ng, Communica ons and External

Rela ons. The remaining TAA staff is organized into six divisions, each managed by a Vice President

appointed by and repor ng directly to the CEO. These six divisions are Opera ons, Finance, Legal

Services, Planning and Engineering, Business and Commercial Development, and People Opera ons. The

organiza onal chart that follows this le er refl ects the opera onal structure as of September 30, 2021.

The TAA’s airport system consists of TUS and RYN. TUS is a cer fi cated commercial service airport

facilita ng opera on of both commercial passenger airlines and cargo carriers. The primary catchment

area for TUS includes the Tucson metropolitan area, southern Arizona, and northern Sonora, Mexico. TUS

encompasses 7,986 acres of land and is located eight miles south of the City’s central business district. The

TAA maintains an agreement with the Morris Air Na onal Guard 162nd Fighter Wing of the Arizona Air

Na onal Guard for access and its use of the airfi eld at TUS through an Airport Joint Use Agreement (AJUA).

RYN is located 12 miles southwest of downtown Tucson and serves as a general avia on reliever airport for

TUS. It encompasses 1,904 acres of land and accommodates a wide variety of general avia on and military

ac vity.

Economic Conditions and Outlook

State and Local Economic Outlook

Economic condi ons are an important factor in how o en people travel. This, in turn, impacts passenger

levels at airports, how much money passengers and visitors spend at airports, and airline decisions on

maintaining and adding new service at individual airports. The U.S. Census Bureau defi nes the Tucson

Metropolitan Sta s cal Area (MSA) as encompassing all of Pima County. The County covers an area of

approximately 9,200 square miles and, according to the Arizona Offi ce of Economic Opportunity, had

an es mated popula on of 1,058,318 as of July 1, 2021, which represents an increase of 0.6% from July

1, 2020. The Tucson metro area consists of about 495 square miles that contain more than 95% of the

County’s popula on, including the incorporated municipali es of Tucson, Marana, Oro Valley, Sahuarita

and South Tucson. Thirty-fi ve percent of the County’s popula on resides in unincorporated areas. The

metro area is the origin or des na on of nearly all airport users.

Tourism and recrea on are important components of the Tucson economy. The area has a sunny, dry

climate with moderate temperatures annually, on average, crea ng ideal condi ons for year-round play at

approximately fi y golf courses in and around the city. Tourism has been a signifi cant contributor to past

growth in annual passenger traffi c at TUS.

The Tucson area is also home to a diverse group of employers in industry sectors such as aerospace,

defense, biotechnology, and mining. Davis-Monthan Air Force Base in Tucson and Fort Huachuca Army

Intelligence Center southeast of Tucson are also two of the area’s largest employers. The University of

Arizona, Pima Community College, and a large healthcare sector are other signifi cant sources of jobs for

southern Arizona residents.

According to a May 26, 2022 report by Dr. George W. Hammond, Director of the Economic and Business

Research Center at the University of Arizona, the Arizona economy maintained a strong yet uneven

recovery from the recession brought on by the COVID-19 pandemic.

Organization (continued)

INTRODUCTION 3

State and Local Economic Outlook (continued)

The job count in Arizona as of April 2022 was 48,700 more than its February 2020 peak; however, jobs

in the Tucson, Sierra Vista-Douglas, and Flagstaff metropolitan areas remain below pre-pandemic levels.

Furthermore, the na onal infl a on rate was es mated to be 4.7% for calendar year 2021 with an addi onal

increase of 6.8% projected for calendar year 2022. Growth projec ons for Arizona jobs, personal income,

and popula on, however, remain posi ve through at least 2024.

Air Service at Tucson International Airport

TUS is the principal commercial service airport serving metropolitan Tucson, southern Arizona and

northern Sonora, Mexico. The TAA considers Pima County as its primary airport service area.

The TAA focuses its strategic air service development eff ort on achievable goals that are consistent

with the community’s needs and the dynamics of the airline industry. TUS is subject to compe on for

airline services and passengers residing in the Tucson service area, with the Phoenix Sky Harbor Airport

110 highway miles to the north. TUS’s compe ve posi on is strengthened economically through its

rela onships with key air service stakeholders that include Visit Tucson, a regional des na on marke ng

organiza on, the Metropolitan Tucson Chamber of Commerce, the Southern Arizona Leadership Council

and Sun Corridor, Inc., (a regional economic development organiza on).

The TAA’s primary air service objec ves are to accommodate demand by increasing nonstop fl ights

throughout the U.S. to new and exis ng hub des na ons with new and incumbent carriers, while reducing

both leakage and spillage of passengers to Phoenix. “Leakage” refers to passengers consciously choosing to

use an airport other than the airport closest to their home for reasons such as more fl ight op ons or lower

fares. “Spillage” refers to passengers using another airport because they are unable to fi nd a seat available

at their home airport when they want to travel. Emphasis has also been directed toward a rac ng carriers

that could serve key interna onal des na ons in Mexico and Canada.

The airlines that provide regularly scheduled service to TUS include network carriers, their owned regional

carrier subsidiaries, and contract regional carriers. As no single carrier holds a dominant market posi on,

compe on remains robust along Tucson’s top origin and des na on routes.

The eff ects of the COVID-19 pandemic con nued to impact TUS’s passenger volumes in 2021; however,

annual traffi c stabilized compared to the prior year. TUS experienced large decreases in passenger traffi c

(compared to pre-pandemic periods) for the fi rst few months of the fi scal year with a marked recovery in

the second half of the year. Total annual passenger traffi

c fell from 2,283,777 in FY 2020 to 2,257,581 in FY

2021, a decrease of 1.15%. This compares to 3,783,535 annual passengers in FY 2019 – a decrease of 40.3%.

Total scheduled inbound/outbound seat capacity in FY 2021 decreased 7.4% from FY 2020, a er a decrease

of 25.1% in FY 2020 compared to FY 2019.

Nineteen des na on airports were served nonstop from TUS in FY 2021, which was three less than in FY

2020. The nonstop des na ons served in FY 2021 were:

Economic Conditions And Outlook (continued)

• Atlanta (ATL)

• Chicago-Midway (MDW)

• Chicago O’Hare (ORD)

• Dallas/Ft. Worth (DFW)

• Denver (DEN)

• Houston Bush (IAH)

• Houston Hobby (HOU)

• Indianapolis (IND)

• Las Vegas (LAS)

• Los Angeles (LAX)

• Minneapolis/St. Paul (MSP)

• Oakland (OAK)

• Phoenix (PHX)

• Portland (PDX)

• Provo (PVU)

• Salt Lake City (SLC)

• San Diego (SAN)

• San Francisco (SFO)

• Sea le (SEA)

4 TUCSON AIRPORT AUTHORITY 2021 ACFR

Air Service at Tucson International Airport (continued)

Air service at TUS improved during the second half of FY 2021 from the decline brought on by the COVID-19

pandemic. As health safety restric ons loosened in the later months of the fi scal year, passengers returned

to the airport in increasing numbers. Airlines struggled in that me to return to full capacity because of

staffi ng reduc ons and decisions to temporarily decommission aircra during the ini al stages of the

pandemic. Airlines con nue to deal with staffi ng shortages and global infl a onary pressures.

The ming and pace of a recovery in demand for air service in the U.S. and worldwide is not yet possible to

predict with any degree of certainty. However, assuming demand for air service does return to levels that

existed prior to the COVID-19 pandemic, the TAA is confi dent that most, if not all, routes will be restored

to previous service levels and that suffi cient demand exists for year-round daily service to a myriad of

domes c des na ons. Less than daily year-round service to a limited number of des na ons in Mexico

and seasonal service from one or more Canadian ci es are also considered viable. Addi onally, strong

performance of certain exis ng seasonal routes such as Minneapolis and Portland suggest opportuni es to

maintain these routes year-round.

Financial Impact on the TAA of Reduced Travel Related To COVID-19

Like other commercial service airports throughout the country, a signifi cant share of the TAA’s revenues is

driven by commercial airline fl ights and associated purchases of goods and services by passengers at TUS.

The con nued eff ects of the COVID-19 pandemic were felt in FY 2021 as revenues remained below pre-

pandemic levels. The TAA has made plans to withstand con nued nega ve condi ons in FY 2022.

In FY 2021, the TAA completed its draw down of the funds it was awarded by the Federal Avia on

Administra on (FAA) from the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The CARES

Act provided relief in the form of grants to reimburse airport opera ng and capital expenditures, to

maintain employment levels, and help off set the impact of revenue losses from the drama c reduc on

in air travel. The TAA received $22.6 million in CARES Act grants. The TAA ini ated its draw down of

the funds it was awarded under the Coronavirus Response and Relief Supplemental Appropria on Act

(CRRSAA), which was an extension of relief in the form of airport grants for purposes like those authorized

in the CARES Act. The TAA received $6.0 million in CRRSAA grants. In March 2021, the federal government

enacted the American Rescue Plan Act (ARPA), which authorized addi onal grant funding to airports for

similar purposes as the CARES Act and CRRSAA. The TAA has been awarded $15.8 million in ARPA grants.

One of the signifi cant condi ons for airports accep ng these grants is that they must maintain employment

levels at a minimum of 90% of pre-pandemic levels through September 30, 2021. The TAA maintained the

required minimum employment levels as defi ned by the three relief acts.

The federal relief funds provided through the three programs described above, posi ons the TAA to

con nue opera ng TUS and RYN in a manner like the pre-COVID period. The total dollars awarded are

expected to provide for ongoing relief and con nuity of opera ons for mul ple years, even if air travel

recovery con nues at its currently reduced pace.

Major Initiatives

CAPITAL IMPROVEMENT PROGRAM

The TAA Board approves development programs and projects, and management executes the development

plans for TUS and RYN. As such, the Board approved the Master Plan update for TUS in 2013 and RYN in

2020, respec vely, that outlined the development plans to address future airport capital needs. The TUS

Master Plan also included a land use plan which iden fi es the highest and best use of property owned by

Economic Conditions And Outlook (continued)

INTRODUCTION 5

the TAA and iden fi es land which should be acquired in the future for expansion. The TAA addresses the

Master Plan and any new capital spending needs that arise through its Capital Improvement Program (CIP),

which is updated and adopted annually. TAA staff execute the project plans as outlined in the respec ve

master plans.

Capital improvement projects require funding apart from rou ne opera ng expenses. Such projects entail

the purchase, construc on, or replacement of the physical assets of the TAA. The purpose of the CIP

process is to evaluate, priori ze, and coordinate proposed projects for a fi ve-year period. The compila on

of the CIP has as its primary goal the development of a detailed capital budget for the current fi scal year

and a plan for capital development during the four subsequent years. The Board, by approving the CIP, sets

a strategy and schedule for budge ng and construc ng facili es at TUS and RYN.

Funding for CIP projects can come from a variety of sources including grants from the Federal Avia on

Administra on (FAA), the Arizona Department of Transporta on (ADOT) and other governmental agencies,

or from Passenger Facility Charges (PFCs) and TAA opera ng revenues.

FY 2021 COMPLETED CIP CONSTRUCTION AND PROJECTS AT TUS (GREATER THAN $75,000)

10112255 EIS for Relocated Runway 11R and Associated Taxiways | Cost: $3,370,192.

Scope: Environmental Impact Study (EIS) for reloca on of Runway 11R and associated taxiway

enhancements. Included inventory of environmental resources within the project area, an assessment of

alterna ves, an analysis of impacts, and the iden fi ca on of poten al mi ga on measures and/or fi ndings

of no signifi cant impact.

Consultant: Landrum and Brown.

10113364 Reconstruct HIDTA, Universal and Helicopter Pad Pavement Areas | Cost: $540,196.

Scope: Reconstruc on of approximately 114,600 square feet of asphalt apron pavement in General

Avia on Area B1 that serves mul ple hangars. Included marking and re-striping.

Consultant: Ninyo & Moore Geotech.

Contractor: Granite Construc on

10119021 Jet Bridge Replacement | Cost: $563,753.

Scope: Installed and commissioned a replacement passenger boarding bridge at Gate B1.

Contractor: John Bean Technologies Corpora on

10119202 Runway 11L/29R Shoulder Widening | Cost: $925,939.

Scope: Widened the runway shoulders on Runway 11L to 50’ to mi gate the issue with Foreign Object

Debris (FOD) created and associated with cleanup caused by wide body four engine aircra .

Consultant: AECOM.

Contractor: Granite Construc on.

FY 2021 COMPLETED CIP CONSTRUCTION AND PROJECTS AT RYN (GREATER THAN $75,000)

20112259 Ryan Master Plan Update | Cost: $706,688.

Scope: Updated the exis ng 20-year Master Plan for Ryan Airfi eld. Avia on ac vity forecasts, development

alterna ves, fi nancial plan, strategic plan, and security assessment elements were included in the update.

Consultant: Mead & Hunt.

FY 2021 CIP AT TUS – ONGOING AND NEW PROJECTS (GREATER THAN $500,000)

U.S. Customs and Border ProtecƟ on (CBP) RelocaƟ on | Cost: $1.8 million.

Major Initiatives (continued)

6 TUCSON AIRPORT AUTHORITY 2021 ACFR

Renova ons to the fi rst fl oor of the former Execu ve Terminal building to relocate general avia on

customs processing facili es, CBP offi ces and Global Entry enrollment offi ce.

Consultant: DLR Group Architecture

Contractor: Canyon Building and Design

Reconstruct Taxiway D, Shoulders & Connectors | Cost: $12.8 million.

Reconstruct (mill and overlay) Taxiway D Shoulders and Connectors.

Consultant: Dibble Engineering

Contractor: Granite Construc on

Airfi eld Safety Enhancement (ASE) Program | Cost: $300 million.

The ASE Program includes improvements to the Tucson Interna onal Airport (TUS) airfi eld to meet current

FAA airfi eld design and safety standards. The program will be completed in phases over mul ple years

depending on availability of grant funds.

Consultant(s): WSP USA, Jacobs Engineering Group, Garver LLC, RS&H, Inc., HDR Engineering

Contractor: Granite Construc on

Electronic Video InformaƟ on Display System (EVIDS)/Audio Paging Replacement | Cost: $2.8 million.

Replace EVIDS and Audio Paging System for the TUS terminal complex.

Contractor: Arizona Sound and Light, Inc.

FY 2021 CIP AT RYN – ONGOING AND NEW PROJECTS (GREATER THAN $500,000)

On-Airport Sanitary Sewer CollecƟ on System | Cost: $1,023,783.

Install piping and connect to a new trunk sewer line from the exis ng connec on point at the northeast

corner of RYN’s property to the Administra on Offi ce area.

Consultant: Crown West Land Group

Contractor: KE&G

APMS-Pavement PreservaƟ on-Runway 6R/24L | Cost: $947,379.

Crack seal and apply rubberized asphalt emulsion seal coat to RW 6R/24L. Re-stripe pavement markings.

Consultant: Kimley-Horn Associates

Install Precision Approach Path Indicators (PAPI) at Ryan Airfi eld (RYN) | Cost: $573,302.

PAPIs will be installed at approach to Runway 6R, 6L and 24R to enhance the level of fl ight safety by

providing addi onal visual approach slope guidance at RYN’s primary and secondary runways.

Consultant: CR Engineers, Inc.

Contractor: Rural Electric Inc.

MAJOR MAINTENANCE PROGRAM

The TAA Board has governance oversight of the TAA; TAA management is responsible for the maintenance

of TUS and RYN. Accordingly, the Board approves a Major Maintenance Program (MMP) as part of each

year’s budget process, and the TAA staff execute or implement the program, respec vely. MMP projects

require funding apart from rou ne maintenance opera ons. The purpose of the MMP is to evaluate,

priori ze, and coordinate proposed projects for a fi ve-year period.

FY 2021 COMPLETED MM PROJECTS AT TUS (GREATER THAN $75,000)

10214546 GA Valencia Landscaping | Cost: $90,961.

Major Initiatives (continued)

INTRODUCTION 7

Scope: Installed gravel and plant landscaping along Valencia to Millionaire.

Contractor: Northwest Landscaping

10215653 Sealcoat Economy Lot – Phase 1 | Cost: $209,920.

Scope: Power-cleaned and seal coated 829,660 square feet of asphalt payment at the Economy Parking Lot

Contractor: Sunland Asphalt

10216850 New IDF-17 Concourse B | Cost: $640,804.

Scope: Designed and built 500 sq. . of exis ng space on the Concourse B opera ons level to provide

new space for IDF Room #17. Project includes ITT IDF equipment, grounding, racks, cabinets, emergency

UPS power/panel, outlets, dedicated/redundant in-rack air condi oning, AEMCS connec on, TAB, fi re

protec on, modifi ca ons to ligh ng, fi re alarm, telecom, and ACS (Access Control System).

Consultant: DWL Architects

Contractor: Core Construc on

10217934 Air Handler Unit (AHU) 1 and 2 Replacement | Cost: $666,933.

Scope: Replaced the exis ng AHU 1 and 2 air handlers in Bag Alley with new Trane AHU’s. Demoli on of

exis ng AHU-1 and 2 and associated VFDs.

Consultant: Adams & Associates Engineering

Contractor: Sun Mechanical

10217954 RAC Expansion and Joint Sealer Repair | Cost: $845,896.

Scope: Replaced the expansion joints on the second and third levels of the parking garage.

Consultant: Kimley-Horn and Associates, Inc.

Contractor: Granite Construc on

10217978 Update Family Restrooms on A and B Concourses | Cost: $933,962.

Scope: Added family restrooms pre- and post-security and on Concourses A and B.

Consultant: Herzog Associates.

Contractor: Marsh Development

10219001 Pavement Management System Update | Cost: $400,673.

Scope: Pavement Condi on Inspec on (PCI) and updated TAA’s Pavement Management System for all

airside and landside pavements at TUS and landside pavements at RYN.

Consultant: Kimley-Horn Associates, Inc.

10219024 Concourse A and B Service Hallway and Elevator Upgrades | Cost: $163,339.

Scope: Upgraded fi nishes in service hallways with galvanized wainscot panels and vinyl fl ooring. Also

updated fi nishes in elevator interiors.

Contractor: Chase Building Team and KONE, Inc.

10219075 RAC Building Air CondiƟ oning (AC) Replacements | Cost: $419,035.

Scope: Redesigned the exis ng central cooling system and installed a new complete system with two 32-

ton systems that work in unison.

Contractor: EMCOR Services Arizona

10219079 Jet Bridge Repairs (A3, B1, B9) | Cost: $76,613.

Scope: Upgraded and repaired Jet Bridges A3, A4, B1 and B9.

Contractor: John Bean Technologies Corpora on

Major Initiatives (continued)

8 TUCSON AIRPORT AUTHORITY 2021 ACFR

10219246 Bridge InspecƟ ons | Cost: $78,500.

Scope: Safety inspec on and evalua on of two bridges, three box culverts and the main departure

vehicular deck bridge.

Consultant: Dibble & Associates Consul ng

10219250 Pullouts and RIP RAP Along Los Reales Road | Cost: $126,339.

Scope: Placement of pavement and concrete curb for pullouts along Los Reales Road and place RIP RAP to

control drainage areas.

Contractor: Granite Construc on and Northwest Landscaping

10220259 Outbound Baggage Belt Overhaul | Cost: $445,019.

Scope: Complete overhaul of the Southwest Airlines outbound baggage belt system by relacing all cri cal

components such as conveyor belts, bearings, tensioning rollers, main drive motors and programmable

logic controllers.

Contractor: ERMC Avia on, Inc.

10220339 Jet Bridge Improvements (A4 & B4) | Cost: $151,028.

Scope: Upgraded and repaired Jet Bridges A4 and B4.

Contractor: John Bean Technologies Corpora on

10220415 Replace Core Switches for Enterprise Network| Cost: $144,080.

Scope: Upgraded two exis ng Cisco 6880 core network switches to a set of four new Catalyst 9500

switches confi gured as two separate and connected Stackwise Virtual cluster pairs of Catalyst 9500

switches.

Contractor: Sen nel Technologies

FY 2021 COMPLETED MMP PROJECTS AT RYN (GREATER THAN $75,000)

20215735 Replace IATA Building HVAC Roof Top Units | Cost: $253,342.

Scope: Replaced exis ng HVAC units for IATA building.

Contractor: Pueblo Mechanical and Controls

FEDERAL AND STATE FUNDING

The TAA par cipates in the FAA’s Airport Improvement Program (AIP), which provides Airport and Airway

Trust Fund funds for airport development, airport planning, and noise compa bility programs. The FAA

off ers both en tlement and discre onary grants for eligible projects. Grants received under this program

in FY 2021 totaled $32,799,824. The FAA has awarded $183,065,140 in grants to the TAA during the past

ten years.

The State of Arizona also provides grant assistance to airports. These grants may cover up to half of the

TAA’s required match for AIP projects or full funding for projects of smaller size and scope. Grants received

under this program in FY 2021 totaled $1,338,930. ADOT has awarded $14,898,877 million to the TAA

during the past ten years.

PASSENGER FACILITY CHARGE PROGRAM

In 1990, Congress approved the Avia on Safety and Capacity Expansion Act which authorized domes c

airports to impose Passenger Facility Charges (PFCs) fees on enplaned passengers to generate revenues

for airport projects that increase capacity, enhance compe on among and between air carriers, enhance

Major Initiatives (continued)

INTRODUCTION 9

safety or security, or mi gate noise impacts. Airport sponsors planning to impose PFCs must apply to the

FAA and meet specifi c requirements set forth in the enabling legisla on. Airport operators may impose

PFCs a er receiving wri en approval and authoriza on from the FAA.

The TAA currently has approval from the FAA to collect $117,744,485 under PFC applica on 97-01-C-03-TUS,

$44,194,512 under PFC applica on 06-02-C-00-TUS, and $17,351,019 under PFC applica on 17-03-C-00-

Major Initiatives (continued)

TUS, extending through February 1, 2027. As of September 30, 2020, the TAA had earned $141,100,560 in

PFCs since the incep on of the program, plus associated interest.

The FAA’s PFC approvals included authoriza on to u lize PFCs for the payment of principal and interest

on general airport revenue bonds issued to pay construc on costs related to eligible projects. PFCs

are currently being used to pay debt service on subordinate lien revenue bonds for landside terminal

expansion in 2001, land acquisi ons completed in 2005 and a concourse renova on project completed in

2008.

Financial Policies and Practices

BUDGETARY CONTROLS

An annual budget is prepared on a residual cost basis as established by Sec on 5.03(a) of the Airport Use

Agreement dated April 27, 1977, and amended therea er to September 30, 2023, for all accounts and

funds established by the agreement. The annual budget serves as a founda on for the TAA’s fi nancial

planning and control. All appropria ons, except for those for open project accounts, lapse at the end

of each fi scal year. Since there is no legal requirement for the TAA to report on a budgetary basis, no

addi onal budget informa on is presented in the accompanying fi nancial statements.

Sec on 4 of the City of Tucson Agreement (Lease) dated October 14, 1948, requires the TAA to present a

biennial version of the budget to the Mayor and City Council for informa on purposes. The annual budget

is approved by the Board prior to its implementa on and, in accordance with the Airport Use Agreement,

is presented to the Airline and Airport Aff airs Commi ee (AAAC) for review.

The “Residual Cost” approach forms the basis of the TAA’s contractual rela onship with signatory airlines.

This approach is common, but not universal, among U.S. airport operators. It is a methodology that

encompasses the following concepts:

Residual Cost | A method of determining which costs are the responsibility of the airlines as payment to

the TAA for providing, opera ng, and managing the airport system (TUS and RYN). The result is coverage of

all TAA opera ng and capital improvement costs on a break-even basis.

Airline Reserve Fund | The excess, if any, of revenues over costs calculated in accordance with the Airport

Use Agreement at the end of each year.

Majority-In-Interest (MII) | A vo ng formula used by the signatory airlines in considering approval of

signifi cant capital expenditures and use of Airline Reserve Fund monies. The use agreement defi nes MII as

a numerical majority of the signatory airlines that represent more than 50% of the total landed weight at

the airport.

Exclusive Rights | Rights provided to individual airlines through the Airport Use Agreement for the use of

exclusive space to accommodate their opera ons and paid for in the form of rents.

PreferenƟ al Rights | Rights provided to individual airlines through the Airport Use Agreement for the use

10 TUCSON AIRPORT AUTHORITY 2021 ACFR

Financial Policies and Practices (continued)

To provide fi nancial resources adequate to meet the TAA’s needs, the Airport Use Agreement includes a

formula for the calcula on of rates and charges, including landing fees. This formula, the “Airport System

Income Requirement,” serves as a template in crea ng the annual budget and is commonly referred to

simply as the “Airport System.”

The formula consists of four elements:

• Opera on and Maintenance Expenses — in addi on to day-to-day opera ng requirements, this

item provides for capital needs, short-term debt obliga ons, and any other requirements not

included elsewhere in the formula.

• Debt Service Requirements — includes 125% of the principal and interest payments due in

accordance with senior lien revenue bond resolu ons and debt amor za on schedules. The 25%

excess is called “coverage.” For subordinate lien revenue bonds where other revenue sources

such as PFCs are not pledged for debt service, the excess coverage requirement is 10%. Providing

coverage fulfi lls a covenant in the bond resolu ons that requires this surplus as assurance to bond

holders that adequate funds will be available to pay debt service requirements on a mely basis.

In the normal course of business, the coverage is not needed and it fl ows through the airport

system.

• Fund Replenishments — provides for the funding and refunding of the various reserve funds

required by the TAA’s senior and subordinate lien bond resolu ons and the Airport Use

Agreement.

• Adjustments — 100% of opera ng income fl ows through the airport system. At year-end, certain

revenues defi ned in the use agreement are transferred out of the airport system into the Special

Reserve Fund and are excluded from the residual cost calcula on. These revenues include:

• 52% of the net income generated from designated “industrial area” developments, which are

geographic loca ons at TUS.

• Interest income earned from the investment of monies accumulated in the Special Reserve

Fund and Insurance Reserve Fund.

Together, these four elements (Debt Service, Opera ons & Maintenance, Fund Replenishment, and

Adjustments) comprise the “Total Gross Requirement.” This requirement is then reduced by all of the

available resources that include:

• Opera ng income.

• Beginning cash balance that is the coverage from the prior year, adjusted by any overage or

shor all from opera ons.

The net amount resul ng from this calcula on is the residual amount that is used to calculate landing fees

required to be paid by the signatory airlines in order to “balance” the budget.

LONG-TERM FINANCIAL PLANNING

One of the tools the TAA uses for long-term planning is the Master Plan. This document was prepared

with the input of TAA staff , the signatory airlines and other key tenants and stakeholders. The Master Plan

projects airport growth and then specifi es the physical improvements that are needed to meet these

projec ons of future demand. It consists of a technical report that specifi es the logic and reasoning for the

proposed capital improvements as well as large scale drawings that illustrate the physical layout of the

improvements. The fi nancial implica ons of the Master Plan are important because they serve as the basis

for reques ng federal funds for the construc on of capital improvements proposed in the plan.

INTRODUCTION 11

The TAA’s most recent update of the Master Plan provides a fl exible and cost-eff ec ve guide for the future

development of TUS through the year 2030. Capital improvements recommended by the plan are demand

driven. This means that although there are many projects proposed by the plan, only those that are needed

because of actual increase in demand will be constructed. The TAA Board of Directors adopted an updated

RYN Master Plan Update in December of 2020. The RYN Airport Layout Plan (ALP), as part of the Master

Plan Update, was approved and signed by the FAA on March 31, 2021. The plan is available for viewing on

the TAA’s website: fl ytucson.com.

The Airport Master Plan forms the basis for a mul -year Capital Improvement Plan, which is updated

on a regular basis. The plan typically contains at least fi ve years of projec ons, longer, if necessary,

for a par cular need such as a bond-fi nancing project or airline use agreement nego a ons. Capital

Improvement Plan assump ons are based on the best informa on available of needs on a project-by-

project basis extending through the planning horizon.

CAPITAL FINANCING AND DEBT MANAGEMENT

Capital improvements that require long-term fi nancing are typically funded using either TAA reserves

or airport revenue bonds. Unrestricted Special Reserve Fund balances that are the result of the sharing

of industrial area revenues with airline tenants give the TAA considerable fl exibility in fi nancing capital

improvements. The most signifi cant benefi t is that the TAA’s share (amounts not reimbursed with

grants or passenger facility charges) of most capital improvements is fi nanced internally rather than

through issuance of airport revenue bonds. This prac ce avoids bond issuance and interest costs, creates

administra ve effi ciencies, and results in a lower total cost of fi nancing for airline tenants. Reserve funds

are restored as the costs of improvements are amor zed, with interest, over their useful lives and paid

back to the TAA by the airline tenants through rates and charges.

Capital expenditures for FY 2021 were fi nanced through a combina on of federal and state grants, internal

fi nancing from unrestricted reserve funds, and funds generated through the Airport System Income

Requirement formula.

INTERNAL CONTROLS

Management of the TAA is responsible for establishing and maintaining adequate internal controls

designed to ensure that assets are protected from loss, the , or misuse; to promote effi ciency of

opera ons; to comply with applicable laws and regula ons; and to ensure that accurate accoun ng records

are kept, allowing for the prepara on of fi nancial statements in accordance with GAAP. The internal

control structure is designed to provide reasonable, but not absolute, assurance that these objec ves are

met. The TAA works to ensure that its internal control processes are suffi ciently documented and that the

performers of the controls are trained to perform them.

Other Information

REQUESTS FOR INFORMATION

This fi nancial report, along with the audited fi nancial statements, is designed to provide a general overview

of the Tucson Airport Authority.

Ques ons concerning the informa on contained in this report should be addressed to:

Tucson Airport Authority Finance Department

7250 S. Tucson Blvd., Suite 300

Tucson, Arizona 85756

Financial Policies and Practices (continued)

12 TUCSON AIRPORT AUTHORITY 2021 ACFR

AWARDS AND ACKNOWLEDGEMENTS

The Government Finance Offi cers Associa on of the United States and Canada (GFOA) awarded a

Cer fi cate of Achievement for Excellence in Financial Repor ng to the TAA for its Annual Report for the

fi scal year ended September 30, 2020. This was the 27th consecu ve year that the TAA achieved this

pres gious award. To be awarded a Cer fi cate of Achievement, a government must publish an easily

readable and effi ciently organized Annual Report. This report must sa sfy both GAAP and applicable legal

requirements.

A Cer fi cate of Achievement is valid for a period of one year only. We are confi dent that the current Annual

Report con nues to meet the Cer fi cate of Achievement Program’s requirements; it will be submi ed to

the GFOA to determine its eligibility for another Cer fi cate of Achievement.

This report is off ered in a PDF format, allowing the user to download it and save, print, or view it online at

the airport website: www.fl ytucson.com.

The publica on of this Annual Report refl ects the level of excellence and professionalism of the TAA

Finance Department. In addi on, it is appropriate to express apprecia on to all members of the TAA staff

who contributed to the prepara on of this Annual Report and the accomplishments that we are privileged

to report.

Thank you for your con nuing interest and support of the staff ’s eff orts to conduct the fi nancial opera ons

of the Tucson Airport Authority in a responsible and progressive manner.

Respec ully submi ed,

Dane e M. Bewley, A.A.E. Kirk Eickhoff , CPA

President/Chief Execu ve Offi cer Vice President and Chief Financial Offi cer

INTRODUCTION 13

Government Finance Officers Association

Certificate of

Achievement

for Excellence

in Financial

Reporting

Presented to

Tucson Airport Authority

Arizona

For its Annual Comprehensive

Financial Report

For the Fiscal Year Ended

September 30, 2020

Executive Director/CEO

14 TUCSON AIRPORT AUTHORITY 2021 ACFR

Organizational Structure

Executive Vice President

and Chief Operating

Offi cer

Bruce Goetz

Vice President

Planning & Engineering

Michael Smejkal

Facility DevelopmentPolice

Airside Operations

Airport

Communications

Center

Maintenance &

Custodial Services

Fire

Civil Development

Environmental

Services

Airport Planning

Vice President Finance

and Chief Financial

Offi cer

Kirk Eickhoff

Finance/Accounting

Programs & Regulatory

Compliance

Information

Technology

People Operations

Vice President

Business & Commercial

Development and Chief

Commercial Offi cer

John Voorhees

Properties/

Concessions/Ground

Transpor tation

Board of Directors

and TAA Membership

Support

Government Aff airs

Procurement/

Warehouse

Board of Directors

President and Chief

Executive Offi cer

Danette Bewley

Executive Assistant

Cathy Borders

Air Service Development,

Marketing, Communica-

tions, External Relations,

and Community Relations

Safety Programs

Vice President People

Operations and Chief

People Offi cer

Twyla Salaiz

Vice President Legal and

General Counsel

Christopher Schmaltz

INTRODUCTION 15

PASSENGER

AIRLINES

Alaska Airlines

American Airlines

Delta Air Lines

Frontier Airlines

Mesa Airlines

Sierra Pacifi c

SkyWest Airlines

Southwest Airlines

Sun Country Airlines

United Airlines

CARGO AIRLINES

Amerifl ight

Federal Express

CAR RENTALS

Alamo

Avis

Budget

Dollar

Enterprise

Hertz

National

RYAN AIRFIELD

Aero Smith

Aero Experts

Air Center West

Aircrafters

Air Ventures Ltd.

Air West, Inc.

Alpha Air, Inc.

Aviation Pursuits

Cherokee Cabañas

Corsair Condos

Dangle Aviation

Double Eagle Aviation

Duncan & Associates

Jim’s Aircraft

Kelly’s Aviation

Marjet, Inc.

Mobile Aire Hangars

North American Aerial

Surveys

Richie’s Café

Sonora Avionics

Tuc son Upholster y

United Indian Missions

Velocity Air, Inc.

Vistawest Hangars

Serco Inc.

TUCSON

INTERNATIONAL

AIRPORT

AT&T

A.E. Petsche Company,

Inc.

Ace Parking

Management, Inc.

AERGO-TUS, LLC

Aerospace Hangar, LLC

Aerovation

Airport Information

Centre

Amalong, Terry

Apple Autos

Arizona Aero-Tech

Morris Air National

Guard

Arizona Aviation

Associates

Ascent Aviation

Services

Arizona Department of

Public Safety

Ashton Company

Atlantic Aviation

Bags, Inc.

Bombardier Aerospace/

Learjet Inc.

Broward Aviation

City of Tucson

Civil Air Patrol

Delaware North

Delta Global Logistics

Double Eagle Aviation

Flight School

Federal Aviation

Administration

FlightSafety

International, Inc.

General Services

Administration

Granite Construction

Company

Handy Hangars

The Hudson Group

Hughes Federal Credit

Union

Jet, LLC

Lamar Advertising

Lan-Dale Co.

Luggage Services &

Logistics

Lyft

Airlines and Tenants As Of September 30, 2021

Matheson Flight

Extenders, Inc.

Military Lounge

Million Air

Mitsubishi Heavy

Industrial – RJ Aviation

Pima Community

College

Pima County Sheriff ’s

Department

PrimeFlight Aviation

Services

Prospect International

Airport Services, Inc.

Raytheon Missiles &

Defense

Real Air Hangar, Inc.

Rolls Royce

Simplicity USA Ground

Services

Smarte Carte, Inc.

Southwest Airport

Services

SOS Security

Southwest Heliservices

Swissport Fueling

Services

Transpor tation Securit y

Administration

Tucson Aviation, LLC

Tuc son E xecutive

Center

Tuc son Fuel Facilities,

LLC

Tucson Jet Center

Tuc son Police

Department

Two-Shakes of a

Lambs Tail Baggage

Delivery Service

Uber

Tuc son Stagecoach

Express

Universal Avionics

U.S. Customs &

Border Protection

U.S. REIF Tucson

Commerce Center

VIP Cab

Verizon Wireless

Victor II, Ltd.

Wright Flight, Inc.

Yellow Cab

FINANCIAL

FINANCIAL

SECTION

16 TUCSON AIRPORT AUTHORITY 2021 ACFR

Independent Auditors’ Report

FINANCIALS 17

Independent Auditors’ Report (continued)

18 TUCSON AIRPORT AUTHORITY 2021 ACFR

The following discussion and analysis of the fi nancial performance and ac vity of the Tucson Airport

Authority, Inc. (TAA) provides an introduc on to the TAA’s fi nancial statements for the fi scal year ended

September 30, 2021 (FY 2021). Informa on for the two preceding fi scal years ended September 30, 2020

and 2019 (FY 2020 and FY 2019, respec vely) has been included to provide a be er insight into the overall

fi nancial posi on of the TAA.

The TAA is a business-type ac vity and, as such, the Basic Financial Statements and Required

Supplementary Informa on (RSI) consist of Management’s Discussion and Analysis (MD&A), the

Statements of Net Posi on, the Statements of Revenues, Expenses and Changes in Net Posi on, the

Statements of Cash Flows, and the Notes to Financial Statements. This MD&A has been prepared by

management and should be read and considered in conjunc on with the TAA’s basic fi nancial statements.

AIRPORT ACTIVITIES & HIGHLIGHTS

Passenger and air carrier ac vity decreased in both FY 2021 and FY 2020 at the Tucson Interna onal

Airport (TUS) a er an increase in FY 2019. Total passengers decreased by 1.1% for FY 2021, which followed

a decrease of 39.6% for FY 2020 and an increase of 6.5% for FY 2019. The TAA noted a marked recovery

from the impacts of the COVID-19 pandemic when compared to FY 2020. Daily nonstop departures

increased to 43 at the end of FY 2021, which is a signifi cant recovery from the count of 24 at the end of FY

2020, though slightly down from the count of 47 daily nonstop departures recorded at the end of FY 2019.

In general, average nonstop departures are impacted by a number of factors and vary from day-to-day

and month-to-month. The average daily seat capacity in FY 2021 was a 7.6% decrease over FY 2020, which

followed a 24.9% decrease over FY 2019, and a 9.6% increase in FY 2019 compared to FY 2018.

Total aircra opera ons (take-off s and landings) at TUS increased 14.3% in FY 2021 a er decreasing 6.7%

in FY 2020 and increasing 0.2% in FY 2019. Total FY 2021 opera ons comprised 74,758 general avia on

opera ons, 45,023 air carrier and air taxi (passenger airline, cargo airline, and charter) opera ons and

20,401 military opera ons. In contrast to air carrier and air taxi opera ons that generate landing fee

revenue, general avia on and military opera ons do not directly generate revenue for the TAA. The

increase in opera ons for FY 2021 was primarily a ributed to an increase in military and general avia on

of 21.1% and 19.5%, respec vely. The decrease in opera ons for FY 2020 was primarily a ributed to a

decrease in air carrier and military opera ons of 25.9% and 9.7%, respec vely, which was par ally off set by

an increase of 5.1% in general avia on.

Landed weight decreased by 2.7% in FY 2021 from FY 2020 to 1,633,047 one-thousand pound units, a er

decreasing by 25.2% in FY 2020 and increasing by 7.9% in FY 2019. In addi on to changes in overall air

traffi c resul ng from the COVID-19 pandemic in FY 2021, the changes across all years have been caused by

varia ons in passenger carrier air service through a combina on of increases and/or decreases in fl ights

and the size of aircra used for fl ights.

Mail and express cargo shipments increased by 7.0% in FY 2021 from FY 2020, following a decrease of 4.0%

in FY 2020 and an increase of 4.0% in FY 2019. The changes in mail and express cargo shipments in each

of these years were primarily a result of changes experienced by Federal Express, the single major cargo

carrier opera ng scheduled fl ights at TUS.

Eight major domes c passenger carriers served TUS as of both September 30, 2021 and September 30,

2020 and six as of September 30, 2019. American Airlines and Southwest Airlines have dominated in both

passenger ac vity and landed weight over the three repor ng periods. These two carriers accounted for

59.5% of passenger traffi c in FY 2021, 62.1% FY 2020 and 63.5% in FY 2019.

Management’s Discussion and Analysis

September 30, 2021

FINANCIALS 19

AIRPORT ACTIVITIES & HIGHLIGHTS (continued)

Management’s Discussion and Analysis (continued)

September 30, 2021

Passengers by Airline (Thousands)

2021 2020 2019

1,400

1,200

1,000

800

600

400

200

0

American Southwest Delta United Alaska Other

Total Passengers and Landed Weight (Thousands)

Passengers Landed Weight

3,500

3,000

2,500

2,000

1,500

1,000

500

2021 2020 2019

Activities & Highlights 2021 2020 2019

Total passengers 2,257,581 2,283,777 3,783,535

% increase/decrease(-) -1.1% -39.6% 6.5%

Average daily seat capacity 4,308 4,663 6,212

% increase/decrease(-) -7.6% -24.9% 9.6%

Aircraft operations 140,182 122,631 131,416

% increase/decrease(-) 14.3% -6.7% 0.2%

Landed weight (1,000 lb. Units) 1,633,047 1,677,958 2,243,559

% increase/decrease(-) -2.7% -25.2% 7.9%

Mail & express cargo (pounds) 67,643,468 63,246,903 65,916,153

% increase/decrease(-) 7.0% -4.0% 4.0%

20 TUCSON AIRPORT AUTHORITY 2021 ACFR

Management’s Discussion and Analysis (continued)

September 30, 2021

AIRPORT ACTIVITIES & HIGHLIGHTS (continued)

Operations by Type (Thousands)

2021 2020 2019

80

60

40

20

0

Air Carrier Air Taxi Military General Aviation

Landed Weight by Airline (Thousands)

2021 2010 2019

1,000

800

600

400

200

0

American Southwest United Delta Federal Alaska

Express

Aircraft Operations (Thousands)

145

140

135

130

125

120

115

110

105

2021 2020 2019

FINANCIALS 21

Total opera ng revenues decreased $2.5 million (6.5%) in FY 2021 over FY 2020 and decreased $8.4 million

(17.8%) in FY 2020 over FY 2019. Decreases in opera ng revenues in FY 2020 were primarily related to

decreases in space rental revenue during the pandemic as rent relief (including waivers of minimum

annual guarantees) was provided to tenants during FY2021. Decreases in opera ng revenues in FY 2020

were primarily related to decreases in concessions and landing fees due to travel restric ons during the

pandemic.

Total opera ng expenses in FY 2021 decreased by $2.8 million (8.5%) over FY 2020. The decrease was

largely a ributable to decreases in personnel and other opera ng expenses par ally off set by an increase

in contractual services. Total opera ng expenses in FY 2020 increased by $0.4 million (1.2%) over FY 2019,

with increases in personnel and other opera ng expenses par ally off set by a decrease in contractual

services.

SUMMARY OF OPERATIONS AND CHANGES IN NET POSITION

Management’s Discussion and Analysis (continued)

September 30, 2021

FINANCIAL HIGHLIGHTS

The TAA’s assets and deferred ou lows exceeded liabili es and deferred infl ows at the end of FY 2021

by $439.4 million, compared to $423.9 million and $396.0 million at the end of FY 2020 and FY 2019,

respec vely. Unrestricted net posi on for fi scal years 2021, 2020 and 2019 was $106.9 million, $99.6

million and $86.2 million, respec vely. The TAA experienced increases in net posi on of $15.5 million, $27.8

million and $9.0 million for FY 2021, FY 2020 and FY 2019, respec vely, compared to the previous years.

The FY 2021 decrease is largely a ributable to a decrease in both non-opera ng revenues of $6.0 million

due to a large gain on disposed fi xed assets in FY 2020 and a decrease in capital contribu ons of $5.1

million due to large draws on federal grant funding in FY 2020. The FY 2020 increase is largely a ributable

to capital contribu ons of $16.8 million and other nonopera ng grants-in-aid of $14.2 million, off set by an

$8.4 million decrease in opera ng revenues due to the global response to the COVID-19 pandemic.

The TAA’s total noncurrent liabili es decreased by $40.5 million in FY 2021 over FY 2020 and decreased

by $0.1 million in FY2020 over FY 2019. These decreases refl ect changes in the net pension liability, long-

term debt and noncurrent environmental liabili es. Par cular to FY 2021, the TAA made a lump sum

contribu on payment of $27.2 million to the Public Safety Personnel Re rement System (PSPRS) during

the year for its fi re department and police department pension plans to reduce the associated net pension

liabili es for each.

Summary of Operations and Changes in Net Position 2021 2020 2019

Operating revenues $ 36,328,027 $ 38,869,374 $ 47,261,051

Operating expenses 30,484,383 33,313,961 32,907,346

Operating income before

depreciation & amortization 5,843,644 5,555,413 14,353,705

Depreciation & amortization 20,148,835 19,514,629 18,393,628

Operating (loss) (14,305,191) (13,959,216) (4,039,923)

Nonoperating revenues 20,400,093 26,394,334 12,364,496

Nonoperating expenses (2,205,762) (1,354,548) (2,664,201)

Income (loss) before capital contributions

3,889,140 11,080,570 5,660,372

Capital contributions 11,614,274 16,763,540

3,386,455

Increase in net position 15,503,414 27,844,110 9,046,827

Net position, beginning of year

423,861,783 396,017,673

386,970,845

Net position, end of year $ 439,365,197 $ 423,861,783 $ 396,017,672

22 TUCSON AIRPORT AUTHORITY 2021 ACFR

Management’s Discussion and Analysis (continued)

September 30, 2021

FINANCIAL POSITION

Increase % Increase

Summary of Net Position 2021 2020 (decrease) decrease (-)

Assets

Current (unrestricted) $

154,267,021 $ 176,314,340 $ (22,047,319) -13.9%

Current (restricted) 23,678,719 23,014,065 664,654 2.9%

Net capital assets

335,774,792 331,407,192 4,367,600 1.3%

Net Pension/OPEB Asset

1,711,563 0 1,711,563 100.00%

Other noncurrent assets 88,995 298,252 (209,257) -70.2%

Total assets

515,521,090 531,033,849 (17,224,322) -3.2%

Deferred outfl ows of resources

4,180,444 6,091,332 (1,910,888) -31.4%

Total assets and deferred outfl ows of resources $ 519,701,534 $ 537,125,181 $ (19,135,210) -3.6%

Liabilities

Current (payable from unrestricted assets)

16,842,881 17,556,125 (713,245) -4.1%

Current (payable from restricted assets) 392,447 402,420 (9,973) -2.5%

Noncurrent

55,643,245 94,435,684 (40,504,000) -42.9%

Total liabilities

72,878,574 112,394,229 (41,227,218) -36.7%

Deferred infl ows of resources 7,457,762 869,169 6,588,593 758.0%

Total liabilities and deferred infl ows of resources

80,336,336 113,263,398 (34,638,625) 721.4%

Net position

Net investment in capital assets

309,147,343 301,652,819 7,494,524 2.5%

Restricted 23,286,272 22,611,645 674,627 3.0%

Unrestricted 106,931,583 99,597,319 7,334,264 7.4%

Net position $

439,365,198

$

423,861,783

$

15,503,415 3.7%

Non-opera ng revenues in FY 2021 decreased 22.7% compared to FY 2020. This was mainly due to a

decrease gain on disposi on of fi xed assets in FY 2021 compared to FY 2020. FY 2020 increased 113.5%

compared to FY 2019. This was primarily a ributable to an increase in the gain on disposi on of capital

assets resul ng from a one- me land sale and other non-opera ng revenue, which includes federal

assistance related to the pandemic. Non-opera ng expenses increased by 62.8% in FY 2021 due to

increased environmental expenses. This follows a decrease in FY 2020 by 49.2% compared to FY 2019,

which was primarily due to decreases in environmental expense and interest expense in that year.

Capital contribu ons in FY 2021 decreased by 30.7% from FY 2020 and FY 2020 increased by 395.0% over

FY 2019. Year-to-year variances in capital contribu ons are determined by factors such as grant availability

and project ming and are not generally expected to be consistent between years.

FINANCIALS 23

Management’s Discussion and Analysis (continued)

September 30, 2021

FINANCIAL POSITION (continued)

Increase % Increase

Summary of Net Position 2020 2019 (decrease) decrease (-)

Assets

Current (unrestricted) $

176,314,340

$

158,585,935

$

17,728,405 11.2%

Current (restricted)

23,014,065 21,646,775 1,367,290 6.3%

Net capital assets 331,407,192 321,124,814 10,282,378 3.2%

Other noncurrent assets 298,252 501,534 (203,282) -40.5%

Total assets

531,033,849 501,859,059 29,174,790 5.8%

Deferred outfl ows of resources 6,091,332 3,992,003 2,099,329 52.6%

Total assets and deferred outfl ows of resources $ 537,125,181 $ 505,851,062 $ 31,274,119 6.2%

Liabilities

Current (payable from unrestricted assets)

17,556,125 13,853,564 3,702,561 26.7%

Current (payable from restricted assets) 402,420 149,762 252,658 168.7%

Noncurrent

94,435,684 94,486,891 (51,207) -0.1%

Total liabilities 112,394,229 108,490,217 3,904,012 3.6%

Deferred infl ows of resources 869,169 1,343,173 (474,004) -35.3%

Total liabilities and deferred infl ows of resources

113,263,398 109,833,390 3,430,008 3.1%

Net position

Net investment in capital assets

301,652,819 288,319,668 13,333,151 4.6%

Restricted 22,611,645 21,497,013 1,114,632 5.2%

Unrestricted

99,597,319 86,200,991 13,396,328 15.5%

Net position $ 423,861,783 $ 396,017,672 $ 27,844,111 7.0%

24 TUCSON AIRPORT AUTHORITY 2021 ACFR

FINANCIAL POSITION (continued)

Current unrestricted assets decreased in FY 2021 over FY 2020 $22.0M and increased in FY 2020 over FY

2019 by $17.7 million. The FY 2021 decrease was primarily due to a decrease in cash and cash equivalents

of $56.2 million, par ally off set by an increase in investments of $42.4 million. The FY 2020 increase was

due mainly to an increase in cash and cash equivalents of $43.5 million and grants receivable of $16.5

million, par ally off set by a $40.8 million decrease in investments. Current restricted assets increased by

$0.7 million in FY 2021 following an increase of $1.4 million in FY 2020. The increase in FY 2021 resulted

from an increase in investments in both the Passenger Facility Charge (PFC) fund and Land Acquisi on

fund, off set by a decrease in cash in both funds. The increase in FY 2020 resulted from an increase in cash,

off set by a decrease in investments. Net capital assets increased by $4.4 million in FY 2021 over FY 2020

and increased by $10.3 million in FY 2020 over FY 2019, both years being impacted by projects in the TAA’s

capital improvement program.

Current liabili es payable from unrestricted assets in FY 2021 decreased $0.7 million compared to FY

2020. There was li le change in current liabili es payable from restricted assets in FY 2021 compared to FY

2020, with both years totaling $0.4 million. Current liabili es payable from unrestricted assets in FY 2020

increased $3.7 million compared to FY 2019. Current liabili es payable from restricted assets in FY 2020

increased $0.3 million compared to FY 2019. Total noncurrent liabili es decreased by $38.8 million in FY

2021 compared to FY 2020 and decreased by $0.1 million in FY 2020 compared to FY 2019. The decrease

in FY 2021 was primarily due to a decrease in the net pension liability of $36.8 million. The TAA made a

lump sum payment during FY 2021 to PSPRS of $27.2 million to reduce the net pension liability for both its

fi re department and police department pension programs. The decrease in FY 2020 was primarily due to

normal debt service, off set by an increase in net pension/other post-employment benefi ts (OPEB) liability.

The largest por on of the TAA’s net posi on, 70.4% for FY 2021, 71.2% for FY 2020 and 72.8% for FY

2019, represents its investment in capital assets (e.g., land, buildings, machinery and equipment), less

outstanding debt used to acquire those assets. The TAA uses these assets to provide services to its

passengers, visitors and tenants that generate future revenue streams. Although the TAA’s investment in

its capital assets is reported net of related debt, the resources needed to repay this debt must be provided

from opera ons, since the capital assets themselves cannot be used to re re these liabili es.

An addi onal por on of the TAA’s net posi on, 5.3% for both FY 2021 and FY 2020 and 5.4% for FY 2019,

represents resources that are subject to restric ons from government grantors, bond resolu ons and

State and Federal regulators on how they may be used. The changes in restricted net posi on over the

three-year period are primarily a ributable to passenger facility charge funds that are accumula ng for

re rement of debt used to fi nance completed terminal expansion and concourse renova

on projects,

off set by decreases in assets restricted for payment of environmental remedia on expenses. The

remaining unrestricted net posi on balances of $106.9 million for FY 2021, $99.6 million for FY 2020 and

$86.2 million for FY 2019 may be used for any lawful purpose of the TAA.

REVENUES

In FY 2021, total revenues of $68.3 million were less than the prior fi scal year by 16.7%, whereas FY 2020

revenues of $82.0 million were more than FY 2019 by 30.2%.

Opera ng revenues decreased in FY 2021 over FY 2020 by $2.5 million (6.5%). Revenue category changes

included decreases in space rentals of $2.7 million and airport services of $0.3 million, and an increase in

concession revenue of $0.5 million. The largest decrease over prior year was for space rentals (18.2%) and

it is generally a ributable to rent relief that was provided to airport tenants during FY 2021 due to the

COVID-19 pandemic.

Management’s Discussion and Analysis (continued)

September 31, 2021

FINANCIALS 25

Management’s Discussion and Analysis (continued)

September 30, 2021

Opera ng revenues decreased in FY 2020 over FY 2019 by $8.4 million (17.8%). Revenue category

changes included decreases in landing fees of $1.0 million, concession revenue decreases of $6.7 million,

and other opera ng revenue decreases of $0.7 million. The landing fees decreased from the prior year

(33.7%), concession revenues (36.2%) and other opera ng revenue decreases (19.7%) are generally

a ributable to the declining traffi c at the airport due to restric ons in domes c and interna onal travel

during the COVID-19 pandemic.

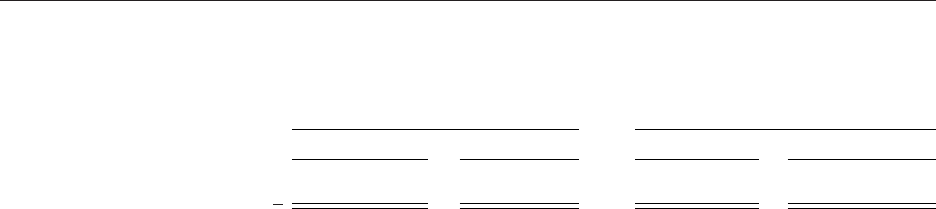

The following charts show the major sources and the percentage of operating revenues for fi scal years 2021 and 2020:

Increase % Increase

Revenues by Major Source 2021 2020 (decrease) decrease (-)

Landing fees $ 1,973,618 $ 2,037,041 $ (63,423) -3.1%

Space rentals 11,906,284 14,560,223 (2,653,939) -18.2%

Land rent 3,705,607 3,789,349 (83,742) -2.2%

Concession revenue 12,386,429 11,878,384 508,045 4.3%

Airport services 3,354,818 3,611,852 (257,034) -7.1%

Other operating revenues 3,001,271 2,992,525 8,746 0.3%

Total operating revenues 36,328,027 38,869,374 (2,541,347) -6.5%

Interest income 485,673 2,330,044 (1,844,371) -79.2%

Net increase (decrease) in fair value

of investments (169,672) 47,394 (217,066) -458.0%

Passenger facility charges 4,628,663 4,265,140 363,523 8.5%

Gain on disposition of fi xed assets (22,866) 5,538,871 (5,561,737) -100.4%

Nonoperating grants-in-aid 15,478,295 14,153,997 1,324,298 9.4%

Other nonoperating revenue - 58,888 (58,888) 0.0%

Total nonoperating revenues 20,400,093 26,394,334 (5,994,241) -22.7%

Capital contributions 11,614,274 16,763,541 (5,149,267) -30.7%

Total revenues $ 68,342,394 $ 82,027,249 $ (13,684,855) -16.7%

Operating Revenues FY 2021

Other Operating Revenues

8.3%

Airport Services

9.2%

Concession Revenue

34.1%

Landing Fees

5.4%

Space Rentals

32.8%

Land Rent

10.2%

Operating Revenues FY 2020

Other Operating Revenues

7.7%

Airport Services

9.3%

Concession Revenue

30.6%

Landing Fees

5.2%

Space Rentals

37.5%

Land Rent

9.7%

26 TUCSON AIRPORT AUTHORITY 2021 ACFR

Management’s Discussion and Analysis (continued)

September 30, 2021

REVENUES (continued)

Nonopera ng revenues consist mainly of income on investments, gain on disposi on of capital assets, federal grant

assistance related to the pandemic reported in other nonopera ng revenue, and passenger facility charges (PFCs).

PFC revenue fl uctuates based on passenger levels. FY 2021 nonopera ng revenues decreased $6.0 million (22.7%)