ELECTRONIC TRANSMISSION DISCLAIMER

STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS

IMPORTANT: You must read the following disclaimer before continuing. This electronic transmission applies to

the attached document and you are therefore advised to read this disclaimer carefully before reading, accessing or

making any other use of the attached prospectus (the “Prospectus ”) relating to Avast plc (the “Company”) dated

10 May 2018 accessed from this page or otherwise received as a result of such access and you are therefore

advised to read this disclaimer carefully before reading, accessing or making any other use of the attached

document. In accessing the attached document, you agree to be bound by the following terms and conditions,

including any modifications to them from time to time, each time you receive any information from us as a result

of such access. You acknowledge that this electronic transmission and the delivery of the attached document is

confidential and intended for you only and you agree you will not forward, reproduce, copy, download or publish

this electronic transmission or the attached document, in whole or in part, whether electronically or otherwise to

any other person. The Prospectus has been prepared solely in connection with the proposed offer to certain

institutional and professional investors (the “Global Offer”) of ordinary shares (the “Shares”) of the Company.

The Prospectus has been published in connection with the admission of the Shares to the premium listing

segment of the Official List of the UK Financial Conduct Authority (the “FCA”) and to trading on the London

Stock Exchange plc’s main market for listed securities (together, “Admission”). The Prospectus has been

approved by the FCA as a prospectus prepared in accordance with the Prospectus Rules made under section 73A

of the FSMA. The Prospectus has been published and is available from the Company’s registered office and on

the Company’s website at http://investors.avast.com. Pricing information and other related disclosures have also

been published on this website. Prospective investors are advised to access such information prior to making an

investment decision.

THIS ELECTRONIC TRANSMISSION AND THE ATTACHED DOCUMENT MAY ONLY BE

DISTRIBUTED IN CONNECTION WITH “OFFSHORE TRANSACTIONS” AS DEFINED IN, AND IN

RELIANCE ON, REGULATION S UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE

“U.S. SECURITIES ACT”) (“REGULATION S”) OR WITHIN THE UNITED STATES TO QUALIFIED

INSTITUTIONAL BUYERS (“QIBs”) AS DEFINED IN RULE 144A UNDER THE U.S. SECURITIES ACT

(“RULE 144A”) OR PURSUANT TO ANOTHER EXEMPTION FROM, OR IN A TRANSACTION NOT

SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE U.S. SECURITIES ACT. ANY

FORWARDING, DISTRIBUTION OR REPRODUCTION OF THE ATTACHED DOCUMENT IN WHOLE

OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS NOTICE MAY RESULT IN A

VIOLATION OF THE U.S. SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS.

NOTHING IN THIS ELECTRONIC TRANSMISSION AND THE ATTACHED DOCUMENT CONSTITUTES

AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO.

THE SHARES REFERRED TO HEREIN HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER

THE U.S. SECURITIES ACT OR WITH ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE

OF THE UNITED STATES OR OTHER JURISDICTION AND MAY NOT BE OFFERED, SOLD, PLEDGED

OR OTHERWISE TRANSFERRED EXCEPT (1) TO A PERSON THAT THE SELLER AND ANY PERSON

ACTING ON ITS BEHALF REASONABLY BELIEVES IS A QIB IN RELIANCE ON RULE 144A OR

PURSUANT TO ANOTHER EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE

REGISTRATION REQUIREMENTS OF THE U.S. SECURITIES ACT OR (2) IN AN “OFFSHORE

TRANSACTION“ AS DEFINED IN, AND IN ACCORDANCE WITH RULE 903 OR RULE 904 OF,

REGULATION S, IN EACH CASE IN ACCORDANCE WITH ANY APPLICABLE SECURITIES LAWS OF

ANY STATE OF THE UNITED STATES.

This electronic transmission and the attached document and the Global Offer when made are only addressed to

and directed at persons in member states of the European Economic Area who are “qualified investors” within

the meaning of Article 2(1)(e) of the Prospectus Directive (Directive 2003/71/EC) and amendments thereto

(“Qualified Investors”). In addition, in the United Kingdom, this electronic transmission and the attached

document is being distributed only to, and is directed only at, Qualified Investors (i) who have professional

experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”); (ii) who are high net worth companies,

unincorporated associations and other persons falling within Article 49(2)(a) to (d) of the Order, and (iii) to

whom it may otherwise lawfully be communicated (all such persons together being referred to as “relevant

persons”). This electronic transmission and the attached document must not be acted on or relied on (i) in the

United Kingdom, by persons who are not relevant persons, and (ii) in any member state of the European

Economic Area other than the United Kingdom, by persons who are not Qualified Investors. Any investment or

investment activity to which this document relates is available only to (i) in the United Kingdom, relevant

persons, and (ii) in any member state of the European Economic Area other than the United Kingdom, Qualified

Investors, and will be engaged in only with such persons.

Confirmation of your Representation: This electronic transmission and the attached document is delivered to

you on the basis that you are deemed to have represented to Morgan Stanley & Co. International plc (“Morgan

Stanley”), UBS Limited (“UBS”), Barclays Bank PLC, acting through its Investment Bank (“Barclays”), Merrill

Lynch International (“BofA Merrill Lynch”), Credit Suisse Securities (Europe) Limited (“Credit Suisse”),

Jefferies International Limited (“Jefferies”), and KeyBanc Capital Markets Inc. (“KeyBanc” and together with

Morgan Stanley, UBS, Barclays, BofA Merrill Lynch, Credit Suisse and Jefferies, the “Underwriters”), N M

Rothschild & Sons Limited (the “Financial Adviser”), the Company, each of the Selling Shareholders and the

Over-allotment Shareholders (as defined in Part 15 “Definitions and Glossary”) that (i) you are (a) a QIB

acquiring such securities for its own account or for the account of another QIB or (b) acquiring such securities in

“offshore transactions”, as defined in, and in reliance on, Regulation S; (ii) if you are in the United Kingdom, you

are a relevant person, and/or a relevant person who is acting on behalf of, relevant persons in the United

Kingdom and/or Qualified Investors to the extent you are acting on behalf of persons or entities in the United

Kingdom or the EEA; (iii) if you are in any member state of the European Economic Area other than the United

Kingdom, you are a Qualified Investor and/or a Qualified Investor acting on behalf of, Qualified Investors or

relevant persons, to the extent you are acting on behalf of persons or entities in the EEA or the United Kingdom;

(iv) if you are outside of the EEA and the United States, you are a person to whom this electronic transmission

and the attached document may be lawfully delivered in accordance with the laws of the jurisdiction in which

you are located and (v) you are an institutional investor that is eligible to receive this document and you consent

to delivery by electronic transmission.

You are reminded that you have received this electronic transmission and the attached document on the basis that

you are a person into whose possession this document may be lawfully delivered in accordance with the laws of

the jurisdiction in which you are located and you may not nor are you authorised to deliver this document,

electronically or otherwise, to any other person. This document has been made available to you in an electronic

form. You are reminded that documents transmitted via this medium may be altered or changed during the

process of electronic transmission and consequently none of the Company, the Selling Shareholders, the Over-

allotment Shareholders, the Underwriters, the Financial Adviser nor any of their respective affiliates accepts any

liability or responsibility whatsoever in respect of any difference between the document distributed to you in

electronic format and the hard copy version. By accessing the attached document, you consent to receiving it in

electronic form. None of the Underwriters, the Financial Adviser nor any of their respective affiliates accepts any

responsibility whatsoever for the contents of the attached document or for any statement made or purported to be

made by it, or on its behalf, in connection with the Company, the Global Offer or the Shares. To the fullest extent

permitted by law, the Underwriters, the Financial Adviser and each of their respective affiliates, each accordingly

disclaims all and any liability whether arising in tort, contract or otherwise which they might otherwise have in

respect of such document or any such statement. No representation or warranty express or implied, is made by

any of the Underwriters, the Financial Adviser or any of their respective affiliates as to the accuracy,

completeness, reasonableness, verification or sufficiency of the information set out in the attached document.

The Underwriters and the Financial Adviser are acting exclusively for the Company and no one else in

connection with the Global Offer. They will not regard any other person (whether or not a recipient of this

document) as their client in relation to the Global Offer and will not be responsible to anyone other than the

Company for providing the protections afforded to their respective clients nor for giving advice in relation to the

Global Offer or any transaction or arrangement referred to the attached document.

Restriction: Nothing in this electronic transmission constitutes, and this electronic transmission may not be used

in connection with, an offer of securities for sale to persons other than the specified categories of institutional

buyers described above and to whom it is directed and access has been limited to that it shall not constitute a

general solicitation. If you have gained access to this transmission contrary to the foregoing restrictions, you will

be unable to purchase any of the securities described herein.

You are responsible for protecting against viruses and other destructive items. Your receipt of this document via

electronic transmission is at your own risk and it is your responsibility to take precautions to ensure that it is free

from viruses and other items of a destructive nature.

This document comprises a prospectus (the “Prospectus”) for the purposes of Article 3 of European Union

Directive 2003/71/EC, as amended (the “Prospectus Directive”) relating to Avast plc (the “Company”)

prepared in accordance with the Prospectus Rules of the Financial Conduct Authority (the “FCA”) made under

section 73A of the Financial Services and Markets Act 2000 (the “FSMA”). The Prospectus has been approved

by the FCA in accordance with section 87A of the FSMA and has been made available to the public in

accordance with Prospectus Rule 3.2.1.

Application has been made to the FCA for all of the ordinary shares of the Company (the “Shares”) issued and to

be issued in connection with the Global Offer to be admitted to the premium listing segment of the Official List

of the FCA and to London Stock Exchange plc (the “London Stock Exchange”) for all of the Shares to be

admitted to trading on the London Stock Exchange’s main market for listed securities (together, “Admission”).

Admission in trading on the London Stock Exchange’s main market for listed securities constitutes admission to

trading on a regulated market. In the global offering (the “Global Offer”), 58,977,478 new Shares are being

offered by the Company (the “New Shares ”) and 181,815,424 existing Shares (the “Existing Shares”) are being

offered by certain existing holders of Shares. Conditional dealings in the Shares are expected to commence on

the London Stock Exchange on 10 May 2018. It is expected that Admission will become effective and that

unconditional dealings in the Shares will commence on 15 May 2018. All dealings before the commencement

of unconditional dealings will be of no effect if Admission does not take place and such dealings will be at

the sole risk of the parties concerned. No application is currently intended to be made for the Shares to be

admitted to listing or dealt with on any other exchange. The New Shares issued by the Company will rank

pari passu in all respects with the Existing Shares. No application has been made or is currently intended

to be made for the Shares to be admitted to listing or dealt with on any other exchange.

The directors of the Company, whose names appear on page 50 of this Prospectus (the “Directors”), and the

Company accept responsibility for the information contained in this Prospectus. To the best of the knowledge of

the Directors and the Company (each of whom has taken all reasonable care to ensure that such is the case), the

information contained in this Prospectus is in accordance with the facts and contains no omission likely to affect

the import of such information.

Prospective investors should read this Prospectus in its entirety before making any

decision as to whether to subscribe for or purchase Shares. See in Part 1—“Risk

Factors” for a discussion of certain risks and other factors that should be considered

prior to any investment in the Shares.

AVAST PLC

(Incorporated under the Companies Act 2006 and registered in England and Wales with registered

number 07118170)

Global Offer of 240,792,902 Shares

at an Offer Price of 250 pence per Share

and admission to the Premium Listing Segment of the Official List

and to trading on the Main Market of the London Stock Exchange

Joint Global Co-ordinators, Joint Bookrunners

and Joint Sponsors

Morgan Stanley UBS Investment Bank

Joint Bookrunners

Barclays BofA Merrill

Lynch

Credit Suisse Jefferies

Co-Lead Manager

KeyBanc Capital Markets

Financial Adviser

Rothschild

ORDINARY SHARE CAPITAL IMMEDIATELY FOLLOWING ADMISSION

Issued and fully paid

Number Nominal Value

952,639,185 10 pence

The contents of this Prospectus are not to be construed as legal, business or tax advice. Each prospective investor

should consult his or her own lawyer, independent financial adviser or tax adviser for legal, financial or tax

advice in relation to any subscription, purchase or proposed subscription or purchase of Shares. Prospective

investors should be aware that an investment in the Company involves a degree of risk and that, if certain of the

risks described in the Prospectus occur, investors may find their investment materially adversely affected.

Accordingly, an investment in the Shares is only suitable for investors who are particularly knowledgeable in

investment matters and who are able to bear the loss of the whole or part of their investment.

Each of Morgan Stanley & Co. International plc (“Morgan Stanley”), UBS Limited (“UBS”), Barclays Bank

PLC, acting through its Investment Bank (“Barclays”), Merrill Lynch International (“BofA Merrill Lynch”) and

Credit Suisse Securities (Europe) Limited (“Credit Suisse”) is authorised by the Prudential Regulation Authority

(the “PRA”) and regulated by the FCA and the PRA in the United Kingdom. Jefferies International Limited

(“Jefferies”) and N M Rothschild & Sons Limited (“Rothschild” or the “Financial Adviser”) are authorised and

regulated by the FCA in the United Kingdom. KeyBanc Capital Markets Inc. (“KeyBanc Capital Markets”) is

regulated by the U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority.

Morgan Stanley, UBS, Barclays, Credit Suisse, Jefferies, BofA Merrill Lynch and KeyBanc Capital Markets

(together, the “Underwriters”) and Rothschild (together with the Underwriters, the “Banks”) are acting

exclusively for the Company and no-one else in connection with the Global Offer. None of the Banks will regard

any other person (whether or not a recipient of this Prospectus) as a client in relation to the Global Offer and will

not be responsible to anyone other than the Company for providing the protections afforded to their respective

clients or for the giving of advice in relation to the Global Offer or any transaction, matter, or arrangement

referred to in this Prospectus. Apart from the responsibilities and liabilities, if any, which may be imposed on the

Banks by the FSMA or the regulatory regime established thereunder or under the regulatory regime of any

jurisdiction where exclusion of liability under the relevant regulatory regime would be illegal, void or

unenforceable, none of the Banks nor any of their respective affiliates accepts any responsibility whatsoever for

the contents of this Prospectus including its accuracy, completeness and verification or for any other statement

made or purported to be made by them, or on their behalf, in connection with the Company, the Shares or the

Global Offer. Each of the Banks and each of their respective affiliates accordingly disclaim, to the fullest extent

permitted by applicable law, all and any liability whether arising in tort, contract or otherwise (save as referred to

above) which they might otherwise be found to have in respect of this Prospectus or any such statement.

Investors should rely only on the information contained in this Prospectus. No representation or warranty express

or implied, is made by any of the Banks or any of their respective affiliates as to the accuracy, completeness,

verification or sufficiency of the information set out in this Prospectus, and nothing in this Prospectus will be

relied upon as a promise or representation in this respect, whether or not to the past or future. This Prospectus is

not intended to provide the basis of any credit or other evaluation and should not be considered as a

recommendation by the Company, the Directors, the Selling Shareholders or any of the Banks or any of their

representatives or affiliates that any recipient of this Prospectus should subscribe for or purchase Shares.

In connection with the Global Offer of the Shares, each of the Underwriters and any of their respective affiliates

or agents acting as an investor for its or their own account(s) may purchase Shares and, in that capacity, may

retain, purchase, sell, offer to sell or otherwise deal for its or their own account(s) in such securities, any other

securities of the Company or other related investments in connections with the Global Offer or otherwise.

Accordingly, references in this Prospectus to Shares being offered, sold or otherwise dealt with should be read as

including any offer to purchase or dealing to any of the Underwriters or any of them or any of their respective

affiliates acting in such capacity as an investor for its or their own account(s). In addition, certain of the

Underwriters and any of their respective affiliates may in the ordinary course of their business activities enter

into financing arrangements (including swaps) with investors in connection with which such Underwriters (or

their affiliates) may from time to time acquire, hold or dispose of Shares. The Underwriters do not intend to

disclose the extent of any such investment or transactions otherwise than in accordance with any legal or

regulatory obligation to do so.

Each of the Underwriters and their respective affiliates may have engaged in transactions with, and provided

various investment banking, financial advisory and other services for, the Company and/or the Selling

Shareholders for which they would have received customary fees. Each of the Underwriters and their respective

affiliates may provide such services to the Company and/or the Selling Shareholders and any of its affiliates in

the future.

This Prospectus does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of

any offer to purchase or subscribe for, any securities other than the securities to which it relates or any offer or

invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, such securities by any

person in any circumstances or in any jurisdiction in which such offer or solicitation is unlawful.

i

Information to Distributors: Solely for the purposes of the product governance requirements contained within:

(a) EU Directive 2014/65/EU on markets in financial instruments, as amended (“MiFID II”); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing

measures (together, the “MiFID II Product Governance Requirements”), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any “manufacturer” (for the purposes of the Product

Governance Requirements) may otherwise have with respect thereto, the Shares the subject of the Global Offer

have been subject to a product approval process, which has determined that such Shares are: (i) compatible with

an end target market of retail investors and investors who meet the criteria of professional clients and eligible

counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as

are permitted by MiFID II (the “Target Market Assessment”). Notwithstanding the Target Market Assessment,

distributors should note that: the price of the Shares may decline and investors could lose all or part of their

investment; the Shares offer no guaranteed income and no capital protection; and an investment in the Shares is

compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or

in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to bear any losses that may result therefrom. The

Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling

restrictions in relation to the Offer. Furthermore, it is noted that, notwithstanding the Target Market Assessment,

the Underwriters will only procure investors who meet the criteria of professional clients and eligible

counterparties. For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment

of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group

of investors to invest in, or purchase, or take any other action whatsoever with respect to the Shares. Each

distributor is responsible for undertaking its own target market assessment in respect of the Shares and

determining appropriate distribution channels.

Notice to overseas shareholders

The Shares have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”). The Shares offered by this Prospectus may not be offered or sold in the United States,

except to qualified institutional buyers (“QIBs”), as defined in, and in reliance on, the exemption from the

registration requirements of the U.S. Securities Act provided in Rule 144A under the U.S. Securities Act

(“Rule 144A”) or another exemption from, or in a transaction not subject to, the registration requirements of the

U.S. Securities Act. Prospective investors are hereby notified that the sellers of the Shares may be relying on the

exemption from the provisions of section 5 of the U.S. Securities Act provided by Rule 144A. Outside of the

United States, the Global Offer is being made in offshore transactions as defined in Regulation S of the U.S.

Securities Act. No actions have been taken to allow a public offering of the Shares under the applicable securities

laws of any jurisdiction, including Canada, Australia or Japan. Subject to certain exceptions, the Shares may not

be offered or sold in any jurisdiction, or to or for the account or benefit of any national, resident or citizen of any

jurisdiction, including Canada, Australia or Japan. This Prospectus does not constitute an offer of, or the

solicitation of an offer to subscribe for or purchase any of the Shares to any person in any jurisdiction to whom it

is unlawful to make such offer or solicitation in such jurisdiction.

The Shares have not been and will not be registered or qualified for distribution by this Prospectus under the

applicable securities laws of Canada, Australia or Japan. Subject to certain exceptions, the Shares may not be

offered or sold in any jurisdiction, or to or for the account or benefit of any national, resident or citizen in

Australia or Japan or to any person located or resident in Canada. The Shares have not been recommended by

any U.S. federal or state securities commission or regulatory authority. Furthermore, the foregoing authorities

have not confirmed the accuracy or determined the adequacy of this Prospectus. Any representation to the

contrary is a criminal offence in the United States.

The distribution of this Prospectus and the offer and sale of the Shares in certain jurisdictions may be restricted

by law, including, without limitation, the United States, Australia, Canada, Dubai, Hong Kong, Japan, Singapore,

South Africa and Switzerland. No action has been or will be taken by the Company, the Selling Shareholders (as

defined in Part 15—“Definitions and Glossary”) or the Banks to permit a public offering of the Shares under the

applicable securities laws of any jurisdiction. Other than in the United Kingdom, no action has been taken or will

be taken to permit the possession or distribution of this Prospectus (or any other offering or publicity materials

relating to the Shares) in any jurisdiction where action for that purpose may be required or where doing so is

restricted by law. Accordingly, neither this Prospectus, nor any advertisement, nor any other offering material

may be distributed or published in any jurisdiction except under circumstances that will result in compliance with

any applicable laws and regulations. Persons into whose possession this Prospectus comes should inform

themselves about and observe any such restrictions. Any failure to comply with such restrictions may constitute a

violation of the securities laws of any such jurisdiction. In particular, no actions have been or will be taken to

ii

permit a public offering of the Shares under the applicable securities laws of any jurisdiction, including the

United States, Australia, Canada, Dubai, Hong Kong, Japan, Singapore, South Africa and Switzerland.

Accordingly, subject to certain exceptions, the Shares may not be offered, sold or delivered within the United

States, Australia, Canada, Dubai, Hong Kong, Japan, Singapore, South Africa and Switzerland.

For a description of these and certain further restrictions on the offer, subscription, sale and transfer of the Shares

and distribution of this Prospectus, please see Part 13—“Details of the Global Offer” of this Prospectus. Please

note that by receiving this Prospectus, subscribers and purchasers shall be deemed to have made certain

representations, acknowledgements and agreements set out herein including, without limitation, those set out in

Part 13—“Details of the Global Offer” of this Prospectus.

Available information

For so long as any of the Shares are in issue and are “restricted securities” within the meaning of Rule 144(a)(3)

under the U.S. Securities Act, the Company will, during any period in which it is not subject to section 13 or

15(d) under the U.S. Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), nor exempt from

reporting under the U.S. Exchange Act pursuant to Rule 12g3-2(b) thereunder, make available to any holder or

beneficial owner of a Share, or to any prospective purchaser of a Share designated by such holder or beneficial

owner, the information specified in, and meeting the requirements of, Rule 144A(d)(4) under the U.S. Securities

Act.

iii

TABLE OF CONTENTS

SUMMARY ........................................................................... 1

PART 1 RISK FACTORS ................................................................. 19

PART 2 PRESENTATION OF FINANCIAL AND OTHER INFORMATION ....................... 38

PART 3 DIRECTORS, SECRETARY, REGISTERED AND HEAD OFFICE AND ADVISERS ........ 50

PART 4 EXPECTED TIMETABLE OF PRINCIPAL EVENTS AND OFFER STATISTICS ........... 52

PART 5 INDUSTRY OVERVIEW ......................................................... 53

PART 6 BUSINESS ..................................................................... 61

PART 7 DIRECTORS AND CORPORATE GOVERNANCE .................................... 81

PART 8 SELECTED FINANCIAL INFORMATION ........................................... 89

PART 9 OPERATING AND FINANCIAL REVIEW ........................................... 95

PART 10 CAPITALISATION AND INDEBTEDNESS ......................................... 145

PART 11 HISTORICAL FINANCIAL INFORMATION ........................................ 147

PART 12 UNAUDITED PRO FORMA FINANCIAL INFORMATION ............................ 264

PART 13 DETAILS OF THE GLOBAL OFFER ............................................... 268

PART 14 ADDITIONAL INFORMATION ................................................... 277

PART 15 DEFINITIONS AND GLOSSARY ................................................. 319

iv

SUMMARY

Summaries are made up of disclosure requirements known as “Elements”. These Elements are numbered in

Sections A-E (A. 1 - E. 7). This summary contains all the Elements required to be included in a summary for this

type of security and issuer. Because some Elements are not required to be addressed, there may be gaps in the

numbering sequence of the Elements.

Even though an Element may be required to be inserted in the summary because of the type of securities and

issuer, it is possible that no relevant information can be given regarding the Element. In this case a short

description of the Element is included in the summary with the mention of “not applicable”.

Section A—Introductions and warnings

A.1 Warning

This summary should be read as an introduction to the prospectus (the “Prospectus”).

Any decision to invest in the securities should be based on consideration of the Prospectus as a whole

by the investor. Where a claim relating to the information contained in the Prospectus is brought

before a court, the plaintiff investor might, under the national legislation of the Member States, have

to bear the costs of translating the prospectus before the legal proceedings are initiated.

Civil liability attaches only to those persons who have tabled the summary including any translation

thereof, and applied its notification, but only if the summary is misleading, inaccurate or inconsistent

when read together with the other parts of the Prospectus or it does not provide, when read together

with the other parts of the Prospectus, key information in order to aid investors when considering

whether to invest in such securities.

A.2 Subsequent resale of securities or final placement of securities through financial intermediaries

Not applicable. No consent has been given by the Company or any person responsible for drawing up

this Prospectus to the use of the Prospectus for subsequent resale or final placement of securities by

financial intermediaries.

Section B—Issuer

B.1 Legal and commercial name

Avast plc (the “Company”).

B.2 Domicile and legal form

The Company was incorporated and registered in England and Wales on 7 January 2010 as a private

company limited by shares with the name Avast Limited and with the registered number 07118170.

On 18 April 2018, the Company was acquired by Sybil Holdings S.à r.l. Prior to acquisition, the

Company was a dormant company. On 3 May 2018, the Company was re-registered as a public

limited company with the name Avast plc.

The principal legislation under which the Company operates and under which the New Shares will be

created is the Companies Act 2006, as amended (the “Act”).

B.3 Key factors affecting current operations and principal activities

The Group is the number one provider of security software to the consumer market as measured by

number of users. The Group has been delivering security solutions to the consumer market for the last

30 years and offers a range of products that protect users’ security, device performance and privacy

(collectively, their “digital lives”). Headquartered in the Czech Republic, the Group has users in

almost every country in the world, with more than 435 million users worldwide as of 31 December

2017, including more than 290 million desktop users. Of these desktop users, approximately 4% were

users of paid products (“customers”). As of the same date, there were 59 countries in which the

Group had at least one million users. The Group’s consumer personal computer (“PC”) software

products had over 290 million users as of 31 December 2017, approximately six times more than the

Group’s nearest competitor.

1

The Group offers products in two segments: consumer products (which generate direct and indirect

revenue streams) and products for the small and medium business (“SMB”) market. These products

secure not just the devices of users, but also their data, families, networks and homes. The Group

offers next-generation consumer PC antivirus security software under the Avast and AVG brands,

each in the form of both free offerings and paid premium products. In addition to security products,

the Group also offers value-added solutions for PCs and mobile devices focused on performance and

privacy, such as optimisation products (including CCleaner, Avast Cleanup and AVG Tune Up), VPN

products (including HideMyAss (“HMA ”) and Avast SecureLine and AVG Secure VPN), password

manager products (including Avast Passwords) and family safety products (such as Location Labs’

mobile parental controls products). The Group is also developing products to address the Smart Home

market and the privacy and security threats posed by the rapid growth of connected devices,

collectively known as the internet of things (“IoT”). In addition, the Group monetises its users

indirectly through advertisements and third party software distribution agreements, as well as through

its secure browser, Avast Secure Browser; its e-commerce offering, SafePrice; and its data analytics

business, Jumpshot. Specifically designed for the SMB market, the Group offers cloud and

on-premises antivirus protection and IT administrative solutions under both the Avast and AVG

brands.

The Group’s antivirus solutions use artificial intelligence (“AI”) and employ machine-learning

capabilities to conduct behavioural analysis and improve detection abilities. With both local and

cloud-based deep learning capabilities, the Group’s security engine is powered by a continuous data

loop of inputs from the Group’s users, who act as a geographically dispersed global threat detection

system. The Group’s security engine stopped approximately two billion attacks per month in the year

ended 31 December 2017. The Group places a heavy focus on the continuous development and

improvement of these technologies, with more than 45% of its employees working in research and

development (“R&D”). The Group believes this focus on R&D strongly contributes to the fact that

the Group’s products are consistently ranked among the highest-rated antivirus solutions by both users

and editors on leading download websites, as well as in popular media globally.

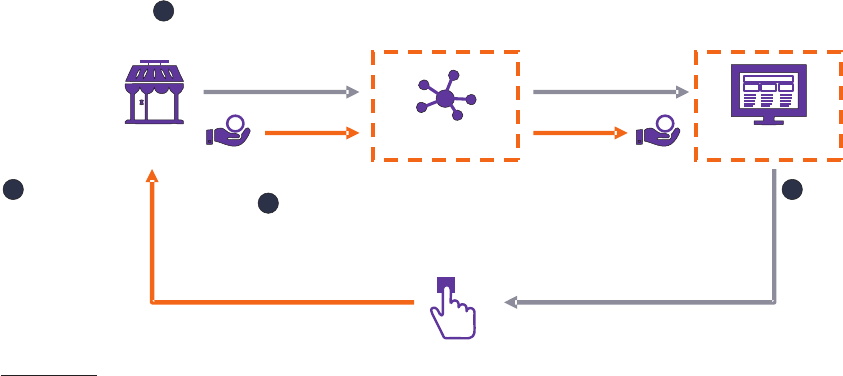

The Group offers versions of its high-performance consumer PC antivirus security software to

consumers free of charge. The Group focuses on promoting these free products as a part of its user

acquisition strategy. The Group monetises its user base by converting users of its free antivirus

software to paid antivirus customers and selling existing customers of its paid antivirus products a

higher tier of paid antivirus software (collectively, “up-selling”) or adjacent (non-antivirus) paid

products, such as VPN products or PC optimisation tools (“cross-selling”). The large user base not

only drives direct revenues by growing the market to which the Group can target its up-selling and

cross-selling campaigns, but it also improves the accuracy and effectiveness of the Group’s machine-

learning-powered consumer monetisation platform. The platform becomes more effective with

increased inputs, improving the Group’s ability to market and advertise its products to its existing user

base by learning the most effective time and manner to message and prompt users to purchase

premium paid antivirus software or value-added solutions. The Group’s free products provide

comprehensive malware protection to users, while imposing low user support and servicing costs on

the Group, amounting to, on average, $0.02 per free incremental PC antivirus software user per

annum for the year ended 31 December 2017.

The Group has successfully grown its business in recent years while maintaining strong levels of

profitability. Further, the Group’s billings are primarily composed of subscription agreements, which

enhance the predictability and visibility of the Group’s future revenue streams. Subscription

agreements are typically paid in full up front with revenue being recognised on a deferred basis over

the life of the agreements, which typically vary from one to three years. On a like-for-like basis, the

Group’s Adjusted Billings increased 9% from $745.4 million for the year ended 31 December 2016 to

$811.3 million for the year ended 31 December 2017 and increased 1% from $739.0 million for the

year ended 31 December 2015 to $745.4 million for the year ended 31 December 2016. Piriform

contributed $10.6 million to the Group’s 2017 Adjusted Billings of $811.3 million from the date of its

acquisition on 18 July 2017 to 31 December 2017, and, had Piriform always been a part of the Group,

it would have contributed an additional $10.9 million. The Discontinued Business contributed

$38.5 million to the Group’s Adjusted Billings in 2017, $66.7 million in 2016, and $101.4 million in

2015. Excluding Piriform and Discontinued Business, on a like-for-like basis, the Group’s Adjusted

Billings increased 11% from 2016 to 2017, and 6% from 2015 to 2016. On a like-for-like basis, the

2

Group’s Adjusted Revenues increased 6% from $736.5 million for the year ended 31 December 2016

to $779.5 million for the year ended 31 December 2017 and 2% from $720.5 million for the year

ended 31 December 2015 to $736.5 million for the year ended 31 December 2016. Piriform

contributed $6.1 million to the Group’s 2017 Adjusted Revenues of $779.5 million from the date of

its acquisition on 18 July 2017 to 31 December 2017, and, had Piriform always been a part of the

Group, it would have contributed an additional $15.6 million. Discontinued Business contributed

$38.5 million to 2017, $66.7 million to 2016, and $101.4 million to 2015 Adjusted Revenue.

Excluding Piriform and Discontinued Business, on a like-for-like basis, the Group’s Adjusted

Revenue increased 7% from 2016 to 2017, and 8% from 2015 to 2016.

B.4a Significant recent trends affecting the Group and the industry in which it operates

The Group offers products directly to consumers and SMBs in several markets encompassing

cybersecurity, device computing performance and data privacy. The Group also generates revenue

indirectly through the analytics, affiliate publishing and web browsing markets. Despite operating in

several varied markets, the core of the Group’s business is its global user base. The Group has

achieved significant scale and success by developing products for hundreds of millions of consumers

who have recognised the growing need for solutions that enable them to live their online lives safely

and securely.

As increasingly larger segments of consumers’ lives become digital, fear of financial losses to hackers

has risen. The primary attack vectors fuelling these fears include ransomware, identity theft and

socially engineered malware. Ransomware enables hackers to extort consumers and businesses by

first encrypting all of the data at the centre of consumers’ digital lives and then demanding monetary

compensation to prevent the permanent deletion of that data. Identity theft involves stealing key

personal information, often online or in a digital form, to gain benefits, financial or otherwise.

Socially engineered malware disguises malware inside seemingly innocuous links, email attachments

and images to covertly collect consumer information. As a result, consumers reported worrying

approximately twice as often about digital crimes such as identity theft and online financial hacking

compared to physical crimes such as car theft, home burglary and terrorism (source: Gallup—Gallup

Poll Social Series: Crime; October 2017).

Furthermore, the scale and magnitude of broader cybercrime has increased. According to Norton,

53% of consumers have experienced a cybercrime or know someone who has, and the average

affected consumer spends approximately 24 hours of total time recovering from a cybercrime. This

reduction in consumers’ sense of safety has culminated in 51% of consumers believing it has become

more difficult to stay secure online over the last five years (source: Norton Cyber Security Insights

Report 2016). In total, 978 million consumers were impacted by a cybercrime in 2017, generating

$172 billion in losses to cybercrime during the same period (source: Norton Cyber Security Insights

Report 2017).

The Group’s markets can be divided into three categories: Consumer Direct, Consumer Indirect, and

SMB. The Consumer Direct category includes consumer security, performance and privacy products

and services sold directly to customers to protect their devices and data and to improve device

performance. Consumer Indirect includes a broad range of products and services which aim to

generate revenue from the Group’s existing user community without the direct sale of products or

services. These products and services include analytics, affiliate publishing, secure web browsing,

advertising within applications and distribution of third party software. The SMB category includes

endpoint and network security products for small and medium-sized businesses as well as tools for

managed service providers to maintain and monitor security on a customer’s behalf.

The Group believes its current addressable market achieved total revenue of $14.5 billion in 2017 and

that the market will reach revenues of $21.3 billion in 2021, representing a CAGR of 10.1% (source:

Company market study). The Consumer Direct segment revenue projections have been based on

global consumer spend on desktop & mobile antivirus (“AV”), VPN, PC utilities, other consumer

endpoint products and protection products for home-centric IoT devices. The Consumer Indirect

segment revenue projections have been based on the market for paid distribution of consumer

software, the non-network half of the e-commerce affiliate publishing market, the search distribution

market represented by third-party browsers, the market for advertising within applications and a

combination of the clickstream analytics and specialised analytics markets. The SMB segment

revenue projections include the global SMB endpoint spend and the total SMB network security

spend attributable to cloud-based, Software-as-a-Service (SaaS) products.

3

B.5 Group description

The term “Group” refers to Avast Holding B.V. and each of its consolidated subsidiaries and

subsidiary undertakings prior to the completion of a Group reorganisation (the “Reorganisation”)

(which is expected to be immediately prior to Admission) and, thereafter, the Company and its

consolidated subsidiaries and subsidiary undertakings from time to time. The main trading entity of

the Group is Avast Software s.r.o. Upon completion of the Reorganisation, the Company will,

immediately prior to Admission, become the holding company of the Group. The term “Admission”

refers to admission of the ordinary shares of the Company of 10 pence each (“Shares”) to the

premium listing segment of the Official List of the FCA (the “Official List”) and to trading on the

London Stock Exchange’s main market for listed securities.

B.6 Major shareholders

As at the date of this Prospectus, the Company is owned or controlled by Sybil Holdings S.à r.l.,

which is owned by funds advised by affiliates of CVC Capital Partners Advisory Company

(Luxembourg) S.à r.l. (“Sybil”); Pavel Baudisˇ; Eduard Kucˇera; funds advised by Summit Partners,

L.P. and its affiliates (“Summit Partners” and together with Sybil, Pavel Baudisˇ and Eduard Kucˇera,

the “Major Shareholders”) and current and former Directors and employees, which together hold

100% of the voting rights attached to the issued share capital of the Company. Immediately following

the Global Offer and Admission, it is expected that the Major Shareholders will hold approximately

65.9%, assuming no exercise of the Over-allotment Option, and 62.1%, assuming the Over-allotment

Option is exercised in full.

As far as it is known to the Company, the following are the interests (within the meaning of Part IV of

the Act) (other than interests held by the Directors) which represent, or will represent, directly or

indirectly 3% or more of the issued share capital of the Company (assuming no exercise of the option

granted to Morgan Stanley & Co. International plc as stabilising manager (the “Stabilising

Manager”) to purchase, or procure purchasers for, up to 36,118,935 additional Existing Shares (as

defined below) (the “Over-Allotment Option”)):

Immediately prior to

Admission

Immediately following

Admission

Shareholders

Number of

Shares

Percentage

of issued

share

capital

Number of

Shares

Percentage

of issued

share

capital

Sybil Holdings S.à r.l. ................................ 270,378,756 30.3% 216,303,002 22.7%

Pavel Baudisˇ

(1)

...................................... 317,696,900 35.6% 257,182,165 27.0%

Eduard Kucˇera

(2)

.................................... 123,275,331 13.8% 99,793,912 10.5%

Summit Partners

(3)

................................... 68,416,648 7.7% 54,733,318 5.7%

Notes

(1) Immediately prior to Admission, Pavel Baudisˇ will hold Shares in the Company directly and through PaBa Software s.r.o.

Mr. Baudisˇ will hold 60,514,735 Shares on an individual basis immediately prior to Admission (and 0 Shares immediately

following Admission). Mr. Baudisˇ will hold 257,182,165 Shares through PaBa Software s.r.o. immediately prior to

Admission (and 257,182,165 Shares immediately following Admission).

(2) Immediately prior to Admission, Eduard Kucˇera will hold Shares in the Company directly and through Pratincole

Investments Limited. Mr. Kucˇera will hold 23,481,419 Shares on an individual basis immediately prior to Admission (and

0 Shares immediately following Admission). Mr. Kucˇera held 99,793,912 Shares through Pratincole Investments Limited

immediately prior to Admission (and 99,793,912 Shares immediately following Admission).

(3) Immediately prior to Admission, Summit Partners will hold Shares in the Company through its funds Leia 1 S.a` r.l,

Summit Investors I, LLC and Summit Investors I (UK), L.P.

The Shares owned by the Major Shareholders rank pari passu with other Shares in all respects.

Sybil Relationship Agreement

On 10 May 2018, the Company entered into a relationship agreement with Sybil (the “Sybil Relationship

Agreement”), which will take effect on Admission. Pursuant to the Sybil Relationship Agreement, Sybil

shall, and shall (so far as it is legally able to do so) procure that certain of its affiliates (excluding any

portfolio or investee companies in which funds advised by affiliates of CVC Capital Partners Advisory

Company (Luxembourg) S.à r.l. hold an interest or investment) (“CVC Affiliates”) shall:

(a) (i) conduct all transactions, agreements or arrangements entered into between any member of the

Group and Sybil and/or any CVC Affiliates (or the enforcement, implementation or amendment

thereof) and all relationships between any member of the Group and Sybil and/or any CVC

Affiliates at arm’s length and on normal commercial terms; and (ii) where applicable, enter into

4

all transactions, agreements or arrangements in accordance with the related party transaction

rules set out in Chapter 11 of the listing rules of the FCA made under section 74(4) of the FSMA

(the “Listing Rules”);

(b) not take any action which would have the effect of preventing the Company or any other member

of the Group from carrying on its business independently of Sybil and/or any CVC Affiliates;

(c) not take any action which would have the effect of preventing the Company or any other member

of the Group from complying with its obligations under the Listing Rules, the Disclosure

Guidance and Transparency Rules of the FCA (the “DGTRs”), Regulation (EU) 596/2014 of the

European Parliament and of the Council of 16 April 2014 on market abuse (the “Market Abuse

Regulation”), the FSMA, the Financial Services Act 2012 (the “FS Act”) or the principles of

good governance set out in the UK Corporate Governance Code issued by the Financial

Reporting Council from time to time in force (the “Governance Code”) save in respect of any

matters of non compliance with the Governance Code which are disclosed in this Prospectus or

in the Company’s annual report or which have been agreed to in writing by a majority of the

Independent Non-Executive Directors;

(d) not exercise any of their voting rights in a manner which would prevent the Company from

making decisions for the benefit of the Shareholders taken as a whole;

(e) not exercise any of their voting rights in a manner that would require the Company to operate or

make decisions solely for the benefit of Sybil and/or any CVC Affiliates;

(f) not propose or procure the proposal of a shareholder resolution which is intended or appears to

be intended to circumvent the proper application of the Listing Rules;

(g) without prejudice to (f) above, not exercise any of their voting rights to vary the articles of

association of the Company to be adopted upon Admission (the “Articles”) which would:

(A) be contrary to the maintenance of the Company’s independence (including the Company’s

ability to operate and make decisions independently of Sybil and/or any CVC Affiliates); or

(B) prevent the election of independent directors; or

(C) be inconsistent with, undermine or breach any provision of the Sybil Relationship

Agreement or the Listing Rules, the DGTRs or the Market Abuse Regulation; and

(h) abstain from voting on any resolution required by paragraph 11.1.7R(3) of the Listing Rules to

approve a related party transaction where Sybil or any of its associates is the related party for the

purposes of the Listing Rules and, in any event that any of Sybil’s associates are shareholders at

the relevant time, Sybil shall take all reasonable steps to ensure that such associates also abstain

from voting on such resolution.

In addition, pursuant to the Sybil Relationship Agreement:

(a) Sybil has agreed that, for a period of two years from Admission, or, if earlier, the date which is

three months after the date of termination of the Sybil Relationship Agreement, subject to limited

exceptions, it shall not, and will (insofar as it is legally able to do) direct the CVC Affiliates not

to, solicit for service or employment any of the executive Directors of the Company or any other

member of the executive management team of the Group, in each case without the prior written

consent of the Company;

(b) Sybil is entitled to appoint one natural person to be a non-executive director of the Company for

so long as Sybil and/or CVC Affiliates hold in aggregate 10% or more of the voting rights

attaching to the issued share capital of the Company;

(c) for so long as Sybil and/or CVC Affiliates hold in aggregate 10% or more of the voting rights

attaching to the issued share capital of the Company, the Company shall, if requested by Sybil,

procure that the director appointed by Sybil is permitted to attend as an observer at the Board’s

Nomination Committee, Audit Committee and Remuneration Committee;

(d) the Company has agreed, to the extent permitted by applicable laws and regulation, to provide

certain information to Sybil on an ongoing basis in order to enable Sybil and certain connected

persons to complete any tax return, compilation or filing or to comply with any audit or

regulatory request or any other laws or regulations which apply to Sybil or any such person;

5

(e) the Company has agreed, subject to compliance with relevant regulatory requirements, to procure

that the Group’s senior management shall provide reasonable assistance to Sybil or any CVC

Affiliate in relation to any proposed sale of Shares by Sybil or any CVC Affiliate at any time

following Admission; and

(f) the Company agrees not to undertake any transaction in the Shares which may reasonably be

expected to give rise to an obligation for Sybil or any CVC Affiliate (and/or persons with whom

they are acting in concert within the meaning of the UK City Code on Takeovers and Mergers

(the “City Code”) to make a general offer in accordance with Rule 9 of the City Code unless the

Company has first obtained a waiver of Rule 9 in accordance with the City Code, or the

Company has otherwise obtained the necessary waivers or consents from the Takeover Panel to

prevent such obligations from applying.

The Sybil Relationship Agreement will be effective as from Admission and remain in effect for so

long as Sybil and/or any of the CVC Affiliates hold, in aggregate, 10% of voting rights attaching to

the Shares and the Shares continue to be admitted to listing on the Official List of the FCA.

Founder Relationship Agreement

On 10 May 2018, the Company entered into a relationship agreement with Pavel Baudisˇ and Eduard

Kucˇera and their respective investment vehicles. PaBa Software s.r.o. and Pratincole Investments

Limited (each a “Founder” and together, the “Founders”) (the “Founder Relationship Agreement”,

and, together with the Sybil Relationship Agreement, the “Relationship Agreements”), which will

take effect on Admission. Pursuant to the Founder Relationship Agreement, each Founder shall, and

shall (so far as he or it is legally able to do so) procure that any of his or its associates shall:

(a) conduct all transactions, agreements or arrangements entered into between any member of the

Group and such Founder and/or any of his or its associates (or the enforcement, implementation

or amendment thereof) and all relationships between any member of the Group and such Founder

and/or any of his or its associates at arm’s length and on normal commercial terms and where

applicable, enter into all transactions, agreements or arrangements in accordance with the related

party transaction rules set out in Chapter 11 of the Listing Rules;

(b) not take any action which would have the effect of preventing the Company or any other member

of the Group from carrying on its business independently of the Founders and/or any of their

associates;

(c) not take any action which would have the effect of preventing the Company or any other member

of the Group from complying with its obligations under the Listing Rules, the DGTRs, the

Market Abuse Regulation, the FSMA, the FS Act or the principles of good governance set out in

the Governance Code (save in respect of any matters of non compliance with the Governance

Code which are disclosed in this Prospectus or in the Company’s annual report or which have

been agreed to in writing by a majority of the Independent Non-Executive Directors);

(d) not exercise any of their voting rights in a manner which would prevent the Company from

making decisions for the benefit of the Shareholders taken as a whole;

(e) not exercise any of their voting rights in a manner that would require the Company to operate or

make decisions solely for the benefit of any of the Founders and/or any of their associates;

(f) not propose or procure the proposal of a shareholder resolution which is intended or appears to

be intended to circumvent the proper application of the Listing Rules;

(g) without prejudice to (f) above, not exercise any of their voting rights to vary the Articles which

would:

(A) be contrary to the maintenance of the Company’s independence (including the Company’s

ability to operate and make decisions independently of the Founders and/or any of their

associates); or

(B) prevent the election of independent directors; or

(C) be inconsistent with, undermine or breach any provision of the Founder Relationship

Agreement or the Listing Rules, the DGTRs or the Market Abuse Regulation; and

(h) abstain from voting on any resolution required by paragraph 11.1.7R(3) of the Listing Rules to

approve a related party transaction where such Founder or any of his or its associates is the

related party for the purposes of the Listing Rules.

6

In addition, pursuant to the Founder Relationship Agreement:

(a) each Founder has undertaken that, until the later of the termination of the Founder Relationship

Agreement and the date falling two years after Admission, he or it shall not, and will procure

(insofar as is within his or its power or control) that any of his or its associates shall not, operate,

establish, own or acquire a Competing Business. This undertaking shall not prohibit, after

Admission, either of Mr. Baudisˇ or Mr. Kucˇera (together with their connected founder

investment vehicle) from being entitled to acquire up to 5% in aggregate of the shares of any

class of any company engaged in business that would constitute a Competing Business provided

the shares of such company are listed on a recognised stock exchange. For the purposes of this

Prospectus, “Competing Business” means a company, an undertaking, a business, a business

operation or other enterprise or entity which from time to time itself or through one or more of its

subsidiary undertakings, operates in the software anti-virus or cyber-security sector, or offers any

products or services which compete with such products or services as are offered or marketed by

the Group at the date of this Prospectus;

(b) each Founder has agreed that, during the period from the date of the Founder Relationship

Agreement to the later of: (i) the termination of such agreement or (ii) the date which is two

years after the date of Admission, subject to certain limitations, he or it shall not, and will

procure (insofar as is within his or its power or control) that any of his or its associates shall not,

solicit for service or employment any employee of the Group;

(c) the Founders are jointly entitled to appoint: (i) one natural person to be a non-executive director

of the Company for so long as the Founders and/or their associates hold in aggregate 10% or

more (but less than 20%) of the voting rights attaching to the issued share capital of the

Company; and (ii) two natural persons to be non-executive directors for so long as the Founders

and/or their associates hold 20% or more of the voting rights attaching to the issued share capital

of the Company;

(d) for so long as the Founders hold in aggregate 10% or more of the voting rights attaching to the

issued share capital of the Company, the Company shall, if requested by the Founders, procure

that one of the directors appointed by the Founders is permitted to attend as an observer at the

Board’s Nomination Committee, Audit Committee and Remuneration Committee;

(e) if, at any time after Admission, either of Mr. Baudisˇ and his connected founder investment

vehicle on the one hand and Mr. Kucˇera and his connected founder investment vehicle on the

other hand: (i) is in material breach of the Founder Relationship Agreement; or (ii) together with

any of his associates, holds, in aggregate, fewer than 5% of the voting rights attaching to the

issued share capital of the Company, the other Founders shall become so entitled to appoint (and

remove and reappoint) directors or an observer to the committees as described above; and

(f) the Company has agreed, to the extent permitted by applicable laws and regulation, to provide

certain information to each Founder on an ongoing basis in order to enable such Founder or any

of his associates to complete any tax return, compilation or filing or to comply with any other

laws or regulations which apply to such Founder or any of his or its associates.

The Founder Relationship Agreement will be effective as from Admission and remain in effect for so

long as the Founders and any of their associates together hold, in aggregate, 10% of voting rights

attaching to the Shares and the Shares continue to be admitted to listing on the Official List of the

FCA.

The Group believes that the terms of the Relationship Agreements will enable the Group to carry on

its business independently of Sybil and the Founders and ensure that all transactions and arrangements

between the Group, on the one hand, and Sybil and the CVC Affiliates and/or the Founders and their

respective associates, on the other hand, will be conducted at arm’s length and on normal commercial

terms.

Following Admission, the Articles will allow the election of independent directors to be conducted in

accordance with any requirements of the Listing Rules.

In all other circumstances, the Company’s major shareholders have and will have the same voting

rights attached to the Shares as all other shareholders.

7

B.7 Key financial information and narrative description of significant changes to financial condition

and operating results of the Group during or subsequent to the period covered by the historical

key financial information

The selected financial information set out below has been extracted without material adjustment from

the historical financial information relating to the Group and the historical financial information

relating to AVG, each as included in Part 11—“Historical Financial Information”.

The Group

Consolidated Income Statement Data

Group

Year ended 31 December

2015 2016 2017

(in $ millions)

Revenues ............................................................ 251.0 340.7 652.9

Cost of revenues ....................................................... (72.8) (112.1) (232.8)

Gross profit .......................................................... 178.2 228.6 420.1

Operating costs:

Sales and marketing ................................................ (29.0) (59.6) (121.4)

Research and development ........................................... (23.7) (46.8) (75.5)

General and administrative ........................................... (25.9) (90.3) (98.9)

Total operating costs .................................................... (78.6) (196.7) (295.8)

Operating profit (loss) ................................................. 99.6 31.9 124.3

Analysed as:

Underlying Operating Profit ............................................ 165.7 183.8 299.7

Share-based payment ................................................... (6.1) (2.7) (7.7)

Exceptional items ...................................................... (0.8) (69.8) (34.8)

Amortisation of acquisition intangible items ................................. (59.2) (79.4) (132.9)

Finance income and expenses, net ......................................... (27.9) (12.4) (153.2)

Profit (loss) before income tax ........................................... 71.7 19.5 (28.9)

Income tax ............................................................ (0.2) 5.1 (4.9)

Profit (loss) for the financial year ........................................ 71.5 24.6 (33.8)

8

Consolidated Balance Sheet Data

Group

As at 31 December

2015 2016 2017

(in $ millions)

Assets

Current assets

Cash and cash equivalents ................................................. 141.2 240.7 176.3

Trade and other receivables ................................................ 34.7 71.4 93.2

Prepaid expenses ........................................................ 3.1 14.8 35.8

Inventory .............................................................. — — 0.5

Tax receivables ......................................................... 1.6 3.4 7.5

Other financial assets ..................................................... 0.4 2.0 1.0

Total current assets ................................................. 181.0 332.3 314.3

Non-current assets

Property, plant and equipment .............................................. 10.1 34.7 29.5

Intangible assets ......................................................... 255.5 492.3 394.3

Deferred tax asset ........................................................ 6.4 46.9 66.3

Other financial assets ..................................................... 0.4 3.6 1.9

Prepaid expenses ........................................................ 1.5 1.8 0.5

Goodwill .............................................................. 720.5 1,895.8 1,986.7

Total non-current assets ............................................. 994.4 2,475.1 2,479.2

Total assets ............................................................ 1,175.4 2,807.4 2,793.5

Shareholders’ equity and liabilities

Current liabilities

Trade and other payables .................................................. 9.5 44.3 35.4

Lease liability ........................................................... 0.3 1.6 1.7

Provisions .............................................................. 1.0 27.9 6.2

Income tax liability ...................................................... 9.6 25.0 28.1

Deferred revenues ....................................................... 121.9 201.1 324.3

Other current liabilities ................................................... 13.5 81.1 38.7

Term loan .............................................................. 263.1 81.5 92.5

Financial liability ........................................................ — 0.3 —

Total current liabilities .............................................. 418.9 462.8 526.9

Non-current liabilities

Lease liability ........................................................... — 4.3 3.3

Provisions .............................................................. 0.2 1.6 1.2

Deferred revenues ....................................................... 15.1 30.0 54.5

Term loan .............................................................. — 1,476.5 1,688.8

Financial liability ........................................................ 0.5 — 3.2

Other non-current liabilities ................................................ — 0.9 2.2

Deferred tax liability ..................................................... 46.4 106.8 78.3

Total non-current liabilities .......................................... 62.2 1,620.1 1,831.5

Shareholders’ equity

Share capital ............................................................ 565.3 565.3 371.7

Share premium, statutory and other reserves ................................... 70.7 73.1 3.3

Translation differences ................................................... — 2.9 1.3

Retained earnings ........................................................ 57.9 82.5 57.9

Equity attributable to equity holders of the parent ........................... 693.9 723.8 434.2

Non-controlling interest ................................................... 0.4 0.7 0.9

Total shareholders’ equity ........................................... 694.3 724.5 435.1

Total shareholders’ equity and liabilities ................................... 1,175.4 2,807.4 2,793.5

9

Consolidated Cash Flow Data

Group

Year ended 31 December

2015 2016 2017

(in $ millions)

Net cash flows from operating activities ...................................... 202.3 224.6 306.5

Net cash used in investing activities .......................................... (30.5) (1,250.0) (173.8)

Net cash used in financing activities ......................................... (154.3) 1,124.9 (193.7)

Cash and cash equivalents at end of period .................................. 141.2 240.7 176.3

Certain significant changes to the Group’s financial condition and results of operations occurred

during the years ended 31 December 2015, 2016 and 2017, respectively, which are set out below.

The Group’s Revenues increased by $312.2 million, or 92%, from $340.7 million in 2016 to

$652.9 million in 2017, and by $89.7 million, or 36%, from $251.0 million in 2015 to $340.7 million

in 2016. The Group’s Adjusted Revenue increased by $358.0 million, or 85%, from $421.5 million in

2016 to $779.5 million in 2017, and by $126.8 million, or 43%, from $294.7 million in 2015 to

$421.5 million in 2017. On a like-for-like basis, with 2017 including full year Piriform results,

Adjusted Revenue for the Group for the year ended 31 December 2016 as compared to the year ended

31 December 2017 increased (by $43.0 million, from $736.5 million in 2016 to $779.5 million in

2017). Excluding the impact of the AVG Acquisition in the fourth quarter of 2016, Adjusted Revenue

for the Group for the year ended 31 December 2015 as compared to the year ended 31 December 2016

increased on a like-for-like basis (by 8% or $23.2 million, from $294.7 million in 2015 to

$317.9 million in 2016). Excluding Piriform and Discontinued Business, on a like-for-like basis, the

Group’s Adjusted Revenue increased 7% from 2016 to 2017, and 8% from 2015 to 2016.

Net Income decreased by $58.4 million, from $24.6 million in 2016 to a net loss of $33.8 million in

2017, and decreased by $46.9 million, from $71.5 million in 2015 to $24.6 million in 2016. Adjusted

Net Income increased by $84.6 million, or 53%, from $159.5 million in 2016 to $244.1 million in

2017 and increased by $29.0 million, or 22%, from $130.5 million in 2015 to $159.5 million in 2016.

On a like-for-like basis, with 2017 including Piriform results from date of acquisition, Adjusted Net

Income for the Group for the year ended 31 December 2016 as compared to the year ended

31 December 2017 increased (by $46.6 million, from $197.5 million in 2016 to $244.1 million in

2017), due to the factors described above. Excluding the impact of the AVG Acquisition, Adjusted

Net Income for the Group for the year ended 31 December 2015 as compared to the year ended

31 December 2016 decreased on a like-for-like basis (by $11.6 million, from $130.5 million in 2015

to $118.9 million in 2016).

There has been no significant change in the financial position or results of operations of the Group

since 31 December 2017, the date to which the last audited consolidated financial information of the

Group was prepared.

10

AVG

Consolidated Income Statement Data

AVG

Year ended 31 December

2015 2016

(in $ millions)

Revenues .............................................................. 425.8 418.6

Cost of revenues ........................................................ (64.4) (85.8)

Gross profit ........................................................... 361.4 332.8

Operating costs:

Sales and marketing .................................................. (126.6) (123.2)

Research and development ............................................ (88.4) (91.5)

General and administrative ............................................ (69.1) (118.3)

Total operating costs ..................................................... (284.1) (333.0)

Operating profit (loss) ................................................... 77.3 (0.2)

Analysed as:

Underlying Operating Profit ............................................. 132.6 131.6

Share-based payment ..................................................... (15.3) (14.8)

Exceptional items ....................................................... (9.0) (86.9)

Amortisation of acquisition intangible items .................................. (31.0) (30.1)

Finance income and expenses, net .......................................... (16.7) (24.1)

Profit (loss) before income tax ............................................. 60.6 (24.3)

Income tax ......................................................... (11.4) (4.1)

Profit (loss) for the financial year ......................................... 49.2 (28.4)

11

Consolidated Balance Sheet Data

AVG

As at 31 December

2015 2016

(in $ millions)

Assets

Current assets

Cash and cash equivalents ................................................... 123.8 33.2

Trade and other receivables .................................................. 44.0 38.0

Prepaid expenses .......................................................... 16.6 17.6

Inventory ................................................................ 1.0 —

Tax receivables ........................................................... 8.7 2.1

Other financial assets ....................................................... 27.3 1.7

Total current assets ................................................... 221.4 92.6

Non-current assets

Property, plant and equipment ................................................ 23.5 23.9

Intangible assets ........................................................... 105.7 76.3

Deferred tax asset .......................................................... 36.6 43.1

Other financial assets ....................................................... 0.8 3.1

Prepaid expenses .......................................................... 4.0 2.8

Goodwill ................................................................ 296.8 297.1

Total non-current assets ............................................... 467.4 446.3

Total assets .............................................................. 688.8 538.9

Shareholders’ equity and liabilities

Current liabilities

Trade and other payables .................................................... 33.4 25.6

Lease liability ............................................................. 1.8 1.6

Provisions ................................................................ 4.1 26.9

Income tax liability ........................................................ 1.1 6.0

Deferred revenues ......................................................... 167.1 157.4

Other current liabilities ..................................................... 90.3 22.4

Term loan ................................................................ 2.3 38.5

Financial liability .......................................................... 1.8 0.1

Total current liabilities ................................................ 301.9 278.5

Non-current liabilities

Lease liability ............................................................. 4.1 4.3

Provisions ................................................................ 1.0 0.9

Deferred revenues ......................................................... 33.0 29.9