Serving

Others

Dollar General Corporation

Annual Report for the year ended January 30, 2004

Team On A Mission...

Serving

Others

Dollar General

Corporation

100 Mission Ridge

Goodlettsville, TN 37072

www.dollargeneral.com

907091 DP_CVR_r3 4/15/04 12:16 PM Page 1

Dollar General Corporation is the nation's largest small box retailer of consum-

able basic items such as food, snacks, health and beauty aids and cleaning

supplies, as well as basic apparel, housewares and seasonal items. What is

now Dollar General was founded in 1939 as J.L. Turner & Son, Wholesale, in

Scottsville, Kentucky. In 1955, the Company's retail outlet was converted to the

first Dollar General store with no item over $1. Dollar General continues to offer

convenience and value by providing national name brand consumable basic

products as well as high quality private label products to its customers at

everyday low prices. The mission statement for each of the Company's 57,800

employees is "Serving Others: for customers, a better life; for shareholders, a

superior return; for employees, respect and opportunity."

Dollar General's stock was first offered to the public in 1968 and has been

listed on the New York Stock Exchange since 1995, trading under the symbol

DG. The Company was added to the S&P 500

®

in 1998 and was named a

Fortune 500

®

company for the first time in 1999.

Corporate Profile

Financial Highlights

Dollar General has identified the following financial metrics that we believe are most important to increasing shareholder value and have built these

metrics into our long-term strategic planning process: EPS growth, total sales growth, operating profit margins, return on invested capital, free cash

flow, inventory turns and return on average assets. The graphs included over the next few pages reflect our five-year performance in some of these

areas. Please see page 11 for a description of how these metrics are calculated and the reasons we believe they are useful.

This document contains financial information not derived in accordance with generally accepted accounting principles, including certain of these metrics.

See pages 8 and 9 for additional information.

(In thousands except per share data)

January 30, January 31, February 1, February 2, January 28,

2004 2003 2002 2001 (b) 2000 (c)

_____________________________________________________________________________________________________________________________

Net sales $ 6,871,992 $ 6,100,404 $ 5,322,895 $ 4,550,571 $ 3,887,964

Net income $ 301,000 $ 264,946 $ 207,513 $ 70,642 $ 186,673

Diluted earnings per share (a) $0.89$ 0.79 $ 0.62 $ 0.21 $ 0.55

Basic earnings per share (a) $0.90$ 0.80 $ 0.63 $ 0.21 $ 0.61

Cash dividends per share of

common stock (a) $0.14$ 0.13 $ 0.13 $ 0.12 $ 0.10

Total assets $ 2,652,709 $ 2,333,153 $ 2,552,385 $ 2,282,462 $ 1,923,628

Long-term obligations $ 265,337 $ 330,337 $ 339,470 $ 720,764 $ 514,362

_____________________________________________________________________________________________________________________________

(a) As adjusted to give retroactive effect to all common stock splits.

(b) 53-week year.

(c) The Company restated its financial statements for the fiscal year ended January 28, 2000 by means of its

Form 10-K for the fiscal year ended February 2, 2001.

The Dollar General Literacy Foundation

Dollar General's mission of "Serving Others" extends beyond our belief in providing our customers

quality basic merchandise they need at prices they can afford. We recognize the responsibility of being

a good neighbor and community partner and pledge to engage in philanthropic activities that empower

our neighbors to lead a better life.

During 2003, the Dollar General Literacy Foundation awarded grants to 110 non-profit literacy providers

serving more than 40,000 individuals and families. Our employees, customers and vendors contributed

more than $1.9 million dollars to the advancement of

literacy through our in-store literacy cash cube program

and other fundraising activities. Through the

Foundation's Learn to Read literacy referral program,

our store teams, in partnership with ProLiteracy

America, provided more than 9,000 customers with a

referral to a literacy program in their local community

that could help them learn to read, prepare for the GED

or learn English as another language free of charge.

For more information, visit the Community section of

our Web site at www.dollargeneral.com, or write to:

Dollar General Literacy Foundation, 100 Mission

Ridge, Goodlettsville, Tennessee 37072.

907091 DP_CVR_r3 4/15/04 12:17 PM Page 2

Dollar General had 6,700 retail stores as of

January 30, 2004, after adding 587 net new stores

during the year, continuing its trend of increasing store

growth. A majority of the Company's stores are located

in small towns and rural communities, which continue to

be the primary areas for adding new stores. In 2004,

Dollar General plans to open 675 new Dollar General

stores. In addition, we plan to open 20 Dollar General

Markets, a new concept we are testing with an expanded

food section. For the first time, customers will be able to

find Dollar General stores in New Mexico, Arizona and

Wisconsin. The typical Dollar General store has approx-

imately 6,800 square feet of selling space and is located

within a five-mile radius of its customers. The

Company's seven distribution centers are strategically

located to minimize the time and cost associated with

serving the stores. An eighth distribution center is sched-

uled to open in 2005 in Union County, South Carolina.

6,700

stores as of January 30, 2004

(Numbers indicate total number of stores per state)

Market Area

Store Growth

Distribution Center

Ardmore, Oklahoma

Distribution Center

Fulton, Missouri

Distribution Center

Indianola, Mississippi

Distribution Center

Alachua, Florida

Distribution Center

Scottsville, Kentucky

Distribution Center

South Boston, Virginia

Executive Offices

Goodlettsville, Tennessee

Distribution Center

Zanesville, Ohio

•

•

•

•

•

•

•

•

79

145

234

813

203

285

144

278

125

262

355

363

151

24

24

62

239

371

125

256

340

234

387

349

208

248

396

•

Distribution Center

Union County,

South Carolina

planned opening in 2005

Stores Opening In 2004

"Anything I use in the

kitchen I buy here

and all my cards and

knick-knacks. I'm

always surprised

by what I find

for the prices!"

1

Company Stores

Fiscal years

4,294

5,000

5,540

6,113

6,700

1999

2000

2001

2002

2003

DP_General_1-16 4/15/04 4:46 M Page 3

It is truly an honor to address you in my first letter to shareholders,

as Chairman and CEO of Dollar General Corporation. As the first

Chairman and CEO who is not a member of the founding Turner fam-

ily, I can report to you today, almost a year after my arrival, that the

transition has gone very smoothly. I continue to be extremely excit-

ed about Dollar General's strong legacy, robust business model, loyal

customer base and talented management team. Our mission,

Serving Others, is real to us and is the perspective through which we

develop priorities to meet the needs of our customers.

As you may know, in 2003, we reorganized our senior management

team by bringing in outside talent and blending it with seasoned

Dollar General veterans. With your Board of Directors, we complet-

ed a comprehensive strategic plan and are aligned with its strategic

imperatives. As you will see in this Annual Report, we are your Team

on a Mission for 2004 and beyond.

From a retailer’s perspective, 2003 was a particularly challenging

year because of the tough economy and uncertainties created by the

war in Iraq and the continuing war on terrorism. Nonetheless, part-

ly because of the continued blurring of retail channels in the U.S. and

partly due to the resilience of our own model, we were able to post

record results for the year. To recap:

• Total net sales grew 12.6% to $6.87 billion, while same store

sales increased 4.0%.

• We opened 673 new Dollar General stores, including two Dollar

General Market stores, exceeding our goal of 650 new stores,

and grew net store selling square footage by 10%.

• Net income increased 13.6%. However, when you exclude

restatement-related items, it grew 24.1%.

• Operating profit margin, excluding restatement-related items,

improved from 7.1% of sales in 2002 to 7.6% in 2003. Including

restatement-related items, operating profit margin was 7.4% of

sales in 2003 compared to 7.5% of sales in 2002.

• We generated $320 million of cash flow before financing activ-

ities that we used to reduce debt, pay dividends and repurchase

1.5 million shares of our stock. At the end of the fiscal year,

cash on our balance sheet exceeded our outstanding borrow-

ings by $116 million, compared to the end of 2002 when our net

debt was $225 million.

• Our return on invested capital (ROIC) increased to 13.3% com-

pared to 12.9% in 2002, and, excluding restatement-related

items, ROIC increased to 13.6% in 2003 compared to 12.5% in

2002.

In fiscal 2003, Dollar General paid cash dividends to shareholders of

$46.9 million, or $0.14 per share, on an annual basis. In March

2004, your Board of Directors increased the quarterly dividend by an

additional 14.3%, to $0.04 from $0.035 per share. During the fourth

quarter of 2003, the Company also repurchased approximately 1.5

million shares of its outstanding common stock for $29.7 million.

The Company’s current share repurchase authorization for up to 12

million shares expires in March 2005.

In 2003, the Securities and Exchange Commission continued its

investigation relating to Dollar General’s January 14, 2002, restate-

ment of the 1998 and 1999 financial statements and certain unaudit-

ed financial information for fiscal year 2000. The matter appears to

be drawing to a close as the Company has reached an agreement in

principle with the staff of the SEC. We believe the proposed settle-

ment represents a fair conclusion to this matter. While we are hope-

ful that the full Commission will approve this agreement in principle,

we have no assurance that it will.

As it is for all public companies, corporate governance is a critical

issue for Dollar General. With the enactment of Sarbanes-Oxley in

2002, many of the rules have become more stringent and more

formalized. At Dollar General, your Board of Directors and your

management team take this topic very seriously and have taken

appropriate steps to ensure continued compliance. For more

information, visit the Corporate Governance section of our Web

site, www.dollargeneral.com, located under Investing.

As we move into 2004, the retailing landscape is changing very rap-

idly in America and indeed around the world. The significant growth

of big-box mass retailers over the past three decades has dramati-

cally influenced how consumers shop. A shopper today is much

more likely to shop different retail channels for different products

than a few years ago. This channel blurring benefits Dollar General

as more new customers are being introduced to our model each

year. According to ACNielsen’s Homescan® data, 66% of all

To Our Shareholders

2

Net Sales

Fiscal years

(Dollars in millions)

as reported

excluding restatement-

related items

Earnings Per Share

Fiscal years

$3,888

$4,551

$5,323

$6,100

$6,872

1999

2001 2002 2003

$0.55

$0.55

$0.21

$0.62

$0.67

$0.51

$0.79

$0.75

$0.89

$0.92

1999 2000 2001

2002

2003

2000

DP_General_1-16 4/15/04 4:47 M Page 4

American households and 49% of all households earning annual

income greater than $70,000 shopped at a dollar store last year. The

fast pace of our customers’ lifestyles has also increased the impor-

tance of convenience in their shopping requirements. We think we

are well-positioned to be a store of choice for those customers look-

ing for convenience as well as great value. Finally, the aging popu-

lation in the U.S. means there are more people on fixed incomes.

These customers typically find Dollar General stores particularly

appealing and frequently shop with us.

With that background, let’s talk about our future. Our vision for the

future of Dollar General is quite simple. We want to become one of

the leading providers of highly consumable basic products for under-

served customers regardless of geography or demography. Today,

dollar stores are becoming more mainstream. Even though Dollar

General is the oldest and largest player in the dollar channel, we are

still growing very rapidly. As we grow, we will continue to provide

our customers unique assortments of products at low prices through

our growing network of conveniently located small stores. We will

remain focused on meeting the needs of the underserved customer.

We will continue to compete on price and convenience –– our points

of differentiation. Our reputation for delivering tremendous value to

our customers and for placing many stores where other big-box

retailers will not is well-deserved, and we plan to continue to think

of our customers’ needs first when we source our products and when

we choose sites for our stores.

To accomplish our vision, we must continue to grow. The opportu-

nity to grow our footprint at a rapid pace certainly exists, and we

plan to take advantage of it. In 2003, we were in 27 states, having

just opened stores in Michigan, New York and New Jersey within the

past four years. In 2004, we plan to open stores in New Mexico,

Arizona and Wisconsin for the first time. Finally we continue to test

new formats that will allow us to present variations of our model and

increase the breadth of our product offerings.

At Dollar General, we have rededicated ourselves to improving our

customers' shopping experience. We are committed to providing a

friendly, fun and easy place for our customers to purchase those

products they need on a regular basis. To that end, we have begun

our "EZstore" project that is focused on making our stores "EZer" to

shop and "EZer" to operate. We are also committed to scouring the

world for unique values and reinventing the "treasure hunt" dimen-

sion of our merchandise mix. It is also imperative that we remain a

leader in the use of technology to further develop our supply

chain.

We enjoy strong relationships with our vendors around the

world. We have many major national and international brands

in our mix as well as our own private label brands. Providing

a dependable, branded merchandise mix at everyday low

prices is a cornerstone of our business model. Quality remains

a passion at Dollar General, and we plan to keep it that way.

This year, we are focused on preparing for a strong future. Our

retail sector is growing, and we are planning to take advan-

tage of the growth opportunities. We will build on our four key

core competencies which we believe will allow us to continue

to compete successfully in this environment. They are:

• Our ability to open a large number of well-located new

stores,

• Our ability to successfully run a large network of profitable

stores,

• Our ability to provide a unique and diversified mix of products

that our customers need, and

• Our ability to resupply our stores efficiently through our supply

chain.

By capitalizing on these

competencies, we can

better serve our existing

customers, attract new

customers and signifi-

cantly grow our busi-

ness. We have also

planned several impor-

tant initiatives for 2004,

a big investment year

for us, to help achieve

our goals as quickly

as possible. While I

am excited about

each of these initiatives

and their long-term

prospects, there is an

element of risk associ-

ated with their imple-

mentation in 2004. We

will work diligently to

minimize these risks.

I personally consider it a privilege to lead this company at this point

in its history and am dedicated to growing shareholder value. We

have a competitive business model and a great team working on

your behalf. Thank you for your investment in Dollar General

Corporation and your continued support.

Kindest regards,

David A. Perdue

Chairman and Chief Executive Officer

March 31, 2004

"We are probably in here

twice a week, and we know

everybody in here. I find

what I'm looking for and

more – usually too much!

We buy lots of milk and

ice cream, and every-

thing is always fresh.

It helps to be able to

get a lot for so little."

3

2001 2002 2003

$319.9

$300.2

$141.6

Cash Flow Before

Financing Activities

Fiscal years

(Dollars in millions)

1999 2000

$96.5

$57.7

DP_General_1-16 4/15/04 4:47 M Page 5

Dollar General stores pro-

vide convenience and value to customers by offering

consumable basics, items that are frequently used and

replenished, such as food, snacks, health and beauty

aids and cleaning supplies. Dollar General ranks as one

of the top ten customers of numerous national brand

consumer product manufacturers and also takes pride

in the quality and selection of its private-label consum-

able basic merchandise. Dollar General stores carry a

focused selection of basic clothing for men, ladies and

children, housewares, giftware, seasonal items and sta-

tionery, including popular 2/$1 greeting cards.

National brands. Our pricing strategy allows us

to carry a wide assortment of national

brands at everyday low prices.

Dollar General stores are

stocked with a wide

selection of well-known,

high quality brands -

brands that appeal

to a wide range of

consumers, pack-

aged and priced for

our typical low- and middle-income customers. Every

day our customers can find the most popular brands of

laundry and dishwashing detergents, fabric softeners,

and home cleaning products, as well as paper items and

plastic bags of all sizes. Health and beauty items include

the leading brands of soap, body washes and lotions,

deodorants, hair care products, toothpaste and brushes,

and razors and blades, in addition to over-the-counter

medications. In the food section, customers can find

many of their favorite brands of items, including cof-

fees, other beverages, cereals, cake mixes and spaghet-

ti sauce to name a few. Dollar General is also well-

stocked with many of the preferred brands of candy and

snacks, pet foods, garden supplies, and batteries. All of

these items are available at everyday low prices.

Clover Valley

®

, DG

Guarantee

®

and

American

Value

®

.

For the

more value-conscious

customer who still demands

a quality product, Dollar

Dollar General’s mission is “Serving Others.” For its customers that means giving them a

better life. We think we do this by providing life’s basic necessities at everyday low prices.

Team On A Mission

4

Our merchandise.

Clover Valley

®

, DG

Guarantee

®

and

American

Value

®

.

DP_General_1-16 4/15/04 4:48 M Page 6

General stores have a tremendous selection of quality,

private label merchandise. Clover Valley products

include a variety of national brand quality soups, salad

dressings, breakfast foods, pasta, crackers, cookies and

snacks, peanut butter, pudding and gelatin, pickles

and relishes, spices, carbonated beverages, and much

more. DG Guarantee items, also national brand quali-

ty, include almost every category of health and beauty

aids, including soaps, cleansers, lotions, hair care,

toothpaste and razors as well as a wide

variety of laundry supplies and home

cleaning products and highly consumable

items, including batteries and pet food.

The Clover Valley and DG Guarantee

brands, which carry a money back

guarantee, are well established and

are trusted by our customers.

In fiscal 2003, Dollar General established

a new private label brand in several

food and paper categories called

American Value, which serves to provide

an even lower price point for the

extreme value-conscious customer.

Many Dollar General

stores are equipped with refrigerated coolers, filled with

frequently purchased items including milk, dairy prod-

ucts, eggs, packaged luncheon meats and selected

frozen foods, including ice cream, pizzas and frozen

meals, hamburger and chicken. By the end of 2004, we

expect more than 80% of our stores to be offering these

items to customers.

"I come in here every

week, sometimes twice

a week. Today, I'm

buying for a baby

shower, but I usually

buy my washing

powders, canned

goods...oh,

and my mother

and I always get

our cards here."

5

Refrigerated items.

DP_General_1-16 4/15/04 4:49 M Page 7

Team On A Mission

Dollar General stores primari-

ly serve the consumable basics needs of low- or mid-

dle-income customers, many of whom are on fixed

incomes. According to ACNielsen's Homescan® data,

in 2003 approximately 48% of the Company's cus-

tomers lived in households earning less than $30,000

a year and 26% earned less than $20,000. To Dollar

General, serving customers means meeting their

needs, at conveniently located stores, by providing

quality consumable basics as well as basic clothing,

home products and seasonal merchandise at prices

they can afford. Increasingly, Dollar General's mer-

chandise selection, prices and con-

venience also attract many higher

income, value-conscious customers.

Because many of Dollar

General's stores are

located in areas

with significant

ethnic populations, we have begun to focus on serving

these customers with products specific to their needs

and desires.

Our employees. For a Dollar General store to

be successful it not only needs the right location and

strong product brands, but it also needs the right team

of people to serve the customers, the right products

and ideas to make the store interesting and fun to

shop, and the right processes and systems for support.

Our store managers and employees are the key to

serving our customers. These men and

women are the caretakers

of our stores. They

represent Dollar

General to our cus-

tomers, and they

are ultimately

responsible for the

6

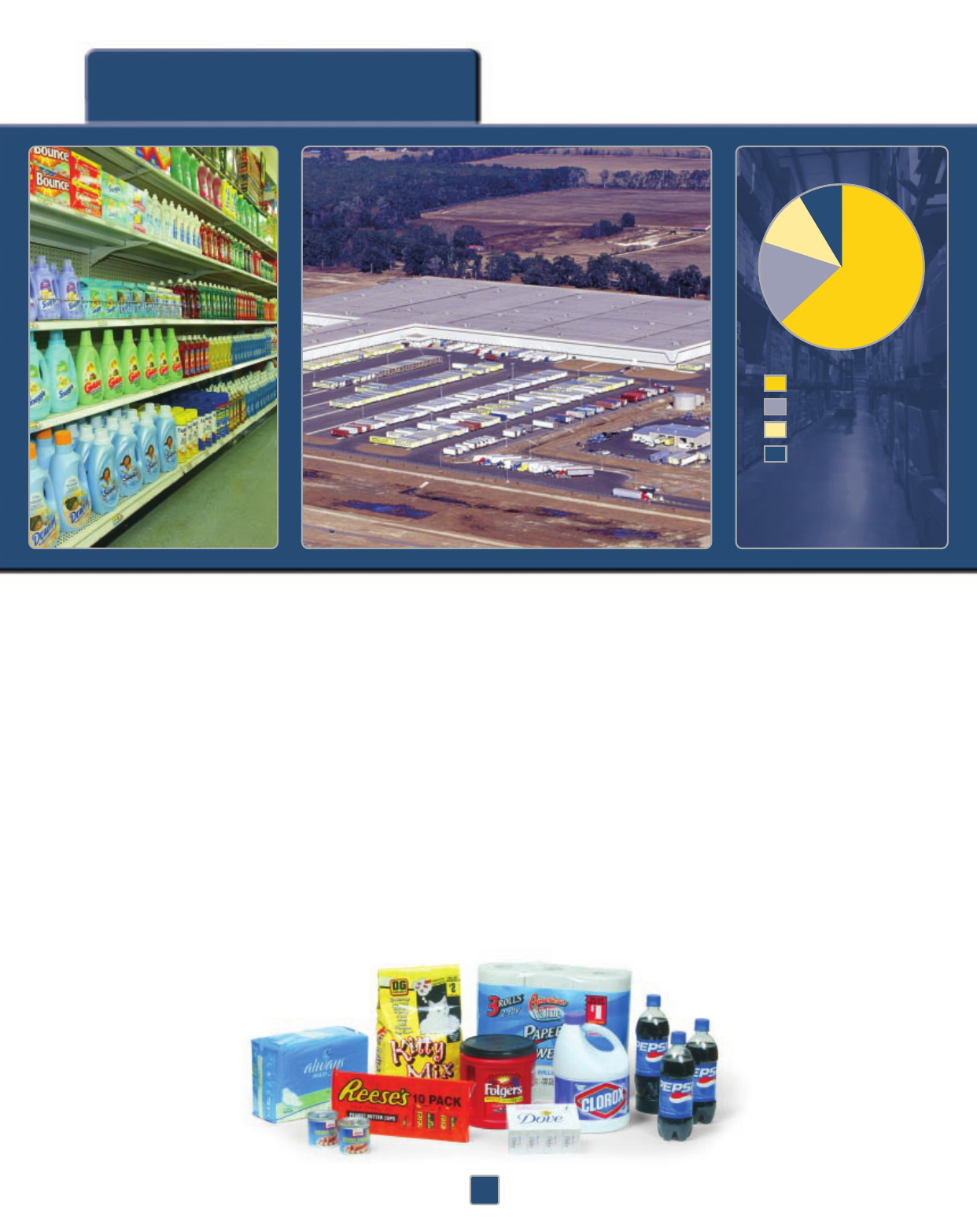

Sales By

Category

Highly Consumables

Seasonal

Home Products

Basic Clothing

9.5%

12.5%

16.8% 61.2%

DP_General_1-16 4/15/04 4:49 M Page 8

success of their stores. Dollar General recognizes the

importance of hiring the right people and giving them

the necessary support and training to succeed. Today,

we train every new store manager with the necessary

skills to operate a Dollar General store, and we teach

them the tenets of Dollar General's mission of Serving

Others. With this training and support, we believe we

are making Dollar General a rewarding place to work.

Our supply chain. Dollar General cur-

rently operates seven merchandise distribution

centers. These centers are equipped with state-

of-the-art technology and, we believe, are

among the best-run distribution centers in the

country. In 2003, Dollar General's distribution

centers shipped more than 320 million cartons

of merchandise. The teamwork of the men and

women working at our distribution centers and

on the road delivering merchandise to the

stores is a critical part of serving our customers

successfully. In 2004, Dollar General plans to increase

its capacity by expanding two distribution centers,

converting them to dual sortation systems, and by

adding a third shift in one of its distribution centers.

Construction of the Company's eighth distribution

center is scheduled to commence in 2004 as well

.

"We buy all our deter-

gents, and we buy

canned foods here. We

like the prices; there

are so many things

for just a dollar.

Today, we came in

to get paper plates

for our son's first

birthday party."

As a customer-driven distributor of consumable basics, we focus not only on the merchandise

we sell, but on the flow of product from vendor to distribution center to store shelf.

7

DP_General_1-16 4/15/04 4:49 M Page 9

NON-GAAP DISCLOSURES

8

NON-GAAP DISCLOSURES

This document contains certain financial information not derived in accordance with generally accepted accounting principles

("GAAP"), such as selling, general and administrative (SG&A) expenses, net income, diluted earnings per share, operating margin

and return on invested capital ("ROIC"), each of which excludes the impact of restatement-related items. The reasons the Company

believes this information is useful to investors and management’s uses of this information are set forth on page 11.

In addition, ROIC may be considered a non-GAAP financial measure. Management believes that ROIC is useful because it provides

investors with additional useful information for evaluating the efficiency of the Company’s capital deployed in its operations.

None of this information should be considered a substitute for any measures derived in accordance with GAAP. A reconciliation of

this information to the most comparable measure derived in accordance with GAAP is contained on page 12 of this document,

except for the reconciliation of operating profit margin, earnings per share, each excluding restatement-related items, and ROIC to

the most comparable measures derived in accordance with GAAP, which are set forth below.

Reconciliation of Non-GAAP Disclosures

Operating Profit Margin

(Dollars in millions)

Fiscal Years

________________________________________________________________________________________________________________________________

2003 2002

________________________________________________________________________________________________________________________________

Operating profit $511.3 $457.3

Restatement-related items

:

Penalty and litigation settlement (proceeds) 10.0 (29.5)

Restatement-related expenses included in SG&A 0.6 6.4

Operating profit, excluding restatement-related items $521.9 $434.1

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

Operating profit, % to sales 7.4% 7.5%

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

Operating profit, excluding restatement-related items, % to sales 7.6% 7.1%

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

Earnings Per Share

(In millions except per share amounts)

Fiscal Years

________________________________________________________________________________________________________________________________

2003 2002 2001 2000

________________________________________________________________________________________________________________________________

Net income $ 301.0 $ 264.9 $ 207.5 $ 70.6

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

Diluted earnings per share $ 0.89 $ 0.79 $ 0.62 $ 0.21

Weighted average diluted shares 337.6 335.1 335.0 333.9

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

Restatement-related items

:

Penalty and litigation settlement (proceeds) 10.0 (29.5) - 162.0

Restatement-related expenses included in SG&A 0.6 6.4 28.4 -

________________________________________________________________________________________________________________________________

10.6 (23.1) 28.4 162.0

Tax effect (0.2) 9.1 (10.4) (63.0)

________________________________________________________________________________________________________________________________

Total restatement-related items, net of tax 10.4 (14.1) 18.0 99.0

________________________________________________________________________________________________________________________________

Net income, excluding restatement-related items $ 311.4 $ 250.9 $ 225.5 $ 169.6

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

Diluted earnings per share, excluding restatement-related items $ 0.92 $ 0.75 $ 0.67 $ 0.51

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

DP_General_1-16 4/15/04 4:49 M Page 10

NON-GAAP DISCLOSURES

9

Return on Invested Capital (a)

(Dollars in thousands)

Fiscal Years

________________________________________________________________________________________________________________________________

2003 2002

________________________________________________________________________________________________________________________________

Net income $ 301,000 $ 264,946

Add:

Interest expense, net 31,503 42,639

Rent expense 247,309 216,345

Tax effect of interest and rent (103,886) (93,493)

_______________________________________________________________________________________________________________________________

Interest and rent, net of tax 174,926 165,491

_______________________________________________________________________________________________________________________________

Return, net of tax 475,926 430,437

Restatement-related items, net of tax 10,359 (14,073)

_______________________________________________________________________________________________________________________________

Return, excluding restatement-related items $ 486,285 $ 416,364

_______________________________________________________________________________________________________________________________

Average Invested Capital:

Average long-term obligations (b) $ 309,234 $ 570,764

Shareholders' equity (c) 1,421,308 1,148,030

Average rent x 8 (d) 1,854,608 1,608,713

_______________________________________________________________________________________________________________________________

Invested capital $ 3,585,150 $ 3,327,507

Return on invested capital 13.3% 12.9%

_______________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________

Return on invested capital, excluding restatement-related items 13.6% 12.5%

_______________________________________________________________________________________________________________________________

_______________________________________________________________________________________________________________________________

(a) The Company believes that the most directly comparable ratio calculated solely using GAAP measures is the ratio of net income to

the sum of average long-term obligations, including current portion, and average shareholders' equity. This ratio was 17.4% and

15.4% for fiscal 2003 and 2002, respectively.

(b) Average long-term obligations is equal to the average long-term obligations, including current portion, measured at the end of each

of the last five fiscal quarters.

(c) Average shareholders' equity is equal to the average shareholders' equity measured at the end of each of the last five fiscal quarters.

(d) Average rent expense is computed using a rolling two-year period. Average rent expense is multiplied by a factor of eight to capitalize

operating leases in the determination of pretax invested capital. This is a conventional methodology utilized by credit rating agencies

and investment bankers.

DP_General_1-16 4/15/04 4:49 M Page 11

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

Accounting Periods. The following text contains references to years 2004, 2003, 2002, and 2001, which represent fiscal years end-

ing or ended January 28, 2005, January 30, 2004, January 31, 2003, and February 1, 2002, respectively, each of which will be or was

a 52-week accounting period. This discussion and analysis should be read with, and is qualified in its entirety by, the Consolidated

Financial Statements and the notes thereto.

Executive Overview. In 2003, the Company hired a new Chief Executive Officer, a new President and Chief Operating Officer and

a new Executive Vice President of Store Operations. During the year, the Company focused on the following seven operating ini-

tiatives:

• The opening of 673 new stores;

• The continued implementation of the "seven habits" store retailing program which was designed to improve

store level execution of certain key processes. This program was recently redefined as a result of the change in senior

management in the store operations area;

• The addition of coolers (which allow the Company’s stores to carry perishable products) in 1,078 stores,

bringing the total number of stores with coolers to 2,445 at January 30, 2004;

• The rollout of automatic inventory replenishment to 2,473 stores, bringing the total number of stores on

automatic replenishment to 2,648 at January 30, 2004;

• Testing the acceptance of debit cards in five states, credit cards in four states and electronic benefit transfers ("EBT") in

four states;

• A multi-faceted program focused on shrink which included the development and implementation of a comprehensive

shrink reduction action plan; and

• The selection of a location for its eighth distribution center and the resulting announcement of plans to build that facility

in Union County, South Carolina.

In 2004, the Company will focus its efforts on accomplishing the following operating initiatives:

• Opening 675 new Dollar General stores and 20 new Dollar General Market stores;

• Expanding stores into three additional states: Arizona, New Mexico, and Wisconsin;

• Expanding its distribution centers in Ardmore, Oklahoma and South Boston, Virginia and beginning construction of the

new distribution center in South Carolina;

• Implementing a merchandising data warehouse;

• Maintaining an acceptable in-stock level on all core items as well as for its 100 fastest moving items;

• A store work-flow project being undertaken with the assistance of McKinsey and Company;

• A continued focus on shrink reduction efforts, particularly at "high shrink" stores;

• The addition of coolers in approximately 2,850 existing stores and the installation of coolers in virtually all new stores;

• Improving the merchandising productivity of its stores that have more than 8,000 square feet of selling space;

• The potential expansion of its debit and credit card and EBT test;

• Increasing its emphasis on opportunistic inventory purchases; and

• The stabilization, or reduction of, its retail management turnover rate.

The Company can provide no assurance that it will be successful in executing these initiatives nor can the Company guarantee that

the successful implementation of these initiatives will result in superior financial performance.

In addition to undertaking the operating initiatives described above, the Company also intends to monitor and/or analyze the sta-

tus of certain other issues. Those issues are likely to include:

• The status of the Company’s rating agency debt ratings;

• The analysis of the appropriate level of share repurchases for 2004 (in 2003 the Company spent $29.7 million

repurchasing approximately 1.5 million shares, and may consider increasing its share repurchases in 2004);

• The impact on the Company, if any, from recent legislation affecting the number of hours that truck drivers can operate

their trucks;

• The progress of the wage and hour collective action litigation in the state of Alabama discussed more fully in Note 7 to the

Consolidated Financial Statements;

M D & A

10

DP_General_1-16 4/15/04 4:49 M Page 12

• The effectiveness of its newly formed global sourcing subsidiary that replaces certain aspects of its importing process

which had previously been outsourced to a third party;

• The Company’s plans to install some additional fixtures in over three-quarters of its existing stores and the potential for

this disruption to have a temporary negative impact on same-store sales; and

• The Company’s progress toward fulfilling its Sarbanes-Oxley internal controls certification process which must be

completed before the filing of its annual report on Form 10-K in early 2005.

The Company measures itself against seven key financial metrics that it believes provide a well-balanced perspective regarding its

overall financial health. Those metrics are as follows, together with how they are computed:

• Earnings per share ("EPS") growth (current year EPS minus prior year EPS divided by prior year EPS equals percentage

change) which is an indicator of the increased returns generated for the Company’s shareholders.

• Total net sales growth (current year total net sales minus prior year total net sales divided by prior year total net sales

equals percentage change) which indicates, among other things, the success of the Company’s selection of new store

locations and merchandising strategies.

• Operating margin rate (operating profit divided by net sales) which is an indicator of the Company’s success in leveraging

its fixed costs and managing its variable costs.

• Return on invested capital (numerator – net income plus interest expense, net of tax, plus rent expense, net of tax;

denominator – average long-term debt plus average shareholders’ equity, both measured at the end of the latest five fiscal

quarters, plus average rent expense multiplied by eight. Average rent expense is computed using a two-year period).

Although this measure is a non-GAAP measure, the Company believes it is useful because return on invested capital

measures the efficiency of the Company’s capital deployed in its operations.

• Free cash flow (the sum of net cash flows from operating activities, net cash flows from investing activities and net cash

flows from financing activities, excluding share repurchases and changes in debt other than required payments). Although

this measure is a non-GAAP measure, the Company believes it is useful as an indicator of the cash flow generating

capacity of the Company’s operations. It is also a useful metric to analyze in conjunction with net income to determine

whether there is any significant non-cash component to the Company’s net income.

• Inventory turns (cost of goods sold for the year divided by average inventory balances, at cost, measured at the end of the

latest five fiscal quarters) which is an indicator of how well the Company is managing the largest asset on its balance sheet.

• Return on average assets (net income for the year divided by average total assets, measured at the end of the latest five

fiscal quarters), an overall indicator of the Company’s effectiveness in deploying its resources.

The Company computes the above metrics using both GAAP and certain non-GAAP information. As discussed further below under

"Results of Operations", the Company generally excludes non-recurring items, such as the restatement-related items, to more effec-

tively evaluate the Company’s performance on a comparable and ongoing basis.

The Company also pays particular attention to its same-store sales growth, which is a sub-category of its total sales growth, and

its shrink performance, which is a sub-category of its operating margin rate. In 2003 and 2002, the Company experienced same-

store sales growth of 4.0% and 5.7%, respectively. In 2003 and 2002, the Company’s shrink, expressed in retail dollars as a per-

centage of sales, was 3.05% and 3.52%, respectively.

Results of Operations

The following discussion of the Company’s financial performance is based on the Consolidated Financial Statements set forth here-

in. The Company has included in this document certain financial information not derived in accordance with generally accepted

accounting principles ("GAAP"), such as selling, general and administrative ("SG&A") expenses, net income and diluted earnings

per share that exclude the impact of restatement-related items. The Company believes that this information is useful to investors

as it indicates more clearly the Company’s comparative year-to-year operating results. This information should not be considered

a substitute for any measures derived in accordance with GAAP. Management may use this information to better understand the

Company’s underlying operating results.

The following table contains results of operations data for the 2003, 2002 and 2001 fiscal years, and the dollar and percentage vari-

ances among those years:

M D & A

11

DP_General_1-16 4/15/04 4:49 M Page 13

2003 vs. 2002 2002 vs. 2001

(amounts in millions, $% $%

excluding per share amounts) 2003 2002 2001 change change change change

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Net sales by category:

Highly consumable $ 4,206.9 $ 3,674.9 $ 3,085.1 $ 531.9 14.5% $ 589.8 19.1%

% of net sales 61.22% 60.24% 57.96%

Seasonal 1,156.1 994.3 888.3 161.9 16.3 106.0 11.9

% of net sales 16.82% 16.30% 16.69%

Home products 860.9 808.5 767.7 52.3 6.5 40.8 5.3

% of net sales 12.53% 13.25% 14.42%

Basic clothing 648.1 622.7 581.8 25.4 4.1 40.9 7.0

% of net sales 9.43% 10.21% 10.93%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Net sales $ 6,872.0 $ 6,100.4 $ 5,322.9 $ 771.6 12.6% $ 777.5 14.6%

Cost of goods sold 4,853.9 4,376.1 3,813.5 477.7 10.9 562.7 14.8

% of net sales 70.63% 71.74% 71.64%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Gross profit 2,018.1 1,724.3 1,509.4 293.9 17.0 214.9 14.2

% of net sales 29.37% 28.26% 28.36%

SG&A:

SG&A excluding

restatement-related

expenses 1,496.3 1,290.1 1,107.4 206.1 16.0 182.8 16.5

% of net sales 21.77% 21.15% 20.80%

Restatement-related expenses

included in SG&A 0.6 6.4 28.4 (5.8) (90.9) (22.0) (77.5)

% of net sales 0.01% 0.10% 0.53%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Total SG&A 1,496.9 1,296.5 1,135.8 200.3 15.5 160.7 14.2

% of net sales 21.78% 21.25% 21.34%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Penalty and litigation

settlement proceeds 10.0 (29.5) - 39.5 - (29.5) -

% of net sales 0.15% (0.48)% -

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Operating profit 511.3 457.3 373.6 54.0 11.8 83.7 22.4

% of net sales 7.44% 7.50% 7.02%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Interest expense, net 31.5 42.6 45.8 (11.1) (26.1) (3.2) (6.9)

% of net sales 0.46% 0.70% 0.86%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Income before taxes on

income 479.8 414.6 327.8 65.1 15.7 86.8 26.5

% of net sales 6.98% 6.80% 6.16%

Provisions for taxes on

income 178.8 149.7 120.3 29.1 19.4 29.4 24.4

% of net sales 2.60% 2.45% 2.26%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Net income $ 301.0 $ 264.9 $ 207.5 $ 36.1 13.6% $ 57.4 27.7%

% of net sales 4.38% 4.34% 3.90%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Diluted earnings per share $ 0.89 $ 0.79 $ 0.62 $ 0.10 12.7% $ 0.17 27.4%

Weighted average diluted

shares 337.6 335.1 335.0 2.6 0.8 --

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Restatement-related items:

Penalty and litigation

settlement proceeds 10.0 (29.5) - 39.5 - (29.5) -

Restatement-related expenses

included in SG&A 0.6 6.4 28.4 (5.8) (90.9) (22.0) (77.5)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

10.6 (23.1) 28.4 33.7 - (51.6) -

Tax effect (0.2) 9.1 (10.4) (9.3) - 19.5 -

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Total restatement-related

items, net of tax 10.4 (14.1) 18.0 24.4 - (32.1) -

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Net income, excluding

restatement-related items $ 311.4 $ 250.9 $ 225.5 $ 60.5 24.1% $ 25.4 11.2%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

Diluted earnings per share,

excluding restatement-

related items $ 0.92 $ 0.75 $ 0.67 $ 0.17 22.7% $ 0.08 11.9%

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––-

M D & A

12

DP_General_1-16 4/15/04 4:49 M Page 14

Net Sales. Increases in net sales resulted primarily from 587 net new stores and a same-store sales increase of 4.0% in 2003 com-

pared to 2002, and 573 net new stores and a same-store sales increase of 5.7% in 2002 compared to 2001. Same-store sales cal-

culations for a given period include only those stores that were open both at the end of that period and at the beginning of the pre-

ceding fiscal year. The Company monitors its sales internally by the four major categories noted in the table above. The Company’s

merchandising strategy in recent years has been to place a greater emphasis on faster-turning consumable products and to give

less prominence to slower-turning home products and clothing. The Company believes that this strategy has enabled it to better

serve its customers while improving its inventory turns. As a result of this strategy, over the past three years the highly consum-

able category has become a greater percentage of the Company’s overall sales mix while the percentages of the home products and

basic clothing categories have declined.

The Company’s same-store sales increase in 2003 over 2002 of 4.0%, or $228.3 million, was due to a number of factors, including

but not limited to: increased sales of candy and snacks of $64 million, which can be partially attributed to the introduction of new

items and the placement of many of the items in this category near the front of the store; an increase of $31 million in sales of

health and beauty aids items due primarily to improved in-stocks and increased sales of certain over-the-counter medications; an

increase of $30 million in sales of pet supplies primarily due to the success of private label pet foods and the addition during the

year of certain pet accessories; an increase of approximately $30 million in sales of perishable products primarily due to the increase

in the number of stores with coolers; and an increase of $24 million in sales of hard goods due primarily to expanded offerings of

automotive products.

The Company’s same-store sales increase in 2002 over 2001 of 5.7%, or $284.0 million, was due to a number of factors, including

but not limited to: the introduction of approximately 400 new items in the highly consumable category which, net of the sales of

the items they replaced, generated an estimated $85 million increase in same-store sales; a strong performance of seasonal mer-

chandise in the first half of 2002, which increased same-store sales by an estimated $42 million during that period, a portion of

which the Company attributes to the introduction of new outdoor items and the staging of warm weather items in its stores earli-

er than in prior years; an increase of approximately $25 million in sales of perishable products primarily due to the increase in the

number of stores with coolers; and improved ordering practices by its store employees.

Gross Profit. The gross profit rate increased 111 basis points in 2003 as compared with 2002 primarily due to the following:

• Higher initial mark-ups on merchandise received during 2003 as compared with 2002 (approximately 59 basis points of

gross margin improvement). This improvement was achieved primarily from increased purchases of higher margin

seasonal and home product items; a 31% increase in imported purchases, which carry higher than average mark-ups; and

a 72% increase in various performance-based vendor rebates.

• A reduction in the Company’s shrink provision from 3.52% in 2002 to 3.05% in 2003, calculated using retail dollars as a

percentage of sales (approximately 41 basis points of gross margin improvement, at cost). The Company made progress

in reducing the shrink at problem stores during 2003 but generally fell short of corporate goals. The 3.05% recorded in the

current year exceeds the shrinkage rate recorded in each of the four fiscal years between 1998 and 2001 (2.60%, 2.62%,

2.80% and 2.90%, respectively) and also exceeded the Company’s internal plan for 2003. Some of the actions taken by the

Company to combat shrink beginning in 2002 included the development of an asset protection department devoted to

reducing shrink losses, the installation and utilization of software that identifies unusual cash register transactions,

increasing the emphasis of shrink in the store bonus plan and the establishment of a multi-disciplinary shrink task force

that has developed a comprehensive shrink reduction action plan, which included the increased use of closed circuit

television monitors and burglar alarms, a specific high shrink store action plan, the creation of various shrink awareness

tools and the production of various exception reports to identify high risk stores. As mentioned in the Executive Overview

above, a continued emphasis on shrink reduction has been identified as a significant operating initiative for 2004.

• Higher average mark-ups on the Company’s beginning inventory in 2003 as compared to 2002 (approximately 18 basis

points of gross margin improvement). This increased average mark-up represents the cumulative impact of higher margin

purchases over time.

• A reduction in transportation expenses as a percentage of sales (approximately 14 basis points of gross margin

improvement). This reduction resulted primarily from system enhancements and improved process efficiencies in

managing outbound freight costs, which contributed to an approximate 7% decline in outbound cost per carton delivered

in 2003 as compared to 2002.

These components of margin, which all positively impacted the Company’s results, were partially offset by:

• The impact of the Company’s LIFO valuation adjustments in the fourth quarters of 2003 versus 2002 (approximately 16

basis points of gross margin decline). In 2002, the Company recorded an $8.9 million LIFO adjustment, which had the effect

M D & A

13

DP_General_1-16 4/15/04 4:49 M Page 15

of increasing gross margin and primarily resulted from the Company’s ability to lower its product costs through effective

purchasing methods and the general lack of inflation during the period. The Company did not benefit from a comparable

adjustment in 2003 primarily because the LIFO reserves in certain inventory departments had been reduced to nominal

amounts, or zero, in 2002 or prior years.

• An increase in markdowns of 14 basis points. The increase in markdowns was due principally to increased Christmas-

related markdowns compared to those the Company had taken in the past and, to a lesser extent, markdowns taken to

assist with the sale of both discontinued and slower moving apparel items.

The slight decline in the gross profit rate in 2002 as compared with 2001 was due primarily to an increase in the Company’s shrink-

age provision from 2.90% in 2001 to 3.52% in 2002, calculated using retail dollars as a percentage of sales. As discussed above, the

Company has taken several actions to combat shrink and continues to focus on this effort. The Company improved its initial mar-

gin on inventory purchases in all four of its major categories in 2002 as compared against 2001, which partially offset the increase

in the shrinkage provision. However, the continued shift in the Company’s sales mix to lower margin highly consumable items

noted above limited the year over year increase in the total initial margin rate to 7 basis points. The Company recorded an $8.9

million adjustment and a $3.5 million adjustment in the fourth quarters of 2002 and 2001, respectively, pertaining to its LIFO valu-

ation, which had the effect of increasing gross profit in both years. These adjustments were primarily the result of the Company’s

ability to lower its product costs through effective purchasing methods and the general lack of inflation.

Distribution and transportation costs decreased by approximately seven and six basis points, respectively, as a percentage of sales

in 2002 as compared to 2001. The reduction in distribution costs as a percentage of sales was due primarily to occupancy and

depreciation expenses that grew at a rate less than the sales increase, while the reduction in transportation costs as a percentage

of sales was due primarily to freight expenses that grew at a rate less than the sales increase. Occupancy costs represented a

decline of approximately five basis points as a percentage of sales in 2002 as compared to 2001, due primarily to reduced rental

and real property tax expenses as a percentage of sales. Depreciation expenses represented a decline of approximately three basis

points as a percentage of sales in 2002 as compared to 2001, due primarily to the fact that distribution center depreciation is rela-

tively fixed in comparison with the growth in the Company’s sales base. Factors contributing to the reduction in freight expense as

a percentage of sales in 2002 include lower fuel costs during the first half of the year and an effective freight revenue sharing pro-

gram whereby the Company picks up product directly from its vendors as opposed to having it shipped, each of which resulted in

a decline of approximately four basis points as a percentage of sales in 2002 as compared to 2001.

Selling, General and Administrative ("SG&A") Expense. The increase in SG&A expense as a percentage of sales, excluding restate-

ment-related expenses (primarily professional fees), in 2003 as compared with 2002 was due to a number of factors including but

not limited to increases in the following expense categories that were in excess of the 12.6 percentage increase in sales: store labor

(increased 14.6%) primarily due to increases in store training-related costs; the cost of workers’ compensation and other insurance

programs (increased 29.8%) primarily due to an increase in medical inflation costs experienced by the Company compared to pre-

vious years; store occupancy costs (increased 15.8%) primarily due to rising average monthly rentals associated with the Company’s

leased store locations; and higher bonus expense (increased 34.4%) related to the Company’s financial performance during 2003.

The increase in SG&A expense as a percentage of sales, excluding restatement-related expenses, in 2002 as compared with 2001

was due to a number of factors including but not limited to increases in the following expense categories that were in excess of the

14.6 percentage increase in sales: store labor (increased 21.1%) primarily due to continued efforts to improve store conditions by

both increasing the total number of hours worked in the stores and the average wage of the store employees; the cost of workers’

compensation and other insurance programs (increased 54.2%) primarily due to higher average medical costs relating to worker’s

compensation claims and increased premiums for directors’ and officers’ insurance; store occupancy costs (increased 18.6%) pri-

marily due to rising common area maintenance costs associated with leased store locations; and store repairs and maintenance

(increased 44.5%) primarily due to increased floor cleaning expenses and higher fixture repair costs.

Penalty and Litigation Settlement Proceeds. As more fully discussed in Note 7 to the Consolidated Financial Statements, the

Company accrued $10.0 million in 2003 with respect to a civil penalty related to its agreement in principle with the Securities and

Exchange Commission ("SEC") staff to settle the matters arising out of the Company’s financial restatement. In 2002, the Company

recorded $29.5 million in net litigation settlement proceeds, which amount included $29.7 million in insurance proceeds associat-

ed with the settlement of the restatement-related class action and shareholder derivative litigation offset by a $0.2 million settle-

ment of a shareholder class action opt-out claim related to the Company’s restatement.

Interest Expense, Net. The decrease in net interest expense over the period from 2001 to 2003 is due primarily to debt reduction

achieved during 2003 and 2002. The average daily total debt outstanding over the past three years was as follows: 2003 - $301.5

million at an average interest rate of 8.6%; 2002 - $575.7 million at an average interest rate of 6.6%; and 2001 - $738.8 million at

M D & A

14

DP_General_1-16 4/15/04 4:49 M Page 16

an average interest rate of 6.3%. The increase in the Company’s average interest rate over the periods above is due primarily to the

reduction of variable rate debt. All of the Company’s outstanding indebtedness at January 30, 2004 is fixed rate debt.

Provision for Taxes on Income. The effective income tax rates for 2003, 2002 and 2001 were 37.3%, 36.1% and 36.7%, respective-

ly. The higher tax rate in 2003 is due primarily to the $10.0 million penalty accrual discussed above which will not be deductible

for income tax purposes. The lower effective tax rate in 2002 was primarily due to recording higher work opportunity tax credits

than in 2001 and the favorable resolution of certain state tax related items during 2002.

Liquidity and Capital Resources

Current Financial Condition / Recent Developments. During the past three years, the Company has generated over $1.2 billion in

cash flows from operating activities. During that period, the Company has expanded the number of stores it operates by 34%, (1,700

stores) and has incurred $409 million in capital expenditures, primarily to support this growth. Also during this three-year period,

the Company has reduced its long-term debt by $448 million.

The Company is involved in a number of legal actions and claims in the ordinary course of business, some of which could poten-

tially result in a material cash settlement. In addition, the Company is involved in a collective action pending in the United States

District Court for the Northern District of Alabama. If the Company is not successful in defending that action, it could result in a

material cash settlement. The Company also has certain income tax-related contingencies as more fully described below under

"Critical Accounting Policies and Estimates". Estimates of these contingent liabilities are included in the Company’s Consolidated

Financial Statements. However, future negative developments could have a material adverse effect on the Company’s liquidity. See

Notes 4 and 7 to the Consolidated Financial Statements.

The Company’s inventory balance represented over 43% of its total assets as of January 30, 2004. The Company’s proficiency in

managing its inventory balances can have a significant impact on the Company’s cash flows from operations during a given fiscal

year. For example, in 2001, changes in inventory balances represented a $118.8 million use of cash while in 2002, changes in inven-

tory balances represented an $8.0 million source of cash. Inventory turns, which increased from 3.5 times in 2001 to 3.8 and 4.0

times in 2002 and 2003, respectively, contributed to the improved cash flows.

A substantial portion of the jobs credit programs utilized by the Company to reduce its federal income tax liability expired as of

December 31, 2003 for new employees hired after that date. Currently, there is legislation pending in Congress that will reinstate

these credits on a retroactive basis. While the enactment of this legislation is expected, its passage is not certain. The Company

anticipates that its 2004 income tax liability will increase by approximately $2.6 million if these credit programs are not re-enacted

on a retroactive basis.

On March 13, 2003, the Board of Directors authorized the Company to repurchase up to 12 million shares of its outstanding com-

mon stock. Purchases may be made in the open market or in privately negotiated transactions from time to time subject to mar-

ket conditions. The objective of the share repurchase program is to enhance shareholder value by purchasing shares at a price that

produces a return on investment that is greater than the Company's cost of capital. Additionally, share repurchases will be under-

taken only if such purchases result in an accretive impact on the Company's fully diluted earnings per share calculation. This

authorization expires March 13, 2005. During 2003, the Company purchased approximately 1.5 million shares at a total cost of $29.7

million.

The following table summarizes the Company’s significant contractual obligations as of January 30, 2004, which excludes the effect

of imputed interest (in thousands):

Payments Due by Period

Contractual obligations Total < 1 yr 1-3 yrs 3-5 yrs > 5 yrs

––––––––––––––––– –––––––––––––––––– –––––––––––––––––– –––––––––––––––––– ––––––––––––––––––

Long-term debt (a) $ 200,000 $ - $ - $ - $ 200,000

Capital lease obligations 38,228 15,902 16,703 4,923 700

Financing obligations 93,186 1,739 4,003 5,181 82,263

Inventory purchase obligations 111,700 111,700 - - -

Operating leases 948,984 221,838 314,127 166,233 246,786

––––––––––––––––– –––––––––––––––––– –––––––––––––––––– –––––––––––––––––– ––––––––––––––––––

Total contractual cash obligations $ 1,392,098 $ 351,179 $ 334,833 $ 176,337 $ 529,749

–––––––––––––––––--------------------------------------------------------------------------------------------------------------------

–––––––––––––––––--------------------------------------------------------------------------------------------------------------------

(a) As discussed below, represents unsecured notes whose holders have a redemption option in 2005, which could result in the acceleration of all or

a portion of these payments due.

M D & A

15

DP_General_1-16 4/15/04 4:49 M Page 17

The Company has a $300 million revolving credit facility (the "Credit Facility"), which expires in June 2005. During 2004, the

Company intends to begin discussions with its lenders about amending or replacing the Credit Facility. As of January 30, 2004, the

Company had no outstanding borrowings and $22.5 million of standby letters of credit under the Credit Facility. The standby letters

of credit reduce the borrowing capacity of the Credit Facility. The Credit Facility contains certain financial covenants, all of which

the Company was in compliance with at January 30, 2004. See Note 5 to the Consolidated Financial Statements for further discus-

sion of the Credit Facility.

The Company has $200 million (principal amount) of 8 5/8% unsecured notes due June 15, 2010. This indebtedness was incurred

to assist in funding the Company’s growth. Interest on the notes is payable semi-annually on June 15 and December 15 of each year.

The note holders may elect to have these notes repaid on June 15, 2005, at 100% of the principal amount plus accrued and unpaid

interest. The Company may seek, from time to time, to retire its outstanding notes through cash purchases on the open market,

privately negotiated transactions or otherwise. Such repurchases, if any, will depend on prevailing market conditions, the

Company’s liquidity requirements, contractual restrictions and other factors. The amounts involved may be material.

Significant terms of the Company’s outstanding debt obligations could have an effect on the Company’s ability to incur additional

debt financing. The Credit Facility contains financial covenants which include the ratio of debt to EBITDAR (as defined in the debt

agreement), fixed charge coverage, asset coverage, minimum allowable consolidated net worth and maximum allowable capital

expenditures. The Credit Facility also places certain specified limitations on secured and unsecured debt. The Company’s out-

standing notes discussed above place certain specified limitations on secured debt and place certain limitations on the Company’s

ability to execute sale-leaseback transactions. The Company has generated significant cash flows from its operations during recent

years, and had no borrowings outstanding under the Credit Facility at any time during 2003. Therefore, the Company does not

believe that any existing limitations on its ability to incur additional indebtedness will have a material impact on its liquidity. Notes

5 and 7 to the Consolidated Financial Statements contain additional disclosures related to the Company’s debt and financing obli-

gations.

At January 30, 2004 and January 31, 2003, the Company had commercial letter of credit facilities totaling $218.0 million and $150.0

million, respectively, of which $111.7 million and $85.3 million, respectively, were outstanding for the funding of imported mer-

chandise purchases.

The Company believes that its existing cash balances ($398.3 million at January 30, 2004), cash flows from operations ($518.6 mil-

lion generated in 2003), the Credit Facility ($277.5 million available at January 30, 2004) and its anticipated ongoing access to the

capital markets, if necessary, will provide sufficient financing to meet the Company’s currently foreseeable liquidity and capital

resource needs.

Cash flows provided by operating activities. Cash flows from operations for 2003 compared to 2002 increased by $84.5 million. In

2002, the Company paid $162.0 million in settlement of the restatement-related class action lawsuit, as discussed in Note 7 to the

Consolidated Financial Statements, which did not recur in 2003. Partially offsetting this cash outflow were 2002 tax benefits total-

ing approximately $139.3 million, of which approximately $121 million either directly or indirectly related to the Company’s finan-

cial restatement and subsequent litigation settlement. The timing of these tax benefits was a significant component of the reduc-

tion of cash flows from deferred ($63.0 million) and current ($77.9 million) income taxes in 2003 compared to 2002. An increase

in accrued liabilities resulted in a $44.7 million increase in 2003 cash flows compared to 2002 due in part to the accrued SEC penal-

ty and increased 2003 bonuses described above, increased deferred compensation liabilities and increases in certain tax reserves.

Contributing to the increase in cash flows provided by operating activities in 2003 was an increase in net income of $36.1 million

driven by the improved operating results discussed above (see "Results of Operations").

Cash flows from operations for 2002 compared to 2001 increased by $168.4 million due principally to the increase in net income

described above and improved inventory productivity. As a result of the improvement in inventory turns to 3.8 times in 2002 from

3.5 times in 2001, the change in inventory in 2002 was an $8.0 million source of cash as compared against a $118.8 million use of

cash in 2001. Also affecting cash flows from operating activities was the restatement-related class action lawsuit settlement and

related tax effects described above.

Cash flows used in investing activities. The Company’s purchases of property and equipment in 2003 included the following: $63.2

million for new, relocated and remodeled stores; $22.0 million for systems-related capital projects; and $25.2 million for distribu-

tion and transportation-related capital expenditures. During 2003, the Company opened 673 new stores and relocated or remod-

eled 76 stores. Systems-related projects in 2003 included $5.9 million for point-of-sale and satellite technology and $3.1 million

related to debit/credit/EBT technology. Distribution and transportation expenditures in 2003 include $19.1 million at the Ardmore,

Oklahoma and South Boston, Virginia DCs primarily related to the ongoing expansion of those facilities.

M D & A

16

DP_General_1-16 4/15/04 4:49 M Page 18

During 2003, the Company purchased two secured promissory notes totaling $49.6 million which represent debt issued by a third

party entity from which the Company leases its DC in South Boston, Virginia. See Note 7 to the Company’s Consolidated Financial

Statements.

The Company’s purchases of property and equipment in 2002 included the following: $50.9 million for new, relocated and remod-

eled stores; $30.2 million for systems-related capital projects; and $21.3 million for distribution and transportation-related capital

expenditures. The Company opened 622 new stores and relocated or remodeled 73 stores in 2002. Systems-related capital proj-

ects in 2002 included $15.0 million for satellite technology and $3.0 million for point-of-sale cash registers. Expenditures for dis-

tribution and transportation consisted in part of $8.3 million for the purchase of new trailers and $5.0 million related to the instal-

lation of a dual sortation system in the Fulton, Missouri DC.

The Company’s purchases of property and equipment in 2001 included the following: $55.8 million for new, relocated and remod-

eled stores; $31.7 million for systems-related capital projects; and $6.6 million on distribution and transportation-related capital

expenditures. The Company opened 602 new stores and relocated or remodeled 78 stores in 2001. Systems-related capital proj-

ects in 2001 included $10.0 million for satellite technology and $8.3 million for new point-of-sale cash registers.

Capital expenditures during 2004 are projected to be approximately $300 million. The Company anticipates funding its 2004 capi-

tal requirements with cash flows from operations and the Credit Facility, if necessary. Significant components of the 2004 capital

plan include, in order of anticipated magnitude, leasehold improvements and fixtures and equipment for 695 new stores, which

includes 20 new Dollar General Market stores; the construction of the new DC in Union County, South Carolina; expansions and

equipment upgrades of the Company’s DCs in Ardmore, Oklahoma and South Boston, Virginia; the rollout of coolers into approxi-

mately 2,850 existing stores; and the cost of some additional store fixtures related to merchandising initiatives. The Company plans

to undertake these expenditures in order to improve its infrastructure and provide support for its continued growth.

Cash flows used in financing activities. The Company paid cash dividends of $46.9 million, or $0.14 per share, on its outstanding

common stock during 2003. The Company repurchased approximately 1.5 million shares of its common stock during 2003 at a total

cost of $29.7 million, as discussed above. The Company expended $15.9 million during 2003 to reduce its outstanding capital lease

and financing obligations. These uses of cash were partially offset by proceeds from the exercise of stock options during 2003 of

$49.5 million. The use of cash in 2002 reflects the net repayment of $397.1 million in outstanding debt and the payment of $42.6

million of cash dividends. The net repayment of debt was undertaken to strengthen the Company’s financial position and was