LETTER FROM

OUR CHAIRMAN AND CHIEF EXECUTIVE OFFICER

Dear Fellow Shareholders,

You are cordially invited to join us for our 2023 virtual annual meeting of shareholders, which

will be held on Tuesday, June 13, 2023, at 9:00 a.m. Eastern Time. The meeting will be held entirely

online via live webcast at www.virtualshareholdermeeting.com/DLTR2023. The Notice of Annual Meeting

of Shareholders and the Proxy Statement that follow describe the business to be conducted at the

meeting.

The Dollar Tree organization experienced substantial change in 2022. Seven new directors

were added to the Board of Directors as part of the reconstitution of the Board in March 2022, and

since that time the Board has been focused on the transformational change that is needed to drive growth

and unlock long-term shareholder value. As part of this process, the Board initiated the hiring of a

new team of diverse executive leaders with the knowledge, experience and dedication to aggressively

implement change. I am excited about the exceptional executive leadership team that is now in place, and

we are moving as quickly as possible to capture the full potential of the business. With the current

economic climate driving higher income consumers into value retail, we believe we are in an excellent

position to deliver the quality, value and convenience that shoppers want and expect today.

The cornerstone of our business is our people, and a key focus continues to be on supporting

and enabling our associates to be successful. Under our new leadership team, we are increasing

average hourly wages for store associates and making investments in field personnel. Importantly, we

expect these labor and wage investments will drive improved execution in our stores and overall greater

productivity and efficiency. Our associates and field personnel are critical to our transformational

journey, and we are excited about these investments in our talent. We are looking to invigorate the

culture of our business and not only give our associates the tools they need to perform their roles but

provide them with the opportunities they deserve to grow within the Company.

To be successful, we must run well-maintained, efficient and productive stores, which drives

our intense focus on store standards. When we maintain clean, fully stocked stores, our customers

respond with bigger baskets and repeat visits. In addition to improving sales and the customer’s

experience, improved efficiencies and productivity positively impact the work experience of our associates.

Our certified GOLD (Grand Opening Look Daily) stores will serve as a clear example of what our

most successful and well-run stores look like for our district and store leadership teams across all regions.

The Dollar Tree and Family Dollar banners are intensely focused on how to be the best retail

destination for their unique customer bases. At Dollar Tree, our merchant team successfully managed

through the transition to the $1.25 primary price point, an initiative that significantly enhances our ability

to provide a meaningful assortment at extreme value to our Dollar Tree shoppers. We also added $3

and $5 Dollar Tree Plus merchandise into more than 1,800 Dollar Tree stores in 2022, and we plan to add

this multiple price point product to many more stores in 2023. Separately, we have been aggressively

expanding our $3, $4, and $5 frozen and refrigerated product across the Dollar Tree store base, installing

additional cooler doors with an attractive selection of proteins, pizza, ice cream and more that our

customers are responding to positively.

In addition to the opportunities at the Dollar Tree banner, we have a tremendous long-term

opportunity to improve the operating performance at Family Dollar. In 2022, we took action to bring

Family Dollar pricing into parity with key competitors, and we continue to be pleased with our positioning

from a price perspective. In addition, we have sales and margin-driving initiatives underway, albeit in

the early stages to grow our SKU base and expand the number of cooler doors, providing shoppers in

our communities with consumable products they rely on to feed their families. We are also incorporating

more of our private brands into the merchandise mix. These products will include new labels and

redefined labels, many of which are being developed in our new test kitchen in Chesapeake, Virginia.

We are also working on new initiatives to improve our technology and supply chain that are

important to our future success. In order to unlock the full value creation opportunity ahead of us, we

must have the right tools and technology in place to support our accelerated growth, and we are prioritizing

projects that will have the greatest impact on improving our performance. We are working to enhance

our supply chain efficiencies and ensure that our stores have the merchandise they need in a timely

manner and can stock it easily. This will be a big step forward for our organization and especially for our

store associates.

We recognize that stakeholders within our communities expect the Company to be a responsible

corporate citizen and to respond to issues of concern, including diversity, equity and inclusion for all

peoples, the potential impact of climate change, and other sustainability risks. The Board of Directors

is committed to addressing these challenges and opportunities, and in 2022 we hired a Chief Diversity

Officer and Chief Sustainability Officer to lead management’s efforts in these important areas. These

executives will work with the Board’s Sustainability and Corporate Social Responsibility Committee to

focus on key sustainability issues that affect the Company, such as environmental change, human

capital management and workplace environment and culture matters. In addition, we continue to update

our corporate sustainability reporting in 2023 to share our efforts across a range of topics, including

environmental stewardship, DEI in our workforce, product safety and more. I am confident the Company

is well-positioned from a governance perspective to address and manage current and future risks to

our business.

Finally, I want to thank all of you for your support and confidence in the Board as we move

forward to execute our strategy for long-term value creation. The long-term opportunity ahead of us is

bigger than I imagined before I joined the Dollar Tree team, and I look forward to engaging with you in

the months and years ahead. Whether or not you plan to attend the virtual annual meeting, your vote

is important, and I encourage you to vote your shares.

Sincerely yours,

Richard W. Dreiling

Chairman and Chief Executive Officer

2

LETTER FROM

OUR LEAD INDEPENDENT DIRECTOR

Dear Fellow Shareholders,

I am pleased to report that many significant positive changes took place at Dollar Tree in 2022.

Beginning with the Board refreshment in March 2022 that brought seven new directors to the Board,

the reconstituted Board embarked on a drive to bring new leadership to the Company led by Rick Dreiling,

a distinguished retail executive who became Executive Chairman of the Board, and to enhance our

corporate governance. The Board views the arrival of Rick as a watershed event for the Company. Under

his guidance as Chairman in 2022 the Company hired an outstanding and diverse new executive

leadership team with extensive retail experience dedicated to the transformational goals of the Board.

As a result of this success, the Board appointed Rick as Chief Executive Officer effective January 29,

2023. The Board looks forward to his continued leadership in achieving the next chapter of growth for

Dollar Tree.

SHAREHOLDER-FRIENDLY GOVERNANCE

Among the first steps taken by our Board under Rick Dreiling’s leadership was to improve our

governance structure to increase our responsiveness to our shareholders. We amended our By-Laws

to move the advance notice time period for shareholder nominations of directors and the proposal of

certain business closer to the annual meeting date. The Board also amended the proxy access

provision in our By-Laws to increase the maximum number of shareholder nominees that may appear

in the Company’s proxy statement with respect to an annual meeting of shareholders and to eliminate the

previous restriction that limited the aggregate number of shareholders that were permitted to form a

nominating group.

The Board also proposed an amendment to the Company’s Articles of Incorporation to permit

shareholders that own 15% or more of the Company’s common stock to call a special meeting. The

proposal was approved by shareholders at the 2022 annual meeting.

In addition, the Board revised the charters of the Audit Committee, Nominating and Governance

Committee and Compensation Committee, and established a new Finance Committee and a new,

separate committee focused solely on Sustainability and Corporate Social Responsibility. We believe

these changes have allowed the Board to exercise improved oversight in many critical areas, including

diversity, equity and inclusion as well as greenhouse gas emission reductions.

Moreover, the Board amended our Corporate Governance Guidelines to improve Board

governance, including revising the director stock ownership guidelines to increase the amount of Dollar

Tree stock each director should hold to no less than five times the annual cash retainer paid to directors,

and clarifying that unexercised stock options do not count toward the stock ownership requirement. The

Board also changed the policy on director overboarding to provide that directors generally should not

serve on more than four public company boards other than the Company.

The Board believes that these governance enhancements have not only improved our Board

functions but also have empowered shareholders to engage with the Company more effectively and

conveniently. Our policies represent Dollar Tree’s ongoing commitment to preserving shareholder rights,

and we will continue to assess additional governance changes against emerging best practices in the

future.

INCENTIVE COMPENSATION FOR OUR CHAIRMAN & CEO

Prior to the reconstitution of the Board, members of our Board leadership met with shareholders

owning more than 50% of the Company’s stock to understand their perspectives on our business

strategy and leadership. The dominant view of those shareholders was that the Company should do

3

whatever was necessary to secure Rick Dreiling’s services as the Company’s top executive for a

multi-year period. Without the inducement grant described below, the Board does not believe we would

have achieved that objective.

In order to persuade Rick to take an active operating leadership role and employment with

Dollar Tree as Executive Chairman and fully align his interests with the interests of shareholders over

the long-term, the Board approved a five-year employment agreement with Rick and granted him an

option to purchase 2,252,587 shares of Dollar Tree common stock at an exercise price of $157.17 per

share, the closing trading price of Dollar Tree common stock on March 18, 2022. This was at the time

the Company’s all-time high closing stock price and we believe already reflected the market’s optimism

that Dollar Tree would achieve transformational change and materially enhance long-term shareholder

value. The number of shares covered by the award represented 1% of the shares of common stock then

outstanding.

The option award vests over five years and, in addition to an annual base salary of $1 million,

was the only direct compensation that Rick was eligible to receive for his service as Executive Chairman

in 2022 and for the five-year term of his agreement. Rick was not eligible for annual or long-term

incentive awards based on his service as Executive Chairman in 2022. As a result, more than 95% of

his annualized compensation was fully at risk and aligned directly with the creation of exceptional value

for shareholders.

In January 2023, upon appointment as Chief Executive Officer, Rick’s annual base salary was

increased to $1,350,000 to align with market median and he became eligible for an annual cash

incentive bonus award. However, he continues to be ineligible for additional long-term equity incentive

awards under the terms of his agreement, as amended. If in the future Rick no longer serves as CEO of

the Company but remains as Executive Chairman, his annual compensation will revert to the terms of

the original agreement.

In the Board’s view, options are an ideal vehicle to support the creation of long-term value for

the direct benefit of shareholders. Rick’s option will have economic value only if he builds long-term

shareholder value in excess of the option’s exercise price of $157.17 per share. The long-term, five-

year vesting schedule and ten-year term of the option award is intended to ensure that Rick will remain

focused on long-term value-creating activity, including investments in talent and leadership, culture,

succession planning, technology and transformational change of the business.

The other members of the Board and I believe Rick is in a unique position to drive long-term

shareholder benefit. As Chairman & CEO, Rick will be intimately involved in the operations of the

Company and, because he will not participate in the Company’s long-term equity incentive plans, he

will be positioned to ensure that Dollar Tree’s incentive plans incorporate metrics and targets that align

directly with long-term shareholder value creation.

We want to thank you for the input and support we have received to date and we look forward

to engaging with you in the future.

Sincerely yours,

Edward J. Kelly, III

Lead Independent Director

4

QUICK INFORMATION

The following charts provide quick information about Dollar Tree’s 2023 annual meeting and

our corporate governance and executive compensation practices. These charts do not contain all of

the information provided elsewhere in the proxy statement; therefore, you should read the entire proxy

statement carefully before voting.

Annual Meeting Information

DATE & TIME VIRTUAL MEETING

APR

IL

9

2021

RECORD DATE

Tuesday, June 13, 2023

at 9:00 a.m., Eastern Time

The 2023 annual meeting will be

held in a virtual meeting format.

Shareholders can access the

meeting online through

April 14, 2023

www.virtualshareholdermeeting.com/DLTR2023

Proposals That Require Your Vote

Proposal Voting Options

Board

Recommendation

More

Information

Proposal No. 1

Election of Directors

FOR, AGAINST, or ABSTAIN

for each Director Nominee

FOR each Nominee on

the proxy card

Page 111

Proposal No. 2

Advisory Vote on NEO

Compensation

FOR, AGAINST, or ABSTAIN FOR Page 112

Proposal No. 3

Advisory Vote on the

Frequency of Future

Advisory Votes on

Executive Compensation

Every 1 YEAR, 2 YEARS,

3 YEARS, or ABSTAIN

1 YEAR Page 113

Proposal No. 4

Ratification of

Appointment of

Independent Auditors

FOR, AGAINST, or ABSTAIN

FOR Page 114

Proposal No. 5

Shareholder Proposal

Regarding a Report on

Economic and Social

Risks of Company

Compensation and

Workforce Practices and

any Impact on

Diversified Shareholders

FOR, AGAINST, or ABSTAIN

AGAINST Page 117

See “Information About the Annual Meeting and Voting” beginning on page 106 for the various ways

available for submitting your vote.

We are making the Proxy Statement and the form of proxy first available to shareholders on or about

May 2, 2023.

5

Corpora te Governance & Compensation Quick Facts

Governance or Compensation Item Dollar Tree’s Practice

Board Composition, Leadership and Operations

Number of directors 10

Director independence 90%

Standing Board committee independence 100%

Robust Lead Independent Director Role Yes

Majority voting standard in uncontested director elections Yes

Director resignation policy Yes

Board oversight of Company strategy and risks Yes

Annually-elected Board Yes

Average director age 64

Average director tenure 2.1 years

Directors attending fewer than 75% of meetings None

Annual Board, committee and individual director evaluation process Yes

Independent directors meet without management present Yes

Number of Board meetings held in fiscal 2022 18

Total number of Board and committee meetings held in fiscal 2022 50

Sustainability and Corporate Responsibility

Dedicated Board Committee provides oversight of sustainability Yes

Environmental Policy Yes

Human Rights Policy Yes

Occupational Health and Safety Policy Yes

Political Contribution and Expenditure Policy Statement Yes

Corporate Sustainability Report Yes

Strategic report on impact of climate change (included in Corporate

Sustainability Report)

Yes

Vendor code of conduct Yes

6

Governance or Compensation Item Dollar Tree’s Practice

Other Governance Practices

Codes of conduct for directors, officers and associates Yes

Shareholder engagement policy Yes

Anti-hedging policy Yes

Robust stock ownership policies Yes

Shares pledged by officers and directors None

Family relationships None

Independent auditor KPMG LLP

Compensation Practices

Executive compensation programs designed to reward performance,

incentivize growth and drive long-term shareholder value

Yes

Robust clawback policy Yes

Employment agreements for executive officers Only Chairman & CEO

Incentive awards based on challenging performance targets Yes

Percentage of incentive compensation at risk 100%

Annual risk assessment of compensation policies and practices Yes

Frequency of say on pay advisory vote Annual

Independent compensation consultant Yes

Double-trigger change-in-control provisions Yes

Policy for timing of annual grant of incentive awards Yes

Repricing of underwater options No

Excessive perks No

Our Compensation Philosophy

Our compensation program is grounded in a pay-for-performance philosophy to

align pay outcomes with the interests of our shareholders. Performance goals in

both our short- and long-term incentive plans are set at challenging levels, with the

ultimate goal that achievement of performance goals will drive long-term,

sustainable shareholder value growth. When financial targets and performance

goals are not met, pay outcomes for our executives result in lower or zero payouts.

7

DOLLAR TREE, INC.

500 Volvo Parkway

Chesapeake, Virginia 23320

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on

Tuesday, June 13, 2023

To Our Shareholders:

We will hold the annual meeting of shareholders of Dollar Tree, Inc. in a virtual format again

this year. As a result, the entire meeting will be held online and there will be no physical location for

shareholders to attend. Shareholders may participate in the annual meeting on Tuesday, June 13,

2023 at 9:00 a.m. Eastern Time by logging in at:

www.virtualshareholdermeeting.com/DLTR2023

Shareholders will be afforded the same rights and opportunities to participate as they would at an

in-person meeting. During the meeting, shareholders will be able to listen, vote and submit questions

from any location using any internet-connected device. You may submit questions in advance of the

meeting at www.proxyvote.com after logging in with your control number. Questions may also be submitted

during the annual meeting through www.virtualshareholdermeeting.com/DLTR2023. To be admitted to

the annual meeting, you must enter the control number found on your proxy card, voting instruction form

or notice.

The following items of business are on the agenda for the annual meeting:

• To elect ten director nominees to the Company’s Board of Directors (“Board”) as identified

in the attached proxy statement, each to serve as a director for a one-year term;

• To approve, by a non-binding advisory vote, the compensation of the Company’s named

executive officers;

• To vote, in a non-binding advisory vote, on the frequency of future advisory votes on

executive compensation;

• To ratify the selection of KPMG LLP as the Company’s independent registered public

accounting firm for the fiscal year 2023;

• To vote on a shareholder proposal regarding a report on economic and social risks of

company compensation and workforce practices and any impact on diversified shareholders;

and

• To act upon any other business that may properly come before the meeting or any

adjournments or postponements thereof.

8

Shareholders of record at the close of business on April 14, 2023 will receive notice of and be

allowed to vote at the annual meeting.

We have elected to distribute our proxy materials primarily over the Internet rather than mailing

paper copies of those materials to each shareholder. We believe this will increase shareholder value by

decreasing our printing and distribution costs, reducing the potential for environmental impact by

conserving natural resources, and allowing for convenient access to and delivery of materials in an

easily searchable format. If you would prefer to receive paper copies of our proxy materials, please follow

the instructions included in the Notice of Internet Availability of Proxy Materials that is being mailed to

our shareholders on or about May 2, 2023.

Your vote is important to us. To ensure the presence of a quorum at the annual meeting, we

encourage you to read the proxy statement and then vote your shares promptly by Internet, by phone

or by signing, dating and returning your proxy card (if you request a paper copy). Sending in your proxy

card will not prevent you from voting your shares at the annual meeting, as your proxy is revocable at

your option.

By Order of the Board of Directors

John S. Mitchell, Jr.

Corporate Secretary

Chesapeake, Virginia

May 2, 2023

IMPORTANT NOTICE ABOUT THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL

MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 13, 2023

The Company’s proxy sta tement and annual report to shareholders for the fiscal year ended

January 28, 2023 are available at

https://corporate.dollartree.com/investors/financial-information/annual-reports-proxies.

9

TABLE OF CONTENTS

Page

LETTER FROM OUR CHAIRMAN AND CHIEF EXECUTIVE OFFICER .................... 1

LETTER FROM OUR LEAD INDEPENDENT DIRECTOR .............................. 3

QUICK INFORMATION ..................................................... 5

Corporate Governance & Compensation Quick Facts .......................... 6

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS ............................... 8

CORPORATE GOVERNANCE HIGHLIGHTS ...................................... 12

The Work of the Board ............................................... 13

Director Refreshment ................................................. 13

Board Commitments ................................................. 13

Board Skills Matrix .................................................. 14

DIRECTOR BIOGRAPHIES .................................................. 16

THE BOARD AND ITS COMMITTEES ........................................... 26

Audit Committee .................................................... 27

Compensation Committee ............................................. 27

Nominating and Governance Committee ................................... 28

Finance Committee .................................................. 29

Sustainability and Corporate Social Responsibility Committee ..................... 29

Meetings of the Board of Directors ....................................... 30

BOARD GOVERNANCE ..................................................... 31

Independence ..................................................... 32

Board Leadership Structure ............................................ 32

Director Stock Holding Requirements ..................................... 33

Majority Voting in Uncontested Election of Directors ........................... 33

Board’s Role in Risk Oversight .......................................... 34

Information Security Risk Management .................................... 34

Environmental and Social Sustainability .................................... 35

Code of Ethics ..................................................... 38

Engagement with Shareholders ......................................... 38

Communications with the Board ......................................... 39

DIRECTOR COMPENSATION ................................................ 40

HOW NOMINEES TO OUR BOARD ARE SELECTED ................................ 43

Stewardship Framework Agreement ...................................... 43

Board Diversity ..................................................... 44

Board Tenure ...................................................... 44

Shareholder Nominations for Election of Directors ............................. 45

Proxy Access ...................................................... 46

EXECUTIVE OFFICERS .................................................... 47

Executive Officer Biographies ........................................... 47

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION ............... 50

COMPENSATION DISCUSSION AND ANALYSIS ................................... 50

A. Executive Summary ................................................ 51

B. Compensation Principles ............................................ 59

C. Components of Executive Compensation ................................. 62

D. Compensation Governance .......................................... 71

ANNUAL COMPENSATION OF EXECUTIVE OFFICERS .............................. 77

Potential Payments upon Termination or Change in Control ...................... 86

PAY RATIO DISCLOSURE ................................................... 95

Pay Ratio Methodology ............................................... 95

Required Pay Ratio .................................................. 95

10

Page

Supplemental Pay Ratio ............................................... 95

PAY VERSUS PERFORMANCE ............................................... 97

Pay versus Performance Table .......................................... 97

Relationship Between Pay and Performance ................................. 100

Tabular List of Performance Measures ..................................... 101

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS .......................... 101

Review of Transactions with Related Parties ................................. 101

Related Party Transactions ............................................. 101

OWNERSHIP OF COMMON STOCK ............................................ 103

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING ......................... 106

PROPOSAL NO. 1: ELECTION OF DIRECTORS .................................... 111

Directors and Nominees ............................................... 111

Vote Required ...................................................... 111

PROPOSAL NO. 2: ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE

OFFICERS ............................................................ 112

Vote Required ...................................................... 112

PROPORAL NO. 3: ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON

EXECUTIVE COMPENSATION .............................................. 113

Vote Required ...................................................... 113

PROPOSAL NO. 4: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS ........ 114

Independent Registered Public Accounting Firm Fees .......................... 114

Report of the Audit Committee .......................................... 115

Vote Required ...................................................... 116

PROPOSAL NO. 5: SHAREHOLDER PROPOSAL REGARDING A REPORT ON ECONOMIC AND

SOCIAL RISKS OF COMPANY COMPENSATION AND WORKFORCE PRACTICES AND ANY

IMPACT ON DIVERSIFIED SHAREHOLDERS .................................... 117

Shareholder Proposal ................................................ 117

Statement from Dollar Tree’s Board Regarding the Shareholder Proposal ............. 119

Vote Required ...................................................... 120

FORWARD-LOOKING STATEMENTS ........................................... 121

OTHER MATTERS ........................................................ 121

Director Nominations and Shareholder Proposals for the 2024 Annual Meeting ......... 121

Copies of Form 10-K Available .......................................... 122

11

CORPORATE GOVERNANCE HIGHLIGHTS

As the Company grows and evolves, our Board of Directors is engaged in an effort to enhance

its governance policies and practices. The Board seeks to further increase its effectiveness as well as

its alignment with and transparency to shareholders. These changes include:

▶ Board leadership. In 2022, the Board:

◊

Appointed Richard W. Dreiling to be our new Chairman and Chief Executive Officer;

◊

Elected a new Lead Independent Director, Edward J. Kelly, III, who has robust authority to

oversee the Board’s operations and relationship with management; and

◊

Appointed Paul Hilal as Vice Chairman of the Board, Jeffrey G. Naylor as Chair of our

Audit Committee, Cheryl W. Grisé as Chair of our Compensation Committee, Edward J.

Kelly, III as Chair of our Nominating and Governance Committee, Daniel J. Heinrich as Chair

of our newly formed Finance Committee and Stephanie P. Stahl as Chair of our newly

formed Sustainability and Corporate Social Responsibility (CSR) Committee.

▶ Strengthened ESG oversight. Over the last couple of years the Board and its committees have

enhanced ESG oversight to increase its focus and transparency about the Company’s sustainability

and ESG risks. Among other things, the Board:

◊

Created a new Sustainability and CSR Committee to assist the Board in its oversight of

the Company’s sustainability and social-related risks and strategies, external reporting, and

workplace environment and culture;

◊

Directed the Sustainability and CSR Committee to oversee the Company’s strategies and

policies related to human capital management, including matters related to diversity, equity

and inclusion as it relates to the Company’s workforce, workplace environment and

culture, and the recruiting, selection, talent development, progression and retention of the

Company’s workforce; and

◊

Specified that the Sustainability and CSR Committee will, at least twice a year, evaluate,

discuss, and, as appropriate, direct the disclosure of the Company’s risks relating to

corporate social responsibility and sustainability, including the environment, human rights,

labor, health and safety, workforce diversity, supply chain, and similar matters affecting

Company stakeholders.

▶ Enhanced governance best practices. The Board previously adopted best practices such as a

declassified board, a majority voting standard for uncontested elections of directors and proxy

access, which are intended to increase accountability to shareholders. Building on these actions in

2022, the Board:

◊

Amended our Articles of Incorporation to permit shareholders representing 15% or more

of the Company’s common stock to call a special meeting of shareholders;

◊

Enhanced the Company’s Bylaws by moving the advance notice time period for shareholder

nominations of directors and the proposal of business closer to the annual meeting;

◊

Expanded proxy access by raising the number of permitted shareholder nominees and

removing restrictions that limited the size of a shareholder nominating group; and

◊

Updated the charters of key Board committees to clarify and enhance the roles of these

committees in accordance with corporate governance best practices.

12

The Work of the Board

Our Board of Directors is highly engaged and focused on strategy and the best use of capital

to maximize shareholder value. The Board is also committed to having highly qualified and diverse

directors with varying experiences, skills and perspectives to accomplish that goal. In fiscal 2022, the

Board met eighteen (18) times, the Nominating and Governance Committee met nine (9) times, the Audit

Committee met eight (8) times, the Compensation Committee met nine (9) times, the Finance

Committee met three (3) times and the Sustainability and Corporate Social Responsibility Committee

met three (3) times.

In 2022 the Board focused on positioning the Company for continued growth and transformational

change. The Board appointed Richard W. Dreiling as our new Chairman and Chief Executive Officer.

Mr. Dreiling brings to our Company more than 40 years of retail industry experience at all operating levels

and has a proven record of success in the dollar store segment and other segments of the retail

market. The Board also refreshed the leadership team with a new Chief Financial Officer, Chief

Operating Officer, Chief Supply Chain Officer, Chief Information Officer and Chief Merchandising Officer

for Family Dollar, all of whom have the skills and experience needed to drive growth and improve our

operating performance.

Our Board plays a critical role in overseeing enterprise risk, primarily through the work of its

committees, which report matters relating to their areas of responsibility back to the full Board. In

2022, the Board created two new standing committees, a Finance Committee and Sustainability and

CSR Committee. These new committees have allowed the Board to increase its focus on its strategic,

finance and sustainability objectives and risks.

Director Refreshment

On March 8, 2022, we entered into a Stewardship Framework Agreement with affiliates of

Mantle Ridge LP, a registered investment advisory firm and owner of approximately 5.8% of our

outstanding shares. Pursuant to the Stewardship Framework Agreement, our Board of Directors was

reconstituted to consist of seven new directors and five continuing directors following the retirement of

six incumbent directors. In addition to the changes that occurred in March 2022, in January 2023, Mike

Witynski left his position as Chief Executive Officer and resigned from the Board and Thomas Dickson

will be retiring from the Board at the 2023 annual meeting of shareholders. After considering the size and

composition of the Board in light of these vacancies, the Board approved an amendment to our By-

Laws to reduce the size of the Board from twelve directors to ten directors effective immediately prior

to the convening of the 2023 annual meeting of shareholders. Upon the reelection of the ten directors

that have been renominated by the Board, the tenure profile of the Board will be comprised of seven

directors having two years or less in tenure and three directors with between three and five years in

tenure.

Board Commitments

Our Board is comprised of members with valuable experience gained from service on the

boards of directors of other public companies, including companies in the retail industry. When making

its recommendations for director nomination, the Nominating and Governance Committee considers

the value of experience gained through service on other boards and conducts a rigorous review of the

demands that such service may have on the director’s time. As set forth in our Corporate Governance

Guidelines, as a general rule, the Nominating and Governance Committee will not recommend the

election or reelection of an individual who (i) serves on more than four public company boards, or

(ii) serves as the chief executive officer of a public company and serves on more than two public

company boards, other than the Company. All of our nominees satisfy this rule.

13

In 2022 our Nominating and Governance Committee oversaw an annual performance review of

our Board and its members that included comprehensive interviews of our directors and considered a

number of factors including meeting attendance, preparation and director engagement with the Board

and management. As part of this process, the Committee and the Board assessed our nominees for

reelection and affirms that each nominee has demonstrated that they are capable of devoting the

necessary time to successfully meet their duties and otherwise fulfill the responsibilities required of

directors in 2023, taking into account their principal occupation and membership and leadership

positions on other boards.

Board Skills Matrix

The Board is committed to ensuring it has a relevant diversity of skills and experience to

oversee the Company, its management, its strategic plan and the execution of that plan. The Board

believes that our director nominees, as a group, represent an effective mix of skills, experiences, diversity

and fresh perspectives. The table below summarizes the key skills, experiences, diversity and other

qualifications of our nominees for director. The director biographies beginning on page 16 describe each

nominee’s background and relevant experience in more detail.

14

Director Skills, Experiences, Diversity and Other Qualifications

Dreiling

(Chair)

Grise´

Heinrich

Hilal

Kelly

Laschinger

Naylor

Park

Scott

Stahl

Director Skills and Experiences

Executive Leadership

Public Company CEO Experience

• •••

Private Company CEO Experience

• • • •••

Senior Executive Experience

••••••••••

Financial Expertise

Public Company CEO/CFO Experience

• • •••••

Private Company CFO Experience

CPA/Audit/Accounting Experience

••

Other Professional Expertise

Consumer/Retail Industry

••• •••••

Marketing/Advertising/Communications

•• • •••

Strategic Planning

••••••••••

Operations

•••••• ••

Human Resources

•••

Information Technology

•••

Cybersecurity

••

Risk Management

•• •••

Global Sourcing/Supply Chain

•• •

Director Qualifications

Dollar Tree Independent Director

•••••••••

Dollar Tree Board Tenure (years) 1111115215

Other Public Board Experience

••••••••••

Demographic Background

Age 69 70 67 56 69 63 64 52 72 56

Gender Identity

Male

••••••

Female

• •••

Ethnicity

White/Caucasian

••••••• •

Black or African American

•

Asian

•

15

DIRECTOR BIOGRAPHIES

Biographical and other information for each of our directors nominated for election at the 2023

annual meeting of shareholders is provided below.

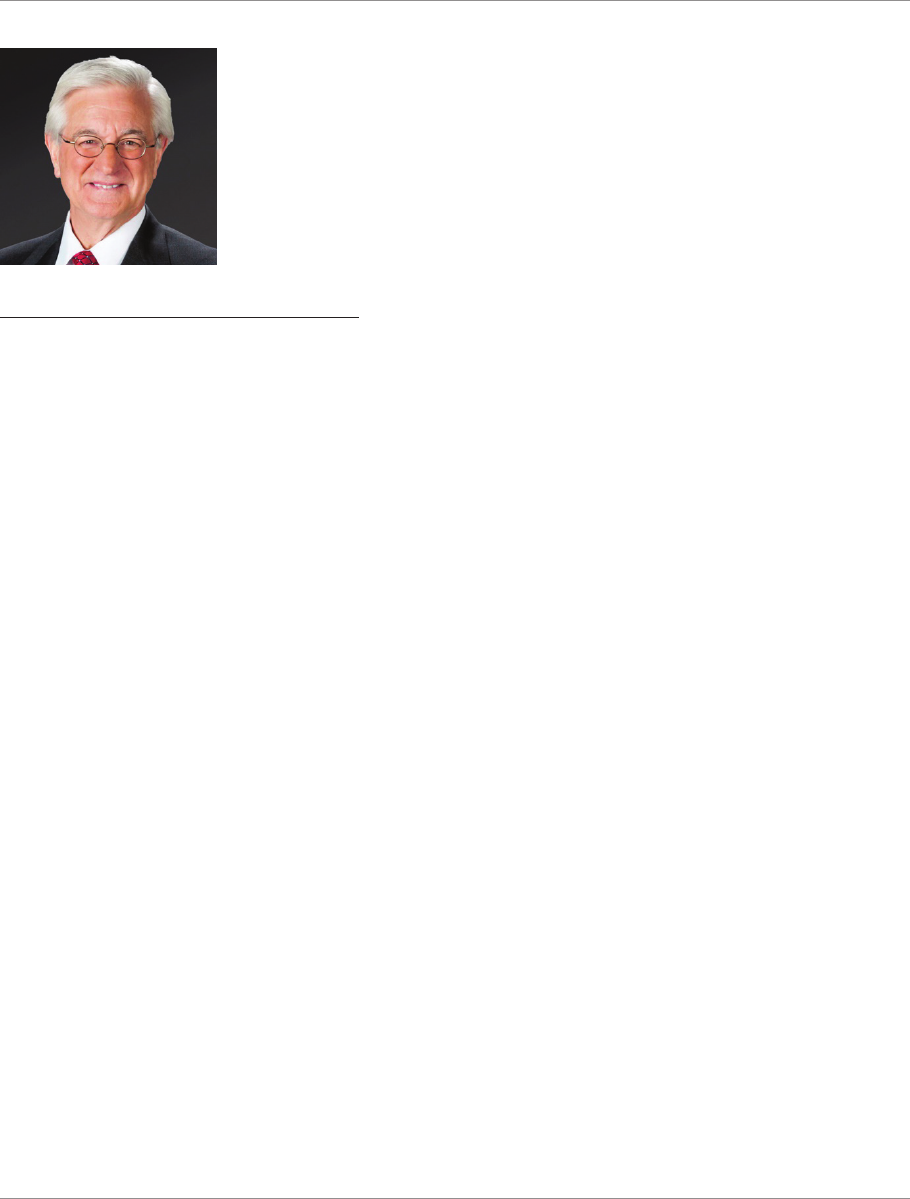

RICHARD W. DREILING

DIRECTOR SINCE MARCH 2022

AGE: 69

CHAIRMAN & CHIEF EXECUTIVE

OFFICER

Mr. Dreiling—

Chairman and Chief Executive Officer of Dollar

Tree, Inc. Mr. Dreiling assumed the role of Executive Chairman in

March 2022 and in January 2023 the Board of Directors

appointed Mr. Dreiling to serve as Chief Executive Officer. He

currently serves on the Board of Directors of Lowe’s Companies,

Inc. (Lead Independent Director; Nominating and Governance

Committee).

PREVIOUS WORK EXPERIENCE

• 2015 to 2016: Chairman of the Board of Directors,

Dollar General Corporation

• 2008 to 2015: Chief Executive Officer and Chairman of

the Board of Directors, Dollar General Corporation

• 2005 to 2008: President, Chief Executive Officer and

Chairman of the Board of Directors, Duane Reade

Holdings, Inc. and Duane Reade Inc.

• 2003 to 2005: Executive Vice President and Chief

Operations Officer, Longs Drug Stores Corp.

• 2000 to 2003, Executive Vice President of Marketing,

Safeway Inc.

• 1998 to 2000: President, Vons Co Inc.

PREVIOUS BOARD EXPERIENCE

• 2016 to January 2023: Board of Directors of Kellogg

Company (Audit Committee; Compensation and Talent

Management Committee)

• 2015 to 2022: Board of Directors, Pulte Group, Inc.

(Nominating and Governance Committee, Chair;

Compensation and Management Development

Committee)

• 2016 to 2022: Board of Directors, Aramark

(Compensation and Human Resources Committee;

Nominating, Governance and Corporate Responsibility

Committee)

EDUCATION

• Mr. Dreiling graduated with a B.A. from Rockhurst

University.

EXPERTISE

• Mr. Dreiling brings to our Board over 40 years of retail

experience at all operating levels. He has strong

business development expertise in expanding the

footprint and offerings of several retailers. Mr. Dreiling

also brings unique experience in the value retail sector

gained from his role as the former Chairman and CEO

of Dollar General Corporation.

16

CHERYL W. GRISÉ

DIRECTOR SINCE MARCH 2022

AGE: 70

BOARD COMMITTEES:

Compensation Committee, Chair

Nominating and Governance Committee

Ms. Grisé—Former Executive Vice President of Northeast Utilities

and Chief Executive Officer of its principal operating companies.

She currently serves on the Board of Directors of ICF

International, Inc. (Human Capital Committee; Governance and

Nominating Committee), PulteGroup, Inc. (Nominating and

Governance Committee; Compensation and Management

Development Committee) and Metlife, Inc. (Compensation

Committee, Chair; Governance and Corporate Responsibility

Committee; Audit Committee).

PREVIOUS WORK EXPERIENCE

• 1998 to 2007: held several executive leadership

positions at Northeast Utilities (now known as

Eversource Energy), including President, Utilities

Group.

PREVIOUS BOARD EXPERIENCE

• 2007 to 2015: Board of Directors, Pall Corporation

(Compensation Committee, Chair; Nominating and

Governance Committee)

• 2002 to 2008: Board of Directors, Dana Holding

Corporation (Audit Committee; Nominating and

Governance Committee, Chair)

EDUCATION

• Ms. Grisé graduated with a B.A. from the University of

North Carolina at Chapel Hill, a J.D. from Thomas

Jefferson School of Law, and the Yale University

School of Organization and Management, Executive

Management Program.

EXPERTISE

• Ms. Grisé brings to our Board substantial executive

leadership experience with a large consumer facing

business, a strong governance and legal background

and an unusually solid and strong record of leadership

in public company boardrooms in many different

sectors. She was named by the National Association of

Corporate Directors (NACD) to their Top 100, a list of

the top 100 most influential directors in the U.S.

17

DANIEL J. HEINRICH

DIRECTOR SINCE MARCH 2022

AGE: 67

BOARD COMMITTEES:

Audit Committee

Finance Committee, Chair

Mr. Heinrich—Former Chief Financial Officer of The Clorox

Company. He currently serves on the Board of Directors of

Lowe’s Companies, Inc. (Compensation Committee; Technology

Committee).

PREVIOUS WORK EXPERIENCE

• 2001 to 2011: held various senior level positions at The

Clorox Company, including Executive Vice President

and Chief Financial Officer, The Clorox Company

• 1996 to 2001: Senior Vice President and Treasurer of

Transamerica Finance Corporation

• 1994 to 1996: Senior Vice President, Treasurer and

Controller, Granite Management Company

• 1986 to 1994: Senior Vice President, Controller and

Chief Accounting Officer, First Nationwide Bank

• 1978 to 1986: Senior Audit Manager, Ernst & Young

PREVIOUS BOARD EXPERIENCE

• 2013 to February 2023: Board of Directors, Aramark

(Audit Committee, Chair; Finance Committee)

• 2016 to 2022: Board of Directors, Ball Corporation

(Audit Committee, Chair; Compensation Committee)

• 2012 to 2022: Board of Directors, Edgewell Personal

Care Company (Compensation Committee, Chair; Audit

Committee, Chair; Finance Committee, Chair)

• 2011 to 2021: Board of Directors,E&JGalloWinery

(Finance & Audit Committee; Executive Compensation

Committee)

• 2013 to 2019: Board of Directors, G3 Enterprises, Inc.

(Audit Committee, Chair; Compensation Committee)

• 2007 to 2009: Board of Directors, Advanced Medical

Optics (Audit Committee; Finance Committee)

EDUCATION

• Mr. Heinrich is a licensed Certified Public Accountant

(inactive), and graduated with a B.S. in Business

Administration (with Honors) from the University of

California, Berkeley and an M.B.A. (with Honors) from

Saint Mary’s College of California.

EXPERTISE

•• Mr. Heinrich brings to our Board his substantial

experience as a director and executive at consumer

packaged goods companies and consumer facing

businesses. He has extensive executive-level financial

knowledge and experience and has developed strong

expertise in the areas of strategic business

development, risk management, mergers and

acquisitions, accounting and information technology. In

addition, our Board has determined that Mr. Heinrich

qualifies as an Audit Committee financial expert.

18

PAUL C. HILAL

DIRECTOR SINCE MARCH 2022

AGE: 56

VICE CHAIRMAN

BOARD COMMITTEES:

Compensation Committee

Finance Committee

Nominating and Governance Committee

Mr. Hilal—Founder and Chief Executive Officer of Mantle Ridge

LP, an investment fund. Over the past two decades, he has built a

strong record as an engaged or activist investor and as a passive

value investor. He currently serves on the Board of Directors of

Aramark (Vice Chairman; Nominating, Governance and Corporate

Responsibility Committee; Compensation and Human Resources

Committee) and CSX Corporation (Vice Chairman; Executive

Committee; Finance Committee; Governance and Sustainability

Committee).

PREVIOUS WORK EXPERIENCE

• 2006 to 2016: Partner and Senior Investment

Professional, Pershing Square Capital Management

• 2002 to 2005: Managing Partner, Caliber Capital

Management

• 1998 to 2001: Partner, Hilal Capital Management

• 1999 to 2000: Acting Chief Executive Officer, WorldTalk

Communications Corporation

• 1992 to 1999: Investment Banker, Broadview

Associates

PREVIOUS BOARD EXPERIENCE

• 2012 to 2016: Board of Directors, Canadian Pacific

Railway Limited (Management Resources and

Compensation Committee, Chair; Finance Committee)

• 1999 to 2000: Chairman of the Board of Directors,

WorldTalk Communications

• 1999 to 2016: Board of Directors, Grameen Foundation

EDUCATION

• Mr. Hilal graduated with a A.B. in Biochemistry from

Harvard College, an M.B.A. from Columbia Business

School and a J.D. from Columbia Law School.

EXPERTISE

• Mr. Hilal brings to our Board substantial experience

enabling companies to successfully effect value-

creating change. His experience as a value investor,

capital allocator and engaged steward during corporate

transformations, in addition to his knowledge of the

Company, enables him to contribute to the Board and

its mission in unique and extremely valuable ways.

Additionally, Mr. Hilal’s service on the boards of multiple

public companies will allow him to provide key strategic

perspectives to the Board.

19

EDWARD J. KELLY, III

DIRECTOR SINCE MARCH 2022

AGE: 69

LEAD INDEPENDENT DIRECTOR

BOARD COMMITTEES:

Nominating and Governance Committee,

Chair

Finance Committee

Sustainability and CSR Committee

Mr. Kelly—Retired Chairman of the Institutional Clients Group of

Citigroup, Inc. He currently serves on the Board of Directors of

Citizens Financial Group, Inc. (Compensation and Human

Resources Committee, Chair; Nominating and Corporate

Governance Committee, Chair) and Metlife, Inc. (Audit Committee;

Compensation Committee; Finance and Risk Committee, Chair).

PREVIOUS WORK EXPERIENCE

• 2011 to 2014: Chairman, Institutional Clients Group,

Citigroup, Inc.

• 2010 to 2011: Chairman, Global Banking, Citigroup,

Inc.

• 2009 to 2010: Vice Chairman, Citigroup, Inc.

• 2009: Chief Financial Officer, Citigroup, Inc.

• 2008 to 2009: Head of Global Banking, President and

CEO, Citi Alternative Investments, Citigroup, Inc.

• 2007 to 2008: Managing Director, The Carlyle Group

• 2007: Vice Chairman, PNC Financial Services Group,

Inc.

• 2001 to 2007: Chairman and Chief Executive Officer,

Mercantile Bankshares Corporation

• 1995 to 2001: Managing Director, J.P. Morgan

• 1994 to 1995: General Counsel, J.P. Morgan

• 1988 to 1994: Partner, Davis Polk & Wardwell, LLP

PREVIOUS BOARD EXPERIENCE

• 2002 to 2019: Board of Directors, CSX Corporation

(Chairman of the Board; Audit Committee; Governance

Committee; Executive Committee; Compensation and

Talent Management Committee; Finance Committee)

• 2014 to 2018: Board of Directors, XL Group (Executive

Committee; Audit Committee; Compensation

Committee; Risk Committee; Corporate Governance

Committee; Finance Committee)

EDUCATION

• Mr. Kelly graduated with an A.B. from Princeton

University and a J.D. from University of Virginia School

of Law.

EXPERTISE

• Mr. Kelly brings to our Board business, strategic,

financial and legal acumen and extensive leadership

expertise. His experience includes key roles in building

a client-centric model and managing the global

operations of a major financial institution. In addition,

he provides a local perspective as a long-time Virginia

resident and lecturer at the University of Virginia

School of Law.

20

MARY A. LASCHINGER

DIRECTOR SINCE MARCH 2022

AGE: 63

BOARD COMMITTEES:

Compensation Committee

Sustainability and CSR Committee

Ms. Laschinger—Former Chairman of the Board of Directors

and Chief Executive Officer of Veritiv Corporation. She currently

serves on the Board of Directors of Newmont Corporation

(Leadership Development and Compensation Committee) and

Kellogg Company (Compensation and Talent Management

Committee, Chair; Executive Committee; and Nominating and

Governance Committee).

PREVIOUS WORK EXPERIENCE

• 2014 to 2020: Chairman and Chief Executive Officer,

Veritiv Corporation

• 2010 to 2014: SVP, International Paper Company,

President, xpedx distribution company

• 2007 to 2014: Senior Vice President, International

Paper Company

PREVIOUS BOARD EXPERIENCE

• 2017 to 2021: Board of Directors, Federal Reserve

Bank of Atlanta (Audit Committee; Operational and

Risk Committee, Chair)

• 2007 to 2010: Board of Directors, Ilim Group, Russian

(Lead Director; Human Resource Committee)

EDUCATION

• Ms. Laschinger graduated with a B.A. in Business

Administration from University of Wisconsin—Eau

Claire, an M.B.A. from University of Connecticut and

the Kellogg School of Management, Postgraduate

Studies, Executive Management.

EXPERTISE

• Ms. Laschinger brings to our Board substantial

experience as a senior executive at some of the largest

companies in the United States. In addition, she has led

and served on the board of directors of several major

U.S. and foreign companies and institutions. Her

extensive experience in operating manufacturing and

global supply chain businesses includes defining

product line up, sourcing products and services and the

operational delivery of products and services globally.

Through these roles and through her experience as a

public company CEO and the Chair of the Audit,

Operational and Risk Committee for the Federal

Reserve Bank of Atlanta, she has gained deep

knowledge of financial, controls and risk management

issues. Additionally, through executive leadership and

board positions, she has developed expert knowledge

of leadership development, defining and implementing

compensation, benefits, and related human resource

matters.

21

JEFFREY G. NAYLOR

DIRECTOR SINCE MARCH 2018

AGE: 64

BOARD COMMITTEES:

Audit Committee, Chair

Finance Committee

Mr. Naylor—Former Chief Financial Officer and Senior Executive

of The TJX Companies. He is the Managing Director of his

consulting firm, Topaz Consulting LLC, where he advises private

equity firms on potential transactions and provides services in the

area of strategy and finance. In addition, he currently serves on

the Board of Directors of Synchrony Financial (Chairman of the

Board; Audit Committee; Management and Compensation

Committee) and Wayfair, Inc. (Audit Committee, Chair).

PREVIOUS WORK EXPERIENCE

• 2004 to 2014: held various senior level positions at TJX

Companies, Inc., including Senior Executive Vice

President, Chief Financial and Administrative Officer of

TJX Companies, Inc.

• 2001 to 2004: Chief Financial Officer, Big Lots, Inc.

• Held senior level positions with Limited Brands, Sears,

Roebuck and Co., and Kraft Foods, Inc.

• Mr. Naylor began his career as a Certified Public

Accountant with Deloitte Haskins & Sells.

PREVIOUS BOARD EXPERIENCE

• 2013 to 2021: Board of Directors, Emerald Holding, Inc.

(Audit Committee, Chair; Nominating and Corporate

Governance Committee, Chair; Compensation

Committee)

• 2010 to 2016: Board of Directors, Fresh Market, Inc.

(Audit Committee, Chair)

EDUCATION

• Mr. Naylor graduated with a B.A. in Economics from

Northwestern University and an M.B.A. from

J.L. Kellogg School of Management.

EXPERTISE

• Mr. Naylor brings to our Board an extensive financial

and accounting background as well as significant

leadership and retail experience. In addition, our Board

has determined that Mr. Naylor qualifies as an Audit

Committee financial expert.

22

WINNIE Y. PARK

DIRECTOR SINCE DECEMBER 2020

AGE: 52

BOARD COMMITTEES:

Audit Committee

Compensation Committee

Ms. Park—Chief Executive Officer of Forever 21 from

January 2022 to present. She currently serves on the Board of

Directors of Sound Point Acquisition Corp. I, Ltd.

PREVIOUS WORK EXPERIENCE

• 2015 to 2021: CEO of Paper Source

• 2012 to 2015: Executive Vice President, Global

Marketing and eCommerce, DFS Group Ltd.

• 2006 to 2012: Global Vice President, Fashion, DFS

Group Ltd.

• 2004 to 2006: Senior Director, Women’s Merchandising

for the Dockers brand, Levi Strauss & Co.

• 2003 to 2004: Director, Global Strategy for the Dockers

brand, Levi Strauss & Co.

• 2001 to 2003: Engagement Manager, McKinsey &

Company

PREVIOUS BOARD EXPERIENCE

• 2017 to 2022: Board of Directors, Express, Inc.

(Compensation Committee; Governance Committee;

and Audit Committee)

EDUCATION

• Ms. Park graduated with a B.A., Cum Laude, in Public

and International Affairs from Princeton University and

an M.B.A. in Corporate Finance and Marketing from

Northwestern University.

EXPERTISE

• Ms. Park is a retail and marketing leader with deep

experience in brand-building, e-Commerce, omni-

channel specialty retail, merchandising and

international expertise. In addition, the Board has

determined that Ms. Park qualifies as an Audit

Committee financial expert.

23

BERTRAM L. SCOTT

DIRECTOR SINCE MARCH 2022

AGE: 72

BOARD COMMITTEES:

Audit Committee

Sustainability and CSR Committee

Mr. Scott—Retired health care executive who formerly served as

the President and Chief Executive Officer of Affinity Health Plan

and President, US Commercial, of CIGNA Corporation. He

currently serves on the Board of Directors of the following public

companies: Equitable (Compensation Committee; Nominating and

Corporate Governance Committee), Lowe’s Companies, Inc.

(Audit Committee, Chair; Nominating and Governance

Committee) and Becton, Dickinson and Company (Lead Director;

Audit Committee, Chair; Compensation and Human Capital

Committee).

PREVIOUS WORK EXPERIENCE

• 2015 to 2019: Senior Vice President of Population

Health and Value Based Care at Novant Health

• 2012 to 2014: President and Chief Executive Officer,

Affinity Health Plan

• 2010 to 2011: President, US Commercial, CIGNA

Corporation

• 2000 to 2010: Executive Vice President and Chief

Institutional Development and Sales Officer,

TIAA-CREF

• 2000 to 2007: President and Chief Executive Officer,

TIAA-CREF

• 1996 to 2001: President and Chief Executive Officer,

Horizon Mercy Healthcare

PREVIOUS BOARD EXPERIENCE

• 2020 to 2022: AllianceBernstein (Compensation and

Workplace Practices Committee)

EDUCATION

• Mr. Scott graduated with a B.A. in Business

Administration from DePaul University, a Doctor of

Humane Letters from DePaul University and the

Harvard Business School Advanced Management

Program.

EXPERTISE

• Mr. Scott brings to our Board his substantial corporate

governance and business expertise, in addition to

extensive experience serving as a director on the

boards of several large, complex, publicly-traded

companies, as well as serving as chair of several board

committees. Mr. Scott draws on his professional

experiences to provide perspective to the boards on

which he serves with respect to development and the

implementation of strategy, mergers and acquisitions,

merger integration, and sales and marketing. In

addition, the Board has determined that Mr. Scott

qualifies as an Audit Committee financial expert.

24

STEPHANIE P. STAHL

DIRECTOR SINCE JANUARY 2018

AGE: 56

BOARD COMMITTEES:

Nominating and Governance Committee

Sustainability and CSR Committee, Chair

Ms. Stahl—Former Global Marketing & Strategy Officer of Coach,

Inc. She is the Founder of her investment and advisory company

Studio Pegasus LLC which she launched in 2015 to focus on

supporting early-stage consumer ventures. In addition, she serves

on the Board of Directors of Carter’s, Inc. (Compensation

Committee and Nominating and Corporate Governance

Committee) and Newell Brands, Inc.

PREVIOUS WORK EXPERIENCE

• 2015 to current: Owns and operates Studio Pegasus,

LLC, an investment and advisory company focused on

consumer sector digital startups.

• 2012 to 2015: Executive Vice President, Global

Marketing & Strategy, Coach, Inc.

• 2010 to 2011: Chief Executive Officer, Tracy Anderson

Mind & Body, LLC

• 2003 to 2006: Executive Vice President, Chief

Marketing Officer, Revlon, Inc.

• 1998 to 2003: Partner and Managing Director, The

Boston Consulting Group, Inc.

• 1997: Vice President, Strategy & New Business

Development, Toys “R” Us, Inc.

PREVIOUS BOARD EXPERIENCE

• 2017 to 2022 Board of Directors of Founders Table

Restaurant Group

• 2013 to 2021 Board of Directors of Knoll, Inc. (Audit

Committee and Nominating Committee)

EDUCATION

• Ms. Stahl graduated with a B.S. in Quantitative

Economics from Stanford University and an M.B.A.

(with distinction) from Harvard University.

EXPERTISE

• Ms. Stahl brings to our Board significant experience in

marketing, data analytics, digital, sustainability, brand

building and strategy. Ms. Stahl has spent her career

focused on the retail/consumer sector with extensive

experience in developing, executing and optimizing

major change initiatives including fundamental business

transformation, mergers and acquisitions, and post-

merger integrations.

25

THE BOARD AND ITS COMMITTEES

The Board has re-nominated 10 current directors for election at the 2023 annual meeting of

shareholders to serve as directors for a one-year term.

The Board of Directors has five standing committees, each comprised solely of independent

directors: the Audit Committee, the Compensation Committee, the Nominating and Governance

Committee, the Finance Committee and the Sustainability and CSR Committee. These committees

operate under written charters which are available on our corporate website, at www.dollartreeinfo.com/

corporate-governance.

The current Board committee assignments of our re-nominated directors are as follows:

Director

Independent

Director

(1)

Audit

Committee

(2)

Compensation

Committee

Nominating

and

Governance

Committee

Finance

Committee

Sustainability

and CSR

Committee

Richard W. Dreiling

Cheryl W. Grisé

◾ C ◾

Daniel J. Heinrich ◾◾ C

Paul C. Hilal

◾◾◾◾

Edward J. Kelly, III LD C ◾◾

Mary A. Laschinger ◾◾ ◾

Jeffrey G. Naylor ◾ C ◾

Winnie Y. Park ◾◾ ◾

Bertram L. Scott ◾◾ ◾

Stephanie P. Stahl ◾◾C

LD Lead Independent Director

C Committee chair

(1) Our Board reviewed the composition of each committee and determined that all of our non-employee directors were

independent within the meaning of the listing standards of the Nasdaq Stock Market and SEC regulations.

(2) The Board, after review of each individual’s employment experience and other relevant factors, has determined that

Daniel Heinrich, Jeffrey Naylor, Winnie Park and Bertram Scott are qualified as audit committee financial experts within

the meaning of SEC regulations.

26

Audit Committee

The purpose of the Audit Committee is to assist the Board in fulfilling its oversight responsibilities

regarding the quality and integrity of the accounting, auditing and financial reporting practices of the

Company. At each regular meeting, the Audit Committee meets in executive sessions with the Company’s

independent auditors, Chief Legal Officer, Vice President—Internal Audit, Chief Financial Officer and

Senior Vice President—Principal Accounting Officer to discuss accounting principles, financial and

accounting controls, the scope of the annual audit, internal controls, regulatory compliance and other

matters. The independent auditors have access to the Audit Committee without management present to

discuss the results of their audits and their views on the adequacy of our internal controls, quality of

financial reporting and other accounting and auditing matters.

The Committee’s primary duties and responsibilities include:

• monitoring our financial reporting processes and internal control systems;

• overseeing our internal and external audit processes, including participation in the planning

of the audit efforts of our independent auditors, internal audit department and our finance

department;

• reviewing and discussing the Company’s practices with respect to risk assessment and

risk management, including financial, operational, information security, data privacy, business

continuity and legal and regulatory risks;

• providing an open avenue of communication among the independent auditors, internal

auditors, financial and senior management, and the Board;

• reviewing our quarterly and annual financial statements;

• reviewing related party transactions; and

• appointing and evaluating the independent auditors of our financial statements.

The Audit Committee met eight (8) times in 2022. In addition, the Chair of the Committee

conducted periodic updates with the independent auditors and/or financial management.

All members of the Audit Committee during 2022 met the independence requirements of the

Nasdaq Stock Market and SEC regulations. The report of the Committee can be found beginning on

page 115.

Compensation Committee

The purpose of the Compensation Committee is to assist the Board in its oversight of the

Company’s executive compensation structure, including salary, incentives and benefits, in order to

attract and retain key executives. The Committee also monitors the Company’s compensation policies

and practices to determine whether they create risks that are reasonably likely to have a material adverse

effect on the Company.

The Committee’s primary duties and responsibilities include:

• overseeing our compensation and benefit practices;

• establishing the compensation arrangements for our executive officers;

• overseeing the administration of our executive compensation plans and Employee Stock

Purchase Plan;

27

• approving awards under our equity-based compensation arrangements;

• overseeing the Company’s strategies, policies and key metrics with respect to diversity,

equity and inclusion and human capital management, talent development and retention of

key personnel;

• approving the design and payouts under our incentive plans for executive officers;

• reviewing the compensation of the independent members of the Board for service on the

Board and its committees and recommending any changes to the Board for approval; and

• reviewing annually the executive officers’ stock ownership levels to ensure compliance with

the Company’s executive target ownership policy.

The Compensation Committee met nine (9) times in 2022. In addition, the Chair separately

engaged in numerous in-depth discussions with members of management.

All members of the Compensation Committee during 2022 met the independence requirements

of the Nasdaq Stock Market and SEC regulations. The report of the Committee, together with our

Compensation Discussion and Analysis and information regarding executive compensation, can be

found beginning on page 50.

Nominating and Governance Committee

The purpose of the Nominating and Governance Committee is to advise the Board of Directors

on the composition, organization and effectiveness of the Board and its committees and on other

issues relating to the corporate governance of the Company. The Committee’s primary duties and

responsibilities include:

• recommending candidates to be nominated by the Board, including the re-nomination of

any currently serving director, to be placed on the ballot for shareholders to consider at the

annual shareholders’ meeting;

• if the Chairman of the Board is not independent, recommending an independent director

to be appointed as Lead Independent Director;

• recommending nominees to be appointed by the Board to fill interim director vacancies;

• reviewing periodically the membership and Chair of each committee of the Board and

recommending committee assignments to the Board, including rotation or reassignment of

any Chair or committee member;

• reviewing and resolving requests for waivers from directors of any provision of the

Company’s Code of Conduct;

• monitoring significant developments in regulations and best practices concerning corporate

governance and the duties and responsibilities of each director;

• leading the Board in its annual performance evaluation;

• evaluating and administering our Corporate Governance Guidelines and recommending

changes to the Board;

• reviewing and overseeing our governance structure and other facets of the Company’s

corporate governance, including the structure of the Board, provisions of the Company’s

articles and bylaws, arrangements containing provisions that become operative in the event

28

of a change in control of the Company and other documents, policies and procedures in

the governance framework;

• reviewing annually the directors’ stock ownership levels to ensure compliance with our

director stock ownership requirements; and

• monitoring annually the education of Board members on matters related to their service on

the Board.

In addition, the Committee oversees the Shareholder Engagement Policy, recommends to the

Board any proposed changes to such policy, monitors the process for shareholders to communicate

with the Board, and assesses and recommends action on any matters raised in shareholder

communications relating to governance topics.

The Nominating and Governance Committee met nine (9) times in 2022. For further information

on the Committee, please see “How Nominees to our Board are Selected” beginning on page 43.

All members of the Nominating and Governance Committee during 2022 met the independence

requirements of the Nasdaq Stock Market.

Finance Committee

The purpose of the Finance Committee is to assist the Board in its oversight of the Company’s

financial policies, strategies, capital structure and allocation. The Committee’s primary duties and

responsibilities include:

• reviewing and advising the Board on the Company’s capital structure and allocation;

• reviewing and advising the Board on significant financing and related transactions;

• reviewing and advising the Board on financial considerations relating to the leasing,

purchase, sale, conveyance and other acquisition and disposition of stores, facilities and

real property;

• reviewing and evaluating new store openings and performance;

• reviewing and advising the Board on the annual capital budget and advising the Board on

major capital projects and commitments; and

• reviewing and advising the Board on acquisitions and divestitures and supporting the

Board’s review with management of previously effected acquisitions and divestitures.

The Finance Committee met three (3) times in 2022. In addition, the Chair separately engaged

in numerous in-depth discussions with members of management.

Sustainability and Corporate Social Responsibility Committee

The purpose of the Sustainability and CSR Committee is to assist the Board in its oversight of

the Company’s sustainability and environment and social-related risks and strategies, external reporting,

and workplace environment and culture. The Committee’s primary duties and responsibilities include:

• assisting the Board in discharging its responsibilities relating to oversight of the Company’s

strategies, policies and initiatives, and assessing, monitoring and making recommendations

to the Board, with respect to sustainability and corporate social responsibility matters,

including those related to environmental and social issues, human rights, labor, health and

29

safety, workplace environment and culture, vendor and supplier diversity, philanthropy, and

community and governmental engagement and relations;

• overseeing the Company’s strategies and policies related to human capital management,

including with respect to matters such as diversity, equity, and inclusion as it relates to the

Company’s workforce, workplace environment and culture, and the recruiting, selection,

talent development, progression and retention of the Company’s workforce;

• reviewing and discussing with management key human capital metrics for the Company’s

workforce that may be used by the Company; and

• at least semi-annually, evaluating, discussing, and, as appropriate, directing the disclosure

of the Company’s risks relating to corporate social responsibility and sustainability,

including the environment, human rights, labor, health and safety, workforce diversity,

supply chain, and similar matters affecting Company stakeholders.

The Sustainability and CSR Committee met three (3) times in 2022.

Meetings of the Board of Directors

The Board of Directors has scheduled four regular meetings in 2023 and recently held one of

these meetings in March 2023. The Board will hold special meetings when Company business requires.

During 2022, the Board held eighteen (18) meetings. Informational update calls are periodically

conducted during the year. Each member of the Board attended more than 75% of all Board meetings

and meetings of committees of which he or she was a member.

We expect each of our directors to attend the annual meeting of our shareholders. All of the

then incumbent directors were in attendance at the 2022 virtual annual meeting of our shareholders.

30

BOARD GOVERNANCE

Our Board operates within a strong set of governance principles and practices, including:

Governance Practice Dollar Tree’s Governance Policies and Actions

All directors elected annually

upon majority vote, except where

contested

YES Our Board is not classified, and in uncontested

elections our directors are elected by the vote of a

majority of the votes cast. See “Proposal

No. 1—Election of Directors” on page 111.

Robust Lead Independent

Director position

YES When our Board Chairman is not independent, a

Lead Independent Director is elected from among

the independent directors. Our Corporate

Governance Guidelines enumerate the robust

authority and responsibilities of the Lead

Independent Director in managing Board matters.

See “Board Leadership Structure” on page 32.

Enhanced director stock

ownership guidelines

YES Each director must hold Dollar Tree stock worth no

less than five times the annual cash retainer. See

“Director Stock Holding Requirements” on page 33.

Enhanced shareholder

engagement program

YES We formalized our policy to facilitate shareholder

access to senior management and independent

directors. See “Engagement with Shareholders” on

page 38.

A strong corporate commitment

to environmental stewardship

and sustainability

YES We have made a commitment to environmental

stewardship and are pursuing meaningful

strategies and initiatives that address the

sustainability risks associated with our business.

We strongly support policies that benefit our

customers, our associates, our communities and

our environment. See “Environmental and Social

Sustainability” on page 35.

Thoughtful approach to director

tenure and board diversity

YES We endeavor to include women and minority

candidates in the pool from which Board nominees

are chosen and to consider diverse directors for

leadership positions on the Board. While directors

have no term limit, the Board values the benefits of

regular board refreshment and annually reviews

director tenure. See “Board Diversity” and “Board

Tenure” on page 44.

31

Independence

Dollar Tree is committed to principles of good corporate governance and the independence of

a majority of our Board of Directors from the management of our Company. Of our eleven current

directors, the following ten have been determined by our Board to be independent directors within the

applicable listing standards of the Nasdaq Stock Market: Thomas W. Dickson, Cheryl W. Grisé, Daniel J.

Heinrich, Paul C. Hilal, Edward J. Kelly, III, Mary A. Laschinger, Jeffrey G. Naylor, Winnie Y. Park,

Bertram L. Scott and Stephanie P. Stahl.

All members of our Audit Committee, our Compensation Committee and our Nominating and