The MetLife Federal Dental Plan

MetLife.com/FEDVIP-Dental

(888) 865-6854

2023

IMPORTANT

• Rates: Back Cover

• Changes for 2023: Page 6

• Summary of Benefits: Page 59

A Nationwide Dental PPO Plan

Who may enroll in this Plan: All Federal employees and annuitants in the United States and overseas who

are eligible to enroll in Federal Employees Dental and Vision Insurance Program.

Enrollment Options for this Plan:

•High Option – Self Only

•High Option – Self Plus One

•High Option – Self and Family

•Standard Option – Self Only

•Standard Option – Self Plus One

•Standard Option – Self and Family

This Plan has 5 enrollment regions, including international; please see the end of this brochure to determine

your region and corresponding rates

1 2023 The MetLife Federal Dental Plan

Introduction

On December 23, 2004, President George W. Bush signed the Federal Employee Dental and Vision Benefits Enhancement

Act of 2004 (Public Law 108-496). The law directed the Office of Personnel Management (OPM) to establish supplemental

dental and vision benefit programs to be made available to Federal employees, annuitants, and their eligible family members.

In response to the legislation, OPM established the Federal Employees Dental and Vision Insurance Program (FEDVIP).

OPM has contracted with dental and vision insurers to offer an array of choices to Federal employees and annuitants. Section

715 of the National Defense Authorization Act for Fiscal Year 2017 (FY 2017 NDAA), Public Law 114-38, expanded

FEDVIP eligibility to certain TRICARE-eligible individuals.

This brochure describes the benefits of The MetLife Federal Dental Plan under Metropolitan Life Insurance Company

(MetLife) contract OPM02-FEDVIP-02AP-11 with OPM, as authorized by the FEDVIP law. The address for our

administrative office is:

MetLife

501 US Highway 22

Bridgewater, NJ 08807

(888) 865-6854*

MetLife.com/FEDVIP-Dental

This brochure is the official statement of benefits. No oral statement can modify or otherwise affect the benefits, limitations,

and exclusions of this brochure. It is your responsibility to be informed about your benefits.

If you are enrolled in this Plan, you are entitled to the benefits described in this brochure. If you are enrolled in Self Plus

One, you and your designated family member are entitled to these benefits. If you are enrolled in Self and Family coverage,

each of your eligible family members is also entitled to these benefits, if they are also listed on the coverage. You and your

family members do not have a right to benefits that were available before January 1, 2023 unless those benefits are

also shown in this brochure.

OPM negotiates rates with each carrier annually. Rates are shown at the end of this brochure.

The MetLife Federal Dental Insurance Plan is responsible for the selection of In-Network providers in your area. Contact us

at (888) 865-6854* for the names of participating providers or to request a provider directory. You may also view current In-

Network providers via our web website at MetLife.com/FEDVIP-Dental. Continued participation of any specific provider

cannot be guaranteed. Thus, you should make coverage decisions based on the plan benefits, not based on a specific provider.

When you phone for an appointment, please remember to verify that the provider is currently in the MetLife network. If

your provider is not currently participating in the provider network, you can ask them to join; or ask your dentist to visit

www.metdental.com or call (877) MET-DDS9. Note this website and phone number are specifically for dentists and not

accessible to employees/annuitants. You cannot change plans, outside of Open Season, because of changes to the provider

network.

Provider networks may be more extensive in some areas than others. We cannot guarantee the availability of every specialty

in all areas. If you require the services of a specialist and one is not available in your area, please contact us for assistance.

*Hearing and Speech impaired individuals may communicate using a text telephone device and Relay Services by dialing the

MetLife Federal Dental number of “888-865-6854”. Relay Services is immediate assistance. The Message Relay Service

enables customers who are deaf, hard of hearing, or speech impaired, and who use a Teletypewriter (TTY), to communicate

with others via the telephone. You simply type your conversation to a Relay Agent who then reads the typed conversation to

the other party. The text telephone is used through a callers wireless provider as long as they have a TTY compatible phone.

This MetLife Federal Dental Plan and all other FEDVIP plans are not a part of the Federal Employees Health

Benefits (FEHB) Program.

We want you to know that protecting the confidentiality of your individually identifiable health information is of the utmost

importance to us. To review full details about our privacy practices, our legal duties, and your rights, please visit our website

at MetLife.com/FEDVIP-Dental and link to the “Privacy Policy” at the bottom MetLife Federal Dental's home page. If you

do not have access to the internet or would like further information, please contact us by calling

1-888-865-6854. Furthermore, you may view the HIPAA information and other Personal Health Information beginning on

page 49 of this document.

2 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Discrimination is Against the Law

The MetLife Federal Dental Plan complies with all applicable Federal civil rights laws, to include both Title VII of the Civil

Rights Act of 1964 and Section 1557 of the Affordable Care Act. Pursuant to Section 1557, MetLife does not discriminate,

exclude people, or treat them differently on the basis of race, color, national origin, age, disability, or sex.

3 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Table of Contents

Introduction ...................................................................................................................................................................................2

Table of Contents ..........................................................................................................................................................................4

How We Have Changed for 2023 .................................................................................................................................................6

FEDVIP Program Highlights ........................................................................................................................................................7

A Choice of Plans and Options ...........................................................................................................................................7

Enroll Through BENEFEDS ...............................................................................................................................................7

Dual Enrollment ..................................................................................................................................................................7

Coverage Effective Date .....................................................................................................................................................7

Pre-Tax Salary Deduction for Employees ...........................................................................................................................7

Annual Enrollment Opportunity .........................................................................................................................................7

Continued Group Coverage After Retirement ....................................................................................................................7

Waiting Period .....................................................................................................................................................................7

Section 1 Eligibility ......................................................................................................................................................................8

Federal Employees ..............................................................................................................................................................8

Federal Annuitants ..............................................................................................................................................................8

Survivor Annuitants ............................................................................................................................................................8

Compensationers .................................................................................................................................................................8

Family Members .................................................................................................................................................................8

Not Eligible .........................................................................................................................................................................9

Section 2 Enrollment ...................................................................................................................................................................10

Enroll Through BENEFEDS .............................................................................................................................................10

Enrollment Types ..............................................................................................................................................................10

Dual Enrollment ................................................................................................................................................................10

Opportunities to Enroll or Change Enrollment .................................................................................................................10

When Coverage Stops .......................................................................................................................................................12

Continuation of Coverage .................................................................................................................................................13

FSAFEDS/High Deductible Health Plans and FEDVIP ...................................................................................................13

Section 3 How You Obtain Care .................................................................................................................................................15

Identification Cards / Enrollment Confirmation ...............................................................................................................15

Where You Get Covered Care ...........................................................................................................................................15

Plan Providers ...................................................................................................................................................................15

In-Network ........................................................................................................................................................................15

Out-of-Network .................................................................................................................................................................15

Emergency Services ..........................................................................................................................................................15

Plan Allowance .................................................................................................................................................................15

Pre-Treatment Estimate .....................................................................................................................................................16

Alternate Benefit ...............................................................................................................................................................16

Dental Review ...................................................................................................................................................................16

FEHB First Payor ..............................................................................................................................................................16

Coordination of Benefits ...................................................................................................................................................17

Right of Recovery .............................................................................................................................................................18

Rating Areas ......................................................................................................................................................................18

Limited Access Area .........................................................................................................................................................18

Claim Determination Period .............................................................................................................................................19

Section 4 Your Cost For Covered Services .................................................................................................................................20

Deductible .........................................................................................................................................................................20

4 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Coinsurance .......................................................................................................................................................................20

Annual Benefit Maximum ................................................................................................................................................21

Orthodontia Lifetime Benefit Maximum ..........................................................................................................................21

In-Network Services .........................................................................................................................................................21

Out-of-Network Services ..................................................................................................................................................21

Calendar Year ....................................................................................................................................................................21

Prorated Orthodontia Benefits ..........................................................................................................................................21

Section 5 Dental Services and SuppliesClass A Basic ................................................................................................................23

Class B Intermediate ...................................................................................................................................................................27

Class C Major ..............................................................................................................................................................................31

Class D Orthodontic ....................................................................................................................................................................39

General Services .........................................................................................................................................................................41

Section 6 International Services and Supplies ............................................................................................................................46

Section 7 General Exclusions – Things We Do Not Cover .........................................................................................................47

Section 8 Claims Filing and Disputed Claims Processes ............................................................................................................49

How to File a Claim for Covered Services .......................................................................................................................49

Deadline for Filing Your Claim .........................................................................................................................................49

Disputed Claims Process ...................................................................................................................................................49

Initial Determination .........................................................................................................................................................50

Overpayments ...................................................................................................................................................................50

HIPAA Privacy Practices ..................................................................................................................................................51

Section 9 Definitions of Terms We Use in This Brochure ..........................................................................................................55

Non-FEDVIP Benefits Available to Members ............................................................................................................................57

Stop Health Care Fraud! .............................................................................................................................................................58

Summary of Benefits ..................................................................................................................................................................59

• High Option Benefits ....................................................................................................................................................59

• Standard Option Benefits ..............................................................................................................................................59

Rate Information .........................................................................................................................................................................63

5 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

How We Have Changed for 2023

•Lower competitive rates for the High option;

•For services incurred on/after January 1, 2023, for both the High and Standard options, Resin-based composite fillings on

posterior teeth, molars, will no longer receive an alternate benefit of amalgam as a class B service.

New Non-FEDVIP Benefits Offering

The MetLife Federal Legal Plan

Being eligible for FEDVIP means that you now have year-round access to even more benefit options through

www.MetLifeFederalBenefits.com; your new source for innovative benefit solutions at discounted rates.

The MetLife Federal Legal Plan is our first benefit plan being offered to you on the www.MetLifeFederalBenefits.com

platform. You can choose from two competitively priced plan options, Standard and High, each covering a broad range of

legal matters from buying a home to dealing with traffic tickets. For a set monthly fee, you get unlimited in-person access to

a vast network of highly qualified attorneys for covered services with no deductibles, copays or claim submissions from

network attorneys.

To get started, visit www.MetLifeFederalBenefits.com for additional information, to register and enroll. We will be adding

new benefit options throughout the year, so be sure to visit the site regularly to keep up to date on your options.

6 2023 The MetLife Federal Dental Plan

FEDVIP Program Highlights

You can select from several nationwide, and in some areas, regional dental Preferred

Provider Organization (PPO) or Health Maintenance Organization (HMO) plans, and high

and standard coverage options. You can also select from several nationwide vision plans.

You may enroll in a dental plan or a vision plan, or both. Some TRICARE beneficiaries

may not be eligible to enroll in both. Visit www.opm.gov/dental or www.opm.gov/

vision for more information.

A Choice of Plans and

Options

You enroll online at www.BENEFEDS.com. Please see Section 2, Enrollment, for more

information.

Enroll Through

BENEFEDS

If you or one of your family members are enrolled in or covered by one FEDVIP plan, that

person cannot be enrolled in or covered as a family member by another FEDVIP plan

offering the same type of coverage; i.e., you (or covered family members) cannot be

covered by two FEDVIP dental plans

Dual Enrollment

If you sign up for a dental and/or vision plan during the 2022 Open Season, your coverage

will begin on January 1, 2023. Premium deductions will start with the first full pay period

beginning on/after January 1, 2023. You may use your benefits as soon as your

enrollment is confirmed.

Coverage Effective Date

Employees automatically pay premiums through payroll deductions using pre-tax dollars.

Annuitants automatically pay premiums through annuity deductions using post-tax

dollars. TRICARE enrollees automatically pay premiums through payroll deduction or

automatic bank withdrawal (ABW) using post-tax dollars.

Pre-Tax Salary Deduction

for Employees

Each year, an Open Season will be held, during which you may enroll or change your

dental and/or vision plan enrollment. This year, Open Season runs from November 14,

2022 through midnight EST December 12, 2022. You do not need to re-enroll each Open

Season, unless you wish to change plans or plan options; your coverage will continue

from the previous year. In addition to the annual Open Season, there are certain events

that allow you to make specific types of enrollment changes throughout the year. Please

see Section 2, Enrollment, for more information.

Annual Enrollment

Opportunity

Your enrollment or your eligibility to enroll may continue after retirement. You do not

need to be enrolled in FEDVIP for any length of time to continue enrollment into

retirement. Your family members may also be able to continue enrollment after your

death. Please see Section 1, Eligibility, for more information.

Continued Group

Coverage After

Retirement

None. Waiting Period

7 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Section 1 Eligibility

If you are a Federal or U.S. Postal Service employee, you are eligible to enroll in FEDVIP,

if you are eligible for the Federal Employees Health Benefits (FEHB) Program or the

Health Insurance Marketplace (Exchange) and your position is not excluded by law or

regulation, you are eligible to enroll in FEDVIP. Enrollment in the FEHB Program or a

Health Insurance Marketplace (Exchange) plan is not required.

Federal Employees

You are eligible to enroll if you:

• retired on an immediate annuity under the Civil Service Retirement System (CSRS),

the Federal Employees Retirement System (FERS) or another retirement system for

employees of the Federal Government;

• retired for disability under CSRS, FERS, or another retirement system for employees

of the Federal Government.

Your FEDVIP enrollment will continue into retirement if you retire on an immediate

annuity or for disability under CSRS, FERS or another retirement system for employees

of the Government, regardless of the length of time you had FEDVIP coverage as an

employee. There is no requirement to have coverage for 5 years of service prior to

retirement in order to continue coverage into retirement, as there is with the FEHB

Program.

Your FEDVIP coverage will end if you retire on a Minimum Retirement Age (MRA) + 10

retirement and postpone receipt of your annuity. You may enroll in FEDVIP again when

you begin to receive your annuity.

Federal Annuitants

If you are a survivor of a deceased Federal/U.S. Postal Service employee or annuitant and

you are receiving an annuity, you may enroll or continue the existing enrollment.

Survivor Annuitants

A compensationer is someone receiving monthly compensation from the Department of

Labor’s Office of Workers’ Compensation Programs (OWCP) due to an on-the-job injury/

illness who is determined by the Secretary of Labor to be unable to return to duty. You are

eligible to enroll in FEDVIP or continue FEDVIP enrollment into compensation status.

Compensationers

An individual who is eligible for FEDVIP dental coverage based on the individual's

eligibility to previously be covered under the TRICARE Retiree Dental Program or an

individual eligible for FEDVIP vision coverage based on the individual's enrollment in a

specified TRICARE health plan.

Retired members of the uniformed services and National Guard/Reserve components,

including “gray-area” retirees under age 60 and their families are eligible for FEDVIP

dental coverage. These individuals, if enrolled in a TRICARE health plan, are also eligible

for FEDVIP vision coverage. In addition, uniformed services active duty family members

who are enrolled in a TRICARE health plan are eligible for FEDVIP vision coverage.

TRICARE-eligible

individual

Except with respect to TRICARE-eligible individuals, family members include your

spouse and unmarried dependent children under age 22. This includes legally adopted

children and recognized natural children who meet certain dependency requirements.

This also includes stepchildren and foster children who live with you in a regular parent-

child relationship. Under certain circumstances, you may also continue coverage for a

disabled child 22 years of age or older who is incapable of self-support. FEDVIP rules

and FEHB rules for family member eligibility are NOT the same. For more information

on family member eligibility visit the website at www.opm.gov/healthcare-insurance/

dental-vision/ or contact your employing agency or retirement system.

Family Members

8 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

With respect to TRICARE-eligible individuals, family members include your spouse,

unremarried widow, unremarried widower, unmarried child, and certain unmarried

persons placed in your legal custody by a court. Children include legally adopted children,

stepchildren, and pre-adoptive children. Children and dependent unmarried persons must

be under age 21 if they are not a student, under age 23 if they are a full-time student, or

incapable of self-support because of a mental or physical incapacity.

The following persons are not eligible to enroll in FEDVIP, regardless of FEHB eligibility

or receipt of an annuity or portion of an annuity:

• Deferred annuitants

• Former spouses of employees or annuitants. Note: Former spouses of TRICARE-

eligible individuals may enroll in a FEDVIP vision plan.

• FEHB Temporary Continuation of Coverage (TCC) enrollees

• Anyone receiving an insurable interest annuity who is not also an eligible family

member

• Active duty uniformed service members. Note: If you are an active duty uniformed

service member, your dental and vision coverage will be provided by TRICARE.

Your family members will still be eligible to enroll in the TRICARE Dental Plan

(TDP).

Not Eligible

9 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Section 2 Enrollment

You must use BENEFEDS to enroll or change enrollment in a FEDVIP plan. BENEFEDS

is a secure enrollment website (www.BENEFEDS.com) sponsored by OPM. If you do not

have access to a computer, call 1-877-888-FEDS (1-877-888-3337), to enroll or change your

enrollment.

Hearing and Speech impaired individuals may communicate using a text telephone device and

Relay Services by dialing the MetLife Federal Dental number of “888-865-6854”. Relay

services is immediate assistance. The Message Relay Service enables customers who are deaf,

hard of hearing, or speech impaired, and who use a Teletypewriter (TTY), to communicate with

others via the telephone. You simply type your conversation to a Relay Agent who then reads the

typed conversation to the other party. The text telephone is used through a callers wireless

provider as long as they have a TTY compatible phone.

If you are currently enrolled in FEDVIP and do not want to change plans your enrollment

will continue automatically. Please Note: your plan(s) premiums may change for 2023.

Note: You cannot enroll or change enrollment in a FEDVIP plan using the Health Benefits

Election Form (SF 2809) or through an agency self-service system, such as Employee Express,

PostalEase, EBIS, MyPay, or Employee Personal Page. However, those sites may provide a link

to BENEFEDS.

Enroll Through

BENEFEDS

Self Only: A Self Only enrollment covers only you as the enrolled employee or annuitant. You

may choose a Self Only enrollment even though you have a family; however, your family

members will not be covered under FEDVIP.

Self Plus One: A Self Plus One enrollment covers you as the enrolled employee or annuitant

plus one eligible family member whom you specify. You may choose a Self Plus One

enrollment even though you have additional eligible family members, but the additional family

members will not be covered under FEDVIP.

Self and Family: A Self and Family enrollment covers you as the enrolled employee or

annuitant and all of your eligible family members. You must list all eligible family members

when enrolling.

Enrollment Types

If you or one of your family members are enrolled in or covered by one FEDVIP plan, that

person cannot be enrolled in or covered as a family member by another FEDVIP plan offering

the same type of coverage; i.e., you (or covered family members) cannot be covered by two

FEDVIP dental plans.

Dual Enrollment

Open Season

If you are an eligible employee, annuitant, or TRICARE-eligible individual, you may enroll in a

dental and/or vision plan during the November 14, through midnight EST December 12, 2022,

Open Season. Coverage is effective January 1, 2023.

During future annual Open Seasons, you may enroll in a plan, or change or cancel your dental

and/or vision coverage. The effective date of these Open Season enrollments and changes will

be set by OPM. If you want to continue your current enrollment, do nothing. Your

enrollment carries over from year to year, unless you change it.

New hire/Newly eligible

You may enroll within 60 days after you become eligible as:

• a new employee;

• a previously ineligible employee who transferred to a covered position;

• a survivor annuitant if not already covered under FEDVIP; or

• an employee returning to service following a break in service of at least 31 days.

Opportunities to

Enroll or Change

Enrollment

10 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

• a TRICARE-eligible individual

Your enrollment will be effective the first day of the pay period following the one in which

BENEFEDS receives and confirms your enrollment.

Qualifying Life Event

A qualifying life event (QLE) is an event that allows you to enroll, or if you are already enrolled,

allows you to change your enrollment outside of an open season.

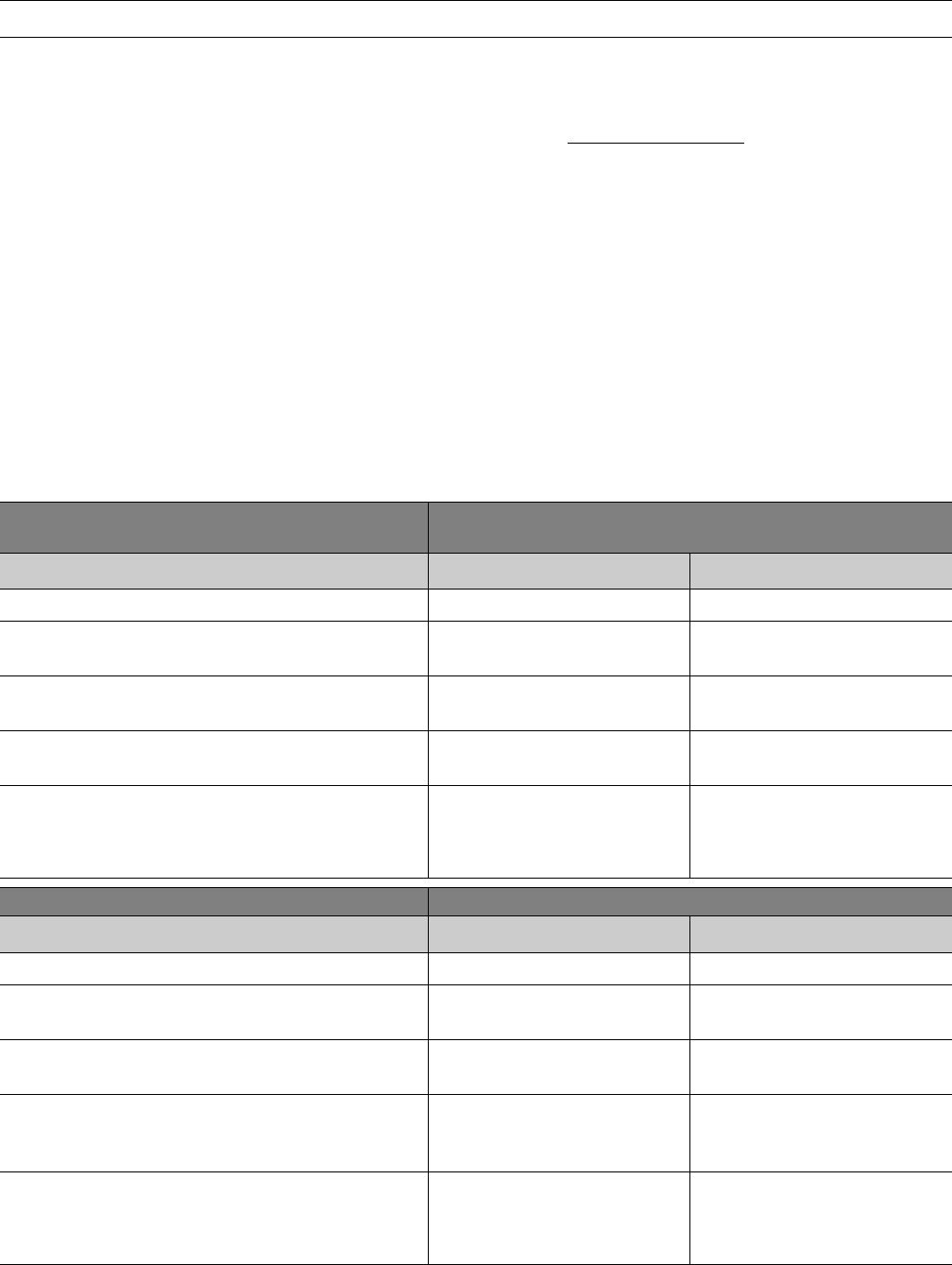

The following chart lists the QLE’s and the enrollment actions you may take:

Qualifying Life Event: Marriage

From Not Enrolled to Enrolled: Yes

Increase Enrollment Type: Yes

Decrease Enrollment Type: No

Cancel: No

Change from One Plan to Another: Yes

Qualifying Life Event: Acquiring an eligible family member (non-spouse)

From Not Enrolled to Enrolled: No

Increase Enrollment Type: Yes

Decrease Enrollment Type: No

Cancel: No

Change from One Plan to Another: No

Qualifying Life Event: Losing a covered family member

From Not Enrolled to Enrolled: No

Increase Enrollment Type: No

Decrease Enrollment Type: Yes

Cancel: No

Change from One Plan to Another: No

Qualifying Life Event: Losing other dental/vision coverage (eligible or covered person)

From Not Enrolled to Enrolled: Yes

Increase Enrollment Type: Yes

Decrease Enrollment Type: No

Cancel: No

Change from One Plan to Another: No

Qualifying Life Event: Moving out of regional plan's service area

From Not Enrolled to Enrolled: No

Increase Enrollment Type: No

Decrease Enrollment Type: No

Cancel: No

Change from One Plan to Another: Yes

Qualifying Life Event: Going on active military duty, non- pay status (enrollee or spouse)

From Not Enrolled to Enrolled: No

Increase Enrollment Type: No

Decrease Enrollment Type: No

Cancel: Yes

Change from One Plan to Another: No

11 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Qualifying Life Event: Returning to pay status from active military duty (enrollee or

spouse)

From Not Enrolled to Enrolled: Yes

Increase Enrollment Type: No

Decrease Enrollment Type: No

Cancel: No

Change from One Plan to Another: No

Qualifying Life Event: Returning to pay status from Leave without pay

From Not Enrolled to Enrolled: Yes (if enrollment cancelled during LWOP)

Increase Enrollment Type: No

Decrease Enrollment Type: No

Cancel: No

Change from One Plan to Another: Yes (if enrollment cancelled during LWOP)

Qualifying Life Event: Annuity/ compensation restored

From Not Enrolled to Enrolled: Yes

Increase Enrollment Type: No

Decrease Enrollment Type: No

Cancel: No

Change from One Plan to Another: No

Qualifying Life Event: Transferring to an eligible position*

From Not Enrolled to Enrolled: No

Increase Enrollment Type: No

Decrease Enrollment Type: No

Cancel: Yes

Change from One Plan to Another: No

*Position must be in a Federal agency that provides dental and/or vision coverage with 50

percent or more employer- paid premium.

The timeframe for requesting a QLE change is from 31 days before to 60 days after the event.

There are two exceptions:

• There is no time limit for a change based on moving from a regional plan’s service area and

• You cannot request a new enrollment based on a QLE before the QLE occurs, except for

enrollment because of a loss of dental or vision insurance. You must make the change no

later than 60 days after the event.

Generally, enrollments and enrollment changes made based on a QLE are effective on the first

day of the pay period following the one in which BENEFEDS receives the enrollment or

change. BENEFEDS will send you confirmation of your new coverage effective date.

Once you enroll in a plan, your 60-day window for that type of plan ends, even if 60 calendar

days haven’t yet elapsed. That means once you have enrolled in either a dental or a vision plan,

you cannot change or cancel that particular enrollment until the next Open Season, unless you

experience a QLE that allows such a change or cancellation.

Canceling an enrollment

You can cancel your enrollment only during the annual Open Season. An eligible family

member’s coverage also ends upon the effective date of the cancellation.

Your cancellation is effective at the end of the day before the date OPM sets as the Open Season

effective date.

Coverage ends for active and retired Federal, U.S. Postal employees, and TRICARE-eligible

individuals when you:

When Coverage

Stops

12 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

• no longer meet the definition of an eligible employee, annuitant, or TRICARE-eligible

individual;

• as a Retired Reservist you begin active duty;

• as sponsor or primary enrollee leaves active duty

• begin a period of non-pay status or pay that is insufficient to have your FEDVIP premiums

withheld and you do not make direct premium payments to BENEFEDS;

• are making direct premium payments to BENEFEDS and you stop making the payments;

• cancel the enrollment during Open Season;

• a Retired Reservist begins active duty; or

• the sponsor or primary enrollee leaves active duty.

Coverage for a family member ends when:

• you as the enrollee lose coverage; or

• the family member no longer meets the definition of an eligible family member.

Note: Coverage ends for a covered individual when MetLife does not receive premium payment

for that covered individual.

Under FEDVIP, there is no 31-day extension of coverage. The following are also NOT

available under the FEDVIP plans

• Temporary Continuation of Coverage (TCC),

• spouse equity coverage, or

• right to convert to an individual policy (conversion policy).

However, we will pay benefits for a 31 day period after your insurance ends if before coverage

ends the dentist:

• prepared the abutment teeth for the completion of installation of prosthetic devices;

• made an impression;

• prepared the tooth for cast restoration; or

• your dentist opened the pulp chamber before your insurance ends and the device is installed

or treatment was finished within 31 days after the termination of coverage.

Continuation of

Coverage

If you are planning to enroll in an FSAFEDS Health Care Flexible Spending Account (HCFSA)

or Limited Expense Health Care Flexible Spending Account (LEX HCFSA), you should

consider how coverage under a FEDVIP plan will affect your annual expenses, and thus the

amount that you should allot to an FSAFEDS account. Please note that insurance premiums are

not eligible expenses for either type of FSA.

If you have an HCFSA or LEX HCFSA FSAFEDS account and you haven’t exhausted your

funds by December 31st of the plan year, FSAFEDS can automatically carry over up to $610 of

unspent funds into another health care or limited expense account for the subsequent year. To be

eligible for carryover, you must be employed by an agency that participates in FSAFEDS and

actively making allotments from your pay through December 31. You must also actively

reenroll in a health care or limited expense account during the NEXT Open Season to be

carryover eligible. Your reenrollment must be for at least the minimum of $100. If you do not

reenroll, or if you are not employed by an agency that participates in FSAFEDS and actively

making allotments from your pay through December 31st, your funds will not be carried over.

Because of the tax benefits an FSA provides, the IRS requires that you forfeit any money for

which you did not incur an eligible expense and file a claim in the time period permitted. This is

known as the “Use-it-or-Lose-it” rule. Carefully consider the amount you will elect.

FSAFEDS/High

Deductible Health

Plans and FEDVIP

13 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

For a health care or limited expense account, each participant must contribute a minimum of

$100 to a maximum of $3,050.

Current FSAFEDS participants must re-enroll to participate next year. See www.fsafeds.com or

call 1-877-FSAFEDS (372-3337).

Hearing and Speech impaired individuals may communicate using a text telephone device and

Relay Services by dialing the MetLife Federal Dental number of “888-865-6854”. Relay

Services is immediate assistance. The Message Relay Service enables customers who are deaf,

hard of hearing, or speech impaired, and who use a Teletypewriter (TTY), to communicate with

others via the telephone. You simply type your conversation to a Relay Agent who then reads the

typed conversation to the other party. The text telephone is used through a callers wireless

provider as long as they have a TTY compatible phone.

Note: FSAFEDS is not open to retired employees, or to TRICARE eligible individuals.

If you enroll or are enrolled in a high deductible health plan with a health savings account

(HSA) or health reimbursement arrangement (HRA), you can use your HSA or HRA to pay for

qualified dental/vision costs not covered by your FEHB and FEDVIP plans.

14 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Section 3 How You Obtain Care

When you enroll for the first time, you will receive a welcome letter along with an

identification card ("ID Card"). It is important to bring your FEDVIP and FEHB ID card

to every dental appointment because most FEHB plans offer some level of dental

benefits separate from your FEDVIP coverage. Presenting both ID cards can ensure that

you receive the maximum allowable benefit under each Program. If you require a

replacement ID card, you will be able to view and print your ID card via MyBenefits

after entering MetLife.com/FEDVIP-Dental. An ID card is neither a guarantee of

benefits nor does your provider need it to render dental services. Your dentist may call

(877) 638-3379 to confirm your enrollment in the Plan and the benefits available to you.

If you were enrolled in the MetLife Federal Dental Plan in 2022 and continue coverage

for 2023, MetLife will provide you with a confirmation letter only.

Identification Cards /

Enrollment

Confirmation

You can obtain care from any licensed dentist in the United States or overseas. Where You Get Covered

Care

We list our Plan providers on our website at: MetLife.com/FEDVIP-Dental which we

update weekly. When you make your appointment please inform the dental office you

are enrolled in the FEDVIP plan and that you wish to use your In-Network benefits. This

will also serve to confirm that the dentist is a MetLife provider. You may also contact

customer service at (888) 865-6854.

Plan Providers

Care that you receive from a MetLife Preferred Dentist Program (PPO) provider is

considered In-Network. Plan participants are not required to select a primary care dentist

and are free to select the dentist of their choice. MetLife’s PPO network consists of

independently credentialed and contracted providers. To find a dentist in your area go to:

MetLife.com/FEDVIP-Dental. You may also contact customer service at (888)

865-6854.

In-Network

Care that you receive from a licensed provider that does not participate in the MetLife

Preferred Dentist Program (PPO) is considered Out-of-Network. You are responsible for

any difference between the plan payment and the amount billed.

Out-of-Network

All expenses for emergency services are payable as any other expense and are subject to

plan limitations such as frequencies, deductibles, and maximums. If you utilize the

services of an Out-of-Network dentist for emergency services, benefits will be paid

under the Out-of-Network Plan provisions. You are responsible for the difference

between the Plan payment and billed charges.

Emergency Services

The plan allowance is the maximum amount we will consider for payment for a specific

procedure. The actual benefit will be a specified percentage of the plan allowance. When

you use a participating (in-network) provider, your out-of-pocket cost is limited to the

difference between the plan allowance and our payment. When you use services

provided by a provider that does not participate in our network of providers, they are

considered out-of-network services.

The Plan Allowance for Out-of-Network services will be equal to the In-Network Plan

Allowance for the covered service (see page 52 for further details). When you use an

Out-of-Network provider, you are responsible for the difference between the Plan

Allowance and our payment plus the difference between the amount the provider bills

and the Plan Allowance. Out-of-Network providers may charge their normal fees which

may be greater than the Plan Allowance.

The Plan Allowance may very by geographic location and/or a participating provider's

contracted fee schedule.

Plan Allowance

15 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

A pre-treatment estimate of benefits is recommended for any procedure which is

anticipated to cost at least $300 or which involves mandatory consultant review.

Mandatory consultant review applies to services such as but not limited to, periodontal

services, crowns, bridges, inlays/onlays (when performed together) veneers, implants

(when a plan provides benefits for these procedures) and overdentures, among other

services. When your dentist suggests treatment, have them send a claim form, along with

the proposed treatment plan and supporting documentation to MetLife. An explanation

of benefits (EOB) will be sent to you and the dentist detailing an estimate of what

services MetLife will cover and at what payment level. Actual payments may vary from

the pre-treatment estimate depending upon annual maximums, deductibles, plan

frequency limits and other plan provisions at time of payment.

Pre-Treatment Estimate

Alternate benefits applicable to your treatment plan will be determined during Pre-

certification. However, should the services billed differ from those pre-certified, MetLife

reserves the right to determine if an Alternate Benefit is applicable to the actual services

rendered.

If MetLife determines that a less costly covered service other than the covered service

the dentist performed could have been performed to treat a dental condition we will pay

benefits based upon the less costly service if such service would produce a professionally

acceptable result under generally accepted dental standards

For example, when an amalgam filling and a composite filling are both professionally

acceptable methods for filling a molar, or when a partial denture and fixed bridgework

are both professionally acceptable methods for replacing multiple missing teeth in an

arch we may base our benefit determination upon the amalgam filling or partial denture

which is the less costly service.

If we pay benefits based upon a less costly service in accordance with this section the

Dentist may charge you or your dependent for the difference between the service that

was performed and the less costly service. This is the case even if the service is

performed by an In-Network dentist.

Alternate Benefit

MetLife's claim review is conducted by licensed dentist consultants who review the

clinical documentation submitted by your treating dentist. These dentist consultants

review this material checking for dental necessity for certain procedures such as crowns,

bridges, onlays, implants, periodontal treatments, as well as other services. The dentist

consultants may also recommend that an alternate benefit be applied to a service in

accordance with the terms of the plan. Therefore, we strongly recommend that you or

your dentist request a pre-treatment estimate for services that are expected to cost at least

$300, so that, you and your dentist are aware of the coverage terms and benefits before

services are performed.

Dental Review

If you have dental coverage through your FEHB plan and coverage under FEDVIP, your

FEHB plan will be the first payor of any benefit payments. When services are rendered

by a provider, who participates with both your FEHB and your FEDVIP plan, the

FEDVIP Plan Allowance will prevail. We are responsible for facilitating the process with

the primary FEHB payor. You are responsible for the difference if any between the

FEHB and FEDVIP benefit payments and the FEDVIP Plan Allowance subject to any

deductibles and benefits maximums. See examples 1 and 2 below.

It is important to bring your FEDVIP and FEHB identification cards to every dental

appointment because most FEHB plans offer some level of dental benefits separate from

your FEDVIP coverage. Presenting both identification cards can ensure that you receive

the maximum allowable benefit under each Program.

FEHB First Payor

16 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

When the covered individual has FEHB coverage that offers dental benefits, FEHB is

always First Payor.

Services are provided by an In-Network Provider

Provider submitted charge for a one surface amalgam filling*: $108.00

In-Network fee: $60.00

FEHB paid as first-payor (or MetLife's estimate): $16.00

MetLife benefits payable in the absence of FEHB coverage: $42.00 ($60.00 at 70%).

Payment by MetLife: $42.00

Patient's responsibility to the provider: $2.00 ($60.00-$16.00-$42.00=$2.00).

*This example assumes all deductibles have been met and annual maximums have not

been reached.

Example 1: High

Option coverage when

services are provided by

an In-Network provider.

When the covered individual has FEHB coverage that offers dental benefits, FEHB is

always First Payor.

Services are provided by an Out-of-Network Provider

Provider submitted charge for one surface amalgam filling*: $108.00

Plan Allowance**: $90.00

FEHB payment as first payor (or MetLife's estimate): $16.00

MetLife benefits payable in the absence of FEHB coverage: $54.00 ($90.00 x 60%).

Payment by MetLife**:$54.00

Patient's responsibility to the provider**: $38.00 ($108.00-$16.00-$54.00=$38.00)

*This example assumes all deductibles have been met and annual maximums have not

been reached.

**Assumes the provider charge is higher than MetLife's plan allowance. The plan

allowance may vary by geographic location and/or a participating provider's contracted

fee schedule.

Example 2: High Option

coverage when services

are provided by an Out-

of-Network provider.

If you are covered under a non-FEHB plan, your MetLife Federal Dental benefits will be

coordinated using traditional COB provisions for determining payment. Please see

examples 1 and 2 below.

When benefits are coordinated between MetLife and a non-FEHB carrier, the maximum

allowable charge may vary depending upon the contractual relationship and contracted

fee between MetLife and non-FEHB carrier. The participant may be responsible for the

difference between the combined non-FEHB and MetLife benefit payment and the

providers’ allowable charge.

Coordination of Benefits

When MetLife is secondary to a non-FEHB dental carrier.

Services are provided by an In-Network Provider

Provider submitted charge for two surface amalgam filling: $121.00

In-Network Fee: $73.00

Payable by Primary Carrier: $60.50

MetLife benefits payable in the absences of other insurance*: $51.10 ($73.00 at 70%)

Payment by MetLife: $12.50

Patient’s responsibility to the provider **: $0 ($73.00 - $60.50 - $12.50 = $0.00)

Example 1:

Coordination of Benefits

with High Option

coverage when services

are performed by an In-

Network provider.

17 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

*This example assumes all deductibles have been met and annual maximums have not

been reached.

** Assumes the provider has no other contractual relationship regarding negotiated fees

with the primary carrier.

When MetLife is secondary to a non-FEHB carrier

Services are provided by an Out-of-Network Provider

Provider submitted charge for 2 surface amalgam fillings: $113.00

Plan Allowance** $113.00:

Payment of Primary Carrier: $96.80

MetLife benefits payable in the absence of other insurance*: $67.80 ($113.00 x 60%)

Payment by MetLife: $16.20

Patient’s responsibility to the provider **: $0 ($113.00 - $96.80 - $16.20 = $0)

*This example assumes all deductibles have been met and annual maximums have not

been reached.

**Assumes the provider charge is within MetLife’s plan allowance. The plan allowance

may vary be geographic location and/or a participating provider's contracted fee

schedule.

Example 2: Coordination

of Benefits with High

Option coverage where

services are provided by

an Out-of-Network

provider.

If the amount we pay is more than we should have paid under the First Payor provision

or when benefits are coordinated we may recover the excess from one or more of:

• the person we have paid;

• insurance companies; or

• other organizations.

The amount of the payment includes the reasonable cash value of any benefits provided

in the form of services. However, in no circumstance will the member be responsible for

a greater out of pocket amount then he/she would have been responsible for had there

been no overpayment.

Right of Recovery

Your rates are determined based on where you live. This is called a rating area. If you

move, you must update your address through BENEFEDS. Your rates might change

because of the move. Your rates will not be impacted if you temporarily reside at

another location

Rating Areas

If you live in a limited access area and you receive covered services from an Out-of-

Network provider, we will pay benefits based on our In-Network Plan Allowances. The

determination of network adequacy is based on a ratio of Federal eligibles to network

and general dentistry providers in a particular area. To determine if you are in a limited

access area or specialty services are needed, please contact MetLife at (888) 865-6854*.

MetLife reviews the limited access areas quarterly to ensure you have adequate access to

our general dentistry In-Network providers. Therefore, we recommend you call (888)

865-6854 to confirm if you are still in a limited access area as your claim payment may

be impacted. The limited access rule applies to general dentistry providers and specialty

services. If the services must be provided by a specialist and one is not available in your

area, please call us for assistance. If an In-Network provider (general or specialist) can

perform a specialty service, then that service will be covered at the In-Network benefit.

Please contact MetLife at (888) 865-6854 or visit our website at MetLife.com/FEDVIP-

Dental to obtain a list of In-Network general dentists in your area, who may be able to

perform specialty services.

Limited Access Area

18 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

*Hearing and Speech impaired individuals may communicate using a text telephone

device and Relay Services by dialing the MetLife Federal Dental number of

“888-865-6854”. Relay Services is immediate assistance. The Message Relay Service

enables customers who are deaf, hard of hearing, or speech impaired, and who use a

Teletypewriter (TTY), to communicate with others via the telephone. You simply type

your conversation to a Relay Agent who then reads the typed conversation to the other

party. The text telephone is used through a callers wireless provider as long as they have

a TTY compatible phone.

A period that starts on any January 1 and ends on the next December 31. A claim

determination period for any covered person will not include the periods of time during

which that person is not covered under this Plan.

Should you experience a lapse in coverage during the calendar year, any benefits paid

after reinstatement will be accrued to the maximums applicable to that same calendar

year.

Claim Determination

Period

19 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Section 4 Your Cost For Covered Services

This is what you will pay out-of-pocket for covered services:

A deductible is a fixed amount of expenses you must incur for certain covered services

and supplies before we will pay for covered services. There is no family deductible limit.

Covered charges credited to the deductible are also counted towards the Plan maximum

and limitations.

Class A

In-Network High Option: $0

In-Network Standard Option: $0

Out-of-Network High Option: $50

Out-of-Network Standard Option: $100

Class B

In-Network High Option: $0

In-Network Standard Option: $0

Out-of-Network High Option: $50

Out-of-Network Standard Option: $100

Class C

In-Network High Option: $0

In-Network Standard Option: $0

Out-of-Network High Option: $50

Out-of-Network Standard Option: $100

Orthodontics

In-Network High Option: $0

In-Network Standard Option: $0

Out-of-Network High Option: $0

Out-of-Network Standard Option: $0

Deductible

Coinsurance is the percentage of our allowance that you must pay for your care.

Coinsurance does not begin until you meet your deductible, if applicable.

Class A

In-Network High Option: 0%

In-Network Standard Option: 0%

Out-of-Network High Option: 10%

Out-of-Network Standard Option: 40%

Class B

In-Network High Option: 30%

In-Network Standard Option: 45%

Out-of-Network High Option: 40%

Out-of-Network Standard Option: 60%

Class C

In-Network High Option: 50%

In-Network Standard Option: 65%

Out-of-Network High Option: 60%

Out-of-Network Standard Option: 80%

Orthodontics

In-Network High Option: 30%

In-Network Standard Option: 50%

Out-of-Network High Option: 30%

Out-of-Network Standard Option: 50%

Coinsurance

20 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Once you reach this amount, you are responsible for all additional charges. The Annual

Benefit Maximums within each option are combined between In and Out-of-Network

services. The total Annual Benefit Maximum will never be greater than the In-Network

Annual Benefit Maximum.

Annual Benefits Maximum

In-Network High Option: Unlimited

In-Network Standard Option: $1,500

Out-of-Network High Option: Unlimited

Out-of-Network Standard Option: $1,000

Annual Benefit

Maximum

The Orthodontia Lifetime Benefit Maximum is applicable to Orthodontia benefits only.

There are no other lifetime maximums under this Plan.

Lifetime Orthodontia Maximum

In-Network High Option: $5,000 (child)/ $3,000 (adult)

In-Network Standard Option: $2,000

Out-of-Network High Option: $5,000 (child)/ $3,000 (adult)

Out-of-Network Standard Option: $2,000

Orthodontia Lifetime

Benefit Maximum

Care that you receive from a MetLife Preferred Dentist Program (PPO) provider is

considered In-Network. Plan participants are not required to select a primary care dentist

and are free to select the dentist of their choice. No referral process is needed for access to

specialty care. In most cases, use of In-Network providers results in a lower out-of-pocket

expense to you.

If you reside in a limited access area your benefits will be paid at the In-Network benefit

level. For additional information on limited access areas, please see Section 3, How You

Obtain Care.

Remember, for In-Network services you only pay the difference between the Plan

Allowance for the covered service and the plan's benefit payment subject to any

deductibles and benefits maximums.

In-Network Services

All services rendered by an Out-of-Network dentist will be paid as Out-of-Network

benefits. except for limited access benefits.

The plan allowance for Out-of-Network services will be equal to the In-Network Plan

Allowance for the covered service. The Out-of-Network Plan Allowance may vary be

geographic location and/or a participating provider's contracted fee schedule.

When you use an Out-of-Network provider, you are responsible for the difference between

the Plan Allowance and our payment plus the difference between the amount the provider

bills and the Plan Allowance.

Out-of-Network Services

The calendar year refers to the plan year, which is defined as January 1, 2023 to December

31, 2023.

Calendar Year

If orthodontia services are initiated prior to the effective date of coverage, we will prorate

benefits. Twenty-five percent (25%) of the Plan Allowance is considered as the fee for

initial placement of the appliance. Because this occurred prior to the effective date of

coverage, it is considered a non- covered expense. The balance of the Plan Allowance,

75%, will be divided by the total number of monthly visits provided in the orthodontist's

treatment plan. Benefits are payable at 50% of the Plan Allowance.

Prorated Orthodontia

Benefits

Actual Fee: $6,400 • Standard Option

Benefits

21 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Treatment Plan: 24 visits

Number of monthly visits (not covered): 14, Provided prior to being eligible for

orthodontia benefits.

Number of monthly visits (covered): 10, 24 total visits minus 14 provided prior to being

eligible for orthodontia benefits.

Plan Allowance for initial placement: $1,600, $6,400 x 25% = $1,600 (This is a non-

covered expense as it occurred prior to being eligible for orthodontia benefits

Plan Allowance for monthly visits: $4,800, $6,400 - $1,600 = $4,800

Plan Allowance per visit: $200, $4,800 divided by 24

Total Plan Allowance for covered visits: $2,000, $200 times 10 covered visits

Total plan payment: $1,000, Benefit is 50% of Plan Allowance for covered services

Actual Fee: $6,400

Treatment Plan: 24 visits

Number of monthly visits (not covered): 14, Provided prior to being eligible for

orthodontia benefits.

Number of monthly visits (covered): 10, 24 total visits minus 14 provided prior to being

eligible for orthodontia benefits.

Plan Allowance for initial placement: $1,600, $6,400 x 25% = $1,600. (This is a non-

covered expense as it occurred prior to being eligible for orthodontia benefits)

Plan Allowance for monthly visits: $4,800, $6,400 - $1,600 = $4,800

Plan Allowance per visit: $200, $4,800 divided by 24

Total Plan Allowance for covered visits: $2,000, $200 x 10 covered visits

Total Plan Payment: $1,400, Benefit is 70% of Plan Allowance for covered

orthodontia services

• High Option Benefits

In-progress treatment for dependents of retiring active duty service members who were

enrolled in the TRICARE Dental Program (TDP) will be covered for the 2023 plan year,

regardless of any current plan exclusion for care initiated prior to the enrollee's effective

date

This requirement includes assumption of payments for covered orthodontia services up to

the FEDVIP policy limits, and full payment where applicable up to the terms of FEDVIP

policy for covered services completed (but not initiated) in the 2023 plan year such as

crowns and implants.

FEDVIP carriers will not cover in-progress treatment if you enroll in a FEDVIP plan that

has a waiting period, or does not cover the service. Several FEDVIP dental plans have

options that offer orthodontia coverage without a 12-month waiting period, and without

age limits. Note - There are no waiting periods for any benefits on this plan.

In-Progress Treatment

22 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Section 5 Dental Services and Supplies

Class A Basic

Important things you should keep in mind about these benefits:

•Please remember that all benefits are subject to the definitions, limitations, and exclusions in this

brochure and are payable only when we determine they are necessary for the prevention, diagnosis,

care, or treatment of a covered condition and meet generally accepted dental protocols.

•The calendar year deductible is $0, if you use an In- Network- provider. There is no family

deductible. If you elect to use an Out-of-Network provider, the Standard Option contains a $100

deductible per person, and the High Option has a $50 deductible per person. Neither Option contains

a family deductible, each enrolled covered person must satisfy their own deductible. The calendar

year deductible may apply to Type A expenses provided by an Out-of-Network provider.

•The Annual Benefit Maximum in the High Option for non-orthodontia services is unlimited,

combined, for both In-Network and Out-of-Network services. The Standard Option Annual Benefit

Maximum for non-orthodontia services is $1,500 for In-Network services and $1,000 for Out-of-

Network services. In no instance will MetLife allow more than $1,500 in combined benefits under

the Standard Option in any plan year.

•All exams, oral evaluations and treatments such as fluorides and some images are combined under

one limitation under the plan. Complete set of radiographic images (D0210) and /or panoramic

radiographic image (D0330) are combined and limited to one every 60 months. Periodic oral exam,

(D0120) Oral evaluations (D0140, D0145), and Comprehensive oral exam (D0150, D0180) are

combined and limited to one exam in every 6 months from the date services were last rendered. For

example, if you have a periodic oral evaluation and a limited oral examination both services are

combined, so that, not more than the maximum allowable benefits and limitations are applied. There

must be a six month separation between services, even when the separation of services duration

enters a new plan year.

•All services requiring more than one visit are payable once all visits are completed.

•The following list of services includes those services most commonly provided to covered

individuals. It is not an all-inclusive list of covered services. MetLife will provide benefits for ADA

codes not included in the following list, subject to the exclusions and limitations shown in this

section and Section 7.

You Pay (subject to any deductibles, plan limitations and maximums):

•

High Option

•In-Network: Nothing.

•Out-of-Network: 10% of the Plan Allowance plus any amount above the Plan Allowance billed by

the provider.

•Standard Option

•In-Network: Preventive and Diagnostic Services - Nothing.

•Out-of-Network: 40% of the Plan Allowance plus any amount above the Plan Allowance billed by

the provider.

23 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Diagnostic and Treatment Services

D0120 Periodic oral evaluation - Limited to 1 every 6 months

D0140 Limited oral evaluation - problem focused - Limited to 1 every 6 months

D0150 Comprehensive oral evaluation - Limited to 1 every 6 months

D0180 Comprehensive periodontal evaluation - Limited to 1 every 6 months

D0210 Intraoral – complete set of radiographic images including bitewings - 1 every 60 (sixty) months

D0220 Intraoral - periapical radiographic image

D0230 Intraoral - additional periapical image

D0240 Intraoral - occlusal radiographic image

D0260 Extraoral – Each Additional Radiographic Image

D0270 Bitewing - single image Adult - 1 set every calendar year/Children - 1 set every 6 months

D0272 Bitewings - two images - Adult - 1 set every calendar year/Children - 1 set every 6 months

D0274 Bitewings - four images - Adult - 1 set every calendar year/Children - 1 set every 6 months

D0277 Vertical bitewings – 7 to 8 images – Adult - 1 set every calendar year/Children - 1 set every 6 months

D0330 Panoramic radiographic image – 1 image every 60 (sixty) months

D0340 Cephalometric radiographic image

D0350 2D Oral / Facial Photographic Images-obtained intraorally and extraorally

D0372 A radiographic survey of the whole mouth intended to display the crowns and roots of all teeth, periapical areas,

interproximal areas and alveolar bone including edentulous areas. Comprehensive series of radiographic images - 1 every

60 (sixty) months

D0373 Intraoral tomosynthesis- bitewing radiographic image - 1 set every 6 months

D0374 Intraoral tomosynthesis – periapical radiographic image

D0391 Interpretation of Diagnostic Image

D0415 Lab test

D0422 Collect & Prep Genetic Sample-1 per lifetime.

D0423 Genetic Test-Specimen Analysis-1 per lifetime.

D0470 Diagnostic Models

Preventive Services

D1110 Prophylaxis – Adult - Limited to 1 every 6 months

D1120 Prophylaxis – Child - Limited to 1 every 6 months

D1206 Topical Fluoride - Varnish -1 in 12 months for adults, 2 every 12 months for dependent children based on age

limits.

D1208 Topical application of fluoride (excluding prophylaxis) - 2 every 12 months for dependent children based on age

limits.

D1351 Sealant - per tooth - unrestored permanent molars - Less than age 19. 1 sealant per tooth every 36 months

D1352 Preventative resin restorations in a moderate to high caries risk patient - permanent tooth - 1 sealant per tooth every

36 months.

D1353 Sealant Repair –Per tooth-Permanent tooth-1 every 36 months

D1354 Interim Caries Medicament-Permanent teeth 1 per tooth every 36 months (Molars/Bicuspids excluding Wisdom

Teeth).

D1355 caries preventive medicament application – per tooth - 1 every 36 months

D1510 Space maintainer – fixed – unilateral - Limited to children under age 19

D1516 Space Maintainer- Fixed-bilateral, Maxillary-Limited to children under age 19.

D1517 Space Maintainer- Fixed-bilateral, mandibular-Limited to children under under age 19.

D1520 Space maintainer - removable – unilateral - Limited to children under age 19

D1526 Space Maintainer removable-bilateral,maxillary-Limited to children under age 19.

Preventive Services - continued on next page

24 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Preventive Services (cont.)

D1527 Space Maintainer Removable bilateral,mandibular-Limited to children under age 19.

D1551 Re-cement or re-bond bilateral space maintainer-maxillary

D1552 Re-cement or re-bond bilateral space maintainer-mandibular.

D1553 Re-cement or re-bond unilateral space maintainer-per quadrant.

D1575 Distal space maintainer fixed.

Additional Procedures covered as Basic Services

D9110 Palliative treatment of dental pain – minor procedure

D9310 Consultation (diagnostic service provided by dentist or physician other than practitioner providing treatment)

D9311 Consultation With Medical Professional

D9440 Office Visit- after regularly scheduled hours

Services Not Covered: (Please refer to Section 7 for a list of General Exclusions)

D0320 TMJ arthrogram

D0321 Other TMJ images, by report

D0322 Tomographic survey

D0387 Intraoral tomosynthesis – comprehensive series of radiographic images

D0388 Intraoral tomosynthesis – bitewing radiographic image – image capture only

D0389 Intraoral tomosynthesis – periapical radiographic image – image capture only

D0414 Lab microbial specimen

D0416 Viral culture

D0418 Analysis of saliva example chemical or biological analysis of saliva for diagnostic purposes

D0419 Assessment of salivary flow by measurement.

D0425 Caries test

D0431 Adjunctive pre-diagnostic test

D0475 Declassification procedure

D0476 Special stains for microorganisms

D0477 Special stains not for microorganisms

D0478 Immunohistochemical stains

D0479 Tissue in-situ-hybridization

D0481 Electron microscopy

D0482 Direct immunofluorescence

D0483 In-direct immunofluorescence

D0484 Consultation on slides prepared elsewhere

D0485 Consultation including preparation of slides

D0486 Accession Transepithelial

D0600 Non-ionizing diagnostic procedure.

D0604 Antigen Test For Pathogen

D0605 Antibody Test For Pathogen

D0606 Molecular testing for a public health related pathogen, including Coronavirus

D0701 Panoramic radiographic image – image capture only

D0702 2-D cephalometric radiographic image – image capture only

D0703 2-D oral/facial photographic image obtained intra-orally or extra-orally – image capture only

D0705 Extra-oral posterior dental radiographic image – image capture only

D0706 Intraoral – occlusal radiographic image – image capture only

D0707 Intraoral – periapical radiographic image – image capture only

Services Not Covered: (Please refer to Section 7 for a list of General Exclusions) - continued on next page

25 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Services Not Covered: (Please refer to Section 7 for a list of General Exclusions) (cont.)

D0708 Intraoral – bitewing radiographic image – image capture only

D0709 Intraoral – complete series of radiographic images – image capture only

D0801 3D dental surface scan – direct

D0802 3D dental surface scan – indirect

D0803 3D facial surface scan – direct

D0804 3D facial surface scan – indirect

D1320 Tobacco counseling

D1310 Nutritional counseling

D1321 Counseling for the control and prevention of adverse oral, behavioral, and systemic health effects associated with

high-risk substance use

D1330 Oral Hygiene Instruction

D1556 Removal of fixed unilateral space maintainer – per quadrant.

D1557 Removal of fixed bilateral space maintainer – maxillary.

D1558 Removal of fixed bilateral space maintainer – mandibular.

D1701 Pfizer COVID vaccine administration first dose.

D1702 Pfizer COVID administration second dose

D1703 Moderna COVID vaccine administration first dose

D1704 Moderna COVID vaccine administration second dose

D1705 AstraZen COVID vaccine administration first dose

D1706 AstraZen COVID vaccine administration second dose

D1707 Janssen COVID vaccine administration

D1708 Pfizer-BioNTech Covid-19 vaccine administration – third dose

D1709 Pfizer-BioNTech Covid-19 vaccine administration – booster dose

D1710 Moderna Covid-19 vaccine administration – third dose

D1711 Moderna Covid-19 vaccine administration – booster dose

D1712 Janssen Covid-19 Vaccine Administration - booster dose

D1713 Pfizer-BioNTech Covid-19 vaccine administration tris-sucrose pediatric – first dose

D1714 Pfizer-BioNTech Covid-19 vaccine administration tris-sucrose pediatric – second dose

D1781 Vaccine administration – human papillomavirus – Dose 1

D1782 Vaccine administration – human papillomavirus – Dose 2

D1783 Vaccine administration – human papillomavirus – Dose 3

26 2023 The MetLife Federal Dental Plan Enroll at www.BENEFEDS.com

Class B Intermediate

Important things you should keep in mind about these benefits:

•Please remember that all benefits are subject to the definitions, limitations, and exclusions in this

brochure and are payable only when we determine they are necessary for the minor restorative care

or treatment of a covered condition and meet generally accepted dental protocols.

•The calendar year deductible is $0, if you use an In-Network provider. Should you elect to use an

Out-of-Network provider, the Standard Option contains a $100 deductible per covered person, and

the High Option has a $50 deductible per covered person. Neither Option contains a family

deductible; each enrolled covered person must satisfy their own deductible.

•The Annual Benefit Maximum in the High Option for non-orthodontia services is unlimited,

combined, for both In-Network and Out-of-Network services. The Standard Option Annual Benefit

Maximum for non-orthodontia services is $1,500 for In-Network services and $1,000 for Out-of-

Network services. In no instance will MetLife allow more than $1,500 in combined benefits under

the Standard Option in any plan year.