Oracle Fusion

Cloud Financials

Implementing Receivables Credit to

Cash

24C

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Contents

Get Help ................................................................................................................................ i

1

Define Common Accounts Receivable Configuration

1

Overview of Oracle Receivables ................................................................................................................................................... 1

Simple Configuration to Operate Receivables ......................................................................................................................... 2

Predefined Receivables Data in Subledger Accounting ......................................................................................................... 3

Receivables Accounting Event Model ...................................................................................................................................... 16

Reference Data Sets in Receivables .......................................................................................................................................... 18

Translated Display of Transaction Type, Transaction Source, and Receipt Method ....................................................... 19

Ledger and Legal Entity Document Sequencing .................................................................................................................. 20

Receivables Activities .................................................................................................................................................................. 25

AutoCash Rule Sets ..................................................................................................................................................................... 28

Approval Limits ............................................................................................................................................................................. 37

Credit Memo Workflow ............................................................................................................................................................... 38

Statements .................................................................................................................................................................................... 40

FAQs for Standard Messages .................................................................................................................................................... 45

FAQs for Distribution Sets ......................................................................................................................................................... 45

FAQs for Define Common Accounts Receivable Configuration ......................................................................................... 46

2

Manage Receivables System Options

47

Guidelines for Receivables System Option Settings ............................................................................................................ 47

Example of Header Level Rounding ........................................................................................................................................ 48

AutoInvoice Tuning Segments .................................................................................................................................................. 49

AutoInvoice Log File Message Levels ..................................................................................................................................... 50

FAQs for Manage Receivables System Options ..................................................................................................................... 51

Email Delivery ................................................................................................................................................................................ 53

Multifund Accounting ................................................................................................................................................................. 57

3

Define Customer Billing Configuration

71

AutoInvoice ..................................................................................................................................................................................... 71

Payment Terms ............................................................................................................................................................................. 78

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

AutoAccounting ............................................................................................................................................................................ 85

Transaction Types ......................................................................................................................................................................... 91

Transaction Sources .................................................................................................................................................................... 95

Memo Lines .................................................................................................................................................................................. 101

Prepayments ................................................................................................................................................................................ 102

Balance Forward Billing ............................................................................................................................................................ 106

Remit-to Addresses ..................................................................................................................................................................... 113

FAQs for Salesperson Reference Accounts ............................................................................................................................ 115

B2B XML ........................................................................................................................................................................................ 115

OAGIS 10.1 XML ............................................................................................................................................................................ 119

UBL 2.1 XML ................................................................................................................................................................................. 133

4

Define Customer Payments

141

Create a Shared Service Model in Receivables ..................................................................................................................... 141

Application Rule Sets ................................................................................................................................................................. 143

Receipt Classes and Methods ................................................................................................................................................. 149

Lockbox ......................................................................................................................................................................................... 154

Transmission Formats for Lockbox ........................................................................................................................................ 174

AutoMatch Rule Sets ................................................................................................................................................................. 185

Application Exception Rule Sets .............................................................................................................................................. 191

Customer Paying Relationships ............................................................................................................................................... 193

FAQs for Receipt Sources ......................................................................................................................................................... 195

5

Configure Payment System Connectivity

197

Options for Validations .............................................................................................................................................................. 197

How You Set Up Formats ......................................................................................................................................................... 198

Transmission Protocols ............................................................................................................................................................. 201

Transmission Configurations ................................................................................................................................................... 202

How You Set Up Transmission Configurations ................................................................................................................... 202

Considerations for Environment Cloning ............................................................................................................................. 204

How You Configure Pretty Good Privacy (PGP) Encryption and Digital Signature for Outbound and Inbound Messages

......................................................................................................................................................................................................... 205

How You Configure Two-Factor Authentication Using A Security Key File ................................................................... 210

How You Test the Transmission Configuration .................................................................................................................... 211

How You Configure a Communication Channel to a Payment System .......................................................................... 213

How You Set Up a Payment System ...................................................................................................................................... 214

Payment System Accounts ....................................................................................................................................................... 217

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

How You Set Up Payment System Connections for Multiple Business Units ................................................................ 218

Import and Export Tokenization Setup Data ....................................................................................................................... 222

Import a Security Credential File ............................................................................................................................................ 224

FAQs for Configure Payment System Connectivity ............................................................................................................ 225

6

Define Funds Capture

227

Funds Capture Process Profiles .............................................................................................................................................. 227

External Settlement of Credit Card and Bank Accounts ................................................................................................... 228

Examples of Settlement Grouping Rules .............................................................................................................................. 229

Routing Rules .............................................................................................................................................................................. 230

Reevaluate Routing Rules During Receipt Remittance ....................................................................................................... 231

How You Use Oracle Analytics Publisher to Modify Templates for Use with Formats ................................................ 232

FAQs for Define Funds Capture .............................................................................................................................................. 233

7

Define Payments Security

237

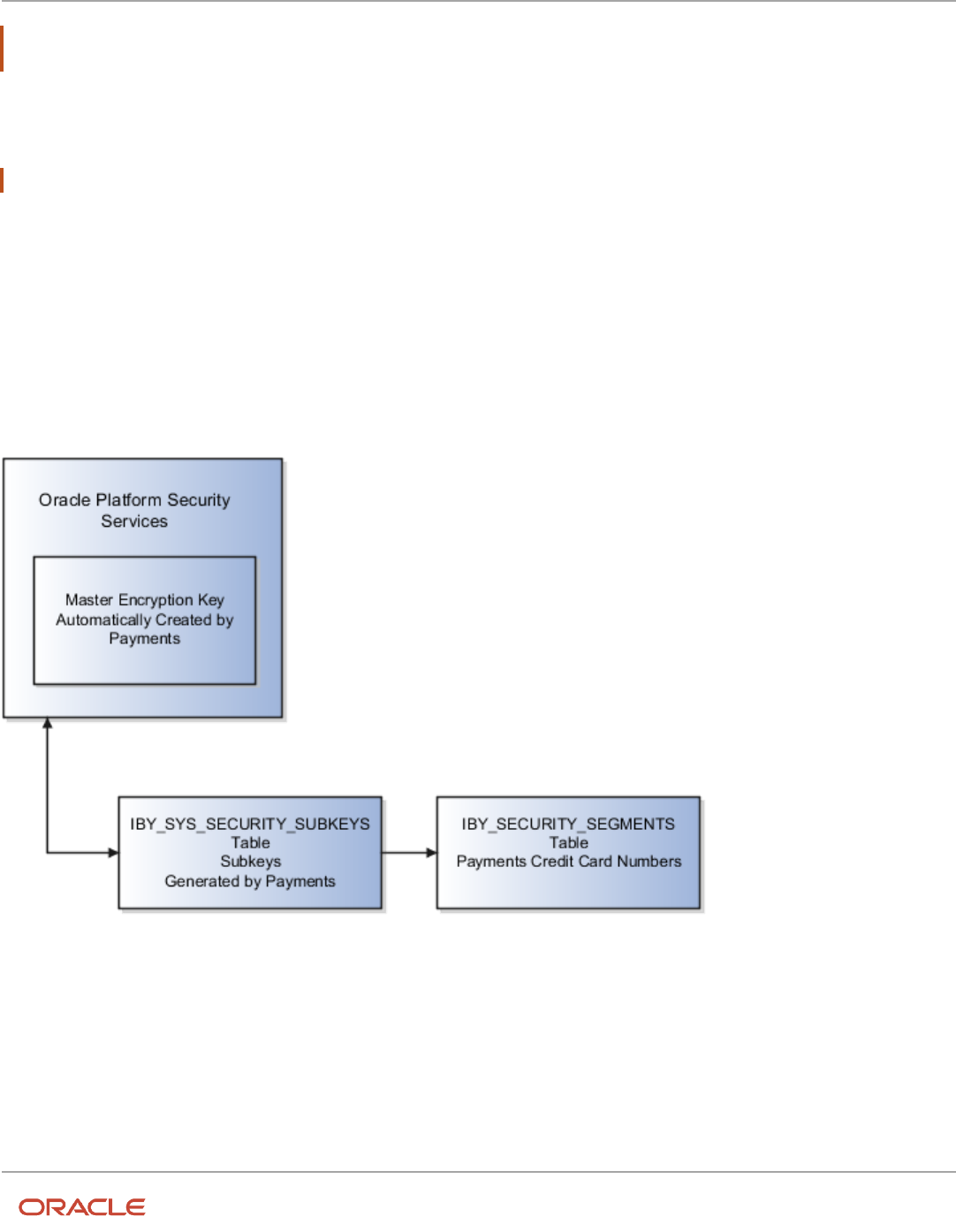

Options for System Security .................................................................................................................................................... 237

Enable Encryption of Sensitive Payment Information ....................................................................................................... 240

PCI DSS Credit Card Processing Requirements .................................................................................................................. 240

How You Enable Credit Card Tokenization ........................................................................................................................... 241

How Imported Legacy Credit Cards Are Processed ........................................................................................................... 242

Removal of Personally Identifiable Information .................................................................................................................. 246

8

Define Customer

253

Define Customer Account ........................................................................................................................................................ 253

Manage Receivables Customer Profile Classes ................................................................................................................... 257

Manage Customers .................................................................................................................................................................... 261

Manage Customer Data Uploads ........................................................................................................................................... 264

Manage Data Import ................................................................................................................................................................. 276

9

Define Bills Receivable

287

Enable System Options for Bills Receivable ......................................................................................................................... 287

Create a Bills Receivable Creation Receipt Method ............................................................................................................ 287

Prepare Transactions for Bills Receivable Batches ............................................................................................................. 289

Create a Bills Receivable Remittance Receipt Method ....................................................................................................... 291

Create a Remittance Bank Account for Bills Receivable .................................................................................................... 292

FAQs for Define Bills Receivable ............................................................................................................................................. 293

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

10

Define Revenue Management Configuration for Receivables

295

Guidelines for Defining Revenue Policies ............................................................................................................................. 295

How Event-Based Revenue Management Works ............................................................................................................... 296

Revenue Contingencies ............................................................................................................................................................ 297

Payment-Based Revenue Contingencies .............................................................................................................................. 298

Revenue Contingency Removal Events ................................................................................................................................ 300

Revenue Contingency Assignment Rules ............................................................................................................................. 301

FAQs for Define Revenue Management Configuration for Receivables ........................................................................ 302

11

Define Credit Management

305

Components of the Credit Profile .......................................................................................................................................... 305

Credit Analysts and Credit Managers ................................................................................................................................... 307

Create a Scoring Model ............................................................................................................................................................ 309

How You Define a Scoring Model Calculation ...................................................................................................................... 311

Create a Credit Case Folder Template ................................................................................................................................... 314

How You Maintain the Summary Tables for Data Points ................................................................................................... 315

How You Import Third-Party Credit Data for Data Points ................................................................................................. 316

How You Import Credit Management Data Points .............................................................................................................. 318

Descriptive Flexfields in Credit Case Folders ....................................................................................................................... 319

FAQs for Define Credit Management .................................................................................................................................... 320

12

Define Cash Management and Banking Configuration

323

How Bank, Branch, and Account Components Work Together ....................................................................................... 323

Considerations When You Create Accounts ........................................................................................................................ 324

Cash Management Profile Options ........................................................................................................................................ 326

Overview of Parse Rule Sets ................................................................................................................................................... 328

Overview of Transaction Type Mapping ............................................................................................................................... 329

Overview of Tolerance Rules ................................................................................................................................................... 330

Reconciliation Matching Rules ................................................................................................................................................. 331

Overview of Reconciliation Rules Sets .................................................................................................................................. 337

Overview of Bank Statement Transaction Codes ............................................................................................................... 338

How You Map Configurable BAI2 Transaction Codes ........................................................................................................ 338

How You Set Up Wildcard Support for Bank Statement Processing Using UCM Protocol ......................................... 339

Overview of Bank Statement Transaction Creation Rules ................................................................................................ 339

Create Banks, Branches, and Accounts in Spreadsheet ................................................................................................... 340

Set Up Cash Positioning and Forecasting ............................................................................................................................ 341

Bank Account Validation .......................................................................................................................................................... 345

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

13

Define Advanced Collections Configuration

427

Manage Collections Preferences ............................................................................................................................................ 427

Manage Aging Methods ........................................................................................................................................................... 433

Manage Collectors ..................................................................................................................................................................... 436

Manage Dunning Configuration ............................................................................................................................................ 446

Define Scoring ............................................................................................................................................................................ 449

Define Strategy ........................................................................................................................................................................... 461

Manage Collections Scoring and Strategy Assignments .................................................................................................. 469

14

Define Bill Management

473

Set Up Bill Management .......................................................................................................................................................... 473

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Get Help

Get Help

There are a number of ways to learn more about your product and interact with Oracle and other users.

Get Help in the Applications

Use help icons to access help in the application. If you don't see any help icons on your page, click your user image

or name in the global header and select Show Help Icons.

Get Support

You can get support at My Oracle Support. For accessible support, visit Oracle Accessibility Learning and Support.

Get Training

Increase your knowledge of Oracle Cloud by taking courses at Oracle University.

Join Our Community

Use Cloud Customer Connect to get information from industry experts at Oracle and in the partner community. You

can join forums to connect with other customers, post questions, suggest ideas for product enhancements, and watch

events.

Learn About Accessibility

For information about Oracle's commitment to accessibility, visit the Oracle Accessibility Program. Videos included in

this guide are provided as a media alternative for text-based topics also available in this guide.

Share Your Feedback

We welcome your feedback about Oracle Applications user assistance. If you need clarification, find an error, or just

want to tell us what you found helpful, we'd like to hear from you.

You can email your feedback to oracle_fusion_applications_help_ww_grp@oracle.com.

Thanks for helping us improve our user assistance!

i

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Get Help

ii

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

1 Define Common Accounts Receivable

Configuration

Overview of Oracle Receivables

Oracle Receivables provides integrated functionality to perform day-to-day accounts receivable operations. Receivables

functionality is managed from these Overview work areas: Billing, Receivables Balances, Revenue Management, and

Credit Management.

All work areas provide access to general ledger account activities, including creating accounting, creating manual

journal entries, and reviewing journal entries.

Billing Work Area

Use the Billing work area to perform tasks related to customer billing activities. Monitor and review incomplete

transactions, and approve and research pending adjustments. Use AutoInvoice to import transactions from other

systems and generate invoices and credit memos automatically according to your requirements. You can review and

correct AutoInvoice import errors and resubmit AutoInvoice. Create new invoices, debit memos, credit memos, and on-

account credit memos. Perform related activities to manage your transactions: update, duplicate, credit, adjust, dispute,

and preview a transaction. You can also create a new customer record and manage existing customers from the Billing

work area.

Receivables Balances Work Area

Use the Receivables Balances work area to perform tasks related to customer payment activities and the management

of accounts receivable balances. Review actionable items, including open receipts and receipt batches, unapplied and

on-account receipts and credit memos, receipt remittance batches, and funds transfer errors. Create receipts manually,

import receipts using lockbox or spreadsheet, or create automatic receipts. Perform related activities to manage your

receipts: apply, unapply, reverse, delete; create invoice adjustments or chargebacks during receipt application; and

remit, clear, or risk eliminate factored receipts. You can manage receipt remittances: create, modify, and approve

receipt remittance batches. You can also perform tasks related to managing accounts receivables balances, including

reconciling receivables to the general ledger and managing receivables accounting period statuses.

Revenue Management Work Area

Use the Revenue Management work area to perform tasks related to revenue recognition and revenue adjustments.

Run the Recognize Revenue program to generate revenue distribution records for invoices and credit memos that

use invoicing and revenue scheduling rules. Perform revenue adjustments on one or more transactions, including

scheduling and unscheduling revenue; reviewing, adding, and expiring revenue contingencies; and transferring sales

credits. You can also manage revenue policies, revenue contingencies, and rules that assign revenue contingencies to

transactions automatically.

Credit Management Work Area

Use the Credit Management work area to create credit profiles for your customers. The credit profile contains key

information for establishing the creditworthiness of each of your customers, including credit classifications, credit

1

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

limits, and credit review cycles. Review and evaluate specific credit authorization requests; run periodic reviews of the

creditworthiness of your existing customers; review customer credit scores, and provide recommendations for customer

credit. Build scoring models that calculate a credit score based on credit data specific to a customer; maintain detailed

information about customer financial and accounting history; and create templates for different types of credit reviews

that are automatically assigned to specific credit scenarios.

Customer Information

From either the Billing or Receivables Balances work area, you have access to manage both customer information

and customer account activities, in summary and in detail. You can review customer account information by a single

business unit, bill-to site, or across all business units and bill-to sites. For each customer account, you can review

transactions and receipts, dispute and adjust transactions, and drill down to current or historical customer account

activity.

Simple Configuration to Operate Receivables

You can create an operational Receivables environment with seven configurations. The remaining configurations are

either optional or have predefined values.

If applicable, your Receivables configuration must include a plan to migrate your customer information from your legacy

system.

Receivables Configuration Tasks

There are seven configuration tasks necessary to create an operational Receivables environment. Before you perform

these tasks, you must ensure that you have completed all of the required implementation tasks for Oracle Financials.

Perform these seven tasks in the order indicated:

1. Set Receivables System Options

Set Receivables system options to define your Receivables environment. During Receivables setup, you specify

your accounts, customer and invoice parameters, and how the AutoInvoice and Automatic Receipts programs

operate.

2. Define Receivables Activities

Define receivables activities to create default accounting for all activities other than transactions and receipts,

including, for example, miscellaneous cash, discounts, late charges, adjustments, and write-offs.

3. Define AutoAccounting Rules

Defining AutoAccounting is a required configuration task for processing customer billing.

Define AutoAccounting to specify how you want Receivables to determine the default general ledger accounts

for transactions. Receivables creates default accounts for revenue, receivable, freight, tax, unearned revenue,

unbilled receivables, late charges, and AutoInvoice clearing (suspense) accounts using your AutoAccounting

setup.

4. Define Receipt Classes and Methods

Defining receipt classes and receipt methods is a required configuration task for processing customer

payments.

2

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Receipt classes determine the required processing steps for receipts to which you assign receipt methods with

this class. These steps include confirmation, remittance, and clearance. Receipt methods specify accounting

for receipt entries and applications, determine customer remittance bank account information, and configure

automatic receipt processing and fund transfer error handling.

5. Define Remit-to Addresses

Define remit-to addresses to let your customers know where to send payment for open receivables. Receivables

uses the addresses to provide default remit-to information when you enter transactions.

You must provide a remit-to address to complete a transaction.

If you use AutoInvoice, but you haven't defined a remit-to address for a particular customer site, AutoInvoice

rejects all transactions for which it couldn't determine a remit-to address.

6. Define Approval Limits

Define approval limits to determine whether a Receivables user can approve adjustments or credit memo

requests. You define approval limits by document type, amount, and currency.

7. Define Statement Cycles

Define statement cycles to control when you create customer statements. You assign statement cycles to

customer profiles.

Related Topics

•

How can I use remit-to addresses?

•

Guidelines for Receivables System Option Settings

•

AutoAccounting Account Types and Segment Values

•

Receivables Activity Types

Predefined Receivables Data in Subledger Accounting

Oracle Receivables provides predefined data for Oracle Subledger Accounting that you can use to integrate the two

applications.

When you run Create Receivables Accounting, the program accepts the default accounting information from

AutoAccounting without change and uses the predefined data to create accounting in the subledger. Subledger

Accounting transfers the final accounting to General Ledger.

Note: You can optionally define your own subledger accounting rules to overwrite the default accounts from the

accounting events.

Receivables predefines one application in Subledger Accounting named Receivables. Most of the data that Receivables

predefines for Subledger Accounting is associated with the Receivables application.

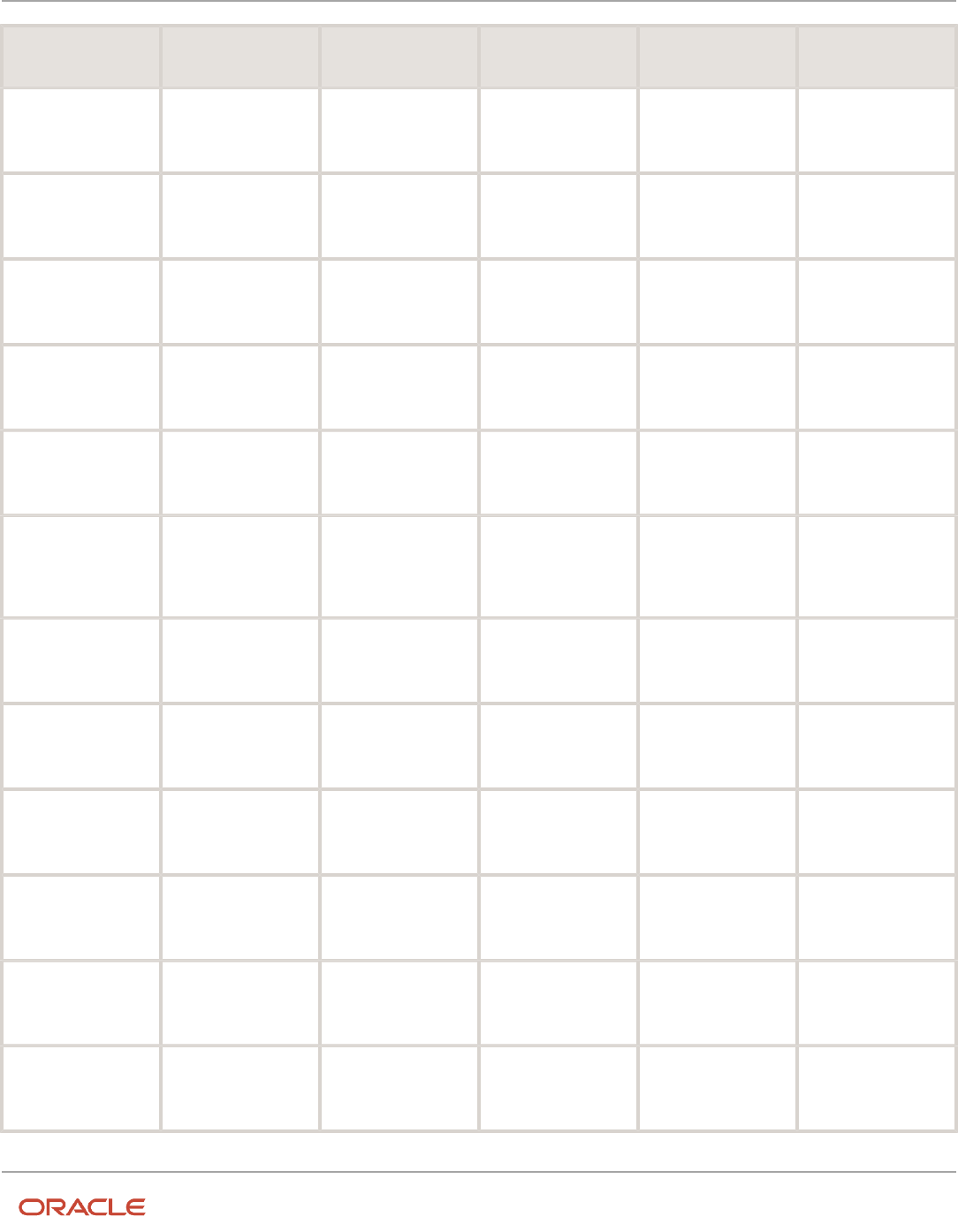

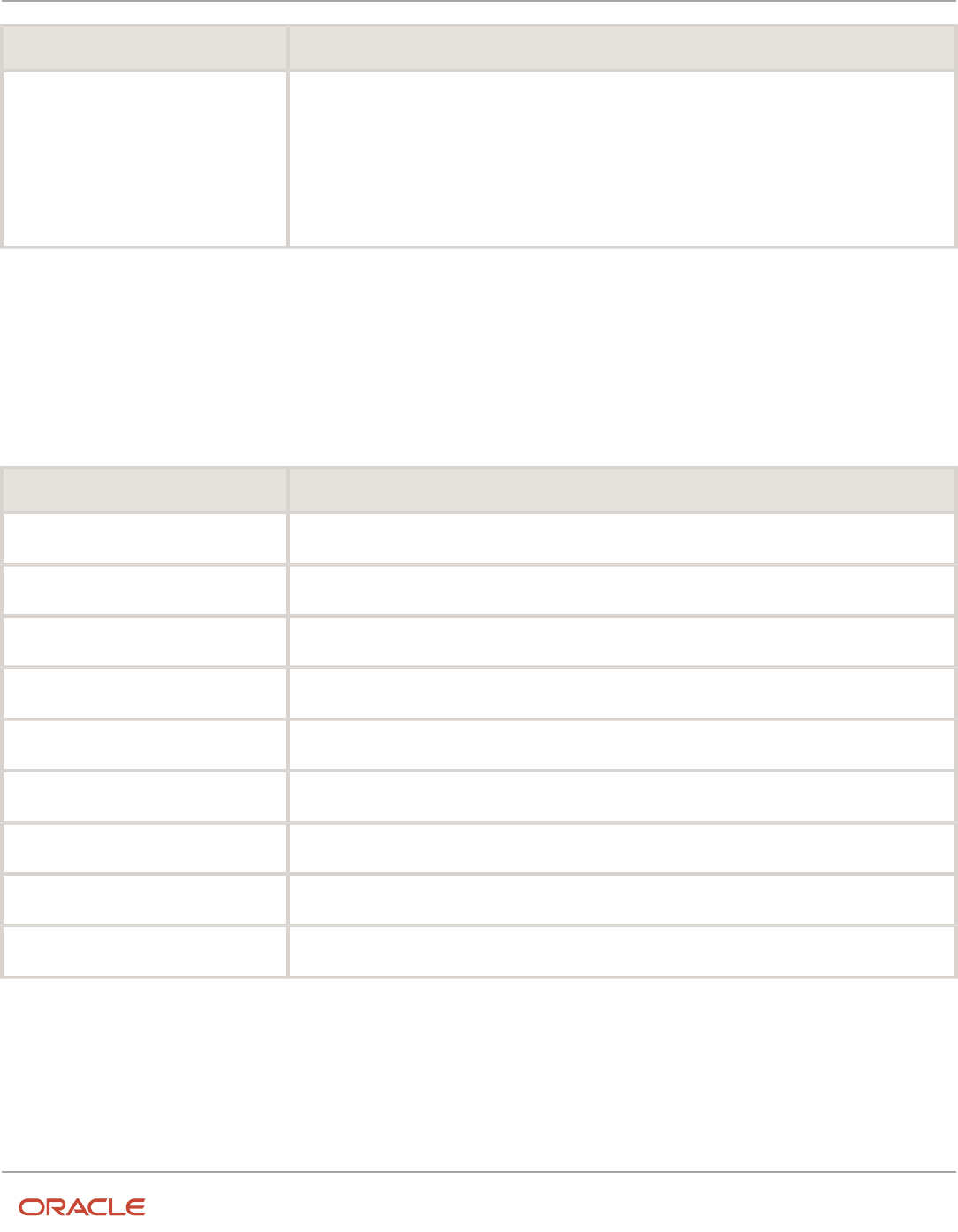

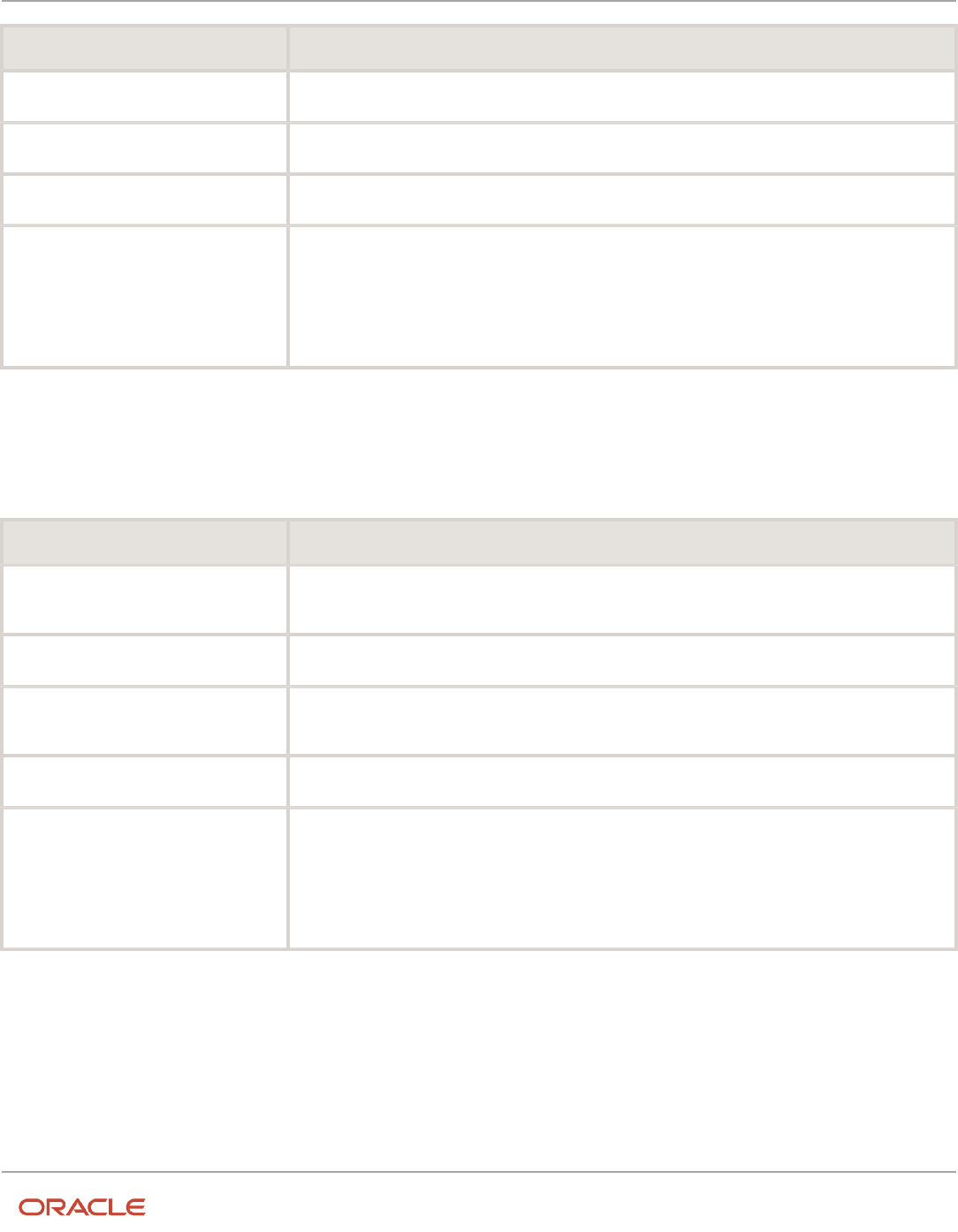

This table shows the attribute values that Receivables predefines for the Receivables application:

3

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Field Value

Application Name

Receivables

Drill-down Procedure

AR_DRILLDOWN_PUB_PKG.DRILLDOWN

Use Security

Yes

Policy Function

XLA_SECURITY_POLICY_PKG.MO_POLICY

Journal Source

Receivables

Third Party Control Account Type

Customer

Subject to Validation

No

Calculate Reporting Currency Amounts

Yes

This table lists the setup information that Receivables predefines for the event entities:

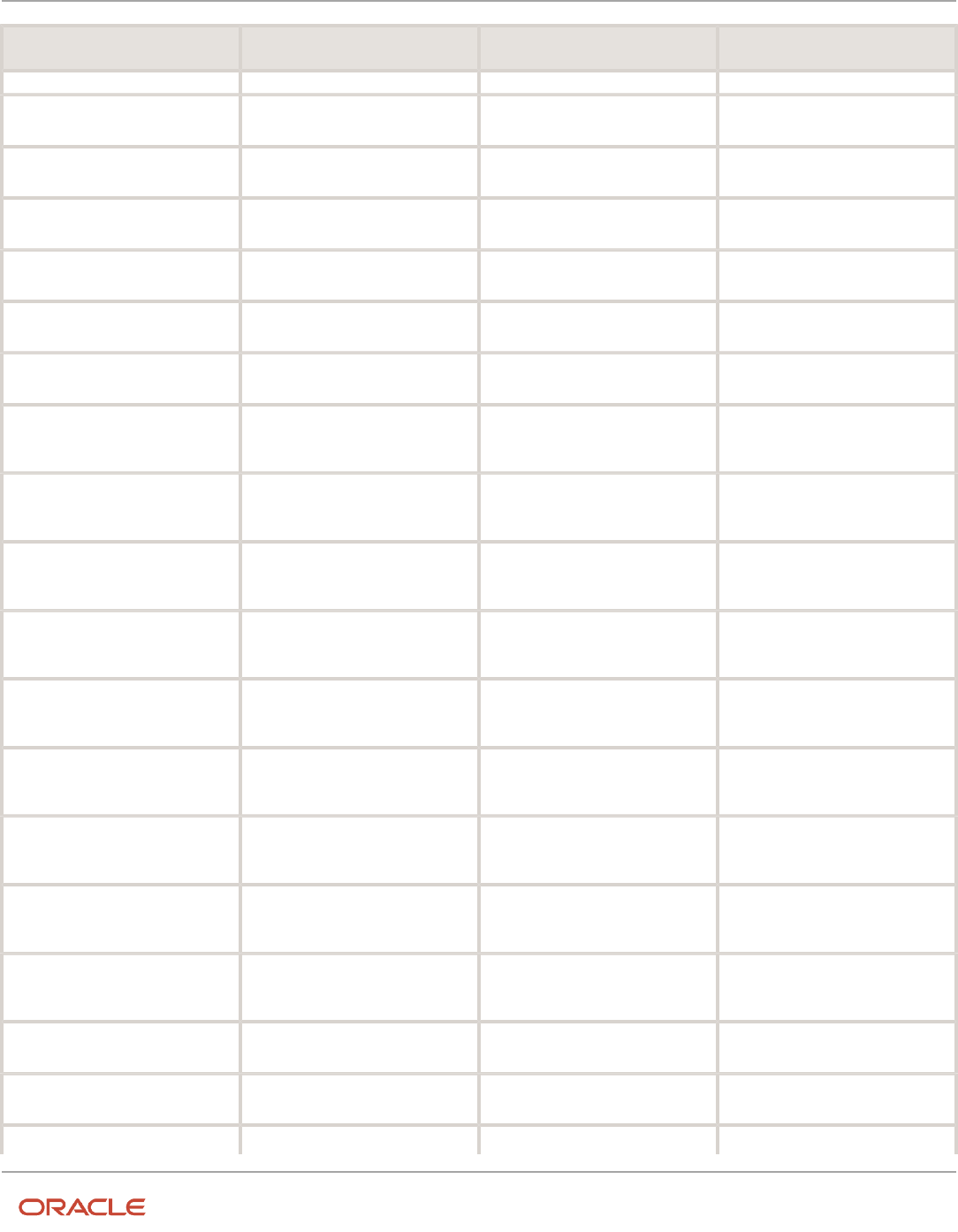

Application Entity Name Description Gapless Event Processing

Receivables

Adjustments

Adjustments

No

Receivables

Receipts

Receipts

No

Receivables

Transactions

Transactions

No

Receivables predefines process categories for the Receivables application. These process categories are:

• Adjustments

• Miscellaneous Receipts

• Standard Receipts

• Third Party Merge

• Transactions

Additional considerations for Receivables predefined data for subledger accounting include:

• Event Classes and Event Class Options

• Sources, Source Assignments, and Accounting Attribute Assignments

• Journal Line Rules

• Account Rules

• Journal Entry Rule Set

• Accounting Method

4

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Classes and Event Class Options

Receivables predefines event classes for each event entity that belongs to the Receivables application.

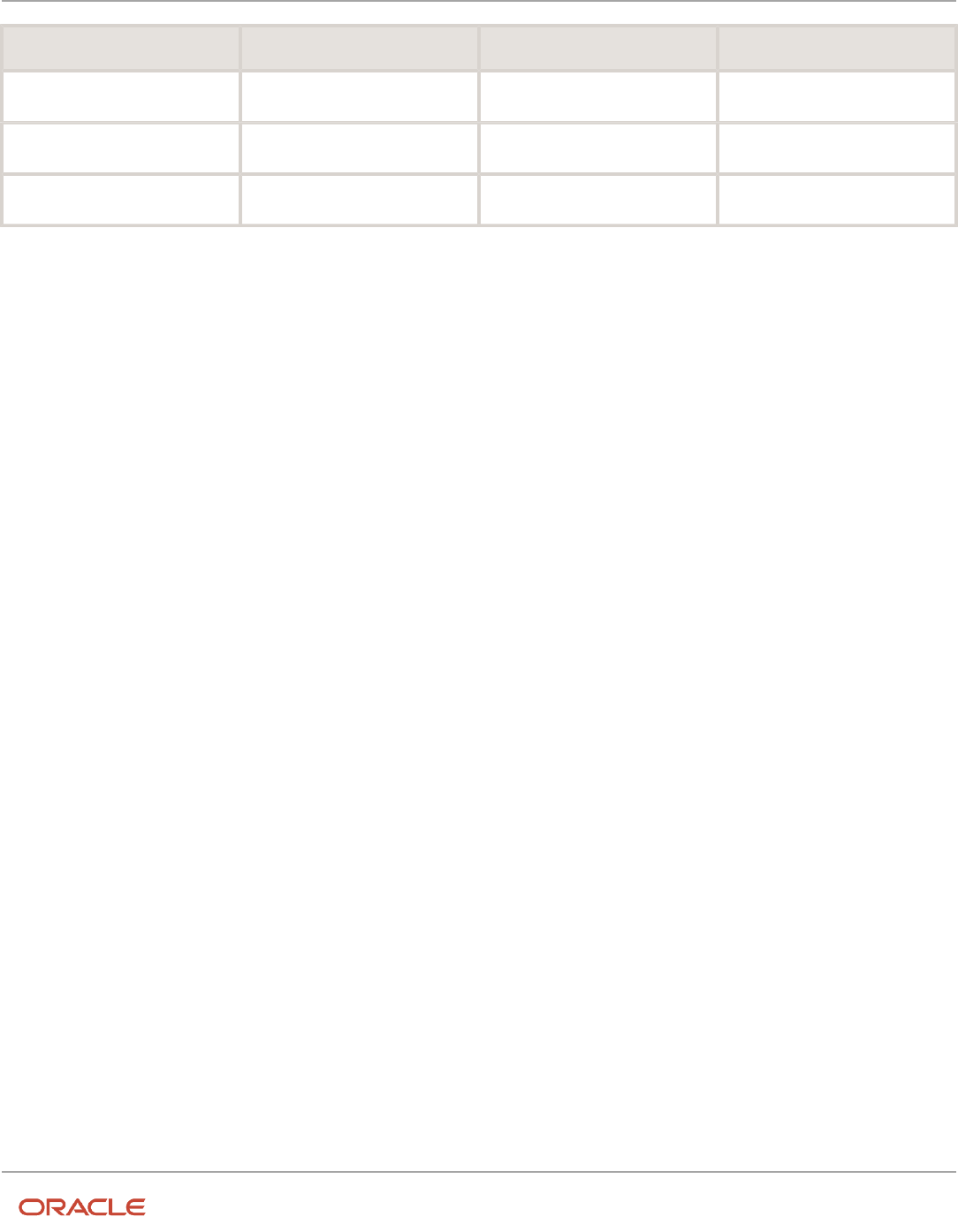

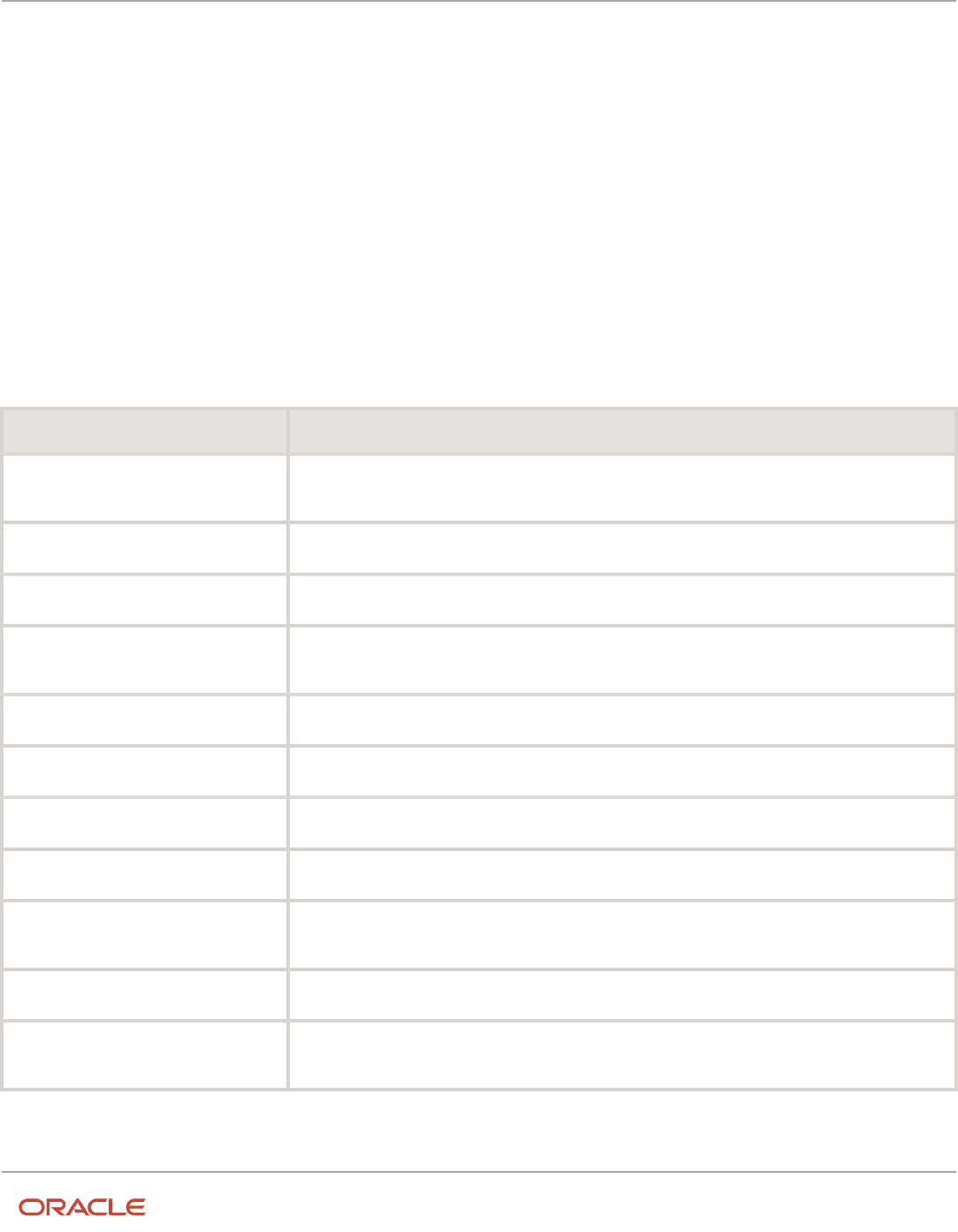

This table lists the event classes that Receivables predefines for the Receivables application:

Entity Event Class Name

Adjustments

Adjustment

Receipts

Miscellaneous Receipt

Receipts

Receipt

Transactions

Chargeback

Transactions

Credit Memo

Transactions

Debit Memo

Transactions

Invoice

Accounting event class options define attributes of an event class. Receivables defines the accounting event class

options for each predefined event class.

This table lists the accounting event class options that Receivables predefines for the Receivables application:

Event Class Process Category Default Journal Category Transaction View Balance Types

Adjustment

Adjustments

Adjustment

AR_ADJ_INF_V

Actual

Bills Receivable

Bills Receivable

Bills Receivable

AR_TRX_INF_V

Actual

Miscellaneous Receipt

Miscellaneous Receipts

Misc Receipts

AR_CR_INF_V

Actual

Receipt

Standard Receipts

Receipts

AR_CR_INF_V

Actual

Chargeback

Transactions

Chargebacks

AR_TRX_INF_V

Actual

Credit Memo

Transactions

Credit Memos

AR_TRX_INF_V

Actual

Debit Memo

Transactions

Debit Memos

AR_TRX_INF_V

Actual

Invoice

Transactions

Sales Invoices

AR_TRX_INF_V

Actual

5

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Sources, Source Assignments, and Accounting Attribute Assignments

Receivables predefines sources, source assignments, and accounting attribute assignments for Subledger Accounting.

You can't make changes to predefined sources, source assignments, or accounting attribute assignments. However, you

can define your own sources.

If you choose to define your own journal line rules or accounting methods, you can override the default accounting

attribute assignments.

Use the Manage Subledger Transaction Objects task in Oracle Subledger Accounting to retrieve a list of Receivables

sources for an event class:

1. Navigate to the Manage Subledger Transaction Objects page.

2. Select a Receivables event class: Adjustment, Bills Receivable, Chargeback, Credit Memo, Debit Memo, Invoice,

Miscellaneous Receipt, Receipt.

3. Click the View Source Assignments button.

4. In the View Source Assignments page, review the available sources for the event class.

Journal Line Rules

Receivables predefines journal line rules for each predefined event class. Receivables specifies conditions for the use of

each journal line rule.

This table lists the journal line rules that Receivables predefines for the Receivables application:

Event Class Name Balance Type Side

Adjustment

Adjustment

Actual

Credit

Adjustment

Adjustment Charge

Actual

Credit

Adjustment

Adjustment Default Receivable

Actual

Credit

Adjustment

Adjustment Deferred Tax

Actual

Credit

Adjustment

Adjustment Charge

Nonrecoverable Tax

Actual

Credit

Adjustment

Adjustment Nonrecoverable Tax

Actual

Credit

Adjustment

Adjustment Tax

Actual

Credit

Adjustment

Adjustment Transaction Creation

Date

Actual

N/A

Adjustment

Adjustment Transaction Created By

Actual

N/A

6

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Name Balance Type Side

Adjustment

Adjustment Transaction Last

Updated Date

Actual

N/A

Adjustment

Adjustment Transaction Last

Updated By

Actual

N/A

Chargeback

Chargeback Default Receivable

Actual

Debit

Chargeback

Chargeback Revenue

Actual

Credit

Credit Memo

Credit Memo Default Deferred Tax

Application

Actual

Credit

Credit Memo

Credit Memo Default Application

Actual

Credit

Credit Memo

Credit Memo Default Tax

Application

Actual

Credit

Credit Memo

Credit Memo Refund Application

Actual

Credit

Credit Memo

Credit Memo Charges

Actual

Credit

Credit Memo

Credit Memo Default Receivable

Actual

Debit

Credit Memo

Credit Memo Default Revenue

Actual

Credit

Credit Memo

Credit Memo Default Tax

Actual

Credit

Credit Memo

Credit Memo Rounding

Actual

Credit

Credit Memo

Credit Memo Unbilled Receivable

Actual

Credit

Credit Memo

Credit Memo Deferred Revenue

Actual

Credit

Credit Memo

Credit Memo Product Type

Actual

N/A

Credit Memo

Credit Memo Transaction Creation

Date

Actual

N/A

Credit Memo

Credit Memo Transaction Created

By

Actual

N/A

Credit Memo

Credit Memo Transaction Last

Updated Date

Actual

N/A

7

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Name Balance Type Side

Credit Memo

Credit Memo Transaction Last

Updated By

Actual

N/A

Debit Memo

Debit Memo Charges

Actual

Credit

Debit Memo

Debit Memo Default Receivable

Actual

Debit

Debit Memo

Debit Memo Freight

Actual

Credit

Debit Memo

Debit Memo Revenue

Actual

Credit

Debit Memo

Debit Memo Rounding

Actual

Credit

Debit Memo

Debit Memo Tax

Actual

Credit

Debit Memo

Debit Memo Unbilled Receivable

Actual

Debit

Debit Memo

Debit Memo Deferred Revenue

Actual

Credit

Debit Memo

Debit Memo Product Type

Actual

N/A

Debit Memo

Debit Memo Transaction Creation

Date

Actual

N/A

Debit Memo

Debit Memo Transaction Created

By

Actual

N/A

Debit Memo

Debit Memo Transaction Last

Updated Date

Actual

N/A

Debit Memo

Debit Memo Transaction Last

Updated By

Actual

N/A

Invoice

Invoice Charges

Actual

Credit

Invoice

Invoice Default Receivable

Actual

Debit

Invoice

Invoice Freight

Actual

Credit

Invoice

Invoice Revenue

Actual

Credit

Invoice Invoice Rounding Actual Credit

8

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Name Balance Type Side

Invoice

Invoice Tax

Actual

Credit

Invoice

Invoice Unbilled Receivable

Actual

Credit

Invoice

Invoice Deferred Revenue

Actual

Credit

Invoice

Invoice Product Type

Actual

N/A

Invoice

Invoice Transaction Creation Date

Actual

N/A

Invoice

Invoice Transaction Created By

Actual

N/A

Invoice

Invoice Transaction Last Updated

Date

Actual

N/A

Invoice

Invoice Transaction Last Updated

By

Actual

N/A

Miscellaneous Receipt

Miscellaneous Receipt Bank

Charges

Actual

Credit

Miscellaneous Receipt

Miscellaneous Receipt Cleared

Cash

Actual

Credit

Miscellaneous Receipt

Miscellaneous Receipt Confirmed

Cash

Actual

Credit

Miscellaneous Receipt

Miscellaneous Receipt Short Term

Debt

Actual

Credit

Miscellaneous Receipt

Miscellaneous Receipt Factored

Cash

Actual

Credit

Miscellaneous Receipt

Miscellaneous Receipt

Miscellaneous Cash

Actual

Credit

Miscellaneous Receipt

Miscellaneous Receipt Remitted

Cash

Actual

Credit

Miscellaneous Receipt

Miscellaneous Receipt Tax

Actual

Credit

Receipt

Receipt On Account Application

Actual

Credit

Receipt Receipt Application to Freight Actual Credit

9

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Name Balance Type Side

Receipt

Receipt Application to Revenue

Actual

Credit

Receipt

Receipt Application to Rounding

Actual

Credit

Receipt

Receipt Application to Suspense

Revenue

Actual

Credit

Receipt

Receipt Application to Tax

Actual

Credit

Receipt

Receipt Application to Unbilled

Revenue

Actual

Credit

Receipt

Receipt Application to Earned

Revenue

Actual

Credit

Receipt

Receipt Bank Charges

Actual

Credit

Receipt

Receipt Cleared Cash

Actual

Credit

Receipt

Receipt Credit Card Chargeback

Application

Actual

Credit

Receipt

Receipt Chargeback Application

Actual

Credit

Receipt

Receipt Confirmed Cash

Actual

Credit

Receipt

Receipt Currency Rounding

Actual

Credit

Receipt

Receipt Short Term Debt

Actual

Credit

Receipt

Receipt Default Application

Actual

Credit

Receipt

Receipt Deferred Tax

Actual

Credit

Receipt

Receipt Earned Discount

Actual

Credit

Receipt

Receipt Earned Discount on Freight

Actual

Debit

Receipt

Receipt Earned Discount

Nonrecoverable Tax

Actual

Credit

Receipt

Receipt Earned Discount on

Revenue

Actual

Debit

10

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Name Balance Type Side

Receipt

Receipt Earned Discount on Tax

Actual

Debit

Receipt

Receipt Exchange Gain

Actual

Credit

Receipt

Receipt Exchange Gain Loss

Actual

Gain/Loss

Receipt

Receipt Exchange Loss

Actual

Credit

Receipt

Receipt Factored Cash

Actual

Credit

Receipt

Receipt Payment Netting

Application

Actual

Credit

Receipt

Receipt Prepayment Application

Actual

Credit

Receipt

Receipt Refund Application

Actual

Credit

Receipt

Receipt Remitted Cash

Actual

Credit

Receipt

Receipt Tax

Actual

Credit

Receipt

Receipt Unapplied Cash

Actual

Debit

Receipt

Unapplied Cash

Actual

Debit

Receipt

Receipt Unapplied for Gain Loss

lines

Actual

Debit

Receipt

Receipt Unearned Discount

Actual

Credit

Receipt

Receipt Unearned Discount on

Freight

Actual

Debit

Receipt

Receipt Unearned Discount on

Nonrecoverable Tax

Actual

Credit

Receipt

Receipt Unearned Discount on

Revenue

Actual

Debit

Receipt

Receipt Unearned Discount on Tax

Actual

Debit

Receipt Receipt Unidentified Cash Actual Credit

11

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Name Balance Type Side

Receipt

Receipt Write-Off Application

Actual

Credit

Receipt

Receipt Reversed Unapplied for

Unidentified Receipt

Actual

Debit

Receipt

Receipt Reversed Unidentified

Balance Line

Actual

Debit

Receipt

Receipt Unapplied for Unidentified

Receipt

Actual

Debit

Receipt

Receipt Unidentified Balance Line

Actual

Debit

Receipt

Receipt Unapplied Reversed Cash

Actual

Debit

Receipt

Receipt Bill To Site Receivable

Account

Actual

N/A

Receipt

Receipt Bill To Site Clearing

Account

Actual

N/A

Receipt

Receipt Bill To Site Freight Account

Actual

N/A

Receipt

Receipt Bill To Site Revenue

Account

Actual

N/A

Receipt

Receipt Bill To Site Tax Account

Actual

N/A

Receipt

Receipt Bill To Site Unbilled

Receivable

Actual

N/A

Receipt

Receipt Bill To Site Unearned

Account

Actual

N/A

Receipt

Receipt Creation Date

Actual

N/A

Receipt

Receipt Created By

Actual

N/A

Receipt

Receipt Last Updated Date

Actual

N/A

Receipt

Receipt Last Updated By

Actual

N/A

12

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Account Rules

Receivables predefines account rules. When Subledger Accounting uses the predefined account rules that Receivables

provides, it accepts the default accounting that Receivables generates using AutoAccounting without change.

You can optionally define your own account rules for an Accounting Flexfield or for a segment. In this case, Subledger

Accounting overrides the default accounts that Receivables generates, or individual segment values in the default

accounts, when it creates the draft or final subledger accounting.

The account rules that Receivables predefines for the Receivables application are as follows:

• Credit Memo Distribution GL Account

• Collection Bank Charges Account

• Collection Bank Account Cash Account

• Collection Bank Factoring Charges Account

• Distribution GL Account

• Remit Bank Unapplied Account

• System Gain GL Account

• System Loss GL Account

• Transaction Distribution GL Account

• Transaction Distribution GL Account with reference

Journal Entry Rule Sets

Receivables predefines journal entry rule sets that group the predefined journal line rules and account rules within each

of the predefined event types. Receivables assigns each predefined journal entry rule set to all event types within an

event class.

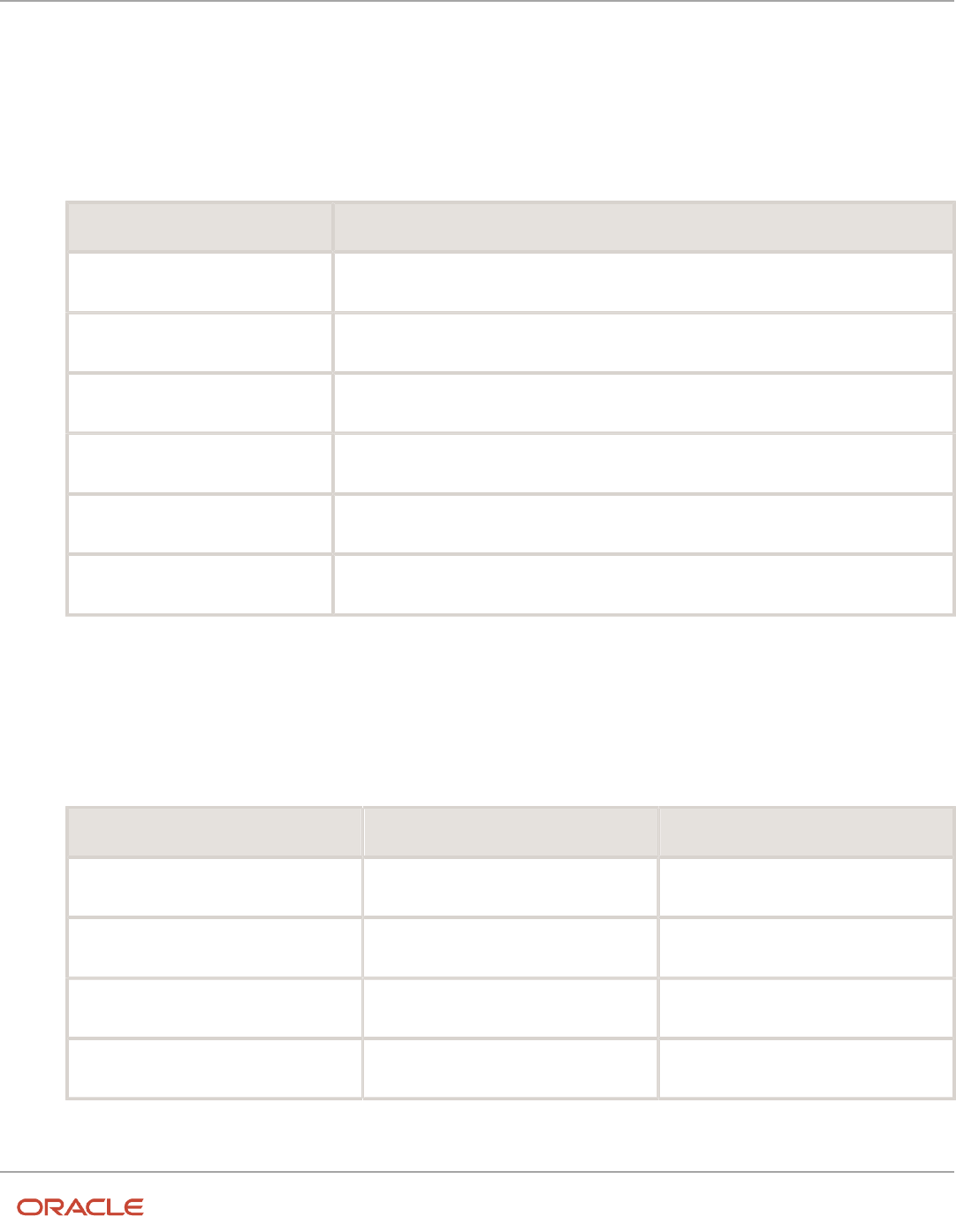

This table lists the journal entry rule sets that Receivables predefines for the Receivables application:

Event Class Journal Entry Rule Set Name Journal Line Rules

Adjustment

Adjustments - Default Accrual

Adjustment, Adjustment Charge, Adjustment

Charge Nonrecoverable Tax, Adjustment

Default Receivable, Adjustment Deferred Tax,

Adjustment Nonrecoverable Tax, Adjustment

Tax

Chargeback

Chargebacks - Default Accrual

Chargeback Default Receivable, Chargeback

Revenue

Credit Memo

Credit Memos - Default Accrual

Credit Memo Charges, Credit Memo Default

Application, Credit Memo Default Deferred Tax

Application, Credit Memo Default Receivable,

Credit Memo Default Revenue, Credit

Memo Default Tax, Credit Memo Default Tax

Application, Credit Memo Deferred Revenue,

Credit Memo Refund Application, Credit Memo

Rounding, Credit Memo Unbilled Receivable

13

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Journal Entry Rule Set Name Journal Line Rules

Debit Memo

Debit Memos - Default Accrual

Debit Memo Charges, Debit Memo Default

Receivable, Debit Memo Deferred Revenue,

Debit Memo Freight, Debit Memo Revenue,

Debit Memo Rounding, Debit Memo Tax, Debit

Memo Unbilled Receivable

Invoice

Invoices - Default Accrual

Invoice Charges, Invoice Default Receivable,

Invoice Deferred Revenue, Invoice Freight,

Invoice Revenue, Invoice Rounding, Invoice Tax,

Invoice Unbilled Receivable

Miscellaneous Receipt

Miscellaneous Receipts

Miscellaneous Receipt Bank Charges,

Miscellaneous Receipt Cleared Cash,

Miscellaneous Receipt Confirmed Cash,

Miscellaneous Receipt Factored Cash,

Miscellaneous Receipt Miscellaneous Cash,

Miscellaneous Receipt Remitted Cash,

Miscellaneous Receipt Short Term Debt,

Miscellaneous Receipt Tax

Receipt

Receipts - Default Accrual

Receipt Bank Charges, Receipt Chargeback

Application, Receipt Cleared Cash, Receipt

Confirmed Cash, Receipt Credit Card

Chargeback Application, Receipt Currency

Rounding, Receipt Default Application, Receipt

Deferred Tax, Receipt Earned Discount,

Receipt Earned Discount Nonrecoverable

Tax, Receipt Exchange Gain Loss, Receipt

Factored Cash, Receipt On Account Application,

Receipt Payment Netting Application, Receipt

Prepayment Application, Receipt Refund

Application, Receipt Remitted Cash, Receipt

Short Term Debt, Receipt Tax, Receipt

Unapplied Cash, Receipt Unearned Discount,

Receipt Unearned Discount on Nonrecoverable

Tax, Receipt Unidentified Cash, Receipt Write-

Off Application, Unapplied Cash

Receipt

Receipt - Basis Journal Entry Rule Set

Receipt Application to Earned Revenue, Receipt

Application to Freight, Receipt Application to

Revenue, Receipt Application to Rounding,

Receipt Application to Suspense Revenue,

Receipt Application to Tax, Receipt Application

to Unbilled Revenue, Receipt Bank Charges,

Receipt Cleared Cash, Receipt Confirmed Cash,

Receipt Currency Rounding, Receipt Earned

Discount, Receipt Earned Discount on Freight,

Receipt Earned Discount on Revenue, Receipt

Earned Discount on Tax, Receipt Exchange

Gain Loss, Receipt Factored Cash, Receipt On

Account Application, Receipt Payment Netting

Application, Receipt Prepayment Application,

Receipt Refund Application, Receipt Remitted

Cash, Receipt Short Term Debt, Receipt

Unapplied Cash, Receipt Unapplied for Gain

Loss lines, Receipt Unearned Discount,

Receipt Unearned Discount on Freight, Receipt

Unearned Discount on Revenue, Receipt

Unearned Discount on Tax, Receipt Unidentified

14

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Journal Entry Rule Set Name Journal Line Rules

Cash, Receipt Write-Off Application, Unapplied

Cash

Accounting Method

Receivables provides the predefined Receivables Default Accrual accounting method.

Subledger Accounting provides the predefined Standard Accrual subledger accounting method that groups the

predefined accounting methods for subledger applications. You can optionally create your own subledger accounting

method.

Receivables assigns the predefined Receivables Default Accrual accounting method to the predefined Standard

Accrual subledger accounting method. You can assign this subledger accounting method to your ledgers.

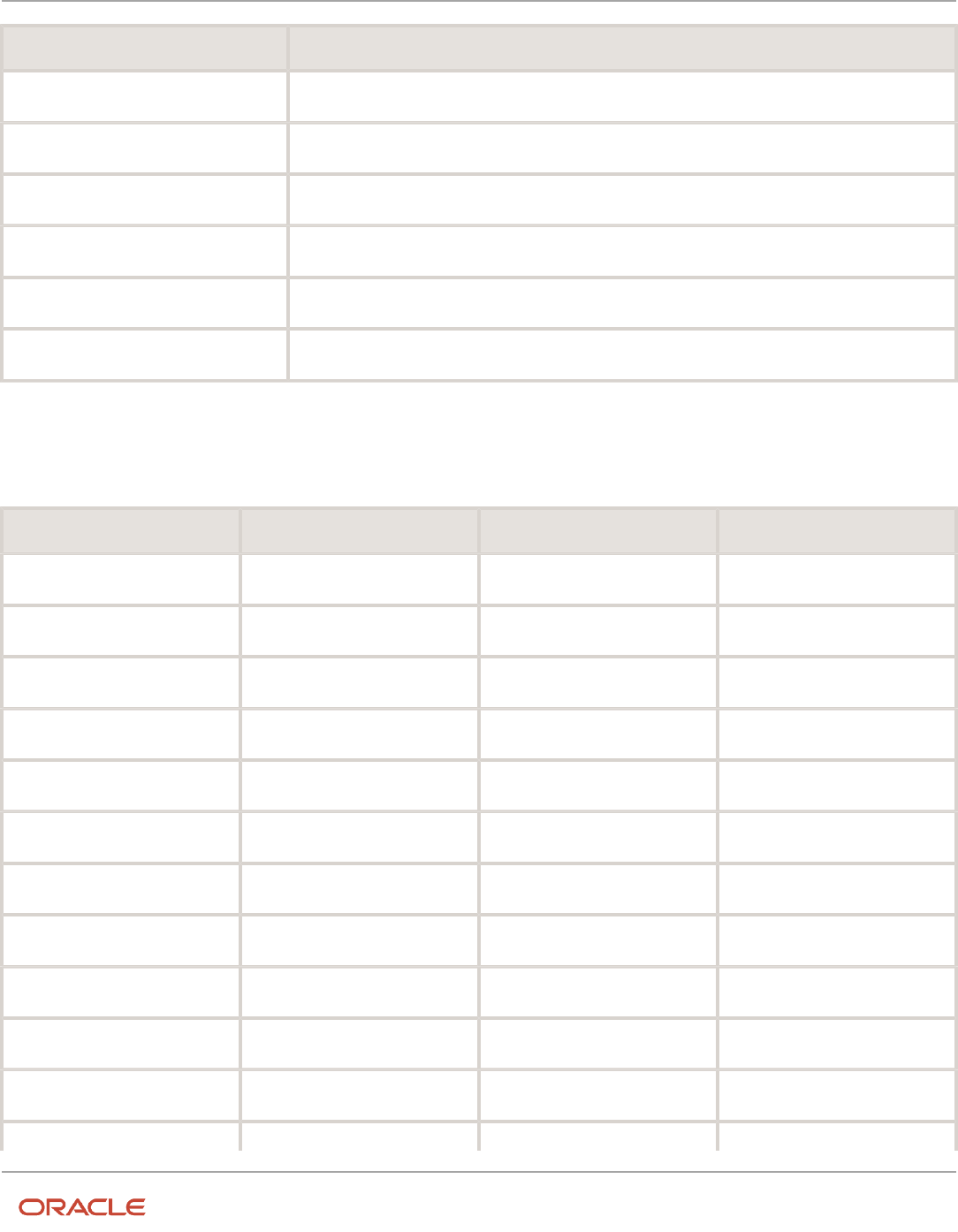

This table lists the assignments for the Receivables Default Accrual accounting method that Receivables predefines for

the Receivables application:

Event Class Assignments Event Type Assignments Create Accounting Journal Entry Rule Set

Assignments

Adjustment

All

Yes

Adjustments - Default Accrual

Chargeback

All

Yes

Chargebacks - Default Accrual

Credit Memo

All

Yes

Credit Memos - Default Accrual

Debit Memo

All

Yes

Debit Memos - Default Accrual

Invoice

All

Yes

Invoices - Default Accrual

Miscellaneous Receipt

All

Yes

Miscellaneous Receipts

Receipt

All

Yes

Receipts - Default Accrual

You can copy the predefined Receivables Default Accrual accounting method and update the accounting method with

new attributes, according to your business requirements.

The following steps provide general guidelines for copying and updating the predefined Receivables Default Accrual

accounting method:

• Create a mapping set for the new attribute values.

• Create an accounting rule based on the mapping set.

• Duplicate the predefined journal entry rule set you want and assign the new accounting rule.

• Duplicate the predefined accounting method assigned to your ledger.

15

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

• In the new accounting method, assign an end date to the applicable predefined journal entry rule set

assignment and assign the new journal entry rule set.

• Activate the new accounting method. This sets the journal entry rule sets to Active.

• Assign the new accounting method to your ledger.

Related Topics

•

Accounting Attribute Assignments

Receivables Accounting Event Model

An accounting event is a business event in Receivables that has an accounting impact. For example, creating or

applying a receipt is an accounting event.

Not all business events have an accounting impact, but you can decide which events you want to monitor as accounting

events. You can modify the accounting setup to create accounting for some events and not for others.

Subledger Accounting categorizes accounting events as event types. Event types are grouped into event classes

that in turn are grouped into event entities. The overall grouping of these components is called an event model. The

Receivables accounting event model is predefined for you, and includes each Receivables event class and its life cycle.

This accounting event model forms the basis for creating subledger accounting.

As the foundation of the event model, Receivables contains predefined event entities. An event entity enables

Subledger Accounting to handle the accounting for similar business events in a consistent manner. The event entities

for Receivables are:

• Transactions

• Receipts

• Adjustments

• Bills Receivable

Each event entity is associated with one or more event classes. An event class represents a category of business events

for a particular activity or document. Event classes group similar event types and enable the sharing of accounting

definitions.

An event type represents a business operation that you can perform for an event class. An accounting event has both

an event class and an event type that affect how the Create Receivables Accounting process determines the subledger

accounting for it. Event types provide the lowest level of detail for storing accounting definitions.

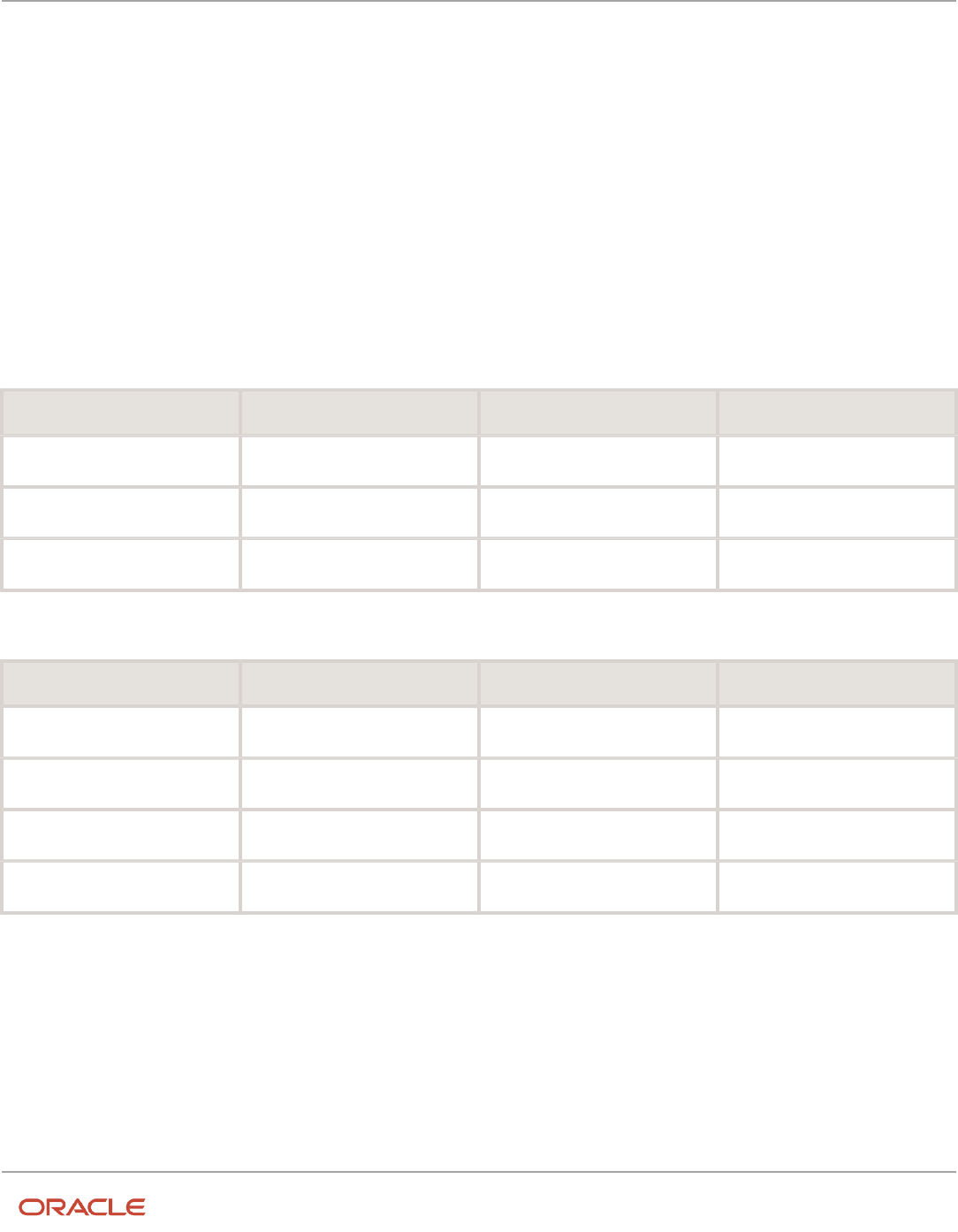

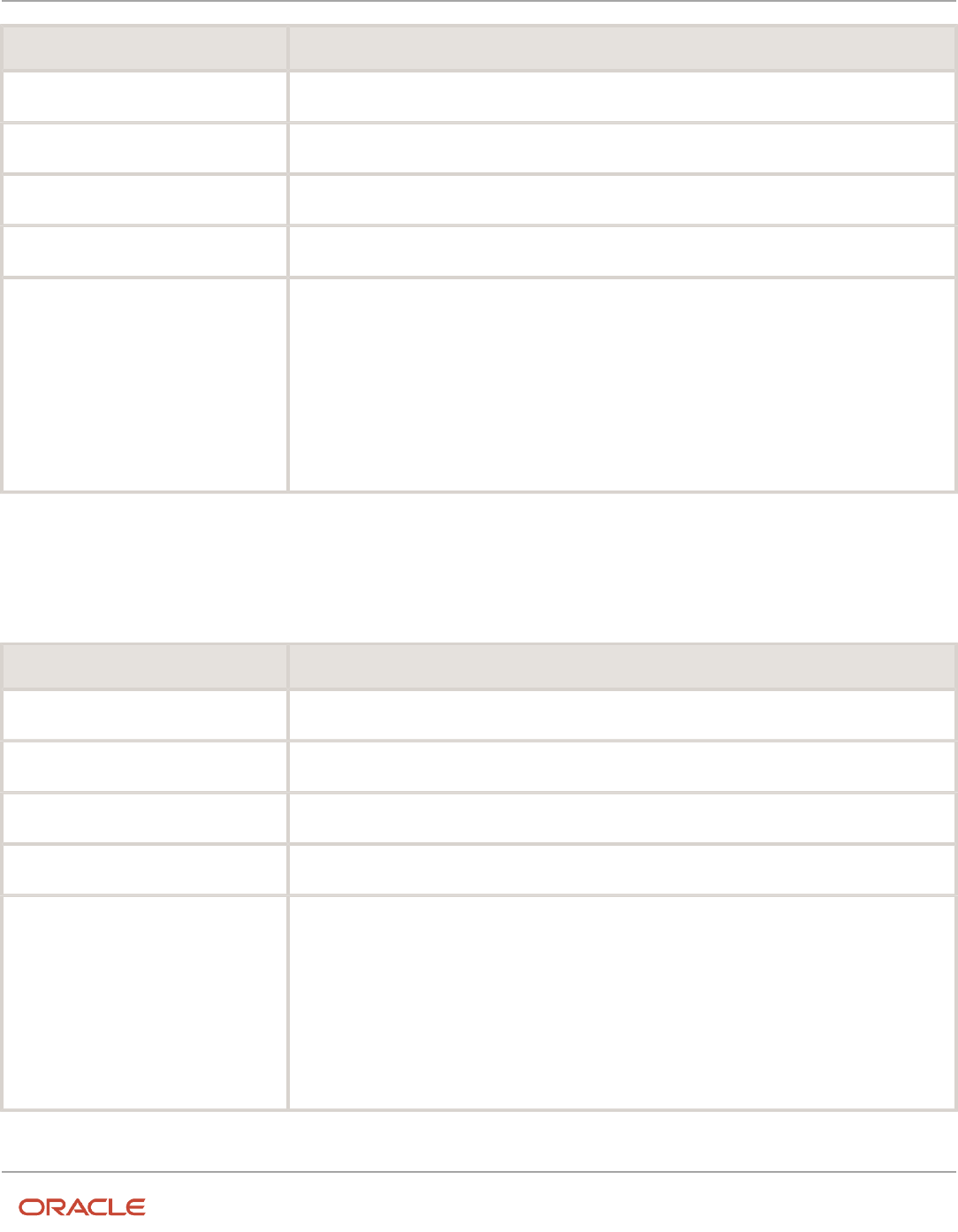

Transactions Event Entity

This table describes the predefined event classes and event types for the Transactions event entity.

Event Class Event Types

Chargeback

Chargeback Created

Credit Memo

Credit Memo Created

16

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Event Types

Credit Memo Updated

Debit Memo

Debit Memo Created

Debit Memo Updated

Invoice

Invoice Created

Invoice Updated

Receipts Event Entity

This table describes the predefined event classes and event types for the Receipts event entity.

Event Class Event Types

Miscellaneous Receipt

Miscellaneous Receipt Created

Miscellaneous Receipt Reverse

Miscellaneous Receipt Updated

Receipt

Receipt Created

Receipt Reverse

Receipt Updated

Adjustments Event Entity

This table describes the predefined event classes and event types for the Adjustments event entity.

Event Class Event Types

Adjustment

Adjustment Created

Bills Receivable Event Entity

This table describes the predefined event classes and event types for the Bills Receivable event entity.

Event Class Event Types

Bills Receivable

Bills Receivable Created

Bills Receivable Updated

17

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Event Class Event Types

Reference Data Sets in Receivables

Use reference data sets to share the values in your Receivables reference data objects either across business units or

within one business unit only.

Receivables includes a predefined Common reference data set. Use the Common set to share reference data that you

want to make available to all business units. For example, you can make the transactions types and transaction sources

created in each business unit available to all other business units.

Create business unit-specific data sets for reference data for use by one business unit only. For example, each business

unit may want to create and maintain its own salespersons and memo lines data.

Note: You must create business unit-specific reference data sets for Customer Sites and Customer Account

Relationships. All other reference data objects can use the predefined Common set.

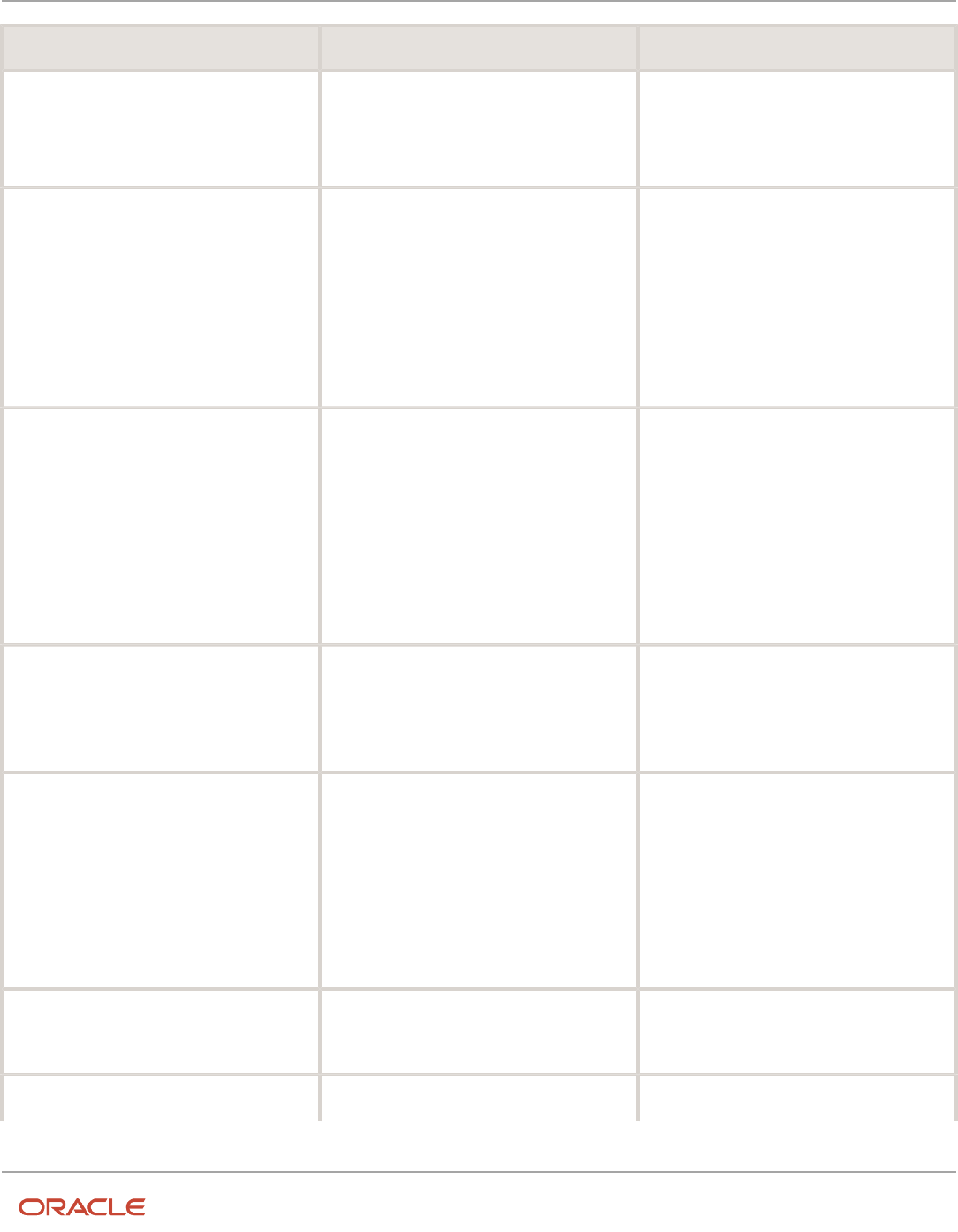

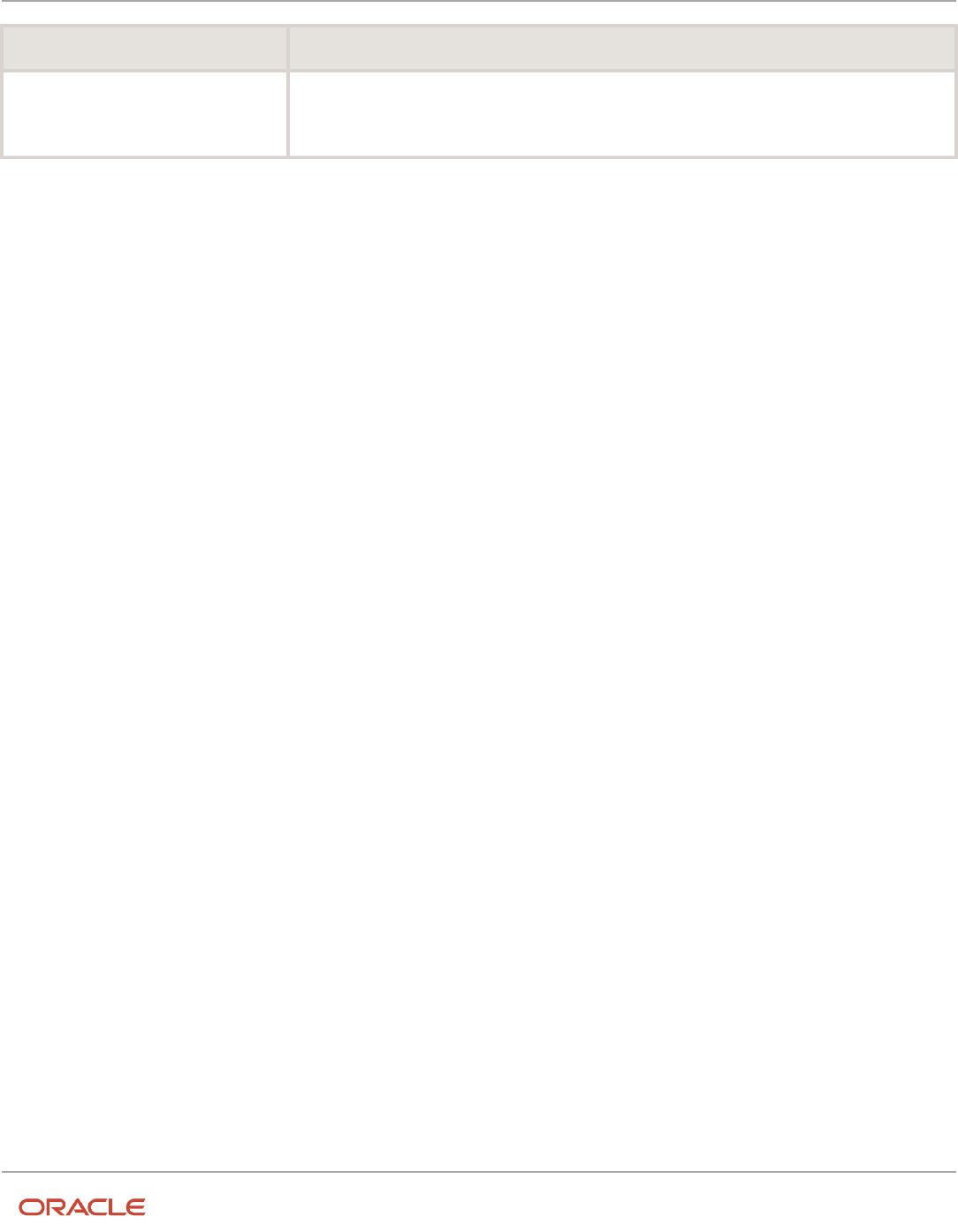

This tables lists the reference data objects in Receivables that are assigned a reference data set.

Receivables Reference Data Objects

Reference Data Object Method of Sharing

Transaction Types Common Set or BU-Specific

Transaction Sources Common Set or BU-Specific

Payment Terms Common Set or BU-Specific

Remit-to Addresses Common Set or BU-Specific

Memo Lines Common Set or BU-Specific

Salespersons Common Set or BU-Specific

Customer Sites BU-Specific Only

Customer Account Relationships BU-Specific Only

AutoCash Rule Sets Common Set or BU-Specific

AutoMatch Rule Sets Common Set or BU-Specific

Application Exception Rule Sets Common Set or BU-Specific

Revenue Scheduling Rules Common Set or BU-Specific

Revenue Contingencies Common Set or BU-Specific

18

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Reference Data Object Method of Sharing

Lockboxes Common Set or BU-Specific

Translated Display of Transaction Type, Transaction

Source, and Receipt Method

You can display the translated names of your transaction types, transaction sources, and receipt methods in your local

language on important Receivables pages and windows.

In certain countries it is a requirement to display the names of these objects in the local language.

Use these three lookup types to create lookup codes with the translation in the local language for each corresponding

object:

• Transaction Type: ORA_AR_TRANSLATED_TRX_TYPE lookup type

• Transaction Source: ORA_AR_TRANSLATED_TRX_SOURCE lookup type

• Receipt Method: ORA_AR_TRANSLATED_RCPT_METHOD lookup type

Use these values for each lookup code:

• Lookup Code: Numerical identifier of the object.

• Reference Data Set: Common Set or any custom set.

• Meaning: Translated name of the object in the local language.

• Description: Description of the translated object.

Before you enter lookup codes with translated names under one of these lookup types, complete these prerequisites:

• Collect the numerical identifiers for the transaction types, transaction sources, and receipt methods that you

want to display in translation.

• Create a list of translated names in advance of entering the corresponding lookup codes.

• Log in under the language that you intend to enter lookup codes for.

To find the numerical identifiers for transaction types and transaction sources:

1. Navigate to the Setup and Maintenance work area.

2. Navigate to the Manage Transaction Types page or Manage Transaction Sources page.

3. Click the Search button to display all transaction types or transaction sources.

4. Select View > Columns > Transaction Type Identifier or Transaction Source Identifier to display this column.

5. Make note of the identifiers for the transaction types and transaction sources that you want to translate.

To find the numerical identifiers for receipt methods:

1. Navigate to the Setup and Maintenance work area.

2. Navigate to the Manage Receipt Class and Methods page.

3. Click the Search button to display all receipt classes.

4. Open the first receipt class that you want in the Edit Receipt Class and Methods page.

5. Select the first receipt method that you want.

19

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

6. Select View > Columns > Receipt Method Identifier to display this column.

7. Make note of the receipt method identifier.

8. Repeat these steps for all receipt methods in all receipt classes that you want.

When you have completed translation of the objects you need and collected the corresponding identifiers, use the

Manage Receivables Lookups task to enter the lookup codes under each lookup type.

In this example, you want to display the transaction type Invoice_1 in French. The translated name of this transaction

type is Facture_1. You confirm that the transaction type identifier for Invoice_1 is 001.

To create the lookup code for this translated transaction type:

1. Log in under the French language.

2. Navigate to the Setup and Maintenance work area.

3. Search for the setup task Manage Receivables Lookups.

4. In the Manage Receivables Lookups page, search for the ORA_AR_TRANSLATED_TRX_TYPE lookup type.

5. Enter a new row for the lookup code.

6. In the Lookup Code field, enter 001.

7. In the Reference Data Set field, enter Common Set.

8. If not selected, enable the Enabled option.

9. In the Start Date field, enter the date from which to display the transaction type in French.

10. In the Meaning field, enter Facture_1.

Note: There is no validation on the text you enter in lookup code fields. You must ensure that the translated

name of the object that you enter in the Meaning field matches the original language name exactly.

11. In the Description field, enter French translation of Invoice_1.

12. Save your work.

The French translation of this transaction type will appear on Receivables pages and windows.

Add as many translated name lookup codes that you need for both new and existing transaction sources, transaction

types, and receipt methods. You may want to create a procedure for regular updates to all objects that require translated

display.

You can create lookup codes under the ORA_AR_TRANSLATED lookup types in all the languages your system supports.

You must log in under each language separately and update the translated names and descriptions for each lookup

code in that language.

Ledger and Legal Entity Document Sequencing

Ledger and Legal Entity Document Sequencing in Receivables

You can set up your primary ledger to use document sequencing in Receivables at the ledger level or legal entity level.

If you enable document sequencing at the legal entity level, then if you have more than one legal entity assigned to

the same ledger, you can assign separate document sequences to Receivables transactions, adjustments, and receipts

belonging to each legal entity.

Legal entity level document sequencing helps you conform to local and governmental authority requirements, while still

being able to organize multiple legal entities under the same primary ledger.

20

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Review these guidelines for document sequencing in Receivables:

• Document Sequencing in Receivables

• Receivables Document Categories

• Chronological Document Sequencing

• Chronological Document Sequencing and Manual Transactions

• Chronological Document Sequencing and AutoInvoice

Document Sequencing in Receivables

To use document sequencing in Receivables, in the Sequencing section of the Specify Options page of your primary

ledger, perform one or both of these tasks:

1. Set the Sequencing By option to Ledger or Legal Entity.

2. Optionally enable the Enforce Document Sequencing option for Receivables.

If you perform step 1 and step 2, then document sequencing is always used in the ledger or all legal entities assigned to

the ledger. You must assign a document sequence to every document category generated by Receivables events.

If you perform step 1 but not step 2, then you can optionally assign document sequences to the Receivables document

categories that meet your business requirements. For example, you can use sequential numbering for receipt

processing only and not for transactions.

Receivables Document Categories

If the primary ledger is enabled for document sequencing at the legal entity level (Sequencing By option set to Legal

Entity), then Receivables creates a document category for each of these Receivables events in all legal entities assigned

to the ledger:

• Invoice transaction type

• Credit memo transaction type

• Debit memo transaction type

• Bills receivable transaction type

• Standard receipt

• Adjustment

To assign a document sequence to a document category:

1. Navigate to the Manage Document Sequence Categories page.

2. Search for the document categories that you want.

You can use the Category Code field to limit your search by entering, for example, Invoice or Receipt.

3. Review the search results to find the document category that you want

4. If necessary, update the category name according to your requirements.

5. Save your changes.

6. Navigate to the Manage Receivables Document Sequences page.

7. Search for the document sequence name that you want, or create a new document sequence.

8. In the Search Results section, update or complete the document sequence setup according to your

requirements.

9. In the Assignments section, select the document category to assign to this document sequence.

10. Save your changes.

21

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

For each Receivables event, the document sequence number is generated when the following related action takes place:

• Transactions: At the time of either saving or completing the transaction, depending on the setting of the

Receivables system option Document Number Generation Level for the applicable business units.

• Adjustments: When the adjustment is submitted.

• Receipts: When the receipt is submitted.

• Bills Receivable: When the bill receivable is completed.

These rules apply to Receivables document sequencing:

• Document sequence date is the accounting date (not, for example, the transaction date or receipt date).

Note: If a bill receivable requires drawee acceptance, then Receivables uses the transaction date instead of

the accounting date to assign the document number. This is because a bills receivable document number is

generated when the bill is completed, not accepted.

• You can't change the legal entity on any transaction that has a document sequence number.

• By default, you can't delete any transaction or receipt that has a document sequence number. If the Receivables

system option Allow payment deletion is enabled, then you can delete receipts and bills receivable

transactions only for the applicable business units.

Chronological Document Sequencing

Document sequencing uses the accounting date as the document sequence date. To help ensure reliable document

sequencing for your transactions, you can enforce the sequencing of document numbers in chronological order.

Note: Chronological document sequencing applies to invoice, credit memo and debit memo transactions only, either

entered manually or imported using AutoInvoice. It doesn't apply to receipts, adjustments, or bills receivable.

To enable chronological document sequencing on Receivables transactions, in the Sequencing section of the Specify

Options page of your primary ledger perform these three tasks:

1. Set the Sequencing By option to Ledger or Legal Entity.

2. Enable the Enforce Document Sequencing option for Receivables.

3. Enable the Enforce Chronological Order on Document Date option.

You must perform all three steps for chronological document sequencing. Enabling the Enforce Chronological

Order on Document Date option enforces the correlation between the document sequence accounting date and the

transaction accounting date. This prevents Receivables from creating a transaction with an accounting date earlier than

the accounting date of the last sequenced document within the same document sequence.

For example, you create an invoice with an accounting date of 01-Jan-2014. This invoice is assigned the document

number 100. The next invoice you create is assigned the document number 101 provided the accounting date of the

invoice is 01-Jan-2014 or later. If the accounting date is earlier than 01-Jan-2014, then Receivables doesn't create the

transaction.

Chronological Document Sequencing and Manual Transactions

If you're using document sequencing and the primary ledger option Enforce Chronological Order on Document

Date is enabled, then you can enforce chronological document sequencing on transactions created manually in your

transaction type setup.

22

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

To enforce chronological document sequencing on transactions created manually:

1. Navigate to the Create or Edit Transaction Type page.

2. Enable the No future dates with chronological document sequencing option.

3. Complete the transaction type setup according to your requirements.

4. Assign this transaction type to the applicable transactions.

When you use this transaction type with transactions you create manually, then Receivables won't create the transaction

if both the transaction and accounting dates are in the future.

Chronological Document Sequencing and AutoInvoice

If you're using document sequencing and the primary ledger option Enforce Chronological Order on Document Date

is enabled, then for AutoInvoice you must set the Receivables system option Accounting Dates Out of Order. Setting

this option determines how AutoInvoice processes transactions when the accounting date is out of order within the

document sequence.

In the Receivables System Options page: Billing and Revenue tab: AutoInvoice section, set the Accounting Dates Out of

Order field to Reject or Adjust:

• Reject: If the transaction accounting date is out of order within the document sequence, reject the transaction

and transfer it to the error table.

• Adjust: If the transaction accounting date is out of order within the document sequence, adjust the accounting

date to conform to the document sequence accounting date.

Related Topics

•

What legal entity is assigned to a transaction?

•

Accounting Date Derivation During AutoInvoice Import

•

Document Sequences

•

Document Sequence Categories

How AutoInvoice Processes Transactions with Document

Sequencing

If the primary ledger is enabled for document sequencing, AutoInvoice validates and assigns document numbers to

transactions according to the requirements of the ledger settings.

Note: If an imported transaction line already has a document number, then AutoInvoice accepts this document

number without further validation.

Settings That Affect AutoInvoice Processing with Document Sequencing

If the primary ledger option Enforce Chronological Order on Document Date is enabled, then you must set the

Receivables system option Accounting Dates Out of Order. Setting this option determines how AutoInvoice processes

transactions when the accounting date is out of order within the document sequence.

23

Oracle Fusion Cloud Financials

Implementing Receivables Credit to Cash

Chapter 1

Define Common Accounts Receivable Configuration

Before you run the Import AutoInvoice program, you must also create and assign document sequences to the document

categories of the transaction types that you plan to assign to imported transactions.

How Transactions with Document Sequencing Are Processed

For the most complete example, if the primary ledger is set for document sequencing at the legal entity level,

AutoInvoice processes transactions in this way: