I-111

FEDERAL PRIVACY ACT In compliance with federal law, you are hereby notified that the request for your Social Security number on the Wisconsin income tax return is made under the

authority of sec. 71.03(6)(a) of the Wisconsin Statutes. The disclosure of this number on your return is mandatory. It will be used for identification purposes throughout the processing,

filing and auditing of your return, and issuing refund checks.

revenue.wi.gov

Wisconsin Income Tax

1

Form 1 Instructions

2023

New in 2023

Capital Loss Deduction – The maximum deduction for a net capital loss

has increased from $500 to $3,000 for most taxpayers. If you are married

College Savings Account – The subtraction for contributions to a

Wisconsin state-sponsored college savings account is increased to $3,860

return or a divorced parent). See the Schedule CS instructions.

Tax Rates Reduced

brackets were reduced. The new tax rates for those brackets are 3.5% and

4.4% respectively.

Tuition and Fee Expenses – The subtraction for tuition and fees decreased

the Schedule SB instructions.

Earned Income Credit – Wisconsin has adopted the changes made to the

federal earned income credit in Public Law 117-2. This law increased the

the credit and made other changes. For Wisconsin's earned income credit,

you must still have a qualifying child to be eligible.

Tax returns are due:

Monday

April 15, 2024

Free help with your taxes

You may be eligible for free

tax help. See page 2 for:

• Who can get help

• How to find a location

• What to bring with you

Para Assistencia Gratuita

en Español

Ver página 2

Reminder

IRS Adjustments – If the IRS adjusted any of your federal income tax

My Tax Account allows taxpayers to:

• Sign up for Wisconsin Identity Protection PIN (see page 34)

• View/schedule estimated payments and cancel previously

scheduled payments

• Opt in to get email from DOR – no need to wait for the mail

• File a standalone homestead credit claim

• Check refund status and more

Visit My Tax Account to file your Wisconsin individual income tax

return (Form 1) online for free (see page 5).

MY TA X

ACCOUNT

Become an Organ Donor

Visit donatelifewisconsin.org to learn about organ and tissue donation in Wisconsin, or

visit the National Donor Registry Program at donatelife.net to learn about organ and tissue

donation in the United States.

2

Para ayuda gratuita para la declaración de sus impuestos y de el Crédito por Vivienda Familiar, llame al “211” para encontrar

un sitio de Asistencia de Voluntarios para Impuestos (Volunteer Income Tax Assistance también conocido como VITA) cerca de

usted. Muchos lugares ofrecen servicios en español.

Para respuestas a las preguntas sobre impuestos, por favor llame el Departamento de Impuestos al (608) 266-2486 para impuestos

individuales y al (608) 266-2776 para impuestos de negocios. Oprima el “2” para ayuda en español.

Para más información, visite revenue.wi.gov, en el vinculo (link) “En Español” usted encontrará información sobre el Credito por

Ingreso de Trabajo, información del Crédito por Vivienda Familiar, y mucho más – todo disponible en español.

Servicio en Español

Free Tax Preparation Available (commonly referred to as VITA or TCE)

Need help filing your taxes?

Wisconsin residents can have their taxes prepared for free at any IRS sponsored Volunteer Income Tax Assistance (VITA) site or

at any AARP sponsored Tax Counseling for the Elderly (TCE) site. These two programs have helped millions of individuals across

the country in preparing their taxes. Trained volunteers will fill out your tax return. Many sites will even e-file your return.

Who can use these services?

• Low to moderate income individuals • Individuals with disabilities • Elderly individuals

• Individuals who qualify for the homestead

credit or the earned income tax credit

What should you bring?

• W-2 wage and tax statements • Information on other sources of income and any deductions

• Photo ID of taxpayer(s) • Social security cards of taxpayer(s) and dependents

• If you are claiming a homestead credit, bring a • Both spouses must be present to file a joint return

completed rent certificate or a copy of your 2023

property tax bill, a record of any Wisconsin Works (W2)

payments received in 2023, and a statement from your

physician or the Veteran’s Administration, or a document

from the Social Security Administration if disabled and under age 62

VITA and TCE locations:

revenue.wi.gov and search “VITA sites”

Table of Contents

Page

General Instructions ................................................. 3

• Which Form to File ................................................ 3

• Who Must File .................................................... 3

• Age ............................................................ 3

• Other Filing Requirements ........................................... 3

• Who Should File .................................................. 4

• How To Get An Extension Of Time To File .............................. 4

• Filing Your Return ................................................. 4

• Questions About Refunds ........................................... 6

• Amending Your Return ............................................. 7

Special Instructions .................................................

Tax Help / Resources ............................................... 11

Line Instructions ................................................... 12

2023 Standard Deduction Table ....................................... 35

2023 Tax Table .................................................... 38

2023 Tax Computation Worksheet ..................................... 44

Wisconsin School District Number ..................................... 45

Index ............................................................ 46

3

General Instructions

Other Filing Requirements

You may have to file a return even if your income is less than the amounts shown on the table. You must file a return for 2023 if:

• You could be claimed as a dependent on someone else’s return and either of the following applies:

(1) Your gross income was more than $1,250 and it included at least $401 of unearned income, or

(2) Your gross income (total unearned income and earned income) was more than –

$12,760 if single,

$16,480 if head of household,

$23,620 if married filing jointly, or

$11,220 if married filing separately.

Unearned income includes taxable interest, dividends, capital gain distributions, and taxable scholarship and fellowship

grants that were not reported to you on a Form W-2. Earned income includes wages, tips, self-employment income, and

scholarship and fellowship grants that were reported to you on a Form W-2.

• You owe a penalty on an IRA, retirement plan, Coverdell education savings account (excess contribution), ABLE account, health

savings account, or Archer medical savings account.

• You were a nonresident or part-year resident of Wisconsin for 2023 and your gross income was $2,000 or more. If you were

married, you must file a return on Form 1NPR if the combined gross income of you and your spouse was $2,000 or more. A

during a state of emergency declared by the Governor. For further information, see Publication 411, Disaster Relief.

Who Must File

Age as of You must file if your gross income*

Filing status December 31, 2023 (or total gross income of a married couple) during 2023 was:

Single Under 65 $13,460 or more

65 or older $13,710 or more

Married-filing joint Both spouses under 65 $25,020 or more

return

One spouse 65 or older $25,270 or more

Both spouses 65 or older $25,520 or more

return

65 or older $12,170 or more (applies to each spouse individually)

Head of household Under 65 $17,180 or more

65 or older $17,430 or more

*

Gross income means all income (before deducting expenses) reportable to Wisconsin. The income may be received in the form

of money, property, or services. It does not include items that are exempt from Wisconsin tax. For example, it does not include

If your birthday falls on January 1, 2024, you are considered to be a year older as of December 31, 2023. Example: If you

Age

Which Form to File

You must file Form 1 if you were a full-year resident of Wisconsin. You must file Form 1NPR if you:

• Were domiciled* in another state or country at any time during the year, OR

• Are married filing a joint return and your spouse was domiciled* in another state or country at any time during the year.

*Your domicile is your true, fixed, and permanent home to which, whenever absent, you intend to return. You can be physically

present or residing in one locality but maintain your domicile in another.

Your domicile, once established, does not change unless all three of the following circumstances occur or exist:

(1) You intend to abandon your old domicile and take actions consistent with that intent

(2) You intend to acquire a new domicile and take actions consistent with that intent

(3) You are physically present in the new domicile

Service members and their spouses If you meet the conditions under 50 U.S.C. 4001, you may elect to treat Wisconsin as your

state of residence. See Publication 128, Wisconsin Tax Information for Military Personnel and Veterans, for more information. If

you are married and filing jointly, both spouses must be a full-year resident of Wisconsin or elect to claim Wisconsin as their state

of residence to file on Form 1.

4

General Instructions

Who Should File

Even if you do not have to file, you should file to get a refund if:

• You had Wisconsin income tax withheld from your wages

• You paid estimated taxes for 2023

• You claim the earned income credit or the veterans and surviving spouses property tax credit

How To Get An Extension Of Time To File

Your return is due April 15, 2024.

If you cannot file on time, you can get an extension. You can use any federal extension provision for Wisconsin, even if you are

filing your federal return by April 15.

How to get an extension You do not need to submit a request for an extension to us prior to the time you file your Wisconsin

return. When you file your Form 1 Include either of the following:

• A copy of your federal extension application (for example, Form 4868)

• A statement indicating which federal extension provision you want to apply for Wisconsin (for example, the federal automatic

6-month extension provision)

Note You will owe interest on any tax that you have not paid by April 15, 2024. This applies even though you may have an

extension of time to file. If you do not file your return by April 15, 2024, or during an extension period, you may have to pay

additional interest and penalties. If you expect to owe tax with your return, you can avoid the 1% per month interest charge during

the extension period by paying the tax by April 15, 2024. Submit the payment with a 2023 Wisconsin Form 1-ES. You can get this

form at any Department of Revenue office or use our estimated income tax interactive voucher on our website. Use Form 1-ES

to make an extension payment even if you will be filing your return electronically – do not use Form PV. Exception: You will not

be charged interest during an extension period if (1) you served in support of Operation Enduring Sentinel in the United States,

(2) you qualify for a federal extension because of service in a combat zone or contingency operation, or (3) you qualify for a federal

extension due to a federally declared disaster. See Special Conditions below.

If you were a farmer or fisher and you did not make estimated tax payments, you must file your return and pay any tax due by

March 1, 2024, to avoid paying interest for underpayment of estimated tax. Farmers and fishers are individuals who earn at least

two-thirds of their gross income (gross income of both spouses if married filing a joint return) from farming or fishing.

Special Conditions A “Special Conditions” section is located to the right of the Filing Status section on page 1 of Form 1. If you

have an extension of time to file due to service in support of Operation Enduring Sentinel in the United States, enter “01” in the

Special Conditions box. If you qualify for an extension because of service in a combat zone or contingency operation, enter “02”

in the box. If you qualify for a 2-month extension because you live outside or are on duty in military or naval service outside the

United States or Puerto Rico on the due date of the return, enter "18" in the box. If you qualify for an extension because of a

federally-declared disaster, enter “03” in the box and indicate the specific disaster on the line provided.

Filing Your Return

Preparing to file

Before filing your return, follow the steps below in the order listed:

1. Gather your records – Make sure that you have all of your income expense records (for example, wage, interest, and dividend

statements)

2. Electronic filing (e-filing) vs. paper filing – If you e-file, follow the instructions included in your software; otherwise, for paper

filing, continue with step 3

3. Complete federal return – Complete your federal return and its supporting schedules; however, if you are not required to file

a federal return, list the sources and amounts of your income and deductions on a separate sheet

Electronic filing (e-filing)

revenue.

wi.gov/Pages/FAQs/pcs-e-faq.aspx for more information.

5

General Instructions

• My Tax Account (MTA)

revenue.wi.gov/Pages/WisTax/home.aspx for

more information.

• Full-year Wisconsin resident

• Only claiming limited additions to income on Schedule AD and/or subtractions from income on Schedule SB

• Only claiming the following credits: school property tax credit, itemized deduction credit, additional child and dependent care

credit, married couple credit, earned income credit, and/or veterans and surviving spouses property tax credit

Note:

the homestead credit through MTA.

• Tax professional – Visit our website at revenue.wi.gov/Pages/OnlineServices/city-home.aspx

professional

• Tax preparation software

(see

see revenue.wi.gov/Pages/OnlineServices/webased.aspx)

Paper filing

to ensure you receive your refund faster.

Important information:

• Send original copies

• Use black ink

• Clearly write your name and address using capital letters (do not use mailing labels)

• Do not use commas and dollar signs as they can be misread when scanned

• Round amounts to whole dollars

• Do not add cents in front of the preprinted zeros on entry lines

• To indicate a negative number, use a negative sign (for example, -8300 not (8300))

• Print your numbers clearly: Do not use:

• If you make a mistake, erase or start over (do not cross out entries)

• Put entries on the lines and do not write in the margins or above or below the lines

• Lines where no entry is required should be left blank (do not enter zeros)

” when scanned)

• Do not staple your return as stapling will delay the processing of your return and any refund

Filing your return

When filing your return, complete the steps below in the order listed:

1. Complete Wisconsin return – Follow the line instructions as you fill in your return and sign your complete return (a joint return

must be signed by both spouses)

2. Check and assemble return – Check your return for any errors or missing documents and see below for information on how

to assemble your return

3. Make a copy – Make a copy of your return for your records

4. Mail return – Mail your return and all required documents (see page 6 for the address)

Assembling your return

Begin by putting the four pages of Form 1 in numerical order. Then, attach, using a paper clip, the following in the order listed.

Note: If filing Form 804, Claim for Decedent's Wisconsin Income Tax Refund, with the return, place Form 804 on top of Form 1.

Do not attach a Form W-RA if you are filing your return on paper. Form W-RA is used only when submitting information for

an electronically filed return.

1. Payment – If you owe an amount with your return, paper clip your payment to the front of Form 1, unless you are paying by

credit card or online.

6

General Instructions

2. Wisconsin schedules – Copies of appropriate Wisconsin schedules and supporting documents, such as Schedule H or H-EZ

(homestead credit), Schedule FC or FC-A (farmland preservation credit), or Schedule CR. If you are reporting income and

expenses of a disregarded entity, attach Schedule DE, Disregarded Entity Schedule.

3. Amended return – Include Schedule AR, Explanation of Amended Return, with your amended return and all supporting forms

and schedules for items changed. Don’t send a copy of your original return.

4. Form W-2 or 1099

5. Federal return – A complete copy of your federal return (Form 1040 or 1040-SR) and its supporting schedules and forms (such

as federal Form 8886, Reportable Transaction Disclosure Statement.)

6. Extension form or statement – A copy of your federal extension application form or required statement if you are filing under

an extension of time to file.

7. Divorce decree –

• Persons divorced after June 20, 1996, who compute a refund - If your divorce decree apportions any tax liability owed to the

department to your former spouse, include a copy of the decree with your Form 1. Enter “04” in the Special Conditions box

on page 1 of Form 1. This will prevent your refund from being applied against such tax liability.

• Persons divorced who file a joint return – If your divorce decree apportions any refund to you or your former spouse, or

between you and your former spouse, the department will issue the refund to the person(s) to whom the refund is awarded

under the terms of the divorce. Include a copy of the portion of your divorce decree that relates to the tax refund with your

Form 1. Enter “04” in the Special Conditions box on page 1 of Form 1.

8. Injured spouseInjured Spouse Allocation, include a copy with your Form 1. Enter “05”

in the Special Conditions box on page 1 of Form 1.

CAUTION Be sure to file all four pages of Form 1. Send the original of your return. Do not send a photocopy.

Where to File

Mail your return (an original return or amended return) to the Wisconsin Department of Revenue at:

(if tax is due) (if refund or no tax due) (if homestead credit claimed)

Madison WI Madison WI Madison WI

Envelopes without enough postage will be returned to you by the post office. Your envelope may need additional postage if it

contains more than five pages or is oversized (for example, it is over ¼” thick). Also, include your complete return address.

Private Delivery Services You can use certain private delivery services approved by the Internal Revenue Service (IRS) to meet

the timely filing rule. The approved private delivery services are listed in the instructions for your federal tax form. Items must be

delivered to Wisconsin Department of Revenue, 2135 Rimrock Rd., Madison WI 53713. Private delivery services cannot deliver

items to PO boxes. The private delivery service can tell you how to get written proof of the mailing date.

Questions About Refunds

Call:

(608) 266-8100 in Madison,

Visit our website at:

revenue.wi.gov

or

If you need to contact us about your refund, please wait at least 12 weeks after filing your Form 1. Refund information may not

be available until that time. The department may not issue a refund before March 1 unless both the individual and the individual’s

employer have filed all required returns and forms with the department for the taxable year for which the refund was claimed.

You may call one of the numbers listed above or write to:

Mail Stop 5-77

Wisconsin Department of Revenue

If you call, you will need your social security number and the dollar amount of your refund.

An automated response is available when you call one of the numbers listed above. If you need to speak with a person, assistance

is available Monday through Friday from 7:45 a.m. to 4:30 p.m. by calling (608) 266-2486 in Madison (long-distance charges, if

applicable, will apply).

You may also get information on your refund using our secure website at revenue.wi.gov.

7

General Instructions

Amending Your Return

unextended due date of your original return (for example, April 17, 2028, for 2023 calendar-year returns). However, a claim for

your federal or other state return.

space at the top of page 1. Exception: If you incurred a net operating loss (NOL) on your 2023 Form 1 and elect to carry the NOL

Carryback of Wisconsin Net Operating Loss, for the appropriate year to amend

your return and claim a refund.

Be sure to include Schedule AR with your amended return to explain all changes and the reason for the change.

joint return, both of you must sign the amended return. If there is any tax due, it must be paid in full. You cannot change from joint

pro forma return are then used to complete the amended return. Follow the Form 1 instructions to complete your amended return.

Credit Repayments

If you are required to repay a Wisconsin credit, you must amend your Wisconsin return for the year in which the disposal of the

property occurred to report the amount of the repayment. Report the repayment on line 25. See below for examples of credits

which you may have to repay.

• State historic rehabilitation credit You may have to repay all or part of the state historic rehabilitation credit if you dis posed

of the property within 5 years after the date on which the preservation or rehabilitation work was complete or the Wisconsin

Historical Society determines that you have not complied with all of the requirements.

If sale, conveyance, or noncompliance of the property on which the historic rehabilitation credit is computed occurs during the

1st, 2nd, 3rd, 4th, or 5th year after the date on which the preservation or rehabilitation is completed, then 100%, 80%, 60%,

40%, or 20%, respectively, of the amount of the credits received for rehabilitating or preserving the property will be calculated

and added back into the individual's tax liability, according to sec. , Wis. Stats. The repayment is made for the taxable

year in which the recapture event occurs.

The IRS created federal Form 4255, Recapture of Investment Credit, and the federal Form 4255 instructions in order to compute

the amount of the historic rehabilitation tax credit required to be repaid. While Wisconsin has a separate historic tax credit for

personal residences, federal Form 4255 can be used to determine the repayment by substituting the Wisconsin credit for the

federal credit.

Example: Taxpayer completed $20,000 of historic rehabilitation expenditures which were approved on November 1, 2021.

1.

the recapture percentage in the chart on the next page. The number of full years between November 1, 2021, and December

1, 2023, is two, so the recapture percentage is 60%.

8

General Instructions

Applicable Laws and Rules

This document provides statements or interpretations of the following laws and regulations enacted as of October 31, 2023:

4. Reporting the repayment

Enter the repayment on line 25 of Form 1. Include a copy or attach a PDF of the federal Form 4255 used to compute the

repayment. Write "Wisconsin" at the top.

• Supplement to federal historic rehabilitation credit If you were required to repay to the IRS a portion of the federal historic

the department a proportionate amount of the Wisconsin credit.

Note:

If you did not claim the federal historic rehabilitation tax credit and only claimed the Wisconsin supplement to federal historic

rehabilitation credit, the computation for repayment of the supplement to the federal historic rehabilitation credit is the same as

the computation for repayment of the state historic rehabilitation credit shown above.

• Angel investment credit or early stage seed investment credit If an investment for which you claimed the angel invest ment

credit or early stage seed investment credit in a prior year was held for less than three years, you must repay the amount of the

credit that you received related to the investment. This does not apply if the investment becomes worthless, as determined by

by WEDC, occurs during the 3-year period.

• Low-income housing credit

of the last day of the immediately preceding taxable year, you must repay an amount equal to the amount you were required to

repay to the IRS for the federal low-income housing credit.

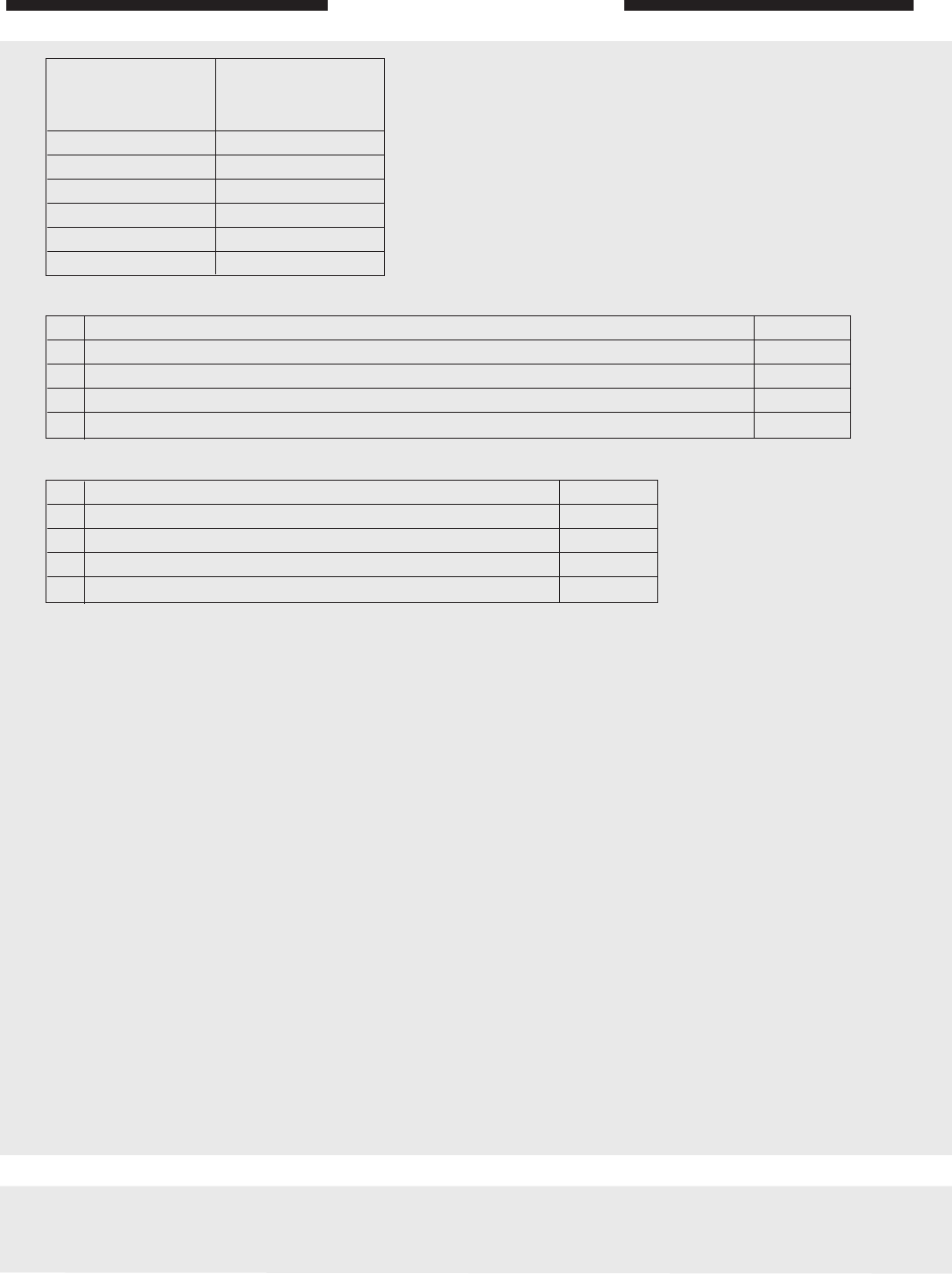

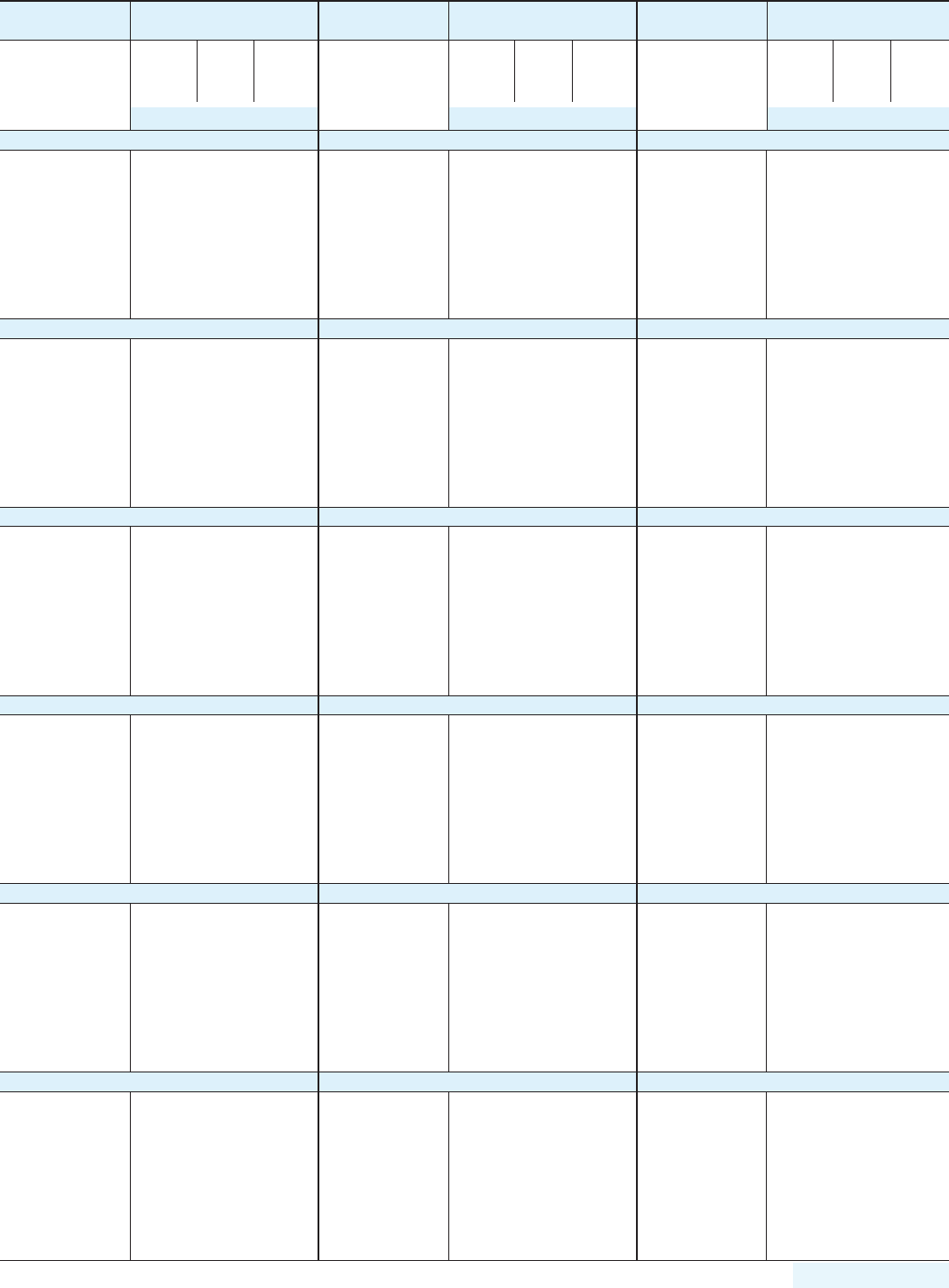

Number of Full Years

from Date Approved

to Recapture Date

Recapture

Percentage

0

1

2

3

4

5

100%

80%

60%

40%

20%

0%

2. Determine the recapture amount:

$3,000

$ 0

0.60

1

2

3

4

5

Total (subtract line 2 from line 1)

Recapture percentage from table above

Multiply line 3 by line 4. This is the amount of repayment required on the 2023 tax return

$3,000

$1,800

3. Compute the amount of unused credit carryover available

1

2

3

4

5

Total amount of credit computed

Less: Amount of credit claimed on tax return

Total (subtract line 2 from line 1)

Enter the inverse of the recapture percentage (1-0.60)

Multiply line 3 by line 4. This is the available credit carryover

$ 800

$5,000

0.40

$2,000

$3,000

Special Instructions

Penalties for Not Filing Returns or Filing Incorrect Returns

If you do not file an income tax return which you are required to file, or if you file an incorrect return due to negligence

or fraud, penalties and interest may be assessed against you. The interest rate on delinquent taxes is 18% per year.

Civil penalties can be as much as 100% of the amount of tax not reported on the return. Criminal penalties for failing

to file or filing a false return include a fine up to $10,000 and imprisonment.

Fraudulent or Reckless Credit Claims

Fraudulent or reckless claims for any refundable credit, including, but not limited to, the earned income credit,

homestead credit, or the veterans and surviving spouses property tax credit, are subject to filing limitations. If you

file a “fraudulent claim,” you will not be allowed to take any refundable credit for 10 years. “Fraudulent claim” means

a claim that is false or excessive and filed with fraudulent intent. If you file a “reckless claim,” you will not be allowed

to take any refundable credit for 2 years. “Reckless claim” means a claim that was improper, due to reckless or

intentional disregard of income tax law or department rules and regulations. You may also have to pay penalties.

Internal Revenue Service Adjustments

Did the IRS adjust any of your federal income tax returns? If yes, you may have to notify the Department of Revenue

of such adjustments. You must notify the department if the adjustments affect your Wisconsin income, any credit, or

tax payable.

The department must be notified within 180 days after the adjustments are final. You must submit a copy of the final

federal audit report by doing one of the following:

(1) Including it with an amended return that reflects the federal adjustments

(2) Mailing the copy to: Wisconsin Department of Revenue

Audit Bureau

Estimated Tax Payments Required for Next Year

If your 2024 Wisconsin income tax return will show a tax balance due to the department of $500 or more, you must

do one of the following:

• Make estimated tax payments for 2024 in installments beginning April 15, 2024, using Wisconsin Form 1-ES

• Increase the amount of income tax withheld from your 2024 pay

For example, you may have a tax balance due with your return if you have income from which Wisconsin tax is not

withheld. If you do not make required installment payments, you may be charged interest.

For more information, contact the department’s Customer Service Bureau at (608) 266-2486 or visit any Department

of Revenue office. For additional information on making payments, see our Make a Payment website.

If you must file Form 1-ES and do not receive a form in the mail, go to our website to fill out the Wisconsin Estimated

Income Tax Interactive Voucher or contact any Department of Revenue office.

Armed Forces Personnel

If you were a Wisconsin resident on the date you entered military service, you are considered a Wisconsin resident

during your entire military career unless you take action to change your legal residency or qualify to make an election

under 50 U.S.C. 4001. For more information, get Publication 128, Wisconsin Tax Information for Military Personnel

and Veterans.

Homestead Credit

The Wisconsin homestead credit program provides direct relief to homeowners and renters. You may qualify if you

were:

– At least 18 years old on December 31, 2023

– If you were under age 62, and not disabled, you must have earned income to qualify

10

Special Instructions

– A legal resident of Wisconsin for all of 2023

– Not claimed as a dependent on anyone’s 2023 federal tax return (unless you were 62 or older on December 31, 2023)

– Not living in tax-exempt public housing for all of 2023 (Note: Some exceptions apply to this rule and are explained

in the instructions for the homestead credit schedule)

– Not living in a nursing home and receiving medical assistance (Title XIX) when you file for homestead credit

– Had total household income, including wages, interest, social security, and income from certain other sources, below

$24,680 in 2023

If you (or your spouse if married) claim the veterans and surviving spouses property tax credit or farmland preservation

credit, you are not eligible for homestead credit.

For more information about homestead credit, contact our Homestead Unit in Madison at (608) 266-8641 or any

department office. See page 11 for information on obtaining Schedule H or H-EZ, which you must complete to apply

for the credit. Schedules H and H-EZ are also available at many libraries.

Farmland Preservation Credit

The farmland preservation credit program provides an income tax credit to Wisconsin residents who own farmland

in Wisconsin. If you claim homestead credit or the veterans and surviving spouses property tax credit, you are not

eligible for farmland preservation credit. For more information about farmland preservation credit, contact our Farmland

Preservation Unit in Madison at (608) 266-2442 or visit any department office. See page 11 for information on obtaining

Schedule FC or FC-A, which you must complete to apply for the credit.

Death of a Taxpayer

A return for a taxpayer who died in 2023 should be filed on the same form which would have been used if they had

lived. Include only the taxpayer’s income up to the date of their death.

If there is no estate to probate, a surviving heir may file Form 1 for the person who died. If there is an estate, the

personal representative for the estate must file the return. The person filing the Form 1 should sign it and indicate

their relationship to the person who died (for example, “surviving heir” or “personal representative”).

Be sure to fill in the surviving heir’s or personal representative’s mailing address in the address area of Form 1. If the

taxpayer did not have to file a return but paid estimated tax or had tax withheld, a return must be filed to get a refund.

Claim for Decedent’s Wisconsin Income Tax

Refund, with the return and check the box below the special conditions box on page 1 of Form 1. If you did not submit

Form 804 with the return, you were issued a refund, and you are not able to cash the refund check, complete Form 804

and mail the completed form and refund check to the address shown on Form 804.

If your spouse died during 2023 and you did not remarry in 2023, you can file a joint return. You can also file a joint

return if your spouse died in 2024 before filing a 2023 return. A joint return should show your spouse’s 2023 income

before death and your income for all of 2023. Write “Filing as surviving spouse” in the area where you sign the return.

If someone else is the personal representative, they must also sign.

If the return for the decedent is filed as single, head of household, or married filing separate, enter “06” in the Special

Conditions box and indicate the date of death on the line provided. If a joint return is being filed, enter “06” in the

box if it is the primary taxpayer (person listed first on the tax form) who is deceased and the date of death. If it is the

spouse who is deceased, enter “07” in the box and the date of death. If both spouses are deceased, enter “08” in the

box and both dates of death.

If your spouse died before 2023 and you have not remarried, you must file as single or, if qualified, as head of house-

hold. For more information about the final income tax return to be filed for a deceased person, visit any Department

of Revenue office or call the department’s Customer Service Bureau at (608) 266-2486.

Requesting Copies of Your Returns

The Department of Revenue will provide copies of your Wisconsin returns for prior years. Persons requesting copies

should complete the online application at tap.revenue.wi.gov/mta, then click on Request Tax Record Copy under

Additional Services. Include all required information and fee with your application.

11

Tax Help and Additional Forms

Tax Help / Resources

The Wausau office is open on a limited schedule.

Customer assistance:

phone: (608) 266-2486

email: DORIncome@wisconsin.gov

Forms requests:

website: revenue.wi.gov

Madison –

Mail Stop 5-77

2135 Rimrock Rd.

Milwaukee –

Milwaukee WI 53203-1606

Appleton –

265 W. Northland Ave.

Eau Claire –

State Office Bldg., 718 W. Clairemont Ave.

Eau Claire WI 54701-4558

Green Bay –

200 N. Jefferson St., Rm. 140

Internet Address

Our website, revenue.wi.gov, has many resources to help you with your tax needs, including:

• Completing electronic forms and submitting them for free

• Downloading forms, schedules, instructions, and publications

• Viewing answers to common questions

• Emailing us comments or requesting help

• Filing your return electronically

TTY Equipment – Telephone help is available using TTY equipment. Call the Wisconsin Telecommunications Relay

System at 711.

Publications Available

The following is a list of some of our publications. These publications give detailed information on specific areas of

Wisconsin tax law. You can get these publications from any department office or from our website.

Number and Title

102 Wisconsin Tax Treatment of Tax-Option (S) Corporations and Their Shareholders

103 Reporting Capital Gains and Losses for Wisconsin

106 Wisconsin Tax Information for Retirees

111 How to Get a Private Letter Ruling From the Wisconsin Department of Revenue

113 Federal and Wisconsin Income Tax Reporting Under the Marital Property Act

117 Guide to Wisconsin Wage Statements and Information Returns

120 Net Operating Losses for Individuals, Estates, and Trusts

121 Reciprocity

122 Tax Information for Part-Year Residents and Nonresidents

125 Credit for Tax Paid to Another State

126 How Your Retirement Benefits Are Taxed

127 Wisconsin Homestead Credit Situations and Solutions

128 Wisconsin Tax Information for Military Personnel and Veterans

401 Extensions of Time to File

405 Wisconsin Taxation Related to Native Americans

503 Wisconsin Farmland Preservation Credit

600 Wisconsin Taxation of Lottery Winnings

601 Wisconsin Taxation of Pari-Mutuel Wager Winnings

You can get tax help, forms, or publications at any of the following Department of Revenue offices:

(Note: Mail completed returns to the address shown on the return.)

12

Line Instructions

Before completing Form 1, first fill in your federal return and its supporting attachments. If you are not required to file a federal

return, list the sources and amounts of your income and deductions on a separate sheet and include it with your Form 1.

Follow these instructions to complete Form 1. Prepare one copy for your records and another to be filed with the department.

Use black ink to complete the copy of Form 1 that you submit to the department. Do not use pencil or red ink.

Amended Return If you already filed your original return and this is an amended return, place a check mark where indi-

cated at the top of Form 1. For more information, see Amending Your Return on page 7 of these instructions. Be sure

to include a copy of Schedule AR with your amended return.

Period Covered File your 2023 return for calendar year 2023 and fiscal years that begin in 2023. For a fiscal year, a 52-

53 week period, or a short-period return, fill in the taxable year beginning and ending dates in the taxable year space at

the top of the form. If your return is for a fiscal year, a 52-53 week period, or a short-period, also enter “11” in the Special

Conditions box located to the right of the Filing Status section on page 1 of Form 1.

Name and Address Print or type your legal name and address. Include your apartment number, if any. If you are married

filing a joint return, fill in your spouse’s legal name (even if your spouse did not have any income). If you filed a joint return

for 2022 and you are filing a joint return for 2023 with the same spouse, be sure to enter your names and social security

numbers in the same order as on your 2022 return.

Fill in your PO Box number only if your post office does not deliver mail to your home.

Social Security Number Fill in your social security number. You must also fill in your spouse’s social security number if

you are married filing a joint return or married filing a separate return (including married filing as head of household).

Filing Status Check the appropriate space to indicate your filing status. More than one filing status may apply to you. If

it does, choose the one that will give you the lowest tax.

If you became divorced during 2023 or are married and will file a separate return (including a married person filing

Tax Information for Married Persons Filing Separate Returns and

Persons Divorced in 2023, for information on what income you must report.

Single You may check “single” if any of the following was true on December 31, 2023:

• You were never married

• You were legally separated under a final decree of divorce or separate maintenance. Note: A decree of separate main-

tenance in Wisconsin is a judgement of legal separation granted by a judge under sec. 767.35, Wis. Stats.

• You were widowed before January 1, 2023, and did not remarry in 2023

Married filing joint return Most married couples will pay less tax if they file a joint return. You may check “married filing

joint return” if any of the following is true:

• You were married as of December 31, 2023

• Your spouse died in 2023 and you did not remarry in 2023

• You were married at the end of 2023, and your spouse died in 2024 before filing a 2023 return

A married couple may file a joint return even if only one had income or if they did not live together all year. However, both

spouses must sign the return. If you file a joint return, you may not, after the due date for filing that return, amend it to file

as married filing separately. A joint return cannot be filed if you and your spouse have different tax years.

If you file a joint return, both you and your spouse are responsible for any tax due on the return. This means that if one

spouse does not pay the tax due, the other may have to.

Married filing separate return If you file separate returns, you will usually pay more state tax than if you file a joint return.

Your tax may be higher on separate returns because:

• You cannot take the married couple credit

• If you lived with your spouse at any time in 2023, a greater amount of any unemployment compensation that you received

may be taxable

• You will not qualify for the disability income exclusion

13

Line Instructions

Code

01

Code

02

Code

03

Code

04

Code

05

Code

06

Code

07

Code

08

Code

11

Code

16

Code

99

Head of household If you qualify to file your federal return as head of household, you may also file as head of household

for Wisconsin. Unmarried individuals who paid over half the cost of keeping up a home for a qualifying person (such as a

child) can use this filing status. Certain married persons who lived apart from their spouse for the last 6 months of 2023 and

paid over half the cost of keeping up a home that was the main home of their child, stepchild, or foster child for more than

half of 2023 may be able to use this status.

If you qualify to file as head of household and are NOT married, check "Head of household, NOT married".

If you are married and qualify to file as head of household, be sure to check “Head of household, married". Also fill in your

spouse’s name and social security number in the spaces provided.

If you do not have to file a federal return, contact any Department of Revenue office to see if you qualify. If you file your

federal return as a qualifying surviving spouse, you may file your Wisconsin return as head of household.

Tax District Check either city, village, or town and fill in the name of the Wisconsin city, village, or town in which you lived

on December 31, 2023. Also fill in the name of the county in which you lived.

School District Number See the list of school district numbers on page 45. Fill in the number of the school district in

which you lived on December 31, 2023.

Special Conditions Below is a list of the special condition codes that you may need to enter in the special conditions

box on Form 1. Be sure to read the instruction on the page listed for each code before using it. Using the wrong code or not

using a code when appropriate could result in an incorrect tax computation or a delay in processing your return.

Extension – Operation Enduring Sentinel (page 4) Both taxpayers deceased (page 10)

Extension – Combat zone (page 4) Fiscal filer (page 12)

Extension – Federally declared disaster (page 4) Schedule RT attached (Schedule SB instructions,

page 12)

Divorce decree (page 6)

Extension – Live outside or military naval service

Injured spouse (page 6) outside U.S. or Puerto Rico (page 4)

Single decedent or primary taxpayer if joint return (page 10)

Multiple special conditions

Spouse deceased if joint return (page 10)

on the line next to the box, in addition to any other information required on the line.

Rounding Off to Whole Dollars The form has preprinted zeros in the place used to enter cents. All amounts filled in on

Round off all amounts. But if you have to add two or more amounts to figure the amount to fill in on a line, include cents

when adding and only round off the total. If completing the form by hand, DO NOT USE COMMAS when filling in amounts.

Line 1 Federal Adjusted Gross Income

Fill in your federal adjusted gross income from line 11 of your federal Form 1040 or 1040-SR.

Line 2 Adjustments to Federal Adjusted Gross Income

If you completed Schedule I, enter the amount from Schedule I, line 3. If the amount is a negative number, place a minus

sign (-) in front of the number. Adjustments may be needed because Wisconsin uses the provisions of federal law amended to

December 31, 2022, with certain exceptions. Laws enacted after December 31, 2022, may not be used for Wisconsin unless

adopted by the Legislature.

A comprehensive list of provisions of federal law that may not be used for Wisconsin for 2023 can be found in the instructions

for Wisconsin Schedule I. Following is a partial list of the items that may affect the largest number of taxpayers.

• Bonus depreciation • Student loan forgiveness

• Business interest expense deduction limitation • Entertainment, amusement, and recreation expenses

Code

18

14

Line Instructions

Line 2 Adjustments to Federal Adjusted Gross Income – continued

Note: Due to law changes which may occur after the Schedule I instructions have been completed, the Schedule I instruc-

tions are not being printed by the department. You may view the Schedule I instructions on our website by visiting

revenue.wi.gov/Pages/Form/2023Individual.aspx.

If any provision of federal law which does not apply for Wisconsin purposes affects your federal adjusted gross income,

you must complete Wisconsin Schedule I and include it with your Form 1. The amount you fill in on line 2 of Form 1 (and

amounts filled in on Schedule 1 on page 4 of Form 1) should be the revised amount determined on Schedule I, line 3 (or

in Part II of Schedule I.)

If Schedule I

in 2023, you must also make adjustments on Schedule I for 2023. For example, you had to make an adjustment on Schedule I

because Wisconsin did not allow bonus depreciation. You must continue to make an adjustment on Schedule I each year

until the depreciable asset is fully depreciated or you sell or otherwise dispose of the asset.

You may also be required to complete Schedule I if you sold assets during 2023, and the gain or loss from the sale is

different for Wisconsin and federal purposes due to Schedule I adjustments made in a prior year. Note: The basis of a

depreciated or amortized asset owned on December 31, 2013, or on the last day of your tax year beginning in 2013, is the

same for federal and Wisconsin purposes and no further Schedule I adjustment is required.

Line 4 Total Additions to Income from Schedule AD

– Enterprise zone jobs credit

– Economic development tax credit

– Jobs tax credit

– Capital investment credit

– Community rehabilitation program credit

– Research credits

– Manufacturing and agricultural credit

– Business development credit

– Electronics and information technology

manufacturing zone credit

– Employee college savings account contribution

credit

• Tax-option (S) corporation adjustments

• Tax-option (S) corporation entity level tax election

adjustments

• Partnership, limited liability company, trust, or

estate adjustments

• Partnership entity level tax election adjustments

• Other additions to income

• State and municipal interest

• Capital gain/loss addition

Tomorrow's Scholar college savings account

• Federal net operating loss deduction

• Income (lump-sum distributions) reported on

• Excess distribution from a passive foreign

investment company

• Expenses paid to or incurred with related entities

• Expenses for moving business outside Wisconsin or

the United States

marital property (community) income

• Addition required for certain credits

– Farmland preservation credit

– Development zones credits

Line 6 Total Subtractions from Income from Schedule SB

• Taxable refund of state income tax

• United States government interest

• Unemployment compensation

• Social security adjustment

• Capital gain/loss subtraction

• Medical care insurance

• Long-term care insurance

• Tuition and fee expenses

• Private school tuition

• Contributions to Edvest or Tomorrow's Scholar

college savings account

• Distribution of certain earnings from Wisconsin

state-sponsored college tuition programs

• Retirement income subtraction

• Reserve or National Guard members

• U.S. Armed Forces active duty pay

• Combat zone related death

15

Line Instructions

Line 6 Total Subtractions from Income from Schedule SB – continued

• Adoption expenses

• Contributions to ABLE accounts

• Disability income exclusion

• Wisconsin net operating loss deduction

• Farm loss carryover

• Native Americans

• Sale of business assets or assets used in farming

to a related person

• Recoveries of federal itemized deductions

• Repayment of income previously taxed

• Human organ donation

• Expenses paid to related entities

• Income from a related entity

• Legislator's per diem

• Olympic, Paralympic, and Special Olympic medals

and United States Olympic Committee and Special

Olympic Board of Directors prize money

• Sales of certain insurance policies

• Physician or psychiatrist grant

• AmeriCorps education awards

marital property (community) income

• Charitable contributions from tax-option (S)

corporations

• Partnership, limited liability company, trust, or

estate adjustments

• Tax-option (S) corporation adjustments

• Tax-option (S) corporation entity level tax election

adjustments

• Partnership entity level tax election adjustments

• Other subtractions

Line 8 Standard Deduction

Most people can find their standard deduction by using the Standard Deduction Table on page 35. Use the amount on line 7

to find the standard deduction for your filing status. Do not use the table if any one of the following applies:

• You (or your spouse if filing a joint return) can be claimed as a dependent on another person’s (for example, parent’s)

income tax return. Use the Standard Deduction Worksheet for Dependents to figure your standard deduction.

• You are filing a short period income tax return or are filing federal Form 4563 to claim an exclusion of income from sources

within U.S. possessions. You are not allowed any amount of standard deduction. Enter 0 (zero) on line 8.

Line 10 Exemptions

Complete lines 10a and 10b. Fill in the number of exemptions on the lines provided. Multiply that number by the amount

indicated ($700 or $250), and fill in the result on line a or b, as appropriate. Add lines a and b and fill in on line 10c.

Line 10a

The exemptions allowed for you (and your spouse, if married) on line 10a are equal to:

0 – If you are single and can be claimed as a dependent on someone else’s return, or if you are married filing jointly and

both you and your spouse can be claimed as a dependent on someone else’s return.

1 – If you are single and cannot be claimed as a dependent on someone else’s return, or if you are married filing jointly and

either you or your spouse (not both) can be claimed as a dependent on someone else’s return.

2 – If you are married filing jointly and neither you nor your spouse can be claimed as a dependent on someone else’s return.

Additional exemptions are allowed equal to the number of dependents you may claim, which is the number of dependents

listed on the front of federal Form 1040 or 1040-SR. Enter an additional exemption for each dependent filled in on federal

Form 1040 or 1040-SR.

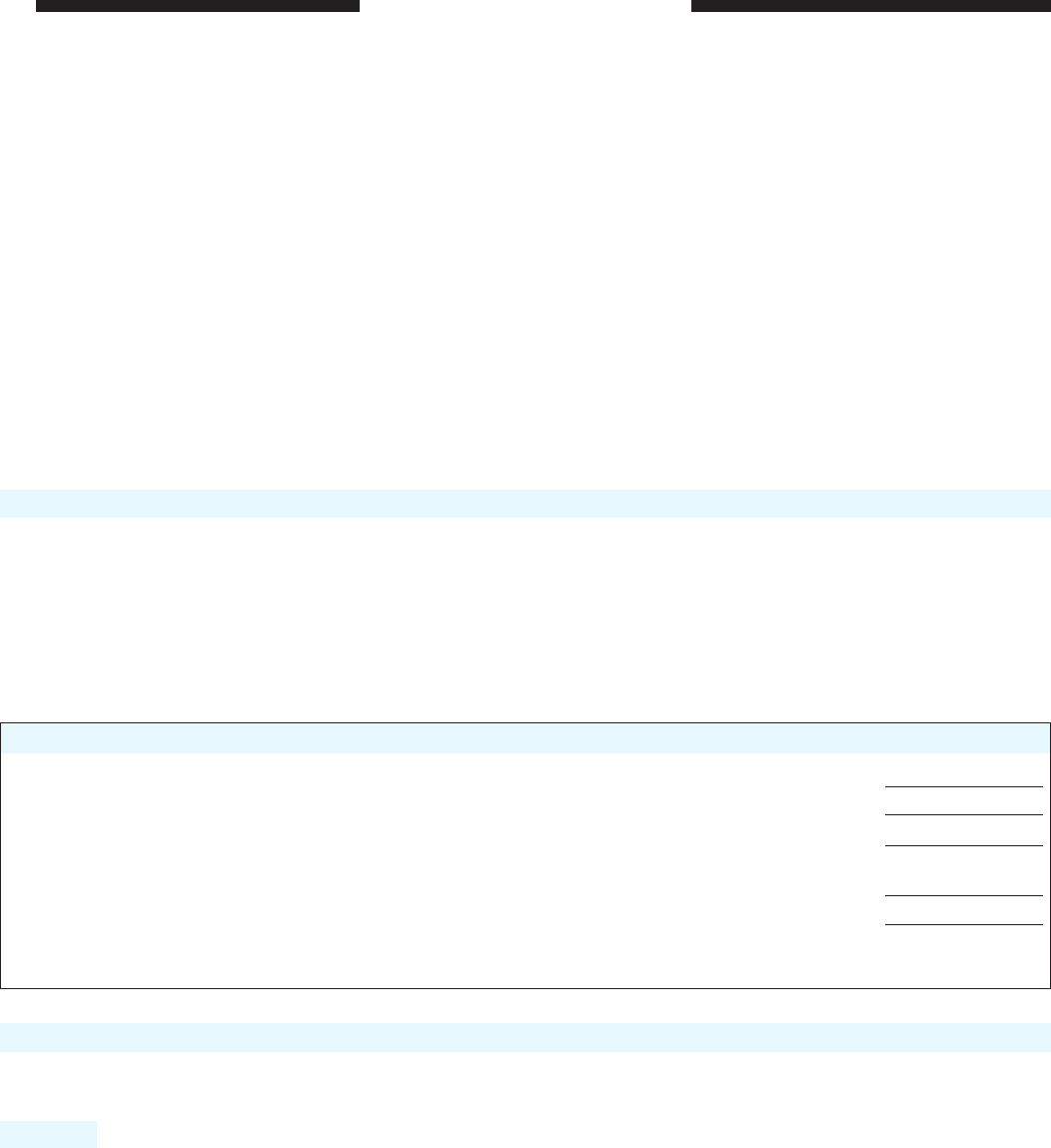

1. Earned income* included on line 7 of Form 1 ...........................................1. .00

2. Addition amount ..................................................................2. 400.00

3. Add lines 1 and 2. If total is less than $1,250, enter $1,250 ................................3. .00

standard deduction

from table, page 35 ...............................................................4. .00

5. Fill in the SMALLER of line 3 or 4 here and on line 8 of Form 1 .............................5. .00

Standard Deduction Worksheet for Dependents

* Earned income includes wages, salaries, tips, professional fees, and any other compensation received for services you

performed. It does not include scholarship or fellowship income that is not reported on a Form W‑2.

16

Line Instructions

Line 10b

If you or your spouse were 65 or older on December 31, 2023, check the appropriate lines. Your number of exemptions is

equal to the number of lines checked.

You may claim the $250 exemption on line 10b for you and/or your spouse only if you and/or your spouse are 65 years of

age or older and are allowed the $700 exemption on line 10a.

Line 12 Tax

Use the amount on line 11 to find your tax in the Tax Table on pages 38-43. Find your income-level bracket and read across

to the column showing your filing status to find your tax. Be sure you use the correct column in the Tax Table for your filing

status. Fill in your tax on line 12.

EXCEPTION If line 11 is $100,000 or more, use the Tax Computation Worksheet on page 44 to compute your tax.

Line 13 Itemized Deduction Credit

If the total of certain federal itemized deductions exceeds your Wisconsin standard deduction, you may be able to claim the

itemized deduction credit.

Complete Schedule 1 on page 4 of Form 1 to see if you can claim the credit. Schedule 1 lists the specific deductions to use

from federal Schedule A (Form 1040) (see EXCEPTIONS below).

If you did not itemize deductions for federal tax purposes, use the amounts which would be deductible if you had itemized

deductions. To determine the amounts to use, complete a federal Schedule A (Form 1040). Write “Wisconsin” at the top of

this Schedule A and include it with your Form 1.

Caution: If your federal adjusted gross income has been increased or decreased in Part I of Schedule I, itemized deductions

which are computed using federal adjusted gross income may require adjustment. The deductible amounts of any such items

used to compute the Wisconsin itemized deduction credit must be determined by using the federal adjusted gross income

computed on line 3 of Form 1. Complete Part II of Schedule I

Example: You made charitable contributions in 2023 in the amount of $20,000. Your federal adjusted gross income for federal

purposes is $20,000. Your charitable contributions reported on line 11 of Schedule A are $12,000 based on an income limita-

adjusted gross income is required. The amount of federal adjusted gross income for Wisconsin purposes, as reported on line

3 of Form 1, is $30,000. The amount of charitable contributions allowed as an itemized deduction for Wisconsin purposes is

$18,000 ($30,000 x 60% = $18,000). Enter $18,000 on line 3 of Schedule 1.

EXCEPTIONS Even though Schedule 1 has entry lines for medical expenses, interest paid, and gifts to charity, not all of

the amounts of these items that are deducted on federal Schedule A (Form 1040) can be used for the itemized deduction

credit. The following describes the portion of these items that may not be used to compute the itemized deduction credit.

• Amounts allocated to you on Schedule 5K-1 or 3K-1 by a tax-option (S) corporation or partnership if the entity elected to

be taxed at the entity level.

• Medical expenses – the amount of medical care insurance and long-term care insurance claimed as a subtraction on

Schedule SB, lines 6 and 7. If this applies to you, complete the worksheet on the next page to figure the amount which

you are allowed, if any, for purposes of the itemized deduction credit.

• Interest – Paid to purchase a second home located outside Wisconsin

– Paid to purchase a residence which is a boat

– Paid to purchase or hold U.S. government securities

– Mortgage insurance premiums treated as interest

• Contributions and interest allocated to you by a tax-option (S) corporation if you treated the amount as a subtraction on

Schedule SB, line 42.

Line 10 Exemptions – continued

17

Line Instructions

Line 13 Itemized Deduction Credit – continued

Line 14 Additional Child and Dependent Care Tax Credit

If you claimed the federal child and dependent care tax credit on your federal return, you may claim the additional child and

in the required information in the spaces provided on line 14.

and one spouse is a full-year Wisconsin resident, you may claim the additional child and dependent care tax credit.

Step 1 Fill in the amount of your federal child and dependent care tax credit on the line provided next to "Federal credit".

Form 2441.

Step 2 Multiply the amount of your federal credit (Step 1) by 50%. Fill in the result on line 14. This is your additional child

and dependent care tax credit.

What to include with your return You must include a copy of your completed federal Form 2441 with Form 1. Failure to

provide this information may delay your refund.

Line 15 Renter’s and Homeowner’s School Property Tax Credit

You may claim a credit if you paid rent during 2023 for living quarters used as your primary residence OR you paid property

taxes during 2023 on your home. You are eligible for a credit whether or not you claim homestead credit on line 32.

You may not claim the school property tax credit if you or your spouse are claiming the veterans and surviving spouses

property tax credit.

Special Cases

If You Paid Both Property Taxes and Rent You may claim both the renter’s credit and the homeowner’s credit. The total

combined credit claimed on lines 15a and 15b may not be more than $300 ($150 if married filing a separate return or married

filing as head of household).

Married Persons Filing a Joint Return Figure your credit by using the rent and property taxes paid by both spouses.

1. Amount of medical care insurance (MCI) included on line 1 of federal Schedule A (Form 1040)

If none, skip lines 1-5 and go to line 6 ............................................... 1.

2. Total medical expenses from line 1 of federal Schedule A (Form 1040) ..................... 2.

3. Divide the amount on line 1 by the amount on line 2.

Carry the decimal to 4 places. This is your MCI ratio ................ 3. .

4. Fill in the amount from line 4 of federal Schedule A (Form 1040) ......... 4.

5. Multiply line 4 by the decimal on line 3 .............................................. 5.

6. Long-term care insurance (LTCI) included on line 1 of federal Schedule A

.............. 6.

7. Divide the amount on line 6 by the amount on line 2.

Carry the decimal to 4 places. This is your LTCI ratio ................ 7. .

8. Multiply line 4 by the decimal amount on line 7 ........................................ 8.

...............................................................

.............. 10.

11. MCI subtracted on line 6 of Schedule SB. If none, skip to line 13 ......................... 11.

12. Subtract line 11 from line 5. If zero or less, enter 0 (zero) ............. 12.

13. LTCI subtracted on line 7 of Schedule SB. If none, skip to line 15 ......................... 13.

14. Subtract line 13 from line 8. If zero or less, enter 0 (zero) ............. 14.

15.

Add lines 10, 12, and 14. This is the amount that may be used as medical

expenses for the itemized deduction credit on line 1 of Schedule 1 ....... 15.

Worksheet for Medical Care Insurance and Long-Term Care Insurance Allowable for the Itemized Deduction Credit

18

Line Instructions

Line 15 Renter's and Homeowner's School Property Tax Credit – continued

Married Persons Filing Separate Returns or Married Persons Filing as Head of Household Each spouse may claim

a credit. Each of you may use only your own property taxes and rent to figure the credit. The maximum credit allowable to

each spouse is $150.

Persons Who Jointly Own a Home or Share Rented Living Quarters When two or more persons (other than a married

couple) jointly own a home or share rented living quarters, each may claim a credit. However, the property taxes and rent

paid must be divided among the owners or occupants. See the instructions for lines 15a and 15b.

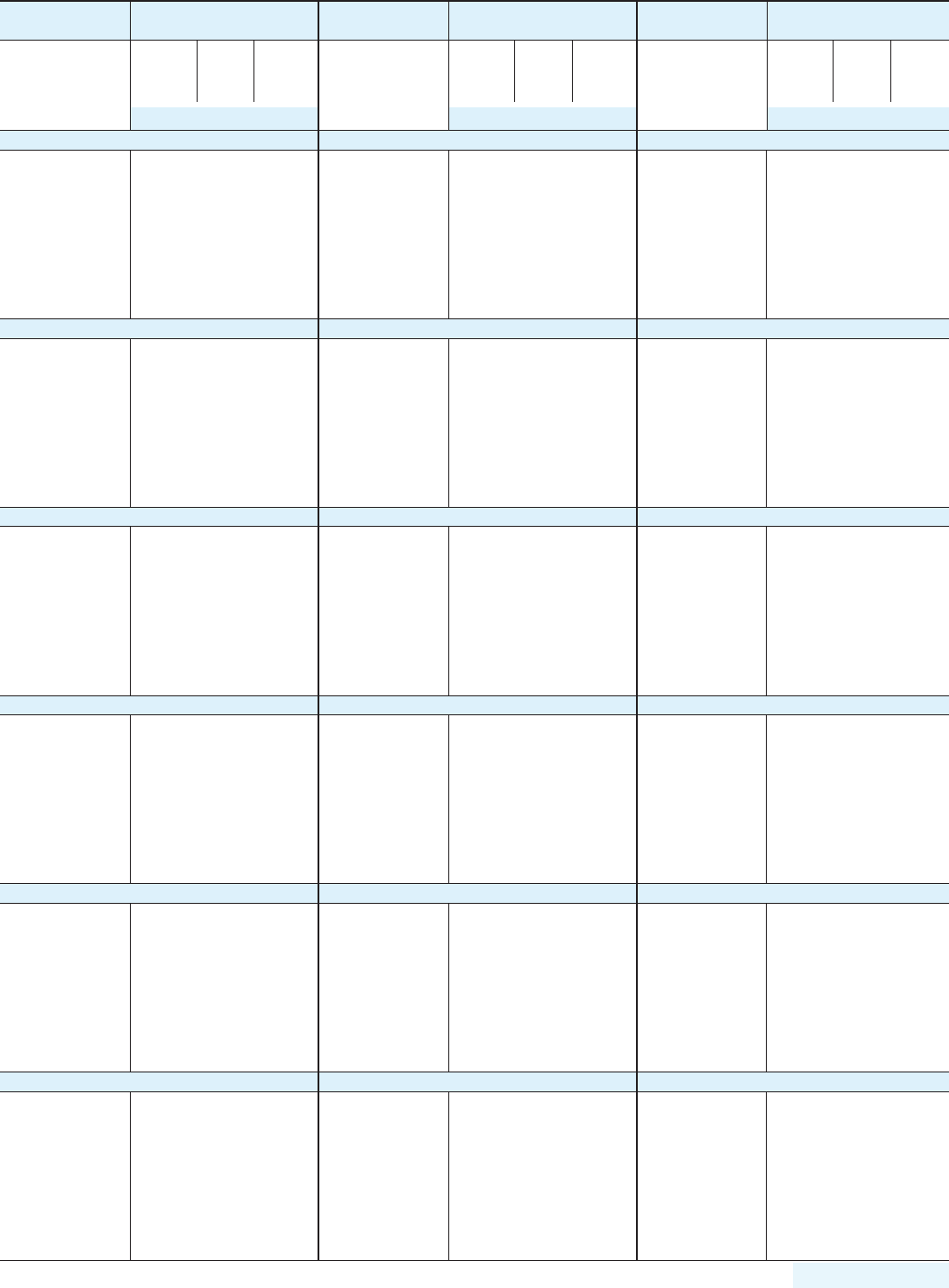

Line 15a How to Figure the Renter’s School Property Tax Credit

Step 1 Rent Paid in 2023 Fill in on the appropriate line(s) the total rent that you paid in 2023 for living quarters (1) where

the heat was included in the rent, and (2) where the heat was not included in the rent. These living quarters must have

been used as your principal home. Do not include rent that you may claim as a business expense. Do not include rent paid

for housing that is exempt from property taxes, for example, rent for a university dorm, nonprofit senior housing, or public

housing. Note: Property owned by a public housing authority is considered tax-exempt unless that authority makes pay-

ments in place of property taxes to the city or town in which it is located. If you live in public housing, you may wish to ask

your manager about this.

If the rent you paid included food, housekeeping, medical, or other services, reduce the amount filled in for rent paid in 2023

by the value of these items. If you shared living quarters with one or more persons (other than your spouse or dependents),

fill in only the portion of the rent which you paid in 2023. For example, if you and two other persons rented an apartment and

paid total rent of $6,000 in 2023, and you each paid $2,000 of the rent, each could claim a credit based on $2,000 of rent.

Step 2 Refer to the Renter’s School Property Tax Credit Table below to figure your credit. If heat was included in your rent,

use Column 1 of the table. If heat was not included, use Column 2. Fill in your credit on line 15a.

Exception If you paid both rent where heat was included and rent where heat was not included, complete the worksheet

below.

.......................1.

....................2.

3. Add lines 1 and 2. Fill in on line 15a of Form 1* .........................................3.

Renter’s Worksheet

Complete only if Exception described above applies

*

Line Instructions

3,500 3,600 85 107

3,600 3,700 88 110

3,700 3,800

3,800 3,900

3,900 4,000

4,000 4,100

4,100 4,200 100 125

4,200 4,300 102 128

4,300 4,400 104 131

4,400 4,500 107 134

4,500 4,600

4,600 4,700 112 140

4,700 4,800 114 143

4,800 4,900 116 146

4,900 5,000

5,000 5,100 121 152

5,100 5,200 124 155

5,200 5,300 126 158

5,300 5,400 128 161

5,400 5,500 131 164

5,500 5,600 133 167

5,600 5,700 136 170

5,700 5,800 138 173

5,800 5,900 140 176

5,900 6,000

6,000 6,100 145 182

6,100 6,200 148 185

6,200 6,300 150 188

6,300 6,400

6,400 6,500

6,500 6,600

6,600 6,700 160 200

6,700 6,800 162 203

6,800 6,900 164 206

6,900 7,000

7,000 7,100

7,100 7,200 172 215

7,200 7,300 174 218

7,300 7,400 176 221

7,400 7,500

7,500 7,600 181 227

7,600 7,700 184 230

7,700 7,800 186 233

7,800 7,900 188 236

7,900 8,000

8,000 8,100

8,100 8,200

8,200 8,300

8,300 8,400 200 251

8,400 8,500 203 254

8,500 8,600 205 257

8,600 8,700 208 260

8,700 8,800 210 263

8,800 8,900 212 266

8,900 9,000

9,000 9,100 217 272

9,100 9,200 220 275

9,200 9,300 222 278

9,300 9,400 224 281

9,400 9,500 227 284

9,500 9,600

9,600 9,700

9,700 9,800

9,800 9,900

9,900 10,000

10,000 10,100 241 300

10,100 10,200 244 300

10,200 10,300 246 300

10,300 10,400 248 300

10,400 10,500 251 300

1 100 1 2

100 200 4 5

200 300 6 8

300 400 8 11

400 500 11 14

500 600 13 17

600 700 16 20

700 800 18 23

800 900 20 26

900 1,000

1,000 1,100 25 32

1,100 1,200 28 35

1,200 1,300 30 38

1,300 1,400 32 41

1,400 1,500 35 44

1,500 1,600 37 47

1,600 1,700 40 50

1,700 1,800 42 53

1,800 1,900 44 56

1,900 2,000

2,000 2,100

2,100 2,200 52 65

2,200 2,300 54 68

2,300 2,400 56 71

2,400 2,500

2,500 2,600 61 77

2,600 2,700 64 80

2,700 2,800 66 83

2,800 2,900 68 86

2,900 3,000

3,000 3,100

3,100 3,200

3,200 3,300

3,300 3,400 80 101

3,400 3,500 83 104

10,500 10,600 253 300

10,600 10,700 256 300

10,700 10,800 258 300

10,800 10,900 260 300

10,900 11,000 263 300

11,000 11,100 265 300

11,100 11,200 268 300

11,200 11,300 270 300

11,300 11,400 272 300

11,400 11,500 275 300

11,500 11,600 277 300

11,600 11,700 280 300

11,700 11,800 282 300

11,800 11,900 284 300

11,900 12,000 287 300

12,000 12,100

12,100 12,200

12,200 12,300

12,300 12,400

12,400 12,500

12,500 or more 300 300

Renter’s School Property Tax Credit Table*

*Caution The credit allowed certain persons may be less than the amount indicated. See “Special Cases” on page 17.

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $

If Rent Your Line 15a

Paid is: Credit is:

Col. 1 Col. 2

Heat Heat

But In- Not In-

At Less cluded cluded

Least Than in Rent in Rent

If Rent Your Line 15a

Paid is: Credit is:

Col. 1 Col. 2

Heat Heat

But In- Not In-

At Less cluded cluded

Least Than in Rent in Rent

If Rent Your Line 15a

Paid is: Credit is:

Col. 1 Col. 2

Heat Heat

But In- Not In-

At Less cluded cluded

Least Than in Rent in Rent

If Rent Your Line 15a

Paid is: Credit is:

Col. 1 Col. 2

Heat Heat

But In- Not In-

At Less cluded cluded

Least Than in Rent in Rent

Line 15b How to Figure the Homeowner’s School Property Tax Credit

Step 1 Property Taxes Paid on Home in 2023 Fill in the amount of property taxes that you paid in 2023 on your home.

Do not include:

• Charges for special assessments, delinquent interest, or services that may be included on your tax bill (such as trash

removal, recycling fee, or a water bill)

• Property taxes that you can claim as a business expense (for example, farm taxes or rental property taxes)

• Property taxes paid on property that is not your primary residence (such as a cottage or vacant land)

• Property taxes that you paid in any year other than 2023

Property taxes are further limited as follows:

a. If you bought or sold your home during 2023, the property taxes of the seller and buyer are the taxes set forth for each

in the closing agreement made at the sale or purchase. If the closing agreement does not divide the property taxes

between the seller and buyer, divide them on the basis of the number of months each owned the home.

Line 15a How to Figure the Renter's School Property Tax Credit – continued

20

Line Instructions

b. If you owned a mobile home during 2023, property taxes include the municipal permit fees paid to your municipality

and/or the personal property taxes paid on your mobile home. (Payments for space rental for parking a mobile home or

manufactured home should be filled in as rent on line 15a.)

c. If you, or you and your spouse, owned a home jointly with one or more other persons, you may only use that portion of the

property taxes that reflects your percentage of ownership. For example, if you and another person (other than your spouse)

jointly owned a home on which taxes of $1,500 were paid, each of you would claim a credit based on $750 of taxes.

CAUTION Property taxes paid during 2023 must be reduced by any amount received as a refund of such taxes. For

example, a taxpayer claimed farmland preservation credit on Schedule FC (which is considered a refund of property taxes)

on their 2022 Wisconsin return. The taxpayer received a farmland preservation credit in 2023 of $600 that was based on

2022 property taxes accrued of $6,000. The 2022 property taxes were paid in 2023 and 10% of such taxes were allocable

during 2023 are $5,400 ($6,000 less $600 farmland preservation credit). Of this amount, $540 (10% of $5,400) is used to

compute the 2023 school property tax credit.

Step 2 Use the Homeowner’s School Property Tax Credit Table below to figure your credit. Fill in the amount of your credit

on line 15b.

CAUTION If you are also claiming the renter’s credit on line 15a, the total of your renter’s and homeowner’s credits can’t

be more than $300 ($150 if married filing a separate return or married filing as head of household).

*Caution The credit allowed certain persons may be less than the amount indicated. See “Special Cases” on page 17.

1 25 2

25 50 5

50 75 8

75 100 11

100 125 14

125 150 17

150 175 20

175 200 23

200 225 26

225 250

250 275 32

275 300 35

300 325 38

325 350 41

350 375 44

375 400 47

400 425 50

425 450 53

450 475 56

475 500

500 525 62

525 550 65

550 575 68

575 600 71

600 625 74

625 650 77

650 675 80

675 700 83

700 725 86

725 750

750 775

775 800

800 825

825 850 101

850 875 104

875 900 107

900 925 110

925 950 113

950 975 116

975 1,000

1,000 1,025 122

1,025 1,050 125

1,050 1,075 128

1,075 1,100 131

1,100 1,125 134

1,125 1,150 137

1,150 1,175 140

1,175 1,200 143

1,200 1,225 146

1,225 1,250

1,250 1,275 152

1,275 1,300 155

1,300 1,325 158

1,325 1,350 161

1,350 1,375 164

1,375 1,400 167

1,400 1,425 170

1,425 1,450 173

1,450 1,475 176

1,475 1,500

1,500 1,525 182

1,525 1,550 185

1,550 1,575 188

1,575 1,600

1,600 1,625

1,625 1,650

1,650 1,675 200

1,675 1,700 203

1,700 1,725 206

1,725 1,750

1,750 1,775 212

1,775 1,800 215

1,800 1,825 218

1,825 1,850 221

1,850 1,875 224

1,875 1,900 227

1,900 1,925 230

1,925 1,950 233

1,950 1,975 236

1,975 2,000

2,000 2,025 242

2,025 2,050 245

2,050 2,075 248

2,075 2,100 251

2,100 2,125 254

2,125 2,150 257

2,150 2,175 260

2,175 2,200 263

2,200 2,225 266

2,225 2,250

2,250 2,275 272

2,275 2,300 275

2,300 2,325 278

2,325 2,350 281

2,350 2,375 284

2,375 2,400 287

2,400 2,425

2,425 2,450

2,450 2,475

2,475 2,500

2,500 or more 300

Homeowner’s School Property Tax Credit Table*

If Property Taxes

are:

But Line 15b

At Less Credit

Least Than is

$ $ $ $ $ $ $ $ $ $ $ $ $ $ $

If Property Taxes

are:

But Line 15b

At Less Credit

Least Than is

If Property Taxes

are:

But Line 15b

At Less Credit

Least Than is

If Property Taxes

are:

But Line 15b

At Less Credit

Least Than is

If Property Taxes

are:

But Line 15b

At Less Credit

Least Than is

Line 16 Working Families Tax Credit

If you are married filing a separate return, are under age 65, and your income on line 7 of Form 1 is less than $10,000, you

may claim the working families tax credit.

Exception You may not claim the working families tax credit if you may be claimed as a dependent on another person’s (for

example, your parent’s) income tax return.

from line 12 of Form 1 on line 16.

Line 15b How to Figure the Homeowner's School Property Tax Credit – continued

21

Line Instructions

Line 16 Working Families Tax Credit – continued

Working Families Tax Credit Worksheet

Do not complete this worksheet if:

• Line 7 of your Form 1 is $10,000 or more.

• You may be claimed as a dependent on another person’s return.

.

1. Amount from line 12 of Form 1 ............................................................... 1.

instructions ............................................................................. 2.

3. Subtract line 2 from line 1. If the result is zero or less, stop here. You do not qualify for the credit ........... 3.

4. Enter $10,000 ............................................................. 4.

5. Fill in amount from line 7 of Form 1 ............................................. 5.

6. Subtract line 5 from line 4..................................................... 6.

7. Divide line 6 by one thousand (1,000). Fill in decimal amount ....................................... 7.

8. Multiply line 3 by line 7. This is your working families tax credit. Fill in this amount on line 16 of Form 1 ...... 8.

working families tax credit.

• If the amount on line 7 of Form 1 is $10,000 or more, leave line 16 blank. You do not qualify for the credit.

Line 17 Married Couple Credit

You can claim the married couple credit if all of the following apply:

• You are married filing a joint return

• Both you and your spouse have qualified earned income

• You do not file federal Form 2555 or Form 2555-EZ to claim an exclusion of foreign earned income or Form 4563 to claim

an exclusion of income from sources in U.S. possessions

To figure the credit, complete Schedule 2 on page 4 of Form 1. Figure earned income separately for yourself and your

spouse on lines 1 through 3 in Columns (A) and (B) of Schedule 2.

“Earned income” includes taxable wages, salaries, tips, scholarships or fellowships (only amounts reported on a Form W-2),

other employee compensation, disability income treated as wages, and net earnings from self-employment.

Example You are a member of the U.S. Armed Forces on active duty. You claimed a subtraction on line 18 of Schedule SB

for the amount of military pay you received for active duty. Because this military pay is not taxable to Wisconsin, it cannot

be used when computing the married couple credit.

“Earned income” does not include other income such as interest, dividends, IRA distributions, deferred compensation (even

though it may be reported on a W-2), unemployment compensation, rental income, social security, pensions, annuities, or

income that is not taxable to Wisconsin. Do not consider marital property law, marital property agreements, or unilateral

statements in figuring each spouse’s earned income.

The credit is based on qualified earned income. You must figure qualified earned income separately for yourself and your

spouse. Figure it on lines 4 and 5 of Schedule 2 by subtracting the total of certain adjustments from earned income. These

adjustments (as reported as an adjustment to income on federal Schedule 1 (Form 1040)) are:

• IRA deduction (line 20 of federal Schedule 1)

• Self-employed SEP, SIMPLE, and qualified plans (line 16 of federal Schedule 1)

• Repayment of supplemental unemployment benefits (line 24e of federal Schedule 1)

• Certain business expenses of reservists, performing artists, and fee-basis government officials (line 12 of federal Schedule 1)

• Contributions to secs. 501(c)(18)(D) and 403(b) pension plans (lines 24f and 24g of federal Schedule 1)

• Disability income exclusion (from line 22 of Wisconsin Schedule SB)

22

Line Instructions

Line 18 Nonrefundable Credits

If you are claiming any of the credits listed below, you must complete Schedule CR.

Include Schedule CR, along with the appropriate schedule for the credit(s) you are claiming and any required Department

of Commerce (DOC), Wisconsin Economic Development Corporation (WEDC), or Wisconsin Housing and Economic

Development Authority (WHEDA) approval, certification, or allocation with Form 1. Include Schedule CF for each credit for

which you claim a carryforward of unused credit. Fill in the amount from line 34 of Schedule CR on line 18. See page 11 for

information on obtaining Schedule CR.

• Postsecondary Education Credit Carryforward (Schedule CF)