2023 Report on Availability,

Quality,

and Pricing of Certain

Financial

Services and Consumer

Loan

Products

12/1/2023

2 | P a g e

TABLE OF CONTENTS

EXECUTIVE SUMMARY ............................................................................................... 3

INTRODUCTION ......................................................................................................... 4

ECONOMIC EFFECTS ON WILLINGNESS TO BORROW AND LEND ............................... 6

LENDING VOLUMES ................................................................................................... 9

HOME EQUITY LOAN 50(A)(6) .................................................................................. 10

CONSUMER LOANS: PERSONAL/SECURED LOANS (342-E) ....................................... 13

CONSUMER LOANS: SIGNATURE/SMALL INSTALLMENT LOANS (342-F) .................. 14

PROPERTY TAX LOANS (351) .................................................................................... 17

CREDIT ACCESS BUSINESSES (PAYDAY AND TITLE LOANS) CHAPTER 393 ................. 20

PAWN LOANS (371) ................................................................................................. 24

MOTOR VEHICLE SALES FINANCE (348) .................................................................... 27

EMERGENCY OR UNEXPECTED CREDIT – PURPOSE AND AMOUNT .......................... 32

INSTALLMENT LOAN COMPARISONS – EXAMPLES OF PRICING AND RESTRICTIONS 33

EMERGING PRODUCTS AND INNOVATION .............................................................. 34

FINANCIAL EDUCATION ............................................................................................ 35

DISTRIBUTION OF LICENSED LOCATIONS BY ZIP CODE ............................................ 36

NATIONAL CREDIT TRENDS ...................................................................................... 39

ECONOMIC REPORTS AND FORECASTS: STATE OF TEXAS ........................................ 43

REPORTING REQUIREMENTS ................................................................................... 44

WORKS CITED .......................................................................................................... 45

3 | P a g e

Executive Summary

Availability of consumer loan products is being impacted by tighter lending standards, especially for higher-

risk borrowers. Loan volumes are declining in many industries and have not rebounded to pre-pandemic levels.

Delinquencies on products such as credit cards and auto loans are increasing, and credit application denials are on

the rise as well.

Pricing increases are common for transactions that allow higher lending costs to be passed on to borrowers.

Products that are routinely made at state rate limits cannot pass on increased costs of lending. The effective federal

funds effective rate has increased to 5.33% from .08% just two years ago. Cumulative inflation is approximately 20%

higher over the last three years.

Innovation in credit expands consumer options but poses complications for established regulatory frameworks.

Some novel products operate outside of state licensing; however, this may change as lawmakers and regulators

continue to review such transactions.

Economic Activity

could slowdown in 2024. Consumer debt levels continue to increase and interest rates

remain elevated. Mortgage loans have decreased substantially due to affordability concerns. If the Federal Reserve

decides to reduce the federal funds rate because inflation is on target, the impact could benefit borrowers. While

Texas has performed better than the nation during economic slowdowns over the past twenty years, there is still

inherent risk in the state.

Items of Note include borrowing trends in mortgage refinances, declining loan originations in the small dollar

sector, and special circumstances in the automobile finance sector.

Mortgage Refinances

Nearly 9 out of 10 current (2023) mortgage refinances include cash-out to

the borrower. On average, 24% of equity is loaned out during such

transactions. These are similar statistics to the 2005-2008 crisis, but the

volume of refinances thus far is much lower.

Small Dollar Sector 37% of consumers said they could not cover a $400 emergency with

current savings. In Texas, small consumer loan originations (342-F) have

declined 30% since 2019. Regulatory tightening lending standards, as

lending costs rise, could also limit availability of small dollar loans.

Automobile Financing Average interest rates for car loans are currently at 8%. Prices remain high

(at levels set during the supply chain issue of 2021); however, they are no

longer increasing. Buyers who purchased cars at elevated prices, with long

loan terms and higher interest rates, may have issues trading in vehicles

for new purchases in the future.

4 | P a g e

Introduction

The Office of Consumer Credit Commissioner (OCCC), established in 1963, licenses companies that extend consumer

loans and retail installment sales. Each industry has its own unique and specific consumer benefits as well as unique

compliance concerns. The OCCC works to ensure that the non-depository financial services industry that it regulates

provides compliant financial products. Most non-depository lenders, non-real estate lenders, and small segments

of real property loans are supervised by the OCCC. Exempt lenders (authorized lenders that are exempt from

OCCC

licensing, e.g. banks) and exempt transactions (e.g. loans at rates lower than 10%) contribute to the

remaining

marketplace.

Several types of credit products are available and range from those frequently used by Texas consumers to niche

offerings. Most of these industries must file annual reports for the preceding year that detail the growth or decline

in their transactions. This report highlights seven of the most common credit transactions that Texas consumers

received from OCCC licensees in data reports filed for the year 2022 and lists general alternatives to those products.

Industry (Statutory Provision)

Home Equity Loans - Section 50(a)(6), Article XVI of the Texas Constitution

Regulated Lenders -Texas Finance Code (TFC) ch. 342

Large Installment Loans - TFC ch. 342 subch. E

Small Installment Loans - TFC ch. 342 subch. F

Property Tax Loans - TFC ch. 351

Credit Access Businesses/(Payday and Title Loans) - TFC ch. 393

Pawn Loans - TFC ch. 371

Motor Vehicle Sales Finance - TFC ch. 348

Of the seven types of consumer credit listed above, the OCCC possesses sole authority over pawn loans, property

tax loans, and credit access business transactions. The annual report data for those three loan types should reflect

trends in the entire industry. Home equity loans, although made by OCCC licensees are common products offered by

depository institutions and other mortgage lenders not regulated by the OCCC; trends in OCCC licensed lenders

may

not be indicative of the entire marketplace. Motor Vehicle Sales Finance dealers and holders of motor vehicle

retail installment contracts are the OCCC’s largest licensee base and originate or hold retail installment transactions,

not loans. In addition, this report does not include consumer lending

transactions that are made by depository

institutions, most loans secured by real estate, or credit exempt by other laws.

5 | P a g e

Access

Overall, 88% of consumers believe access to credit and financial products is important to achieve their financial goals

while only 58% believe that they have sufficient access. (Transunion, 2023) A generational divide is observed with

younger consumers more likely to believe access is important but also are more pessimistic regarding availability

sufficient for their needs. Additional customer choice, increasing access to and improving quality of traditional

lending channels, and innovating credit for younger generations might change perceptions of access.

Competition and Availability

Historically low interest rates of 2020-2021

fueled a mortgage boom that presented

opportunities to refinance existing loans

and allowed consumers to shop for new

homes. Approximately 1/3 of all existing

mortgage debt was refinanced during this

period. (Haughwout, Donghoon, Mangrum,

Scalley, & van der Klaauw, 2023). During

this time, non-depository lenders

accounted for over 60% of mortgage

originations (Federal Financial Institutions

Examination Council, 2022) (Cameron,

2022). The boom took off suddenly in 2020

and the availability of other market participants outside of the depository space was important for the following

reasons:

1. Additional capacity to help meet surging demand.

2. Generally, when firms must compete and consumer choices increase, downward pressure is applied to prices.

3. Differing risk tolerances among lenders increases overall availability.

Although non-depository business lines are more concentrated and under increased pressure when interest rates

dramatically rose in 2022, the homeowners who were able to close loans during the boom undoubtedly benefited.

As of Q1 2023 almost 2/3 of all mortgage debt was at rates of 4% or less (FreddieMac, 2023). Ensuring there is a

robust market with many competitors is important for consumer choice and availability.

6 | P a g e

Economic Effects on Willingness to Borrow and Lend

Federal Reserve monetary policy has a trickle-down effect on lending costs for most borrowers. Financial institutions

set their prime rate (the rate offered to the most credit worthy borrowers) based on the current federal funds rate.

(Board of Governors of the Federal Reserve System, 2023) An increase in the federal funds rate causes an increase

in both new fixed rate loans (e.g. conventional mortgages, auto loans) and variable rate loans (e.g. credit cards and

adjustable rate mortgages).

At the beginning of COVID the federal

funds rate was lowered to a target of 0%

to .25% to ensure credit was available

during the uncertainty of the pandemic.

(Milstein & Wessel, 2021) As the

economy recovered from the pandemic

inflation rose faster than it had in

decades. To combat inflation, the

federal funds effective rate has

increased 528 basis points since April 1,

2020. During that same time period,

inflation rose 20%. (Federal Reserve

Bank of St. Louis, 2023) (U.S. Bureau of

Labor Statistics, 2023)

Demand of Credit

As rates rise, certain financial

institutions can pass on the rate

increase on to their customers.

Borrower demand for loans can

decrease during this time as credit

becomes more expensive. Mortgage

borrowers are especially sensitive to

rate increases and the industry saw

the lowest weekly application

volume since 1995 in October 2023.

-0.2%

8.9%

-0.5%

1.5%

3.5%

5.5%

7.5%

9.5%

2013-10-01

2014-05-01

2014-12-01

2015-07-01

2016-02-01

2016-09-01

2017-04-01

2017-11-01

2018-06-01

2019-01-01

2019-08-01

2020-03-01

2020-10-01

2021-05-01

2021-12-01

2022-07-01

2023-02-01

2023-09-01

Fed Funds & Inflation - 10 Years

Fed Funds CPI YOY

Type of Credit 2022 Rejection Rate 2023 Rejection Rate

Credit Cards 18.5% 19.6%

Mortgage 14.6% 12.1% (remains above 2019 rate

of 10.2%)

Auto Loans 5.2% 11.0% (highest rate since series

began in 2013)

Credit Card Limit Increases 35.3% 30.9%

Mortgage Refinance 9.9% 15.5%

Lender-Initiated Account Closures

5.3% 7.2%

7 | P a g e

Supply of Credit and Rejection Rates

Rejection rates for credit applications have risen from 2022 according to the October 2023 FED Survey of Consumer

Expectations Credit Access Survey. (Federal Reserve Bank of New York, 2023) Automobile loans showed the largest

increase in rejection rates reaching the highest point since the survey began tracking.

Potential Availability Concerns from the Effect of Market Conditions

The rates charged on credit products include compensation to the creditor for forbearance and risk

1

. Additionally,

creditors have fixed costs to originate, service, and collect that are captured by interest rates or a fixed fee on the

agreement. (Chen & Elliehausen, 2020)

Three of the most common credit products offered by licensees of the OCCC are motor vehicle retail installments

sales, small installment consumer loans, and large installment consumer loans. Each of these products have rate

ceilings and fee limitations and generally cannot pass on market increases to borrowers. When the cost of borrowed

funds (evidenced by the federal funds rate) and operating expenses (inflation) increase, lenders must make decisions

as loans become less profitable.

Economic theory and consumer lending studies point to credit rationing or lower

availability especially to more risky borrowers when market rates approach rate ceilings. (Vandenbrink, 1982)

(Garon, Braga, Oglesby-Neal, & Martire, 2023)

Demand has decreased in mortgage applications (at least partially) because consumers want to avoid the current

borrowing expense. Lenders have increased rejection rates in certain lines of credit due to tightening restrictions.

There are potential concerns of an unbalanced market if there are no changes in demand for loans and a lender’s

willingness to make loans is curtailed.

1

Forbearance is forgoing current income for future income. Risk or Credit Risk is the probability of loss of borrower

default.

Credit Product

Fees at Origination

Credit Rates

Can fees

automatically

increase due to

market adjustments?

348

(motor vehicle

sales)

2

Doc

be a

and

umentary Fee - Must A dealer must file for a

reasonable amount

documentary fee over

$150 is presumed

$150 and submit a

reasonable 7 TAC

cost justification to

§84.205

the OCCC which is

reviewed for

reasonableness

Certain used cars up to

$15 per $100 add-on

time price differential

(roughly 26%

depending on finance

term). New cars are

limited to 18%. 7 TAC

§84.201

342-F (small Acquisition Charge -

No

Installment Account

installment loans)

Limited to the lesser of

Handling Charge of $4

10% of the cash advance

per $100 loaned per

or $100 7 TAC §83.605

month. (Maximum

Effective rate of roughly

79% depending on

term) 7 TAC §83.606

342-E (large

No

Tiered rate depending

installment loans)

on the cash advance

Administrative Fee -

Limited to $100 7 TAC

§83.503

(maximum rate of 30%)

7 TAC §83.501

8 | P a g e

The following chart outli

nes Texas motor vehicle retail installments sales, small installment consumer loans, and

large installment consumer loans and their rate and fee limitations.

The Conference Board predict

s the federal funds rate will decrease in the second half of 2024 to near 4% and by the

end of 2024 inflation will have slowed to near 2%. (The Conference Board, 2023) If these predictions hold it would

alleviate some short-term pressure faced by lenders to limit credit availability to riskier borrowers. In the long term,

availability of credit to sub-prime borrowers should be considered in the context of how market forces on the costs

of loans affect their supply.

2

A seller cannot increase the sale price to include increased financing costs on credit sales 12 CFR Part 1026

(Regulation Z) §1026.2(a)(9)

9 | P a g e

Lending Volumes

Non-real estate loans account for most consumer loans (Installment Loans, Pawn Loans, and Payday/Title Loans).

OCCC licensed lenders and financial service providers profiled in this report made

12,310,000

3

loans for $10.8

billion in 2022. This number does not reflect the number of borrowers as they may take out several loans during a

year by refinancing a loan or receiving multiple loans throughout the year.

Loan originations

increased by approximately 8% in number over 2021. This number is still down 25% from before

the 2020 pandemic. Loan amounts for pawn transactions (371) have increased 24% since 2019 and a portion of the

transaction decrease might be explained by combining more items on one transaction instead of “splitting pawn

tickets.

4

” The number of CAB loans (393 Payday and Title) also experienced a large decline that did not rebound

after COVID. Structural developments in that industry are explained in more detail in the CAB specific section.

Pawn and CAB transaction are the shortest term of credit licensed by the OCCC with maturities ranging from one to

six months. The short terms of such loans enable consumers to obtain multiple transactions in a year if they choose

and account for the greatest number of loans annually. Small consumer loans (342-F) are the next most originated

loans; these loans have fallen almost 30% since pre-pandemic times. Compared with Pawn and CAB loans they are

the least expensive loan product. Economic and interest rate effects could be impacting 342-F loan levels and

monitoring 2023 annual report data could indicate if availability is diminishing.

$4.0

$4.5

$3.9

$5.4

$5.4

$2.6

$2.5

$1.9

$2.0

$1.9

$1.0

$1.0

$0.8

$0.9

$1.0

$3.3

$3.1

$1.9

$2.1

$2.5

$10.9

$11.1

$8.5

$10.4

$10.8

$-

$2

$4

$6

$8

$10

$12

2018 2019 2020 2021 2022

Billions

$ Loaned by License Type

0.69

0.80

0.82

1.04

1.00

3.67

3.43

2.54

2.41

2.44

7.40

7.37

5.17

5.04

5.75

4.97

4.75

3.19

2.88

3.12

16.63

16.35

11.73

11.38

12.31

0

2

4

6

8

10

12

14

16

18

2018 2019 2020 2021 2022

Millions

# Loans by License Type

3

Data submitted by OCCC licensees is aggregated and published on the OCCC website by industry. https://occc.texas.gov/publications/activity-

reports

4

Splitting Pawn Tickets can occur at the customer request in order to redeem items on different days. Splitting pawn items can also be initiated by

the pawnbroker but items normally sold as a set should not be split in order to obtain a higher finance charge due to rate ceiling limitations on

higher loan amounts.

10 | P a g e

Home Equity Loan 50(a)(6)

Overview

Home equity loans allow borrowers to use the equity accumulated in their homestead as collateral for a loan. The

loan amount is determined by the value of the property and may not exceed 80% of the fair market value of the

home. The fair market value of the homestead must be determined and agreed to, in writing, by both the borrower

and lender. A borrower may opt to have the loan set up as a revolving line of credit instead of a lump sum payment;

this is known as a home equity line of credit (HELOC).

Borrowers may not take out a home equity loan before the first anniversary (minimum of 365 days) of the closing

date of any existing home equity loan that is secured by the same homestead property. Borrowers may only have

one home equity loan against an existing homestead at any given time. Borrowers must wait at least 12 days before

closing the home equity loan. Under certain conditions, a rate & term-only refinance is allowed and the loan would

then lose its status as a Home Equity Loan.

5

Type of Customer

Borrowers need to own their home and have accumulated enough equity to borrow against it.

Lenders should

not lend based solely on the value of the home. Credit scores and debt-to-income ratios are

also considered to

ensure borrowers have enough stable income to repay the home equity loan.

Typical Rates

Home equity loans are generally the least expensive loan option offered by OCCC regulated lenders. Lenders can

offer lower interest rates because the borrower’s home is used as security. Home equity loans typically have

a fixed

rate whereas HELOCs use adjustable interest rates. Interest rates are generally set in a manner similar to other

mortgage products.

Non-interest closing costs are limited to 2% of the original

principal balance of the home equity

loan.

6

In addition to interest, lenders may charge fees, including but not limited to, title fees and an appraisal fee.

These fees add to the overall cost of the home equity loan.

Allowable Charges

Interest Rates: up to 18% (current market rate 9.82%) (Bank Rate, 2023)

Closing costs may not exceed 2% of the loan

Late fees may apply

Discount points are optional

Loan Terms

1-year prohibition on renewals

Total loans may not exceed 80% of fair market value

12-day waiting period on closing

15-30-year repayment options common

May be provided as a line of credit (HELOC)

5

Preamble for 7 TAC §153.45

6

Effective 1/01/2018 closing costs (with some exclusions) are limited to 2%.

11 | P a g e

Default

The greatest risk the borrower faces is the foreclosure and loss of their homestead. The foreclosure must be

performed

through a judicial process or an expedited foreclosure procedure (Rule 736 Texas Rules of Civil

Procedure). After foreclosure,

the borrower does not face any recourse if the lender fails to recover the loan balance.

Alternatives

Low-interest rates and flexible repayment terms make home equity loans advantageous to other types of borrowing.

However, defaulting on this type of loan could end up in foreclosure posing a high risk to borrowers. Unsecured

options

such as personal loans, unsecured bank loans, credit cards, and peer-to-peer lending typically include higher interest rates

but are considered a less risky alternative for borrowers. Another alternative is a reverse mortgage available to homeowners

62 years and older.

Trends in Home Equity Lending

7

Most of the mortgage debt in America is sitting at rates of 4% or less and with current rates approximately double that it

doesn’t make sense for most Americans to refinance. However, home appreciation has resulted in many borrowers

possessing equity in their homes and now most refinances include cash-out. In the first half of 2023 almost 9 out of 10

refinance transactions were cash-out (Freddie Mac, 2023).

When rates were at historic lows in 2020-2022 homeowners were refinancing with lower rates and obtaining accrued equity

in their homes. Now, mortgage rates are much higher, and appreciation has slowed. Some of the consumer behavior

occurring in 2023 is beginning to resemble borrowing leading up to and during the great recession of 2007-2009. One

important difference is the total equity removed from housing is much lower due to refinancing activity slowing considerably

and home prices have not significantly declined. Texas has additional protections that limit the amount of equity that is

loaned to borrowers limiting the chance of owing more than their house is worth if the market were to decline. Continued

observation in this market is important due to the potential economic impacts.

7

Figures represent yearly averages from the time frame.

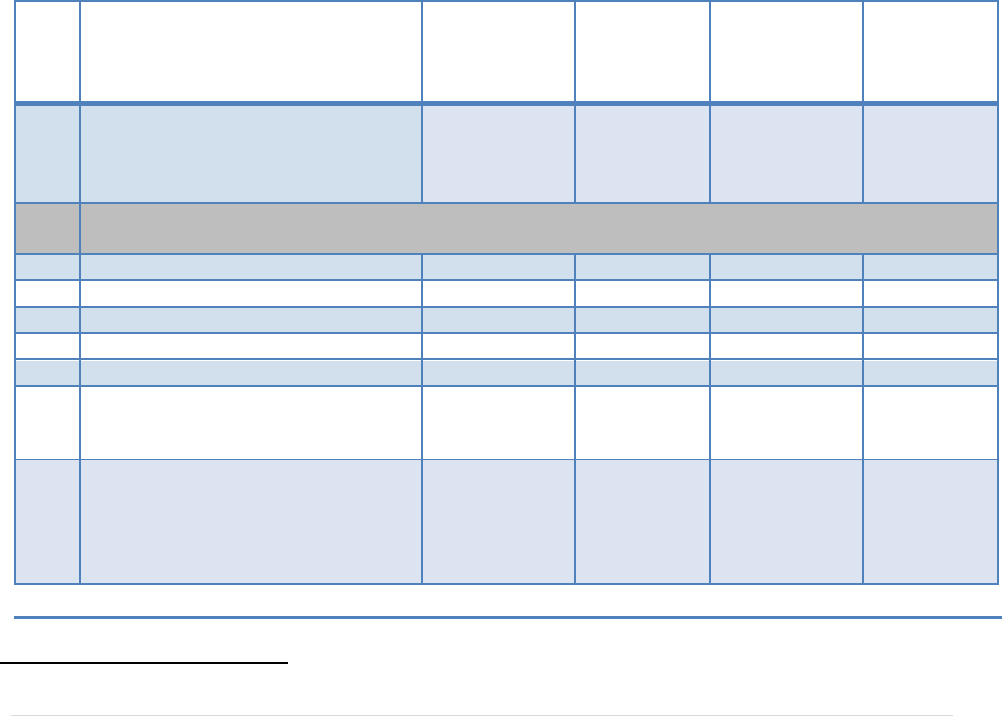

Year(s) of

Refinance

Cash out Share

of Refinances

Average Dollars

of Equity

Cashed Out

Average Equity

Cashed Out as

a Percent of

Property Value

Total Home

Equity Cashed

Out per Year(in

2022 dollars,

billions)

1998-2004

53.4%

$59,286

18.1%

$136

2005-2008

76.1%

$86,750

20.9%

$332

2009-2019

35.3%

$65,182

17.1%

$66

2020-2022

56.4%

$68,667

15.7%

$211

Jan - Jun 2023

88.8%

$89,000

24.0%

$24

12 | P a g e

2022 Home Equity Lending Report

Data contained in this report is reported on a calendar year basis and reflects data through CY 2022. Data in this report

includes information reported by OCCC licensees and may not reflect data or trends for the entire mortgage industry.

This section presents data on mortgage activity conducted by lenders licensed by the OCCC, including information about

home equity and Texas Finance Code Chapter 342, Subchapter G (second-lien mortgage) loans. Home equity loans fall into

two broad categories: second mortgage and first mortgage. A first-lien home equity loan allows a consumer to refinance an

existing mortgage and receive cash (commonly called a ‘Cash-Out Refinance’). A second-lien home equity loan typically is

made at a higher interest rate than a first-lien transaction. Most 342-G loans are typically home improvement or purchase

money loans. Secondary mortgage loans may also include second-lien loans with a cash advance made to or on behalf of the

borrower.

In 2011, Texas Finance Code §342.051 (c-1) was added and provided that a person who holds a residential mortgage loan

company license under Chapter 156 or a mortgage banker license registration under Chapter 157 is not required to hold a

license under Chapter 342 to make, arrange, or service secondary mortgage loans. Other home equity lenders are regulated

by different regulatory agencies, such as the Texas Department of Savings and Mortgage Lending.

Home Equity Lending Data

LOANS MADE

2022

2021

2020

2019

2018

1st Lien Home Equity Loans

6,462

34,432

24,639

15,840

15,612

Total Dollar Amount Loaned

$1,619,641,517

$7,708,880,666

$5,334,114,525

$3,144,035,892

$2,783,790,222

Average Loan Amount

$250,641

$223,887

$216,491

$198,487

$178,311

2nd Lien Home Equity Loans

8

-

-

-

-

-

Total Dollar Amount Loaned

-

-

-

-

-

Average Loan Amount

-

-

-

-

-

342-G Loans

-

-

-

-

-

Total Dollar Amount Loaned

-

-

-

-

-

Average Loan Amount

- -

-

-

-

LOANS RECEIVABLE

2022

2021

2020

2019

2018

1st Lien Home Equity Loans

10,518

9658

9,824

10,093

15,472

Total Dollar Amount Loaned

$1,315,530,163

$829,759,690

$669,234,312

$692,430,754

$1,279,891,075

Average Loan Amount

$125,074

$85,914

$68,122

$71,230

$82,723

2nd Lien Home Equity Loans

259

487

673

1,027

1,579

Total Dollar Amount Loaned

$7,331,421

$11,731,572

$14,899,211

$66,964,593

$43,989,976

Average Loan Amount

$28,307

$24,089

$22,139

$65,204

$27,859

342-G Loans

669

1,075

1,663

2,616

5,332

Total Dollar Amount Loaned

$60,373,929

$103,136,949

$60,155,317

$294,665,056

$271,577,094

Average Loan Amount

$90,245

$95,941

$36,172

$112,640

$50,933

Number of Companies

Reporting

9

806 813 801 772 794

8

Certain transactions were reported by five or less locations. Data was withheld to protect confidentiality of reporting businesses. All brokered loans since

2021, secondary home equity loans since 2017, and 342.G loans since 2017 were reported by five or less companies.

9

Includes all regulated lender submissions. The number of mortgage companies reporting is smaller.

13 | P a g e

Consumer Loans: Personal/Secured Loans (342-E)

Overview

In 2022, 995,604 personal/secured loans were issued under Chapter 342-E. These loans offer higher advance

amounts and lower annual interest rates compared to signature and small installment loans. The cost to refinance

these obligations is also typically lower than alternative products. Collateral for 342-E loans is not required; however,

lenders may choose to request security from borrowers. Loan applications are normally processed and closed on the

same day. Subchapter E loans are typically more affordable than subchapter F loans or payday loans. Lenders are

typically

located in business districts and suburban areas. An increasing amount of loans are offered online.

Type of Customer

Borrowers of consumer loans made under Chapter 342-E typically have better credit profiles than

unsecured/signature loan borrowers. A 342-E borrower will need sufficient disposable income to demonstrate to

the lender they can afford the loan.

Typical Rates

The maximum allowable rates for Chapter 342-E loans are determined in statute and depend on the amount loaned.

Some borrowers may receive a lower-than-maximum interest rate and the lender may offer additional products

and services such as credit insurance or automobile club memberships. Fees common with these loans are filing liens

(perfecting a security interest) and prepaid administrative fees.

Allowable Charges

Interest Rates: typically 18% - 30%

A prepaid Administrative Fee of up to $100 may be included

A late charge of 5% of the missed payment may be assessed 10 days after the due date

$30 fee for dishonored payments by check

Loan Terms

No maximum loan amount (if the rate is 18% or less). General Purpose loans average around

$5,000.

Loan term can be 60 months or more

Typically, no more than one outstanding loan per borrower per company

Prepayment allowed and interest is normally calculated on a simple annual basis

Default

Borrowers with secured loans risk losing their personal property, motor vehicle, or other security to the lender. The

lender or third- party debt collector may pursue the remaining deficiency balance after the collateral has been

disposed of or the entire remaining balance of unsecured loans. A lender may file suit against the borrower, and

most report the repayment history to consumer reporting agencies. A borrower may also face attorney fees,

repossession fees, and court costs added to the loan balance.

Alternatives

Chapter 342-E borrowers could potentially qualify for more traditional and lower cost methods of credit such as:

credit cards for purchases or cash advances; personal loans from credit unions and community banks; loans from

online peer-to-peer lending platforms, or home equity loans.

14 | P a g e

Consumer Loans: Signature/Small Installment Loans (342-F)

Overview

In 2022, 2,440,161 small installment loans averaging $780 were issued under Chapter 342-F. Due to the higher-cost

nature of these loans the cash advance amounts are limited by law. Borrowers can obtain Chapter 342-F loans with

minimal to no security or credit references. Lenders may require collateral such as personal property, including

holding a vehicle title; however, lenders rarely file liens (or perfect a security interest) as the costs of filing such

liens

cannot be recouped from the consumer.

The industry is very homogeneous: storefronts of different companies may be clustered within a specific region or

location, and different lenders may have common borrowers. Lenders depend on repeat business and many

customers end up refinancing their loans several times.

Small installment lenders are located in high-traffic areas such as strip malls. Some lenders may offer loans through

the mail where the offer in the form of a live check can be accepted and cashed outside of a store. In most cases,

borrowers can expect to receive their funds the same day they apply. Loan proceeds are typically provided by check.

Type of Customer

Small Consumer loans made under Chapter 342-F rates are available to customers with below-average credit scores.

A Chapter 342-F borrower needs employment income or some other source of a steady income in order to qualify for

the loan, and the borrower must be able to repay the loan and all other known obligations concurrently.

Typical Rates

The maximum allowable rates for Chapter 342-F loans are determined by statute. Most lenders charge the maximum

interest rates (installment account handling charge), but some may compete with a lower acquisition charge. The

current maximum rates are as follows:

Allowable Charges

Fee structure for loans > $100:

APR 80% - 113%

10% non-refundable Acquisition Charge (limited to $100)

$4 per $100/month Installment Account Handling Charge

A late charge of $10 or 5% of the scheduled installment (whichever is greater) is typically

assessed 10 days after the due date

$30 fee for dishonored payment by check

Loan Terms

Maximum loan amount: $1,700*

Limited loan terms. Usually 9 - 24 months

Typically, no more than one outstanding loan per borrower per company

Prepayment is allowed (without penalty) and interest is normally calculated on a simple or

precomputed basis

*Finance charge brackets and maximum effective rates as of July 1, 2023. Loan ceilings adjust each July 1 based upon the Consumer

Price Index.

15 | Page

Default

Borrowers utilizing secured loans risk losing their personal property, motor vehicle, or other security to the lender.

The lender or third-party debt collector may pursue the remaining deficiency balance after the collateral has been

disposed of or the entire remaining outstanding balance of unsecured loans. A lender may file suit against the

borrower or repossess the collateral, and some lenders report the repayment history to consumer reporting

agencies.

Alternatives

Small consumer loan borrowers may run into eligibility issues with other credit products. Possible alternatives are

pawn loans, credit card advances, and payday loans.

Factors Affecting Consumer Loans

The amount a consumer may borrow is limited on a 342-F loan. The 2023 loan ceiling is $1,700, reflecting an increase

in the Consumer Price Index (CPI) from December 2021 to December 2022. During periods of low inflation, the loan

ceiling has not changed. For the three consecutive years of 2014-2016, the loan ceiling remained at $1,340. Other

than automatic increases in the CPI, the 79

th

Texas Legislature doubled the reference base effective 9/1/2005.

The CPI adjustment has resulted in

the maximum 342-F loan amount

increasing 6.25% in the past year.

An analysis of Transunion credit

data found that the average balance

of all new unsecured personal loans

increased 14.4% nationwide from

Q1 2022 to Q1 2023

. (Transunion,

2023)

$510

$540

$1,080

$1,340$1,340

$1,480

$1,700

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

2003

2004

2005

9/1/2005*

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

342-F Max Loan Amounts

16 | Page

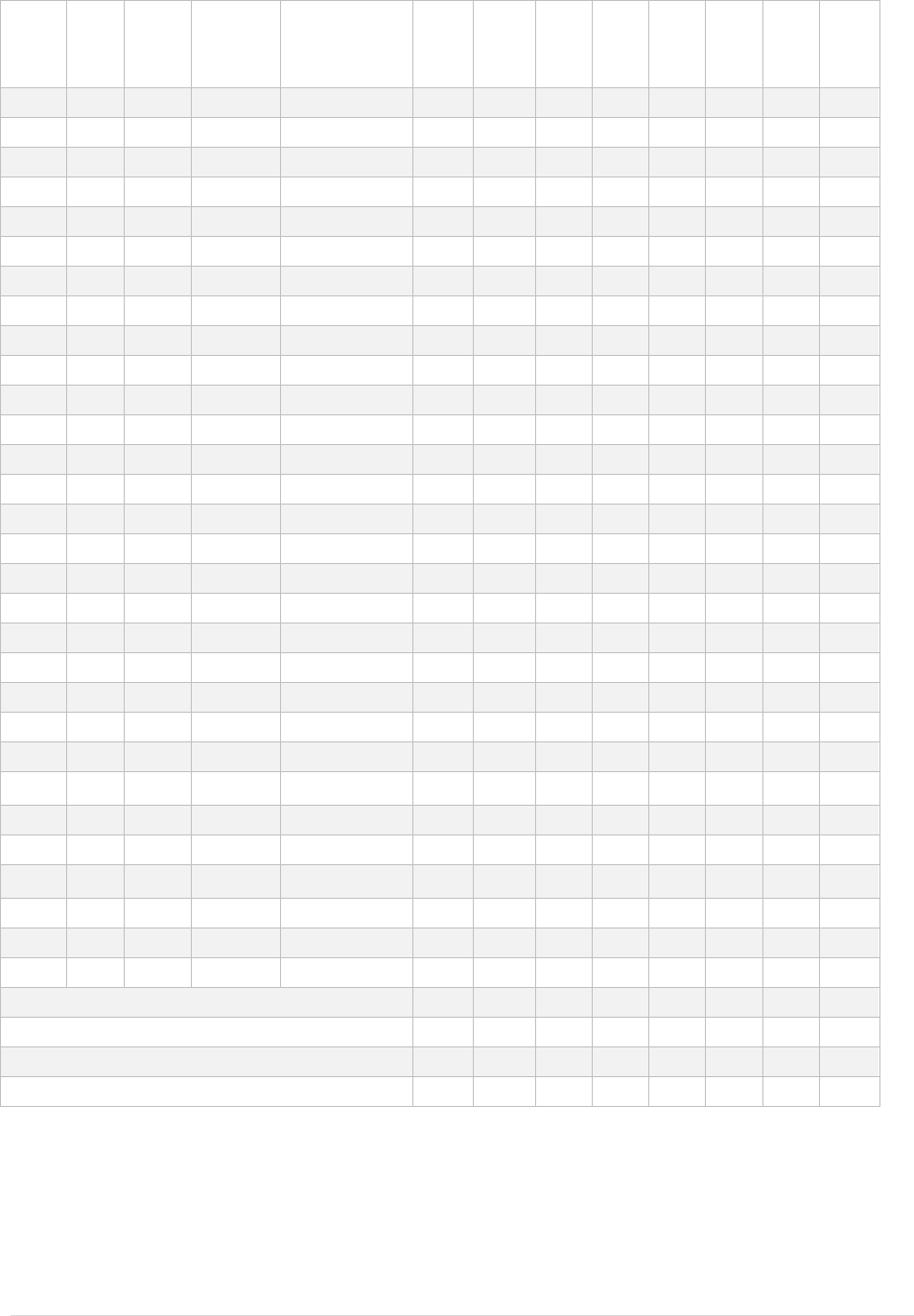

Regulated Lender Consolidated Volume Report for

Calendar Year 2022

Loans Made

Number

of Loans Dollar Value of Loans

Chapter 342-E

995,604

$5,367,220,173

Chapter 342-F

2,440,161 $1,902,459,872

Chapter 342 G – Secondary Mortgages

10

Home Equity Loans – 1st Lien

6,462

$1,619,641,517

Home Equity Loans – 2nd Lien

7

Chapter 346 – Revolving Credit Accounts

14,753

$93,547,787

Chapter 348 – Motor Vehicle Sales Finance

346,805

$12,976,091,591

Chapter 345 – Retail Installment Sales/Contracts

4,618,045 $1,244,198,853

Chapter 347 Loans – Manufactured Housing

3,145

$346,378,876

Number of Companies Reporting: 806

10

Volume below reportable activity

17 | Page

Property Tax Loans (351)

Overview

In 2022, 6,346 property tax loans averaging $14,526 were made under Chapter 351 on residential properties. With

the consent of the property owner, a property tax lender is allowed to transfer and assume the special lien generated

by taxing units of the property by paying delinquent taxes. The special lien retains its superior lien position (e.g.

priority position in front of a purchase mortgage) after transfer and is foreclosable.

The industry relies on direct mail solicitation, web search results, and repeat customers for its business. Property

owner information is generally public record and can be used in mail solicitations; however, specific advertisement

rules in 7 Texas Administrative Code §89.208 apply. Property Tax Loans on residential properties must be closed by

licensed residential mortgage loan originators.

Type of Customer

Property owners 65 and older claiming a homestead exemption on the property may defer their property taxes and

are not eligible for a property tax loan. Property tax loan borrowers either own their house without a mortgage or

have at least one mortgage but do not escrow their taxes.

Typical Rates

The maximum allowable rates for Chapter 351 loans are determined by statute. The average rate is lower than the

maximum interest rate of 18%. Lenders can also charge closing costs associated with the review and preparation of

loan documents.

Allowable Charges

Interest Rate of 18% or less:

General Closing Cost limit of $900

Additional Closing Costs of $100 per additional parcel of real property

Reasonable fee if required to repair a title defect

A late charge of 5% of the scheduled installment assessed 10 days after the due date

Additional fees paid to attorneys for foreclosure and bankruptcy actions can be substantial

Loan Terms

Maximum loan amount is based on the definition of Funds Advanced in Texas Tax Code §32.06 and is

limited to items on the tax receipt, fees to record the lien, and closing costs

Loan terms vary from one year to several years

Notification to any pre-existing lienholders required after transfer and after 90 days of delinquency

Prepayment is allowed (without penalty on homestead property) and loans that become

delinquent by 90+ days are often paid by the borrower’s pre-existing mortgage company

18 | P a g e

Default

Similar to a mortgage or home equity loan, borrowers risk foreclosure for non-payment. After a foreclosure sale, the

original residential property owner has a right to redeem by paying 125 percent of the foreclosure sale price during

the first year of the redemption period or 150 percent of the foreclosure sale price during the second year of the

redemption period with cash or cash equivalent funds.

Alternatives

1. Taxing Unit Payment Plan for Residence Homesteads

11

2. Credit Card with a low-interest rate

3. Home Equity Loan

4. Other options may be offered by individual County Tax Collectors or Texas Tax Code Chapter 31 (some options may

have eligibility requirements)

Factors Affecting

Property Tax Loans

Texas has the sixth highest

property tax burden in the United

States. An analysis of 2020 tax

payment data concluded that the

median taxes on a median-priced

Texas home produced an

effective tax rate of 1.66%. (Fritts,

2023) High tax rates on property

and increasing property values

would generally raise the cost of

home ownership through

increasing taxes.

Increased property values represent unrealized gains to Texans maintaining residency. Texas property values have

seen a dramatic increase over the last 10 years (Texas Real

Estate Research Center - Texas A&M University, 2023) largely

outpacing both real and nominal wages. (US. Census Bureau,

2022)

Homestead exemptions are an important tool in mitigating

the rise in taxes as they limit assessed value increases from

year to year and exempt a portion of the property’s taxable

value. Texas voters have amended the Texas Constitution four times in the last 26 years increasing the homestead

exemption. Important public policy decisions affecting taxes on homesteads, property owners on fixed incomes

(aged 65 and older, disabled, surviving spouses), and payment options at the tax office all impact the amount of

taxes owed and the demand for property tax loans.

11

Texas Tax Code §33.02

Year Homestead Exemption

< 1997

$5,000

1997

$15,000

2015

$25,000

2022

$40,000

2023

$100,000

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

$350,000

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

Texas Home Prices and Nominal

Family Income

Median Sales Price for January of the Year

Nominal Median Family Income Texas

19 | P a g e

Property Tax

L

e

nding

Consolidated Volume

R

e

po

r

t

Calendar Year

2022

Loans Made Statistics

Residential Non-Residential Total

Number of Loans 6,346 1,192 7,538

Amount of Loans $92,185,081 $73,847,388 $166,032,469

Average Loan Amount $14,526 $61,953 $22,026

Total Closing Costs $5,266,412 $2,083,811 $7,350,223

Average Closing Costs $830 $1,748 $975

Average Interest Rate 12.99% 11.76%

Total Volume Statistics

Number of Loans Receivable 24,506

Amount of Loans Receivable $500,679,742

Number of Loans 90+ Delinquent 5,131

Amount of Loans 90+ Delinquent $128,915,838

Number of Foreclosures

193

Amount of Foreclosures $9,964,692

Number of Companies Reporting: 67

Data as of 6/20/2023

20 | P a g e

Credit Access Businesses (Payday and Title Loans) Chapter 393

Overview

Credit access businesses (CABs) obtain credit for a consumer from an independent third-party lender in the form of

a deferred presentment transaction or a motor vehicle title loan, more commonly referred to as “payday loans” or

“title loans.” In Texas, the actual third-party lender is not licensed; rather, the credit access business that serves as

the broker is the licensee in this regulated industry.

Credit access businesses charge a fee to the consumer for obtaining a third-party loan. Fees are usually calculated

as

a percentage of the loan amount, either paid at the inception of the loan or accrued daily while the loan is

outstanding. All payments are made directly to the CAB, and the borrower will generally not have any direct contact

with the lender. The CAB provides the borrower with a check for the proceeds issued from the lender’s account.

Borrowers can obtain these loans in high-traffic areas and increasingly online.

Type of Customer

Payday loan customers need an active bank account and lenders will advance money to the consumer based on the

expectation that money is regularly deposited in that bank account. Title loan customers are required to have an

unencumbered motor vehicle title to offer as security. Both types of customers could have anywhere from average

to poor credit scores and choose these loans out of convenience or eligibility reasons.

Typical Rates

The majority of the loan cost is not capped. Fees charged to borrowers by the CAB typically depend on the amount

of the loan and the length of the term. CAB agreement terms are limited to 180 days or less. The entire loan may be

due in a matter of days, or the loan may be due over several equal payments. Refinancing or renewing payday and

title loans is very common and can add to the cost.

Allowable Charges

Fees charged by broker are uncapped (lender interest is 10% or less)

APR can exceed 400%

Late charge is 5% of payment or $7.50 (whichever greater). Late charges may be assessed 10

days after the due date.

Filing fees and non-sufficient fund fees

Consumer may have the option to purchase insurance or motor club memberships

Loan Terms

No maximum loan amount (typically $400 - $1,200)

Loan terms range from 3 - 180 days

Entire amount may be due in a single payment

Prepayment allowed (without penalty) but fees may be non-refundable

21 | P a g e

Default

Borrowers utilizing title loans risk losing their motor vehicle to the lender or to the CAB. The loan is usually

guaranteed by the CAB and the borrower will be pursued for the deficiency balance. Creditors may file suit against

the borrower for non-payment and some may report the repayment history to consumer reporting agencies. A

borrower may also face attorney fees, repossession fees, and court costs added to the loan balance.

The prevalence of motor vehicle

repossessions in the CAB industry is

reported by quarter and has typically

totaled 8,000 to 12,000. However, total

repossessions in Q1 2020 peaked at

about 13,100. This number then fell

significantly in Q2 2020 as creditors

worked with borrowers at the height of

the coronavirus pandemic. Many people

lost their jobs; however federal stimulus

and loan forbearance played a large role

in limiting Q2 repossessions. Since the

beginning of the pandemic, total

repossessions have fluctuated from

quarter to quarter, and repossessions as

a percent of active title loans have

continued to remain higher than

historical norms. Since borrowers may

obtain multiple loans throughout the year the repossession rate reflects the likeliness on a transaction basis not a

borrower basis.

Alternatives

Payday and title loan borrowers generally pay a high rate for their credit and may run into eligibility issues with other

products. Possible alternatives are pawn loans, small installment loans, employer loans, or other competitive small-

dollar loan products sometimes offered by credit unions or nonprofit organizations.

Data Limitations

The reported loans made have decreased in this industry since 2019 and factors specific to industry are likely a bigger

cause than the COVID pandemic. CABs are a specific subset of a broader classification of businesses registered as

Credit Service Organizations (CSOs) with the Texas Secretary of State. In 2019, the Attorney General of Texas opined

that CSOs that are not CABs can still arrange extensions of credit for consumers so long as they are not deferred

presentment transactions

12

or motor vehicle title loans. (Attorney General of Texas, 2019) CSOs which are not CABs

might not: (1) obtain OCCC licenses, (2) receive OCCC compliance exams and (3) report transaction data to the OCCC.

Additionally, the transaction itself has evolved from a predominantly single payment loan with multiple renewals to

one installment loan with the term and renewal equivalent to multiple loans.

12

See Texas Finance Code §341.001(6) for definition

13,113

7.50%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

8.00%

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

Repossessions

Total Percentage of Active Title Loans

22 | P a g e

Credit Access Business (CAB) Annual Data Report, CY 2022

Data contained within the below summary represents aggregated statewide annual data reported by credit access

businesses

(CABs) as of 3/15/2023. The OCCC reviewed the data for reasonableness. The OCCC continues to receive

amended or corrected

data submissions and periodic revisions are published when significant. The OCCC will request

verification from the licensee of any data that is found to be questionable or unreasonable.

Title 7, Section 83.5001 of the Texas Administrative Code requires CABs to file annual data reports with the Office of

Consumer Credit Commissioner (OCCC) identifying loan activity associated with:

•

single and installment deferred presentment (payday) loans, and

•

single and installment auto title loans.

Data Limitations

Data provided by reporting CABs reflects location-level activity for the identified year. Each licensed location is

treated

as an individual reporting unit. If data was compiled from individual customers, it could produce different

results.

The data presented in the following summary represents CAB submissions via electronic and manual reporting (including

any corrected data) of annual activity as of March 15, 2023.

Item

#

Item Description

Single Payment

Deferred

Presentment

Transactions

Installment

Deferred

Presentment

Transactions

Single Payment

Auto Title

Loans

Installment

Title Loans

1

Number of extensions of consumer

credit paid in full or otherwise closed

for reduced payoff during 2022 that

did not refinance.

177,002 834,160 13,930 41,191

2

Number of refinances of extensions of consumer credit before paid in full or otherwise closed for reduced

payoff in the report year.

13

2A

Refinancing 1 time

43,446

54,682

1,753

6,212

2B

Refinancing 2-4 times

54,161

31,309

9,378

9,190

2C

Refinancing 5-6 times

6,027

3,144

3,734

1,116

2D

Refinancing 7-10 times

3,381

1,781

4,258

837

2E

Refinancing more than 10 times

2,342

1,074

7,243

624

3

Total amount of CAB fees charged by

the CAB on all CAB contracts during

2022.

$71,190,940 $1,235,423,411

$203,008,710 $276,572,253

4

Total number of extensions of

consumer credit or refinances where

the CAB repaid the third-party lender

under a contractual obligation,

guaranty, or letter of credit.

90,402 751,793 95,447 51,546

(Table continued on next page)

13

Item 2 collects information on the number of times a loan was refinanced before it was ultimately paid off. Data includes all loans paid out in the calendar

year that had been refinanced prior to being paid in full, regardless of when the loan was originated.

23 | P a g e

Item

#

Item Description

Single Payment

Deferred

Presentment

Transactions

Installment

Deferred

Presentment

Transactions

Single Payment

Auto Title

Loans

Installment

Title Loans

5

Number of consumers for whom the CAB

obtained or assisted in obtaining an

extension of consumer credit during

2022.

124,839 1,177,720 75,392 84,372

6

Total number of new extensions of consumer credit during the report year for each of the following loan

ranges (cash advance amounts).

6A

$0 - $250

82,333

286,905

8,895

3,008

6B

$251 - $500

116,641

480,416

19,774

14,513

6C

$501 - $750

43,299

234,111

14,273

11,966

6D

$751 - $1000

33,037

215,431

18,691

15,739

6E

$1001 - $1500

18,116

116,990

19,766

17,732

6F

$1501 - $2000

5,415

31,789

13,563

11,986

6G

$2,001 - $2,500

7

12,372

7,707

7,627

6H

$2,501 - $3,000

6

4,060

7,118

5,540

6I

$3,001 - $5,000

0

401

10,344

9,306

6J

$5,001 - $7,500

0

4

4,047

2,350

6K

Over $7,500

0

0

2,858

1,395

7

Total dollar amount of new extensions of consumer credit during the report year for each of the following

loan ranges.

7A

$0 - $250

$14,669,075

$45,793,819

$1,415,401

$555,559

7B

$251 - $500

$45,091,277

$199,894,505

$8,031,924

$6,057,396

7C

$501 - $750

$27,000,797

$149,223,619

$9,075,406

$7,572,740

7D

$751 - $1000

$30,334,558

$195,374,535

$17,298,015

$14,567,372

7E

$1001 - $1500

$23,306,659

$147,140,556

$25,626,151

$22,656,335

7F

$1501 - $2000

$9,988,419

$58,586,784

$24,891,795

$21,779,436

7G

$2,001 - $2,500

$16,080

$29,225,904

$17,845,424

$17,460,568

7H

$2,501 - $3,000

$16,996

$11,726,448

$20,401,493

$15,698,853

7I

$3,001 - $5,000

$0

$1,390,130

$40,770,126

$37,020,048

7J

$5,001 - $7,500

$0

$24,851

$24,551,256

$14,006,685

7K

Over $7,500

$0

$0

$26,687,706

$14,073,505

8

Total number of refinances on

extensions of consumer credit

originated in 2022.

191,453 211,428 185,983 41,167

9

Total dollar amount of extensions of

consumer credit for 2022.

$150,423,930 $838,381,133 $216,594,713 $171,448,507

10

Total dollar amount of refinances for

2022.

$148,522,821 $341,692,690 $530,001,711 $120,886,860

Number of locations reporting activity 431 545 681 570

Total Number of Companies Reporting: 1,652

24 | P a g e

Pawn Loans (371)

Overview

A pawnshop offers short-term credit to customers (pledgors) who pledge their tangible personal property as

collateral for a cash advance. This is the only type of consumer loan that involves a possessory interest where the

pledgor relinquishes use of the security during the life of the loan.

Most pawnshops are storefronts in high-traffic areas. Depending on the wait in the pawnshop, the

customer

could expect to receive the cash proceeds in a matter of minutes.

Type of Customer

A pawn loan is strictly an asset-backed loan and no credit application is required. The pledgor is not required to have

a job or the ability to repay the loan. The only eligibility requirements are:

1.

Age 18 or over

2.

Proper form of Identification

3.

Legal right to possess and pledge the goods

Typical Rates

The maximum allowable rates for pawn loans are determined by statute. Most pawnshops charge the maximum

rates with occasional promotional offers. The current maximum rates are as follows:

Allowable

240% for loans up to $255

Charges*

180% for loans up to $1,700

30% for loans for up to $2,550

12% for loans up to $21,250

Loan Terms

Cannot exceed one month

Minimum additional 30-day grace period

May be renewed or extended

No personal liability for pledgor

*Finance charge brackets and maximum effective rates as of July 1, 2023. Rates adjust each July 1 based upon the Consumer Price

Index.

25 | P a g e

Default

To reclaim possession of the pledged goods the pledgor must repay the entire loan. If the customer does not redeem

pledged items at the end of the loan term those items may then become part of the pawnshop’s inventory and are

offered for sale to the public. In the event of forfeiture, the pledgor has no further obligations and the pawnshop is

prohibited from seeking a deficiency, filing suit, or reporting the default of the loan on the pledgor’s credit history.

Alternatives

Generally, pawn loans have the least restrictive eligibility and almost anyone could choose to become a customer.

The most direct alternative would be selling the secured goods to a pawnshop, a consignment shop, or a private

party. If the customer qualifies, a small consumer loan (342-F) secured by personal property could be less expensive.

Factors Affecting the Pawn Loan Amount

From 2020 to 2022 the number of Texas pawn

loans rose 11% and the amount loaned rose 29%.

Two factors stand out for the increase in pawn

loan demand: (1) The recovery from the Covid-

19 pandemic and subsequent end to many

economic relief programs, and (2) Price increases

of around 15% through inflation (CPI-W) (Social

Security Administration, 2023) from December

2020 through December 2022. Although loan

activity remains lower than pre-pandimic levles.

In Texas, there are additional factors affecting

the amount loaned on items due to the

allowable rate structure. When prices rise consumers may seek to borrow more and in the case of a pawn loan their

collateral for the loan could also be worth

more. Pawn rates are tied to the amount

loaned on each pawn ticket and the overall

rates decrease when predetermined loan

amount are exceeded. Those loan amounts

are computed every year according to

inflation and have risen approximately 15%

from 2021 to 2023. The

One Month Pawn

Service Charge graph (at right) illustrates three examples of similar loan amounts and how the pawn service charge

declines after the loan amount surpasses the next rate threshold. The hypothetical decision on how much to loan

on an item is influenced by the maximum interest that a pawnbroker can earn. The largest difference is seen at the

rate ceiling between 15% (180% APR) and 2.5% (30% APR) per month which currently occurs at $1,700. Despite the

fact that the consumer desires a larger loan, the consumer may be artificially limited to a loan size due to the

structure of the pawn service charge rate brackets.

Example Item Loan Amount 1 Month Interest Earned

Power Tools

$225

$45

$260

$39

Gold Jewelry

$1,500

$225

$1,750

$44

Motorcycle

$2,250

$56

$2,600

$26

$45

$39

$225

$44

$56

$26

$0

$50

$100

$150

$200

$250

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$225 $260 $1,500 $1,750 $2,250 $2,600

One Month Pawn Service Charge

Loan Amount 1 Month Interest Earned

240% limit

180% limit

30% limit

26 | P a g e

Paw

n Industry Consolidated Volume Report by Calendar Year

Loans Made

Number of Loans Dollar Value of Loans Average Loan

2022

5,752,850 $982,305,520 $171

2021

5,041,993 $875,583,904 $174

2020

5,174,572 $761,250,480 $147

Loans Outstanding

Nu

mber of Loans Dollar Value of Loans Average Loan

2022

1,265,258 $282,908,435 $224

2021

1,277,783 $252,223,573 $197

2020

1,258,157 $221,982,276 $176

Number of Companies Reporting in CY 2022: 1,352

Number of Companies Reporting in CY 2021: 1,382

Number of Companies Reporting in CY 2020: 1,374

27 | P a g e

Motor Vehicle Sales Finance (348)

Overview

Many motor vehicle dealers offer financing directly at their dealership. These retail installment transactions involve

two parties: (1) a retail seller and (2) a retail buyer. The retail installment contract is either immediately assigned to

a separate holder or serviced by the selling dealer.

Franchised dealers are authorized to sell new cars and maintain an affiliation with a specific auto manufacturer.

Financing arranged through a franchised dealership is usually assigned to a captive finance company of the

manufacturer or an independent acceptance company. These dealers are usually found on frontage roads of major

highways.

Independent dealers exclusively sell used cars. Financing is often in-house or referred to as “buy-here pay-here.”

Size and location vary but many are very small businesses located throughout cities and towns.

Type of Customer

Franchised and independent dealers attract customers based on their type of inventory. A franchised customer is in

the market for a new or certified pre-owned car, has disposable income to cover monthly payments, and has an

average to great credit score. There is usually more underwriting involved at a dealer that assigns contracts than one

that collects payments themselves. Buyers at franchised dealerships can often negotiate lower rates, sometimes as

low as 0%. Independent dealers often do not perform credit checks and rely on current income or down payment

affordability to underwrite the transaction.

Typical Rates

The maximum allowable rates for motor vehicle sales finance are determined by statute as add-on rates (e.g. $15

of finance charge per $100 financed per year). Most dealerships convert the add-on rates to equivalent rates that

depend on term of the contract and age of the vehicle. The current maximum rates are as follows:

Maximum

Rates

18% for New Cars

~ 18% for cars one to two years old

~ 22% for cars three to four years old

~ 26% for cars five years and older

Example

Other Charges

5% late fee for payments more than 15 days late

Actual government official fees for taxes, title, license, inspection

Reasonable Documentary Fee (normally $150)

Ancillary products may be purchased

Out-of-pocket expenses are required the for repossession of the vehicle

28 | P a g e

Default

A buyer risks repossession for late payment, failing to maintain insurance, filing for bankruptcy, or any other

provisions of default as listed in the contract. In addition to losing the vehicle, a repossession can negatively impact

a consumer’s credit history. The buyer might be required to pay the entire amount owed and not just the past due

amount to redeem their vehicle.

Initial delinquencies generally rise

during times of economic stress.

After the recovery of the “great

recession”, auto financing that was

30+ days delinquent remained

relatively stable. According to the

most recent data (Q3 2023), new

delinquencies have risen 118 basis

points since Q3 of 2022. Vehicle

prices have increased substantially

in the past couple of years and

remain elevated despite rising

interest rates. The higher costs of

vehicles are causing many

Americans to struggle to make loan

payments.

Alternatives

Traditional car shopping advice is for perspective buyers to first obtain pre-approval of financing through their bank

or credit union and bring that with them to the dealership. After negotiating a sale price for the car at the dealership

then financing should be discussed. If the dealership can offer better financing terms than the consumer obtained

from their financial institution, they could make a reasoned decision on how they wish to finance the vehicle.

Unique supply issues during the pandemic upended the traditional advice. Several consumers reported that dealers

would not sell them vehicles unless they obtained financing through the dealership (Wheeler, 2022). During this

period, demand exceeded supply and dealers could select buyers that benefited them through (1) quicker timing of

funding, (2) less paperwork, and (3) receiving financing incentives. The car supply challenges of 2020-2022 was a

unique period but the impacts on consumer choice in obtaining financing should be considered.

Source: New York Fed Consumer Credit Panel/Equifax

Source: New York Fed Consumer Credit Panel/Equifax

0

2

4

6

8

10

12

Transition into Delinquency (30+)

29 | P a g e

Motor Vehicle Sales Industry Data

The OCCC does not currently collect annual report

data from motor vehicle sales finance dealers who

hold a chapter 348 license. Industry monitoring is

primarily completed through examinations,

stakeholder meetings, and changes in license levels.

The highest licensing levels used to occur in the third

fiscal quarter of every year and renewals occurred in

the fourth fiscal quarter. There is an anticipated drop

regarding companies that have closed and do not

renew their license. Starting in 2020, renewals were

moved to the first quarter of the year and now the

highest levels should be in Q4 of each fiscal year. The

chart shows the peak licensing levels for the last five

years. License volumes were steadily increasing before

the COVID-19 pandemic but have been on a slight downward trend ever since.

National Trends

United States motor vehicle sales increased from 2009 to 2016, but rising vehicle prices may have capped consumer

enthusiasm in the ensuing years. Seasonally adjusted sales stagnated from 2016 through 2019, with figures hovering

around the 17-18 million vehicles range. In 2020, supply chain disruptions significantly impacted total vehicle sales.

Today, total vehicle sales are on a steady upward trend to gradually reach pre-pandemic levels.

Prices of both new and used vehicles today are significantly elevated above historical norms. Additionally, interest

rates have risen as the Fed attempts to combat inflation. Although the combination of higher auto loan amounts

and higher interest rates was expected to curb demand, many citizens need a vehicle to work and thus were forced

to take on this greater financial burden.

9,537

9,963

9,684

9,644

9,339

8,000

8,200

8,400

8,600

8,800

9,000

9,200

9,400

9,600

9,800

10,000

10,200

2019 2020 2021 2022 2023

Motor Vehicle Sales Finance

(License Volumes)

30 | P a g e

Average Auto Loan Amount

The average auto loan amount

increased to $14,844 in 2023 Q3. Over

the last decade, the average auto loan

balance has increased $5,157. General

inflation of the dollar over time and

longer-term loans have contributed to

this jump. This average represents the

average amount that a person has left

to pay on an auto loan, not the amount

of a brand-new loan.

(Federal Reserve Bank of New York,

2023)

Motor Vehicle Sales

Motor vehicle sales steadily increased

following the great recession before

stalling around 2015. Covid-related

supply chain disruptions had a great

effect on the number of motor vehicle

sales in the first year following the

pandemic. Today motor vehicle sales

are climbing back to their pre-pandemic

trends despite larger average auto

loans and higher interest rates.

0

2

4

6

8

10

12

14

16

18

20

Millions of Vehicles

Total Light Vehicle Sales

$8,000

$9,000

$10,000

$11,000

$12,000

$13,000

$14,000

$15,000

$16,000

2005

2010

2015

2020

Average Auto Loan Balance

31 | P a g e

Interest Rates for New Cars

Bank rates dipped following the recession but had

been rising for the last few years. Rates peaked in

2019 before decreasing during the COVID-19

pandemic. These low-interest rates coupled with

severe inventory shortages caused the price of

vehicles to increase. Today, despite the supply-

chain issues of the pandemic being largely

neutralized and interest rates sitting at just under

8%, car prices remain high. (Board of Governors of

the Federal Reserve System, 2023)

Current Outlook of Motor Vehicle Sales

Recessions tend to depress sales of motor vehicles like many other household purchases. The “great recession” of

2008 also impacted credit markets causing a dramatic decrease in new car sales. (Kellogg Insight, 2016) The current

economic conditions present their own challenges for car sales.

Wholesale used-vehicle prices (on a mix,

mileage, and seasonally adjusted basis)

decreased 2.3% in October from

September. The Manheim Used Vehicle

Value Index dropped to 209.4, down 4.0%

from a year ago. (Manheim, 2023) Car

prices are still elevated far above historical

norms and are likely to remain elevated for

the foreseeable future, but the downward

trend emerging from the data suggests

that used cars prices are stabilizing.

4

5

6

7

8

9

2017 2018 2019 2020 2021 2022 2023

Interest Rate

Interest Rates for New Cars

Commercial Bank Rates - New Car Loans (60 month)

Commercial Bank Rates - New Car Loans (72 month)

Finance Companies - New Car Loans

32 | P a g e

Emergency or Unexpected Credit – Purpose and Amount

Since 2013, the Federal Reserve has conducted surveys on likelihood that an American adult could pay for an

unexpected $400 expense with cash or its equivalents. In 2021, a record high number (68%) reported they could

cover the expense with cash or its equivalents. However, a year later the survey found consumers were doing

noticeably worse, with only 63% reporting they would be able to cover a $400 expense and 18% saying the largest

expense they could cover was less than $100 with current savings. (Board of Governors of the Federal Reserve

System)

Lending Club Corporation in partnership with PYMTS conducted a similar survey and concluded that the static $400

metric used by the Federal Reserve was not relevant for the types of expenses consumers face today. (PYMNTS and

LendingClub Collaboration, 2022) Their survey found that the average emergency expense is roughly $1,400 with car

repairs being the most common.

Type of Expense

14

Frequency of Expense

Average Cost

Car repairs 30% $1,008

Health-related occurrences 21.40% $1,361

House-related issues and relocating 19.40% $2,042

Unexpected high bills or taxes 6.90% $1,852

Kids or grandkids-related expenses 5.30% $1,742

Vet or pet-related expenses 4.30% $1,070

Loaned money to relatives 0.80% $1,051

Other expenses 11.80% $1,536

Weighted average emergency expense

$1,446

14

Based on consumers who reported an emergency expense in the preceding three months of the 2022 PYMNTS.com “New Reality Check: The

Paycheck to Paycheck Report” survey.

33 | P a g e

Installment Loan Comparisons – Examples of Pricing and Restrictions

The OCCC licenses four types of installment loans a consumer might turn to in the case of an unexpected

$1,000 - $2000 expense.

FEATURES

342-E 342-F CAB Payday CAB Title

Loan Terms

Average Loan Amount $5,391 $780 $624 $1,634

Typical Term in Months 36-60 12-24 5 5

Typical APR

15

18%-32% 82%-98% 411% 369%

Direct Comparisons (cab loans are limited to 180 days

and those loan terms are unusual for 342-F and 342-E)

Hypothetical Loan Amount $1,700 $1,700 $1,700 $1,700

Hypothetical Term 5 5 5 5

Monthly Payment $386 $428 $756 $708

Total Finance Charge $230 $440 $2,078 $1,838

Consumer Protections

Ability to Repay Analysis Required

Prepayment Penalty Prohibition

Additional Fees limited

Refund of Unearned Finance

Charge Required

Contracts are Required to be

Written in Plain Language

Eligible to Military

16

No Other Fees or Products Allowed

(e.g. credit insurance)

15

CAB APR is estimated from fees reported to the OCCC in 2023 Q2 Data reports.

16

10 U.S. Code §987 restricts loan terms to members of the military including a “all-in” APR limit of 36%. Not all 342-E loans are eligible but are the

most likely option.

34 | P a g e

Emerging Products and Innovation

The OCCC is monitoring several emerging financial products. These products contain possible benefits and expanded

access to customers but also possess some regulatory uncertainty. If the products or providers don’t perform then

the customer risks having few options for corrective assistance.

A 2023 Government Accountability Office (GAO) report highlighted several innovative products that market to

underserved and unbanked populations. The report highlighted potential benefits such as lower costs and increased

access compared to alternatives such as payday loans. Highlighted risks include a lack of full transparency related to

product fees and features. Additional risks to banking partners (an integral source upon which many innovative

products rely) are due to fair lending concerns, lack of FDIC insurance for fintech deposit accounts, 3

rd

party fraud

and anti-money laundering compliance.

The GAO issued a recommendation to the Consumer Financial Protection Bureau (CFPB) that additional Truth in

Lending Act guidance is needed to further define “credit” in relation to Earned Wage Access (EWA) providers. (United

States Government Acountability Office, 2023) In 2020, the CFPB issued an advisory opinion that one specific EWA

product was not an extension of credit. A coalition of 96 consumer advocates sent a letter to the CFPB in October

2021 asking them to review the issue and regulate the EWA industry, especially products that charge a fee. (National

Consumer Law Center, 2021) On June 30, 2022, the CFPB rescinded its approval of the special “regulatory sandbox”

treatment of a particular EWA company. Innovation in financial services promises to offer many benefits in relation

to availability, pricing, and service. Regulatory clarification is important to ensure a fair marketplace and proper

consumer protection safeguards.

35 | P a g e

Financial Education

The OCCC supports and promotes financial education throughout the state to encourage and empower Texans to

achieve financial capability. The OCCC partners with many organizations throughout the state to host, participate,

and assist with financial education programs. During Fiscal Year 2023, the OCCC participated in 24 financial education

events where 1052 people received direct educational services.

The OCCC administers the Texas Financial Education Endowment (TFEE) Grant. TFEE supports statewide financial

capability and consumer credit building activities and programs. The endowment is funded through assessments on

each credit access business and is administered by the Finance Commission of Texas.

The 2022-2023 TFEE grant cycle is currently in progress. For this grant cycle, the Finance Commission awarded

$409,000 in aggregate awards to 12 organizations. As of June 2023, approximately $343,000 has been disbursed to

grant award recipients.

The 2024-2025 TFEE grant cycle begins on January 1, 2024. Fifty-two applications were received for the upcoming

grant cycle, requesting nearly $4 million in funding. To guide the TFEE application and funding recommendations,

the agency coordinates a Grant Advisory Committee (GAC). The role of the GAC is to evaluate grant applications

objectively and transparently, then make recommendations to the Finance Commission. The GAC considers several

factors in determining TFEE grant award recipients, including TFEE priorities, geographic areas, unique and