0

COSHOCTON

COUNTY

ECONOMIC

DEVELOPMENT

STRATEGIC PLAN

Prepared for:

Coshocton County Port Authority

Prepared by:

Voinovich School of Leadership and Public Service at

Ohio University

Staff Research Team:

Marty Hohenberger, Director, Center for Economic

Development & Community Resilience

Clara Bone, Senior Project Manager

Student Research Team:

Vic Crawford, Graduate Research Assistant

Ryan Humeniuk, Undergraduate Voinovich Scholar

Ava Hamilton, Undergraduate Voinovich Scholar

December

2023

Funded by:

U.S. Economic

Development

Administration

Assistance to Coal

Communities (ACC),

JobsOhio, and the

Ohio Appalachian New

Economy Partnership

1

Executive Summary

This report, developed by Ohio University’s Voinovich School of Leadership and Public Service,

investigates strategies to enhance economic development for Coshocton County, Ohio as part of

RISE Ohio. RISE Ohio was funded by U.S. Economic Development Administration Assistance to

Coal Communities (ACC), JobsOhio, and the Ohio Appalachian New Economy Partnership, a

program of the Ohio Department of Higher Education and the State of Ohio.

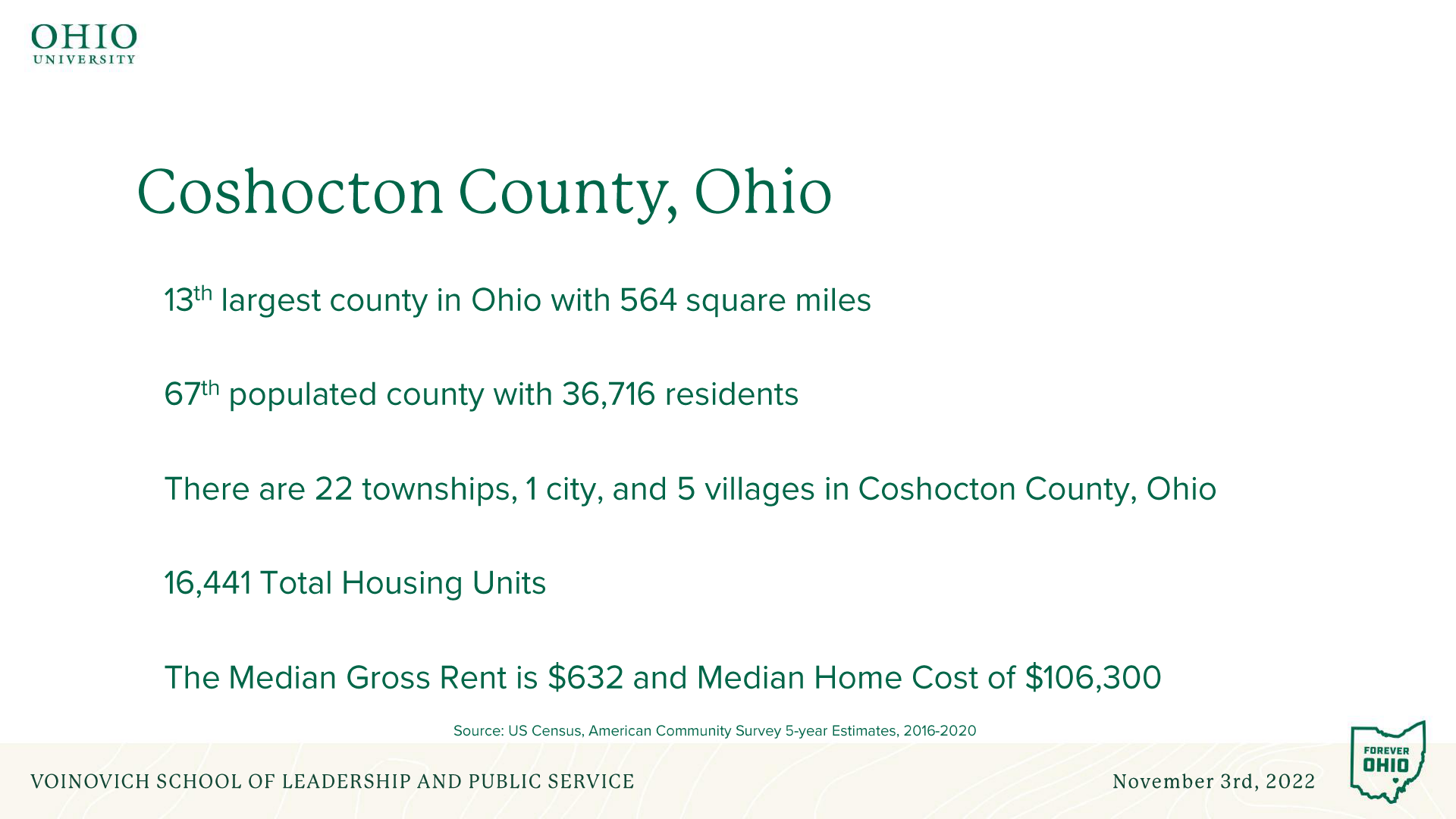

Coshocton County has seen population decline over the last two decades, as well as overall

hollowing of prime working age adults. Over 40% of Coshocton County’s population is 50 or

older. The availability of quality housing is limited, which restricts Coshocton County’s ability

to address this population decline by attracting first-time home buyers, middle-class families, or

those looking to locate near Columbus or the new Intel facility in Licking County for work.

Additionally, the closure Conesville Coal-fired power plant was a significant loss in employment

and tax revenue for the county. Opportunities for redevelopment of the site should be explored.

Manufacturing remains Coshocton’s primary employer. Supporting this industry and attracting

potential Intel supply chain businesses could be beneficial for Coshocton County.

Coshocton County has key decisions to make to stabilize and ultimately reverse this population

decline, and the resulting “brain drain” and other ancillary challenges. This plan specifically

recommends three focus areas: 1) Infrastructure (including Housing); 2) Workforce and

Entrepreneurial Development; and 3) Tourism. Concentrated strategic investment and support of

these themes may help capitalize on emerging opportunities resulting from the development of

the Intel facility in Licking County through workforce opportunities, supply chain development,

and attraction of new residents. Coshocton County should focus on implementing the priorities

put forth in this plan.

2

Table of Contents

Coshocton County Economic Development Strategic Plan

Executive Summary ....................................................................................................................................... 1

Table of Contents .......................................................................................................................................... 2

1. Economic Scan .......................................................................................................................................... 3

2. Comparable Communities Assessment .................................................................................................. 21

3. Examining the Potential for Using Tax Increment Financing (TIF) in Coshocton, Ohio .......................... 32

4. Additional Studies ................................................................................................................................... 49

5. Community Engagement ........................................................................................................................ 49

6. Priorities .................................................................................................................................................. 54

6.1 Infrastructure (including Housing) .................................................................................................... 54

6.2 Workforce and Entrepreneurial Development ................................................................................. 55

6.3 Tourism ............................................................................................................................................. 56

3

1. Economic Scan

The first task associated with this work involved a demographic and economic scan in order to

compile a foundation of solid information on key economic and demographic descriptors (e.g.,

unemployment rates, income, labor markets, etc.) of Coshocton County and the surrounding

areas.

This section provides the existing population and household trends and characteristics of

Coshocton County and Ohio, including age, educational attainment, and household incomes.

Additionally, this section provides the economic trends in unemployment, labor force

participation, and employment by industry.

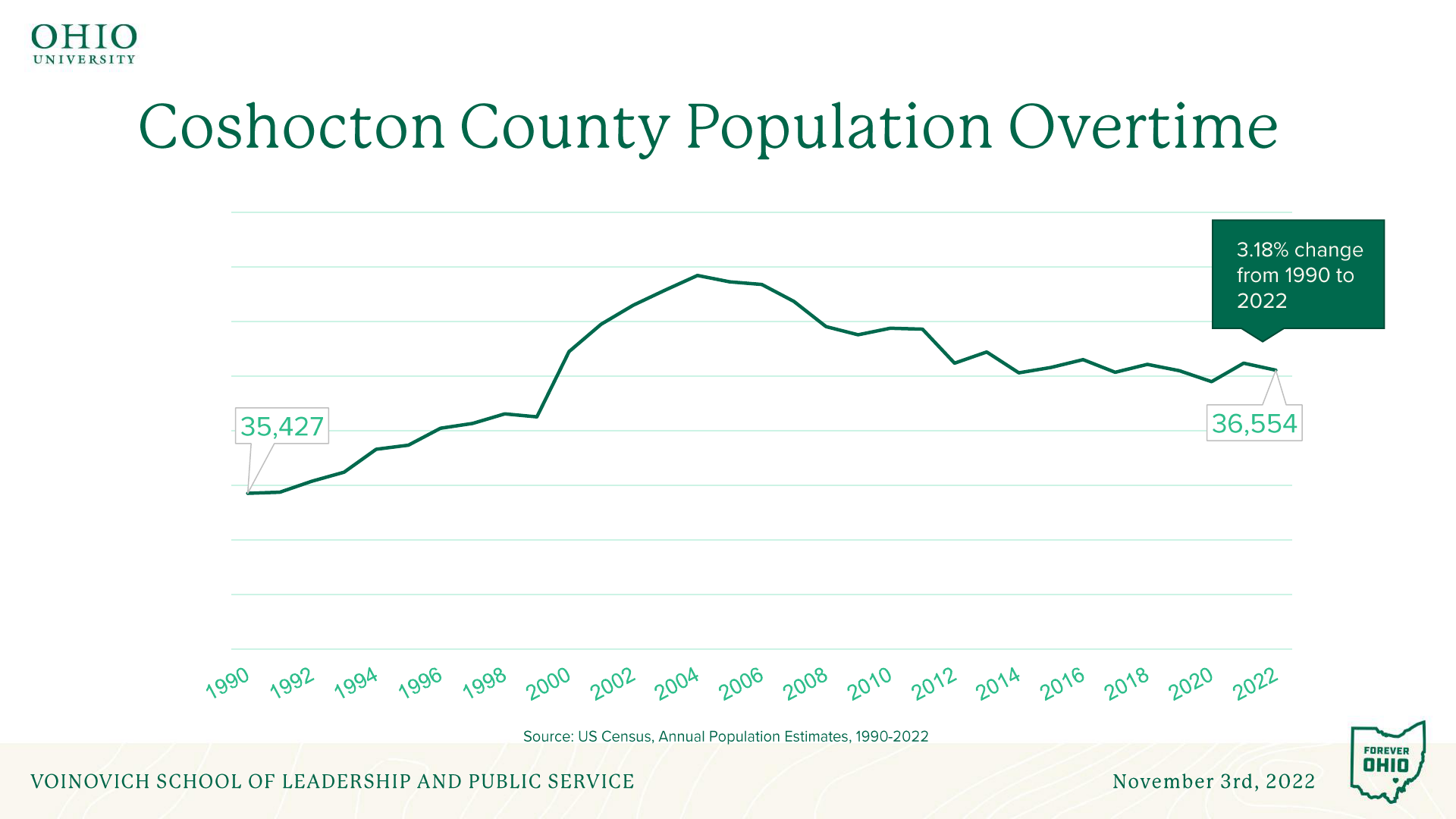

Figure 1 shows the change in population in Coshocton County from 1990 to 2022. Overall, there

has been about a 3% decrease in population during this period. However, the population grew

from about 35,427 in 1990 to 37,421 in 2005 before falling to 36,554 in 2022. This more trend of

decline is one facing almost ever Appalachian Ohio community as they look for ways to grow

their existing population, whether through retention or attraction of new residents. When

compared to surrounding Appalachian communities, Coshocton population decline is relatively

small. This may be due in part to the proximity to the Columbus MSA. Coshocton is in a good

position to attract people who work in Columbus, but no longer wish to live there or wish to have

a shorter commute if they are from another further away county.

Figure 2 shows the population distribution of Coshocton County’s population. In a perfect

scenario, the figure would form a pyramid or triangle with the most residents in the youngest age

range, and declining in number as age increased. The figure shows a hollowing in working age

individuals from age 20 to 49. This indicates that young people are likely moving to another area

to live and work, taking their knowledge and skills with them. Additionally, the figure indicates

that there is a significant portion of the population over the age of 50. This can impact on

resources such as healthcare and eldercare in the community.

Figure 3 shows the population by place within Coshocton County. This shows that the majority

live outside of a village or city. Likewise, figure 4 shows the dispersal by township and city in

Coshocton with the majority living in the city of Coshocton which is about 30% of the

population. This shows that people are more concentrated in the central and eastern portion of

the county.

Figure 5 shows the median income per household for each township or city in Coshocton

County. The highest median income is found in the northeast portion of the county, while the

area the lower median income is found in in the southern portion of the county and in the area

around the city of Coshocton.

Figure 6 shows the median age in Coshocton County as compared to the median age in the

surrounding counties, the State of Ohio, and the United States. At 41.1 years old, the median age

in Coshocton is higher than all three comparisons. Like the population distribution, this indicates

a loss of young people and their talents.

4

Figure 7 shows the educational attainment in Coshocton County as compared to the educational

attainment in the surrounding counties, the State of Ohio, and the United States. Only 36% of

Coshocton County residents 25 years of age or older have at least some college education. This

includes community college or other postsecondary education. This is much lower than the

surrounding area at 47%.

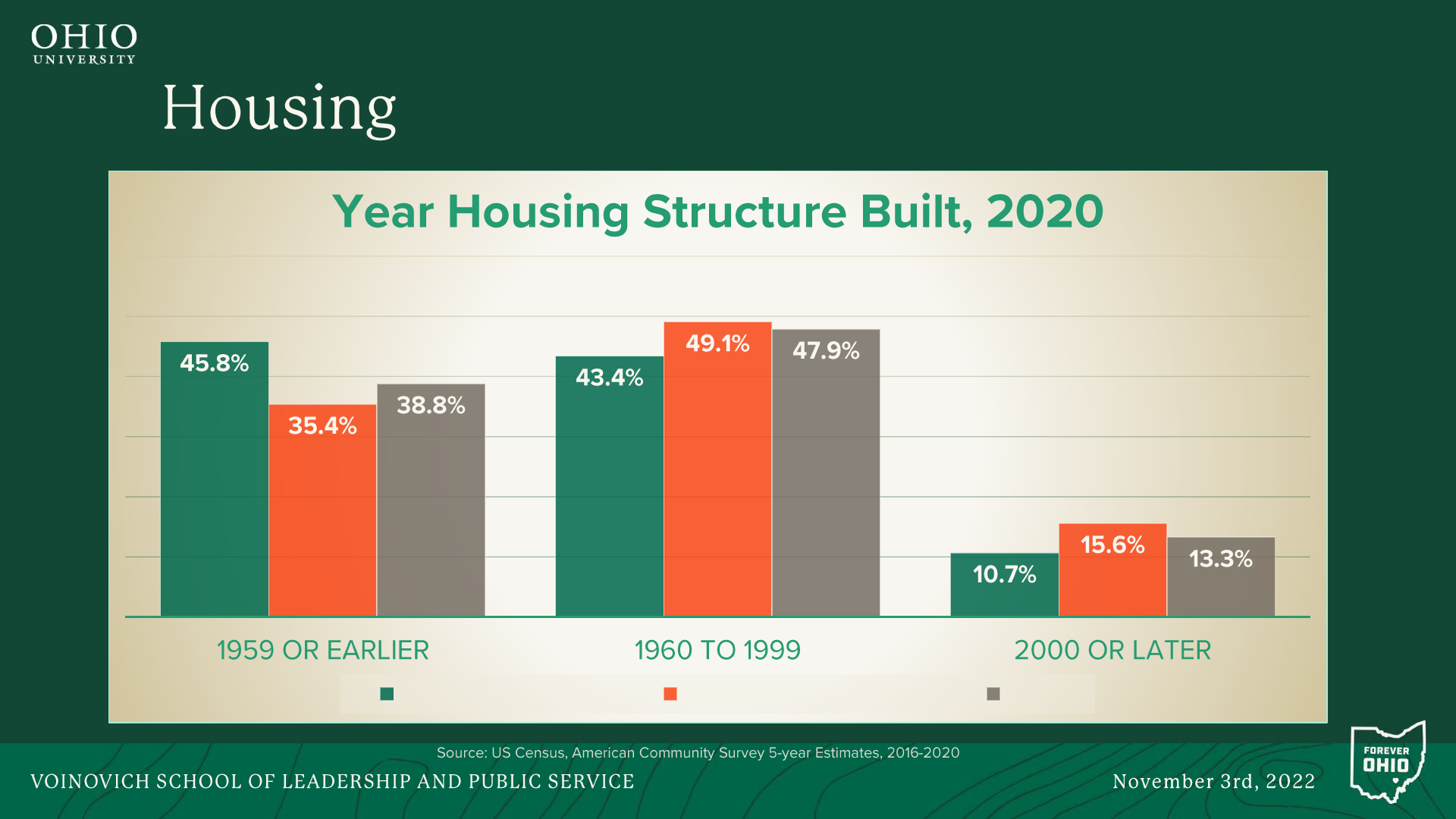

Figure 8 shows the age of the housing stock in Coshocton County as compared to the age of the

housing stock in the surrounding counties and the State of Ohio. Coshocton has more very old

housing, built in 1959 or before, in comparison. Additionally, Coshocton County has less new

housing, built in 2000 or later, in comparison. This is a concern as they would be poised to

attract residents from the Intel facility in Licking County. However, without housing

development, there just are not enough homes to support the potential that exists.

Figure 9 shows the housing property values in Coshocton County as compared to the housing

property values in the surrounding counties and the State of Ohio. Coshocton has less expensive

housing and lacks homes over $300,000 in comparison. On one hand, the low prices are

attractive to potential new residents. However, it is likely that these are old homes or homes in

need of repair, which could be a detriment to attraction. Likewise, the lack of more expensive

housing could also be a problem for attracting residents looking for higher end living.

Figure 10 shows the monthly unemployment rate from 2019 to 2021 in Coshocton County, the

State of Ohio, and the United States. Coshocton County has followed the same general trend as

the state and country but is slightly higher. This indicates that residents may be having a harder

time finding a job than in other areas.

Figure 11 shows the labor market participation rate from 2010 to 2020 in Coshocton County, the

State of Ohio, and the United States. Coshocton County has a much lower rate of participation.

Even though unemployment rates are low, this indicates that a larger proportion of the

population in Coshocton County is not actively seeking employment or employed. There could

be untapped potential in the population that could be attractive to potential businesses looking to

locate in Coshocton County if these individuals could be captured in the workforce. Likewise,

figure 12 shows the labor force participation rate for Coshocton and the surrounding counties in

2020. When compared this way, Coshocton is doing better than their surrounding counties,

except for Guernsey County.

Figure 13 shows the employment by industry in Coshocton County in 2020. Manufacturing is

Coshocton County’s largest industry employing around 3243 individuals. This is followed by

Healthcare and Social Assistance employing around 1571 individuals. With the announcement of

the Intel facility in Licking County, Coshocton is positioned to take advantage of their strength in

manufacturing as supply chain businesses look to locate near to Intel.

•

•

•

•

•

•

•

•

•

•

•

34,000

34,500

35,000

35,500

36,000

36,500

37,000

37,500

38,000

Figure 1:

0 to 9 years

10 to 19 years

20 to 29 years

30 to 39 years

40 to 49 years

50 to 59 years

60 to 69 years

70 to 79 years

80 years and over

Female

Male

Figure 2

:

OHIO

UNIVERSITY

r

>

Figure 3:

OHIO

UNIVERSITY

Population Map

-�,

_

,

J -

-

>

Figure 4:

OHIO

UNIVERSITY

Median Income Map

� lI,

-�,

1 I

l

>

Figure 5:

Coshocton County Surrounding Counties Ohio US

Figure 6:

us

Figure 7:

Coshocton County Surrounding Counties Ohio

Figure 8:

Less than $100,000 $100,00-$299,999 $300,000 or more

Coshocton County Surrounding Counties Ohio

Figure 9:

0

2

4

6

8

10

12

14

16

18

Coshocton Ohio United States

Figure 10

:

52%

54%

56%

58%

60%

62%

64%

66%

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Coshocton County Ohio USA

Figure 11

:

52%

54%

56%

58%

60%

62%

64%

66%

Coshocton

County

Guernsey

County

Holmes

County

Knox

County

Licking

County

Muskingum

County

Tuscarawas

County

Figure 12

:

0 500 1000 1500 2000 2500 3000 3500

Figure 13:

21

2. Comparable Communities Assessment

Prepared by the Center of Economic Development and Community Resilience, the

Voinovich School of

Leadership and Public Service

December 2022

Clara Bone, Senior Project Manager

Victoria Crawford, Undergraduate Scholar

Comparable Communities Assessment

Prepared by the C

enter of Economic Development and Community Resilience, the Voinovich School of

Leadership and Public Service

December 2022

Clara Bone, Senior Project Manager

Victoria Crawford, Undergraduate Scholar

Table of Contents

Introduction ……………………………………………….………………………………….………….2

New Investments…………………………………………………………………………………………2

National Comparisons to Coshocton County………………………………………………....…...…….5

Ohio Counties Similar to Coshocton………….……………………………………………....…....…....7

Recommendations for Coshocton County……………………………………………………....………8

References…………………………………………………………………………………............…….9

Introduction:

The comparative communities project looks at how communities/counties (under an hour) were affected

by the announcement of large investment by a company. It looks at what those communities did to

attract the supply chain businesses, training/workforce development needs of the company/supply

chain, how they attract the workforce to reside in their county, and how they retain current workers

when the new facility may have higher paying jobs. The community that was mainly compared was

Coshocton County and/or City and the announcement of a $20 billion investment by Intel. As well, this

project looks at how Intel, Ford Motor Company, and Walmart’s new plants will affect supply chains in

the areas they are moving to.

New Investments:

Intel Coming to Ohio

Intel’s projected plant in Licking county will not only add 7,000 construction jobs and 3,000

high-skilled and well-paid jobs ($135,000 per year plus benefits) but will add an additional

20,000 jobs that are indirect such as electricians, healthcare workers, engineers, housing, etc.

The international supply chain will be affected, as Asia currently produces the majority of

microchips for the rest of the world. With Intel’s new plant, the United States will now become a

mass producer as well, thus taking dependence away from foreign companies that produce

microchips. This increases the United States’ role in the global supply chain for semiconductors

and paves the way for the U.S. to have a more stable supply. It is estimated that Intel will

establish 30 to 40 supplier companies around the new Intel plant. There are currently more than

140 Ohio businesses that are Intel suppliers, so this will create more indirect jobs as well.

This plant, harboring two large factories, will become the company’s most advanced

semiconductor plant in the world, bringing recognition to Ohio as being a technology hub. Intel’s

arrival to Ohio amplifies interest in manufacturing jobs which could help grow Ohio’s skilled

workforce and bring in more college graduates. Intel has also pledged to give $100 million to

Ohio education, providing long-term investment into the state. Intel’s investment of 20 billion is

the largest investment to Ohio by a private sector company. This could give way for other

companies to follow suit, paving the way for future large investments to Ohio. Lastly, there is an

expected increase of $2.8 billion to the Ohio annual gross state product.

There are some potential disadvantages to a large company moving into an area. For example, a

tight manufacturing labor market may mean Intel’s hiring could add pressure to the market.

Some have discussed a lack of housing in surrounding areas and there are questions surrounding

the impacts on the housing market. In addition, the impact could take years to be felt. However,

Ohio has many training initiatives, including TechCred, that help employers build a more robust

workforce and help people complete their education. Intel may engage “hidden workers” who

are people that could move into that specific labor force with additional training. They may also

be people overlooked by the workforce due to health reasons, gaps in employment,

disadvantaged backgrounds, etc.

Since Intel’s announcement, other companies have pledged to invest into Licking County as well

as other counties in central Ohio. These announcements have occurred in 2022 and tell of places

opening in 2024. The company Pharmavite, which is a supplement and vitamin manufacturing

company, is investing $200 million into the area. They plan to build a 200,000-250,000 sq ft

manufacturing facility in Licking County. This company is looking to employ around 225 full-time

employees to start with. This highlights that some of the business positive policies central Ohio

counties like Licking have been implementing are making a difference. Production on the facility

is expected by 2024. Prudential Cleanroom Services, a California-based company from Irvine

pledged to invest $35 million into Licking County. The company purchased a 66,715 sq ft

industrial facility and will create 80 jobs. At this facility, workers will clean the garments worn by

those involved in direct production of pharmaceutical products and semiconductor chips. EASE

Logistics Services LLC, city of Dublin in Franklin County, aims to create 140 full-time positions,

which would generate $7 million in new annual payroll and retain $14.1 million in existing

payroll. This third-party logistics company specializes in expedited freight for non-consumer

goods. BJSS Inc., in Franklin County, is expected to create around 50 full-time positions,

generating $6.75 million in new annual payroll. BJSS is an award-winning technology and

engineering consultancy for businesses. Ford Motor Company, City of Avon Lake in Lorain

County, is expected to create 2,000 full-time positions, generating $108.1 million in new annual

payroll and retaining $121.2 million in existing payroll. The Avon Lake manufacturing plant makes

the F-650/750 truck the F-350/450/550 Super Duty Chassis, e-series cutaway. Involta LLC, City of

Independence in Cuyahoga County, is expected to create 11 full-time positions, generating $1.15

million in new annual payroll and retaining $1.65 million in existing payroll. Involta is an

award-winning IT service provider and consulting firm that helps organizations plan, manage,

and execute IT strategies by utilizing a broad range of services. The industry’s focus includes

health care, manufacturing, finance, and technology. ORBIS Corporation of Wisconsin, City of

Urbana in Champaign County, is expected to create 46 full-time positions, generating $2.6

million in new annual payroll and retaining $17.4 million in existing payroll. ORBIS is a part of

Menasha Corporation, the third oldest family-owned business in the United States. This

company provides reusable plastic containers, pallets, dunnage, and bulk systems.

Ford Motor Company

Ford has pledged $11.4 Billion to construct plants in Kentucky and Tennessee and aims to create

a total of 11,000 jobs. The Tenessee site called Blueoval City in Stanton, TN, broke ground in

September 2022 and plans to create around 6,000 jobs. It will be the company’s largest and most

advanced auto production complex. Ford’s all-new electric truck and the batteries for it will be

produced here. Ford continues to engage with the local communities in West Tennessee through

online and in-person discussions and collaborative projects. As well, the company is working

with the University of Tennessee to restore the stream waters flowing through the University’s

Lone Oaks Farm. Additionally, they seek to expand STEM education to Tennessee students from

kindergarten through 12th grade. This is similar to Intel’s plans to invest in Ohio educational

institutions.

Ford has invested 5.8 billion into another plant in Glendale Kentucky. This will produce 5,000

jobs. There are other Ford plants in Louisville, KY, and Ford has repeatedly stated its devotion to

the communities that have continued to work for them. They are eager to invest more into

places that have continuously helped their business thrive. In addition, Ford employs more than

12,000 people in Kentucky and supports nearly 120,000 direct and indirect jobs in the state and

a state GDP contribution of $11.8 billion.

There is an interesting parallel between Intel and Ford. Ford has been battling a shortage of

semiconductor chips due to their global demand, as they are needed for manufacturing vehicles.

By Intel moving to Columbus, Ford’s supply chain could be positively impacted, especially

because these industries are closely located.

Walmart

Walmart is building a new high-tech grocery distribution center in Spartanburg County, South

Carolina that plans to open in 2024. This $450 million dollar investment will bring about 400 jobs

and will be Walmart’s largest distribution center at 720,000 sq ft. The center will sit along

Highway 129, making it highly accessible for people and industries like transportation.

Major population growth is expected for the city of Lyman, where the center will be, and it is a

good location between Atlanta and Charlotte (much like how Coshocton is between Columbus

and Pittsburgh). Coshocton is 34 minutes from i-70, the main road transporting goods between

Columbus and Pittsburgh. Spartanburg County, SC, along with neighboring counties will benefit

from the influx of jobs and expanded tax base.

National Comparisons to Coshocton County:

Chandler City, AZ

Chandler is a city in Maricopa County, Arizona, that has similarities to Coshocton County and

gives insight into the possibility of Coshocton’s future. In 1980, Chandler's population was barely

30,000 (around the size of Coshocton County) but since Intel’s arrival, the population now

exceeds 220,000. During the company’s first decade in the town, it grew to 90,000 and from

1990 to 2000, the population was 180,000. The population now exceeds 270,000. However, due

to the arrival of new industrial companies, the farming industry was wiped out there. In the

years following the company’s arrival, Intel helped grow Chandler schools’ computer and science

programs. This may also be the case for the communities surrounding Licking County, especially

with the $100 million investment into Ohio education by Intel. In the city of Chandler and the

county of Maricopa, there has been a large influence from Intel to the community. The influx of

workers to the county has increased the number of volunteers there and Intel has incentives for

workers to volunteer. For example, the company pays schools $200 for every 20 hours of

volunteer work done by an employee. In addition, Intel spurred local small businesses to thrive

in Chandler.

Pinal County, AZ (near Chandler in Maricopa County)

Pinal County lies directly southeast of Maricopa County and has a population of 449,557, per the

2021 census. In 1980, the population was 90,918. During the first decade of Intel’s arrival in

Chandler, Pinal’s population grew to 116,397. From 1990 to 2000, the population was 181,280

(around the same as Chandler at the time). Unlike Chandler, this county is still considered rural,

even though it is the third largest county in the state based on population. There are still

significant companies that operate here though, such as Abbott, Attesa, Lucid Motors, Hexcel,

Walmart, FritoLay, Union Pacific, and Nikola, and these companies have been incredibly

successful. In addition, mining is a strong industry in the eastern mountainous portion of the

county. In this county, there has been growth and diversification in manufacturing and trade

services since the county is located between Phoenix and Tucson (but does not include those

cities). Locally owned businesses have a long-term commitment to the community as well and

stay rather than leave for other places. Like Chandler, this county has undergone significant

population growth after the arrival of Intel, but this county has taken off economically in its own

ways. Coshocton may expect to see significant population growth with Intel moving to a nearby

county.

Provo, UT

This county houses thriving manufacturing industries and attracts large industries for their

workforce such as Nestle, Texas Instruments, Nike, Ford Motor Company, Sherwin Williams, and

General Motors. They are heavily reliant on large firms and the companies that are looking to

provide jobs in the area are Tech companies.

Spartanburg County, SC

Like Intel making an investment into Licking County, Walmart plans to invest $450 Million in a

grocery distribution center in Spartanburg County, South Carolina. It will be Walmart’s largest

distribution center and this will help move the county’s tax base forward as well as add 3,500

jobs. Spartanburg has a poverty rate of 21.1 % whereas the average rate in the U.S. is around

10-13%. So, this investment by Walmart will have positive economic impacts for the county and

the surrounding communities. In addition, trucking companies’ upstream and downstream

supply chains will be impacted. Spartanburg has two locations of the Plumley Trucking company

which could be directly impacted by the mass amount of goods needing to be shipped to and

from the new Walmart distribution center. There are 23 other trucking, freight, and shipping

companies located in this county that could all feel the impacts. Interstates 85, 26, and 585

intersect in this county and run through surrounding counties such as Union County, Cherokee

County, Greenville County, and Laurens County. These neighboring counties could also benefit

from Walmart’s investment into Spartanburg.

Union County, SC (near Spartanburg)

Union County borders the southeastern side of Spartanburg County and has a population of

27,016. There are opportunities for manufacturing but also in the shipping sector. US Xpress Inc.

has a sizeable location in Jonesville, SC (in Union County) and is one of the nation’s largest

truckload carriers. Employment could be increased with the introduction of Walmart’s largest

distribution center coming to nearby Spartanburg County.

Ohio Counties Similar to Coshocton:

Ohio counties that are similar in population size to Coshocton County (36,618) as of 2019 data. The

counties closest in population to Coshocton are Champaign, Defiance, Guernsey, Jackson, Morrow,

Ottawa, Perry, Preble, Putnam, and Williams. Out of these counties, Guernsey, Morrow, and Perry were

most like Coshocton in terms of economic recovery.

Morrow County

Morrow County’s economy has recovered significantly in recent years and its job market has

increased by 0.6% over the last year. The most common jobs are in office and administrative

support occupations, production, and sales. The most common employment sector as well as

most specialized sector is manufacturing. It is comparable to Coshocton in that they are both

geographically located within Appalachia and have relatively same populations sizes. Both

counties used to be primarily dependent on agriculture/manufacturing industries but now

manufacturing is the sector with the highest employment in both counties. Additionally, these

counties are part of the Ohio Residential Broadband Expansion Grant Program where $232

million in grants are allocated to 11 different internet providers.

Perry County

Perry County’s economy is on the road to recovery as ODNR has dedicated $7 million to improve

former coal mine properties. In addition, $4 million is going to the Tecumseh Theater in the

mining community of Shawnee. Coming in July of 2023, a development company will launch a

visitors’ bureau this July to enhance the Shawnee area making it more of a tourist destination.

The expansion of the Black Diamond Tavern has allowed Perry County to fund the startup of a

nonprofit visitors’ bureau. Perry County is Comparable to Coshocton in that they are close in

population, both are included in the ODNR investment to make abandoned coal mine locations

safer. Coshocton has received $2 million to fill 6,000 feet of highwall left behind from a mine

located at the Richard Downing Airport. Both counties are closely located geographically and

have a labor force of around 16 years of age.

Guernsey County

Guernsey County has had to diversify its economy due to the declining extraction/timber sector.

Like much of the Appalachia region, the timber industry has declined and so new markets were

sought out. In regards to their economic recovery, in recent years, Healthcare and Social

Assistance have become the economic sector with the most employment. As well, wage trends

for healthcare and social assistance, manufacturing, and retail trade have been on the incline.

However, Guernsey has a large percentage of people employed in major/large firms which can

be positive if a new company is creating jobs but can negatively impact a community if

something happens to the firm. The major employers in this county are Detroit Diesel, Bi-Con

Services, Colgate, and Palmolive. Guernsey is comparable to Coshocton County in that it has a

similar population size, it is close to Coshocton in proximity, and it is also reliant on large firms

for employment.

Recommendations for Coshocton County:

Companies are coming back to places that were left in the dust when they moved overseas. With that

being said, reinvestment into rust belt communities eager for jobs has begun. Other counties and cities

like Maricopa and Chandler in Arizona have felt the positive impacts from Intel’s arrival. By looking at

those examples, Coschocton can expect a rise in population, an increase in demand for housing, and

more community engagement by Intel employees. With a rise in population, Coshocton may want to

invest into new infrastructure such as roads and houses. A housing boom may occur and so creating

access and accessibility to housing may attract Intel employees. Those living in Coshocton that could

possibly be hired by Intel may have incentive to become more engaged with the community, as seen

with the volunteer work done in Chandler. Even though Coshocton may also expect to see some other

large corporations moving nearby, they should also seek to attract small businesses, as they would

promote a long-term commitment to the community. There are long term effects of having a company

staying around for awhile, but Coshocton may want to also prioritize growth and development not

dependent on a large company because if Intel were to move or close, the effects may not be as

detrimental.

Colleges in central Ohio are preparing for Intel’s arrival, such as the Central Ohio Technical College

(COTC). The COTC offers engineering programs that provide students with around 90% of what Intel is

looking for. With this being said, the college is placing a strong focus on an industrial electrician

certificate as well as electrical engineering technology and engineering technology associate degrees.

The COTC has expressed an eagerness to partner with the Coshocton County Career Center in order to

help the college with training all the workers required for these programs. The COTC and the Coshocton

County Career Center has been working with the International Brotherhood of Electrical Workers Local

on creating apprenticeship programs due to the increase in need for skilled trades like electricians. These

programs aim to start in 2023 and would allow students to come out with a level two apprenticeship.

This is a huge feature, as Intel has already stated that these students could get a job with the company

right away and even retire from there. Great partnerships are happening between Intel, the COTC, and

Coshocton.

References:

“Ford to Lead America's Shift to Electric Vehicles with New Mega Campus in Tennessee and Twin

Battery Plants in Kentucky; $11.4B Investment to Create 11,000 Jobs and Power New Lineup of

Advanced EVs | Ford Media Center.” Ford Media Center,

https://media.ford.com/content/fordmedia/fna/us/en/news/2021/09/27/ford-to-lead-americas-s

hift-to-electric-vehicles.html.

“Governor DeWine Announces Monumental Investment by Intel to Bring Their Most Advanced

Semiconductor Manufacturing Plants to Ohio.” Mike DeWine Governor of Ohio,

https://governor.ohio.gov/media/news-and-media/Governor-DeWine-Announces-Monumental-In

vestment-by-Intel-to-Bring-Their-Most-Advanced-Semiconductor-Manufacturing-Plants-to-Ohio-01

212022.

Guest Columnist, cleveland.com. “Intel's Benefits to Ohio - in Manufacturing and beyond: Ryan

Augsburger.” Cleveland, 11 Mar. 2022,

https://www.cleveland.com/opinion/2022/03/intels-benefits-to-ohio-in-manufacturing-and-beyon

d-ryan-augsburger.html.

Hayhurst, Leonard L. “COTC + Intel + Coshocton = New Opportunities.” Coshocton Tribune,

Coshocton Tribune, 22 May 2022,

https://www.coshoctontribune.com/story/news/local/2022/05/22/cotc-intel-coshocton-new-opp

ortunities/9806110002/.

“Hottinger Praises Pharmavite's $200 Million Investment in Licking County.” The Ohio Senate 134th

General Assembly,

https://ohiosenate.gov/senators/hottinger/news/hottinger-praises-pharmavites-200-million-invest

ment-in-licking-county.

“Intel Announces Next US Site with Landmark Investment in Ohio.” Intel,

https://www.intel.com/content/www/us/en/newsroom/news/intel-announces-next-us-site-landm

ark-investment-ohio.html#gs.ibywbn.

Markham, Chris. “Chandler's Upscale Growth Tied to Intel.” East Valley Tribune, 7 Oct. 2011,

https://www.eastvalleytribune.com/local/chandler/chandlers-upscale-growth-tied-to-intel/article

_eff95a9b-65cc-5670-9c49-05cbf9265b3a.html.

“New Projects Expected to Create More than $21.5 Billion in Investments.” Ohio Department of

Development,

https://development.ohio.gov/home/news-and-events/all-news/2022-0926-new-projects-expecte

d-to-create-more-than-21-billion.

Owen Milnes | Columbus Business First. “California-Based Company Investing $35M in New

Licking County Facility.” NBC4 WCMH-TV, NBC4 WCMH-TV, 26 Apr. 2022,

https://www.nbc4i.com/news/columbus-business-first/california-based-company-investing-35m-i

n-new-licking-county-facility/.

“Pinal County.” PinalCentral.com, https://www.pinalcentral.com/site/pinal_county.html.

Staff, WGB. “Walmart Opens $220M Distribution Center in South Carolina.” Winsight Grocery

Business, Winsight Grocery Business, 25 Apr. 2022,

https://www.winsightgrocerybusiness.com/retailers/walmart-opens-220m-distribution-center-sou

th-carolina.

“Success Stories.” Economic Development for Pinal County Arizona - Business Success Stories,

https://www.pinalcountyaz.gov/ed/businessconnections/Pages/SuccessStories.aspx.

Wayland, Michael. “Ford to Restructure Supply Chain Following $1 Billion in Unexpected Quarterly

Costs.” CNBC, CNBC, 22 Sept. 2022,

https://www.cnbc.com/2022/09/22/ford-to-restructure-supply-chain-after-1-billion-in-unexpected

-costs.html.

WKSU | By Annie Wu. “Ford to Create 1,800 New Jobs at Avon Lake Assembly Plant.” WKSU, 2 June

2022,

https://www.wksu.org/economy/2022-06-02/ford-to-create-1-800-new-jobs-at-avon-lake-assembl

y-plant.

32

3. Examining the Potential for Using Tax Increment Financing

(TIF) in Coshocton, Ohio

This report demonstrates that even at the most conservative estimates, TIF could be a

beneficial financing tool for Coshocton. As TIF has never been used before in

Coshocton, this report was also accompanied by an educational meeting to explain

what TIF is, how it can be utilized, and the potential benefits for Coshocton. This

meeting was targeted to local leadership in government, education, and other key

groups. Parts of this report have been redacted at the request of the executive director

of the Coshocton Port Authority as it contains sensitive information.

Examining the Potential for Using Tax Increment Financing (TIF) in Coshocton, Ohio

Clara Bone,

Economic Development Specialist

Center for Economic Development and Community Resilience

Voinovich School of Leadership and Public Service, Ohio University

May 23

rd

, 2022

Abstract

Coshocton is need of housing to attract and retain young families and professionals in the workforce.

Coshocton’s current housing stock is both limited and old. To be competitive with other Ohio communities

looking to capitalize on its proximity to both Columbus and the newly announced Intel site in Licking

County, Coshocton needs to have new housing developments built. However, conversations with

developers have revealed reluctance to build in Coshocton. Working with the Coshocton Port Authority, I

explored the potential use of TIF (tax increment financing) as an option that could help alleviate these fears.

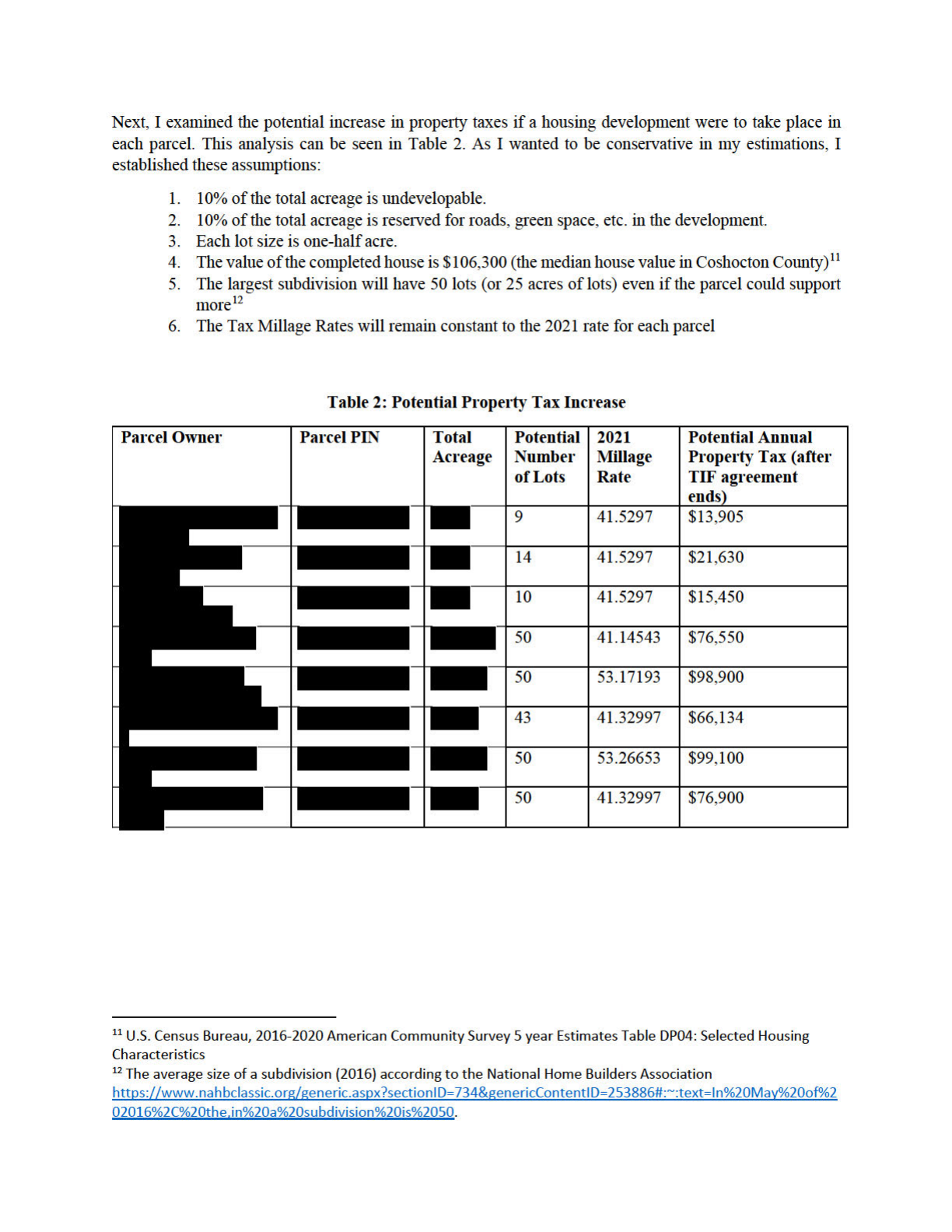

This report looked at 8 parcels in and around Coshocton to determine if the use of TIF could be used to

finance the construction of water/sewer and road infrastructure to the potential parcels if a housing

development were to be constructed. For at least one of the parcels, this seems to be a viable option.

However, this analysis took a very conservative approach as to not overestimate the capability of TIF or

the potential increase in property values. It is possible that TIF, in addition to other financing options, may

be impactful in starting a new housing development in Coshocton. The analysis in this report will continue

as conversations with potential developers are on-going and provide more precise data on the size, value,

and timeline of the development project. Additionally, community engagement to discuss the potential of

TIF with stakeholders, such as the school districts, and the general community will continue as to try to

build support for TIF and housing developments in the community. Whether or not TIF is used to finance

a housing development, will depend on the potential project passing the “but for” test, meaning that the

project would not be happening “but for” the use of TIF being established. Likewise, even if TIF is not used

to finance a development, the true measure of success for this project will be using all the financial and

incentive options in the “toolkit” as was taught at the OEDI course to finance a housing development. By

completing this project, I have helped the Coshocton Port Authority, the City of Coshocton Government,

and the overall Coshocton community widen their options in terms of creative financing for development

projects.

Introduction

1

Coshocton, Ohio is the county seat for Coshocton County, and is located between Columbus, OH and

Pittsburg, PA to the west and east, and Cleveland, OH and Charleston, WV to the north and south. The

Coshocton Port Authority is actively working to attract new businesses, support existing businesses and

entrepreneurs, revitalize their downtown, and otherwise improve the quality of life for the residents in

Coshocton. In fact, the Port Authority received a Vibrant Communities Grant from JobsOhio to renovate a

downtown building into a business incubator/co-working/makerspace building. While I do not work for the

Port Authority myself, as part of the Ohio University team working on the EDA funded RISE Ohio grant,

I began working on the project with a particular focus on the closure of the Conesville coal-fired power

plant. During a conversation with the Executive Director of the Port Authority, Tiffany Swigert, I became

aware of the need to examine the possibility of using TIF for Coshocton as related to infrastructure for

housing developments. As part of the OEDI Finance and Incentives course, I had learned about TIF and its

ability to be used to help finance projects that would otherwise not be able to be completed but for the use

of TIF.

First, I began my research into the existing housing stock of Coshocton to determine if there truly was a

need for new housing developments in the area. According to the US Census data for 2020, over 96% of

housing in Coshocton was built prior to the year 2000. Furthermore, over 76% of the housing was built

prior to 1970. Likewise, in 2020, 509 housing units were vacant in the city or about 9.8% of the housing

stock. However, most of the vacancy occurred in rental units rather than homeowner units.

2

These facts

coupled together demonstrate the need for new single family homes in Coshocton in order to attract and

retain families in the area. This is a key demographic for building an attractive workforce in Coshocton. As

it stands, without suitable housing in the area, this target demographic is likely to move elsewhere to find

housing, and a community, that fits their needs. In 2010, approximately 23%, or 2,611 residents, were aged

30-49 years old. In 2020, only 22.2% or 2,440 residents, were aged 30-49 years old.

3

Without any changes,

Coshocton will likely continue to lose residents in this key demographic and will be unlikely to be able to

attract new families with their current limited housing stock of older homes.

1

Image source: https://www.coshoctonportauthority.com/site-selection-resources/

2

U.S. Census Bureau, 2016-2020 American Community Survey 5 year Estimates Table DP04: Selected Housing

Characteristics

3

U.S. Census Bureau, 2006-2010 and 2016-2020 American Community Survey 5 year Estimates Table S0101: Age &

Sex

However, with a median housing value of $106,300 in the county

4

, Coshocton is poised to offer affordable

housing and low cost of living within an hour of the announced Intel plant in Licking County. Additionally,

Columbus is situated less than an hour and half from the Coshocton. These opportunities along with the

potential for supply chain business locate to the nearby area as they follow the Intel development, puts

Coshocton in a great position to attract workers looking to move to the area. If Coshocton can develop this

housing, they will be in a much better position to attract not only workers themselves, but the supply chain

businesses who are looking for communities with an available workforce.

So what is Tax Increment Financing (TIF) anyways?

After identifying the need for housing and the potential opportunities that made now the right to time to

act, I examined TIF in more detail to determine whether or not this finance tool made sense for Coshocton.

Tax Increment Financing, or TIF, is a financing tool that can be administered by local jurisdictions in order

to fund public infrastructure improvements that benefit private development.

5

Most often this is used for

commercial development, but it can be used for residential development, as would be the case in Coshocton.

A TIF works by exempting the increase in property value caused by a development project. Instead, the

property owners make “payments in lieu of taxes (PILOTS)” equal to the exempted to the local jurisdiction

that created the TIF agreement. These PILOTS are collected by the county treasurer and used by the local

jurisdiction to pay for the cost of public infrastructure improvements.

6

It is important to note that unlike a

tax abatement, with a TIF only the increased property tax is exempt. For example, if before the development

the parcel had a $5,000 due in property tax, but after the development the property tax would have risen to

$50,000, the property owner would still only pay $5,000

7

during the TIF period.

The TIF can be structured in one of two ways: either pay-as-you-go, where the TIF fund is used on a

reimbursement basis to the developer and/or local jurisdiction (depending on which party bore the initial

cost of the infrastructure) or a to pay off debt service on bonds or notes issued by the local jurisdiction to

finance the infrastructure.

8

The TIF structure will have to be created via an ordinance or resolution by the

local jurisdiction and establishes the public purpose of the TIF as well as the exemption rate and duration

of the TIF. The exemption rate and duration are particularly important when establishing the TIF as with

rates above 75% and/or durations beyond 10 years, the TIF becomes subject to the consent of the school

districts that would be impacted. Even if the TIF is set up at these thresholds and is not subject to the school

districts’ approval, it is still important to discuss the impact to the school districts and gain community

support for the projects. It is important to emphasize that the school districts won’t be losing any property

tax funding, and that without the TIF, the development project would not happen and the projected increase

in property tax would not have been realized anyways.

4

U.S. Census Bureau, 2016-2020 American Community Survey 5 year Estimates Table DP04: Selected Housing

Characteristics

5

Bricker & Eckler (2021) DevelopOhio Economic Incentives Toolkit.

https://connect.bricker.com/101/654/uploads/developeohio-toolkit-july-2021.pdf

6

Bricker & Eckler (2021) DevelopOhio Economic Incentives Toolkit.

https://connect.bricker.com/101/654/uploads/developeohio-toolkit-july-2021.pdf

7

Assuming a 100% exemption rate TIF

8

Bricker & Eckler (2021) DevelopOhio Economic Incentives Toolkit.

https://connect.bricker.com/101/654/uploads/developeohio-toolkit-july-2021.pdf

Next Steps

As mentioned, the next steps for this project include meeting again with Max Crown and David Kadri from

the City of Coshocton Government and Tiffany Swigert of the Port Authority. We need to confirm that

there are not any other infrastructure needs facing these parcels. Additionally, I have will be sharing my

findings on TIF in Coshocton with the Mayor and other stakeholders in Coshocton including the school

districts. This will be in part to share how using TIF can benefit the whole community and hopefully build

community support for the use of TIF if the opportunity arises. An important piece of this community

engagement will be explaining that the school districts are not losing any property tax funding, and that

without using TIF, the development and growth in property tax would not be occurring at all. A list of

stakeholders can be found in Appendix B.

As Tiffany Swigert continues to meet with housing developers, she will be able to suggest TIF as financing

option. Once a developer has strong interest, but is unable to secure the financing to develop on the

identified parcel, I can rerun the analysis using their specific data on number of houses being built, the value

of the houses, the timeline for construction, etc. to make sure that TIF is still a viable option and/or suggest

other financing options.

Once it is time to actually create the TIF, it will take a city ordinance or resolution to establish the use of

TIF. Currently, the Port Authority and City of Coshocton are using Bricker and Eckler to examine the

potential for establishing a JEDD and/or annexing parts of the townships into the City of Coshocton. As

Bricker and Eckler are experts in this field, I would suggest using them or another experienced law firm

when establishing the use of TIF in Coshocton. This is particularly true when realizing that some of the

identified parcels are outside of the incorporated city. In these cases, the Port Authority would need to work

with the local townships and villages rather than the city to establish the use of TIF. Again, this highlights

how important it will be to have community support for TIF before it needs to be used. Until the City

proceeds with either creating a JEDD or annexing, the uncertainty around who will be responsible for

establishing the use of TIF will remain one of the biggest problems for the Port Authority.

I will remain a resource for the Port Authority as I work on the community engagement piece of this project

and will update the analysis if any new data is discovered or information is received from a potential

developer. Additionally, Bricker & Eckler’s “DevelopOhio Economic Incentives Toolkit”, the Ohio

Auditor of State Training PowerPoint “Tax Increment Financing and Residential Incentive Districts”, and

the Kentucky League of Cities’ “Tax Increment Finance Best Practice Reference Guide” can all be

resources for Tiffany Swigert and the Port Authority as they establish (or decide not to establish) the use of

TIF in Coshocton. The resources can also point to alternative financing options that can be used in addition

to, or instead of, TIF. See Appendix C for links to these resources.

The point of the project was not to shoehorn in the use of TIF, but rather to determine if it was a good fit

for Coshocton. I believe this reports shows there is evidence to support that TIF can work in Coshocton.

However, the true measure of success for this project will be the attraction of a housing development project

using all the financing tools taught to us during our OEDI courses. I will support Tiffany Swigert by helping

her determine whether or not the increase in property values will support the infrastructure needed for a

developer to be able to finance the project and whether or not it truly is a case where the developer would

not be able to undertake the project without the use of TIF. During this capstone project, I have helped the

Coshocton Port Authority, the City of Coshocton Government, and overall Coshocton community widen

their options in terms of creative financing for development projects. And while we hope to put it into

practice soon, this knowledge will be useful for years and years to come.

Appendix B: Stakeholder List

City of Coshocton

Mayor Mark Mills mark.mills@cityofcoshocton.com

Safety Service Director Max Crown max.crown@cityofcoshocton.com

Utility Director David Kadri davekadri@cityofcoshocton.com

Co

shocton County Commissioners

Gary Fischer – GaryFischer@coshoctoncounty.net

Dane Shryock - daneshryock@coshoctoncounty.net

Rick Conkle - RickConkle@coshoctoncounty.net

V

illage of West Lafayette

Mayor Stephan Bordenkircher -sbordenkircher@westlafayettevillage.com

V

illage of Warsaw

Mayor Ron Davis - [email protected]

Supe

rintendents

Matt Colvin – Coshocton County Career Center [email protected]rg

Chuck Rinkes – River View Local School District chuck.rinkes@rvbears.org

David Hire – Coshocton City School District dave.hire@coshoctoncityschools.com;

Mike Masloski – Ridgewood Local School District mike.masloski@ridgewood.k12.oh.us

Appendix C: Resource Links

1. https://connect.bricker.com/101/654/uploads/developeohio-toolkit-july-2021.pdf

2. ht

tps://ohioauditor.gov/trainings/lgoc/2010/Tax%20Increment%20Financing%20and%20R

esidential%20Incentive%20District.pdf

3. https://www.klc.org/UserFiles/TIF Best Practices(2).pdf

49

4. Additional Studies

Several other reports were conducted for Coshocton Port Authority over the course of

the RISE Ohio project. These include a cluster analysis of the industries in Coshocton, a

housing market analysis, and a hotel development study. These reports can be found in

the full RISE Ohio report located on the center’s website:

http://economicdevelopment.ohio.edu

5. Community Engagement

On November 3rd, 2022, the research team conducted a public meeting in Coshocton to explain

the current demographic and economic trends in Coshocton County, share the findings of the

stakeholder meeting conducted by Hamman Consulting on September 9th, 2021, and ask for

comprehensive input to economic development priorities for Coshocton County in a public setting. At

the end of the meeting, community members were asked to volunteer if interested in being involved on

the task force to help with refining specific goals and implementing the priorities for Coshocton County.

Overall, these community engagement activities helped identify community goals and promote buy-in

from the citizenry.

After compiling the results of the 2021 stakeholder meeting, the research team met with Tiffany

Swigert, executive director of the Coshocton Port Authority and a selected group of community leaders

and stakeholders on September 26th, 2022. Through our discussion, we determined broad categories of

priorities to use as a starting point during the community meeting. These categories were Infrastructure,

Broadband, Housing, and Workforce & Education.

The community engagement research for this project involved a formal meeting that was open

to the public. This meeting served as a platform to provide citizens and Coshocton County leadership

with objective information about the area’s economy and subsequently seek feedback on determining

the community’s economic development priorities. We invited local stakeholders, such as the county

commissioners and other government officials, business owners, health department employees, and the

concerned citizenry of Coshocton County. There were approximately 35 attendees in the audience.

After a formal presentation of the economic scan data (e.g., age, educational attainment,

household income, unemployment rates, employment by industry, commuter patterns, etc.), Jason

50

Hamman of Hamman Consulting, and the recovery coordinator for the RISE Ohio project, shared the

results of his previous stakeholder meeting and asked for community input for anything that may have

been left off the lists or changed in the past year. Afterward, we placed the categories of priorities on a

series of posters, and then asked attendees for specific needs under each category. Additionally, the

community noted three other potential priorities: Justice Center Programming, Entrepreneurial

Programming, and Tourism. After the notetaking was completed, the attendees were each given three

green dots and one red dot. We asked the attendees to place a green sticky dots next to each of the

priorities that they felt should be focused on. Specifically, if the dots were placed on the broader

category to indicate support for all potential work in that category, and on the specific ideas to highlight

the importance of that aspect. On the other hand, the red dot was placed on the priority they felt should

be the last one focused on.

The detailed results of this exercise are displayed below in Table 1. Likewise, Figure 1 shows the

totalled results for each broad category. It is also important to remember that the use of red dots does

not necessarily indicate that the priority should not be chosen, but rather that it should be chosen last

as compared to the other options. Furthermore, one will see that most attendees chose not to use their

red dots at all, indicating that there was no obvious “last choice” priority in their opinion.

The community indicated that housing is their number one priority, followed by workforce &

education programs. Infrastructure, Broadband, and Tourism were approximately equal in community

support. Finally, there was some community support for Entrepreneurial Programs as well. At the end of

the meeting, attendees were invited to sign-up for task forces to be created around these six identified

priorities. Additional follow-up from our team member in Coshocton County helped to identify and

establish these task forces for the purpose of both refining the broader priority categories to specific

and actionable items for Coshocton to pursue with the resources available in the county, and to act

champions for the implementation of said actionable items. GVS staff led the task force kick off

meetings in July 2023.

51

Table 1: Priority Balloting Results

Green

dots

Red

dots

Infrastructure

9

0

Water and Sewer Capacity

1

0

Improvement for Sewer System

0

0

Western Portion: Infrastructure to support sprawl from

Intel

3

0

ACG: streetscape as opportunity to improve aging

infrastructure

0

0

Roads and Bridges: lack of funding opportunities

0

0

Roads and Bridges: need for repair, resurface, etc.

0

0

TOTAL

13

0

Broadband

2

0

Spectrum Fiber to home

6

1

Need for high speed connection for students at home

5

0

Need for consistency/homes near Broadband terminals

still lack access

0

0

ARPA fund opportunities

0

0

TOTAL

13

1

Housing

13

0

Affordability

4

0

Elder population Housing

2

0

Youthful population Housing

5

0

Transitional Housing

2

0

52

Keeping the younger generations in town

1

0

Handicap housing accessibility

0

0

TOTAL

27

0

Workforce & Education

5

0

Inability to fill job openings

3

0

Manufacturing Jobs have been open for years

3

0

Workforce lacks physicality, willingness to work

2

0

Need for transportation to workplace

1

0

Need for maintenance workers/technicians

1

0

Need for Childcare support for workers

2

0

Opportunity to use Veteran-care as marketing

0

0

Financial literacy & employer support

0

0

Private Investment (reading, childcare, anti-drug

programs)

2

0

TOTAL

19

0

Justice Center future programs & outreach

0

0

Justice Center rehabilitation

0

0

Justice Center work w/ people w/ criminal records

0

0

TOTAL

0

0

Entrepreneurial Programs

3

0

Business start up programs

0

0

Internship programs

0

0

TOTAL

3

0

Tourism

0

0

53

Need for hotels

7

0

Demand exists

7

0

Losing overnights to other counties

0

0

Event Center

0

1

TOTAL

14

1

Figure 1: Priority Total Results

0 5 10 15 20 25 30

Entrepreneurial Programs

Infrastructure

Broadband

Tourism

Workforce & Education

Housing

Priority Categories

Green Dots Red Dots

54

6. Priorities

Utilizing the information gathered from the economic scan and community engagement sections,

3 priorities were identified for Coshocton County: Infrastructure (including Housing), Workforce

and Entrepreneurial Development, and Tourism. Each priority is broken down into action steps

to be achieved in Coshocton County.

6.1 Infrastructure (including Housing)

In order to capitalize on potential opportunities, Coshocton County needs to address

infrastructure. Firstly, the Conesville brownfield site of the former coal-fired power plant could

be a large and attractive site for new industrial development. Additionally, in order to attract

supply chain businesses for Intel the infrastructure is needed to support them. Currently, the lack

of quality housing in Coshocton County is detrimental to the community. Infrastructure is needed

to get potential housing developers interested in Coshocton County. Once housing is available, it

could be an attractive feature for supply chain businesses or employees from Intel looking for a

place to live. A TIF analysis was conducted by Ohio University and a housing study was

conducted by Hamman Consulting to support these efforts. Furthermore, there is a need for

broadband to support opportunities such as education and work-from-home or hybrid working.

Action Steps:

1. Strategic identification of properties or locations

a. Determine best use to support different types of development projects

i. Industrial

ii. Commercial

iii. Residential

2. Financing

a. Determine available options for incentives and other financing options

b. Educate leaders and community about options

3. Broadband

a. Identify availability and determine ability to support:

i. Businesses

ii. Educational Opportunities

iii. Work-from-Home or Hybrid Working

b. Communicate with community about broadband and connectivity projects

55

6.2 Workforce and Entrepreneurial Development

As shown in the economic scan, Coshocton County has a lack of individual aged 20 to 49 which

is a key demographic needed by employers. This indicates that after high school, many

Coshocton County graduates are taking their skills, knowledge, and talent to other communities

leaving Coshocton County with a deficit. Coshocton County needs to market existing

educational, training, and employment opportunities to retain youth in the community.

Additionally, Coshocton County should work with employers to remove barriers to work, and

engage with individuals usually left behind from the workforce. Likewise, an overall marketing

strategy to communicate and attract workers to opportunities Coshocton County may be

beneficial.

Action Steps:

1. Communicating with schools and employers about mentorships

a. Coordinated effort to engage local employers with high school students

b. Communicate with parents

c. Prepare students with needed soft skills in addition to technical skills

2. Utilize tech to communicate opportunities to target audience

a. Marketing geared for youth

b. Cross-platform marketing

c. Targeted recruitment for businesses

3. Remove barriers to workforce

a. Childcare barriers

b. Work/life balance

c. Opportunities for part-time work instead of 40 hours

d. Opportunities for work-from-home or hybrid working

4. Support for nontraditional workers

a. Individuals who were previously incarcerated

b. Individuals experiencing homelessness

c. Individuals in substance recovery

5. Telling the Story of Coshocton---Marketing Scheme

56

6.3 Tourism

Developing the tourism industry in Coshocton County has the potential to be an economic boon

in the community. Current assets and events could be tied into the larger community to attract

people to stay longer in the community. Turning “day visits” into “overnight stays” is one way to

increase the economic benefit gained through tourists to a community. In addition to growing

current tourism assets, Coshocton County could benefit from determining the effectiveness of

their tourism marketing strategy to determine where improvements could be made. Additionally,

a hotel development study was conducted by Hamman Consulting for Coshocton County to

support this effort around tourism.

Action Steps:

1. Improve Outdoor Recreation Assets

a. Hunting and Wildlife

b. Hiking/Biking/Walking Trails to connect tourism locations

c. The 3 Rivers area

2. Roscoe Village

a. Develop consistency among businesses through incentives to:

i. Expand hours, or have village-wide consistent operating hours

ii. Remaining open during large draw events/festivals

b. Communication and tie-in with other tourism areas in Coshocton

3. Marketing Effectiveness

a. Use surveys during/after events

b. Track social media engagement

c. Improve technology use