Contents

© 2017 Potomac Economics 2016 State of the Market Report | i

/

/

deLimit 9

2022 STATE OF THE MARKET REPORT

FOR THE MISO ELECTRICITY MARKETS

Prepared By:

Independent Market Monitor

for the Midcontinent ISO

June 15, 2023

Contents

© 2023 Potomac Economics 2022 State of the Market Report

/

/

TABLE OF CONTENTS

Executive Summary ..................................................................................................................................... i

I. Introduction ...................................................................................................................................... 1

II. Price and Load Trends ..................................................................................................................... 3

A. Market Prices in 2022 ............................................................................................................................ 3

B. Fuel Prices and Energy Production ........................................................................................................ 6

C. Load and Weather Patterns .................................................................................................................... 7

D. Ancillary Services Markets .................................................................................................................... 8

E. Winter Storm Elliott and Market Outcomes ........................................................................................ 10

III. Future Market Needs ..................................................................................................................... 15

A. MISO’s Future Supply Portfolio .......................................................................................................... 15

B. The Evolution of the MISO Markets to Satisfy MISO’s Reliability Imperative ................................. 22

IV. Energy Market Performance and Operations ............................................................................. 35

A. Day-Ahead Prices and Convergence with Real-Time Prices ............................................................... 35

B. Virtual Transactions in the Day-Ahead Market ................................................................................... 37

C. Real-Time Market Pricing ................................................................................................................... 40

D. Uplift Costs in the Day-Ahead and Real-Time Markets ...................................................................... 43

E. Real-Time Commitment Patterns ........................................................................................................ 45

F. Regional Directional Transfer Flows and Regional Reliability ........................................................... 47

G. Real-Time Dispatch Performance ........................................................................................................ 48

H. Coal Resource Operations ................................................................................................................... 51

I. Wind Generation .................................................................................................................................. 52

J. Outage Scheduling ............................................................................................................................... 55

V. Transmission Congestion and FTR Markets ............................................................................... 57

A. Real-Time Value of Congestion in 2022 ............................................................................................. 57

B. Day-Ahead Congestion and FTR Funding ........................................................................................... 59

C. Market-to-Market Coordination with PJM and SPP ............................................................................ 65

D. Congestion on Other External Constraints ........................................................................................... 69

E. Transmission Ratings and Constraint Limits ....................................................................................... 70

F. Other Key Congestion Management Issues ......................................................................................... 72

VI. Resource Adequacy ........................................................................................................................ 75

A. Regional Generating Capacity ............................................................................................................. 75

B. Changes in Capacity Levels ................................................................................................................. 76

C. Planning Reserve Margins and Summer 2023 Readiness .................................................................... 77

D. Capacity Market Results ...................................................................................................................... 80

E. Long-Term Economic Signals ............................................................................................................. 83

F. Existing Capacity at Risk Analysis ...................................................................................................... 85

G. Capacity Market Reforms .................................................................................................................... 86

VII. External Transactions .................................................................................................................... 89

A. Overall Import and Export Patterns ..................................................................................................... 89

B. Coordinated Transaction Scheduling ................................................................................................... 89

C. Interface Pricing and External Transactions ........................................................................................ 92

VIII. Competitive Assessment and Market Power Mitigation ............................................................. 97

A. Structural Market Power Indicators ..................................................................................................... 97

B. Evaluation of Competitive Conduct ..................................................................................................... 98

C. Summary of Market Power Mitigation ................................................................................................ 99

IX. Demand Response and Energy Efficiency .................................................................................. 101

A. Demand Response Participation in MISO ......................................................................................... 101

B. DRR Participation in Energy and Ancillary Services Markets .......................................................... 104

C. Energy Efficiency in MISO’s Capacity Market ................................................................................. 106

X. Recommendations ......................................................................................................................... 107

Contents

2022 State of the Market Report © 2023 Potomac Economics

TABLE OF FIGURES

Figure 1: All-In Price of Electricity .............................................................................................................. 3

Figure 2: Cross Market All-In Price Comparison ......................................................................................... 4

Figure 3: Implied Marginal Heat Rate .......................................................................................................... 5

Figure 4: Heating and Cooling Degree Days ................................................................................................ 7

Figure 5: Real-Time ASM Prices and Shortage Frequency .......................................................................... 9

Figure 6: Gas-Fired Generation Outages .................................................................................................... 10

Figure 7: Winter Storm Elliott Power Flows and Locational Prices ........................................................... 11

Figure 8: Winter Storm Elliott Emergency Declarations and Prices .......................................................... 12

Figure 9: Net Scheduled Interchange During Winter Storm Elliott ............................................................ 13

Figure 10: Manual Re-Dispatch and Associated DAMAP ......................................................................... 14

Figure 11: Anticipated Resource Mix ......................................................................................................... 16

Figure 12: Share of MISO Load Served by Wind Generation .................................................................... 18

Figure 13: Daily Range of Wind Generation Output .................................................................................. 19

Figure 14: Net Load in MISO on a Representative Winter Day ................................................................. 21

Figure 15: Uncertainty and MISO’s Operating Requirements ................................................................... 24

Figure 16: Comparison of IMM Economic ORDC to the Current ORDC ................................................. 26

Figure 17: Supply and Demand in 2021/2022 PRA ................................................................................... 31

Figure 18: Marginal Reliability Value of Solar Resources ......................................................................... 33

Figure 19: Day-Ahead and Real-Time Prices at Indiana Hub .................................................................... 36

Figure 20: Virtual Demand and Supply in the Day-Ahead Market ............................................................ 37

Figure 21: The Effects of Fast Start Pricing in ELMP ................................................................................ 41

Figure 22: Day-Ahead RSG Payments ....................................................................................................... 44

Figure 23: Real-Time RSG Payments ......................................................................................................... 44

Figure 24: Monthly Real-Time Capacity Commitments and RSG Costs in 2022 ...................................... 46

Figure 25: Example of Wind Resource Failing to Follow Dispatch Instructions ....................................... 49

Figure 26: Coal Capacity Impacted by Coal Conservation Measures ........................................................ 51

Figure 27: Wind Forecast Methodology Improvement ............................................................................... 54

Figure 28: MISO Outages ........................................................................................................................... 55

Figure 29: Value of Real-Time Congestion ................................................................................................ 57

Figure 30: Average Real-Time Congestion Components in MISO’s LMPs .............................................. 58

Figure 31: Day-Ahead and Balancing Congestion and FTR Funding ........................................................ 60

Figure 32: Balancing Congestion Revenues and Costs............................................................................... 62

Figure 33: FTR Profits and Profitability ..................................................................................................... 63

Figure 34: Prompt-Month MPMA FTR Profitability.................................................................................. 64

Figure 35: Congestion Affected by Multiple Planned Generation Outages ................................................ 73

Figure 36: Distribution of Existing Generating Capacity ........................................................................... 75

Figure 37: Distribution of Additions and Retirements of Generating Capacity ......................................... 76

Figure 38: Planning Resource Auctions ...................................................................................................... 80

Figure 39–40: Net Revenue Analysis ......................................................................................................... 83

Figure 41: Capacity at Risk by Technology Type ...................................................................................... 85

Figure 42: MISO and PJM CTS Forecast Errors ........................................................................................ 90

Figure 43: Constraint-Specific Interface Congestion Prices ....................................................................... 94

Figure 44: Economic Withholding – Output Gap Analysis ........................................................................ 98

Figure 45: Energy Market Payments to DRR Type I Resources .............................................................. 105

Contents

© 2023 Potomac Economics 2022 State of the Market Report

/

/

TABLE OF TABLES

Table 1: Capacity, Energy Output, and Price-Setting by Fuel Type ............................................................. 6

Table 2: Effects of Sloped Demand Curve by Type of Participant ............................................................. 32

Table 3: Comparison of Virtual Trading Volumes and Profitability .......................................................... 39

Table 4: Efficient and Inefficient Virtual Transactions by Type of Participant in 2022............................. 40

Table 5: Price Volatility Make-Whole Payments ($ Millions) ................................................................... 45

Table 6: Average Five-Minute and Sixty-Minute Net Dragging ................................................................ 48

Table 7: Proposed Uninstructed Deviation Penalties and Effective Rate in 2022 ...................................... 50

Table 8: Coal-Fired Resource Operation and Profitability ......................................................................... 52

Table 9: Day-Ahead and Real-Time Wind Generation............................................................................... 53

Table 10: M2M Settlements with PJM and SPP ($ Millions) ..................................................................... 66

Table 11: Real-Time Congestion on Constraints Affected by Market-to-Market Issues............................ 67

Table 12: Benefits of Ambient-Adjusted and Emergency Ratings ............................................................. 71

Table 13: Summer 2023 Planning Reserve Margins................................................................................... 78

Table 14: 2023–24 Planning Resource Auction Results ............................................................................. 81

Table 15: CTS with Five-Minute Clearing Versus Current CTS ................................................................ 92

Table 16: Demand Response Capability in MISO and Neighboring RTOs ............................................. 102

Table 17: Growth of Energy Efficiency in MISO ..................................................................................... 106

Contents

2022 State of the Market Report © 2023 Potomac Economics

Guide to Acronyms

AAR

Ambient Adjusted Rating

M2M

Market-to-Market

AMP

Automated Mitigation Procedure

MCC

Marginal Congestion Component

ARC

Aggregator of Retail Customers

MCP

Market Clearing Price

ARR

Auction Revenue Rights

MISO

Midcontinent Independent Sys. Operator

ASM

Ancillary Services Market

MMBtu

Million British thermal units

BCA

Broad Constrained Area

MSC

MISO Market Subcommittee

BTMG

Behind-The-Meter Generation

MVL

Marginal Value Limit

CDD

Cooling Degree Day

MW

Megawatt

CONE

Cost of New Entry

MWh

Megawatt-hour

CRA

Competitive Retail Area

NCA

Narrow Constrained Area

CROW

Control Room Operating Window

NERC

North American Electric Reliability Corp.

CTS

Coordinated Transaction Scheduling

NSI

Net Scheduled Interchange

DA

Day-Ahead

NYISO

New York Independent System Operator

DAMAP

Day-Ahead Margin Assurance Pmt.

ORDC

Operating Reserve Demand Curve

DIR

Dispatchable Intermittent Resource

PJM

PJM Interconnection, Inc.

DR

Demand Response

PRA

Planning Resource Auction

DRR

Demand Response Resource

PRMR

Planning Reserve Margin Requirement

ECF

Excess Congestion Fund

PVMWP

Price Volatility Make-Whole Payment

EDR

Emergency Demand Response

RAN

Resource Availability and Need

EEA

Emergency Energy Alert

RDT

Regional Directional Transfer

ELMP

Extended LMP

RPE

Reserve Procurement Enhancement

FERC

Federal Energy Reg. Commission

RSG

Revenue Sufficiency Guarantee

FFE

Firm Flow Entitlement

RT

Real-Time

FRAC

Fwd. Reliability Assessment

Commitment

RTO

Regional Transmission Organization

FSR

Fast-Start Resource

RTORSGP

Real-Time Offer Revenue Sufficiency

Guarantee Pmt.

FTR

Financial Transmission Right

SMP

System Marginal Price

GSF

Generation Shift Factor

SOM

State of the Market

HDD

Heating Degree Day

SPP

Southwest Power Pool

HHI

Herfindahl-Hirschman Index

SSR

System Support Resource

ICAP

Installed Capacity

STLF

Short-Term Load Forecast

IESO

Ontario Electricity System Operator

STR

Short Term Reserves

IMM

Independent Market Monitor

TCDC

Transmission Constraint Demand Curve

ISO-NE

ISO New England, Inc.

TLR

Transmission Line Loading Relief

JOA

Joint Operating Agreement

TO

Transmission Owner

LAC

Look-Ahead Commitment

TVA

Tennessee Valley Authority

LBA

Local Balancing Area

UCAP

Unforced Capacity

LMP

Locational Marginal Price

UDS

Unit Dispatch System

LMR

Load-Modifying Resource

VLR

Voltage and Local Reliability

LRZ

Local Resource Zone

VOLL

Value of Lost Load

LSE

Load-Serving Entity

WUMS

Wisconsin-Upper Michigan System

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | i

/

/

EXECUTIVE SUMMARY

As the Independent Market Monitor (IMM) for the Midcontinent Independent System Operator

(MISO), we evaluate the competitive performance and efficiency of MISO’s wholesale

electricity markets. The scope of our work in this capacity includes monitoring for attempts to

exercise market power or manipulate the markets, identifying market design flaws or

inefficiencies, and recommending improvements to market design and operating procedures.

This Executive Summary to the 2022 State of the Market Report provides an overview of our

assessment of the performance of the markets and summarizes our recommendations.

MISO operates competitive wholesale electricity markets

in the Midcontinent region that extends geographically

from Montana in the west, to Michigan in the east, and to

Louisiana in the south. The MISO South subregion

shown to the right in blue was integrated in late 2013.

MISO launched its markets for energy and financial

transmission rights (FTRs) in 2005, ancillary services

market in 2009, and the capacity market in 2013. These

markets coordinate the planning, commitment, and

dispatch of generation to ensure that resources are

meeting system demand reliably at the lowest cost.

Additionally, the MISO markets establish prices that

reflect the marginal value of energy at each location on the network (i.e., locational marginal

prices or LMPs). These prices facilitate efficient actions by participants in the short term (e.g., to

make resources available and to schedule imports and exports) and support long-term decisions

(e.g., investment, retirement, and maintenance). The remainder of this Executive Summary

provides an overview of market outcomes, a discussion of key market issues, and a list of

recommended improvements.

Summary of Market Outcomes and Competitive Performance

The MISO energy and ancillary services markets generally performed competitively in 2022.

Multiple factors affected market outcomes, including higher average load caused by economic

growth as the effects of COVID-19 diminished, the continuing change in the resource mix, and

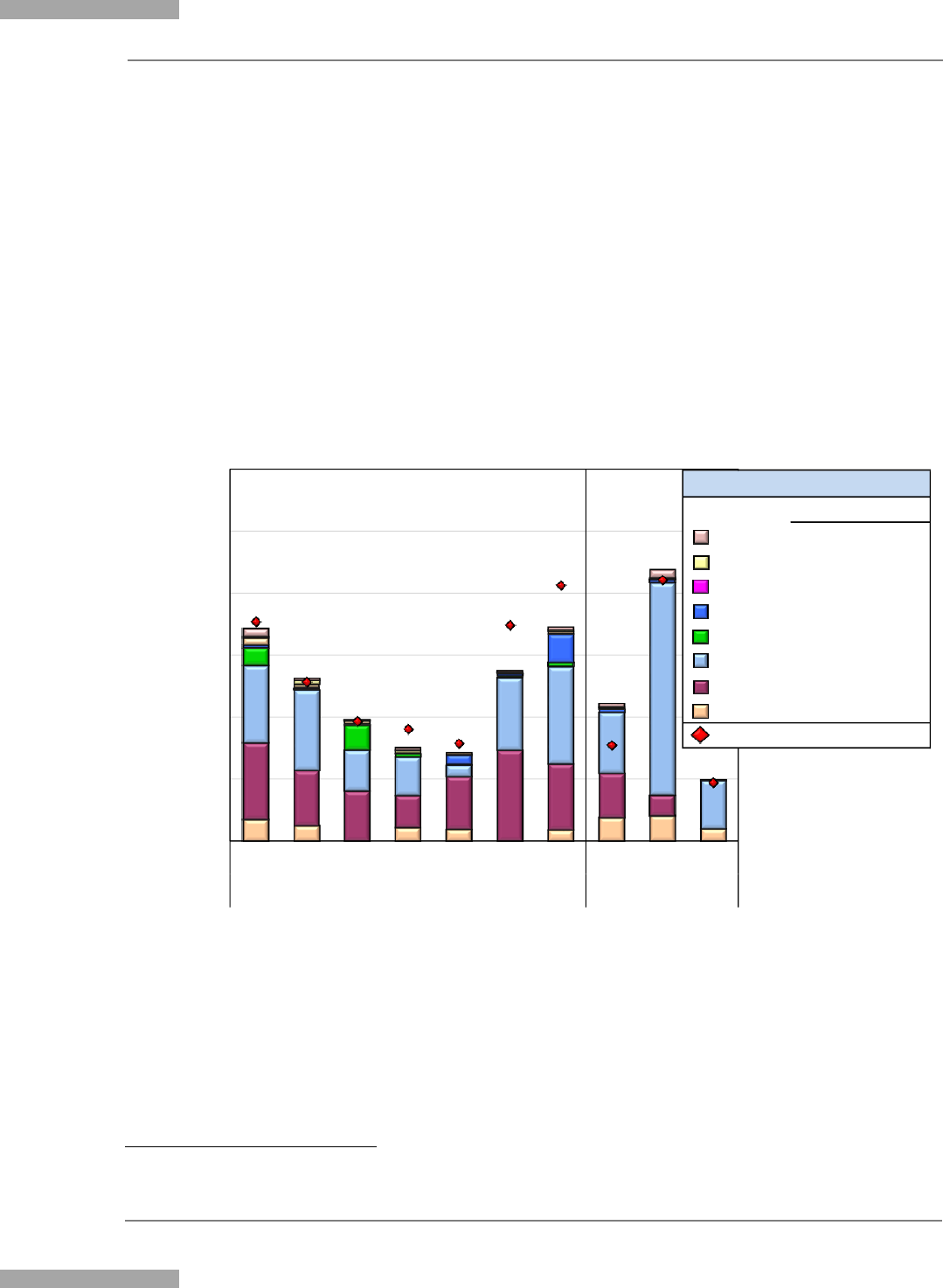

rising natural gas prices. The figure below shows a 65 percent increase in real-time energy

prices throughout MISO, which averaged $65 per MWh. Multiple factors contributed to this

increase, including a 36 percent increase in natural gas prices, a reduction in coal conservation

measures by the fall, the effects of Winter Storm Elliott in late December, and a 2 percent

increase in average load.

Executive Summary

ii | 2022 State of the Market Report © 2023 Potomac Economics

/

All-In Price of Electricity

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

$20

$22

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

$110

13 14 15 16 17 18 19 20 21 22 J F M A M J J A S O N D J F M A M J J A S O N D

Annual Average 2021 2022

Natural Gas Price ($/MMBtu)

All-In Price ($/MWh)

Capacity-Michigan Capacity

Ancillary Services Uplift

Energy (Shortage) Energy (Non-shortage)

Natural Gas Price

Frequent transmission congestion often caused prices to diverge throughout MISO. The value of

real-time congestion increased by nearly thirty percent to a record $3.6 billion in 2022, largely

because of rising natural gas prices and higher wind output throughout the year. Wind output

now contributes to just under half of MISO’s real-time congestion. Congestion also resulted in

wind curtailments averaging approximately 726 MW per hour and as high as 5.9 GW in some

hours. Ten percent of this congestion occurred during Winter Storm Elliott in just two days.

Real-time congestion was higher than optimal because several key issues continue to encumber

congestion management, including:

• Conservative static ratings by most transmission owners;

• Not utilizing network reconfigurations to redirect flows around overloaded constraints;

• Issues in defining and coordinating market-to-market constraints;

• More active and larger transmission derates by MISO operators; and

• MISO’s limited authority to coordinate outages.

To address these concerns, we continue to recommend a number of improvements to lower the

cost of managing congestion on MISO’s system. These improvements promise some of the

largest short-term benefits of any of the recommendations we make in this report.

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | iii

/

/

Competitive Performance

Outcomes in the MISO markets continue to show a consistent correlation between energy and

natural gas prices that is expected in a well-functioning, competitive market. Gas-fired resources

are most often the marginal source of supply, and fuel costs constitute the vast majority of most

resources’ marginal costs. Competition provides a powerful incentive to offer resources at prices

reflecting their marginal costs. We evaluate the competitive performance of the markets by

assessing the suppliers’ conduct using the following two empirical measures of competitiveness:

• A “price-cost mark-up” compares simulated energy prices based on actual offers to

energy prices based on competitive offer prices. As in prior years, the price-cost mark-up

was effectively zero, indicating the markets were highly competitive.

• The “output gap” is a measure of potential economic withholding. It remained very low,

averaging 0.2 percent of load, which is effectively de minimus. Consequently, market

power mitigation measures were applied infrequently.

These results, as well as the results of our ongoing monitoring, confirm that the MISO markets

are delivering the benefits of robust competition to MISO’s customers.

Market Design Improvements

Although MISO’s markets continue to perform competitively, we have identified a number of

key areas that should be improved as MISO’s generating fleet evolves in the coming years.

Hence, this report provides several recommendations, five of which are new this year. MISO has

continued to respond to past recommendations and implemented several key changes in 2022.

Key changes included:

• Transitioning to a seasonal market with availability-based accreditation for conventional

resources. The first auction under this new framework ran in the spring of 2023;

• Implementing changes in the reliability commitment process in late 2022 and early 2023

to reduce unnecessary resource commitments and associated RSG;

• Continuing to lower the Generator Shift Factor (GSF) cutoff for constraints, which allows

a broader set of generators to be utilized to manage transmission constraints; and

• Improving the demand curves for the Short-Term Reserve (STR) product and the Ramp-

Up Capability product.

These improvements have improved the performance of the markets and the operation of the

system. These improvements and other recommendations are discussed throughout this report.

Winter Storm Elliott Event

MISO experienced a significant event late in the year—Winter Storm Elliott—that stressed its

ability to maintain reliability and assist its neighbors. We evaluate this event because it

illuminates market and operational issues that do not arise under normal conditions. During the

Executive Summary

iv | 2022 State of the Market Report © 2023 Potomac Economics

/

event, widespread extremely cold temperatures simultaneously increased demand and reduced

supply. MISO and most neighboring control areas experienced large load forecasting errors,

causing capacity shortfalls in a number of these areas. Tight gas supply conditions contributed to

the capacity shortages. These events are evaluated in Section II.E of the report.

The most serious reliability issues were experienced by TVA, which implemented rolling

blackouts throughout the day on December 23. MISO provided extensive support to TVA and

other neighboring LBAs, including Southern Company, AECI, SPP, and PJM. Unusually large

exports and wheels contributed to more than $350 million in real-time congestion on December

23 and 24. MISO took unprecedented actions to maintain exports to its neighbors, including:

• Committing many resources to sustain the exports, even as congestion caused a large

number of resources to be “stranded” behind constraints. These commitments generated

more than $11 million in RSG;

• Calling a capacity emergency with no forecasted capacity deficiency in order to curtail

Load Modifying Resources (LMRs) that would otherwise be unavailable;

• Deciding not to curtail non-firm exports to a number of areas that MISO’s operating

procedures called for it to cut; and

• Manually redispatching (MRD) generation to manage severe congestion associated with

the unusually large net exports to neighboring areas.

The last action, which involves directing a unit’s output to a fixed level, can be necessary when

the cost of moving the resources needed is higher than the perceived value of managing the flows

on the constraint. MRD is not ideal because it prevents the market from properly pricing the

congestion, is often inefficient, and can generate large uplift costs. These actions generated an

additional $19 million in uplift costs during the event.

Our evaluation of this event highlights opportunities for operational improvements and we

provide the following recommendations for MISO to consider:

1. To avoid MRDs in the future, we recommend that MISO:

a. Add higher-priced steps to the Transmission Constraint Demand Curves (TCDC).

b. Improve its procedures to increase TCDCs as needed to ensure that the dispatch

model will reasonably manage network flows and violations under all conditions.

2. Strengthen controls and logging to reduce deviations from its operating procedures.

3. To the extent that operating actions will be taken in the future primarily to support

neighboring areas, MISO should:

a. Modify its operating procedures to specify these actions and the requisite criteria

for taking each action; and

b. Establish operating agreements with neighboring areas to better coordinate during

emergencies and to establish equitable provisions to allocate the associated costs.

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | v

/

/

Future Market Needs

The MISO system is changing rapidly as the generating fleet transitions and new technologies

enter the market. Although the nature and pace of the change is uncertain, MISO will have to

adapt to new operational and planning needs. MISO has been grappling with these issues in

several initiatives. Fortunately, MISO’s markets are robust and well-suited to facilitate this

transition without fundamental market changes. However, we discuss below some key

improvements that will be needed as this transition occurs.

Over the past decade, the penetration of wind resources has steadily increased as baseload coal

resources have retired. This trend is likely to accelerate as large quantities of solar, battery

storage resources, and hybrid resources join new wind resources in the interconnection queue.

The most significant supply-side challenges include:

• Wind: As wind generation increases, the volatility of its output grows as do the errors in

forecasting the wind output.

• Solar: Solar resources are forecasted to grow more rapidly than any other resource type

in the next 20 years. This will lead to significant changes in the system’s ramping needs.

For example, conventional resources will increasingly have to ramp up quickly in the

evenings as the sun sets, particularly in the winter season since load peaks in the evening.

• Distributed Energy Resources: MISO is grappling with visibility and uncertainty around

these resources. They are generally going to be connected to the distribution system, yet

FERC has ordered that DERs be able to participate in all aspects of the RTO markets.

1

• Energy Storage: MISO is working to enable Energy Storage Resources (ESRs) to

participate in the markets while recognizing their unique characteristics. Falling costs

and rising price volatility should cause ESRs to be increasing economic in the future.

MISO has managed the growth in intermittent resources reliably so far, but we discuss three

critical improvements in the following subsections that will be needed:

• Improving shortage pricing to compensate resources that are available and flexible and

that allow MISO to maintain reliability when shortages arise;

• Introducing a reliability-based demand curve in the capacity market that will align with

the marginal reliability value that capacity provides; and

• Accrediting capacity resources based on their marginal contribution to reliability.

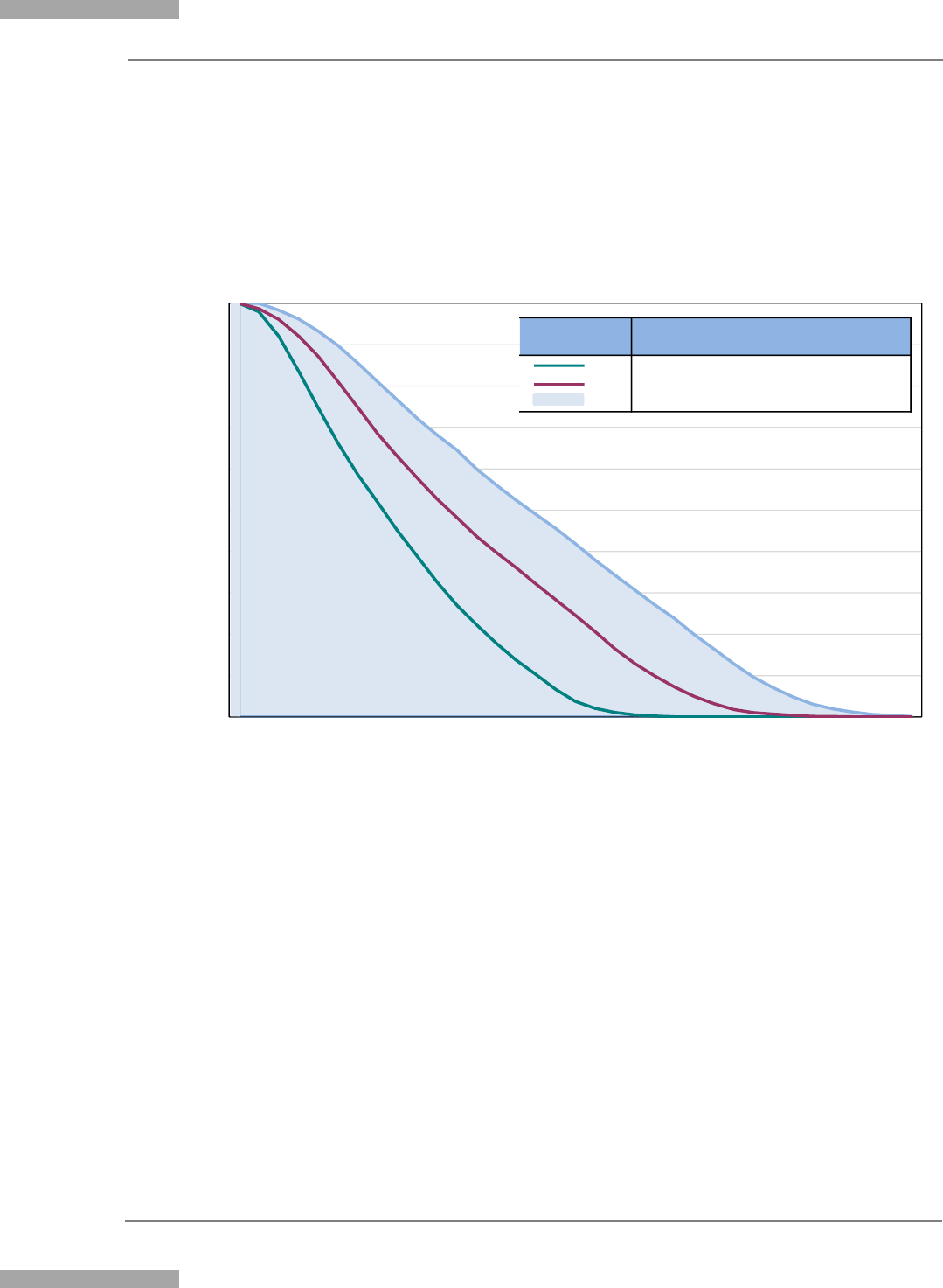

Shortage Pricing in the Energy and Ancillary Services Markets

Virtually all shortages in energy and ancillary markets are of reserve products (i.e., RTOs will

hold less reserves rather than not serve the energy demand). When an RTO is short of reserves,

the value of the foregone reserves should set the clearing price for reserves and be embedded in

1

See: Participation of Distributed Energy Resource Aggregations in Markets Operated by Regional

Transmission Organizations and Independent System Operators, Order No. 2222, 172 FERC ¶ 61,247 (2020).

Executive Summary

vi | 2022 State of the Market Report © 2023 Potomac Economics

/

all higher-value products, including energy. Efficient shortage prices play a key role in

establishing economic signals to guide investment and retirement decisions in the long term,

facilitating optimal interchange and generator commitments in the short-run, and efficiently

compensating flexible resources. Compensating flexible resources efficiently will be

increasingly important as the penetration of renewable resources increases. We expect the

frequency of shortages to rise in the future as intermittent output volatility increases.

The shortage value is established by the reserve demand curve for each reserve product, so

efficient shortage pricing requires a properly-valued operating reserve demand curve (ORDC).

An efficient ORDC should reflect the marginal reliability value of reserves at each shortage

level, which is equal to: the value of lost load (VOLL) * the probability of losing load.

Unfortunately, neither of these two components is efficiently reflected in MISO’s ORDC.

Improving the VOLL. We conducted a literature review and ultimately utilized a model

developed by Lawrence Berkeley National Laboratory to estimate an updated VOLL for MISO.

Based on this analysis, we recommend MISO update its current assumed VOLL of $3500 to an

efficient VOLL of $25,000 per MWh. Although we support this value as the basis for an

efficient ORDC, we believe it would be reasonable to cap the maximum ORDC at a lower value

(e.g., $10,000) because: (i) very few shortages would be priced in this range; (ii) pricing

shortages at higher prices could result in inefficient interchange with MISO’s neighbors who

price shortages at lower levels; and (iii) pricing at higher price levels could cause MISO’s

dispatch model to make inefficient trade-offs between retaining reserves and managing flows on

network constraints.

Improving the Slope of the ORDC. The slope of the ORDC should be determined by how the

probability of losing load changes as the level of operating reserves falls. We estimated the

probability of losing load using a Monte Carlo model that simulated: generation contingencies,

wind forecast errors, load forecast errors, and NSI uncertainty. Considering all these factors

produces a flatter slope for the ORDC than MISO’s current approach. Adopting this approach to

determine the ORDC slope along with a reasonable VOLL will result in more efficient economic

signals to govern both short-term and long-term decisions by MISO participants.

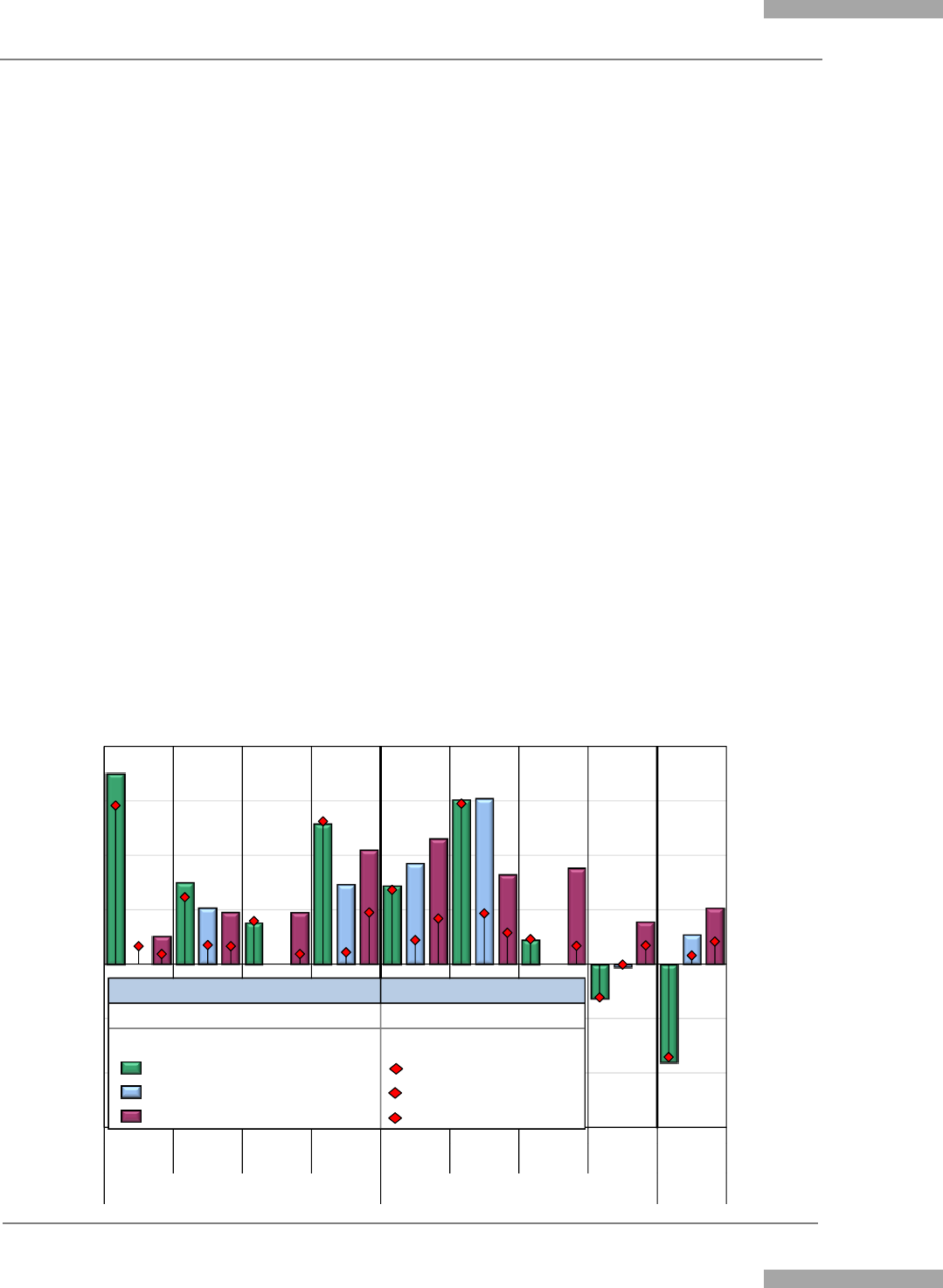

Reliability-Based Capacity Market Demand Curve

One of the most essential changes to the MISO markets is to reform the capacity market so it

provides efficient economic incentives. These reforms will generally benefit MISO’s regulated

utilities that have historically shouldered most of the burden of ensuring resource adequacy. The

problem is that the demand for capacity does not reflect its true reliability value. The fixed

quantity of required demand subject to a deficiency price represents a “vertical demand curve.”

The implication of a vertical demand curve is that the first MW of surplus capacity beyond the

minimum requirement has no reliability value. Clearing prices under a vertical demand curve

(where it intersects supply) will be close to zero when the market has even a small surplus.

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | vii

/

/

In reality, each unit of surplus capacity above the minimum requirement will increase system

reliability and lower real-time energy and ancillary services costs for consumers, although these

effects diminish as the surplus increases. Hence, the true marginal contribution of surplus

capacity to reliability can only be captured by a sloped reliability-based demand curve, which

will set capacity prices that reflect this marginal reliability value.

The effect of setting inefficiently low prices has manifested in a shortage in the Midwest region

in the 2022/2023 PRA by facilitating a sustained trend of retirements of resources that would

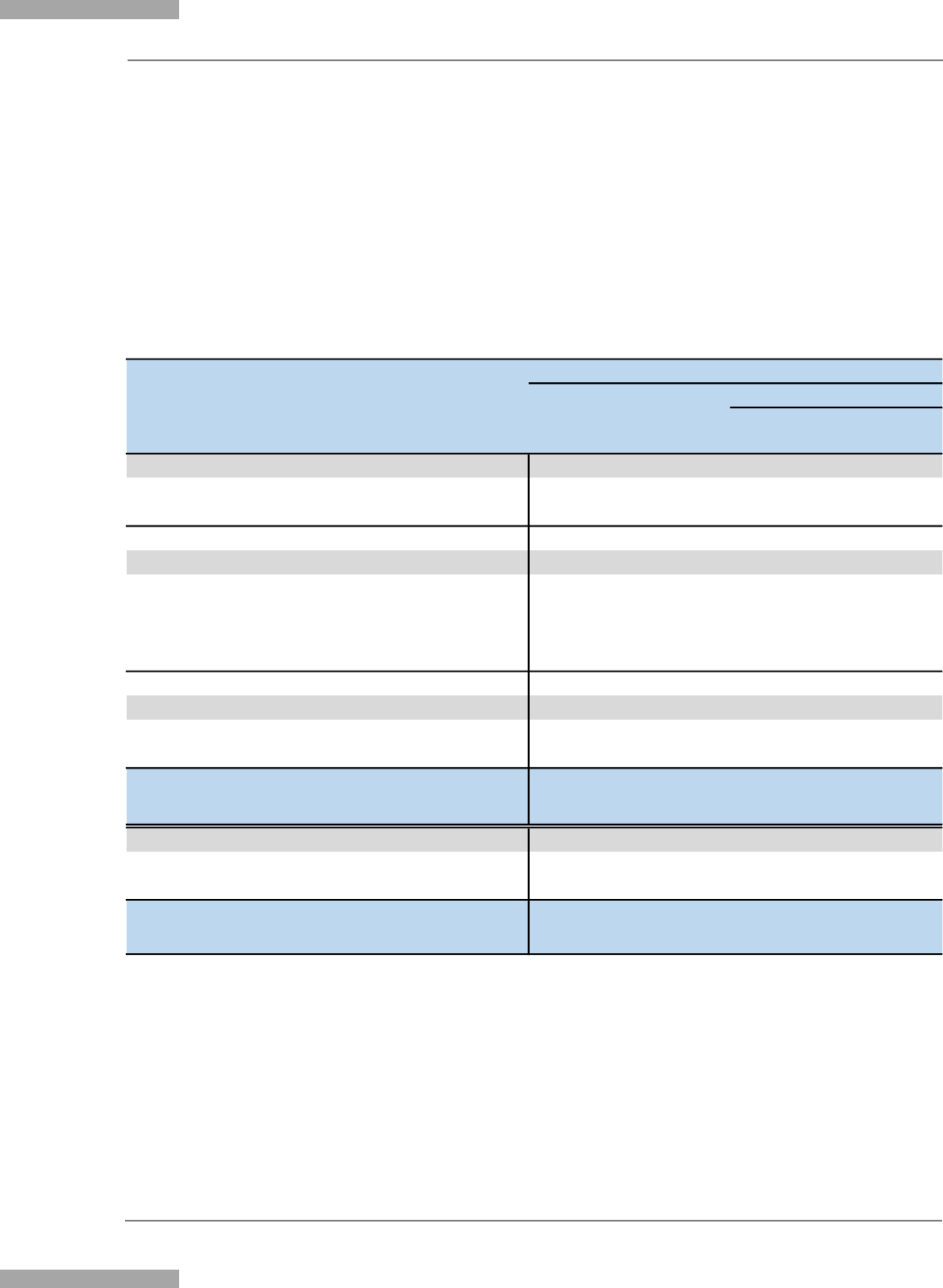

have been economic to remain in operation. This outcome is demonstrated in the following

figure, which shows: a) the economic capacity in the Midwest (by type of participant) that retired

each year; b) the actual capacity prices compared to our estimate of an efficient capacity price in

each year; and c) the range of net going-forward costs that resources would have needed to

recover in the capacity auction to avoid suspension or retirement.

Inefficient Auction Clearing Prices and Retirements in the Midwest Region

Most of the inefficient retirements over the past four years were made by merchant generators

who rely on market signals to make long-term investment and retirement decisions. Retail

ratepayers subsidize resources owned by vertically-integrated utilities and shield those resources

from MISO’s inefficient capacity prices. MISO’s poor capacity market design led to a shortage

of resources in the 2022/2023 PRA in the Midwest. MISO was not short in the 2023/2024 PRA

as its load forecast and requirements fell and some new capacity resources entered. However,

we expect this design flaw to cause the region to struggle to maintain adequate resources.

Executive Summary

viii | 2022 State of the Market Report © 2023 Potomac Economics

/

In conclusion, implementing a reliability-based demand curve should be one of MISO’s highest

priorities under its Reliability Imperative because it will:

• Establish stable and efficient capacity prices to govern investment and retirement

decisions, which is particularly important for unregulated competitive suppliers;

• Ensure that participants supplying more than their share of the required capacity in MISO

receive capacity revenues that reflect their contribution to the system’s reliability needs (

this is most vertically integrated utilities whose regulated retail customers currently

support the bulk of the costs of MISO’s generating resources); and

• Provide incentives for load-serving entities (LSEs) that do not have sufficient capacity to

plan better by contracting for existing capacity or building new capacity.

Improving MISO’s Capacity Accreditation

A resource’s true reliability value is its expected availability to provide energy or reserves when

the system is at risk of load shedding. This value depends on (a) the timing of the system’s hours

of greatest need and (b) the factors that affect the availability of a resource in those hours.

Importantly, the hours of greatest need are affected by the portfolio of generation and the output

profile of the portfolio – this value can be characterized as a “marginal value”. For resources to

be accredited accurately, RTOs must utilize methods that determine their marginal value.

MISO’s recently implemented availability-based accreditation is generally consistent with this

principle because it measures resources’ availability during the tightest hours, which are

determined by the operating characteristics of the existing generation portfolio. Intermittent

resources are generally accredited using methods that predict the expected output of the

resources under different conditions. One such method is the Expected Load Carrying

Capability (ELCC) used by MISO, although its current approach is not marginal.

If MISO fails to accredit resources based on their marginal value, the inflated accreditation to

low-value (over-saturated) resources will substantially increase costs to consumers and

undermine incentives to the resources with high-value attributes that the system needs.

Additionally, accurate accreditation will inform the states’ integrated resource planning

processes and ensure that these processes produce resource plans that will satisfy the reliability

needs of the MISO region. For all of these reasons we find that accrediting all resources based

on their marginal reliability value is essential for satisfying MISO’s reliability imperative.

Other Important Market Design Improvements

As MISO’s generating fleet transforms, its markets will play an essential role in integrating new

resources and maintaining reliability. Improving shortage pricing, the capacity demand curve,

and capacity accreditation are the highest priority changes. However, Section II.B of the report

recommends other important improvements to account for the rising system uncertainty and to

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | ix

/

/

improve the utilization of the network as transmission flows become more volatile. These are

changes that will be key for successfully navigating the transition of MISO’s portfolio:

• Introduction of an uncertainty product to reflect MISO’s current and future need to

commit resources to have sufficient supply available in real time to manage uncertainty;

• Implementation of a look-ahead dispatch and commitment model in the real-time market;

• Introduction of new processes to optimize the operation of the transmission system and

improve its utilization; and

• Development of rules and processes for integrating DERs that will satisfy essential

reliability and efficiency objectives.

Energy Market Performance and Operations

Day-Ahead Market Performance

The day-ahead market is critical because it coordinates most resource commitments and is the

basis for almost all energy and congestion settlements with participants. Day-ahead market

performance can be judged by the extent to which day-ahead prices converge with real-time

prices, because this will result in resource commitments that efficiently satisfy the system’s real-

time operational needs. In 2022:

• The difference between day-ahead and real-time prices, including day-ahead and real-

time uplift charges, was roughly 3 percent. This is good convergence overall.

• However, episodes of congestion caused by generation and transmission line outages led

to transitory periods of divergence at various locations.

Virtual transactions provided essential liquidity and improved the convergence of day-ahead and

real-time energy prices. Average cleared virtual transactions in the Midwest and South increased

by 36 and 15 percent in 2022, respectively. Our evaluation of virtual transactions revealed:

• The vast majority of the virtual trading was by financial participants whose transactions

were the most price sensitive and the most beneficial to the market;

• Most of the virtual transactions improved price convergence and economic efficiency in

the day-ahead market based on our detailed assessment of the transactions; and

• Participants continued to submit price-insensitive matching virtual supply and demand

transactions to arbitrage congestion differences. The virtual spread product we continue

to recommend would facilitate this arbitrage in a more efficient, lower-risk manner.

Real-Time Market Performance and Price Formation

The performance of the real-time market is crucial because it governs the dispatch of MISO’s

resources. The real-time market sends economic signals that facilitate scheduling in the day-

ahead market and longer-term investment and retirement decisions. Efficient price signals

during shortages and tight operating conditions provide incentives for resources to be flexible

Executive Summary

x | 2022 State of the Market Report © 2023 Potomac Economics

/

and perform well. Shortage pricing will be increasingly important as intermittent resources

continue to grow. Shortage pricing also reduces reliance on revenue from the capacity market to

maintain resource adequacy. Hence, improving MISO’s ORDC is essential.

In addition to shortage pricing, its ELMP pricing model plays a key role in achieving efficient

price formation by allowing online fast-start peaking resources (FSRs) and emergency supply to

set prices when they are economic. Initially, ELMP’s effectiveness was limited, but MISO has

implemented a number of our recommendations in recent years. Section IV.C of this report

shows that the average effects of ELMP on MISO’s real-time energy prices rose 24 percent to

$1.45 per MWh in 2022. While some of this increase is due to the effects of Winter Storm

Elliott in December and higher natural gas prices, much of it is due to the recent ELMP changes.

In addition to FSRs, emergency actions and emergency resources can set prices in ELMP during

emergencies. In 2021, MISO implemented our recommendations to expand the set of resources

that can set prices during an emergency event

2

and increased the default minimum offer floors

for emergency resources. These changes significantly improved MISO’s emergency pricing.

However, pricing when large quantities of LMRs are deployed is still problematic because the

ELMP model cannot ramp other units up quickly enough to replace them. Hence, they can set

inefficiently high prices when they are no longer needed. This causes excessive non-firm

imports, increased settlement costs, and inflated DAMAP uplift payments to resources that must

be held down at overstated prices to make room for the imports and load curtailments. To

address this concern, we recommend MISO reintroduce LMR curtailments as an STR demand in

the ELMP model instead of energy demand. This will allow the ELMP model to more

accurately determine whether they are needed without manipulating the energy dispatch.

Uplift Costs in the Day-Ahead and Real-Time Markets

Evaluating uplift costs is important because they are difficult for customers to forecast and

hedge, and generally reveal areas where the market prices do not fully capture the needs of the

system. Most uplift costs are the result two primary forms of guarantee payments made to

ensure resources cover their as-offered costs and provide incentives to be flexible:

• Revenue Sufficiency Guarantee (RSG) payments ensure that a resource’s market revenue

is at least equal to its as-offered costs over its commitment period; and

• Price Volatility Make-Whole Payments (PVMWP) ensure suppliers will not be

financially harmed by following the five-minute dispatch signals.

Day-ahead RSG. Day-ahead RSG payments fell 25 percent to total $65 million. However,

excluding the effects of Winter Storm Uri in 2021, day-ahead RSG fell 9 percent from last year.

As usual, almost all day-ahead VLR costs were accumulated in two load pockets in MISO South.

2

Resources offering up to a four hour start and minimum run time may now set the price during emergencies.

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | xi

/

/

Real-time RSG. Real-time RSG payments fell 40 percent in 2022, largely because RSG

payments generated in Winter Storm Uri in 2021 were around $125 million, dwarfing the real-

time RSG payments of $24 million paid in Winter Storm Elliott in 2022.

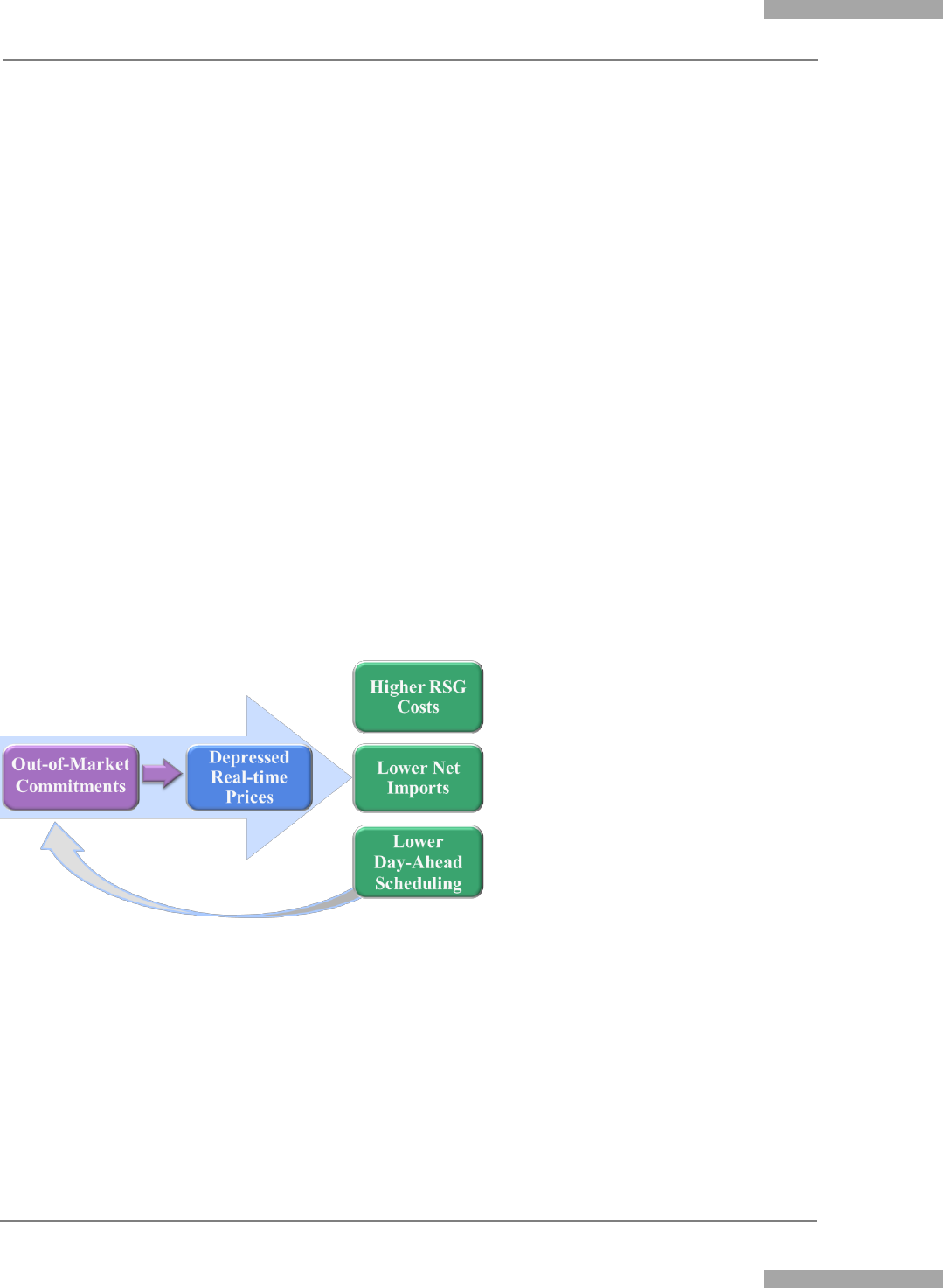

Real-Time Commitment Patterns

Out-of-market commitments by MISO account for most of the RSG incurred in real time, which

we assess in Section IV.E of this report. This assessment reveals a pattern of increasing

capacity-related commitments beginning in the summer months. During the summer quarter,

MISO’s day-ahead and real-time RSG payments more than doubled over the prior year. Our

evaluation showed that of the RSG costs incurred to maintain sufficient capacity (rather than to

manage congestion or satisfy local reliability needs):

• Only 7.5 percent was associated with real-time commitments that were actually needed;

• Another 37 percent appeared to be needed when the commitment decision was made; and

• More than 50 percent was associated with excess commitments that were not forecasted

to be needed. More than a third of the excess is associated with resources being started

earlier than needed or not being decommitted when they are no longer needed.

These results indicate opportunities for substantial improvements in MISO’s commitment

processes. This is important because excess out-of-market commitments undermine the markets

by creating a self-enforcing cycle of excess commitments. They tend to depress real-time prices,

which increases RSG costs and

reduces supply – increasing the need

for more out-of-market

commitments. The lower real-time

prices: a) decrease net supply

scheduled in the day-ahead market

(averaging 97.5 percent of peak real-

time load in 2022), and b) reduce net

imports in the real-time market.

We have been working with MISO to improve real-time commitment practices to reduce

excessive commitments and prevent price suppression. We have recommended a number of

improvements designed to reduce the frequency of unnecessary commitments, including:

• Eliminating the use of manual inputs to the LAC model to address uncertainty since they

cause it to recommend unnecessary commitments, increasing STR requirements instead.

• Deferring commitments that do not need to be made immediately given resources’ start-

up times and decommitting them when no longer needed.

• Use reserve demand curves and TCDCs in the LAC and other commitment models that

are more closely aligned with the market demand curves.

Executive Summary

xii | 2022 State of the Market Report © 2023 Potomac Economics

/

MISO has created a team to evaluate existing tools and operating practices and has begun

working with the IMM to make recommended changes. Improving operator logging is also

important because it will facilitate better understanding of the causes of excess commitments.

Real-Time Generator Performance

We monitor and evaluate the poor performance of some generators in following MISO’s

dispatch instructions on an ongoing basis. Accounting for poor performance over a period of an

hour, the accumulated dragging by MISO’s generators (producing less output than had they

followed MISO’s instructions) averaged nearly 1,000 MW and almost 1300 MW in the worst 10

percent of hours. This continues to raise economic and reliability concerns because these

deviations are often not detected by MISO’s operators. The largest source of dispatch deviations

are wind resources, which is due to: (a) forecast errors and (b) the fact that wind resources

causing congestion are often indifferent to following dispatch. Section IV.I. provides an

example of the latter. Such deviations can result in severe transmission violations and compel

MISO to use out-of-market actions.

To address this issue, we propose a deviation penalty based on the marginal congestion

component (MCC) of the resource’s LMP that is described in Section IV.G. For deviations that

load a constraint, we recommend that MISO impose a penalty equal to an escalating share of the

MCC beginning with 25 percent in the first interval and rising to 100 percent by the fourth

interval. This MCC-based penalty is appropriate because it reflects the congestion value of the

deviation volumes and scales with the severity of congestion. Our analysis of this proposal

shows that it would produce very small penalties for most types of resources, but the largest

penalties for the wind resources that are deviating and causing constraint violations. In

summary, the proposed penalties will improve dispatch incentives for all resources, but

particularly for those whose deviations cause the most serious reliability concerns.

Coal Resource Operations

As natural gas and energy prices rose during the summer months of 2021, the economic

operating margins of MISO’s coal-fired resources rose substantially and caused them to operate

economically at higher capacity factors than in 2020. This also resulted in more frequent starts

and higher output in 2021 until fuel limitations and other supply chain issues compelled many

coal resources to begin running less to conserve coal. Many coal resources began engaging in

coal conservation strategies in late 2021 that persisted through most of 2022. The coal supply

chain issues began to dissipate in the fall of 2022. Apart from this issue, coal units generally

operated economically, although regulated utilities designated their units “must-run” roughly

half of their operating hours. This compels the market to dispatch them and has resulted in them

running uneconomically in seven percent of their operating hours.

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | xiii

/

/

Wind Generation and Forecasting

Installed wind capacity now accounts for over 30 GW of MISO’s installed capacity and

produced 13 percent of all energy in MISO in 2022. Wind output also increased by 23 percent

compared to 2021 and almost 75 percent over the past three years to average 11.3 GW per hour.

MISO set a new all-time wind record on November 30 at 24 GW. These trends in wind output

are likely to continue for the next few years as investment remains strong. The report identifies a

number of operational and market issues associated with the growth of wind resources.

Day-Ahead Scheduling. Wind suppliers generally under-schedule wind in the day-ahead market,

averaging roughly 1,200 MW less than their real-time output. This can be attributed to the

suppliers’ contracts and the financial risk related to being allocated RSG costs when day-ahead

wind output is over scheduled. Under-scheduling can create price convergence and resource

commitment issues. These issues are partially addressed by net virtual suppliers that sell energy

in the day-ahead market in place of the wind suppliers.

Real-Time Wind Forecasting. One of MISO’s operational challenges is the large dispatch

deviations that can be caused by wind forecast errors. The unit’s forecast is used by MISO to set

the unit’s dispatch maximum and, because wind offer prices are low, the forecast also tends to

determine the dispatch level. Dispatch deviations caused by wind forecast errors contribute to

higher congestion and under-utilization of the transmission network, supply and demand

imbalances, and cause non-wind resources to be dispatched at inefficient levels.

Most wind resources rely on the MISO forecast in real-time, which we evaluate in this report.

We find that MISO’s simple persistence forecast (i.e., the most recently observed wind output

will continue) tends to often produce large errors. We developed a forecast methodology that is

also persistence-based, but also incorporates the recent direction in output changes. Our analysis

of this approach shows that this modest change would substantially improve the MISO forecast –

reducing the frequency of the highest portfolio-level errors by more than 90 percent, while

reducing the highest average unit-level errors by 45 percent. Improving the forecast of wind

resources’ output will be increasingly important as the penetration of intermittent resources

increases. We recommend that MISO implement such a change in forecast methodology.

Transmission Congestion

Transmission congestion costs arise on the MISO network when a higher-cost resource is

dispatched in place of lower-cost ones to avoid overloading transmission constraints. These

congestion costs arise in both the day-ahead and real-time markets. These costs are reflected in

MISO’s location-specific energy prices, which represent the marginal costs of serving load at

each location given the marginal energy costs, network congestion, and losses. Because most

transactions are settled through the day-ahead market, most congestion costs are collected in this

market. The maps below show the changes in congestion patterns between 2021 and 2022.

Executive Summary

xiv | 2022 State of the Market Report © 2023 Potomac Economics

/

Congestion Costs in 2022

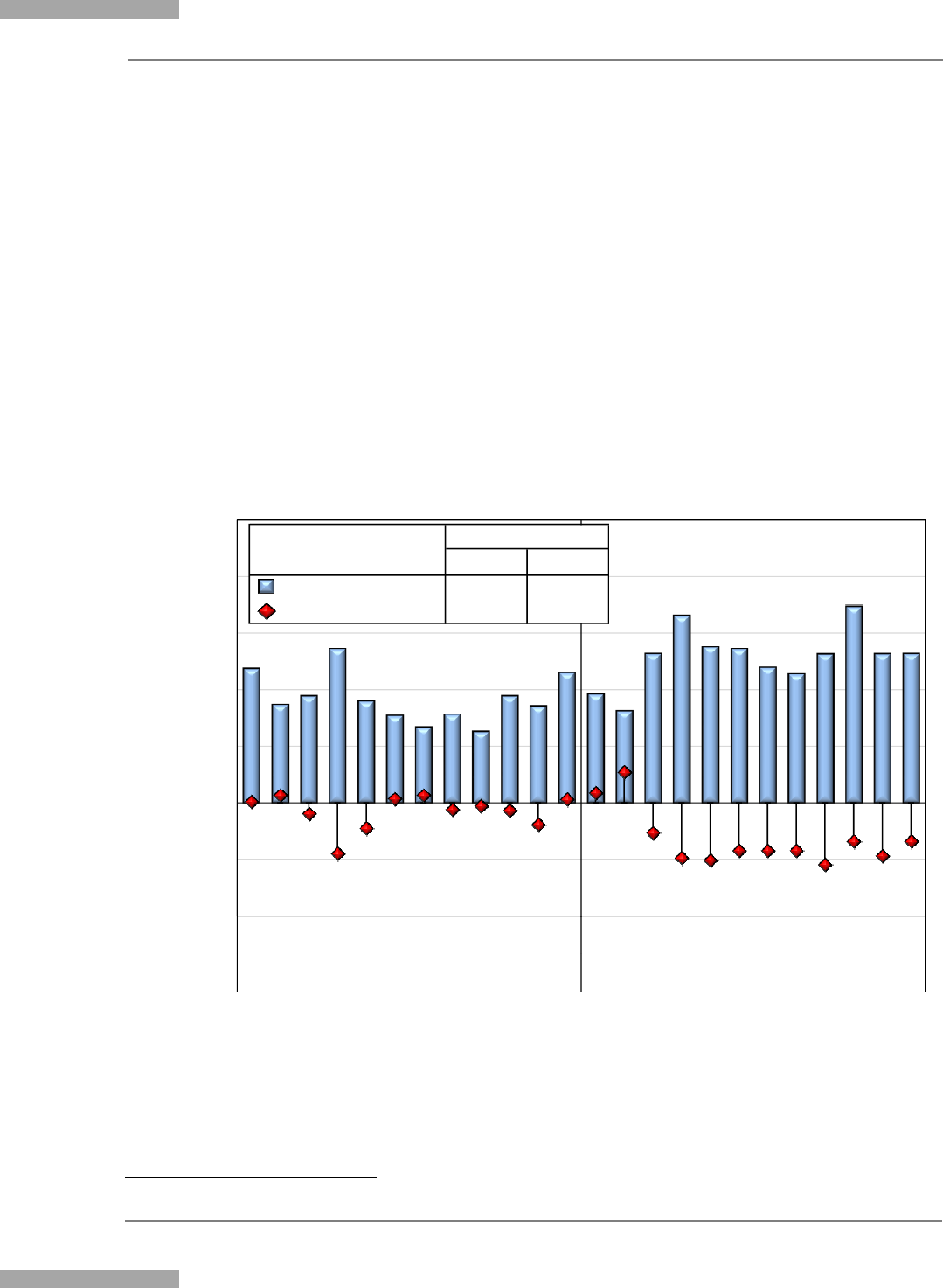

The value of real-time congestion rose 30 percent in 2022 to $3.7 billion. The maps below show

where the congestion became more severe in 2022.

Average Real-Time Congestion Components in MISO’s LMPs

2021 2022

The substantial increase in real-time congestion was caused be the following factors:

• A substantial increase gas prices, beginning in the spring quarter, contributed to much of

this increase because it raised the cost of re-dispatching natural gas-fired generation.

• Roughly $360 million of this increase was related to severe congestion that occurred

during Winter Storm Elliott over just two days in December.

• Transmission constraints loaded by wind resources accounted for an increasing level of

real-time congestion— exceeding $1.5 billion in 2022—because of the continued entry of

new wind resources in MISO, SPP, and PJM that increase loadings on key constraints.

• Available relief on wind-related constraints has fallen in recent years because of the

retirement of some key coal and gas-fired resources.

• Higher imports from Manitoba occurred in 2022, where in 2021 hydro output has been

limited by drought conditions.

Not all of the $3.7 billion in real-time congestion cost is collected by MISO through its markets,

primarily because there are loop flows caused by external areas and flow entitlements granted to

PJM, SPP, and TVA under JOAs, resulting in uncompensated use of MISO’s network. Hence,

day-ahead congestion costs increased by 35 percent to $2.2 billion in 2022.

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | xv

/

/

Day-ahead congestion revenues are used to fund MISO’s FTRs. FTRs represent the economic

property rights associated with the transmission system and serve as a hedge against day-ahead

congestion costs. If the FTRs issued by MISO are physically feasible (do not imply more flows

over the network than the limits in the day-ahead market), then MISO will always collect enough

congestion revenue through its day-ahead market to “fully fund” the FTRs—to pay them 100

percent of the FTR entitlement. FTRs were fully funded in 2022.

Congestion Management Concerns and Potential Improvements

Although overall there have been improvements in MISO’s congestion management processes,

we remain concerned about a number of issues that undermine the efficiency of MISO’s

management of transmission congestion. Given the vast costs incurred annually to manage

congestion, initiatives to improve congestion management are likely to be among the most

beneficial. Hence, we encourage MISO to assign a high priority to addressing these issues.

Outage Coordination. Transmission and generation outages often occur simultaneously and

affect the same constraints. Multiple simultaneous generation outages contributed to more than

$1 billion in real-time congestion costs in 2022 – 30 percent of real-time congestion costs. We

continue to recommend MISO explore improvements to its coordination of transmission and

generation outages, including expanding its outage approval authority to include some form of

economic criteria for approving and rescheduling planned outages.

Understated Transmission Ratings. Most transmission owners still do not actively adjust their

facility ratings to reflect ambient temperatures or provide emergency ratings for contingent

constraints (when the actual flow would temporarily approach this rating only after the

contingency). As a result, MISO often uses lower fixed ratings, which reduces MISO’s

utilization of its transmission network. We estimate MISO could have saved over $540 million

in congestion costs in 2022 by using temperature-adjusted and emergency ratings. In late 2020,

FERC issued a proposed rule that would make this a requirement. We urge MISO to work with

the TOs to provide such improved ratings in a more timely manner than required by the Rule.

Transmission Reconfiguration. It can often be highly economic to alter the configuration of the

network (e.g., opening a breaker) to reduce flows on a severely-constrained transmission facility.

This is done currently to mitigate reliability concerns under procedures established with the

transmission owners impacted by the reconfiguration. Such procedures should be expanded to

economically manage congestion. The report illustrates examples of constraints that generated

tremendous amounts of congestion and compelled sizable and sustained wind curtailments.

Market-to-Market Coordination

There are many MISO constraints that are greatly affected by generation in PJM and SPP, and

likewise constraints in these areas that are affected by MISO generation. Therefore, MISO

Executive Summary

xvi | 2022 State of the Market Report © 2023 Potomac Economics

/

coordinates congestion management on these constraints through the market-to-market (M2M)

process with SPP and PJM. Congestion on MISO’s M2M constraints nearly doubled to total $2

billion in 2022, which was more than 30 percent of all congestion in MISO. Because there are so

many MISO constraints that are affected by generators in SPP and PJM, it is increasingly

important that M2M coordination operate as effectively as possible.

We evaluate the M2M process by tracking the convergence of the shadow prices of M2M

constraints. When the process is working well, the “non-monitoring RTO” (NMRTO) will

continue to provide additional relief until the marginal cost of its relief (its shadow price) is equal

to the shadow price of the “monitoring RTO” (MRTO), which is responsible for managing the

constraint. Our analysis of M2M coordination provided the following findings:

• M2M coordination has generally contributed to shadow price convergence over time and

lowered costs of managing congestion. However, we also find that coordination could be

improved with three key changes and deliver substantial additional savings.

• Relief request software. Improving the software used to determine the amount of relief

requested by the MRTO from the NMRTO will provide significant savings. The current

process often produces suboptimal relief quantities that prevent the NMRTO from

providing all available economic relief or can cause a constraint to oscillate from binding

to unbinding. Based on our analysis of this issue with SPP, we believe improving the

relief requests would generate well over $100 million in annual savings.

• Five-percent test: Constraints are identified as M2M constraints if the NMRTO has

substantial market flows on the constraint or has a single generator with a GSF greater

than five percent on the constraint. The five percent test has frequently resulted in

constraints designated as M2M constraints for which the benefits of coordinating are

extremely small. Hence, we recommend that MISO replace the current five-percent test

with a test based on the NMRTO’s relief capability on the constraint.

• Automation of the M2M Processes. MISO has made progress in improving the M2M

processes over the years, particularly in the area of testing new constraints in a timely

manner. Given that much of this process continues to be implemented manually, there

are still significant opportunities to improve the timeliness with which constraints are

tested and activated by expanding the automation of the M2M processes.

Long-Term Economic Signals and Resource Adequacy

Capacity Levels and Summer Capacity Margins

The capacity surplus MISO had enjoyed prior to the 2022/2023 Planning Year dwindled in

recent years as the retirements of baseload resources have mostly been replaced with intermittent

renewable resources. In 2022:

• 4 GW of resources retired or suspended operations in MISO, comprised mostly of coal,

gas steam, and nuclear resources. The continuing trend of suspensions and retirements

into the 2022/2023 Planning Year resulted in a capacity shortage in the Midwest region.

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | xvii

/

/

• 2 GW of new unforced capacity entered MISO, including a 1.1 GW natural gas-fired

combined-cycle in the Central region. 2.8 GW (nameplate) of wind resources were

added in 2022, providing 380 MW of unforced capacity. 600 MW of solar unforced

capacity entered, primarily in the North and Central regions.

MISO was not short of capacity in the 2023/2024 PRA as its load forecast and requirements fell

and some new capacity resources entered. Nonetheless, we expect the retirement trends above to

continue and for MISO to continue to struggle to maintain adequate resources if it does not

improve the price formation in its capacity market. These price formation issues discussed

above substantially affect the net revenues available to new and existing resources in MISO,

which is discussed in the next subsection.

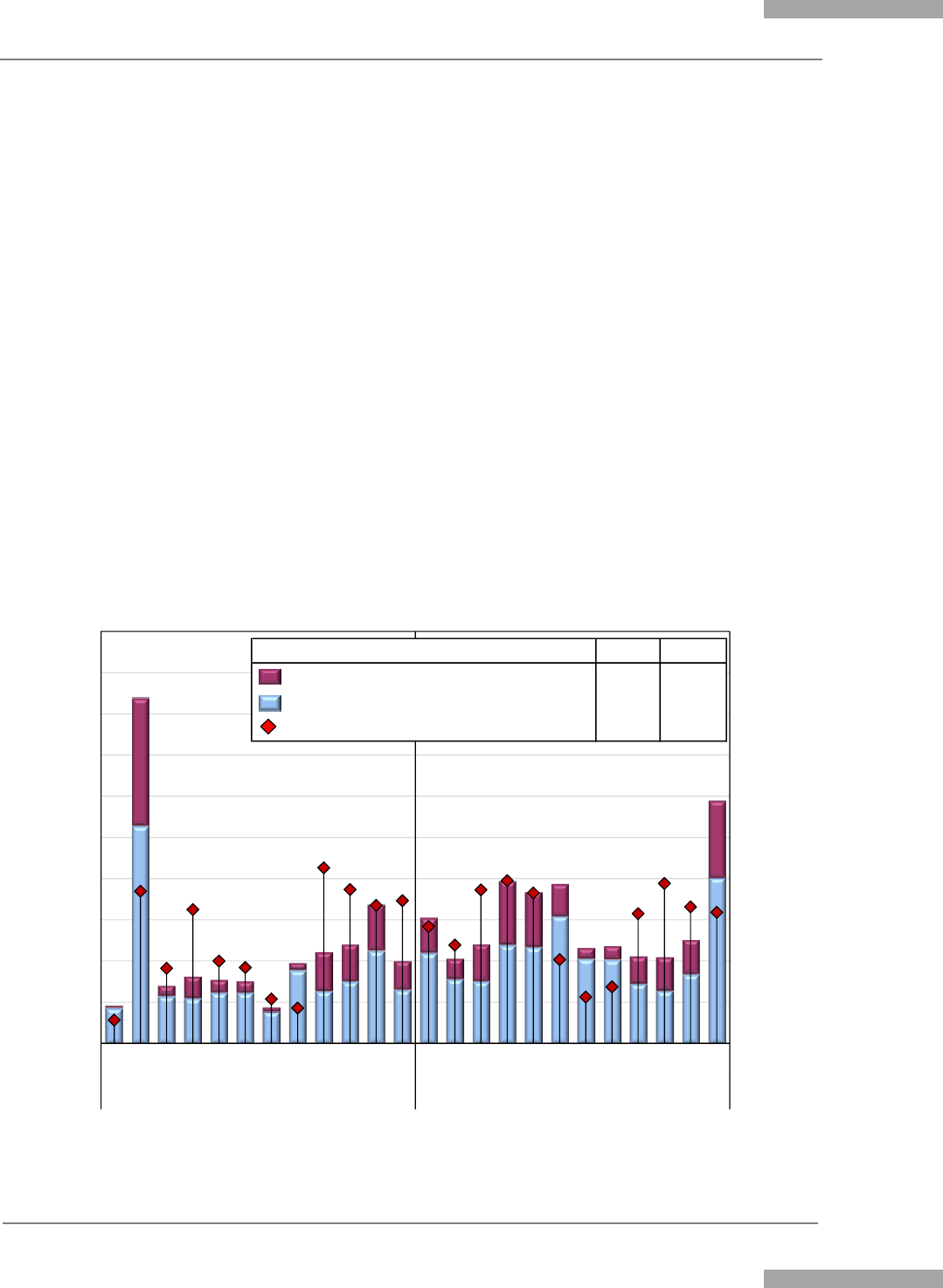

Long-Term Signals: Net Revenues

Market prices should provide signals that govern participants’ long-run investment, retirement,

and maintenance decisions. These signals can be measured by the “net revenues” generators

receive in excess of their production costs. We evaluate these signals by estimating the net

revenues that different types of new resources would have received in 2022.

We find net revenues rose in almost all regions in 2022 as rising natural gas prices contributed to

higher energy and ancillary services prices throughout MISO. High capacity prices and

congestion caused net revenues for new combustion turbines and combined-cycle resources to

generally exceed their cost of new entry in most of the Midwest region. This is not likely to be

sustained given the falling capacity prices and natural gas prices in early 2023. In other areas,

including all of the South, net revenues were well short of those needed to support investment in

new resources. This is largely a result of the market design issues described above.

PRA Market Design

MISO has implemented two significant changes in its capacity market to more effectively and

efficiently satisfy its resource adequacy requirements – (i) a seasonal capacity market; and (2) an

availability-based accreditation for thermal resources. We provided extensive feedback and

analyses to MISO in the implementation of these changes. The first PRA with these changes

occurred in early May and while it could have gone more smoothly, the results were consistent

with the design of the market. We have identified elements of these new designs that could be

improved in the future and will continue to discuss them with MISO and its participants.

We have also recommended several other improvements to the PRA. A number of these changes

involve improving the accuracy of the supply and demand in the PRA, including:

• Disqualifying energy efficiency from selling capacity in the PRA or improving Tariff

provisions to help ensure that they provide some value to MISO;

• Improving the accreditation rules for emergency-only resources in the PRA; and

Executive Summary

xviii | 2022 State of the Market Report © 2023 Potomac Economics

/

• Modeling constraints in the PRA by assigning a zonal shift factor for each modeled

constraint that reflects how the resources in each zone affect the flow on the constraint.

We will continue to discuss these improvements with MISO along with the high-priority changes

to the capacity demand curve and accreditation methodologies that will allow the MISO region

to remain reliable as its generation fleet transitions.

Long Range Transmission Planning

In July of 2022 the MISO Board approved $10.3 billion of Long Range Transmission Plan

(LRTP) projects. The LRTP Tranche 1 evaluation focused on the most clearly beneficial

projects as well as projects that could use existing rights-of-way. As MISO moves towards

evaluating Tranche 2 of the LRTP, it will be increasingly important to accurately evaluate the

costs and benefits of the transmission investments to avoid costly, inefficient investments. This

is critical because inefficient investment in transmission can undermine incentives that govern

other long-term decisions, some of which can address congestion at a fraction of the costs of the

transmission upgrades. These long-term decisions include generation investment and siting

decisions, retirement decisions, energy storage and grid-enhancing technologies investment.

The report identifies concerns regarding the methodologies and assumptions for identifying

expected long-term resource changes and for estimating benefits of new transmission projects.

We recommend changes to address these concerns in the evaluation of future LRTP tranches.

External Transaction Scheduling and External Congestion

As in prior years, MISO remained a substantial net importer of power in 2022, importing an

average of 4.2 GW per hour in real time, down from 4.6 GW in 2021. MISO’s imports from

PJM in 2022 averaged 2.2 GW per hour, down 20 percent from 2021. Price differences at the

interfaces between MISO and neighboring areas create incentives to schedule imports and

exports between areas. We evaluate interface pricing in this report because of the key role it

plays in facilitating efficient external transaction scheduling. We also assess the coordination of

interchange with PJM. Efficient interchange is essential because poor interchange can reduce

dispatch efficiency, increase uplift costs, and sometimes create operating reserve shortages.

Interface pricing. To calculate an accurate congestion price at the interface, an RTO must

assume the sources or sinks in the neighboring area (referred to as the “interface definition”).

Ideally, RTOs would assume sources and sinks throughout each RTO’s footprint since this is

what happens in reality. Unfortunately, MISO agreed to adopt a “common interface” definition

for the PJM interface in June 2017 consisting of 10 generator locations near the PJM seam. This

has increased interface price volatility, resulted in less efficient imports and exports, and raised

costs for customers in both regions. Hence, we encourage MISO to consider revising its

interface pricing with PJM to match our recommended pricing for the SPP interface.

Executive Summary

© 2023 Potomac Economics 2022 State of the Market Report | xix

/

/

At the SPP interface, we have verified that redundant congestion pricing is occurring based on

their overlapping interface definitions. In other words, when an M2M constraint binds in both

markets, both RTOs will settle with an importer/exporter at the full congestion value of the

constraint in each respective market. This results in duplicative payments/charges and inefficient

incentives to schedule imports or exports. We encourage MISO to adopt an efficient interface

pricing method at the SPP interface and its other interfaces by removing all external constraints

from its interface prices (i.e., pricing only MISO constraints). If SPP does the same, the

redundant congestion issue will be eliminated, and the interface prices will be efficient.

Interchange Coordination. Coordinated Transaction Scheduling (CTS) is the most promising

means to improve interchange coordination. CTS allows participants to submit offers to transact

within the hour if the forecasted spread in the RTOs’ real-time interface prices is greater than the

offer price. MISO worked with PJM to implement CTS on October 3, 2017. The participation

in CTS has been minimal because of high transmission charges and persistent forecast errors

have likely deterred traders from using CTS. Hence, it has produced very little of the sizable

savings it could generate. To improve the CTS process, we recommend that MISO:

• Eliminate all transmission and other charges applied to CTS transactions, while

encouraging PJM to do the same;

• Modify the CTS to clear transactions every five minutes through the real-time dispatch

model based on the most recent five-minute prices in the neighboring RTO area; and

• Implement a CTS process with SPP based on this type of five-minute clearing process.

Our analysis of the benefits of this change in Section VII.B of this report shows that it would

have raised the production cost savings in 2022 of the CTS process with PJM from actual

savings of $3 million under the current approach to more than $100 million under the 5-minute

adjustment approach. We estimate savings of $63 million for a similar approach with SPP. This

would also improve incentives for participants to utilize CTS because profits would have

exceeded $60 million versus only $76,000 under the current approach at the PJM interface.

Demand Response and Energy Efficiency

Demand response is an important contributor to MISO’s resource adequacy. MISO had 12 GW

of DR resources in 2022, which included 4.2 GW of behind-the-meter generation. Most of its

DR capability is in the form of interruptible load developed under regulated utility programs.

DR resources are registered in three primary MISO programs depending on their capabilities.

Load-Modifying Resources (LMRs). Almost 95 percent of MISO’s DR resources are LMRs that

can only be accessed after MISO has declared an emergency. MISO has recently made several

changes to improve the accessibility and information on the availability of LMRs. These

changes are discussed in Section IX.A. Although they are clear improvements, we still have

concerns that LMRs are not as accessible or as valuable as generating resources from a reliability

perspective. Hence, we recommend MISO make further accreditation improvements for LMRs.

Executive Summary

xx | 2022 State of the Market Report © 2023 Potomac Economics

/

Demand Response Resources (DRRs). DRRs are a category of DR that can participate in the

energy and ancillary services markets because they are assumed to be able to respond to MISO’s

real-time curtailment instructions. DRRs are divided into two subcategories:

• Type I: These resources can supply a fixed quantity of energy or reserves by interrupting

load. These resources can qualify as FSRs and set price in ELMP;

3

and

• Type II: These resources can supply varying levels of energy or operating reserves on a

five-minute basis and are eligible to set prices, just like generating resources.

DRR schedules and the associated payments fell 34 percent 2022 as resources we previously

identified as engaging in problematic conduct ceased participation in MISO. Almost all of the

payments to these resources produced no meaningful demand curtailments and were largely the

result of opportunistic conduct. To address this issue, we recommended two potential

improvements to provide more efficient incentives and ensure all payments are justified:

• DRRs should be obligated to submit their anticipated consumption absent any

curtailments, which could be the basis of legitimate settlements. This could be monitored

to identify when a participant has submitted inaccurate data to inflate their settlements.

• MISO should establish a price floor that is significantly higher than typical LMPs, which

would effectively preclude the strategies we detected. This is reasonable because a load

could just not consume at the current price rather than offer curtailments as a price-taker.

Emergency Demand Response Resources (EDRs). These are called in emergencies, but not