EUROPEAN COMMISSION

Competition DG

CASE AT.39437 – TV and computer

monitor tubes

(Only the English text is authentic)

CARTEL PROCEDURE

Council Regulation (EC) 1/2003

Article 7 Regulation (EC) 1/2003

Date: 05/12/2012

Please note that in its judgment of 9 September 2015 in Toshiba v Commission, T-104/13,

ECLI:EU:T:2015:610, the General Court annulled this decision insofar as the Commission

had found Toshiba liable for the CPT cartel from 16 May 2000 to 31 March 2003. In its

judgment of 18 January 2017, the Court of Justice confirmed the judgment of the General

Court (Toshiba v Commission, C-623/15 P, ECLI:EU:C:2017:21).

This text is made available for information purposes only. A summary of this decision is

published in all EU languages in the Official Journal of the European Union.

Parts of this text have been edited to ensure that confidential information is not disclosed.

Those parts are replaced by a non-confidential summary in square brackets or are shown as

[…].

EN EN

EUROPEAN

COMMISSION

Brussels, 5.12.2012

C(2012) 8839 final

COMMISSION DECISION

of 5.12.2012

addressed to:

- Chunghwa Picture Tubes Co., Ltd.

- Chunghwa Picture Tubes (Malaysia) Sdn. Bhd.

- CPTF Optronics Co., Ltd.

- Samsung SDI Co., Ltd.

- Samsung SDI Germany GmbH

- Samsung SDI (Malaysia) Berhad

- Koninklijke Philips Electronics N.V.

- LG Electronics, Inc.

- Technicolor S.A.

- Panasonic Corporation

- Toshiba Corporation

- MT Picture Display Co., Ltd.

relating to a proceeding under Article 101 of the Treaty on the Functioning of the

European Union and Article 53 of the EEA Agreement

(COMP/39437 - TV and Computer Monitor Tubes)

(Only the English language text is authentic)

EN 1 EN

EN 2 EN

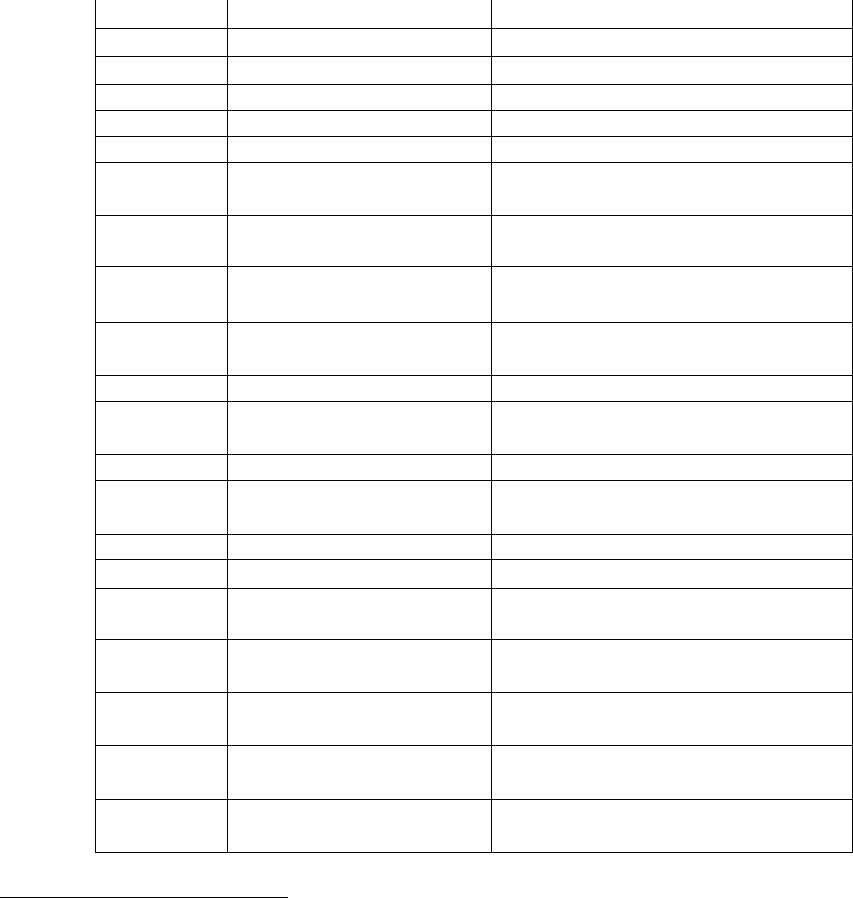

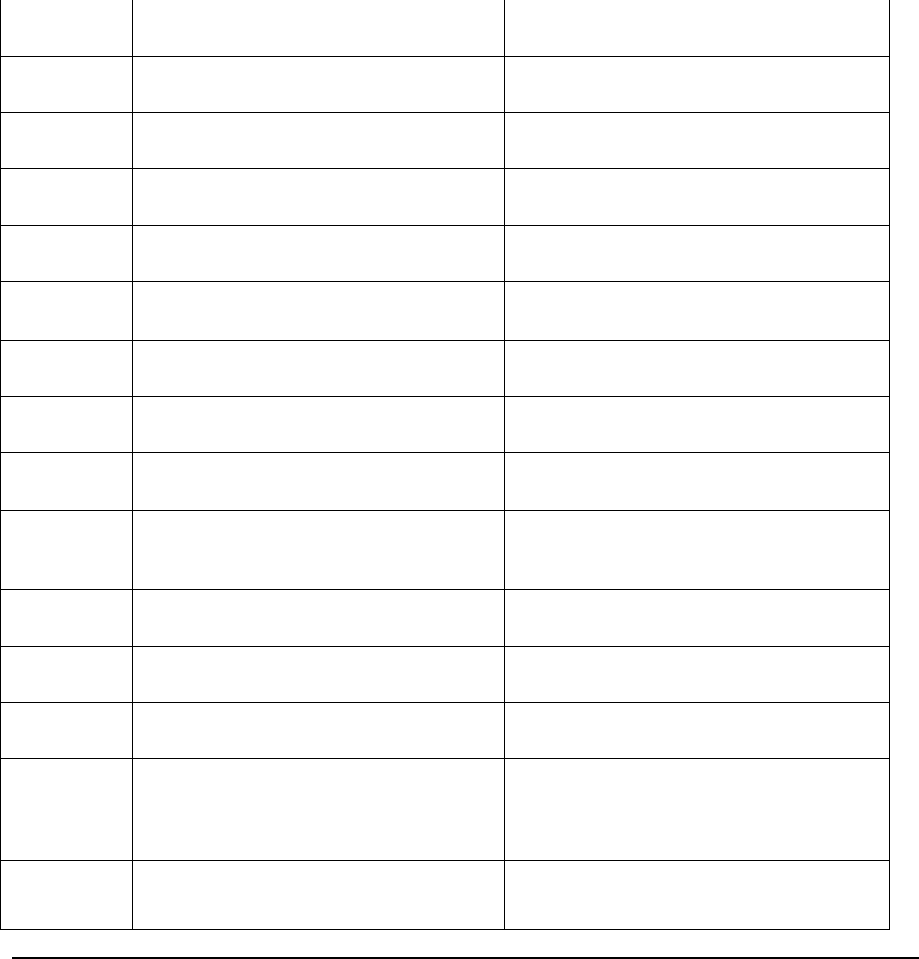

TABLE OF CONTENTS

1. Introduction .................................................................................................................. 7

2. The industry subject to the proceedings ....................................................................... 7

2.1. The product .................................................................................................................. 7

2.2. The market players ....................................................................................................... 8

2.2.1. Undertakings subject to these proceedings .................................................................. 8

2.2.1.1. Chunghwa Picture Tubes Co., Ltd. .............................................................................. 8

2.2.1.2. Samsung SDI Co., Ltd. ................................................................................................ 9

2.2.1.3. Koninklijke Philips Electronics N.V. ......................................................................... 10

2.2.1.4. LG Electronics, Inc. ................................................................................................... 13

2.2.1.5. [Philips/LGE joint venture]. ....................................................................................... 14

2.2.1.6. Thomson S.A./Technicolor S.A. ................................................................................ 16

2.2.1.7. Matsushita Electric Industrial Co., Ltd./Panasonic Corporation ................................ 18

2.2.1.8. Toshiba Corporation ................................................................................................... 18

2.2.1.9. Matsushita Toshiba Picture Display Co. Ltd./ MT Picture Display Co., Ltd ............ 20

2.2.1.10.Other suppliers of CRT .............................................................................................. 20

2.3. Description of the market ........................................................................................... 21

2.3.1. The supply .................................................................................................................. 21

2.3.2. The demand ................................................................................................................ 21

2.3.3. Inter-state trade ........................................................................................................... 22

3. Procedure .................................................................................................................... 22

3.1. The Commission's investigation ................................................................................ 22

4. Description on the events ........................................................................................... 25

4.1. CDT cartel .................................................................................................................. 25

4.1.1. Basic principles .......................................................................................................... 25

4.1.2. Organisation ............................................................................................................... 26

4.2. CPT cartel ................................................................................................................... 28

4.2.1. Basic principles .......................................................................................................... 28

4.2.2. Organisation ............................................................................................................... 28

4.3. The chronology of cartel events and evidence relating to specific meetings ............. 31

4.3.1. Initial years of the collusion ....................................................................................... 31

4.3.2. CDT cartel .................................................................................................................. 33

4.3.2.1. Period from 1996 to 1999 .......................................................................................... 33

4.3.2.2. Period from 2000 to 2003 .......................................................................................... 48

4.3.2.3. Period from 2004 to March 2006 ............................................................................... 60

EN 3 EN

4.3.3. CPT cartel ................................................................................................................... 67

4.3.3.1. Early years – from 1997 to 1999 ................................................................................ 67

4.3.3.2. Middle period – from 2000 to 2003 ........................................................................... 89

4.3.3.3. Last phase – from 2004 to 2006 ............................................................................... 127

4.3.4. Assessment of parties' arguments on facts ............................................................... 142

4.3.4.1. Product scope of the CDT and CPT cartels ............................................................. 142

4.3.4.2. Geographic scope of the CPT cartel ......................................................................... 146

4.3.4.3. MTPD continuing the participation of Toshiba and Panasonic ............................... 166

4.3.4.4. Technicolor's participation in an overarching CPT cartel ........................................ 167

4.3.4.5. Role of bilateral contacts in the participation of the Japanese companies in the CPT

cartel and parties' arguments on corporate statements ............................................. 170

4.3.4.6. Information exchange in the CPT cartel via contacts reported by Thomson ........... 174

4.3.4.7. Meetings relating to Turkey ..................................................................................... 177

4.3.4.8. Economic arguments on geographic and product scope of the CPT cartel and on an

EU anti-dumping case .............................................................................................. 179

5. Application of Article 101 of the Treaty and Article 53 of the EEA Agreement .... 183

5.1. The Treaty and EEA Agreement .............................................................................. 183

5.1.1. Relationship between the Treaty and the EEA Agreement ...................................... 183

5.1.2. Jurisdiction ............................................................................................................... 184

5.1.2.1. Principles and application to this case ..................................................................... 184

5.1.2.2. Assessment of parties' arguments ............................................................................ 185

5.2. Application of the relevant competition rules .......................................................... 188

5.2.1. Application of Article 101(1) of the Treaty and Article 53(1) of the EEA Agreement

.................................................................................................................................. 188

5.2.2. The nature of the infringement ................................................................................. 189

5.2.2.1. Agreements and concerted practices ........................................................................ 189

5.2.2.2. Single and continuous infringement......................................................................... 197

5.2.3. Restriction of competition ........................................................................................ 210

5.2.3.1. Restriction of competition in this case ..................................................................... 210

5.2.3.2. Assessment of parties' arguments ............................................................................ 213

5.2.4. Non-applicability of Article 101(3) of the Treaty and Article 53(3) of the EEA

Agreement ................................................................................................................ 215

5.2.5. Effect upon trade between Member States and between EEA Contracting Parties . 215

5.2.5.1. Principles .................................................................................................................. 215

5.2.5.2. Application to this case ............................................................................................ 216

6. Addressees ................................................................................................................ 217

6.1. General principles .................................................................................................... 217

EN 4 EN

6.2. Application to this case ............................................................................................ 222

6.2.1. Chunghwa ................................................................................................................ 222

6.2.2. Samsung ................................................................................................................... 224

6.2.3. Philips ....................................................................................................................... 228

6.2.4. LG Electronics ......................................................................................................... 237

6.2.5. [Philips/LGE joint venture] ...................................................................................... 241

6.2.5.1. The Commission's findings ...................................................................................... 241

6.2.5.2. Assessment and conclusion on Philips' and LGE's arguments ................................ 256

6.2.6. Thomson/Technicolor .............................................................................................. 281

6.2.7. Matsushita/Panasonic ............................................................................................... 281

6.2.8. Toshiba ..................................................................................................................... 282

6.2.9. MTPD ....................................................................................................................... 283

6.2.9.1. The Commission's findings ...................................................................................... 283

6.2.9.2. Assessment and conclusion on Panasonic's and Toshiba's arguments ..................... 287

6.3. Conclusion................................................................................................................ 298

7. Duration of the infringement .................................................................................... 300

7.1. Starting and end dates .............................................................................................. 300

7.1.1. CDT cartel ................................................................................................................ 300

7.1.2. CPT cartel ................................................................................................................. 301

8. Remedies .................................................................................................................. 305

8.1. Article 7 of Regulation (EC) No 1/2003 .................................................................. 305

8.2. Article 23(2) of Regulation (EC) No 1/2003 ........................................................... 305

8.3. Article 25 of Regulation (EC) No 1/2003 ................................................................ 306

8.4. Calculation of the fines ............................................................................................ 307

8.4.1. Methodology for setting the fine amount ................................................................. 307

8.4.2. Determination of the value of sales .......................................................................... 307

8.4.2.1. Products concerned .................................................................................................. 307

8.4.2.2. Sales related to the infringement .............................................................................. 309

8.4.2.3. Identifying the value of Direct EEA Sales and Direct EEA Sales Through

Transformed Products by place of delivery ............................................................. 315

8.4.2.4. Relevant year ............................................................................................................ 316

8.4.2.5. Calculation of the value of sales of the joint ventures ............................................. 318

8.4.3. Determination of the basic amount of the fine ......................................................... 323

8.4.4. Gravity ...................................................................................................................... 323

8.4.4.1. Nature ....................................................................................................................... 323

8.4.4.2. Combined market share ............................................................................................ 324

EN 5 EN

8.4.4.3. Geographic scope ..................................................................................................... 324

8.4.4.4. Implementation ........................................................................................................ 324

8.4.4.5. Assessment of parties' arguments ............................................................................ 324

8.4.4.6. Conclusion on gravity .............................................................................................. 326

8.4.5. Duration .................................................................................................................... 326

8.4.6. The percentage to be applied for the additional amount .......................................... 328

8.4.7. Calculation and conclusion on basic amounts ......................................................... 328

8.5. Adjustments to the basic amounts of the fine .......................................................... 329

8.5.1. Aggravating circumstances ...................................................................................... 329

8.5.2. Mitigating circumstances ......................................................................................... 329

8.5.2.1. Substantially limited role and limited participation ................................................. 329

8.5.2.2. Non implementation of the cartels ........................................................................... 332

8.5.2.3. Absence of benefits .................................................................................................. 333

8.5.2.4. Effective co-operation outside the 2006 Leniency Notice ....................................... 333

8.5.2.5. Difficult economic situation ..................................................................................... 335

8.5.2.6. Investigation by national competition authorities in the EEA ................................. 335

8.5.3. Deterrence multiplier ............................................................................................... 336

8.5.4. Application of the 10% turnover limit ..................................................................... 337

8.6. Application of the 2006 Leniency Notice ................................................................ 337

8.6.1. Chunghwa ................................................................................................................ 338

8.6.2. Samsung ................................................................................................................... 340

8.6.3. Panasonic/MTPD ..................................................................................................... 343

8.6.4. Philips ....................................................................................................................... 347

8.6.5. Technicolor .............................................................................................................. 349

8.6.6. Conclusion on the application of the 2006 Leniency Notice ................................... 352

8.7. Ability to pay............................................................................................................ 354

8.7.1. Introduction .............................................................................................................. 354

8.7.2. [Party to the proceedings] ........................................................................................ 356

8.8. Conclusion: final amount of individual fines ........................................................... 356

EN 6 EN

COMMISSION DECISION

of 5.12.2012

addressed to:

- Chunghwa Picture Tubes Co., Ltd.

- Chunghwa Picture Tubes (Malaysia) Sdn. Bhd.

- CPTF Optronics Co., Ltd.

- Samsung SDI Co., Ltd.

- Samsung SDI Germany GmbH

- Samsung SDI (Malaysia) Berhad

- Koninklijke Philips Electronics N.V.

- LG Electronics, Inc.

- Technicolor S.A.

- Panasonic Corporation

- Toshiba Corporation

- MT Picture Display Co., Ltd.

relating to a proceeding under Article 101 of the Treaty on the Functioning of the

European Union and Article 53 of the EEA Agreement

(COMP/39437 - TV and Computer Monitor Tubes)

(Only the English language text is authentic)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to the Agreement on the European Economic Area,

Having regard to Council Regulation (EC) No 1/2003 of 16 December 2002 on the

implementation of the rules on competition laid down in Articles 81 and 82 of the Treaty

1

,

and in particular Article 7 and Article 23(2) thereof,

Having regard to the Commission decision of 23 November 2009 to initiate proceedings in

this case,

Having given the undertakings concerned the opportunity to make known their views on the

objections raised by the Commission pursuant to Article 27(1) of Regulation (EC) No 1/2003

1

OJ L 1, 4.1.2003, p. 1. With effect from 1 December 2009, Articles 81 and 82 of the Treaty have

become Articles 101 and 102 respectively of the Treaty on the Functioning of the European Union ("the

Treaty"). The two sets of provisions are, in substance, identical. For the purposes of this Decision

references to Articles 101 and 102 of the Treaty should be understood as references to Articles 81 and

82, respectively, of the Treaty where appropriate. The Treaty also introduced certain changes in

terminology, such as the replacement of "Community" by "Union" and "common market" by "inernal

market". The terminology of the Treaty will be used throughout this Decision.

EN 7 EN

and Article 12 of Commission Regulation (EC) No 773/2004 of 7 April 2004 relating to the

conduct of proceedings by the Commission pursuant to Articles 81 and 82 of the Treaty

2

,

After consulting the Advisory Committee on Restrictive Practices and Dominant Positions,

3

Having regard to the final report of the hearing officer in this case

4

,

Whereas:

1. INTRODUCTION

(1) This Decision relates to two cartels concerning Colour Display Tubes ("CDT")

and Colour Picture Tubes ("CPT") that are used for computers and TVs

respectively.

2. THE INDUSTRY SUBJECT TO THE PROCEEDINGS

2.1. The product

(2) A Cathode Ray Tube (hereinafter "CRT") is an evacuated glass envelope

containing an electron gun and a fluorescent screen, usually with internal or

external means to accelerate and deflect the electrons. When electrons from the

electron gun strike the fluorescent screen, light is emitted creating an image on

the screen. The single electron beam can be processed in such a way as to

display moving pictures in natural colours.

5

(3) There are two distinct types of CRTs relevant for this case: (i) Colour Display

Tubes (hereinafter "CDT") used in computer monitors and (ii) Colour Picture

Tubes

6

(hereinafter "CPT") used for colour televisions. CPTs and CDTs cannot

normally be used interchangeably because television and monitor uses require

specialised and different resolution. The standard computer monitor requires a

higher resolution and contains more pixels than a standard CRT-based

television. Also, analogue television systems use a different scanning system.

7

(4) CDTs and CPTs are a single component that are combined by other firms (for

example so called integrators) with the chassis and other components necessary

to produce a monitor or a colour television.

8

Around 50-70% of the costs of

televisions and monitors are made up by the CRT.

9

(5) Neither CPTs nor CDTs are homogenous products. Each can be assembled in

different ways, or include attributes, that make the product better for certain

uses. Product variations include among other things flat and rounded screens.

Flat screens are more desirable and demand a higher price. There are also so

2

OJ L 123, 27.4.2004, p. 18.

3

OJ C 303/04 and C 303/05, 19.10.2013.

4

OJ C 303/06, 19.10.2013.

5

[…]

6

In some pieces of documentary evidence also alternatively referred to as CTV.

7

[…]

8

[…]

9

[…]

EN 8 EN

called glare and antiglare features

10

, the latter being more desirable and

allowing manufacturers to charge a higher price. Finally, so called bare tubes

and integrated tube components (ITC) represent another type of product

variation, where integrated tube components demand a higher price.

11

(6) CRTs come in a number of different sizes, expressed in inches

12

. Alternatively,

the different sizes are referred to as small, medium, large and jumbo.

13

CRTs

are large, deep, heavy and relatively fragile.

14

2.2. The market players

2.2.1. Undertakings subject to these proceedings

2.2.1.1. Chunghwa Picture Tubes Co., Ltd.

(7) Chunghwa Picture Tubes Co., Ltd. (hereinafter "Chunghwa Ltd.") is the ultimate

parent company of the Chunghwa Group. Its headquarters are located in

Taoyuan, Taiwan. Its largest shareholders are Chunghwa Electronics Investment

Co. [15-20%] and Tatung Company [10-15%]. The rest of the shares are in the

hands of the general public. Chunghwa Group’s main activities currently

include the manufacture and sale of CRTs, electron guns, deflection yokes,

TFT-LCD (Thin Film Transistor-Liquid Crystal Displays) panels, colour filters

and related materials, parts and components.

15

(8) Chunghwa Group manufactured and sold CDTs and CPTs in the period covered

by this Decision (see Recitals (986) and (1003) concerning the period). The

manufacture and sale of CRT products was accomplished by Chunghwa directly

and by its three subsidiaries: Chunghwa Picture Tubes (Malaysia) Sdn. Bhd. in

Kuala Lumpur, Malaysia (hereinafter "CPTM"), CPTF Optronics Co., Limited

(hereinafter "CPTF") in Fuzhou, China and Chunghwa Picture Tubes (U.K.)

Co., Ltd. (hereinafter "CPT UK") in Mossend, United Kingdom. Chunghwa

Group sold CRT products to customers within the EEA.

16

CPT UK has gone out

of the business.

17

(9) CPTM is a wholly owned subsidiary of Chunghwa Ltd.. Chunghwa Ltd. owns

CPTM through a wholly owned intermediary holding company, Chunghwa

Picture Tubes (Bermuda) Ltd. CPTM manufactured and sold CPTs throughout

the period covered by this Decision and CDTs until 2003.

18

(10) Until 2000 CPTF was 100% owned by Chunghwa Ltd. (indirectly through other

subsidiaries: Chunghwa PT (Labuan) Ltd. and Chunghwa Picture Tubes

(Bermuda) Ltd.). In 2000 and 2001 Chunghwa Ltd. held [90-95%] of the CPTF

10

For both television and monitor applications, a reduced amount of glare is desirable, as it makes the

picture easier to see or the text and graphics easier to view. To control glare, an antiglare feature called

MPR II is used. Other tubes utilize other antiglare features. […]

11

[…]

12

CPT sizes include 14” (inches), 15”, 17”, 19”, 21”, 24”, 28”, 29”, 32” and 34”. CDTs come in sizes

such as 14”, 17”, 19”, 20” and 21”. […]

13

[…]

14

[…]

15

[…]

16

Chunghwa does not produce monitors or televisions. […]

17

[…]

18

[…]

EN 9 EN

shares (through Chunghwa PT (Labuan) Ltd. –[10-15%] and Chunghwa Picture

Tubes (Bermuda) Ltd. – [80-85%] and since 2002 Chunghwa Ltd. has

owned[85-90%] of the shares in CPTF (through Chunghwa PT (Labuan) Ltd. –

[10-15%] and Chunghwa Picture Tubes (Bermuda) Ltd. – [75-80%], the rest of

the shares being owned by minority investors. CPTF manufactured and sold

CPTs since 2006 and CDTs since 1998.

19

(11) CPT UK was a Europe-based wholly owned subsidiary of Chunghwa Ltd., located

in Mossend, Lanarkshire, Scotland. Chunghwa Ltd. opened a plant in UK in

October 1997 and closed it in November 2002, although sales continued into

early 2003. CPT UK primarily manufactured and sold CPTs from 1998 until

2003 and also had small quantities of CDT sales.

20

(12) In this Decision, and unless otherwise specified, companies of the Chunghwa

Group which participated in, or bear liability for, the cartel(s), will be referred

to as "Chunghwa". The individuals representing Chunghwa in the contacts with

competitors described in this Decision are identified in […].

2.2.1.2. Samsung SDI Co., Ltd.

(13) Samsung SDI Co., Ltd (hereinafter "Samsung SDI") is the ultimate parent

company of Samsung SDI Group and it was incorporated in 1970 initially as

Samsung-NEC Co. Ltd. The company was listed on the Korea Stock Exchange

in January 1979. In 1984, it was renamed Samsung Display Device Co., Ltd.,

and in November 1999, the company changed its name to Samsung SDI Co.,

Ltd.

21

Samsung SDI's largest shareholder is Samsung Electronics Co. Ltd.

(hereinafter "SEC") with 19,68% of shares, the rest of the shares being

distributed between numerous stock exchange investors.

22

(14) Samsung SDI Group is a global company active in display and energy products.

Samsung operates Plasma Display Panel, CRT, Mobile Display and Battery

Divisions.

23

Samsung SDI Group was also selling CRTs to its largest

shareholder SEC.

24

(15) In the period covered by this Decision Samsung SDI Group manufactured and

sold CRTs in the EEA directly (CPTs and CDTs manufactured in Busan and

Suwon) or via the following subsidiaries: [Samsung SDI's subsidiary] (CPTs);

[Samsung SDI's subsidiary] (CPTs); Samsung SDI Germany GmbH (CPTs);

Samsung SDI Hungary Ltd. (CPTs); Samsung SDI (Malaysia) Berhad. (CPTs

and CDTs); Samsung SDI Mexico S.A. de C.V. (CPTs) and Samsung SDI

Brasil Ltd. (CDTs).

25

19

[…]Chunghwa Picture Tubes (Bermuda) Ltd. is […] owned by Chunghwa and Chunghwa PT (Labuan)

Ltd. is [40-45%] owned by Chunghwa and [55-60%] owned by Chunghwa Picture Tubes (Bermuda)

Ltd […].

20

[…]

21

Samsung SDI web-site under frequently asked questions (FAQ), investor relations (IR):

http://www.samsungsdi.com/f_faq_list.sdi?category=IA&pageNo=1&post=E&key=title&keyword=&p

ageNo=1#

22

[…]

23

[…]

24

[…]

25

[…]

EN 10 EN

(16) All the entities referred to in Recital (15) except for Shenzen Samsung SDI Co.,

Ltd., Tianjin Samsung SDI Co., Ltd. and Samsung Samsung SDI Malaysia Sdn.,

Bhd. were wholly owned by companies from Samsung SDI Group throughout

the period covered by this Decision. Specifically, the ownership was either

directly by Samsung SDI or together with or via one of its wholly owned (or

almost wholly owned) subsidiaries.

26

Shenzen Samsung SDI Co., Ltd. and

Tianjin Samsung SDI Co., Ltd. were owned by another indirectly wholly owned

Samsung SDI subsidiary, Samsung SDI Ltd. Hong Kong and by local Chinese

companies.

27

In the years 1996 to 2006 Samsung SDI Malaysia Sdn., Bhd. was

owned by Samsung SDI, Samsung Corporation and SAPL (Samsung Asia Pte.

Ltd., sales subsidiary of Samsung Electronics).

28

Samsung SDI Germany GmbH

stopped production in December 2005 and Samsung SDI Hungary Ltd. ceased

CRT production in November 2007.

29

(17) In this Decision, and unless otherwise specified, companies of the Samsung SDI

Group which participated in, or bear liability for, the cartel(s) will be referred to

as "Samsung" or "SDI". The individuals representing Samsung in the contacts

with competitors described in this Decision are identified in […].

2.2.1.3. Koninklijke Philips Electronics N.V.

(18) Koninklijke Philips Electronics N.V.

30

("KPE N.V.") is the ultimate holding

company of the Philips Group. The Philips Group is active in electronic

products in various sectors including healthcare, lighting and consumer

electronics.

31

KPE N.V. employes the highest levels of management within the

group, namely the Board of Management and the Group Management

Committee, including the [manager] of the Product Division Components

("PDC"), which held decision/ management responsibilities in relation to

CRTs.

32

(19) The business activities of the Philips Group were organised into several Product

Divisions until 30 June 2001. One of those Product Divisions was the PDC

which encompassed various Philips components businesses, organised in

Business Groups. Until 30 June 2001 the entire CRT business of the Philips

26

For example, Samsung SDI Germany GmbH was 100% owned by Samsung SDI […]

27

[…]

28

[…]

29

[…]

30

During the proceedings, the Commission asked the representatives of the Philips Group to specify the

name of its holding company. The reply given was Royal Philips Electronics N.V. […] This name was

also used in some of the replies provided to the Commission […]. During the meeting with the case

team on 17 November 2011 Philips noted that the name Royal Philips Electronics N.V. did not refer to

any company. In response to the Commission's Request for Information of 21 February 2012, Philips

clarified that the name of the holding company of the Philips Group as set out in its articles of

association is Koninklijke Philips Electronics N.V. and that "Royal Philips Electronics" is its

international trade name. Philips also confirmed that any of their previous reference to "Royal Philips

Electronics N.V" referred to Koninklijke Philips Electronics N.V. […]

31

[…]

32

[…]

EN 11 EN

Group was organised in the Business Group Display Components ("BGDC").

33

It was the largest business unit within PDC of the Philips Group.

34

(20) Until 30 June 2001, all the legal entities of the Philips Group's CRT business were

part of BGDC and PDC

35

, including the following companies: Philips

Components International B.V., Philips Components B.V., Philips Nederland

B.V., Philips Electronics Nederland B.V., Philips Innovative Applications N.V.,

Philips Do Brasil Ltda., Philips Electronic Industries (Taiwan) Ltd., Philips

Taiwan Ltd., Philips Electronics Korea Ltd., and [CRT producer]. All those

companies were directly or indirectly wholly owned by KPE N.V., with the

exception of [CRT producer], in which Philips held a […] majority share and

[…]

36

(the rest being owned by [companies located in non EU/EEA territory]).

The BGDC was further subdivided in the following units: Product & Process

Development, Equipment Engineering Department and New Display

Technologies, Region Europe, Region Asia Pacific, Region South America,

Region North America.

37

The PDC was dissolved in January 2003.

38

(21) Philips Components International B.V. was wholly owned by KPE N.V. It

employed the [management] and provided support for the entire PDC

39

.[…]

40

.

(22) Philips Components B.V. was a wholly owned subsidiary of […] Philips

Electronics Netherland B.V., which was wholly owned by KPE N.V.

41

It

supported the [manager] for […] CRT business and dealt with functions like

R&D and sales of CRT products […]. In relation to the CRT activities the

individuals within Philips Components B.V. reported to [manager]. The global

management functions of the BGDC (for example, global Finance, HR, etc.)

were also dealt with by this entity

42

.

(23) Philips Nederland B.V., a wholly owned subsidiary of Philips Electronics

Nederland B.V., was incorporated in the Netherlands on 20 December 2001. Its

statutory aim was trade of electric, electronic, mechanic, chemical and other

products and systems produced by it and by other companies within Philips

Group. KPE N.V. is currently active as a holding company involved in asset

management and has no employees.

43

(24) Philips Electronics Nederland B.V., was a wholly owned subsidiary of KPE N.V.

throughout the period between 1997 and 2001.

44

(25) Philips Innovative Applications N.V., a wholly owned subsidiary of KPE N.V.,

was first established in Belgium in 1983 in the form of a limited company for an

33

[…]

34

[…]

35

[…]

36

[…]

37

[…]

38

[…]

39

[…]

40

[…]

41

[…]

42

[…]

43

[…]

44

[…]

EN 12 EN

unlimited time period. Its main activity was the development, construction,

installation and sale of various technical and electronic products.

45

(26) Philips Do Brasil Ltda., a wholly owned subsidiary of KPE N.V, was in the period

between 1997 and 2001 […] which supported the [manager] for […] CRT

business. It dealt with production, R&D and sales of CPT products. Individuals

within Philips Do Brasil Ltda reported to the [manager] and subsequently to the

[manager] on CRT activities. The functions of [manager] and [manager] ceased

to exist in 2000 and were replaced by the [manager].

46

(27) Philips Electronic Industries (Taiwan) Ltd., a wholly owned subsidiary of KPE

N.V., was […] which supported the [manager]. This entity and its subsidiaries

dealt with CDT products (sales, production, etc.). Philips Taiwan Ltd. was a

subsidiary of Philips Electronis Industries (Taiwan) Ltd. and dealt with sales

and marketing for various product divisions, including PDC and in particular

CDTs. Individuals within these entities reported to [manager] on CRT

activities

47

. Philips Electronic Industries (Taiwan) Ltd. owned 100% of the

shares of Philips Taiwan Ltd. Philips Electronic Industries (Taiwan) Ltd. was

dissolved as of 8 March 2010 […].

48

(28) Philips Electronics Korea Ltd., a wholly owned subsidiary of KPE N.V., was […]

which supported the [manager] for the […] CRT business and which dealt with

sales of CDT products in Korea and had other local support tasks. Individuals

within this entity reported to the [manager] on CRT activities

49

.

(29) [CRT producer] was incorporated on [date]. From […] until around […] a wholly

owned subsidiary of KPE N.V., held […] of the shares in [CRT producer].

50

On

or around […] the shares held in [CRT producer] were transferred to […],

which was a wholly owned subsidiary of […]. On […] all the shares of […]

were transferred to KPE N.V., which subsequently transferred the shares of […]

to the [Philips/LGE joint venture] on […]. [CRT producer] was […] which

supported [manager] for the CRT business […]. It dealt with production and

sales of CPT products […]. Individuals within this entity reported to the

[manager] on CRT activities

51

.

(30) In the period between 1997 and July 2001, Philips Group manufactured both

CPTs and CDTs in factories around the world. Philips Group supplied some

CRTs it produced to intra-group companies (mainly Philips Consumer

Electronics) for production of TV sets. The remaining production was sold to

customers in Europe and Asia.

52

In the period from 1995 to 2001 the following

wholly owned subsidiaries of KPE N.V. sold both CPTs and CDTs in the EEA:

Philips Nederland B.V. (the Netherlands); Philips Components B.V. (the

Netherlands); Philips Iberica S.A. (Spain); Divisione della Philips S. p. A.

45

[…]

46

[…] Unless otherwise mentioned in recitals (26)-(30), the information of Philips Group companies'

structure concerns period between 1997 and July 2001.

47

[…]

48

[…]

49

[…]

50

[…]

51

[…]

52

[…]

EN 13 EN

(Italy); Philips Components AB (Sweden); Philips Components A/S (Denmark);

Philips Electronics UK Ltd. (United Kingdom); Compagnie Française Philips

SAS (France) and Philips GmbH (Germany).

53

(31) On 1 July 2001 Philips transferred its CRT business to a newly created joint

venture under the company [Philips/LGE joint venture] (hereinafter

"[Philips/LGE joint venture]", see Section 2.2.1.5).

(32) In this Decision, and unless otherwise specified, companies belonging to the

Philips Group which participated in, or bear liability for, the cartels are referred

to as "Philips" or "Philips Group". The individuals representing Philips in the

contacts with competitors described in this Decision are identified in […].

2.2.1.4. LG Electronics, Inc.

(33) LG Electronics, Inc. (“LGE Inc.”), formerly GoldStar (1958 to 1995), is a

Korean-based publicly traded company that manufactures and sells electronics,

information and communication products in various countries around the world.

LGE Inc's shares are publicly quoted on the Korean stock exchange. LGE Inc’s

largest shareholder is LG Corporation which, as of 31 December 2007, owned

[30-35%] of its total stock. The remaining shares are owned by financial

institutions, foreign investors and general public.

54

(34) Until 1 July 2001, LGE Inc. and its indirectly wholly owned subsidiary LG

Electronics Wales Ltd. (United Kingdom) manufactured and sold CPTs and

CDTs. PT LG Electronics Display Device Indonesia (now named PT LG

Electronics Indonesia Ltd.), a wholly owned subsidiary of LGE Inc., and […] a

joint venture company in which LGE Inc. held a stake of […] with the

remaining shares being held by [companies located in non EU/EEA territory],

manufactured and sold CPTs.

55

LG MITR Electronics Co., Ltd., which has now

merged into LG Electronics Thailand Co., Ltd., LGE Singapore and LGE

Taiwan are wholly owned subsidiaries of LGE Inc.

56

(35) LGE Inc. and certain subsidiaries of it are active in markets for TV sets and

computer monitors which have CRTs included in them

57

. LGE Inc. also

purchased CRTs from the above subsidiaries (see Recital (34))

58

.

(36) On 1 July 2001, LGE Inc. transferred its CRT business into the joint venture

company [Philips/LGE joint venture's parent company] (see Section 2.2.1.5).

Throughout the period covered by this Decision, LGE Inc. used CRTs to

manufacture colour TV sets and computer monitors.

59

(37) LGE Inc. did not respond to the Commission question as to which of the entities

in Recital (34) had sales to the EEA and in what quantities, referring to the fact

53

[…]

54

[…] Information available from 1998.

55

[…]

56

[…]

57

[…]

58

[…]

59

[…]

EN 14 EN

that relevant documents were transferred to the joint venture company,

[Philips/LGE joint venture's parent company].

60

(38) In this Decision, and unless otherwise specified, companies belonging to the LGE

Group which participated in the cartels, or bear liability, are referred to as

“LGE” or “LGE Group”. The individuals representing LGE in the contacts

with competitors described in this Decision are identified in […].

2.2.1.5. [Philips/LGE joint venture].

(39) By an agreement of 11 June 2001, which took effect on 1 July 2001, KPE N.V.

and LGE Inc. merged their respective CRT businesses into a joint venture,

under the company [Philips/LGE joint venture's parent company] […]

61

,forming

the [Philips/LGE joint venture] Group. Philips and LGE contributed their

respective businesses of CRTs and CRT components (used to manufacture

CRTs) to the joint venture. The creation of the joint venture was approved by

the Commission on 9 April 2001.

62

(40) [Philips/LGE joint venture's parent company] was the holding company for the

[Philips/LGE joint venture] which manufactured and sold both CPTs and CDTs

via numerous subsidiaries located in Europe, Asia and the Americas..

63

(41) From 19 March until 26 June 2001, Philips held […] shares in the company that

was to become the joint venture. From 26 June 2001, the shares in the joint

venture were held by KPE N.V. ([35-40%]) and its wholly owned subsidiary

Philips GmbH from Germany ([5-10%], altogether [50-55%] plus 1 share for

Philips Group) and by LGE Inc. ([35-40%]) and LGE Inc.'s wholly owned

subsidiary LG Electronics Wales Ltd. ([10-15%], altogether [45-50%] less 1

share for LGE Group). In 2003, LGE Inc. increased its shareholding to [40-

45%] and decreased the shareholding of its subsidiary to [5-10%]. From the

second quarter of 2004, [50-55% plus 1 share] were held by KPE N.V. and [45-

50 % less 1 share by LG Electronics Wales Ltd.

64

(42) [Philips/LGE joint venture's parent company] filed for bankruptcy […] in January

2006. On […], [Philips/LGE joint venture's parent company] was officially

declared bankrupt.

65

Thereafter, between February 2006 and July 2006, certain

other companies in the [Philips/LGE joint venture] were declared bankrupt.

Following a restructuring in 2006, shortly before the bankruptcy, [Philips/LGE

joint venture's parent company] transferred its shares in [Philips/LGE joint

venture's subsidiary] to [Philips/LGE joint venture's subsidiary], a company

wholly-owned by [Philips/LGE joint venture's parent company]. After the

bankruptcy judgment against [Philips/LGE joint venture's parent company],

[Philips/LGE joint venture's subsidiary] was renamed [Philips/LGE joint

venture's holding company] and became the holding company for all viable

60

[…]

61

[…]

62

See the Commission Decision in case COMP/M.2263 – Philips/ LG Electronics/ JV, OJ C180,

26.06.2001, p. 16.

63

For the complete corporate structure of [Philips/LGE joint venture] at its creation […].

64

[…]

65

[…]

EN 15 EN

companies of the [Philips/LGE joint venture] Group that continued to operate.

[Philips/LGE joint venture's holding company] was declared bankrupt […].

(43) [Philips/LGE joint venture's subsidiary] was a (directly and indirectly) wholly

owned subsidiary of [Philips/LGE joint venture's subsidiary]

66

[Philips/LGE

joint venture's subsidiary] employed the members of the Board of Directors of

[Philips/LGE joint venture parent company]. [Philips/LGE joint venture's

subsidiary] and [Philips/LGE joint venture parent company] signed a

management service agreement on […] on the basis of which operational

management of [Philips/LGE joint venture] Group was carried out by

[Philips/LGE joint venture's subsidiary]. After the bankruptcy of [Philips/LGE

joint venture's parent company], its side in the management services contract

was taken over by [Philips/LGE joint venture's subsidiary].

67

On […],

[Philips/LGE joint venture's subsidiary] entered into voluntary liquidation.

68

(44) [Philips/LGE joint venture's subsidiary] was an indirect […] subsidiary of

[Philips/LGE joint venture's subsidiary]. [Philips/LGE joint venture's

subsidiary] (declared bankrupt […]) and [Philips/LGE joint venture's

subsidiary](declared bankrupt […]) each held […] of the shares in

[Philips/LGE joint venture's subsidiary]. [Philips/LGE joint venture's

subsidiary] owned […] [Philips/LGE joint venture's subsidiaries]. […]

[Philips/LGE joint venture's subsidiary] has de facto ceased all activities and is

essentially bankrupt. A [manager] has been appointed by a local District

Court.

69

(45) [Philips/LGE joint venture's subsidiary] was a wholly owned subsidiary of

[Philips/LGE joint venture's subsidiary]. In […], the shares in [Philips/LGE

joint venture's subsidiary] were sold to […].

70

(46) [Philips/LGE joint venture's subsidiary], a wholly owned subsidiary of

[Philips/LGE joint venture's parent company], was declared bankrupt […] at its

own request.

71

(47) [Philips/LGE joint venture's subsidiary] is a wholly owned subsidiary of

[Philips/LGE joint venture's subsidiary]. It was incorporated after the

bankruptcy judgement to take over the assets and activities […] of [Philips/LGE

joint venture's subsidiary]. By an agreement […] the [officer] sold and delivered

the respective assets.

72

(48) [Philips/LGE joint venture's subsidiary]

73

was a (directly and indirectly) wholly

owned subsidiary of [Philips/LGE joint venture's parent company]. In […], a

decision was taken to liquidate it since [Philips/LGE joint venture's subsidiary]

no longer carried out any business activities.

74

66

[…]

67

[…]

68

[…]

69

[…]

70

[…]

71

[…]

72

[…]

73

[…]

74

[…]

EN 16 EN

(49) [Philips/LGE joint venture's subsidiary] was a wholly owned subsidiary of

[Philips/LGE joint venture's parent company].

75

It was liquidated in […].

76

(50) After July 2001, [CPT producer] was a […] owned subsidiary of [Philips/LGE

joint venture's subsidiary]. The other shareholders were [companies located in

non EU/EEA territory]. [CPT producer] ceased all its activities […]. On […] it

was declared bankrupt and it is currently being wound up.

77

(51) [Philips/LGE joint venture's subsidiary] [non EU/EEA territory] was a […] owned

subsidiary of [Philips/LGE joint venture's subsidiary] Its other shareholders

were [companies located in non EU/EEA territory]. In […] the [officer] sold the

[…] share interest in this company to a new buyer [CRT producer] with a

registered office in the […].

78

(52) In this Decision, and unless otherwise specified, companies belonging to the

[Philips/LGE joint venture] Group which participated in the cartels will be

referred to as "[Philips/LGE joint venture]" or "[Philips/LGE joint venture]

Group". The individuals representing [Philips/LGE joint venture] in the

contacts with competitors described in this Decision are identified […].

2.2.1.6. Thomson S.A./Technicolor S.A.

(53) Thomson S.A. (hereinafter "Thomson" or, following the 2010 change of the

name, "Technicolor"

79

) is the ultimate parent company of a worldwide group of

companies active in technology, services and systems to communication, media

and entertainment industries.

80

(54) Thomson was incorporated in 1985 in France

81

and until end of 1997 was wholly

owned by the French State. The company through which the French State

owned its interest in Thomson was first called Thomson S.A. and was renamed

TSA in 2002. Beginning in 1998, the French State began reducing its

shareholding in the group with 70% of shares, reduced to 51,73% in 1999 (in

stock exchange); 37,98% in 2000 and 2001; 20,81% in 2002. In the years 2003

to 2006 the French State held between 1,93 and 2,03% of shares in Thomson

and, by 1 March 2007, held approximately 1,92% of Thomson's share capital.

82

(55) Thomson was active in the production and sale of CPTs and components for

CPTs.

83

Some of the CPTs manufactured by Thomson were used in-house by

Thomson's TV set manufacturing business.

84

(56) Among Thomson's numerous subsidiaries active in the CPT business located

around the world (United States, Mexico and China

85

), three had CPT sales in

75

[…]

76

[…]

77

[…]

78

[…]

79

Thomson Consumer Electronics changed its name to Thomson Multimedia S.A. in 1995. Thomson

Multimedia S.A. changed its name to Thomson S.A. in 2002 […]. Thomson S.A. changed its name to

Technicolor S.A. in 2010 […].

80

[…]

81

[…]

82

[…]

83

[…]

84

[…]

EN 17 EN

the EEA during the period from 1995 to 2007. First, Thomson Polkolor Sp. z

o.o. (in 2003 its name was changed to Thomson Multimedia Polska Sp. z o.o.

86

)

in Poland; second, Videocolor SpA in Italy

87

. Those two entities were directly

wholly owned by Thomson Tubes & Displays SA

88

(hereinafter "TTD"), a

company incorporated […] in which Thomson owned 100% of the shares

89

.

Both manufactured, sold and purchased CPTs. Thomson Polkolor Sp. z o.o. sold

CPTs to customers in Poland, the Czech Republic, Slovakia and Hungary.

Videocolor SpA sold CPTs to Italian customers. TTD was a third company that

had EEA sales of CPTs and acted as a trading company. TTD sold CPTs and

invoiced customers in the rest of Europe.

90

(57) During the period covered by this Decision (see Recital (1003) for the period), the

CPT business was part of Thomson's Displays and Components Strategic

Business Unit. From 1995 to September 2001, the CPT business was organised

in two regions: Americas (North America and Latin America) and Europe (in

1999, Asia was added to Europe). With effect from 1 October 2001, the two

regional divisions were merged into one with a single sales and marketing

organisation.

91

(58) […] Videocolor SpA was sold to [CRT producer], a company wholly owned by

the [entity located in non EU/EEA territory]. Following the sales process

launched in […], Thomson concluded a second transaction with [CRT

producer], including sales of its CPT production facilities in Mexico, Poland

and China to [CRT producer], thereby completely divesting its CPT business.

By […] the transaction was completed.

92

(59) In early 2009, Thomson undertook negotiations with its creditors regarding the

restructuring of its debts. An agreement was signed with the majority of its

senior creditors in July 2009, which expired in November 2009. Thomson

requested from the Commercial Court of Nanterre the opening of a protective

bankruptcy proceeding for the benefit of the holding company, which carries

most of the debt of the group. That proceeding was opened on 30 November

2009

93

. On 27 January 2010, an extraordinary shareholder meeting of Thomson

approved the change of the company name to Technicolor S.A. On 17 February

2010, the Commercial Court of Nanterre approved the restructuring plan, which

will last seven years, bringing an end to the protective bankruptcy proceeding

94

.

(60) In this Decision, and unless otherwise specified, companies of the Thomson group

which participated in the cartel(s), or bear liability, will be referred to as

"Thomson". The individuals representing Thomson in the contacts with

competitors described in this Decision are identified […].

85

[…]

86

[…]

87

[…]

88

[…]

89

[…]

90

[…]After 1 May 2001 "the rest of Europe" included Italy.

91

[…]

92

[…]

93

In addition, on 16 December 2009, Thomson filed for bankruptcy protection at a New York bankruptcy

court to protect its U.S. assets from creditors. The bankruptcy Judge granted a provisional stay.

94

[…]

EN 18 EN

2.2.1.7. Matsushita Electric Industrial Co., Ltd./Panasonic Corporation

(61) Matsushita Electric Industrial Co., Ltd. (hereinafter "MEI" or, following change

of the name, "Panasonic") is the ultimate parent company of a group of

companies producing various electronic and electrical products which the group

manufactures and markets under brand names Panasonic, National, Technics

and Quasar.

95

On 1 October 2008, MEI changed its company name to Panasonic

Corporation .

96

(62) Companies in the MEI group have been in the period covered by this Decision

(see Recital (1003) for the period) manufacturing and selling CRTs (both CDTs

and CPTs) around the world. Until the fiscal year 2000, the CRT business was

part of one of MEI's wholly owned subsidiaries, Matsushita Eletronics

Corporation (hereinafter "MEC"), located in Osaka, Japan. In April 2001, MEC

merged with MEI and since then MEI has been engaged in CRT business

directly.

97

(63) MEI exited the CDT business in fiscal year 2001,

98

but continued in the CPT

business. Until the fiscal year 2000, the CPTs sold in the EEA were

manufactured by the CRT division of MEC (Takatsuki and Utsunomiya

factories in Japan and EMEC in Germany). During that time, sales of CPTs in

the EEA were handled by Panasonic Industrial UK Ltd. (UK) and Panasonic

Industrial Europe GmbH (Germany). During fiscal years 2001 and 2002, the

CPTs sold in the EEA were manufactured by the CRT division of MEI (Japan,

Germany, United States) and the sales of CPTs in the EEA were handled by

Panasonic Industrial Europe GmbH.

99

(64) On 31 March 2003, MEI transferred all

100

of its CRT business to a joint venture

company Matsushita Toshiba Picture Display Co. Ltd (hereinafter "MTPD", see

Section 2.2.1.9).

101

(65) MEI manufactures and sells TV sets through Panasonic AVC Networks Company.

MEI also sold PC monitors in Europe until 2001.

102

(66) In this Decision, and unless otherwise specified, companies of the MEI group

which participated in, or bear liability for, the cartel(s), will be referred to as

"MEI" or since the 2008 change of the name as "Panasonic" prior to creation of

the joint venture MTPD. The individuals representing MEI in the contacts with

competitors described in this Decision are identified[…].

2.2.1.8. Toshiba Corporation

(67) Toshiba Corporation (hereinafter "Toshiba") is a manufacturer and marketer of

electronic and electrical products, headquartered in Tokyo, Japan. Toshiba was

95

[…]

96

See: http://www.panasonic.net/brand.

97

[…]

98

[…]

99

[…]

100

[…]

101

[…]

102

[…]

EN 19 EN

founded in 1875 and today it operates a global network of more than 670

companies worldwide.

103

(68) Toshiba has been involved in the production and sale of CPTs and CDTs directly

and through numerous subsidiaries located in Europe, Asia and North America

including [CRT producers] and Toshiba Electronics Europe GmbH.

104

(69) [CRT producer], later renamed […], abbreviated in the documents either as […]

or as […]) was a joint venture amongst Toshiba, [CRT producers]. Toshiba

owned […]

105

of the shares in [CRT producer]. They were transferred to MTPD

in June 2003. [CRT producer] was […] MT Picture Display Indonesia

(hereinafter "MTPDI") in September 2003. It was dissolved in September 2007

and is being liquidated.

106

[CRT producer] was a joint venture between Toshiba

and [CRT producer] and it was transferred to MTPD in June 2003. It was

dissolved in July 2006 and is currently being liquidated.

107

Toshiba Electronics

Europe (hereinafter "TEE") was incorporated in 1987 and is the European

Headquarters for the electronic components business of Toshiba located in

Düsseldorf (Germany). TEE is wholly owned by Toshiba Europe GmbH

(hereinafter "TEG"), which in turn is Toshiba's wholly owned subsidiary. TEE

was Toshiba's exclusive distributor of both CPTs and CDTs in the EEA during

the period between 1995 and 31 March 2003.

108

(70) During the period in which TEE dealt with CRTs (and for a period thereafter)

some Toshiba entities, to which TEE sold CRTs in the EEA, were involved in

the manufacture of products incorporating CRTs, in the distribution of such

products or in both. For instance, Toshiba Information Systems (UK) Limited

(hereinafter "TIU") manufactured and sold CRT TV sets, whereas TEG and

Toshiba Systèmes France (hereinafter "TSF") sold CRT TV sets.

109

(71) TEE exited the market for CDTs in 2003, making its last sales in the first half of

2003. It exited the market for CPTs in 2004, with its last sale in July 2004.

110

(72) Toshiba transferred its CRT business into the joint venture called Matsushita

Toshiba Picture Display Co. Ltd. on 31 March 2003 (see Section 2.2.1.9).

111

(73) In this Decision, and unless otherwise specified, companies of the Toshiba

Corporation which participated in, or bear liability for, the cartel(s) will be

referred to as "Toshiba" prior to the creation of the joint venture MTPD. The

individuals representing Toshiba in the contacts with competitors described in

this Decision are identified […].

103

See: www.toshiba.co.jp.

104

[…]

105

Originally Toshiba submitted that P.T. Toshiba Display Devices Indonesia was 100% owned by

Toshiba prior to transfer to MTPD on 31 March 2003, […], but afterwards explained that it was a joint

venture […]

106

[…]

107

[…]

108

[…]

109

[…]

110

[…]

111

[…]

EN 20 EN

2.2.1.9. Matsushita Toshiba Picture Display Co. Ltd./ MT Picture Display Co., Ltd

(74) On 26 September 2002 MEI and Toshiba reached an agreement to integrate both

companies' CRT operations and in March 2003 they created a joint venture

named Matsushita Toshiba Picture Display Co., Ltd. ("MTPD", see Recital

(64)). MEI and Toshiba transferred their respective CRT operations to the joint

venture on 31 March 2003. MTPD was 64,5% owned by MEI and 35,5% by

Toshiba until 31 March 2007 when Toshiba's interest was transferred to MEI.

At that date, MTPD became a wholly owned subsidiary of MEI and changed its

name to MT Picture Display Co., Ltd (also referred to as "MTPD").

112

(75) From its creation in March 2003, MTPD produced and sold CPTs.

113

The last

CPT sales by MTPD in the EEA took place in fiscal year 2006. MTPD never

manufactured CDTs but it did sell a small amount of CDTs outside the EEA,

which were all of MEI's stock sales.

114

Sales in the EEA were primarily made

by MT Picture Display Germany (hereinafter "MTPDG"). In addition, a

number of CPTs manufactured in Japan, the United States and Southeast Asia

were sold in the EEA. The legal entities that were involved in those sales were:

MTPD, MT Picture Display Malaysia (hereinafter "MTPDM"), MT Picture

Display Thailand (hereinafter "MTPDT"), MT Picture Display Indonesia

("MTPDI"), MT Picture Display America (Ohio) (hereinafter "MTPDAO")

and MT Picture Display America (New York) (hereinafter "MTPDAN").

115

All

those wholly owned subsidiaries of MTPD gradually closed down in 2006 and

2007 (and the shares in MTPDG were sold to third parties on 1 July 2007) and

both MTPD and MEI have ceased production and sale of CRTs.

116

(76) In this Decision, and unless otherwise specified, companies of the MTPD group

which participated in, or bear liability for, the cartel(s), will be referred to as

"MTPD". The individuals representing MTPD in the contacts with competitors

described in this Decision are identified […].

2.2.1.10. Other suppliers of CRT

(77) [other suppliers of CRT]

117

(78) [other suppliers of CRT]

118

(79) [other suppliers of CRT]

119

(80) [other suppliers of CRT]

120121

(81) [other suppliers of CRT]

122

(82) [other suppliers of CRT]

123

112

[…]

113

[…]

114

Fiscal year 2006 ended on March 31, 2007. […]

115

[…]

116

[…]

117

[…]

118

[…]

119

[…]

120

[…]

121

[…]

122

[…]

EN 21 EN

(83) [other suppliers of CRT]

124

(84) [other suppliers of CRT]

125

2.3. Description of the market

2.3.1. The supply

(85) The geographic scope of the CRT business (both for CDTs and CPTs) is

worldwide. During the time period of the cartels (see Recitals (986) and

(1003)), the major suppliers and customers were present in each of the principal

economic regions of the world and operated on a global basis. The CRT

business is a process industry with high fixed costs and major investments are

involved with the production lines which each have a fixed capacity and are

normally in operation 7 days a week. There is a certain seasonality to the sales:

around 40% of the sales occur in the first half of the year and the remaining

60% in the second half of the year.

126

2.3.2. The demand

(86) CPT customers are TV manufacturers and CDT customers are monitor makers

manufacturers (not computer manufacturers). During the infringement period,

CPT customers included TV manufacturers such as Aiwa Co. Ltd. (Aiwa),

Thomson Consumer Electronics (TCE), Orion, Sharp Roxy Electronics Corp.

(SREC), Funai Electric Co., Ltd (Funai), Grundig AG (Grundig), Victor

Company of Japan Ltd. (JVC), Sanyo Electronics (Sanyo), Thomson, Philips,

Samsung, LGE, Daewoo electronics Corp. (Daewoo), Sony, Mitsubishi Electric

Corporation (Mitsubishi), Vestel Electronics (Vestel) and Mivar di Carlo Vichi

E C. s.a.s. (Mivar).

127

The six largest CDT customers were Samsung Electronics

(SEC), AOE International (AOC), Philips, EMC Corporation (EMC) and Lite-

On Computer Technology (Lite-On). Other, smaller CDT customers included

BenQ Corporation (Ben-Q), Compal Electronics, Inc. (Compal), Delta

Electronics Inc. (Delta), Tatung Company (Tatung), Hyundai Group (Hyundai),

Hansol Corporation (Hansol), Nokia Corporation (Nokia) and Tecnimagen SA

(Tecnimagen). In addition, until LCD became the dominant product for

computer monitors, there were several important Japanese CDT customers,

including Fujitsu Limited (Fujitsu), Iiyama Corporation (Iyama), Eizo Nanao

Corporation (Nanao), Sony, Mitsubishi, Hitachi, MEI and Totoku Electric Co.,

Ltd. (Totoku).

128

(87) The CRT technology was dominant for both computer monitors and TVs in the

second half of the 1990s. However, beginning around the year 2000, the

demand for CRTs started to slow down due to the introduction of alternative

technologies (LCD and PDP)

129

). This ultimately resulted in over-capacity for

both CPTs and CDTs which in turn led to a sharp fall in prices. Especially in

123

[…]

124

[…]

125

[…]

126

[…]

127

[…]

128

[…]

129

Liquid Crystal Displays and Plasma Display Panels.

EN 22 EN

Europe, sales of CRTs have been falling each year as consumers replaced their

TVs and computer monitors with LCD and plasma screens.

130

(88) In 2005, the last full year of the cartel, the worldwide market

131

for CDTs

amounted to some EUR 1 100 million. The value of the sales of CDTs made in

the EEA in 2005 totalled approximately EUR 19 million. The corresponding

figures for 2003 were EUR 2 250 million and EUR 69 million and for 2001

EUR 3 650 million and EUR 300 million, respectively.

(89) In 2005, the last full year of the cartel, the worldwide market for CPTs amounted

to some EUR 5 500 million. The value of the sales of CPTs made in the EEA in

2005 totalled approximately EUR 831 million

132

. The corresponding figures for

2003 were EUR 6 250 million and EUR 1 681 million and for 2001 EUR 6 000

million and EUR 1 890 million, respectively.

2.3.3. Inter-state trade

(90) During the cartel period (see Recitals (986) and (1003)), the participants sold

CRTs produced in Germany, the United Kingdom, Austria, Spain, France,

Poland, the Czech Republic, Hungary, as well as in Korea, Taiwan, China,

Japan and elsewhere to customers established in numerous Member States and

in the Contracting Parties to the EEA Agreement. Therefore, during the cartel

period, there were important trade flows of CRTs between Member States and

between the Contracting Parties to the EEA Agreement.

3. PROCEDURE

3.1. The Commission's investigation

(91) Following its application for a marker of 9 March 2007

133

, Chunghwa submitted,

on 23 March 2007, an […] application for immunity from fines under the

Commission notice on Immunity from fines and reduction of fines in cartel

cases (hereinafter “the 2006 Leniency Notice”)

134

. The application was

subsequently supplemented […]

135

. On 24 September 2007, Chunghwa was

granted conditional immunity

136

.

(92) On 8 and 9 November 2007, inspections under Article 20(4) of Regulation (EC)

No 1/2003

137

were carried out at the premises of [legal entity]

138

and [legal

130

[…]

131

The Commission has calculated the aggregate market values for CDT and CPT in 2001, 2003 and 2005

both worldwide and in the EEA on the basis of the sales figures it has obtained from undertakings

subject to the investigations in this case.

132

[…] [A]s concerns televisions, in 2003, CRTs comprised 95% of the worldwide market. In 2006, some

75% of all televisions sold worldwide contained a CRT. In Europe, CRT models made up 80-90% of

the volume of televisions sold at Christmas in 2004 and only 15-20% one year later. At the end of 2006,

CRT televisions were estimated to account for less than 5% of all the televisions sold in Europe […].

133

The marker was granted to Chunghwa on 12 March 2007.

134

OJ C 298 of 8.12.2006, p. 17.

135

[…]

136

[…]

137

OJ L 1, 4.1.2003, pp. 1-25.

138

[…]

EN 23 EN

entity]. The inspection […] found at [legal entity] continued at the

Commission's premises on 6 and 7 December 2007

139

.

(93) Between 8 November 2007

140

and 2 July 2009, the Commission's requests for

information pursuant to Article 18(2) of Regulation (EC) No 1/2003

or pursuant

to Point 12 of the 2006 Leniency Notice were sent to all main CRT producers.

(94) On 11 November 2007, Samsung filed a leniency application pursuant to the 2006

Leniency Notice which was followed by subsequent submissions […].

(95) On 12 November 2007, MEI and all its subsidiaries filed a leniency application

pursuant to the 2006 Leniency Notice which was followed by subsequent

submissions […].

(96) On 16 November 2007, [party to the proceedings] reported a telephone call from

an employee of [party to the proceedings] to one [party to the proceedings']

employee, thereby alleging a continuation of the anticompetitive behaviour by

[party to the proceedings]. Further telephone calls during the time period

between March and October 2007 were reported by [party to the proceedings]

on […] 2008

141

. Having been confronted by the Commission with [party to the

proceedings'] allegations, [party to the proceedings] explained that, in defiance

of direct instructions, a […] employee located in a [non EU/EEA territory] had a

few telephone conversations with a [party to the proceedings'] employee in late

2007 that involved prices quoted to a particular customer located in the PRC. This

employee did not possess pricing authority regarding CRTs, so the conversations

are presumed to have had no effect, and […] was promptly suspended from all

[…] responsibilities by [party to the proceedings] when it was informed of the

conduct.

142

Following [party to the proceedings'] explanations, and in view of

the fact that no further incidents were reported, the Commission did not take

any further procedural steps in this context.

(97) On 27 November 2007, Philips filed a leniency application pursuant to the 2006

Leniency Notice

143

which was followed by subsequent submissions […].

(98) On 14 March 2008, Thomson filed a leniency application pursuant to the 2006

Leniency Notice which was followed by subsequent submissions […].

(99) On 23 November 2009 the Commission adopted a Statement of Objections in

respect of Chunghwa Picture Tubes Co., Ltd., Chunghwa Picture Tubes

(Malaysia) Sdn. Bhd., CPTF Optronics Co., Ltd., Samsung SDI Co. Ltd,

Samsung SDI Germany GmbH, Samsung SDI (Malaysia) Sdn. Bhd.,

Koninklijke Philips Electronics N.V., LG Electronics, Inc., [addressee of the

Statement of Objections], Thomson S.A., Panasonic Corporation, Toshiba

Corporation, [addressee of the Statement of Objections], [addressee of the

Statement of Objections ].

144

.

139

[…]

140

At the same time as the inspections were launched.

141

[…]

142

[…]

143

Philips had already applied for a marker on 19 November 2007. This application was rejected on 26

November 2007.

144

[…]

EN 24 EN

(100) All parties to these proceedings had access to the Commission's investigation file

in the form of a copy on two DVDs. On the DVDs, the parties received a list

specifying the documents contained in the file (with consecutive page

numbering) and indicating the degree of accessibility of each document. In

addition, the parties were informed that the DVD gave them full access to all the

documents obtained by the Commission during the investigation, except for

business secrets and other confidential information and parts of the file which

are only 'accessible at the Commission's premises'. All parties had access to

those parts at the Commission's premises.

(101) After having access to the file, all addressees of the Statement of Objections made

known to the Commission in writing their views on the objections raised against

them and took part in an Oral Hearing held on 26 to 27 May 2010.

(102) Following the Oral Hearing, Toshiba and Panasonic/MTPD filed additional

submissions and presented evidence regarding the issue of decisive influence

over MTPD.

(103) On 22 December 2010 the Commission issued a Letter of Facts to

Panasonic/MTPD and Toshiba regarding their decisive influence over MTPD.

Toshiba responded to it on 4 February 2011, whereas Panasonic/MTPD did not

submit any further comments.

(104) Following Panasonic/MTPD's requests, dated 6 April 2010 and 27 September

2010, for access to exculpatory evidence in other parties' responses to the

Statement of Objections, Toshiba agreed to provide access to non-confidential

versions of [annex to Toshiba's reply to the Statement of Objections] to all

addressees of the Statement of Objections. On 9 to12 November 2010 the

Commission accordingly provided access to the [annex to Toshiba's reply to the

Statement of Objections], that were prepared for Toshiba's reply to the

Statement of Objections, to all of the addressees of the Statement of Objections.

The addressees were given a possibility to comment on [annex to Toshiba's

reply to the Statement of Objections], but only [a party] and [a party] submitted

comments. By letter of 19 November 2010 the Commission rejected otherwise

Panasonic/MTPDs request for access to Statement of Objections replies. By

letter from the Hearing Officer, dated 19 January 2011, the Commission

rejected Toshiba's request of 23 December 2010 for access to other parties'

replies to the Statement of Objections.

(105) On 4 March 2011, requests for information were sent to the addressees of the

current Decision asking them to provide information about their sales and

overall turnover, followed by further requests to supplement or clarify the data

provided.

(106) On 1 June 2012, after serveral requests for information since 15 November 2011

pursuant to Article 18(2) of Regulation (EC) No 1/2003 or pursuant to Point 12

of the 2006 Leniency Notice, Supplementary Statements of Objections were

adopted to supplement, amend and/or clarify the objections addressed to Philips

and LGE regarding their respective liability in the infringements concerning

both the CDT and the CPT, prior to the creation of [Philips/LGE joint venture],

as well their liability after the creation of [Philips/LGE joint venture]. Following

the access to file, the two addressees of the Supplementary Statements of

Objections, Philips and LGE, made known to the Commission in writing their

EN 25 EN

views on the objections raised against them and took part in an Oral Hearing

held on 6 September 2012.

(107) On 5 July 2012 the Commission issued a Letter of Facts to all the addressees of

the 23 November 2009 Statement of Objections regarding updates […] in

relation to the participating individuals from Philips Group, LGE Group and

[Philips/LGE joint venture]. Toshiba, Samsung SDI and Panasonic/MTPD

responded to it on 19 July 2012, 27 July 2012 and 31 July 2012 respectively

145

,

whereas the other addresees did not submit any comments.