Commercial Properties Stock Vacancy Rates

Backed

by:

The 27

th

edition of the GeoDirectory Commercial Buildings Report provides an

analysis of the commercial building stock across Ireland, with sectoral analysis

of commercial address points in towns, counties, and provinces.

This report reveals a rise in the national commercial vacancy rate. Commercial

property owners continue to face many challenges, including the rising costs of

doing business, which have led to some closures in the hospitality sector over

recent months.

However, the outlook for the economy remains positive, albeit growth will likely be

more moderate over the coming period. With further growth in consumer spending

expected, the hope is that the commercial vacancy rate will fall in the near future.

Year‑On‑Year Trends

Facts at a glance

GeoDirectory

Commercial

Buildings Report

14.4%

National vacancy rate

20.5%

Co. Sligo recorded the highest

vacancy rate at 20.5%

9.8%

Co. Meath recorded the lowest

vacancy rate at 9.8%

210,761

Total stock of commercial properties

180,515

Occupied commercial properties

30,246

Vacant commercial properties

14

Counties had an increase

in vacancy rates

8

Counties had a decrease

in vacancy rates

4

Counties had an

unchanged vacancy rate

85.6%

occupied

properties

14.4%

vacancy

rate

Q2 2024

Changes in national, provincial, town, and Dublin district vacancy rates from Q2 2023 to Q2 2024

can be found on page 2 onwards.

P2

GeoDirectory Commercial Buildings Report Q2 2024

Executive Summary

The data reveals that that

the national commercial

vacancy rate increased

by 0.3 ppts from Q2 2023

to Q2 2024, now reaching

14.4%. The total number

of commercial properties

in the country rose by 154

units over the past year, with

210,761 units recorded in Q2.

National commercial vacancy rate continues to grow in Q2 2024

The commercial vacancy rate in Ireland hit a new high in Q2 2024, with 30,246 vacant

commercial units across the country. This led to an increase in the national commercial

vacancy rate by 0.3 percentage points (ppts) year-on-year (YoY) to 14.4%, the highest it has

been since the report’s introduction in 2013. There were 210,761 commercial properties

recorded in the total commercial stock in Q2 2024, after increasing by 154 units since

Q2 2023. Of these, 180,515 were classified as occupied.

Commercial vacancy rates increased in 14 of the 26 counties

Since Q2 2023, the commercial property vacancy rate has increased in 14 out of the 26

counties, continuing a trend of more than half of the counties experiencing an increase

in vacancy rates. Donegal and Leitrim recorded the highest increases in vacancy rates,

rising by 1.5 and 0.7 ppts respectively. Eight counties saw a decline in commercial vacancy

rates while Westmeath, Mayo, Wexford and Offaly’s commercial vacancy rates remained

unchanged.

The services sector continues to hold the largest proportion of commercial units

in Ireland, at 49.3%

Out of a total of 180,515 commercial units which were classified as occupied in Q2 2024,

85.4% (or 154,217 units) were allocated a NACE code. This is a reduction of 0.9% YoY.

Businesses in the services sector accounted for the largest share of commercial properties

(49.3%), more than twice as much as the next largest sector. The retail and wholesale

sector had the second largest share of commercial units, making up 22.0% of the total,

while the health sector represented the third largest share of occupied commercial units,

accounting for 9.5% of the total.

While the services sector had the highest share of commercial properties in Ireland, it

also had the largest reduction in the number of commercial units, with a decrease of 625

units, accounting for 45.6% of the total decrease in commercial units assigned a NACE

code YoY. Retail and wholesale had the second highest reduction of commercial units (514

units), while the industrial sector saw the third largest decrease (129 units).

Connacht

In Q2 2024, the commercial vacancy rate in Connacht reached 18.3%, an increase of

0.4 ppts from the same period in 2023. Each of the five counties in Connacht reported

increases in their vacancy rates compared with the previous year, with the exception of Co.

Mayo, which remained unchanged at 17.3%. All of the counties also reported commercial

vacancy rates above the national vacancy rate, with Boyle in Co. Roscommon having the

highest vacancy rate at 27.7% amongst the selected towns in the region. Westport in

Co. Mayo was the only town sampled which reported a vacancy rate (11.7%) below the

national vacancy rate (14.4%), falling by 0.9 ppts since Q2 2023.

In terms of sectoral composition, almost half (49.6%) of all commercial units in Connacht

fell under the services sector, with Westport in Co. Mayo having the highest percentage of

commercial properties engaged in services-type activities and accounting for 60.1% of all

commercial units. After services, the retail and wholesale sector was the second largest

occupier of commercial units in Connacht, representing 22.2% of all commercial units,

with Ballina (30.1%) and Boyle (29.4%) having the highest shares of commercial units

engaged in the sector.

Leinster

In Leinster, the services sector made up 47.3% of commercial units, remaining unchanged

from a year prior. The retail and wholesale sector had the second largest share, with 29

of the 35 towns in Leinster registering above the national average proportion. Callan, Co.

Kilkenny had the lowest occupancy rate of retail and wholesale commercial units, at 17.4%.

The health sector represented 8.4% of all commercial units in Leinster, while Co. Laois

held the highest proportion of Public Administration premises in Leinster (3.3%). Callan,

Co. Kilkenny, was the town with the highest concentration of public administration

premises at 4.3%, followed closely by Portlaoise at 4.0%.

P3

GeoDirectory Commercial Buildings Report Q2 2024

Executive Summary continued

Munster

From Q2 2023 to Q2 2024, the commercial vacancy rate in Munster increased by 0.1

ppts to 14.0%, remaining lower than the national vacancy rate of 14.4%. Co. Limerick

maintained the highest vacancy rate in the province at 17.5%, while Co. Cork had the

lowest at 12.4%.

The services sector occupied nearly half of all units in Munster at 49.5%, whilst retail and

wholesale accounted for 22.1%. The health sector had an occupancy rate of 9.6%, with

Midleton and Carrigaline in Co. Cork boasting occupancy rates of over 17% in the sector.

The industrial sector held a total of 5.0%, matching the national rate. Of the sampled

towns, Carrigaline, Co. Cork had the highest share of occupied units allocated to industry

at 4.5%, while industrial units accounted for 4.2% of the total occupied units in Shannon,

Co. Clare.

Ulster

Ulster’s vacancy rate in Q2 2024 increased 1.0 ppts to 16.7%, 2.3 ppts higher than

the national vacancy rate. Following a substantial increase of 1.5 ppts, Co. Donegal

had the highest vacancy rate in Ulster at 19.4%, meaning nearly 1 in 5 buildings were

vacant. Ballybofey, Co. Donegal held the highest vacancy rate of all towns sampled in

the country, with over a third of commercial buildings lying vacant in Q2 2024 (33.6%).

Services accounted for almost half of all occupied units in Ulster (47.7%), while retail and

wholesale and construction remained prominent sectors. Ulster had the lowest share of

commercial health units (7.3%) amongst the four provinces.

Co. Cavan’s vacancy rate fell by 0.1 ppts to 12.5%, while Co. Monaghan’s vacancy

rate rose by 0.6 ppts, to 14.6%. Bundoran and Bailieborough had the lowest overall

vacancy rates in Ulster, at 13.4% and 14.4% respectively. Education, financial, and public

administration each held overall shares of less than 5% of occupied commercial units.

Overall, the commercial landscape in Ulster shows a higher-than-average proportion of

units in the retail, construction, and industrial businesses.

Dublin

Dublin’s Q2 2024 vacancy rate was 13.3%, 0.2 ppts higher than Q2 2023, but still lower

than the national vacancy rate of 14.4%. Dublin 2 and Dublin 9 held the highest vacancy

rates (17.8% and 17.5% respectively), whilst Dublin 15 and Dublin 16 held the lowest

(6.7% each). The services sector was the leading commercial sector, accounting for the

highest percentage of total units occupied at 51.9%, with the largest shares found in

Dublin 2, Dublin 8, and Dublin 4. Following services, the retail and wholesale sector made

up 19.3% of the total occupied units, 2.7 ppts below the national average. The health

sector accounted for 11.6% of total occupied commercial units, and the financial sector

had a share of 5.1% of the total number of occupied units with a NACE code in Dublin,

more than double the national average. The proportion of commercial occupancy in the

retail, industry, construction, education, and public administration sectors was lower in

Dublin than the national rate.

Commercial property owners face many challenges in today’s economy, including hybrid

working and rising business costs. The latter have led to several high-profile restaurant

closures in Dublin and across the country over recent months. The commercial vacancy

rate continues to slowly creep upwards as the total stock of buildings stagnates, and

the count of vacant properties continues to rise. Looking ahead, there is potential to turn

vacant commercial properties into occupied homes under a key pillar of the Government’s

Housing for All Plan which looks to address the urgent need for housing in the country.

Connect today

www.geodirectory.ie

Smarter Data for

Better Results

2,151,000+

Residential Addresses

210,000+

Business Addresses

P4

GeoDirectory Commercial Buildings Report Q2 2024

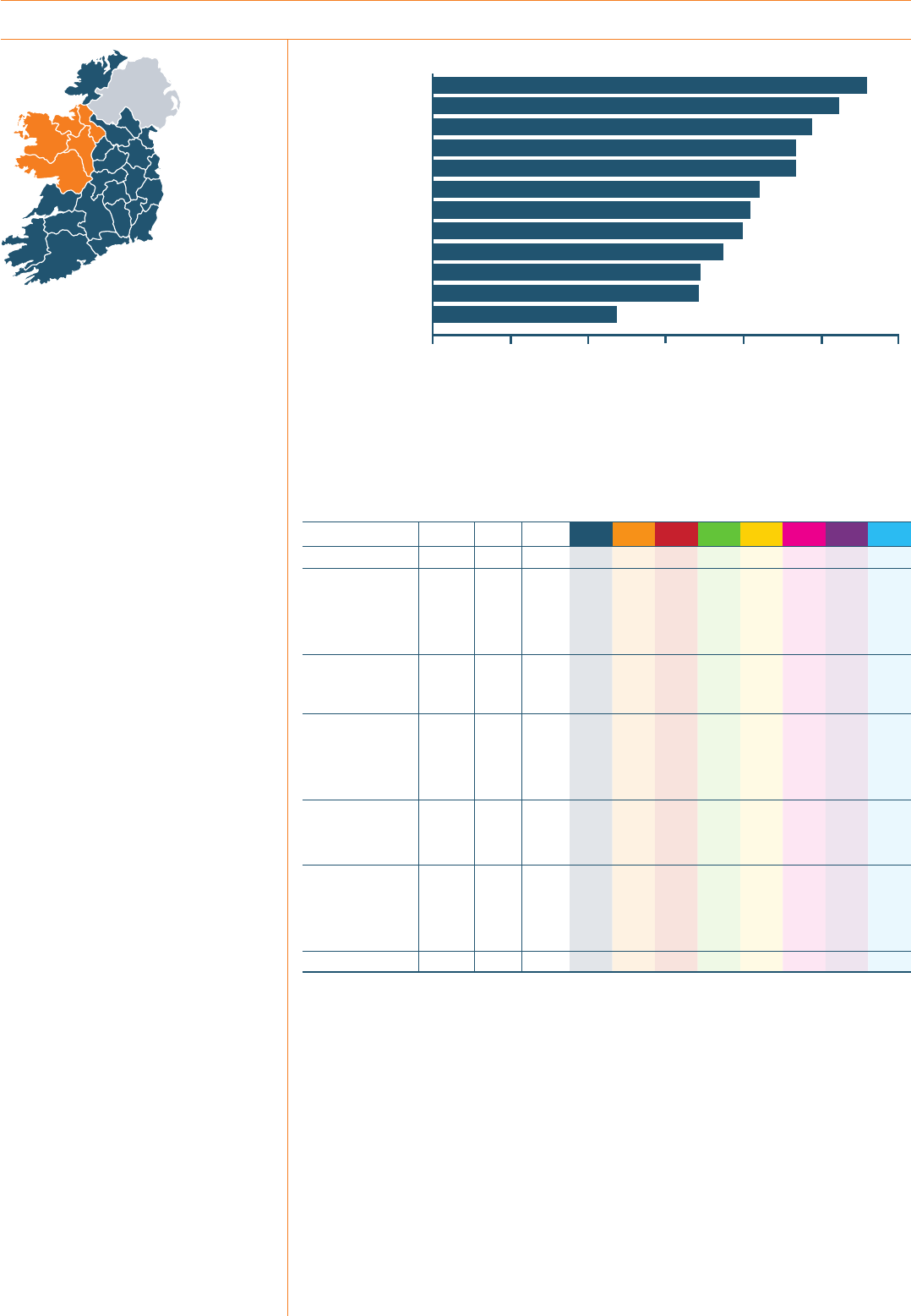

Commercial Vacancy Rates by County

The commercial vacancy rate

in Ireland stood at 14.4% in

Q2 2024, an increase of 0.3

percentage points since Q2

2023. Although this increase is

marginal, the continued increase

in vacancies again delivers the

highest national vacancy rate

since the report began.

• 14 counties experienced an increase

in vacancy rates, while 8 counties

saw a decline, and 4 counties

remained unchanged.

• The counties with the lowest vacancy

rates were Meath (9.8%), Wexford

(10.6%), and Cork (12.4%).

• With a 0.6 percentage point (ppt)

increase from Q2 2023, Sligo had the

highest vacancy rate of 20.5%.

• 12 counties had a vacancy rate below

the national vacancy rate of 14.4%.

• Connacht, Ulster, and Munster all

experienced an increase in vacancy

rates compared with Q2 2023. The

vacancy rate in Leinster fell by 0.1 ppt.

• Connacht had the highest vacancy

rate of the four provinces, at 18.3%,

followed by Ulster (16.7%), Munster

(14.0%), and Leinster (12.9%).

• The five counties in Connacht were

all in the top seven counties with the

highest vacancy rates.

Figure 1: Commercial Vacancy Rates by County, Q2 2024

Source: GeoDirectory Database

Analysis of Commercial Address Points by County

In Q2 2024, the commercial stock

database consisted of 210,761

units, an increase of 154 units

compared to Q2 2023.

• The Greater Dublin Area (GDA*)

represented 33.6% of the total

commercial stock, with Dublin

accounting for 23.9% of the

total stock.

• The counties with the largest urban

areas - Dublin (23.9% or 50,373

commercial addresses), Cork (11.2%

or 23,590), Galway (6.0% or 12,687),

Limerick (4.3% or 9,104), and

Waterford (2.6% or 5,507) - made up

48.0% of the total commercial stock.

• Leinster had the most significant

share of commercial units, with

almost half of the total stock (49.7%

or 104,848 units). However, this

figure fell to 25.8% when Dublin

was excluded.

• Amongst the four provinces, Munster

held the second-largest share of

commercial units (28.6%), followed by

Connacht (13.7%), and Ulster, which

had the smallest share (8.0%).

* The Greater Dublin Area is defined as

Dublin and the surrounding counties of

Kildare, Meath, and Wicklow.

Figure 2: Commercial Address Points by County – Share of the National Total, Q2 2024

Source: GeoDirectory Database

SLIGO

DONEGAL

GALWAY

LIMERICK

LEITRIM

ROSCOMMON

M AYO

OFFALY

CLARE

LOUTH

LONGFORD

TIPPERARY

MONAGHAN

WATERFORD

KILDARE

CARLOW

LAOIS

DUBLIN

WICKLOW

WESTMEATH

KILKENNY

C AVA N

KERRY

CORK

WEXFORD

MEATH

20.5%

19.4%

18.5%

17.5%

17.5%

17.4%

17.3%

16.0%

15.5%

14.8%

14.7%

14.6%

14.6%

14.5%

14.3%

14.1%

14.0%

13.3%

12.9%

12.7%

12.7%

12.5%

12.5%

12.4%

10.6%

9.8%

0% 5% 10% 15% 20% 25%

14.4%

NATIONAL

COMMERCIAL

VACANCY RATE

%

0% 5% 10% 15% 20%

25%

DUBLIN

CORK

GALWAY

LIMERICK

DONEGAL

TIPPERARY

KERRY

MEATH

M AYO

KILDARE

WEXFORD

LOUTH

CLARE

WICKLOW

WATERFORD

KILKENNY

WESTMEATH

C AVA N

MONAGHAN

SLIGO

ROSCOMMON

LAOIS

OFFALY

CARLOW

LONGFORD

LEITRIM

23.9%

11.2%

6.0%

4.3%

4.3%

3.8%

3.7%

3.5%

3.5%

3.4%

3.3%

3.2%

3.0%

2.8%

2.6%

2.2%

2.2%

1.9%

1.9%

1.7%

1.5%

1.5%

1.5%

1.3%

1.0%

0.9%

P5

GeoDirectory Commercial Buildings Report Q2 2024

Annual Change in Vacancy Rates by County

The national vacancy rate for

commercial properties in Ireland

has been rising, with Q2 2024

recording the highest rate in this

series of reports so far at 14.4%.

The rise in the national vacancy

rate is reflected in the increasing

vacancy rates recorded in 14 out

of 26 counties, with 8 counties

reporting a decrease, and 4

remaining unchanged.

• In Q2 2024, Donegal and Leitrim

had the highest increases in vacancy

rates amongst the 14 counties,

recording increases of 1.5 and 0.7

ppts respectively.

• Meanwhile, Laois and Meath

experienced the largest decrease

in vacancy rates amongst the eight

counties reporting a reduction,

recording decreases of 0.5 and 0.4

ppts respectively.

• The vacancy rates in Westmeath,

Mayo, Wexford, and Offaly

remained unchanged from Q2 2023

to Q2 2024.

• Connacht, Ulster, and Munster all

reported increases in their overall

vacancy rates, with Connacht having

the highest rate at 18.3%, 3.9 ppts

above the national vacancy rate.

• On the other hand, Leinster

(excluding Dublin) recorded the

lowest commercial vacancy rate

at 12.9% in Q2 2024, falling from

13.0% in Q2 2023.

Table 1: Annual Change in Vacancy Rates by County (%), Q2 2023 – Q2 2024

COUNTY

VACANCY RATE

Q2 2023 (%)

VACANCY RATE

Q2 2024 (%) PP CHANGE

DONEGAL 17.9% 19.4% 1.5

LEITRIM 16.8% 17.5% 0.7

LIMERICK 16.9% 17.5% 0.6

MONAGHAN 14.0% 14.6% 0.6

SLIGO 19.9% 20.5% 0.6

CARLOW 13.6% 14.1% 0.5

ROSCOMMON 16.9% 17.4% 0.5

GALWAY 18.0% 18.5% 0.5

LOUTH 14.4% 14.8% 0.4

KERRY 12.2% 12.5% 0.3

DUBLIN 13.1% 13.3% 0.2

WICKLOW 12.8% 12.9% 0.1

CORK 12.3% 12.4% 0.1

KILDARE 14.2% 14.3% 0.1

WESTMEATH 12.7% 12.7% 0.0

MAYO 17.3% 17.3% 0.0

WEXFORD 10.6% 10.6% 0.0

OFFALY 16.0% 16.0% 0.0

CAVAN 12.6% 12.5% -0.1

TIPPERARY 14.7% 14.6% -0.1

WATERFORD 14.6% 14.5% -0.1

CLARE 15.7% 15.5% -0.2

KILKENNY 13.0% 12.7% -0.3

LONGFORD 15.1% 14.7% -0.4

MEATH 10.2% 9.8% -0.4

LAOIS 14.5% 14.0% -0.5

STATE 14.1% 14.4% 0.3

Source: GeoDirectory Database

Figure 3: Commercial Vacancy Rates, Q2 2024

Source: GeoDirectory Database

The figure for Leinster excludes Dublin

LEINSTER 12.9%

MUNSTER 14.0%

16.7%

ULSTER

0%

10% 20%

5% 15%

CONNACHT

18.3%

P6

GeoDirectory Commercial Buildings Report Q2 2024

Analysis of Commercial Address Points by Economic Sector

In Q2 2024, there were 210,761

commercial units reported, with

the total number of occupied

units equating to 180,515. Of

these occupied units, 154,217

were assigned a NACE code,

which amounts to 85.4% of the

total occupied units.

• The number of commercial units

classified by a NACE code decreased

by 1,370 units from Q2 2023

to Q2 2024.

• The largest proportion of this

decline can be attributed to the

services sector suffering a decline

of 625 units, followed by retail and

wholesale which faced a decline of

514 units.

• With the exceptions of public

administration, and human health

and social work activities, all

sectors witnessed a decline in the

number of commercial units. The

services sector, which had the

highest reduction in the number of

commercial units, still held the largest

share of commercial sites, accounting

for 49.3% of the total or 76,087 units.

• Within the services sector,

accommodation and food

services had the highest number

of commercial units, accounting

for 22,211 units or 14.4% of the

total NACE codes. The next two

sectors with the highest number of

commercial units were professional

scientific and technical services with

11,996 units or 7.8%, followed by

arts, entertainment and recreation

activities with 8,908 units or 5.8%.

• The retail and wholesale sector was

the second-largest sector in terms of

occupied commercial sites, making

up 22.0% of the total NACE codes or

33,967 commercial units.

• The health sector represented the

third-largest share of occupied

commercial sites, accounting for

9.5% or 14,706 units of the total.

This figure is an increase of 65 units

from Q2 2023.

• Industrial activities accounted for

5.0% of the total commercial units,

but there was a decrease of 129 units

from Q2 2023.

• Construction, education, financial and

insurance, and public administration

each contributed less than 5.0% to

the total number of commercial units.

The analysis of commercial units by NACE codes uses the statistical classification

of economic activities used within the European Communities. For the purposes of

presentation here, 18 NACE codes are used to group the commercial stock according to

the following eight broad groupings:

1. Industry (B, C, D, E)

2. Financial and Insurance (K)

3. Services (H, I, J, L, M, N, R, S)

4. Construction (F)

5. Retail and Wholesale (G)

6. Education (P)

7. Public Administration and Defence; Compulsory and Social Security (O)

8. Human Health and Social Work Activities (Q)

Table 2: Year‑on‑Year Change in Total Occupied Commercial Address Points by Sector,

Q2 2023 – Q2 2024

SECTOR

NUMBER OF

ADDRESS

POINTS

Q2 2023

NUMBER OF

ADDRESS

POINTS

Q2 2024

PERCENTAGE

SHARE (%)

Q2 2024

CHANGE IN

NUMBER OF

ADDRESS

POINTS

Q2 2023–Q2 2024

SERVICES 76,712 76,087 49.3% -625

RETAIL AND

WHOLESALE 34,481 33,967 22.0% -514

HEALTH 14,641 14,706 9.5% 65

INDUSTRY 7,901 7,772 5.0% -129

CONSTRUCTION 7,485 7,424 4.8% -61

EDUCATION 7,115 7,095 4.6% -20

FINANCIAL

AND INSURANCE 3,948 3,841 2.5% -107

PUBLIC

ADMINISTRATION 3,304 3,325 2.2% 21

TOTAL 155,587 154,217 100.00% ‑1,370

Source: GeoDirectory Database

Note: Percentages may not sum due to rounding.

Figure 4: Nationwide Commercial Address Points by Sector of Economic Activity, Q2 2024

Source: GeoDirectory Database

Service

Retail and Wholesale

Human Health and

Social Work Activities

Industry

Construction

Education

Financial and Insurance

Public Administration

22.0%

33,967

9.5%

14,706

5.0%

7,772

4.8%

7,424

4.6%

7,095

3,841

2.2%2.5%

3,325

49.3

%

76,087

P7

GeoDirectory Commercial Buildings Report Q2 2024

Analysis of Accommodation and Food Services Sector

The accommodation and food

services sector accounted

for 14.4% of the total stock of

commercial sites with a NACE

code and 29.2% of the total stock

of units within the services sector.

• The accommodation and food

services sector experienced a

decrease of 270 units in the last year

to an overall total of 22,211 units. The

top five counties with the highest

concentration of accommodation

and food services units were mostly

located along the western coast:

Kerry (24.0%), Clare (20.5%),

Donegal (19.2%), Leitrim (18.5%),

and Galway (17.8%).

• The sub-sector can be further divided

into three categories: “Restaurants,

Event Catering and Other Food

Service Activities” (44.7% of total

Accommodation and Food Services),

“Beverage Serving Activities” (30.5%

of the total), and “Hotels and other

short-term accommodation” (24.7%

of the total).*

• Monaghan has the lowest reliance

on the accommodation and food

services sector, with only 8.1% of

its commercial stock allocated to

this sector.

* ”Restaurants, Event Catering and Other Food

Service Activities” includes NACE code; I56.10,

I56.21 and I56.29, “Beverage Serving Activities”

includes I56.30 and “Hotels and other short-term

accommodation” includes I55.10, I55.20, I55.30

and I55.90.

Table 3: Year‑on‑Year Change in Total Occupied Commercial Address Points involved in

Accommodation and Food Services, Q2 2023‑ Q2 2024

REGION

NUMBER

OF ADDRESS

POINTS

Q2 2023

NUMBER

OF ADDRESS

POINTS

Q2 2024

PERCENTAGE

SHARE (%)

OF COUNTY

COMMERCIAL

STOCK

Q2 2024

CHANGE

IN NUMBER

OF ADDRESS

POINTS

Q2 2023–Q2 2024

KERRY 1,476 1,430 24.0% -46

CLARE 974 964 20.5% -10

DONEGAL 1,217 1,192 19.2% -25

LEITRIM 261 251 18.5% -10

GALWAY 1,582 1,559 17.8% -23

MAYO 982 965 17.7% -17

SLIGO 426 413 16.5% -13

WATERFORD 605 594 14.7% -11

WEXFORD 787 777 14.1% -10

WICKLOW 648 636 13.7% -12

TIPPERARY 821 812 13.7% -9

KILKENNY 512 507 13.6% -5

CORK 2,430 2,382 13.6% -48

DUBLIN 4,680 4,701 13.2% 21

ROSCOMMON 319 308 13.1% -11

CAVAN 402 397 13.0% -5

OFFALY 296 300 12.9% 4

LIMERICK 851 833 12.9% -18

WESTMEATH 437 435 12.7% -2

LOUTH 575 558 12.2% -17

CARLOW 257 250 12.0% -7

LONGFORD 176 174 11.6% -2

KILDARE 634 631 11.4% -3

LAOIS 274 281 11.3% 7

MEATH 631 639 11.1% 8

MONAGHAN 228 222 8.1% -6

STATE 22,481 22,211 14.4% ‑ 270

Source: GeoDirectory Database

Figure 5: Composition of commercial stock operating in the Accommodation and Food

Services sector, Q2 2024

Source: GeoDirectory Database

24.7%30.5%

44.7%

Total Hotels and Short Term Accommodation

Restaurants, Event Catering, and Other Services

Beverage Serving Activities

P8

GeoDirectory Commercial Buildings Report Q2 2024

Towns and Dublin Districts Analysis

This section examines a sample

of 80 towns throughout Ireland,

as well as 22 districts in Dublin,

to assess the shift in vacancy

rates from the second quarter of

2023 to the same period in 2024.

• Ballybofey, Co. Donegal reported the

highest commercial vacancy rate at

33.6%, after increasing by 3.7 ppts

between Q2 2023 and Q2 2024.

• Edgeworthstown, Co. Longford moved

to second place with a vacancy rate of

30.2%, an increase of 1.0 ppt on the

vacancy rate from the previous year.

• Of the 15 towns with the highest

vacancy rates in Ireland, four towns

recorded a decline in vacancy rates

whilst 10 recorded an increase, and

1 remained unchanged (Kilrush,

Co. Clare).

• Newcastle West, Co. Limerick;

Mountmellick, Co. Laois, and New

Ross, Co. Wexford are three new

additions to the top 15 towns with

the highest vacancy rates in Q2 2024,

whilst Abbeyfeale, Co. Limerick;

Cootehill, Co. Cavan, and Monaghan,

Co. Monaghan, all exited from the top

15 since Q2 2023.

• The lowest commercial vacancy rates

amongst the 80 towns sampled were

registered in Greystones, Co. Wicklow

and Carrigaline, Co. Cork at 5.6% and

7.2% respectively, with vacancy rates in

both towns having decreased YoY.

Dublin’s commercial vacancy rate

stood at 13.3% in Q2 2024, a 0.2

ppt increase on Q2 2023. However,

it remains below the national

vacancy rate of 14.4%.

• Dublin 2 had the highest vacancy rate

of 17.8%, 3.4 ppts higher than the

national vacancy rate.

• Dublin 11 experienced the largest

vacancy rate increase, growing by 1.3

ppts when compared with Q2 2023,

followed by Dublin 2 which grew by

1.1 ppts.

• Dublin 20, Dublin 16 and Dublin 15 all

reported vacancy rates below 10%

in Q2 2024.

• Of the 22 Dublin Districts, 18 had

vacancy rates below the national

vacancy rate of 14.4%.

• Of the 22 Dublin districts, 10

recorded a decrease in vacancy

rates, with the largest fall in Dublin 6

( -1.1 ppts).

Table 4: Top 15 Vacancy Rates by Town, Q2 2024

TOWN COUNTY

VACANCY RATE

Q2 2023 (%)

VACANCY RATE

Q2 2024 (%)

PPT

CHANGE

BALLYBOFEY DONEGAL 29.9% 33.6% 3.7

EDGEWORTHSTOWN LONGFORD 29.2% 30.2% 1.0

SHANNON CLARE 29.4% 29.8% 0.4

BOYLE ROSCOMMON 27.6% 27.7% 0.1

LETTERKENNY DONEGAL 24.0% 26.6% 2.6

EDENDERRY OFFALY 24.6% 26.6% 2.0

SLIGO SLIGO 25.4% 26.0% 0.6

NEWCASTLE WEST LIMERICK 21.6% 24.9% 3.3

MOUNTMELLICK LAOIS 20.7% 24.6% 3.9

KILRUSH CLARE 24.5% 24.5% 0.0

TUAM GALWAY 24.8% 24.2% -0.6

CASTLEBLAYNEY MONAGHAN 24.9% 23.9% -1.0

BALLINA MAYO 23.5% 23.2% -0.3

TUBBERCURRY SLIGO 24.5% 23.2% -1.3

NEW ROSS WEXFORD 21.2% 23.2% 2.0

NATIONAL VACANCY RATE 14.1% 14.4% 0.3

Source: GeoDirectory Database

Table 5: Vacancy Rates by Dublin District, Q2 2024

DUBLIN DISTRICT

VACANCY RATE

Q2 2023 (%)

VACANCY RATE

Q2 2024 (%)

PPT

CHANGE

DUBLIN 2 16.7% 17.8% 1.1

DUBLIN 9 18.3% 17.5% -0.8

DUBLIN 8 17.0% 17.3% 0.3

DUBLIN 3 14.5% 14.7% 0.2

DUBLIN 17 13.8% 13.4% -0.4

DUBLIN 14 13.4% 13.1% -0.3

DUBLIN 12 13.0% 13.1% 0.1

DUBLIN 13 12.7% 12.8% 0.1

DUBLIN 1 12.2% 12.8% 0.6

DUBLIN 4 11.9% 12.7% 0.8

DUBLIN 6W 13.1% 12.5% -0.6

DUBLIN 11 11.0% 12.3% 1.3

DUBLIN 6 13.4% 12.3% -1.1

DUBLIN 10 11.4% 12.2% 0.8

DUBLIN 24 11.6% 12.1% 0.5

DUBLIN 18 11.6% 12.1% 0.5

DUBLIN 22 11.6% 11.4% -0.2

DUBLIN 7 11.9% 11.3% -0.6

DUBLIN 5 10.5% 10.6% 0.1

DUBLIN 20 9.3% 8.5% -0.8

DUBLIN 16 7.6% 6.7% -0.9

DUBLIN 15 6.9% 6.7% -0.2

DUBLIN 13.1% 13.3% 0.2

Source: GeoDirectory Database

P9

GeoDirectory Commercial Buildings Report Q2 2024

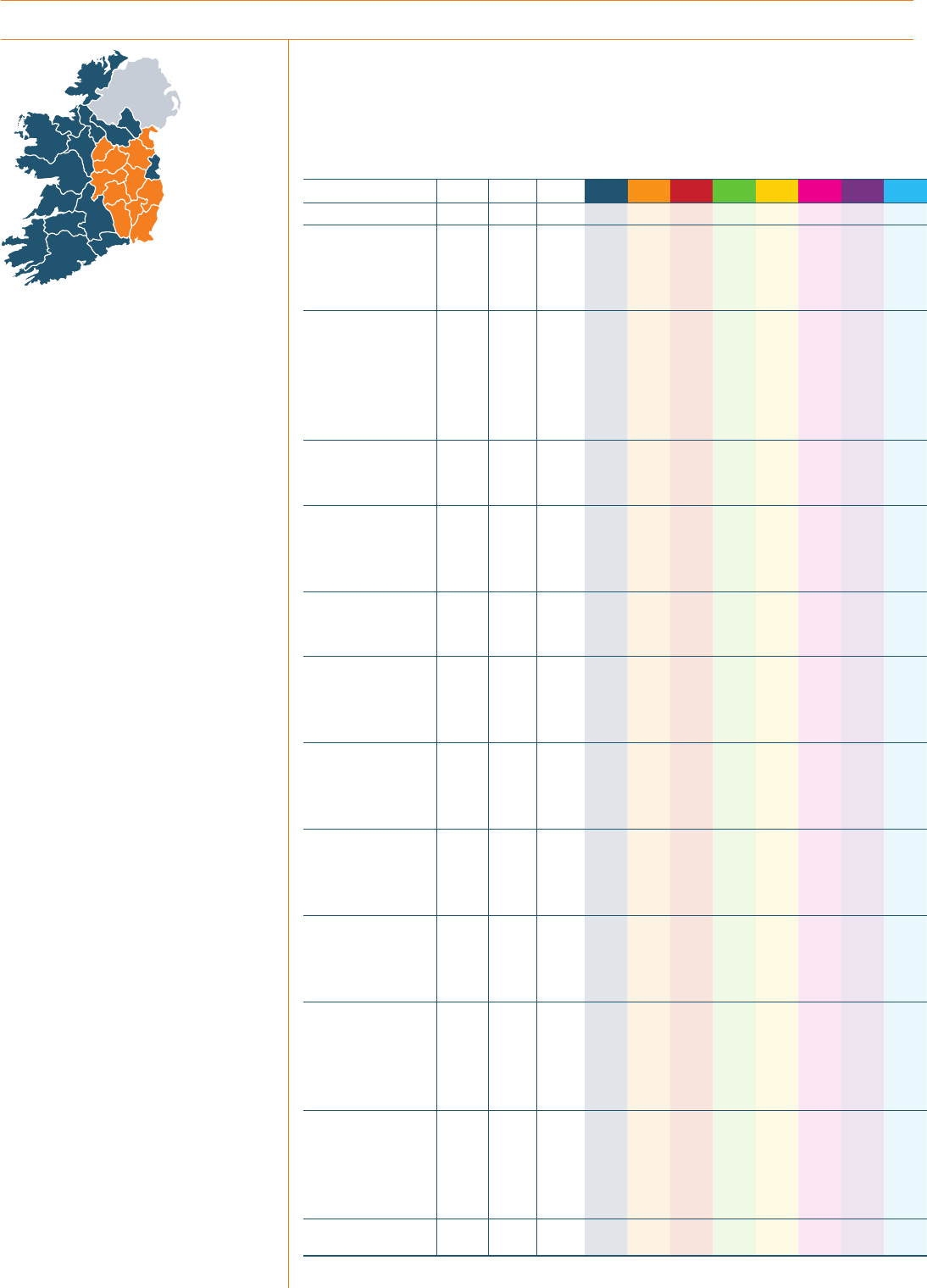

Connacht

Connacht had the highest

vacancy rate of the four provinces

in Ireland. In Q2 2024 the vacancy

rate reached 18.3%, an increase

of 0.4 ppts from Q2 2023.

• All five counties in Connacht reported

commercial vacancy rates greater

than the national vacancy rate. Each of

the counties’ vacancy rates rose YoY,

with the exception of Mayo’s which

remained unchanged.

• Boyle, Co. Roscommon, had the

highest vacancy rate at 27.7%. after

recording an increase of 0.1 ppts.

• Of the 12 towns, Westport, Co.

Mayo, was the only town to register

a vacancy rate below the national

vacancy rate, at 11.7% (-0.9 ppts YoY).

• Of the 12 towns, 7 experienced YoY

declines in their vacancy rates, while

4 rose, and Inniscrone, Co. Sligo

remained the same.

• In Q2 2024, 20,394 commercial

addresses in Connacht were assigned

a NACE code, which accounted

for 13.2% of the national total. The

services sector had the highest

proportion of commercial properties

in Connacht, with almost half (49.6%)

of all units falling under this category,

remaining the same as Q2 2023.

• Westport in Co. Mayo had the highest

percentage of commercial properties

engaged in service-type activities,

accounting for 60.1% of all commercial

units, a fall of 0.1 ppts from Q2 2023.

Inniscrone in Co. Sligo had the next

highest proportion at 59.4%, remaining

unchanged since Q2 2023.

• Tuam in Co. Galway and Ballina in Co.

Mayo had the lowest proportion of

commercial properties in the services

sector, with 43.6% and 45.1%

respectively.

• Retail and wholesale was the second

largest occupier of commercial units in

Connacht, representing 22.2%. Ballina

in Co. Mayo at 30.1%, and Boyle in Co.

Roscommon at 29.4%, had the highest

shares of commercial units engaged in

the retail and wholesale sector.

• Sligo town and Roscommon town

had the highest proportions of

occupied premises attributed to the

health sector at 14.7% and 14.6%

respectively.

Figure 6: Vacancy Rates by Town – Connacht Q2 2024

Source: GeoDirectory Database

Table 6: NACE Percentage Breakdown by Town – Connacht Q2 2024

% % % % % % % % % %

CONNACHT 20,394 1 7. 9 18.3 49.6 22.2 9.6 4.2 4.7 5.5 1.8 2.4

CO. GALWAY 8,742 18.0 18.5 50.0 21.2 10.8 3.5 4.8 5.6 2.1 2.0

GALWAY 2,804 19.5 20.9 53.2 20.5 13.9 2.2 2.5 3.7 2.9 1. 1

LOUGHREA 274 19.0 18.5 48.5 26.6 10.9 2.9 3.6 2.9 1. 8 2.6

TUAM 406 24.8 24.2 43.6 26.1 12.1 2.2 5.9 5.4 2.7 2.0

CO. LEITRIM 1,356 16.8 17. 5 52.6 22.3 7. 1 3.8 4.1 4.8 1.9 3.4

CARRICK-ON-

SHANNON

293 16.6 16.9 49.8 26.3 9.2 0.7 3.8 3.1 2.7 4.4

CO. MAYO 5,447 1 7. 3 1 7. 3 49.1 23.3 8.6 4.5 4.9 5.4 1.5 2.7

BALLINA 585 23.5 23.2 45.1 30.1 11. 3 2.4 3.2 2.7 2.6 2.6

CASTLEBAR 724 20.8 20.2 46.0 28.7 12.8 2.9 2.6 2.9 1. 7 2.3

WESTPORT 439 12.6 11.7 60.1 23.2 6.8 0.9 2.1 3.2 2.5 1. 1

CO. ROSCOMMON

2,349 16.9 17. 4 45.9 24.5 8.8 6.3 4.6 5.8 1.3 2.9

BOYLE 163 27.6 27.7 46.6 29.4 9.8 2.5 1. 8 2.5 2.5 4.9

ROSCOMMON 412 21.0 19.8 46.8 25.7 14.6 0.7 3.4 3.4 1. 9 3.4

CO. SLIGO 2,500 19.9 20.5 51.0 21.3 9.4 4.7 4.7 5.0 1.6 2.4

INNISCRONE 64 1 7. 1 1 7. 1 59.4 17. 2 14.1 0.0 0.0 3.1 0.0 6.3

SLIGO 933 25.4 26.0 48.3 22.4 14.7 2.7 3.5 2.9 2.8 2.7

TUBBERCURRY 127 24.5 23.2 48.8 24.4 9.4 3.1 2.4 2.4 2.4 7. 1

NATIONAL 154,217 14.1 14.4 49.3 22.0 9.5 4.8 5.0 4.6 2.5 2.2

Source: GeoDirectory Database

Note: *The percentage point changes figures in some of the towns/counties do not work out exactly

due to rounding.

Vacancy Rate

Q2 2024

Vacancy Rate

Q2 2023

Occupied units

with NACE Code

Services

Retail and

Wholesale

Health

Construction

Industry

Education

Public Admin

Financial

30% 0% 5% 15% 20%

BOYLE

SLIGO

TUAM

BALLINA

TUBBERCURRY

GALWAY

CASTLEBAR

ROSCOMMON

LOUGHREA

INNISCRONE

CARRICK-ON-SHANNON

WESTPORT

27.7%

26.0%

24.2%

23.2%

23.2%

20.9%

20.2%

19.8%

18.5%

17.1%

16.9%

11.7%

10% 25%

P10

GeoDirectory Commercial Buildings Report Q2 2024

Leinster (excl. Dublin)

The vacancy rate in Leinster,

excluding Dublin, was 12.9%

in Q2 2024, 0.1 ppt below the

level in Q2 2023. However, when

Dublin is included, the rate

increases to 13.1%.

• Co. Offaly had the highest vacancy rate

of all the counties in Leinster at 16.0%,

remaining unchanged from Q2 2023.

• Co. Meath had the lowest vacancy rate

at 9.8%, 0.4 ppts lower than it was

in Q2 2023.

• Out of the 35 towns in Leinster, 17

recorded increases in their vacancy

rates, with rates decreasing in 13

towns. Five towns had unchanged

vacancy rates: Callan, Co Kilkenny;

Ardee, Co. Louth; Athlone, Co.

Westmeath; Mullingar, Co.

Westmeath; and Bray, Co. Wicklow.

• Amongst the 35 towns in Leinster,

19 had vacancy rates higher than the

national vacancy rate, whilst 15 had

rates lower than the national vacancy

rate. At 14.4%, Tullow, Co. Carlow

shared the same vacancy rate as

the state.

• The towns of Greystones, Co.

Wicklow, and Gorey, Co. Wexford had

the lowest vacancy rates at 5.6% and

10.0% respectively. On the other hand,

Edgeworthstown, Co. Longford, had

the highest vacancy rate at 30.2%,

after it had increased by 1.0 ppt

from Q2 2023.

• The town of Mountmellick, Co. Laois

showed the most substantial year-on-

year increase, with its vacancy rate

rising by 3.9 ppts from 20.7% in Q2

2023 to 24.6% in Q2 2024.

• Ashbourne, Co. Meath, recorded the

most significant year-on-year decrease

in its vacancy rate, dropping by 2.2

ppts to 11.1% in Q2 2024, making it

the fourth lowest town vacancy rate in

the province.

Figure 7. Vacancy Rates by Town – Leinster (excl. Dublin) Q2 2024

Source: GeoDirectory Database

30% 0% 5%

15%

20%

EDGESWORTHTOWN

EDENDERRY

MOUNTMELLICK

NEW ROSS

ATHLONE

TULLAMORE

LONGFORD

DROGHEDA

CARLOW

CALLAN

DUNDALK

MUINE BHEAG

MOATE

ENNISCORTHY

ARKLOW

BIRR

LEIXLIP

BRAY

CELBRIDGE

TULLOW

NEWBRIDGE

KILKENNY

PORTLAOISE

WICKLOW

ARDEE

NAAS

MULLINGAR

N AVA N

WEXFORD

MAYNOOTH

PORTARLINGTON

ASHBOURNE

TRIM

GOREY

GREYSTONES

30.2%

26.6%

24.6%

23.2%

20.1%

19.9%

19.8%

19.7%

19.1%

18.9%

18.6%

18.5%

17.0%

16.6%

16.1%

15.9%

15.9%

15.2%

14.6%

14.4%

14.1%

14.1%

13.7%

13.7%

13.5%

13.4%

13.2%

12.7%

12.6%

12.4%

12.1%

11.1%

11.0%

10.0%

5.6%

10% 25%

35%

Data intelligence for targeted growth

Visit: www.geodirectory.ie Call: 01‑705 7005

Our data toolkit can help you:

• Verify

customer data

• Identify

opportunities

• Win

customers

P11

GeoDirectory Commercial Buildings Report Q2 2024

Leinster (excl. Dublin) continued

• The services sector made up the

largest proportion of commercial units

in Leinster, accounting for 47.3% of all

units in Q2 2024.

• Amongst the 35 towns in Leinster, 28

registered shares above the national

average in the retail and wholesale

sector. The highest share was

recorded in New Ross, Co. Wexford,

at 31.3%, followed by Gorey, Co.

Wexford, at 30.6%.

• Callan, Co. Kilkenny, had the lowest

occupancy rate in the retail and

wholesale sector, with only 17.4% of

all units allocated to this sector.

• In Q2 2024, the health sector

accounted for 8.4% of all commercial

units in Leinster, excluding Dublin.

• Laois was the county with the

highest share of public administration

premises, outside of Dublin, at 3.3%.

Callan, Co. Kilkenny, was the town with

the highest concentration of public

administration premises at 4.3%.

Table 7: NACE Percentage Breakdown by Town – Leinster (ex. Dublin) Q2 2024

% % % % % % % % % %

LEINSTER 41,560 13.0 12.9 47.3 23.8 8.4 6.6 5.7 4.6 1.6 2.0

CO. CARLOW 2,079 13.6 14.1 47.7 24.0 8.3 5.2 6.3 5.0 1.3 2.3

CARLOW 911 18.2 19.1 47.4 26.7 12.8 2.5 3.5 3.4 1. 4 2.2

MUINE BHEAG 157 16.4 18.5 49.0 28.7 7. 0 1. 3 7. 0 2.5 1. 3 3.2

TULLOW 194 15.2 14.4 47.9 27.8 9.3 2.6 2.1 3.6 2.6 4.1

CO. KILDARE 5,549 14.2 14.3 47.3 24.1 9.7 5.8 4.8 4.3 2.3 1.6

CELBRIDGE 272 13.8 14.6 49.3 20.2 14.0 2.6 3.7 5.5 3.7 1. 1

LEIXLIP 212 16.5 15.9 50.5 21.2 12.3 4.2 2.4 6.1 1. 9 1. 4

MAYNOOTH 382 12.0 12.4 51.6 19.9 11.3 3.1 3.1 5.2 4.7 1. 0

NAAS 817 13.9 13.4 45.5 24.6 12.9 3.3 5.6 3.2 3.1 1. 8

NEWBRIDGE 552 15.6 14.1 48.6 30.4 9.8 1. 3 2.5 3.4 2.7 1. 3

CO. KILKENNY 3,715 13.0 12.7 47.0 23.4 8.2 6.8 5.6 4.9 1.5 2.7

CALLAN 92 18.9 18.9 47.8 17. 4 14.1 4.3 3.3 6.5 2.2 4.3

KILKENNY 1455 14.5 14.1 46.0 27.5 10.7 3.0 3.9 3.9 2.5 2.5

CO. LAOIS 2,481 14.5 14.0 47.2 24.8 8.1 4.6 5.2 5.2 1.7 3.3

MOUNTMELLICK 127 20.7 24.6 49.6 23.6 11. 0 2.4 2.4 4.7 2.4 3.9

PORTARLINGTON 241 13.4 12.1 49.8 27.0 9.5 2.9 2.1 4.1 2.5 2.1

PORTLAOISE 731 15.3 13.7 44.5 29.1 10.3 1. 9 4.1 3.4 2.7 4.0

CO. LONGFORD 1,500 15.1 14.7 45.5 25.3 9.1 6.8 5.5 4.7 1.1 2.1

EDGEWORTHSTOWN 62 29.2 30.2 50.0 27.4 8.1 3.2 6.5 1. 6 0.0 3.2

LONGFORD 592 21.1 19.8 45.6 27.2 12.3 3.4 4.6 3.4 1. 7 1. 9

CO. LOUTH 4,561 14.4 14.8 46.3 24.1 9.3 6.7 6.0 4.0 2.1 1.5

ARDEE 260 13.5 13.5 43.1 25.4 13.8 2.7 6.5 2.7 3.1 2.7

DROGHEDA 1229 18.0 19.7 48.5 23.9 12.8 3.7 4.4 3.7 2.2 0.8

DUNDALK 1325 19.3 18.6 48.7 26.4 10.0 2.3 4.0 3.8 3.0 1. 8

CO. MEATH 5,743 10.2 9.8 45.8 23.2 8.0 9.0 6.8 4.2 1.8 1.4

ASHBOURNE 289 13.3 11.1 49.5 24.6 12.1 3.1 3.1 2.8 4.2 0.7

NAVAN 864 12.1 12.7 44.0 27.3 12.2 3.2 5.6 3.2 2.4 2.1

TRIM 312 9.5 11.0 44.9 26.3 8.3 6.4 3.2 4.5 3.2 3.2

CO. OFFALY 2,333 16.0 16.0 47.1 24.1 7. 5 5.4 6.7 5.3 1.3 2.5

BIRR 216 1 7. 2 15.9 53.2 28.2 7. 4 0.5 1. 4 4.6 2.3 2.3

EDENDERRY 194 24.6 26.6 46.4 29.9 8.2 2.1 6.2 4.1 1. 0 2.1

TULLAMORE 622 19.0 19.9 45.7 28.6 11. 3 2.3 2.9 3.5 2.7 3.1

CO. WESTMEATH 3,433 12.7 12.7 46.8 23.7 8.4 8.4 5.2 4.1 1.6 1.9

ATHLONE 752 20.1 20.1 51.3 27.3 11.0 1. 6 2.3 2.1 2.8 1. 6

MOATE 112 16.8 17. 0 54.5 21.4 10.7 2.7 3.6 4.5 0.9 1. 8

MULLINGAR 883 13.2 13.2 47.0 26.4 10.6 4.1 3.5 3.7 2.5 2.2

CO. WEXFORD 5,528 10.6 10.6 48.0 25.3 7. 1 6.3 5.3 5.0 1.1 2.0

ENNISCORTHY 477 16.3 16.6 45.1 29.6 10.3 2.3 4.8 3.8 1. 9 2.3

GOREY 500 9.3 10.0 50.2 30.6 8.6 2.0 2.2 3.4 1. 4 1. 6

NEW ROSS 310 21.2 23.2 46.5 31.3 8.7 2.6 3.9 2.6 1. 6 2.9

WEXFORD 856 12.9 12.6 47.8 29.9 10.4 1. 8 2.1 4.0 2.6 1. 5

CO. WICKLOW 4,638 12.8 12.9 50.6 21.4 8.5 5.3 5.2 5.4 1.5 2.0

ARKLOW 442 14.7 16.1 48.9 26.5 9.7 2.0 3.6 5.0 2.3 2.0

BRAY 905 15.2 15.2 50.5 23.4 12.3 2.1 3.9 5.1 1. 5 1.2

GREYSTONES 288 6.8 5.6 55.6 18.4 12.8 1. 4 1.4 5.6 2.4 2.4

WICKLOW 372 12.8 13.7 50.8 22.0 10.2 1. 1 3.8 6.2 2.4 3.5

NATIONAL 154,217 14.1 14.4 49.3 22.0 9.5 4.8 5.0 4.6 2.5 2.2

Source: GeoDirectory Database

Vacancy Rate

Q2 2024

Vacancy Rate

Q2 2023

Occupied units

with NACE Code

Services

Retail and

Wholesale

Health

Construction

Industry

Education

Public Admin

Financial

P12

GeoDirectory Commercial Buildings Report Q2 2024

Dublin

Dublin’s overall vacancy rate in

Q2 2024 was 13.3%, an increase

of 0.2 ppts on the previous year,

but lower than the national

vacancy rate of 14.4%.

• Dublin 2 and Dublin 9 were the districts

with the highest rates of unoccupied

spaces, with Dublin 2 at 17.8% and

Dublin 9 closely following at 17.5%.

• Dublin 15 had the lowest vacancy rate

of all the areas at 6.7%, 0.9 ppts below

the level from the previous year.

• The services sector was the leading

industry in Dublin, occupying just over

half of the total units at 51.9%, and

higher than the national rate of 49.3%.

• Dublin 2, Dublin 8, and Dublin 4 had a

significantly high portion of business

units within the services sector, with

the highest concentration in Dublin 2 at

61.4%, followed by Dublin 8 at 59.2%

and Dublin 4 at 56.9%.

• The retail and wholesale sector

accounted for 19.3% of the total NACE-

occupied units in Dublin. In Dublin 10

and Dublin 22, the percentage was

higher at 31.0% each, compared with

the national rate of 22.0%.

• The health sector constituted 11.6%

of total occupied commercial units in

Dublin, surpassing the national rate

of 9.5%. Dublin 9 had the highest

percentage of the health sector

amongst all the districts with 20.0%,

followed by Dublin 6 and Dublin 7 at

18.7% apiece.

• The financial sector had a share of

5.1% of the total number of occupied

units with a NACE code in Dublin,

which is significantly higher than the

national rate of 2.5%. This reflects the

concentration of financial institutions

in Dublin, particularly around the IFSC.

Amongst all the districts in Dublin,

Dublin 8 recorded the highest share of

the financial sector at 12.9%, followed

by Dublin 4 at 10.6%.

• The numbers of commercial occupied

units in the industry, construction,

education, and public administration

sectors were lower in Dublin than they

were nationally.

Figure 8: Vacancy Rates by Dublin district, Q2 2024

Source: GeoDirectory Database

Table 8: NACE – Percentage Breakdown by Dublin district, Q2 2024

% % % % % % % % % %

DUBLIN 35,626 13.1 13.3 51.9 19.3 11.6 2.7 3.9 3.8 5.1 1.7

DUBLIN 2 6,210 16.7 17. 8 61.4 11.3 6.5 1.5 1. 7 2.9 12.8 1. 8

DUBLIN 9 1,380 18.3 1 7. 5 48.3 1 7. 0 20.0 2.6 2.4 3.9 4.6 1.2

DUBLIN 8 2,000 1 7. 0 1 7. 3 59.2 15.0 12.1 1. 8 3.2 3.5 2.8 2.4

DUBLIN 3 949 14.5 14.7 54.4 20.6 11. 8 2.6 2.3 3.0 3.7 1. 6

DUBLIN 17 612 13.8 13.4 42.6 23.2 12.9 3.6 8.0 4.0 2.1 3.6

DUBLIN 14 1,137 13.4 13.1 50.2 20.7 15.9 1. 9 2.3 3.3 5.0 0.8

DUBLIN 12 2,676 13.0 13.1 44.0 29.0 5.5 5.1 10.4 2.4 2.6 1.0

DUBLIN 13 796 12.7 12.8 48.3 19.5 12.9 3.9 5.9 6.3 1.5 1.7

DUBLIN 1 2,970 12.2 12.8 56.6 19.1 9.0 0.5 1.7 4.5 6.8 1.8

DUBLIN 4 1,500 11.9 12.7 56.9 10.0 11.7 1.9 2.9 3.6 10.6 2.4

DUBLIN 6W 520 13.1 12.5 54.8 21.8 11.8 1. 5 1.5 4.8 3.4 0.4

DUBLIN 11 1,720 11.0 12.3 43.4 27.7 8.4 5.3 9.1 3.5 1. 4 1. 2

DUBLIN 6 1,049 13.4 12.3 54.8 15.5 18.7 1. 8 1. 0 3.8 3.8 0.6

DUBLIN 10 462 11. 4 12.2 41.0 31.0 11.1 2.2 7. 5 3.6 1. 7 1. 9

DUBLIN 24 2,146 11. 6 12.1 43.1 25.4 12.2 4.3 6.1 4.9 2.2 1.9

DUBLIN 18 1,582 11.6 12.1 52.6 13.5 14.4 2.5 3.8 3.6 8.0 1.6

DUBLIN 22 1,485 11. 6 11.4 44.2 31.0 9.9 3.5 6.3 2.0 2.2 1. 1

DUBLIN 7 1,854 11.9 11. 3 54.8 11.1 18.7 1.2 1. 5 4.3 5.2 3.3

DUBLIN 5 714 10.5 10.6 51.0 20.6 15.5 0.5 0.9 7. 5 1. 9 2.0

DUBLIN 20 205 9.3 8.5 49.2 16.9 18.6 1. 7 4.0 7. 3 0.6 1. 7

DUBLIN 16 638 7. 6 6.7 47.4 24.6 14.0 1. 4 2.7 7. 4 2.1 0.4

DUBLIN 15 2,087 6.9 6.7 47.1 20.5 14.5 4.0 5.1 4.4 3.1 1. 3

NATIONAL 154,217 14.1 14.4 49.3 22.0 9.5 4.8 5.0 4.6 2.5 2.2

Source: GeoDirectory Database

DUBLIN 2

DUBLIN 9

DUBLIN 8

DUBLIN 3

DUBLIN 17

DUBLIN 14

DUBLIN 12

DUBLIN 13

DUBLIN 1

DUBLIN 4

DUBLIN 6W

DUBLIN 11

DUBLIN 6

DUBLIN 10

DUBLIN 24

DUBLIN 18

DUBLIN 22

DUBLIN 7

DUBLIN 5

DUBLIN 20

DUBLIN 16

DUBLIN 15

17.8%

17.5%

17.3%

14.7%

13.4%

13.1%

13.1%

12.8%

12.8%

12.7%

12.5%

12.3%

12.3%

12.2%

12.1%

12.1%

11.4%

11.3%

10.6%

8.5%

6.7%

6.7%

0% 5% 10% 20%15%

Vacancy Rate

Q2 2024

Vacancy Rate

Q2 2023

Occupied units

with NACE Code

Services

Retail and

Wholesale

Health

Construction

Industry

Education

Public Admin

Financial

P13

GeoDirectory Commercial Buildings Report Q2 2024

Munster

In the second quarter of

2024, there were 8,448 vacant

commercial units in Munster,

and the vacancy rate increased

to 14.0%, the second lowest

amongst the four provinces,

behind Leinster. Although

Munster’s vacancy rate was

0.4 ppts below the national

vacancy rate, it increased by 0.1

ppts compared with Q2 2023.

• Within the Munster province, Co.

Limerick had the highest vacancy rate

of 17.5% (+0.6 ppts), and with Co.

Clare following at 15.5% (-0.2 ppts).

• Co. Cork had the lowest vacancy rate

of 12.4%, although rising by 0.1 ppts

compared to Q2 2024.

• In the province’s sampled towns,

Shannon, Co. Clare (29.8%)

and Newcastle West, Co.

Limerick (24.9%) had the highest

vacancy rates.

• The services sector accounted for

49.5% of occupied units in Munster,

whilst retail and wholesale accounted

for 22.1%.

• The services sector occupied over

half of the units in counties Clare,

Kerry, and Waterford, with Tramore,

Co. Waterford, and Killarney, Co.

Kerry having the highest proportions

of occupied units in the sector at

59.9% and 58.4%, respectively.

• Health occupied 9.6% of the total

NACE occupied units, followed by

industry at 5.0%. Midleton, Co.

Cork had the highest proportion of

properties classified in the health

sector at 17.4%, followed by

Carrigaline, Co. Cork at 17.3%.

• Of the sampled towns, Carrigaline,

Co. Cork, and Shannon, Co. Clare had

the highest shares of occupied units

allocated to the industry at 4.5% and

4.2% respectively.

• The remaining sectors, including

construction, education, financial,

and public administration, each had

shares of less than 5.0% in Munster.

Figure 9: Vacancy Rates by Town – Munster Q2 2024

Source: GeoDirectory Database

Table 9: NACE – Percentage Breakdown by Town – Munster Q2 2024

% % % % % % % % % %

MUNSTER 44,638 13.9 14.0 49.5 22.1 9.6 4.8 5.0 4.8 1.8 2.5

CO. CLARE 4,711 15.7 15.5 52.0 21.1 7. 3 5.4 5.5 4.5 1.5 2.7

ENNIS 1,102 18.7 18.5 45.8 29.3 11. 3 1. 9 3.9 3.1 1. 9 2.7

KILRUSH 185 24.5 24.5 41.6 32.4 15.1 0.5 2.2 1. 6 1. 6 4.9

SHANNON 167 29.4 29.8 50.3 18.0 10.8 1. 2 4.2 7. 2 4.2 4.2

CO. CORK 17,499 12.3 12.4 48.0 21.5 11.1 5.1 5.4 4.8 2.0 2.2

CARRIGALINE 312 7. 5 7. 2 45.2 19.6 1 7. 3 4.5 4.5 4.5 2.9 1. 6

COBH 182 1 7. 4 19.2 56.6 22.0 10.4 1. 6 0.5 4.4 2.2 2.2

CORK 4,848 13.3 13.6 50.2 19.2 16.0 2.8 2.9 4.3 2.8 1. 7

MALLOW 342 1 7. 0 17. 1 51.5 24.0 11. 4 2.0 2.3 2.9 3.2 2.6

MIDLETON 386 13.8 15.6 46.1 24.9 1 7. 4 1. 0 2.1 4.1 2.8 1. 6

YOUGHAL 251 19.8 18.5 50.6 23.1 13.1 1.6 2.4 4.0 1. 6 3.6

CO. KERRY 5,959 12.2 12.5 53.7 22.4 8.4 3.5 3.8 4.2 1.3 2.7

KILLARNEY 822 12.6 11.5 58.4 21.9 12.0 0.9 0.9 2.2 1. 9 1.8

LISTOWEL 235 19.2 20.2 46.4 27.2 15.3 0.9 1.7 3.4 3.0 2.1

TRALEE 779 18.0 18.8 53.0 23.4 12.5 1. 9 1. 9 1. 8 2.3 3.2

CO. LIMERICK 6,482 16.9 17. 5 47.6 23.2 10.1 5.0 4.9 4.7 2.2 2.3

ABBEYFEALE 164 22.1 20.8 48.2 31.1 9.8 1. 2 0.6 4.3 1. 8 3.0

LIMERICK 3,045 19.4 19.9 48.2 23.7 13.4 2.5 3.6 3.6 3.0 1. 9

NEWCASTLE WEST 229 21.6 24.9 46.3 32.3 8.3 1. 3 3.9 1. 7 3.5 2.6

CO. TIPPERARY 5,948 14.7 14.6 48.6 23.6 8.0 4.6 5.1 5.4 1.6 3.0

CLONMEL 732 18.6 18.6 48.0 28.0 11.1 2.0 2.0 4.2 1. 2 3.4

NENAGH 448 15.2 14.1 44.6 27.9 11.2 0.4 2.5 4.9 4.0 4.5

THURLES 422 18.0 17. 3 48.6 24.2 13.7 1.4 2.1 4.3 2.8 2.8

CO. WATERFORD 4,039 14.6 14.5 51.0 21.2 8.7 4.5 4.9 5.2 1.8 2.7

DUNGARVAN 431 15.0 15.0 49.0 24.8 8.6 3.9 3.7 4.2 2.3 3.5

TRAMORE 222 11.5 11.3 59.9 1 7. 6 10.8 1. 8 0.9 4.5 2.3 2.3

WATERFORD 1,753 17. 9 1 7. 8 50.0 23.9 11. 0 3.4 3.6 3.8 2.3 2.1

NATIONAL 154,217 14.1 14.4 49.3 22.0 9.5 4.8 5.0 4.6 2.5 2.2

Source: GeoDirectory Database

*Note: Percentage point changes may not add up exactly due to the rounding of values.

30% 0% 5% 15% 20%

SHANNON

NEWCASTLE WEST

KILRUSH

ABBEYFEALE

LISTOWEL

LIMERICK

COBH

TRALEE

CLONMEL

ENNIS

YOUGHAL

WATERFORD

THURLES

MALLOW

MIDLETON

DUNGARVAN

NENAGH

CORK CITY

KILLARNEY

TRAMORE

CARRIGALINE

29.8%

24.9%

24.5%

20.8%

20.2%

19.9%

19.2%

18.8%

18.6%

18.5%

18.5%

17.8%

17.3%

17.1%

15.6%

15.0%

14.1%

13.6%

11.5%

11.3%

7.2%

10% 25%

Vacancy Rate

Q2 2024

Vacancy Rate

Q2 2023

Occupied units

with NACE Code

Services

Retail and

Wholesale

Health

Construction

Industry

Education

Public Admin

Financial

P14

GeoDirectory Commercial Buildings Report Q2 2024

Ulster

The vacancy rate for Ulster

in Q2 2024 was 16.7%, which

is an increase of 1.0 ppt from

the previous year. Ulster’s

vacancy rate was 2.3 ppts

higher than the national

commercial vacancy rate.

• Co. Donegal had the highest

vacancy rate in Ulster, at 19.4%.

This is an increase of 1.5 ppts

compared with Q2 2023.

• The vacancy rate in Co. Cavan

decreased by 0.1 ppts to 12.5%. Co.

Monaghan’s vacancy rate increased

by 0.6 ppts to 14.6%.

• Ballybofey, a town in Co. Donegal,

had the highest vacancy rate at

33.6%, followed by Letterkenny

(26.6%) and Castleblayney (23.9%).

On the other hand, Bundoran

(13.4%) and Bailieborough (14.4%)

had the lowest vacancy rates

in Ulster.

• Services accounted for nearly half

(47.7%) of the total occupied units

in Ulster. The highest share of this

was in Bundoran (76.4%), followed

by Donegal town (53.0%), Buncrana

(52.3%), Letterkenny (51.6%), and

Ballybofey (51.4%).

• The share of construction

businesses in commercial units in

Ulster was 6.2%, which was higher

than the national rate of 4.8%.

• Retail and wholesale constituted

23.5% of commercial address

points in Ulster, which is 1.5 ppts

above the national rate.

• Industry stood at 6.7%, 1.7 ppts

higher than the national rate.

• Health accounted for just 7.3% of

occupied commercial units in Ulster,

which is the lowest among the four

provinces. Cavan town had the

highest share of health services,

at 14.2%, followed by Monaghan

town at 12.8%.

• Education, financial, and public

administration sectors each had

shares of less than 5% in Ulster.

Figure 10: Vacancy Rates by Town – Ulster Q2 2024

Source: GeoDirectory Database

Table 10: NACE – Percentage Breakdown by Town – Ulster Q2 2024

% % % % % % % % % %

ULSTER 11,999 15.7 16.7 47.7 23.5 7. 3 6.2 6.7 4.6 1.4 2.6

CO. CAVAN 3,054 12.6 12.5 46.0 25.1 7. 4 7. 6 6.4 3.8 1.4 2.2

BAILIEBOROUGH 143 19.4 14.4 49.0 25.2 11. 2 4.9 1. 4 2.1 1. 4 4.9

CAVAN 515 16.4 16.9 46.4 25.6 14.2 1. 7 2.3 2.5 4.5 2.7

COOTEHILL 129 23.2 22.2 49.6 28.7 8.5 0.8 3.9 5.4 0.8 2.3

CO. DONEGAL 6,214 1 7. 9 19.4 50.9 22.5 7. 5 3.8 5.5 5.4 1.5 3.0

BALLYBOFEY 148 29.9 33.6 51.4 27.7 8.1 3.4 1. 4 1.4 4.7 2.0

BUNCRANA 256 13.9 14.7 52.3 23.0 5.9 3.9 2.7 5.9 3.5 2.7

BUNDORAN

199 12.2 13.4 76.4 13.6 3.5 1. 0 0.0 4.0 0.5 1. 0

DONEGAL

253 18.7 20.4 53.0 27.7 8.7 1. 2 1.2 3.2 3.2 2.0

LETTERKENNY 670 24.0 26.6% 51.6 24.2 11. 5 1. 3 1. 2 4.5 3.1 2.5

CO. MONAGHAN 2,731 14.0 14.6 42.3 24.2 6.7 9.8 9.7 3.8 1.3 2.1

CARRICKMACROSS 279 13.4 19.1 44.4 28.7 9.7 5.0 3.9 3.9 2.2 2.2

CASTLEBLAYNEY 204 24.9 23.9 47.1 29.4 10.3 2.5 3.4 2.9 2.0 2.5

MONAGHAN 423 21.9 20.7 46.1 25.3 12.8 1.9 4.0 2.8 3.5 3.5

NATIONAL 154,217 14.1 14.4 49.3 22.0 9.5 4.8 5.0 4.6 2.5 2.2

Source: GeoDirectory Database

BALLYBOFEY

LETTERKENNY

CASTLEBLAYNEY

COOTEHILL

MONAGHAN

DONEGAL

CARRICKMACROSS

C AVA N

BUNCRANA

BAILIEBOROUGH

BUNDORAN

35%30%

0%

5% 15%

20%

10%

25%

33.6%

26.6%

23.9%

22.2%

20.7%

20.4%

19.1%

16.9%

14.7%

14.4%

13.4%

Vacancy Rate

Q2 2024

Vacancy Rate

Q2 2023

Occupied units

with NACE Code

Services

Retail and

Wholesale

Health

Construction

Industry

Education

Public Admin

Financial

Aimsigh 2.3 milliún

deiseanna gnó ag

www.geodirectory.ie

Tabhair cuairt ar www.geodirectory.ie nó glaoigh ar: 01‑705 7005

Déan

ceangal

Dírigh ar

Spriocanna

Gearr

Costais

P15

GeoDirectory Commercial Buildings Report Q2 2024

Appendix A: Classifications

NACE Rev. 2 is the statistical

classification of economic

activities, an acronym for

General Industrial Classification

of Economic Activities within

the European Communities.

Broad Structure of NACE Rev. 2

SECTION A Agriculture, forestry and fishing

SECTION B Mining and quarrying

SECTION C Manufacturing

SECTION D Electricity, gas, steam and air conditioning supply

SECTION E Water supply; sewerage, waste management and remediation

SECTION F Construction

SECTION G Wholesale and retail trade; repair of motor vehicles and motorcycles

SECTION H Transportation and storage

SECTION I Accommodation and food service activities

SECTION J Information and communication

SECTION K Financial and insurance activities

SECTION L Real estate activities

SECTION M Professional, scientific and technical activities

SECTION N Administrative and support service activities

SECTION O Public administration and defence; compulsory social security

SECTION P Education

SECTION Q Human health and social work activities

SECTION R Arts, entertainment and recreation

SECTION S Other service activities

SECTION U Activities of extraterritorial organisations and bodies

The grouping of Economic Activities used for the purposes of this publication is

based on the following:

1.

Industry (B, C, D, E)

2.

Financial and Insurance (K)

3.

Service (H, I, J, L, M, N, R, S)

4.

Construction (F)

5.

Retail and Wholesale (G)

6.

Education (P)

7.

Public Administration and Defence; Compulsory and Social Security (O)

8.

Human Health and Social Work Activities (Q)

Section A (Agriculture) and Section U (Embassies) are not considered in our analysis

of commercial units.

P16

GeoDirectory Commercial Buildings Report Q2 2024

About this report

The report, published on a

bi‑annual basis, relies solely on

the GeoDirectory database of

commercial address points for

its information.

The database distinguishes between ‘an address point’ which is a unit as opposed to

a ‘building’ which can comprise one or more units. The term ‘address point’ is used in

this report as a proxy for each unit.

The GeoDirectory dataset contains a range of variables on commercial address points,

including the following:

• Address Point for each unit

• Vacancy/Derelict

• Under Construction

• Address Points by Town and County

• Type of business operating in unit, according to NACE code classifications.

The GeoDirectory database codes commercial address points by economic activity

(i.e., NACE Codes). NACE codes are a statistical classification of economic activities

used within the European communities.

Figures presented in this report are subject to rounding. Percentage point changes,

which show the actual mathematical change, are also subject to rounding.

For the purposes of this publication, all non-residential address points are classified

as commercial address points, implying a very broad definition for the commercial

property sector in Ireland. It essentially comprises of all building units excluding

residential units. Also excluded are units classified as Agriculture, Forestry and Fishing

and Extraterritorial Organisations and Bodies (e.g., Embassies).

The database also contains information on vacancies, providing the first

all-encompassing national database of vacant commercial buildings.

As the GeoDirectory dataset improves and expands overtime, it will be possible to

provide further information on the commercial building sector.

GeoDirectory

GeoDirectory was jointly

established by An Post and Tailte

Éireann to create and manage

Ireland’s only complete database

of commercial and residential

buildings.

The figures are recorded through a combination of the An Post network of 5,600

delivery staff working with Tailte Éireann.

Each of the over 2.1 million residential building records and the over 210,000

commercial building records contained in GeoDirectory includes:

• An accurate standardised postal address;

• Usage details for each building (commercial or residential);

• A unique 8-digit identity number or fingerprint; and

• x, y coordinates which accurately locate the centre point of each building to within

one metre on the National Grid.

The GeoDirectory database is used by many different companies and organisations

across a diverse range of applications, including the emergency services, utility

companies, banking and insurance providers, and all local authorities.

EY Economic Advisory

EY Economic Advisory provides

first class economic research

and advice to both public and

private sector clients.

It is a leading economic consultancy with a strong record of research across many

areas and sectors, including real estate, housing and construction. EY staff have

accumulated considerable experience in working with a range of private and public

sector clients, including Government departments, local authorities and other public

sector agencies. Their firm is renowned for presenting their analysis in a jargon free

and succinct manner to both public and private sector clients.

Connect to data intelligence for targeted growth

W

www.geodirectory.ie

@GeoDirectory.ie

@GeoDirectory_ie

geodirectory

Find locations faster with the free GeoFindIt App