2

nd

CMDF Certificate in Quantitative Finance (CQF) Scholarship

Program

Budsara Trithipcharoenchai, Senior Executive Vice President, Thailand Capital Market Development Fund

10

th

August 2022

Introduction

To provide knowledge

regarding the Thai financial

market, investment, capital

market development, and

financial literacy to the public,

investors, citizens, and

related agencies or

organizations.

To promote the development

of organizations and

infrastructures related to the

Thai capital market, as well

as to increase the capital

market’s competitiveness on

national and international

scales.

To promote the development

of human resources for the

capital market industry or the

capital market supervision.

To support higher education,

research, and training in the

fields beneficial to the Thai

capital market.

Thailand Capital Market Development Fund (CMDF)

2

As a grant-giving organization, CMDF aims to promote the development of the Thailand capital market, with 4 statutory objectives:

1 2 3 4

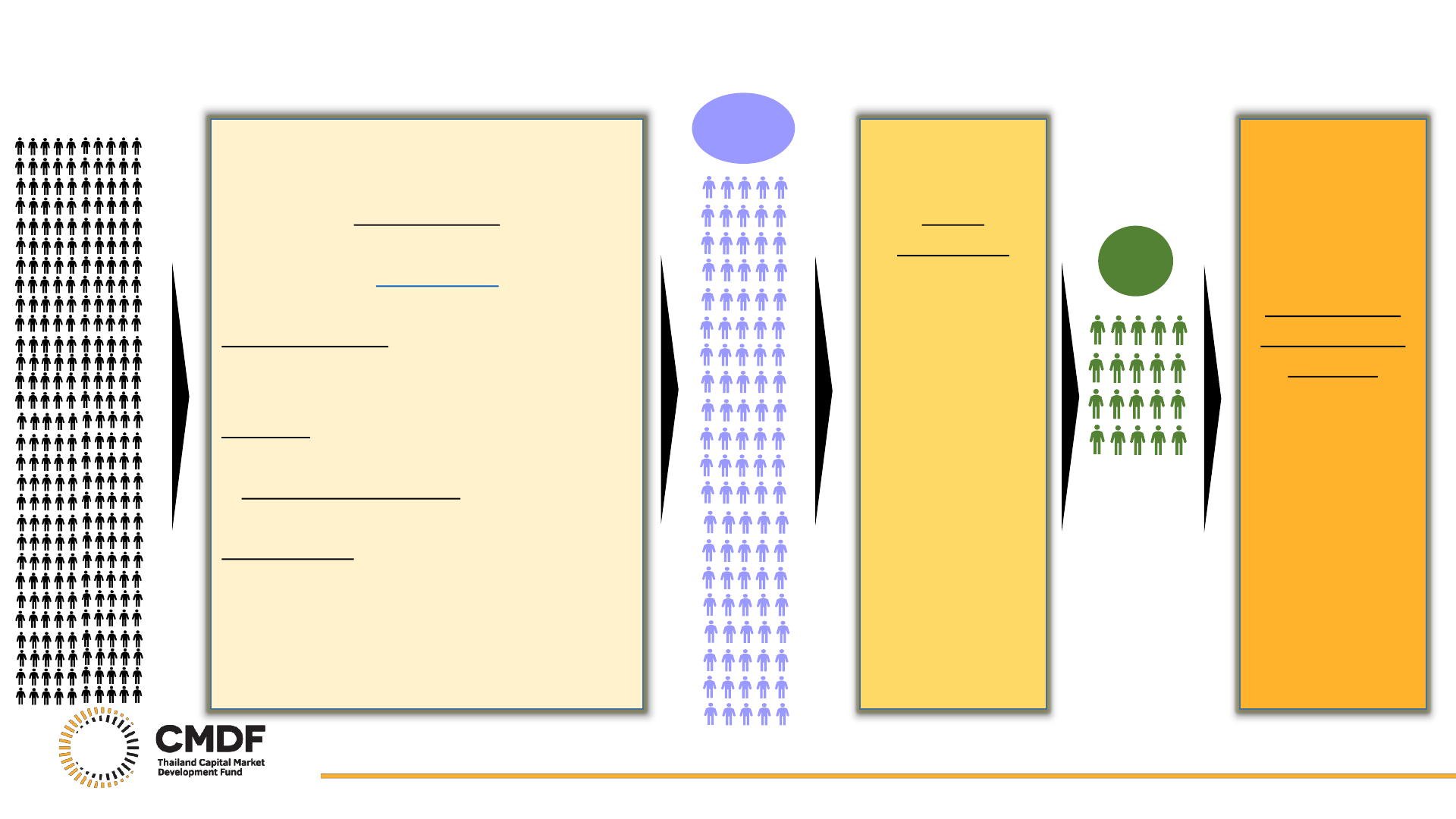

About the CMDF Scholarship Program

3

Objective:

Enhancing Quantitative Finance skills to strengthen the Thai Capital Markets.

Pilot Programs:

We have given scholarships to fundamental finance & Sustainability certification programs

Finance

Sustainability

1

st

CMDF CQF Scholarship Program

2

nd

CMDF CQF Scholarship Program

▪ Prioritizing AM & Securities Co. Professionals

▪ 40 Candidates for Math and Programming Review

(Class & Exam)

▪ 20 Scholarships

▪ Open For All

▪ 100 Candidates for Math & Python Examination

▪ 20 Scholarships

Previously...

Now…

Condition for 20

CQF Scholarship

Recipients

▪ Must participate

in CMDF's

survey for

research

purposes.

20 CQF

Scholarships

▪ 100 Applicants

for Scholarship

Exam

▪ Awarded to Top

20 candidates

with

Examination

minimum score

of 60% by

ranking**

Selection Criteria

Interest applicants need to register for the program

at (www.cmdf.or.th)

Limit only 100 applicants

Eligible candidates:

1. Thai Nationality

Approach:

1. Open to all and limit only 100 applicants on a

first-come-first-served basis

Application Fee: THB 400

AIMC* (assigned by CMDF) will manage all process

(registration, fee collection and examination)

20 CQF Scholarships

4

Applicants

100

20

* AIMC = Association of Investment Management Companies

** In case of a tie, the scholarship

will be awarded by Lucky draw.

Application Process and Timeline

5

Registration Period*

(www.cmdf.or.th)

The application fee : THB 400

Registration opens at 9 a.m.

1

TIMELINE

15

th

– 31

th

Aug 2022

** Mathematic and Python

Programing

100 Eligible Applicants

Announcement

(www.cmdf.or.th)

Scholarship Examination**

Exam Location : Sasin

Graduate Institute of

Business Administration

CQF Preparation: Primer

Courses

CQF Program

2

3

4

5

1

th

Oct 2022

9 a.m. – 12 p.m.

Mid Nov to

Early Dec 2022

24

th

Jan 2023

5

th

Sep 2022

6

19

th

Oct 2022

20 Scholarship Recipients

Announcement

(www.cmdf.or.th)

* Registration will be closed

once the 100 candidate quota is

filled.

7

Delivered By

CQF Executive Summary for

Thailand Capital Market

Development Fund

10

th

of August 2022

Prepared by:

Randeep Gug, PhD, CQF – Managing Director, CQF

Christian Figorito – Senior Director, CQF

Karl Viscayno – APAC Institutional Relations, CQF

1

The Thailand Capital Market Development Fund (CMDF) is looking to develop & promote quant finance expertise across Thailand’s

Capital Market industry. Through a comprehensive syllabus and a unique balance of theory and practice, the CQF have been helping

many organizations develop incoming talent and upskill existing employees in order to bring current, essential quantitative finance,

data science and machine learning techniques within their teams.

The unparalleled flexibility of the program ensures that employees gain cutting-edge skills while being able to continue to work and

allows up to three years to complete the qualification.

Executive Summary

www.cqf.com

Learn practical techniques from

a globally renowned faculty and

apply them the moment you

return to your desk.

IMPACT

Over 8,000 professionals in 90+

countries have chosen the CQF.

CQF alumni lead the industry at

the forefront of quant finance.

EXPERTISE

The world’s largest quantitative

finance certification program.

Over 19 years of experience in

training finance professionals.

TRUSTED

22

About the CQF

World’s largest professional qualification for quantitative finance

8,000+ Alumni globally in over 90 countries

Masters-level education delivered online, over 6 months

2 Cohorts every year - January and June

Full flexibility, allowing up to 3 years to complete (6 cohorts)

Cutting-edge, practical quant finance and data science skills

Practical exams and final project to ensure mastery can be applied

Flexible learning, with unparalleled faculty support

Delivered by world-renowned practitioners, led by

Dr. Paul Wilmott

Awarded by the CQF Institute, part of Fitch Learning

Trusted by hundreds of repeat sponsoring clients

Helping people master

quant finance for

20 Years

www.cqf.com

3

Some of our Clients & Sponsoring Institutions

www.cqf.com

4

Name

Position

Location

Siam East Solutions

Chief Financial Officer

Thailand

TMBThanachart

Bank

Head of Integrated Risk Management

Thailand

Morgan Stanley

Executive Director,

Global Lead Surveillance

Tuning Analytics

Japan

UBS

Chief Risk Officer

Japan

Nikko Asset

Management

Vice President, Market Risk Team

Japan

RBS

Vice President, Currencies

Australia

Citi

Vice President, Valuation Control & Analytics

Australia

National Australia Bank

Head of FX e

-Trading

Australia

Manulife

Vice President & Chief Product Officer

Hong Kong

DBS Bank

SVP of Wealth Management Solutions

Hong Kong

Name

Position

Location

Crédit Agricole CIB

Managing Director

Hong Kong

ING Wholesale Banking

Director, Market Risk Management & Product

Control

Singapore

HSBC

Managing Director

- Chief Compliance Officer

Singapore

GE Capital

Risk Strategy Leader

Singapore

UOB Bank

Head of Quantitative Analytics, Global

Markets

Singapore

Julius Baer

Head Markets Risk and Product Control Asia

Singapore

Standard Chartered

Head, Financial Engineering Credit Risk

Singapore

Barclays

Senior Vice President, Internal Audit

India

Credit Suisse

Director, Head of EMEA & Swiss Product

Control Analytics, India

India

JP Morgan

VP, Model Governance Group Equities

India

Some of the CQF Alumni in the Financial Sector, in APAC

www.cqf.com

The CQF program has been used throughout the financial sector and the APAC region to help upskill employees from a number of organisations.

Many CQF alumni progress to take up significant leadership positions.

Below shows a small selection of current positions taken by CQF alumni within the Financial Sector, in APAC

5

The core program consists of:

Six core modules

Two advanced electives

Three exams

One final project

The Library consists of:

900+ hours of lectures

100+ hours of masterclasses

70+ hours of C++ tuition

The latest CQF curriculum

Optional primers:

Mathematics

Python Programming

Finance

CQF Program Overview: Three Phases

www.cqf.com

Made up of six modules, two

chosen advanced electives, three

exams and a final project. Each

exam is a practical assessment of

knowledge and skills.

Available at no extra cost to alumni

can keep pace with the latest quant

finance skills with permanent

access to our Lifelong Learning

library.

Delegates prepare for their first

lectures through our unique

Python Programming,

Mathematics and Finance Primers.

The CQF program can be split into the following three phases:

Preparation CQF Qualification

Lifelong Learning

6

Mathematics Primer

Teaches you how to program in

Python from the beginning:

Python syntax

Standard mathematical functions

SciPy and NumPy libraries

Good programming practices

Documenting code and debugging

Introduces key concepts and

asset classes:

Macroeconomics

Capital markets fundamentals

Introduction to money markets

Time value of money

Introduction to financial assets

Covers the mathematical

preliminaries needed for quant

finance:

Calculus

Differential equations

Linear algebra

Probability

Statistics

Preparation: Primers

www.cqf.com

The Python Programming Primer is ideal if

you’re new to coding, it assumes no prior

knowledge and will teach you Python from

the beginning.

The Finance primer introduces the key

financial concepts and range of asset

classes that will be discussed in the CQF.

The Mathematics Primer has been

carefully designed to refresh the core

mathematical tools used within

quantitative finance.

Delegates can access primers as soon as their CQF enrolment has been processed.

Python Programming Primer Finance Primer

7

The qualification is made up of six modules and advanced electives. Modules two, three, and four are examined. At the end of

module six, all delegates complete a practical project and apply their theoretical knowledge to real-world problems.

CQF: Modules

www.cqf.com

Module Two

Quantitative Risk and Return

In module two, you will learn about the classical portfolio

theory of Markowitz, the capital asset pricing model, and

the recent developments of these theories. We will

investigate quantitative risk and return, looking at

econometric models such as the ARCH framework and

risk management metrics such as VaR and how they are

used in the industry.

Modern portfolio theory

Capital asset pricing model

Portfolio optimization for portfolio selection

Risk regulation and Basel III

Value at risk and expected shortfall

Collateral and margins

Liquidity asset liability management

Volatility filtering (GARCH Family)

Asset returns: key, empirical stylized facts

Volatility models: The ARCH Framework

Module Three

Equities and Currencies

In module three, we will explore the importance of the

Black-Scholes theory as a theoretical and practical

pricing model, which is built on the principles of delta

heading and no arbitrage. You will learn about the theory

and results in the context of equities and currencies

using different kinds of mathematics to make you

familiar with techniques in current use.

The Black-Scholes Model

Hedging and the Greeks

Options strategies

Early exercise and American options

Finite-difference and methods

Monte Carlo simulations

Exotic options

Volatility arbitrage strategies

Martingale theory for pricing

Girsanov’s theorem

Advanced Greeks

Derivatives market practice

Advanced volatility modeling in complete markets

Non-probabilistic volatility models

Module One

Building Blocks of Quantitative Finance

In module one, we will introduce you to the rules of

applied Itô calculus as a modeling framework. You will

build tools using stochastic calculus and martingale

theory and learn how to use simple stochastic

differential equations and their associated Fokker-

Planck and Kolmogorov equations.

Random behavior of assets

Important mathematical tools and results

Taylor series

Partial differential equations

Transition density functions

Fokker-Planck and Kolmogorov

Stochastic calculus and Itô’s Lemma

Manipulating stochastic differential equations

Martingales

The binomial model for asset prices

8

The qualification is made up of six modules and advanced electives. Modules two, three, and four are examined. At the end of

module six, all delegates complete a practical project and apply their theoretical knowledge to real-world problems.

CQF: Modules (Cont.)

www.cqf.com

Module Five

Data Science and Machine Learning II

In module five, you will learn several more methods used for

machine learning in finance. Starting with unsupervised

learning, deep learning and neural networks, we will move

into natural language processing and reinforcement

learning. You will study the theoretical framework, but

more importantly, analyze practical case studies exploring

how these techniques are used within finance.

Unsupervised learning techniques

K-means clustering

Self-organizing maps

T-distributed stochastic neighbor embedding

Uniform manifold approximation and projection

Autoencoders

Artificial neural networks

Neural network architectures

Natural language processing

Deep learning and NLP tools

Reinforcement learning

Practical machine learning case studies for finance

AI-based Algorithmic Trading strategies

Quantum Computing

Module Six

Fixed Income and Credit

In the first part of module six, we will review the multitude

of interest rate models used within the industry, focusing on

the implementation and limitations of each model. In the

second part, you will learn about credit and how credit risk

models are used in quant finance, including structural,

reduced form, as well as copula models.

Fixed-income products and market practices

Yield, duration, and convexity

Stochastic interest rate models

Probabilistic methods for interest rates

Calibration and data analysis

Heath, Jarrow, and Morton

Libor market model

Structural models

Reduced-form model and the hazard rate

Credit risk and credit derivatives

X-valuation adjustment (CVA, DVA, FVA, MVA)

CDS pricing, market approach

Risk of default, structural and reduced form

Implementation of copula models

Module Four

Data Science and Machine Learning I

In module four, you will be introduced to the latest data

science and machine learning techniques used in finance.

Starting with a comprehensive overview of the topic, you

will learn essential mathematical tools, followed by a deep

dive into supervised learning, including regression methods,

k-nearest neighbors, support vector machines, ensemble

methods, and many more.

What is mathematical modeling?

Math toolbox for machine learning

Principal component analysis

Supervised learning techniques

Linear regression

Penalized regressions: lasso, ridge, and elastic net

Logistic, SoftMax regression

K-nearest neighbors

Naïve bayes classifier

Support vector machines

Decision tress

Ensemble models – bagging and boosting

Python – Scikit learn

9

Advanced Electives

Advanced electives are the final element in qualification.

Delegates select two electives from the extensive choice

below to complete the CQF.

• Advanced Machine Learning

• Advanced Portfolio Management

• Advanced Risk Management

• Advanced Volatility Modelling

• Algorithmic Trading I

• Algorithmic Trading II

• Behavioural Finance for Quants

• C++

• Counterparty Credit Risk Modelling

• Fintech

• Numerical Methods

• R for Quant Finance

• Risk Budgeting : Risk-Based Approaches to Asset Allocation

www.cqf.com

10

Weekly

Delegates receive problem sets and

solutions, further reading and programming

exercises which are recommended but are

not compulsory

Exams

At the end of modules 2, 3 and 4, delegates

are given a compulsory take-home written

examination

Delegates have two weeks to complete

each exam

Final Project

Delegates must complete a project at the

end of Module Six

This is a practical programming project

which is set during the second half of the

course

It is designed to ensure delegates apply

their theoretical knowledge to real-life

problems that they can then take back to

the workplace

Final Examination for Distinction

The final three-hour exam is optional and

takes place in exam centers worldwide

Delegates who score 80% or above receive

a distinction

Extensions

Two extensions are available for the exams

in modules 2, 3 and 4

Program deferral is also available, if

required

Assessment

www.cqf.com

11

Online Learning Resources

CQF Portal – Access to all

study resources, including live

extra help sessions, lecture

notes, and exercises

CQF App – Mobile access

with lecture download for

offline viewing available on

iOS/Android

Learn

2.5 hour interactive, live online lectures twice a week

Lectures start at 6pm UK time (or 12AM BKK Time)

Lectures are streamed live, recorded, and uploaded to the CQF portal within 24 hours

Review

Review of annotated class notes after every lecture

Pre- and post-lecture stimulating exercises

Tutorials – Deeper exploration of key concepts covered in lectures in discussion-based tutorials

Implement

Python Labs – Building the models covered in the lectures in problem-solving labs

Support

Access to full program support every step of the way

Faculty support via email, phone calls, 1-1 Zoom meetings

Private CQF Discussion Forum to exchange ideas with fellow delegates

Learning Methodology

www.cqf.com

12

All textbooks are written by the CQF faculty

www.cqf.com

13

The Lifelong Learning Library

contains over 900 hours of

recorded lectures and

educational content.

Alumni are given permanent

access to the lifelong learning

library allowing them to

continue professional

development for the rest of

their career.

Lifelong Learning for Alumni

Alumni Lectures

Frequent lectures are arranged for CQF Alumni which are recorded and placed on the portal.

The portal also gives delegates access to a full online library of previous classes

Master Classes

Continue to learn and delve deeper into specific subjects with the one or two day CQF’s

Masterclasses

C++ for Quant Finance

Starting with elementary C++, the sessions cover both the principles and practicalities of

producing robust code in a quant finance environment

Latest CQF Program

Access to all the lectures and resources from the most recent completed CQF program

www.cqf.com

14

Immediate ROI

Your employees will be taught by the world's

leading experts

Emphasis on practical application enables

your people to apply their new skills

immediately after each lecture

Increase employee retention and

loyalty

Increase retention of your top and emerging

talent by using the CQF as a rewarding

professional development program

The CQF is a resource proven to keep teams

engaged and competitive, and to reduce

recruitment costs

A proven, cost-effective solution

Hundreds of sponsoring companies globally

rely on the CQF to deliver desk-ready quant

finance skills

Lifelong Learning Library for alumni means no

more expenditures on and time lost to “one-

off” trainings

No downtime

The part-time nature of the CQF means

your people study in their own time, without

an impact on work time

Key Benefits of the CQF

14

www.cqf.com

15

Enrolment

www.cqf.com

The CMDF Scholars will be taking Level 1 in the upcoming January 2023 cohort; then take Level 2 in the June 2023 Cohort

Level 1 includes the Primers + Module 1 – 3; while Level 2 includes Module 4 – 6 and Advance Electives

There are only two (2) cohorts each year, one in January and the other is in June

Each candidate has up to 3 years to complete the qualification, which is a total of 6 cohorts

Upon enrollment, candidates will have access to all learning resources including live online lectures, tutorial, exercises, python

labs, supplementary textbooks, exams (plus re-takes if required), faculty support and access to the portal/app

There are no hidden additional fees once the enrollment fees are fully settled.

16

The Institute is the awarding body for the CQF and a global

membership organization dedicated to educating and connecting the

worldwide quant finance community.

Awarding body for the CQF with Dr. Paul Wilmott as President

Steering committee includes Edward Thorp, Pat Hagan, Conrad Wolfram

Over 20,000 members globally

Annual conferences exploring the latest ideas in quant finance

High-profile speakers: Harry Markowitz, Emanuel Derman, Helyette Geman, Nassim

Taleb

Regular talks from leading practitioners and academics

Educational resources to provide members insights into industry practices

Local Societies and networking opportunities

www.cqf.com

CQF Institute

Wilmott MagazinePodcast

17www.cqf.com

Questions & Answer

Information contained herein is provided “as is” without any representation or warranty of any kind, and Fitch does

not represent or warrant that the presentation or any of its contents will meet any of the requirements of a recipient.

Copyright © 2021 by Fitch Learning, Inc. and its subsidiaries. 33 Whitehall Street, NY, NY 10004. Reproduction or

retransmission in whole or in part is prohibited except by permission. All rights reserved.

DC-5458