May 2022

Information on the

Credit Institution Charges

Approval Process –

Consumer Protection Directorate

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 2

Contents

Introduction ................................................................................................................... 4

The Obligation to Notify the Central Bank of Charges ................................... 4

Exemptions for New Entrants .................................................................................. 5

Contravention of Section 149 ................................................................................. 5

The Cost of Making a Section 149 Notification ................................................. 6

What Firms Section 149 Applies to ....................................................................... 6

Examples of Products to which Section 149 Applies ......................................................... 6

Definition of a Charge................................................................................................. 6

Examples of Charges to which Section 149 Applies ........................................................... 6

Third Party Charges .................................................................................................... 7

Non-credit Institution to Credit Institution ......................................................................... 7

Credit Institution to Credit Institution .................................................................................. 7

Industry Letter .............................................................................................................................. 7

The Notification Process ........................................................................................... 8

1. Pre-notification Phase ........................................................................................................ 8

2. Consideration Phase ........................................................................................................... 9

3. Completion Phase ................................................................................................................ 9

Timelines ......................................................................................................................... 9

The Four Assessment Criteria ............................................................................... 11

The Central Bank’s Section 149 Process and Information Requirements

.......................................................................................................................................... 11

Peer Research/Analysis ........................................................................................................... 11

Switching Research/Analysis.................................................................................................. 12

Customer Usage Patterns ........................................................................................................ 12

Financial Information ................................................................................................................ 12

Sample Commercial Justification .......................................................................................... 14

Sample Supplemental Commercial Justification .............................................................. 15

Pricing Strategy .......................................................................................................................... 17

Letter of Direction ..................................................................................................... 18

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 3

Other Disclosure Obligations ................................................................................................. 18

The Exemption Process ............................................................................................ 19

Contact .......................................................................................................................... 19

Section 149 Process Flow Chart ........................................................................... 20

Section 149 Notification Checklist ...................................................................... 21

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 4

Introduction

The purpose of this document is to assist credit institutions as defined in section 2 of the

Consumer Credit Act 1995 (as amended) (the Act) when making a notification under section

149 of the Consumer Credit Act 1995 (section 149 of the Act), by providing information on the

process employed by the Central Bank of Ireland (Central Bank) when assessing these

notifications. This document builds on best practice seen by the Central Bank in the

notifications received from credit institutions to date. It also provides credit institutions with

information on the scope of section 149, together with the timelines and the process employed

by the Central Bank when considering section 149 notifications. This document also seeks to

inform credit institutions about the type of information the Central Bank requires from credit

institutions in order to consider notifications made under section 149.

This document was originally published in 2014 to explain the changes in the Central Bank’s

section 149 process following amendments made to section 149 by the Central Bank

(Supervision and Enforcement) Act 2013 and following on from the Department of Finance’s

Report of the Review of Regulation of Bank Charges in Ireland

1

. This document has now been

amended to include the updated notional activity customer profiles, used by the Central Bank

to assist in assessing section 149 notifications relating to personal current accounts, published

in August 2020. This document was further amended, following the enactment of the Consumer

Protection (Regulation of Retail Credit and Credit Servicing Firms) Act 2022 (the RCF/CSF Act),

to reflect the updated definition of credit institution

2

in section 2 the Act (as amended by the

RCF/CSF Act ).

This document does not constitute legal advice nor does it seek to interpret relevant legislation.

It does not provide guidance on any codes of conduct or legislation that may be applicable to

charges imposed by credit institutions. This document relates to the text of section 149 in place

at the time of publication of this note. Section 149 may be changed over time, so affected credit

institutions should have on-going regard to the legislation in force at the time in question and

seek legal advice on its application to them, where appropriate.

Credit institutions should feel free to contact the Central Bank at section149@centralbank.ie

in respect of any intended notification or any notification which is currently under consideration

by the Central Bank.

The Obligation to Notify the Central Bank of Charges

Under section 149, credit institutions must notify the Central Bank if they wish to introduce any

new customer charges or increase any existing customer charges in respect of certain services.

There is also a facility in section 149 for the Central Bank to grant an exemption from the

obligation to make a notification under section 149 for individually negotiated charges. It is the

responsibility of each credit institution to determine whether a charge is to be notified to the

1

The Report can be accessed at

http://www.finance.gov.ie/sites/default/files/Review%20of%20the%20Regulation%2

0of%20Bank%20Charges%20in%20Ireland%20v8.pdf.

2

The updated definition of a credit institution in section 2 of the Act (as amended by the

RCs/CSFs Act) includes a retail credit firm authorised under the Act of 1997.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 5

Central Bank under section 149. If, having sought the necessary legal advice a credit institution

determines notification is required, a notification (or in an appropriate case, an application for

an exemption) must be submitted to the Central Bank.

It should be noted that section 149 applies to relevant charges to all customers, not just retail

consumers. Therefore, as well as personal consumer charges it also applies to charges to

business customers such as large corporate customers and SMEs.

Exemptions for New Entrants

Following the Central Bank (Supervision and Enforcement) Act 2013 relevant new credit

institutions establishing business in the State after 1 August 2013 are not subject to section 149

(1) and are not required to notify the Central Bank of charges imposed for their services for a

period of 3 years after the credit institution commences business in the State.

A ‘relevant new credit institution’ is a credit institution which commences business in the State

after 1 August 2013

3

. It does not refer to a credit institution which, at the time it commences

business in the State, is a related undertaking

4

of another credit institution carrying on business

as a credit institution in the State.

Before the end of the 3 year exemption period, a credit institution must notify the Central Bank

of all the charges imposed during that period and of any charges which it plans to impose or

increase after the 3 year exemption period. This notification should be submitted in sufficient

time such that the Central Bank may fully consider and issue a decision on the notification

immediately after the end of the 3 year exemption period. This notification will be considered to

be a notification made under subsection 1 of section 149 and will be subject to the statutory

timelines as set out in section 149 (and described below). A relevant new credit institution may

continue to impose these charges while the Central Bank is considering its notification.

However, if on foot of the notification, the Central Bank issues a direction to refrain from

imposing the charge (or from imposing it at a given level or in a specified circumstance) or to

publish information on the charge, the credit institution must comply with this direction.

Contravention of Section 149

Under section 12 of the Act, it is an offence for a person to impose a charge that has not been

previously notified to the Central Bank as required by section 149 (1) of the Act.

Also, the Central Bank has the power to administer sanctions in relation to a contravention of

section 149 under Part IIIC of the Central Bank Act 1942. This can include fines and other

penalties.

3

The Central Bank (Supervision and Enforcement) Act 2013 came into operation on 1

August 2013.

4

“Related undertaking" is defined in Section 3 of the Central Bank (Supervision and

Enforcement) Act 2013 and includes (amongst other undertakings), where a person is

a company, another company that is related within the meaning of section 140 (5) of

the Companies Act 1990.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 6

The Cost of Making a Section 149 Notification

The Central Bank may request that a notification made under section 149 be accompanied by a

fee, up to a maximum amount of €31,750. This fee is generally not imposed by the Central Bank

except in circumstances where the notification contains a large number of charges or is very

complex in nature. A fee may be imposed for Section 149 notifications and should a fee be

imposed at any stage by the Central Bank, this will be communicated to the credit institution at

the earliest opportunity during the Consideration Phase. Further information on the

Consideration Phase is contained below in The Notification Process.

What Firms Section 149 Applies to

(a) Credit Institutions as defined in the Act and authorised in Ireland; and

(b) European Credit Institutions authorised in another Member State of the European

Economic Area (EEA) and operating in the State either on a branch or a cross-border

basis.

For the purposes of this document, the term credit institution refers to all regulated entities

listed in (a) and (b) above. See below concerning exemptions for new entrants.

Examples of Products to which Section 149 Applies

Credit cards;

Credit/Loan accounts (including mortgage accounts);

Personal current accounts;

Business current accounts;

Commercial products such as letters of credit, guarantees etc.;

Foreign exchange products.

Definition of a Charge

A ‘charge’ includes a penalty or surcharge interest by whichever name called, being an interest

charge imposed in respect of arrears on a credit agreement or a loan. However, it does not

include any rate of interest or any charge, cost or expense levied by a party other than a credit

institution in connection with the provision of a service to the credit institution or the customer

and that is to be discharged by the customer (see Third Party Charges below).

Examples of Charges to which Section 149 Applies

Current account, term loan, overdraft or credit card charges;

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 7

Mortgage charges

5

;

Foreign exchange margins and spreads;

Merchant service charges, e.g. charges imposed on retailers for the acceptance and

processing of credit/debit cards; and

Hire purchase charges.

Third Party Charges

Non-credit Institution to Credit Institution

If a charge is imposed on a credit institution by a non-credit institution and this charge is passed

on to the customer in an unaltered way, this charge is not notifiable to the Central Bank by the

credit institution.

However, the credit institution must satisfy itself that it does not generate any income from the

provision of the particular service in order for the charge to be exempted from notification as a

‘third-party pass on charge’. If the credit institution in question receives any income from the

charge then the full charge is notifiable to the Central Bank under section 149.

Credit Institution to Credit Institution

If a charge for a service (e.g. cash advance fee) is imposed by one credit institution (A) on another

(B) and this charge is in turn passed on to the customer, the charge would be required to be

notified by institution (A) as institution (A) is imposing the charge and institution (B) is simply

passing on the charge.

However credit institution (B) must satisfy itself that it does not generate any income from the

charge for the provision of the particular service in order for the charge to be exempted from

notification by credit institution (B) as a ‘third-party pass on charge’. If credit institution (B)

receives any income from the charge then the charge is notifiable by credit institution (B) to the

Central Bank under section 149.

Industry Letter

Credit institutions should pay particular attention to the industry letter issued by the Central

Bank on 23 October 2019

6

in relation to charging of costs associated with the legal process

including third party costs (the costs) to borrowers in mortgage arrears and charging of interest

on the costs.

5

Mortgage arrears charges e.g. letter issue fee, surcharge interest etc. for customers

who are in the Mortgage Arrears Resolution Process have been prohibited since 1

January 2011 in conjunction with the Code of Conduct on Mortgage Arrears.

6

https://www.centralbank.ie/regulation/consumer-protection/consumer-protection-

codes-regulations#charging-of-costs

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 8

The Notification Process

Each notification received by the Central Bank is assessed according to the criteria set out in

section 149. The Central Bank may request additional information or clarification in respect of

a notification.

A notification is not deemed to be a complete notification made to the Central Bank under

section 149 until the Central Bank is satisfied that sufficient information has been received from

the credit institution in order for the Central Bank to commence considering that notification

under the criteria set out in section 149. Once a complete notification has been received, the

Central Bank will notify the credit institution to this effect.

This document provides general guidance on the information to be submitted, however, credit

institutions may also contact the Central Bank if they have any queries in advance of submitting

a notification.

The notification process itself can be broken down into three distinct phases:

Pre-notification Phase;

Consideration Phase; and

Completion Phase.

Information on the regulatory timelines (referred to as “the clock” in this document) is contained

below in the ‘Timelines’ section and in the ‘Section 149 Notification Process Flow Chart’.

1. Pre-notification Phase

During this phase a credit institution prepares a notification to the Central Bank. At this stage

the credit institution should:

a) seek legal advice on the application of section 149 to the proposed charge(s)

b) refer to this process information document;

c) gather the information relevant to its notification;

d) contact the Section 149 team in the Central Bank for further information on the process,

if required;

e) complete the checklist attached to this information note; and

f) submit a notification to the Central Bank in electronic format only.

The Central Bank will conduct a preliminary assessment of the completeness of the notification

as quickly as possible upon receipt, and in any event within 2 weeks. If it is not considered that a

complete notification has been made, this will be communicated to the credit institution in

writing, stating the further information required by the Central Bank to be provided by the

credit institution for the performance of the Central Bank’s functions. No further consideration

will be given to the notification until the credit institution submits all of the further information

sought, at which point the process will begin again.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 9

2. Consideration Phase

This phase commences once the Central Bank has received sufficient information to commence

its consideration of a notification. This means that the Central Bank is satisfied that it has

received a complete notification and has sufficient information to commence its consideration

of the substance of the notification by reference to the criteria in section 149 (see below).

However, in the course of such consideration the Central Bank may identify that further

information is required to be provided by the credit institution for the performance of the

Central Bank’s functions under section 149, in which case such information will be sought in

writing and the statutory 3 month time period (see timelines below) will stop pending receipt of

all this information. During this phase the Central Bank may also challenge the assumptions

provided by the credit institution as part of its notification and request that further clarifying or

corroborative information be provided.

During this phase therefore the Central Bank will:

a) communicate with the credit institution that a full notification has now been received;

b) carry out analysis of the notification under the criteria in section 149; and

c) revert to the credit institution seeking further information or clarification of information

received, if required.

During this phase the credit institution should reply to any requests from the Central Bank in

relation to the notification.

3. Completion Phase

Once the Central Bank has completed its assessment of the notification against the criteria in

section 149, the Central Bank will direct the credit institution to refrain from imposing a new

charge or changing an existing charge above a certain limit (which may be lower than that

requested by the credit institution in its notification) in relation to the provision of a service to

a customer or group of customers. This letter may also direct the credit institution to publish, in

such manner as may be specified by the Central Bank from time to time, information on any

charge in relation to the provision of a service to a customer or group of customers.

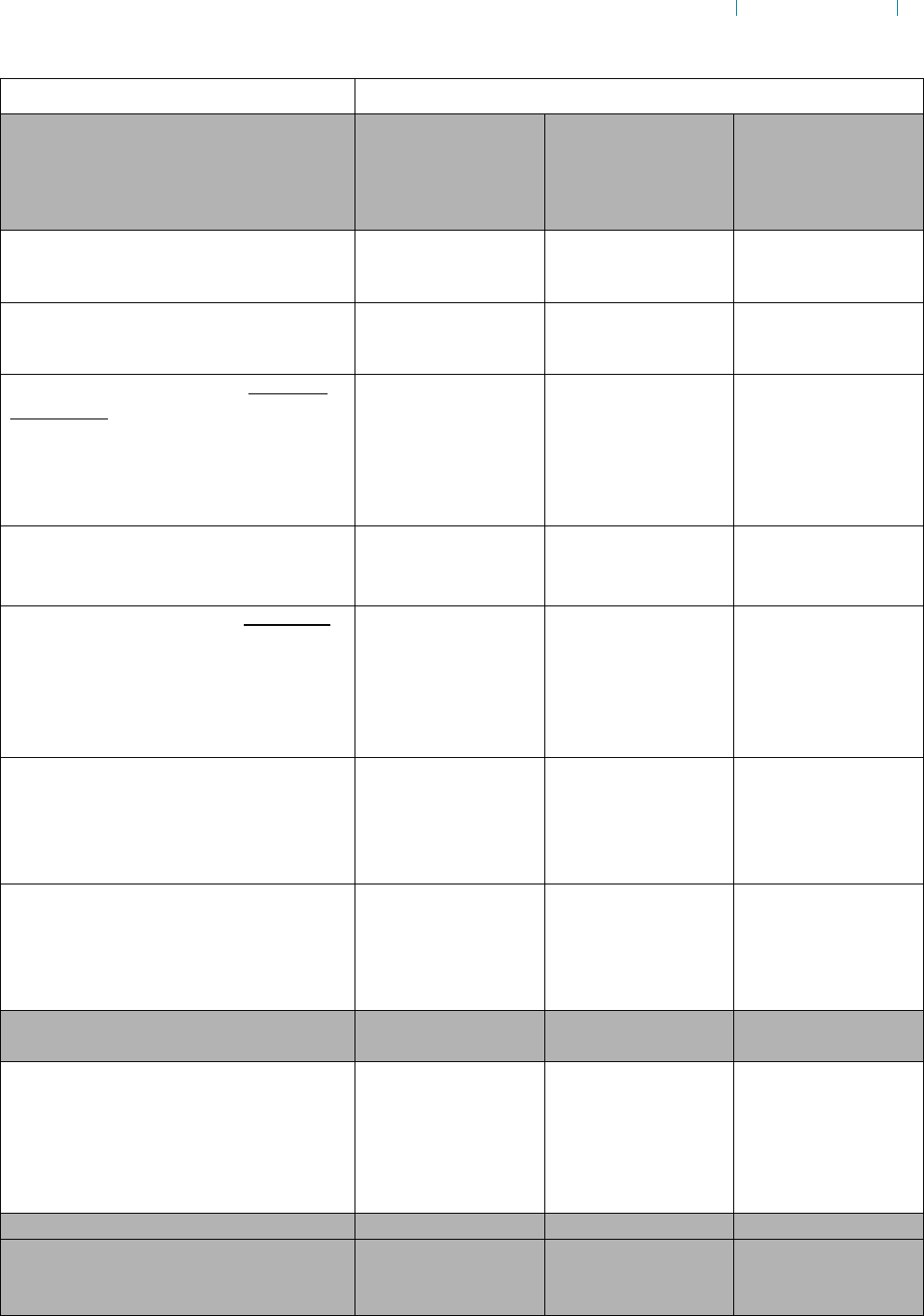

A diagram of the process is available below under Section 149 Process Flow Chart.

Queries may be sent to the Central Bank at section149@centralbank.ie.

Timelines

The Central Bank (Supervision and Enforcement) Act 2013, made changes to the regulatory

timelines applying to new charge notifications and increasing charge notifications. The timeline

for the Central Bank to decide upon notifications for both new and increasing charges is now 3

months. This means that the Central Bank may, within 3 months of receipt of a complete

notification under section 149, direct a credit institution to refrain from imposing or changing a

charge in relation to the provision of a service to a customer or to a group of customers. There

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 10

is no statutory timeline set out for exemptions to be considered by the Central Bank, but the

Central Bank will make every effort to consider exemptions within a reasonable timeframe.

Under section 149 (6A), in calculating the periods of 3 months specified in subsections (5) and

(6), no account shall be taken of any day on which any information required by the Central Bank

to be provided by the credit institution for the performance of the Central Bank’s functions

under section 149 has not yet been so provided. In other words, the 3 month ‘clock’ will stop

running where the Central Bank seeks further information from the credit institution and will

not start running again until all the required information has been received by the Central Bank

(which will be confirmed in writing by the Central Bank).

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 11

The Four Assessment Criteria

Each notification received by the Central Bank is assessed according to the criteria set out in

section 149, and the contents of that particular notification. The criteria set out in section 149

are:

(a) the promotion of fair competition between-

(i) credit institutions; and

(ii) credit institutions carrying on a particular type of banking or financial business;

(b) the statement of commercial justification referred to in subsection 149(2)(b) of the Act;

and

(c) a credit institution passing any costs on to its customers or a group of its customers in

proposing to impose or change any charge, in relation to the provision of a service to a

customer or a group of its customers; and

(d) the effect on customers or a group of customers of any proposal to impose or change any

charge in relation to the provision of such service.

The Central Bank’s Section 149 Process and Information

Requirements

The Central Bank recognises that section 149 covers a number of different charges across a

range of services, so no two notifications will contain the same research/analysis and

information. This information note seeks to cover most types of notifications, however if the

information is not appropriate to a particular notification or is not available, the credit

institution should state this in its notification, giving reasons where relevant. Similarly, if

relevant information or analysis is available to a credit institution and not referred to in this

document, it should be submitted to the Central Bank as part of the notification.

Peer Research/Analysis

Where appropriate, the Central Bank conducts a peer analysis of similar charges in the Irish

market. This is a review of the current charges imposed by credit institutions for similar

products in the market. In addition to this peer analysis, the Central Bank also carries out a

review of the effect on customers of the proposed new charges or charge increases, in order to

assist in its consideration of a notification. This is a review of the proposed charge increases

against available customer profiles as well as a review of the number and type of customers

affected by the notification.

A credit institution should provide the Central Bank with any research/analysis it has

undertaken on the service provided by market competitors. This may take the form of

research/analysis of charges imposed by other credit institutions for a similar service.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 12

Switching Research/Analysis

The Central Bank welcomes competition and customer choice in financial services. A customer’s

ability to switch financial services provider for the provision of a particular service will therefore

be taken into account by the Central Bank in its consideration of a notification under the criteria

in section 149. To this end, any analysis or information the credit institution may have on the

ability and incentives for customers to switch financial services provider for a particular product

should be included in a section 149 notification to the Central Bank.

Customer Usage Patterns

It is recommended that credit institutions include, as part of their notification, analysis or

research that they have carried out on the effect of charge changes on their customers and

groups of customers. Where appropriate, this analysis or research should include:

customer profiles, showing typical usage patterns and the effect of the price changes on

customers. This analysis should show the effect of the proposed charge on customers

under current usage patterns and any anticipated changes to those patterns, given the

behavioural assumptions contained in the notification;

the effect of new charges or changes to existing charges on customers who may be at

risk of being financially excluded; and

customer profiles showing the effect of any charge changes on different groups of

customers.

Financial Information

In its assessment of proposed new charges and charge increases; the Central Bank considers the

commercial justification of the new charges or charge increases submitted by the credit

institution in its notification, which should include:

historic and forecasted profit and loss data;

projected changes in customer behaviour and how this may impact charges in the

future. For example, if a current account notification is proposing to use pricing to

alter customer behaviour, the assumptions underlying this strategy should be

clearly explained in the commercial justification provided by the credit institution;

the cost of providing a product as well as the income earned and any other impact

the changes will have on overall profit, in order to understand the commercial

justification. The Central Bank also looks at the impact the notification will have on

overall profit in order to fully understand the commercial justification. Therefore,

the commercial justification should include all income from the product. For

example, a notification relating to current account charges should include all

projected costs, including overheads, and all projected income, including income

from all the charges associated with the product as well as income from the credit

institution having the use of the funds deposited with it; and

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 13

any other pertinent financial information e.g. data relating to differential or

absolute price changes in line with the credit institution’s pricing strategy.

The tables below illustrate a sample commercial justification as well as supplemental

commercial justification for notifications relating to products which provide multiple services,

such as current accounts. These tables are for illustration purposes only and do not provide a

full list of income and costs. A credit institution should provide all information deemed

necessary for the consideration of a particular notification.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 14

Sample Commercial Justification

Product Name

XXXXXX

Launch of Product to

end of first calendar

year

Second calendar year

Third calendar year

Expected no. of customers:

X

X

X

Expected no. of instances incurred by

customer

X

X

X

Expected income from product (other than

from charges):

1

All other income streams (Please specify):

Examples:

Funds Based Income

Card Interchange

€X

€X

€X

€X

€X

€X

€X

€X

€X

Expected unit income from service (other

than from charges)

€X

€X

€X

Expected income from product per charges:

1

X Charge (value of proposed charge * no of

instances incurred by customer)

Y Charge (value of proposed charge * no of

instances incurred by customer)

€X

€X

€X

€X

€X

€X

Expected fixed costs

(To provide service):

Staff

IT

Etc.

€X

€X

€X

€X

€X

€X

€X

€X

€X

Expected variable costs

(To provide service):

ATM refills

Fraud

Etc.

€X

€X

€X

€X

€X

€X

€X

€X

€X

Expected Total Income from Product:

€X

€X

€X

Expected total Costs

(To provide product):

Staff

IT

Etc.

€X

€X

€X

€X

€X

€X

€X

€X

€X

Expected Total Cost from Product:

€X

€X

€X

Total expected Profit/Loss

€X

€X

€X

1. Alternatively, details of the forecasted Average Margin Earned for this product may be provided.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 15

If the service to which the proposed charges would apply relates to a product with which

different types of transactions can be made, for example personal and business current

accounts, the following information should be provided to the Central Bank in addition to the

information contained in the table above. The purpose of seeking the information in the table

below is to assist the Central Bank in analysing the unit cost and income for providing each

service within a product.

Sample Supplemental Commercial Justification

Product Name

xxxxx

Launch of Product to

end of first calendar

year

Second calendar year

Third calendar year

Expected unit income from service (other

than from charges)

€X

€X

€X

Expected fixed costs

(to provide service):

Staff

IT

Etc.

€X

€X

€X

€X

€X

€X

€X

€X

€X

Expected variable costs

(to provide service):

ATM refills

Fraud

Etc.

€X

€X

€X

€X

€X

€X

€X

€X

€X

Expected unit costs

(to provide service)

Fixed

Variable

Total

€X

€X

€X

€X

€X

€X

€X

€X

€X

Total expected unit Profit/Loss

The Central Bank will consider the costs provided by the credit institution as well as the effect

on customers in terms of the service provided and the charges involved. All relevant information

should be submitted and should include an overview of the service to be provided and the

justification of the cost involved.

Relevant information may include costs incurred by the credit institution when providing a

particular service or any other costs it may be seeking to pass on to customers.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 16

As part of any notification made under Section 149 to the Central Bank, the credit institution

should address at least the following questions:

1

How many customers does this proposal affect? What percentage of the product’s

total number of customers does this number represent?

2

What type(s) of customers would this proposal affect? For example, large corporates,

SMEs, personal customers etc.? Will the proposal affect some customer segments

more than others? If so, what are these effects?

3

What are the projected changes in customer usage patterns resulting from the

proposed charge increases/new charges, should approval be granted? Information

such as customer profiles illustrating changes to customer patterns/behaviours

forecasted for different segments as a result of the notification should also be

included, including any projected savings to the credit institution resulting from

these changing customer behaviours.

5

What customer segmentation/differentiation information is available?

6

What impact, if any, will this notification have on customers at risk of financial

exclusion?

7

What research/analysis has the credit institution carried out on the ability of

customers to switch provider/choose an alternative service?

The Central Bank may, as part of the assessment of the effect on customers of proposed new

charges or increased charges on personal current accounts, make use of customer profiles

(which were originally contained in a research paper entitled A Review of Personal Current

Account Charges - this paper is available here). These customer profiles were updated in August

2020 and are available here. These profiles may be updated from time to time.

Should a credit institution wish to submit a notification proposing charges designed to

incentivise particular customer behaviour, it should be clearly demonstrated that this is to be

done fairly and that costs are being passed on to customers in an equitable manner. This will

include the extent to which a customer can avoid or limit the charge by changing his/her own

behaviour or usage of a service. It will also include consideration of the reasonableness of

customers changing their behaviour or usage in this manner, including having regard to the

service they have contracted to receive from their credit institution and behavioural norms as

to service usage and cost.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 17

Pricing Strategy

It is the responsibility of each credit institution to justify any new charges or charge increases

under the criteria set out in section 149 and the Central Bank must assess the notification under

those criteria. However, it is of assistance to the Central Bank in this regard to understand in as

much detail as possible where the charge notification sits within the overall strategy of the

credit institution, including when and how the credit institution proposes to impose charges

under the approved limit. A credit institution may therefore reference relevant initiatives, for

example the National Payments Plan

7

, or any other strategy or plan as part of its notification of

charges and we encourage credit institutions to do so where it would provide the Central Bank

with a better understanding of the issues arising under the statutory criteria in section 149.

It will be for each credit institution to explain its strategy in its own words of course. However,

the following information will be relevant to the Central Bank’s considerations:

if a credit institution proposes to use pricing affected by the notification to incentivise

customers to favour automated transactions rather than paper-based transactions, the

credit institution should provide analysis or research of the effect of the proposed

changes on customers and groups of customers, particularly customers at risk of being

financially excluded;

customer profiles showing the effect of any proposed charge changes on different

groups of customers;

the behavioural assumptions underlying the strategy and the justification for these

assumptions; and

any reduction in costs/savings to be made by the credit institution over time, as a result

of the notification.

7

The National Payments Plan, which was launched in April 2013, aims to make savings

of €1bn annually to the Irish economy by increasing the use of electronic forms of

payment such as debit cards and electronic banking. Further information on the National

Payments Plan is available here.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 18

Letter of Direction

On completing its consideration of a notification, the Central Bank will issue a “Letter of

Direction” to the credit institution within the timeframe set down in section 149. The letter will

direct a credit institution to:

refrain from imposing or changing a charge in relation to the provision of a

service to a customer or to a group of customers, without prior approval of the

Central Bank; and/or

publish, in such manner as may be specified by the Central Bank from time to

time, information on any charge in relation to the provision of a service to a

customer or to a group of customers.

The Letter of Direction sets out the maximum approved charges that may be imposed by a credit

institution. In this Letter of Direction therefore, the Central Bank approves maximum charges

and credit institutions are free to impose a charge at any level up to this maximum. They are also

free to waive charges at their discretion.

The Letter of Direction may also require the credit institution to publish the charges at the level

to be imposed (e.g. on notices, leaflets, promotional material and/or on the institution’s website).

A direction under section 149 pertains only to the subject of Central Bank approval under

section 149 and should not be taken to constitute approval by the Central Bank of any matter

or for any purpose outside of section 149.

Other Disclosure Obligations

Each credit institution is required to comply with the terms as set out in the Letter of Direction

issued by the Central Bank, the requirements of the Consumer Protection Code and the

Payment Service Regulations with regard to the disclosure of approved charges, as well as all

other requirements of Irish financial services legislation and other applicable laws.

Information on the Credit Institution Charges Approval Process

Central Bank of Ireland

Page 19

The Exemption Process

A credit institution can request an exemption if it wishes to be exempt from the requirement to

notify specific charges that are individually negotiated bona fide with the credit institution by a

customer, or by or on behalf of a group of customers. An application for an exemption should

include confirmation that:

(a) the charge has been individually negotiated bona fide;

(b) the negotiations and outcome of the negotiations are documented by the credit

institution and a written record of these negotiations will be maintained for inspection,

if required, by the Central Bank; and

(c) the charge(s) do not appear on any of the credit institution’s standard tariff documents.

Exemptions are approved or rejected by a Letter of Exemption issued, by the Central Bank to

the credit institution under section 149 (11) of the Act.

Contact

This document provides general information on the process employed by the Central Bank

when considering notifications made under section 149. Should you have any questions or

queries in relation to the content of this document or in relation to a particular section 149

notification, please feel free to contact the Central Bank at section149@centralbank.ie.

Information on the Bank Charges Approval Process

Central Bank of Ireland

Page 20

Section 149 Process Flow Chart

CENTRAL BANK CREDIT INSTITUTION

COMPLETION PHASECONSIDERATION PHASEPRE-NOTIFICATION PHASE

NEW CHARGES OR

INCREASE TO

EXISTING CHARGES

DOES CHARGE

NEED TO BE

NOTIFIED UNDER

SECTION 149

REVIEW

INFORMATION

ON CENTRAL

BANK WEBSITE.

CONTACT

SECTION 149

TEAM IF

REQUIRED.

COMPILE

INFORMATION

FOR SECTION

149

NOTIFICATION

YES

RECEIVE AND

ACKNOWLEDGE

NOTIFICATION

INITIAL REVIEW OF

NOTIFICATION

FURTHER

INFORMATION OR

CLARIFICATION

REQUIRED?

FINAL REVIEW

CHARGES

APPROVED,

PARTIALLY

APPROVED OR

REJECTED?

LETTER OF

DIRECTION

SENT TO CREDIT INSTITUTION

NO SECTION 149

NOTIFICATION

REQUIRED.

COMPILE

REQUESTED

INFORMATION

AND RESPONSE TO

QUERIES

FURTHER REVIEW

OF NOTIFICATION

COMPLETE

NOTIFICATION?

REQUEST INFORMATION

NO

NOT A

COMPLETE

NOTIFICATION

NO

ACK’MENT TO

CREDIT

INSITUTION

18/08/28

Clock stops

SUBMIT TO

CENTRAL BANK

PROVIDE ALL

INFORMATION/

CLARIFICATION

REQUESTED BY

CENTRAL BANK

12/05/14 - 19/05/14

Timeline

12/05/14

3 Months

Yes

No

LETTER OF

DIRECTION

SEND QUERIES TO

FIRM

YES

18/08/28

Clock restarts

12/05/14

Day 1

Information on the Bank Charges Approval Process

Central Bank of Ireland

Page 21

Section 149 Notification Checklist

If the answer to any of the questions contained in this checklist is ’No’ or ‘Not Required’ the

reason why certain information is not included in the notification made to the Central Bank

should be included in the comments box.

Section 149 Notification Checklist

Checklist Items

Yes

No

Not

Required

Comments

Has the overall rationale behind the

notification and how the proposed

charge(s) fit with current strategy

been included in the notification?

Have details on the effect on

customers, including any research

that may have been carried out by

the credit institution, been

included?

Have Central Bank customer

profiles (available here) been

included in the submission?

Have the credit institution’s own

customer profiles been included in

the notification?

Have all assumptions underlying

any perceived or intended changes

to customer behaviours which are

expected been included in the

notification?

Have any projected long-term

savings to the credit institution,

which may be driven by changes in

customer behaviours, been included

in the notification?

Has detailed information around

affected customers’ ability to switch

to an alternative financial services

provider for a particular service or

an alternative corresponding

service, been included in the

notification?

Information on the Bank Charges Approval Process

Central Bank of Ireland

Page 25

Has the effect on customers at risk

of being financially excluded been

assessed? Have the results of this

assessment been included in the

notification?

Has a full statement of commercial

justification (including any

supplemental commercial

justification) been provided?

Has all information relevant to the

notification been included in the

notification?

Does the notification include an

overview of the service to be

provided and the justification of the

costs incurred by the credit

institution when providing a

particular service or any other costs it

may be seeking to pass on to

customers?

Has fair competition

research/analysis undertaken by the

credit institution been included in

the notification?

Note: This may take the form of an

analysis of fees imposed by other

credit institutions for a similar

service.

Has this checklist been completed

and included in the

notification?

End of Information Note.