New Issue: FCT French Prime Cash

2023

Primary Credit Analyst:

Florent Stiel, Paris + 33 14 420 6690; [email protected]

Secondary Contact:

Leslie Selamme, Paris +331.44.20.73.40; leslie[email protected]

Table Of Contents

Transaction Summary

The Credit Story

Environmental, Social, And Governance

Origination And Servicing

Operational Risk

Collateral

Credit Analysis And Assumptions

Transaction Structure

Cash Flow Mechanics

Cash Flow Modeling And Analysis

Forward-Looking View

Counterparty Risk

WWW.SPGLOBAL.COM DECEMBER 8, 2023 1

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global

Ratings' permission. See Terms of Use/Disclaimer on the last page.

3100355

New Issue: FCT French Prime Cash 2023

Ratings Detail

Rating assigned

Class Rating*

Amount (mil.

€)

Available credit

enhancement (%) Coupon (%)

Optional redemption

date

Final legal maturity

date†

A AAA (sf) 683.500 10.4% 0.25 April 27, 2027 Oct. 25, 2051

B NR 67.585 1.4% 0.00 April 27, 2027 Oct. 25, 2051

*Our rating addresses timely payment of interest and ultimate payment of principal. NR--Not rated.

Transaction Summary

• S&P Global Ratings assigned its 'AAA (sf)' credit rating to FCT French Prime Cash 2023's €683.5 million senior class

A asset-backed fixed-rate notes. At closing, the issuer also issued unrated subordinated class B notes.

• FCT French Prime Cash 2023 is a true sale securitization of residential loan receivables originated by Milleis Banque

Privée (Milleis), a private and retail banking institution. The seller, Milleis, is the former Barclays France Bank PLC.

AnaCap Financial Partners (a European private equity firm) acquired Barclays France in 2017.

• A combination of subordination, reserve and available excess spread provides credit enhancement for the notes.

• The class A notes benefit from liquidity support from a liquidity reserve and can use principal to cure interest

shortfalls.

• Counterparty, operational, or sovereign risks do not constrain our rating. The issuer is a French securitization fund

("Fonds Commun de Titrisation" [FCT]), which is bankruptcy remote by law. We consider the legal framework to

comply with our legal criteria.

• We have not identified any material environmental, social, and governance credit factors in our analysis.

The Credit Story

The credit story

Strengths Concerns and mitigating factors

The pool has a low current indexed loan-to-value (LTV) ratio of 79%

compared to the French mortgage market, which is more likely to

incur lower loss severities if the borrower defaults.

Jumbo loans and properties comprise a high concentration in the pool

because of Milleis' strong presence in the Paris and Ile de France areas.

We considered this in our analysis.

The structure benefits from a liquidity reserve available to cover

shortfalls on senior fees and class A interest. Principal can be used to

pay senior fees and interest on the class A notes if there is a shortfall

in the revenue priority of payments.

Milleis is a niche player targeting high-net-worth individuals. Although

Barclays France was an established player, Milleis was incorporated in

2018 and is still expanding. FCT French Prime Cash 2023 will be Milleis'

first public transaction.

Servicing is in-house. Milleis has well-established and fully integrated

servicing systems and policies.

If the servicer becomes insolvent, the transaction is exposed to a credit

loss on all collections payments transferred through the servicer collection

accounts. To mitigate such risk, we have accounted for a commingling

loss in our cash flow model.

WWW.SPGLOBAL.COM DECEMBER 8, 2023 3

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

The credit story (cont.)

Strengths Concerns and mitigating factors

The historical performance of the lender's mortgage book has proven

strong to date, with very low arrears. The pool had no delinquent or

defaulted loans at closing.

Deposit setoff risk could arise whereby borrowers would offset their loans

repayments with deposits held with the originator considering the

originator is a deposit-taking entity. According to the legal documentation,

no loans are granted to employees of the originator.

Most loans in the portfolio pay a fixed interest rate while the notes

pay fixed coupons. Consequently, the transaction does not include

any hedging mechanisms.

Of the properties, 12.4% have an original value above €2 million. The

share of the current property balance and borrowers are still

well-diversified and follow the same underwriting criteria than the overall

portfolio.

The issuer is an FCT and is considered bankruptcy remote under

French law.

Environmental, Social, And Governance

Our analysis considers a transaction's potential exposure to environmental, social, and governance (ESG) credit

factors. For RMBS, we view the exposure to environmental credit factors as average, social credit factors as above

average, and governance credit factors as below average (see "ESG Industry Report Card: Residential

Mortgage-Backed Securities," published on March 31, 2021).

In our view, the exposure to social credit factors is in line with the sector benchmark. Social credit factors are generally

considered above average because housing is viewed as one of the most basic human needs, and conduct risk presents

a direct social exposure for lenders and servicers, particularly as regulators are increasingly focused on ensuring fair

treatment of borrowers. For RMBS, social risk is generally factored into our base-case assumptions. The risk of a usury

rate is mitigated as in France the credit rates are capped by usury laws.

The transaction's exposure to environmental credit factors is also in line with the sector benchmark, in our opinion.

Physical climate risks, such as floods or wildfires, or long-term shifts in climate patterns, such as rising sea levels or

increased weather variability, could severely damage properties and reduce their value, decreasing recoveries if

borrowers default. We believe that well-diversified portfolios reduce exposure to physical climate risks.

In our view, the exposure to governance credit factors is in line with the sector benchmark. There are very tight

restrictions on what activities the special-purpose entity can undertake compared with other entities.

As a result, we have not separately identified a material ESG credit factor in our analysis.

Origination And Servicing

Milleis originated the portfolio's home loans. It is a French bank created in 2018 arising from the acquisition of

Barclays France in 2017 by a private equity investor, AnaCap Financial Partners. Milleis benefits from Barclays

France's experience as it had originated loans in France for nearly 100 years. Of the loans in the pool, Barclays France

had originated 23%.

Milleis is focusing on the private banking segment and targets high-net-worth individual borrowers who have a

minimum of €100,000 of assets. Following the acquisition of Cholet Dupont-Oudart in 2023, Milleis extended its

WWW.SPGLOBAL.COM DECEMBER 8, 2023 4

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

customer base to include ultra-high-net worth individuals with more than €10 billion of assets (the securitized pool

includes no loans from Cholet Dupont-Oudart). In addition, Milleis also provides life insurance or portfolio

management for its clients' assets.

Milleis being a bank, its underwriting conditions are in line with High Council for Financial Stability's

recommendations. Implemented since September 2021 in France, these state that a debt-to-income ratio should not

exceed 35% and loan maturity should not exceed 25 years, with a 20% tolerance on the originator's total book on

these two conditions, particularly for owner-occupied properties and first-time borrowers. In line with the French

market, most of the loans originated by Milleis have a Credit Logement guarantee. The pool reflects this strategy, with

more of 65% of loans having a Credit Logement guarantee.

In our view, the Milleis' underwriting and servicing procedures are in line with the French mortgage market.

Our rating reflects our assessment of the Milleis' origination policies and our evaluation of its ability to fulfill its role as

the portfolio's servicer.

Operational Risk

Our operational risk criteria focus on key transaction parties (KTPs) and the potential effect of a disruption in the KTPs'

services on the issuer's cash flows, as well as the ease with which the KTPs could be replaced if needed (see "Global

Framework For Assessing Operational Risk In Structured Finance Transactions," published on Oct. 9, 2014).

In our view, Milleis has a history of stable, good-quality asset origination, as well as tested underwriting and servicing

procedures. We have assessed Milleis' origination policies, by conducting an on-site visit and we were satisfied with

the review. Under our operational risk criteria, we consider prime RMBS, which is the case for this transaction, as

having low "severity" and low "portability" risks.

Based on our analysis, our operational risk criteria do not constrain the maximum potential rating in this transaction.

Collateral

We based our analysis on a pool as of Oct. 31, 2023.

WWW.SPGLOBAL.COM DECEMBER 8, 2023 5

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Chart 1

WWW.SPGLOBAL.COM DECEMBER 8, 2023 6

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

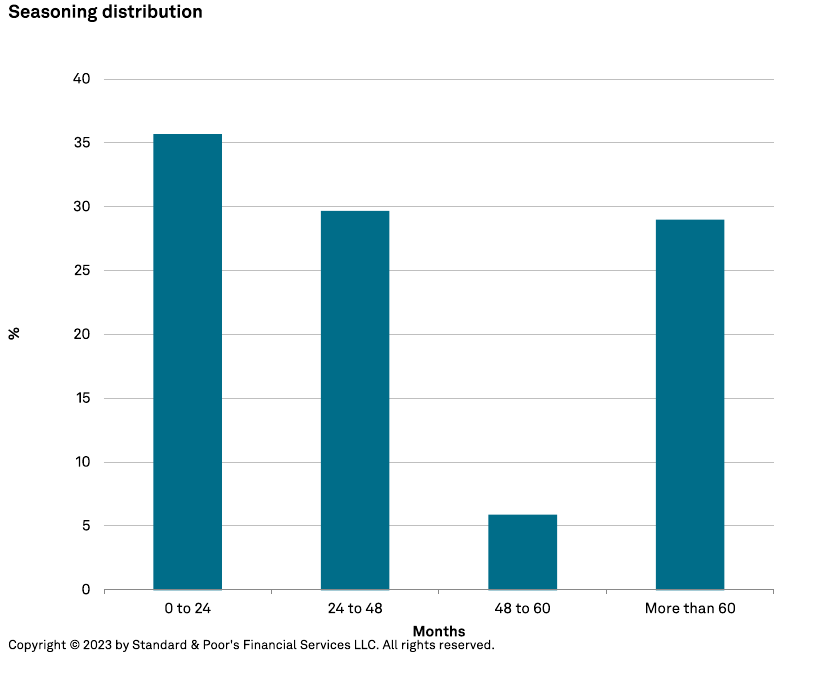

Chart 2

WWW.SPGLOBAL.COM DECEMBER 8, 2023 7

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Chart 3

Of the portfolio's loans, 84.3% do not benefit from a first-ranking mortgage. Rather, they benefit from a guarantee

granted from a "caution" from Credit Logement. In France, a guarantee ("caution") secures about 60% of existing loans

and about two-thirds of newly originated loans, rather than a mortgage on the property. These guarantees are popular,

partly because they save the cost of registering a mortgage. If the guarantor does not perform when an obligor

defaults, the servicer would bear the risk of other creditors registering a judicial mortgage on the property before it.

Our European residential loans criteria give credit, to some extent, to the guarantor. The loss severity depends on the

guarantor's creditworthiness and the target rating on the notes.

Table 1

Collateral key features*

Pool cutoff date Oct. 31, 2023

Jurisdiction France

Principal outstanding of the pool (mil. €) 751.085

Number of loans 3,847

Average loan balance (€) 195,239

Weighted-average indexed current LTV ratio (%) 56.7

Weighted-average original LTV ratio (%) 79.2

Weighted-average seasoning (months) 54

WWW.SPGLOBAL.COM DECEMBER 8, 2023 8

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Table 1

Collateral key features* (cont.)

Top three regional concentration (by balance) Ile-de-France (53.5), Provence-Alpes-Cote d'Azur (13.9%), and Auvergne-Rhone-Alpes

(8.0%)

Buy-to-let (%) 27.9

Jumbo valuations (%) 54.4

Weighted-average 'AAA' RMVD (%) 55

Current arrears greater than or equal to one month (%) 0.00

*Calculations are according to S&P Global Ratings' methodology. LTV--Loan-to-value. RMVD--Repossession market value declines.

The issuer's eligibility criteria for mortgage loans

The list below outlines the transaction's key eligibility criteria, among others:

• Milleis or Barclays France has originated the loan.

• The loan has a maximum principal amount of €4,500,000.00 and the loan's outstanding balance of the loan is no

less than €100.

• The loan has periodic interest payment streams.

• The loan is euro-denominated.

• The loan's LTV ratio does not exceed 100% at origination.

• The loan will result from the seller's normal origination process.

• The loan has at least one paid installment.

• The loan is current (i.e., not in arrears nor in default).

WWW.SPGLOBAL.COM DECEMBER 8, 2023 9

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Chart 4

Credit Analysis And Assumptions

We applied our global residential loans criteria to the pool to derive the weighted-average foreclosure frequency

(WAFF) and the weighted-average loss severity (WALS) at each rating. We assumed the total mortgage balance to

default and determined the total amount of this defaulted balance that is not recovered for the entire pool by

calculating the WAFF and the WALS.

The WAFF and WALS assumptions increase at each rating level because notes with a higher rating should be able to

withstand a higher level of mortgage defaults and loss severity. Our credit analysis reflects the characteristics of loans,

properties, and associated borrowers.

WWW.SPGLOBAL.COM DECEMBER 8, 2023 10

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Table 2

Portfolio WAFF and WALS

Rating level WAFF (%) WALS (%) Credit coverage (%)

AAA 16.25 31.90 5.18

WAFF--Weighted-average foreclosure frequency. WALS--Weighted-average loss severity.

Transaction Structure

The issuer, French Prime Cash 2023, is an FCT, a securitization vehicle set up under French law. An FCT is

bankruptcy remote by law. It was established for the sole purpose of purchasing residential loans from Milleis and

issuing notes (see chart 4).

Chart 5

WWW.SPGLOBAL.COM DECEMBER 8, 2023 11

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Credit enhancement

A combination of subordination, a reserve fund, and available excess spread provides credit enhancement for the

notes.

Cash Flow Mechanics

The transaction has separate interest and principal waterfalls.

Priority of payments

The transaction has a split priority of payments. The redemption of the notes is fully sequential. The management

company applies the issuer's available funds toward the following payments in the relevant order of priority below.

Table 4

Interest priority of payments during the amortization period (simplified)

1 Senior fees

2 Class A notes' interest

3 Class A notes' PDL

4 Top up of the reserve

5 Class B notes' interest

6 Class B notes' PDL

7 Reserve release

8 Junior fees if any

9 Interest to residual unitholders

PDL--Principal deficiency ledger.

Table 5

Principal priority of payments during the amortization period (simplified)

1 Payments of items (1) and (2) of the interest priority of payments, if unpaid

2 Class A notes' amortization amount

3 Class B notes' amortization amount

4 Liquidation surplus to the residual unitholders

Liquidity reserve

The structure benefits from a liquidity reserve which will be aggregated in the available distribution amount to pay all

the items of the interest priority of payments. This reserve will be the minimum between the class A notes' outstanding

balance and the maximum of 1.5% of the class A notes' outstanding balance and €3.5 million.

Principal deficiency ledger (PDL)

Two default-based PDLs exist for the class A and B notes. The PDLs are booked if principal defaults occur on the

collateral or if principal is borrowed to pay the items (1) and (2) of the interest priority of payments.

Principal to pay interest

Principal can be used to pay items (1) and (2) if the revenue priority of payments registers a shortfall. The use of

principal to pay interest would result in the registering of a debit in the PDL.

WWW.SPGLOBAL.COM DECEMBER 8, 2023 12

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Cash collection arrangements and commingling reserve

The servicer collects borrowers' installments by direct debit into the servicer collection account and transfers them

daily into the issuer's general account.

If the servicer becomes insolvent, the transaction is exposed to a credit loss on all collections payments that transit

through the servicer collection accounts. Furthermore, the borrowers will be notified that the mortgage loans have

been assigned to the issuer and will be instructed to pay directly into the issuer's transaction account. However, some

payments could still be made to the seller's account, and as a result, become commingled with other amounts in the

same seller account. We have stressed this risk in our analysis. To mitigate such risk, we factored this into our cash

flow analysis by assuming that one-third of a month of collections would be lost.

Setoff risk

Potential employee setoff risk and deposit setoff risk could arise if the originator becomes insolvent. Employee setoff

risk could arise whereby borrowers/originator employees would offset their loan repayments with salaries due by the

originator. Deposit setoff risk could arise whereby borrowers would offset their loans repayments with deposits held

with the originator considering the originator is a deposit-taking entity. According to the legal documentation, no loans

are granted to the orginator's employees.

Cash Flow Modeling And Analysis

We stressed the transaction's cash flows to test the credit and liquidity support from the assets, the subordinated

tranche, and the cash reserve.

Fees

Contractually, the issuer is obliged to pay periodic fees to various parties providing services to the transaction such as

servicers, the management company, and cash managers, among others.

Default and recovery timings

We used the WAFF and WALS derived in our credit analysis as inputs in our cash flow analysis. At each rating level,

the WAFF specifies the total balance of the mortgage loans we assume will default over the transaction's life. Defaults

are applied on the outstanding balance of the assets as of the closing date. We simulate defaults following two paths

(i.e., one front-loaded and one back-loaded) over a six-year period (see table 6). During the recessionary period within

each scenario, we assume 25% of the expected WAFF is applied annually for three years.

Table 6

Default timings for front-loaded and back-loaded default curves

Year after closing Front-loaded defaults (% of WAFF per year) Back-loaded defaults (% of WAFF per year)

1 25.0 5.0

2 25.0 10.0

3 25.0 10.0

4 10.0 25.0

5 10.0 25.0

WWW.SPGLOBAL.COM DECEMBER 8, 2023 13

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Table 6

Default timings for front-loaded and back-loaded default curves (cont.)

Year after closing Front-loaded defaults (% of WAFF per year) Back-loaded defaults (% of WAFF per year)

6 5.0 25.0

WAFF--Weighted-average foreclosure frequency.

Delinquencies

To simulate the effect of delinquencies on liquidity, we model a proportion of scheduled collections equal to one-third

of the WAFF (in addition to assumed foreclosures reflected in the WAFF) to be delayed. We apply this in each of the

first 18 months of the recession and assume a full recovery of these delinquencies will occur 36 months after they

arise.

Prepayments

To assess the impact on excess spread and the absolute level of defaults in a transaction, we model both high and low

prepayment scenarios at all rating levels (see table 7).

Table 7

Prepayment assumptions

High Low

Pre-recession 24.0 1.0

During recession 1.0 1.0

Post-recession 24.0 1.0

Interest rates

We modeled two interest rate scenarios in our analysis: up and down.

Summary

Combined, the default timings, recession timings, interest rates, and prepayment rates described above give rise to

eight different scenarios at each rating level (see table 8).

Table 8

RMBS stress scenarios

Total number of scenarios Prepayment rate Interest rate Default timing

8 High and low Up and down Front-loaded and back-loaded

Forward-Looking View

We consider the transaction's resilience in case of additional stresses to some key variables, in particular defaults and

loss severity, to determine our forward-looking view.

In our view, the ability of the borrowers to repay their mortgage loans will be highly correlated to macroeconomic

conditions, particularly the unemployment rate, consumer price inflation, and interest rates. Our current

unemployment forecasts for 2023 and 2024 are 7.3% and 7.5%, respectively.

Furthermore, a decline in house prices typically affects the level of realized recoveries. For France in 2023 and in 2024,

WWW.SPGLOBAL.COM DECEMBER 8, 2023 14

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

we expect them to decrease respectively by 2.6% and 4.0%, respectively.

Given our current macroeconomic forecast and our forward-looking view of France's housing market, our sensitivity

scenarios consider, all else being equal, the hypothetical effect on our credit ratings of different combinations of:

• An increase in the WAFF (foreclosure frequency/defaults) by up to 30% at each rating level; and

• An increase in the WALS (loss severity) by up to 30% at each rating level.

We therefore ran eight scenarios with increased defaults and higher loss severity, as shown in the table below.

The results of the above sensitivity analysis indicate no credit deterioration for the notes, which is in line with the

credit stability considerations in our rating definitions.

A general housing market downturn may delay recoveries. We also ran extended recovery timings to understand the

transaction's sensitivity to liquidity risk.

The transaction embeds some strengths that may offset deteriorating collateral performance. Given its sequential

amortization, credit enhancement is likely to build up over time. The existence of a reserve fund may to a certain

extent, insulate the notes against credit losses and liquidity stresses.

Counterparty Risk

The issuer is exposed to BNP Paribas as transaction account provider (see table 11).

The transaction's documented replacement language for all of its relevant counterparties is in line with our

counterparty criteria (see "Counterparty Risk Framework: Methodology and Assumptions," published on March 8,

2019). Our analysis shows that counterparty risk does not constrain our rating on the class A notes.

WWW.SPGLOBAL.COM DECEMBER 8, 2023 15

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Table 11

Supporting ratings

Institution/role

Current counterparty

rating

Replacement

trigger

Collateral posting

trigger

Maximum supported

rating

BNP Paribas SA as transaction

account provider

A+/Stable/A-1 A/A-1 N/A AAA

N/A--Not available.

Sovereign Risk

Our long-term unsolicited sovereign credit rating on France is 'AA'. Therefore, our rating in this transaction is not

constrained by our structured finance sovereign risk criteria.

Surveillance

We will regularly assess the following as part of our ongoing surveillance of this transaction:

• The performance of the underlying portfolio;

• The supporting ratings in the transaction; and

• The servicer's operations and its ability to maintain minimum servicing standards.

Appendix

Transaction participants

Seller and originator Milleis Banque Privée

Mortgage administrator/servicer Milleis Banque Privée

Management company IQ EQ Management

Related Criteria

• General Criteria: Environmental, Social, And Governance Principles In Credit Ratings, Oct. 10, 2021

• Criteria | Structured Finance | General: Global Framework For Payment Structure And Cash Flow Analysis Of

Structured Finance Securities, Dec. 22, 2020

• Criteria | Structured Finance | General: Methodology To Derive Stressed Interest Rates In Structured Finance, Oct.

18, 2019

• Criteria | Structured Finance | General: Counterparty Risk Framework: Methodology And Assumptions, March 8,

2019

• Criteria | Structured Finance | General: Incorporating Sovereign Risk In Rating Structured Finance Securities:

Methodology And Assumptions, Jan. 30, 2019

• Criteria | Structured Finance | RMBS: Global Methodology And Assumptions: Assessing Pools Of Residential

WWW.SPGLOBAL.COM DECEMBER 8, 2023 16

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

Loans, Jan. 25, 2019

• Legal Criteria: Structured Finance: Asset Isolation And Special-Purpose Entity Methodology, March 29, 2017

• Criteria | Structured Finance | General: Global Framework For Assessing Operational Risk In Structured Finance

Transactions, Oct. 9, 2014

• General Criteria: Global Investment Criteria For Temporary Investments In Transaction Accounts, May 31, 2012

• General Criteria: Principles Of Credit Ratings, Feb. 16, 2011

• Criteria | Structured Finance | General: Methodology For Servicer Risk Assessment, May 28, 2009

Related Research

• ESG Industry Report Card: Residential Mortgage-Backed Securities, March 31, 2021

• 2017 EMEA RMBS Scenario And Sensitivity Analysis, July 6, 2017

• Global Structured Finance Scenario And Sensitivity Analysis 2016: The Effects Of The Top Five Macroeconomic

Factors, Dec. 16, 2016

• European Structured Finance Scenario And Sensitivity Analysis 2016: The Effects Of The Top Five Macroeconomic

Factors, Dec. 16, 2016

WWW.SPGLOBAL.COM DECEMBER 8, 2023 17

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

3100355

New Issue: FCT French Prime Cash 2023

S&P may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from

obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.spglobal.com/ratings (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via

S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.spglobal.com/usratingsfees.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment

and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does

not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be

reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-

related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not

limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties

disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage

alleged to have been suffered on account thereof.

Copyright © 2023 Standard & Poor's Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL

EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR

A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING

WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no

event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential

damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the Content even if advised of the possibility of such damages.

WWW.SPGLOBAL.COM DECEMBER 8, 2023 18

3100355