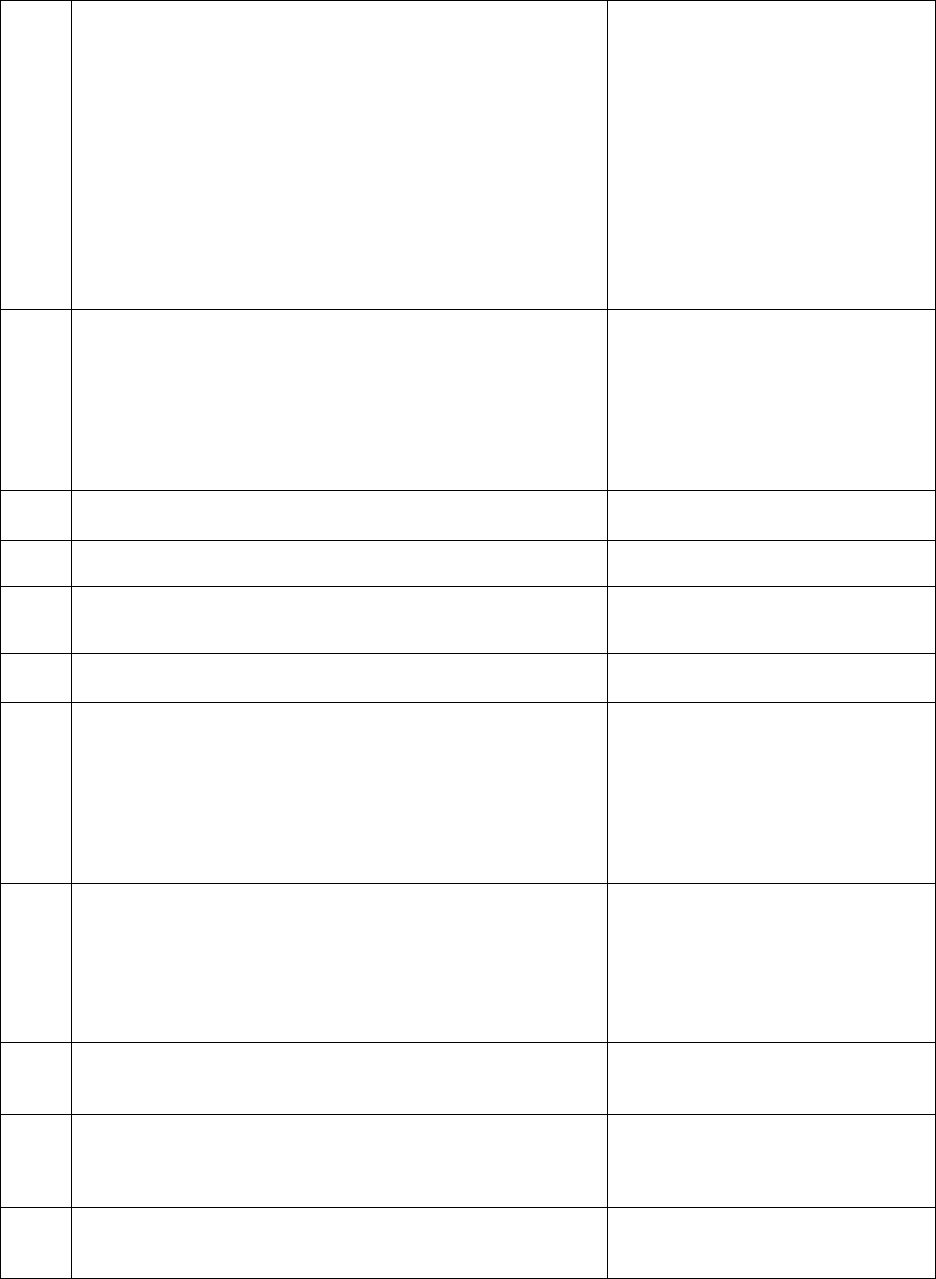

Direct Deposit- Does your state allow employers to require direct deposit of paychecks?

Federal law- Under federal law, the Electronic Fund Transfer Act (EFTA) governs matters

related to direct deposits and payroll cards. In sum, the EFTA and its corresponding Regulation

E allow private employers to require employees to receive their pay via direct deposit; however,

the law prohibits requiring employees to establish an account at a specific institution for the

receipt of electronic wage payments.Thus, employers may (1) require employees to accept

direct deposit at the financial institution of their choosing; or (2) require employees using direct

deposit to do so at the financial institution of the employer’s choosing, but also allow the option

of being paid by other means. State laws may differ and be more restrictive.

State

Main provisions of law

Covered employers

AL

Private employers may require direct deposit, but public-

sector employers may not.• Citation: No statute. Based on

attorney general’s opinion letter.

Public-sector employers.

AK

Employers may not make direct deposit of wages unless

employees voluntarily authorize it. Employers must use a

bank of the employee’s choosing.• Citation: AS 23.10.043.

All employers.

AZ

Employers may direct deposit to an employee’s choice of

financial institution with his or her written consent. If no consent

is given, the employer may deposit to the employee’s credit to

a payroll card account. No person shall be denied employment

nor discharged or reprimanded for refusal to consent to

payment of wage by deposit in a financial institution. • Citation:

A.R.S. §§23-351(D) and 23-351(E).

All employers.

AR

All employees shall be paid in currency or by check or

electronic direct deposit into the employee’s account.

Employees may opt out of direct deposit by providing

employers with a written statement requesting payment by

check. State government employees hired on or after August

12, 2005, shall be required to accept payment of salary or

wages by direct deposit. Anyone affected by the requirement

may request an exemption upon a showing of hardship. The

direct deposit requirement does not apply to a person who is

in the employment of the state prior to August 12, 2005.•

Citation: Ark. Code Ann. §11-4-402(b). Local government

employees: Ark. Code Ann. §14-59-105(c); Ark. Code Ann.

§21-5-109. Municipal water and sewer employees: Ark.

Code Ann.

§14-237-106(d).

Private employers.

CA

Employers may pay by direct deposit but only if employees

voluntarily authorize such deposits.• Citation: Cal. Lab.

Code §212.

All employers.

CO

Employers may pay by direct deposit as long as it’s

authorized by the employee and the deposits are made to

Private employers.

the financial institution of the employee’s choosing.• Citation:

C.R.S. §8-4-102(2).

CT

Employers may not require direct deposit, but it’s permitted

on the written request of employees.• Citation: Conn. Gen.

Stat. §31-71b.

All employers.

DE

Employers may pay by direct deposit but only if employees

sign a written request authorizing it. Regulations adopted by

the Delaware Department of Labor also authorize employers

to use payroll debit cards as a mechanism for wage payments

in lieu of cash or check.• Citation: 19 Del. C. §1102(a) and Del.

Code Regs.

65-400-013 (2005).

Private employers.

DC

Private employers may not require direct deposit. Employers

may only use direct deposit if employees voluntarily give

written authorization. Public employees may only be paid by

direct deposit or delivery of the check by U.S. mail to their

residences.• Citation: Private employers: D.C. Code §32-

1302. Public employers: D.C. Code §1-611.20.

Private employers and local

government.

FL

Employers may not make direct deposit of wages without the

employee’s written consent. Employers must use a bank of the

employee’s choosing..• Citation: FSA §532.04.

All employers.

GA

Employers may not require the direct deposit of paychecks, but

direct deposit is permitted with the consent of the employee. If

an employee willingly consents to the direct deposit of

paychecks, the pay period must be divided into at least two

equal periods in the month.• Citation: O.C.G.A. §34-7-2.

All employers except those in the

farming, sawmill, and turpentine

industries.

HI

Employers may not pay wages by direct deposit without

obtaining the employee’s written consent and using a bank of

the employee’s choosing. Employers must prevent

employees from being charged a fee for using direct deposit.•

Citation: HRS §§387-2 and 388-7.

All employers.

ID

Direct deposit is permitted if voluntary written

authorization is received from employees, employees

are allowed to use a bank of their choosing, and

employees are allowed to cancel direct deposit.•

Citation: Idaho Code §45-608.

All employers.

IL

Direct deposit of a paycheck into a bank or other financial

institution is permitted, but employers may not require it.

Employees who authorize direct deposit designate financial

institutions for deposit. Employers may not designate a

particular financial institution for exclusive payment of

wages.• Citation: 820 ILCS

115/4 and 56 ILAC 300.600.

All private employers

and local

governments but not

state and federal

governments.

IN

Indiana law provides that an employer may pay an employee

by electronic transfer to the financial institution designated by

the employee. While Indiana statutes do not address whether

an employer may require employees to accept electronic

deposit, nor what happens if an employee refuses to

designate a financial institution for receipt of such transfers,

the Indiana Department of Labor’s website indicates that

employers can require direct deposit. • Citation: I.C. §§22-2-4-

1.

All employers.

IA

Employers may not require a current employee to participate

in direct deposit. An employer may require a new employee

to sign up for direct deposit as a condition

All employers.

of hire unless the costs to the employee of establishing and

maintaining an account would effectively reduce the

employee’s wages to a level below the minimum wage, the

employee would incur fees charged to the employee’s account

as a result of the direct deposit, or if the provisions of a

collective bargaining agreement mutually agreed on by the

employer and the employee organization prohibit the employer

from requiring an employee to sign up for direct deposit as a

condition of hire.• Citation: Iowa Code §91A.3(3).

KS

Employers can choose from the following payment methods,

regardless of

employee consent: (1) cash; (2) locally-negotiable check or

draft; (3) electronic fund transfer; or (4) payroll card. Any

employer choosing electronic fund transfer must offer an

alternative method for employees who don’t designate a bank

account for the electronic transfer. Employers choosing a

payroll card must allow employees a free means of fund

withdrawal per pay period. • Citation: Kan. Stat. Ann. §44-314.

All employers.

KY

Mandatory direct deposit is permitted, but employees must be

able to withdraw each payment at full face value and

employers must pay any resulting service charge. For example,

an employer cannot require an employee to have his or her

paycheck deposited in a particular bank where the employee

would be charged a fee if the employee’s account balance fell

below a particular sum. An employer may face civil and

criminal penalties if this situation occurs and the employee

does not receive the full wages due.• Citation: KRS

§§337.010(1)(c), 337.020, 337.060, amended by 2013 Ky.

Laws Ch. 25 (HB 3), 337.385, 337.990(4); Ky. Op. Att’y.

Gen. 83-ORD-459.

All employers.

LA

Public sector: All state-government executive branch

agencies and all state boards, commissions, and

corporations are to provide electronic direct deposit payroll

for state employees. Private sector: No law.• Citation:

Public sector: La. Rev. Stat. Ann. §39:247.

Public sector: State government.

ME

Mandatory direct deposit is permitted so long as the

employee can withdraw the employee’s entire net pay

without additional costs or can choose another form of

payment without additional costs.• Citation: 26 M.R.S.A.

§663(5).

All employers.

MD

Private sector: Employers can’t require direct deposit, but

wages may be paid by direct deposit if the employee

authorizes it. Public sector: State-government employees

hired before the effective date of regulations on direct deposit

may not be required to accept direct deposit. Also,

employees may request an exemption from direct deposit,

and all newly hired employees must be notified of the right to

request an exemption to direct deposit rules.• Citation:

Private sector: Md. Code Ann., Lab. & Empl. §3-502. Public

sector: Md. Code Ann., State Pers. & Pens.

§2-405.

All employers under various statutes.

MA

Employers may not require direct deposit, employees must be

permitted to choose the financial institution.• Citation: Mass.

Gen. Laws. ch. 167B, §7; Mass. Gen. Laws ch. 41, §41B.

All employers.

MI

Effective December 21, 2010, Michigan employers may require

an employee to receive wages through direct deposit or payroll

debit card. The employer must provide a written election notice

All employers.

that allows the employee to choose whether to receive wages

through direct deposit or a payroll debit card. The employer

must also provide a statement indicating that employees who

fail to return the election notice, along with needed account

information, will be presumed to consent to receive pay via a

payroll debit card. (However, employees that are already paid

by direct deposit may only have their payment method

changed by written consent.) The employee may request a

change in the method of receiving wages at any time. If a

payroll debit card is used, the employer is required to give

written disclosure of certain items concerning the debit card,

including itemization of all fees and the methods to access

funds free of charge.• Citation: 2010 MI HB5821; MI Pub. Ch.

323; MCL 408.476.

MN

Private sector: The definition of wages in Minnesota allows

private employers to use direct deposit as a means of

payment. The employee may opt out of direct deposit by

notifying the employer in writing. Public sector: The

Commissioner of Labor & Industry may require direct deposit

for all state employees.• Citation: Private sector: Minn. Stat.

§177.23, subd. 4. Public sector: Minn. Stat. §16A.17, subd.

10.

All employers under various statutes.

MS

Mississippi does not have any law that addresses an

employer’s ability to pay employees by direct deposit.

There is no provision for this topic in

this state.

MO

No law.

There is no provision for this topic in

this state.

MT

Employers may pay wages by direct deposit with employee’s

written consent. Employers must offer a non-electronic form of

wage payment..• Citation: Mont. Code Ann. §39-3-204(2).

All employers.

NE

There is no statute on direct deposit, but employers aren’t

prohibited from requiring it.

All employers.

NV

Employers cannot require direct deposit; however, direct

deposit is permissible at the election of the employee if the

employee can obtain immediate payment in full, the employee

receives at least one free transaction per pay period, any other

fees are prominently disclosed and consented to by the

employee in writing, and there are no other unreasonable

requirements or restrictions.• Citation: NRS 608.120 and NAC

608.135.

All employers.

NH

No. Employers may pay employees by electronic fund transfer,

direct deposit, or a payroll card, provided there is no charge to

the employee. However, if the employer elects to pay its

employees by one of the above methods, it must also offer

employees the option of receiving their pay by check.• Citation:

N.H. Rev. Stat.

Ann. §275:43.

All employers.

NJ

Employers may institute a direct deposit mode of payment

only if the individual employee consents to such a method

of payment.• Citation: N.J.A.C. 12:55-2.4.

All employers.

NM

Direct deposit is allowed when employees voluntarily authorize

it.• Citation: NMSA

1978, §50-4-2(B) (2005).

All employers except employers of

domestic labor in private homes

and employers of livestock and

agricultural labor.

NY

Under Section 192 of the New York Labor Law, in order to

provide for direct deposit of an employee’s wages, the

employer shall obtain advance written consent from the

There is no provision for this topic in

this state.

employee. Under Section 190(7), the advance written consent

requirement

shall not apply to any bona fide executive, administrative,

and professional employees earning in excess of $900

(U.S.) per week. In March 2008, the New York State

Department of Labor issued a publication entitled

“Guidelines - Direct Deposit of Wages in a Bank or Financial

Institution” for assistance on compliance with the Labor

Laws. Available online:

http://www.labor.state.ny.us/formsdocs/wp/LS445.pdf.The

Guidelines state: (1)

Advance Written Consent. Advance written consent of the

employee should be kept on file by the employer. The consent

form should contain the name and location of the bank or

financial institution and a description of the account. The

consent of the employee must be voluntary and an employer

shall not institute an arrangement of direct deposit of wages in

a bank or financial institution in the face of employee objection.

The consent must be revocable at will. Employees who do not

consent to a direct deposit arrangement must receive wages in

cash or by check; (2)

Expenses to an Employee. An employee shall not be obliged to

incur expense in the arrangement whereby the employee’s

wages or salary are directly deposited in a bank or financial

institution or in the withdrawal of such wages or salary from the

bank or financial institution. Some examples of expenses are as

follows: (i) a service charge, “per check” charge or

administrative or processing charge; (ii) car fare in order to get

to the bank or financial institution to withdraw wages; (3)

Withdrawal of Directly Deposited Wages. An employee shall not

be obliged to lose a substantial amount of uncompensated time

in order to withdraw wages from a bank or financial institution.

Although the employer is not required to provide employees

with paid time in which to withdraw such monies, the

Department has held that the employer should provide for the

loss of time when the employee requires more than 15 minutes

to withdraw wages. Such time includes travel time to and from,

as well as actual time spent at the bank or financial institution in

withdrawing such monies. Moreover, the withdrawal of wages

may not interfere with an employee’s meal period to the extent

that it decreases the meal period to less than 30 minutes. Thus,

although the time required for withdrawal of wages may be 15

minutes or less, the loss of even eight or 10 minutes from a

30-minute meal period curtails it to an unacceptably short

duration. The law requires that an employee be paid wages in

full on regular agreed paydays. The direct deposit of wages in

a bank or financial institution, therefore, should anticipate that

an employee should be able to withdraw such wages in full on

the regular agreed payday. The arrangement of direct deposit,

therefore, may not include the withholding of any part of the

employee’s wages on the regular payday or afterwards. State

employers: Upon written request of a state employee, the

comptroller may cause wages to be deposited directly into the

employee’s bank account.• Citation: N.Y. Labor Law §§190(7)

and 192, and

http://www.labor.state.ny.us/formsdocs/wp/LS445.pdf., State

Fin. Law §200.

NC

Mandatory direct deposit is allowed.• Citation: N.C.

Administrative Code Title 13

All employers.

§12.0309.

ND

Employers may require direct deposit of paychecks in the

financial institution of the employee’s choice. If an employer

also offers wage payment with a pay card (stored value card),

the employee may elect to be paid with a pay card rather than

by direct deposit.• Citation: N.D.C.C. §34-14-02.

All employers.

OH

Public employers: A state employee who commenced

employment on or after June 5, 2002, and who is paid by the

state director of budget and management, must provide to the

appointing authority a written authorization for payment by

direct deposit. The authorization must include the employee’s

designated financial institution equipped to accept the

employee’s direct deposit. This rule does not apply to

employees who began work after June 5, 2002, or whose

applicable collective bargaining agreement does not require

the employee to be paid by direct deposit. Private employers:

There is no express provision in state law prohibiting or

permitting private employers from requiring direct deposit of

paychecks.• Citation: Ohio Rev. Code §124.151(B).

There is no provision for this topic in

this state.

OK

Private sector: In November 2009, the Oklahoma attorney

general issued an official position on direct deposit and payroll

cards. The AG determined that federal law and, through

supercession, Oklahoma law allow employers to require

employees to receive their pay via direct deposit. What the law

prohibits is requiring employees to establish an account at a

specific institution for the receipt of electronic wage payments.

So employers may either (1) require employees to accept

direct deposit at the financial institution of their choosing; or (2)

require employees using direct deposit to do so at the financial

institution of your choosing, but allow them the option of

receiving their pay by other means (e.g., check or cash). In

other words, you can’t require employees to receive their pay

through direct deposit at a bank you specify.Employers who

use direct deposit must still provide employees with an

itemized statement of their pay. State government: State-

government employees are required to participate in direct

deposit.• Citation: Private sector: OK Attorney General opinion

(2009); State Department of Labor information. State

government: Okla Stat. Title 74 §292.12.

All employers under different

circumstances.

OR

Employers may use direct deposit without employee consent.

Employers must pay an employee by check if requested orally

or in writing by the employee. An employer and employee

may agree that the employer will pay wages through an ATM

card, payroll card, or other means of electronic transfer. The

employee must be permitted to (a) withdraw the entire amount

of net pay without cost to the employee; or (b) choose to use

another means of payment of wages that involves no cost to

the employee. Such an agreement must be made in the

language that the employer principally uses to communicate

with the employee.• Citation: ORS

652.110.

All employers.

PA

State law doesn’t explicitly allow employers to require direct

deposit, but at least one Pennsylvania court has implicitly

endorsed the practice.• Citation: Statler v. Unemployment

Comp. Bd. of Review, 728 A.2d 1029 (Pa. Commw. Ct.

1999). Employees must authorize direct deposit in writing.

All employers.

Citation: Letter from the Pa. Bureau of Labor Law

Compliance (Oct. 1, 2009)

RI

Direct deposit is only permissible upon written request of

employees and consent of the employer.• Citation:

R.I.Gen.Laws §28-14-10.1(a).

All employers.

SC

Employers may pay their employees by direct deposit to a

financial institution that is federally insured and doing business

in the state provided that the employee’s account allows for

one withdrawal for each deposit free of any service charge.

When an employee’s wages are paid by direct deposit, the

employee must be furnished a statement of earnings and

withholdings.• Citation: S.C. Code Ann.

§41-10-40.

All employers.

SD

Mandatory direct deposit is allowed.• Citation: SDCL §60-11-9.

All employers.

TN

Employers may use direct deposit as a method of paying

wages. The state attorney general has issued an opinion

seeming to say that employers can require direct deposit.•

Citation: Atty. Gen. Op. 86-94, relying on Tenn. Code Ann.

§50-2-103(e).

Private employers with at least 5

employees.

TX

Employers may use direct deposit for employees who

maintain accounts at a financial institution. Employers who

desire to pay through direct deposit must (1) notify each

affected employee in writing at least 60 days before the date

on which the direct deposit system is scheduled to begin and

(2) obtain from employees any information required by the

financial institutions in which the employees maintain

accounts that is necessary to implement the electronic funds

transfer. • Citation: Tex. Labor Code §61.017(c).

All employers.

UT

Mandatory direct deposit is allowed if the following criteria

are met: (1) If for the calendar year preceding the pay period

for which the employee is being paid, the employer’s federal

employment tax deposits were at least $250,000, and (2) at

least two-thirds of the employees have their wages deposited

by electronic transfer. If those conditions are met, employers

can mandate that paychecks for all employees be deposited by

electronic transfer, but if the conditions are not met, employees

can refuse direct deposit by submitting a written request to the

employer. An employer may not designate a particular

depository institution for the exclusive payment or deposit of a

check or draft for wages.• Citation: Utah Code

§§34-28-1 and 34-28-3(3).

Private employers except those

involved in farm, dairy, agricultural,

viticultural, or horticultural pursuits;

stock or poultry raising; household

domestic service; or other

employment in which a written

agreement provides different terms.

VT

Employers must have written authorization from employees to

use direct deposit.•

Citation: 21 V.S.A. §342(c).

All employers.

VA

Employers cannot require the direct deposit of paychecks.

However, if an employee who is hired after January 1, 2010,

fails to designate an account for the receipt of direct deposits,

the employer may pay wages or salaries to such employee by

credit to a prepaid debit card or card account. Employers may

pay employees by cash, check, direct deposit into an account

in the name of the employee at a financial institution

designated by the employee, or by credit to a prepaid debit

card or card account from which the employee is able to

withdraw or transfer funds.• Citation: VA Code §40.1-29(B).

All employees.

WA

Informal guidance from the Washington State Department of

Labor & Industries says yes, so long as there is no cost to the

There is no provision for this topic in

this state.

employee (and assuming the employee has a bank account —

it is not clear whether the employee can be required to have a

bank account).• Citation:

www.lni.wa.gov/workplacerights/wages/payreq/wages/default.a

sp.

WV

State institutions of higher education: Employees of state

institutions of higher education, to the maximum extent

practicable, must be paid their wages via electronic transfer or

direct deposit.Employers subject to the WPCA: Employers

subject to the West Virginia Wage Payment and Collection Act

(“WPCA”) may pay employees by direct deposit or by deposit

into a payroll card account, provided that the employer and its

respective employees agree in writing to such means of

depositing wages.• Citation: State institutions of higher

education: W. Va. Code

§18B-5-9(c); WPCA: W. Va. Code §21-5-3(b).

There is no provision for this topic in

this state.

WI

Employers may require direct deposit as long as employees

are given the right to designate the recipient bank and there

are no charges to the employees for the direct deposit.

Exceptions are necessary for employees who are ineligible

for checking or savings accounts.• Citation: See Wis. Stat.

§109.03(1); Wis. Stat.

§103.45.

All employers.

WY

Direct deposit is permitted when employees voluntarily

authorize it. • Citation: Wyo. Stat. §27-4-101(b).

All employers.