Iowa Property Tax

Exemption Report

2012

A Report from the

Governor’s Nonprot

Project

Iowa Property Tax

Exemption Report 2012

1.

T

his report is the work of the Governor’s Nonprot Project. Our goal is to make Iowa a nonprot friendly

state. Our partnership, consisting of the Larned A. Waterman Iowa Nonprot Resource Center, the Iowa

Nonprot Collaborative, and various state agencies, will work to nd eective and ecient collaborative

eorts between state agencies and private nonprots to address Iowa’s community needs.

The Property Tax Exemption Committee of the Governor’s Nonprot Project convened in the summer of 2012.

Our goal was to preserve the tax exempt status for nonprots owning real property in Iowa in the education,

medical and religious categories. Property Tax Exemption Committee members are:

Tami Gilmore Four Oaks

Bill Nutty Leading Age Iowa

Maureen Keehnle Iowa Hospital Association

Richard Koontz Iowa Nonprot Resource Center

Liz Weinstein Elizabeth Weinstein & Associates, Inc.

The Property Tax Exemption Committee of the Governor’s Nonprot Project wishes to thank Governor

Branstad for his support of this study. Additionally, we wish to thank Jerey Boeyink, Chief of Sta, and his sta

for their eorts.

This survey report was authored by Richard Koontz, Director of the Larned A. Waterman Iowa Nonprot

Resource Center, a program at the University of Iowa College of Law.

Introduction

2.

I

owa’s nonprots believe it is crucial that exemption from property taxes, which has been part of Iowa law

for over 150 years, remain Iowa law. Not having to use nonprot funds for property taxes allows nonprots

to deliver more services to fulll its mission to Iowa’s citizens. A number of states have recently altered their

exemption statutes, but Iowa should not pursue this trend.

The Property Tax Exemption Committee also identied education on property tax exemption as an issue to

improve. There must be wider communication on why the exemption exists, how it operates and the resulting

benets to the citizens of Iowa. While the Department of Revenue has some very helpful materials, it is our

hope that further guidelines can be developed and disseminated to assist nonprots in applying for and

maintaining their exemption from property tax.

3.

In Defense, continued next page

I

owa’s charities contribute signicantly to the quality of life in Iowa. Using their resources wisely helps make

that eort ecient and eective. Iowa’s charities deserve the relief of property tax exemption so that their

resources can be used more fully in resolving community problems. Property tax exemption was challenged

in 2012 in Illinois taking property tax exemption from a good number of hospitals.

1

Property tax exemption is often seen as a kind of governmental subsidy for charities providing services that

are benecial to their communities. Charitable tax exemptions are generally justied as relieving “the burdens

of government” by providing goods or services that otherwise would not be provided by government or

society.

2

This raises the issue of whether a nonprot’s assets should even be seen as an important part of the

tax base. Do we tax a church or low income housing so that the money can be used for education? Charities

face budget problems if subject to property tax. A nonprot with real estate, which is often not easily

liquidated, must pay property tax if it did not apply for exemption or its application was denied. For-prot

endeavors are usually able to use real estate to earn income through leasing or other earned income activities.

However, if nonprots engage in this earned income activity, under Iowa law they lose their property tax

exemption. Consequently, nonprots have to pay a property tax while also trying to use their revenues wisely

to fulll their charitable missions. They face the problem of either mortgaging the real estate to obtain some

cash to pay real estate taxes or delivering fewer services to their beneciaries.

Tax exemption is sometimes seen as an avenue for tax abuse. However, the way that the property tax

exemption is structured in Iowa prevents abuse. Only charities that own real estate from which their services

are administered can get the exemption. Charities that rent from for-prot landlords do not get a property tax

exemption. Charities that own real estate not used for their charitable activities do not get an exemption from

property tax on those pieces of property. For example, a charity cannot own an apartment complex operated

at the going rate and get property tax exemption. If the charity owns a signicantly large piece of real estate,

exemption can only be taken for 320 acres.

3

Charities that own real estate and use that real estate to earn

money lose property tax exemption.

4

There are a wide variety of forms of exemption from property tax in Iowa. Property tax exemption is based

on a concept of allowing resources of social structures that aid communities to be used as much as possible

for meeting community needs. Most forms of property tax exemption in Iowa are based on this rationale. For

instance, governmentally owned real estate such as state universities, schools, drainage districts, national

guard posts, etc. are exempt from property tax.

5

Private colleges and schools in Iowa obtain property

exemption to aid the same function as governmental schools and universities in the state of Iowa under

In Defense of Iowa’s Charitable

Property Tax Exemption

1

See http://www.washingtonmonthly.com/ten-miles-square/2011/08/some_illinois_hospitals_losing031596.php

2

Nonprot Cases and Materials, Fishman and Schwarz, 4th ed., Foundation Press 2010

3

Iowa Code 427.1(8). Property must be used “solely for their appropriate objects.”

4

Iowa Code 427.1(8). Property must “not leased or otherwise used… with a view to pecuniary prot.”

5

Iowa Code 427.1(1) and (2).

4.

the general charitable provisions.

6

A library, art gallery or museum owned by the government is exempt

under one code section,

7

but privately owned libraries etc. (while accomplishing the same function in the

community) are exempt under another.

8

We want to meet the needs of veterans of wars, and Iowa’s statute

allows veterans associations

9

and homes for disabled soldiers

10

to have property tax exemption on real estate

owned by these groups. Other kinds of charities that meet needs of veterans (food, education, medical,

etc.) get exemption under the general charitable provision. Any strategy to balance budgets by removing

exemption for charities’ real estate, but not other kinds of organizations working for community needs, is a

lopsided deprivation of charitable resources, a strategy short-sighted and unfair. We should not deal with the

problems of economically slow times by placing the burden solely on the backs of charities.

One of the kinds of charities that receives tax exemption for its real estate is religious organizations. Churches

are not without assets; a compilation of Iowa exempt organization values for property tax purposes was done

in 2011, with a total value of Iowa churches at $2,755,504,122.

11

Some writers have cited Biblical sources for

reasons not to tax churches.

12

The U.S. Congress early in our history exempted churches from taxation. And

the U.S. Supreme Court has considered the constitutionality of taxation of churches.

13

In one case, Walz v.

Tax Commissioner, the Supreme Court noted that the church’s “uninterrupted freedom from taxation” has

“operated armatively to help guarantee the free exercise of all forms of religious belief.” On the other hand,

proponents of taxing churches say it violates the Constitution’s Establishment Clause by singling out churches

for freedom from taxation.

14

Whichever way the constitutionality of taxing churches is decided, it is dicult to

imagine that the people of Iowa will be comfortable with property taxation of churches. Given this dilemma, it

puts an even greater burden on other kinds of charities if the property tax exemption is kept for churches and

denied for other charities.

While all revenues are important to governmental entities in Iowa these days, the portion of real property

held by charities is relatively small. The total assessed value of property subject to Iowa taxation in 2010 was

$218,992,539,370.

15

The total assessed value of all property with exemption from property tax in the same tax

year was $9,570,779,595, with $3,655,313,289 held by charities. In other words, nonprots have a little less

than 1.7% of the real property subject to property tax in Iowa.

In Defense, continued

6

Iowa Code 427.1(8) (and (9)

7

Iowa Code 427.1(2)

8

Iowa Code 427.1(7) or (8)

9

Iowa Code 427.1(5).

10

Iowa Code 427.1(10).

11

See Iowa Department of Revenue website at http://www.iowa.gov/tax/locgov/propreports.html. Total value

of all religious properties is $3,758,486,585.

12

See Genesis 47:26 (Pharaoh not taxing priests’ lands) and Ezra 7:14.

13

Walz v. Tax Commission of the City of New York, 397 U.S. 664 (1970).

14

See http://taxthechurches.org/

15

See Iowa Department of Revenue, Property Tax Division, “2010 Property Valuation Report” at http://www.

iowa.gov/tax/locgov/PropValReport2010.pdf (Ag Land and Structures $38,062,377,455; Ag Dwelling Realty

$10,374,686,921; Residential $124,532,360,575; Commercial $34,668,843,221; Industrial $6,937,283,186; and

Utilities $4,416,988,012)

Before making changes to its property tax exemption structure, Iowa needs to study the economic

impact of doing so. Iowa has done some review of its property tax practices. In 2004 the Iowa Property

Tax Implementation Committee was created by House File 692.

16

A 2007 study group looked to outside

consultants to, among other things, “identify and review alternative sources of local government revenue by

other states… [for] persons and entities who own property that is exempt from property taxation because

the property is used for religious, educational, or charitable purposes.”

17

The importance of these eorts is

acknowledged, but there has not been a systematic study showing that increasing property tax on charities

will have a signicant impact on increasing Iowa’s economic outlook.

On the other hand, Iowa’s charities are clearly an important economic factor for stimulating Iowa’s economy.

Increasing their property tax exemption will impede this economic force. A 2005 report from the Iowa

Nonprot Resource Center and Iowa Workforce Development stated that Iowa charities in 2004 had $20.7

billion in assets, spent more than $8.3 billion, and employed 8.9% of Iowa’s workforce.

18

Imposing a property

tax on Iowa nonprots would impede the economic stimulus provided by its nonprot sector.

In Defense, continued

16

See Iowa Department of Revenue website at http://www.iowa.gov/tax/taxlaw/PTCLegRep1.html

17

See Iowa Department of Revenue website at http://www.legis.state.ia.us/Contracts/PropertyTaxStudy/RFP.

pdf

18

See http://www.iowaeconomicdevelopment.com/downloads/char_giving_report_FINAL-02-01-2007.pdf

5.

Changes in Property Tax Exemption in

Surrounding States

T

here have been alterations in property tax exemption rules for nonprots in two states neighboring

Iowa, and these changes have made Iowa nonprots quite concerned about the stability of their nancial

positions if such a change were made to the Iowa law of property tax exemption.

Illinois’ Property Tax Reform and Relief Task Force completed a report to the Illinois General Assembly on the

property tax exemption in 2009.

19

In 2010, the Illinois Supreme Court ruled that Provena Covenant Medical

Center in Urbana must pay local property taxes.

20

As a result of this decision, a number of other Illinois

hospitals’ property tax exemptions were denied. By summer of 2012, Illinois’ legislature had enacted a new law

setting standards for hospitals seeking property tax exemption (SB2194).

Minnesota’s constitution has provisions about private charities not being subject to property tax.

21

What

constitutes a “charity” for purposes of this constitutional provision has been debated, and a 2007 appellate

decision, Under the Rainbow Childcare Ctr., interpreted it broadly.

22

But this was followed by an amendment to

the property tax statute in 2011, setting forth six factors needed to establish charitable status for the purpose

of the exemption from property tax.

23

Iowa charities believe that the current statutory provisions in Iowa allowing charitable property tax exemption

ought to remain unchanged.

6.

19

Illinois Property Tax Reform and Relief Task Force, Report to the General Assembly (2009)

20

Provena Covenant Medical Center v. Illinois Department of Revenue, 236 Ill. 2d 368 (Ill. Sup. Ct. 2010).

21

Minn. Const. art. X, sec. 1.

22

Under the Rainbow Childcare Ctr. V, City of Goodhue, 741 N.W.2d 880 (Minn. 2007)

23

Minn. Stat. sec. 272.02(7). For an in-depth account of the statutory changes, see Minnesota Council of Non-

prots at http://www.minnesotanonprots.org/mcn-at-the-capitol/past-successes/charitable-property-tax-

exemption-redened

Educating Iowa on Property Tax Exemption

I

t is important for Iowa’s citizens, and nonprots especially, to have access to information about the

charitable property tax exemption. There are currently some good sources, but even more are needed.

Iowa Department of Revenue

There is currently a substantial amount of information on the property tax exemption in Iowa. Iowa’s statute

on property tax exemption for nonprots is available both in print and online.

24

The Iowa Department of

Revenue has numerous helpful resources which include “An Introduction to Iowa Property Tax,”

25 “

Property

Tax Credits and Exemptions,”

26

and the “Application for Property Tax Exemption for Certain Nonprot and

Charitable Organizations.”

27

Going beyond the exemption, there are other helpful pieces on property tax on

the DOR website, such as several years of property tax newsletters,

28

property tax opinions,

29

and contact

information for sta at the Property Tax Division.

30

The DOR’s Property Tax Division is involved in continuing education for county assessors. One of its listed

tested courses is “Credit and Exemption workshop (T-0154-15).”

Iowa County Assessor’s Oces

Another source for guidance on property tax exemption is county assessor’s oces. It is at the county

assessor’s oce where the property is located that the application for exemption is originally led. For

example, the Madison County Assessor’s oce has a brief portion of its website on property tax credits and

exemptions that begins:

Iowa law provides for a number of credits and exemptions. It is the property owner’s

responsibility to apply for these as provided by law. It is also the property owner’s responsibility

to report to the Assessor when they are no longer eligible for any credit or exemption they have

applied for. Following is a list of several credits and exemptions available in Iowa.

31

Often the assessor’s oce focuses on exemptions for private landowners – Homestead Tax Credit, Military

Service Exemption and Family Farm Credits. But there is usually a link to the application for charitable

exemption on county assessors’ webpages. Other examples of county assessors that provide helpful

information on some property tax exemptions are Henry County,

32

Greene County,

33

and Emmet County.

34

24

See http://coolice.legis.iowa.gov/Cool-ICE/default.asp?category=billinfo&service=IowaCode&ga=83&inp

ut=427.

25

See http://www.iowa.gov/tax/educate/78573.html.

26

See http://www.iowa.gov/tax/taxlaw/PropertyTaxCredits.html

27

See http://www.iowa.gov/tax/forms/54269.pdf

28

See http://www.iowa.gov/tax/locgov/propnews.html

29

See http://www.iowa.gov/tax/locgov/proppolicies.html

30

See http://www.iowa.gov/tax/contact/propdiv.html

31

See http://www.madisoncoia.us/oces/assessor/assessortaxes.htm

32

See http://www.henrycountyiowa.us/oces/assessor/index.htm

33

See http://www.co.greene.ia.us/assessor/assessor.htm

34

See http://www.emmetcountyia.com/assessor.html

7.

I

t is not easy to nd signicant amounts of information about a nonprot’s real estate and whether it

is exempt from property tax. Sources to consider are the Form 990, the DOR Property Tax Exemption

databases, and the county assessor’s oce website.

A. Form 990

Any nonprot that has a Form 990 ling is listed on guidestar.org’s website. Nonprots that own real estate

must report the asset on the balance sheet on Part X of the Form 990, line 10. (For smaller nonprots using

Form 990-EZ, this is completed on Part II, line 23.) Line 10 includes both investment real estate (which cannot

get property tax exemption) and real estate used for the exempt purposes (which can get property tax

exemption).

Finding Information About a Nonprot’s

Tax Exemption

8.

a

Finding Information, continued next page

Finding Information, continued

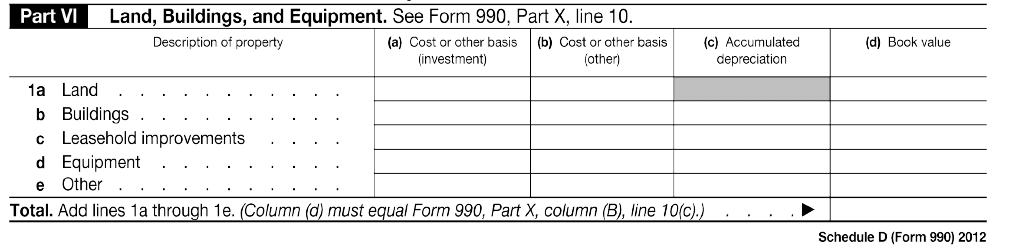

This information must also be reported on Form 990, Schedule D, Part VI. Schedule D allows you to break out

the land owned from other assets reported on the core Form 990, part X, line 10.

If the nonprot pays real estate taxes that amount would be reported on line 24 of Part IX of the core Form

990.

9.

B. Iowa Department of Revenue

The Iowa Department of Revenue has a Property Tax Division. Property tax treatment of individual nonprot

properties is not available from this source, but reports on exemption by county are available on this division’s

website at http://www.iowa.gov/tax/locgov/propreports.html

Finding Information, continued

10.

C. Iowa County Assessors’ Oces

Iowa Property Tax Exemption is primarily administered through the county assessor’s oce of the county

where the real estate is located. Most if not all assessors’ oces have a parcel-by- parcel search function on

their home pages to see which parcels are exempt. A list of county assessors’ websites and property search

links can be found at the Iowa Assessor and Property Tax Records Directory online at http://publicrecords.

onlinesearches.com/Iowa-Assessor-and-Property-Tax-Records.htm

An example of this is the Grundy County Assessor’s Oce. Below is the Grundy County Assessor’s oce search

tool for properties located there. You reach the search page by going to the primary Grundy County Assessor’s

Oce page at http://www.grundycounty.org/DEPARTMENTS/ASSESSOR/tabid/244/Default.aspx and then

clicking on the “Property Search” tab on the right of the screen.

Finding Information, continued

11.

Finding Information, continued

Below is the Grundy County Assessor’s oce record for the Methodist Church of Conrad. It shows a Gross

Assessed Value of $270,959, and an Exempt Value for the same amount. It is given a “class” of Ex – Exempt

Parcels.

12.

The Iowa State Association of County Auditors is working on a Real Estate Statewide Search that would

consolidate the counties’ information into one search engine.

35

35

See http://www.iowaauditors.org/real_estate_search/index.html

W

hen property tax exemption is denied by the county, the decision can be appealed rst to the board

of review (Iowa Code 441.31), and then to the District Court (Iowa Code 441.38). Finally there can be

an appeal to the appellate court.

While these sources provide some information about property tax exemption of nonprots, a more

consolidated system would help. For larger nonprots that administer services in multiple counties, and own

real estate in multiple counties, there is not a single source to bring together the records of real estate exempt

in these various counties. In addition, nonprots could use more assistance in understanding the exemption

application process, in remaining in compliance with the law during the period of exemption.

Property Tax Exemption Appeals

13.

Recommendation: There should be a long-standing Iowa Nonprot Committee that continues to review

issues central to the complex nonprot world, including those of property tax exemption. The committee

would cooperate with state government by providing helpful information from the nonprot sector, proposed

solutions to nonprots on issues, and advice on proposed legislation concerning nonprots.

Recommendation: The current structure for property tax exemption for nonprot charities in Iowa is fair and

reasonable and should not be altered.

Recommendation: There should be broader and more readily available educational resources on property tax

exemption. If the Department of Revenue’s Property Tax Division could do an annual training for nonprots,

it would be a signicant step forward. This could be a workshop that is part of the Iowa Nonprot Summit.

In addition, the Property Tax Division and the Iowa Nonprot Collaborative and/or Iowa Nonprot Resource

Center, could collaborate on a guidebook for Iowa nonprots on applying for and/or sustaining their property

tax exemption. It would also be extremely helpful if county assessors had a fuller explanation of charitable

property tax exemption on their websites.

Property Tax Exemption Committee

Recommendations

14.

For more information contact:

The Larned A. Waterman

Iowa Nonprot Resource Center

130 Grand Avenue Court

Iowa City, IA 52242

Telephone: 319-335-9765 or 866-500-8980 (toll free)

Web: http://inrc.continuetolearn.uiowa.edu

Email: law-nonpro[email protected]